Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PARKER HANNIFIN CORP | exhibit9913qfy20.htm |

| 8-K - 8-K - PARKER HANNIFIN CORP | ph-20200430.htm |

Parker Hannifin Corporation Exhibit 99.2 3rd Quarter Fiscal Year 2020 Earnings Release April 30, 2020

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. Additionally, the actual impact of changes in tax laws in the United States and foreign jurisdictions and any judicial or regulatory interpretation thereof on future performance and earnings projections may impact the company’s tax calculations. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance are: the impact of the global outbreak of COVID-19 and governmental and other actions taken in response; changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of CLARCOR, LORD Corporation or Exotic Metals; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully capital allocation initiatives, including timing, price and execution of share repurchases; availability, limitations or cost increases of raw materials, component products and/or commodities that cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; compliance costs associated with environmental laws and regulations; potential labor disruptions; threats associated with and efforts to combat terrorism and cyber-security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; global competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability, as well as uncertainties associated with the timing and conditions surrounding the return to service of the Boeing 737 MAX. The company makes these statements as of the date of this disclosure and undertakes no obligation to update them unless otherwise required by law. This presentation contains references to non-GAAP financial information including adjusted operating margin, adjusted EBITDA margin, adjusted cash flow from operating activities, free cash flow, and adjusted earnings per share. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before business realignment, integration costs to achieve, and acquisition related expenses. Free cash flow is defined as cash flow from operations less capital expenditures plus discretionary pension contribution. Although adjusted operating margin, adjusted EBITDA margin, adjusted cash flow from operating activities, free cash flow, and adjusted earnings per share are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the periods presented. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Please visit www.PHstock.com for more information 2

Agenda • CEO Update on Parker’s Response to COVID-19 • CEO Highlights of Quarter Results • CFO Summary of Quarter Results • Questions & Answers 3

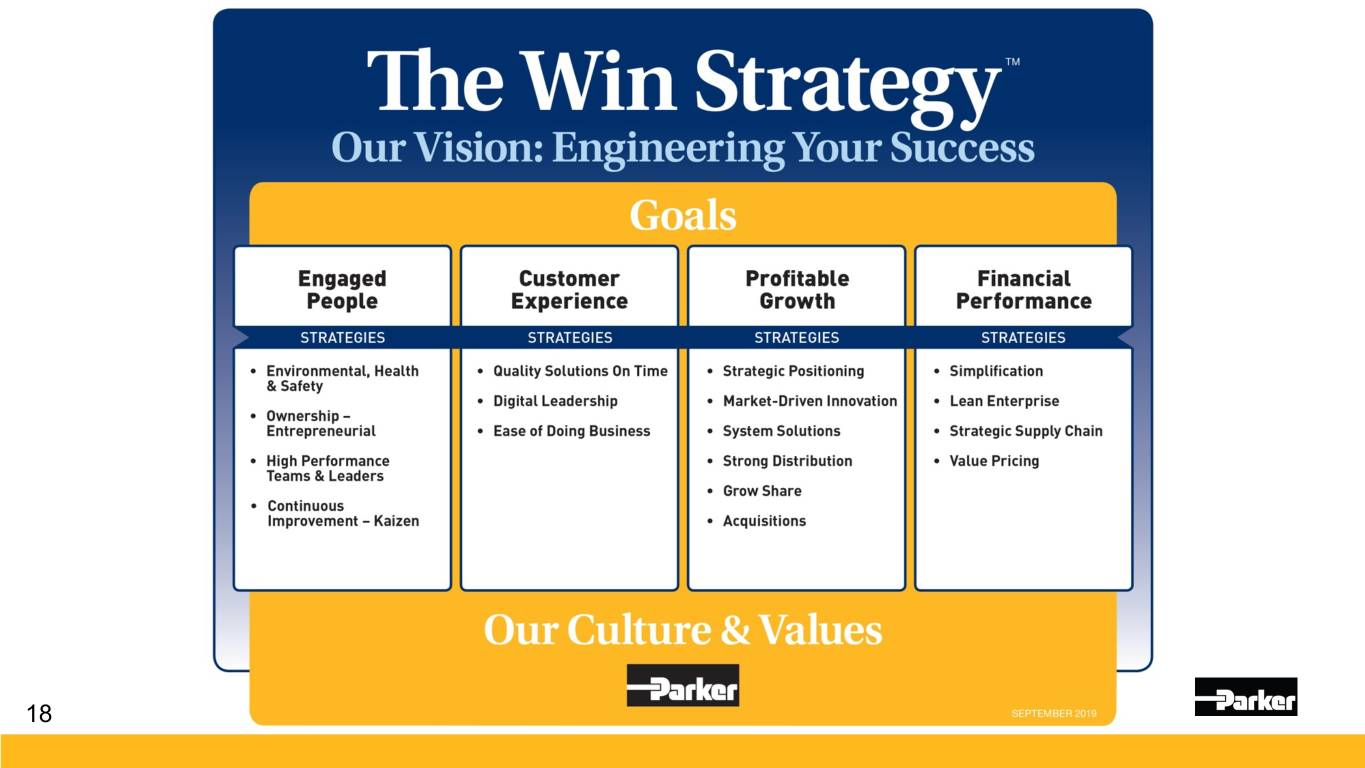

Performance During a Health & Economic Crisis Our strength comes from: . The Win Strategy™ . A Portfolio of Products & Technologies that are needed . Our Culture & Values . Our Purpose . Engaged People 4

Crisis Management Strategy . Safety of our team members and their families . Helping society through the crisis: • We are Essential • Our Purpose in Action . Standing strong after the crisis Utilizing our crisis response management team 5

Health & Safety Actions: Early & Decisive . Enhanced hygiene, cleaning & sanitization protocols . Physical distancing . Early travel restrictions . Early cancellation of in-person meetings . Standard work: Investigation, disinfection & return-to-work protocols . Contact tracing and quarantines . Transparent communications to team members Two Safest Places…Work and Home 6

Our Purpose in Action Food Supply Helping Patients Essential Manufacturing Climate Control Electromechanical Engineered Materials Filtration Fluid & Gas Handling Hydraulics Pneumatics Process Control 7

Our Purpose in Action Transportation Power Generation Healthcare - Ventilators Climate Control Electromechanical Engineered Materials Filtration Fluid & Gas Handling Hydraulics Pneumatics Process Control 8

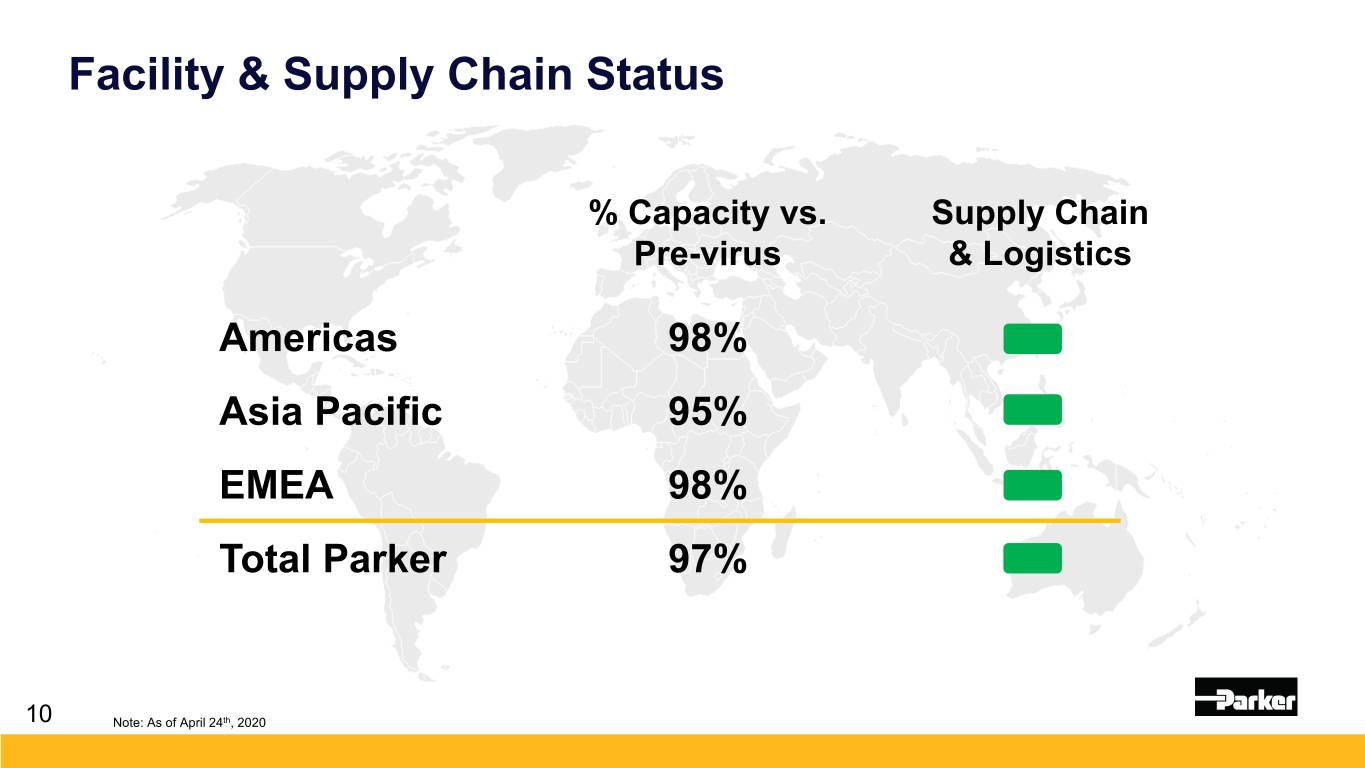

Facility & Supply Chain Status % Capacity vs. Supply Chain Pre-virus & Logistics Americas 98% Asia Pacific 95% EMEA 98% Total Parker 97% 10 Note: As of April 24th, 2020

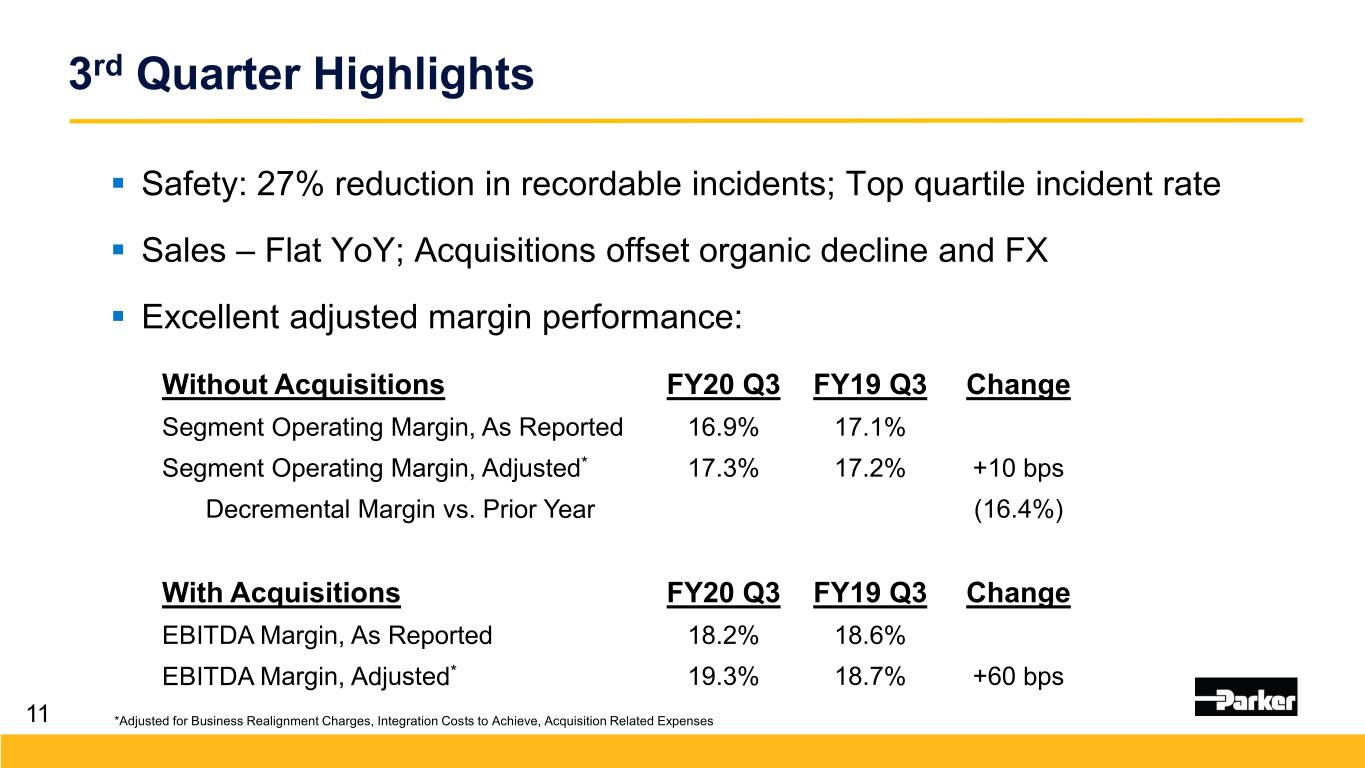

3rd Quarter Highlights . Safety: 27% reduction in recordable incidents; Top quartile incident rate . Sales – Flat YoY; Acquisitions offset organic decline and FX . Excellent adjusted margin performance: Without Acquisitions FY20 Q3 FY19 Q3 Change Segment Operating Margin, As Reported 16.9% 17.1% Segment Operating Margin, Adjusted* 17.3% 17.2% +10 bps Decremental Margin vs. Prior Year (16.4%) With Acquisitions FY20 Q3 FY19 Q3 Change EBITDA Margin, As Reported 18.2% 18.6% EBITDA Margin, Adjusted* 19.3% 18.7% +60 bps 11 *Adjusted for Business Realignment Charges, Integration Costs to Achieve, Acquisition Related Expenses

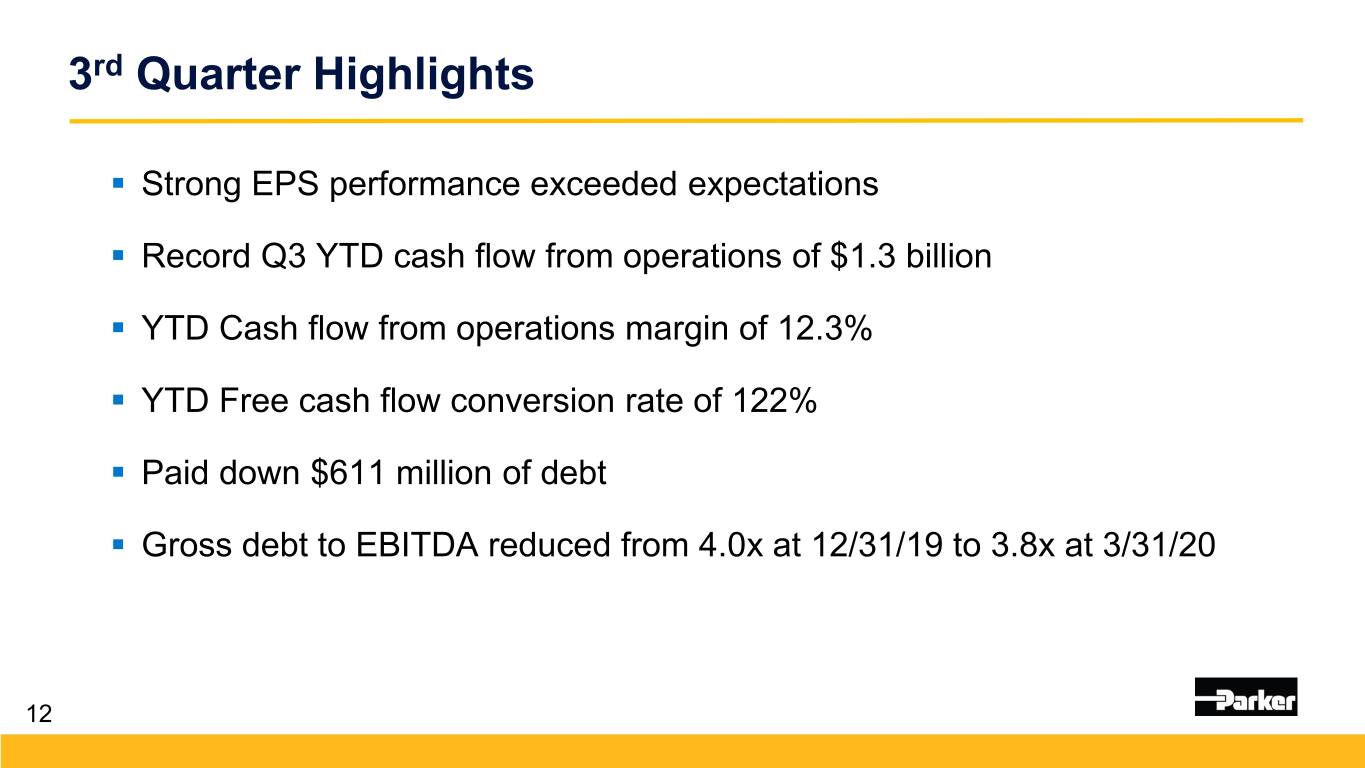

3rd Quarter Highlights . Strong EPS performance exceeded expectations . Record Q3 YTD cash flow from operations of $1.3 billion . YTD Cash flow from operations margin of 12.3% . YTD Free cash flow conversion rate of 122% . Paid down $611 million of debt . Gross debt to EBITDA reduced from 4.0x at 12/31/19 to 3.8x at 3/31/20 12

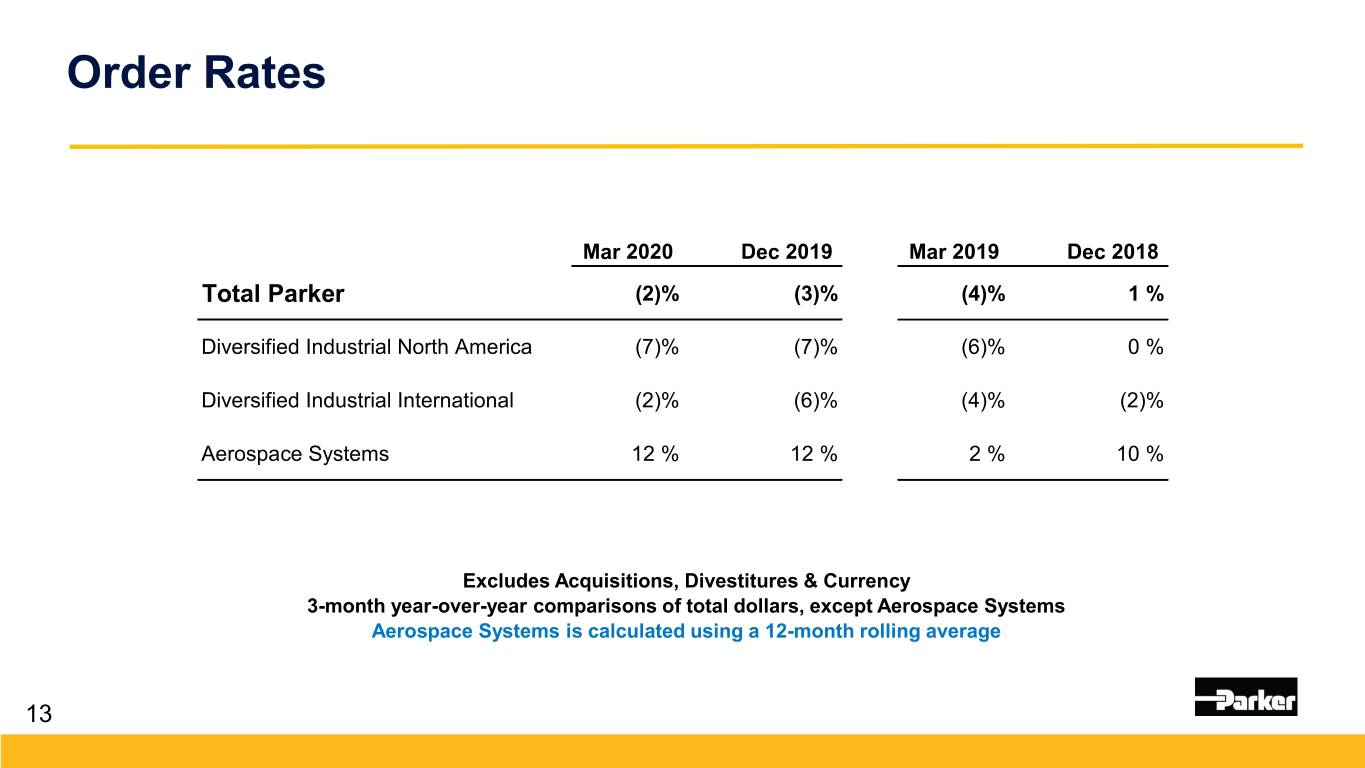

Order Rates Mar 2020 Dec 2019 Mar 2019 Dec 2018 Total Parker (2)% (3)% (4)% 1 % Diversified Industrial North America (7)% (7)% (6)% 0 % Diversified Industrial International (2)% (6)% (4)% (2)% Aerospace Systems 12 % 12 % 2 % 10 % Excludes Acquisitions, Divestitures & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Systems Aerospace Systems is calculated using a 12-month rolling average 13

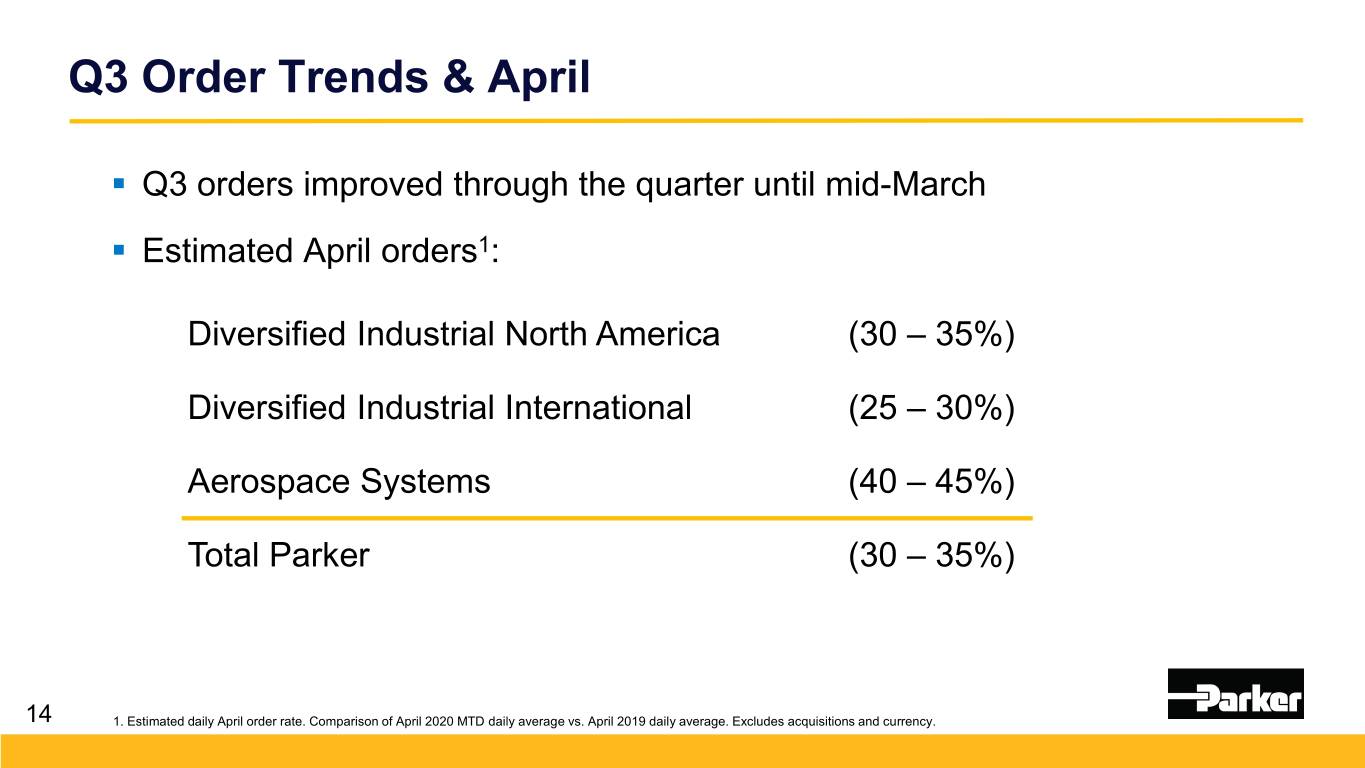

Q3 Order Trends & April . Q3 orders improved through the quarter until mid-March . Estimated April orders1: Diversified Industrial North America (30 – 35%) Diversified Industrial International (25 – 30%) Aerospace Systems (40 – 45%) Total Parker (30 – 35%) 14 1. Estimated daily April order rate. Comparison of April 2020 MTD daily average vs. April 2019 daily average. Excludes acquisitions and currency.

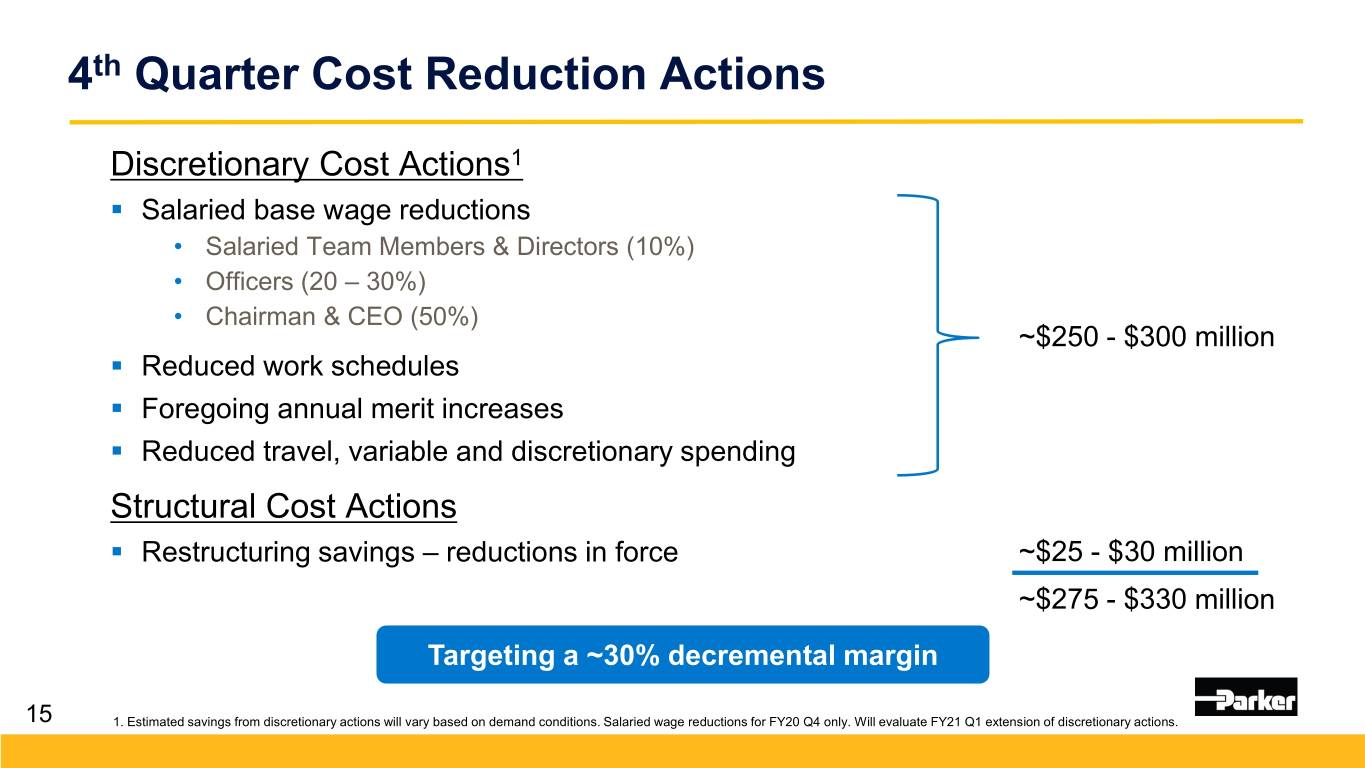

4th Quarter Cost Reduction Actions Discretionary Cost Actions1 . Salaried base wage reductions • Salaried Team Members & Directors (10%) • Officers (20 – 30%) • Chairman & CEO (50%) ~$250 - $300 million . Reduced work schedules . Foregoing annual merit increases . Reduced travel, variable and discretionary spending Structural Cost Actions . Restructuring savings – reductions in force ~$25 - $30 million ~$275 - $330 million Targeting a ~30% decremental margin 15 1. Estimated savings from discretionary actions will vary based on demand conditions. Salaried wage reductions for FY20 Q4 only. Will evaluate FY21 Q1 extension of discretionary actions.

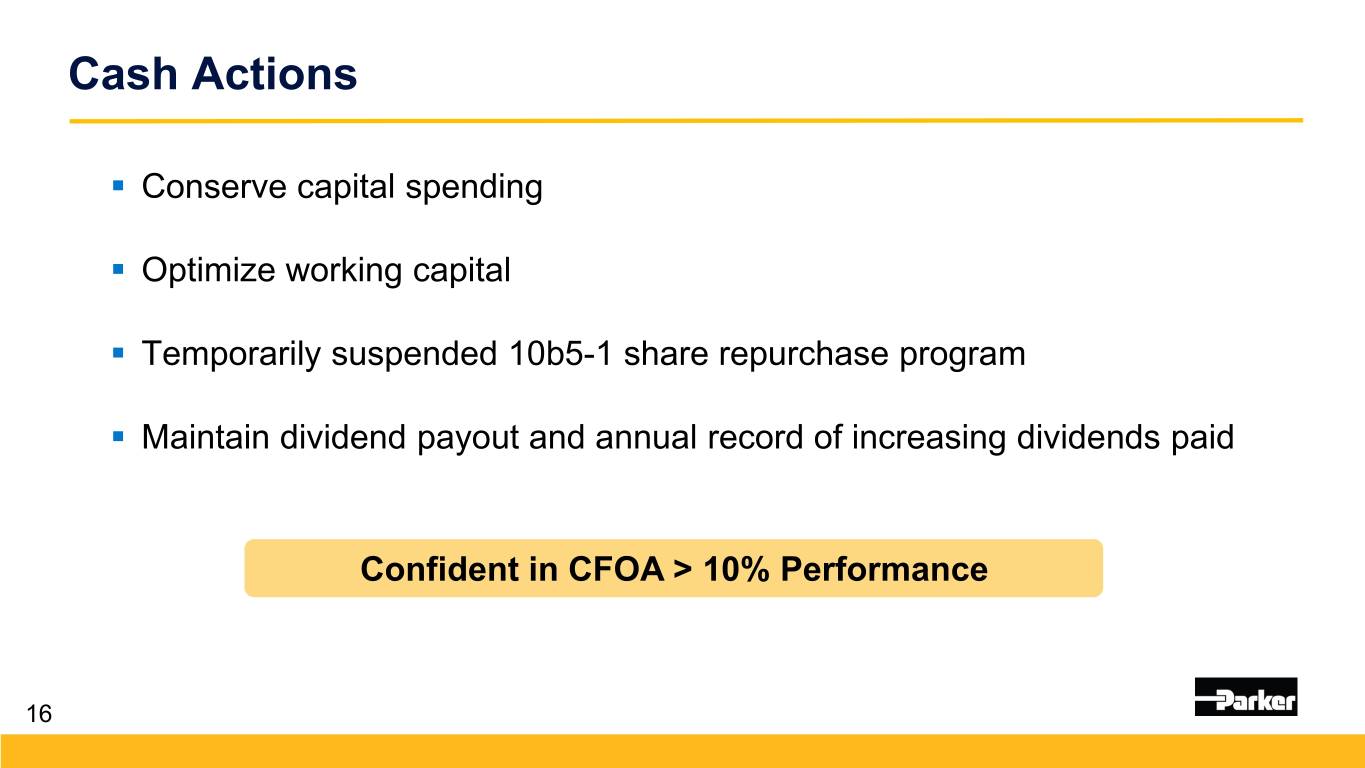

Cash Actions . Conserve capital spending . Optimize working capital . Temporarily suspended 10b5-1 share repurchase program . Maintain dividend payout and annual record of increasing dividends paid Confident in CFOA > 10% Performance 16

18

Unmatched Breadth of Technologies 19

Transformational Acquisitions . $3 billion in acquired sales1 . More resilient . Accretive to growth & margins 20 1. As announced at time of acquisition

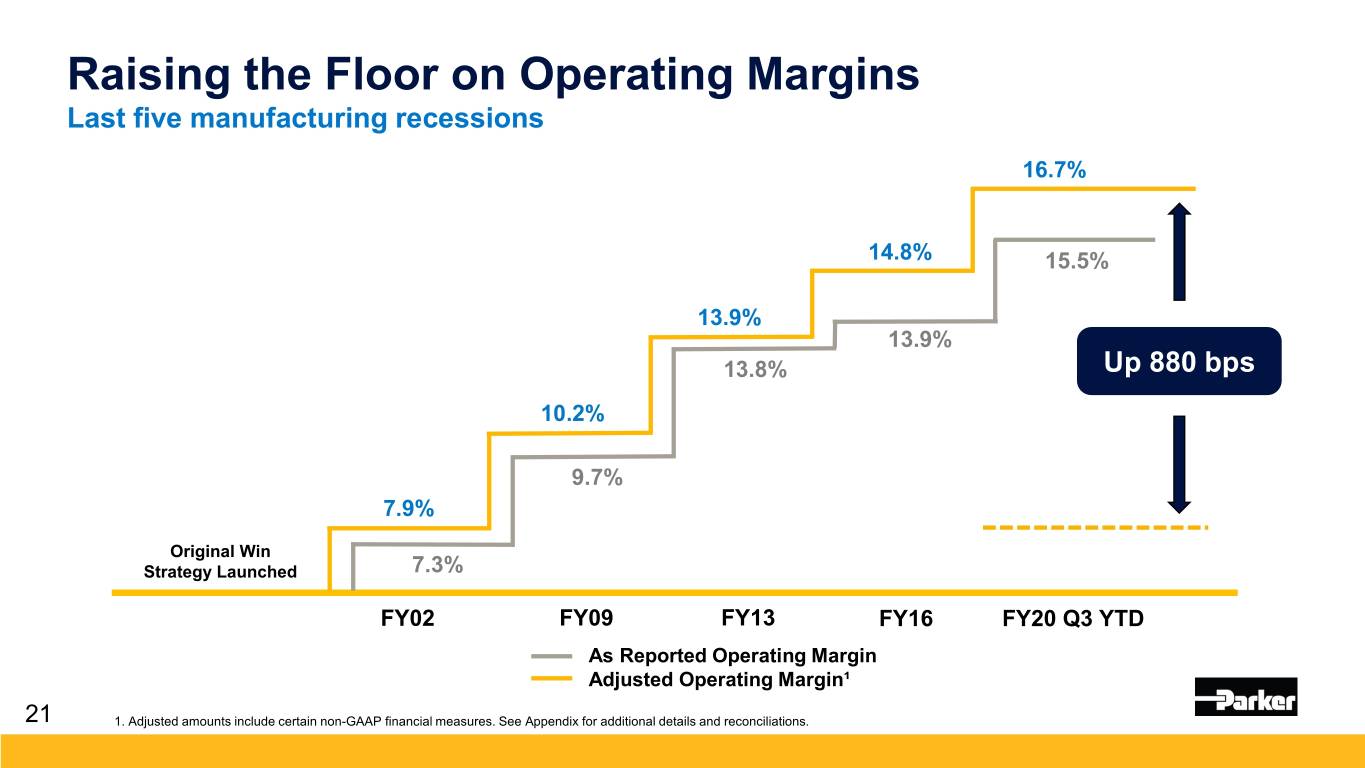

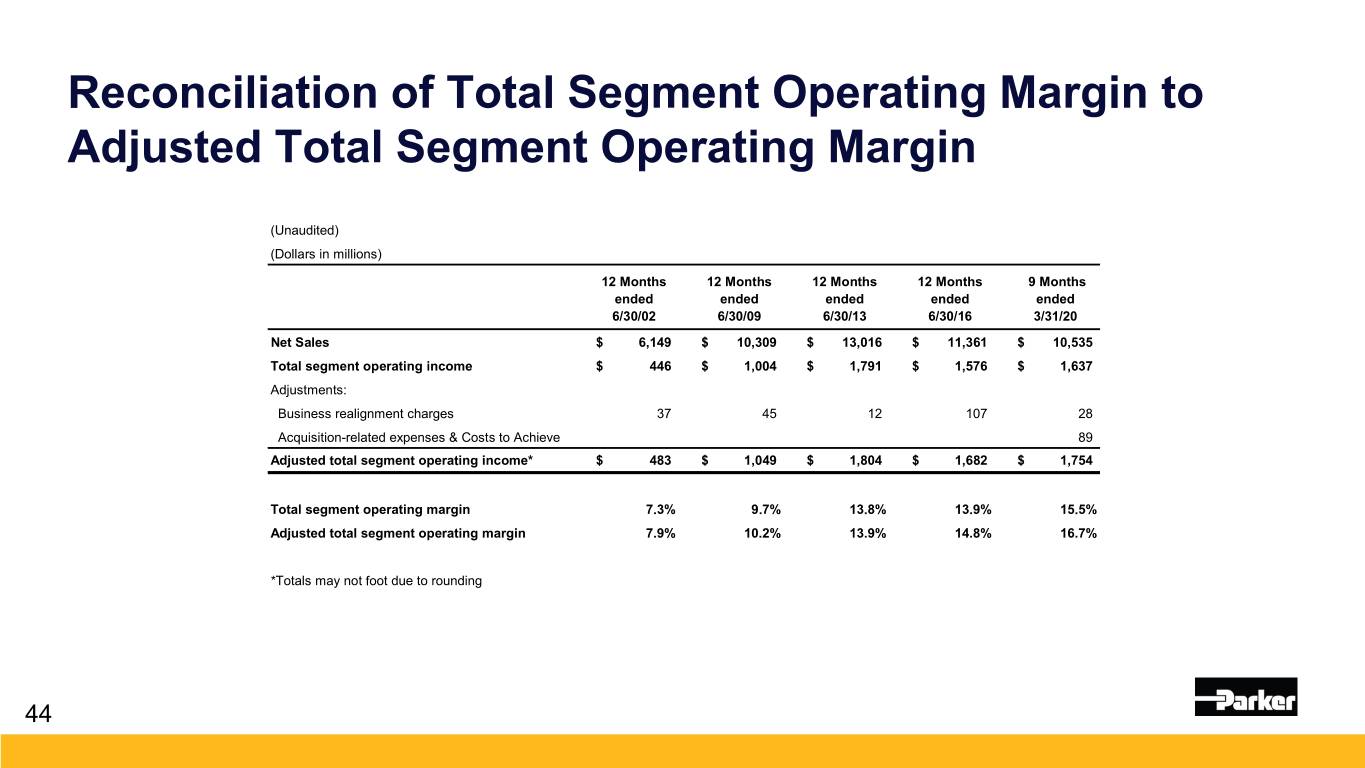

Raising the Floor on Operating Margins Last five manufacturing recessions 16.7% 14.8% 15.5% 13.9% 13.9% 13.8% Up 880 bps 10.2% 9.7% 7.9% Original Win Strategy Launched 7.3% FY02 FY09 FY13 FY16 FY20 Q3 YTD As Reported Operating Margin Adjusted Operating Margin¹ 21 1. Adjusted amounts include certain non-GAAP financial measures. See Appendix for additional details and reconciliations.

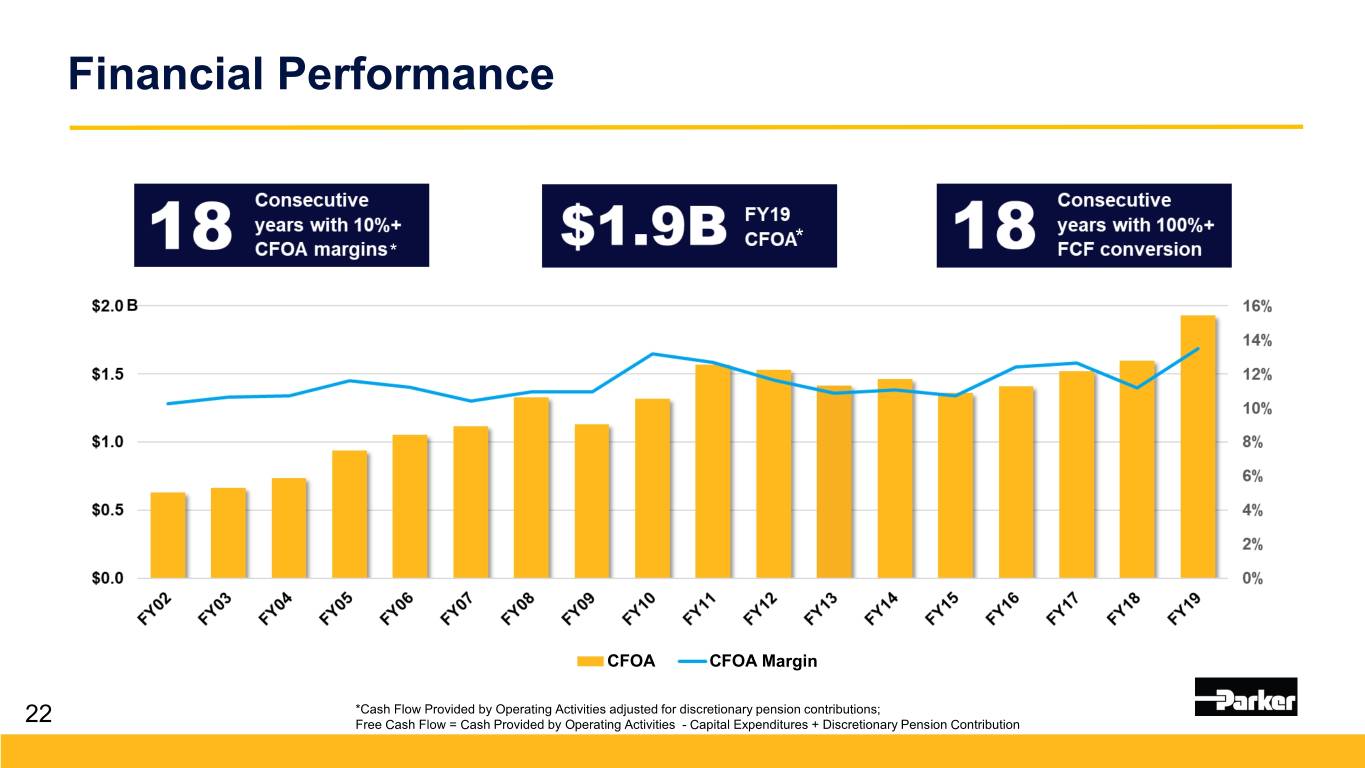

Financial Performance * * CFOA CFOA Margin *Cash Flow Provided by Operating Activities adjusted for discretionary pension contributions; 22 Free Cash Flow = Cash Provided by Operating Activities - Capital Expenditures + Discretionary Pension Contribution

FY20 Outlook . Current environment highly uncertain – withdrawing FY20 guidance . Portfolio & cost structure has been transformed over the last five years . Rapidly and aggressively adjusting costs to current environment . Resilient – consistent cash flow from operations* >10% last 18 years Win Strategy 3.0 & Our Purpose will Propel our Future 23 *Cash Flow Provided by Operating Activities adjusted for discretionary pension contributions

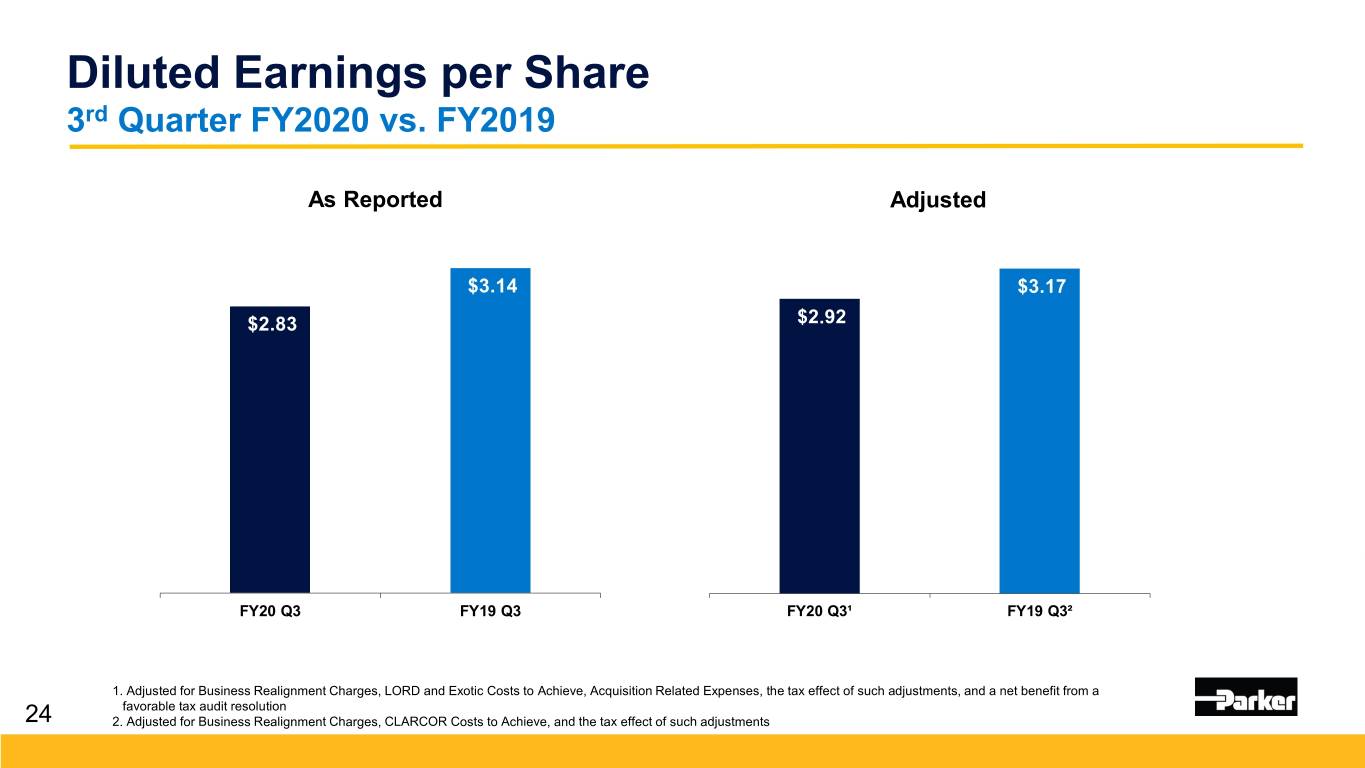

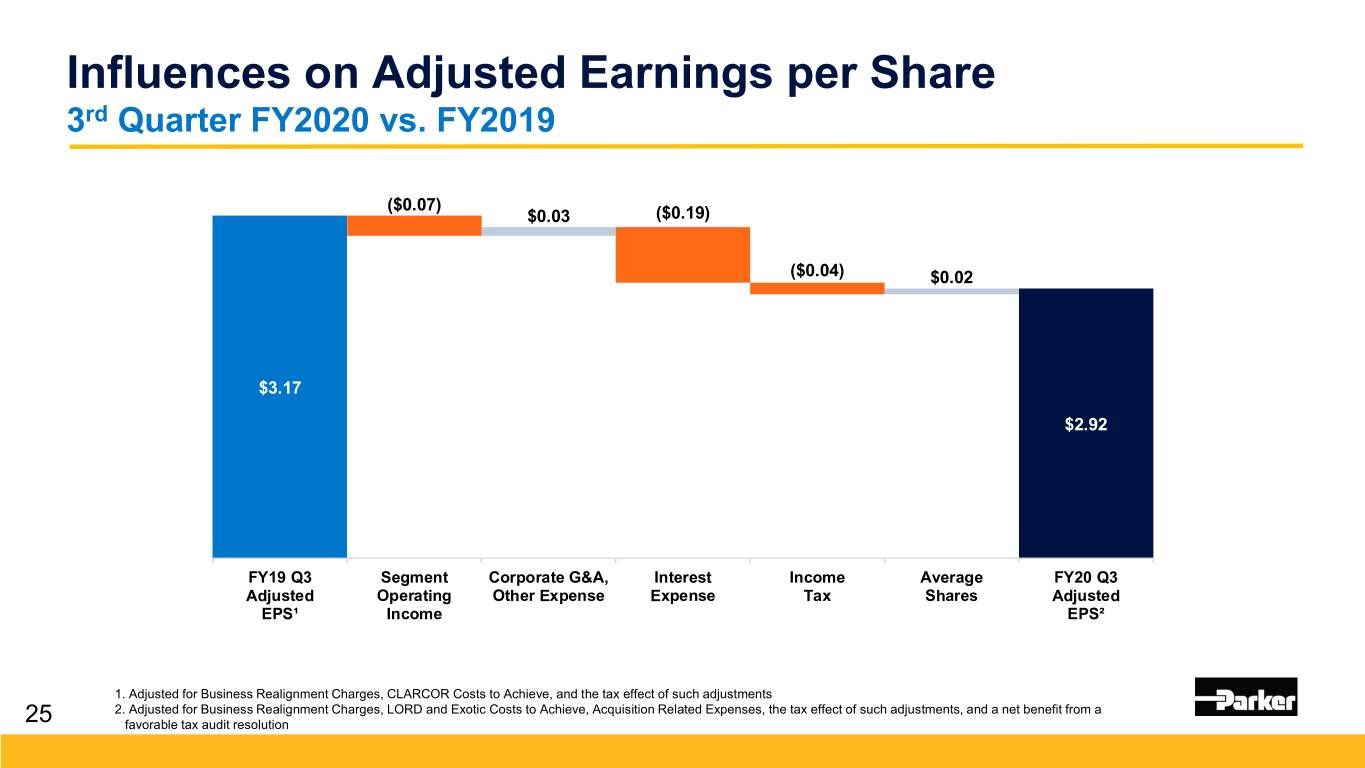

Diluted Earnings per Share 3rd Quarter FY2020 vs. FY2019 As Reported Adjusted $3.14 $3.17 $2.83 $2.92 FY20 Q3 FY19 Q3 FY20 Q3¹ FY19 Q3² 1. Adjusted for Business Realignment Charges, LORD and Exotic Costs to Achieve, Acquisition Related Expenses, the tax effect of such adjustments, and a net benefit from a favorable tax audit resolution 24 2. Adjusted for Business Realignment Charges, CLARCOR Costs to Achieve, and the tax effect of such adjustments

Influences on Adjusted Earnings per Share 3rd Quarter FY2020 vs. FY2019 ($0.07) $0.03 ($0.19) ($0.04) $0.02 $3.17 $2.92 FY19 Q3 Segment Corporate G&A, Interest Income Average FY20 Q3 Adjusted Operating Other Expense Expense Tax Shares Adjusted EPS¹ Income EPS² 1. Adjusted for Business Realignment Charges, CLARCOR Costs to Achieve, and the tax effect of such adjustments 2. Adjusted for Business Realignment Charges, LORD and Exotic Costs to Achieve, Acquisition Related Expenses, the tax effect of such adjustments, and a net benefit from a 25 favorable tax audit resolution

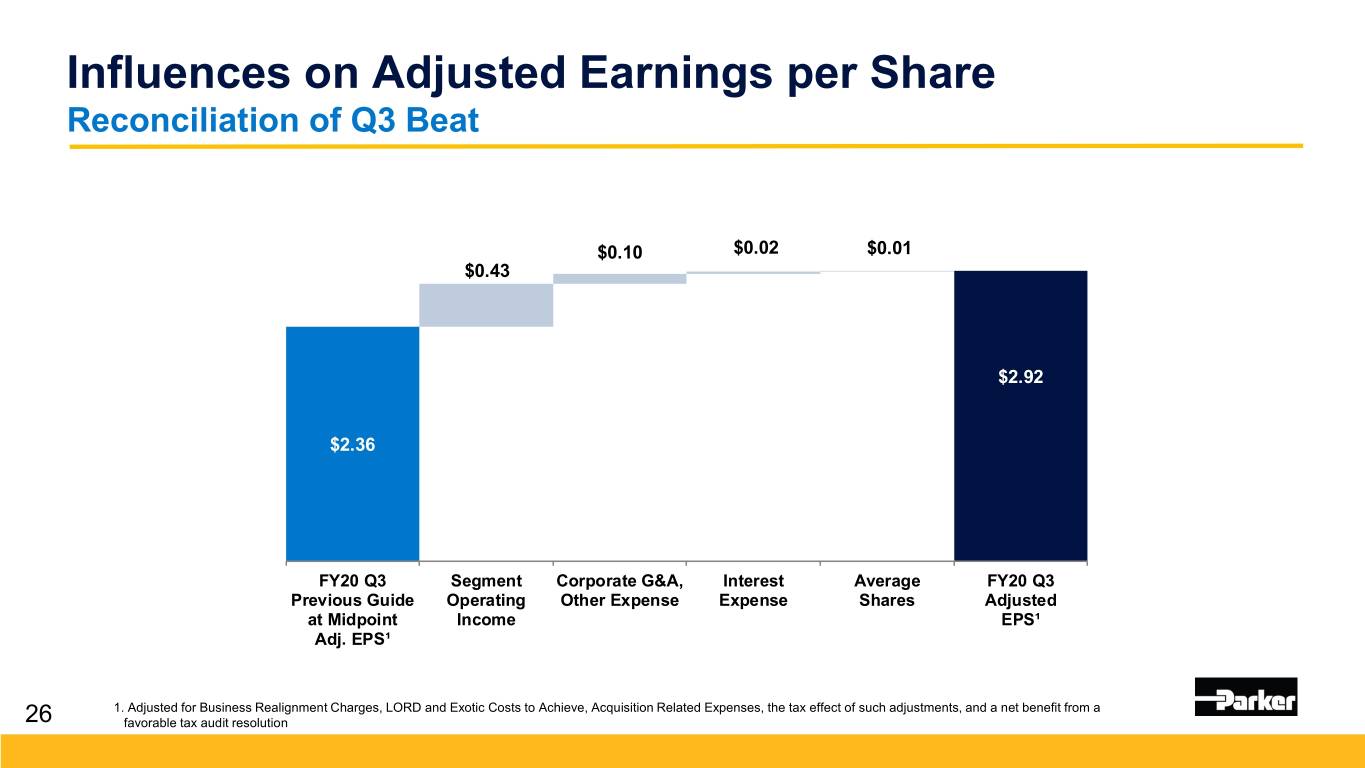

Influences on Adjusted Earnings per Share Reconciliation of Q3 Beat $0.10 $0.02 $0.01 $0.43 $2.92 $2.36 FY20 Q3 Segment Corporate G&A, Interest Average FY20 Q3 Previous Guide Operating Other Expense Expense Shares Adjusted at Midpoint Income EPS¹ Adj. EPS¹ 1. Adjusted for Business Realignment Charges, LORD and Exotic Costs to Achieve, Acquisition Related Expenses, the tax effect of such adjustments, and a net benefit from a 26 favorable tax audit resolution

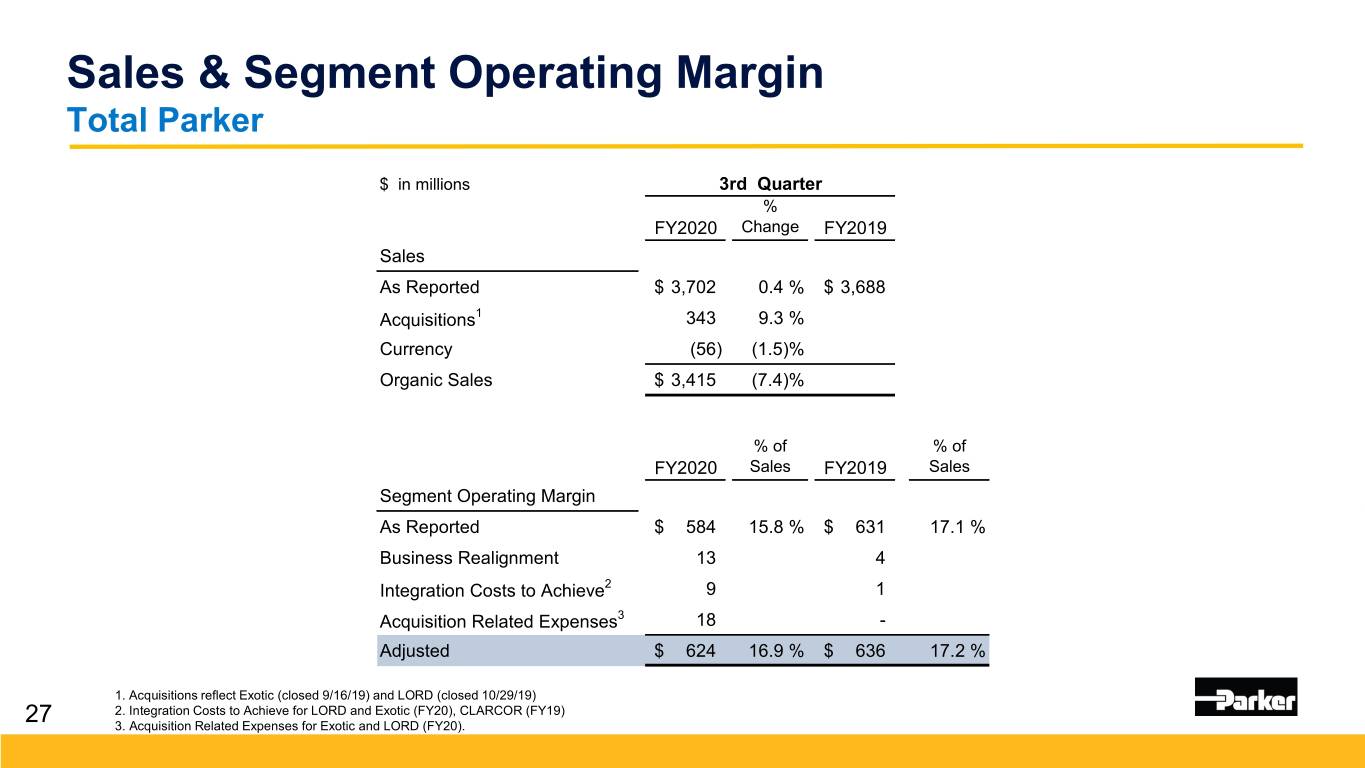

Sales & Segment Operating Margin Total Parker $ in millions 3rd Quarter % FY2020 Change FY2019 Sales As Reported $ 3,702 0.4 % $ 3,688 Acquisitions1 343 9.3 % Currency (56) (1.5)% Organic Sales $ 3,415 (7.4)% % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 584 15.8 % $ 631 17.1 % Business Realignment 13 4 Integration Costs to Achieve2 9 1 Acquisition Related Expenses3 18 - Adjusted $ 624 16.9 % $ 636 17.2 % 1. Acquisitions reflect Exotic (closed 9/16/19) and LORD (closed 10/29/19) 2. Integration Costs to Achieve for LORD and Exotic (FY20), CLARCOR (FY19) 27 3. Acquisition Related Expenses for Exotic and LORD (FY20).

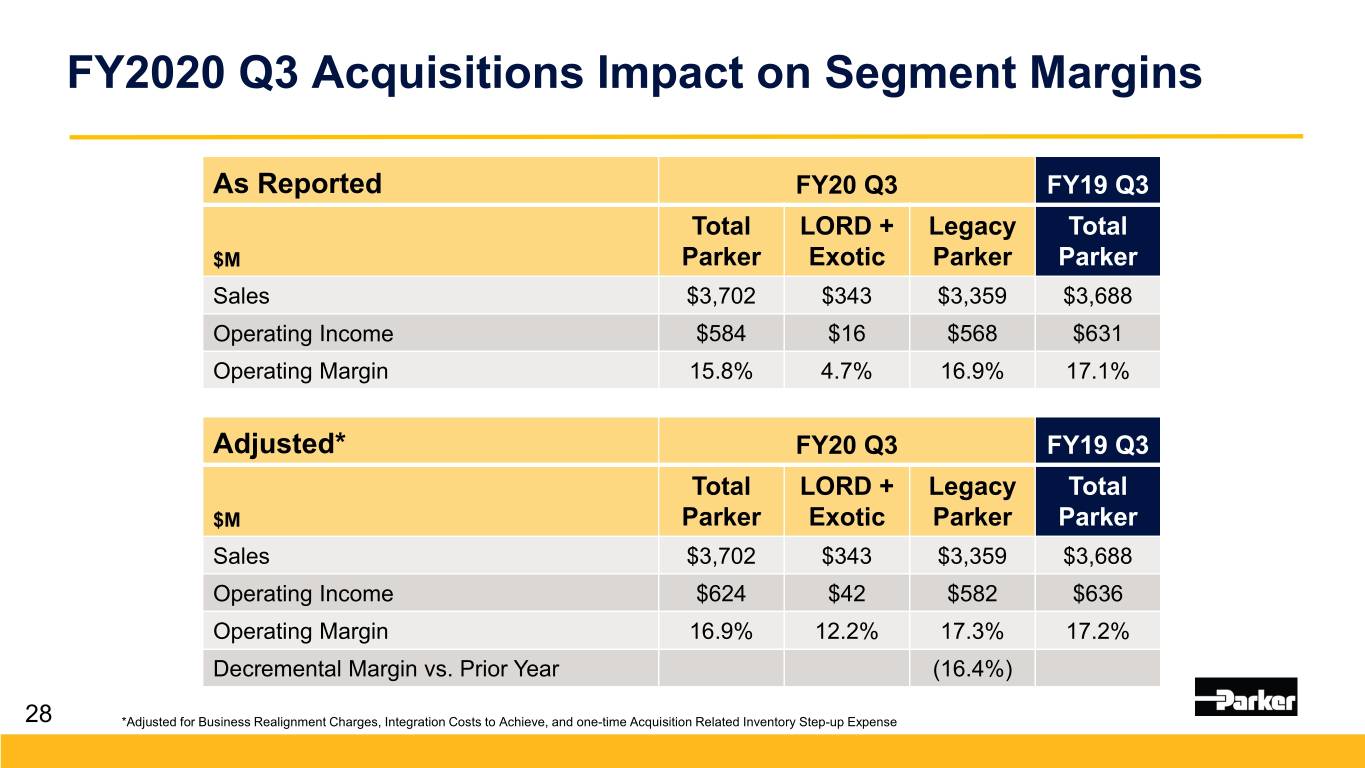

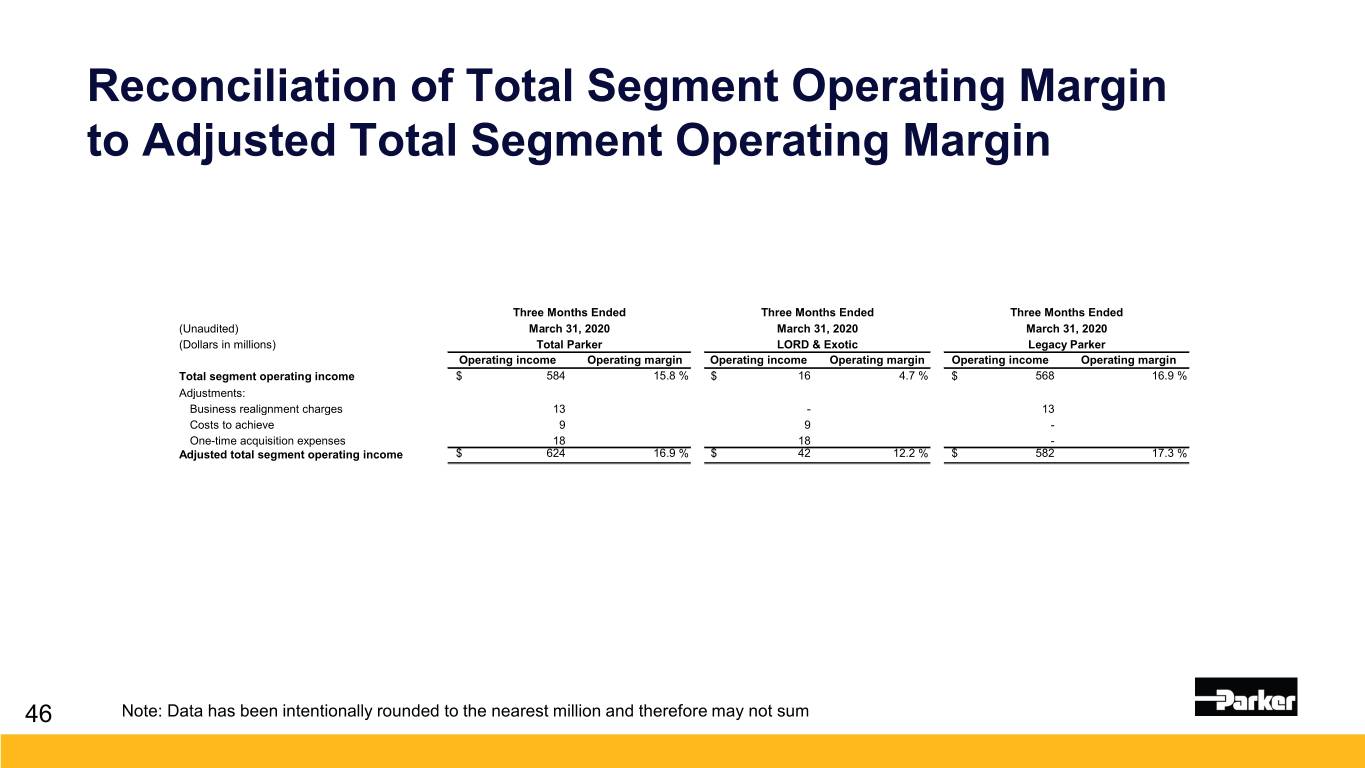

FY2020 Q3 Acquisitions Impact on Segment Margins As Reported FY20 Q3 FY19 Q3 Total LORD + Legacy Total $M Parker Exotic Parker Parker Sales $3,702 $343 $3,359 $3,688 Operating Income $584 $16 $568 $631 Operating Margin 15.8% 4.7% 16.9% 17.1% Adjusted* FY20 Q3 FY19 Q3 Total LORD + Legacy Total $M Parker Exotic Parker Parker Sales $3,702 $343 $3,359 $3,688 Operating Income $624 $42 $582 $636 Operating Margin 16.9% 12.2% 17.3% 17.2% Decremental Margin vs. Prior Year (16.4%) 28 *Adjusted for Business Realignment Charges, Integration Costs to Achieve, and one-time Acquisition Related Inventory Step-up Expense

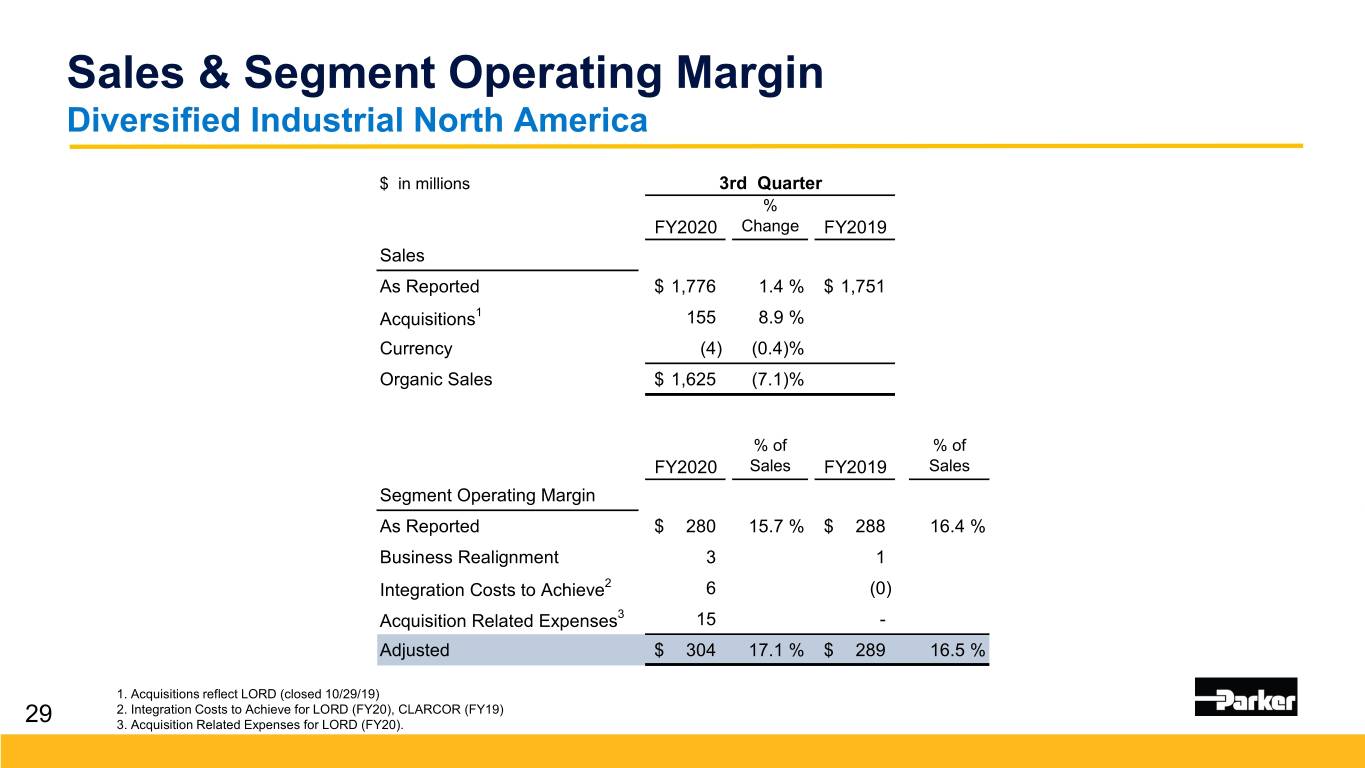

Sales & Segment Operating Margin Diversified Industrial North America $ in millions 3rd Quarter % FY2020 Change FY2019 Sales As Reported $ 1,776 1.4 % $ 1,751 Acquisitions1 155 8.9 % Currency (4) (0.4)% Organic Sales $ 1,625 (7.1)% % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 280 15.7 % $ 288 16.4 % Business Realignment 3 1 Integration Costs to Achieve2 6 (0) Acquisition Related Expenses3 15 - Adjusted $ 304 17.1 % $ 289 16.5 % 1. Acquisitions reflect LORD (closed 10/29/19) 2. Integration Costs to Achieve for LORD (FY20), CLARCOR (FY19) 29 3. Acquisition Related Expenses for LORD (FY20).

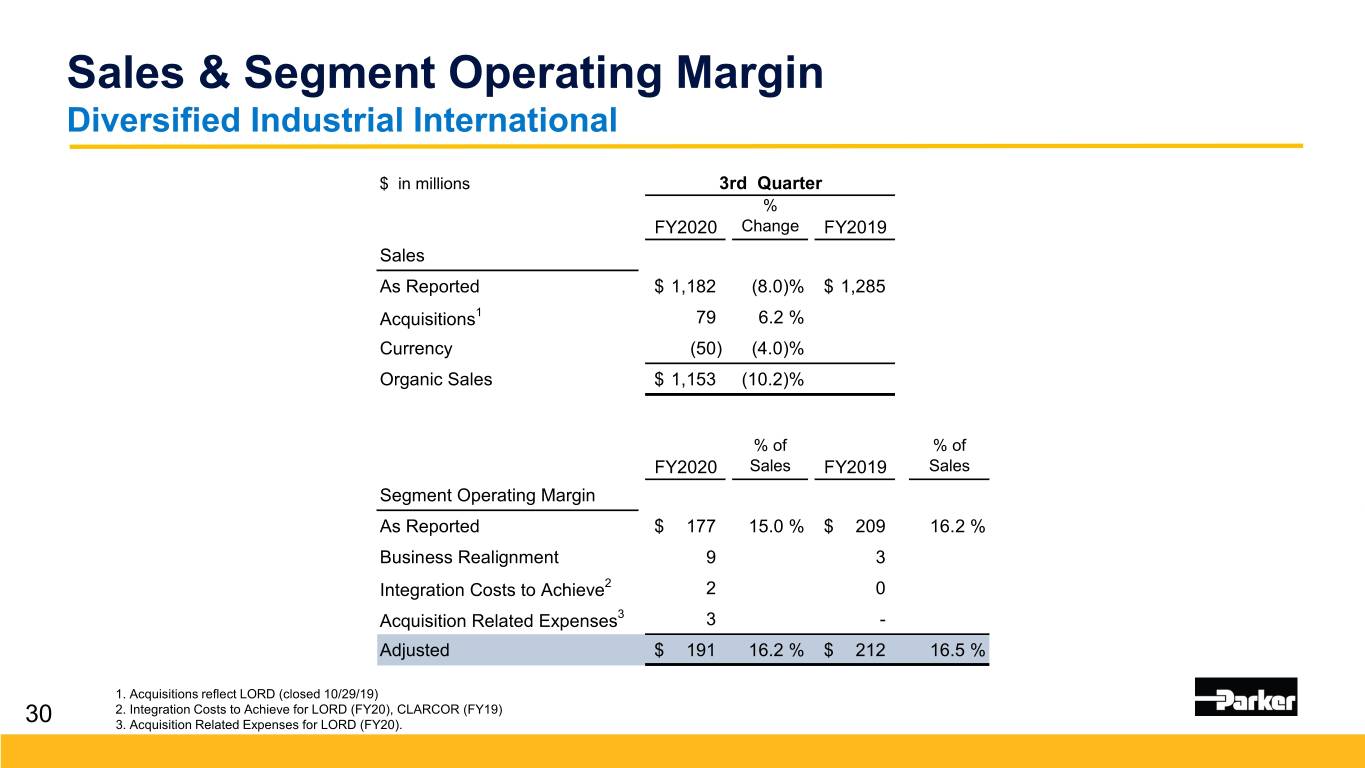

Sales & Segment Operating Margin Diversified Industrial International $ in millions 3rd Quarter % FY2020 Change FY2019 Sales As Reported $ 1,182 (8.0)% $ 1,285 Acquisitions1 79 6.2 % Currency (50) (4.0)% Organic Sales $ 1,153 (10.2)% % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 177 15.0 % $ 209 16.2 % Business Realignment 9 3 Integration Costs to Achieve2 2 0 Acquisition Related Expenses3 3 - Adjusted $ 191 16.2 % $ 212 16.5 % 1. Acquisitions reflect LORD (closed 10/29/19) 2. Integration Costs to Achieve for LORD (FY20), CLARCOR (FY19) 30 3. Acquisition Related Expenses for LORD (FY20).

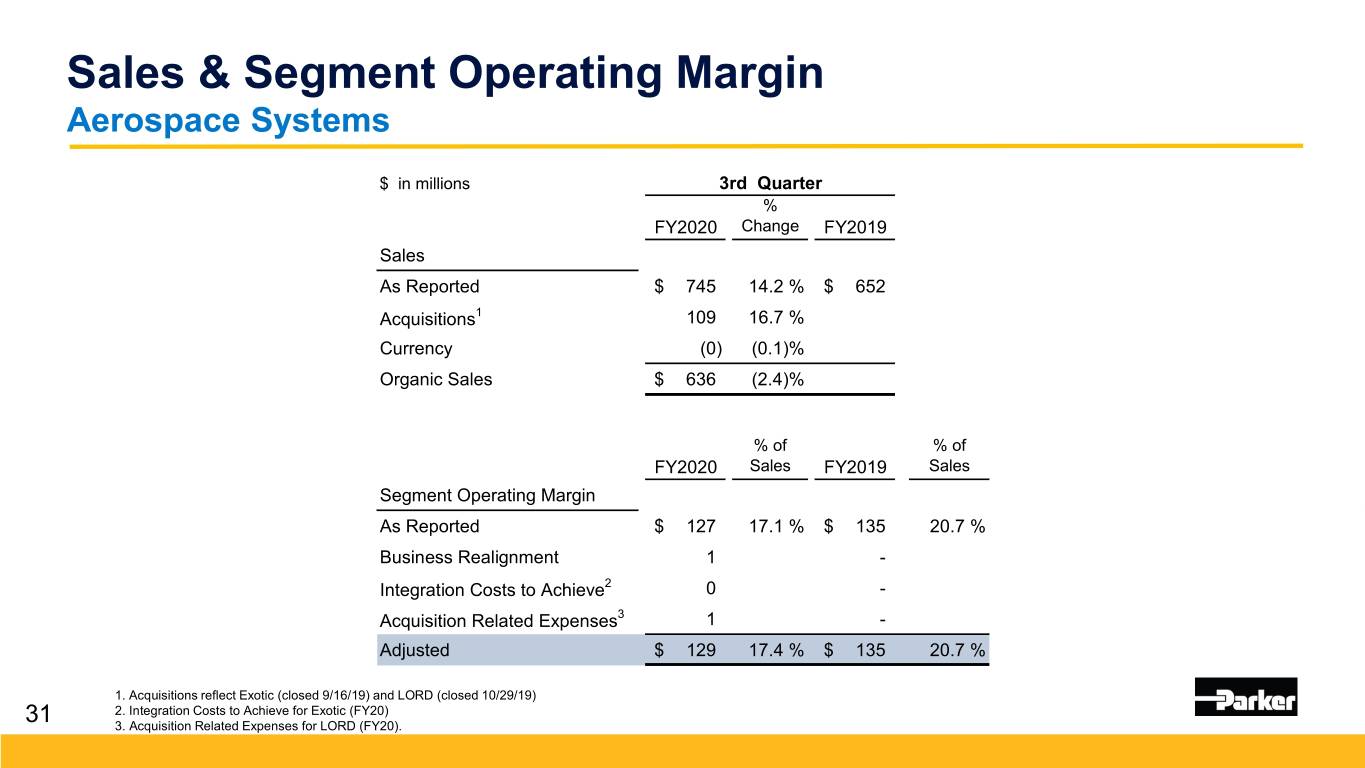

Sales & Segment Operating Margin Aerospace Systems $ in millions 3rd Quarter % FY2020 Change FY2019 Sales As Reported $ 745 14.2 % $ 652 Acquisitions1 109 16.7 % Currency (0) (0.1)% Organic Sales $ 636 (2.4)% % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 127 17.1 % $ 135 20.7 % Business Realignment 1 - Integration Costs to Achieve2 0 - Acquisition Related Expenses3 1 - Adjusted $ 129 17.4 % $ 135 20.7 % 1. Acquisitions reflect Exotic (closed 9/16/19) and LORD (closed 10/29/19) 2. Integration Costs to Achieve for Exotic (FY20) 31 3. Acquisition Related Expenses for LORD (FY20).

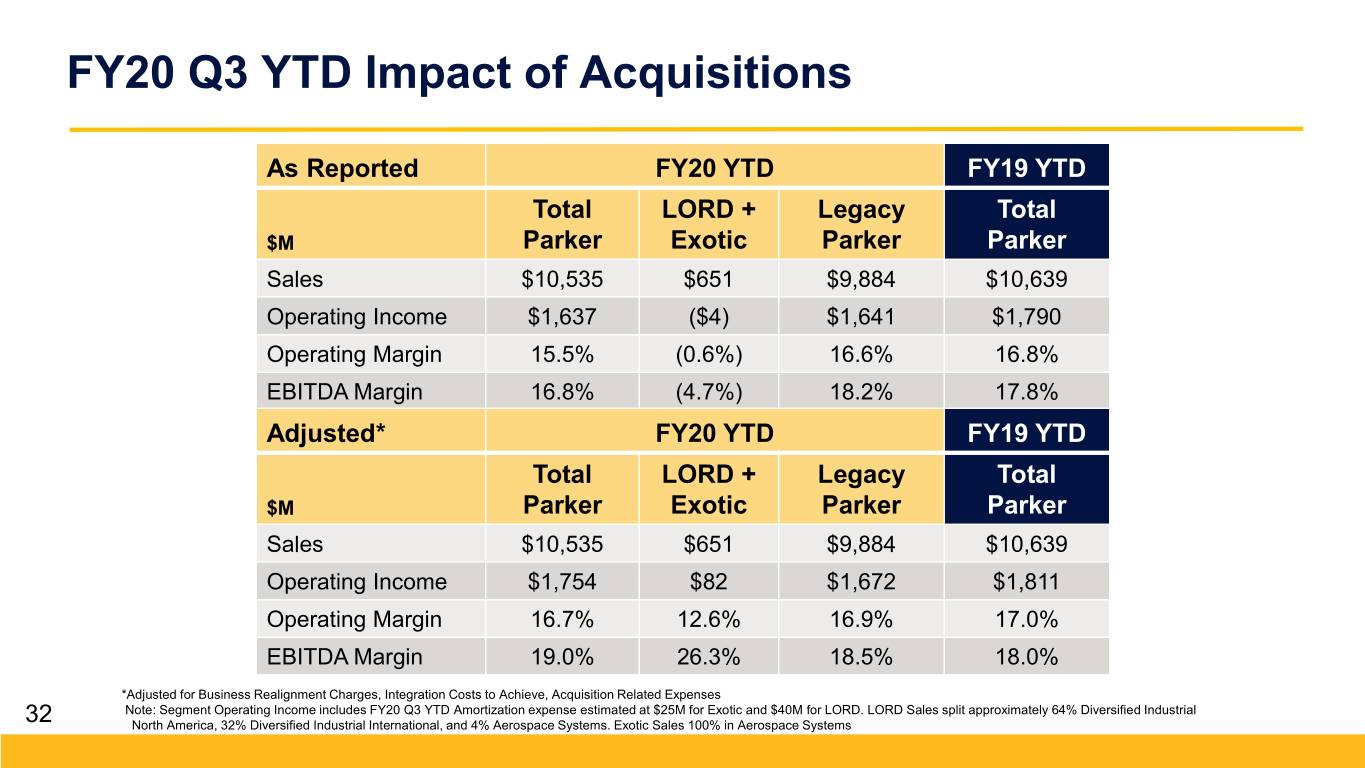

FY20 Q3 YTD Impact of Acquisitions As Reported FY20 YTD FY19 YTD Total LORD + Legacy Total $M Parker Exotic Parker Parker Sales $10,535 $651 $9,884 $10,639 Operating Income $1,637 ($4) $1,641 $1,790 Operating Margin 15.5% (0.6%) 16.6% 16.8% EBITDA Margin 16.8% (4.7%) 18.2% 17.8% Adjusted* FY20 YTD FY19 YTD Total LORD + Legacy Total $M Parker Exotic Parker Parker Sales $10,535 $651 $9,884 $10,639 Operating Income $1,754 $82 $1,672 $1,811 Operating Margin 16.7% 12.6% 16.9% 17.0% EBITDA Margin 19.0% 26.3% 18.5% 18.0% *Adjusted for Business Realignment Charges, Integration Costs to Achieve, Acquisition Related Expenses Note: Segment Operating Income includes FY20 Q3 YTD Amortization expense estimated at $25M for Exotic and $40M for LORD. LORD Sales split approximately 64% Diversified Industrial 32 North America, 32% Diversified Industrial International, and 4% Aerospace Systems. Exotic Sales 100% in Aerospace Systems

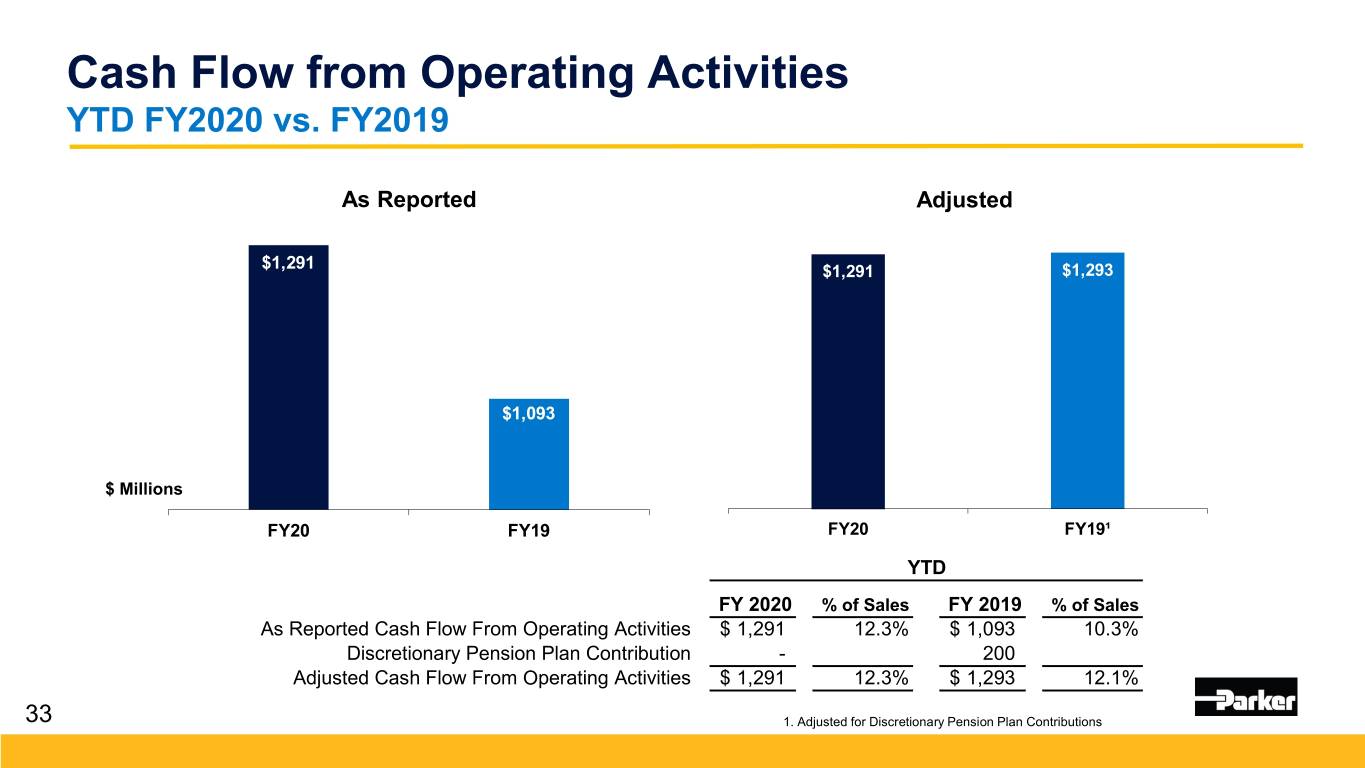

Cash Flow from Operating Activities YTD FY2020 vs. FY2019 As Reported Adjusted $1,291 $1,291 $1,293 $1,093 $ Millions FY20 FY19 FY20 FY19¹ Adjusted YTD FY 2020 % of Sales FY 2019 % of Sales As Reported Cash Flow From Operating Activities $ 1,291 12.3% $ 1,093 10.3% Discretionary Pension Plan Contribution - 200 Adjusted Cash Flow From Operating Activities $ 1,291 12.3% $ 1,293 12.1% 33 1. Adjusted for Discretionary Pension Plan Contributions

Liquidity and Credit . Cash balance $0.7B as of March 31, 2020 – International operations self-financing . Free cash flow > 100% conversion rate for 18+ years – expected to continue • Optimizing working capital • Deferring tax payments per government initiatives • Reducing capex spend . Temporarily suspended 10b5-1 share repurchase program . Remain committed to dividend and annual record of increasing dividends paid . $2.5B Revolving credit facility – matures September 2024 . No major debt repayment due until FY23 - $1.0B . Commercial paper readily available – March 31, 2020 balance $0.9B . Financial covenant: debt to debt-shareholders’ equity cannot exceed 65% • 59.4% as of March 31, 2020 • $2.5B headroom as of March 31, 2020 . Gross Debt / EBITDA = 3.8x (down from 4.0x at December 31); Net Debt/EBITDA = 3.5x • $611M reduction in debt during Q3 FY20 34

Appendix . Consolidated Statement of Income . Adjusted Amounts Reconciliation . Reconciliation of EPS . Business Segment Information . Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin . Reconciliation of EBITDA to Adjusted EBITDA . Consolidated Balance Sheet . Consolidated Statement of Cash Flows . Reconciliation of Cash Flow from Operations to Adjusted Cash Flow from Operations . Reconciliation of Free Cash Flow Conversion . Supplemental Sales Information – Global Technology Platforms

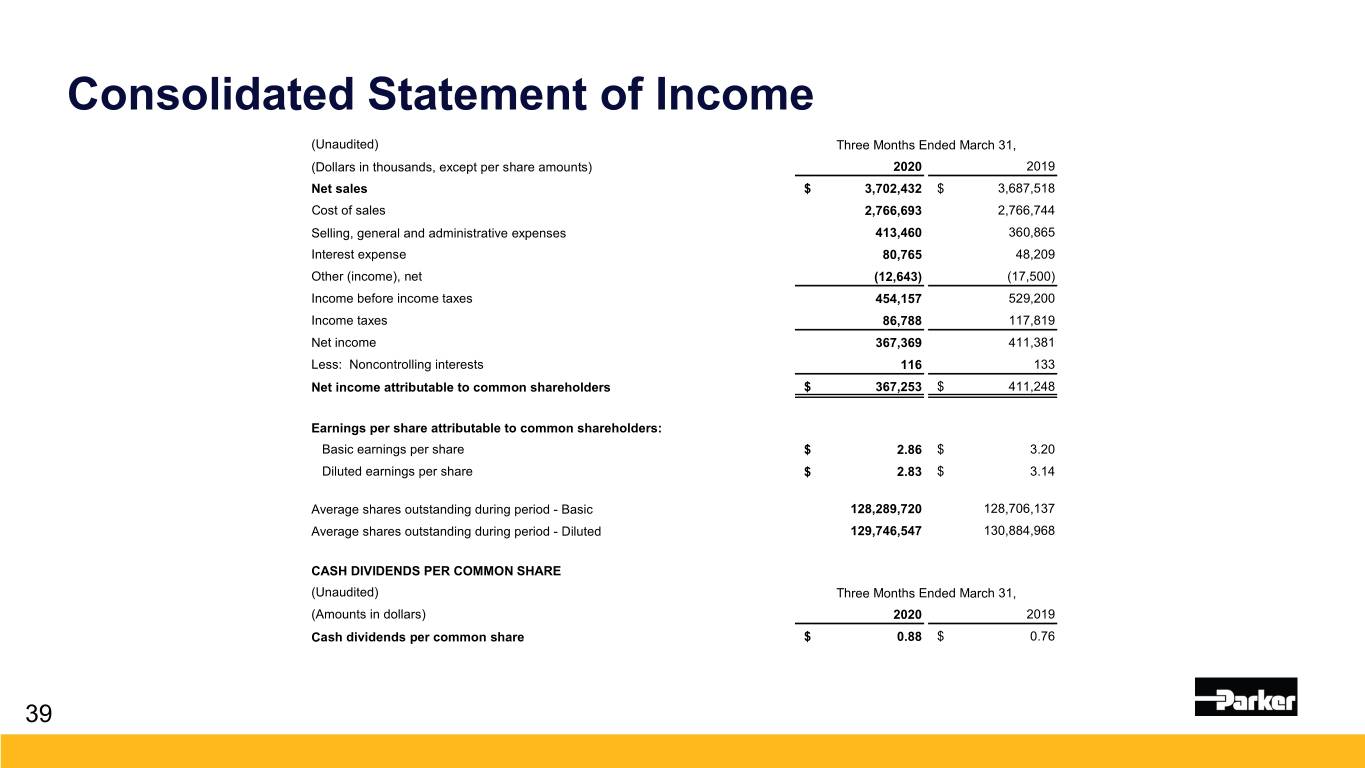

Consolidated Statement of Income (Unaudited) Three Months Ended March 31, (Dollars in thousands, except per share amounts) 2020 2019 Net sales $ 3,702,432 $ 3,687,518 Cost of sales 2,766,693 2,766,744 Selling, general and administrative expenses 413,460 360,865 Interest expense 80,765 48,209 Other (income), net (12,643) (17,500) Income before income taxes 454,157 529,200 Income taxes 86,788 117,819 Net income 367,369 411,381 Less: Noncontrolling interests 116 133 Net income attributable to common shareholders $ 367,253 $ 411,248 Earnings per share attributable to common shareholders: Basic earnings per share $ 2.86 $ 3.20 Diluted earnings per share $ 2.83 $ 3.14 Average shares outstanding during period - Basic 128,289,720 128,706,137 Average shares outstanding during period - Diluted 129,746,547 130,884,968 CASH DIVIDENDS PER COMMON SHARE (Unaudited) Three Months Ended March 31, (Amounts in dollars) 2020 2019 Cash dividends per common share $ 0.88 $ 0.76 39

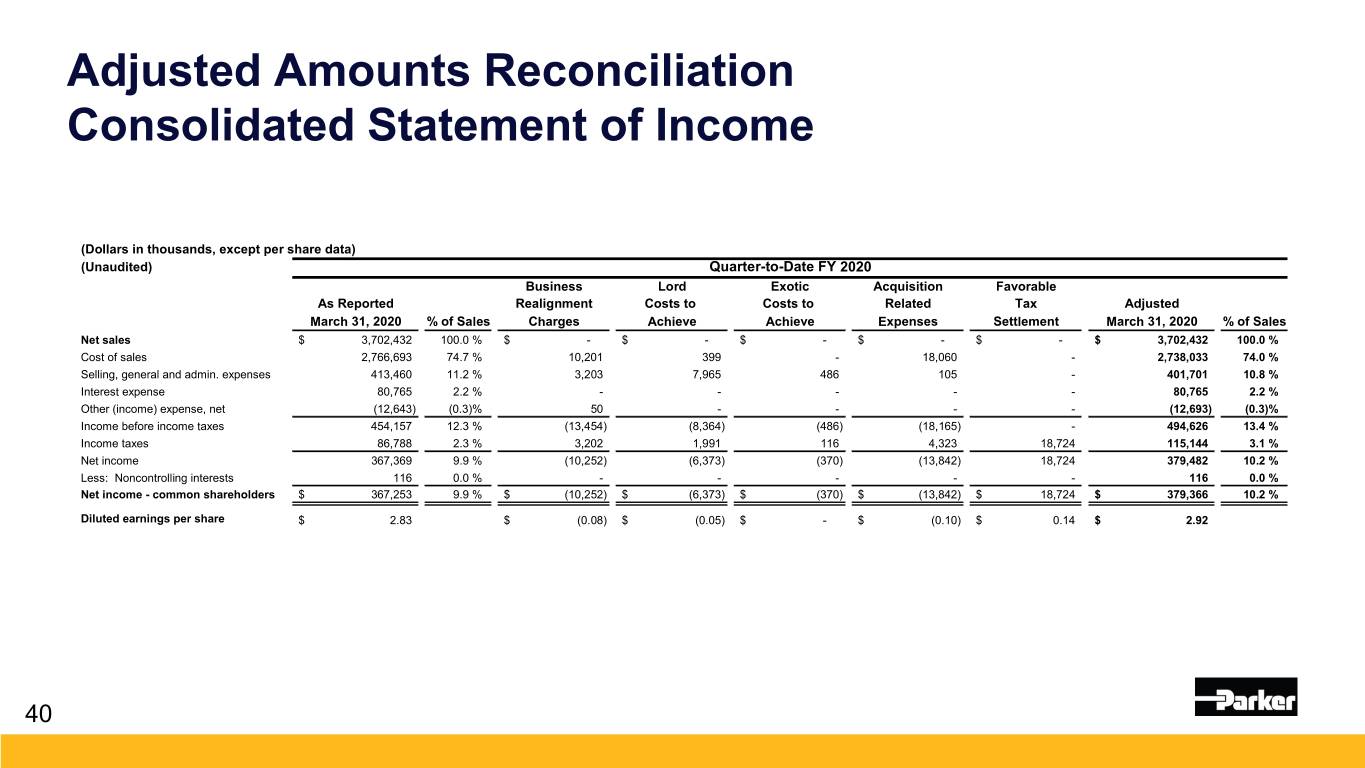

Adjusted Amounts Reconciliation Consolidated Statement of Income (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2020 Business Lord Exotic Acquisition Favorable As Reported Realignment Costs to Costs to Related Tax Adjusted March 31, 2020 % of Sales Charges Achieve Achieve Expenses Settlement March 31, 2020 % of Sales Net sales $ 3,702,432 100.0 % $ - $ - $ - $ - $ - $ 3,702,432 100.0 % Cost of sales 2,766,693 74.7 % 10,201 399 - 18,060 - 2,738,033 74.0 % Selling, general and admin. expenses 413,460 11.2 % 3,203 7,965 486 105 - 401,701 10.8 % Interest expense 80,765 2.2 % - - - - - 80,765 2.2 % Other (income) expense, net (12,643) (0.3)% 50 - - - - (12,693) (0.3)% Income before income taxes 454,157 12.3 % (13,454) (8,364) (486) (18,165) - 494,626 13.4 % Income taxes 86,788 2.3 % 3,202 1,991 116 4,323 18,724 115,144 3.1 % Net income 367,369 9.9 % (10,252) (6,373) (370) (13,842) 18,724 379,482 10.2 % Less: Noncontrolling interests 116 0.0 % - - - - - 116 0.0 % Net income - common shareholders $ 367,253 9.9 % $ (10,252) $ (6,373) $ (370) $ (13,842) $ 18,724 $ 379,366 10.2 % Diluted earnings per share $ 2.83 $ (0.08) $ (0.05) $ - $ (0.10) $ 0.14 $ 2.92 40

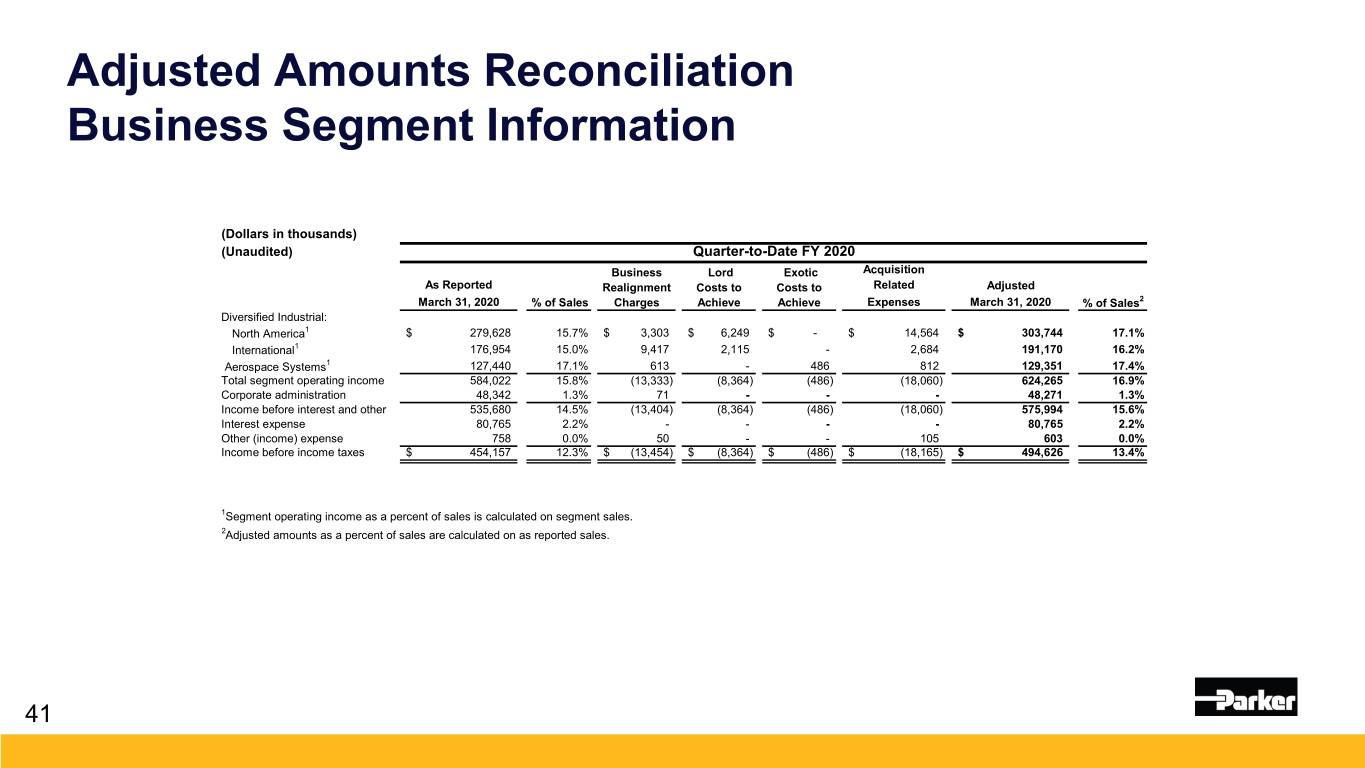

Adjusted Amounts Reconciliation Business Segment Information (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2020 Business Lord Exotic Acquisition As Reported Realignment Costs to Costs to Related Adjusted March 31, 2020 % of Sales Charges Achieve Achieve Expenses March 31, 2020 % of Sales2 Diversified Industrial: North America1 $ 279,628 15.7% $ 3,303 $ 6,249 $ - $ 14,564 $ 303,744 17.1% International1 176,954 15.0% 9,417 2,115 - 2,684 191,170 16.2% Aerospace Systems1 127,440 17.1% 613 - 486 812 129,351 17.4% Total segment operating income 584,022 15.8% (13,333) (8,364) (486) (18,060) 624,265 16.9% Corporate administration 48,342 1.3% 71 - - - 48,271 1.3% Income before interest and other 535,680 14.5% (13,404) (8,364) (486) (18,060) 575,994 15.6% Interest expense 80,765 2.2% - - - - 80,765 2.2% Other (income) expense 758 0.0% 50 - - 105 603 0.0% Income before income taxes $ 454,157 12.3% $ (13,454) $ (8,364) $ (486) $ (18,165) $ 494,626 13.4% 1Segment operating income as a percent of sales is calculated on segment sales. 2Adjusted amounts as a percent of sales are calculated on as reported sales. 41

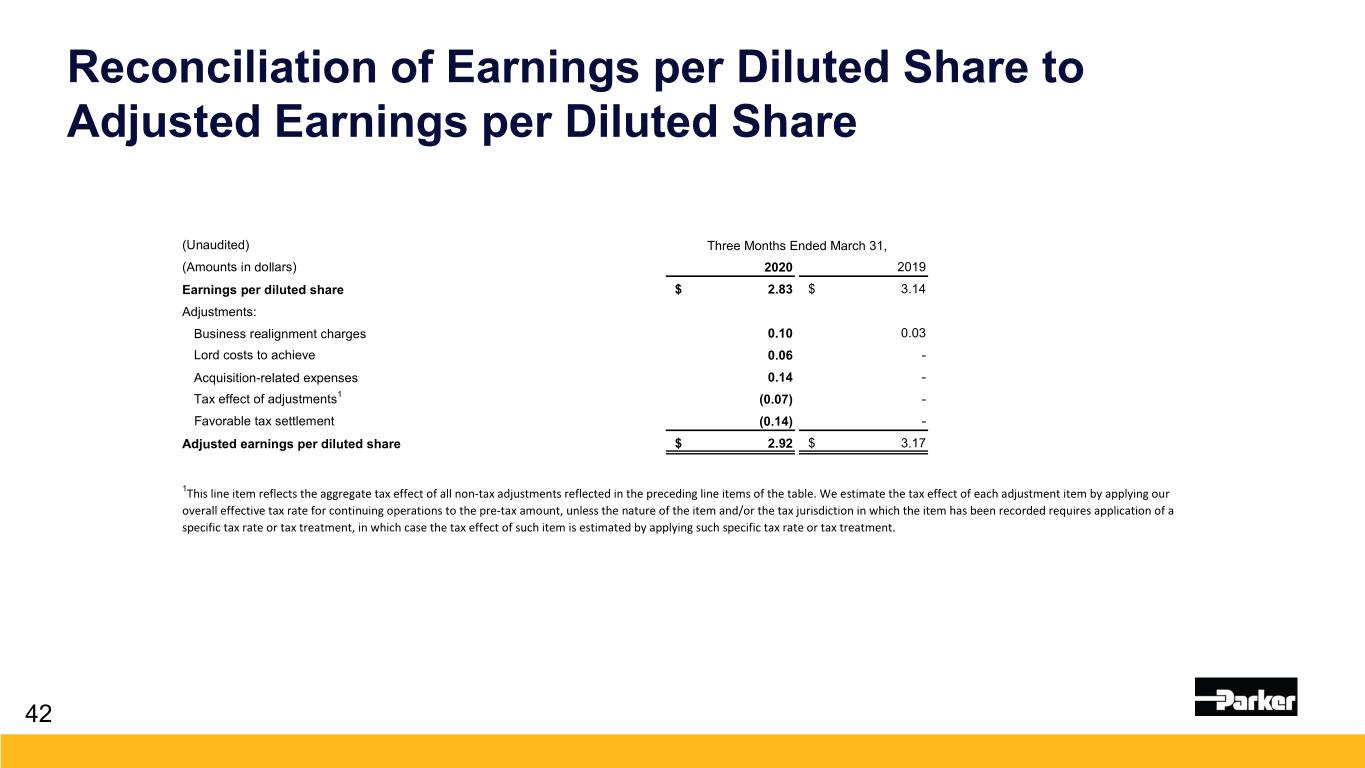

Reconciliation of Earnings per Diluted Share to Adjusted Earnings per Diluted Share (Unaudited) Three Months Ended March 31, (Amounts in dollars) 2020 2019 Earnings per diluted share $ 2.83 $ 3.14 Adjustments: Business realignment charges 0.10 0.03 Lord costs to achieve 0.06 - Acquisition-related expenses 0.14 - 1 Tax effect of adjustments (0.07) - Favorable tax settlement (0.14) - Adjusted earnings per diluted share $ 2.92 $ 3.17 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 42

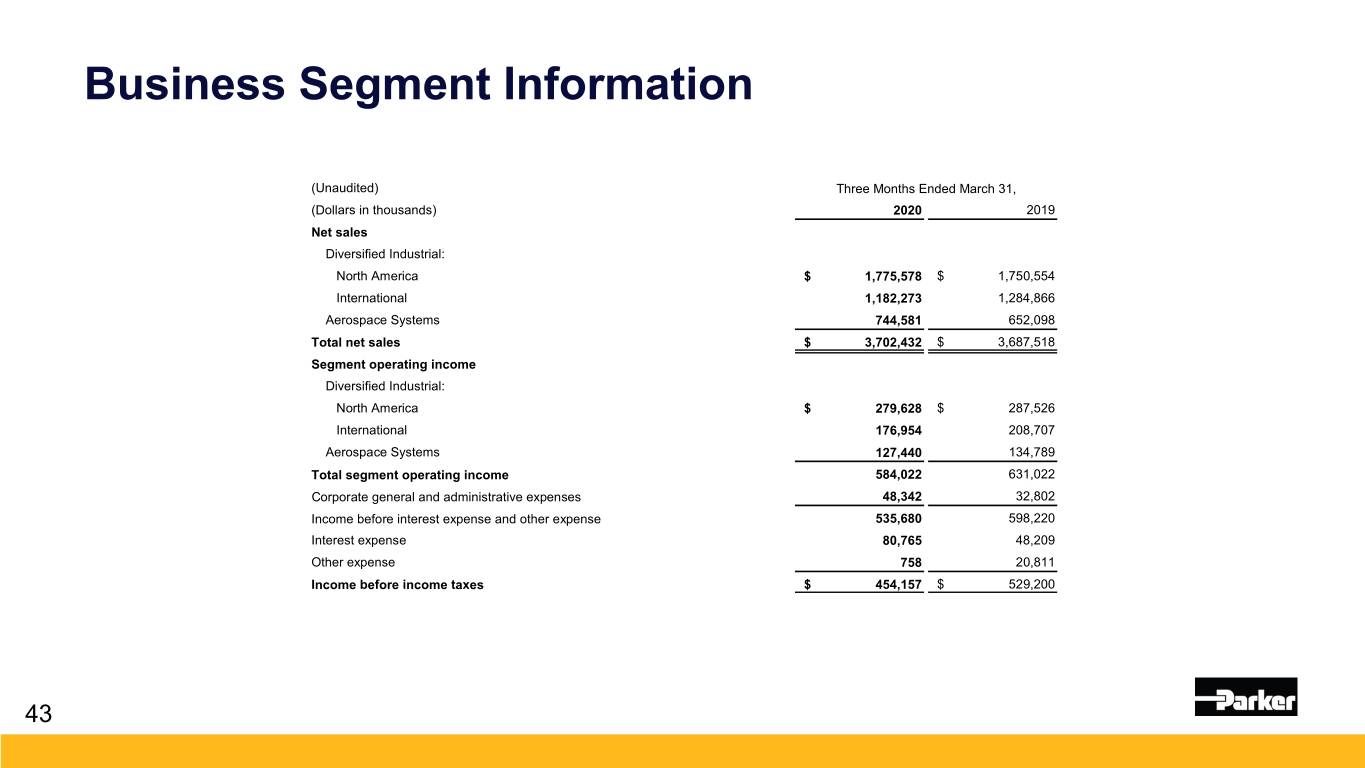

Business Segment Information (Unaudited) Three Months Ended March 31, (Dollars in thousands) 2020 2019 Net sales Diversified Industrial: North America $ 1,775,578 $ 1,750,554 International 1,182,273 1,284,866 Aerospace Systems 744,581 652,098 Total net sales $ 3,702,432 $ 3,687,518 Segment operating income Diversified Industrial: North America $ 279,628 $ 287,526 International 176,954 208,707 Aerospace Systems 127,440 134,789 Total segment operating income 584,022 631,022 Corporate general and administrative expenses 48,342 32,802 Income before interest expense and other expense 535,680 598,220 Interest expense 80,765 48,209 Other expense 758 20,811 Income before income taxes $ 454,157 $ 529,200 43

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) (Dollars in millions) 12 Months 12 Months 12 Months 12 Months 9 Months ended ended ended ended ended 6/30/02 6/30/09 6/30/13 6/30/16 3/31/20 Net Sales $ 6,149 $ 10,309 $ 13,016 $ 11,361 $ 10,535 Total segment operating income $ 446 $ 1,004 $ 1,791 $ 1,576 $ 1,637 Adjustments: Business realignment charges 37 45 12 107 28 Acquisition-related expenses & Costs to Achieve 89 Adjusted total segment operating income* $ 483 $ 1,049 $ 1,804 $ 1,682 $ 1,754 Total segment operating margin 7.3% 9.7% 13.8% 13.9% 15.5% Adjusted total segment operating margin 7.9% 10.2% 13.9% 14.8% 16.7% *Totals may not foot due to rounding 44

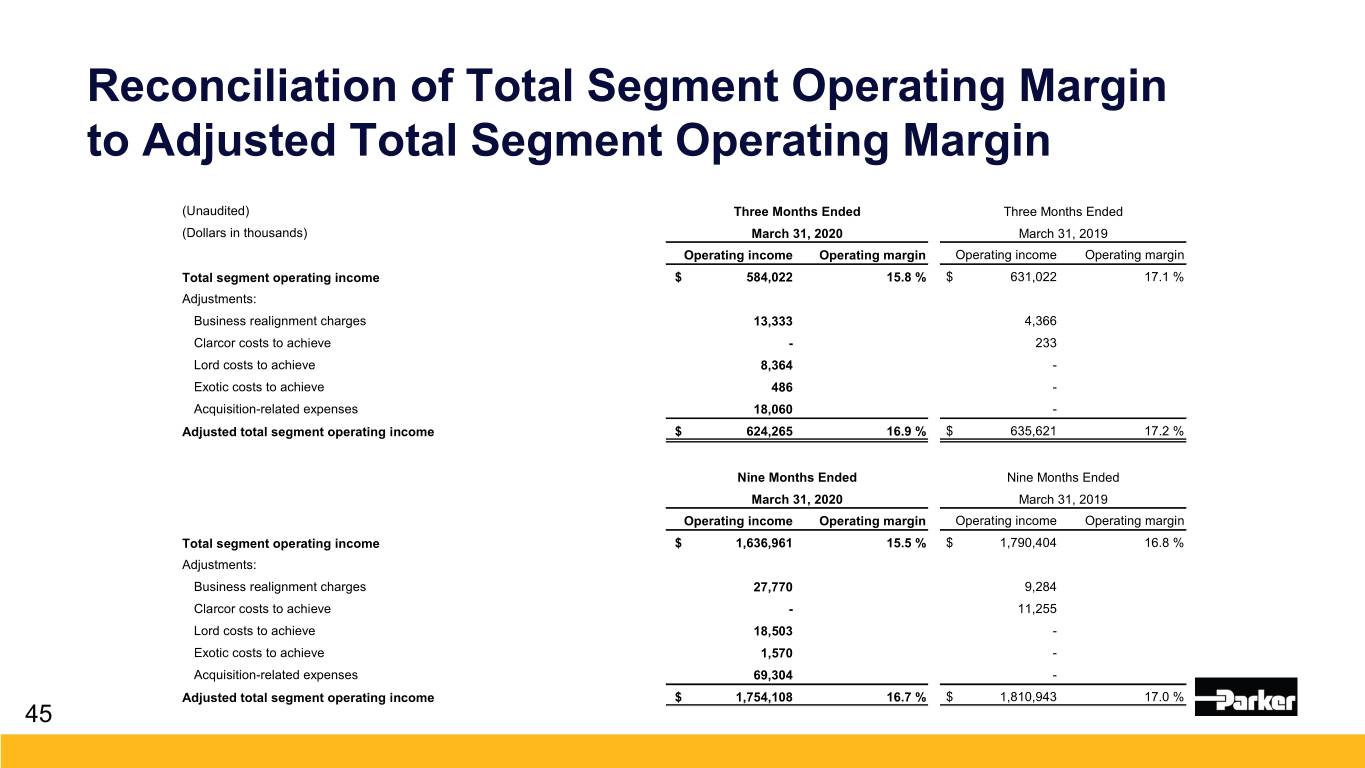

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) Three Months Ended Three Months Ended (Dollars in thousands) March 31, 2020 March 31, 2019 Operating income Operating margin Operating income Operating margin Total segment operating income $ 584,022 15.8 % $ 631,022 17.1 % Adjustments: Business realignment charges 13,333 4,366 Clarcor costs to achieve - 233 Lord costs to achieve 8,364 - Exotic costs to achieve 486 - Acquisition-related expenses 18,060 - Adjusted total segment operating income $ 624,265 16.9 % $ 635,621 17.2 % Nine Months Ended Nine Months Ended March 31, 2020 March 31, 2019 Operating income Operating margin Operating income Operating margin Total segment operating income $ 1,636,961 15.5 % $ 1,790,404 16.8 % Adjustments: Business realignment charges 27,770 9,284 Clarcor costs to achieve - 11,255 Lord costs to achieve 18,503 - Exotic costs to achieve 1,570 - Acquisition-related expenses 69,304 - Adjusted total segment operating income $ 1,754,108 16.7 % $ 1,810,943 17.0 % 45

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin Three Months Ended Three Months Ended Three Months Ended (Unaudited) March 31, 2020 March 31, 2020 March 31, 2020 (Dollars in millions) Total Parker LORD & Exotic Legacy Parker Operating income Operating margin Operating income Operating margin Operating income Operating margin Total segment operating income $ 584 15.8 % $ 16 4.7 % $ 568 16.9 % Adjustments: Business realignment charges 13 - 13 Costs to achieve 9 9 - One-time acquisition expenses 18 18 - Adjusted total segment operating income $ 624 16.9 % $ 42 12.2 % $ 582 17.3 % 46 Note: Data has been intentionally rounded to the nearest million and therefore may not sum

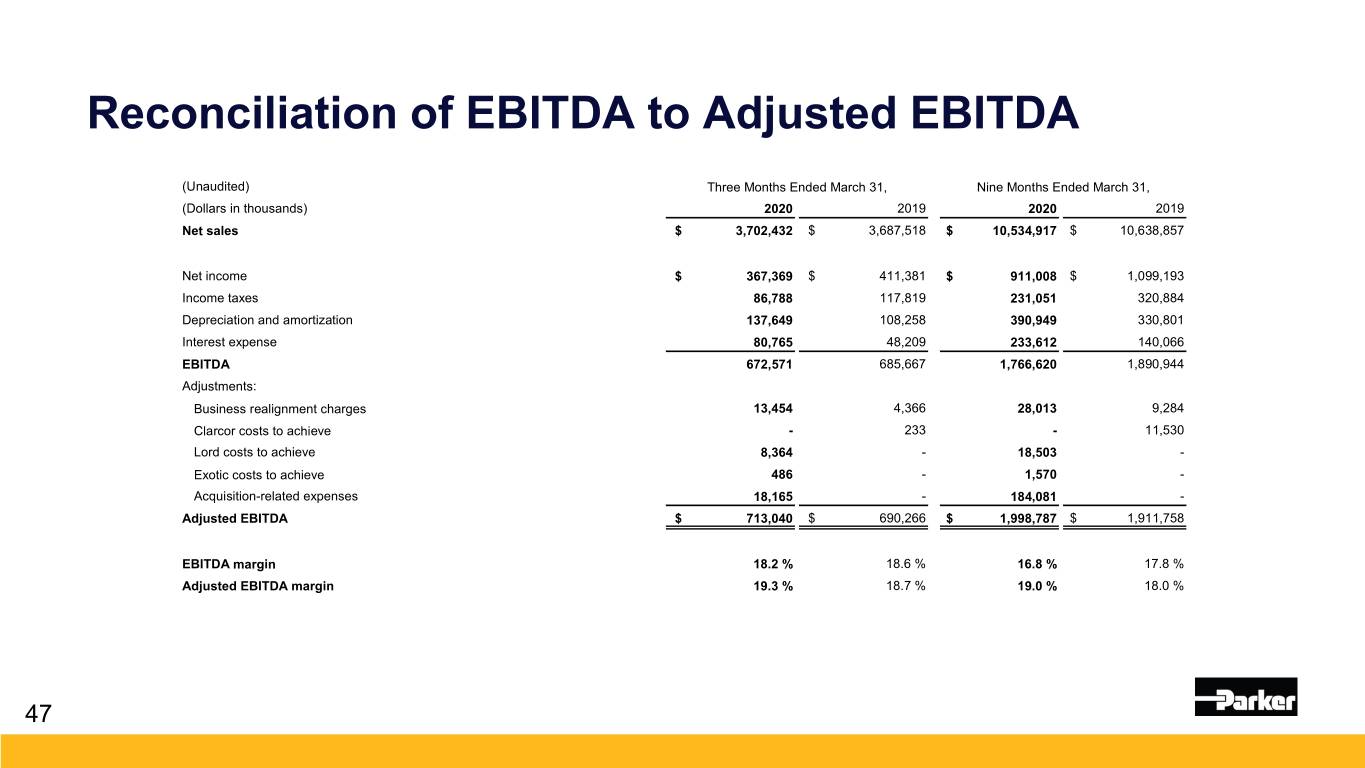

Reconciliation of EBITDA to Adjusted EBITDA (Unaudited) Three Months Ended March 31, Nine Months Ended March 31, (Dollars in thousands) 2020 2019 2020 2019 Net sales $ 3,702,432 $ 3,687,518 $ 10,534,917 $ 10,638,857 Net income $ 367,369 $ 411,381 $ 911,008 $ 1,099,193 Income taxes 86,788 117,819 231,051 320,884 Depreciation and amortization 137,649 108,258 390,949 330,801 Interest expense 80,765 48,209 233,612 140,066 EBITDA 672,571 685,667 1,766,620 1,890,944 Adjustments: Business realignment charges 13,454 4,366 28,013 9,284 Clarcor costs to achieve - 233 - 11,530 Lord costs to achieve 8,364 - 18,503 - Exotic costs to achieve 486 - 1,570 - Acquisition-related expenses 18,165 - 184,081 - Adjusted EBITDA $ 713,040 $ 690,266 $ 1,998,787 $ 1,911,758 EBITDA margin 18.2 % 18.6 % 16.8 % 17.8 % Adjusted EBITDA margin 19.3 % 18.7 % 19.0 % 18.0 % 47

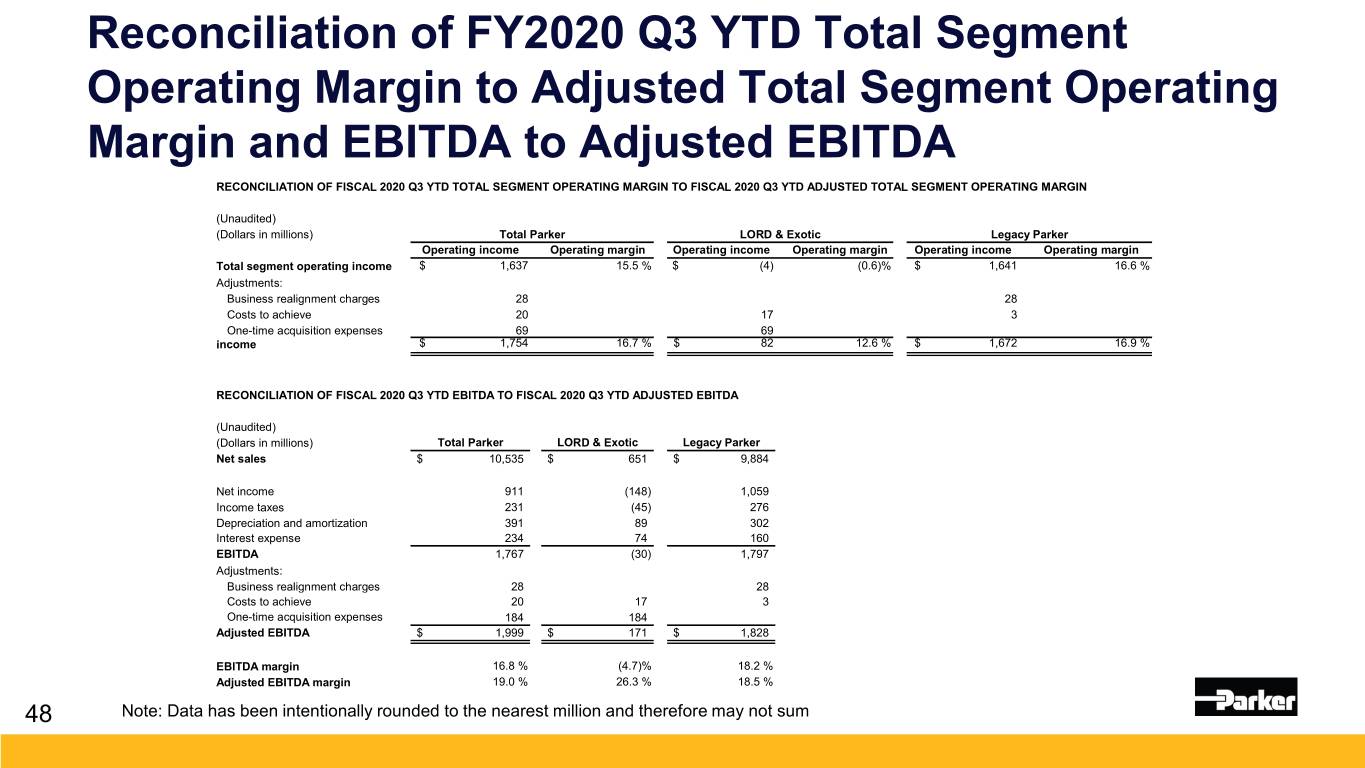

Reconciliation of FY2020 Q3 YTD Total Segment Operating Margin to Adjusted Total Segment Operating Margin and EBITDA to Adjusted EBITDA RECONCILIATION OF FISCAL 2020 Q3 YTD TOTAL SEGMENT OPERATING MARGIN TO FISCAL 2020 Q3 YTD ADJUSTED TOTAL SEGMENT OPERATING MARGIN (Unaudited) (Dollars in millions) Total Parker LORD & Exotic Legacy Parker Operating income Operating margin Operating income Operating margin Operating income Operating margin Total segment operating income $ 1,637 15.5 % $ (4) (0.6)% $ 1,641 16.6 % Adjustments: Business realignment charges 28 28 Costs to achieve 20 17 3 One-time acquisition expenses 69 69 income $ 1,754 16.7 % $ 82 12.6 % $ 1,672 16.9 % RECONCILIATION OF FISCAL 2020 Q3 YTD EBITDA TO FISCAL 2020 Q3 YTD ADJUSTED EBITDA (Unaudited) (Dollars in millions) Total Parker LORD & Exotic Legacy Parker Net sales $ 10,535 $ 651 $ 9,884 Net income 911 (148) 1,059 Income taxes 231 (45) 276 Depreciation and amortization 391 89 302 Interest expense 234 74 160 EBITDA 1,767 (30) 1,797 Adjustments: Business realignment charges 28 28 Costs to achieve 20 17 3 One-time acquisition expenses 184 184 Adjusted EBITDA $ 1,999 $ 171 $ 1,828 EBITDA margin 16.8 % (4.7)% 18.2 % Adjusted EBITDA margin 19.0 % 26.3 % 18.5 % 48 Note: Data has been intentionally rounded to the nearest million and therefore may not sum

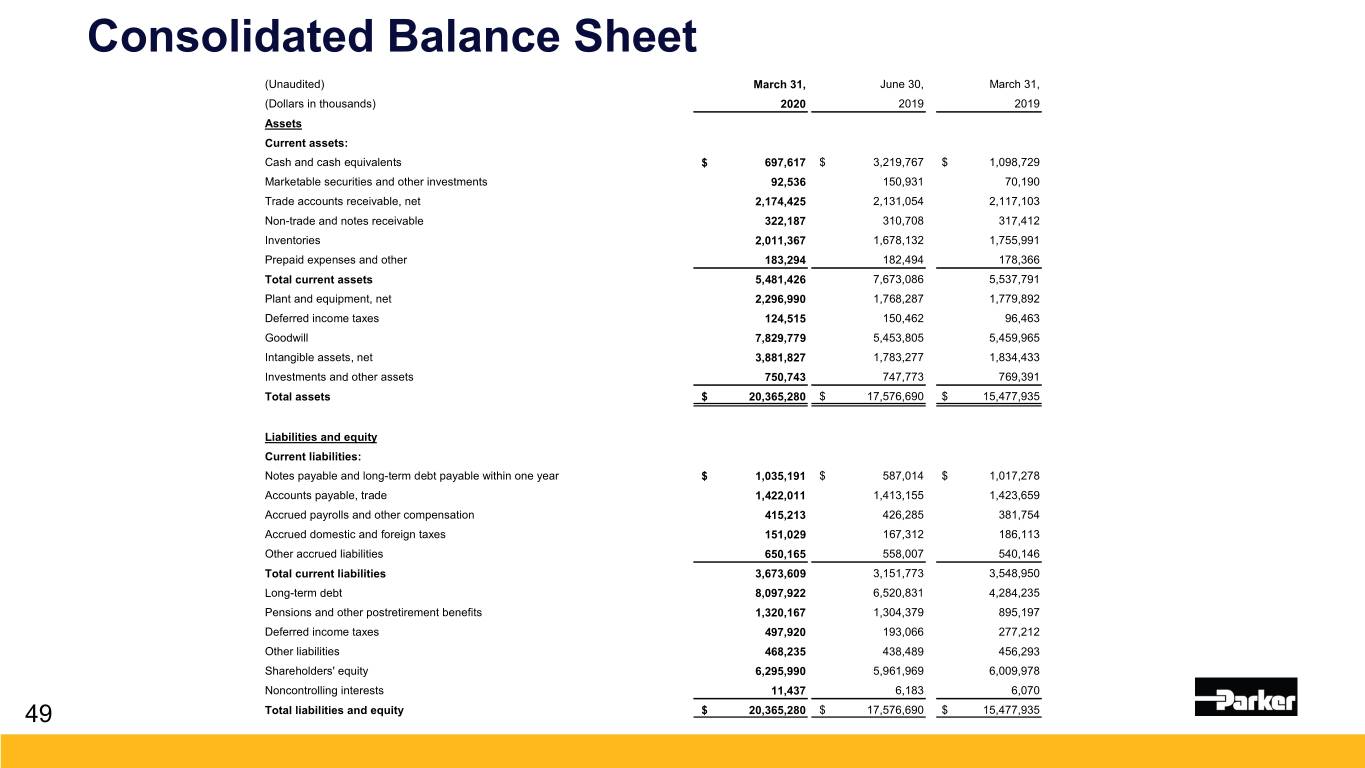

Consolidated Balance Sheet (Unaudited) March 31, June 30, March 31, (Dollars in thousands) 2020 2019 2019 Assets Current assets: Cash and cash equivalents $ 697,617 $ 3,219,767 $ 1,098,729 Marketable securities and other investments 92,536 150,931 70,190 Trade accounts receivable, net 2,174,425 2,131,054 2,117,103 Non-trade and notes receivable 322,187 310,708 317,412 Inventories 2,011,367 1,678,132 1,755,991 Prepaid expenses and other 183,294 182,494 178,366 Total current assets 5,481,426 7,673,086 5,537,791 Plant and equipment, net 2,296,990 1,768,287 1,779,892 Deferred income taxes 124,515 150,462 96,463 Goodwill 7,829,779 5,453,805 5,459,965 Intangible assets, net 3,881,827 1,783,277 1,834,433 Investments and other assets 750,743 747,773 769,391 Total assets $ 20,365,280 $ 17,576,690 $ 15,477,935 Liabilities and equity Current liabilities: Notes payable and long-term debt payable within one year $ 1,035,191 $ 587,014 $ 1,017,278 Accounts payable, trade 1,422,011 1,413,155 1,423,659 Accrued payrolls and other compensation 415,213 426,285 381,754 Accrued domestic and foreign taxes 151,029 167,312 186,113 Other accrued liabilities 650,165 558,007 540,146 Total current liabilities 3,673,609 3,151,773 3,548,950 Long-term debt 8,097,922 6,520,831 4,284,235 Pensions and other postretirement benefits 1,320,167 1,304,379 895,197 Deferred income taxes 497,920 193,066 277,212 Other liabilities 468,235 438,489 456,293 Shareholders' equity 6,295,990 5,961,969 6,009,978 Noncontrolling interests 11,437 6,183 6,070 49 Total liabilities and equity $ 20,365,280 $ 17,576,690 $ 15,477,935

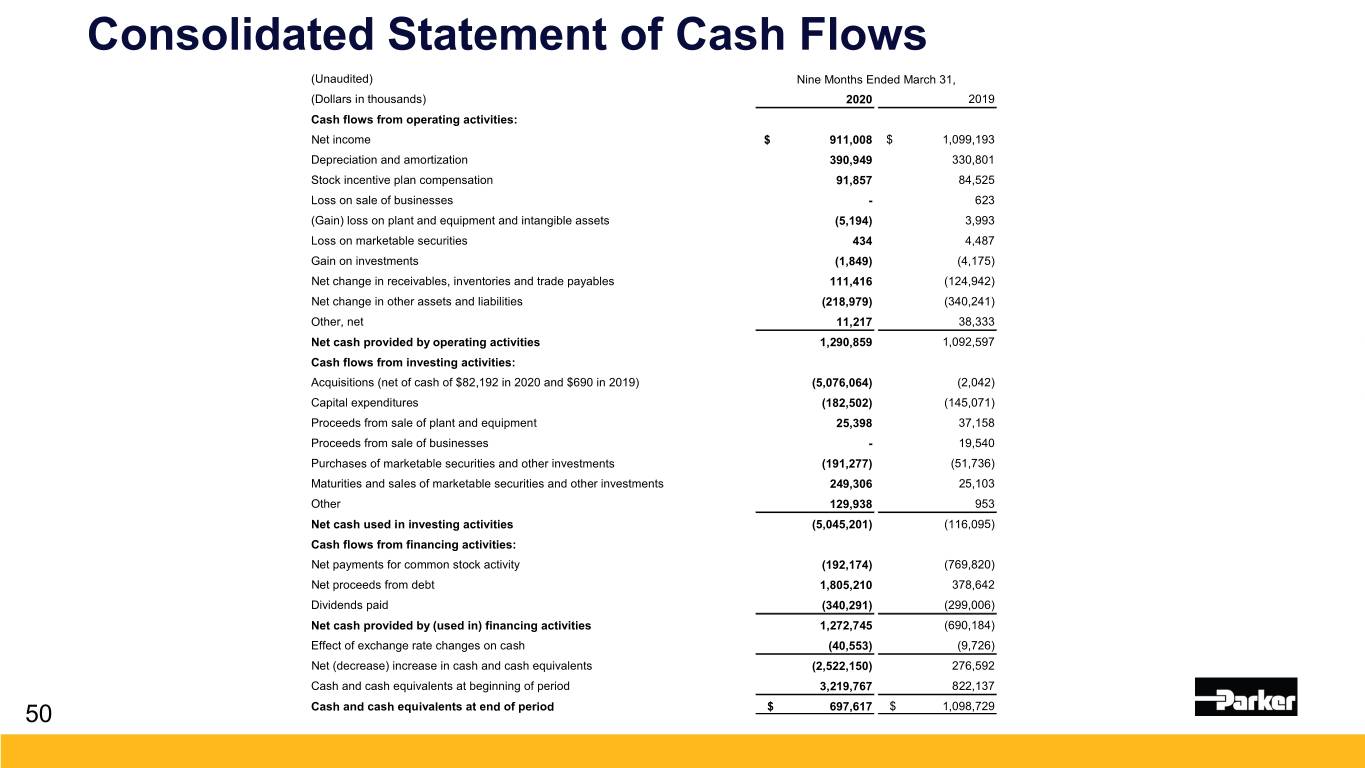

Consolidated Statement of Cash Flows (Unaudited) Nine Months Ended March 31, (Dollars in thousands) 2020 2019 Cash flows from operating activities: Net income $ 911,008 $ 1,099,193 Depreciation and amortization 390,949 330,801 Stock incentive plan compensation 91,857 84,525 Loss on sale of businesses - 623 (Gain) loss on plant and equipment and intangible assets (5,194) 3,993 Loss on marketable securities 434 4,487 Gain on investments (1,849) (4,175) Net change in receivables, inventories and trade payables 111,416 (124,942) Net change in other assets and liabilities (218,979) (340,241) Other, net 11,217 38,333 Net cash provided by operating activities 1,290,859 1,092,597 Cash flows from investing activities: Acquisitions (net of cash of $82,192 in 2020 and $690 in 2019) (5,076,064) (2,042) Capital expenditures (182,502) (145,071) Proceeds from sale of plant and equipment 25,398 37,158 Proceeds from sale of businesses - 19,540 Purchases of marketable securities and other investments (191,277) (51,736) Maturities and sales of marketable securities and other investments 249,306 25,103 Other 129,938 953 Net cash used in investing activities (5,045,201) (116,095) Cash flows from financing activities: Net payments for common stock activity (192,174) (769,820) Net proceeds from debt 1,805,210 378,642 Dividends paid (340,291) (299,006) Net cash provided by (used in) financing activities 1,272,745 (690,184) Effect of exchange rate changes on cash (40,553) (9,726) Net (decrease) increase in cash and cash equivalents (2,522,150) 276,592 Cash and cash equivalents at beginning of period 3,219,767 822,137 50 Cash and cash equivalents at end of period $ 697,617 $ 1,098,729

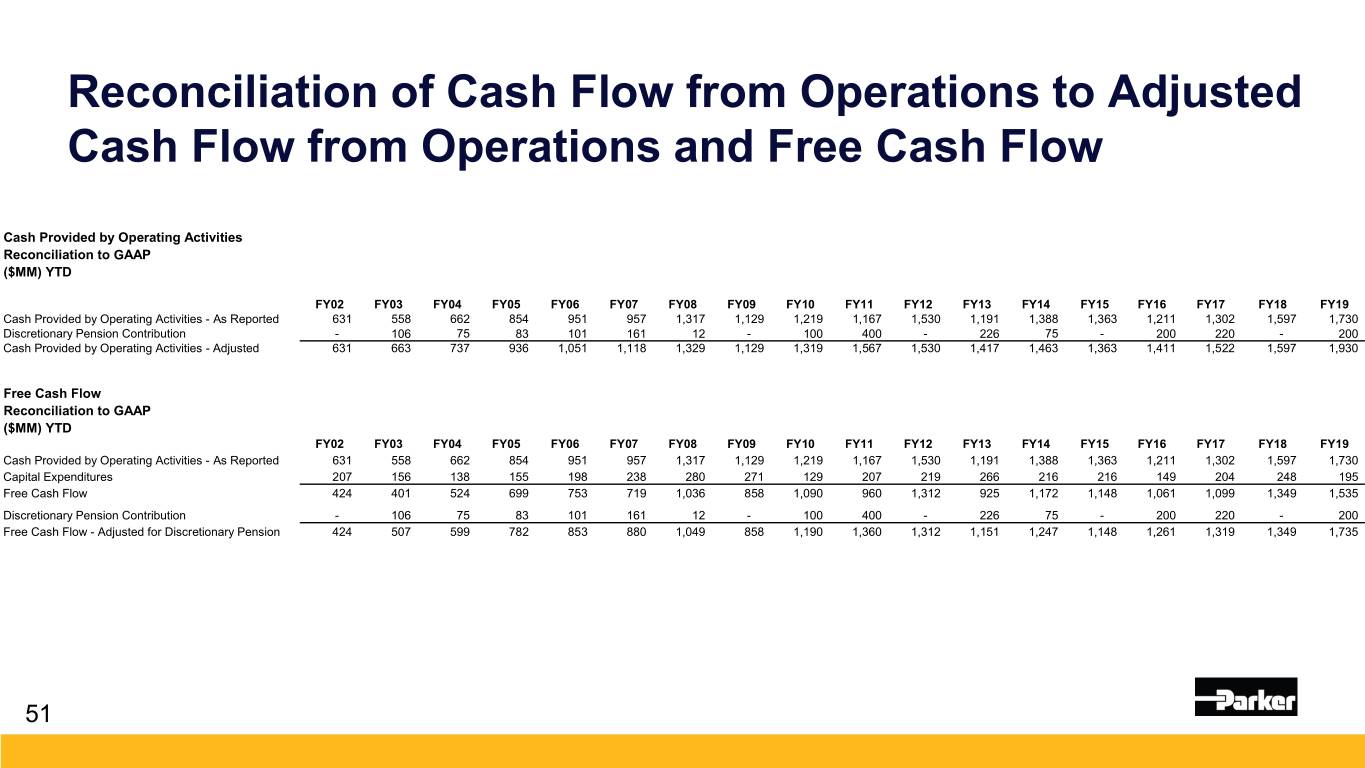

Reconciliation of Cash Flow from Operations to Adjusted Cash Flow from Operations and Free Cash Flow Cash Provided by Operating Activities Reconciliation to GAAP ($MM) YTD FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Cash Provided by Operating Activities - As Reported 631 558 662 854 951 957 1,317 1,129 1,219 1,167 1,530 1,191 1,388 1,363 1,211 1,302 1,597 1,730 Discretionary Pension Contribution - 106 75 83 101 161 12 - 100 400 - 226 75 - 200 220 - 200 Cash Provided by Operating Activities - Adjusted 631 663 737 936 1,051 1,118 1,329 1,129 1,319 1,567 1,530 1,417 1,463 1,363 1,411 1,522 1,597 1,930 Free Cash Flow Reconciliation to GAAP ($MM) YTD FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Cash Provided by Operating Activities - As Reported 631 558 662 854 951 957 1,317 1,129 1,219 1,167 1,530 1,191 1,388 1,363 1,211 1,302 1,597 1,730 Capital Expenditures 207 156 138 155 198 238 280 271 129 207 219 266 216 216 149 204 248 195 Free Cash Flow 424 401 524 699 753 719 1,036 858 1,090 960 1,312 925 1,172 1,148 1,061 1,099 1,349 1,535 Discretionary Pension Contribution - 106 75 83 101 161 12 - 100 400 - 226 75 - 200 220 - 200 Free Cash Flow - Adjusted for Discretionary Pension 424 507 599 782 853 880 1,049 858 1,190 1,360 1,312 1,151 1,247 1,148 1,261 1,319 1,349 1,735 51

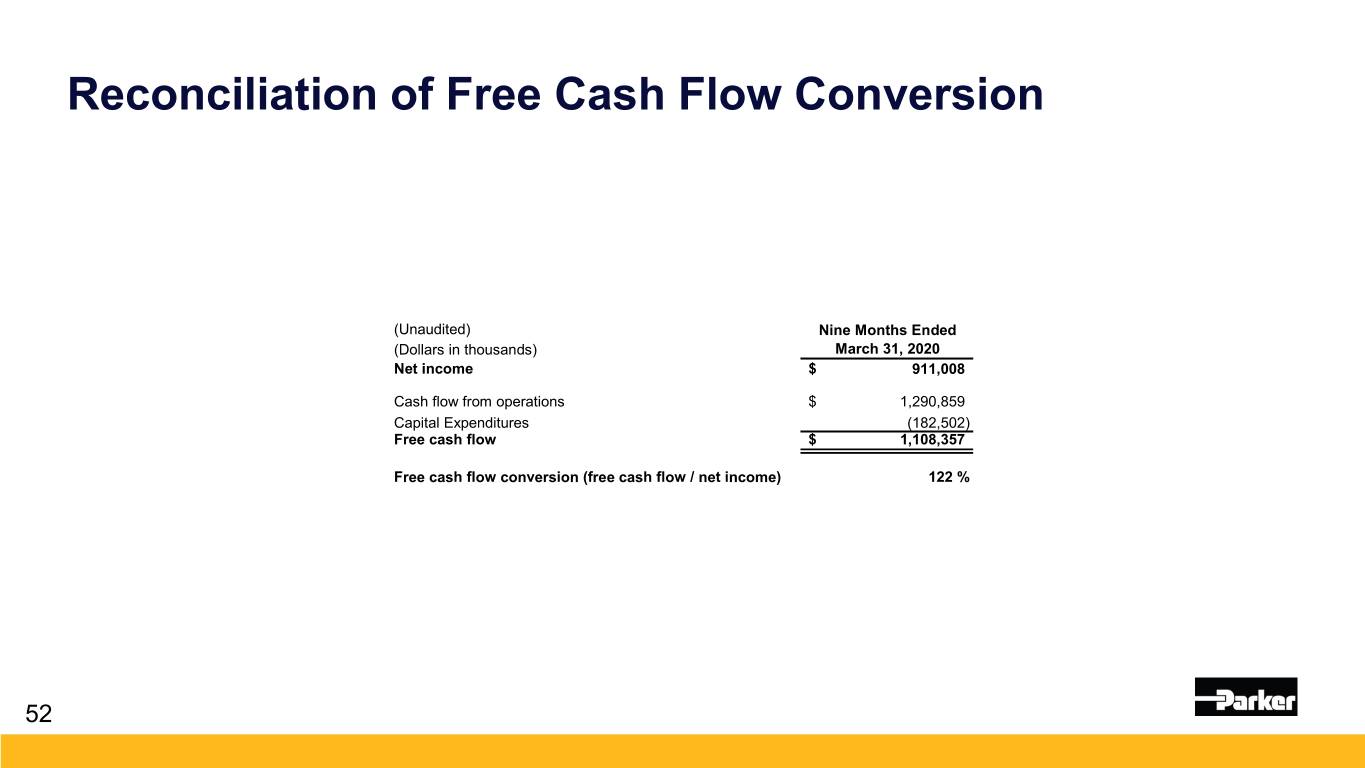

Reconciliation of Free Cash Flow Conversion (Unaudited) Nine Months Ended (Dollars in thousands) March 31, 2020 Net income $ 911,008 Cash flow from operations $ 1,290,859 Capital Expenditures (182,502) Free cash flow $ 1,108,357 Free cash flow conversion (free cash flow / net income) 122 % 52

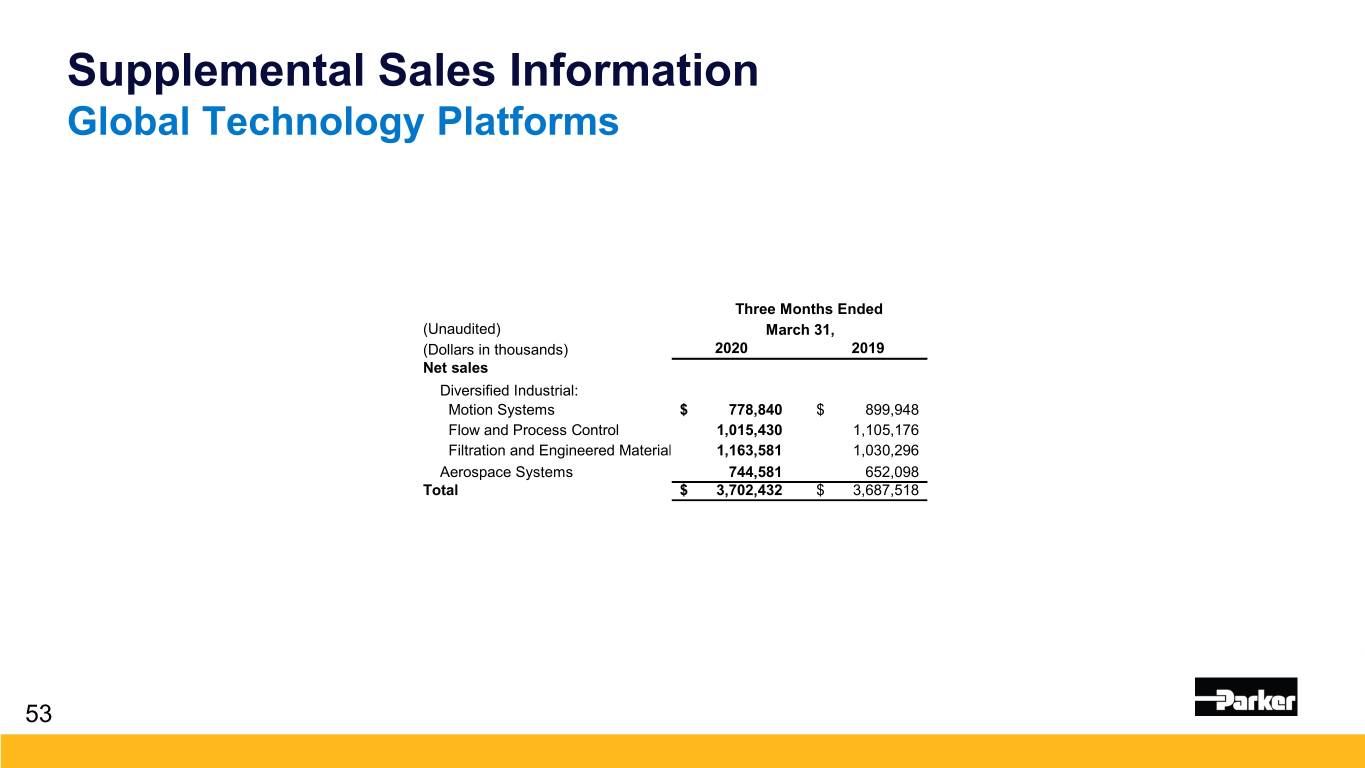

Supplemental Sales Information Global Technology Platforms Three Months Ended (Unaudited) March 31, (Dollars in thousands) 2020 2019 Net sales Diversified Industrial: Motion Systems $ 778,840 $ 899,948 Flow and Process Control 1,015,430 1,105,176 Filtration and Engineered Material 1,163,581 1,030,296 Aerospace Systems 744,581 652,098 Total $ 3,702,432 $ 3,687,518 53