Attached files

| file | filename |

|---|---|

| 8-K - FIRST BANCORP. 8-K - FIRST BANCORP /PR/ | a52212448.htm |

Exhibit 99.1

COVID-19 PandemicPreparedness and ResponseFirst BanCorpInvestor UpdateApril 2020

Forward Looking Statements 2 This presentation may contain “forward-looking statements” concerning

the Corporation’s future economic, operational and financial performance. The words or phrases “expect,” “anticipate,” “intend,” “look forward,” “should,” “would,” “believes” and similar expressions are meant to identify “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by such sections. The Corporation cautions

readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made, and advises readers that various factors, including, but not limited to, the following could cause actual results to differ

materially from those expressed in, or implied by, such forward-looking statements: uncertainties relating to the impact of the COVID-19 pandemic on the Corporation’s business, operations, employees, credit quality, financial condition and net

income, including because of uncertainties as to the extent and duration of the pandemic and the impact of the pandemic on consumer spending, borrowing and saving habits, the underemployment and unemployment rates, the Puerto Rico economy and

the global economy, as well as the risk that COVID-19 may exacerbate any other factor that could cause our actual results to differ materially from those expressed in or implied by any forward-looking statements; risks related to the effect on

the Corporation and its customers of governmental, regulatory, or central bank responses to COVID-19 and the Corporation’s participation in any such responses or programs, such as the Paycheck Protection Program established by the Coronavirus

Aid, Relief, and Economic Security (CARES) Act of 2020, including any judgments, claims, damages, penalties, fines or reputational damage resulting from claims or challenges against the Corporation by governments, regulators, customers or

otherwise, relating to the Corporation’s participation in any such responses or programs; risks, uncertainties and other factors related to the proposed acquisition of BSPR, including the impact of the COVID-19 pandemic on the ability to obtain

regulatory approvals and the timing of such regulatory action and the ability to meet other closing conditions to the acquisition on a timely basis, the risk that deposit attrition, customer loss and/or revenue loss prior to or following the

acquisition may exceed expectations, including because of the impact of the COVID-19 pandemic on customers; the risk that significant costs, expenses, and resources associated with or in funding the acquisition may be higher than expected; the

ability to successfully complete the integration of systems, procedures, and personnel of BSPR into FirstBank that are necessary to make the transaction economically successful; the risk that the Corporation may not be able to effectively

integrate BSPR into the Corporation’s internal control over financial reporting; the risk that the cost savings and any other synergies from the acquisition may not be fully realized or may take longer to realize than expected; uncertainty as

to the ultimate outcomes of actions taken, or those that may be taken, by the Puerto Rico government, or the oversight board established by the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”) to address the

Commonwealth of Puerto Rico’s financial problems, including a court-supervised debt restructuring process similar to U.S. bankruptcy protection undertaken pursuant to Title III of PROMESA, the designation by the PROMESA oversight board of

Puerto Rico municipalities as instrumentalities covered under PROMESA, the effects of measures included in the Puerto Rico government fiscal plan, or any revisions to it, on our clients and loan portfolios, and any potential impact from future

economic or political developments in Puerto Rico; changes in economic and business conditions, including those caused by the COVID-19 pandemic or other global or regional health crises as well as past or future natural disasters that directly

or indirectly affect the financial health of the Corporation’s customer base in the geographic areas we serve and may result in increased costs or losses of property and equipment and other assets; the impact that a slowing economy and

increased unemployment may have on the performance of our loan and lease portfolio, the market price of our investment securities, the availability of sources of funding and the demand for our products; uncertainty as to the timing of the

receipt of disaster relief funds allocated to Puerto Rico; a decrease in demand for the Corporation’s products and services, resulting in lower revenues and earnings because of the impact of the COVID-19 pandemic on the economy of Puerto Rico

which has been in an economic recession since 2006; uncertainty as to the availability of certain funding sources, such as brokered CDs particularly given the impact of the COVID-19 pandemic on the global economy; the weakness of the real

estate markets and of the consumer and commercial sectors, which may be exacerbated by the unemployment and government restrictions imposed as a result of the COVID-19 pandemic, and their impact on the credit quality of the Corporation’s loans

and other assets, which have contributed and may continue to contribute to, among other things, higher than targeted levels of non-performing assets, charge-offs and provisions for loan and lease losses, and may subject the Corporation to

further risk from loan defaults and foreclosures; the impact of changes in accounting standards or assumptions in applying those standards, including the impact of the COVID-19 pandemic on the determination of the allowance for credit losses

required by the new CECL accounting standard effective since January 1, 2020; the ability of FirstBank to realize the benefits of its net deferred tax assets; the ability of FirstBank to generate sufficient cash flow to make dividend payments

to the Corporation; adverse changes in general economic conditions in Puerto Rico, the U.S., the U.S. Virgin Islands, and the British Virgin Islands, including the interest rate environment, market liquidity, housing absorption rates, real

estate prices, including as a result of the COVID-19 pandemic, and disruptions in the U.S. capital markets, which may further reduce interest margins, affect funding sources and demand for all of the Corporation’s products and services, and

reduce the Corporation’s revenues and earnings and the value of the Corporation’s assets; uncertainty related to the discontinuation of the London Interbank Offered Rate at the end of 2021; an adverse change in the Corporation’s ability to

attract new clients and retain existing ones; the risk that additional portions of the unrealized losses in the Corporation’s investment portfolio are determined to be other-than-temporary, including additional impairments on the Corporation’s

remaining $8.1 million exposure to the Puerto Rico government’s debt securities held as part of the available-for-sale securities portfolio; uncertainty about legislative, tax or regulatory changes that affect financial services companies in

Puerto Rico, the U.S., and the U.S. and British Virgin Islands, which could affect the Corporation’s financial condition or performance and could cause the Corporation’s actual results for future periods to differ materially from prior results

and anticipated or projected results; changes in the fiscal and monetary policies and regulations of the U.S. federal government and the Puerto Rico and other governments, including those determined by the Federal Reserve Board, the New York

FED, the FDIC, government-sponsored housing agencies, and regulators in Puerto Rico and the U.S. and British Virgin Islands; the risk of possible failure or circumvention of the Corporation’s internal controls and procedures and the risk that

the Corporation’s risk management policies may not be adequate; the Corporation’s ability to identify and address cyber-security incidents such as data security breaches, malware, “denial of service” attacks, “hacking” and identity theft, a

failure of which could disrupt our business, may result in misuse or misappropriation of confidential or proprietary information, and could result in the disruption or damage to our systems, increased costs and losses or an adverse effect to

our reputation; the risk that the FDIC may increase the deposit insurance premium and/or require special assessments to replenish its insurance fund, causing an additional increase in the Corporation’s non-interest expenses; the impact on the

Corporation’s results of operations and financial condition of business acquisitions, such as the pending acquisition of BSPR, and dispositions; a need to recognize impairments on the Corporation’s financial instruments, goodwill and other

intangible assets relating to business acquisitions, including as a result of the COVID-19 pandemic; the effect of changes in the interest rate environment, including as a result of the impact of the COVID-19 pandemic on the global economy, on

the Corporation’s businesses, business practices and results of operations; the risk that the impact of the occurrence of any of these uncertainties on the Corporation’s capital would preclude further growth of the Bank and preclude the

Corporation’s Board of Directors from declaring dividends; uncertainty as to whether FirstBank will be able to continue to satisfy its regulators regarding, among other things, its asset quality, liquidity plans, maintenance of capital levels

and compliance with applicable laws, regulations, and related requirements, particularly given the increase in the allowance for credit losses resulting from the need to take into account the COVID-19 uncertainties in the implementation of the

new credit loss accounting guidance; and general competitive factors and industry consolidation. The Corporation does not undertake, and specifically disclaims any obligation, to update any “forward-looking statements” to reflect occurrences or

unanticipated events or circumstances after the date of such statements, except as required by the federal securities laws.

Proven Track Record of Operating under Uncertain Conditions. We are entering this crisis from a

position of Strength 3 Operational Readiness We have continued to improve credit quality, grow core deposits and loans, improve earnings and accrete capital throughout decade long recession, devastating hurricanes, and earthquakesExperienced

management team well prepared to manage current market hurdles, executed immediate response to March 16th lock down in main marketTimely investment in digital channels allowed us to be ready to service client needs and drive behavior towards

alternative channels therefore mitigating human contact. Traditional channels remain operational during lock down and under strict safety protocols in order to safeguard the health of our employees and customers Fortress Balance Sheet Capital

ratios among the top 5% of all banks with assets greater than $10 billionCommon Equity Tier-1 capital at $1.96 billion; Core liquidity (cash and free liquid assets) of $2.29 billion, or 17.5% of assets as of March 2020Significant allowance

coverage with an ACL to loans of 3.24% as of March 31, 2020 (compared to an ALLL to total loans of 1.72% on December 31, 2019) Ample levels of capital to support balance sheet initiatives and weather current economic environmentTangible Book

Value as of March 31, 2020 is $9.76 per share post CECL Strong Credit Quality Mitigants in Place Well diversified loan portfolio across three geographic regions operating at the lowest level of delinquencies of the past ten yearsRelatively

low loan portfolio exposure to highly sensitive industries impacted by recent pandemic such as airlines, cruise lines, restaurants & energy oil & gas, and hotelsStrong regulatory support and unprecedented Federal Stimulus under CARES

Act, additional $900 million stimulus provided by the local government, and proactive execution of moratorium programs will provide strong mitigants to credit deterioration in the short term

Operational Readiness COVID-19 Pandemic Response 4 Operations and Employee Considerations Market

Background - Puerto Rico on lockdown since 3/16, ECR “Stay at Home” since 3/13 and Florida on “Stay at Home” since 3/26Dispersion of key operating functions (call centers, customer service, executives); divided staff in A/B teams to maintain

clean team and support distancing rules for business continuity ~1,000 employees or ~80% of support units staff are working remotelyOn April 13, implemented contact tracing; Initiated preventive COVID-19 testing to ~750 employees on

premisesEstablished strict safety and cleaning protocols across all premises and implemented guidelines to keep more vulnerable employees at home (i.e. senior people, pregnant women) Branches Delivery Changes Modified hours at PR and ECR

branch locations (9am –1pm); FL branches remained fully operationalAll branch personnel were divided into two working schedule groups (“Team A” and “Team B”) to reduce contact between employees within the same branch and customersGranted

economic incentives to front line employeesEmergency Cash Protocol – 1) Increased physical cash inventory at selected locations 2) Daily monitoring of cash activities 3) Frequent replenishment of ATMsExperienced reduced branch transaction and

ATM volumes since lockdown was implemented Digital Readiness Overall increase of 11% year-to-date in digital banking registered users across all three regions (reaching 171k) Digital Banking monetary transactions for PR/ECR as of March 2020

are 22% higher year-over-yearMobile RDC transactions as of Q1 2020 are up 117% year-over-yearMobile RDC average daily transactions increased by 47% during last two weeks of lock down (March 16th to March 31st) when compared to first two weeks

of March 2020Florida YTD commercial mobile transactions are 33% higher than 4QIncreased the educational campaigns to promote the use of digital channels; continued to provide extensive call center supportImplemented “Fintech” solution to

automate and expedite PPP loan processing and created dedicated service team to manage PPP applications volumes Swiftly implemented relief programs for commercial, consumer and residential mortgage customers in all regionsStrong performance

in delivering Small Business Administration’s “Paycheck Protection Program” to clients and small business in the communitiesWaived late payment fees on loansHalted foreclosures and repossessions Relief Programs:82,884 / $3.47 bn

loans SBA PPP:2,576 / $319 MM loans Programs to Assist our Customers

Fortress Balance SheetCapital Ratios Among the Highest in the Banking Sector 5 Capital ratios are

among top 5% of banks above $10 billion in assetsCapital ratios are approximately 1,000 basis points above regulatory “Well Capitalized” ratiosFully committed to current dividends, reinstated common dividend in 4Q 2018 and raised 67% to

$0.05/share in 4Q 2019 The events leading to this pandemic situation are happening at a time where the Corporation enjoys record high capital ratios, anchored by the experience of having effectively implemented action plans to deal with

natural disasters such as Hurricanes Maria and Irma as well as recent earthquakes Capital Ratios – Evolution since 2013 Tangible Book Value per Share since 2013 Our dividend is supported by our strong capital position and strong pre-tax

pre-provision revenue, which was $68 million in the first quarter +31% Total Risk-Based Capital Tier-1 Common Equity capital Tier-1 Capital Tangible Common Equity Capital Leverage Ratio 1Q 2020

Fortress Balance SheetDramatically Stronger Financial Profile Compared to prior Financial Crisis

6 Our financial metrics going into this pandemic are substantially stronger than the prior financial crisis Capital Asset Quality Higher quality Loan Portfolio when compared to prior financial crisis and PR recession starting period

The ratio of the total allowance for loans to nonaccrual loans held for investment was 138% as of March 31, 2020, compared to 33% as of December 31, 2009 Significantly stronger capital position when compared to prior financial crisis and PR

recession starting period As of March 31, 2020, we have tangible common equity and Tier 1 common equity of $2.1 billion and $2.0 billion, respectively vs. of $626 million and $586 million, as of December 31, 2009,

respectively 2009 2019 21.8% 4.1% +237.2% CET1 Ratio CET1 Capital 3.2% 2009 16.4% 2019 +240.1% TCE Ratio TCE Capital 2009 8.7% 2.4% 1Q 2020 -81.4% NPAs / Total Assets NPAs 1Q 2020 2009 +418.2% ALLL /

Nonaccrual Loans

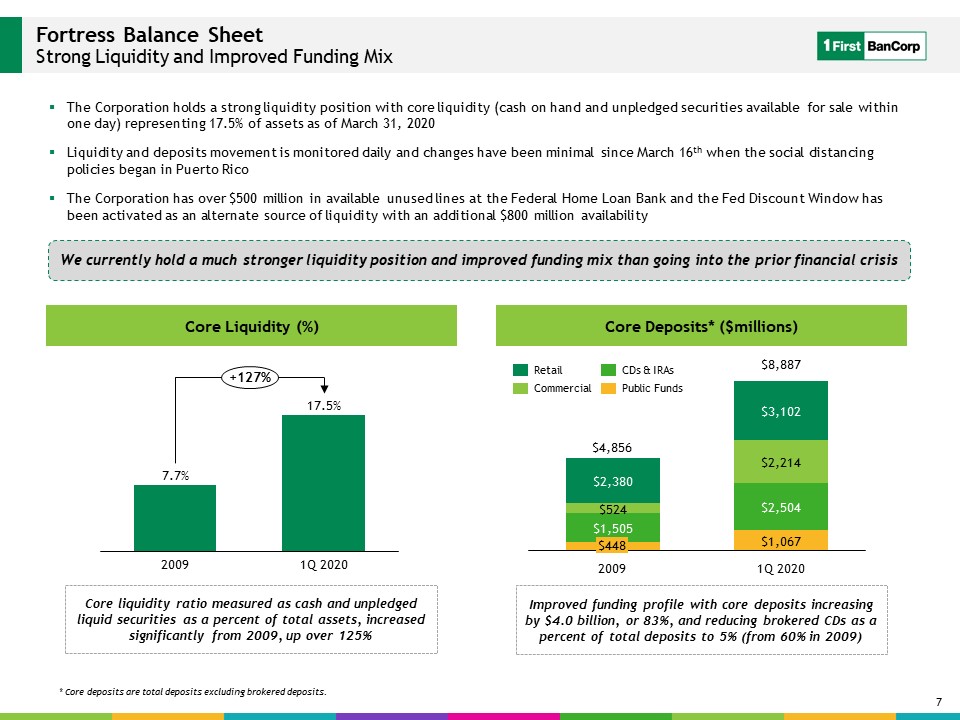

Fortress Balance SheetStrong Liquidity and Improved Funding Mix 7 The Corporation holds a strong

liquidity position with core liquidity (cash on hand and unpledged securities available for sale within one day) representing 17.5% of assets as of March 31, 2020Liquidity and deposits movement is monitored daily and changes have been minimal

since March 16th when the social distancing policies began in Puerto RicoThe Corporation has over $500 million in available unused lines at the Federal Home Loan Bank and the Fed Discount Window has been activated as an alternate source of

liquidity with an additional $800 million availability * Core deposits are total deposits excluding brokered deposits. We currently hold a much stronger liquidity position and improved funding mix than going into the prior financial crisis

Core Liquidity (%) Core Deposits* ($millions) 1Q 2020 2009 +127% Core liquidity ratio measured as cash and unpledged liquid securities as a percent of total assets, increased significantly from 2009, up over 125% $8,887 1Q

2020 $448 2009 $4,856 Retail Commercial CDs & IRAs Public Funds Improved funding profile with core deposits increasing by $4.0 billion, or 83%, and reducing brokered CDs as a percent of total deposits to 5% (from 60% in

2009)

Fortress Balance SheetCECL Q1 2020 ACL to Total Loans Provides Ample Coverage 8 ALLL - Q4 2019

($millions) Day-1 CECL ACL ($millions) CECL ACL Q1 2020 ($millions) $53.6(34%) $44.8(29%) $56.8(36%) Residential Mortgage HTM and Other Assets Commercial Consumer ALLL – Q4 2019: $155.1

million $88.7(36%) $94.6(38%) 53.0(21%) $12.1(5%) Day 1 CECL ACL: $236.3 million $107.1(35%) $108.2(35%) $77.5(25%) $15.4(5%) ACL Q1 2020: $308.2 million ACL Day 1:+ $81.2 million ACL Q1 2020:+ $59.8

million $279.19(89%) Evolution of ACL on Loans to Total Loans (%) Day 1 Impact ALLL Q4 2019 0.90% 1.72% Day 1 ACL ACL Q1 2020 Q1 2020 Impact

Strong Credit Quality Mitigants in PlaceDiversification and Improved Risk Profile Commercial Loan

Categories > $25 million as a % of Total Commercial March 31, 2020 The diverse mix of our loan portfolio by region and industries improves our risk profile; compared to the prior financial crisis, the risk characteristic of our loan

portfolio have been transformed materially into less risky assets Loan Portfolio Distribution ($millions)March 31, 2020 Unlike banks in the US, we have been underwriting loans through a prolonged recession; property values in PR market have

not seen the same level of price appreciation as those found in markets where economy is expanding, thus presenting less downward riskConstruction portfolio reduced from $1.5 billion to $160 million at 1Q

2020 13,949 0 9,051 160 39 -35% Residential Mortgage Loans HFS Commercial Construction Consumer and Finance Leases 1Q 2020 2009 9

Strong Credit Quality Mitigants in PlaceUnprecedented Short-Term Mitigants to Support the

Economy 10 Strong regulatory support under recently issued regulatory inter-agency guidance “encourages financial institutions to work constructively with borrowers affected by COVID 19, will not criticize institutions for prudent loan

modifications, and views prudent loan modifications as positive actions that can effectively manage or mitigate adverse impacts on borrowers due to COVID-19 and lead to improved loan performance and reduced credit risk”Moratorium programs were

swiftly implemented based on prior experience from the natural disasters in Puerto Rico (2017), for commercial, residential and consumer borrowers to provide for deferral of principal and interest up to June 30, 2020; additional extensions may

be granted to borrowers based on the borrower’s situation and timing for reopening of businessMoreover, economic impact of pandemic should be offset by a series of unprecedented actions that will further mitigate credit deterioration in the

short termRecently approved CARES Act will provide extensive federal stimulus to support the economy through the pandemic, mostly through increases in unemployment insurance, cash payments to PR residents, and small business paycheck protection

program (“PPP”)In addition, Puerto Rico Government and Fiscal Oversight Board have allocated more than $900 million to stimulate the economy and provide cash flow relief to those affected by COVID-19 Uncertain credit environment will persist

until a reliable timeline for re-opening the economy is established and performance of pandemic-sensitive businesses is properly assessed Approved Borrower Relief ProgramsApril 28, 2020 Residential Mortgage Commercial Consumer $3.47

billion in approved relief programs or 38% of loan portfolio SBA7(a) Paycheck Protection Program April 29, 2020 More than 2,500 commercial clients benefited from $319 million in SBA PPP loans to support their businesses and protect jobs~90%

of loans were granted in amounts of $250k or less 29% 44% 40% ($ in millions; as a % of portfolio)

Strong Credit Quality Mitigants in PlaceLeveraging Recent Experience Gained through Prior

Cycles 11 Recent experience from 2017 natural disasters (Hurricanes Irma and Maria) has prepared us well for recent events by providing actionable insights for establishing the pandemic relief program on a timely and organized

manner Execution of our contingency preparedness and recovery plans for Hurricanes Irma and Maria demonstrated the operational strength and agility of our InstitutionThe Bank also established loan relief programs for commercial and consumer

borrowers impacted by the stormsIn response to these storms, the Bank posted a Natural Disaster general reserve for losses in order to ensure that the ALLL captured the potential deterioration in loan credit quality on all its three operating

regionsThe successful and timely implementation of the loan relief programs coupled with significant inflow of relief funds to support our main market led to improving credit quality and earnings trends in a relative short duration 6-9 months

following the impact of the natural disastersMajority of borrowers under moratoriums returned to normal payments pattern at expirationAsset quality metrics improved quarterly in the aftermath of the hurricanesThe Bank ended up releasing over

20% of the posted reserve due to improved economic conditions in the storms’ aftermath NPAs to Total Assets (%) 30-89 DPD as a % of Total Loans Net Income

($millions) 3Q18 2Q17 3Q17 4Q17 1Q18 2Q18 -10% 2Q17 1Q18 3Q17 2Q18 4Q17 3Q18 Residential Mortgage Commercial Consumer 3Q17 2Q17 4Q17 1Q18 2Q18 3Q18 +30%

Economic Impact on FirstBank’s Operating EnvironmentExtensive Stimulus and Tax Relief Measures are

Expected to Offset Economic Impact 12 The pandemic has triggered the enactment of meaningful fiscal and economic stimulus at both the federal and local level geared towards containing the magnitude of the economic downturn Puerto Rico

local stimulative / relief measures Government and Fiscal Oversight Board have allocated more than $900 million to stimulate the economy and provide cash flow relief to those affected by COVID-19Authorized the use of a $160 million Emergency

Reserve Fund to immediately tackle the pandemic Allocated $787 million in additional funding mainly to distribute direct cash payments to self-employed (+170K individuals) and SMEs (in addition to federal response); additional funding will be

allocated to restock medical supplies and equipment and invest in public safety measuresGovernment and municipal employees will continue receiving salary (+180K employees)Filing of income tax returns were delayed until June 15, 2020,

restrictions on pension plan distributions were relaxed, and granted certain exemptions for the payment of Sales and Use taxes, among others 1 Federal Stimulus to Support the Economy (~$2.5Tn)* Cash Payments / Tax Relief Cash payments for

US residents of $1,200 (phase out staring at $75K) and $500 per childTax relief: employer payroll tax deferrals, employee retention tax credit and other items 1 Social Programs $260bn of emergency unemployment insurance, $25bn in food

assistance, and ~$20bn for farmers and ranchers 2 Medical and Other Spending ~$100bn for hospitals and veterans care, ~$45bn for FEMA Disaster Relief Fund, $31bn for local education, and $11bn for vaccines$25 bn (additional testing) and $75

bn (hospitals) 3 Economic Stabilization $454bn for US Treasury Stabilization Fund (will be first loss position in Fed SPV that will provide loan and loan guarantees) $46bn for certain industries (national security) 4 Small Business

Loans Enhancements to SBA programs; some loans can be forgiven if companies retain workersAbility for Fed to create “Main Street” lending facility (not

mandated) 5 500(20%) 300(12%) 440(18%) 500(20%) 733(30%) Total Fiscal Stimulus ~$2,473 Additional changes impacting financial companies include mortgage forbearance on GSEs and CECL /

TDR relief for banks until end of emergency or December 31, 2020 Puerto Rico-Specific Mitigating Factors Government’s cash position at $8 billion as of March 2020; additional funding could be repurposed for further pandemic reliefFiscal

Oversight Board estimates between $5 and $10 billion of federal stimulus support; $2.2 billion have already been received by governmentAmple liquidity and strong capital position of PR banks (Industry-wide Tier 1 capital of 21%) provides

extensive coverage to sustain pandemic period Additional liquidity and fiscal flexibility 2 * Funding allocated through the recently enacted “Coronavirus Aid, Relief, and Economic Security Act” and “Paycheck Protection Program and Health

Care Enhancement Act”.

Banco Santander Puerto Rico AcquisitionSummary Transaction Highlights 13 On October 21, 2019, the

Corporation announced the cash acquisition of Banco Santander Puerto Rico (“BSPR”) for 1.175x base purchase price / core tangible common equity ($63 million premium at announcement) Creates a stronger competitor in Puerto Rico with the

scale and breadth to better serve retail and commercial customers Enhances funding profile through the addition of a low-cost core deposit funding base and reduction of wholesale funding Deploys capital efficiently, acquiring a strong and

stable earnings stream with no non-performing assets Expands talent bench across retail, commercial, and risk management functions and allows for increased investment in technological innovation and talent development With respect

to the Corporation’s announced transaction to acquire Banco Santander Puerto Rico, the Corporation continues to work with the applicable regulators in their review of the transaction. Taking into account the impact of the COVID-19 pandemic, the

Corporation now believes it is unlikely that all regulatory approvals will be received to close the transaction by the middle of 2020 as previously expected. The Corporation continues to cooperate with its regulators and to provide requested

additional information as part of the application process.

Appendix