Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 EIX Q1 2020 CONFERENCE CALL PREPARED REMARKS DATED APRIL 30, 2020 - EDISON INTERNATIONAL | eix-sceexhibit992q12020.htm |

| EX-99.1 - EXHIBIT 99.1 EDISON INTERNATIONAL PRESS RELEASE DATED APRIL 30, 2020 - EDISON INTERNATIONAL | eix-sceexhibit99x1q120.htm |

| 8-K - 8-K - EDISON INTERNATIONAL | eix-sceform8xkq12020er.htm |

Exhibit 99.3 First Quarter 2020 Financial Results April 30, 2020

Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the: • ability of SCE to recover its costs through regulated rates, including costs related to uninsured wildfire-related and mudslide-related liabilities, costs incurred to mitigate the risk of utility equipment causing future wildfires, costs incurred to implement SCE's new customer service system and costs incurred as a result of the COVID-19 pandemic; • ability of SCE to implement its Wildfire Mitigation Plan, including effectively implementing Public Safety Power Shut-Offs when appropriate; • ability to obtain sufficient insurance at a reasonable cost, including insurance relating to SCE's nuclear facilities and wildfire-related claims, and to recover the costs of such insurance or, in the event liabilities exceed insured amounts, the ability to recover uninsured losses from customers or other parties; • risks associated with California Assembly Bill 1054 (“AB 1054”) effectively mitigating the significant risk faced by California investor-owned utilities related to liability for damages arising from catastrophic wildfires where utility facilities are alleged to be a substantial cause, including SCE's ability to maintain a valid safety certification, SCE's ability to recover uninsured wildfire-related costs from the insurance fund established under AB 1054 (“Wildfire Insurance Fund”), the longevity of the Wildfire Insurance Fund, and the CPUC's interpretation of and actions under AB 1054, including their interpretation of the new prudency standard established under AB 1054; • decisions and other actions by the California Public Utilities Commission, the Federal Energy Regulatory Commission, the Nuclear Regulatory Commission and other regulatory and legislative authorities, including decisions and actions related to determinations of authorized rates of return or return on equity, the recoverability of wildfire-related and mudslide-related costs, issuance of SCE's wildfire safety certification, wildfire mitigation efforts, and delays in regulatory and legislative actions; • ability of Edison International or SCE to borrow funds and access bank and capital markets on reasonable terms; • risks associated with the decommissioning of San Onofre, including those related to public opposition, permitting, governmental approvals, on-site storage of spent nuclear fuel, delays, contractual disputes, and cost overruns; • pandemics, such as COVID-19, and other events that cause regional, statewide, national or global disruption,, which could impact, among other things, Edison International's and SCE's business, operations, cash flows, liquidity and/or financial results; • extreme weather-related incidents and other natural disasters (including earthquakes and events caused, or exacerbated, by climate change, such as wildfires), which could cause, among other things, public safety issues, property damage and operational issues; • physical security of Edison International's and SCE's critical assets and personnel and the cybersecurity of Edison International's and SCE's critical information technology systems for grid control, and business, employee and customer data; • risks associated with cost allocation resulting in higher rates for utility bundled service customers because of possible customer bypass or departure for other electricity providers such as Community Choice Aggregators (“CCA,” which are cities, counties, and certain other public agencies with the authority to generate and/or purchase electricity for their local residents and businesses) and Electric Service Providers (entities that offer electric power and ancillary services to retail customers, other than electrical corporations (like SCE) and CCAs); • risks inherent in SCE's transmission and distribution infrastructure investment program, including those related to project site identification, public opposition, environmental mitigation, construction, permitting, power curtailment costs (payments due under power contracts in the event there is insufficient transmission to enable acceptance of power delivery), changes in the California Independent System Operator’s transmission plans, and governmental approvals; and • risks associated with the operation of transmission and distribution assets and power generating facilities, including public and employee safety issues, the risk of utility assets causing or contributing to wildfires, failure, availability, efficiency, and output of equipment and facilities, and availability and cost of spare parts. Other important factors are discussed under the headings “Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. April 30, 2020 1

Focus on Operations During COVID-19 Pandemic • Safety of workers and communities is our first priority; procedures in place to protect workers that align with guidance from the World Health Organization and Center for Disease Control • About 2/3 of all employees have been teleworking since March 16; approximately 4,500 SCE Employees workers continue to work at SCE facilities or in the field • Field and facilities workers have additional guidelines and enhanced personal protection equipment • Temporarily suspending service disconnections and waiving late fees • Providing monthly bill discounts/one-time bill relief to certain income-qualified programs; Customers and working closely with the CPUC Communities • Pledged $1 million to local non-profits to assist our communities • Prioritizing public safety and wildfire mitigation work to protect our communities while mitigating impacts of essential outages on customers • Wildfire mitigation work remains a top priority and focused on meeting all compliance targets Wildfire outlined in SCE’s 2020-2022 Wildfire Mitigation Plan (WMP); identified as essential work by Prevention and government agencies; continue activities that minimize the impact of PSPS on our communities Mitigation • Currently on track for 61 of 69 WMP activities through Q1 2020 and action plans in place for all off track activities • Currently no material supply chain disruptions Supply Chain • Continue monitoring our supply chain; receiving feedback from over 100 critical contractors on pandemic impact to their companies Pandemic response grounded in best-in-class emergency management protocols; evaluating additional impact/timing scenarios and mitigations as pandemic progresses April 30, 2020 2

First Quarter Earnings Summary Key SCE EPS Drivers4 Q1 Q1 Variance 2020 2019 Higher revenue $ 0.42 - CPUC revenue 0.37 Basic Earnings Per Share (EPS)1 - FERC revenue 0.05 SCE $ 0.60 $ 0.90 $ (0.30) Higher O&M (0.28) Higher depreciation (0.01) EIX Parent & Other (0.10) (0.05) (0.05) Higher interest expense (0.03) Basic EPS $ 0.50 $ 0.85 $ (0.35) Income taxes 0.02 Less: Non-core Items Results prior to impact from share dilution $ 0.12 Impact from share dilution (0.08) 2,3 SCE $ (0.12) $ 0.22 $ (0.34) Total core drivers $ 0.04 2,3 EIX Parent & Other3 (0.01) — (0.01) Non-core items (0.34) Total $ (0.30) Total Non-core $ (0.13) $ 0.22 $ (0.35) Key EIX EPS Drivers4 Core Earnings Per Share (EPS) EIX parent and other — Higher interest expense and corporate expenses $ (0.05) SCE $ 0.72 $ 0.68 $ 0.04 Impact from share dilution 0.01 EIX Parent & Other (0.09) (0.05) (0.04) Total core drivers $ (0.04) Non-core items3 (0.01) Core EPS $ 0.63 $ 0.63 $ — Total $ (0.05) 1. See Earnings Non-GAAP reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Amortization of Wildfire Insurance Fund expenses, impact from changes in the allocation of deferred tax re-measurement between customers and shareholders and gain from sale of San Onofre nuclear fuel in 2019 3. Re-measurement of uncertain tax positions related to the 2010 – 2012 California state tax filings 4. 2020 EPS drivers are reported based on prior year weighted-average share count of 326 million (2020 YTD weighted-average shares outstanding is 363 million) Note: Diluted earnings were $0.50 and $0.85 per share for the three months ended March 31, 2020 and 2019, respectively. April 30, 2020 3

SCE Capital Expenditure Forecast ($ billions) $19.4 - $21.2 billion capital program Distribution for 2020-2023 Transmission • This capital forecast includes: Generation 1 2018 GRC approved CPUC capital spend Wildire mitigation-related spend for 2019-2020 $5.4 $5.4 $5.4 2021 GRC requested CPUC capital spend $5.0 for 2021-2023 $4.8 Non-GRC capital programs including Charge Ready Pilot, Medium- and Heavy- Duty (MD/HD) Transportation Electrification and 2019-2020 wildfire mitigation-related programs FERC forecasted capital spend • Long term growth drivers include: Infrastructure Replacement Wildfire Mitigation Transportation Electrification Transmission Infrastructure • Authorized/Actual may differ from forecast; 2019 (Actual) 2020 2021 2022 2023 previously authorized amounts in the last Range three GRC cycles were 89%, 92% and 92%2 of 3 $4.8 $4.9 $4.9 $4.8 Case capital requested, respectively 1. In accordance with Assembly Bill 1054, ~$1.6 billion of wildfire mitigation-related spend shall not earn an equity return. 2. Approval percentage for the 2018 GRC excludes Grid Modernization and project approvals that were deferred to the next General Rate Case for timing reasons 3. The low end of the range for 2021-2023 reflects a 10% reduction on the total capital forecast using management judgment based on historical experience of previously authorized amounts and potential for permitting delays and other operational considerations. The low end of the range for 2020 reflects a 10% reduction applied only to FERC capital spending and non-GRC programs April 30, 2020 4

SCE Rate Base Forecast ($ billions) $41.0 $38.2 $35.9 $33.4 $30.8 $28.5 Range Case 1 2018 2019 2020 2021 2022 2023 CAGR Range Case 2 $28.5 $30.8 $33.3 $35.1 $37.0 $39.2 6.6% 1. Morongo Transmission holds an option to invest up to $400 million in the West of Devers Transmission Project, or half of the estimated cost of the transmission facilities only, at the in-service date, estimated to be 2021. In the table above, the rate base has been reduced to reflect this option. Capital forecast includes 100% of the project spend 2. Rate base forecast range case reflects capital expenditure forecast range case Note: Weighted-average year basis. FERC based on latest forecast and represents approximately 20% of total rate base throughout the forecast period. CPUC excludes the ~$1.6 billion of SCE’s fire risk mitigation capital expenditures in accordance with Assembly Bill 1054. CPUC also excludes the “rate-base offset” adjustment related to the 2015 GRC write-off of the regulatory asset for 2012-2014 incremental tax repairs and rate base associated with projects or programs that have not yet been approved. April 30, 2020 5

Regulatory Mechanisms Provide Revenue Certainty • Earnings not affected by variability of retail electricity sales Revenue • Long-standing regulatory mechanism that annually adjusts rates to collect/refund variance Decoupling from authorized revenue requirement • Base Revenue Requirement Balancing Account (BRRBA) allows collection of authorized revenue requirement and cost recovery regardless of change in demand/volumes • Activated Catastrophic Event Memorandum Account (CEMA) for COVID-19 related costs Recovery • CPUC approved resolution for a COVID-19 Pandemic Protections Memorandum Account where Mechanisms we will record non-payment and non-recovery of billed amounts and later seek recovery in our annual Energy Resource Recovery Account or other proceedings • Exploring additional potential mechanisms to mitigate or manage customer rate impacts 6% Decline in System Load During Stay-at-Home Order Vs. Prior Year1 System Load by Segment Total SCE Residential Non-Residential 20201 vs. 2019 (6%) 14% (16%) 20201 vs. 5-year average (11%) 10% (18%) Load and payment impacts may shift as impact of pandemic develops but California’s regulatory construct has established mechanisms for recovery of IOU revenue requirement 1. Data based on period starting March 16, 2020 through April 19, 2020 Note: Information is not weather adjusted. Customer class and system load represent all SCE retail customers (bundled as well as Direct Access and CCA). The load impact by customer class is estimated using interval load data from representative samples of customers in each rate group. These estimates are not derived from SCE billing files therefore they don’t necessarily match what the customers were billed. April 30, 2020 6

Pension Well-Funded at Year End 2019 Postretirement Benefits Other Than Pensions Pension Benefits are 96% Funded (PBOP) are 119% Funded with Resilient Asset with Resilient Asset Allocation1 Allocation2 Total Plan Assets: $3.8 billion Represented PBOP Trust: $1.4 billion Global Equity 10% Alternatives/ Opportunistic 5% U.S. Equity 23% Fixed Income 85% Fixed Income 48% International Non-Represented PBOP Trust: $1.1 billion Equity 17% Fixed Alternatives/ Income 29% Opportunistic Global Equity 12% 58% Alternatives/ Opportunistic 13% Regulatory balancing account in place for variances in benefit plan funding costs 1. Information relates to qualified plans 2. PBOP is comprised of multiple trusts that vary in funding levels from approximately 80% to fully funded April 30, 2020 7

Strong EIX and SCE Liquidity Profiles ($ billions) Liquidity Profile1 Financing Activities • Targeting EIX long-term FFO/debt ratio of 15-17% $6.4 • EIX financing activities: $800 million 364-day term loan to enhance financial flexibility drawn on March 25th $4.0 $400 million senior note offering closed April 3rd $400 million senior notes repaid on April 15th No long-term debt maturities remain in 2020 or 2021 $2.3 • SCE financing activities: $2.3 billion of first mortgage bonds issued across three offerings in the YTD period $800 million 364-day revolver and $475 million 364- day term loan to fund AB 1054 wildfire mitigation 2 EIX SCE Total capital spending st Cash on hand $373 million tax-exempt bonds purchased on April 1 Unused 1-Year Credit Facility (AB 1054) (plan to re-market subject to market conditions) Unused 5-Year Credit Facility (General) No long-term debt maturities at SCE for remainder of 2020; $1 billion of long-term debt maturities in 2021 EIX and SCE have taken proactive steps to enhance liquidity YTD; EIX term loan increased financing flexibility for remaining equity planned for 2020 1. As of April 15, 2020 2. Expected to be repaid with proceeds from securitization of dedicated-rate component Note: Totals may not foot due to rounding. April 30, 2020 8

2020 EIX Core Earnings Guidance 2020 Assumption Additional Notes CPUC Rate Base $26.8 billion Return on Equity (ROE) 10.30% 2020 Cost of Capital Final Decision Capital Structure 52% equity 2020 Cost of Capital Final Decision FERC Rate Base $6.6 billion ~20% of total 2020 rate base forecast Informed by MISO ruling; in line with CPUC 2020 Cost of ROE 10.30% Capital Final Decision Recorded capital structure; 2020 average estimated equity layer; includes charges such as the AB 1054 wildfire insurance Capital Structure 47% equity fund contributions, wildfire-related claims associated with the 2017/2018 wildfire events and the SONGS asset impairment Other Items Expect more volatility across and within categories as we Variances to Rate Base manage within the guidance range; categories include SCE Math ($0.55) – ($0.85) per share Variances, SB 901/AB 1054, EIX Parent and Other and Share Count Dilution 2020 Includes $0.2 billion of remaining 2019 ATM program and Equity Market $0.6 billion of additional 2020 equity needs; $91 million of Activities $0.8 billion of EIX equity issuances equity needs issued through March 31, 2020; evaluating market for timing of remaining equity issuance Based on the timing of 2020 equity Weighted Average issuances, the 2020 weighted average 2019 – 339.7 million shares Share Count share count is subject to change Wildfire Insurance Fund Expense Excluded from core guidance Amortization expense will be a non-core item EIX reaffirms 2020 Core EPS guidance range of $4.32 - $4.62 April 30, 2020 9

Appendix April 30, 2020 10

Earnings Per Share Non-GAAP Reconciliations Reconciliation of EIX Basic Earnings Per Share Guidance to EIX Core Earnings Per Share Guidance EPS Attributable to Edison International 2020 Low High Basic EIX EPS $4.19 $4.49 Total Non-Core Items1 (0.13) (0.13) Core EIX EPS $4.32 $4.62 1. EPS is calculated on the assumed weighted-average share count for 2020 of 369.5 million which was originally provided on February 27, 2020. April 30, 2020 11

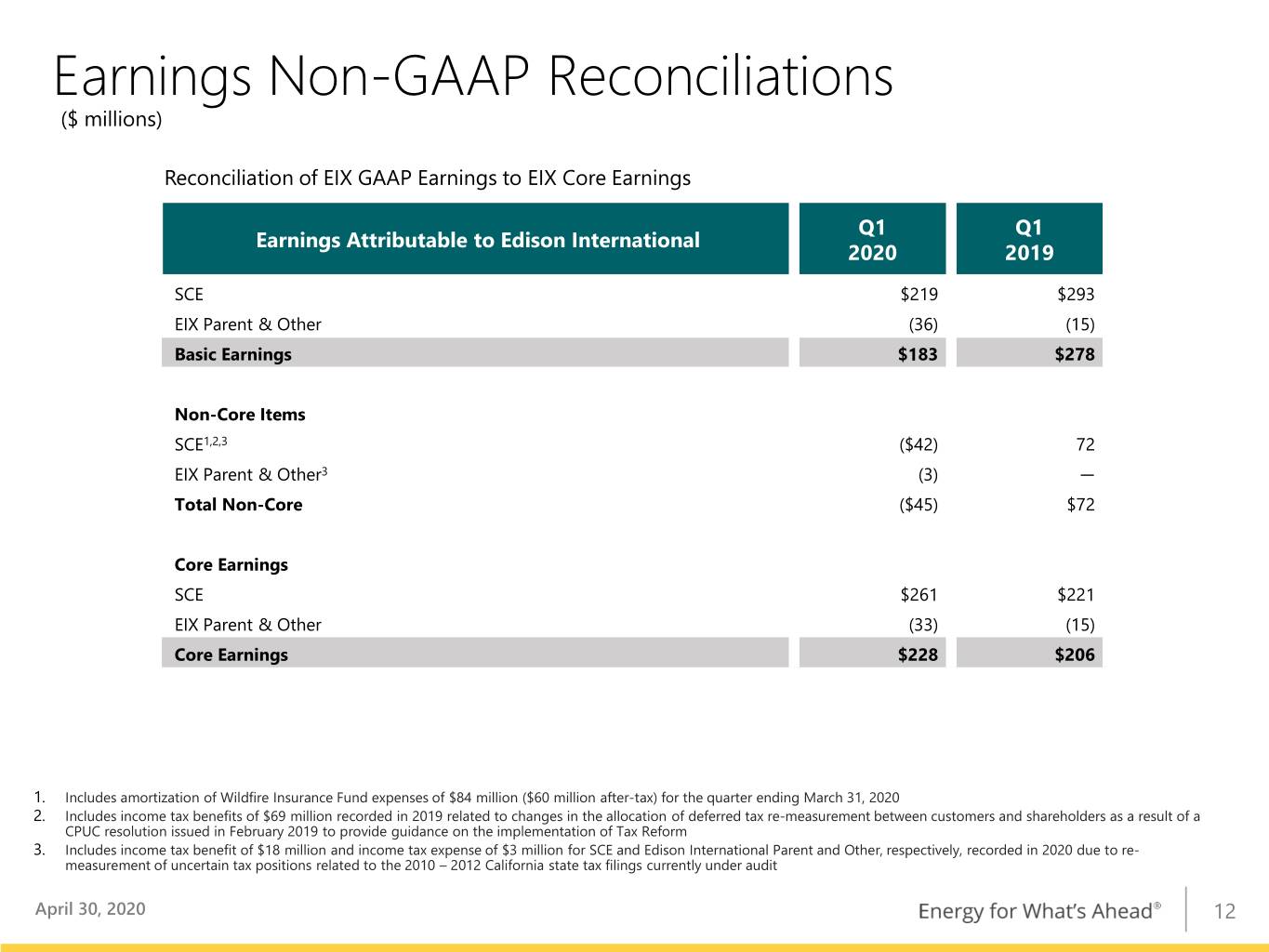

Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX GAAP Earnings to EIX Core Earnings Q1 Q1 Earnings Attributable to Edison International 2020 2019 SCE $219 $293 EIX Parent & Other (36) (15) Basic Earnings $183 $278 Non-Core Items SCE1,2,3 ($42) 72 EIX Parent & Other3 (3) — Total Non-Core ($45) $72 Core Earnings SCE $261 $221 EIX Parent & Other (33) (15) Core Earnings $228 $206 1. Includes amortization of Wildfire Insurance Fund expenses of $84 million ($60 million after-tax) for the quarter ending March 31, 2020 2. Includes income tax benefits of $69 million recorded in 2019 related to changes in the allocation of deferred tax re-measurement between customers and shareholders as a result of a CPUC resolution issued in February 2019 to provide guidance on the implementation of Tax Reform 3. Includes income tax benefit of $18 million and income tax expense of $3 million for SCE and Edison International Parent and Other, respectively, recorded in 2020 due to re- measurement of uncertain tax positions related to the 2010 – 2012 California state tax filings currently under audit April 30, 2020 12

Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings (losses) internally for financial planning and for analysis of performance. Core earnings (losses) are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the company's performance from period to period. Core earnings (losses) are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (losses) are defined as earnings attributable to Edison International shareholders less non-core items. Non-core items include income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as write downs, asset impairments and other income and expense related to changes in law, outcomes in tax, regulatory or legal proceedings, and exit activities, including sale of certain assets and other activities that are no longer continuing. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Sam Ramraj, Vice President (626) 302-2540 sam.ramraj@edisonintl.com Allison Bahen, Principal Manager (626) 302-5493 allison.bahen@edisonintl.com April 30, 2020 13