Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TCF FINANCIAL CORP | tcf033120form8kearning.htm |

| EX-99.1 - EXHIBIT 99.1 - TCF FINANCIAL CORP | tcf033120form8kexhibit991.htm |

April 27, 2020 TCF Financial Corporation 1Q20 Earnings Presentation

Cautionary Statements for the Purposes of Safe Harbor Provisions of the Securities Litigation Reform Act Any statements contained in this presentation regarding the outlook for the Corporation's businesses and their respective markets, such as projections of future performance, targets, guidance, statements of the Corporation's plans and objectives, forecasts of market trends and other matters are forward-looking statements based on the Corporation's assumptions and beliefs. Such statements may be identified by such words or phrases as "will likely result," "are expected to," "will continue," "outlook," "will benefit," "is anticipated," "estimate," "project," "management believes" or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements, and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, TCF claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward- looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events. This presentation also contains forward-looking statements regarding TCF’s (formerly Chemical Financial Corporation) outlook or expectations with respect to the merger and integration with legacy TCF Financial Corporation. Examples of forward-looking statements include, but are not limited to, statements regarding outlook and expectations with respect to strategic and financial benefits of the merger, including the expected impact of the transaction on TCF’s future financial performance (including anticipated accretion to earnings per share, the tangible book value earn-back period and other operating and return metrics), the expected costs to be incurred in connection with the merger, and operational aspects of post-merger integration. Certain factors could cause the Corporation's future results to differ materially from those expressed or implied in any forward-looking statements contained herein. These factors include the factors discussed in Part I, Item 1A of this Annual Report on Form 10-K under the heading "Risk Factors" or otherwise disclosed in documents filed or furnished by the Corporation with or to the SEC after the filing of this Annual Report on Form 10-K, the factors discussed below, and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward- looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive: macroeconomic and other challenges and uncertainties resulting from the COVID-19 pandemic, such as the extent and duration of the impact on public health, the U.S. and global economies, financial markets and consumer and corporate customers and clients, including economic activity, employment levels and market liquidity, as well as the various actions taken in response to the challenges and uncertainties by governments, central banks and others, including TCF; a failure to manage credit risk; cyber-security breaches involving us or third parties, hacking, denial of service, loss or theft of information, or other cyber-attacks that disrupt TCF's business operations or damage its reputation; adverse developments affecting TCF's branches, including supermarket branches; inability to successfully execute on TCF's growth strategy through acquisitions or expanding existing business relationships; adverse effects related to competition from traditional competitors, non-bank providers of financial services and new technologies; failure to keep pace with technological change, including with respect to customer demands or system upgrades; risks related to developing new products, markets or lines of business; risks related to TCF's loan origination and sales activity; lack of access to liquidity or raise capital that isn’t dilutive; adverse changes in monetary, fiscal or tax policies; litigation or government enforcement actions; heightened consumer protection, supervisory or regulatory practices or requirements; deficiencies in TCF's compliance programs or risk mitigation frameworks; dependence on accurate and complete information from customers and counterparties; the failure to attract and retain key employees; ineffective internal controls; soundness of other financial institutions and other counterparty risk, including the risk of default, operational disruptions, or diminished availability of counterparties who satisfy our credit quality requirements; inability to grow deposits, increase earnings and revenue, manage operating expenses, or pay and receive dividends; interruptions, systems failures information technology and telecommunications systems failures of third-party services; deficiencies in TCF's quantitative models; the effect of any negative publicity or reputational damage; technological or operational difficulties; changes in accounting standards or interpretations of existing standards; adverse federal, state or foreign tax assessments; and the effects of man-made and natural disasters, any of which may negatively affect our operations and/or our customers. Use of Non-GAAP Financial Measures Management uses the adjusted net income, adjusted diluted earnings per common share, adjusted ROAA, adjusted ROACE, ROATCE, adjusted ROATCE, adjusted efficiency ratio, adjusted net interest income, net interest margin (FTE), net interest margin (FTE), adjusted net interest margin (FTE), adjusted noninterest income, adjusted noninterest expense, tangible book value per common share and tangible common equity to tangible assets internally to measure performance and believes that these financial measures not recognized under generally accepted accounting principles in the United States ("GAAP") (i.e. non-GAAP) provide meaningful information to investors that will permit them to assess the Corporation's capital and ability to withstand unexpected market or economic conditions and to assess the performance of the Corporation in relation to other banking institutions on the same basis as that applied by management, analysts and banking regulators. TCF adjusts certain results to exclude merger-related expenses and notable items in addition to presenting net interest income and net interest margin (FTE) excluding purchase accounting accretion and amortization. Management believes these measures are useful to investors in understanding TCF's business and operating results. These non-GAAP financial measures are not defined by GAAP and other entities may calculate them differently than TCF does. Non-GAAP financial measures have inherent limitations and are not required to be uniformly applied. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to stockholders. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measure may be found in the reconciliation tables included in this press release. 2

First Quarter Results Driven by MOE Integration and Impact of COVID-19 Diluted Efficiency ROACE ROATCE1 EPS Ratio $0.32 69.6% 3.6% 5.4% Reported Reported Reported Reported $0.57 58.2% 6.4% 9.2% Adjusted1 Adjusted1 Adjusted1 Adjusted1 • Published new Purpose and Beliefs statement in February MOE Integration <$321M • Expanded enhanced CRM capabilities across the footprint in March on Track On track to achieve 4Q20 NIE target • Remain on track to complete final core system conversion in 3Q20 Continued Loan and 4.1% 12.4% 3.9% Loan and lease Commercial growth Deposit growth Deposit Growth 2 growth QoQ YoY QoQ $97M 1.13% $167M 6 bps Add'l total fair value Credit Performance Provision for credit losses ALLL / Loans and Leases Net charge-off ratio discount on acquired (incl. $74M COVID-related) (inclusive of CECL Day 1) loans as of 3/31/20 3 7,300 $825M $1.2B COVID-19 Update loans balances Approved through Paycheck Consumer loan modification requests Protection Program (PPP) Strong Capital and 10.4% 17.4% 74% Liquidity Positions CET1 Ratio Cash and securities / Retail deposits as a % of assets total deposits 1 Denotes a non-GAAP financial measure; see Appendix for "Non-GAAP Reconciliation" slides 2 Based on combined historical TCF and Chemical reported financials 3 3 As of April 23, 2020

A Proactive Response to COVID-19 to Support Team Members and Customers “Caring like a neighbor” is one of our core beliefs – we are taking the necessary actions to reduce the health risk of COVID-19 to our team members and alleviate the financial impact on our customers Team Members Customers Communities • Work From Home – nearly all of • Small Business and Commercial • Financial Support for our Communities – middle and back office employees Borrower Relief – offering loan committed $100K incentives toward both working from home with minimal modifications for impacted customers and the Henry Ford Health System and impact on productivity (>4,000 team participating in the Paycheck Protection University of Minnesota emergency funds members) Program and Economic Injury Disaster for COVID-19 response, along with • Temporary Emergency Company Program to provide loan relief to businesses additional financial support to organizations Paid Time Policy – providing ◦ 8,500 commercial customer loan including Forgotten Harvest, Minnesota company-paid time off for team modification requests1 Disaster Recovery Funds and the City of members not able to work for reasons • Mortgage and Home Equity Payment Detroit related to COVID-19 Deferrals – payment deferrals for up to 90 • Small Business Loan Fund in Wayne • Premium Pay – enhanced days with no credit bureau impact and no County (Detroit) – $10M partnership to compensation for team members late fees provide fast relief through low-interest loans required to work in the office ◦ 7,300 consumer loan modification to help small businesses in Wayne County, (+$3/hr beginning April 1, 2020) requests for $825M2 Michigan • Suspension of Foreclosure Program – • Additional Community Support – donated suspended new residential property essential supplies to TCF Center temporary foreclosures hospital, Cleveland Clinic and Beaumont Hospital while also utilizing 3D printers to • Modified Branch Services – all branches make face shields for local health systems transitioned to drive-up only with lobby servicing by appointment - closed in-store branches near drive-thrus Management Approach • Implemented an internal COVID-19 Task Force • Senior Leadership Team meeting weekly • Executive Leadership Team meeting daily • Enhanced portfolio management and credit committee reporting 4 1 As of April 23, 2020, includes 5,800 requests from Capital Solutions with the remainder from traditional C&I and CRE 2 As of April 23, 2020

MOE Integration Remains on Track Despite challenges related to COVID-19 and our work- Purpose from-home approach, we remain on track to complete our integration activities on time We are a champion for our customers, Recent MOE Actions passionate about • Published new Purpose and Beliefs statement in February building stronger individuals, • Expanded CRM capabilities to branches and bankers businesses, and • Began piloting digital banking upgrades for legacy Chemical communities. • Launched consolidated commercial loan pricing model • 66% of vendor contracts have been renegotiated Beliefs • Migrated integration activities to work-from-home Take Upcoming Priorities Care like a initiative neighbor on all • Complete transition of Legacy Chemical customers onto TCF fronts digital banking platform (2Q20) • Complete Human Capital Management (HCM) system conversion (2Q/3Q20) • Core conversion to FIS IBS (3Q20) Strive for Win as a excellence team • Execution of cost synergy initiatives • Execution of business synergy initiatives 5

Balance Sheet Today Reflects Lower Risk Profile Due to Actions Completed and MOE Additional Credit Support Sale of Legacy TCF Auto Repositioned Securities Provided by Purchase Finance Portfolio & Portfolio Upon Closing of Accounting Mark Through Nonaccrual and TDR Sales MOE MOE $1.1B 96% $167M Legacy TCF auto finance Investment securities Total fair value discount on loans sold (4Q19) rated AA or AAA acquired loans as of 3/31/20 • Completed sale of $1.1B • Sold $1.6B of certain • Both TCF and Chemical Legacy TCF auto finance investment securities in completed comprehensive portfolio in 4Q19 3Q19, reducing interest rate credit due diligence during risk and enhancing capital 2H18 on each other's • Sold $80.5M of consumer efficiency and liquidity respective portfolios over the nonaccrual and TDR loans in course of approximately 6 4Q19 • Terminated $1.1B of interest months rate swaps in 3Q19, reducing asset sensitivity • Acquired loan balances from the MOE contain a total fair value discount of approximately $167M which is in addition to CECL on balance sheet reserves 6

Loan Growth Driven by Commercial Portfolio HFI Loans and Leases ($ billions) HFI Loan and Lease Growth Drivers ($ billions) Legacy TCF auto Loans and leases (ex. legacy TCF auto) $0.2 $35.9 $0.4 $— 8.8% YoY growth, excluding Legacy TCF Auto1 $0.8 $34.7 $33.5 $34.5 $35.9 $34.5 $1.7 $1.2B of commercial loan and lease growth $33.0 in 1Q20 1Q19 3Q19 4Q19 1Q20 4Q19 C&I CRE Lease Consumer 1Q20 financing TCF/Chemical Combined 2 YoY Change2 Mar. 31, 1Q20 Loan and Lease Highlights (Dollars in billions) 2020 $ % Commercial and industrial $ 12.3 $ 1.4 13.0% • $887M of C&I growth QoQ Commercial real estate 9.5 1.1 13.5 Lease financing 2.7 0.2 6.2 ◦ Inventory Finance +$578M / Traditional C&I + Total commercial 24.5 2.7 12.4 $242M / Capital Solutions +$67M Residential mortgage 6.4 0.5 8.6 Home equity 3.5 (0.3) (7.5) ◦ Seasonal peak of inventory finance in 1Q Consumer installment 1.5 — (0.8) • Revolving line draws not a material factor in loan and Legacy TCF auto finance — (1.7) (100) Total consumer 11.4 (1.5) (11.6) lease growth HFI loans and leases $ 35.9 $ 1.2 3.5 HFI loans and leases, ex. TCF auto finance3 $ 35.9 $ 2.9 8.8% 1 Total period-end loans and leases of $35.9B, up $1.2B or 3.5% YoY 2 Combined TCF and Chemical reported financials 7 3 Excludes the Legacy TCF auto finance portfolio at Mar. 31, 2019, which had a balance of $1.7B

Disciplined Deposit Pricing with Improved Mix 3 Deposit Growth ($ billions) Cost of Deposits Down 10 bps from 4Q19 YoY non-CD growth of 7.9%1 0.95% 0.94% $35.1 $35.3 $34.5 $35.8 0.90% 0.88% $8.8 $8.4 $7.5 $7.5 CDs Deposits (ex. CDs) 0.78% $26.3 $26.9 $27.0 $28.3 1Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 TCF/Chemical TCF/Chemical Stub 4 Combined2 Combined2 Period 1Q20 Deposit Highlights 1Q20 Deposit Highlights • Total deposit growth of $1.3B QoQ, driven by non-CD • Cost of CDs of 1.81%, down 16 bps from 4Q19 balances • Cost of deposits (ex. CDs) of 0.50%, down 7 bps from ◦ Non-CD balances up $1.3B, or 4.9% 4Q19 ◦ CD balances relatively flat • Short duration CD portfolio with 57% maturing over the next six months with an average rate of 1.84% 1 Total period-end deposits of $35.8B, up $713M or 2.0% YoY 2 Combined TCF and Chemical reported financials 3 Annualized 8 4 Stub period reflects Legacy TCF July 2019 plus New TCF August/September 2019

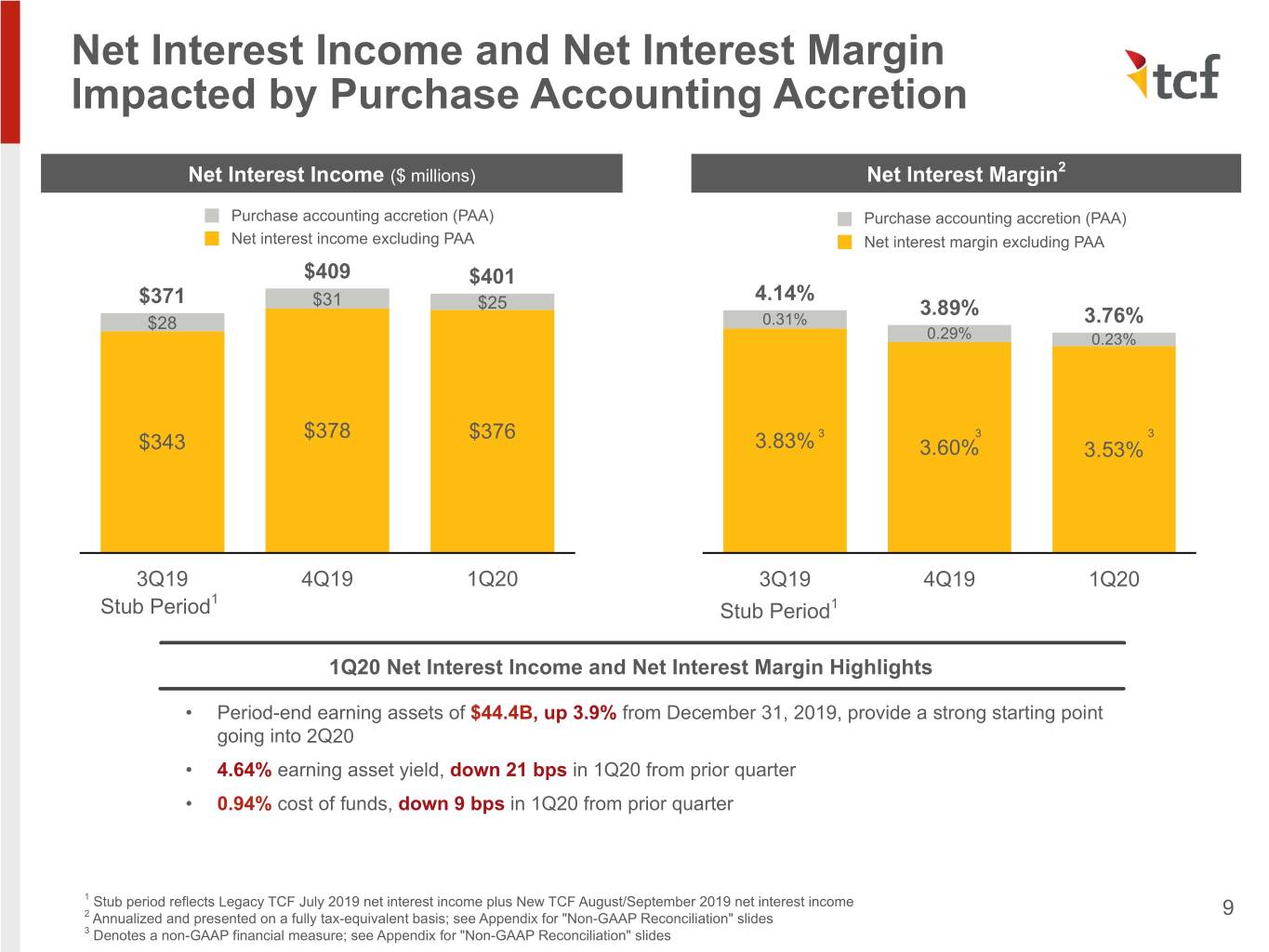

Net Interest Income and Net Interest Margin Impacted by Purchase Accounting Accretion 2 Net Interest Income ($ millions) Net Interest Margin Purchase accounting accretion (PAA) Purchase accounting accretion (PAA) Net interest income excluding PAA Net interest margin excluding PAA $409 $401 $371 4.14% $31 $25 3.89% $28 0.31% 3.76% 0.29% 0.23% $378 $376 3 3 3 $343 3.83% 3.60% 3.53% 3Q19 4Q19 1Q20 3Q19 4Q19 1Q20 1 Stub Period Stub Period1 1Q20 Net Interest Income and Net Interest Margin Highlights • Period-end earning assets of $44.4B, up 3.9% from December 31, 2019, provide a strong starting point going into 2Q20 • 4.64% earning asset yield, down 21 bps in 1Q20 from prior quarter • 0.94% cost of funds, down 9 bps in 1Q20 from prior quarter 1 Stub period reflects Legacy TCF July 2019 net interest income plus New TCF August/September 2019 net interest income 2 Annualized and presented on a fully tax-equivalent basis; see Appendix for "Non-GAAP Reconciliation" slides 9 3 Denotes a non-GAAP financial measure; see Appendix for "Non-GAAP Reconciliation" slides

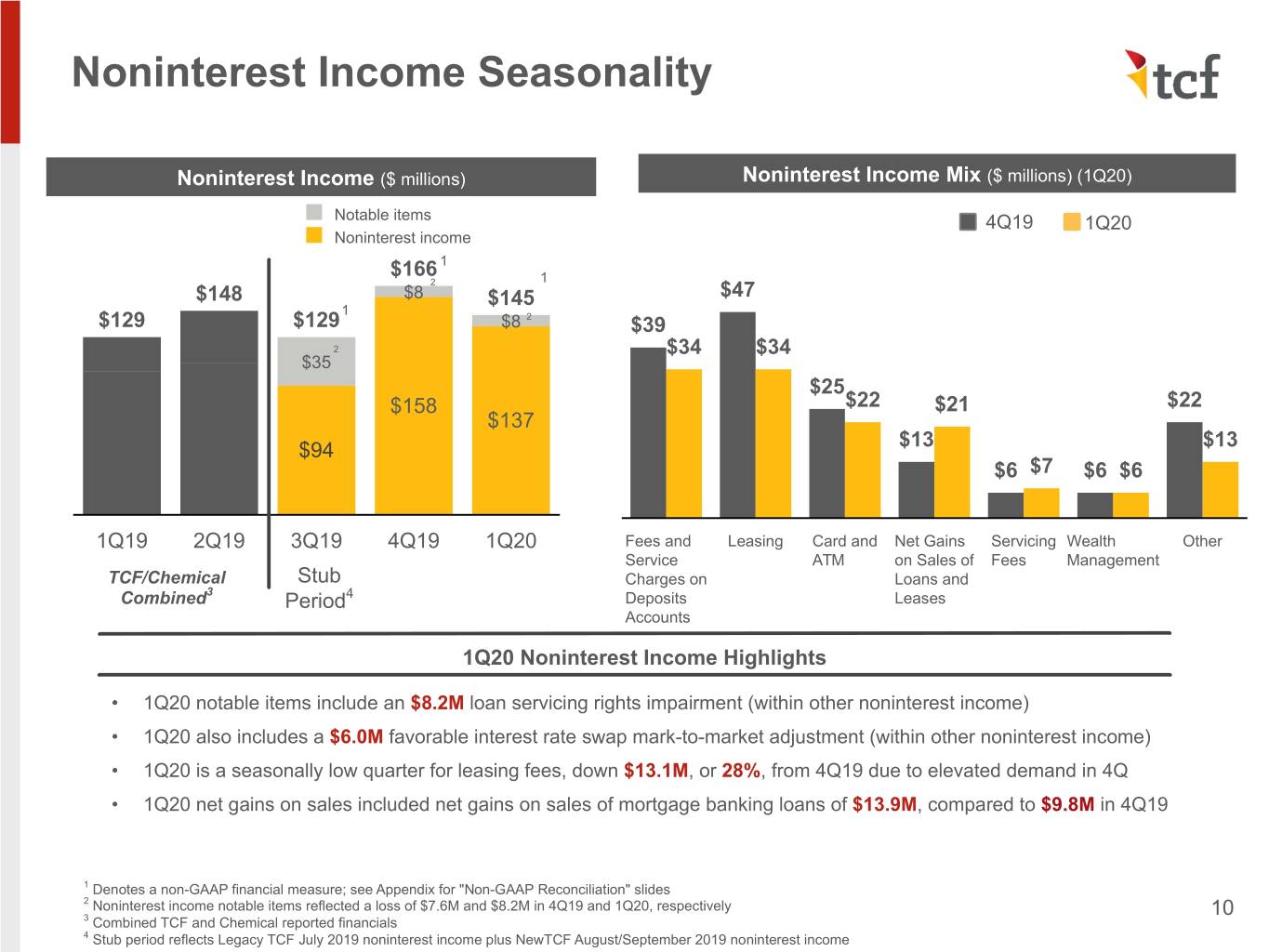

Noninterest Income Seasonality Noninterest Income ($ millions) Noninterest Income Mix ($ millions) (1Q20) Notable items 4Q19 1Q20 Noninterest income $166 1 2 1 $148 $8 $145 $47 1 $129 $129 $8 2 $39 2 $34 $34 $35 $25 $158 $22 $21 $22 $137 $13 $13 $94 $6 $7 $6 $6 1Q19 2Q19 3Q19 4Q19 1Q20 Fees and Leasing Card and Net Gains Servicing Wealth Other Service ATM on Sales of Fees Management TCF/Chemical Stub Charges on Loans and Combined3 Period4 Deposits Leases Accounts 1Q20 Noninterest Income Highlights • 1Q20 notable items include an $8.2M loan servicing rights impairment (within other noninterest income) • 1Q20 also includes a $6.0M favorable interest rate swap mark-to-market adjustment (within other noninterest income) • 1Q20 is a seasonally low quarter for leasing fees, down $13.1M, or 28%, from 4Q19 due to elevated demand in 4Q • 1Q20 net gains on sales included net gains on sales of mortgage banking loans of $13.9M, compared to $9.8M in 4Q19 1 Denotes a non-GAAP financial measure; see Appendix for "Non-GAAP Reconciliation" slides 2 Noninterest income notable items reflected a loss of $7.6M and $8.2M in 4Q19 and 1Q20, respectively 10 3 Combined TCF and Chemical reported financials 4 Stub period reflects Legacy TCF July 2019 noninterest income plus NewTCF August/September 2019 noninterest income

Focus on Delivering on Cost Synergy Commitment Noninterest Expense ($ millions) Driving Toward Below Peer Median Efficiency Notable items Post-Cost Savings Merger-related expenses Adjusted Efficiency Ratio Target4: 2 Adjusted noninterest expense Below Peer Median in Normalized Operating Environment $417 $15 69.6% $375 $362 $47 $3 $15 $37 <$321 58.2% 56.5% 2 1Q20 1Q20 4Q19 Peer 2 2 $347 $355 $335 Adjusted 2 Median 3 1Q20 Noninterest Expense Highlights • 1Q20 includes $36.7M of merger-related expenses and a $3.1M notable item related to the impact of the sale of 1Q19 4Q19 1Q20 4Q20 Legacy TCF auto finance portfolio in 4Q19 TCF/Chemical NIE Target • 1Q20 also included a $1.5M impairment of federal historic Combined1 tax credits 1 Combined TCF and Chemical reported financials 2 Denotes a non-GAAP financial measure; see Appendix for "Non-GAAP Reconciliation" slides 3 Source: S&P Global Market Intelligence (peer data as of 4Q19; TCF data as of 1Q20) 4 Financial targets compared to TCF Peer Group which includes KEY, RF, MTB, FRC, HBAN, CMA, ZION, PBCT, CIT, SNV, EWBC, FHN, FCNC.A, FNB, ASB, BKU, VLY and IBKC. ROATCE and 11 adjusted efficiency ratio are non-GAAP financial measures. A reconciliation of the ROATCE and adjusted efficiency ratio targets to the most directly comparable GAAP measure is not provided because the Corporation is unable to provide such reconciliation without unreasonable effort, however, it is expected to be consistent with historical non-GAAP reconciliation included in the appendix.

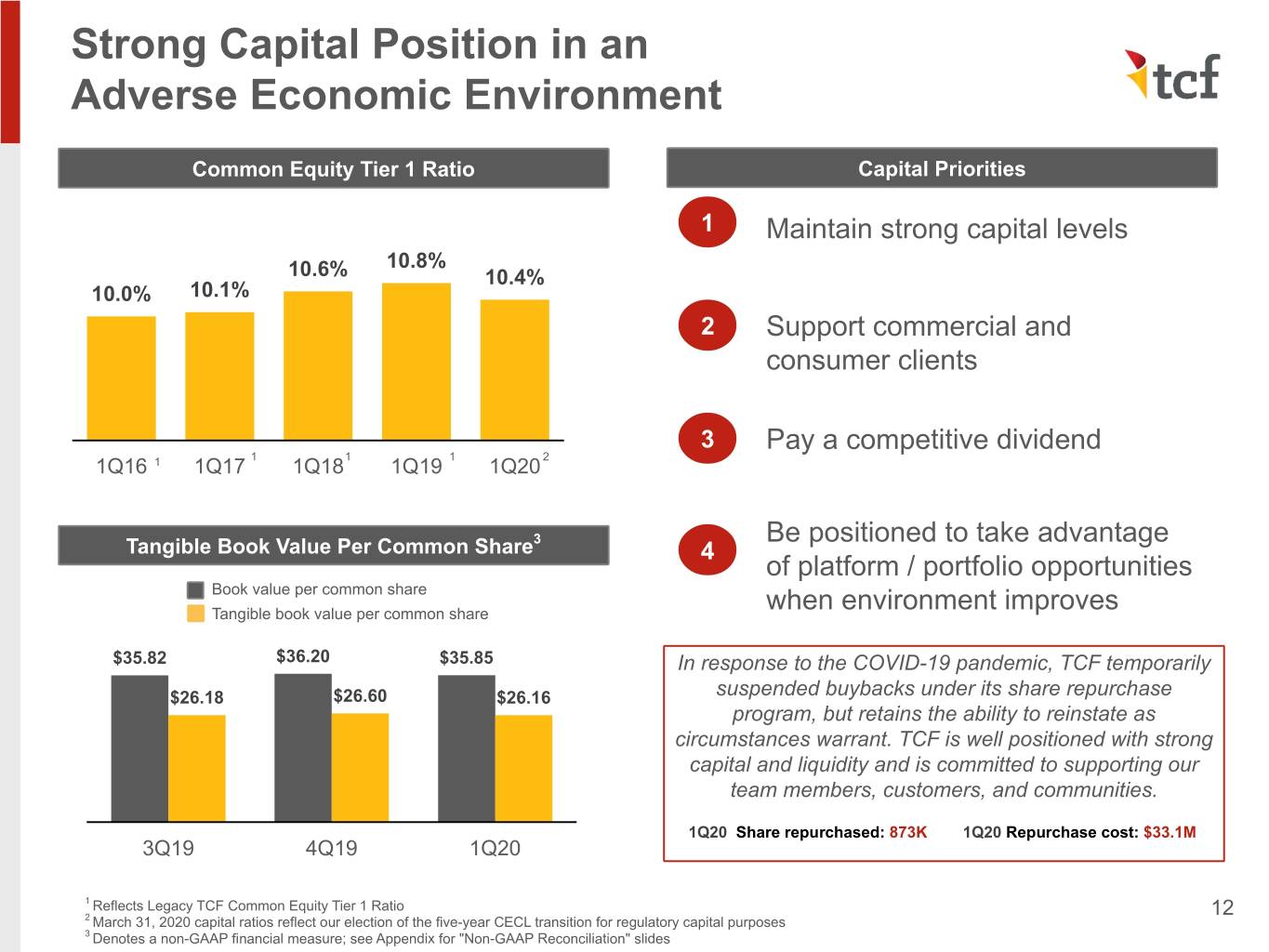

Strong Capital Position in an Adverse Economic Environment Common Equity Tier 1 Ratio Capital Priorities 1 Maintain strong capital levels 10.8% 10.6% 10.4% 10.0% 10.1% 2 Support commercial and consumer clients 3 Pay a competitive dividend 1Q16 1 1Q17 1 1Q181 1Q19 1 1Q20 2 3 Be positioned to take advantage Tangible Book Value Per Common Share 4 of platform / portfolio opportunities Book value per common share Tangible book value per common share when environment improves $35.82 $36.20 $35.85 In response to the COVID-19 pandemic, TCF temporarily $26.18 $26.60 $26.16 suspended buybacks under its share repurchase program, but retains the ability to reinstate as circumstances warrant. TCF is well positioned with strong capital and liquidity and is committed to supporting our team members, customers, and communities. 1Q20 Share repurchased: 873K 1Q20 Repurchase cost: $33.1M 3Q19 4Q19 1Q20 1 Reflects Legacy TCF Common Equity Tier 1 Ratio 12 2 March 31, 2020 capital ratios reflect our election of the five-year CECL transition for regulatory capital purposes 3 Denotes a non-GAAP financial measure; see Appendix for "Non-GAAP Reconciliation" slides

Credit Performance Summary Net Charge-offs ($ millions) Nonaccrual Loans and Leases ($ millions) Net charge-offs Net charge-offs / average loans and leases1 Nonaccrual Loans / Loans $7 $250 $29 $73 $170 $16 0.39% 0.70% 0.18% $6 0.49% 2 $5 0.07% 0.06% 2Q19 3Q19 4Q19 1Q20 4Q19 CECL Other 1Q20 TCF/Chemical Adoption Nonaccrual 3 Combined Impact Change Over 90-Day Delinquencies4 0.09% 0.09% $73M of loans previously accounted for as purchased credit impaired (PCI) at 0.02% December 31, 2019 were reclassified to nonaccrual loans as of January 1, 2020 due to the adoption of CECL 3Q19 4Q19 1Q20 1 Annualized 2 Includes $4.7M recovery from consumer nonaccrual/TDR loan sale. Excluding the recovery, 4Q19 net charge-offs were $10.9M, NCO ratio was 0.13% and provision for credit losses was $19.1M (see Appendix for "Non-GAAP Reconciliation" slides) 3 Combined TCF and Chemical reported financials 13 4 Excludes nonaccrual loans and leases. Prior to the adoption of CECL as of January 1, 2020, purchased credit impaired loans were not classified as nonaccrual loans because they were recorded at their net realizable value based on the principal and interest expected to be collected on the loans.

ACL Driven by CECL and COVID-19 Impacts 1Q20 Allowance for Credit Loss Drivers ($ millions) $93 $406 ACL / Loans $206 $319 $(1) $(5) +$167M $71M of LLP Additional total fair value related to 1.13% COVID-19 2 discount from purchase $113 0.92% accounting on acquired loans at 1Q20 0.33% 1 2 4Q19 CECL Day 1 01/01/20 NCOs Provision Other 1Q20 Provision for Credit Losses ($ millions) 1Q20 Provision Drivers ($ millions) $974 $74M of Factor Amount provision $74 5 related to COVID-19 $ 74.1 5 $21 $27 COVID-19 Net charge-offs 5.5 $14 6 $23 Portfolio changes, net 17.3 Total $ 96.9 2Q19 3Q19 4Q19 1Q20 TCF/Chemical Combined 3 1 Assumes Day 1 CECL reserve applied to ACL and loan and lease balances as of December 31, 2019 2 Provision for credit losses related to loans and leases excludes the provision related to the unfunded commitment liability of $4M and other assets from the total provision for credit losses for the three months ended March 31, 2020. 3 Combined TCF and Chemical reported financials 4 As a result of the adoption of CECL, provision for credit losses also includes a provision for unfunded commitments of $4M 14 5 Includes $71M of impact to the provision for credit losses for loans and leases and $4M of impact to the provision for unfunded commitments 6 Includes loan growth, rate and mix changes

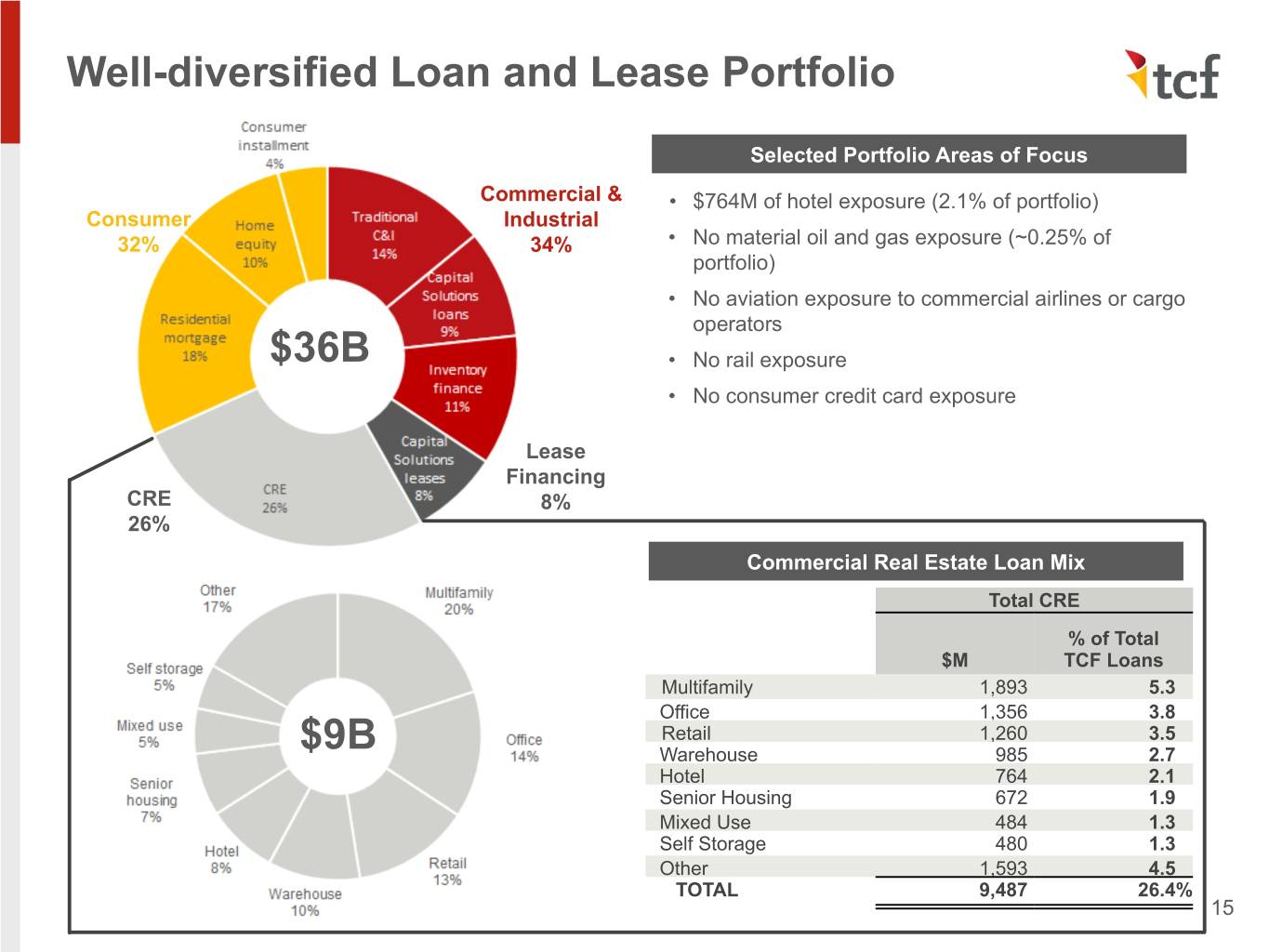

Well-diversified Loan and Lease Portfolio Selected Portfolio Areas of Focus Commercial & • $764M of hotel exposure (2.1% of portfolio) Consumer Industrial 32% 34% • No material oil and gas exposure (~0.25% of portfolio) • No aviation exposure to commercial airlines or cargo operators $36B • No rail exposure • No consumer credit card exposure Lease Financing CRE 8% 26% Commercial Real Estate Loan Mix Total CRE % of Total $M TCF Loans Multifamily 1,893 5.3 Office 1,356 3.8 Retail 1,260 3.5 $9B Warehouse 985 2.7 Hotel 764 2.1 Senior Housing 672 1.9 Mixed Use 484 1.3 Self Storage 480 1.3 Other 1,593 4.5 TOTAL 9,487 26.4% 15

C&I and Lease Financing Diversification C&I and Lease Financing by NAICS Code Inventory Finance (excluding Inventory Finance) by Sector Traditional C&I and Capital Solutions Traditional C&I Capital Solutions % of % of % of % of Trad. Total % of Total Total C&I and TCF Trad. TCF % of TCF $M Cap. Sol. Loans $M C&I Loans $M Cap. Sol. Loans Manufacturing $ 1,725 16% 4.8% $ 1,042 22% 2.9% $ 684 12% 1.9% Transportation and Warehouse 1,688 15% 4.7% 132 3% 0.4% 1,556 25% 4.3% $4B Real Estate Rental and Leasing 1,005 9% 2.8% 712 14% 2.0% 293 5% 0.8% Health Care and Social 977 9% 2.7% 305 6% 0.8% 672 11% 1.9% Assistance Construction 802 7% 2.2% 327 6% 0.9% 476 8% 1.3% Arts, Entertainment, and 701 6% 2.0% 121 2% 0.3% 580 10% 1.6% Recreation Wholesale Trade 647 6% 1.8% 511 10% 1.4% 136 2% 0.4% • Percent of Total TCF Loans: Finance and Insurance 540 5% 1.5% 478 9% 1.3% 62 1% 0.2% ◦ Powersports - 4.5% Other Services (excl. Public Administration) 509 5% 1.4% 105 2% 0.3% 404 7% 1.1% ◦ Lawn and Garden - 3.0% ◦ Marine - 1.6% Admin and Support and Waste 495 4% 1.4% 261 5% 0.7% 234 4% 0.7% Management and Remediation ◦ Spec. Vehicles - 1.0% Retail Trade 414 4% 1.2% 226 4% 0.6% 187 3% 0.5% ◦ RV - 0.9% Accommodation and Food Services 289 3% 0.8% 102 2% 0.3% 188 3% 0.5% • 84% of portfolio tied to exclusive manufacturer programs with All Other 1,269 11% 3.5% 725 15% 2.0% 542 9% 1.5% repurchase agreements TOTAL $ 11,061 100% 30.8% $ 5,047 100% 13.9% $ 6,014 100% 16.7% • Loans asset-secured and financed at wholesale cost vs. retail price • Averaged 12 bps of annual net charge-offs since 2009 16

Strategic Priorities Take Care of our Team Members Continue to prioritize the health and safety of our team members throughout the COVID-19 issue by supporting work-from-home opportunities and providing premium pay for those working in the office Serve our Customers Leverage our enhanced digital banking platform to provide a positive customer experience while also remaining flexible with our customers through various loan modification and SBA programs Execute & Complete Integration Program Integrate systems, branding and culture as One TCF and provide a consistent customer experience by the fourth quarter of 2020 Manage our Credit Risk Profile Leverage our scalable risk management framework to actively monitor and manage credit risk across the organization 1 1 Financial Targets Adj. ROATCE Adj. Efficiency Ratio (Post-Cost Savings in a Normalized Top Quartile Below Operating Environment) Compared to Peers Peer Median 1 Financial targets compared to TCF Peer Group which includes KEY, RF, MTB, FRC, HBAN, CMA, ZION, PBCT, CIT, SNV, EWBC, FHN, FCNC.A, FNB, ASB, BKU, VLY and IBKC. ROATCE and 17 adjusted efficiency ratio are non-GAAP financial measures. A reconciliation of the ROATCE and adjusted efficiency ratio targets to the most directly comparable GAAP measure is not provided because the Company is unable to provide such reconciliation without unreasonable effort, however, it is expected to be consistent with historical non-GAAP reconciliation included in the appendix.

Appendix

Completed Repositioning of Investment Securities Portfolio Investment Securities Balances ($ billions) Investment Securities Mix (1Q20) Yield2 Other $7.2 $6.9 $7.2 $0.6B $5.7 Obligations of states and political 8% subdivisions 12% 2.84% $0.9B 2.81% 2.73% 9% Agency $7B CMBS Agency $0.7B 71% MBS 2Q19 3Q19 4Q19 1Q20 $5.0B 15.3% 12.5% 14.7% 14.7% of total assets of total assets of total assets of total assets TCF/Chemical Combined1 1Q20 Investment Securities Highlights Investment Securities Portfolio Attributes (1Q20) • Completed reinvestment of $1.6B of investments securities sold in 3Q19 3.25 Years 96% • Purchased investment securities in 1Q20 with an average duration at AA and AAA rated tax-equivalent yield of 2.62%2, compared to the 4Q19 March 31, 2020 purchase yield of 2.71%2 and the weighted average yield of securities sold in 3Q19 of 2.43% 1 Combined TCF and Chemical reported financials 19 2 Annualized and presented on a fully tax-equivalent basis

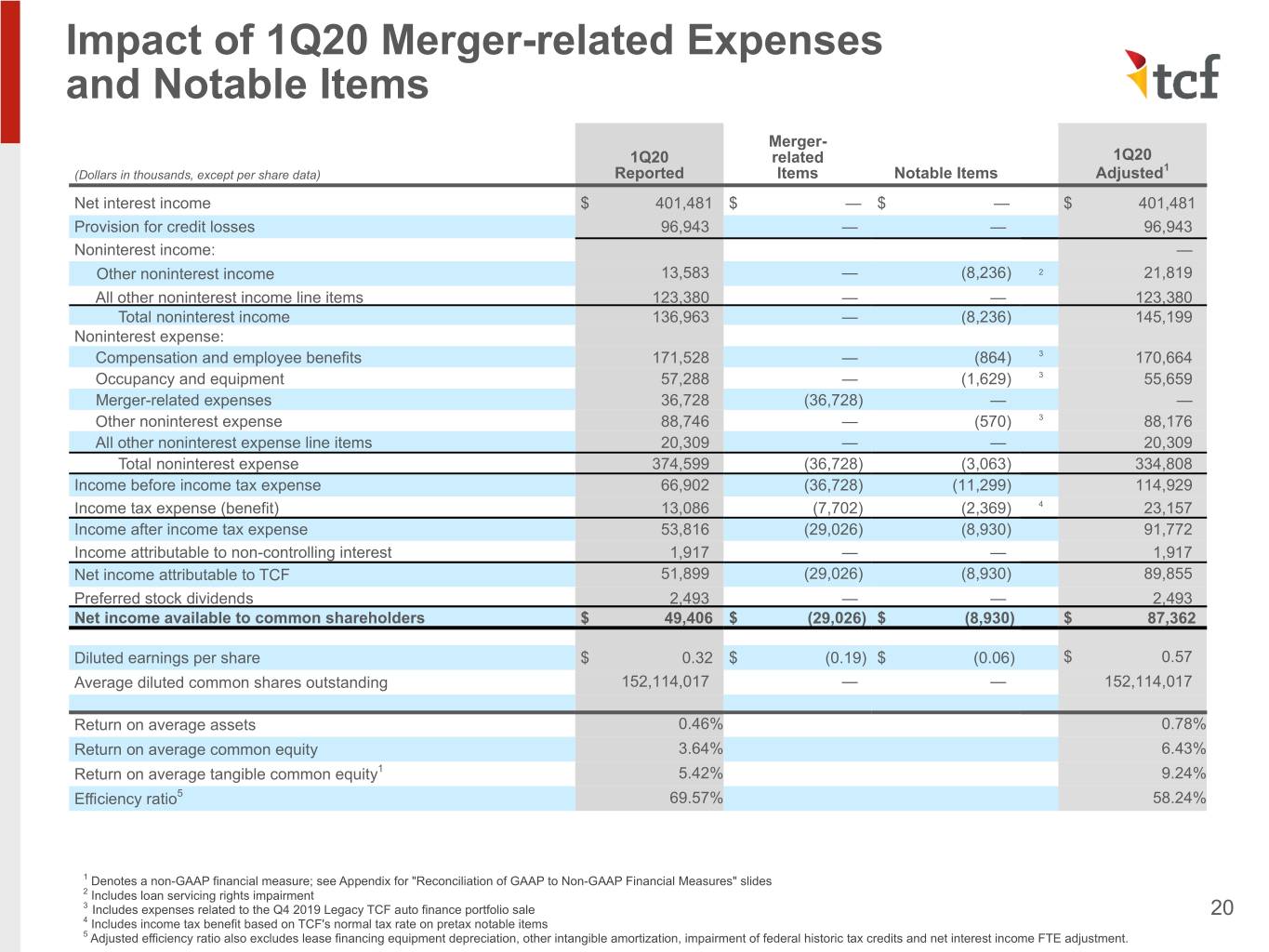

Impact of 1Q20 Merger-related Expenses and Notable Items Merger- 1Q20 related 1Q20 1 (Dollars in thousands, except per share data) Reported Items Notable Items Adjusted Net interest income $ 401,481 $ — $ — $ 401,481 Provision for credit losses 96,943 — — 96,943 Noninterest income: — Other noninterest income 13,583 — (8,236) 2 21,819 All other noninterest income line items 123,380 — — 123,380 Total noninterest income 136,963 — (8,236) 145,199 Noninterest expense: Compensation and employee benefits 171,528 — (864) 3 170,664 Occupancy and equipment 57,288 — (1,629) 3 55,659 Merger-related expenses 36,728 (36,728) — — Other noninterest expense 88,746 — (570) 3 88,176 All other noninterest expense line items 20,309 — — 20,309 Total noninterest expense 374,599 (36,728) (3,063) 334,808 Income before income tax expense 66,902 (36,728) (11,299) 114,929 Income tax expense (benefit) 13,086 (7,702) (2,369) 4 23,157 Income after income tax expense 53,816 (29,026) (8,930) 91,772 Income attributable to non-controlling interest 1,917 — — 1,917 Net income attributable to TCF 51,899 (29,026) (8,930) 89,855 Preferred stock dividends 2,493 — — 2,493 Net income available to common shareholders $ 49,406 $ (29,026) $ (8,930) $ 87,362 Diluted earnings per share $ 0.32 $ (0.19) $ (0.06) $ 0.57 Average diluted common shares outstanding 152,114,017 — — 152,114,017 Return on average assets 0.46% 0.78% Return on average common equity 3.64% 6.43% Return on average tangible common equity1 5.42% 9.24% Efficiency ratio5 69.57% 58.24% 1 Denotes a non-GAAP financial measure; see Appendix for "Reconciliation of GAAP to Non-GAAP Financial Measures" slides 2 Includes loan servicing rights impairment 3 Includes expenses related to the Q4 2019 Legacy TCF auto finance portfolio sale 20 4 Includes income tax benefit based on TCF's normal tax rate on pretax notable items 5 Adjusted efficiency ratio also excludes lease financing equipment depreciation, other intangible amortization, impairment of federal historic tax credits and net interest income FTE adjustment.

Non-GAAP Reconciliation Computation of adjusted diluted earnings per common share: Quarter Ended Mar. 31, (Dollars in thousands, except per share data) 2020 Earnings allocated to common stock (a) $ 49,406 Merger-related expenses 36,728 Notable items: Sale of legacy TCF auto finance portfolio and related expenses1 3,063 Write-down of company-owned vacant land parcels and branch exit costs2 — Pension fair valuation adjustment2 — Loan servicing rights (recovery) impairment3 8,236 Total notable items 11,299 Related income tax expense, net of benefits4 (10,071) Total adjustments, net of tax 37,956 Adjusted earnings allocated to common stock (b) $ 87,362 Weighted-average common shares outstanding used in diluted earnings per common share calculation (c) 152,114,017 Diluted earnings per common share (a) / (c) $ 0.32 Adjusted diluted earnings per common share (b) / (c) 0.57 1 First quarter 2020 amount included within occupancy and equipment ($1.6 million), compensation and employee benefits ($0.9 million) and other noninterest expense ($0.6 million). 2 Included within Other noninterest expense 3 Included in Other noninterest income 4 Included within Income tax expense (benefit) 21

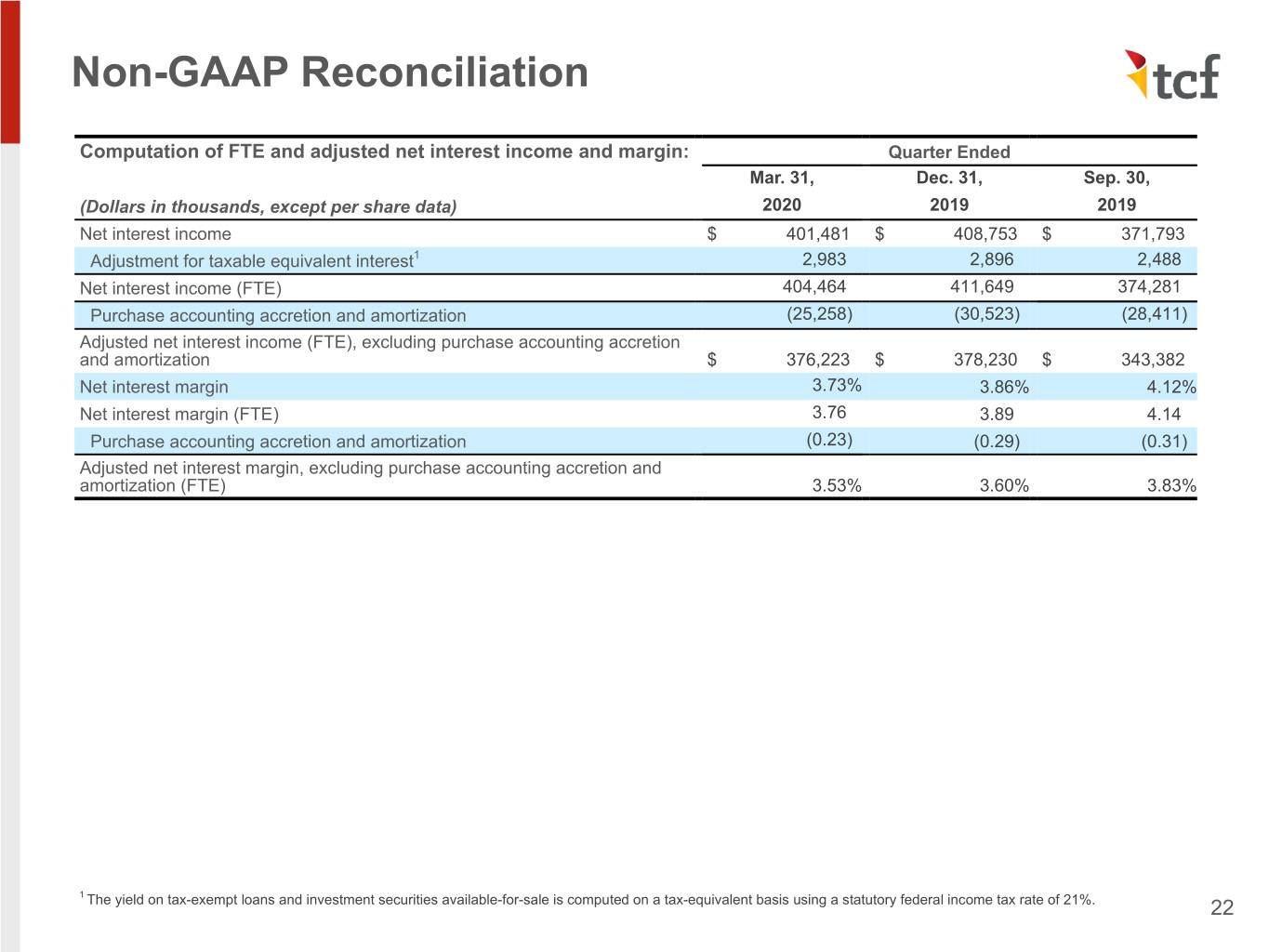

Non-GAAP Reconciliation Computation of FTE and adjusted net interest income and margin: Quarter Ended Mar. 31, Dec. 31, Sep. 30, (Dollars in thousands, except per share data) 2020 2019 2019 Net interest income $ 401,481 $ 408,753 $ 371,793 Adjustment for taxable equivalent interest1 2,983 2,896 2,488 Net interest income (FTE) 404,464 411,649 374,281 Purchase accounting accretion and amortization (25,258) (30,523) (28,411) Adjusted net interest income (FTE), excluding purchase accounting accretion and amortization $ 376,223 $ 378,230 $ 343,382 Net interest margin 3.73% 3.86% 4.12% Net interest margin (FTE) 3.76 3.89 4.14 Purchase accounting accretion and amortization (0.23) (0.29) (0.31) Adjusted net interest margin, excluding purchase accounting accretion and amortization (FTE) 3.53% 3.60% 3.83% 1 The yield on tax-exempt loans and investment securities available-for-sale is computed on a tax-equivalent basis using a statutory federal income tax rate of 21%. 22

Non-GAAP Reconciliation Computation of adjusted provision and net charge-offs: Quarter Ended Dec. 31, (Dollars in thousands) 2019 Provision $ 14,403 Provision benefit due to the consumer nonaccrual and TDR loan sale 4,694 Adjusted provision, excluding consumer nonaccrual and TDR loan sale $ 19,097 Net charge-offs (a) $ (6,237) Recovery related to the consumer nonaccrual and TDR loan sale (b) (4,694) Adjusted net charge-offs, excluding consumer nonaccrual and TDR loan sale (c) $ (10,931) Average loans and leases (d) $ 33,804,883 Net charge-off rate as a percentage of average loans and leases1 (a)/(d) 0.07% Impact of recovery to net charge-off ratio related to the consumer nonaccrual and TDR loan sale1 (b)/(d) 0.06 Adjusted net charge-off ratio, excluding consumer nonaccrual and TDR loan sale1 (c)/(d) 0.13% 23 1 Annualized

Non-GAAP Reconciliation Computation of adjusted return on average assets, common equity, average tangible common equity and average tangible common equity: Quarter Ended Mar. 31, (Dollars in thousands) 2020 Adjusted net income after tax expense: Income after tax expense (a) $ 53,816 Merger-related expenses 36,728 Notable items 11,299 Related income tax expense, net of tax benefits (10,071) Adjusted net income after tax expense for ROAA calculation (b) 91,772 Net income available to common shareholders (c) 49,406 Other intangibles amortization 5,480 Related income tax expense (1,149) Net income available to common shareholders used in ROATCE calculation (d) 53,737 Adjusted net income available to common shareholders: Net income available to common shareholders 49,406 Notable items 11,299 Merger-related expenses 36,728 Related income tax expense, net of tax benefits (10,071) Net income available to common shareholders used in adjusted ROAA and ROACE calculation (e) 87,362 Other intangibles amortization 5,480 Related income tax expense (1,149) Net income available to common shareholders used in adjusted ROATCE calculation (f) 91,693 Average balances: Average assets (g) 46,985,426 Total equity 5,630,487 Non-controlling interest in subsidiaries (25,328) Total TCF Financial Corporation shareholders' equity 5,605,159 Preferred stock (169,302) Average total common shareholders' equity used in ROACE calculation (h) 5,435,857 Goodwill, net (1,301,080) Other intangibles, net (166,298) Average tangible common shareholders' equity used in ROATCE calculation (i) $ 3,968,479 ROAA1 (a) / (g) 0.46% Adjusted ROAA1 (b) / (g) 0.78 ROACE1 (c) / (h) 3.64 Adjusted ROACE1 (e) / (h) 6.43 ROATCE1 (d) / (i) 5.42 Adjusted ROATCE1 (f) / (i) 9.24 24 1 Annualized.

Non-GAAP Reconciliation Computation of adjusted efficiency ratio, noninterest income and noninterest expense: Quarter Ended Mar. 31, Dec. 31, Sep. 30, (Dollars in thousands) 2020 2019 2019 Noninterest expense (a) $ 374,599 $ 416,571 $ 425,620 Merger-related expenses (36,728) (47,025) (111,259) Write-down of company-owned vacant land parcels and branch — (3,494) (5,890) exit costs Sale of Legacy TCF auto finance portfolio (3,063) (4,670) — Pension fair valuation adjustment — (6,341) — Adjusted noninterest expense 334,808 355,041 308,471 Lease financing equipment depreciation (18,450) (18,629) (19,408) Amortization of intangibles (5,480) (5,505) (4,544) Impairment of federal historic tax credits (1,521) (4,030) — Adjusted noninterest expense, efficiency ratio (b) 309,357 326,877 284,519 Net interest income $ 401,481 $ 408,753 $ 371,793 Noninterest income 136,963 158,052 94,258 Total revenue (c) $ 538,444 $ 566,805 $ 466,051 Noninterest income $ 136,963 $ 158,052 $ 94,258 Sale of Legacy TCF auto finance portfolio — 8,194 19,264 Termination of interest rate swaps — — 17,302 Gain on sales of certain investment securities — — (5,869) Loan servicing rights (recovery) impairment 8,236 (638) 4,520 Adjusted noninterest income 145,199 165,608 129,475 Net interest income 401,481 408,753 371,793 Net interest income FTE adjustment 2,983 2,896 2,488 Adjusted net interest income 404,464 411,649 374,281 Lease financing equipment depreciation (18,450) (18,629) (19,408) Adjusted total revenue, efficiency ratio (d) $ 531,213 $ 558,628 $ 484,348 Efficiency ratio (a) / (c) 69.57% 73.49% 91.32% Adjusted efficiency ratio (b) / (d) 58.24% 58.51% 58.74% 25

Non-GAAP Reconciliation Computation of tangible common equity to tangible assets and tangible book value per common share: Quarter Ended Mar. 31, Dec. 31, Sep. 30, (Dollars in thousands, except per share data) 2020 2019 2019 Total equity $ 5,655,833 $ 5,727,241 $ 5,693,417 Non-controlling interest in subsidiaries (30,149) (20,226) (23,313) Total TCF Financial Corporation shareholders' equity 5,625,684 5,707,015 5,670,104 Preferred stock (169,302) (169,302) (169,302) Total common shareholders' equity (a) 5,456,382 5,537,713 5,500,802 Goodwill, net (1,313,046) (1,299,878) (1,265,111) Other intangibles, net (162,887) (168,368) (215,910) Tangible common shareholders' equity (b) $ 3,980,449 $ 4,069,467 $ 4,019,781 Total assets (c) $ 48,594,383 $ 46,651,553 $ 45,692,511 Goodwill, net (1,313,046) (1,299,878) (1,265,111) Other intangibles, net (162,887) (168,368) (215,910) Tangible assets (d) $ 47,118,450 $ 45,183,307 $ 44,211,490 Common stock shares outstanding (e) 152,185,984 152,965,571 153,571,381 Common equity to assets (a) / (c) 11.23% 11.87% 12.04% Tangible common equity to tangible assets (b) / (d) 8.45 9.01 9.09 Book value per common share (a) / (e) $ 35.85 $ 36.20 $ 35.82 Tangible book value per common share (b) / (e) 26.16 26.60 26.18 26