Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED STATES STEEL CORP | form8kercall200501.htm |

First Quarter 2020 Earnings Call David Burritt President and Chief Executive Officer Christie Breves Senior Vice President and Chief Financial Officer Rich Fruehauf Senior Vice President, Chief Strategy and Development Officer Kevin Lewis Vice President, Investor Relations and Corporate FP&A May 1, 2020 U. S. Steel’s Minntac ore operations

Forward-looking statements These slides are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation for the first quarter of 2020. They should be read in conjunction with the consolidated financial statements and Notes to Consolidated Financial Statements contained in our Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission. This presentation contains information that may constitute ”forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward- looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” "should," “will,” "may" and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, U. S. Steel's future ability or plans to take ownership of the Big River Steel joint venture as a wholly owned subsidiary, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward- looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to risks related to the satisfaction of the conditions of creating the joint venture with Stelco in the anticipated timeframe or at all and the possibility that the option will not be exercised by Stelco, possible production or operations interruptions related to the novel coronavirus (COVID-19) pandemic that could disrupt supply or delivery of, or demand for, the Company’s products, as well as the risks and uncertainties described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to "we," "us," "our," the "Company," and "U. S. Steel," refer to United States Steel Corporation and its consolidated subsidiaries. 2

Explanation of use of non-GAAP measures We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share, earnings (loss) before interest, income taxes, depreciation and amortization (EBITDA) and adjusted EBITDA, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA and segment EBITDA, considered along with net earnings (loss) and segment earnings (loss) before interest and income taxes, are relevant indicators of trends relating to our operating performance and provide management and investors with additional information for comparison of our operating results to the operating results of other companies. Net debt is a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. Both EBITDA and net debt are used by analysts to refine and improve the accuracy of their financial models which utilize enterprise value. We believe the cash conversion cycle is a useful measure in providing investors with information regarding our cash management performance and is a widely accepted measure of working capital management efficiency. The cash conversion cycle should not be considered in isolation or as an alternative to other GAAP metrics as an indicator of performance. Adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share are non-GAAP measures that exclude the effects of items such as asset impairments, restructuring and other charges, the December 24, 2018 Clairton coke making facility fire, the Big River Steel options mark to market, the impact of the tax valuation allowance, and significant gains (losses) on the sale or purchase of ownership interests in equity investees, restart and related costs associated with Granite City Works, and debt extinguishment and other related costs that are not part of the Company's core operations (Adjustment Items). Adjusted EBITDA is also a non-GAAP measure that excludes certain Adjustment Items. We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations, by excluding the adjustment items that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the adjustment items when evaluating the Company’s financial performance. Adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA should not be considered a substitute for net earnings (loss), earnings (loss) per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. 3

Comprehensive response to COVID-19 1 Protecting lives and livelihoods Guided by our S.T.E.E.L. Principles 2 Prioritizing cash and liquidity Sufficient balance sheet strength to navigate the current environment 3 “Best of both” strategy remains the future Demonstrating flexibility to be prepared to invest in a recovery 4 Swift and meaningful actions Short-term actions to ensure long-term strategy execution 4

Protecting lives and livelihoods Following and exceeding CDC1 COVID-19 guidelines Examples include: Distributed additional cleaning supplies throughout plants Regular cleaning frequency of high-traffic areas, surfaces and common areas Installed additional wash stations and added hand sanitizer to entrances/exits Limiting outside visitors to our facilities, restricting access for non- essential vendors, suppliers and contractors VISITOR Actively managing physical distancing while at work, including no 6 ft. meetings or gatherings of greater than 10 individuals Issuing weekly communication, including preventive tips, and launched dedicated website for employees and their families 1 Centers for Disease Control and Prevention 5

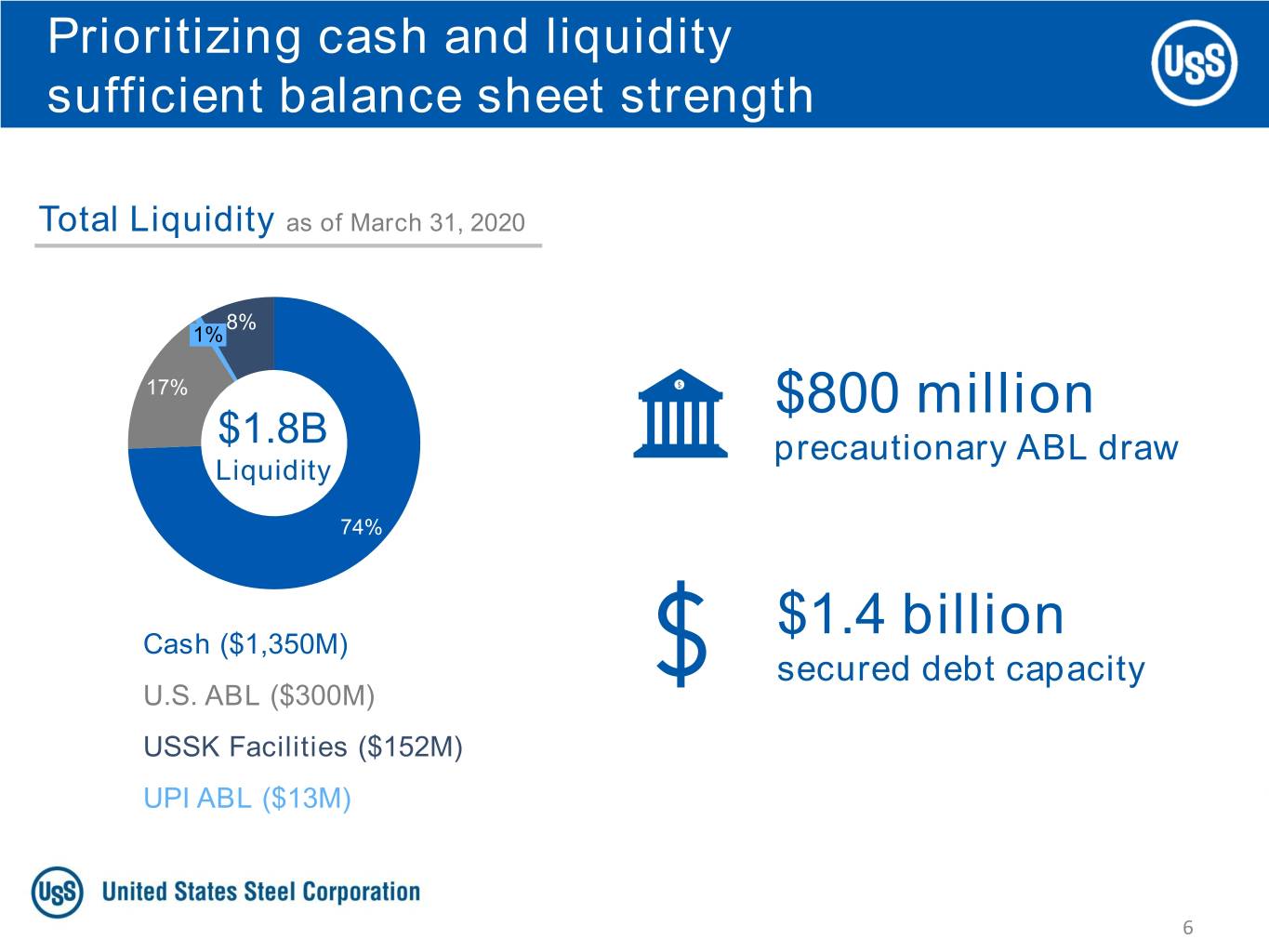

Prioritizing cash and liquidity sufficient balance sheet strength Total Liquidity as of March 31, 2020 8% 1% 17% $800 million $1.8B precautionary ABL draw Liquidity 74% $1.4 billion Cash ($1,350M) secured debt capacity U.S. ABL ($300M) USSK Facilities ($152M) UPI ABL ($13M) 6

Prioritizing cash and liquidity better-positioned for current market dynamics Reshaped More efficient footprint focused on cost or Footprint capability advantages Improved No material notes Balance Sheet maturities until 2025 Improved cash Efficiencies and cost improvements and performance industry-leading CCC1 Executing Demonstrating flexibility to Strategy execute long-term strategy 1 Cash conversion cycle 7

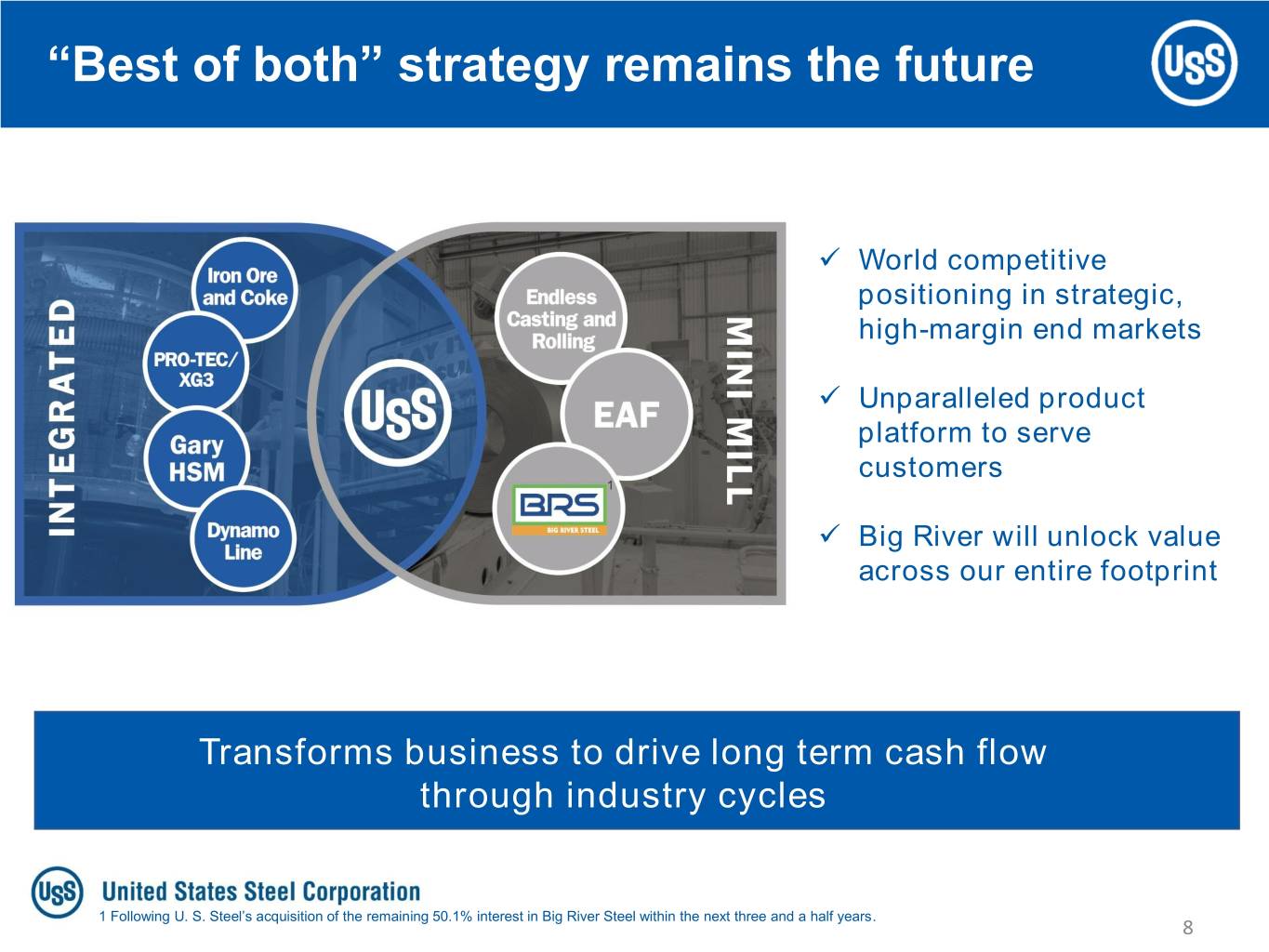

“Best of both” strategy remains the future ✓ World competitive positioning in strategic, high-margin end markets ✓ Unparalleled product platform to serve customers 1 ✓ Big River will unlock value across our entire footprint Transforms business to drive long term cash flow through industry cycles 1 Following U. S. Steel’s acquisition of the remaining 50.1% interest in Big River Steel within the next three and a half years. 8

Swift and meaningful actions Taking action … … to fortify the … to align our … to demonstrate balance sheet operating footprint flexibility 9

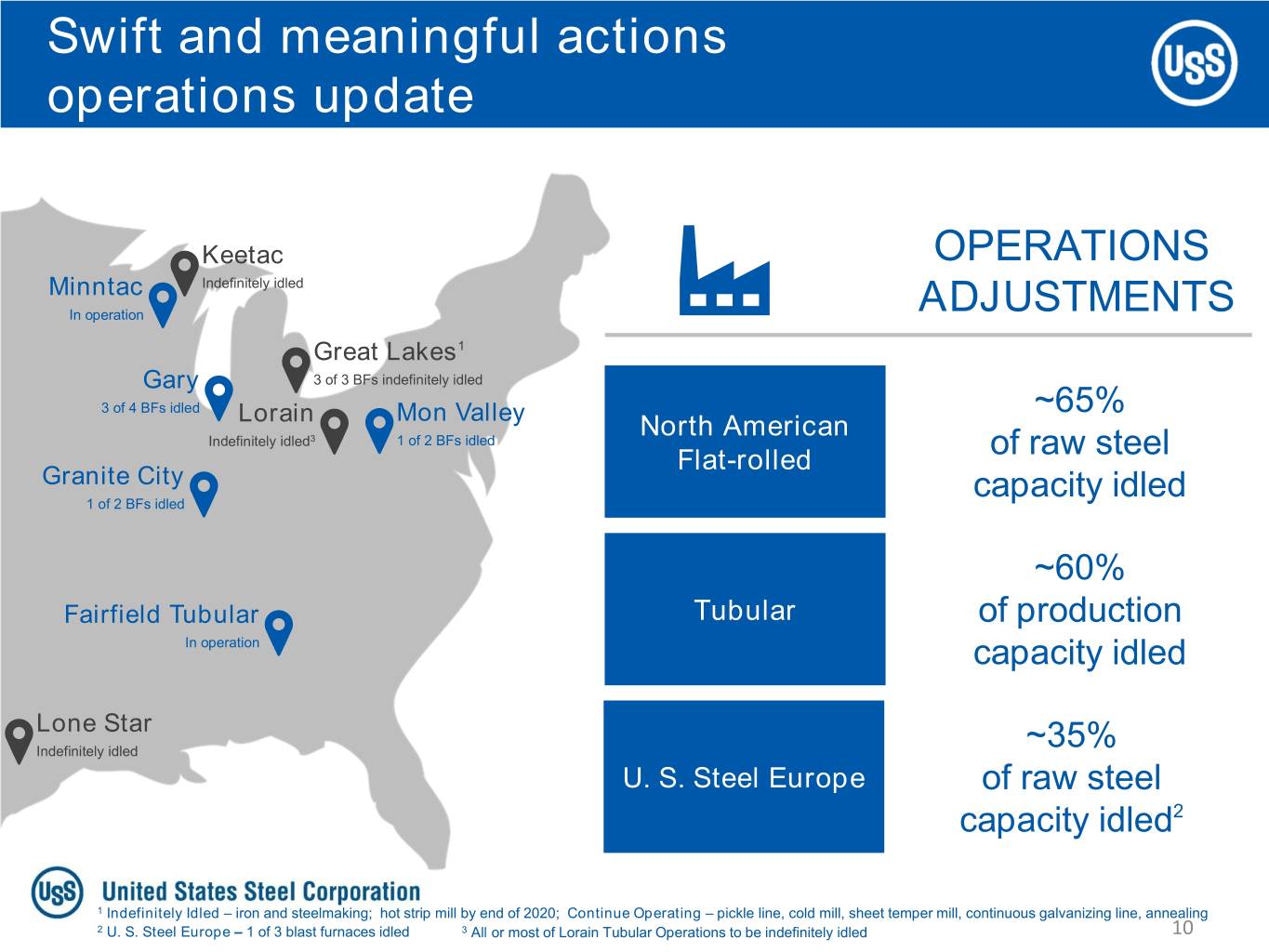

Swift and meaningful actions operations update Keetac OPERATIONS Minntac Indefinitely idled In operation ADJUSTMENTS Great Lakes1 Gary 3 of 3 BFs indefinitely idled 3 of 4 BFs idled ~65% Lorain Mon Valley North American Indefinitely idled3 1 of 2 BFs idled Flat-rolled of raw steel Granite City capacity idled 1 of 2 BFs idled ~60% Fairfield Tubular Tubular of production In operation capacity idled Lone Star Indefinitely idled ~35% U. S. Steel Europe of raw steel capacity idled2 1 Indefinitely Idled – iron and steelmaking; hot strip mill by end of 2020; Continue Operating – pickle line, cold mill, sheet temper mill, continuous galvanizing line, annealing 2 U. S. Steel Europe – 1 of 3 blast furnaces idled 3 All or most of Lorain Tubular Operations to be indefinitely idled 10

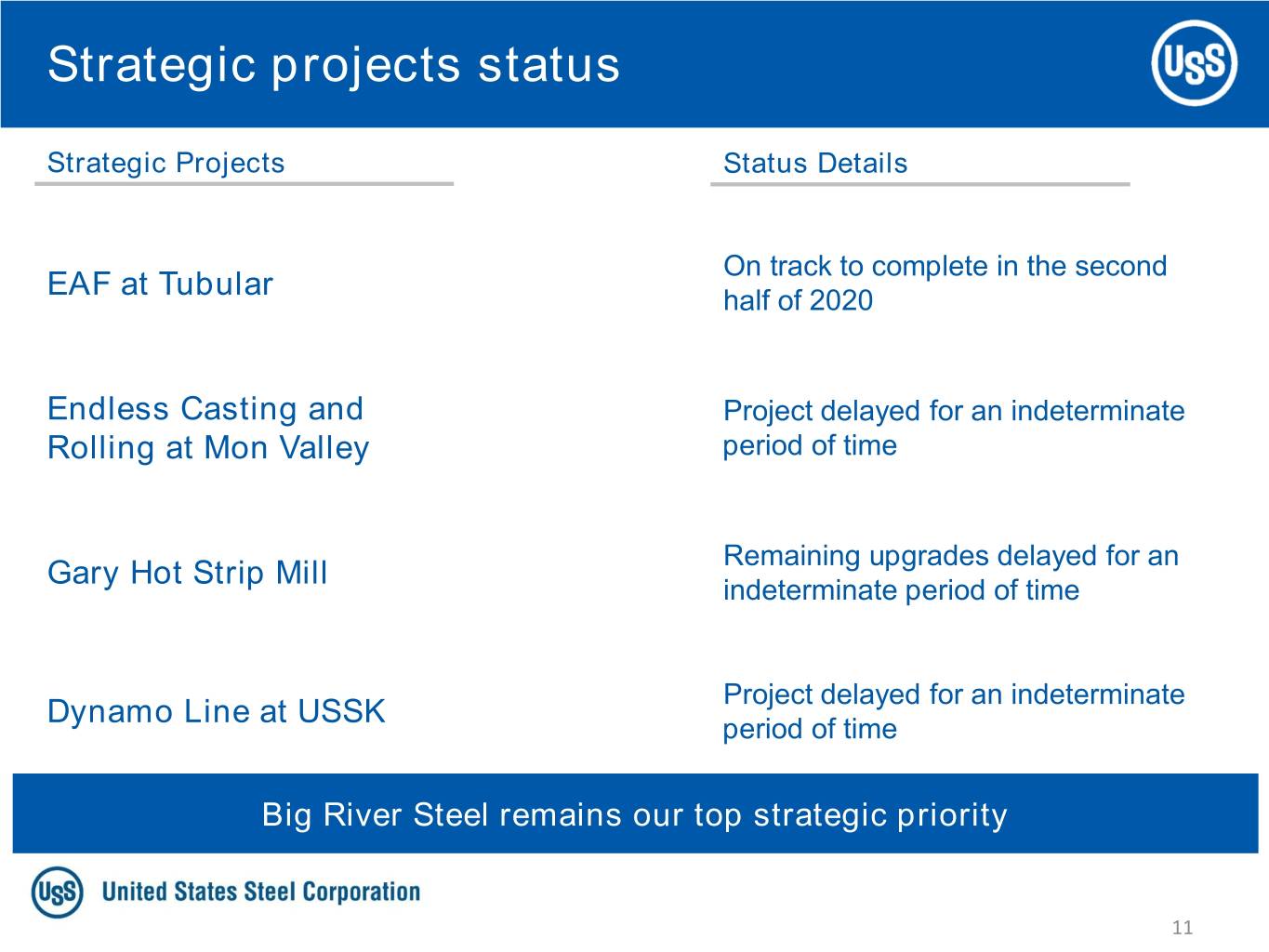

Strategic projects status Strategic Projects Status Details On track to complete in the second EAF at Tubular half of 2020 Endless Casting and Project delayed for an indeterminate Rolling at Mon Valley period of time Remaining upgrades delayed for an Gary Hot Strip Mill indeterminate period of time Project delayed for an indeterminate Dynamo Line at USSK period of time Big River Steel remains our top strategic priority 11

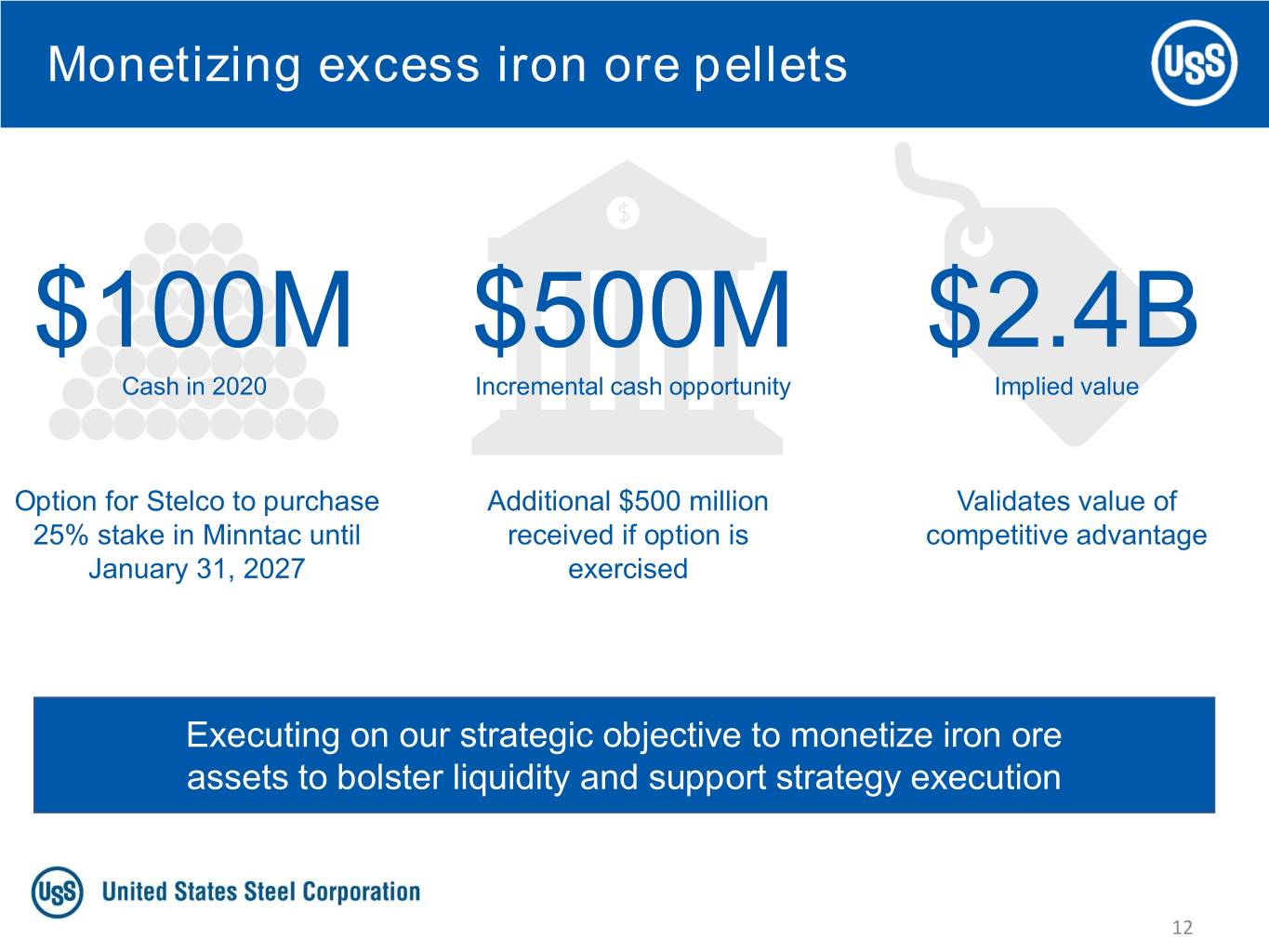

Monetizing excess iron ore pellets $100M $500M $2.4B Cash in 2020 Incremental cash opportunity Implied value Option for Stelco to purchase Additional $500 million Validates value of 25% stake in Minntac until received if option is competitive advantage January 31, 2027 exercised Executing on our strategic objective to monetize iron ore assets to bolster liquidity and support strategy execution 12

More resilient compared to prior downturns ✓ Focused footprint ✓ Improved EBITDA margins ✓ Significant improvement in cash conversion ✓ Long-term debt maturities ✓ Improved pension & OPEB funded status ✓ Sufficient liquidity position 1 Estimated 3rd party shipments for Flat-rolled and U. S. Steel Europe segments. 13

$500 million cash savings Actions taken to ensure Focused on cash strategy execution and liquidity Protecting the lives and ✓ livelihoods of our employees Daily cash calls North American Flat-rolled ✓ footprint actions ~$500 Plant control towers million ✓ Tubular footprint actions Primarily from footprint actions, cost controls and 2020 capital spending actions HQ control towers ✓ fixed cost reductions ✓ Balance sheet actions 14

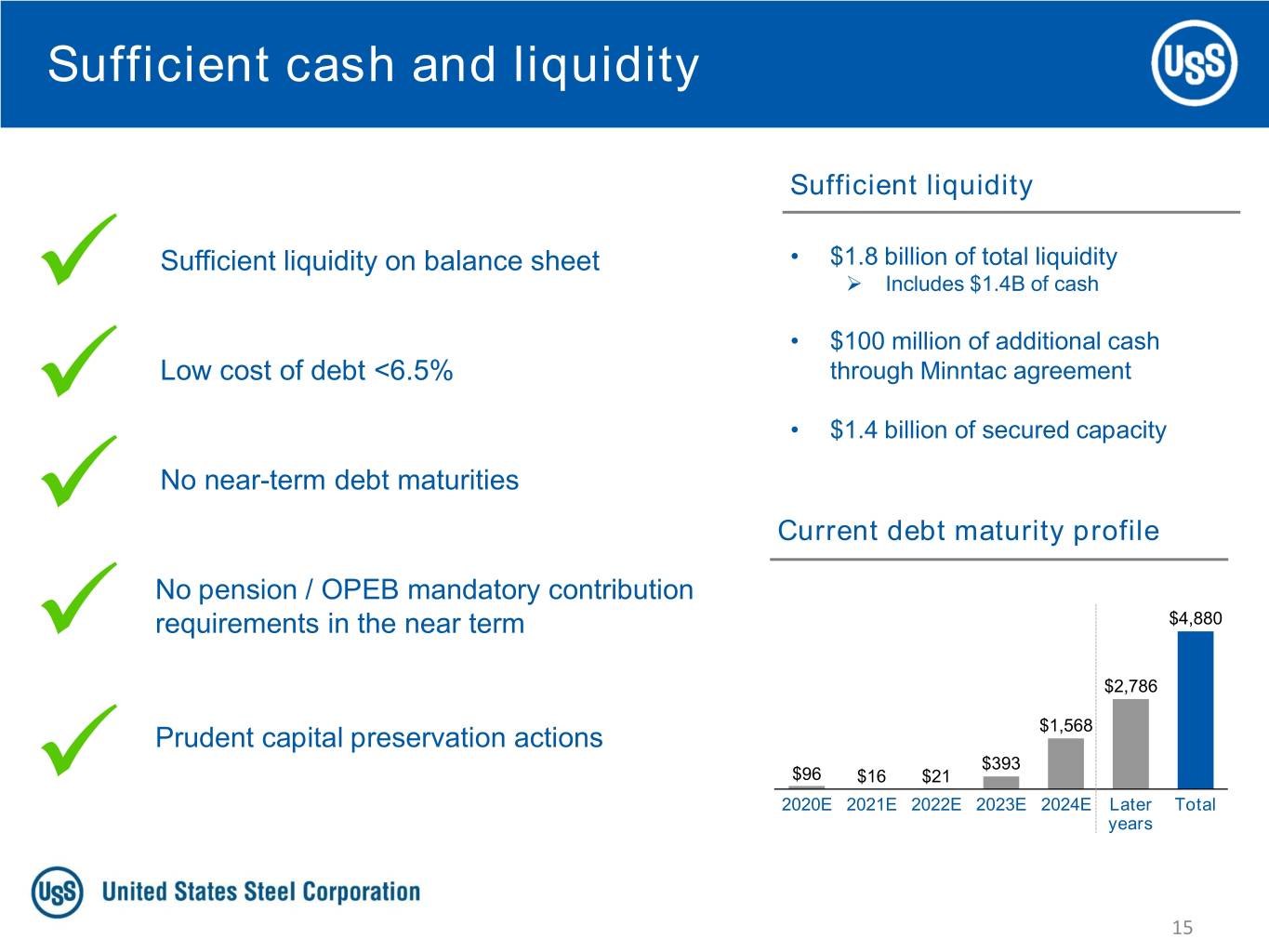

Sufficient cash and liquidity Sufficient liquidity Sufficient liquidity on balance sheet • $1.8 billion of total liquidity ✓ ➢ Includes $1.4B of cash • $100 million of additional cash ✓ Low cost of debt <6.5% through Minntac agreement • $1.4 billion of secured capacity ✓ No near-term debt maturities Current debt maturity profile No pension / OPEB mandatory contribution ✓ requirements in the near term $4,880 $2,786 Prudent capital preservation actions $1,568 $393 $96 $16 $21 ✓ 2020E 2021E 2022E 2023E 2024E Later Total years 15

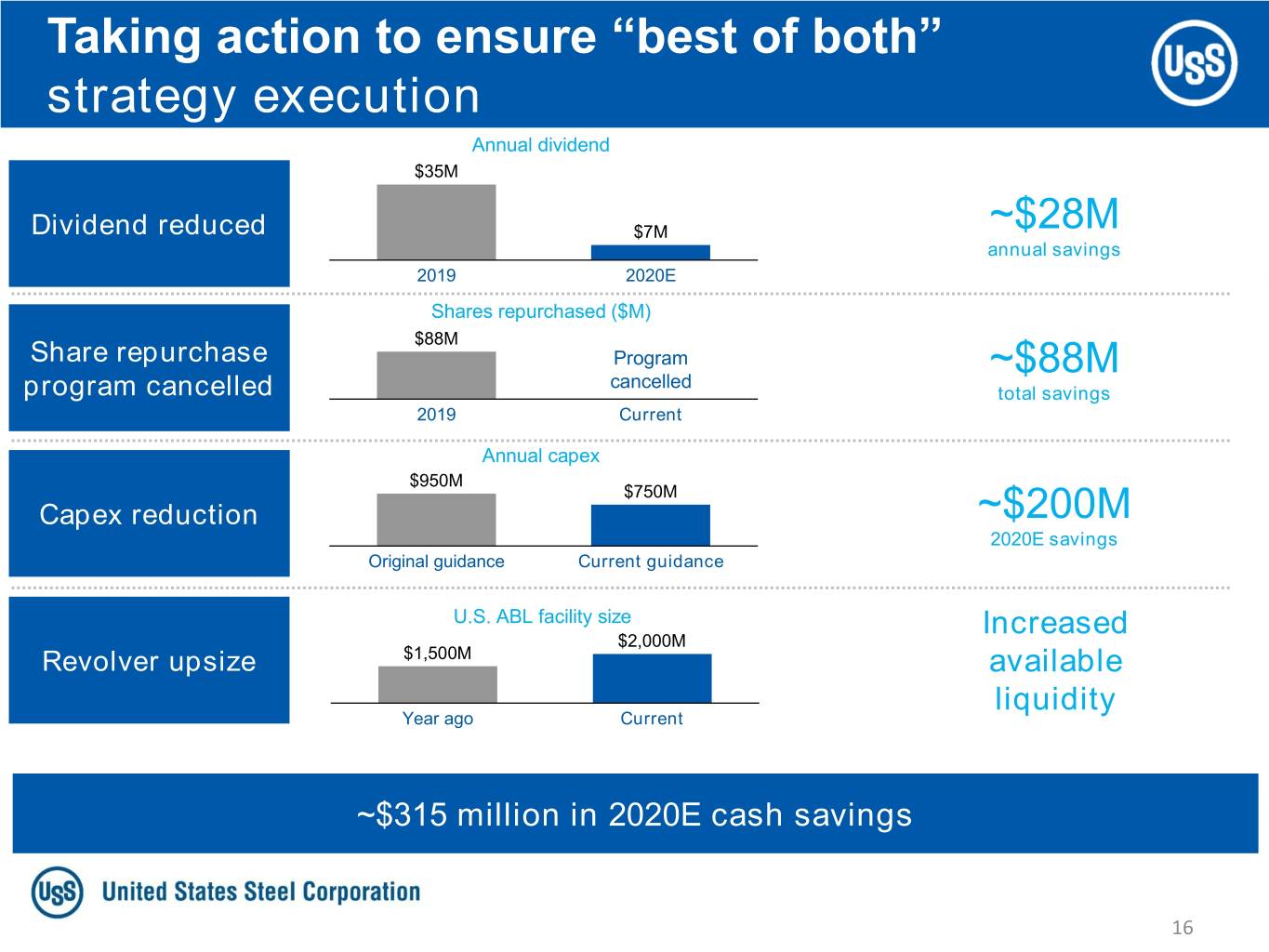

Taking action to ensure “best of both” strategy execution Annual dividend $35M Dividend reduced $7M ~$28M annual savings 2019 2020E Shares repurchased ($M) $88M Share repurchase Program ~$88M cancelled program cancelled total savings 2019 Current Annual capex $950M $750M Capex reduction ~$200M 2020E savings Original guidance Current guidance U.S. ABL facility size Increased $2,000M Revolver upsize $1,500M available liquidity Year ago Current ~$315 million in 2020E cash savings 16

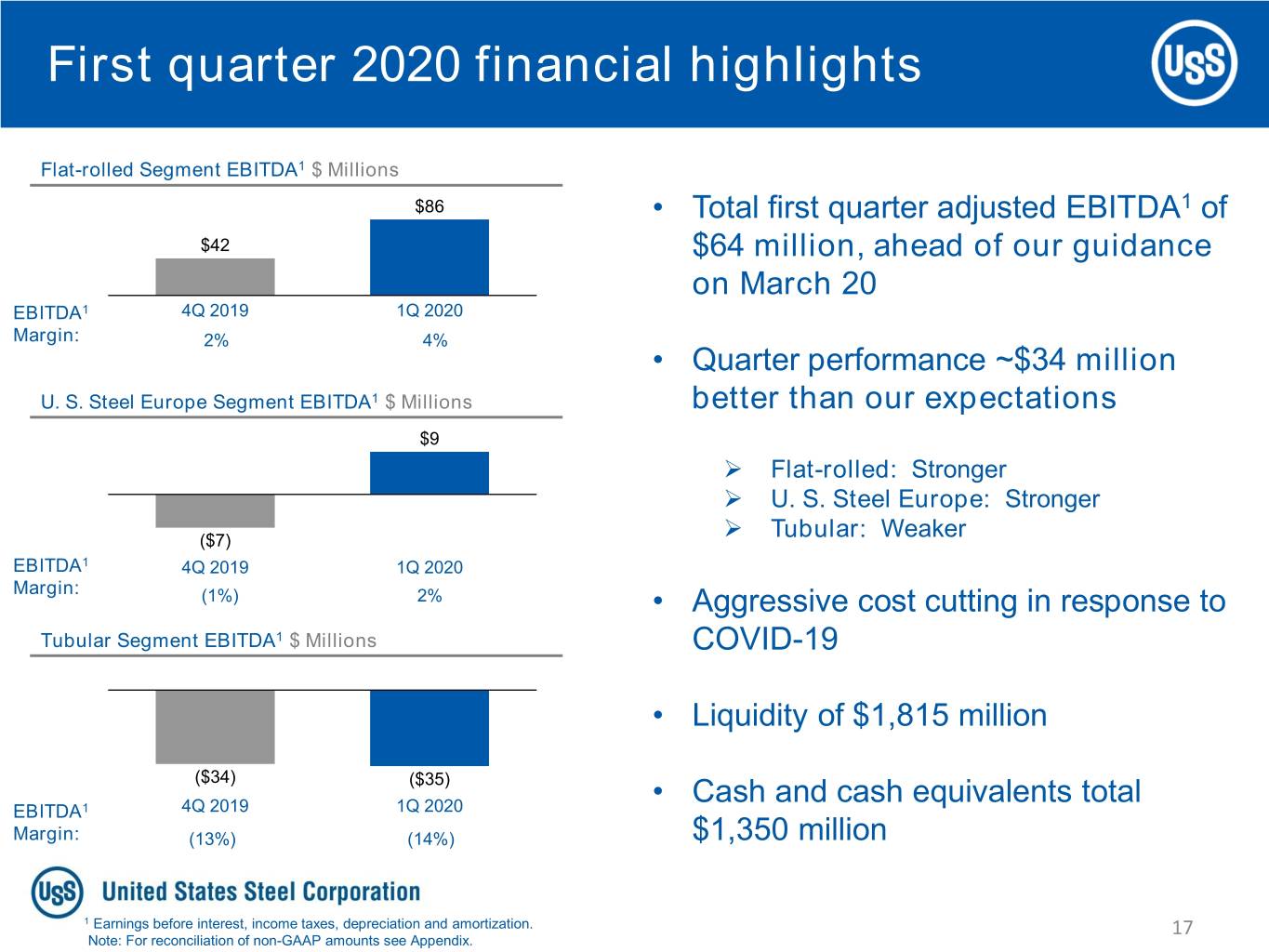

First quarter 2020 financial highlights Flat-rolled Segment EBITDA1 $ Millions $86 • Total first quarter adjusted EBITDA1 of $42 $64 million, ahead of our guidance on March 20 EBITDA1 4Q 2019 1Q 2020 Margin: 2% 4% • Quarter performance ~$34 million U. S. Steel Europe Segment EBITDA1 $ Millions better than our expectations $9 ➢ Flat-rolled: Stronger ➢ U. S. Steel Europe: Stronger ($7) ➢ Tubular: Weaker EBITDA1 4Q 2019 1Q 2020 Margin: (1%) 2% • Aggressive cost cutting in response to Tubular Segment EBITDA1 $ Millions COVID-19 • Liquidity of $1,815 million ($34) ($35) • Cash and cash equivalents total EBITDA1 4Q 2019 1Q 2020 Margin: (13%) (14%) $1,350 million 1 Earnings before interest, income taxes, depreciation and amortization. 17 Note: For reconciliation of non-GAAP amounts see Appendix.

Recap • Protecting lives and livelihoods • Prioritizing cash and liquidity • “Best of both” strategy remains the future • Swift and meaningful actions 18

Q & A

Closing Remarks

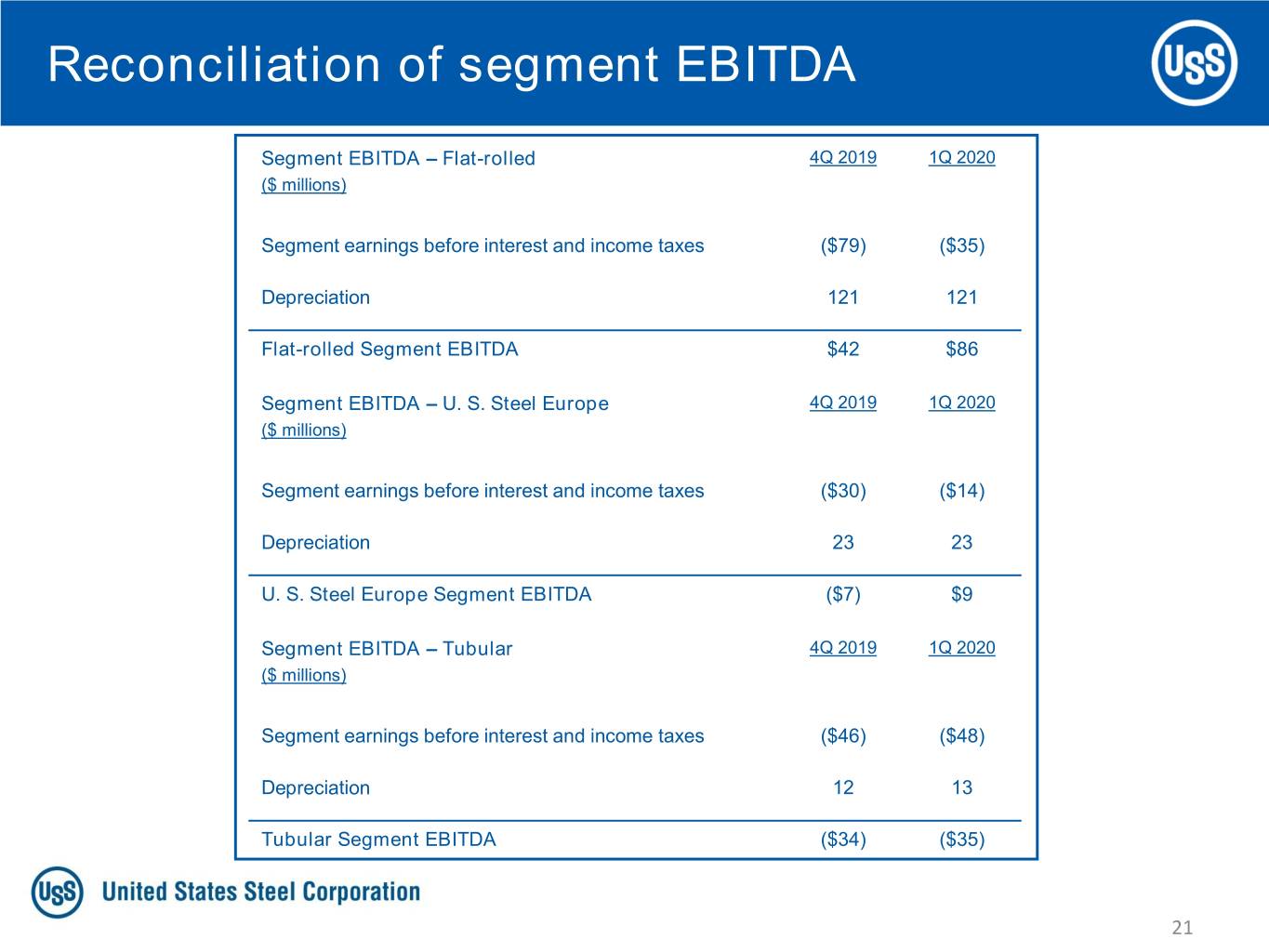

Reconciliation of segment EBITDA Segment EBITDA – Flat-rolled 4Q 2019 1Q 2020 ($ millions) Segment earnings before interest and income taxes ($79) ($35) Depreciation 121 121 Flat-rolled Segment EBITDA $42 $86 Segment EBITDA – U. S. Steel Europe 4Q 2019 1Q 2020 ($ millions) Segment earnings before interest and income taxes ($30) ($14) Depreciation 23 23 U. S. Steel Europe Segment EBITDA ($7) $9 Segment EBITDA – Tubular 4Q 2019 1Q 2020 ($ millions) Segment earnings before interest and income taxes ($46) ($48) Depreciation 12 13 Tubular Segment EBITDA ($34) ($35) 21

Reconciliation of adjusted EBITDA ($ millions) 4Q 2019 1Q 2020 Reported net earnings attributable to U. S. Steel ($680) ($391) Income tax provision 233 (19) Net interest and other financial costs 71 35 Reported earnings before interest and income taxes ($376) ($375) Depreciation, depletion and amortization expense 162 160 EBITDA ($214) ($215) Tubular asset impairment charges ─ 263 December 24, 2018 Clairton coke making facility fire (3) ─ Restructuring and other charges 221 41 Gain on previously held investment in UPI ─ (25) Adjusted EBITDA $4 $64 22

INVESTOR RELATIONS Kevin Lewis Vice President 412-433-6935 klewis@uss.com Eric Linn Senior Manager 412-433-2385 eplinn@uss.com www.ussteel.com