Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KLX Energy Services Holdings, Inc. | tm2016623d3_ex99-1.htm |

| EX-10.3 - EXHIBIT 10.3 - KLX Energy Services Holdings, Inc. | tm2016623d3_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - KLX Energy Services Holdings, Inc. | tm2016623d3_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - KLX Energy Services Holdings, Inc. | tm2016623d3_ex10-1.htm |

| EX-3.1 - EXHIBIT 3.1 - KLX Energy Services Holdings, Inc. | tm2016623d3_ex3-1.htm |

| EX-2.1 - EXHIBIT 2.1 - KLX Energy Services Holdings, Inc. | tm2016623d3_ex2-1.htm |

| 8-K - FORM 8-K - KLX Energy Services Holdings, Inc. | tm2016623-3_8k.htm |

Exhibit 99.2

1 Merger of KLX Energy Services and Quintana Energy Services May 4, 2020

2 Cautionary Statement on Forward - Looking Statements This communication contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amend ed, and Section 21E of the Exchange Act. Some of these forward - looking statements can be identified by the use of forward - looking words such as “believes,” “expects,” “may,” “will,” “ should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “projects,” “strategy,” or “anticipates,” or the negative of those words or other comparable terminology. Such forward - looking s tatements, including those regarding the timing and consummation of the proposed transaction described herein, involve risks and uncertainties. The actual experience and results of KLX Energ y S ervices Holdings, Inc. (“KLXE”) and Quintana Energy Services Inc. (“QES”) may differ materially from the experience and results anticipated in such statements. The accuracy of such state men ts is subject to a number of risks, uncertainties and assumptions including, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals from the stockholders of KLXE or QES for the transaction are not obtained; (2) litigation relating to the transaction; (3) uncertainti es as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operation s o f KLXE or QES; (5) the ability of KLXE and QES to retain and hire key personnel; (6) competitive responses to the proposed transaction; (7) unexpected costs, charges or expenses resultin g f rom the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) the combined companies’ abili ty to achieve the synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; and (10) legislat ive , regulatory and economic developments. Other factors that might cause such a difference include those discussed in KLXE’s and QES’s filings with the Securities and Exchange Commission (“ SEC”), which include its Annual Report on Form 10 - K and Current Reports on Form 8 - K and in the joint proxy statement/prospectus on Form S - 4 to be filed in connection with the proposed transactions. For more information, see sections entitled “Risk Factors” and “Forward - Looking Statements” contained in KLXE’s and QES’s Annual Reports on Form 10 - K and in other filings. The fo rward - looking statements included in this communication are made only as of the date hereof and, except as required by federal securities laws and rules and regulations of the SEC, KLX E and QES undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Additional Information In connection with the proposed transaction between KLXE and QES, KLXE and QES will file with the Securities and Exchange Com mis sion (the “SEC”) a joint proxy statement. KLXE will also file with the SEC a registration statement with respect to the issuance of KLXE shares in connection with the proposed transa cti on with QES. KLXE AND QES SHAREHOLDERS ARE ENCOURAGED TO READ THE JOINT PROXY STATEMENT PROSPECTUS AND THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECA USE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be a ble to obtain the documents free of charge at the SEC’s website, www.sec.gov , from KLXE at its website, www.klxenergy.com , from QES at its website, www.quintanaenergyservices.com , or by contacting KLX Investor Relations at (561) 791 - 5403 and QES Investor Relations at 832 - 594 - 4004. Participants in Solicitation KLXE, QES and their respective directors and executive officers may be deemed to be participants in the solicitation of proxi es in respect of the proposed transaction. Information about these persons, including a description of their direct interests, by security holdings or otherwise, is set forth in KLXE’s Annual Rep ort on Form 10 - K for the fiscal year ended January 31, 2020 and its Definitive Proxy Statement on Form Def 14A filed on May 30, 2019, and QES’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2019 and its Definitive Proxy Statement on Form Def 14A filed on March 27, 2020, all of which are filed with the SEC. Other information regarding the participants in th e p roxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant ma ter ials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes a vai lable before making any voting or investment decisions. You may obtain free copies of these documents from KLXE or QES using the sources indicated above. Disclaimer and Forward Looking Statements

3 • KLX Energy Services Holdings, Inc. ("KLXE") (NASDAQ: KLXE) and Quintana Energy Services Inc. ("QES") (NYSE: QES) today announced that they have entered into a definitive agreement to combine in an all - stock merger transaction • The merger will create a leading provider of production, completion and drilling solutions across all major U.S. basins • The combined company’s broad suite of asset - light products and services includes fishing and rental, thru - tubing, pressure contr ol, down hole completion tools, drilling motors, flowback and testing services and well control, and is supported by a significan t a nd growing portfolio of proprietary technologies • Creates foremost and most modern large - diameter coiled tubing fleet in the U.S. as well as one of the largest fleets of wireline units • As previously announced, QES’s legacy capital - intensive frac business will be idled; the vast majority of the pressure pumping equipment will be repurposed primarily to support the coiled tubing and wireline fleets and other Product Service Lines (“PSLs”) of the combined company in a manner which results in competitive advantages and revenue gain • The combined company expects to generate significant annualized cost synergies of at least $40 million within 12 months, whic h include substantial savings from the closure of KLXE’s corporate headquarters in Wellington, Florida and the combination of b oth companies’ Houston headquarters • On a pro - forma basis, the combined company would have 2019 revenues and adjusted EBITDA¹ of approximately $1 billion and $146 million, respectively, inclusive of an estimated $40 million of annualized cost synergies • Strong liquidity profile with $118 million in cash¹ and a $100 million undrawn revolving credit facility • The combined company will retain the KLX Energy Services corporate name, listing will remain on the NASDAQ under the ticker KLXE, and the corporate headquarters will move to Houston, Texas Industry - Leading Provider of Asset - Light Oilfield Solutions Combination Expected to Deliver Meaningful Cost Synergies of at Least $40 million on an Annualized Basis 1 Based on respective 2019 fiscal year end for KLXE (January 2020 FYE) and QES (Dec 2019 FYE); cash balance is presented net of th e repayment of the QES credit facility

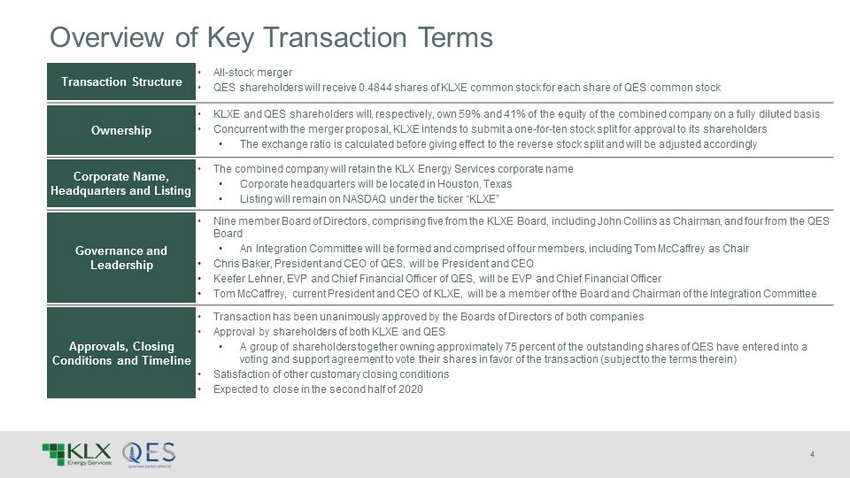

4 Overview of Key Transaction Terms Transaction Structure • All - stock merger • QES shareholders will receive 0.4844 shares of KLXE common stock for each share of QES common stock Ownership • KLXE and QES shareholders will, respectively, own 59% and 41% of the equity of the combined company on a fully diluted basis • Concurrent with the merger proposal, KLXE intends to submit a one - for - ten stock split for approval to its shareholders • The exchange ratio is calculated before giving effect to the reverse stock split and will be adjusted accordingly Corporate Name, Headquarters and Listing • The combined company will retain the KLX Energy Services corporate name • Corporate headquarters will be located in Houston, Texas • Listing will remain on NASDAQ under the ticker “KLXE” Governance and Leadership • Nine member Board of Directors, comprising five from the KLXE Board, including John Collins as Chairman, and four from the QES Board • An Integration Committee will be formed and comprised of four members, including Tom McCaffrey as Chair • Chris Baker, President and CEO of QES, will be President and CEO • Keefer Lehner, EVP and Chief Financial Officer of QES, will be EVP and Chief Financial Officer • Tom McCaffrey, current President and CEO of KLXE, will be a member of the Board and Chairman of the Integration Committee Approvals, Closing Conditions and Timeline • Transaction has been unanimously approved by the Boards of Directors of both companies • Approval by shareholders of both KLXE and QES • A group of shareholders together owning approximately 75 percent of the outstanding shares of QES have entered into a voting and support agreement to vote their shares in favor of the transaction (subject to the terms therein) • Satisfaction of other customary closing conditions • Expected to close in the second half of 2020

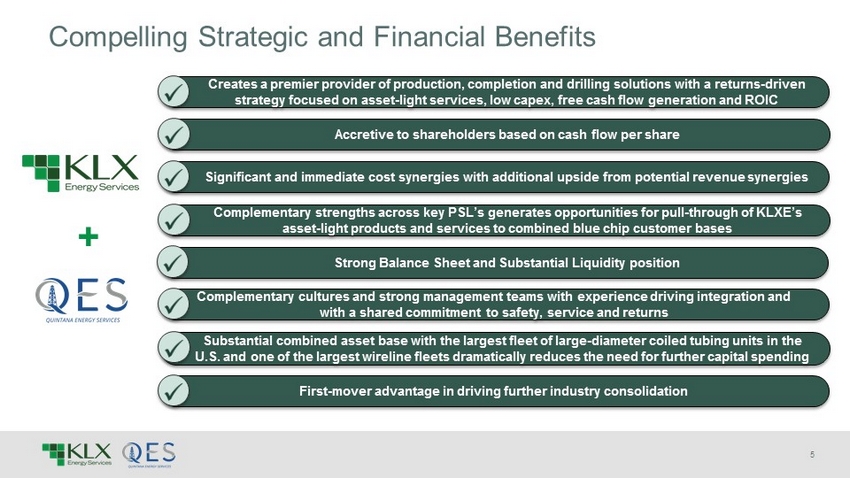

5 Compelling Strategic and Financial Benefits + Creates a premier provider of production, completion and drilling solutions with a returns - driven strategy focused on asset - light services, low capex, free cash flow generation and ROIC Substantial combined asset base with the largest fleet of large - diameter coiled tubing units in the U.S. and one of the largest wireline fleets dramatically reduces the need for further capital spending Strong Balance Sheet and Substantial Liquidity position Complementary strengths across key PSL’s generates opportunities for pull - through of KLXE’s asset - light products and services to combined blue chip customer bases First - mover advantage in driving further industry consolidation Complementary cultures and strong management teams with experience driving integration and with a shared commitment to safety, service and returns Accretive to shareholders based on cash flow per share Significant and immediate cost synergies with additional upside from potential revenue synergies

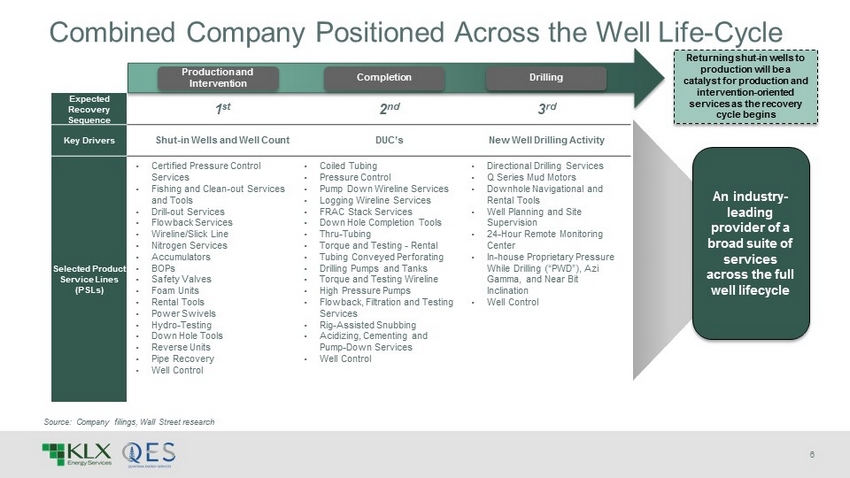

6 Combined Company Positioned Across the Well Life - Cycle Expected Recovery Sequence 1 st 2 nd 3 rd Key Drivers Shut - in Wells and Well Count DUC’s New Well Drilling Activity Selected Product Service Lines (PSLs) • Certified Pressure Control Services • Fishing and Clean - out Services and Tools • Drill - out Services • Flowback Services • Wireline/Slick Line • Nitrogen Services • Accumulators • BOPs • Safety Valves • Foam Units • Rental Tools • Power Swivels • Hydro - Testing • Down Hole Tools • Reverse Units • Pipe Recovery • Well Control • Coiled Tubing • Pressure Control • Pump Down Wireline Services • Logging Wireline Services • FRAC Stack Services • Down Hole Completion Tools • Thru - Tubing • Torque and Testing - Rental • Tubing Conveyed Perforating • Drilling Pumps and Tanks • Torque and Testing Wireline • High Pressure Pumps • Flowback, Filtration and Testing Services • Rig - Assisted Snubbing • Acidizing, Cementing and P ump - Down Services • Well Control • Directional Drilling Services • Q Series Mud Motors • Downhole Navigational and Rental Tools • Well Planning and Site Supervision • 24 - Hour Remote Monitoring Center • In - house Proprietary Pressure While Drilling (“PWD”), Azi Gamma, and Near Bit Inclination • Well Control Source: Company filings, Wall Street research An industry - leading provider of a broad suite of services across the full well lifecycle Production and Intervention Completion Drilling Returning shut - in wells to production will be a catalyst for production and intervention - oriented services as the recovery cycle begins

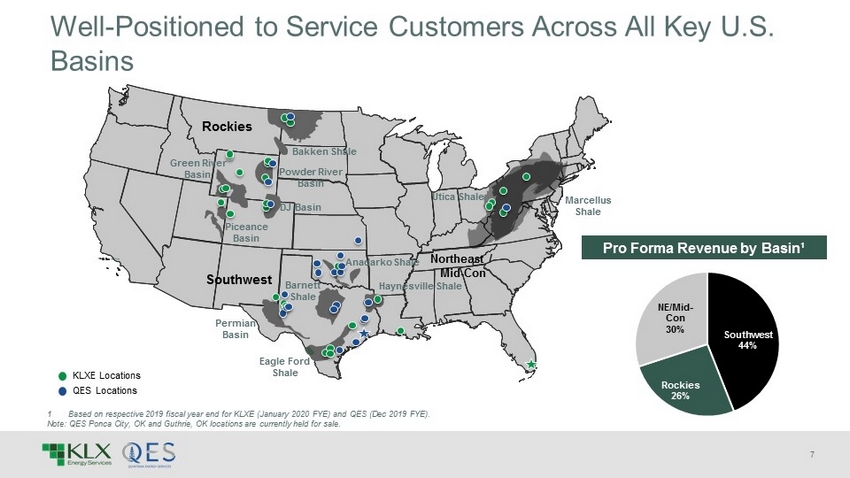

7 Well - Positioned to Service Customers Across All Key U.S. Basins Bakken Shale Permian Basin Haynesville Shale Utica Shale Marcellus Shale Northeast / Mid - Con Southwest Rockies Powder River Basin DJ Basin Piceance Basin Eagle Ford Shale KLXE Locations QES Locations 1 Based on respective 2019 fiscal year end for KLXE (January 2020 FYE) and QES (Dec 2019 FYE). Note: QES Ponca City, OK and Guthrie, OK locations are currently held for sale. Pro Forma Revenue by Basin¹ Southwest 44% Rockies 26% NE/Mid - Con 30% Green River Basin Barnett Shale Anadarko Shale

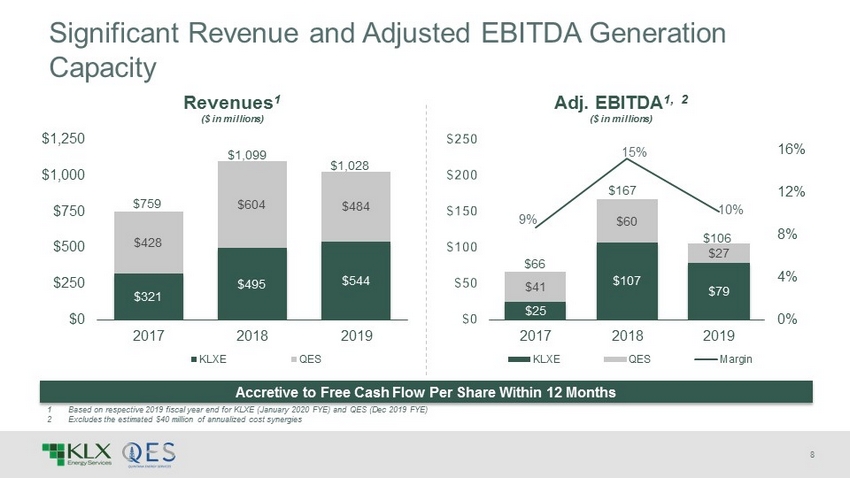

8 $25 $107 $79 $41 $60 $27 9% 15% 10% 0% 4% 8% 12% 16% 2017 2018 2019 Adj. EBITDA 1, 2 ($ in millions) KLXE QES Margin $106 $167 $66 Significant Revenue and Adjusted EBITDA Generation Capacity $321 $495 $544 $428 $604 $484 $0 $250 $500 $750 $1,000 $1,250 2017 2018 2019 Revenues 1 ($ in millions) KLXE QES $1,028 $1,099 $759 1 Based on respective 2019 fiscal year end for KLXE (January 2020 FYE) and QES (Dec 2019 FYE) 2 Excludes the estimated $40 million of annualized cost synergies Accretive to Free Cash Flow Per Share Within 12 Months

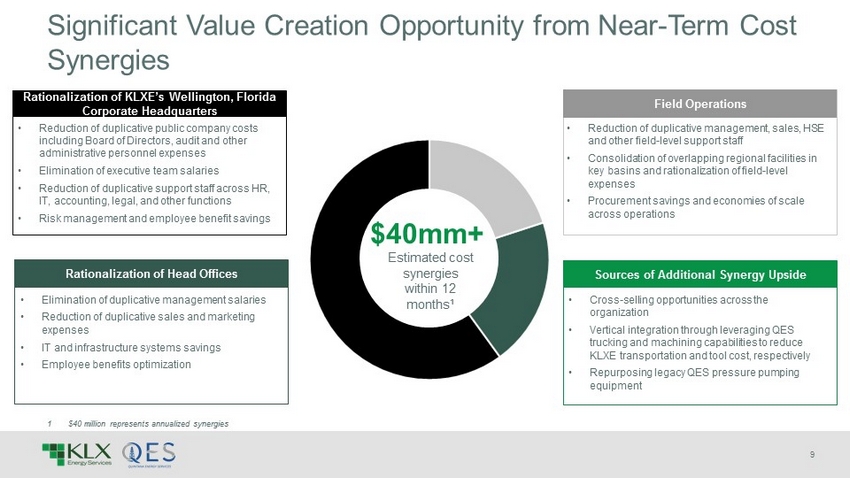

9 Significant Value Creation Opportunity from Near - Term Cost Synergies 1 $40 million represents annualized synergies Rationalization of KLXE’s Wellington, Florida Corporate Headquarters • Cross - selling opportunities across the organization • Vertical integration through leveraging QES trucking and machining capabilities to reduce KLXE transportation and tool cost, respectively • Repurposing legacy QES pressure pumping equipment Rationalization of Head Offices • Elimination of duplicative management salaries • Reduction of duplicative sales and marketing expenses • IT and infrastructure systems savings • Employee benefits optimization Field Operations • Reduction of duplicative management, sales, HSE and other field - level support staff • Consolidation of overlapping regional facilities in key basins and rationalization of field - level expenses • Procurement savings and economies of scale across operations Sources of Additional Synergy Upside $40mm+ Estimated cost synergies within 12 months¹ • Reduction of duplicative public company costs including Board of Directors, audit and other administrative personnel expenses • Elimination of executive team salaries • Reduction of duplicative support staff across HR, IT, accounting, legal, and other functions • Risk management and employee benefit savings

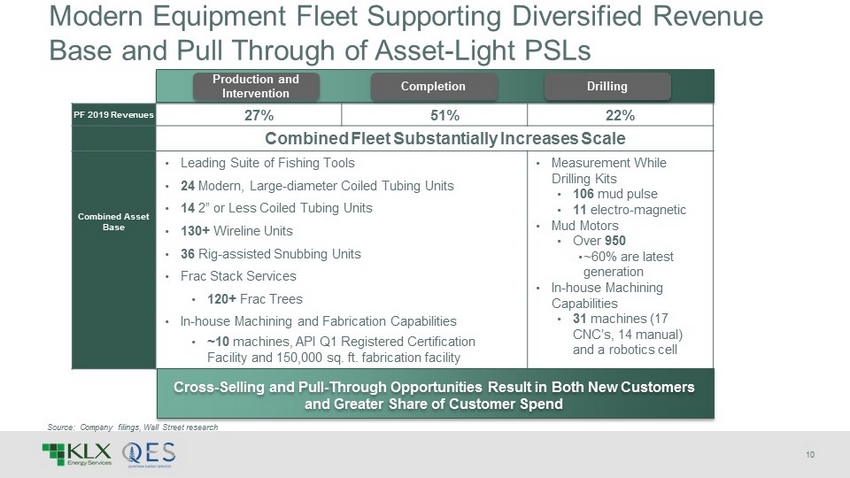

10 Modern Equipment Fleet Supporting Diversified Revenue Base and Pull Through of Asset - Light PSLs PF 2019 Revenues 27% 51% 22% Combined Fleet Substantially Increases Scale Combined Asset Base • Leading Suite of Fishing Tools • 24 Modern, Large - diameter Coiled Tubing Units • 14 2” or Less Coiled Tubing Units • 130+ Wireline Units • 36 Rig - assisted Snubbing Units • Frac Stack Services • 120+ Frac Trees • In - house Machining and Fabrication Capabilities • ~10 machines, API Q1 Registered Certification Facility and 150,000 sq. ft. fabrication facility • Measurement While Drilling Kits • 106 mud pulse • 11 electro - magnetic • Mud Motors • Over 950 • ~60% are latest generation • In - house Machining Capabilities • 31 machines (17 CNC’s, 14 manual) and a robotics cell Source: Company filings, Wall Street research Production and Intervention Completion Drilling Cross - Selling and Pull - Through Opportunities Result in Both New Customers and Greater Share of Customer Spend

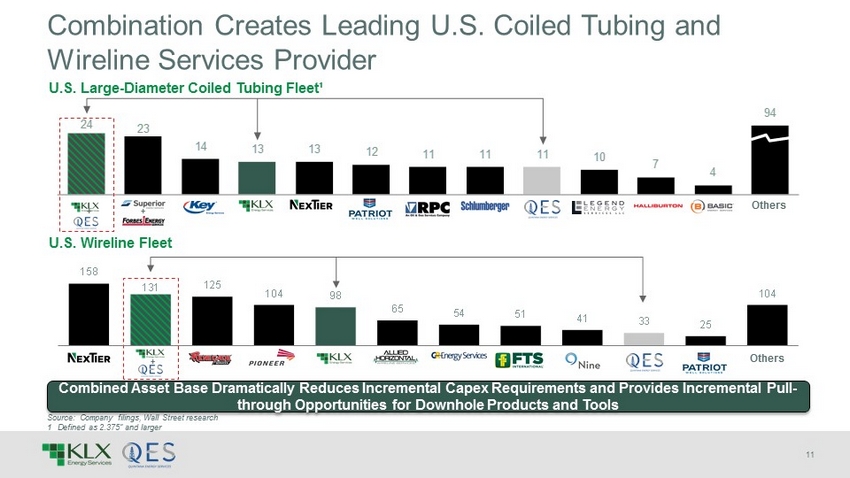

11 Combination Creates Leading U.S. Coiled Tubing and Wireline Services Provider Source: Company filings, Wall Street research 1 Defined as 2.375” and larger Others + U.S. Wireline Fleet 158 131 125 104 98 65 54 51 41 33 25 104 Combined Asset Base Dramatically Reduces Incremental Capex Requirements and Provides Incremental Pull - through Opportunities for Downhole Products and Tools 24 23 14 13 13 12 11 11 11 10 7 4 94 Others + + U.S. Large - Diameter Coiled Tubing Fleet¹

12 • Strong, long - standing relationships with Blue Chip customers across key U.S. basins and PSLs • More than 1,000 customers served on a pro forma basis • No customer comprises greater than 10% of pro forma revenue High Quality and Broad Customer Base with Substantial Cross - Selling Opportunities Combined Customer Relationships

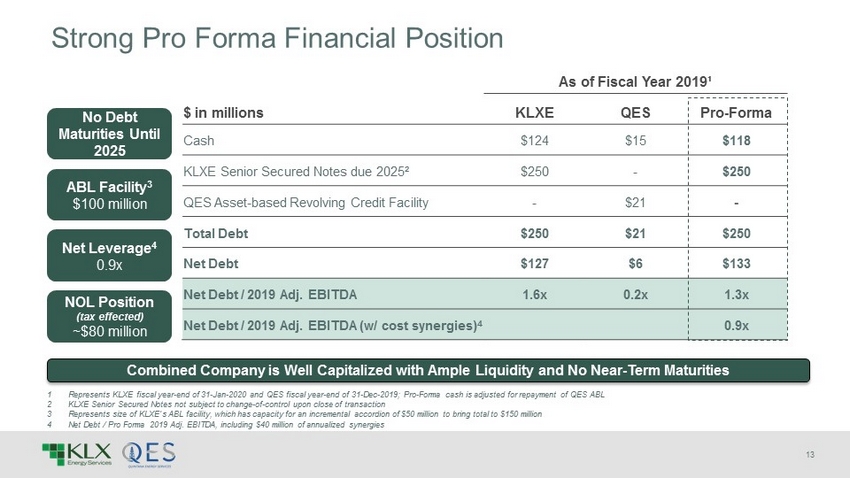

13 Strong Pro Forma Financial Position 1 Represents KLXE fiscal year - end of 31 - Jan - 2020 and QES fiscal year - end of 31 - Dec - 2019; Pro - Forma cash is adjusted for repayment of QES ABL 2 KLXE Senior Secured Notes not subject to change - of - control upon close of transaction 3 Represents size of KLXE’s ABL facility, which has capacity for an incremental accordion of $50 million to bring total to $150 mi llion 4 Net Debt / Pro Forma 2019 Adj. EBITDA, including $40 million of annualized synergies As of Fiscal Year 2019 ¹ $ in millions KLXE QES Pro - Forma Cash $124 $15 $118 KLXE Senior Secured Notes due 2025² $250 - $250 QES Asset - based Revolving Credit Facility - $21 - Total Debt $250 $21 $250 Net Debt $127 $6 $133 Net Debt / 2019 Adj. EBITDA 1.6x 0.2x 1.3x Net Debt / 2019 Adj. EBITDA (w/ cost synergies) 4 0.9x No Debt Maturities Until 2025 Net Leverage 4 0.9x NOL Position (tax effected) ~$80 million ABL Facility 3 $100 million Combined Company is Well Capitalized with Ample Liquidity and No Near - Term Maturities

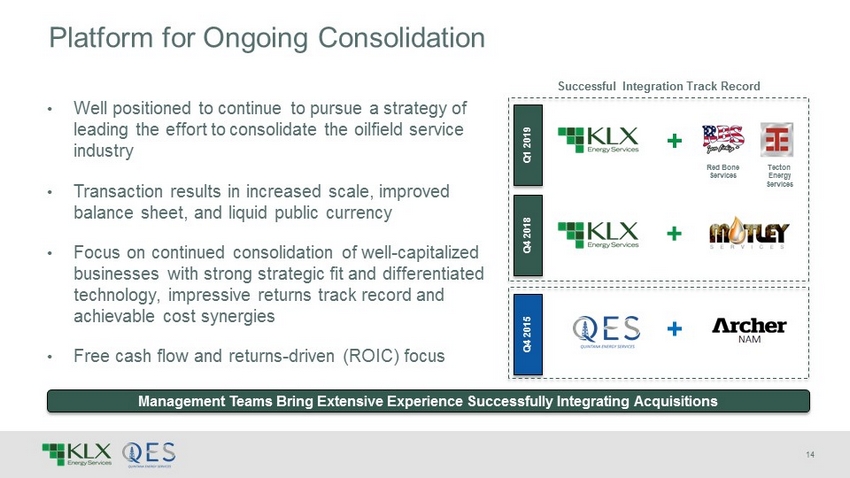

14 • Well positioned to continue to pursue a strategy of leading the effort to consolidate the oilfield service industry • Transaction results in increased scale, improved balance sheet, and liquid public currency • Focus on continued consolidation of well - capitalized businesses with strong strategic fit and differentiated technology, impressive returns track record and achievable cost synergies • Free cash flow and returns - driven (ROIC) focus x Consolidation is key to remain cost - competitive Platform for Ongoing Consolidation + + Tecton Energy Services Management Teams Bring Extensive Experience Successfully Integrating Acquisitions Q1 2019 Q4 2018 Q4 2015 Red Bone Services + Successful Integration Track Record