Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Tremont Mortgage Trust | trmt033120earningsrele.htm |

| 8-K - 8-K - Tremont Mortgage Trust | trmt0331208kcoverpage.htm |

Exhibit 99.2 TREMONT MORTGAGE TRUST TRMT Nasdaq Listed First Quarter 2020 Supplemental Operating and Financial Data The Blazer Plaza, Dublin, OH $22.8 Million First Mortgage Whole Loan 1000 Floral Vale, Yardley, PA $14.9 Million First Mortgage Whole Loan All amounts in this report are unaudited.

TABLE OF CONTENTS CORPORATE INFORMATION Page Company Profile 4 Investor Information 5 Research Coverage 6 FINANCIALS First Quarter 2020 Highlights 8 TABLE OF CONTENTS TABLE Condensed Consolidated Balance Sheets 9 Condensed Consolidated Statements of Operations 10 Debt Summary 11 Reconciliation of Net Income to Core Earnings 12 PORTFOLIO OVERVIEW First Quarter 2020 Portfolio Summary 14 Loan Investment Details 15 Loan Portfolio Diversification 16 Interest Rate Sensitivity 17 Capital Structure Overview 18 WARNING CONCERNING FORWARD-LOOKING STATEMENTS 19 NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS 20 Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 2

CORPORATE INFORMATION West Park II, St. Louis, MO 1000 Floral Vale, Yardley, PA Part of West Park I, West Park II and Pine View Point Office Portfolio $14.9 Million First Mortgage Whole Loan $29.5 Million First Mortgage Whole Loan

COMPANY PROFILE The Company: Tremont Mortgage Trust, or TRMT, we, our or us, is a real estate investment trust, or REIT, that focuses on originating and investing in floating Corporate Headquarters: rate first mortgage whole loans secured by middle market and transitional commercial real estate, or CRE. We define middle market CRE as Two Newton Place commercial properties that have values up to $75.0 million and transitional CRE as commercial properties subject to redevelopment or 255 Washington Street, Suite 300 repositioning activities that are expected to increase the value of the properties. Newton, MA 02458-1634 (617) 796-8317 Management: Our Manager, Tremont Realty Advisors LLC, is registered with the Securities and Exchange Commission, or SEC, as an investment adviser Stock Exchange Listing: and is owned by The RMR Group LLC, or RMR LLC, the majority owned operating subsidiary of The RMR Group Inc., or RMR Inc., a holding Nasdaq COMPANY PROFILE COMPANY company listed on The Nasdaq Stock Market LLC, or Nasdaq, under the symbol “RMR”. We collectively refer to RMR Inc. and its consolidated subsidiaries, including RMR LLC, as RMR. Trading Symbol: RMR is an alternative asset management company that was founded in 1986 to manage real estate companies and related businesses. RMR Common Shares: TRMT primarily provides management services to four publicly traded equity REITs and three real estate related operating businesses. In addition to managing TRMT, RMR manages Service Properties Trust, a REIT that owns a diverse portfolio of hotels and net lease service and necessity- based retail properties, Industrial Logistics Properties Trust, a REIT that owns industrial and logistics properties, Office Properties Income Trust, Key Data (as of and for the three months a REIT that owns properties primarily leased to single tenants and those with high credit quality characteristics such as government entities, ended March 31, 2020): and Diversified Healthcare Trust, a REIT that owns high-quality, private-pay healthcare properties like medical office and life science properties, (dollars in thousands) senior living communities and wellness centers. RMR also provides management services to Five Star Senior Living Inc., a publicly traded Q1 2020 income from operator of senior living communities, Sonesta International Hotels Corporation, a privately owned operator and franchisor of hotels and cruise $ 2,527 boats, and TravelCenters of America Inc., a publicly traded operator and franchisor of travel centers along the U.S. Interstate Highway System investments, net and restaurants. RMR also advises the RMR Real Estate Income Fund, which is in the process of converting from a registered investment Q1 2020 net income $ 1,666 company to a publicly traded mortgage REIT, which will focus on originating and investing in floating rate first mortgage whole loans, secured Q1 2020 Core Earnings $ 1,708 by middle market and transitional commercial real estate, through Tremont Realty Advisors LLC, as well as manages the RMR Office Property Fund, a private, open end core plus fund focused on the acquisition, ownership and leasing of a diverse portfolio of multi-tenant office properties Loans held for investment, net $ 271,487 throughout the U.S. As of March 31, 2020, RMR had $32.0 billion of real estate assets under management and the combined RMR managed Total assets $ 282,840 companies had approximately $12 billion of annual revenues, over 2,100 properties and nearly 50,000 employees. We believe our Manager’s relationship with RMR provides us with a depth of market knowledge that may allow us to identify high quality investment opportunities and to evaluate them more thoroughly than many of our competitors, including other commercial mortgage REITs. We also believe RMR’s broad platform provides us with access to RMR’s extensive network of real estate owners, operators, intermediaries, sponsors, financial institutions and other real estate related professionals and businesses with which RMR has historical relationships. We also believe that our Manager provides us with significant experience and expertise in investing in middle market and transitional CRE. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 4

INVESTOR INFORMATION Board of Trustees John L. Harrington Joseph L. Morea Jeffrey P. Somers Independent Trustee Independent Trustee Independent Trustee David M. Blackman Adam D. Portnoy Managing Trustee Managing Trustee INVESTOR INFORMATION INVESTOR Executive Officers David M. Blackman G. Douglas Lanois President and Chief Executive Officer Chief Financial Officer and Treasurer Contact Information Investor Relations Inquiries Tremont Mortgage Trust Financial inquiries should be directed to Two Newton Place G. Douglas Lanois, Chief Financial Officer and Treasurer, 255 Washington Street, Suite 300 at (617) 658-0755 or dlanois@tremontadv.com Newton, MA 02458-1634 (617) 796-7651 Investor and media inquiries should be directed to cranjitkar@trmtreit.com Christopher Ranjitkar, Senior Director, Investor Relations, www.trmtreit.com at (617) 796-7651 or cranjitkar@trmtreit.com Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 5

RESEARCH COVERAGE Equity Research Coverage UBS Securities, LLC Citibank Global Markets, Inc Brock Vandervliet Arren Cyganovich, CFA RESEARCH COVERAGE (212) 713-2382 (212) 816-3733 brock.vandervliet@ubs.com arren.cyganovich@citi.com JMP Securities Jones Trading Institutional Services, LLC Steven C. DeLaney Jason M. Stewart (212) 906-3517 (646) 465-9932 sdelaney@jmpsecurities.com jstewart@jonestrading.com TRMT is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding TRMT’s performance made by these analysts do not represent opinions, forecasts or predictions of TRMT or its management. TRMT does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 6

FINANCIALS West Park II, St. Louis, MO OrchardPart of West Trails, Park Orono, I, West ME Park II and Pine View Point Office Portfolio $18.1$29.5 Million First Mortgage Whole Loan

FIRST QUARTER 2020 HIGHLIGHTS (1) • Net income and Core Earnings of $1.7 million, or $0.20 and $0.21 per diluted common share, respectively. • Income from investments, net, of $2.5 million. Financial Results • Book value per common share of $10.44. • Distribution of $0.01 per common share declared March 2020 and payable in May 2020. • Closed two first mortgage whole loans with an aggregate total loan commitment of $36.8 million. Loan Originations ◦ Weighted average maturity of 4.1 years based on maximum maturities. ◦ Weighted average coupon of 5.31% and all in yield of 6.45%. • 14 first mortgage whole loans diversified among office, retail, multifamily, industrial and hotel collateral, with an aggregate total loan commitment of $297.0 million. Loan Portfolio ◦ Weighted average maturity of 3.4 years based on maximum maturities. ◦ Weighted average coupon of 5.70% and all in yield of 6.40%. FIRST QUARTER 2020 HIGHLIGHTS • Our master repurchase facility with Citibank, N.A., or Citibank, or our Master Repurchase Facility, has approximately $7.0 million available to be drawn on loans that are below the previously approved maximum leverage amount and an additional $10.1 million available to be Capitalization drawn to fund future advances on unfunded loan commitments. • In place leverage of $196.3 million; 2.2x Net Debt to Equity Ratio. • All loans held for investment have floating interest rates and borrowers have loan required hedging instruments in place to mitigate the risk of rising interest rates. Interest Rates • Borrowings under our Master Repurchase Facility are subject to floating interest rates. • Floating rate investments and floating rate liabilities support earnings stability. (1) As of March 31, 2020, unless otherwise stated. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 8

CONDENSED CONSOLIDATED BALANCE SHEETS (dollars in thousands, except per share data) March 31, December 31, 2020 2019 ASSETS Cash and cash equivalents $ 10,204 $ 8,732 Restricted cash 3 143 Loans held for investment, net 271,487 242,078 Accrued interest receivable 953 755 Prepaid expenses and other assets 193 221 Total assets $ 282,840 $ 251,929 LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable, accrued liabilities and deposits $ 908 $ 1,011 MasterFinancial repurchase facility, net 195,566 164,694 Due to related persons 334 3 TotalSummary liabilities 196,808 165,708 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $0.01 par value per share; 25,000,000 shares authorized; 8,239,226 and 8,239,610 shares issued and outstanding, respectively 82 82 Additional paid in capital 88,909 88,869 Cumulative net income 3,603 1,937 CONDENSED CONSOLIDATED BALANCE SHEETS CONDENSED CONSOLIDATED Cumulative distributions (6,562) (4,667) Total shareholders’ equity 86,032 86,221 Total liabilities and shareholders' equity $ 282,840 $ 251,929 Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 9

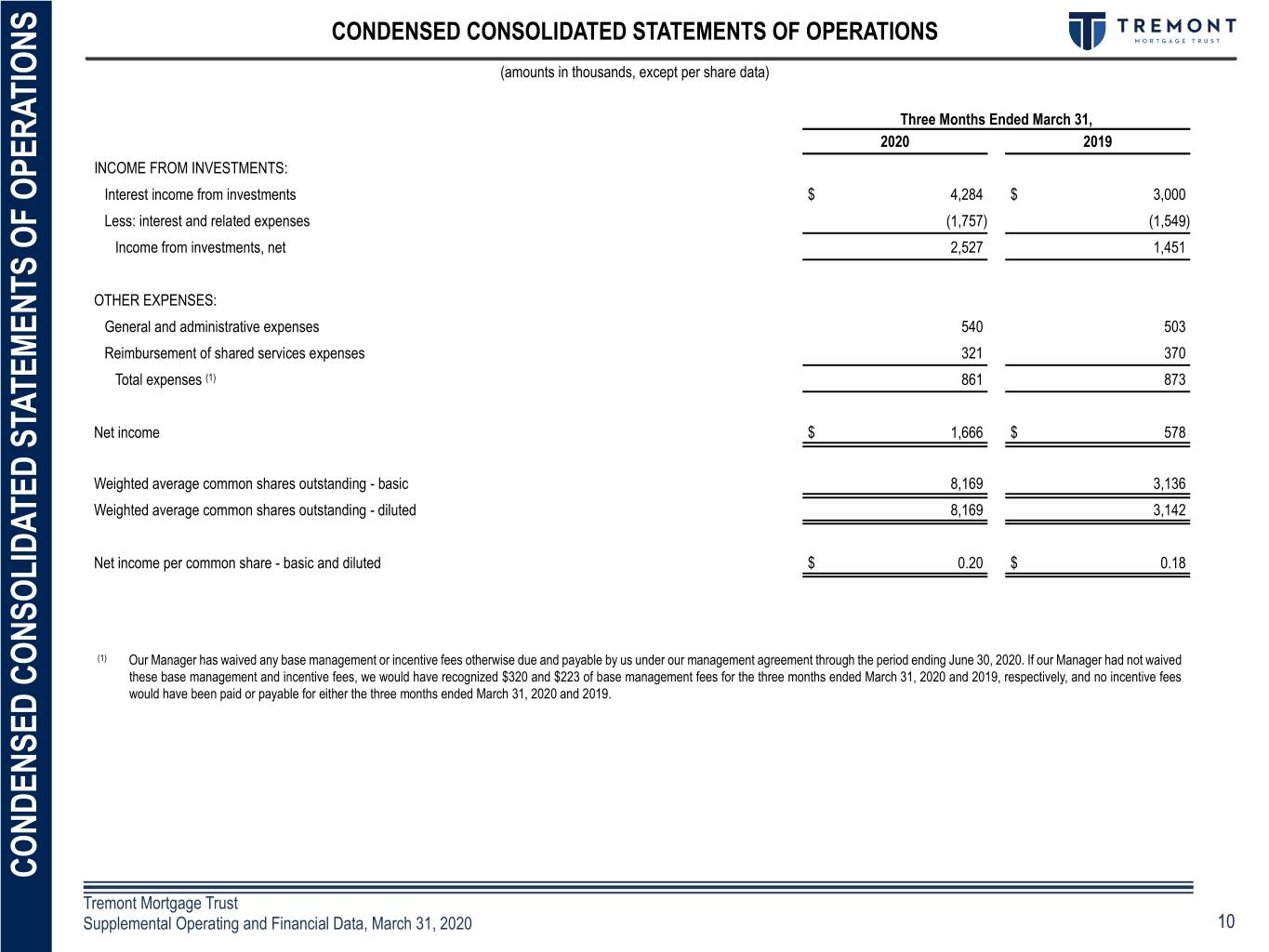

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in thousands, except per share data) Three Months Ended March 31, 2020 2019 INCOME FROM INVESTMENTS: Interest income from investments $ 4,284 $ 3,000 Less: interest and related expenses (1,757) (1,549) Income from investments, net 2,527 1,451 OTHER EXPENSES: General and administrative expenses 540 503 Reimbursement of shared services expenses 321 370 Total expenses (1) 861 873 Net income $ 1,666 $ 578 Weighted average common shares outstanding - basic 8,169 3,136 Weighted average common shares outstanding - diluted 8,169 3,142 Net income per common share - basic and diluted $ 0.20 $ 0.18 (1) Our Manager has waived any base management or incentive fees otherwise due and payable by us under our management agreement through the period ending June 30, 2020. If our Manager had not waived these base management and incentive fees, we would have recognized $320 and $223 of base management fees for the three months ended March 31, 2020 and 2019, respectively, and no incentive fees would have been paid or payable for either the three months ended March 31, 2020 and 2019. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS STATEMENTS CONDENSED CONSOLIDATED Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 10

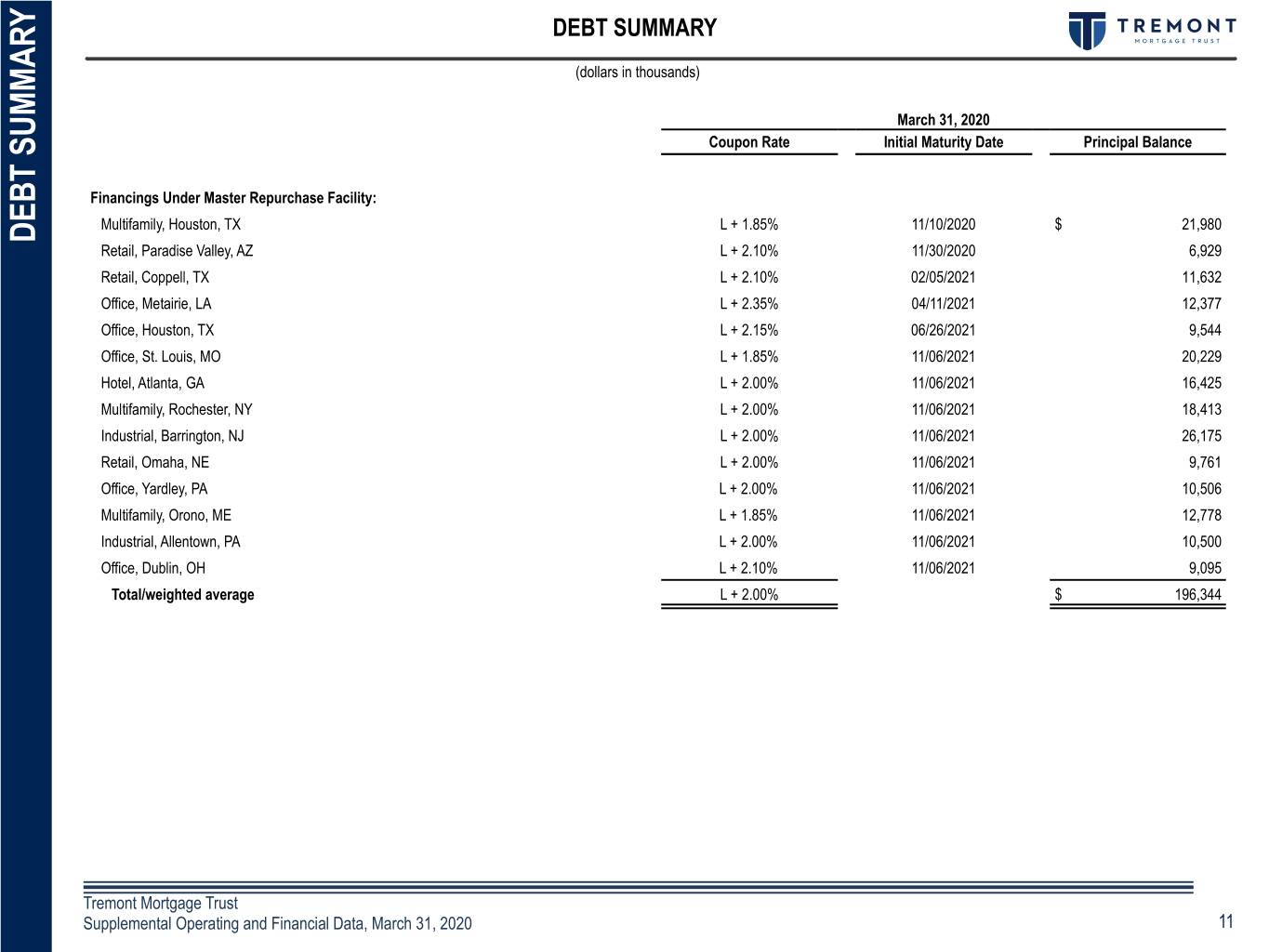

DEBT SUMMARY (dollars in thousands) March 31, 2020 Coupon Rate Initial Maturity Date Principal Balance Financings Under Master Repurchase Facility: Multifamily, Houston, TX L + 1.85% 11/10/2020 $ 21,980 DEBT SUMMARY Retail, Paradise Valley, AZ L + 2.10% 11/30/2020 6,929 Retail, Coppell, TX L + 2.10% 02/05/2021 11,632 Office, Metairie, LA L + 2.35% 04/11/2021 12,377 Office, Houston, TX L + 2.15% 06/26/2021 9,544 Office, St. Louis, MO L + 1.85% 11/06/2021 20,229 Hotel, Atlanta, GA L + 2.00% 11/06/2021 16,425 Multifamily, Rochester, NY L + 2.00% 11/06/2021 18,413 Industrial, Barrington, NJ L + 2.00% 11/06/2021 26,175 Retail, Omaha, NE L + 2.00% 11/06/2021 9,761 Office, Yardley, PA L + 2.00% 11/06/2021 10,506 Multifamily, Orono, ME L + 1.85% 11/06/2021 12,778 Industrial, Allentown, PA L + 2.00% 11/06/2021 10,500 Office, Dublin, OH L + 2.10% 11/06/2021 9,095 Total/weighted average L + 2.00% $ 196,344 Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 11

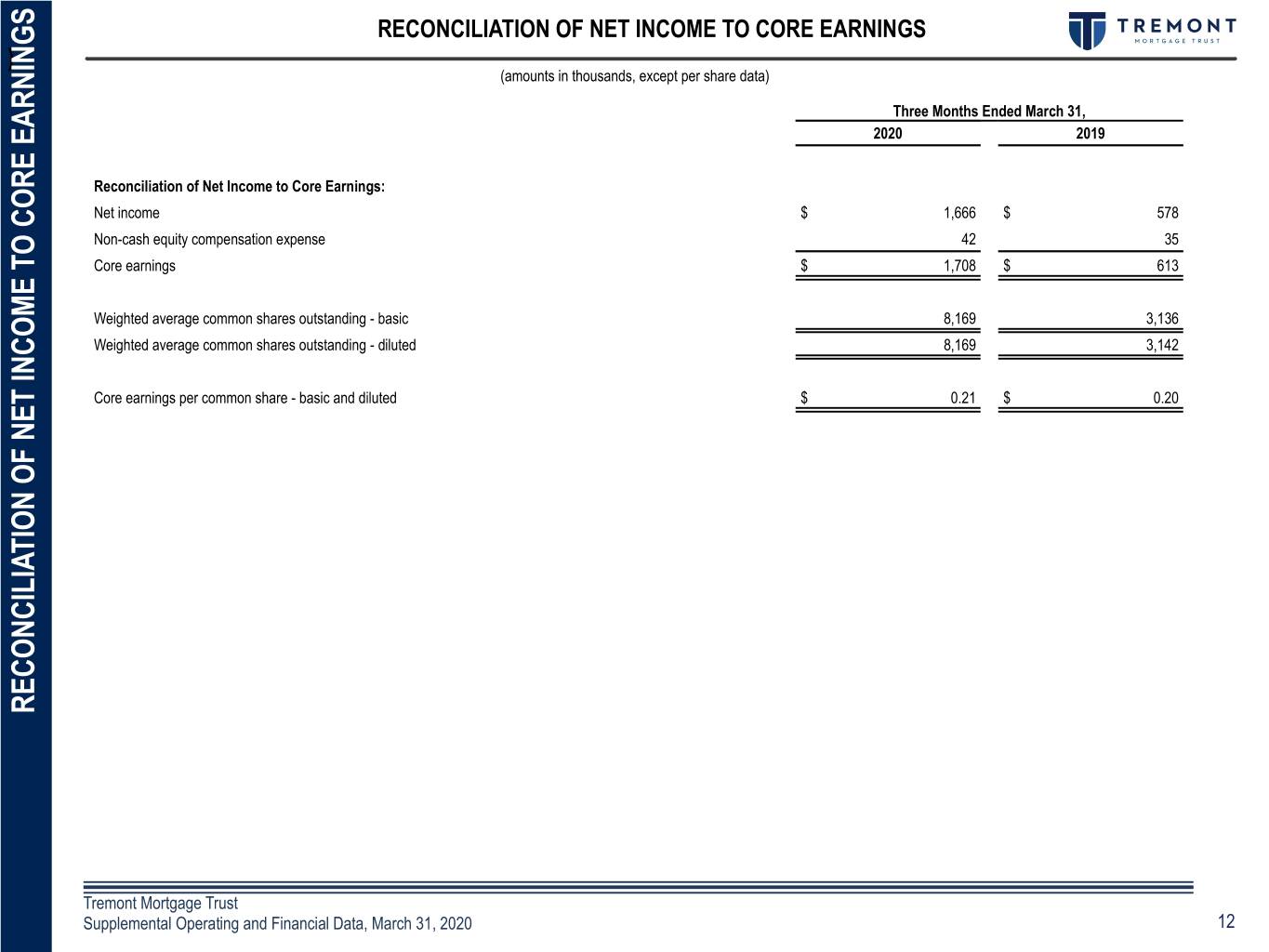

RECONCILIATION OF NET INCOME TO CORE EARNINGS ) (amounts in thousands, except per share data) Three Months Ended March 31, 2020 2019 Reconciliation of Net Income to Core Earnings: Net income $ 1,666 $ 578 Non-cash equity compensation expense 42 35 Core earnings $ 1,708 $ 613 Weighted average common shares outstanding - basic 8,169 3,136 Weighted average common shares outstanding - diluted 8,169 3,142 Core earnings per common share - basic and diluted $ 0.21 $ 0.20 RECONCILIATION OF NET INCOME TO CORE EARNINGS OF NET INCOME TO RECONCILIATION Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 12

PORTFOLIO OVERVIEW 1711 Caroline Street, Houston, TX $28.0 Million First Mortgage Whole Loan 675 Bering Drive, Houston, TX $15.2 Million First Mortgage Whole Loan

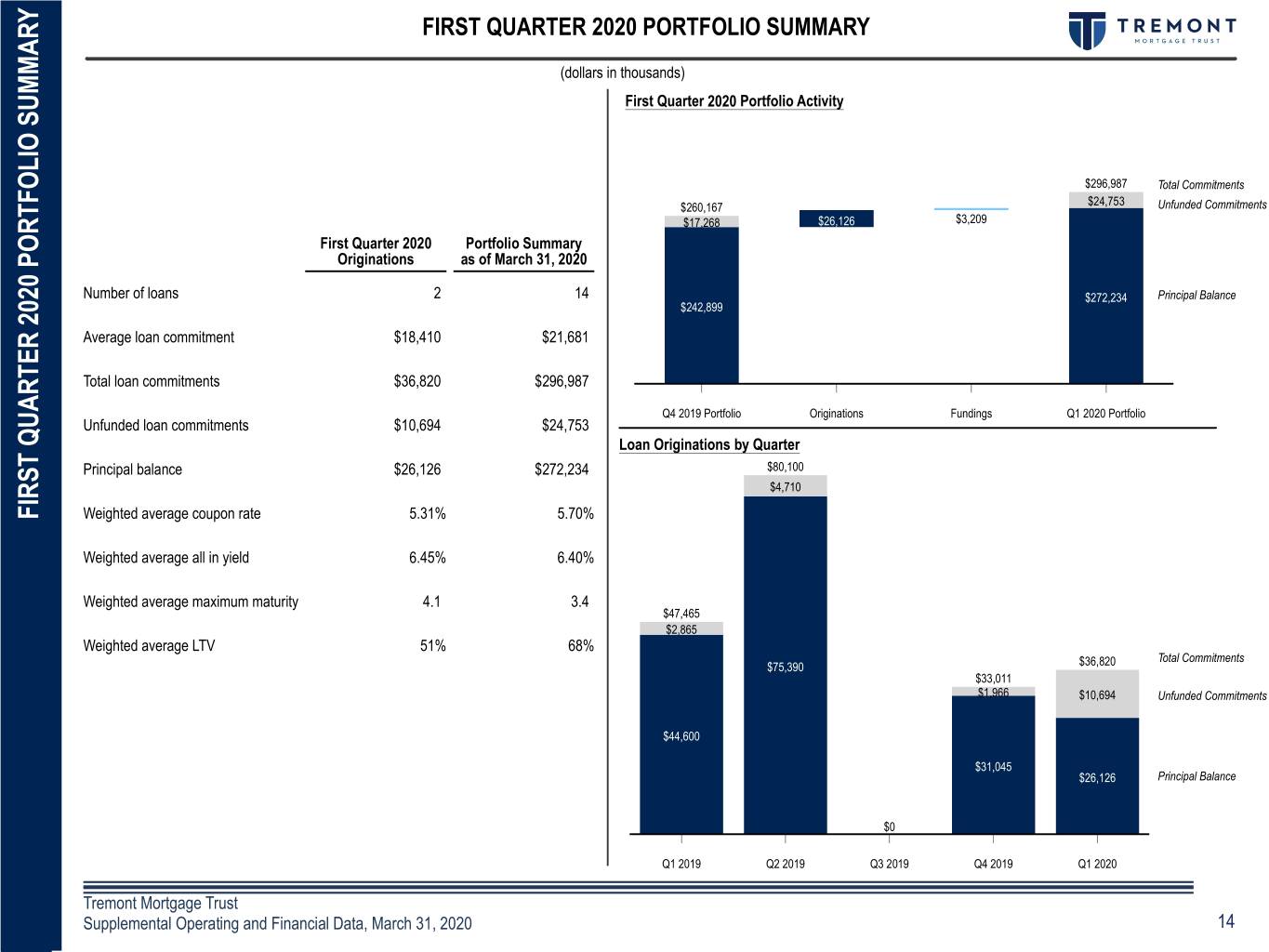

FIRST QUARTER 2020 PORTFOLIO SUMMARY (dollars in thousands) First Quarter 2020 Portfolio Activity Unfunded Commitments $296,987 Total Commitments $24,753 $260,167 Unfunded Commitments $17,268 $26,126 $3,209 First Quarter 2020 Portfolio Summary Originations as of March 31, 2020 Principal Balance Number of loans 2 14 $272,234 Principal Balance $242,899 Average loan commitment $18,410 $21,681 Total loan commitments $36,820 $296,987 Q4 2019 Portfolio Originations Fundings Q1 2020 Portfolio Unfunded loan commitments $10,694 $24,753 Loan Originations by Quarter Principal balance $26,126 $272,234 $80,100 $4,710 Weighted average coupon rate 5.31% 5.70% FIRST QUARTER 2020 PORTFOLIO SUMMARY Weighted average all in yield 6.45% 6.40% Weighted average maximum maturity 4.1 3.4 $47,465 $2,865 Weighted average LTV 51% 68% Total Commitments $75,390 $36,820 $33,011 $1,966 $10,694 Unfunded Commitments $44,600 $31,045 $26,126 Principal Balance $0 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 14

LOAN INVESTMENT DETAILS (dollars in thousands) First Mortgage Whole Loans as of March 31, 2020: Maximum Committed Maximum Maturity Origination Principal Principal Coupon All in Maturity (years Location Property Type Date Amount Balance Rate Yield (date) remaining) LTV Coppell, TX (1) Retail 02/05/2019 $ 22,915 $ 22,204 L + 3.50% L + 4.25% 02/05/2021 0.9 73% Houston, TX Multifamily 05/10/2019 28,000 27,475 L + 3.50% L + 4.37% 11/10/2022 2.7 56% Paradise Valley, AZ Retail 11/30/2018 12,790 9,724 L + 4.25% L + 5.76% 11/30/2022 2.7 48% Dublin, OH Office 02/18/2020 22,820 12,947 L + 3.75% L + 5.55% 02/18/2023 2.9 33% Metairie, LA Office 04/11/2018 18,102 17,030 L + 5.00% L + 5.65% 04/11/2023 3.1 79% Barrington, NJ Industrial 05/06/2019 37,600 34,962 L + 3.50% L + 4.05% 05/06/2023 3.1 79% LOAN INVESTMENT DETAILS Houston, TX Office 06/26/2018 15,200 13,901 L + 4.00% L + 4.60% 06/26/2023 3.3 69% St. Louis, MO Office 12/19/2018 29,500 27,477 L + 3.25% L + 3.75% 12/19/2023 3.8 72% Atlanta, GA Hotel 12/21/2018 24,000 23,904 L + 3.25% L + 3.72% 12/21/2023 3.8 62% Rochester, NY Multifamily 01/22/2019 24,550 24,550 L + 3.25% L + 3.86% 01/22/2024 3.9 74% Omaha, NE Retail 06/14/2019 14,500 13,015 L + 3.65% L + 4.05% 06/14/2024 4.3 77% Yardley, PA Office 12/19/2019 14,900 14,008 L + 3.75% L + 4.48% 12/19/2024 4.8 75% Orono, ME Multifamily 12/20/2019 18,110 17,037 L + 3.25% L + 3.89% 12/20/2024 4.8 72% Allentown, PA Industrial 01/24/2020 14,000 14,000 L + 3.50% L + 4.02% 01/24/2025 4.9 67% Total/weighted average $ 296,987 $ 272,234 L + 3.59% L + 4.29% 3.4 68% (1) The borrower under our loan related to a property located in Coppell, TX requested relief from its debt service obligation owed to us and failed to make its April 2020 debt service payment by the scheduled due date, resulting in a default under the loan agreement. This full recourse loan has an outstanding principal balance of $22,204, which accounts for approximately 8.2% of the aggregate outstanding principal balance of our loan portfolio. In response to this default, we implemented a cash flow sweep on this borrower's accounts and the loan agreement was modified to increase the interest reserve balance that may be used to make interest payments, if needed, and to waive the default. Before this loan modification and related waiver of default become effective, the borrower is required to pay us rent it collected for April 2020 to fulfill a portion of its debt service obligation. As of May 1, 2020, the borrower has not yet fulfilled this obligation. We have not recorded an allowance for loan loss with respect to this investment because we believe it is probable that we will ultimately collect all outstanding loan amounts due under this loan. As of May 1, 2020, all of our other borrowers have paid all of their debt service obligations owed to us and none of the other loans included in our investment portfolio are in default. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 15

LOAN PORTFOLIO DIVERSIFICATION (dollars in thousands) Geographic Diversification by Investment (based on book value of loans held for investment as of March 31, 2020) Maximum Maturity Profile (based on principal balances as of March 31, 2020) Midwest: 20% East: 37% $160,000 West: 4% $140,000 $130,221 $120,000 $100,000 South: 39% $80,000 $68,610 Property Type by Investment $60,000 (based on book value of loans held for investment as of March 31, 2020) LOAN PORTFOLIO DIVERSIFICATION $37,199 $40,000 Retail $22,204 $20,000 $14,000 Industrial: 18% $0 Office: 31% 2020 2021 2022 2023 2024 2025 Multifamily: 25% Hotel: 9% Retail: 17% Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 16

INTEREST RATE SENSITIVITY (dollars in thousands) $3,000 t e N , $2,000 s t n e m t s e v $1,000 n I m o r f e m $0 o c n I l a u n n -$1,000 A l a t n e m e r c -$2,000 n I INTEREST RATE SENSITIVITY INTEREST RATE -$3,000 (0.86%) (0.50%) 0.50% 1.00% Change in USD LIBOR The interest income on our loans held for investment and the interest expense on our borrowings float with LIBOR. Because we generally lever approximately 75% of our investments, as LIBOR increases, our income from investments, net of interest and related expenses, will increase, and, as LIBOR decreases, our income from investments, net of interest and related expenses, will decrease. However, we have interest rate floor provisions in our loan agreements with borrowers which set a minimum LIBOR rate for each loan. Based on our loan portfolio at March 31, 2020, our weighted average LIBOR floor was 2.11% compared to a LIBOR rate of 0.86% used at the time of this analysis. We do not currently have a LIBOR floor provision in our master repurchase agreement. As a result, if LIBOR decreases below the floor established for any of our investments, our income from investments will decrease less than our borrowing costs and the net amount may result in an increase in our net investment income. The above table illustrates the incremental impact on our annual income from investments, net, due to increases and decreases in LIBOR of 50 basis points and 100 basis points taking into consideration our borrowers’ interest rate floors as of March 31, 2020. The 100-basis point decrease in LIBOR used in the analysis above has been limited in that analysis to 0.86% to result in a LIBOR rate of 0.00%. The results in the table above are based on our loan portfolio and debt outstanding at March 31, 2020. Any changes to the mix of our investments or debt outstanding could impact the interest rate sensitivity analysis and this illustration is not meant to forecast future results. LIBOR is currently expected to be phased out in 2021. We currently expect that the determination of interest under the agreements governing our loans held for investment and our master repurchase agreement would be revised as provided under such agreements or amended as necessary to provide for an interest rate that approximates the existing interest rate as calculated in accordance with LIBOR. Despite our current expectations, we cannot be sure that, if LIBOR is phased out or transitioned, the changes to the determination of interest under such agreements would approximate the current calculation in accordance with LIBOR. We do not know what standard, if any, will replace LIBOR if it is phased out or transitioned. Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 17

CAPITAL STRUCTURE OVERVIEW (amounts in thousands) Capital Structure Composition Leverage Capacity (as of March 31, 2020) (as of March 31, 2020) $250,000 $200,000 $17,138 Equity: 30% $150,000 $100,000 $196,344 $50,000 Master Repurchase Facility: 70% $0 Master Repurchase Facility Advanced Unused Capacity CAPITAL STRUCTURE OVERVIEW CAPITAL Outstanding Debt to Funded Investments Capital Structure Detail (as of March 31, 2020) (as of March 31, 2020) $300,000 $272,234 Initial $250,000 Maximum Coupon Maturity Principal Secured Financing Facility Size Rate (1) Date Balance $196,344 Master Repurchase Facility $ 213,482 L + 2.00% 11/06/2021 $ 196,344 $200,000 Book Value per Common Share $150,000 Shareholders’ equity $ 86,032 Total outstanding common shares 8,239 $100,000 Book value per common share $ 10.44 $50,000 (1) Weighted average rate based on outstanding principal balances as of March 31, 2020. $0 Investments Master Repurchase Facility Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 18

WARNING CONCERNING FORWARD-LOOKING STATEMENTS This supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Also, whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward- looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. This presentation indicates that we have implemented a cash sweep on a borrower’s accounts in order to collect future interest payments. This may protect us against investment losses by mitigating the impact from the borrower being unable to pay debt service obligations as scheduled for a temporary period. However, this risk mitigation mechanism may not adequately cover the debt service obligations and will likely not be able to fully fund the debt service obligations if the tenants’ businesses fail or the borrower is unable to remedy the default. The information contained in our filings with the SEC, including under “Risk Factors” in our periodic reports, or incorporated therein, identifies important factors that could cause our actual results to differ materially from those stated in or implied by our forward-looking statements. Our filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. WARNING CONCERNING FORWARD-LOOKING STATEMENTS CONCERNING FORWARD-LOOKING WARNING Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 19

NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS Non-GAAP Financial Measures: We present Core Earnings, which is considered a “non-GAAP financial measure” within the meaning of the applicable SEC rules. Core Earnings does not represent net income or cash generated from operating activities and should not be considered as an alternative to net income determined in accordance with GAAP or an indication of our cash flows from operations determined in accordance with GAAP, a measure of our liquidity or operating performance or an indication of funds available for our cash needs. In addition, our methodology for calculating Core Earnings may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures; therefore, our reported Core Earnings may not be comparable to the core earnings as reported by other companies. We believe that Core Earnings provides meaningful information to consider in addition to net income and cash flows from operating activities determined in accordance with GAAP. This measure helps us to evaluate our performance excluding the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations. In addition, Core Earnings is used in determining the amount of base management and incentive fees payable by us to our Manager under our management agreement. Core Earnings We calculate Core Earnings as net income, computed in accordance with GAAP, including realized losses not otherwise included in net income determined in accordance with GAAP, and excluding: (a) the incentive fees earned by our Manager (if any); (b) depreciation and amortization (if any); (c) non-cash equity compensation expense; (d) unrealized gains, losses and other similar non-cash items that are included in net income for the period of the calculation (regardless of whether such items are included in or deducted from net income or in other comprehensive income under GAAP) (if any); and (e) one-time events pursuant to changes in GAAP and certain non-cash items (if any). Other Measures: All in yield: All in yield is inclusive of the amortization of deferred fees over the initial term of the loan. Maximum Maturity: Maximum maturity assumes all extension options are exercised, which options are subject to the borrower meeting certain conditions. LTV: Loan to Value Ratio, or LTV, represents the initial loan amount divided by the underwritten in place value at closing. Net Debt: Principal balance of debt less cash. NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS AND CERTAIN MEASURES FINANCIAL NON-GAAP Tremont Mortgage Trust ConfidentialSupplemental Operating and Financial Data, March 31, 2020 20