Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Cosmos Group Holdings Inc. | cosmos_ex3202.htm |

| EX-32.1 - CERTIFICATION - Cosmos Group Holdings Inc. | cosmos_ex3201.htm |

| EX-31.2 - CERTIFICTION - Cosmos Group Holdings Inc. | cosmos_ex3102.htm |

| EX-31.1 - CERTIFICATION - Cosmos Group Holdings Inc. | cosmos_ex3101.htm |

| EX-24 - POWER OF ATTORNEY - Cosmos Group Holdings Inc. | cosmos_ex024.htm |

| EX-21 - SUBSIDIARIES - Cosmos Group Holdings Inc. | cosmos_ex021.htm |

| EX-4.2 - DESCRIPTION OF SECURITIES - Cosmos Group Holdings Inc. | cosmos_ex0402.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 000-54288

COSMOS GROUP HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 22-3617931 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

|

Rooms 1309-11, 13th Floor, Tai Yau Building, No. 181 Johnston Road Wanchai, Jong Kong |

N/A | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +852 3643 1111

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Approximate aggregate market value of the voting stock held by non-affiliates of the registrant as of June 28, 2019, based upon the closing sale price reported by the Over-the-Counter Bulletin Board on that date: US$0.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Common Stock | Outstanding at April 28, 2020 | |

| Common Stock, US$.001 par value per share | 21,536,933 shares |

DOCUMENTS INCORPORATED BY REFERENCE: None

| i |

Forward Looking Statements

This Form 10-K contains “forward-looking” statements including statements regarding our expectations of our future operations. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control.

These risks and uncertainties include international, national, and local general economic and market conditions; our ability to sustain, manage, or forecast growth, our ability to successfully make and integrate acquisitions, new product development and introduction, existing government regulations and changes in, or the failure to comply with, government regulations, adverse publicity, competition, the loss of significant customers or suppliers, fluctuations and difficulty in forecasting operating results, change in business strategy or development plans, business disruptions, the ability to attract and retain qualified personnel, the ability to protect technology, and the risk of foreign currency exchange rate. Although the forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. In light of these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to announce publicly revisions we make to these forward-looking statements to reflect the effect of events or circumstances that may arise after the date of this report. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

ITEM 1. DESCRIPTION OF BUSINESS.

OVERVIEW

As of December 31, 2019, we operated two business segments: specialty commercial logistics and artificial intelligence education business., or the AI Education business. Our specialty commercial logistic company operates through Lee Tat Transportation Int’l Limited, our wholly owned Hong Kong subsidiary (“Lee Tat”), and provide timely and reliable logistics and delivery services to commercial clients located in Hong Kong. We offer service to the cable supply industry in Hong Kong, and expect to provide small parcel delivery service in cities near Shanghai in the near future. Lee Tat was organized as a private limited liability company on August 11, 2014, in Hong Kong. We acquired Lee Tat on May 12, 2017.

We operate our artificial intelligence educational business through our wholly owned subsidiaries Cosmos Robotor Holdings Limited 環球機械智能集團有限公司, a British Virgin Islands corporation (“Cosmos Robotor”), organized May 7, 2019, AiTeach International Limited, a Hong Kong limited liability company, organized June 3, 2019. Our AI business is currently in its development stages and has generated no or nominal revenues. We will need significant financing to be able to successfully implement our business plan of establishing AI classrooms in mainland China.

We had initially intended to focus on our resources on developing our AI Education business in mainland China. The challenges presented by Hong Kong’s political situation, US-China trade tensions and the effect of the COVID-19 virus, however, have materially and adversely affected our business plan of developing the AI Education business and our logistics business as a whole. As a result, we did not generate any revenue from our AI Education Business during the year ended December 31, 2019. In light of the challenges presented by the early stage of development of our AI Education business and the long-term impact of the COVID-19 virus on the education industry and Hong Kong industry in general, we decided to discontinue and exit from the AI Education business by the end of first quarter 2020. As a result:

| · | On December 27, 2019, the parties mutually unwound the Company’s acquisition of Hong Kong Healthtech Limited, a Hong Kong limited liability company. As a result, 5,100 Ordinary Shares of HKHL were returned to Wing Lok Jonathan SO and the 6,232,951 shares of our common stock issued in exchange therefor were returned to us for cancellation. On December 30, 2019, Kai Chi WONG resigned from his position as Chief Operating Officer of the Company. Koon Wing Cheung intends to transfer to Kai Chi WONG 215,369 shares of Common Stock of the Company as a token of appreciation of Mr. Wong’s contribution to the Company. |

| 1 |

| · | The Employment Agreement, dated July 19, 2019, by and between Cosmos Group Holdings, Inc. and Wing Lok Jonathan SO was terminated by the parties thereto effective on March 31, 2020. |

| · | Syndicate Capital (Asia) Limited intends to transfer back to Koon Wing Cheung 1,503,185 of the Company’s common stock (of the 2,149,293, shares previously transferred to Syndicate Capital (Asia) Limited from Koon Wing Cheung), with the balance of the 646,108 shares retained by Syndicate Capital (Asia) Limited as consideration for Mr. Tze Wai Albert YIP’s contributions to the Company. |

| · | Mr Tze Wai Albert YIP shall resign from his position as the Chief Financial Officer, effective on 30 April 2020. |

We reported a net loss of $683,537 and a net income of $5,800 for the years ended December 31, 2019, and 2018, respectively. We had current assets of $105,649 and $66,245 as of December 31, 2019 and 2018. Our auditors have prepared our financial statements for the years ended December 31, 2019 and 2018 assuming that we will continue as a going concern. Our continuation as a going concern is dependent upon improving our profitability and the continuing financial support from our stockholders. Our sources of capital in the past have included advances from directors and related parties as well as the sale of equity securities, which include common stock sold in private transactions and short-term and long-term debts. In addition, with respect to the ongoing and evolving coronavirus (COVID-19) outbreak, which was designated as a pandemic by the World Health Organization on March 11, 2020, the outbreak has caused substantial disruption in international economies and global trades and if repercussions of the outbreak are prolonged, could have a significant adverse impact on our business. Given the addition political and public health challenges, our ability to obtain external financing or financing from existing shareholders to fund our working capital needs has been materially and adversely impacted, and there can be no assurance that we will be able to raise such additional capital resources on satisfactory terms. We believe that our current cash and other sources of liquidity discussed below are adequate to support general operations for at least the next 12 months.

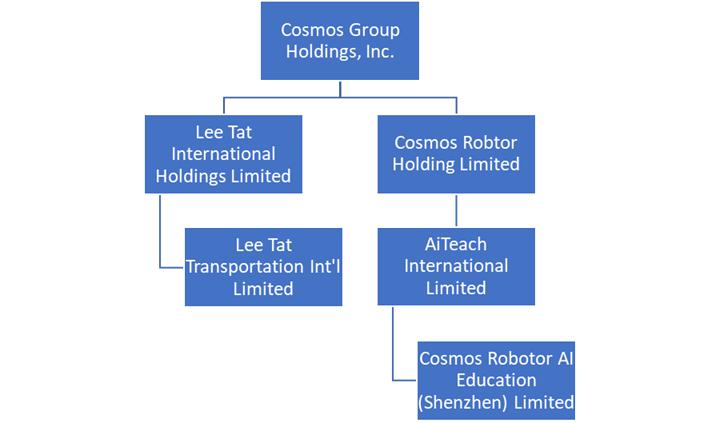

Our corporate organization chart is below.

We are organized under the laws of the State of Nevada as a holding company that conducts its business through subsidiaries organized under the laws of foreign jurisdictions such as Hong Kong. This may have an adverse impact on the ability of U.S. investors to enforce a judgment obtained in U.S. Courts against these entities, or to effect service of process on the officers and directors managing the foreign subsidiaries.

History

We were incorporated in the state of Nevada on August 14, 1987, under the name Shur De Cor, Inc. and engaged in developing certain mining claims. In April 1999, Shur De Cor merged with Interactive Marketing Technology, a New Jersey corporation that was engaged in the business of developing and direct marketing of consumer products. As the surviving company, Shur De Cor changed its name to Interactive Marketing Technology, Inc. Shur De Cor's then management resigned and the management of Interactive New Jersey became the Company’s management. The prior management of Shur De Cor retained Shur De Cor’s business and assets. After that acquisition, the Company, through a wholly owned subsidiary, IMT's Plumber, Inc., produced, marketed, and sold a licensed product called the Plumber's Secret, which was discontinued in fiscal 2001. In May 2002, the Company ceased to actively pursue its product development and marketing business and actively sought to either acquire a third party, merge with a third party or pursue a joint venture with a third party in order to re-enter its former business of development and direct marketing of proprietary consumer products in the United States and worldwide.

| 2 |

On November 17, 2004, the Company acquired MPL, a company organized under the laws of the British Virgin Islands, and its subsidiaries in accordance with the terms of a Share Exchange Agreement executed by the parties (the “2004 Agreement”). In connection with the acquisition, the Company issued an aggregate of 109,623,006 shares of its common stock to Imperial International Limited, a company incorporated under the laws of the British Virgin Islands (“Imperial”), the sole shareholder of MPL, in exchange for 100% of the issued and outstanding shares of MPL capital stock (the "2004 Share Exchange"). Upon completion of the share exchange, MPL became the Company's wholly owned subsidiary and the Company’s former owner transferred control of the Company to Imperial. The Company relied on Rule 506 of Regulation D of the Securities Act of 1933, as amended (the "Act"), in regard to the shares that we issued pursuant to the 2004 Share Exchange. The Company treated this transaction as a qualified "business combination" as defined by Rule 501(d). The Company relied on the exemption from registration pursuant to Section 4(2) of, and or Regulation D promulgated under, the Act in issuing the Company’s securities.

In connection with the 2004 Share Exchange, the Company: (i) changed its name from Interactive Marketing Technology, Inc. to China Artists Agency, Inc. ("China Artists"); (ii) obtained a new stock symbol, "CAAY", and CUSIP Number, effective on December 21, 2004; (iii) increased its authorized common stock to 200,000,000 shares; (iv) effectuated a 1 for 1.69 reverse stock split; and (v) spun off the Company’s existing business into a separate public company, All Star Marketing, Inc., a Nevada corporation ("All Star"). All Star was formed as a wholly owned subsidiary of the Company. The Spin-off was satisfied by means of a pro-rata share dividend to the Company's shareholders of record as of December 10, 2004. The purpose of the Spin-Off was to allow the subsidiary to operate as a separate public company and raise working capital through the sale of its own equity. This allowed the Company’s management to focus on its business, while at the same time, allowing the spun-off company to have greater exposure by trading as an independent public company. Additionally, the shareholders and the market would then more easily identify the results and performance of the Company as a separate entity from that of All Star. In August 2005, the Company changed its name to China Entertainment Group, Inc. and, effective August 9, 2005, obtained a new stock symbol "CGRP", and CUSIP Number.

Because the Company failed to generate revenues in its new business, prior management commenced litigation in the Superior Court for Los Angeles County California which action was removed to the United States District Court for the Central District of California Case No. CV07-1068 GHK. On January 30, 2008, the parties entered into a Settlement Agreement and Conditional Release (the “Settlement Agreement”), pursuant to which, among other things, the Company’s former management reacquired control of the Company and all assets related to the Chinese entertainment business were transferred out of the Company. The Company, under its former management, once again entered the business of locating products to develop and mass market. These efforts did not prove fruitful and the Company, while continuing its product development business, also began to seek another business to acquire.

Effective July 22, 2010, the Company merged with Safe and Secure TV Channel, LLC, a Delaware limited liability company (the “Merger”). In connection with the Merger, the management of the Company resigned and was replaced by the management and principals of Safe and Secure TV Channel, LLC. The holders of interests in Safe and Secure TV Channel, LLC exchanged their interests for approximately 50.2% of the issued and outstanding stock of the Company. In September 2010, the Company effectuated a 9.85 for one stock split to shareholders of record as of August 23, 2010. After the Merger, the Company became a television network and multimedia information and distribution company focused on serving the homeland security and emergency preparedness industry.

On February 15, 2016, the Company sold to Asia Cosmos Group Limited, a private limited liability company incorporated under the laws of British Virgin Islands (“ACOSG”), 10,000,000 shares of its common stock at a per share price of $0.027. ACOSG’s sole shareholder is Miky Wan. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG.

In connection with the private placement to ACOSG, a change of control occurred and Bryan Glass resigned from his position as President, Secretary, Treasurer and Chairman of the Company. Miky Wan was appointed to serve as Chief Executive Officer, Chief Operating Officer, President and Director, effective February 19, 2016. Peter Tong, our Chief Financial Officer, Secretary and director continued in his positions with the Company. Calvin K.W. Lai, Anthony H.H. Chan, Jenher Jeng, Alice K.M. Tang, Connie Y.M. Kwok were appointed to serve on our Board of Directors effective February 19, 2016. Effective February 26, 2016, the Company changed its name to Cosmos Group Holdings Inc. and filed a Certificate of Amendment to such effect with the Nevada Secretary of State. The name change and the related stock symbol change to “COSG” were approved by the Financial Industry Regulatory Authority on March 31, 2016. The Company also increased the number of its authorized common stock, par value $0.001, from 90,000,0000 shares to 500,000,000 and its preferred stock, par value $0.001, from 10,000,000 to 30,000,000 shares. After the private placement, the Company shifted its business plan to focus on acquiring undervalued companies including those in the Greater China region.

| 3 |

On September 27, 2016, Peter Tong and Calvin Lai resigned from all of their positions with the Company. Connie Y.M. Kwok was appointed to serve as the Secretary and Miky Wan, our Chief Executive Officer, was appointed to serve as the interim Chief Financial Officer.

On January 13, 2017, the Company sold 200,000,000 shares of its common stock to ACOSG at a per share price of $0.001 per share for aggregate consideration of US $200,000. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG.

Acquisition of Lee Tat, Our Logistics Business

On May 12, 2017, we acquired all of the issued and outstanding shares of Lee Tat from Mr. Koon Wing CHEUNG, Lee Tat’s sole shareholder, in exchange for 219,222,938 shares of our issued and outstanding common stock. In connection with the Lee Tat acquisition, Miky Wan resigned from her positions as Chief Executive Officer and Chief Operating Officer and Koon Wing CHEUNG and Yongwei HU were appointed to serve as our Chief Executive Officer and Chief Operating Officer, respectively, and also as our directors. In addition, Anthony H.H. CHAN and Alice K. M. TANG resigned from their positions as directors, and Zhigang LIAO and Weiming CHEN were appointed to fill the vacancies created by their resignations. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to the shareholders of Lee Tat.

Termination of Our Vehicle Sales and Leasing Business

Our prior business plan was to develop an ecosystem to address the entire vehicle purchasing, leasing and maintenance process. Our former cooperation partner, Foshan YY Car Rental Limited (“YY”), was an integral part of our ability to offer future car purchasing services and investment vehicle leasing services. Effective July 15, 2018, our Board of Directors dismissed Huan-Ting Peng, our Chief Operating Officer and the statutory representative of our WFOE, from all of her positions with the company and its subsidiaries and affiliated entities. Miky Wan, our President, interim Chief Financial Officer and Director, was concurrently appointed to fill the vacancies created by Ms. Peng’s removal and to serve as our Chief Operating Officer and statutory representative of WFOE. Concurrently with the dismissal of Ms. Peng, our Board of Directors also terminated the Car Rental Collaboration Agreement with YY. Ms. Peng owns approximately 51%of YY and is an officer and executive director of YY.

On September 30, 2018, we sold all of our interests in COSG International to LilunGan, an unaffiliated third party, for cash consideration of Ten Thousand Dollars (US$10,000), which is the stated value of COSG International. COSG International was our wholly owned subsidiary and investment holding company that held all of the issued and outstanding securities of WFOE. We operated our future car purchasing and investment vehicle leasing services and memberships through WFOE. The sale of our interests in COSG International represented the cessation of our future car purchasing and investment vehicle leasing services business.

Termination of Our Artificial Intelligence Educational Content Business

Acquisition and Rescission of Acquisition of HKHL

In July 2019, we entered into the business of developing and delivering educational content. On July 19, 2019, we acquired 5,100 Ordinary Shares of Hong Kong Healthtech Limited, a limited company organized under the laws of Hong Kong (“HKHL”), from Wing Lok Jonathan SO (“SWL”) pursuant to the terms of a Share Exchange Agreement (the “Share Exchange Agreement”). Such securities represented approximately 51% of the issued and outstanding securities of HKHL. As consideration, we issued 6,232,951 shares of our common stock, at a per share price of US$8.99.

In connection with the Share Exchange, we entered into an Intellectual Property Ownership and License Agreement with HKHL, 深圳傅正勤教育科技有限公司Shenzhen Fu Zheng Qin Education Technology Limited (formerly known as Shenzhen Yongle Innovative Education Limited) (“SZFZQ”) and their affiliates (the “IP License Agreement”), pursuant to which we licensed from HKHL, SZFZQ and their affiliates the right to exploit certain intellectual property related to the operations of the AI education business on a worldwide, non-exclusive, perpetual, royalty-free and irrevocable basis. We also entered into employment agreements with the following individuals in connection with their appointment to the offices set forth next to their names:

| 4 |

| Tze Wai Albert YIP | Chief Financial Officer |

| Wing Lok Jonathan SO | Chief Strategy Officer |

| Kai Chi WONG | Chief Operating Officer |

In addition, we entered into a Consulting Agreement with Hung-Yi pursuant to which Mr. Hung agreed to provide certain research and development plans, develop strategic partnerships, and assist the Company in meeting certain financial targets in exchange for 1,074,647 shares of our common stock, at a per share price of US$8.99 (the “Hung Shares”).

Effective November 12, 2019, the parties terminated the Consulting Agreement, and Mr. Hung agreed to return the Hung Shares to the Company for cancellation. On December 27, 2019, the parties mutually terminated the Share Exchange Agreement and IP License Agreement. As a result, 5,100 Ordinary Shares of HKHL were returned to SWL and the 6,232,951 shares of our common stock issued in exchange therefor were returned to us for cancellation. On December 30, 2019, Kai Chi WONG resigned from his position as Chief Operating Officer of the Company. Koon Wing Cheung intends to transfer to Kai Chi WONG 215,369 shares of Common Stock of the Company as a token of appreciation of Mr. Wong’s contribution to the Company.

HKHL and SZFZQ continue their relationship with COSG as a key supplier of educational content pursuant to that certain Supply and Service Agreement (the “Supply and Service Agreement”) with HKHL and SZFZQ dated December 24, 2019. Pursuant to the Supply and Service Agreement, HKHL and SZFZQ agreed to provide us with overall operational advisory services relating to the development and delivery of educational content, technical support related to certain intellectual property previously licensed by COSG from HKHL (the “IP”), and grant to us a worldwide, non-exclusive, perpetual irrevocable right and license to use the IP.HKHL and SZFZQ will receive up to an aggregate of 44,000 shares of our common stock and options to acquire such additional shares of our common stock at a per share price to be mutually determined by the parties in the future. HKHL and SZFZQ will also receive a license fee for the IP in accordance with terms more fully set forth in the Supply and Service Agreement. The Supply and Service Agreement has an initial term of five (5) years with the option to renew every ten (10) years upon the agreement of the parties. The foregoing description of the Supply and Service Agreement is qualified in its entirety by reference to such agreement which is filed as Exhibit 10.8 to this Annual Report.

We had initially intended to focus on our resources on developing our AI Education business. The challenges presented by Hong Kong’s political situation, US-China trade tensions and the effect of the COVID-19 virus, however, have materially and adversely affected Asia’s economic condition, our ability to obtain the financing necessary to implement our business plan and our ability to the AI Education business and our logistics business as a whole. As a result, we did not generate any revenue from our AI Education Business during the year ended December 31, 2019. In light of the challenges presented by the early stage of development of our AI Education business and the long-term impact of the COVID-19 virus on the education industry and Hong Kong industry in general, we decided to discontinue and exit from the AI Education business by the end of first quarter 2020. As a result,

| · | The Employment Agreement, dated July 19, 2019, by and between Cosmos Group Holdings, Inc. and Wing Lok Jonathan SO was terminated by the parties thereto effective on March 31, 2020. |

| · | Syndicate Capital (Asia) Limited intends to transfer back to Koon Wing Cheung 1,503,185 shares of the Company’s common stock (of the 2,149,293, shares previously transferred to Syndicate Capital (Asia) Limited from Koon Wing Cheung), with the balance of the 646,108 shares retained by Syndicate Capital (Asia) Limited as consideration for Mr. Tze Wai Albert YIP’s contributions to the Company. |

| · | Mr Tze Wai Albert YIP shall resign from his position as the Chief Financial Officer, effective on 30 April 2020. |

Reverse Stock Split

Effective February 6, 2018, we engaged in a 1:20 reverse split of our common stock so that each twenty shares of issued and outstanding common stock were exchanged for one share.

| 5 |

Market Overview

The Logistics Market

According to the Research by HKTDC published in April 2019, the logistic market of Hong Kong and China will be benefited by the below factors:

Guangdong-Hong Kong-Macau Bay Area Development

The Greater Bay Area development allows integration of transport networks in the region, including air cargo, ground transportation and warehousing services. Not only Hong Kong, but the four neighboring airports in the mainland have seen rapid growth in terms of air cargo logistics. Service providers can now work together more closely to seize opportunities and build a strategic co-operation platform for air transport. The Hong Kong-Zhuhai-Macau Bridge (HKZMB), a large-scale cross-border infrastructure linking the three places, is expected to improve connections between cities and make journeys between them quicker. We expect cargo movement between Hong Kong and western PRD to be further enhanced.

E-commerce Opportunities

E-commerce represents a competitive pressure to traditional brick and mortar retailers, but it has also created enormous opportunities for air cargo. Consumers demand for speed and reliability and air cargo services would have a significant advantage. According to Airports Council International, the 8% expansion in total cargo handled at all airports worldwide and the 10% growth in international freight in 2017 were mainly driven by e-commerce. However, online retail accounts for less than 10% of total retail sales worldwide, which indicates that there is still huge potential for e-commerce as a future growth driver for the air cargo industry. Air cargo is also likely to be bolstered by the improvement in Asia’s overall manufacturing capability and the continuing shift to Asia of the production of high-value goods. Goods such as telecom equipment and electronic devices and parts are always transported by air, as product life cycles shorten.

Technology Trends

New technologies play an increasingly important role for the logistics industry to improve its operational efficiency. The adoption of automatic identification and data capture (AIDC) technology, which enables users to gain automatic access to information, as well as identify, collect and store data directly to a computer system, is expected to become more prevalent as radio frequency identification (RFID) sensors and Bluetooth technology are implemented throughout the industry. Robotics will also be an important logistics technology trend in the near future. Amazon acquired Kiva Systems back in 2012 and it’s now known as Amazon Robotics. This will result in increased usage of robots in logistics and warehouse operations such as parking and picking. The rising of the Internet of Things (IoT) will also encourage the adoption of mobile apps among logistics service providers which can be used for tracking and customer service interactions.

Our Business

Logistics Business

Lee Tat Transportation Int’l Limited was originally formed as a sole proprietorship in August 11, 1995, and was incorporated on August 11, 2014. Prior to our acquisition, Lee Tat was wholly owned by Koon Wing CHEUNG, its Chief Executive Officer and Chief Financial Officer. Lee Tat initially provided express delivery for commercial clients, delivering small goods to factories and offices in Hong Kong. In 2016, Lee Tat’s conducted its business solely in Hong Kong.

In 2005 in response to the relocation of many local factories to mainland China, we began to focus on providing express delivery and logistic services to local cable and data equipment suppliers, delivering goods to their customers such as construction companies. Hong Kong is a well-developed city with respect to wireless and telecom communication. Because the useful life of cable is 5-10 years and data equipment is 3 years, there is a high demand for equipment replacement. As most of the repairing work happens in night-time, many small and medium cable suppliers outsource to logistic companies to deliver their products to their customers. We currently serve up to 70% of cable suppliers and cable trading companies in Hong Kong and deliver cable wire material to different contracting sites.

| 6 |

We provide our delivery services through direct delivery (Direct Model) and through our network of subcontractors (Network Model) as well as other custom value-added logistics services. In Hong Kong, we direct deliver small goods and primarily work with six network business sub-contractors to find the most competitive partner to deliver our client’s cable products. The lifecycle of a typical delivery is briefly described below.

Work flow of a typical delivery

Step 1: Parcel Pickup.

Our courier team collects the parcel from the sender once it receives a delivery order. Unless the sender chooses pay-at-arrival service, our pickup team collects the delivery service fee from the sender at the time of pickup. The pickup team collects and sends the parcels to our centralized control sorting hub in Zuzhau twice per day. Typically, parcels that are picked up before 9 a.m. will be shipped to the hub on the same day. Through each waybill, we assign a unique tracking number and corresponding barcode to each parcel. The waybills, coupled with our automated systems, allow us to track the status of each individual parcel throughout the entire pickup, sorting and delivery process.

Step 2: Parcel Sorting and Transportation.

Upon receipt of parcels shipped from various pickup outlets within its coverage area, the sorting hub sorts, further packs and dispatches the parcels to the destination by the courier team. Barcodes on each waybill attached to the parcels are scanned as they go through each sorting and transportation gateway allowing us to track the progress of each parcel.

Step 3: Parcel Delivery.

Parcels are then delivered to the recipients by our network delivery team. Once the recipient signs on the waybill to confirm receipt, a full service cycle is completed and the settlement of delivery service fee promptly ensues on our network payment settlement system.

Pricing determination

Pricing of our services is based on our operating costs, service requested, fees assessed by our network partners, market conditions and competition. We participate in a fee sharing arrangement in which the pickup and delivery outlets share the delivery service fees of each delivery order. When we deliver through our network partners, we allocate a portion of the services fees, or network transit fees, to our network partners for express delivery services. The fee typically consists of a fixed amount for a waybill attached to each parcel and a variable per parcel amount based on parcel weight and route. Historically, delivery service fees charged by our network partners have experienced declines due in part to market competition. Based on the market conditions and our cost base, we may evaluate and adjust our service pricing from time to time. The average revenue of a typical parcel delivery is US$102.

We leverage our subcontractor network to reduce costs and generate fees. Before initiating deliveries through our network partners, we are able to search through our system to compare and find the most competitive pricing for pick up and last mile deliveries. This arrangement allows us to control our per parcel costs. Because our network is transparent, our delivery subcontractors are able to directly connect with other member logistic service suppliers. When these third parties directly connect, we benefit through fee rebates provided by our network partner, Suzhou HexieYuantong Logistic Company Limited. We facilitate these connections by providing information and guidance on valuation of the transferred business with participation by both sides.

In light of the competitive nature of our market, we believe that our success will depend upon the reliability and quality of services provided and cost management. As a general matter, we strive to maintain high quality services and meet customer satisfaction. We believe that we have established systems and procedures to achieve service standardization and quality control over the services provided by us and our network partners. We constantly monitor and seek to improve on a series of key service quality indicators such as delivery delay rate, complaint rate and damaged parcel rate. Further, we believe that our focus on the cable and data equipment industry provides a competitive advantage that has enabled us to provide valued added services to better able to meet the specific needs of our customers.

| 7 |

Challenges From Our China Expansion

Effective May 1, 2017, and expiring April 30, 2022, we agreed to provide certain logistics and delivery services to Shanghai Yunda Cargo Company Limited (“Yunda”), in accordance with the terms of that certain Lee Tat Transportation Service Contract, of the Transportation Service Contract. Pursuant to the agreement, Yunda agrees to provide to us not less than RMB 12 million (US $1.76 million) of revenue from cargo business per year. We expected to provide cross-border delivery and logistics services in Shanghai and nearby cities pursuant to the terms of the Transportation Service Contract.

We began operations in China in July 2017. We initially anticipated providing door-to-door cross-border and domestic logistics service for small goods deliveries through subcontractors and network partners to reach and serve fragmented and geographically dispersed merchants at a minimized fixed operation cost. After a quarter trial period, management concluded that the business operations in Suzhou and Shanghai were not cost efficient, and that the profit margins could not meet our expectations. While we are still a party to the Transportation Service Contract, we are reassessing our business analysis of this business relationship.

The foregoing description of the Transportation Service Contract is qualified in its entirety by reference to the Transportation Service Contract, which is filed as Exhibit 10.1 to this Annual Report and incorporated herein by reference.

During the course of our business, we have collected data relating to consumer behavior. We hope to develop a proprietary database and provide data analytics regarding consumer behavior in the commercial logistics and vehicle sales and leasing industries. We believe that we can leverage this database and accompanying analytics to refine our product and services offerings as well as provide relevant industry knowledge.

AI Business

Our AI business is currently in its development stages and has generated no or nominal revenues. We currently operate two AI Classrooms in Hong Kong which serve as demonstration classrooms. We had initially intended to focus on our resources on developing our AI Education business. The challenges presented by Hong Kong’s political situation, US-China trade tensions and the effect of the COVID-19 virus, however, have materially and adversely affected Asia’s economic condition, our ability to obtain the financing necessary to implement our business plan and our ability to the AI Education business and our logistics business as a whole. As a result, we did not generate any revenue from our AI Education Business during the year ended December 31, 2019. In light of the challenges presented by the early stage of development of our AI Education business and the long-term impact of the COVID-19 virus on the education industry and Hong Kong industry in general, we decided to discontinue and exit from the AI Education business by the end of first quarter 2020. As a result:

| · | On December 27, 2019, the parties mutually unwound the Company’s acquisition of Hong Kong Healthtech Limited, a Hong Kong limited liability company. As a result, 5,100 Ordinary Shares of HKHL were returned to Wing Lok Jonathan SO and the 6,232,951 shares of our common stock issued in exchange therefor were returned to us for cancellation. On December 30, 2019, Kai Chi WONG resigned form his position as Chief Operating Officer of the Company. Koon Wing Cheung intends to transfer to Kai Chi WONG 215,369 shares of Common Stock of the Company as a token of appreciation of Mr. Wong’s contribution to the Company. |

| · | The Employment Agreement, dated July 19, 2019, by and between Cosmos Group Holdings, Inc. and Wing Lok Jonathan SO was terminated by the parties thereto effective on March 31, 2020. |

| · | Syndicate Capital (Asia) Limited intends to transfer back to Koon Wing Cheung 1,503,185 of the Company’s common stock (of the 2,149,293, shares previously transferred to Syndicate Capital (Asia) Limited from Koon Wing Cheung), with the balance of the 646,108 shares retained by Syndicate Capital (Asia) Limited as consideration for Mr. Tze Wai Albert YIP’s contributions to the Company. |

| · | Mr Tze Wai Albert YIP shall resign from his position as the Chief Financial Officer, effective on 30 April 2020. |

| 8 |

Sales and Marketing.

Logistics Segment

We expect to continue to focus on providing express delivery and logistic services to cable and data equipment suppliers in Hong Kong and may be seeking other opportunities in China. We anticipate focusing on business to business marketing, cold callings or attending local chamber of commerce events to obtain customers. In the near future, we expect to focus on consolidating our Hong Kong operations. We do not have any current intention to further develop our logistics business segment at this time.

AI Education Segment

In light of the challenges presented by the early stage of development of our AI Education business and the long-term impact of the COVID-19 virus on the education industry and Hong Kong industry in general, we decided to discontinue and exit from the AI Education business by the end of first quarter 2020.

We remain parties to a binding Memorandum of Understanding with Shenzhen Litang Electronics Company Limited (“Litang”) pursuant to which Litang agreed to market our products and services, recruit students, and operate our AI Classroom in China (the “Litang MOU”). The Litang MOU is terminable upon three months prior written notice by either party. We do not expect to continue the Litang MOU upon our withdrawal from the AI Education business. The foregoing description of the Litang MOU is qualified in its entirety by reference to the Litang MOU which is filed as Exhibit 10.3 to this Annual Report and is incorporated herein by reference.

Major Customers.

All of our major customers are located in Hong Kong. During the years ended December 31, 2019, and 2018, the following customers accounted for 10% or more of our total net revenues:

| Year ended December 31, 2019 | December 31, 2019 | |||||||||||

| Revenues | Percentage of revenues | Accounts receivable | ||||||||||

| Hip Tung Cables Company Limited | $ | 332,601 | 50% | $ | 34,892 | |||||||

| Peaceman Cable Engineering Limited | 248,476 | 37% | 20,601 | |||||||||

| TOTAL | $ | 581,077 | 87% | $ | 55,493 | |||||||

| Year ended December 31, 2018 | December 31, 2018 | |||||||||||

| Revenues | Percentage of revenues | Accounts receivable | ||||||||||

| Hip Tung Cables Company Limited | $ | 352,628 | 48% | $ | 25,776 | |||||||

| Peaceman Cable Engineering Limited | 258,689 | 35% | 17,151 | |||||||||

| TOTAL | $ | 611,317 | 83% | $ | 42,927 | |||||||

We have a delivery operations team in Hong Kong consisting of two trucks, two drivers, and three network partners that pick up stocks for us and complete the delivery process. Generally, we are not a party to any long-term agreements with our customers. From time to time, we may enter into long term contracts similar to the Transportation Service with major customers and subcontract the performance of the performance of the contract to corresponding network partner according to the price and area.

| 9 |

Major Network Partners.

All of our major vendors are located in Hong Kong. For the year ended December 31, 2019, one vendor, Po Won Transportation Company Limited, represented more than 10% of the Company’s operating cost. This vendor accounted for 11% of the Company’s operating cost amounting to $64,295 with $18,555 of accounts payable.

Seasonality.

Our logistics business is highly dependent upon the e-commerce industry in Hong Kong and China. In Hong Kong and China, we experience peak demand for our services during the double eleven festival and the Chinese New Year celebrations.

Insurance.

We maintain certain insurance in accordance customary industry practices in Hong Kong. Under Hong Kong law it is a requirement that all employers in the city must purchase Employee's Compensation Insurance to cover their liability in the event that their staff suffers an injury or illness during the normal course of their work. Lee Tat maintains Employee’s Compensation Insurance, vehicle insurance and third party risks insurance for the business purposes.

INTELLECTUAL PROPERTY AND PATENTS

We expect to rely on, trade secrets, copyrights, know-how, trademarks, license agreements and contractual provisions to establish our intellectual property rights and protect our “Cosmos” brand and services. These legal means, however, afford only limited protection and may not adequately protect our rights. Litigation may be necessary in the future to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others. Litigation could result in substantial costs and diversion of resources and management attention.

The laws of Hong Kong, China and our target countries may not protect our brand and services and intellectual property to the same extent as U.S. laws, if at all. We may be unable to fully protect our intellectual property rights in these countries. Further, companies in the internet, social media technology and other industries may own large numbers of patents, copyrights and trademarks and may frequently request license agreements, threaten litigation or file suit against us based on allegations of infringement or other violations of intellectual property rights.

We intend to seek the widest possible protection for significant product and process developments in our major markets through a combination of trade secrets, trademarks, copyrights and patents, if applicable. We anticipate that the form of protection will vary depending upon the level of protection afforded by the particular jurisdiction. We expect that our revenue will be derived principally from our operations in Hong Kong and China where intellectual property protection may be limited and difficult to enforce. In such instances, we may seek protection of our intellectual property through measures taken to increase the confidentiality of our findings.

We intend to register trademarks as a means of protecting the brand names of our companies and products. We intend protect our trademarks against infringement and also seek to register design protection where appropriate.

We rely on trade secrets and unpatentable know-how that we seek to protect, in part, by confidentiality agreements. We expect that, where applicable, we will require our employees to execute confidentiality agreements upon the commencement of employment with us. We expect these agreements to provide that all confidential information developed or made known to the individual during the course of the individual's relationship with us is to be kept confidential and not disclosed to third parties except in specific limited circumstances. The agreements will also provide that all inventions conceived by the individual while rendering services to us shall be assigned to us as the exclusive property of our company. There can be no assurance, however, that all persons who we desire to sign such agreements will sign, or if they do, that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets or unpatentable know-how will not otherwise become known or be independently developed by competitors.

| 10 |

COMPETITION

We operate in a highly competitive and fragmented industry that is sensitive to price and service. We compete with leading domestic express delivery companies including SF Express, STO Express, YTO Express, Yunda Express and EMS. We also compete with international logistics companies such as federal express and DHL. We may in the future compete against major e-commerce platforms, such as Alibaba and JD.com, if they elect to build or further develop in-house delivery capabilities to serve their logistics needs. Some of our current and prospective competitors have greater financial resources, broader product and service offerings, longer operating histories, larger customer base and greater brand recognition, or they are controlled or subsidized by foreign governments, which enable them to raise capital and enter into strategic relationships more easily. We seek to compete on the basis of a number of factors, including business model, operational capabilities, pricing and service quality.

EMPLOYEES

As of December 31, 2019, we employed the following persons:

| Administration Staff | 1 | |||

| Total | 1 |

All of our employees are located in Hong Kong. None of our employees are members of a trade union. We believe that we maintain good relationships with our employees and have not experienced any strikes or shutdowns and have not been involved in any labor disputes.

We are required to contribute to the MPF for all eligible employees in Hong Kong between the ages of eighteen and sixty five. We are required to contribute a specified percentage of the participant’s income based on their ages and wage level. For the years ended December 31, 2019 and 2018, the MPF contributions by us were $4,207 and $4,567, respectively. We have not experienced any significant labor disputes or any difficulties in recruiting staff for our operations.

GOVERNMENT AND INDUSTRY REGULATIONS

Hong Kong

Our business is located in Hong Kong are subject to the laws and regulations of Hong Kong governing businesses concerning, in particular labor, occupational safety and health, contracts, tort and intellectual property. Furthermore, we need to comply with the rules and regulations of Hong Kong governing the data usage and regular terms of service applicable to our potential customers or clients. As the information of our potential customers or clients is preserved in Hong Kong, we need to comply with the Hong Kong Personal Data (Privacy) Ordinance.

The Employment Ordinance is the main piece of legislation governing conditions of employment in Hong Kong since 1968. It covers a comprehensive range of employment protection and benefits for employees, including Wage Protection, Rest Days, Holidays with Pay, Paid Annual Leave, Sickness Allowance, Maternity Protection, Statutory Paternity Leave, Severance Payment, Long Service Payment, Employment Protection, Termination of Employment Contract, Protection Against Anti-Union Discrimination. In addition, every employer must take out employees’ compensation insurance to protect the claims made by employees in respect of accidents occurred during the course of their employment.

An employer must also comply with all legal obligations under the Mandatory Provident Fund Schemes Ordinance, (CAP485). These include enrolling all qualifying employees in MPF schemes and making MPF contributions for them. Except for exempt persons, employer should enroll both full-time and part-time employees who are at least 18 but under 65 years of age in an MPF scheme within the first 60 days of employment. The 60-day employment rule does not apply to casual employees in the construction and catering industries. Pursuant to the said Ordinance, we are required to make MPF contributions for our Hong Kong employees once every contribution period (generally the wage period within 1 month). Employers and employees are each required to make regular mandatory contributions of 5% of the employee’s relevant income to an MPF scheme, subject to the minimum and maximum relevant income levels. For a monthly-paid employee, the minimum and maximum relevant income levels are $7,100 and $30,000 respectively.

| 11 |

Mainland China

A portion of our logistics operations are located in China and subject to the general laws in China governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws.

Employment Contracts

The Employment Contract Law was promulgated by the National People’s Congress’ Standing Committee on June 29, 2007 and took effect on January 1, 2008. The Employment Contract Law governs labor relations and employment contracts (including the entry into, performance, amendment, termination and determination of employment contracts) between domestic enterprises (including foreign-invested companies), individual economic organizations and private non-enterprise units (collectively referred to as the “employers”) and their employees.

a. Execution of employment contracts

Under the Employment Contract Law, an employer is required to execute written employment contracts with its employees within one month from the commencement of employment. In the event of contravention, an employee is entitled to receive double salary for the period during which the employer fails to execute an employment contract. If an employer fails to execute an employment contract for more than 12 months from the commencement of the employee’s employment, an employment contract would be deemed to have been entered into between the employer and employee for a non-fixed term.

b. Right to non-fixed term contracts

Under the Employment Contract Law, an employee may request for a non-fixed term contract without an employer’s consent to renew. In addition, an employee is also entitled to a non-fixed term contract with an employer if he has completed two fixed term employment contracts with such employer; however, such employee must not have committed any breach or have been subject to any disciplinary actions during his employment. Unless the employee requests to enter into a fixed term contract, an employer who fails to enter into a non-fixed term contract pursuant to the Employment Contract Law is liable to pay the employee double salary from the date the employment contract is renewed.

c. Compensation for termination or expiry of employment contracts

Under the Employment Contract Law, employees are entitled to compensation upon the termination or expiry of an employment contract. Employees are entitled to compensation even in the event the employer (i) has been declared bankrupt; (ii) has its business license revoked; (iii) has been ordered to cease or withdraw its business; or (iv) has been voluntarily liquidated. Where an employee has been employed for more than one year, the employee will be entitled to such compensation equivalent to one month’s salary for every completed year of service. Where an employee has employed for less than one year, such employee will be deemed to have completed one full year of service.

d. Trade union and collective employment contracts

Under the Employment Contract Law, a trade union may seek arbitration and litigation to resolve any dispute arising from a collective employment contract; provided that such dispute failed to be settled through negotiations. The Employment Contract Law also permits a trade union to enter into a collective employee contract with an employer on behalf of all the employees.

Where a trade union has not been formed, a representative appointed under the recommendation of a high-level trade union may execute the collective employment contract. Within districts below county level, collective employment contracts for industries such as those engaged in construction, mining, food and beverage and those from the service sector, etc., may be executed on behalf of employees by the representatives from the trade union of each respective industry. Alternatively, a district-based collective employment contract may be entered into.

| 12 |

As a result of the Employment Contract Law, all of our employees have executed standard written employment agreements with us. We have not experienced any significant labor disputes or any difficulties in recruiting staff for our operations.

Regulations Relating to Foreign Exchange

Foreign Currency Exchange

Pursuant to the Foreign Currency Administration Rules, as amended, and various regulations issued by the State Administration of Foreign Exchange, or SAFE, and other relevant PRC government authorities, Renminbi is freely convertible to the extent of current account items, such as trade related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investment, unless expressly exempted by laws and regulations, still require prior approval from SAFE or its provincial branch for conversion of Renminbi into a foreign currency, such as U.S. dollars, and remittance of the foreign currency outside of the PRC. Payments for transactions that take place within the PRC must be made in Renminbi. Foreign currency revenues received by PRC companies may be repatriated into China or retained outside of China in accordance with requirements and terms specified by SAFE.

Dividend Distribution

Wholly foreign-owned enterprises and Sino-foreign equity joint ventures in the PRC may pay dividends only out of their accumulated profits, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, these foreign-invested enterprises may not pay dividends unless they set aside at least 10 percent of their respective accumulated profits after tax each year, if any, to fund certain reserve funds, until such time as the accumulative amount of such fund reaches 50 percent of the enterprise’s registered capital. In addition, these companies also may allocate a portion of their after-tax profits based on PRC accounting standards to employee welfare and bonus funds at their discretion. These reserves are not distributable as cash dividends.

Regulations on loans to and direct investment in PRC entities by offshore holding companies

According to the Implementation Rules for the Provisional Regulations on Statistics and Supervision of Foreign Debt promulgated by SAFE on September 24, 1997 and the Interim Provisions on the Management of Foreign Debts promulgated by SAFE, the NDRC and the MOF and effective from March 1, 2003, loans by foreign companies to their subsidiaries in China, which accordingly are foreign-invested enterprises, are considered foreign debt, and such loans must be registered with the local branches of the SAFE. Under the provisions, the total amount of accumulated medium-term and long-term foreign debt and the balance of short-term debt borrowed by a foreign-invested enterprise is limited to the difference between the total investment and the registered capital of the foreign- invested enterprise.

On January 11, 2017, the People’s Bank of China promulgated the Circular of the People’s Bank of China on Matters relating to the Macro-prudential Management of Comprehensive Cross-border Financing, or PBOC Circular 9, which took effect on the same date. The PBOC Circular 9 established a capital or net assets-based constraint mechanism for cross-border financings. Under such mechanism, a company may carry out cross-border financings in Renminbi or foreign currencies at their own discretion. The total cross-border financings of a company shall be calculated using a risk-weighted approach and shall not exceed an upper limit. The upper limit is calculated as capital or assets multiplied by a cross-border financing leverage ratio and multiplied by a macro-prudential regulation parameter.

In addition, according to PBOC Circular 9, as of the date of the promulgation of PBOC Circular 9, a transition period of one year is set for foreign-invested enterprises and during such transition period, foreign-invested enterprises may apply either the current cross-border financing management mode, namely the mode provided by Implementation Rules for the Provisional Regulations on Statistics and Supervision of Foreign Debt and the Interim Provisions on the Management of Foreign Debts, or the mode in this PBOC Circular 9 at its sole discretion. After the end of the transition period, the cross-border financing management mode for foreign-invested enterprises will be determined by the People’s Bank of China and SAFE after assessment based on the overall implementation of this PBOC Circular 9.

| 13 |

According to applicable PRC regulations on foreign-invested enterprises, the foreign exchange capital of foreign-invested enterprises shall be subject to the Discretional Foreign Exchange Settlement. The term “Discretional Foreign Exchange Settlement” refers to the foreign exchange capital in the capital account of a foreign-invested enterprise for which the rights and interests of monetary contribution has been confirmed by the local foreign exchange bureau (or the book-entry registration of monetary contribution by the banks) can be settled at the banks based on the actual operational needs of the foreign-invested enterprise. The proportion of Discretional Foreign Exchange Settlement of the foreign exchange capital of a foreign-invested enterprise is temporarily determined as 100%. The Renminbi converted from the foreign exchange capital will be kept in a designated account and if a foreign-invested enterprise needs to make further payment from such account, it still needs to provide supporting documents and go through the review process with the banks.

Regulations Relating to Employee Stock Incentive Plan of Overseas Publicly-Listed Company

Pursuant to the Notice on Issues Concerning the Foreign Exchange Administration for Domestic Individuals Participating in Stock Incentive Plan of Overseas Publicly Listed Company, or Circular 7, issued by the SAFE in February 2012, employees, directors, supervisors and other senior management participating in any stock incentive plan of an overseas publicly listed company who are PRC citizens or who are non-PRC citizens residing in China for a continuous period of not less than one year, subject to a few exceptions, are required to register with the SAFE through a domestic qualified agent, which could be a PRC subsidiary of such overseas listed company, and complete certain other procedures. If we fail to complete the SAFE registrations, such failure may subject us to fines and legal sanctions and may also limit our ability to contribute additional capital into our wholly foreign-owned subsidiary in China and limit such subsidiary’s ability to distribute dividends to us.

In addition, the State Administration for Taxation has issued certain circulars concerning employee share options or restricted shares. Under these circulars, the employees working in the PRC who exercise share options or are granted restricted shares will be subject to PRC individual income tax. The PRC subsidiaries of such overseas listed company have obligations to file documents related to employee share options or restricted shares with relevant tax authorities and to withhold individual income taxes of those employees who exercise their share options. If the employees fail to pay or the PRC subsidiaries fail to withhold their income taxes according to relevant laws and regulations, the PRC subsidiaries may face sanctions imposed by the tax authorities or other PRC government authorities.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. Unresolved Staff Comments.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Our corporate and executive office is located at Rooms 1309-11, 13th Floor, Tai Yau Building, No. 181 Johnston Road, Wanchai, Hong Kong, telephone number +852 3643 1111. Our Hong Kong operations hub is located at 2/F and Roof, 52 Chan Uk Po, SheungShui, New Territories, Hong Kong. Both of these locations are provided to us on a rent-free basis from our executive officers. We believe that our existing facilities are adequate to meet our current requirements. We do not own any real property.

There are no material pending legal proceedings to which we are a party or to which any of our property is subject, nor are there any such proceedings known to be contemplated by governmental authorities. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or has a material interest adverse to our business.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

| 14 |

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

The following table sets forth the high and low closing sale prices for the periods presented as reported on the Over the Counter Bulletin Board. There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained.

| Price Range | ||||||||

| High | Low | |||||||

| Fiscal 2019 | ||||||||

| Fourth quarter | US$ | 8.99 | US$ | 8.99 | ||||

| Third quarter | 8.99 | 8.99 | ||||||

| Second quarter | 8.99 | 8.99 | ||||||

| First quarter | 8.99 | 8.99 | ||||||

| Fiscal 2018 | ||||||||

| Fourth quarter | US$ | 20.00 | US$ | 1.55 | ||||

| Third quarter | 27.00 | 10.01 | ||||||

| Second quarter | 32.00 | 27.00 | ||||||

| First quarter | 40.00 | 5.00 | ||||||

Our common stock is quoted on the Over the Counter Bulletin Board under the symbol COSG. As of March 24, 2020, the closing bid price of our securities was US$8.99.

(b) Approximate Number of Holders of Common Stock

As of March 24, 2020, there were approximately 154 shareholders of record of our common stock. Such number does not include any shareholders holding shares in nominee or “street name”.

(c) Dividends

Holders of our common stock are entitled to receive such dividends as may be declared by our board of directors. We paid no dividends during the periods reported herein, nor do we anticipate paying any dividends in the foreseeable future.

(d) Equity Compensation Plan Information

There are no options, warrants or convertible securities outstanding.

(e) Recent Sales of Unregistered Securities

The information set forth below describes our issuance of securities without registration under the Securities Act of 1933, as amended, during the year ended December 31, 2019, that were not previously disclosed in a Quarterly Report on Form 10-Q or in a Current Report on Form 8-K: None.

ITEM 6. Selected Financial Data.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| 15 |

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

This discussion summarizes the significant factors affecting the operating results, financial condition, liquidity and cash flows of the Company and its subsidiaries for the fiscal years ended December 31, 2019 and 2018. The discussion and analysis that follow should be read together with the section entitled “Forward Looking Statements” and our consolidated financial statements and the notes to the consolidated financial statements included elsewhere in this annual report on Form 10-K.

Except for historical information, the matters discussed in this section are forward looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond the Company’s control. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report.

Currency and exchange rate

Unless otherwise noted, all currency figures quoted as “U.S. dollars”, “dollars” or “US$” refer to the legal currency of the United States. References to “HKD” are to the Hong Kong Dollar, the legal currency of Hong Kong. References to “RMB” are to the Renminbi, the legal currency of China. Throughout this report, assets and liabilities of the Company’s subsidiaries are translated into U.S. dollars using the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

Overview

As of December 31, 2019, we operated two business segments: specialty commercial logistics and artificial intelligence education business, or the AI Education business. Our specialty commercial logistic business is operated through Lee Tat Transportation Int’l Limited, our wholly owned Hong Kong subsidiary (“Lee Tat”), and provides timely and reliable logistics and delivery services to commercial clients located in Hong Kong. We offer service to the cable supply industry in Hong Kong, and expect to provide small parcel delivery service in cities near Shanghai in the near future. Lee Tat was organized as a private limited liability company on August 11, 2014, in Hong Kong. We acquired Lee Tat on May 12, 2017.

We operate our artificial intelligence educational business through our wholly owned subsidiaries Cosmos Robotor Holdings Limited 環球機械智能集團有限公司, a British Virgin Islands corporation (“Cosmos Robotor”), organized May 7, 2019, AiTeach International Limited, a Hong Kong limited liability company, organized June 3, 2019. Our AI business is currently in its development stages and has generated no or nominal revenues. We will need significant financing to be able to successfully implement our business plan of establishing AI classrooms in mainland China.

We had initially intended to focus on our resources on developing our AI Education business in mainland China. The challenges presented by Hong Kong’s political situation, US-China trade tensions and the effect of the COVID-19 virus, however, have materially and adversely affected our business plan of developing the AI Education business and our logistics business as a whole. As a result, we did not generate any revenue from our AI Education Business during the year ended December 31, 2019. In light of the challenges presented by the early stage of development of our AI Education business and the long-term impact of the COVID-19 virus on the education industry and Hong Kong industry in general, we decided to discontinue and exit from the AI Education business by the end of first quarter 2020. As a result:

| · | On December 27, 2019, the parties mutually unwound the Company’s acquisition of Hong Kong Healthtech Limited, a Hong Kong limited liability company. As a result, 5,100 Ordinary Shares of HKHL were returned to Wing Lok Jonathan SO and the 6,232,951 shares of our common stock issued in exchange therefor were returned to us for cancellation. On December 30, 2019, Kai Chi WONG resigned from his position as Chief Operating Officer of the Company. Koon Wing Cheung intends to transfer to Kai Chi WONG 215,369 shares of Common Stock of the Company as a token of appreciation of Mr. Wong’s contribution to the Company. |

| · | The Employment Agreement, dated July 19, 2019, by and between Cosmos Group Holdings, Inc. and Wing Lok Jonathan SO was terminated by the parties thereto effective on March 31, 2020. |

| 16 |

| · | Syndicate Capital (Asia) Limited intends to transfer back to Koon Wing Cheung 1,503,185 of the Company’s common stock (of the 2,149,293, shares previously transferred to Syndicate Capital (Asia) Limited from Koon Wing Cheung), with the balance of the 646,108 shares retained by Syndicate Capital (Asia) Limited as consideration for Mr. Tze Wai Albert YIP’s contributions to the Company. |

| · | Mr Tze Wai Albert YIP shall resign from his position as the Chief Financial Officer, effective on 30 April 2020. |

History

We were incorporated in the state of Nevada on August 14, 1987, under the name Shur De Cor, Inc. and engaged in developing certain mining claims. In April 1999, Shur De Cor merged with Interactive Marketing Technology, a New Jersey corporation that was engaged in the business of developing and direct marketing of consumer products. As the surviving company, Shur De Cor changed its name to Interactive Marketing Technology, Inc. Shur De Cor's then management resigned and the management of Interactive New Jersey became the Company’s management. The prior management of Shur De Cor retained Shur De Cor’s business and assets. After that acquisition, the Company, through a wholly owned subsidiary, IMT's Plumber, Inc., produced, marketed, and sold a licensed product called the Plumber's Secret, which was discontinued in fiscal 2001. In May 2002, the Company ceased to actively pursue its product development and marketing business and actively sought to either acquire a third party, merge with a third party or pursue a joint venture with a third party in order to re-enter its former business of development and direct marketing of proprietary consumer products in the United States and worldwide.

On November 17, 2004, the Company acquired MPL, a company organized under the laws of the British Virgin Islands, and its subsidiaries in accordance with the terms of a Share Exchange Agreement executed by the parties (the “2004 Agreement”). In connection with the acquisition, the Company issued an aggregate of 109,623,006 shares of its common stock to Imperial International Limited, a company incorporated under the laws of the British Virgin Islands (“Imperial”), the sole shareholder of MPL, in exchange for 100% of the issued and outstanding shares of MPL capital stock (the "2004 Share Exchange"). Upon completion of the share exchange, MPL became the Company's wholly owned subsidiary and the Company’s former owner transferred control of the Company to Imperial. The Company relied on Rule 506 of Regulation D of the Securities Act of 1933, as amended (the "Act"), in regard to the shares that we issued pursuant to the 2004 Share Exchange. The Company treated this transaction as a qualified "business combination" as defined by Rule 501(d). The Company relied on the exemption from registration pursuant to Section 4(2) of, and or Regulation D promulgated under, the Act in issuing the Company’s securities.

In connection with the 2004 Share Exchange, the Company: (i) changed its name from Interactive Marketing Technology, Inc. to China Artists Agency, Inc. ("China Artists"); (ii) obtained a new stock symbol, "CAAY", and CUSIP Number, effective on December 21, 2004; (iii) increased its authorized common stock to 200,000,000 shares; (iv) effectuated a 1 for 1.69 reverse stock split; and (v) spun off the Company’s existing business into a separate public company, All Star Marketing, Inc., a Nevada corporation ("All Star"). All Star was formed as a wholly owned subsidiary of the Company. The Spin-off was satisfied by means of a pro-rata share dividend to the Company's shareholders of record as of December 10, 2004. The purpose of the Spin-Off was to allow the subsidiary to operate as a separate public company and raise working capital through the sale of its own equity. This allowed the Company’s management to focus on its business, while at the same time, allowing the spun-off company to have greater exposure by trading as an independent public company. Additionally, the shareholders and the market would then more easily identify the results and performance of the Company as a separate entity from that of All Star. In August 2005, the Company changed its name to China Entertainment Group, Inc. and, effective August 9, 2005, obtained a new stock symbol "CGRP", and CUSIP Number.

Because the Company failed to generate revenues in its new business, prior management commenced litigation in the Superior Court for Los Angeles County California which action was removed to the United States District Court for the Central District of California Case No. CV07-1068 GHK. On January 30, 2008, the parties entered into a Settlement Agreement and Conditional Release (the “Settlement Agreement”), pursuant to which, among other things, the Company’s former management reacquired control of the Company and all assets related to the Chinese entertainment business were transferred out of the Company. The Company, under its former management, once again entered the business of locating products to develop and mass market. These efforts did not prove fruitful and the Company, while continuing its product development business, also began to seek another business to acquire.

Effective July 22, 2010, the Company merged with Safe and Secure TV Channel, LLC, a Delaware limited liability company (the “Merger”). In connection with the Merger, the management of the Company resigned and was replaced by the management and principals of Safe and Secure TV Channel, LLC. The holders of interests in Safe and Secure TV Channel, LLC exchanged their interests for approximately 50.2% of the issued and outstanding stock of the Company. In September 2010, the Company effectuated a 9.85 for one stock split to shareholders of record as of August 23, 2010. After the Merger, the Company became a television network and multimedia information and distribution company focused on serving the homeland security and emergency preparedness industry.

| 17 |

On February 15, 2016, the Company sold to Asia Cosmos Group Limited, a private limited liability company incorporated under the laws of British Virgin Islands (“ACOSG”), 10,000,000 shares of its common stock at a per share price of $0.027. ACOSG’s sole shareholder is Miky Wan. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to ACOSG.