Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VICI PROPERTIES INC. | a8-kxinvestorpresentat.htm |

Exhibit 99.1 INVESTOR PRESENTATION

DISCLAIMERS Forward Looking Statements Certain statements in this presentation and that may be made in meetings are forward‐looking statements. Forward‐looking statements are based on VICI Properties Inc.’s (“VICI or the “Company”) current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate to strictly historical and current facts and by the use of the words such as "expects", "plans", "opportunities" and similar words and variations thereof. Although the Company believes that the expectations reflected in such forward‐looking statements are based on reasonable assumptions, its results, performance and achievements could differ materially from those expressed in or by the forward‐looking statements and may be affected by a variety of risks and other factors including, among others: the impact of changes in general economic conditions, including low consumer confidence, unemployment levels, and depressed real estate prices resulting from the severity and duration of any downturn in the U.S. or global economy (including stemming from the COVID-19 pandemic and changes in economic conditions as a result of the COVID-19 pandemic); risks that the pending purchase of three Harrah’s-branded casinos (the “MTA Properties”) pursuant to the transactions described in the Master Transaction Agreement entered into by the Company and Eldorado Resorts, Inc. (“Eldorado”) (the “Eldorado Transaction”) may not be consummated on the terms or timeframe described herein, or at all; the ability of the parties to satisfy the conditions set forth in the definitive transaction documents for the pending transactions, including the ability to receive, or delays in obtaining, the regulatory and other approvals and/or consents required to consummate the transactions; the terms on which the Company finances the pending transactions, including the source of funds used to finance such transactions; disruptions to the real property and operations of the MTA Properties during the pendency of the closings; risks that the Company may not achieve the benefits contemplated by our pending and recently completed acquisitions of real estate assets (including any expected accretion or the amount of any future rent payments); risks that not all potential risks and liabilities have been identified in the due diligence for our pending and recently completed transactions; the Company's dependence on affiliates of Caesars Entertainment Corporation (“Caesars”), Penn National Gaming, Inc. (“Penn”), Seminole Hard Rock Entertainment, Inc. (“Hard Rock”), Century Casinos, Inc. (“Century”) and JACK Ohio LLC (“JACK Entertainment”) (and, following the completion of our pending transactions, Combined Eldorado/Caesars, Penn, Hard Rock, Century and JACK Entertainment respectively) as tenants of all of its properties and Caesars, Penn, Hard Rock, Century and JACK Entertainment (and, following the completion of our pending transactions, Combined Eldorado/Caesars, Penn, Hard Rock, Century and JACK Entertainment) or their affiliates as guarantors of the relevant lease payments, and the consequences of any material adverse effect on their respective businesses could have on the Company; the Company's dependence on the gaming industry; the Company's ability to pursue its business and growth strategies may be limited by its substantial debt service requirements and by the requirement that the Company distribute 90% of its real estate investment trust (“REIT”) taxable income in order to qualify for taxation as a REIT and that the Company distribute 100% of its REIT taxable income in order to avoid current entity level U.S. Federal income taxes; the impact of extensive regulation from gaming and other regulatory authorities; the ability of the Company's tenants to obtain and maintain regulatory approvals in connection with the operation of the Company's properties; the possibility that the Company’s tenants may choose not to renew their lease agreements with the Company following the initial or subsequent terms of the leases; restrictions on the Company's ability to sell its properties subject to the lease agreements; the Company's indebtedness and ability to service and refinance such indebtedness; the Company's historical and pro forma financial information may not be reliable indicators of its future results of operations and financial condition; limits on the Company's operational and financial flexibility imposed by its debt agreements; and the possibility the Company's separation from Caesars Entertainment Operating Company, Inc. fails to qualify as a tax‐free spin‐off, which could subject the Company to significant tax liabilities. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the impact of the COVID-19 pandemic on the financial condition, results of operations, cash flows and performance of the Company, its tenants and its pending transactions. The extent to which the COVID-19 pandemic impacts the Company and its tenants will largely depend on future developments that are highly uncertain and cannot be predicted with confidence, including the impact of the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures on our tenants, including various state governments and/or regulatory authorities issuing directives, mandates, orders or similar actions restricting freedom of movement and business operations, such as travel restrictions, border closures, business closures, limitations on public gatherings, quarantines and “shelter-at-home” orders resulting in the closure of our tenants' operations at our properties. Each of the foregoing could have a material adverse effect on our tenants' ability to satisfy their obligations under their leases with us, including their continued ability to pay rent in a timely manner, or at all, and/or to fund capital expenditures or make other payments required under their leases. In addition, changes and instability in global, national and regional economic activity and financial markets as a result of the COVID-19 pandemic could negatively impact consumer discretionary spending and travel, which could have a material adverse effect on our tenants' businesses. Investors are cautioned to interpret many of the risks identified here and under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019 as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2019, Quarterly Reports on Form 10‐Q and the Company’s other filings with the U.S. Securities and Exchange Commission (“SEC”). The Company does not undertake any obligation to update or revise any forward‐looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Caesars, Eldorado, Penn, Hard Rock, Century and JACK Entertainment Information The Company makes no representation as to the accuracy or completeness of the information regarding Caesars, Eldorado, Penn, Hard Rock, Century and JACK Entertainment included in this presentation. The historical audited and unaudited financial statements of Caesars, as the parent and guarantor of CEOC, LLC (“CEOC”), the Company's significant lessee, have been filed with the SEC. Certain financial and other information for Caesars, Eldorado, Penn, Hard Rock, Century and JACK Entertainment included in this presentation have been derived from their respective filings, if and as applicable, and other publicly available presentations and press releases. While we believe this information to be reliable, we have not independently investigated or verified such data. Market and Industry Data This presentation contains estimates and information concerning the Company's industry, including market position, rent growth and rent coverage of the Company's peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the "Risk Factors" section of the Company's public filings with the SEC. Non‐GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), FFO per share, Adjusted Funds From Operations (“AFFO”), AFFO per share, and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe FFO, FFO per share, AFFO, AFFO per share, and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. For additional information regarding these non-GAAP financial measures see “Definitions of Non-GAAP Financial Measures” included in the Appendix at the end of this presentation. Financial Data Financial information provided herein is as of March 31, 2020 unless otherwise indicated. Published May 4, 2020. 2

VICI PROPERTIES COMPANY SNAPSHOT(1) 4 New Tenants 29 17 Since Formation 83% 6% Properties Markets $200mm+ Non-CZR Rent Acquired 5% 3% 2% Percentages reflect % of total initial base rent(2). 17k+ 1.9mm+ Acquisition Volume Equity Raised Rent Acquired Hotel Rooms Casino Sq. Ft. ~$7.6bn ~$5.9bn ~$600mm $4,893 $1,251 $852 $717 760k+ $2,601 39k+ $2,117 Meeting Space Gaming Units $1,551 Sq. Ft. $1,136 $1,000 2 Properties Acquired in 7 2017 2018 2019 13 Markets Since Formation Announced Acquisition Volume ($mm) Equity Raised ($mm) Run-Rate Ann. Rent ($mm) Note: Transactions pending completion are subject to customary closing conditions and regulatory approvals. The Eldorado Transaction and the pending Harrah’s Reno disposition are also subject to the consummation of the merger of Eldorado with and into Caesars (the “Eldorado/Caesars Combination”). We can provide no assurances that the pending transactions and/or the Eldorado/Caesars Combination will be consummated on the terms or time frames contemplated, or at all. (1) Pro forma for the pending acquisitions of the MTA Properties, the pending CPLV and Non-CPLV Lease Modifications, and the pending Harrah’s Reno and Bally’s Atlantic City dispositions. 3

VICI IS THE NEXT GENERATION EXPERIENTIAL REAL ESTATE COMPANY MISSION TO BE AMERICA’S MOST DYNAMIC LEISURE & HOSPITALITY EXPERIENTIAL REAL ESTATE COMPANY VISION WE SEEK TO BE THE REAL ESTATE PARTNER OF CHOICE FOR THE LEADING CREATORS & OPERATORS OF PLACE -BASED, SCALED LEISURE & HOSPITALITY EXPERIENCES WE SEEK TO LEASE PROPERTIES TO TENANTS WITH MARKET - LEADING RELATIONSHIPS WITH HIGH VALUE CONSUMERS OF LEISURE & HOSPITALITY 4

VICI PROVIDES THE OPTIMAL COMBINATION OF: ✓ Sector Revenue Stability Across All Historical Cycles ✓ Long-Term Leases Backed by ✓ In-Place Corporate Rent Acquisition Coverage Opportunities ✓ Potential & Credibility for Substantial Non-Gaming Growth ✓ $21.5bn of Activity Since Emergence(1) ✓ Fully Internalized Governance & Management (1) Represents $7,594 million of closed or announced acquisitions (Harrah’s Las Vegas, Octavius Tower, Harrah’s Philadelphia, Margaritaville Bossier City, Greektown Casino-Hotel, Hard Rock Cincinnati, Century Portfolio, MTA Properties, Non-CPLV, CPLV and HLV lease amendments and JACK Cleveland/Thistledown), $2,600 million secured debt facilities closed in December 2017, $1,000 million of equity private placement raised in December 2017, $1,392 million of initial public offering of equity raised in February 2018, $725 million of equity raised in November 2018, $128 million of equity raised under ATM in Q1 2019, $600 million of increased availability under our existing revolving credit facility closed in May 2019, $2,473 million of equity raised in 5 June 2019, $2,250 million of unsecured notes raised in November 2019, $2,500 million of unsecured notes raised in February 2020 and $200 million of equity raised under ATM in February 2020.

1Portfolio Income: Character & Quality 6

FUNDAMENTAL ADVANTAGES OF OUR EXPERIENTIAL AND GAMING REAL ESTATE PORTFOLIO Diversified High Barriers to 1 Triple Net REIT 2 Revenue Streams 3 Entry Given 4 Weighted Average with 100% from Gaming, Legislative & Lease Term of Occupancy F&B, Retail and Regulatory 32.9 Years Entertainment Controls Regional Gaming Cash Flows Show Financial Lack of Near Term Significant 7 Low Volatility 5 Transparency & 6 Supply Growth in 8 Embedded Through All Strength of Highly Desirable Growth Pipeline Historical Cycles, Tenants Las Vegas Market Including Financial Crisis 7

INCOME FOUNDATION: STRENGTH OF OUR TENANTS COMBINED ELDORADO/CAESARS(1) Leading U.S. Gaming Operator Pro Forma Geographic Exposure and Asset Mix Eldorado Caesars ~60 ~300 ~51,000 Properties F&B Outlets Hotel Rooms ~4mm ~4,000 ~71,000 Gaming Sq. Ft. Table Games Slot Machines ✓ New Entrepreneurial Vigor ✓ Decentralized Management with Customer Caesars Today(2) Combined Eldorado/Caesars(2) Focus Leased Leased ✓ “Best Athlete” Mentality on Talent 38% 40% 45% Owned 51% Owned ✓ Proven Track Record of Achieving Synergies 15% 11% ✓ Combined Cost Discipline with Revenue Managed Managed Management Combined Tenant Will Pay VICI $1,050mm in Rent Annually Source: Eldorado public filings. We have not independently verified this information and present it in accordance with Eldorado’s public statements. (1) The Eldorado/Caesars Combination is pending completion, subject to closing conditions and regulatory approvals. VICI can provide no assurances that the pending Eldorado/Caesars Combination will be consummated on the terms or time frames contemplated, or at all. (2) Represents an asset mix, calculated based on number of properties. 8

INCOME FOUNDATION: STRENGTH OF OUR TENANTS PENN, HARD ROCK, CENTURY CASINOS & JACK ENTERTAINMENT Penn National Gaming Hard Rock has developed a Century Casinos (NASDAQ: CNTY) JACK Entertainment is a regional (NASDAQ: PENN) is the largest leading global presence as one is an international gaming gaming company that is part of U.S. regional gaming operator of the world’s most recognized company that develops, owns, the Rock Ventures Family of with a leading portfolio of brands and has achieved an and operates small to mid-sized Companies, currently controlled regional assets investment grade credit rating casinos in mid-tier markets by Dan Gilbert and affiliates $79.1mm Rent to VICI $42.8mm Rent to VICI $25.0mm Rent to VICI $65.9mm Rent and $4.5mm Interest Payment to VICI 41 Properties in 19 Over 260 Branded Hard Rock 18 Casinos in 4 Countries and Jurisdictions Across the U.S. Venues in 76 Countries 5 Cruise Ship-Based Casinos Rock Ventures also owns Quicken Loans, Bedrock and the Cleveland Cavaliers 193 Food & Beverage 13 Casinos Locations Mountaineer Casino Hard Rock Cincinnati Greektown Margaritaville JACK JACK Casino-Hotel Century Casino Century Casino Cleveland Thistledown Cape Girardeau Caruthersville Casino Racino Source: Penn and Century public filings, Hard Rock and JACK Entertainment website. We have not independently verified this data and are presenting it in accordance with each company’s respective public disclosure. 9

INCOME DURABILITY THROUGHOUT HISTORICAL ECONOMIC CYCLES Gaming Revenue: 50% Less Volatile than S&P 500 Revenue… 300% Peak-to-Trough: 250% Gambling -9% Retail -11% S&P Sales -18% 200% 150% 100% Casino Gambling PCE (1) Retail & Food Service Sales S&P 500 Revenue/Share 50% Q498 Q400 Q402 Q404 Q406 Q408 Q410 Q412 Q414 Q416 …With Demonstrated Durability in Regional Markets… …And Unwavering Demand in Las Vegas(3) Core Commercial Annual Gaming Revenues ($bn)(2) Las Vegas Strip Occupancy 2017: $18.3bn 18.5 100% 2007 Peak: $18.0bn 2007 Peak: 97% 2017: 91% 18.0 90% 17.5 2009 Trough: 80% Peak-to-Trough: -9.5% Peak-to-Trough: -3.9% 87% 17.0 2017 vs Peak: +1.9% 2017 vs Peak: -6.1% 2009 Trough: 2017 vs Trough: +6.0% 2017 vs Trough: +4.1% $17.3bn 16.5 70% 2007 2009 2011 2013 2015 2017 2005 2007 2009 2011 2013 2015 2017 Source: Haver Analytics, Goldman Sachs Global Investment Research, published February 26, 2018; State Gaming Boards, UNLV, Credit Suisse. Credit Suisse Research, Published September 11, 2018; company filings. (1) Refers to the Personal Consumption Expenditures as defined and reported by the U.S. Bureau of Economic Analysis. (2) Core regional markets focus on more mature and representative commercial regional gaming markets, adjusted for adjacent new supply, cannibalization between markets, and excluding genuinely additive supply and destination markets. (3) Represents average occupancy percentage of Wynn, Las Vegas Sands and MGM Las Vegas properties per company filings. 10

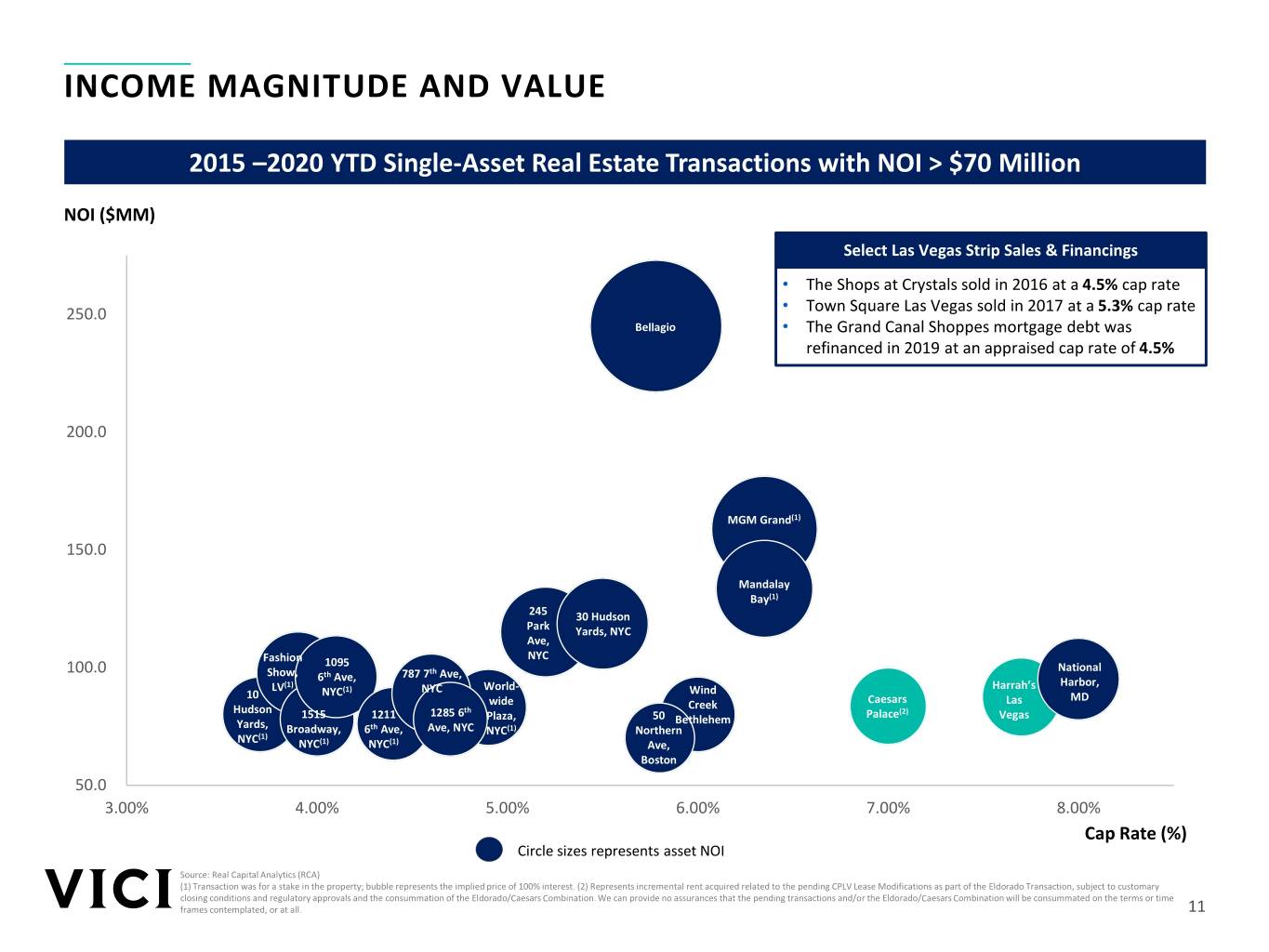

INCOME MAGNITUDE AND VALUE 2015 –2020 YTD Single-Asset Real Estate Transactions with NOI > $70 Million NOI ($MM) Select Las Vegas Strip Sales & Financings • The Shops at Crystals sold in 2016 at a 4.5% cap rate • 250.0 Town Square Las Vegas sold in 2017 at a 5.3% cap rate Bellagio • The Grand Canal Shoppes mortgage debt was refinanced in 2019 at an appraised cap rate of 4.5% 200.0 MGM Grand(1) 150.0 Mandalay Bay(1) 245 30 Hudson Park Yards, NYC Ave, NYC Fashion 1095 100.0 th National Show, 6th Ave, 787 7 Ave, (1) Harbor, LV (1) NYC World- Wind Harrah’s 10 NYC MD wide Creek Caesars Las Hudson th (2) 1515 1211 1285 6 Plaza, 50 Palace Vegas Yards, Bethlehem Broadway, 6th Ave, Ave, NYC NYC(1) Northern NYC(1) NYC(1) NYC(1) Ave, Boston 50.0 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% Cap Rate (%) Circle sizes represents asset NOI Source: Real Capital Analytics (RCA) (1) Transaction was for a stake in the property; bubble represents the implied price of 100% interest. (2) Represents incremental rent acquired related to the pending CPLV Lease Modifications as part of the Eldorado Transaction, subject to customary closing conditions and regulatory approvals and the consummation of the Eldorado/Caesars Combination. We can provide no assurances that the pending transactions and/or the Eldorado/Caesars Combination will be consummated on the terms or time frames contemplated, or at all. 11

2Growth Opportunities

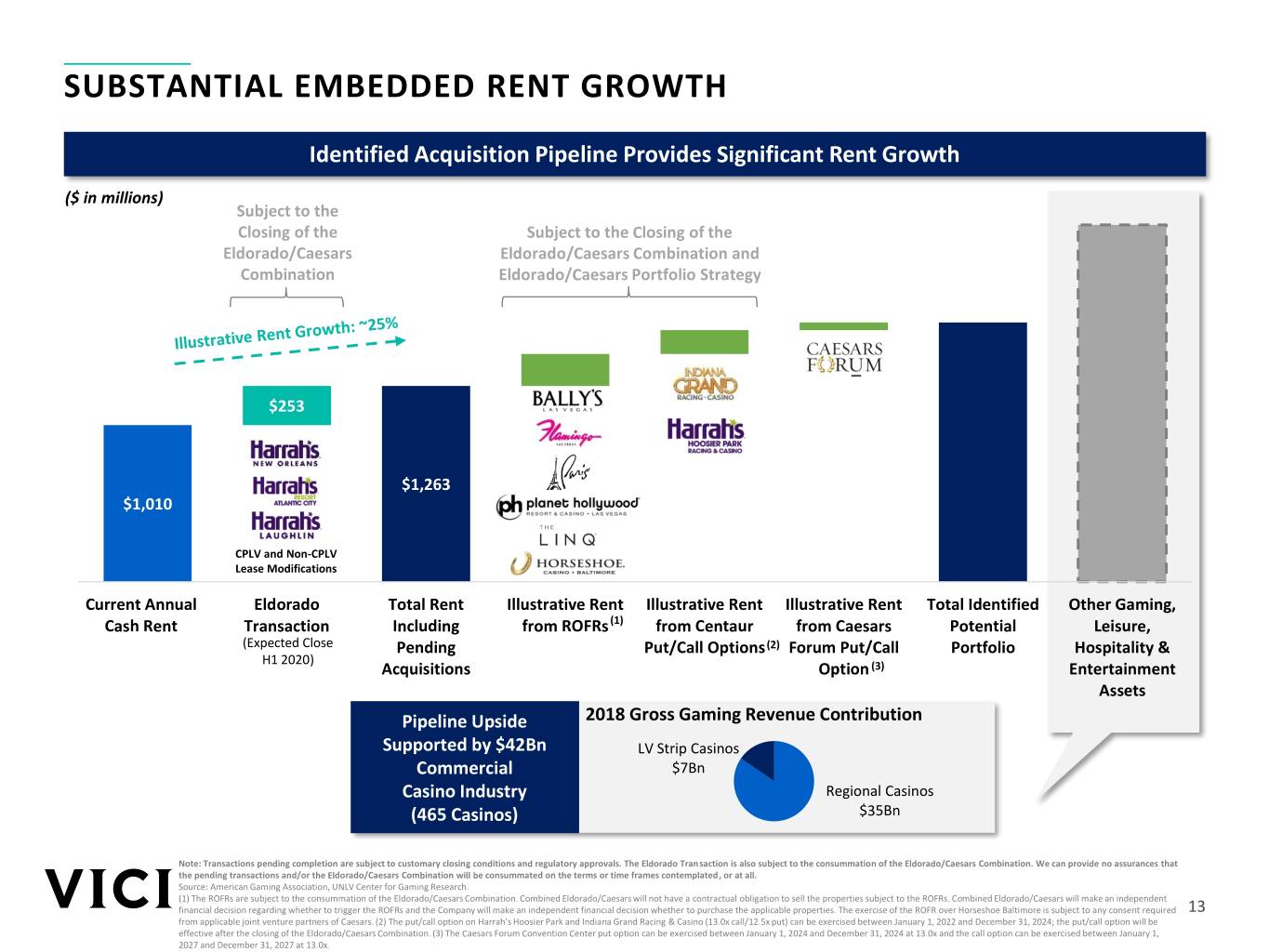

SUBSTANTIAL EMBEDDED RENT GROWTH Identified Acquisition Pipeline Provides Significant Rent Growth ($ in millions) Subject to the Closing of the Subject to the Closing of the Eldorado/Caesars Eldorado/Caesars Combination and Combination Eldorado/Caesars Portfolio Strategy $253 $1,263 $1,010 CPLV and Non-CPLV Lease Modifications Current Annual Eldorado Total Rent Illustrative Rent Illustrative Rent Illustrative Rent Total Identified Other Gaming, Cash Rent Transaction Including from ROFRs (1) from Centaur from Caesars Potential Leisure, (Expected Close Pending Put/Call Options(2) Forum Put/Call Portfolio Hospitality & H1 2020) Acquisitions Option (3) Entertainment Assets Pipeline Upside 2018 Gross Gaming Revenue Contribution Supported by $42Bn LV Strip Casinos Commercial $7Bn Casino Industry Regional Casinos (465 Casinos) $35Bn Note: Transactions pending completion are subject to customary closing conditions and regulatory approvals. The Eldorado Transaction is also subject to the consummation of the Eldorado/Caesars Combination. We can provide no assurances that the pending transactions and/or the Eldorado/Caesars Combination will be consummated on the terms or time frames contemplated, or at all. Source: American Gaming Association, UNLV Center for Gaming Research. (1) The ROFRs are subject to the consummation of the Eldorado/Caesars Combination. Combined Eldorado/Caesars will not have a contractual obligation to sell the properties subject to the ROFRs. Combined Eldorado/Caesars will make an independent financial decision regarding whether to trigger the ROFRs and the Company will make an independent financial decision whether to purchase the applicable properties. The exercise of the ROFR over Horseshoe Baltimore is subject to any consent required 13 from applicable joint venture partners of Caesars. (2) The put/call option on Harrah’s Hoosier Park and Indiana Grand Racing & Casino (13.0x call/12.5x put) can be exercised between January 1, 2022 and December 31, 2024; the put/call option will be effective after the closing of the Eldorado/Caesars Combination. (3) The Caesars Forum Convention Center put option can be exercised between January 1, 2024 and December 31, 2024 at 13.0x and the call option can be exercised between January 1, 2027 and December 31, 2027 at 13.0x.

LAS VEGAS LAND PROVIDES OPPORTUNITY FOR FURTHER GROWTH Unrivaled Opportunity to Deepen the Strip at its Center Treasure Island Wynn VICI has a Put/Call Option on 18 The Mirage The Palazzo acres for the Caesars Forum Convention Center The Venetian MSG Sphere Caesars Harrah’s Caesars-owned 41 acres Palace The LINQ Flamingo Bally’s VICI-owned 27 acres of land that is part of the Non-CPLV lease Bellagio strategically located adjacent Paris to the LINQ and behind Planet Hollywood The Cosmopolitan Planet Hollywood VICI-owned 7 acres of Strip frontage The Shops at property at Caesars Crystals Palace; part of the CPLV lease ARIA and available for redevelopment Note: Map is illustrative and may not be shown exactly to scale. Denotes VICI’s ROFR properties, subject to the consummation of the Eldorado/Caesars Combination. 14

FRAMEWORK FOR EXPLORING EXPERIENTIAL REAL ESTATE SECTORS LOW CYCLICALITY • Relatively lower cyclicality than other consumer discretionary sectors • Balance between drive-to and fly-to destinations, with drive-to destinations generally being less cyclical • Strong CRM capability, enabling cost-effective demand-building efforts LOW CYCLICALITY and customer activation during economic downturns LOW LOW SECULAR THREAT SECULAR • Not currently and not likely to be subject to the “Amazon effect” VICI seeks to THREAT • Dominated by operators with strong economic performance investigate, validate • Core experiences of sector cannot be achieved at home, work or and potentially invest digitally in sectors that feature FAVORABLE these fundamental EXPERIENTIAL DURABILITY & LONGEVITY SUPPLY / characteristics DEMAND • Dominated by operators whose strong customer understanding and innovative capability ensures enduring relevance of experiences BALANCE • Core experiences have proven durability EXPERIENTIAL DURABILITY • Centered around diverse experiences and diverse demographics — & LONGEVITY not over-exposed to any one experience or demographic FAVORABLE SUPPLY / DEMAND BALANCE • Supply growth is difficult and/or costly to achieve • Supply growth may be subject to regulatory control • Dominated by “rational” competitors not prone to over-investment and thus, over-supply 15

3Capability & Governance

PROVEN AND INDEPENDENT MANAGEMENT TEAM WITH EXPERTISE IN REAL ESTATE, GAMING & HOSPITALITY EDWARD PITONIAK JOHN PAYNE Chief Executive Officer President and Chief Operating Officer • Former Vice Chairman, Realterm, private-equity leader in institutionalizing industrial real • Previously served as CEO of Caesars Entertainment Operating Company, Inc. estate sub-asset classes • Held multiple roles with Caesars during the course of his career including President of • Former Independent Director of Ritchie Brothers (NYSE: RBA) Central Markets and Partnership Development, President of Enterprise Shared Services, • In 2014 became Managing Director, Acting CEO & Trustee of InnVest, Canada’s largest President of Central Division, and Atlantic City President hotel REIT. Became Chairman in 2015. REIT sold to Chinese buyer in 2016, producing • Previously served as Gulf Coast Regional President of Caesars and Senior Vice President 146% cumulative total return during period of leadership and General Manager of Harrah’s New Orleans • CEO of CHIP REIT, Canadian hotel REIT with average annual total return of 25% for 4 • Received an MBA from Northwestern University and a BA from Duke University years. Sold to Canadian pension fund in late 2007, doubling value of the REIT over 4 years • SVP, Intrawest Resort Operations, then the world’s largest ski resort operator/developer • Received a BA from Amherst College DAVID KIESKE SAMANTHA GALLAGHER EVP, Chief Financial Officer & Treasurer EVP, General Counsel & Secretary • Previously served as Managing Director of Real Estate & Lodging Investment Banking • Previously served as EVP, General Counsel and Secretary at First Potomac Realty Trust Group at Wells Fargo Securities / Eastdil Secured with a focus on hospitality and leisure (NYSE: FPO), a REIT specializing in office and business park properties in the Washington, • Worked in Real Estate & Lodging Investment Banking at Citigroup and Bank of America D.C. region • Served as Assistant Vice President & Corporate Controller at TriNet Corporate Realty • Oversaw the negotiation and documentation pertaining to First Potomac Realty Trust’s Trust, a triple net single tenant office REIT listed on the NYSE merger with Government Properties Income Trust (NASDAQ: GOV) • Previously was a Senior Accountant at Deloitte & Touche as well as Novogradac & Co. • Previously served as a Partner at Arnold & Porter LLP, Bass, Berry & Sims plc and Hogan • Received an MBA from University of California Los Angeles and a BS from UC Davis Lovells US LLP with a focus on representing REITs and financial institutions in capital markets transactions, mergers and acquisitions, joint ventures and strategic investments • Received a JD from Georgetown University Law Center and an AB from Princeton University VICI Team Experience 17

INDEPENDENT AND EXPERIENCED BOARD OF DIRECTORS ✓ 0% PARENT/ TENANT COMPANY OWNERSHIP ✓ SEPARATION OF CHAIRMAN & CEO ROLE ✓ INDEPENDENT CHAIRMAN ✓ ANNUALLY ELECTED BOARD (1) James Abrahamson* Diana Cantor Monica Douglas Elizabeth Holland AFFILIATIONS AFFILIATIONS AFFILIATIONS AFFILIATIONS BIOGRAPHY BIOGRAPHY BIOGRAPHY BIOGRAPHY • Served as Chairman of Interstate Hotels & • Partner with Alternative Investment • General Counsel, North America of The Coca- • CEO of Abbell Associates, LLC Resorts until October 2019 Management, LLC Cola Company • Currently serves as an independent director • Previously served as Interstate’s CEO from • Vice Chairman of the Virginia Retirement • Previously held the positions of Legal Director of Federal Realty Investment Trust 2011 to March 2017 System of The Coca-Cola Company, South Africa, and • Serves on the Executive Board and the Board • Serves as an independent director at • Served as an MD with New York Private Bank VP of Supply Chain and Consumer Affairs of of Trustees of International Council of CorePoint Lodging and at BrightView and Trust The Coca-Cola Company Shopping Centers Corporation • Serves as a director at Domino’s Pizza, Inc. and • Serves on the Board of Directors of Junior Universal Corporation Achievement USA and Cool Girls, Inc. Craig Macnab Edward Pitoniak Michael Rumbolz AFFILIATIONS AFFILIATIONS AFFILIATIONS BIOGRAPHY BIOGRAPHY BIOGRAPHY • Served as Chairman and CEO of National Retail • CEO of VICI Properties Inc. • President and CEO of Everi Holdings, Inc. Properties, Inc. from 2008 to April 2017 • Previously served as Vice Chairman of Realterm • Serves as an independent director of Seminole • Serves as an independent director of American • Former independent director of Ritchie Brother Hard Rock Entertainment, LLC. Tower Corporation Auctioneers • Previously served as Chairman and CEO of Cash • Previously served as director of Eclipsys • Served as Chairman of InnVest from Systems, Inc. from 2005 – 2008 Corporation from 2008 – 2014, DDR Corp. from 2015 – 2016 2003 – 2015, and Forest City Realty from 2017 – 2018 * Denotes Chairman of the Board of Directors (1) Opted out of the Maryland Unsolicited Takeover Act. 18

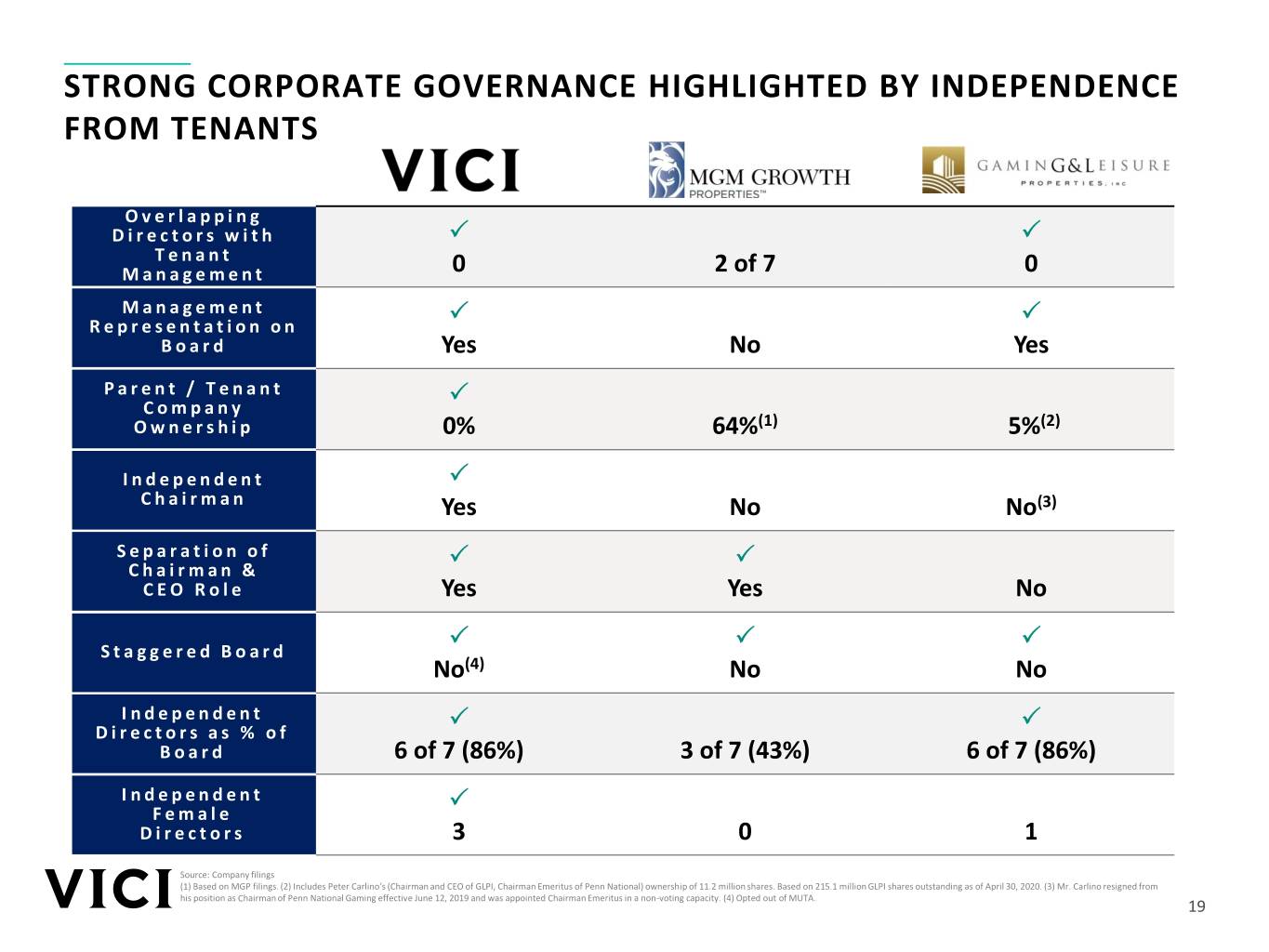

STRONG CORPORATE GOVERNANCE HIGHLIGHTED BY INDEPENDENCE FROM TENANTS Overlapping Directors with P P T e n a n t M a n a g e m e n t 0 2 of 7 0 Management P P Representation on B o a r d Yes No Yes Parent / Tenant P C o m p a n y O w n e r s h i p 0% 64%(1) 5%(2) Independent P C h a i r m a n Yes No No(3) Separation of P P Chairman & C E O R o l e Yes Yes No P P P Staggered Board No(4) No No Independent P P Directors as % of B o a r d 6 of 7 (86%) 3 of 7 (43%) 6 of 7 (86%) Independent P F e m a l e D i r e c t o r s 3 0 1 Source: Company filings (1) Based on MGP filings. (2) Includes Peter Carlino’s (Chairman and CEO of GLPI, Chairman Emeritus of Penn National) ownership of 11.2 million shares. Based on 215.1 million GLPI shares outstanding as of April 30, 2020. (3) Mr. Carlino resigned from his position as Chairman of Penn National Gaming effective June 12, 2019 and was appointed Chairman Emeritus in a non-voting capacity. (4) Opted out of MUTA. 19

Appendix

HIGH QUALITY REAL ESTATE ANCHORED BY ICONIC ASSETS Caesars Palace Las Vegas Harrah’s Lake Tahoe Detroit Lake Tahoe / Reno Joliet / Hammond Cleveland Council Bluffs Philadelphia Cincinnati Atlantic City Las Vegas North Kansas City Louisville Metropolis Caesars Laughlin Caesars Tunica Resorts / Robinsonville CURRENT PORTFOLIO Bossier City Biloxi PENDING ACQUISITIONS New Orleans Hard Rock Cincinnati Harrah’s New Orleans Century Casino Cape Girardeau Harrah’s Atlantic City Harrah’s Laughlin PENDING DISPOSITIONS(1) DESIGNATED ROFR PROPERTIES(3) Harrah’s Reno DESIGNATED PUT-CALL PROPERTIES(2) Bally’s Las Vegas Bally’s Atlantic City Indiana Grand, Centaur Flamingo Las Vegas Hoosier Park, Centaur Hard Rock OWNED GOLF COURSES Paris Las Vegas Century Casinos Cascata, Boulder City, NV Caesars Forum Convention Center Planet Hollywood Rio Secco, Henderson, NV The LINQ Grand Bear, Saucier, MS Horseshoe Baltimore Chariot Run, Laconia, IN JACK Cleveland Greektown Casino-Hotel VICI Continues to Diversify its Rent Base % LV Rent % LV Rent VICI Post VICI At 26% 31% JACK Entertainment Pending Penn National Gaming Formation (4) 74% Transactions 69% % Regional % Regional Rent Rent Note: Transactions pending completion are subject to customary closing conditions and regulatory approvals. The Eldorado Transaction and the pending Harrah’s Reno disposition are also subject to the consummation of the Eldorado/Caesars Combination. We can provide no assurances that the pending transactions and/or the Eldorado/Caesars Combination will be consummated on the terms or time frames contemplated, or at all. (1) On December 31, 2019, VICI and Caesars jointly entered into a definitive agreement to sell Harrah’s Reno for $50 million to a third party; the proceeds shall be split 75% to VICI and 25% to Caesars. On April 24, 2020, VICI and Caesars entered into definitive agreements to sell Bally’s Atlantic City for $25 million to a third party; the proceeds shall be split ~$19.0 million to VICI and ~$6.0 million to Caesars. The annual rent payments under the Non-CPLV lease will remain unchanged following completion of the dispositions. (2) The put/call option on Harrah’s Hoosier Park and Indiana Grand Racing & Casino (13.0x call/12.5x put) can be exercised between January 1, 2022 and December 31, 2024; the put/call option will be effective after the closing of the Eldorado/Caesars Combination. The put option on the Caesars Forum Convention Center can be exercised between January 1, 2024 and December 31, 2024 at 13.0x. The call option on the Caesars Forum Convention Center can be exercised between January 1, 2027 and December 31, 2027 at 13.0x. (3) With respect to the ROFR assets in Las Vegas, the first will 21 be selected from: Flamingo Las Vegas, Bally’s Las Vegas, Paris Las Vegas and Planet Hollywood Resort & Casino, with the second to be selected from one of the previous four plus the LINQ Hotel & Casino. Combined Eldorado/Caesars will not have a contractual obligation to sell the properties subject to the ROFRs and will make independent financial decisions regarding whether to trigger the ROFRs. The ROFRs on these properties will be effective after the closing of the Eldorado/Caesars Combination. The exercise of the ROFR over Horseshoe Baltimore is subject to any consent required from applicable joint venture partners of Caesars. (4) Reflects rent acquired from pending acquisitions of the MTA Properties and the pending CPLV and Non-CPLV Lease Modifications.

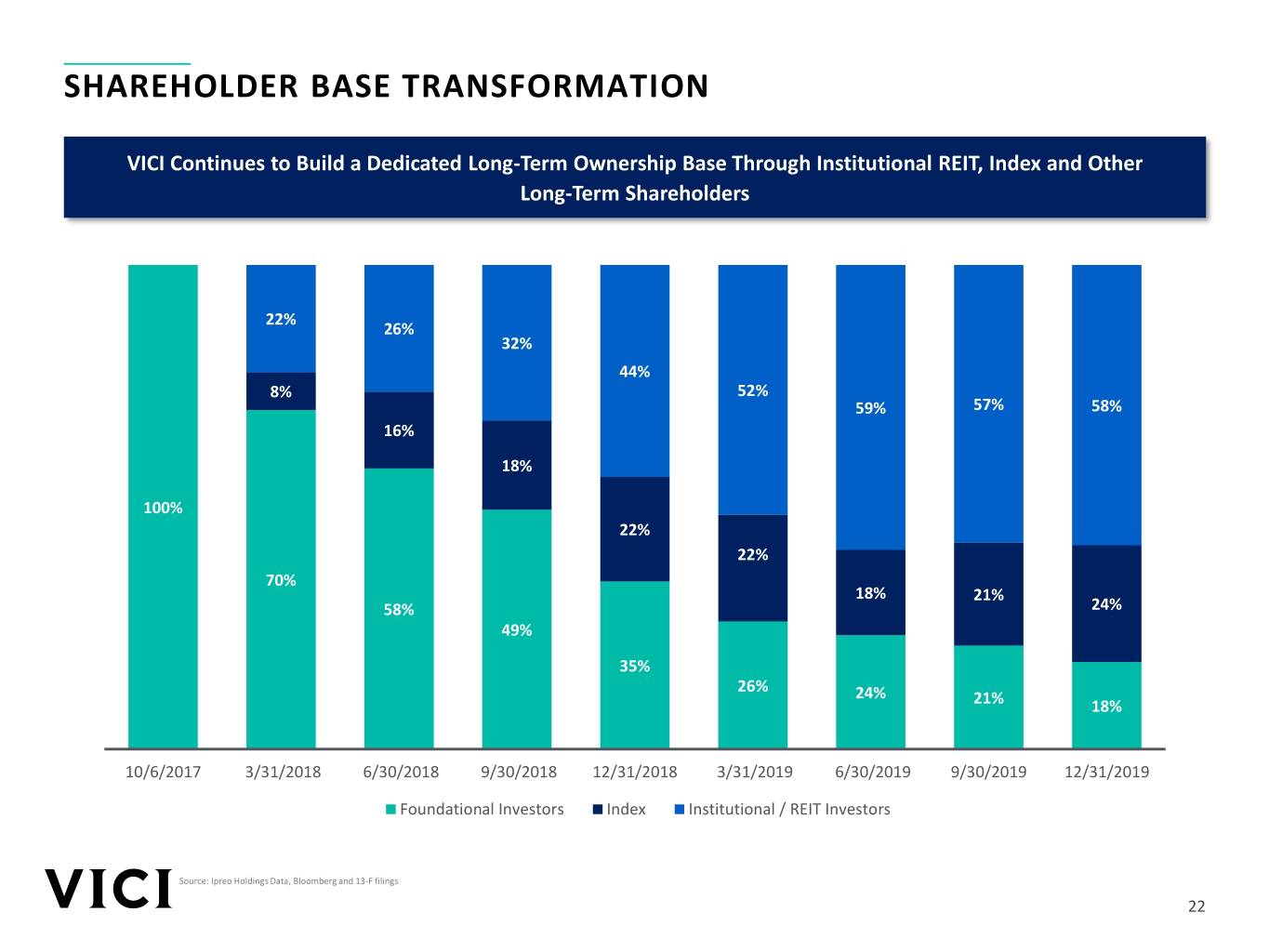

SHAREHOLDER BASE TRANSFORMATION VICI Continues to Build a Dedicated Long-Term Ownership Base Through Institutional REIT, Index and Other Long-Term Shareholders 22% 26% 32% 44% 8% 52% 59% 57% 58% 16% 18% 100% 22% 22% 70% 18% 21% 58% 24% 49% 35% 26% 24% 21% 18% 10/6/2017 3/31/2018 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 Foundational Investors Index Institutional / REIT Investors Source: Ipreo Holdings Data, Bloomberg and 13-F filings 22

BALANCE SHEET POSITIONED FOR GROWTH Capitalization Summary Well-Laddered Maturity Schedule ($ and shares in millions) As of 3/31/2020 Revolving Credit Facility ($1,000 million capacity) $0 $1,000 Term Loan B Facility 2,100 Total Secured Debt 2,100 $2,100 Senior Unsecured Notes 4,750 $1,250 $1,000 $1,000 $750 $750 Total Debt 6,850 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Cash and Cash Equivalents & Restricted Cash(1) (2,371) Term Loan B Unsecured Notes Revolving Credit Facility Net Debt $4,479 Debt Composition Total Common Shares Outstanding 468.6 LTM Q1 2020 Adjusted EBITDA(2) 892 Floating Rate (4) 1% Total Leverage Ratio 7.7x Secured 31% Net Leverage Ratio(2) 5.0x Unsecured Weighted Average Interest Rate 4.19% Fixed Rate 69% 99% Interest Coverage Ratio(3) 3.8x (1) Restricted cash of $2,002 million is solely related to funds held in escrow from the February 2020 Senior Unsecured Notes offering to be used to consummate the Eldorado Transaction. In the event that the Eldorado Transaction does not close, such funds will be used to redeem in full the 2027, the 2030 and a portion of the Senior Unsecured Notes due 2025 through the Special Mandatory Redemption. (2) See “Reconciliation from GAAP to Non-GAAP Financial Measures” in the Appendix for additional information, including the definition and reconciliation to the most comparable GAAP financial measure. (3) Calculated as $892 million LTM Q1 2020 Adjusted EBITDA divided by $233 million cash interest expense. (4) Reflects interest rate swap transactions entered into on April 24, 2018 and January 3, 2019. 23

MASTER LEASE AGREEMENTS: TRIPLE NET STRUCTURE PROVIDES SECURITY & EARNINGS PREDICTABILITY Non-CPLV & Joliet Regional Master Lease & Caesars Palace Las Vegas Harrah’s Las Vegas(2) (2 Leases)(1)(2) Joliet Lease(3) Las Vegas(2) Master Lease(3) Properties 18 Non-CPLV Properties & 18 Non-CPLV Properties, Harrah’s CPLV HLV CPLV and HLV Subject to Lease Harrah’s Joliet Joliet, MTA Properties Current Annual $508.5 Million Cash Rent $662.5 Million $207.7 Million $89.2 Million $395.4 Million Current Lease Nov. 1, 2019 – Oct. 31, 2020 Nov. 1, 2019 – Oct. 31, 2020 Jan. 1, 2020 – Dec. 31, 2020 Nov. 1, 2019 – Oct. 31, 2020 Nov. 1, 2019 – Oct. 31, 2020 Year Lease Year 3 Lease Year 3 Lease Year 2 1.5% in years 2-5 1.5% in years 2-5 >2% / change in CPI beginning in 1% per year for years 2 – 5 and Annual Escalator >2% / change in CPI >2% / change in CPI thereafter >2% / change in CPI thereafter year 2 >2% / change in CPI thereafter EBITDAR 1.2x beginning in year 8 Coverage Floor(4) None 1.7x beginning in year 8 1.6x beginning in year 6 None Year 8: 70% Base / 30% Variable Rent Year 8: 70% Base / 30% Variable Year 8 & 11: 80% Base / Year 8 & 11: 80% Base / Year 8, 11 & 16: 80% Base / Year 11 & 16: 80% Base / 20% Adjustment(5) Year 11: 80% Base / 20% Variable 20% Variable 20% Variable 20% Variable Variable 4% of revenue increase/decrease 4% of revenue increase/decrease 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. Variable Rent Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 8: Avg. of years 5-7 less avg. 4% of revenue increase/decrease of years 0-2 Adjustment of years 0-2 Year 11: Avg. of years 8-10 less of years 0-2 Year 8: Year 7 less year 0 Year 11: Avg. of years 8-10 less Mechanic(5) Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 11: Avg. of years 8-10 less Year 11: Year 10 less year 7 avg. of years 5-7 avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 avg. of years 8-10 Initial term extended to expire Initial term extended to expire 15-year initial term with four Term 15‐years following closing of the 15-year initial term with four 5-year renewal options 15‐years following closing of the 5-year renewal options Eldorado/Caesars Combination Eldorado/Caesars Combination Guarantee Caesars Combined Eldorado/Caesars Caesars Caesars Resorts Collection Combined Eldorado/Caesars $350mm required over rolling 3- Existing capex requirements to be $350mm required over rolling 3- $350mm required over rolling 3- year period at $100mm minimum increased in proportion to the year period at $100mm minimum year period at $100mm minimum $171 Million between 2017 and per year ($84mm allocated to overall increase in tenant’s net per year ($84mm allocated to per year ($84mm allocated to Capex 2021; Capex at 1% of net revenue CPLV, $255mm allocated to Non- revenue arising from the new CPLV, $255mm allocated to Non- CPLV); $171 Million between thereafter CPLV and $11mm allocated by properties (measured prior to CPLV and $11mm allocated by 2017 and 2021; Capex at 1% of the tenant) closing) the tenant) net revenue thereafter Note: Acquisitions pending completion are subject to customary closing conditions and regulatory approvals. The Eldorado Transaction is also subject to the consummation of the Eldorado/Caesars Combination. We can provide no assurances that the pending acquisitions will be consummated on the terms or time frames contemplated, or at all. (1) Cash rent amounts are presented prior to accounting for the portion of rent payable to the 20% JV partner at Harrah’s Joliet. After adjusting for the portion of rent payable to the 20% JV partner, Current Cash Rent is $500.4 million. (2) The information in this column does not reflect the modifications to the Caesars Lease Agreements contemplated in connection with the closing of the Eldorado Transaction. (3) Regional Master Lease reflects $154mm of rent from the pending acquisition of the MTA Properties; Las Vegas Master Lease reflects $98.5mm incremental rent from CPLV and HLV lease modifications, resulting from the Eldorado Transaction. (4) In the event that the EBITDAR to Rent Ratio coverage is below the stated floor, the Escalator of the respective Caesars Lease Agreements will be reduced to such amount to achieve the stated EBITDAR to Rent Ratio coverage, provided that the amount shall never result in a decrease to the prior year’s rent. The EBITDAR to Rent Ratio floor is conditioned upon obtaining a favorable private letter ruling from the Internal 24 Revenue Service. The coverage floors, which coverage floors serve to reduce the rent escalators under the Caesars Lease Agreements in the event that the EBITDAR to Rent Ratio coverage is below the stated floor, will be removed upon execution of the amendments to the Caesars Lease Agreements in connection with the closing of the transaction with Eldorado. (5) Rent adjustments in the Pro Forma Regional Master Lease & Joliet Lease and Pro Forma Las Vegas Master Lease occur in lease years based on a lease commencement date of October 6, 2017.

MASTER LEASE AGREEMENTS: TRIPLE NET STRUCTURE PROVIDES SECURITY & EARNINGS PREDICTABILITY (CONT’D) JACK Cleveland/Thistledown Margaritaville Bossier City Greektown Hard Rock Cincinnati Century Master Lease Master Lease Current Annual $23.5 Million $55.6 Million $42.8 Million $25.0 Million $65.9 Million Cash Rent Current Lease Feb. 1, 2020 – Jan. 31, 2021 May 23, 2019 – May 31, 2020 Sept. 20, 2019 – Sept. 30, 2020 Dec. 6, 2019 – Dec. 31, 2020 Jan. 24, 2020 – Jan. 31, 2021 Year Lease Year 2 Lease Year 1 Lease Year 1 Lease Year 1 Lease Year 1 1.0% in years 2-3 Annual 2% for Building Base Rent 2% for Building Base Rent 1.5% in years 2-4 1.0% in years 2-3 1.5% in years 4-6 Escalator ($17.2 Million) ($42.8 Million) 2.0% / CPI thereafter 1.25% / CPI thereafter > 1.5% / CPI thereafter Net Revenue to Rent Ratio: 6.1x EBITDAR to Rent Ratio(1): 1.85x Net Revenue to Rent Ratio: 7.5x Net Revenue to Rent Ratio: 4.9x Coverage Floor None(2) beginning in year 2 beginning in year 2 beginning in year 6 beginning in year 5 Percentage (Variable) Rent Percentage (Variable) Rent Rent Year 8 & 11: 80% Base / Year 8 & 11: 80% Base / adjusts every 2 years beginning in adjusts every 2 years beginning in Year 8: 80% Base / 20% Variable Adjustment 20% Variable 20% Variable year 3 year 3 4% of net revenue 4% of net revenue increase/decrease increase/decrease Variable Rent 4% of the average net revenues 4% of the average net revenues 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. Year 8: Avg. of years 5-7 less avg. Adjustment for trailing 2-year period less for trailing 2-year period less Year 8: Avg. of years 5-7 less avg. of years 1-3 of years 1-3 Mechanic threshold amount threshold amount of years 1-3 Year 11: Avg. of years 8-10 less Year 11: Avg. of years 8-10 less avg. of years 5-7 avg. of years 5-7 Term 15-year initial term with four 5-year renewal options Seminole Hard Rock Guarantee Penn National Gaming Penn National Gaming Century Casinos, Inc. Rock Ohio Ventures LLC Entertainment, Inc. Minimum 1% of Net Gaming Revenue on a rolling three-year Initial minimum of $30 million in Minimum 1% of Net Revenue Minimum 1% of Net Revenue basis for each individual facility; first 3 years; 1% of Net Revenues Capex Minimum 1% of Net Revenues based on a four-year average based on a four-year average 1% of Net Gaming Revenue per beginning in lease year 4, based fiscal year for the facilities on a rolling three-year basis(3) collectively (1) In relation to the Greektown lease agreement, the EBITDAR to rent ratio floor is conditioned upon obtaining a favorable private letter ruling from the Internal Revenue Service. (2) Starting in lease year 5, if the change in CPI is less than 0.5%, there will be no escalation in rent for such lease year. (3) Minimum of $30 million includes amounts spent on gaming equipment and the May Company Garage from the period commencing April 1, 2019 until December 31, 2022. 25

RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES The following table reconciles net income to FFO, AFFO and Adjusted EBITDA. Three Months Ended Twelve Months Ended ($ in millions) March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2020 Net (loss) income attributable to common stockholders ($24) $99 $144 $152 $371 Real estate depreciation - - - - - Funds From Operations ("FFO") ($24) $99 $144 $152 $371 Non-cash leasing and financing adjustments attributable to 3 3 3 (2) 6 common stockholders (1) Non-cash change in allowance for credit losses attributable 149 - - - 149 to common stockholders Transaction and acquisition expenses 5 0 1 3 9 Non-cash stock-based compensation 1 1 1 1 6 Amortization of debt issuance costs and original issue 6 15 15 2 38 discount Other depreciation (2) 1 1 1 1 4 Capital expenditures (1) (0) (1) (0) (2) Loss on extinguishment of debt 39 58 - - 97 Adjusted Funds From Operations ("AFFO") $180 $177 $165 $157 $678 Interest expense, net 64 52 47 49 213 Income tax expense / (benefit) 0 1 0 1 2 Adjusted EBITDA $245 $230 $212 $206 $892 Total debt 6,850 Cash and cash equivalents & restricted cash 2,371 Net Debt 4,479 Net Leverage Ratio (3) 5.0x (1) Amounts represent the non-cash adjustment to income from direct financing leases, sales-type leases and lease financing receivables in order to recognize income on an effective interest basis at a constant rate of return over the term of the leases. (2) Represents depreciation related to our golf course operations. (3) Net Leverage Ratio calculated as Net Debt divided by Adjusted EBITDA. 26

DEFINITIONS OF NON-GAAP FINANCIAL MEASURES FFO is a non-GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by The National Association of Real Estate Investment Trusts (“NAREIT”), we define FFO as net income (or loss) (computed in accordance with GAAP) excluding (i) gains (or losses) from sales of certain real estate assets, (ii) depreciation and amortization related to real estate, (iii) gains and losses from change in control and (iv) impairment write- downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. AFFO is a non-GAAP financial measure that we use as a supplemental operating measure to evaluate our performance. We calculate AFFO by adding or subtracting from FFO non-cash leasing and financing adjustments attributable to common stockholders, non-cash change in allowance for credit losses attributable to common stockholders, transaction costs incurred in connection with the acquisition of real estate investments, non-cash stock-based compensation expense, amortization of debt issuance costs and original issue discount, other non-cash interest expense, non-real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges related to non-depreciable real estate and gains (or losses) on debt extinguishment. The non-cash allowance for credit losses attributable to common stockholders consists of estimated credit loss for our investments in leases - direct financing and sales-type, investments in leases - financing receivables and investments in loans as a result of our adoption of ASU No. 2016-13 - Financial Instruments-Credit Losses (Topic 326). No similar adjustments are reflected in prior periods because the accounting standard was adopted effective January 1, 2020 and does not require retrospective application. Please see Note 6 - Allowance for Credit Losses in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 for further information. We calculate Adjusted EBITDA by adding or subtracting from AFFO interest expense and interest income (collectively, interest expense, net) and income tax expense. These non-GAAP financial measures: (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, nor do they measure our ability to fund all of our cash needs, including our ability to make cash distributions to our stockholders, to fund capital improvements, or to make interest payments on our indebtedness. Investors are also cautioned that FFO, AFFO and Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other real estate companies, including REITs, due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP. 27