Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Gogo Inc. | d920548d8k.htm |

Gogo 2020 Annual Stockholders’ Meeting April 29th, 2020 Exhibit 99.1

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based on management’s beliefs and assumptions and on information currently available to management. Most forward-looking statements contain words that identify them as forward-looking, such as “anticipates,” “believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Gogo’s actual results, performance or achievements to be materially different from any projected results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent the beliefs and assumptions of Gogo only as of the date of this presentation and Gogo undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. As such, Gogo’s future results may vary from any expectations or goals expressed in, or implied by, the forward-looking statements included in this presentation, possibly to a material degree. Gogo cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial or operational goals and targets will be realized. For a discussion of some of the important factors that could cause Gogo’s results to differ materially from those expressed in, or implied by, the forward-looking statements included in this presentation, investors should refer to the disclosures contained under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K. In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), Gogo also discloses in this presentation certain non-GAAP financial information, including Adjusted EBITDA and Free Cash Flow. These financial measures are not recognized measures under GAAP, and when analyzing our performance or liquidity, as applicable, investors should (i) use Adjusted EBITDA in addition to, and not as an alternative to, net loss attributable to common stock as a measure of operating results, and (ii) use Free Cash Flow in addition to, and not as an alternative to, cash from operating activities, when evaluating our liquidity. Safe harbor statement

Gogo Annual Stockholders’ Meeting CEO Comments Oakleigh Thorne April 29th, 2020

01 Gogo and COVID-19

COVID-19 Unprecedented impact on commercial aviation Impact | SELECTED AIRLINE IMPACTS Delta burning $80MM/day Airlines raising billions from government, debt and equity (United raising ~$1bn public equity) Virgin Australia entered administration GLOBAL INDUSTRY IMPACTS Passenger traffic down ~95% Airline revenue expected to be down $314bn (55%) for 2020 Airbus and Boeing facing production halts, cancellations and reduced deliveries (for years) >6,000 aircraft (incl. 1,124 2Ku) are parked; older aircraft will be retired POTENTIAL “GREEN SHOOTS”? Chinese flights up 20% Feb-Mar (though still well below pre-CV) Delta to continue to focus on delivering a premium experience

Expect CA sales to be down 60-70% in April BA strong but seeing some impact: Account suspensions up in April New activations down significantly in April Prior to cost reductions, Gogo CA is losing $1M a day Government aid may be on the way, but it is still uncertain Our business has been significantly affected…

Work from home Every country in which we operate has issued WFH orders >1000 employees working remotely: Multiple tools employed…Skype, MS Teams, Slack, etc. Communicating and coordinating well So, what is Gogo doing about this? Skeleton crews in place for certain location-specific activities Employees are Gogo’s most important resource Tried to have open communication throughout COVID planning process so the Gogo team is bought into the actions we take First - focused on safety of our people and customers

To ensure adequate liquidity over the medium term To continue paying our interest payments, and To maintain the franchise value of our two businesses So, what is Gogo doing about this? We start with more than $200M in the bank Next, we need to protect our business financially…Gogo has set the following objectives:

Developed (and constantly refining) best- to worst-case revenue scenarios based on depth and duration of Corona-Crisis “16 Levers” to manage costs… Multiple levels of cost reduction developed for each “Lever” which are tied to revenue projections from the scenario plans. Non-personnel levers include Supplier negotiations Airline negotiations Marketing, travel, other non-essential spend Personnel levers include Furloughs (announced last week) Salary Reductions including our Board (announced last week) Hiring freeze, merit increase delays, deferred bonuses In a world of uncertainty, Gogo has developed flexible action plans…

There are two potential opportunities for Gogo to receive assistance under the CARES Act $32b in short-term “payroll protection grants” for air carriers and contractors - we applied for early action on April 3rd $29b in loans and loan guarantees for air carriers, including Part 145 repair stations like Gogo – we applied early on April 17th Should we get Government assistance, we will be able to roll back furloughs and pay reductions earlier than if we don’t get assistance 17th Lever… The United States Government Gogo will provide a progress report on its “16 Lever” plan on its Q1 2020 earnings call

02 A Look Back at 2019

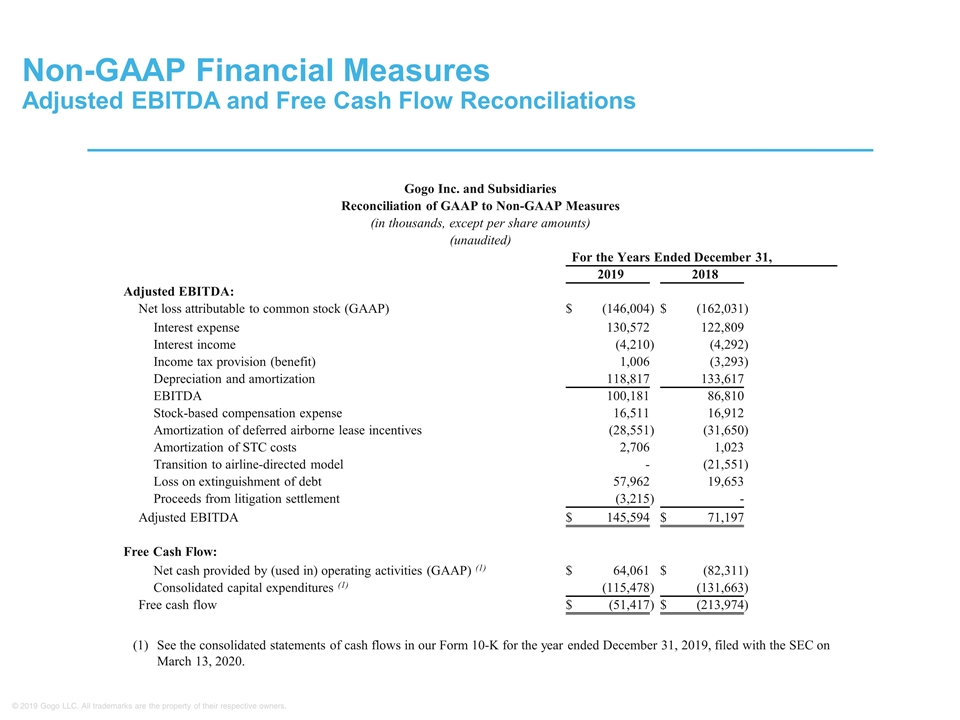

Successfully refinanced $162m convertible stub and $690m senior secured notes Pushed 80% of maturities to 2024 IBP initiatives achieved strong results on quality and cost ZERO de-icing incidents Adjusted EBITDA(1) improved 104% to $146m from $71m in 2018; net loss improved to -$146m from -$162m in 2018 Made substantial progress in move to positive free cash flow Improved free cash flow(1) by $163m, from -$214m to -$51m, and cash flow from operating activities by $146m, from -$82m to $64m Launched Gogo 5G project – on target for 2021 launch (1) See “Non-GAAP Financial Measures” on slide 16. What got done in 2019

03 A Look Past COVID-19

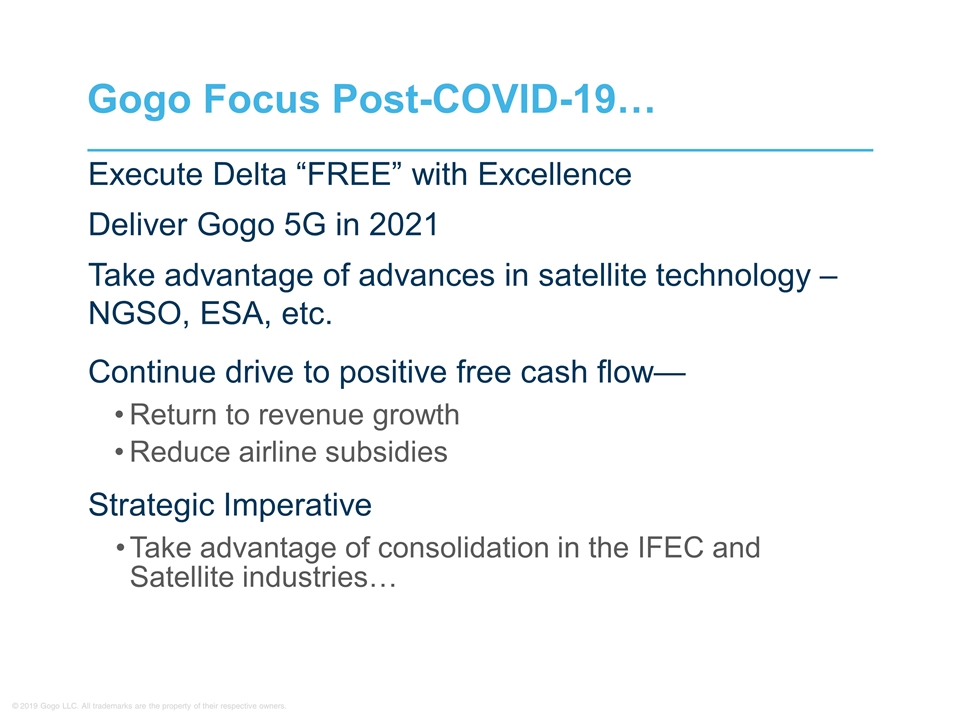

Gogo Focus Post-COVID-19… Execute Delta “FREE” with Excellence Deliver Gogo 5G in 2021 Take advantage of advances in satellite technology – NGSO, ESA, etc. Continue drive to positive free cash flow— Return to revenue growth Reduce airline subsidies Strategic Imperative Take advantage of consolidation in the IFEC and Satellite industries…

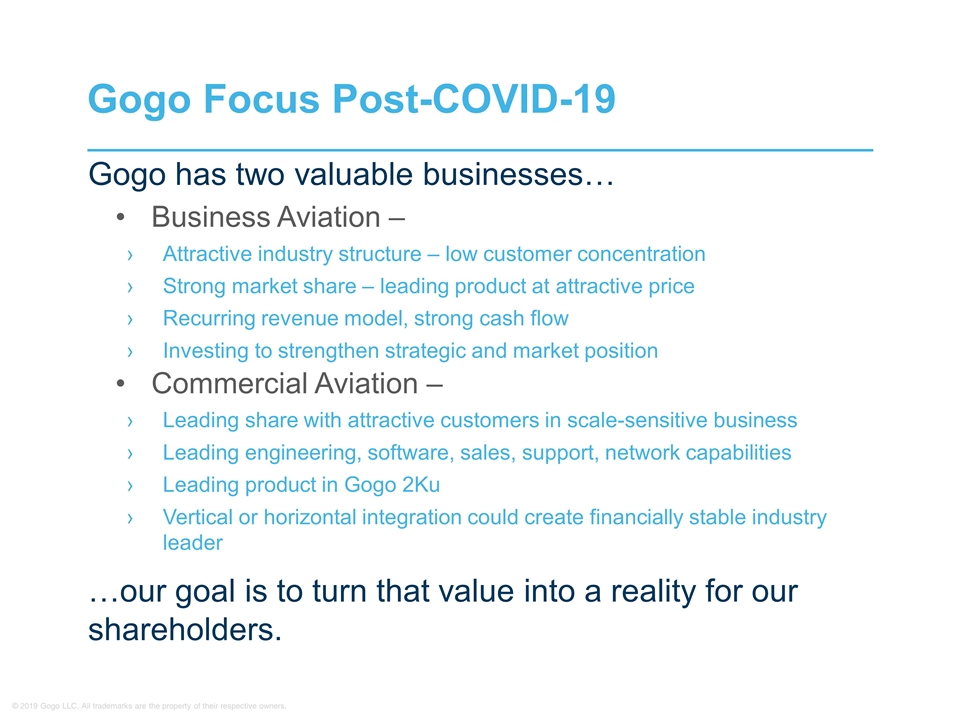

Gogo Focus Post-COVID-19 Gogo has two valuable businesses… Business Aviation – Attractive industry structure – low customer concentration Strong market share – leading product at attractive price Recurring revenue model, strong cash flow Investing to strengthen strategic and market position Commercial Aviation – Leading share with attractive customers in scale-sensitive business Leading engineering, software, sales, support, network capabilities Leading product in Gogo 2Ku Vertical or horizontal integration could create financially stable industry leader …our goal is to turn that value into a reality for our shareholders.

Non-GAAP Financial Measures-GAAP Financial Adjusted EBITDA and Free Cash Flow Reconciliations Gogo Inc. and Subsidiaries Reconciliation of GAAP to Non-GAAP Measures (in thousands, except per share amounts) (unaudited) For the Years Ended December 31, 2019 2018 Adjusted EBITDA: Net loss attributable to common stock (GAAP) $ (146,004 ) $ (162,031 ) Interest expense 130,572 122,809 Interest income (4,210 ) (4,292 ) Income tax provision (benefit) 1,006 (3,293 ) Depreciation and amortization 118,817 133,617 EBITDA 100,181 86,810 Stock-based compensation expense 16,511 16,912 Amortization of deferred airborne lease incentives (28,551 ) (31,650 ) Amortization of STC costs 2,706 1,023 Transition to airline-directed model - (21,551 ) Loss on extinguishment of debt 57,962 19,653 Proceeds from litigation settlement (3,215 ) - Adjusted EBITDA $ 145,594 $ 71,197 Free Cash Flow: Net cash provided by (used in) operating activities (GAAP) (1) $ 64,061 $ (82,311 ) Consolidated capital expenditures (1) (115,478 ) (131,663 ) Free cash flow $ (51,417 ) $ (213,974 ) See the consolidated statements of cash flows in our Form 10-K for the year ended December 31, 2019, filed with the SEC on March 13, 2020.

Thank you