Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - DUKE REALTY CORP | q1d0c2020.htm |

| EX-32.4 - EXHIBIT 32.4 - DUKE REALTY CORP | ex324q12020.htm |

| EX-32.3 - EXHIBIT 32.3 - DUKE REALTY CORP | ex323q12020.htm |

| EX-32.2 - EXHIBIT 32.2 - DUKE REALTY CORP | ex322q12020.htm |

| EX-32.1 - EXHIBIT 32.1 - DUKE REALTY CORP | ex321q12020.htm |

| EX-31.4 - EXHIBIT 31.4 - DUKE REALTY CORP | ex314q12020.htm |

| EX-31.3 - EXHIBIT 31.3 - DUKE REALTY CORP | ex313q12020.htm |

| EX-31.2 - EXHIBIT 31.2 - DUKE REALTY CORP | ex312q12020.htm |

| EX-31.1 - EXHIBIT 31.1 - DUKE REALTY CORP | ex311q12020.htm |

| EX-10.5 - EXHIBIT 10.5 - DUKE REALTY CORP | exhibit105formof2020pspa.htm |

| EX-10.3 - EXHIBIT 10.3 - DUKE REALTY CORP | exhibit103formofrsuaward.htm |

| EX-10.2 - EXHIBIT 10.2 - DUKE REALTY CORP | exhibit102formofannualrs.htm |

| EX-10.1 - EXHIBIT 10.1 - DUKE REALTY CORP | exhibit101formofltipunit.htm |

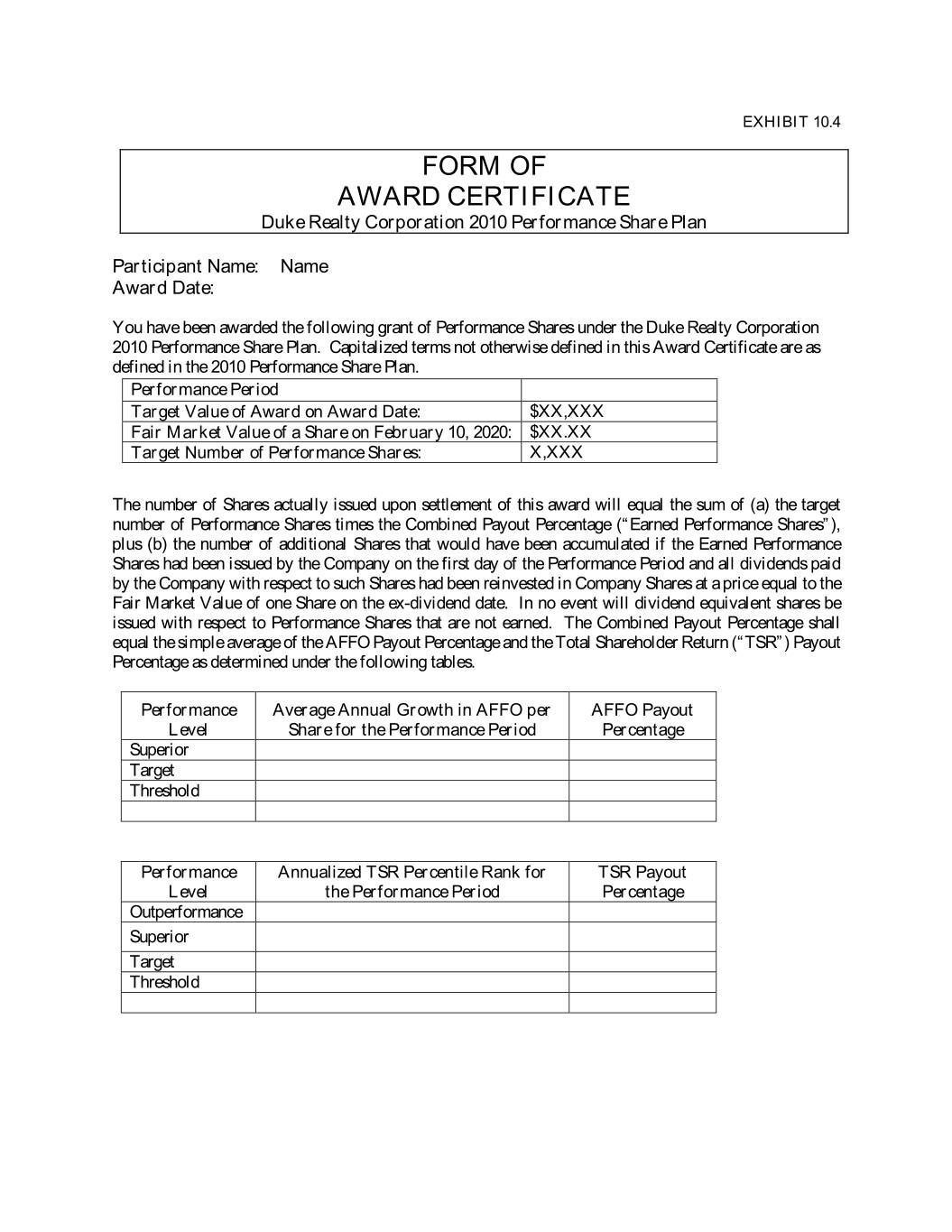

EXHIBIT 10.4 FORM OF AWARD CERTIFICATE Duke Realty Corporation 2010 Performance Share Plan Participant Name: Name Award Date: You have been awarded the following grant of Performance Shares under the Duke Realty Corporation 2010 Performance Share Plan. Capitalized terms not otherwise defined in this Award Certificate are as defined in the 2010 Performance Share Plan. Performance Period Target Value of Award on Award Date: $XX,XXX Fair Market Value of a Share on February 10, 2020: $XX.XX Target Number of Performance Shares: X,XXX The number of Shares actually issued upon settlement of this award will equal the sum of (a) the target number of Performance Shares times the Combined Payout Percentage (“Earned Performance Shares”), plus (b) the number of additional Shares that would have been accumulated if the Earned Performance Shares had been issued by the Company on the first day of the Performance Period and all dividends paid by the Company with respect to such Shares had been reinvested in Company Shares at a price equal to the Fair Market Value of one Share on the ex-dividend date. In no event will dividend equivalent shares be issued with respect to Performance Shares that are not earned. The Combined Payout Percentage shall equal the simple average of the AFFO Payout Percentage and the Total Shareholder Return (“TSR”) Payout Percentage as determined under the following tables. Performance Average Annual Growth in AFFO per AFFO Payout Level Share for the Performance Period Percentage Superior Target Threshold Performance Annualized TSR Percentile Rank for TSR Payout Level the Performance Period Percentage Outperformance Superior Target Threshold

The AFFO Payout Percentage shall be interpolated between the Threshold and Target performance levels and between the Target and Superior performance levels, with the maximum Payout Percentage equal to 200%. The TSR Payout Percentage shall be interpolated between the Threshold and Target performance levels and the Target and Superior performance levels. For example, if the Average Annual Growth in AFFO per Share for the Performance Period was 1.5% and the Annualized TSR for the Performance Period was in the 70th Percentile, then the Combined Payout Percentage would equal 127.5%: the sum of [(a) 75% (AFFO Payout Percentage) and, (b) 180% (TSR Payout Percentage),] divided by 2. A payout percentage shall be zero percent if the threshold performance level is not attained. Average Annual Growth in AFFO Per Share Computation Except as provided below in the case of a Change in Control, Average Annual Growth in AFFO per Share shall mean the simple average of the Annual Growth in AFFO per Share for the three calendar years of the Performance Period. Annual Growth in AFFO per Share for a calendar year shall mean the percentage by which AFFO per Share for the applicable calendar year exceeds AFFO per Share for the prior calendar year. Growth in AFFO per Share may be a negative percentage. AFFO per Share shall be computed in a consistent manner from year to year and in accordance with disclosures made by the Company in its SEC filings or applicable supplemental data filed on the Company’s website. In general, AFFO means core Funds from Operations less recurring building improvements and total second generation capital expenditures (the leasing of vacant space that had previously been under lease by the company is referred to as second generation lease activity) related to leases commencing during the reporting period and adjusted for certain non-cash items including straight line rental income and expenses, non-cash components of interest expense and stock compensation expense, and after similar adjustments for unconsolidated partnerships and joint ventures. Annualized TSR Computation Except as provided below in the case of a Change in Control, Annualized TSR for the Performance Period shall mean the annualized return, assuming annual compounding, that would cause (a) the Fair Market Value of one share of Stock on the date immediately preceding the beginning of the Performance Period, to equal (b) the sum of (i) the Fair Market Value of one share of Stock at the end of the Performance Period and (ii) the cumulative value of the Company’s dividends paid over the Performance Period, assuming the reinvestment of such dividends into Stock on each ex-dividend date. The Company’s Annualized TSR for the Performance Period shall be compared to the Annualized TSR for the Performance Period computed in a consistent manner for the following companies (“Peer Group”): Peer #1 Peer #2 Peer #3 Peer #4 Peer #5 Peer #6 Peer #7 Peer #8 Peer #9 Peer #10 Peer #11 Percentile Rank shall mean the percentage that is (a) the number of Peer Group companies with an Annualized TSR that is less than the Company’s Annualized TSR, divided by (b) the total number of companies in the Peer Group. For example, if five of the Peer Group companies had an Annualized TSR

over the Performance Period that was less than the Company’s Annualized TSR, the Annualized TSR for the Performance Period would be in the 45th percentile [5/11]. In the event any of the companies in the Peer Group cease to be traded on a nationally recognized stock exchange during the Performance Period, such company shall be removed from the Peer Group and excluded from the percentile computations. However, if the reason for the cessation of trading was due to bankruptcy, insolvency or, at the discretion of the Committee, the acquisition of the company as the result of financial distress, the Annualized TSR performance of such company will be treated as underperforming the Company’s Annualized TSR. Additionally, if, prior to the end of the Performance Period, a public announcement is made that states that any member of the Peer Group will cease to be traded on a nationally recognized stock exchange as a result of a capital transaction that will not close until after the end of the Performance Period, then such Peer shall be removed from the Peer Group and excluded from the percentile computations. With regard to the Outperformance payout level under the TSR metric, Absolute TSR shall mean the Company’s annualized TSR for the Performance Period, computed as described above. Retirement Provisions “Retirement” means Participant’s termination of employment with the Company or an Affiliate, other than a Termination for Cause, on or after Participant attains the age of 55 years provided that, as of the date of termination, the sum of the number of whole years of Participant’s employment with the Company or an Affiliate plus Participant’s age totals at least 65 years. Compensation Recoupment Policy This Award shall be subject to any compensation recoupment policy of the Company that is applicable by its terms to Participant and to Awards of this type. Change in Control Provisions For purposes of Section 5.8 of the Performance Share Plan: • If a Change in Control occurs prior to the second anniversary of the beginning of the Performance Period, the AFFO per Share performance level shall be deemed to be at target and, therefore, the AFFO Payout Percentage shall be 100%. If a Change in Control occurs on or after the second anniversary of the beginning of the Performance Period and prior to the end of the Performance Period, the Average Annual Growth in AFFO per Share shall equal the simple average of the Annual Growth in AFFO per Share for the first two calendar years of the Performance Period, and the AFFO Payout Percentage shall be determined accordingly. • If a Change in Control occurs prior to the second anniversary of the beginning of the Performance Period, the Annualized TSR and Absolute TSR performance levels shall be deemed to be at target and, therefore, the TSR Payout Percentage shall be 100%. If a Change in Control occurs on or after the second anniversary of the beginning of the Performance Period and prior to the end of the Performance Period, the Annualized TSR shall be determined based on the number of full and partial years from the beginning of the Performance Period to the date of the Change in Control. The Absolute TSR, if applicable, shall be determined based on the number of full and partial years from the beginning of the Performance Period to the date of the Change in Control.

Additional Rights with Respect to Performance Shares • Without duplication with the provisions of Article 15 of the Equity Incentive Plan, if (i) the Company shall at any time be involved in a merger, consolidation, dissolution, liquidation, reorganization, exchange of shares, sale of all or substantially all of the assets or capital stock of the Company or a transaction similar thereto, (ii) any stock dividend, stock split, reverse stock split, stock combination, reclassification, recapitalization, spin-off, or other similar change in the capital structure of the Company, or any distribution to holders of Common Stock other than ordinary cash dividends, shall occur, or (iii) any other event shall occur which, in each case in the judgment of the Committee, necessitates action by way of adjusting the terms of this Award, then and in that event, the Committee shall take such action, if any, as it determines to be reasonably required to maintain the Participant’s rights hereunder so that they are substantially proportionate to the rights existing under this Agreement prior to such event, including, but not limited to, substitution of other awards or modification of performance targets and performance periods, under the Equity Incentive Plan. _________________________________________________________________________ By your signature and the Company’s signature below, you and the Company agree that these grants are awarded under and governed by the terms and conditions of the Duke Realty Corporation 2010 Performance Share Plan and this Award Certificate. PARTICIPANT _______________________________________ __________________ Name Date COMPANY Duke Realty Corporation _____________________________________ __________________ By: [Name] Date [Title]