Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KKR Real Estate Finance Trust Inc. | a202003-exhibit99x1.htm |

| 8-K - 8-K - KKR Real Estate Finance Trust Inc. | a202003-kref8xk.htm |

KKR Real Estate Finance Trust Inc. 1st Quarter 2020 Supplemental Information April 28, 2020

Legal Disclosures This presentation has been prepared for KKR Real Estate Finance Trust Inc. (NYSE: KREF) for the benefit of its stockholders. This presentation is solely for informational purposes in connection with evaluating the business, operations and financial results of KKR Real Estate Finance Trust Inc. and its subsidiaries (collectively, "KREF“ or the “Company”). This presentation is not and shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell, any securities, any investment advice or any other service by KREF. Nothing in this presentation constitutes the provision of any tax, accounting, financial, investment, regulatory, legal or other advice by KREF or its advisors. This presentation may not be referenced, quoted or linked by website by any third party, in whole or in part, except as agreed to in writing by KREF. This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the Company’s current views with respect to, among other things, its future operations and financial performance. You can identify these forward looking statements by the use of words such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical fact or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify, in particular due to the uncertainties created by the COVID-19 pandemic, including the projected impact of COVID-19 on our business, financial performance and operating results. The forward-looking statements are based on the Company’s beliefs, assumptions and expectations, taking into account all information currently available to it. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to the Company or are within its control. Such forward-looking statements are subject to various risks and uncertainties, including, among other things: the severity and duration of the COVID-19 pandemic; potential risks and uncertainties relating to the ultimate geographic spread of COVID-19; actions that may be taken by governmental authorities to contain the COVID-19 outbreak or to treat its impact; the potential negative impacts of COVID-19 on the global economy and the impacts of COVID-19 on the Company’s financial condition and business operations; deterioration in the performance of the properties securing our investments that may cause deterioration in the performance of our investments and, potentially, principal losses to us; difficulty or delays in redeploying the proceeds from repayments of our existing investments; the general political, economic and competitive conditions in the United States and in any foreign jurisdictions in which the Company invests; the level and volatility of prevailing interest rates and credit spreads; adverse changes in the real estate and real estate capital markets; general volatility of the securities markets in which the Company participates; changes in the Company’s business, investment strategies or target assets; difficulty in obtaining financing or raising capital; adverse legislative or regulatory developments; reductions in the yield on the Company’s investments and increases in the cost of the Company’s financing; acts of God such as hurricanes, earthquakes and other natural disasters, pandemics such as COVID-19, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/ or losses to the Company or the owners and operators of the real estate securing the Company’s investments; deterioration in the performance of properties securing the Company’s investments that may cause deterioration in the performance of the Company’s investments and, potentially, principal losses to the Company; defaults by borrowers in paying debt service on outstanding indebtedness; the adequacy of collateral securing the Company’s investments and declines in the fair value of the Company’s investments; adverse developments in the availability of desirable investment opportunities whether they are due to competition, regulation or otherwise; difficulty in successfully managing the Company’s growth, including integrating new assets into the Company’s existing systems; the cost of operating the Company’s platform, including, but not limited to, the cost of operating a real estate investment platform and the cost of operating as a publicly traded company; the availability of qualified personnel and the Company’s relationship with our Manager; KKR controls the Company and its interests may conflict with those of the Company’s stockholders in the future; the Company’s qualification as a REIT for U.S. federal income tax purposes and the Company’s exclusion from registration under the Investment Company Act of 1940; authoritative GAAP or policy changes from such standard-setting bodies such as the Financial Accounting Standards Board, the Securities and Exchange Commission (the “SEC”), the Internal Revenue Service, the New York Stock Exchange and other authorities that the Company is subject to, as well as their counterparts in any foreign jurisdictions where the Company might do business; and other risks and uncertainties, including those described under Part I—Item 1A. “Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and under Part II – Item 1A. “Risk Factors” of the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in this presentation. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and information included in this presentation and in the Company’s filings with the SEC. All forward looking statements in this presentation speak only as of April 27, 2020. KREF undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All financial information in this presentation is as of March 31, 2020 unless otherwise indicated. This presentation also includes non-GAAP financial measures, including Core Earnings and Core Earnings per Diluted Share. Such non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix of this presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with U.S. GAAP. 2

1Q'20 Key Highlights • Net Loss(1) of $35.2 million or ($0.61) per diluted share, net of $55.3 million or ($0.96) per diluted share for Current Expected Credit Loss (“CECL”) adjustment(2) • Core Earnings(3) of $25.3 million or $0.44 per diluted share • Repurchased 1.6 million shares at an average price per share of $11.64 for a total of $19.2 million; year-to- Financials date as of April 28, 2020, KREF repurchased 2,037,637 shares of common stock at an average price of $12.27 for a total of $25.0 million • Book value(4) of $1,030.2 million or $18.45 per share, inclusive of ($70.3) million or ($1.22) per share CECL adjustment • Paid 1Q dividend of $0.43 per share, equating to an 11.9% annualized dividend yield(5) • $369.9 million cash on hand and $80.1 million approved and undrawn credit capacity Liquidity & • 73% of outstanding secured financing is non-mark-to-market Capitalization • Increased borrowing capacity on the corporate revolving credit facility by $85.0 million to $335.0 million • Entered into a new $500.0 million non-mark-to-market warehouse facility • Outstanding total portfolio of $5.2 billion, up 3% from 4Q'19 and 40% from 1Q'19 • Multifamily and office assets represent 85% of loan portfolio; only 8% of portfolio is comprised of hospitality Portfolio and retail asset classes • Senior loans weighted average LTV of 66%(6) • Weighted average risk rating of 3.0 (Average Risk) • 99.9% of the loan portfolio is floating rate Interest Rate • Portfolio benefits from decreasing rates given in place LIBOR floors Sensitivity • Approximately 98% of the portfolio is subject to LIBOR floor of at least 0.95% Note: Net income attributable to common stockholders per share and Core Earnings per share are based on diluted weighted average shares outstanding as of March 31, 2020; book value per share is based on shares outstanding at March 31, 2020. (1) Represents Net Income attributable to common stockholders. (2) In connection with first quarter adoption of Accounting Standards Updated 2016-13, Financial Instruments-Credit Losses (“ASU 2016-13” or “CECL”) (3) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (4) Book value per share includes the year to date (“YTD”) impact of a ($0.4) million, or ($0.01) per common share, non-cash redemption value adjustment to our redeemable Special Non-Voting Preferred Stock (‘SNVPS’), resulting in a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book value as of March 31, 2020. (5) Based on KREF common stock closing price of $14.40 as of April 27, 2020. (6) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value. 3

Conservative Portfolio Construction and Liability Management Investment Portfolio Evolution Property Type Evolution <3% <1% 100% 100% 86% 85% 27% 80% 80% 6% 62% Multifamily 60% Other Securities 60% and Office 97% 99% Mezz Loan Hospitality 31% 40% Senior Loan 40% and Retail 67% 20% 20% 7% 8% 0% 0% At IPO 4Q'18 1Q'20 At IPO 4Q'18 1Q'20 Larger Average Loan Size Increased Non-MTM Financing $150 100% 80% $100 60% $130 40% 73% $50 $100 60% $50 20% 0% $0 0% At IPO 4Q'18 1Q'20 At IPO 4Q'18 1Q'20 KREF benefits from KKR's alignment of interest (36% ownership), one firm culture and integrated real estate platform 4

1Q'20 Financial Summary Income Statement Balance Sheet ($ in Millions, except per share data) ($ in Millions, except per share data) 1Q20 1Q20 Net Interest Income $32.0 Total Portfolio $5,232.5 Other Income (1.5) Term Credit Facilities 1,095.5 Operating Expenses and Other (10.4) Term Lending Agreement 896.8 CECL Provision for Credit Losses, Net (55.3) Asset Specific Financing 82.3 Net Income Attributable to Common Stockholders ($35.2) Warehouse Facility 45.4 Weighted Average Shares Outstanding, Diluted(1) 57,346,726 Revolving Credit Agreements 335.0 Net Income per Share, Diluted ($0.61) Convertible Notes 143.8 Total Debt $2,598.8 Core Earnings(2) $25.3 Term Loan Facility 924.9 Weighted Average Shares Outstanding, Diluted 57,432,611 Collateralized Loan Obligation 810.0 Core Earnings per Share, Diluted(2) $0.44 Senior Loan Interests(3) 143.6 Dividend per Share $0.43 Total Leverage $4,477.3 Cash 369.9 Total Permanent Equity 1,030.2 Debt-to-Equity Ratio(4) 2.2x Total Leverage Ratio(5) 4.0x Shares Outstanding 55,838,032 Book Value per Share(6) $18.45 (1) Excludes 85,885 anti-dilutive restricted stock units. (2) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (3) Includes loans financed through the non-recourse sale of a senior interest that is not included in our GAAP consolidated financial statements. (4) Represents (i) total debt less cash to (ii) total permanent equity. The debt-to-equity ratio, adjusted for the impact of CECL allowance for credit losses, is 2.0x at 1Q'20. (5) Represents (i) total leverage less cash to (ii) total permanent equity. The total leverage ratio, adjusted for the impact of CECL allowance for credit losses, is 3.7x at 1Q'20. (6) Book value per share includes (i) CECL credit loss provision impact of ($70.3) million or ($1.22) per common share, and (2) the YTD impact of ($0.4) million, or ($0.01) per common share, non-cash redemption value adjustment to our redeemable SNVPS, resulting in a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book value as of March 31, 2020. 5

Recent Operating Performance • 1Q'20 Net loss attributable to common stockholders of ($35.2) million or ($0.61) per diluted share, net of ($55.3) million or ($0.96) per diluted share, provision for credit losses in connection with CECL adoption • 1Q'20 Core Earnings(1) of $25.3 million or $0.44 per diluted share • Book value of $1,030.2 million or $18.45 per share in 1Q'20(3), net of (i) ($70.3) million or ($1.22) per share CECL impact and (ii) $19.2 million of 1,648,551 share buyback, compared to $1,122.0 million or $19.52 per share in 4Q'19 • Paid 1Q dividend of $0.43 per share on April 15, 2020, equating to an 11.9% annualized dividend yield based on KREF common stock closing price of $14.40 as of April 27, 2020 and 9.3% based on 1Q'20 book value per share Net Income(2) and Core Earnings(1) Dividends and Book Value Per Share Net income per diluted share: Book value per share: $19.67 $19.52 $18.45 $0.43 $0.43 ($0.61) CECL adjustment: Core earnings per diluted share: n/a n/a ($1.22) $0.44 $0.44 $0.44 Dividend per share: $0.43 $0.43 $0.43 ($ in Millions) 9.3% $24.7 $25.3 $24.8 $25.5 $25.3 8.7% 8.8% 1Q'19 4Q'19 1Q'20 ($35.2) 1Q'19 4Q'19 1Q'20 Net Income Core Earnings Annualized dividend yield based on book value per share (1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP. (2) Represents Net Income attributable to common stockholders. (3) Book value per share includes the YTD impact of ($0.4) million, or ($0.01) per common share, non-cash redemption value adjustment to our redeemable SNVPS, resulting in a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book value as of March 31, 2020. 6

1Q'20 Equity Activity Changes in Book Value per Share • Cumulative provision for credit losses of ($70.3) million or ($1.22) per diluted share during 1Q'20, inclusive of ($4.3) million or ($0.07) per diluted share allowance for unfunded loan commitments $0.40 ($0.43) ($0.26) $19.67 $(0.05) $0.04 $19.52 $0.19 ($0.96) $18.45 Book Value Net Income, 1Q'20 Share RECOP I Accretion to Subtotal Pre- CECL Day-One 1Q'20 CECL Book Value at 4Q'19 excl. CECL and Dividend Buybacks(3) Unrealized APIC due to CECL impact Adjustment Provision(1) at 1Q'20 (4) RECOP I MTM(1)(2) MTM (1) RSU Amortization (1) Collectively, represents ($0.61) net loss per common share attributable to common stockholders. (2) Includes $2.8 million, or $0.05 per common share, non-recurring exit fee income in 1Q'20. (3) Repurchased 1.6 million shares at an average price per share of $11.64 for a total of $19.2 million. (4) Book value per share includes the YTD impact of ($0.4) million, or ($0.01) per common share, non-cash redemption value adjustment to our redeemable SNVPS, resulting in a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book value as of March 31, 2020. 7

1Q'20 Loan Activity Summary of 1Q'20 Originations $353mm 94% 100% Committed to 3 New Loans Senior Loans Floating-Rate Loans 66% L+3.2% 11.3% Weighted Average LTV Weighted Average Coupon Weighted Average Underwritten IRR (1) Portfolio Funding Activity(2) ($ in Millions) $5,777 $5,826 Future Funding $5,696 Obligations(3) $5,489 $619 $593 $556 $765 $621 $204 $338 $180 $272 $537 $473 $4,111 $1,479 $366 $5,221 $5,233 $4,952 $5,075 $5,075 $3,745 1Q'19 2Q'19 2Q'19 2Q'19 3Q'19 3Q'19 3Q'19 4Q'19 4Q'19 4Q'19 1Q'20 1Q'20 1Q'20 (4) Portfolio Fundings Repayments Portfolio Fundings Repayments (5) Portfolio Fundings Repayments (4) Portfolio Fundings Repayments Portfolio (1) See Appendix for definition. (2) Includes capital committed to our investment in an aggregator vehicle that invests in CMBS. (3) Future funding obligations are generally contingent upon certain events and may not result in investment by us. (4) Excludes non-consolidated senior interests and includes pari passu and vertical loan syndications, as applicable. (5) Includes sale of residual direct CMBS B-Piece investments with an initial cost of $10.0 million. 8

1Q'20 Loan Originations – Case Studies Investment New York Multifamily San Diego Multifamily Plano Office Loan Type Floating-Rate Mezzanine Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Loan Size $20.0 million $106.0 million $226.5 million Location Westbury, NY San Diego, CA Plano, TX 237-unit Class-A 231-unit Class-A Class-A Office Campus Collateral Multifamily Multifamily totaling 930k SF Loan Purpose Construction Acquisition Refinance LTV(1) 66% 71% 64% Investment Date January 2020 February 2020 February 2020 Asset Photos (1) LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated. 9

KREF Portfolio by the Numbers • Outstanding total portfolio of $5.2 billion as of March 31, 2020 • Multifamily and office loans comprise 85% of the portfolio and hospitality and retail loans comprise 8% of the portfolio Total Portfolio Growth Property Type(2) ($ in Millions) ($ in Millions) Current Portfolio: $5.2 billion(1) • Multifamily YoY increase of 97% Including net funding and repayment activity subsequent to quarter end $2,956 1Q'19 1Q'20 $5,221 $5,233 $5,075 $4,952 $4,134 $3,745 $3,383 $1,504 $1,555 $2,960 $1,441 $2,474 $2,083 $1,812 $1,265 $233 $216 $216 $166 $143 $132 $138 $131 $69 $- 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 Multifamily Office Retail Hospitality Condo Industrial Student (Resi) Housing (1) As of April 27, 2020. (2) Chart based on total assets. Total assets reflect the principal amount outstanding of our senior and mezzanine loans. 10

1Q'20 KREF Loan Portfolio • $5.2 billion loan portfolio comprised of 40 investments • Portfolio weighted average LTV of 66%(1) Geography(2) Investment Type(3) Interest Rate Type Mezz Fixed 0.4% 0.1% Senior Floating Loans 99.9% 99.6% Property Type Condo Industrial (Residential) 3% Student 3% Hospitality Housing 4% 1% Retail 4% Office 28% Multifamily 57% Multifamily Other (<5%) NY Office Class-B 19% 22% 12% TX Class-B 5% 25% WA IL Class-A Class-A 7% 12% 75% 88% VA 7% PA CA 9% 7% FL MA 5% 7% Note: The charts above are based on total assets. Total assets reflect the principal amount of our senior and mezzanine loans. (1) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value. See page 20 for additional details. (2) Map does not include Midwest Mezzanine portfolio ($5.5 million). (3) Senior loans include senior mortgages and similar credit quality loans, including related contiguous junior participations in senior loans where KREF has financed a loan with structural leverage through the non-recourse sale of a corresponding first mortgage and excludes vertical loan syndications. 11

Portfolio Credit Quality Remains Strong • KREF’s loan portfolio is 100% performing, with no defaulted or impaired loans Loan-to-Value(1,2) Risk Rating Distribution(2) (% of total portfolio) (% of portfolio) Weighted Average Weighted Average LTV(3): 66% Risk Rating(3): 2.9 4Q'19 4Q'19 89% 29% 25% 20% 18% 9% 8% 2% 1 2 3 4 5 0% - 60% 60% - 65% 65% - 70% 70% - 75% 75% - 80% 1 5 33 0 0 Loan Count Weighted Average Weighted Average 1Q'20 LTV(3): 66% 1Q'20 Risk Rating(3): 3.0 77% 28% 27% 20% 17% 14% 8% 3% 6% 1 2 3 4 5 0% - 60% 60% - 65% 65% - 70% 70% - 75% 75% - 80% 2 3 28 7 0 Loan Count (1) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value. (2) Includes non-consolidated senior interests and excludes vertical loan syndications. (3) Weighted average is weighted by current principal amount for our senior and mezzanine loans. 12

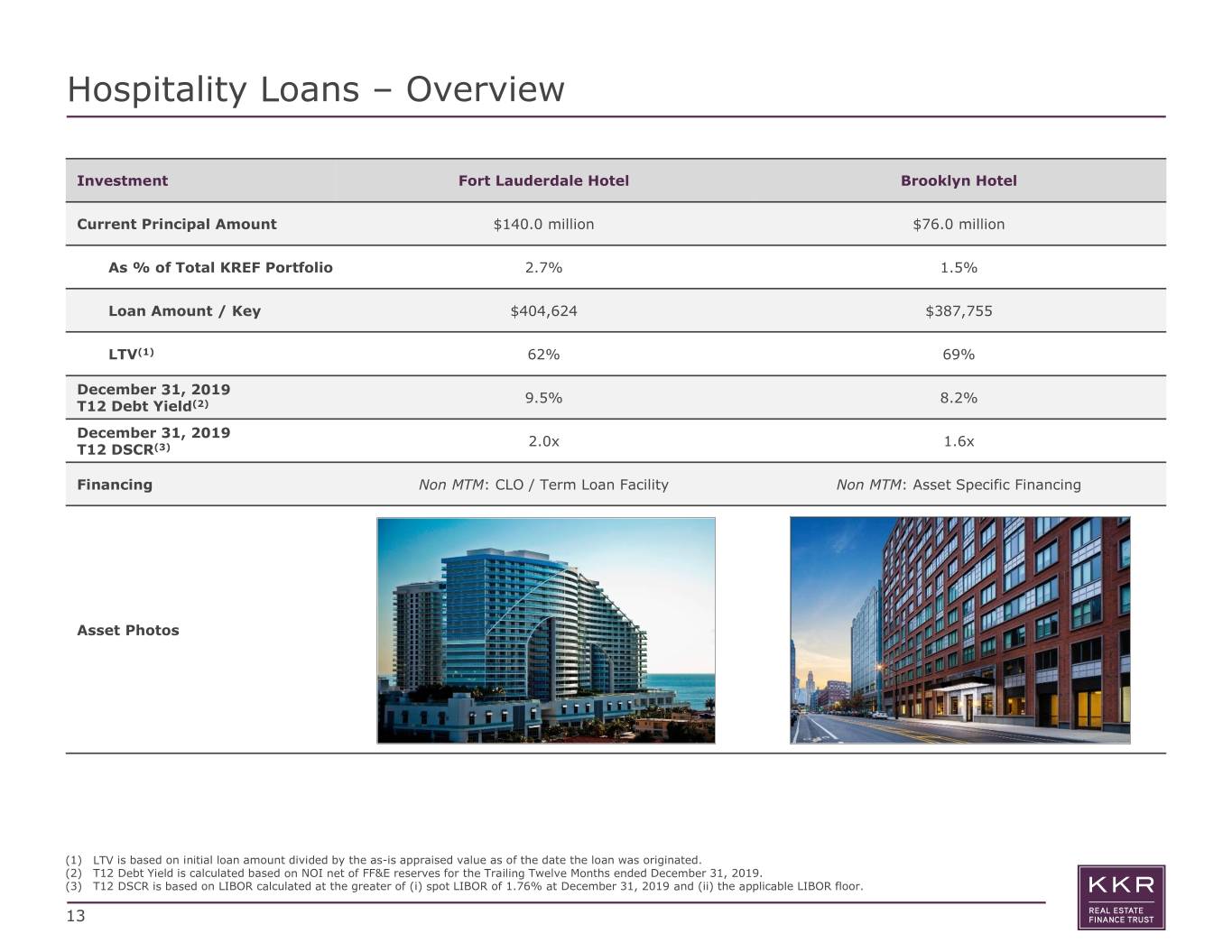

Hospitality Loans – Overview Investment Fort Lauderdale Hotel Brooklyn Hotel Current Principal Amount $140.0 million $76.0 million As % of Total KREF Portfolio 2.7% 1.5% Loan Amount / Key $404,624 $387,755 LTV(1) 62% 69% December 31, 2019 9.5% 8.2% T12 Debt Yield(2) December 31, 2019 2.0x 1.6x T12 DSCR(3) Financing Non MTM: CLO / Term Loan Facility Non MTM: Asset Specific Financing Asset Photos (1) LTV is based on initial loan amount divided by the as-is appraised value as of the date the loan was originated. (2) T12 Debt Yield is calculated based on NOI net of FF&E reserves for the Trailing Twelve Months ended December 31, 2019. (3) T12 DSCR is based on LIBOR calculated at the greater of (i) spot LIBOR of 1.76% at December 31, 2019 and (ii) the applicable LIBOR floor. 13

Financing Overview: 73% Non-Mark-To-Market • Diversified financing sources totaling $6.1 billion with $1.7 billion of undrawn capacity Summary of Outstanding Financing Leverage Ratios ($ in Millions) Weighted Maximum Outstanding Average 4.0x Capacity Face Amount Coupon 0.3x Term Credit $2,000 $1,096 L+1.7% Facilities Term Lending 2.2x CECL Impact $900 $897 L+1.9% 3.7x Agreement 0.2x Pre-CECL Warehouse $500 $45 L+1.5% 2.0x Facility Asset Specific $300 $82 L+1.7% Debt-to-Equity Total Leverage Financing Ratio(2) Ratio(3) Convertible $144 $144 6.1% Notes Outstanding Secured Financing(4) Corporate Revolving Credit $335 $335 L+2.0% Term Credit Facility Facilities Term Loan 27% Facility Total Corporate Warehouse 23% $4,179 $2,599 Facility Obligations 1% Term Loan $1,000 $925 L+1.5% Asset Specific Facility Term Lending Financing Agreement Collateralized 2% $810 $810 L+1.4% 23% Loan Obligation Senior Loan Senior Loan Interests Non-Mark- (1) $144 $144 L+1.6% 4% Collateralized to-Market Interests Loan Obligation 73% 20% Total Leverage $6,133 $4,478 (1) Includes $143.6 million of Non-Consolidated Senior Interests, which result from non-recourse sales of senior loan interest in loans KREF originated. (2) Represents (i) facilities outstanding face amount (excluding non-recourse term loan facility), and convertible notes less cash to (ii) total permanent equity, in each case, at period end. The debt-to-equity ratio, adjusted for the impact of CECL allowance for credit losses, is 2.0x at 1Q'20. (3) Represents (i) facilities outstanding face amount, convertible notes, loan participations sold (excluding pari passu and vertical loan syndications), non-consolidated senior loan interests, and collateralized loan obligation less cash to (ii) total permanent equity, in each case, at period end. The total leverage ratio, adjusted for the impact of CECL allowance for credit losses, is 3.7x at 1Q'20. (4) Based on outstanding face amount of secured financing and excludes convertible notes and the corporate revolving credit facility. 14

Financing Overview: Term Credit Facilities ($ in Millions) Total / Weighted Counterparty Average Drawn $469 $405 $222 $1,096 Capacity $1,000 $600 $400 $2,000 Collateral: Loans / 5 Loans / $653 3 Loans / $545 3 Loans / $311 11 Loans / $1,509 Principal Balance Final Stated Maturity November 2023 December 2022 October 2020 - Weighted Average L + 1.50% L + 1.76% L + 1.93% L + 1.68% Pricing Weighted Average 71.8% 74.4% 71.3% 72.6% Advance Student Housing Condo 5% 9% Office 9% Property Type: Multi- family Retail 62% 15% 15

Liquidity Overview ($ in Millions) Sources of Available Liquidity $500.0 $450.0 Capacity $450.0 $80.1 $400.0 Cash and Cash $369.9 Equivalents $350.0 $369.9 Term Credit 6.9 Facilities $300.0 Term Lending 1.6 Agreement $250.0 Warehouse 2.9 Facility $200.0 Asset Specific 2.6 $150.0 Financing Term Loan 66.2 $100.0 Facility Corporate Revolving $50.0 - Credit Facility $0.0 Total Available $450.0 Cash Approved and Undrawn Total Available Liquidity Credit Capacity (1) (1) Represents under-levered amounts under financing facilities. While these amounts were previously contractually approved and/or drawn, in certain cases, the lender’s consent is required for us to (re)borrow these amounts. 16

Rate Floors Provide Protection in a Declining Rate Environment • 99.9% of the portfolio is indexed to one-month USD LIBOR • Portfolio benefits from decreasing rates given in place LIBOR floors 98% of the portfolio is subject to a LIBOR floor of at least 0.95% 5% of total outstanding financing is subject to a LIBOR floor greater than 0.0% Net Interest Income Per Share Sensitivity to LIBOR Movements(1) ($ Impact Per Share / Q) $0.25 $0.21 $0.20 $0.17 $0.15 $0.13 $0.10 $0.09 $0.05 $0.05 $0.02 $0.00 $0.00 1.76% 1.50% 1.25% 0.99% 0.75% 0.50% 0.25% LIBOR as of LIBOR as of 12/31/2019 3/31/2020 LIBOR (1) Portfolio as of March 31, 2020. 17

Appendix 18

Portfolio Details Loan Per Investment Committed Current Net Future Max Remaining # Investment Location Property Type Coupon(4)(5) SQFT / Unit / LTV(4)(7) Date Principal Amount Principal Amount Equity(2) Funding(3) Term (Yrs)(4)(6) Key Senior Loans(1) 1 Senior Loan Brooklyn, NY Multifamily 5/22/2019 $386.0 $367.6 $91.4 $18.4 L + 2.7% 4.2 $ 428,966 / unit 51% 2 Senior Loan Chicago, IL Multifamily 6/28/2019 340.0 320.3 68.3 19.7 L + 2.8% 6.3 $ 400,426 / unit 75% 3 Senior Loan Arlington, VA Multifamily 6/28/2019 273.5 264.6 65.5 8.9 L + 2.5% 4.3 $ 238,357 / unit 70% 4 Senior Loan New York, NY Multifamily 12/20/2018 234.5 190.2 32.6 44.3 L + 3.6% 3.8 $ 970,296 / unit 71% 5 Senior Loan Boston, MA Office 5/23/2018 227.3 204.9 38.0 22.3 L + 2.4% 3.2 $ 442 / sqft 68% 6 Senior Loan Plano, TX Office 2/6/2020 226.5 164.4 32.4 62.1 L + 2.7% 4.9 $ 177 / sqft 64% 7 Senior Loan Various Multifamily 5/31/2019 216.5 200.8 34.5 15.7 L + 3.5% 4.2 $ 187,693 / unit 74% 8 Senior Loan Minneapolis, MN Office 11/13/2017 194.4 187.8 33.2 6.6 L + 3.8% 2.7 $ 176 / sqft 63% 9 Senior Loan Chicago, IL Multifamily 6/6/2019 186.0 179.5 35.2 1.3 L + 2.7% 4.2 $ 364,837 / unit 74% 10 Senior Loan Denver, CO Multifamily 8/13/2019 185.0 154.4 59.4 30.6 L + 2.8% 4.4 $ 259,986 / unit 64% 11 Senior Loan Irvine, CA Office 11/15/2019 183.3 151.0 34.3 32.3 L + 2.9% 4.6 $ 248 / sqft 66% 12 Senior Loan Philadelphia, PA Office 4/11/2019 182.6 153.3 37.9 29.3 L + 2.6% 4.1 $ 217 / sqft 65% 13 Senior Loan Washington, D.C. Office 12/20/2019 175.5 47.3 12.3 128.2 L + 3.4% 4.8 $ 286 / sqft 58% 14 Senior Loan Seattle, WA Office 9/13/2018 172.0 168.0 29.6 4.0 L + 3.8% 3.5 $ 490 / sqft 62% 15 Senior Loan Chicago, IL Office 7/15/2019 170.0 126.1 20.8 43.9 L + 3.3% 4.4 $ 121 / sqft 59% 16 Senior Loan Philadelphia, PA Office 6/19/2018 165.0 157.3 40.6 7.7 L + 2.5% 3.3 $ 162 / sqft 71% 17 Senior Loan New York, NY Multifamily 12/5/2018 163.0 148.0 23.0 15.0 L + 2.6% 3.7 $ 556,391 / unit 67% 18 Senior Loan North Bergen, NJ Multifamily 10/23/2017 150.0 150.0 35.7 - L + 3.2% 2.6 $ 468,750 / unit 57% 19 Senior Loan Fort Lauderdale, FL Hospitality 11/9/2018 150.0 140.0 27.2 10.0 L + 2.9% 3.7 $ 404,624 / key 62% 20 Senior Loan Various Retail 12/19/2019 147.0 102.2 25.0 44.8 L + 2.6% 5.4 $ 76 / sqft 55% 21 Senior Loan New York, NY Condo (Resi) 8/4/2017 143.4 143.4 46.4 - L + 4.7% 1.5 $ 1,817 / sqft(9) 53% 22 Senior Loan Boston, MA Multifamily 3/29/2019 138.0 137.0 24.3 1.0 L + 2.7% 4.0 $ 351,282 / unit 63% 23 Senior Loan West Palm Beach, FL Multifamily 11/7/2018 135.0 131.6 28.6 3.4 L + 2.9% 3.6 $ 162,040 / unit 73% 24 Senior Loan Portland, OR Retail 10/26/2015 125.0 125.0 49.8 - L + 5.5% 0.6 $ 115 / sqft 61% 25 Senior Loan San Diego, CA Multifamily 2/3/2020 106.0 106.0 41.4 - L + 3.3% 4.9 $ 458,874 / unit 71% 26 Senior Loan State College, PA Student Housing 10/15/2019 93.4 69.4 16.9 23.9 L + 2.7% 4.6 $ 54,620 / bed 64% 27 Senior Loan Seattle, WA Multifamily 9/7/2018 92.3 92.3 16.7 - L + 2.6% 3.4 $ 515,571 / unit 76% 28 Senior Loan Los Angeles, CA Multifamily 12/11/2019 91.0 90.0 18.1 1.0 L + 2.8% 2.8 $ 416,667 / unit 72% 29 Senior Loan New York, NY Multifamily 3/29/2018 86.0 86.0 14.4 - L + 2.6% 3.0 $ 462,366 / unit 48% 30 Senior Loan Seattle, WA Office 3/20/2018 80.7 80.7 14.7 - L + 3.6% 3.0 $ 473 / sqft 61% 31 Senior Loan Philadelphia, PA Multifamily 10/30/2018 77.0 77.0 12.8 - L + 2.7% 3.6 $ 150,980 / unit 73% 32 Senior Loan Brooklyn, NY Hospitality 1/18/2019 76.0 76.0 15.6 - L + 2.9% 3.9 $ 387,755 / key 69% 33 Senior Loan Queens, NY Industrial 7/21/2017 75.1 66.3 12.2 8.8 L + 3.0% 2.3 $ 116 / sqft 64% 34 Senior Loan Atlanta, GA Industrial 7/24/2018 74.5 72.1 15.5 2.4 L + 2.7% 3.4 $ 66 / sqft 74% 35 Senior Loan Herndon, VA Multifamily 12/23/2019 73.9 72.5 11.9 1.4 L + 2.5% 4.8 $ 246,512 / unit 72% 36 Senior Loan Austin, TX Multifamily 9/12/2019 67.5 67.5 12.3 - L + 2.5% 4.5 $ 190,678 / unit 75% 37 Senior Loan Atlanta, GA Multifamily 8/9/2019 61.5 61.5 11.2 - L + 3.0% 4.4 $ 170,833 / unit 74% 38 Senior Loan Queens, NY Multifamily 10/9/2018 45.0 42.0 7.9 3.0 L + 2.8% 3.6 $ 333,333 / unit 70% Total / Weighted Average $5,769.3 $5,174.0 $1,147.6 $590.2 L + 3.0% 3.9 66% Mezzanine Loans 1 Fixed Rate Mezzanine Various Retail 6/8/2015 5.5 5.5 5.5 - 11.0% 5.3 $ 46 / sqft 72% 2 Floating Rate Mezzanine Westbury, NY Multifamily 1/27/2020 20.0 17.3 17.2 2.7 L + 9.0% 4.3 $ 452,875 / unit 66% Total / Weighted Average $25.5 $22.8 $22.7 $2.7 11.0% 4.6 67% CMBS Total / Weighted Average $40.0 $35.7 $35.7 $4.3 4.7% 9.2 58% Portfolio Total / Weighted Average $5,834.8 $5,232.5 $1,206.0 $597.2 4.8% 3.9 66% 1Q20 Outstanding Portfolio(8) $5,232.5 *See footnotes on subsequent page 19

Portfolio Details (1) Senior loans include senior mortgages and similar credit quality investments, including junior participations in our originated senior loans for which we have syndicated the senior participations and retained the junior participations for our portfolio and excludes vertical loan syndications. (2) Net equity reflects (i) the amortized cost basis of our loans, net of borrowings and (ii) the cost basis of our investment in RECOP I. (3) Represents Committed Principal Amount less Current Principal Amount on Senior Loans and $4.3 million of remaining commitment to RECOP I. (4) Weighted averages are weighted by current principal amount for senior loans and mezzanine loans and by net equity for our RECOP I CMBS B-Piece investment. (5) L = one-month USD LIBOR rate; greater of (i) spot one-month USD LIBOR rate of 0.99% and (ii) LIBOR floor, where applicable, included in portfolio- wide averages represented as fixed rates. (6) Max remaining term (years) assumes all extension options are exercised, if applicable. (7) For senior loans, loan-to-value ratio ("LTV") LTV is based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value; for Senior Loan 4, LTV is based on the initial loan amount divided by the appraised bulk sale value assuming a condo-conversion and no renovation; for Senior Loan 21, LTV is based on the current principal amount divided by the adjusted appraised gross sellout value net of sales cost; for mezzanine loans, LTV is based on the current balance of the whole loan dividend by the as-is appraised value as of the date the loan was originated; for RECOP I CMBS B-Pieces, LTV is based on the weighted average LTV of the underlying loan pool at issuance. (8) Represents Current Principal Amount of Senior Loans and Mezzanine Loans and Net Equity for our RECOP I CMBS B-Piece investment. (9) For Senior Loan 21, Loan per SQFT of $1,817 is based on the allocated loan amount of the residential units. Excluding the value of the retail and parking components of the collateral, the Loan per SQFT is $2,039 based on allocating the full amount of the loan to only the residential units. 20

Fully Extended Loan Maturities • Fully extended weighted average loan maturity of 3.9 years(1) Fully Extended Loan Maturities(1) ($ in Millions) $2,500 $2,216.3 $2,000 $1,489.9 $1,500 $1,000 $497.9 $500 $404.0 $320.3 $125.0 $143.4 $0 2020 2021 2022 2023 2024 2025 2026 (1) Excludes RECOP I CMBS B-Piece investment. 21

Consolidated Balance Sheets (in thousands - except share and per share data) March 31, 2020 December 31, 2019 Assets Cash and cash equivalents $ 369,867 $ 67,619 Commercial mortgage loans, held-for-investment 5,089,968 4,931,042 Less: Allowance for credit losses (65,979) - Commercial mortgage loans, held-for-investment, net 5,023,989 4,931,042 Equity method investments 34,441 37,469 Accrued interest receivable 17,263 16,305 Other assets 10,121 4,583 Total Assets $ 5,455,681 $ 5,057,018 Liabilities and Equity Liabilities Secured financing agreements, net $ 3,368,329 $ 2,884,887 Collateralized loan obligation, net 805,008 803,376 Convertible notes, net 139,420 139,075 Loan participations sold, net 64,972 64,966 Dividends payable 24,204 25,036 Accrued interest payable 7,513 6,686 Accounts payable, accrued expenses and other liabilities (1) 8,907 3,363 Due to affiliates 5,022 5,917 Total Liabilities 4,423,375 3,933,306 Commitments and Contingencies Temporary Equity Redeemable preferred stock 2,108 1,694 Permanent Equity Preferred stock, 50,000,000 authorized (1 share with par value of $0.01 issued and outstanding as of March - - 31, 2020 and December 31, 2019, respectively) Common stock, 300,000,000 authorized (55,838,032 and 57,486,583 shares with par value of $0.01 issued and 575 575 outstanding as of March 31, 2020 and December 31, 2019, respectively) Additional paid-in capital 1,167,602 1,165,995 Accumulated deficit (82,777) (8,594) Repurchased stock, 3,511,240 and 1,862,689 shares repurchased as of March 31, 2020 and December 31, (55,202) (35,958) 2019, respectively Total KKR Real Estate Finance Trust Inc. stockholders’ equity 1,030,198 1,122,018 Total Permanent Equity 1,030,198 1,122,018 Total Liabilities and Equity $ 5,455,681 $ 5,057,018 (1) Includes $4.3 million and $0.0 million of reserve for unfunded loan commitments at March 31, 2020 and December 31, 2019, respectively. 22

Consolidated Statements of Income (in thousands - except share and per share data) Three Months Ended March 31, 2020 December 31, 2019 March 31, 2019 Net Interest Income Interest income $ 71,079 $ 72,417 $ 64,751 Interest expense 39,082 41,333 34,842 Total net interest income 31,997 31,084 29,909 Other Income Income (loss) from equity method investments (1,901) 1,254 1,125 Change in net assets related to CMBS consolidated variable interest entities - - 342 Other income 360 447 482 Gain (loss) on sale of investments - 71 - Total other income (loss) (1,541) 1,772 1,949 Operating Expenses General and administrative 3,767 2,676 2,361 Provision for credit losses, net 55,274 - - Management fees to affiliate 4,299 4,280 4,287 Incentive compensation to affiliate 1,606 1,174 953 Total operating expenses 64,946 8,130 7,601 Income (Loss) Before Income Taxes, Preferred Dividends and Redemption Value Adjustment (34,490) 24,726 24,257 Income tax expense (benefit) 82 213 9 Net Income (Loss) (34,572) 24,513 24,248 Preferred Stock Dividends and Redemption Value Adjustment 592 (276) (457) Net Income (Loss) Attributable to Common Stockholders $ (35,164) $ 24,789 $ 24,705 Net Income (Loss) Per Share of Common Stock, Basic $ (0.61) $ 0.43 $ 0.43 Net Income (Loss) Per Share of Common Stock, Diluted $ (0.61) $ 0.43 $ 0.43 Weighted Average Number of Shares of Common Stock Outstanding, Basic 57,346,726 57,486,583 57,387,386 Weighted Average Number of Shares of Common Stock Outstanding, Diluted 57,346,726 57,595,424 57,477,234 Dividends Declared per Share of Common Stock $ 0.43 $ 0.43 $ 0.43 23

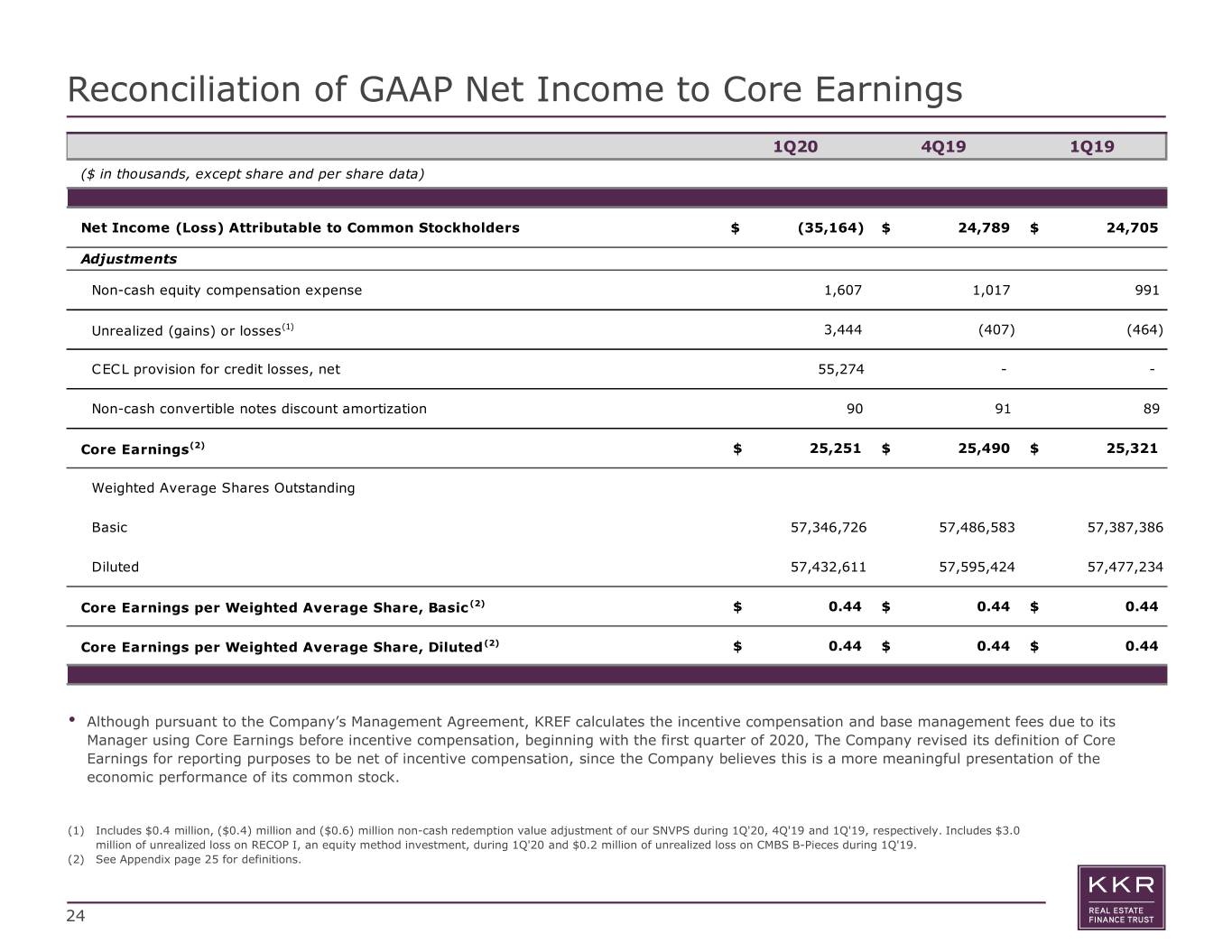

Reconciliation of GAAP Net Income to Core Earnings 1Q20 4Q19 1Q19 ($ in thousands, except share and per share data) Net Income (Loss) Attributable to Common Stockholders $ (35,164) $ 24,789 $ 24,705 Adjustments Non-cash equity compensation expense 1,607 1,017 991 Unrealized (gains) or losses(1) 3,444 (407) (464) CECL provision for credit losses, net 55,274 - - Non-cash convertible notes discount amortization 90 91 89 Core Earnings(2) $ 25,251 $ 25,490 $ 25,321 Weighted Average Shares Outstanding Basic 57,346,726 57,486,583 57,387,386 Diluted 57,432,611 57,595,424 57,477,234 Core Earnings per Weighted Average Share, Basic (2) $ 0.44 $ 0.44 $ 0.44 Core Earnings per Weighted Average Share, Diluted (2) $ 0.44 $ 0.44 $ 0.44 • Although pursuant to the Company’s Management Agreement, KREF calculates the incentive compensation and base management fees due to its Manager using Core Earnings before incentive compensation, beginning with the first quarter of 2020, The Company revised its definition of Core Earnings for reporting purposes to be net of incentive compensation, since the Company believes this is a more meaningful presentation of the economic performance of its common stock. (1) Includes $0.4 million, ($0.4) million and ($0.6) million non-cash redemption value adjustment of our SNVPS during 1Q'20, 4Q'19 and 1Q'19, respectively. Includes $3.0 million of unrealized loss on RECOP I, an equity method investment, during 1Q'20 and $0.2 million of unrealized loss on CMBS B-Pieces during 1Q'19. (2) See Appendix page 25 for definitions. 24

Key Definitions • "Core Earnings": Used by the Company to evaluate the Company's performance excluding the effects of certain transactions and GAAP adjustments the Company believes are not necessarily indicative of the current loan activity and operations. Core Earnings is a measure that is not prepared in accordance with GAAP. The Company defines Core Earnings for reporting purposes as net income (loss) attributable to stockholders or, without duplication, owners of the Company's subsidiaries, computed in accordance with GAAP, including realized losses not otherwise included in GAAP net income (loss) and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) any unrealized gains or losses or other similar non-cash items that are included in net income for the applicable reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net income, and (iv) one-time events pursuant to changes in GAAP and certain material non-cash income or expense items after discussions between the Company’s Manager and board of directors and after approval by a majority of the independent directors. The exclusion of depreciation and amortization from the calculation of Core Earnings only applies to debt investments related to real estate to the extent the Company forecloses upon the property or properties underlying such debt investments. • The Company believes that providing Core Earnings on a supplemental basis to its net income as determined in accordance with GAAP is helpful to stockholders in assessing the overall performance of the Company’s business. Although pursuant to the Management Agreement with its Manager, the Company calculates the incentive compensation and base management fees due to its Manager using Core Earnings before incentive compensation, beginning with the first quarter of 2020, the Company revised its definition of Core Earnings for reporting purposes to be net of incentive compensation, since the Company believes this is a more meaningful presentation of the economic performance of its common stock. • Core Earnings should not be considered as a substitute for GAAP net income. The Company cautions readers that its methodology for calculating Core Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, the Company’s reported Core Earnings may not be comparable to similar measures presented by other REITs. • “IRR”: IRR is the annualized effective compounded return rate that accounts for the time-value of money and represents the rate of return on an investment over a holding period expressed as a percentage of the investment. It is the discount rate that makes the net present value of all cash outflows (the costs of investment) equal to the net present value of cash inflows (returns on investment). It is derived from the negative and positive cash flows resulting from or produced by each transaction (or for a transaction involving more than one investment, cash flows resulting from or produced by each of the investments), whether positive, such as investment returns, or negative, such as transaction expenses or other costs of investment, taking into account the dates on which such cash flows occurred or are expected to occur, and compounding interest accordingly. The weighted average underwritten IRR for the investments shown reflects the returns underwritten by KKR Real Estate Finance Manager LLC, the Company’s external manager, taking into account certain assumptions around leverage up to no more than the maximum approved advance rate, and calculated on a weighted average basis assuming no dispositions, early prepayments or defaults but assuming that extension options are exercised and that the cost of borrowings remains constant over the remaining term. With respect to certain loans included in the weighted average underwritten IRR shown, the calculation assumes certain estimates with respect to the timing and magnitude of the initial and future fundings for the total loan commitment and associated loan repayments, and assumes no defaults. With respect to certain loans included in the weighted average underwritten IRR shown, the calculation assumes the one-month spot USD LIBOR as of the date the loan was originated. There can be no assurance that the actual weighted average IRRs will equal the weighted average underwritten IRRs shown. 25