Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Customers Bancorp, Inc. | cubi-20200504.htm |

| EX-99.1 - EX-99.1 - Customers Bancorp, Inc. | q120pressrelease.htm |

First Quarter 2020 Earnings Conference Call May 4, 2020 NYSE: CUBI

Protecting Our Customers, Communities and Team Team Members Consumers Businesses Communities • 85% of our team • 24/7 Customer Care • Over $5 billion(1) in loans • Customers Bank made members are working Center; mobile app and for small businesses in numerous financial remotely with minimal online banking available the SBA’s Paycheck contributions, including disruption to clients • All drive-in window Protection Program over $1,000,000 of • Special pay service available with • Attracted over 1,000 direct or indirect considerations, bonuses, appointment banking new business checking donations for urgent additional PTO for for in lobby service customers through PPP COVID-19 basic needs essential front line and • Customer Relief offering alone • Volunteering and other support workers Program • Proactively contacted all additional retargeting of existing sponsorship and • No furloughs Under 5%(1) of commercial clients o grants to nonprofits to • Zero-interest loans up to Consumer loan Under 8%(1) of o support COVID-19 $2,500 are available to customers in Commercial loan related activities assist team members deferment customers in and their families facing deferment • Conducted webinar for o Increased deposit unforeseen challenges limits; waiving • Established or expanded entire business due to COVID-19 penalties for early high quality community on how to • Established a hotline for CD withdrawals relationships with “Survive & Thrive” team members to call businesses in segments • Represented community o Waiving or reducing for assistance of any certain fees that are not adversely banks’ perspective on kind for their families impacted the crisis on CNBC o Not reporting payment deferrals to credit bureaus (1) Estimated as of May 2, 2020 2

Serving Our Customers Paycheck Protection Loan Modifications Customer Assistance Program • Committed to helping small • Developed a programmatic • Most branches remain open to businesses, not for profits and deferred payment initiative to serve our customers, in addition communities, Customers has proactively assist borrowers to available mobile and online expanded its platform to issue directly impacted by COVID-19 banking services as many loans as possible • 3,791 (3,495 Consumer / 296 • Actively engaged with clients to • Developed partnerships with Commercial)(2) of customers understand their situation and several fintech platforms to requested relief to minimize credit deterioration expand capacity • Relief Represents 5.6% of • No material changes in • Over 75,000(1) loans originated Portfolio (5.1% Consumer / delinquencies as a result for over $5 billion(1) 7.9% all Commercial)(2) • Average loan size less than • C&I loans deferred are only $75,000(1) 1.7%(2) • Expect to add ~$85 million in revenue from origination alone(1) • Expect ability to assist further if program is expanded (1) Estimated as of May 2, 2020 3 (2) As of April 24, 2020

First Quarter 2020 Highlights EarningsEarnings Deposits • $7.0 million GAAP earnings in Q1 2020, EPS $0.22 • Total deposits up 13% over last year • $38.6 million adjusted PPNR(1) • Demand deposits up 38% over last year • Adjusted PPNR up $13.3 million or 53% over 1Q19 (3) • $23.1 million provision in Q1 2020(2) Capital Ratios* Ratios • Capital ratios significantly in excess of “well capitalized” AssetAsset Quality Quality at 3/31/2020at 3/31/2020 thresholds • $100.4 million reserve build since 12/31/2019 • CET1: 10.7% • Reserves 2.1% of loans held for investment, up from 0.8% • Tier 1 Risk Based Capital: 10.7% at 12/31/2019 • Total Risk Based Capital: 12.3% • Reserves equal 6.4% of other consumer loans • Tier 1 Leverage: 10.1% • Reserves equal 242% of NPLs • NPL 0.61% of total loans and leases Tangible Book Book Value Value at 3/31/2020 • Tangible book value (Excluding CECL)(4) LoanLoan Portfolio Portfolio o $806 million ($25.60/Share) • Loan balances grew 18% over last year, and portfolio well diversified • C&I loans (including CRE owner occupied) up 29% over last TradingTrading Multiples Multiples as of 3/31/2020 year • 0.43x Price to Tangible Book • Multi-family down 36% over last year • C&I loans (including loans to mortgage companies) made up 50% of total loans • CRE (including multi-family) 33% of total loans (1) Adjusted Pre-Tax Pre-Provision Net Income (“adjusted PPNR”) is a non-GAAP measure • Other Consumer 13% of total loans (2) Includes loans & leases and unfunded commitments • Mortgages & manufactured housing 4% of total loans (3) Customers Bank capital ratios are estimated for Q1 2020 (4) Tangible book value excludes the impact of CECL, a non-GAAP measure • No subprime loans in the portfolio (Reconciliation in Appendix) 4

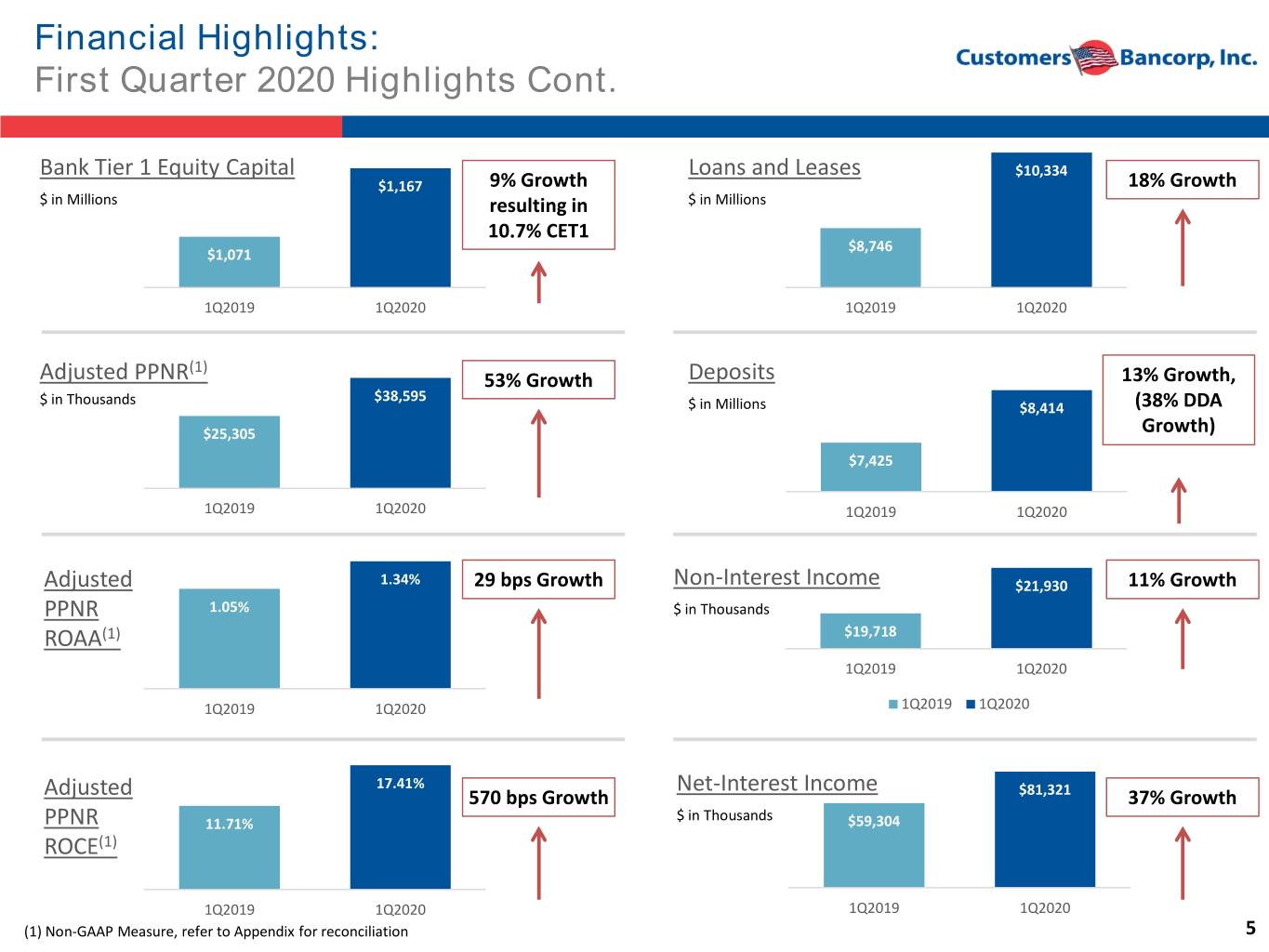

Financial Highlights: First Quarter 2020 Highlights Cont. Bank Tier 1 Equity Capital Loans and Leases $10,334 $1,167 9% Growth 18% Growth $ in Millions resulting in $ in Millions 10.7% CET1 $8,746 $1,071 1Q2019 1Q2020 1Q2019 1Q2020 (1) Adjusted PPNR 53% Growth Deposits 13% Growth, $ in Thousands $38,595 $ in Millions $8,414 (38% DDA $25,305 Growth) $7,425 1Q2019 1Q2020 1Q2019 1Q2020 Adjusted 1.34% 29 bps Growth Non-Interest Income $21,930 11% Growth PPNR 1.05% $ in Thousands ROAA(1) $19,718 1Q2019 1Q2020 1Q2019 1Q2020 1Q2019 1Q2020 17.41% Net-Interest Income Adjusted 570 bps Growth $81,321 37% Growth $ in Thousands PPNR 11.71% $59,304 ROCE(1) 1Q2019 1Q2020 1Q2019 1Q2020 (1) Non-GAAP Measure, refer to Appendix for reconciliation 5

Tangible Book Value (1) Tangible Book Value Per Share TBV/Share(1) 8.6% CAGR $25.60 $36.48 Stock Price(2) $10.93 $26.78 $26.10 $23.81 Value Proposition $17.95 Trading at 43% of TBV $10.93 Highlights: • Significant discount to TBV provides potential $18.39 $20.49 $21.90 $23.32 $26.17 $25.60 upside based on peer YE2015 YE2016 YE2017 YE2018 YE2019 1Q2020 trading levels TBV/Share CUBI Stock Price (1) Tangible book value excludes the initial impact of CECL, a non-GAAP measure (2) As of March 31, 2020 6

Our Top 5 Risk Management Priorities

Our Top 5 Risk Management Priorities Portfolio Management & • Conservative underwriting • Conservative reserving Maintaining Superior Asset • Active portfolio management Quality • Operating in pre-recessionary environment since 2019 • Q1 2020 margin(1) expanded 40 bps compared to Q1 2019 Preserving & Expanding • Margin(1) up 10 bps in Q1 2020 Margin • Margin expected to be above 3.0% for 2020 • Active management and pricing discipline for loans, deposits and borrowings • Strong DDA and core deposit growth • Loans and leases held for investment to deposit ratio 87.5% Strong Liquidity • $3.2 billion of average assets extremely liquid in Q1 2020 • Will not redeem preferred stock as it becomes callable in 2020 • Added $100 million to bank capital, $25 million in Q3 2019 and $75 million in Capital Management Q4 2019 • PPP initiatives will add about $85 million pre-tax to equity capital • Both bank and holding company well above “well capitalized” status • Adjusted PPNR(2) continues to show above average growth, with expanding Maintaining and margin Improving Profitability • Core ROA target of 1.25% and Core ROE of 12% in 2-3 years • Focused on $6 in core EPS with 5-6 years (1) Net Interest margin, taxable equivalent (“margin”) is a non-GAAP measure, refer to Appendix for reconciliation 8 (2) A non-GAAP Measure, refer to Appendix for reconciliation

1) Portfolio Management & Maintaining Superior Asset Quality

Portfolio Management: Details of Portfolio / Asset Quality • $2.6 billion total outstanding for 1Q 2020, Up 29% over last year C&I Loans(1) • Middle market and business banking $1.5 billion total • Specialty Lending $677 million • Equipment Finance $364 million Avg Yield 4.7% • $1.8 billion average outstanding for 1Q 2020, Up 46% over last year Loans to Mortgage • 55 high quality mortgage company clients Companies • Top 10 lenders in the US • $573 million in non interest-bearing deposits at 3/31/2020 Avg Yield 3.8% • Annualized fees 30 bps of outstanding balance Commercial Real Estate • Total outstanding (including multi-family) $3.5 billion, down 21% YoY • CRE non owner occupied $1.4 billion Loans • Multi-family $2.1 billion, down 36% YoY Avg Yield 4.4% • Other Consumer including, Personal, Home Improvement and Student Refinancing outstanding $1.3 billion Consumer Loans • Other Consumer loan average FICO ~750 • No subprime loans • Residential mortgage $339 million Avg Yield 7.8% • Total of $713 million Investment Securities • Average life of 5.38 years Avg Yield 3.5% • Agency backed MBS, high quality investment grade corporate bonds and municipals (1) Includes CRE owner-occupied 10

Portfolio Management: Commercial Loan Portfolio Commercial Loans Highlights: 8.8% Annual Growth • Customers is a Business Bank with “relationship banking” strategy, being executed through the “single point of $8,929 $8,585 $8,435 $8,419 contact” model $7,887 $2,549 $2,573 $2,054 $2,306 • Very experienced and seasoned teams $1,535 executing strategy • Business Banking conducted principally from $3,209 $3,014 $2,798 $2,390 $2,069 New England to Northern Virginia markets, 4.5% 4.5% 4.5% along the I-95 corridor 4.3% 4.2% • LPOs in Boston, Providence, New York, $1,383 Philadelphia and Chicago $1,329 $1,342 $1,237 $1,162 • Middle market lending supported by $2,560 $2,253 $2,382 Specialty Finance, Commercial Finance and $1,982 $2,130 SBA teams in all markets • Mortgage Warehouse is a national business 1Q2019 2Q2019 3Q2019 4Q2019 1Q2020 called “Banking to Mortgage Companies” C&I Investment CRE Multi-Family Loans Mortgage Warehouse • Centralized credit underwriting, supported with regional and specialized credit officers Note: Loan balances include deferred fees and costs 11

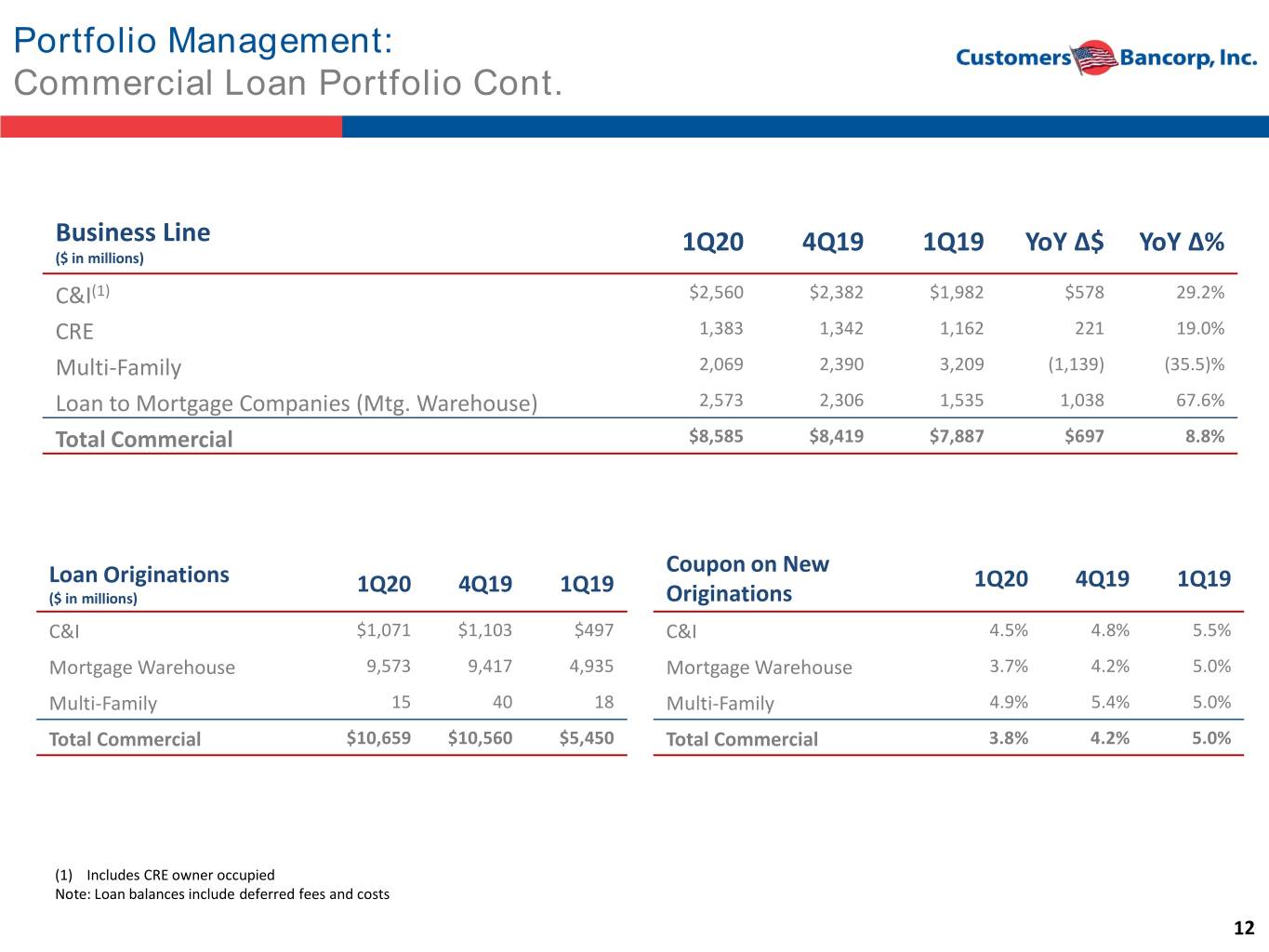

Portfolio Management: Commercial Loan Portfolio Cont. Business Line 1Q20 4Q19 1Q19 YoY ∆$ YoY ∆% ($ in millions) C&I(1) $2,560 $2,382 $1,982 $578 29.2% CRE 1,383 1,342 1,162 221 19.0% Multi-Family 2,069 2,390 3,209 (1,139) (35.5)% Loan to Mortgage Companies (Mtg. Warehouse) 2,573 2,306 1,535 1,038 67.6% Total Commercial $8,585 $8,419 $7,887 $697 8.8% Coupon on New Loan Originations 1Q20 4Q19 1Q19 1Q20 4Q19 1Q19 ($ in millions) Originations C&I $1,071 $1,103 $497 C&I 4.5% 4.8% 5.5% Mortgage Warehouse 9,573 9,417 4,935 Mortgage Warehouse 3.7% 4.2% 5.0% Multi-Family 15 40 18 Multi-Family 4.9% 5.4% 5.0% Total Commercial $10,659 $10,560 $5,450 Total Commercial 3.8% 4.2% 5.0% (1) Includes CRE owner occupied Note: Loan balances include deferred fees and costs 12

Portfolio Management: Our Efforts to Accommodate Deferment Requests C&I Loans • Maximum deferments of 90 days at a time • Customer information solicited prior to approval • Active portfolio management on a weekly/monthly basis • Use Main Street and SBA lending programs wherever possible to support cash needs CRE Loans • Maximum deferments allowed 90 days at a time • Customer information solicited prior to approval • Active portfolio management on a weekly/monthly basis • Use Main Street and SBA lending programs wherever possible to support cash needs Consumer Loans • Active weekly management with servicers • Deferments typically handled 30-90 days at a time • Minimum payment plans requested • Offering of deposit products through BankMobile to deepen relationship 13

Portfolio Management: Commercial Loan Deferments Deferments by Portfolio As of March 31, 2020 As of April 24, 2020 Total Outstanding Loan # Loan $ % Loan # Loan $ % ($ in millions) C&I Transportation 2 $1.7 0.00% 7 $17.0 0.81% Restaurants 1 $0.6 0.00% 9 $4.5 0.21% Middle Market 3 $3.1 0.15% 48 $13.6 0.65% Total C&I (1) 6 $5.4 0.40% 64 $35.1 1.67% CRE Multi-Family 7 $4.9 0.13% 59 $85.1 2.23% Hotels 1 $2.7 0.13% 18 $211.5 5.54% Office 0 $0.0 0.00% 18 $8.3 0.22% Retail 3 $1.2 0.00% 12 $4.7 0.12% Other(2) 21 $9.8 0.25% 125 $124.4 3.26% Total CRE(1) 32 $18.6 0.41% 232 $434.0 11.37% (1) Deferral $ amounts are total for deferred period (2) Includes 1-4 family investment property 14

Portfolio Management: Other Consumer Loan Exposure Breakdown FICO Score Debt to Income Ratios Borrower Income $103K Avg Income 744 Avg FICO Portfolio average DTI 3.4% 0% is 21.9% 7% 16% 15.8% 18% 16% 38% 39.7% 32% 41.0% 28% 43% 0-9.99% 10 – 19.99% 20 – 29.99% 750+ 700-749 660-699 <$49,999 $50K -$99,999 >$100K NA 30 – 39.99% 40 – 45% Geography Profession Purpose Well Diversified Insignificant exposure 4.2% to stressed professions 13.3% 20% 26.8% 40% 49.5% 24.6% 57.9% 9.1% 20% 5.8% 13% 7% 3.6% 2.1% 3.2% Professional Services HealthCare Debt Consolidation Solar & Home Improvement Education Government Northeast Central Southeast West All Other Specialty Student Refinancing Retired Self Employed 15 Other

Portfolio Management: Consumer Loan Portfolio Business Line ($ in millions) 1Q20 4Q19 1Q19 YoY ∆$ YoY ∆% Other Consumer >750 FICO $505 $469 $64 $442 n/a 700-749 FICO 571 511 58 513 n/a 660-699 FICO 238 194 22 216 n/a <660 FICO 0 0 0 0 n/a Total Other Consumer $1,315 $1,174 $144 $1,171 n/a Residential & Home Equity Mortgage $365 $386 $635 ($270) (42.5)% Manufactured Housing $69 $71 $79 ($10) (12.2)% Total Consumer $1,749 $1,632 $859 $891 103.8% 16

Portfolio Management: Consumer Loan Deferments Deferments by Portfolio As of March 31, 2020 As of April 24, 2020 Total Outstanding Loan # Loan $ % Loan # Loan $ % ($ in millions) Other Consumer FICO <750 1,267 $23.7 3.09% 2,558 $39.3 5.19% FICO >750 427 $11.2 2.42% 658 $12.3 2.70% Income > $75,000 959 $24.2 3.18% 1,548 $30.3 4.09% Income <$75,000 735 $10.7 2.29% 1,668 $21.3 4.53% Total Other Consumer (1) 1,694 $34.9 2.91% 3,216 $51.6 4.27% Mortgage Residential Mortgage 13 $1.4 0.43% 103 $23.1 7.04% Modular / Modular Housing 63 $3.4 4.85% 176 $8.8 9.11% Total Mortgage (1) 76 $4.8 279 $31.9 (1) Due to variance in deferral programs, deferral $ amounts are total for 1-month deferral 17

Portfolio Management: Outstanding Credit Quality NPA Amount NPAs to Total Assets $63.2 M One investment CRE 0.24% NPA % of Assets credit already under LOI for disposition 0.53% Highlights: 0.29% 0.29% 0.29% • Q1 2020 NPA’s impacted 0.22% 0.19% 0.19% by one investment CRE credit where Customers Bank is reducing its exposure. 2015 2016 2017 2018 2019 2020 18

Portfolio Management: CECL and Reserve Build Components of CECL “Day 2”(1) Provision $22.3M and Reserve Build Economic & (3) Portfolio Other Factors 2.1% of Net Charge-Offs Change $12.5 Loan HFI “Day 1”(1) ACL $9.8 Adoption Impact 1/1/2020 (2) ($5.9) $152.6 $79.8 $136.2 0.8% of Loan HFI $56.4 ALLL 12/31/2019 ACL 3/31/2020(2) (1) “Day 1” is January 1, 2020 and “Day 2” is March 31, 2020. (2) Excludes reserve for unfunded commitment with ACL balance of $3.4M and $4.2M as of January 1, 2020 and March 31, 2020, respectively. (3) Includes the impact of macroeconomic environment, including COVID-19, provision for individually assessed loans and other qualitative factors. 19

Portfolio Management: CECL and Reserve Build Cont. Allowance for Credit Losses on Loans & Leases As of March 31, 2020 Q1 2020 Estimated Loans & Leases Allowance for Lifetime Loss Provision for ($ in thousands) HFI Outstanding Credit Losses Rate Credit Losses Commercial C&I $2,072,952 $18,806 0.91% $2,534 CRE 1,925,015 32,318 1.68% 8,979 Multi-Family 1,621,634 8,750 0.54% 422 Total Commercial $5,619,601 $59,874 1.07% $11,935 Consumer Residential Mortgage $362,047 $4,180 1.15% ($585) Manufactured Housing 69,239 4,987 7.20% 125 Other Consumer 1,315,171 83,569 6.35% 10,841 Total Consumer $1,746,457 $92,736 5.31% $10,381 Total $7,366,058 $152,610 2.07% $22,316 Does not include Reserve for Unfunded Commitments 20

2) Preserving & Expanding Margin

Preserving & Expanding Margin Margin Expands as Planned Highlights: $ in Millions 5.0% • Focus on building core deposits for core loans 4.5% $81.3 $77.6 $75.7 • Funding costs down 16bps 4.0% in Q1 2020 compared to $67.3 $65.0 $64.0 $64.7 Q4 2019 $61.5 3.5% $59.3 • Considerable 3.0% opportunities to see further decline in deposit 2.5% costs 2.0% • Margin expected to remain above 3% for the 1.5% full year 2020 1.0% 1Q2018 2Q2018 3Q2018 4Q2018 1Q2019 2Q2019 3Q2019 4Q2019 1Q2020 Net Interest Income Yield on Interest-Earning Assets Cost of Interest-Bearing Liabilities NIM 22

3) Strong Liquidity

Liquidity Strong Deposit Growth Loans and Leases Held for Average Liquid Assets 19% Increase Since 2018 Investment to Deposit Ratio for 1Q2020 $2,807 99% 98% $8,414 $4,241 $3,203 $7,425 $7,042 88% $1,842 $589 $772 1Q2018 1Q2019 1Q2020 1Q2018 1Q2019 1Q2020 Investment Mortgage Cash Total Borrowing Securities Warehouse Liquid Capacity Assets Utilized Remaining Highlights: • Strong liquidity position resulting from strong deposit growth • Mortgage Warehouse portfolio can be liquidated under stressed conditions within 60 days • Access to a total of $7.1 billion of borrowing liquidity • $2.8 billion in unused borrowing capacity and brokered deposits as of Mar 31, 2020 24

4) Capital Management

Capital Allocation and Management Customers Bank Customers Bancorp Tier 1 Leverage 10.1% Tier 1 Leverage 9.1% 1Q2020 1Q2020 Total Risk 12.3% Based Capital Total Risk Based 11.8% 1Q2020 Capital CET 1 10.7% 1Q2020 Equity Capitalization 1Q2020 $458 Excess $586 Capital $400 Over Well $217 Capitalized $235 $195 1Q2020 CET 1 Tier 1 Risk Total Risk Tier 1 Based Based Leverage Q1 2020 Capital Ratios are estimates Preferred Common 26

5) Maintaining & Improving Profitability

Maintaining & Improving Profitability: Profitability ($ in thousands except EPS) 1Q2020 4Q2019 1Q2019 $ YoY ∆ % YoY ∆ GAAP Metrics Reported EPS (Diluted) $0.22 $0.75 $0.38 ($0.15) (41.2)% ROAA 0.4% 1.0% 0.7% n/a (0.3)% ROCE 3.5% 11.6% 6.4% n/a (2.9)% Book Value Per Share $23.98 $26.66 $24.44 ($0.46) (1.9)% Consolidated Efficiency Ratio 66.0% 57.0% 68.3% n/a (2.3)% Business Banking Segment Efficiency Ratio 56.5% 51.4% 60.1% n/a (3.6)% Non-GAAP Metrics(1) Core EPS (Diluted) $0.26 $0.75 $0.38 ($0.12) (31.6)% Adjusted PPNR ROAA 1.3% 1.6% 1.1% n/a 0.2% Adjusted PPNR $38,595 $44,676 $25,305 $13,290 53% Tangible Book Value Per Share(2) $25.60 $26.17 $23.92 $1.68 7.0% Net Interest Margin 2.99% 2.89% 2.59% n/a 0.4% (1) Non-GAAP measures refer to reconciliation in Appendix (2) Excludes impact of CECL, Non-GAAP measure refer to reconciliation in Appendix 28

Maintaining & Improving Profitability: Non-Interest Expense Non-Interest Expense 1Q20 1Q19 YoY ∆ ($ in millions) $66.5 Personnel $28.3 $25.8 $ 2.5 $59.6 $59.6 $58.7 $54.0 Technology & 13.0 12.0 1.1 77% Communication Professional 7.7 4.6 3.1 68% Services 67% 66% 62% Occupancy 3.0 2.9 .1 60% 57% 57% 53% Other 14.4 8.7 5.7 51% Total Non- $66.5 $54.0 $12.5 1Q2019 2Q2019 3Q2019 4Q2019 1Q2020 Interest Expense Non-Interest Expense Consolidated Efficiency Ratio Business Banking Efficiency Ratio 29

Key Take Aways The Company is well positioned to execute on its 2020 and 2025 / 2026 LT strategies • NIM expected to remain above 3.0% for 2020 • Operating expenses expected to moderate over next few quarters • Tax rate expected to be 22-23% for 2020 • Excluding PPP Loans, balance sheet at year end 2020 expected to be about the same as at 12/31/2019 • SBA PPP program expected to add about $85 million (pre-tax) to Equity Capital and over 1,000+ new business checking accounts • Run rate of $6.00 per share in core earnings by 2025 / 2026 2020 NIM expansion and profitability targets will be achieved by executing on: Assets: Measured growth while focus on maintaining / increasing yield on assets • Disciplined pricing on new originations of high credit quality loans • Floors built into loan agreements to protect spreads above floating rate indices Deposits: Continue to grow core deposits and experience repricing in 2020 • $1.1 billion of digital ascent deposits expected to re-price on July 1, 2020 by up to 100 bps lower • $1.1 billion of CD’s mature in the 2H of 2020, expected to be repriced significantly downward Capital allocation and philosophy • TCE targeted at 7.0% at year end 2020 excluding the impact of CECL, SBA PPP revenues and PPP loans held on balance sheet • Preferred Equity will not be called in 2020 BankMobile • BankMobile expected to remain profitable in 2020 • Divestiture on target for execution by year end 2020 30

Appendix 31

Forward-Looking Statements In addition to historical information, this presentation may contain ”forward-looking statements” within the meaning of the ”safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Customers Bancorp, Inc.’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words ”may,” ”could,” ”should,” ”pro forma,” ”looking forward,” ”would,” ”believe,” ”expect,” ”anticipate,” ”estimate,” ”intend,” ”plan,” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Customers Bancorp, Inc.’s control). Numerous competitive, economic, regulatory, legal and technological events and factors, among others, could cause Customers Bancorp, Inc.’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements, including: the adverse impact on the U.S. economy, including the markets in which we operate, of the coronavirus outbreak, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan and lease portfolio, the market value of our investment securities, the demand for our products and services and the availability of sources of funding; the effects of actions by the federal government, including the Board of Governors of the Federal Reserve System and other government agencies, that effect market interest rates and the money supply; actions that we and our customers take in response to these developments and the effects such actions have on our operations, products, services and customer relationships; the effects of changes in accounting standards or policies, including Accounting Standards Update (ASU) 2016-13, Financial Instruments—Credit Losses (CECL); and, our ability to divest BankMobile on terms and conditions acceptable to us, in the timeframe we currently intend, and the possible effects on our business and results of operations of a divestiture of BankMobile or if we are unable to divest BankMobile for an extended period of time. Customers Bancorp, Inc. cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward-looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Customers Bancorp, Inc.’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K for the year ended December 31, 2019, subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K, including any amendments thereto, that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Customers Bancorp, Inc. does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by Customers Bancorp, Inc. or by or on behalf of Customers Bank, except as may be required under applicable law. 32

BankMobile Income Statement BankMobile Segment Income Statement ($ in 000s), Except Per Share Data Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Interest income $ - $ 2 $ 1 $ 2 $ 1 $ - $ 2 $ 1,344 $ 2,590 $ 6,761 $ 12,383 $ 11,084 $ 11,194 Interest expense $ 6 $ 11 $ 10 $ 6 $ 8 $ 125 $ 50 $ 179 $ 166 $ 210 $ 249 $ 350 $ 344 Fund transfer pricing net credit $ 4,247 $ 2,738 $ 2,693 $ 3,202 $ 4,401 $ 3,520 $ 3,875 $ 3,822 $ 5,614 $ 2,175 $ 340 $ 758 $ 1,433 Net interest income $ 4,242 $ 2,727 $ 2,684 $ 3,197 $ 4,394 $ 3,394 $ 3,827 $ 4,987 $ 8,038 $ 8,726 $ 12,474 $ 11,492 $ 12,282 Provision for loan losses $ - $ - $ 478 $ 652 $ 243 $ 463 $ 422 $ 1,585 $ 1,791 $ 7,552 $ 1,951 $ 2,843 $ 4,488 Deposit fees $ 2,803 $ 1,875 $ 2,338 $ 1,833 $ 1,805 $ 1,338 $ 1,691 $ 1,713 $ 1,910 $ 2,915 $ 3,185 $ 3,064 $ 2,909 Card revenue $ 13,308 $ 8,521 $ 9,355 $ 9,542 $ 9,438 $ 6,199 $ 6,903 $ 7,362 $ 8,626 $ 6,541 $ 6,688 $ 6,305 $ 6,539 Other fees $ 1,216 $ 1,024 $ 2,143 $ 165 $ 1,228 $ 1,125 $ 1,246 $ 1,450 $ 1,605 $ 1,610 $ 1,739 $ 1,480 $ 1,346 Total non-interest income $ 17,327 $ 11,420 $ 13,836 $ 11,540 $ 12,471 $ 8,662 $ 9,840 $ 10,525 $ 12,140 $ 11,066 $ 11,612 $ 10,849 $ 10,794 Compensation & benefits $ 4,949 $ 6,965 $ 6,154 $ 5,909 $ 5,671 $ 5,918 $ 5,695 $ 5,850 $ 6,064 $ 6,997 $ 7,210 $ 7,235 $ 7,787 Occupancy $ 109 $ 104 $ 297 $ 321 $ 309 $ 321 $ 328 $ 308 $ 303 $ 317 $ 314 $ 399 $ 310 Technology $ 6,617 $ 6,386 $ 11,740 $ 9,796 $ 7,129 $ 7,172 $ 8,171 $ 8,248 $ 8,897 $ 8,347 $ 4,471 $ 4,587 $ 7,922 Outside services $ 4,519 $ 3,310 $ 3,871 $ 3,366 $ 2,899 $ 1,665 $ 2,205 $ 1,902 $ 2,284 $ 3,082 $ 4,320 $ 4,043 $ 4,126 Merger related expenses $ - $ - $ - $ 410 $ 106 $ 869 $ 2,945 $ 470 $ - $ - $ - $ 100 $ 50 Other non-interest expenses $ 3,025 $ 3,081 $ 4,988 $ 1,085 $ 1,835 $ 85 $ 1,645 $ 1,959 $ 1,053 $ 2,732 $ 4,930 $ 882 $ 2,404 Total non-interest expense $ 19,219 $ 19,846 $ 27,050 $ 20,888 $ 17,949 $ 16,029 $ 20,989 $ 18,267 $ 18,600 $ 21,475 $ 21,245 $ 17,246 $ 22,599 Income (loss) before income tax expense $ 2,350 $ (5,699) $ (11,008) $ (6,803) $ (1,327) $ (4,436) $ (7,744) $ (4,340) $ (212) $ (9,235) $ 890 $ 2,252 $ (4,011) Income tax expense (benefit) $ 893 $ (2,166) $ (4,100) $ (2,563) $ (326) $ (1,090) $ (1,902) $ (1,066) $ (49) $ (2,138) $ 206 $ 559 $ (816) Net income (loss) available to common shareholders $ 1,457 $ (3,533) $ (6,908) $ (4,239) $ (1,001) $ (3,346) $ (5,842) $ (3,274) $ (163) $ (7,097) $ 684 $ 1,693 $ (3,195) EPS $ 0.04 $ (0.11) $ (0.21) $ (0.13) $ (0.03) $ (0.10) $ (0.18) $ (0.10) $ (0.01) $ (0.22) $ 0.02 $ 0.05 $ (0.10) Core EPS $ 0.02 $ (0.14) $ (0.16) $ (0.12) $ (0.03) $ (0.08) $ (0.11) $ (0.09) $ (0.01) $ (0.22) $ 0.05 $ 0.06 $ (0.07) End of period deposits ($ in millions) $ 708 $ 453 $ 781 $ 400 $ 624 $ 419 $ 732 $ 376 $ 627 $ 456 $ 666 $ 401 $ 610 Average deposits ($ in millions) $ 794 $ 532 $ 531 $ 558 $ 644 $ 468 $ 497 $ 532 $ 635 $ 489 $ 529 $ 543 $ 622 Average loans ($ in millions) $ 7 $ 2 $ 2 $ 2 $ 2 $ 2 $ 2 $ 59 $ 115 $ 289 $ 498 $ 478 $ 495 Average excess deposits ($ in millions) $ 787 $ 530 $ 529 $ 556 $ 642 $ 466 $ 495 $ 474 $ 520 $ 200 $ 30 $ 65 $ 127 Yield earned on avg. excess deposits 2.19% 2.07% 2.02% 2.29% 2.78% 3.03% 3.11% 3.20% 4.33% 4.36% 4.53% 4.65% 4.51% 33

Contacts Leadership: Analysts: Carla Leibold B. Riley Financial CFO of Customers Bancorp, Inc and Customers Steve Moss Bank Tel: 484-923-8802 D.A. Davidson Company cleibold@customersbank.com Russell Gunther Jay Sidhu Chairman & CEO of Customers Bancorp, Inc. and Keefe, Bruyette & Woods Michael Perito Executive Chairman of Customers Bank Tel: 610-935-8693 jsidhu@customersbank.com Maxim Group Michael Diana Richard Ehst President & COO of Customers Bancorp, Inc. and Piper Sandler Companies CEO of Customers Bank Frank Schiraldi Tel: 610-917-3263 rehst@customersbank.com Sam Sidhu COO of Customers Bank & Head of Corporate Development of Customers Bancorp Tel: 212-843-2485 ssidhu@customersbank.com 34

Reconciliation of Non-GAAP Measures - Unaudited Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our core results of operations and financial condition relative to other financial institutions. These non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in Customers' industry. These non-GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our ongoing financial results, which we believe enhance an overall understanding of our performance and increases comparability of our period to period results. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP. The following tables present reconciliations of GAAP to non-GAAP measures disclosed within this document. 35

Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Core Earnings - Customers Bancorp Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 Per Per Per Per Per (dollars in thousands except per share data) USD share USD share USD share USD share USD share GAAP net income to common shareholders $ 7,027 $ 0.22 $ 23,911 $ 0.75 $ 23,451 $ 0.74 $ 5,681 $ 0.18 $ 11,825 $ 0.38 Reconciling items (after tax): Severance expense — — — — — — 373 0.01 — — Loss upon acquisition of interest-only GNMA securities — — — — — — 5,682 0.18 — — Merger and acquisition related expenses 40 — 76 — — — — — — — Legal reserves 830 0.03 — — 1,520 0.05 — — — — (Gains) losses on investment securities (1,788) (0.06) (310) (0.01) (1,947) (0.06) 347 0.01 (2) — Derivative credit valuation adjustment 2,036 0.06 (429) (0.01) 378 0.01 605 0.02 257 0.01 Losses on sale of non-QM residential mortgage loans — — 595 0.02 — — — — — — Core earnings $ 8,145 $ 0.26 $ 23,843 $ 0.75 $ 23,402 $ 0.74 $ 12,688 $ 0.40 $ 12,080 $ 0.38 Net Interest Margin, Tax Equivalent - Customers Bancorp (dollars in thousands except per share data) Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 GAAP net interest income $ 81,321 $ 77,593 $ 75,735 $ 64,679 $ 59,304 Tax-equivalent adjustment 205 187 184 183 181 Net interest income tax equivalent $ 81,526 $ 77,780 $ 75,919 $ 64,862 $ 59,485 Average total interest earning assets $ 10,976,872 $ 10,676,730 $ 10,667,198 $ 9,851,150 $ 9,278,413 Net interest margin, tax equivalent 2.99 % 2.89 % 2.83 % 2.64 % 2.59 % 36

Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Adjusted Net Income and Adjusted ROAA - Pre-Tax Pre-Provision - Customers Bancorp (dollars in thousands except per share data) Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 GAAP net income $ 10,642 $ 27,526 $ 27,066 $ 9,296 $ 15,440 Reconciling items: Income tax expense 3,834 7,451 8,020 2,491 4,831 Provision for credit losses on loan and leases 22,316 9,689 4,426 5,346 4,767 Provision for credit losses on unfunded commitments 751 3 (235) (102) (69) Severance expense — — — 490 — Loss upon acquisition of interest-only GNMA securities — — — 7,476 — Merger and acquisition related expenses 50 100 — — — Legal reserves 1,042 — 2,000 — — (Gains) losses on investment securities (2,596) (310) (2,334) 347 (2) Derivative credit valuation adjustment 2,556 (565) 497 796 338 Losses on sale of non-QM residential mortgage loans — 782 — — — Adjusted net income - pre-tax pre-provision $ 38,595 $ 44,676 $ 39,440 $ 26,140 $ 25,305 Average total assets $ 11,573,490 $ 11,257,207 $ 11,259,144 $ 10,371,842 $ 9,759,529 Adjusted ROAA - pre-tax pre-provision 1.34 % 1.57 % 1.39 % 1.01 % 1.05 % Adjusted ROCE - Pre-Tax Pre-Provision - Customers Bancorp (dollars in thousands except per share data) Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 GAAP net income to common shareholders $ 7,027 $ 23,911 $ 23,451 $ 5,681 $ 11,825 Reconciling items: Income tax expense 3,834 7,451 8,020 2,491 4,831 Provision for credit losses on loan and leases 22,316 9,689 4,426 5,346 4,767 Provision for credit losses on unfunded commitments 751 3 (235) (102) (69) Severance expense — — — 490 — Loss upon acquisition of interest-only GNMA securities — — — 7,476 — Merger and acquisition related expenses 50 100 — — — Legal reserves 1,042 — 2,000 — — (Gains) losses on investment securities (2,596) (310) (2,334) 347 (2) Derivative credit valuation adjustment 2,556 (565) 497 796 338 Losses on sale of non-QM residential mortgage loans — 782 — — — Pre-tax pre-provision adjusted net income available to common shareholders $ 34,980 $ 41,061 $ 35,825 $ 22,525 $ 21,690 Average total common shareholders' equity $ 807,967 $ 819,018 $ 787,885 $ 768,592 $ 751,133 Adjusted ROCE - pre-tax pre-provision 17.41 % 19.89 % 18.04 % 11.75 % 11.71 % 37

Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Tangible Common Equity to Tangible Assets - Customers Bancorp (dollars in thousands except per share data) Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 GAAP - Total shareholders' equity $ 972,179 $ 1,052,795 $ 1,019,150 $ 991,405 $ 978,373 Reconciling items: Preferred stock (217,471) (217,471) (217,471) (217,471) (217,471) Goodwill and other intangibles (14,870) (15,195) (15,521) (15,847) (16,173) Tangible common equity $ 739,838 $ 820,129 $ 786,158 $ 758,087 $ 744,729 Total assets $ 12,026,342 $ 11,520,717 $ 11,723,790 $ 11,182,427 $ 10,143,894 Reconciling items: Goodwill and other intangibles (14,870) (15,195) (15,521) (15,847) (16,173) Tangible assets $ 12,011,472 $ 11,505,522 $ 11,708,269 $ 11,166,580 $ 10,127,721 Tangible common equity to tangible assets 6.16 % 7.13 % 6.71 % 6.79 % 7.35 % 38

Reconciliation of Non-GAAP Measures – Unaudited (Cont.) Tangible Book Value per Common Share - CAGR - Customers Bancorp (dollars in thousands except share and per share data) Q1 2020 Q1 2015 GAAP - Total shareholders' equity $ 972,179 $ 457,952 Reconciling Items: CECL adjustment 65,821 — Preferred stock (217,471) — Goodwill and other intangibles (14,870) (3,661) Tangible common equity $ 805,659 $ 454,291 Common shares outstanding 31,470,026 26,824,039 Tangible book value per common share $ 25.60 $ 16.94 CAGR 8.6 % 39