Attached files

| file | filename |

|---|---|

| EX-31.4 - EXHIBIT 31.4 - VIEMED HEALTHCARE, INC. | q42019exhibit31210-ka.htm |

| EX-31.3 - EXHIBIT 31.3 - VIEMED HEALTHCARE, INC. | q42019exhibit31110-ka.htm |

| EX-23.2 - EXHIBIT 23.2 - VIEMED HEALTHCARE, INC. | mnpconsent232.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission file number: 001-38973

Viemed Healthcare, Inc.

(Exact name of registrant as specified in its charter)

British Columbia, Canada | N/A | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) | |

625 E. Kaliste Saloom Rd. Lafayette, LA 70508 | ||

(Address of principal executive offices, including zip code) | ||

(337) 504-3802 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of exchange on which registered |

Common Shares, no par value | VMD | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Non-Accelerated filer ☐ | Smaller reporting company x Emerging growth company x | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the voting and non-voting common shares held by non-affiliates of the registrant computed as of June 28, 2019 (the last business day of the registrant’s most recent completed second fiscal quarter) based on the closing price of the common shares on the Toronto Stock Exchange was $117,223,500.

As of February 28, 2020, there were 38,486,772 common shares of the registrant outstanding.

EXPLANATORY NOTE

Viemed Healthcare, Inc. (together with its subsidiaries, “Viemed”, the “Company”, “we”, “our” or “us”) is filing this Amendment No. 1 to Annual Report on Form 10-K/A (this “Amended Form 10-K”) to amend our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as originally filed with the Securities and Exchange Commission on March 4, 2020 (the “Original Form 10-K”), to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in Part III to be incorporated in the Original Form 10-K by reference from our definitive proxy statement or an amendment to the Original Form 10-K if such statement or amendment is filed no later than 120 days after the fiscal year-end covered by the Original Form 10-K. In addition, we are filing this Amended Form 10-K to amend the Original Form 10-K to (i) amend Item 15 of the Original Form 10-K to correct nonfunctioning hyperlinks to certain exhibits listed as incorporated by reference in Item 15 of the Original Form 10-K and (ii) amend the consent of MNP LLP filed as Exhibit 23.2 to the Original Form 10-K to include references to registration statements filed on Form S-8.

In accordance with Rule 12b-15 under the Securities and Exchange Act of 1934, as amended, Part III, Items 10 through 14 of the Original Form 10-K, and Part IV, Item 15 of the Original Form 10-K are hereby amended and restated in their entirety. This Amended Form 10-K does not amend or otherwise update any other information in the Original Form 10-K. Accordingly, this Amended Form 10-K should be read in conjunction with the Original Form 10-K and with our subsequent filings with the SEC. All capitalized terms used but not defined herein shall have the meanings ascribed to them in the Original Form 10-K.

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors and Executive Officers

The following table sets forth the names, ages, and positions of our directors and executive officers as of December 31, 2019:

Name | Age | Position |

Casey Hoyt | 42 | Director and Chief Executive Officer |

Randy Dobbs(1)(2)(3) | 69 | Chairman of the Board of Directors |

Dr. William Frazier | 61 | Director and Chief Medical Officer |

Bruce Greenstein(1)(2)(3) | 51 | Director |

Nitin Kaushal(1)(2)(3) | 54 | Director |

Timothy Smokoff(1)(2)(3) | 55 | Director |

W. Todd Zehnder | 44 | Director and Chief Operating Officer |

Michael Moore | 42 | President |

Trae Fitzgerald | 31 | Chief Financial Officer |

Jerome Cambre | 49 | Vice President of Sales |

(1)Member, Audit Committee of the Board | ||

(2)Member, Compensation Committee of the Board | ||

(3)Member, Corporate Governance and Nominating Committee of the Board | ||

Casey Hoyt is the current Chief Executive Officer of Viemed, a position he has held since its spin out from PHM (as defined below) in December 2017. Mr. Hoyt co-founded the Sleepco Subsidiaries in 2006 with the objective of becoming the leading respiratory disease management company in the United States. After selling the Sleepco Subsidiaries to PHM, Mr. Hoyt became the Chief Executive Officer of PHM until December 2017. His goal has been to enable patients to live better lives through clinical excellence, education and technology. Mr. Hoyt has also successfully managed several other businesses, most recently a worldwide organization offering a comprehensive line of tradeshow display and marketing services. Mr. Hoyt received his Bachelor of Science in General Studies from the University of Louisiana at Lafayette. As a co-founder of the Sleepco Subsidiaries and as the current Chief Executive Officer, Mr. Hoyt brings to the Board substantial familiarity with the leadership and operation of our business.

Randy Dobbs has served as the chairman of the Board since Viemed’s spin out from PHM in December 2017. Mr. Dobbs is a business operating/leadership consultant and motivational speaker and has served in that capacity since 2010. From April 2012 to January 2015, Mr. Dobbs served as the Chief Executive Officer for Matrix Medical Network, a portfolio company of Welsh, Carson, Anderson & Stowe (“WCAS”) and a provider of home health assessments for Medicare Advantage members across 32 states. Prior to that role, he was a Senior Operating Executive at WCAS, where he was responsible for portfolio company operational oversight, business acquisitions and equity opportunity development. From February 2005 to October 2008, he was Chief Executive Officer of US Investigation Services and its subsidiaries (USIS) who provided business intelligence and risk management solutions, security and related services and expert staffing solutions for businesses and federal government agencies. From April 2003 to February 2005, Mr. Dobbs was President and CEO of Phillips Medical Systems North America, providing diagnostic imaging equipment and services throughout all of North America and Latin America. Prior to April 2003, Mr. Dobbs spent 27 years with General Electric Company where he held various senior level positions including President and CEO of GE Capital IT Solutions, a multi-billion dollar enterprise. Mr. Dobbs served on the board of directors of MTGE Investment Corp. (NASDAQ:MTGE) from 2010 to 2018 and serves on the boards of directors of several privately held companies. Mr. Dobbs earned a Bachelor of Science in Education from Arkansas State University. Mr. Dobbs brings to the Board extensive experience resulting from his service on other boards of directors and from his multiple senior level leadership positions, including as the Chief Executive Officer of four companies. Such experience provides us with additional perspective on governance and management issues. He has significant experience with business integration, turnaround performance and executive team building, which provides the Board with important insight into the operation and development of our business.

Page | 4 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Dr. William Frazier has served as Chief Medical Officer and as a director of Viemed since December 2017. Previously, Dr. Frazier served as Chief Medical Officer of PHM from October 2015 to December 2017. Prior to that, Dr. Frazier was the Chief Medical Officer for the Sleepco Subsidiaries since October 2015. Prior to the Sleepco Subsidiaries, Dr. Frazier worked for more than 25 years as a full time practicing pulmonologist and he currently continues to see patients on a part time basis. Dr. Frazier has experience conducting clinical research projects, including trials evaluating new treatment options for COPD. Dr. Frazier has served in many different leadership roles during his career including stints as Chief of the Medical Staff and on the board of directors of two large medical practices and as a Director of a regional health system. Dr. Frazier is currently ABIM Board certified in Internal Medicine, Pulmonary Medicine, Critical Care Medicine and Sleep Disorders Medicine. Dr. Frazier earned his Bachelor of Science Philosophy from Vanderbilt University, his M.D. from the University of Mississippi and post-doctoral training at the University of Virginia. Dr. Frazier’s experience as a practicing pulmonologist provides the Board with important insight into the practice of pulmonary medicine as it applies to the operation of our business.

Bruce Greenstein has served as a director since July 2018. Mr. Greenstein has been the executive vice president and chief strategy and innovation officer of LHC Group, Inc. (NASDAQ:LHCG) since 2018, where he leads the company’s value-based contracting, ACO management company, and alternative payment and delivery model strategies. He also oversees the LHC Group’s operations for technology and for the innovations business segments, as well as LHC Group’s healthcare vision initiatives. Prior to joining LHC Group, Mr. Greenstein served as chief technology officer for the U.S. Department of Health and Human Services (HHS) in Washington, D.C. from May 2017 to June 2018. He has an extensive healthcare industry background in both government and the private sector, having served as president-west for New York-based Quartet Health, CEO of Blend Health Insights, and as managing director of Worldwide Health for Microsoft. Mr. Greenstein was a cabinet member in Louisiana, serving as secretary of the Department of Health and Hospitals. He also previously ran Medicaid-managed care and waivers and demonstrations at the Centers for Medicare & Medicaid Services. Mr. Greenstein’s experience in the healthcare industry provides the Board with important insight into the industry in which Viemed operates.

Nitin Kaushal has served as a director since December 2017 and has been the Managing Director of PWC Corporate Finance Inc. since 2012, and was the Executive Vice President and Managing Director of Medwell Capital Inc. from May 2010 to March 2012. Mr. Kaushal has worked in senior roles with a number of Canadian investment banks focused on healthcare, including Desjardins Securities Inc., Orion Securities Inc., Vengate Capital, HSBC Securities Inc. and Gordon Capital. He has held roles within the private equity/venture capital industry at MDS Capital Corp. and at PricewaterhouseCoopers in its M&A, valuation and audit groups. In addition, Mr. Kaushal has sat on a number of public and private company boards. He was awarded a Bachelor of Science (Chemistry) from the University of Toronto and is a Chartered Accountant. Mr. Kaushal’s experience as a member of various boards of directors and as a Chartered Accountant provides the Board with additional perspective on financial reporting, governance and management issues.

Timothy Smokoff has served as a director since January 2018 and brings more than 25 years of health industry leadership, product development and delivery experience to Viemed. Mr. Smokoff is currently CEO of Isowalk, LLC, a position he has held since January 2019. Mr. Smokoff has also served on the board of Total Triage Holdings, LLC since November of 2019. Prior to Isowalk, Mr Smokoff was CEO of Breathometer, Inc. from January 2017 to January 2019 and Senior Vice President of Health and Wellness of Nortek, Inc. from July 2016 to January 2017. Mr. Smokoff was the Chief Executive Officer of Numera, Inc., a senior in place aging solutions company, from January 2011 until it was purchased by Nortek, Inc. in July of 2016. Prior to Numera,Inc. Mr. Smokoff spent 13 years at Microsoft in various capacities, the last six years leading Microsoft’s global health business. Prior to Microsoft, Mr. Smokoff spent 14 years developing and bringing to market hospital information systems, physician office systems, and medical devices for a variety of companies, including several start-up ventures. Mr. Smokoff earned a Bachelor of Arts in Computer Science from the University of Washington. Mr. Smokoff’s experience in introducing products and services for senior, in-place aging, which includes respiratory care and chronic disease management, for family care givers provides the Board with insight into the operation, development, and growth of our business.

W. Todd Zehnder has served as the Chief Operating Officer and as a director of Viemed since December 2017. Previously, Mr. Zehnder served as Vice President - Finance and as Chief Strategy Officer of PHM from December 2015 to December 2017. Prior to joining PHM, Mr. Zehnder worked for PetroQuest Energy Inc., which was then a NYSE listed company, for 15 years in various leadership positions, including as Chief Operating Officer and Chief Financial Officer from 2008 to December 2015. Mr. Zehnder began his career with KPMG where he attained the level of Manager. Mr. Zehnder received his Bachelor of Science degree in Accounting from Louisiana State University and is a Certified Public Accountant. Mr. Zehnder’s experience as an executive officer of a publicly traded company provides the Board with insights into financial reporting, governance and management matters.

Michael Moore has served as President of Viemed since December 2017. Mr. Moore co-founded the Sleepco Subsidiaries in 2006, which were sold to PHM in May 2015. After selling the Sleepco Subsidiaries to PHM, Mr. Moore became the President of PHM and in March 2016 its Interim CFO. Prior to serving as Viemed’s President, Mr. Moore acted as Managing Director, Disease Management of PHM from May 2015 until December 2017. After completing his degree as a Respiratory Therapist from the California College of Health Science, Mr. Moore began his career as a Respiratory Therapist and later transitioned to Account Executive, with organizations such as Praxair and Home Care Supply, where he continually exceeded sales goals and finished in the top 5 nationally of all Account Executives. Mr. Moore’s experience as a clinician, as well as his knowledge of healthcare trends, played a key role in formulating the strategy that has enabled the business of the Sleepco Subsidiaries to become the diverse respiratory-focused business that it is today.

Page | 5 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Trae Fitzgerald has served as the Chief Financial Officer of Viemed since December 2017. Previously, Mr. Fitzgerald served as finance manager and corporate controller of PHM from January 2015 until December 2017. Prior to joining PHM, Mr. Fitzgerald spent two years serving in a finance, budgeting, and financial reporting role for PetroQuest Energy, Inc., a then NYSE listed company, from April 2013 to January 2015. Mr. Fitzgerald graduated Summa Cum Laude with a Bachelor of Science Degree in Accounting and Masters of Business Administration from the University of Louisiana at Lafayette. He is a Certified Public Accountant, registered in the state of Louisiana with over six years of public accounting experience, three years of which were spent with Ernst & Young’s Houston, Texas office, where he provided audit services to a variety of industries ranging from professional sports to alternative energy.

Jerome Cambre has served as the Vice President of Sales of Viemed since March 2018. Previously, Mr. Cambre served as the National Sales Trainer of Viemed from March 2017 to March 2018, as the Director of Clinical Sales of Sleep Management, LLC from March 2016 to March 2017 and as a Patient Care Coordinator of Sleep Management, LLC from October 2015 to 2016. Prior to joining that, Mr. Cambre was a sales representative at Sleep Management, LLC from November 2013. Mr. Cambre graduated with a Bachelor of Science Degree in Psychology from Louisiana State University. He also holds an Associate of Science Degree in Cardiopulmonary Science from Our Lady of the Lake College.

Audit Committee

During the fiscal year ended December 31, 2019, the Audit Committee consisted of Nitin Kaushal (Chairman), Randy Dobbs, Bruce Greenstein, and Timothy Smokoff. The Audit Committee operates under a written charter adopted by the Board. The purpose of the Audit Committee is that of oversight of the Company’s accounting and financial reporting process and the audit of the Company’s financial statements on behalf of the Board.

The Board has determined that Nitin Kaushal is qualified as an audit committee financial expert under the SEC’s rules and regulations. In addition, the Board has determined that each member of the Audit Committee has the requisite accounting and related financial management expertise under NASDAQ rules.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics that applies to our directors, officers and employees. This Code of Business Conduct and Ethics is available on the corporate governance section of our website (which is a subsection of the investor relations section of our website) at the following address: www.viemed.com/investor-relations. We intend to disclose on our website any amendments or waivers to the code that are required to be disclosed by SEC rules.

Item 11. Executive Compensation

Although we are an emerging growth company and a smaller reporting company, and accordingly may provide disclosure of our executive compensation program under the scaled-down reporting rules applicable to emerging growth companies and smaller reporting companies, we are choosing to provide additional detail with respect to our executive compensation, including in “Compensation Discussion and Analysis,” “Compensation Governance” and “Performance Graph” and in the “Summary Compensation Table,” “Incentive Plan Awards - Value Vested or Earned During the Year” tables, and “Outstanding Share-Based Awards and Option-Based Awards” table consistent with the disclosure requirements that will apply to the Information Circular for our Annual and Special General Meeting Of Shareholders under Canadian securities laws.

Compensation Discussion and Analysis

During the fiscal year ended December 31, 2019, the Company’s executive compensation program was administered by the Compensation Committee of the Board. The Company’s executive compensation program has the objective of attracting and retaining a qualified and cohesive group of executives, motivating team performance and aligning of the interests of executives with the interests of the Company’s shareholders through a package of compensation that is simple and easy to understand and implement. Compensation under the program was designed to achieve both current and longer term goals of the Company and to optimize returns to shareholders. In addition, in order to further align the interests of executives with the interests of the Company’s shareholders, the Company has implemented share ownership incentives through the Option Plan (defined below) and the RSU/DSU Plan (defined below). The Compensation Committee believes that the Company’s overall compensation objectives are consistent with its peer group of healthcare companies with opportunities to participate in equity ownership.

In determining the total compensation of any member of senior management, the Compensation Committee considers all elements of compensation in total rather than one element in isolation. The Compensation Committee also examines the competitive positioning of total compensation and the mix of fixed, incentive and share-based compensation.

Page | 6 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Compensation Governance

On December 21, 2017, concurrent with the closing of the arrangement under the provisions of Division 5 of Part 9 of the Business Corporations Act (British Columbia) (the “Arrangement”) involving the Company, Protech Home Medical Corp. (“PHM”) and the securityholders of PHM, the Board established the Compensation Committee as a standing committee of the Board. The Compensation Committee assists the Board in discharging the directors’ oversight responsibilities relating to the compensation and retention of key senior management employees, and in particular the Chief Executive Officer.

The Compensation Committee is comprised of four (4) directors, Timothy Smokoff (Chairman), Nitin Kaushal, Randy Dobbs and Bruce Greenstein. Each member of the Compensation Committee is independent as such term is defined in NI 52-110 and in the Business Corporations Act (British Columbia), as well as under NASDAQ rules.

The Compensation Committee operates under the Charter of the Compensation Committee, pursuant to which the Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to: setting policies for senior officers’ remuneration; reviewing and approving and then recommending to the Board salary, bonus, and other benefits, direct or indirect, and any change-of-control packages of the Chief Executive Officer; considering the recommendations of the Chief Executive Officer and setting the terms and conditions of employment including, approving the salary, bonus, and other benefits, direct or indirect, and any change-of-control packages, of the key executives of the Company; undertaking an annual review of the Chief Executive Officer goals for the coming year and reviewing progress in achieving those goals; reviewing compensation of the Board on at least an annual basis; overseeing the administration of the Company’s compensation plans, including stock option plans, compensation plans for outside directors, and such other compensation plans or structures as are adopted by the Company from time to time; reviewing and approving executive compensation disclosure to be made in the proxy circular prepared in connection with each annual meeting of shareholders of the Company; and undertaking on behalf of the Board such other compensation initiatives as may be necessary or desirable to contribute to the success of the Company and enhance shareholder value.

Performance Graph

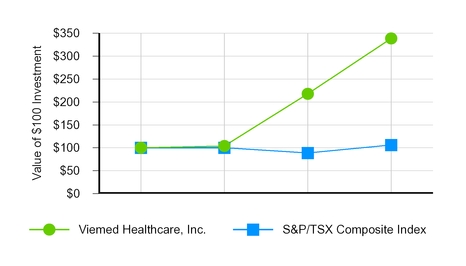

The following graph compares the total cumulative return on funds invested in common shares of the Company, compared to the total cumulative return of the Standard and Poor’s TSX Composite Total Return Index for the period from December 22, 2017, when the common shares of the Company were initially posted for trading on the TSX Venture Exchange, to December 31, 2019 (expressed in Canadian dollars):

December 22, 2017 | December 31, 2017 | December 31, 2018 | December 31, 2019 | |||||||||

Viemed Healthcare, Inc. | $ | 100 | $ | 104 | $ | 218 | $ | 339 | ||||

S&P/TSX Composite Index | $ | 100 | $ | 100 | $ | 89 | $ | 106 | ||||

Page | 7 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Over this period, the Company’s share price increased by 339% and has outperformed the S&P/TSX Composite Index which increased by 106%. As shown in the summary compensation table, during the same period, total compensation received by the Named Executive Officers (as defined below) increased consistently with this trend. The Board considers the Company’s performance (including share price) in its compensation decision-making. Based on the growth and results of the Company over this period and the return to the Company's shareholders, the Board believes there is alignment between the compensation of the Named Executive Officers and the return to the Company's shareholders. In addition, as approximately 29.7% - 47.9% of the aggregate target total direct compensation of the Named Executive Officers in 2019 was security-based compensation (i.e., the grant date fair value of RSUs and options), in the medium to long-term, the realized compensation of the Named Executive Officers will be directly and meaningfully impacted by the market value of the common shares of the Company.

Summary Compensation Table

The table below sets forth the annual compensation paid by Viemed during the years ended December 31, 2019, 2018, and 2017 (expressed in U.S. dollars) to our CEO, CFO, and our next three most highly-compensated executive officers (our “Named Executive Officers”).

Name and Principal Position | Year | Salary ($) | Bonus(1) ($) | Stock Awards(2) ($) | Option-Awards(3) ($) | Nonequity Incentive Plan Compensation(4) ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation(5) ($) | Total(6) ($) | |||||||||

Casey Hoyt | 2019 | 425,000 | 373,176 | — | 1,038,386 | 318,750 | — | 12,332 | 2,167,644 | |||||||||

Chief Executive Officer and Director | 2018 | 389,038 | 7,447 | 550,138 | 233,407 | 637,500 | — | 11,314 | 1,828,844 | |||||||||

2017 | 235,000 | 261,667 | — | 25,554(7) | 555,000 | — | 3,087 | 1,080,308 | ||||||||||

Michael Moore | 2019 | 360,000 | 363,240 | — | 703,660 | 270,000 | — | 33,242 | 1,730,142 | |||||||||

President | 2018 | 360,000 | 7,447 | 535,270 | 227,097 | 540,000 | — | 32,025 | 1,701,839 | |||||||||

2017 | 230,000 | 261,667 | — | 25,554(7) | 540,000 | — | 15,772 | 1,072,993 | ||||||||||

W. Todd Zehnder | 2019 | 350,000 | 353,304 | — | 684,115 | 262,500 | — | 34,442 | 1,684,361 | |||||||||

Chief Operating Officer and Director | 2018 | 350,000 | 7,447 | 520,402 | 220,789 | 525,000 | — | 33,226 | 1,656,864 | |||||||||

2017 | 325,000 | 91,667 | — | 108,878(7) | 525,000 | — | 18,517 | 1,069,062 | ||||||||||

Trae Fitzgerald | 2019 | 200,000 | 95,655 | — | 244,328 | 112,500 | — | 24,842 | 677,325 | |||||||||

Chief Financial Officer | 2018 | 173,846 | 7,447 | 152,651 | 47,102 | 200,000 | — | 12,287 | 593,333 | |||||||||

2017 | 155,962 | 11,667 | — | 6,312(7) | 160,000 | — | 19,508 | 353,449 | ||||||||||

Jerome Cambre | 2019 | 168,846 | 173,155 | — | 195,462 | 95,625 | — | 24,842 | 657,930 | |||||||||

Vice President of Sales(8) | 2018 | 160,000 | 128,697 | 152,433 | 47,102 | 160,000 | — | 23,625 | 671,857 | |||||||||

2017 | 160,000 | 51,667 | — | 19,251(7) | 80,000 | — | 12,754 | 323,672 | ||||||||||

(1) Bonuses in 2019 primarily reflect payments under the Company's Phantom Share Plan (as defined below). Bonuses in 2017 were awarded to the Named Executive Officers in consideration for a portion of their prior year's compensation being deferred prior to the Arrangement.

(2)Restricted stock award value was calculated at the date of the grant using the closing stock price on the date of the grant and represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in “Note 8 - Shareholders’ Equity” to our audited financial statements for the fiscal years ended December 31, 2019 and 2018 included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on March 4, 2020.

(3)The amounts shown represent the aggregate grant date fair value for option awards computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in “Note 8 - Shareholders’ Equity” to our audited financial statements for the fiscal years ended December 31, 2019 and 2018 included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on March 4, 2020.

Page | 8 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

(4)Reflects compensation under the Cash Bonus Plan (as defined below). None of the Named Executive Officers received compensation from a non-equity incentive plan related to a period longer than one year.

(5)Amounts paid in 2019 to each Named Executive Officer represent $11,200 in matching contributions made by the Company under its 401(k) plan for each of Mr. Moore, Mr. Zehnder, Mr. Fitzgerald, and Mr. Cambre, $12,355 in medical insurance premiums for each of Mr. Moore, Mr. Zehnder, Mr. Fitzgerald and Mr. Cambre and $12,244 in medical insurance premiums for Mr. Hoyt, $87 in life insurance premiums for each of Mr. Hoyt, Mr. Moore, Mr. Zehnder, Mr. Fitzgerld, and Mr. Cambre, $9,600 in auto allowances for each of Mr. Moore and Mr. Zehnder, and $1,200 in cell phone allowance for Mr. Zehnder, Mr. Fitzgerald, and Mr. Cambre.

(6)None of the Named Executive Officers received any compensation related to a defined benefit or defined contribution plan.

(7)Represents stock options issued under the Option Plan pursuant to the Arrangement in exchange for previously held options of PHM. Does not represent the issuance of new options. Pursuant to the Arrangement, the exercise prices of the options of the Company issued as a result of the Arrangement were to be determined by the respective trading prices of PHM and the Company for the five trading days following completion of the Arrangement. Accordingly, the exercise prices of the options of the Company were not known until after December 31, 2017, but are known as of the date hereof and thus are being used to complete the disclosure.

(8) Mr. Cambre has served as the Vice President of Sales of Viemed since March 2018. Previously, Mr. Cambre served as the National Sales Trainer of Viemed from March 2017 to March 2018 and as the Director of Clinical Sales of Sleep Management, LLC from March 2016 to March 2017.

Narrative Disclosure to Summary Compensation Table

Base Salary. Base salaries are generally set at levels deemed necessary to attract and retain individuals with superior talent commensurate with their relative expertise and experience, and are set taking into consideration the executive officer’s personal performance and seniority, comparability within industry norms, and contribution to Viemed’s growth and profitability. The Company believes that a competitive base salary is an imperative element of any compensation program that is designed to attract talented and experienced executives. While there is no official set of benchmarks that the Company relies on, the Company makes itself aware of, and is cognizant of, how comparable issuers in its business compensate their executives. The Company's peer group in connection with salary compensation consists of sampling of other similar sized healthcare companies that are reporting issuers (or the equivalent) in Canada and the United States. The base salary for each executive officer is reviewed and established near the end of the fiscal year.

Share-Based and Option Awards. An important part of our compensation program is to offer the opportunity and incentive for executives and staff to own Common Shares. We believe that ownership of common shares of the Company will align the interests of executives and future staff with the interests of the Company's shareholders. Share-based and option-based awards are not granted on a regular schedule but rather as the compensation is reviewed by the Compensation Committee from time to time. When reviewing awards, consideration is given to the total compensation package of the executives and staff and a weighting of appropriate incentives groupings at the senior, mid and junior levels of the staff including past grants. At the time of any award, consideration is also given to the available pool remaining for new positions being contemplated by the Company. We have adopted an Option Plan and a Restricted Share Units/Deferred Share Units Plan. See below under “Incentive Plans” for a summary of our Option Plan and Restricted Share Units/Deferred Share Units Plan.

Bonus Framework. We have adopted a Cash Bonus Plan and a Phantom Share Plan. See below under “Incentive Plans” for a summary of our Cash Bonus Plan and our Phantom Share Plan.

Retirement Benefits. We do not currently maintain a defined benefit pension plan or a nonqualified deferred compensation plan providing for retirement benefits to our Named Executive Officers. Certain of our Named Executive Officers currently participate in our 401(k) plan and are eligible for matching of up to 4%.

Group Benefits. We offer a group benefits plan, which includes medical benefits and a matching (up to 4%) 401(k) plan. The group benefits plan is available to all full-time employees who choose to enroll, including officers of the Company.

Perquisites and Personal Benefits. While Viemed reimburses its Named Executive Officers for expenses incurred in the course of performing their duties as executive officers of Viemed, it did not provide any compensation that would be considered a perquisite or personal benefit to its Named Executive Officers, other than auto allowances of $9,600 a year for each of Mr. Moore and Mr. Zehnder and a $1,200 cell phone allowance for Mr. Zehnder, Mr. Fitzgerald, and Mr. Cambre.

Page | 9 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Employment Agreements

Effective June 3, 2019, we entered into “at will” executive employment agreements with three of our Named Executive Officers, Casey Hoyt, Michael Moore and W. Todd Zehnder, providing for annual base salaries of $425,000, $360,000 and $350,000, respectively. The agreements also provide that the executives are eligible to earn a discretionary annual cash bonus with a target bonus amount equal to 100% of annual base salary and a maximum bonus amount equal to 150% of annual base salary pursuant to the terms of the Cash Bonus Plan. The executives are also eligible to participate in any benefit plans that may be offered from time to time by us to similarly situated employees generally, subject to satisfaction of the applicable eligibility provisions.

In the event the executive’s employment is terminated by us without “cause” or by the executive for “good reason,” the executive will receive, subject to certain conditions, (i) severance equal to his annual base salary, payable in installments, for 12 months following the date of termination (the “Severance Period”), (ii) an amount equal to the unpaid bonus (if any) that the executive would have earned under the Cash Bonus Plan and (iii) payment of the employer portion of the premiums required to continue the executive’s group health care coverage under the applicable provisions of COBRA, until the earliest of (A) the end of the Severance Period, (B) the expiration of the executive’s eligibility for the continuation coverage under COBRA, or (C) the date when the executive becomes eligible for substantially equivalent health insurance coverage in connection with new employment. In the event the executive’s employment is terminated by us without “cause” or by the executive for “good reason” within 12 months of a change in control (as defined under the Cash Bonus Plan), the executive will receive, subject to certain conditions, the same benefits described in the previous sentence, except that the Severance Period will be increased to 24 months and the bonus will instead be payable at the target bonus amount.

In addition, each agreement prohibits the executive from competing with the Company or soliciting its employees, or customers during his employment and for two years after termination of the agreement for any reason, subject to certain exceptions.

Page | 10 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Outstanding Equity Awards at Fiscal Year-End 2019

The following table sets forth all awards outstanding for the Named Executive Officers as of December 31, 2019 (expressed in Canadian dollars):

Option-Based Awards | Stock Awards | |||||||||||||||||||

Number of Securities Underlying Unexercised Options (#) | Number of Shares or Units of Stock that have not Vested (#)(7) | Market Value of Shares or Units of Stock that have not Vested ($)(8) | Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested (#) | Equity incentive plan awards: Market or pay out value of unearned shares, units or other rights that have not vested ($) | ||||||||||||||||

Name | Grant Date | Exercisable | Unexercisable(6)(7) | Option Exercise Price ($) | Option Expiration Date | Grant Date | ||||||||||||||

Casey Hoyt Chief Executive Officer and Director | 12/21/2017 | 50,000 | (1) | — | (1) | 7.45 | 07/10/2020 | 01/04/2018 | 203,999 | 1,658,515 | — | — | ||||||||

01/04/2018 | 44,722 | (1) | 89,444 | (1) | 2.27 | 01/04/2028 | ||||||||||||||

01/17/2019 | — | (1) | 305,802 | (1) | 5.49 | 01/17/2029 | ||||||||||||||

Michael Moore President | 12/21/2017 | 50,000 | (2) | — | (2) | 7.45 | 07/10/2020 | 01/04/2018 | 198,486 | 1,613,691 | — | — | ||||||||

01/04/2018 | 43,513 | (2) | 87,026 | (2) | 2.27 | 01/04/2028 | ||||||||||||||

01/17/2019 | — | (2) | 207,226 | (2) | 5.49 | 01/17/2029 | ||||||||||||||

W. Todd Zehnder Chief Operating Officer and Director | 12/21/2017 | 117,000 | (3) | — | (3) | 3.12 | 12/07/2020 | 01/04/2018 | 192,972 | 1,568,868 | — | — | ||||||||

01/04/2018 | 42,305 | (3) | 84,608 | (3) | 2.27 | 01/04/2028 | ||||||||||||||

01/17/2019 | — | (3) | 201,470 | (3) | 5.49 | 01/17/2029 | ||||||||||||||

Trae Fitzgerald Chief Financial Officer | 12/21/2017 | 5,000 | (4) | — | (4) | 1.53 | 12/07/2020 | 01/04/2018 | 28,303 | 230,101 | — | — | ||||||||

01/04/2018 | 9,025 | (4) | 18,050 | (4) | 2.27 | 01/04/2028 | ||||||||||||||

01/17/2019 | — | (4) | 71,954 | (4) | 5.49 | 01/17/2029 | ||||||||||||||

Jerome Cambre Vice President of Sales | 12/21/2017 | 19,400 | (5) | — | (5) | 4.74 | 12/07/2020 | 01/04/2018 | 28,303 | 230,101 | — | — | ||||||||

01/04/2018 | 9,025 | (5) | 18,050 | (5) | 2.27 | 01/04/2028 | ||||||||||||||

01/17/2019 | — | (5) | 57,563 | (5) | 5.49 | 01/17/2029 | ||||||||||||||

(1) The aggregate value of options for 2017, 2018, and 2019 awards is $34,000, $786,213, and $807,317, respectively. Aggregate value is calculated based on the difference between the exercise price of the options and the last closing price of the common shares on the Toronto Stock Exchange for the year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

(2) The aggregate value of options for 2017, 2018, and 2019 awards is $34,000, $764,959, and $547,077, respectively. Aggregate value is calculated based on the difference between the exercise price of the options and the last closing price of the common shares on the Toronto Stock Exchange for the year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

Page | 11 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

(3) The aggregate value of options for 2017, 2018, and 2019 awards is $586,170, $743,710, and $531,881, respectively. Aggregate value is calculated based on the difference between the exercise price of the options and the last closing price of the common shares on the Toronto Stock Exchange for the year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

(4) The aggregate value of options for 2017, 2018, and 2019 awards is $33,000, $158,660, and $189,959, respectively. Aggregate value is calculated based on the difference between the exercise price of the options and the last closing price of the common shares on the Toronto Stock Exchange for the year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

(5)The aggregate value of options for 2017, 2018, and 2019 awards is $65,766, $158,660, and $151,966, respectively. Aggregate value is calculated based on the difference between the exercise price of the options and the last closing price of the common shares on the Toronto Stock Exchange for the year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

(6) With respect to 2018, these awards will vest in two equal installments on January 4, 2019 and January 4, 2020.

(7) With respect to 2019, these awards will vest in three equal installments on January 17, 2020, January 17, 2021, and January 17, 2022.

(8) Aggregate value is calculated based on the last closing price of the common shares on the Toronto Stock Exchange for the year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

Incentive Plan Awards - Value Vested or Earned During the Year

The following table sets forth the value of all incentive plan awards vested or earned for the Named Executive Officers during the year ended December 31, 2019 (expressed in Canadian dollars):

Name | Option-based awards - Value vested during the year ($)(1) | Share-based awards - Value vested during the year ($)(2) | Non-equity incentive plan compensation - Value earned during the year ($)(3) | ||||||

Casey Hoyt | $ | 143,110 | $ | 557,938 | $ | 318,750 | |||

Trae Fitzgerald | $ | 28,880 | $ | 154,816 | $ | 112,500 | |||

Michael Moore | $ | 139,242 | $ | 542,859 | $ | 270,000 | |||

W. Todd Zehnder | $ | 135,374 | $ | 527,780 | $ | 262,500 | |||

Jerome Cambre | $ | 28,880 | $ | 154,816 | $ | 95,625 | |||

(1) Aggregate value is calculated based on the difference between the exercise price of the options and the closing price of the common shares on the Toronto Stock Exchange on the date they vest.

(2) Aggregate value is calculated based on the closing price of the common shares on the Toronto Stock Exchange on the date they vest.

(3) Reflects compensation under the Cash Bonus Plan (as previously defined and also included in Summary Compensation Table). None of the Named Executive Officers received compensation from a non-equity incentive plan related to a period longer than one year.

Incentive Plans

Cash Bonus Plan

Effective December 28, 2017, Viemed, Inc., our wholly owned subsidiary, adopted an annual discretionary cash bonus plan (the “Cash Bonus Plan”). The purpose of the Cash Bonus Plan is to attract, motivate and retain executive management, officers and other employees by providing a financial incentive for employment with Viemed and its divisions and subsidiaries and rewarding them for performance in line with increasing the value of the Viemed and its divisions and subsidiaries based on a review of objective standards and subjective elements determined by the Compensation Committee.

The Compensation Committee is responsible for determining those officers and other employees of Viemed who will participate in the Cash Bonus Plan for a particular calendar year (a “Plan Year”), and categorizing participants at different levels within Viemed in accordance with the Cash Bonus Plan and their potential bonus as a percentage of their salary (the “Bonus Amount”). Such determinations are made on an annual basis prior to or within 90 days of the beginning of the Plan Year or within 60 days of hire for a newly hired participant.

Page | 12 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

The Compensation Committee determines the criteria, the weight to be given to each criterion, the minimum and maximum thresholds, if any, and other factors utilized by the Compensation Committee in determining whether participants will be eligible to receive Bonus Amounts that are target and maximum or any amount in-between based on the annual performance of Viemed. Cash bonuses are awarded, in large part, when performance meets or exceeds certain objective benchmarks, but the Compensation Committee reserves the ability to determine Bonus Amounts based on discretionary, subjective factors as well. The only criteria used to measure the performance of Viemed under the Cash Bonus Plan to date has been the absolute year over year growth in Viemed’s Adjusted EBITDA. The Compensation Committee, in its sole discretion, may add additional criterion in order to measure the overall performance of Viemed for the purposes of making awards under the Cash Bonus Plan. The Compensation Committee will determine the total annual cash bonus actually awarded to a participant after taking into consideration the foregoing, but retains sole discretion to determine the amount of the actual awarded amount.

Notwithstanding the achievement of the criteria, except after a Change in Control (as more specifically set out in the Cash Bonus Plan), the Compensation Committee may determine in its sole discretion to pay only a portion or pay no Bonus Amount for a Plan Year, including, but not limited to, if, in the sole discretion of the Compensation Committee, the financial health of Viemed or business conditions do not warrant the payment of any Bonus Amounts. Actual awarded amounts will be paid in a cash lump sum as soon as possible after such awards are determined by the Compensation Committee after the end of the Plan Year but not later than 2.5 months after the end of the applicable Plan Year.

Phantom Share Plan

On April 3, 2018, Viemed, Inc., our wholly owned subsidiary, adopted a phantom share plan (the “Phantom Share Plan”) for the purpose of furthering long-term growth in earnings by offering long-term incentives to key employees of Viemed in the form of phantom shares (“Phantom Shares”).

The Phantom Share Plan is administered by the Compensation Committee. The Compensation Committee has the power to: select the employees to be granted awards of Phantom Shares under the Phantom Share Plan (each an “Award” and collectively, “Awards”); determine the number of Phantom Shares to be granted to each employee selected; determine the time or times when Phantom Shares will be granted; determine that all participants shall be of a single class or to divide participants into different classes; determine the time or times, and the conditions, subject to which any Awards may become payable; and determine all other terms and conditions of Awards including accelerating or modifying an Award. The Compensation Committee also has the sole authority to interpret and construe the terms of the Phantom Share Plan, establish and revise rules and regulations relating thereto, and make any other determinations that it believes necessary or advisable for the administration of the Phantom Share Plan. The Compensation Committee retains the complete power and authority to terminate or amend the Phantom Share Plan at any time in writing in its sole discretion and make payments under the Phantom Share Plan.

No employee or other person has any right to be granted an Award. An Award of Phantom Shares does not entitle the participant to hold or exercise any voting rights, rights to dividends or any other rights of a shareholder of Viemed or any affiliate of Viemed.

In the Compensation Committee’s discretion, the Compensation Committee may grant Phantom Shares to a participant (i) that are immediately fully vested, or (ii) subject to a vesting schedule or a performance event as specified in the participant’s Award (a “Vesting Event”). Awards of Phantom Shares are credited to an account (an “Account”) to be maintained for each participant. A participant only has a right to any part of his or her Phantom Shares to the extent that (i) a participant’s interest in such Phantom Shares has vested (in accordance with the applicable Award), and (ii) the rights to such Phantom Shares have not otherwise been forfeited by the participant pursuant to the terms of the Phantom Share Plan or the applicable Award. Payments with respect to Phantom Shares that have vested as specifically provided in the Award will be made in a lump sum within 60 days of the Vesting Event in cash. No participant has any right to receive payment for any part of his or her unpaid Phantom Shares (vested and unvested) if the participant’s employment or other service with Viemed is terminated for cause.

The total cash amount to be paid in the aggregate to a participant upon a Vesting Event is the value of the vested Phantom Shares in the participant’s Account on the date of the Vesting Event giving rise to the obligation to make payment calculated in accordance with the Phantom Share Plan. The value of one Phantom Share will be equal to the fair market value of a common share on the date of a Vesting Event as defined in the participant’s Award.

Option Plan

Viemed’s “fixed” stock option plan (the “Option Plan”) was approved at the annual and special meeting of the shareholders of Viemed on July 17, 2018. The purpose of the Option Plan is to provide incentive to employees, directors, officers, management companies, and consultants who provide services to Viemed or any of its subsidiaries.

Page | 13 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Pursuant to the Option Plan, the maximum number of common shares to be delivered upon the exercise of all stock options granted under the Option Plan combined with any equity securities granted under all other compensation arrangements adopted by Viemed, including the RSU/DSU Plan (as defined below), may not exceed 20% of the issued and outstanding common shares as of the date the Option Plan was approved, namely 7,581,925 common shares based on the number of common shares that were outstanding immediately following completion of the Arrangement, which options may be exercisable for a period of up to ten (10) years from the date of the grant, subject to the exception that expiry dates that fall within a blackout period will be extended by ten (10) business days from the expiry of the blackout period, subject to certain conditions being met.

Subject to obtaining disinterested shareholder approval, the number of common shares reserved for issuance pursuant to grant of options to any individual may not exceed 5% of the issued and outstanding common shares in any 12 month period (2% in the case of all optionees providing investor relations services to Viemed and 2% in the case of all consultants of Viemed in any 12 month period). The exercise price and vesting terms of any option granted pursuant to an option will be determined by the Board (in consultation with the Compensation Committee) when granted, but shall not be less than the market price. Notwithstanding the foregoing, the vesting terms for options granted to optionees performing investor relations activities will vest no sooner than one-quarter (1/4) on every three (3) month interval from the date of grant.

The options granted pursuant to the Option Plan will be non-transferable, except by means of a will or pursuant to the laws of descent and distribution. If the tenure of a director or officer or the employment of an employee of Viemed is terminated for cause, no option held by such optionee may be exercised following the date upon which termination occurred. If termination occurs for any reason other than cause, then any option held by such optionee will be exercisable, in whole or in part, for ninety (90) days from the date of termination, subject to the discretion of the Board (in consultation with the Compensation Committee) to extend such period up to one (1) year following the date of termination, which will be determined by the Board (in consultation with the Compensation Committee) at the time of each grant or on the date of termination; notwithstanding the foregoing, the Board (in consultation with the Compensation Committee) may in its discretion determine that all of the options held by an optionee on the date of termination which have not yet vested shall vest immediately on such date.

Restricted Share Units/Deferred Share Units Plan

A restricted share unit and deferred share unit plan of Viemed (the “RSU/DSU Plan”) was approved at the annual and special meeting of the shareholders of Viemed on July 17, 2018. The RSU/DSU Plan was established as a means by which Viemed may grant awards of restricted share units (“RSUs”) and deferred share units (“DSUs”) as an alternative to stock options to provide incentive to officers, directors and employees who provide services to Viemed or any of its subsidiaries.

The maximum number of common shares to be delivered upon the exercise of all RSUs and DSUs granted under the RSU/DSU Plan, combined with any equity securities granted under all other compensation arrangements adopted by Viemed, including the Option Plan, may not exceed 20% of the issued and outstanding common shares as of the effective date of the RSU/DSU Plan, namely 7,581,925 common shares based on the number of common shares that were outstanding immediately following completion of the Arrangement.

Pursuant to the RSU/DSU Plan, the Board (in consultation with the Compensation Committee) may from time to time, in its discretion, grant DSUs, or if permitted by the Board (in consultation with the Compensation Committee), eligible participants may elect to receive their compensation in the form of DSUs, which will consist of non-transferable rights to receive, on a deferred payment basis, the common shares or a cash payment equal to the fair market value of common shares, or a combination thereof. The number of DSUs to be credited to a person will be determined based on the amount of compensation to be paid in DSUs divided by the fair market value of the common shares as determined by the Board (in consultation with the Compensation Committee), on a one DSU per common share basis. DSUs will be redeemed by Viemed upon the holder ceasing to be employed by or ceasing to provide services to Viemed, as applicable, and will be settled pursuant to the terms and conditions of the RSU/DSU Plan.

The Board (in consultation with the Compensation Committee) may also from time to time grant RSUs, which will represent non-transferable rights to receive, upon vesting of the RSUs, the common shares or cash payments equal to the vesting date value of the common shares. Except as otherwise provided in the RSU/DSU Plan, RSUs will vest on the later of (a) the trigger date, being a date set by the Board (in consultation with the Compensation Committee) that is no later than December 1 of the third calendar year following the grant date, and (b) the date upon which all other applicable vesting conditions determined by the Board (in consultation with the Compensation Committee), including any performance based vesting conditions, have been met. Vesting may be accelerated in certain circumstances, including upon termination without cause in connection with a change of control of Viemed or upon death or permanent disability of the holder. RSUs will be automatically deemed cancelled without compensation if they have not vested on or before the applicable expiry date, which will be December 31 of the third calendar year after the grant date or such earlier date as may be established by the Board (in consultation with the Compensation Committee). Subject to the discretion of the Board (in consultation with the Compensation Committee), RSUs will also be cancelled without compensation in the event that a holder ceases to be engaged as a service provider of Viemed.

Page | 14 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Potential Payments upon Termination or Change in Control

Under the Cash Bonus Plan, if a Named Executive Officer’s employment is terminated by Viemed without cause or the Named Executive Officer resigns for good reason on or after the date of a change in control and prior to the payment of the cash bonus amount for the plan year in which the change of control occurs, then such Named Executive Officer will be entitled to a cash bonus amount, to be paid within 30 days of the termination of employment, equal to the pro rata portion of a target bonus determined as if all applicable measures for the target bonus amount had been achieved. Additionally, upon the occurrence of a change of control, each Named Executive Officer shall be entitled to receive any unpaid cash bonus amount that has been determined payable under the Cash Bonus Plan for any prior year. The payout amount that would have been made to the Named Executive Officers upon termination in the events noted in the preceding paragraph, if such events were to have occurred on December 31, 2019 are: Casey Hoyt (US $318,750), Michael Moore (US $270,000), W. Todd Zehnder (US $262,500), Trae Fitzgerald (US $112,500), Jerome Cambre (US $95,625).

In the event of a change of control, all Phantom Shares held by Named Executive Officers awarded under the Phantom Share Plan will automatically vest, which will trigger payment to such Named Executive Officer in a lump sum within 60 days of the change in control in cash with respect to the vested Phantom Shares. Awards of Phantom Shares made to Named Executive Officers will automatically vest on the date of a termination resulting from the death or disability of such Named Executive Officer.

In the event that a Named Executive Officer ceases to be an eligible person under the RSU/DSU Plan as a result of the retirement, death or total disability of the Named Executive Officer, all unvested RSUs held by such Named Executive Officer at that time will automatically vest, without further action. Additionally, all RSUs held by a Named Executive Officer will automatically vest without further action in the event of a termination of the Named Executive Officer by Viemed without cause or a termination of the Named Executive Officer or the Named Executive Officer’s resignation resulting from a material reduction or change in position, duties or remuneration of the Named Executive Officer at any time within 12 months after the occurrence of a change of control of Viemed. The market or payout value of share based awards that have not vested as disclosed in the above table titled “Outstanding Equity Awards” shows the incremental payments that would be made to the Named Executive Officers upon termination in the events noted in the preceding paragraph, if such events were to have occurred on December 31, 2019.

Under their employment agreements, in the event the employment of any of Messrs. Hoyt, Moore and Zehnder is terminated by us without “cause” or by the executive for “good reason,” such terminated officer will receive, subject to certain conditions, (i) severance equal to his annual base salary, payable in installments, for 12 months following the date of termination (the “Severance Period”), (ii) an amount equal to the unpaid bonus (if any) that the terminated officer would have earned under the Cash Bonus Plan and (iii) payment of the employer portion of the premiums required to continue the terminated officer’s group health care coverage under the applicable provisions of COBRA, until the earliest of (A) the end of the Severance Period, (B) the expiration of the terminated officer’s eligibility for the continuation coverage under COBRA, or (C) the date when the terminated officer becomes eligible for substantially equivalent health insurance coverage in connection with new employment. In the event the employment of any of Messrs. Hoyt, Moore and Zehnder is terminated by us without “cause” or by such officer for “good reason” within 12 months of a change in control (as defined under the Cash Bonus Plan), the terminated officer will receive, subject to certain conditions, the same benefits described in the previous sentence, except that the Severance Period will be increased to 24 months and the bonus will instead be payable at the target bonus amount.

In the event that a Named Executive Officer ceases to be employed by Viemed as a result of the death, disability or termination without cause of such Named Executive Officer, the Board may, in its discretion, resolve that all unvested options held by such Named Executive Officer under the Option Plan shall automatically vest in full. In the event of certain change of control transactions, Viemed may, at its option, permit a Named Executive Officer holding options under the Option Plan to exercise such options in advance of the change of control transaction. Viemed may also, at its option, provide for the assumption of the Option Plan and all outstanding options thereunder by the surviving entity in a change of control transaction.

Pursuant to the RSU/DSU Plan, all unvested RSUs held by any participant (including a Named Executive Officer) will automatically vest, without further act or formality, immediately in the event of a termination of employment by the Company without cause or termination arising from the resignation or cessation of employment or service by the participant based on a material reduction or change in position, duties or remuneration of the participant at any time within 12 months after the occurrence of a Change of Control (as such term is defined in the RSU/DSU Plan). The market or payout value of share based awards that have not vested as disclosed in the table below titled “Outstanding Share-Based Awards and Option-Based Awards” shows the incremental payments that would be made to the Named Executive Officers upon termination in the events noted in the preceding paragraph, if such events were to have occurred on December 31, 2019.

Page | 15 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Pursuant to the RSU/DSU Plan, all unvested RSUs held by any participant (including a Named Executive Officer) will automatically vest, without further act or formality, immediately in the event of a termination of employment by the Company without cause or termination arising from the resignation or cessation of employment or service by the participant based on a material reduction or change in position, duties or remuneration of the participant at any time within 12 months after the occurrence of a Change of Control (as such term is defined in the RSU/DSU Plan). The market or payout value of share based awards that have not vested as disclosed in the table below titled “Outstanding Share-Based Awards and Option-Based Awards” shows the incremental payments that would be made to the Named Executive Officers upon termination in the events noted in the preceding paragraph, if such events were to have occurred on December 31, 2019.

Compensation of Directors

The following table sets forth all compensation provided to each of the directors of Viemed during the year ended December 31, 2019 (other than a director who is a Named Executive Officer, whose disclosure with respect to compensation is set out above).

Name | Year | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Option Awards ($)(3)(4) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||||

Nitin Kaushal | 2019 | 75,000 | 73,447 | — | — | — | 14,479 | 162,926 | ||||||||

Randy Dobbs | 2019 | 75,000 | 73,447 | — | — | — | 14,479 | 162,926 | ||||||||

Timothy Smokoff | 2019 | 75,000 | 73,447 | — | — | — | 14,479 | 162,926 | ||||||||

Bruce Greenstein | 2019 | 75,000 | 73,447 | — | — | — | 14,479 | 162,926 | ||||||||

William Frazier(5) | 2019 | — | — | — | — | — | — | — | ||||||||

(1) Restricted stock award value was calculated at the date of the grant using the closing stock price on the date of the grant and represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in “Note 8 - Shareholders’ Equity” to our audited financial statements for the fiscal years ended December 31, 2019 and 2018 included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on March 4, 2020.

(2) These awards will vest on August 26, 2020.

(3) The amounts shown represent the aggregate grant date fair value for option awards computed in accordance with FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in “Note 8 - Shareholders’ Equity” to our audited financial statements for the fiscal years ended December 31, 2019 and 2018 included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC on March 4, 2020.

(4) As of December 31, 2019, Mr. Kaushal had 326,261 options outstanding, Mr. Dobbs had 36,261 options outstanding, Mr. Smokoff had 36,261 options outstanding and Mr. Greenstein had no options outstanding.

(5) As an employee of Viemed, Dr. Frazier does not receive any compensation for his service as a director of Viemed.

Narrative to Director Compensation Table

Independent directors of Viemed receive cash compensation equal to $60,000 per year. In addition, the Chair of the Board and each Chair of a committee of the Board is paid $15,000 per year. In order to align their interests with those of Viemed, independent directors are also eligible to receive awards under the Option Plan and RSU/DSU Plan in an amount up to a deemed value equal to a maximum of $75,000 per year. Independent directors do not receive meeting fees but are reimbursed for travel and miscellaneous expenses to attend meeting and activities of the Board or its committees.

Page | 16 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth all awards outstanding for each of the directors of the Company (other than a Named Executive Officer, whose disclosure with respect to incentive plan awards is set out above) as of December 31, 2019 (expressed in Canadian dollars):

Option-Based Awards | Share-Based Awards | |||||||||||||

Name | Number of securities underlying unexercised options (#) | Option exercise price(1) ($) | Option expiration date | Value of unexercised in-the-money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share based awards that have not vested(2) ($) | ||||||||

Nitin Kaushal | 120,000 | $ | 1.50 | 11/01/2023 | $ | 795,600 | ||||||||

120,000 | $ | 3.18 | 12/01/2024 | $ | 594,000 | |||||||||

50,000 | $ | 8.44 | 07/28/2025 | Nil | ||||||||||

36,261 | $ | 2.27 | 01/04/2028 | $ | 212,489 | 11,970 | $ | 97,316 | ||||||

Randy Dobbs | 36,261 | $ | 2.27 | 01/04/2028 | $ | 212,489 | 11,970 | $ | 97,316 | |||||

Timothy Smokoff | 36,261 | $ | 2.27 | 01/04/2028 | $ | 212,489 | 11,970 | $ | 97,316 | |||||

Bruce Greenstein | Nil | N/A | N/A | N/A | 11,970 | $ | 97,316 | |||||||

Dr. William Frazier | 36,261 | $ | 2.27 | 01/04/2028 | $ | 212,489 | 11,970 | $ | 97,316 | |||||

(1) Aggregate value is calculated based on the difference between the exercise price of the options and the last closing price of the common shares on the Toronto Stock Exchange in the fiscal year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

(2) Aggregate value is calculated based on the last closing price of the common shares on the Toronto Stock Exchange in the fiscal year ended December 31, 2019 (CDN $8.13 on December 31, 2019).

Incentive Plan Awards - Value Vested or Earned During the Year

The following table sets forth the value of all incentive plan awards vested or earned for each director of the Company during the fiscal year ended December 31, 2019 (other than a Named Executive Officer, whose disclosure with respect to incentive plan awards is set out above)(expressed in Canadian dollars):

Name | Option-based awards - Value vested during the year ($)(1) | Share-based awards - Value vested during the year ($)(2) | Non-equity incentive plan compensation - Value earned during the year ($) | ||||

Nitin Kaushal | $ | 38,678 | $ | 174,806 | N/A | ||

Randy Dobbs | $ | 38,678 | $ | 174,806 | N/A | ||

Timothy Smokoff | $ | 38,678 | $ | 174,806 | N/A | ||

Bruce Greenstein | $ | — | $ | 174,806 | N/A | ||

William Frazier | $ | 38,678 | $ | 174,806 | N/A | ||

(1) Aggregate value is calculated based on the difference between the exercise price of the options and the closing price of the common shares on the Toronto Stock Exchange on the date they vest.

(2) Aggregate value is calculated based on the closing price of the common shares on the Toronto Stock Exchange on the date they vest.

Page | 17 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Security Ownership of Certain Beneficial Owners and Management

The table set forth below is information with respect to beneficial ownership of common shares as of April 1, 2020 by each person known to us to beneficially own more than five percent of our outstanding common shares, by each of the executive officers named in the Summary Compensation Table under Item 11 above, by each of our directors and by all of our current executive officers and directors as a group. To our knowledge, each person named in the table has sole voting and investment power with respect to the common shares identified as beneficially owned.

Unless otherwise indicated, the address of each of the individuals named below is c/o Viemed Healthcare, Inc., 625 E. Kaliste Saloom Road, Lafayette, Louisiana 70508.

Name and Address of Beneficial Owner | Number of shares of Common Shares | Percentage of Common Shares Owned(1) | ||

5% Stockholders | ||||

Claret Asset Management Corporation (2) | 2,389,204 | 6.2 | % | |

Directors and Executive Officers: | ||||

Casey Hoyt(3) | 2,314,563 | 6.0 | % | |

Michael Moore(4) | 2,197,902 | 5.7 | % | |

W. Todd Zehnder(5) | 383,099 | 1.0 | % | |

Trae Fitzgerald(6) | 81,466 | * | ||

Jerome Cambre(7) | 98,222 | * | ||

Randy Dobbs(8) | 66,216 | * | ||

Timothy Smokoff(9) | 58,216 | * | ||

Nitin Kaushal(10) | 383,408 | 1.0 | % | |

Dr. William Frazier(11) | 63,216 | * | ||

Bruce Greenstein | 19,042 | * | ||

Directors and executive officers as a group (10 persons)(12) | 5,665,350 | 14.7 | % | |

*Denotes less than 1% beneficially owned.

(1) Based on 38,486,772 shares outstanding as of April 1, 2020.

(2) Information based on the Schedule 13G filed with the SEC on January 15, 2020, by Claret Asset Management Corporation (“CAMC”). CAMC has sole voting and dispositive power over all 2,389,204 shares. The address for CAMC is 2000 McGill College Avenue, Suite 1150, Montreal, Quebec, Canada H3A 3N4.

(3) Includes 241,378 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(4) Includes 206,101 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(5) Includes 268,765 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(6) Includes 47,035 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(7) Includes 56,638 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(8) Includes 24,174 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(9) Includes 24,174 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(10) Includes 314,174 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(11) Includes 44,174 shares issuable upon the exercise of options that are vested or will vest within 60 days.

(12) Includes 1,226,613 shares issuable upon the exercise of options that are vested or will vest within 60 days.

Page | 18 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Securities Authorized for Issuance under Equity Incentive Plans.

The following table provides information as of December 31, 2019 regarding the number of common shares to be issued pursuant to equity compensation plans of Viemed and the weighted-average exercise price of said securities.

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a)(1) | Weighted-average exercise price of outstanding options, warrants and rights (CDN$) (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | ||||||

Equity compensation plans approved by securityholders(1) | 3,260,527 | $ | 3.39 | 3,076,136 | |||||

Equity compensation plans not approved by securityholders | — | — | |||||||

Total | 3,260,527 | $ | 3.39 | 3,076,136 | |||||

(1) These securities were granted under the Option Plan and the RSU/DSU Plan. Includes 1,545,450 options and 1,715,077 RSUs.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Certain Relationships and Related Transactions

On August 1, 2015, the Company entered into ten-year triple net lease agreements for its former principal executive office at 202 N. Luke Street, Lafayette, Louisiana 70506 (collectively, the “Executive Office Lease”) with a rental company affiliated with the Company’s Chief Executive Officer, Casey Hoyt, and President, Michael Moore. Rental payments under the Executive Officer Lease are $20,000 per month, plus taxes, utilities and maintenance. Total rental payments for the use of the Executive Office Lease were $242,000 for the year ended December 31, 2019 and $235,000 for the year ended December 31, 2018.

Other than the Executive Office Lease, since the beginning of the year ended 2018, there have not been, nor are there currently proposed, any transaction or series of similar transactions to which we were or are a party in which the amount involved exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets at year end 2018 and 2019 and in which any of our directors, executive officers, holders of more than 5% of any class of our voting securities, or any member of the immediate family of any of the foregoing persons, had or will have a direct or indirect material interest.

Independence of the Board of Directors

The Board is currently composed of seven directors who provide us with a wide diversity of business experience. Our Board has determined that Randy Dobbs (Chairman), Bruce Greenstein, Nitin Kaushal and Tim Smokoff are independent in accordance with the listing requirements of the Nasdaq Stock Market, representing a majority of the Board. Each of the independent directors has no direct or indirect material relationship with us, including any business or other relationship, that could reasonably be expected to interfere with the director’s ability to act with a view to our best interests or that could reasonably be expected to interfere with the exercise of the director’s independent judgment. Each member of our Audit Committee and Compensation Committee is an independent director within the meaning of the rules of the Nasdaq Stock Market and meets the standards for independence required by the requirements of National Instrument 58-101 - Disclosure of Corporate Governance Practices and U.S. securities law requirements applicable to public companies, including Rule 10A-3 of the Exchange Act with respect to Audit Committee members and Rule 10C-1 under the Exchange Act with respect to Compensation Committee members. In addition, each member of the Corporate Governance and Nominating Committee is also an independent director. See “Item 10. Directors,Executive Officers and Corporate Governance.” The independent directors have the opportunity, at their discretion, to hold ad hoc meetings that are not attended by management and non-independent directors.

Page | 19 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Item 14. Principal Accounting Fees and Services

Independent Registered Public Accounting Firm

On June 12, 2019, the Company engaged a new independent registered public accounting firm, Ernst & Young, LLP ("EY") to replace the Company's prior independent registered public firm, MNP, LLP ("MNP"). The change in the Company's independent registered public accounting firm was not the result of any disagreements with the Company's prior accounting firm, instead, the Company determined that it was advisable to engage a new independent registered public accounting firm due to the changes in the Company's applicable reporting requirements resulting