Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ONE Gas, Inc. | ogsq12020er8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ONE Gas, Inc. | ogsq12020earningsrelea.htm |

Exhibit 99.2 INVESTOR UPDATE April 27, 2020

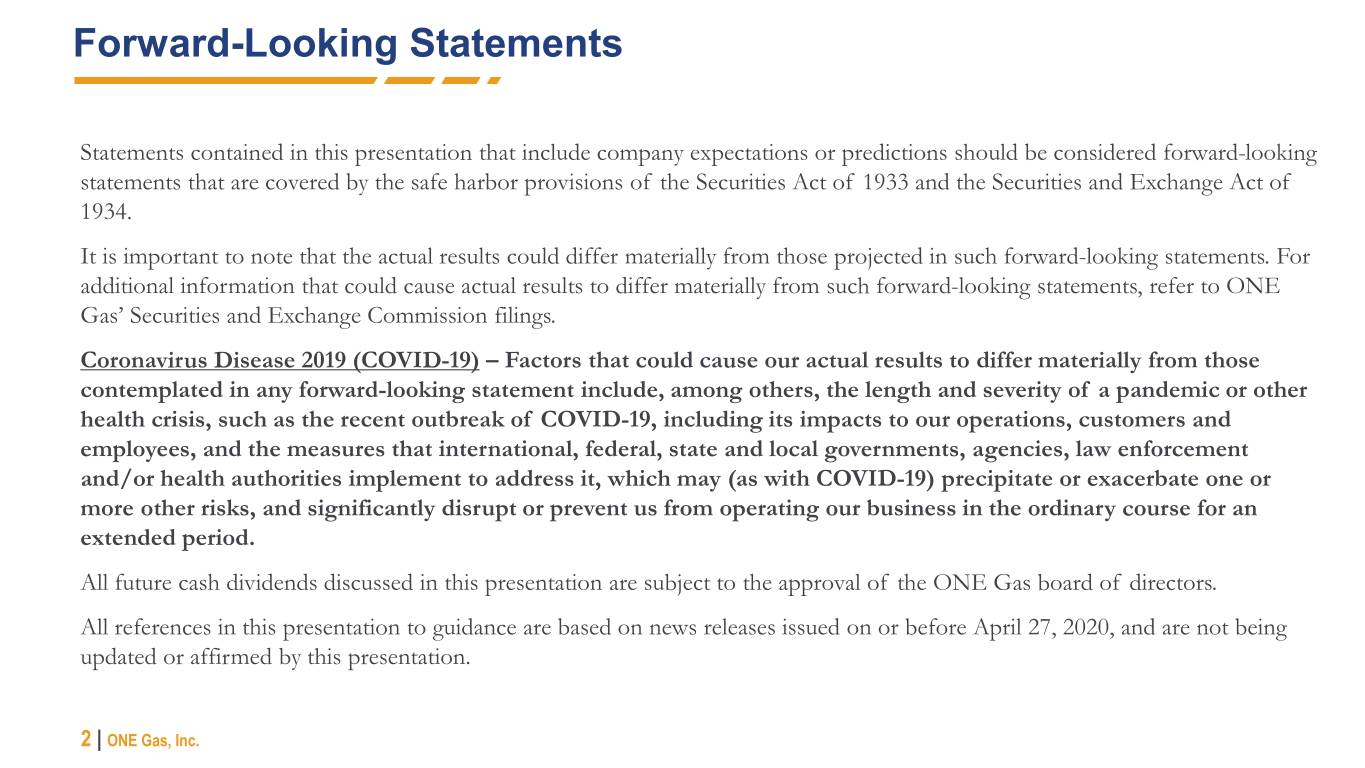

Forward-Looking Statements Statements contained in this presentation that include company expectations or predictions should be considered forward-looking statements that are covered by the safe harbor provisions of the Securities Act of 1933 and the Securities and Exchange Act of 1934. It is important to note that the actual results could differ materially from those projected in such forward-looking statements. For additional information that could cause actual results to differ materially from such forward-looking statements, refer to ONE Gas’ Securities and Exchange Commission filings. Coronavirus Disease 2019 (COVID-19) – Factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement include, among others, the length and severity of a pandemic or other health crisis, such as the recent outbreak of COVID-19, including its impacts to our operations, customers and employees, and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities implement to address it, which may (as with COVID-19) precipitate or exacerbate one or more other risks, and significantly disrupt or prevent us from operating our business in the ordinary course for an extended period. All future cash dividends discussed in this presentation are subject to the approval of the ONE Gas board of directors. All references in this presentation to guidance are based on news releases issued on or before April 27, 2020, and are not being updated or affirmed by this presentation. 2 | ONE Gas, Inc.

RESPONSE TO COVID-19

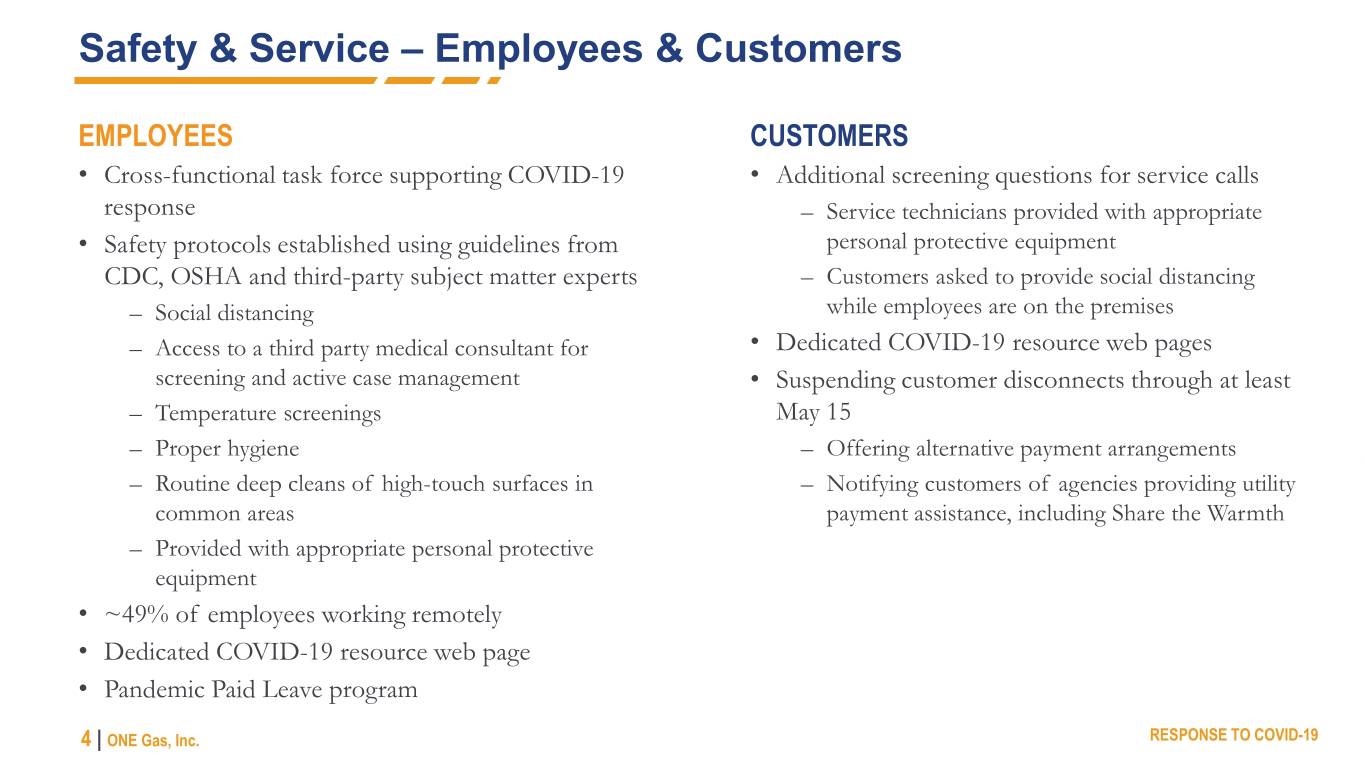

Safety & Service – Employees & Customers EMPLOYEES CUSTOMERS • Cross-functional task force supporting COVID-19 • Additional screening questions for service calls response – Service technicians provided with appropriate • Safety protocols established using guidelines from personal protective equipment CDC, OSHA and third-party subject matter experts – Customers asked to provide social distancing – Social distancing while employees are on the premises – Access to a third party medical consultant for • Dedicated COVID-19 resource web pages screening and active case management • Suspending customer disconnects through at least – Temperature screenings May 15 – Proper hygiene – Offering alternative payment arrangements – Routine deep cleans of high-touch surfaces in – Notifying customers of agencies providing utility common areas payment assistance, including Share the Warmth – Provided with appropriate personal protective equipment • ~49% of employees working remotely • Dedicated COVID-19 resource web page • Pandemic Paid Leave program 4 | ONE Gas, Inc. RESPONSE TO COVID-19

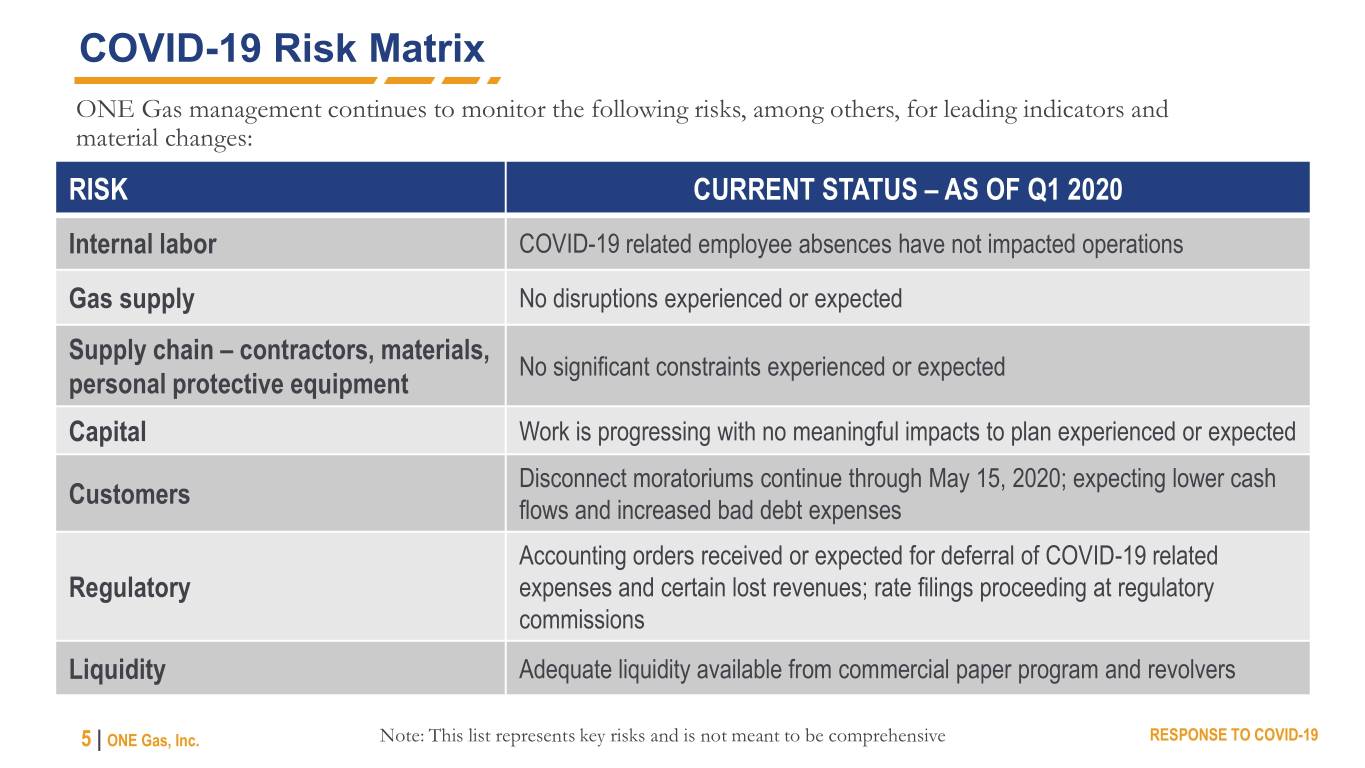

COVID-19 Risk Matrix ONE Gas management continues to monitor the following risks, among others, for leading indicators and material changes: RISK CURRENT STATUS – AS OF Q1 2020 Internal labor COVID-19 related employee absences have not impacted operations Gas supply No disruptions experienced or expected Supply chain – contractors, materials, No significant constraints experienced or expected personal protective equipment Capital Work is progressing with no meaningful impacts to plan experienced or expected Disconnect moratoriums continue through May 15, 2020; expecting lower cash Customers flows and increased bad debt expenses Accounting orders received or expected for deferral of COVID-19 related Regulatory expenses and certain lost revenues; rate filings proceeding at regulatory commissions Liquidity Adequate liquidity available from commercial paper program and revolvers 5 | ONE Gas, Inc. Note: This list represents key risks and is not meant to be comprehensive RESPONSE TO COVID-19

VALUE CREATION STRATEGY

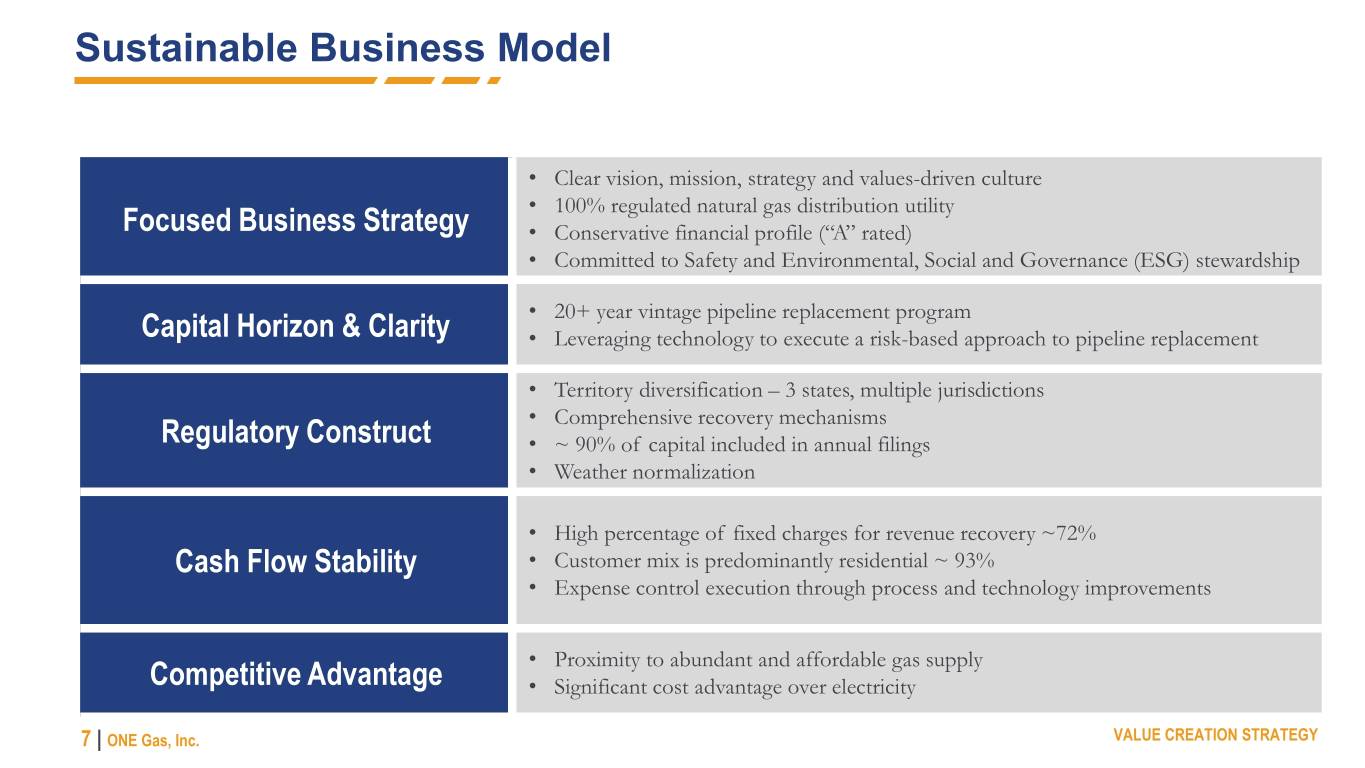

Sustainable Business Model • Clear vision, mission, strategy and values-driven culture • 100% regulated natural gas distribution utility Focused Business Strategy • Conservative financial profile (“A” rated) • Committed to Safety and Environmental, Social and Governance (ESG) stewardship • 20+ year vintage pipeline replacement program Capital Horizon & Clarity • Leveraging technology to execute a risk-based approach to pipeline replacement • Territory diversification – 3 states, multiple jurisdictions • Comprehensive recovery mechanisms Regulatory Construct • ~ 90% of capital included in annual filings • Weather normalization • High percentage of fixed charges for revenue recovery ~72% Cash Flow Stability • Customer mix is predominantly residential ~ 93% • Expense control execution through process and technology improvements • Proximity to abundant and affordable gas supply Competitive Advantage • Significant cost advantage over electricity 7 | ONE Gas, Inc. VALUE CREATION STRATEGY

FOCUSED BUSINESS STRATEGY

Mission, Vision, Strategy and Core Values Mission – Why we exist Core Values – Our compass We deliver natural gas for a better tomorrow SAFETY We are committed to operating safely and in an environmentally responsible manner. Vision – What we want to be ETHICS To be a premier natural gas distribution company We are accountable to the highest ethical standards and are creating exceptional value for our stakeholders committed to compliance. Honesty, trust and integrity matter. INCLUSION AND DIVERSITY Strategy – How we do it We embrace an inclusive and diverse culture that encourages collaboration. Every employee makes a difference and Becoming ONE: contributes to our success. • ONE in Responsibility – safety, reliability and compliance SERVICE • ONE in Value – customers, employees, investors and communities We provide exceptional service and make continuous • ONE in Industry – recognized leader, processes and productivity improvements in our pursuit of excellence. VALUE We create value for all stakeholders, including our customers, employees, investors and communities. 9 | ONE Gas, Inc. FOCUSED BUSINESS STRATEGY

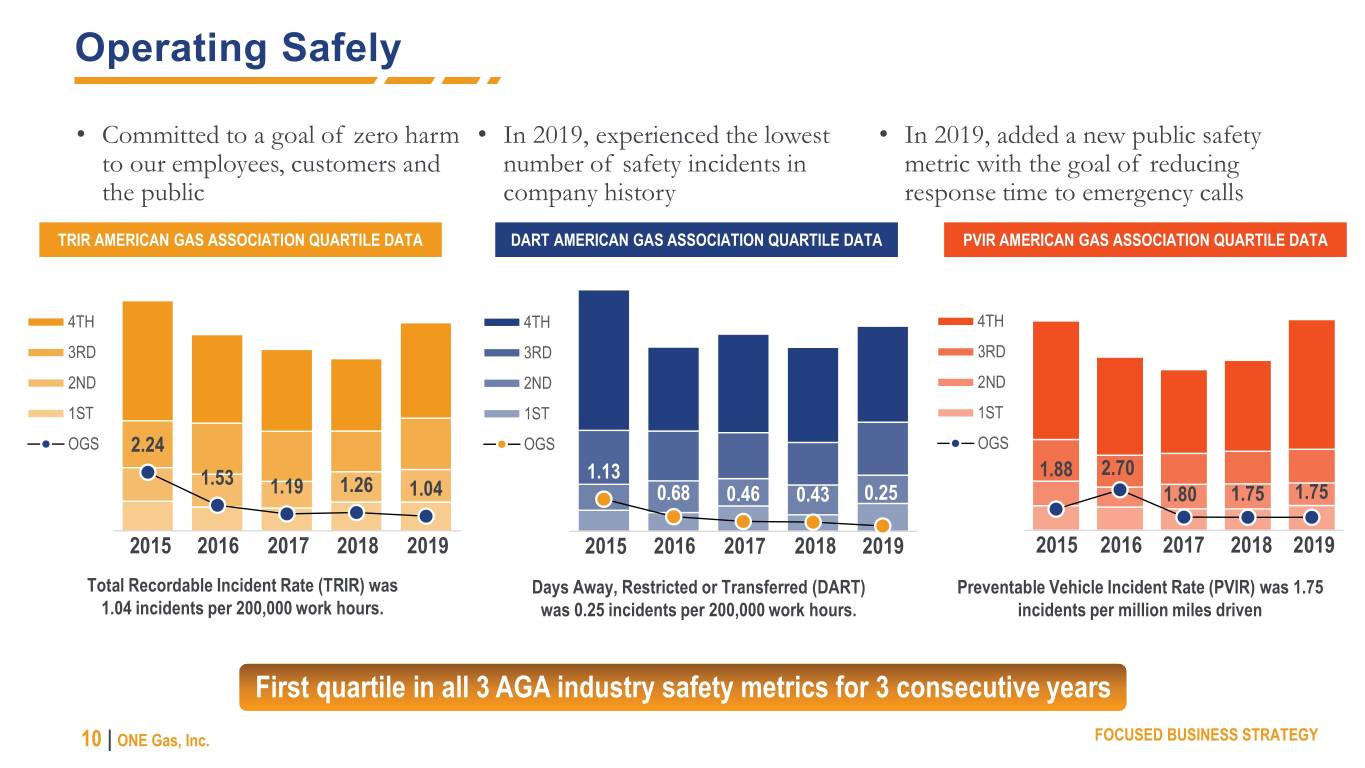

Operating Safely • Committed to a goal of zero harm • In 2019, experienced the lowest • In 2019, added a new public safety to our employees, customers and number of safety incidents in metric with the goal of reducing the public company history response time to emergency calls TRIR AMERICAN GAS ASSOCIATION QUARTILE DATA DART AMERICAN GAS ASSOCIATION QUARTILE DATA PVIR AMERICAN GAS ASSOCIATION QUARTILE DATA 4TH 4TH 4TH 3RD 3RD 3RD 2ND 2ND 2ND 1ST 1ST 1ST OGS 2.24 OGS OGS 1.53 1.13 1.88 2.70 1.19 1.26 1.04 0.68 0.46 0.43 0.25 1.80 1.75 1.75 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Total Recordable Incident Rate (TRIR) was Days Away, Restricted or Transferred (DART) Preventable Vehicle Incident Rate (PVIR) was 1.75 1.04 incidents per 200,000 work hours. was 0.25 incidents per 200,000 work hours. incidents per million miles driven First quartile in all 3 AGA industry safety metrics for 3 consecutive years 10 | ONE Gas, Inc. FOCUSED BUSINESS STRATEGY

Safety and ESG (Environmental, Social & Governance) Stewardship at a Glance… SAFETY Safety is our number one core value and the foundation of what we do as a company. ENVIRONMENTAL We are thoughtful and proactive in caring for the environment. ONE Gas Corporate Responsibility Report www.onegas.com/sustainability AGA Voluntary Sustainability Metrics SOCIAL RESPONSIBILITY www.onegas.com/aga-metrics We use our financial resources responsibly to improve the quality of life for employees and customers in our communities. GOVERNANCE We take ownership over our work and do what’s right. 11 | ONE Gas, Inc. FOCUSED BUSINESS STRATEGY

100% Regulated Natural Gas Utility One of the largest publicly traded natural gas distribution companies 72% market share • ~ 2.2 million customers • ~ 3,600 employees • ~ 62,340 miles of distribution mains, services and transmission pipelines 88% market share Estimated 2020 average rate base: $3.91 billion* • 42% in Oklahoma 13% market share • 29% in Kansas • 29% in Texas * For definition of estimated average rate base, see Appendix 12 | ONE Gas, Inc. FOCUSED BUSINESS STRATEGY

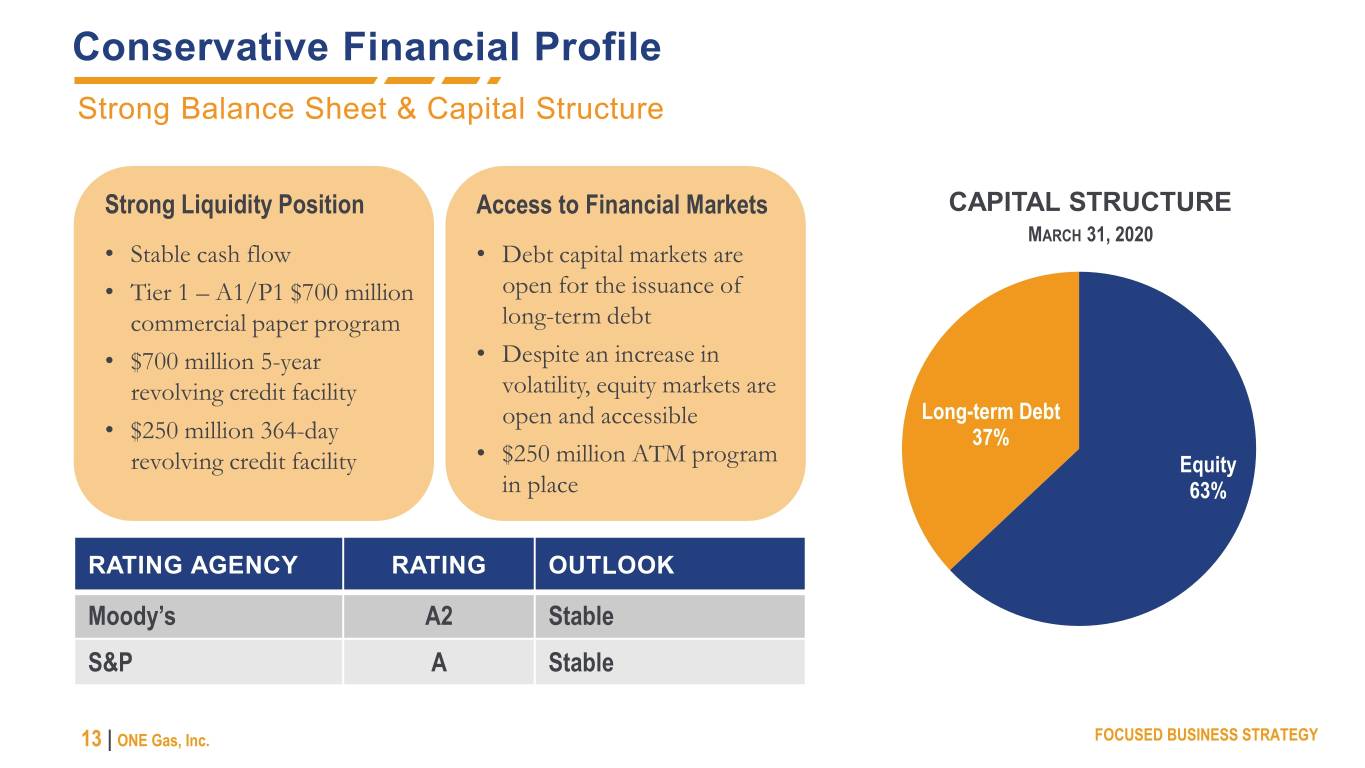

Conservative Financial Profile Strong Balance Sheet & Capital Structure Strong Liquidity Position Access to Financial Markets CAPITAL STRUCTURE MARCH 31, 2020 • Stable cash flow • Debt capital markets are • Tier 1 – A1/P1 $700 million open for the issuance of commercial paper program long-term debt • $700 million 5-year • Despite an increase in revolving credit facility volatility, equity markets are open and accessible Long-term Debt • $250 million 364-day 37% revolving credit facility • $250 million ATM program Equity in place 63% RATING AGENCY RATING OUTLOOK Moody’s A2 Stable S&P A Stable 13 | ONE Gas, Inc. FOCUSED BUSINESS STRATEGY

CAPITAL HORIZON & CLARITY

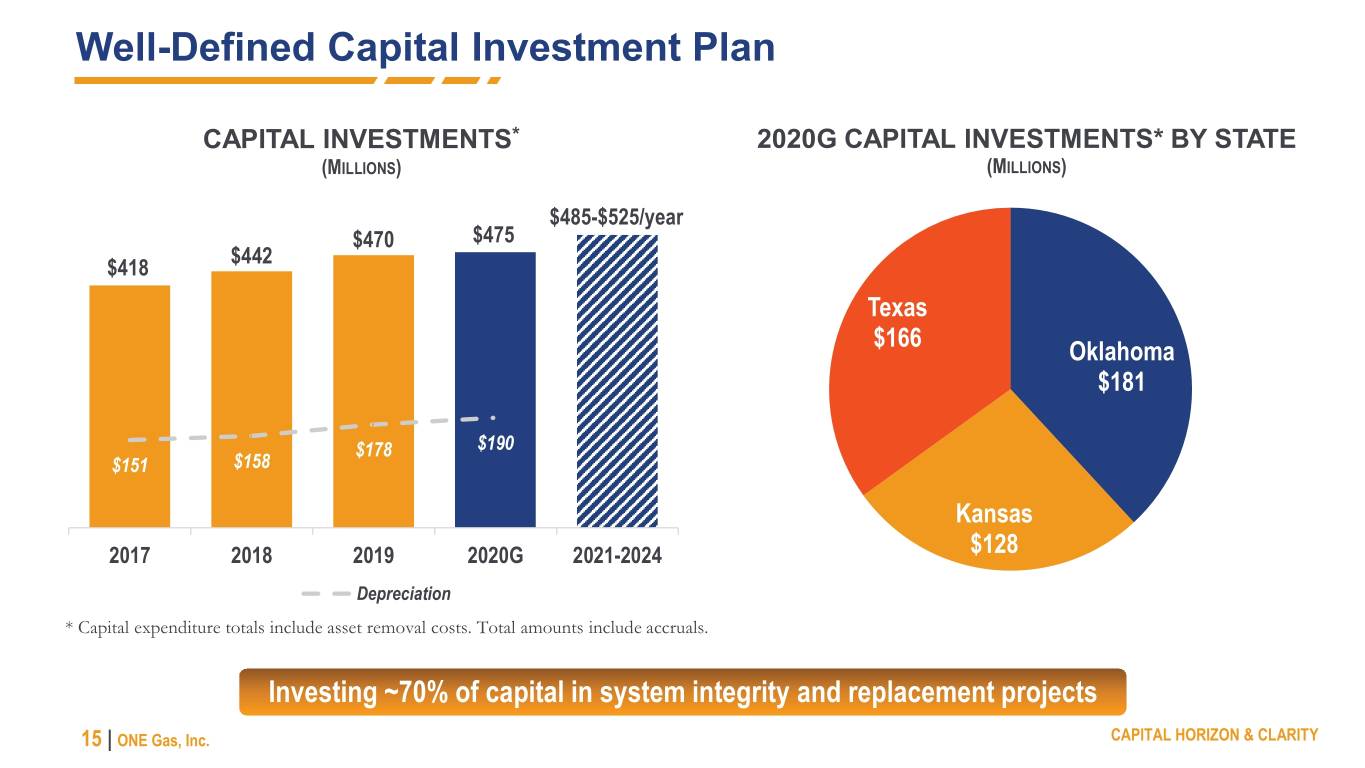

Well-Defined Capital Investment Plan CAPITAL INVESTMENTS* 2020G CAPITAL INVESTMENTS* BY STATE (MILLIONS) (MILLIONS) $485-$525/year $470 $475 $442 $418 Texas $166 Oklahoma $181 $178 $190 $151 $158 Kansas 2017 2018 2019 2020G 2021-2024 $128 Depreciation * Capital expenditure totals include asset removal costs. Total amounts include accruals. Investing ~70% of capital in system integrity and replacement projects 15 | ONE Gas, Inc. CAPITAL HORIZON & CLARITY

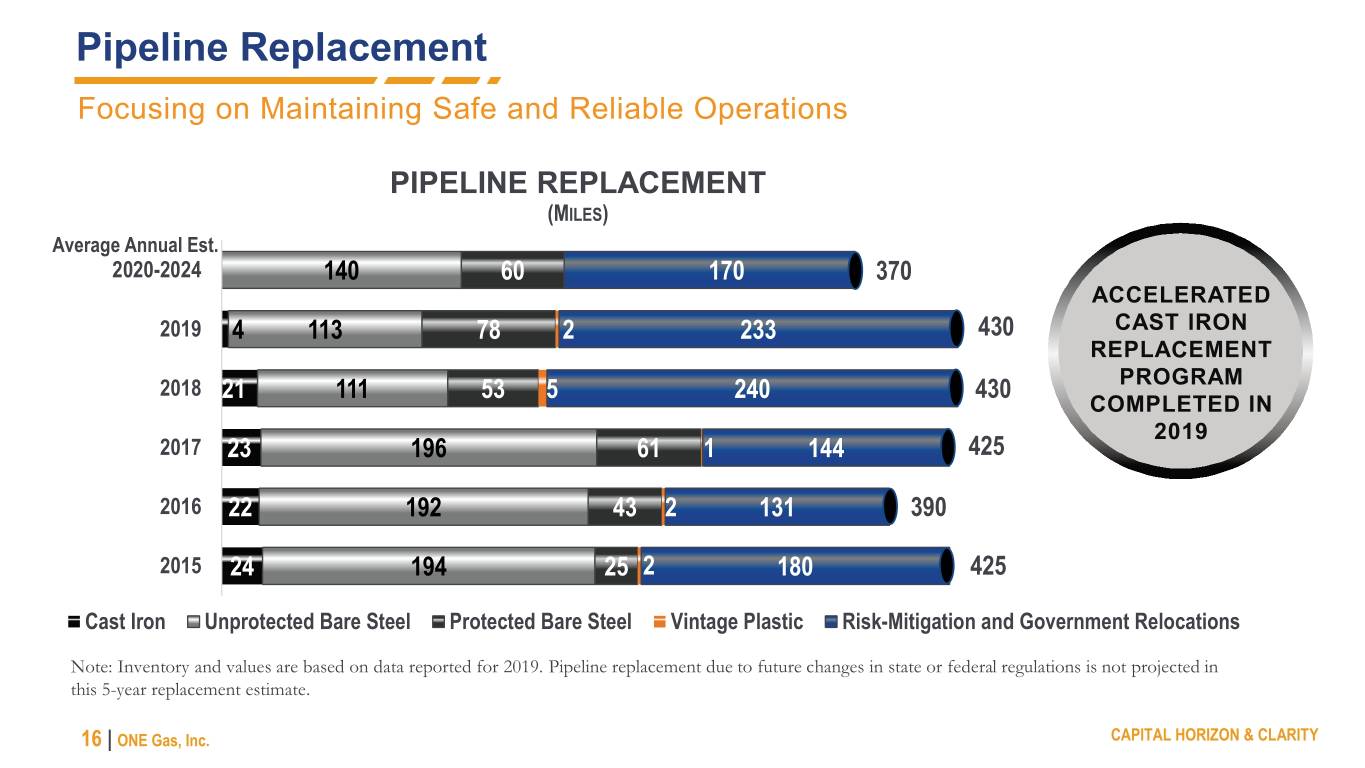

Pipeline Replacement Focusing on Maintaining Safe and Reliable Operations PIPELINE REPLACEMENT (MILES) Average Annual Est. 2020-2024 140 60 170 370 ACCELERATED 2019 4 113 78 2 233 430 CAST IRON REPLACEMENT 2018 21 111 53 5 240 430 PROGRAM COMPLETED IN 2019 2017 23 196 61 1 144 425 2016 22 192 43 2 131 390 2015 24 194 25 2 180 425 Cast Iron Unprotected Bare Steel Protected Bare Steel Vintage Plastic Risk-Mitigation and Government Relocations Note: Inventory and values are based on data reported for 2019. Pipeline replacement due to future changes in state or federal regulations is not projected in this 5-year replacement estimate. 16 | ONE Gas, Inc. CAPITAL HORIZON & CLARITY

Vintage Pipeline Replacement Program As of December 31, 2019 VINTAGE PIPE AS PORTION OF TOTAL PIPELINE INVENTORY (MILES) Over past 5 years, averaged ~ 234 miles vintage pipe 850 1,000 replaced per year 5,240 4,240 2020-2024E 56,250 2025 & Beyond All Other Main, Service & Transmission Pipelines Risk-Mitigation & Government Relocations 2020-2024E Identified Inventory of Vintage Materials Vintage Pipeline Replacement Program 2020-2024E* Note: Inventory and values are based on data reported for 2019. Pipeline replacement due to future changes in state or federal regulations is not projected in this replacement estimate. * The vintage pipeline replacement program includes: wrought iron, unprotected bare steel, protected bare steel and vintage plastic. Vintage pipeline replacement program represents more than a 20-year investment runway 17 | ONE Gas, Inc. CAPITAL HORIZON & CLARITY

Rate Base Growth AVERAGE RATE BASE* 2020 ESTIMATED AVERAGE RATE BASE (BILLIONS) TOTAL: $3.91 BILLION* $3.91** $3.62 $3.18 $3.36 $2.96 $1.14 billion $1.65 billion $1.12 billion 2016 2017 2018 2019 2020G Oklahoma Kansas Texas * For definition of estimated average rate base, see Appendix ** Estimated average rate base Expected average annual growth of 7% between 2019 and 2024 18 | ONE Gas, Inc. CAPITAL HORIZON & CLARITY

REGULATORY CONSTRUCT

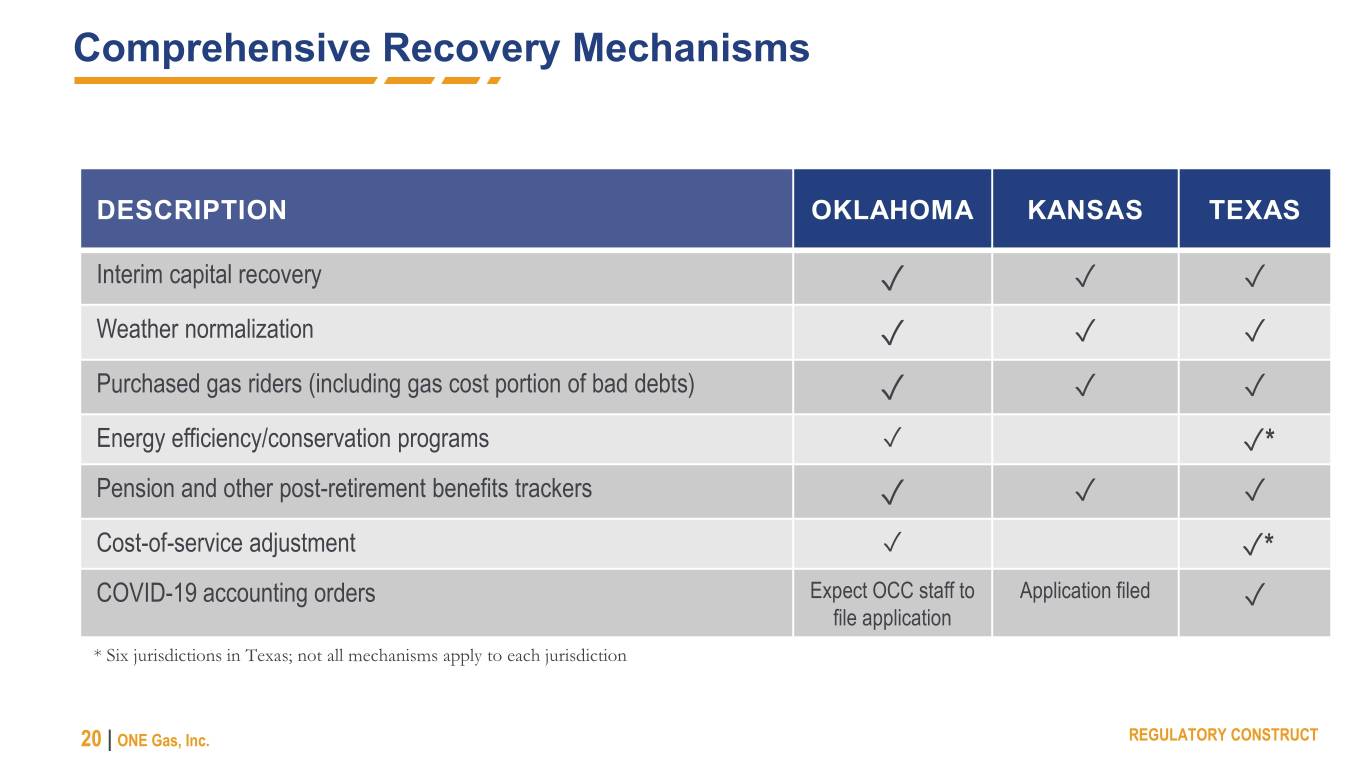

Comprehensive Recovery Mechanisms DESCRIPTION OKLAHOMA KANSAS TEXAS Interim capital recovery ✓ ✓ ✓ Weather normalization ✓ ✓ ✓ Purchased gas riders (including gas cost portion of bad debts) ✓ ✓ ✓ Energy efficiency/conservation programs ✓ ✓* Pension and other post-retirement benefits trackers ✓ ✓ ✓ Cost-of-service adjustment ✓ ✓* COVID-19 accounting orders Expect OCC staff to Application filed file application ✓ * Six jurisdictions in Texas; not all mechanisms apply to each jurisdiction 20 | ONE Gas, Inc. REGULATORY CONSTRUCT

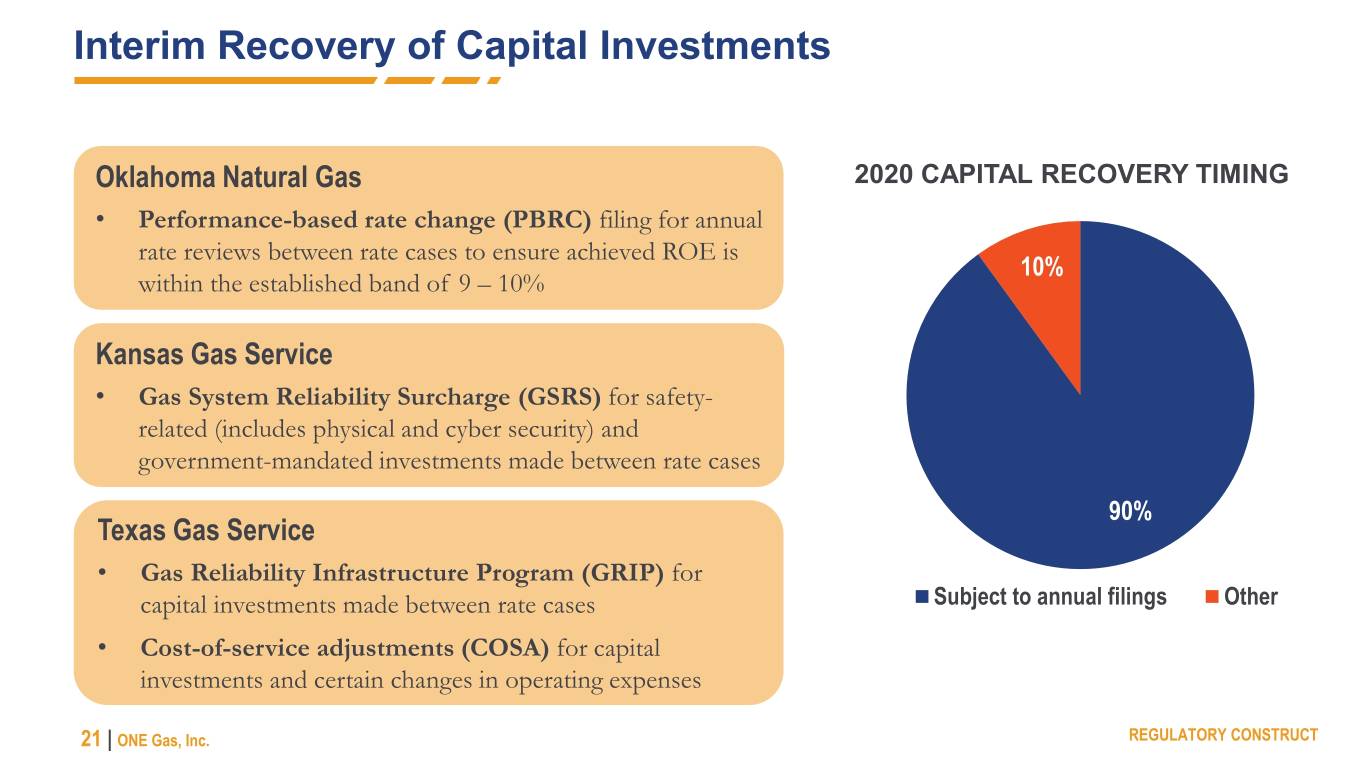

Interim Recovery of Capital Investments Oklahoma Natural Gas 2020 CAPITAL RECOVERY TIMING • Performance-based rate change (PBRC) filing for annual rate reviews between rate cases to ensure achieved ROE is 10% within the established band of 9 – 10% Kansas Gas Service • Gas System Reliability Surcharge (GSRS) for safety- related (includes physical and cyber security) and government-mandated investments made between rate cases 90% Texas Gas Service • Gas Reliability Infrastructure Program (GRIP) for capital investments made between rate cases Subject to annual filings Other • Cost-of-service adjustments (COSA) for capital investments and certain changes in operating expenses 21 | ONE Gas, Inc. REGULATORY CONSTRUCT

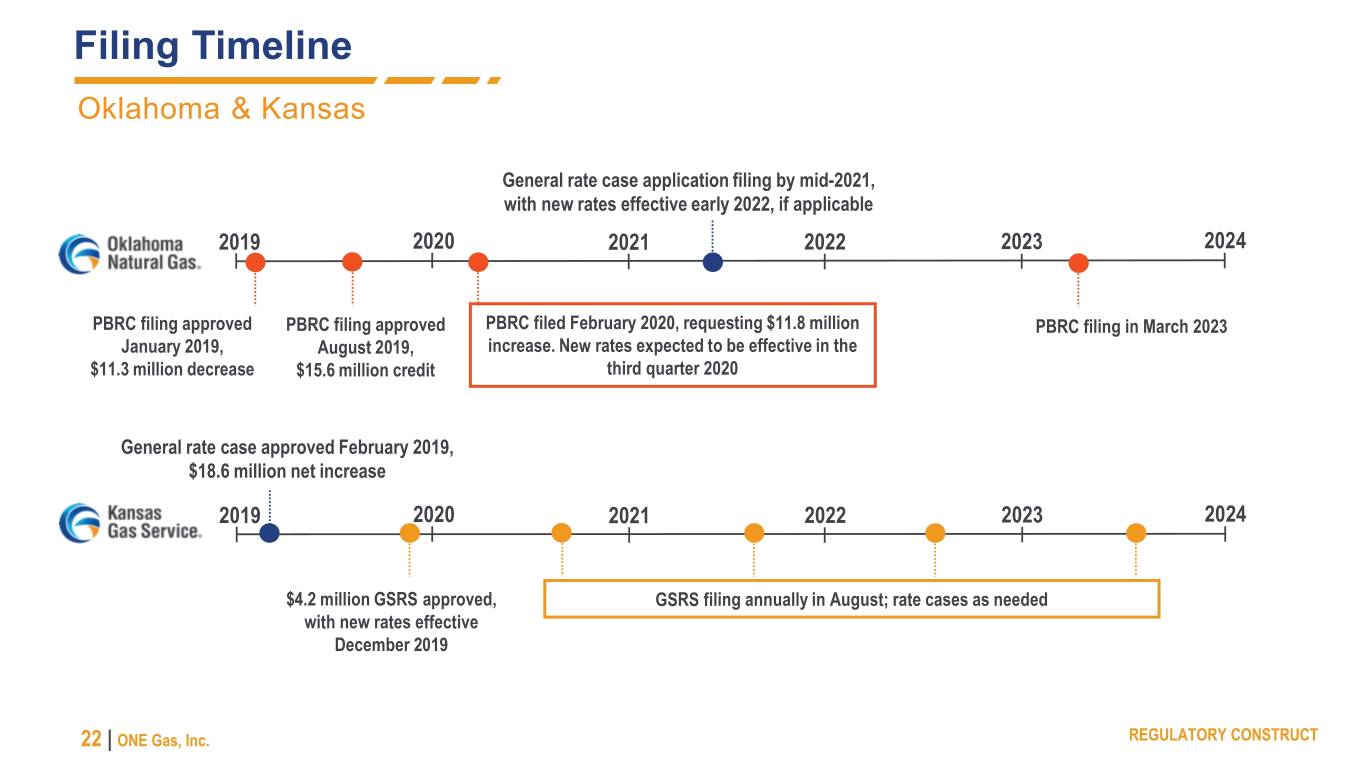

Filing Timeline Oklahoma & Kansas General rate case application filing by mid-2021, with new rates effective early 2022, if applicable 2019 2020 2021 2022 2023 2024 PBRC filing approved PBRC filing approved PBRC filed February 2020, requesting $11.8 million PBRC filing in March 2023 January 2019, August 2019, increase. New rates expected to be effective in the $11.3 million decrease $15.6 million credit third quarter 2020 General rate case approved February 2019, $18.6 million net increase 2019 2020 2021 2022 2023 2024 $4.2 million GSRS approved, GSRS filing annually in August; rate cases as needed with new rates effective December 2019 22 | ONE Gas, Inc. REGULATORY CONSTRUCT

Texas 2020 Central Texas Service Area • $15.6 million rate case filed for Central Texas and Gulf Coast service areas; new rates expected in the third quarter 2020 West Texas Service Area • $4.7 million GRIP filed March 2020; new rates expected in the third quarter 2020 Remainder of Texas • Annual COSA or GRIP filings • Rate cases as needed REGULATORY CONSTRUCT 23 | ONE Gas, Inc. REGULATORY CONSTRUCT

CASH FLOW STABILITY

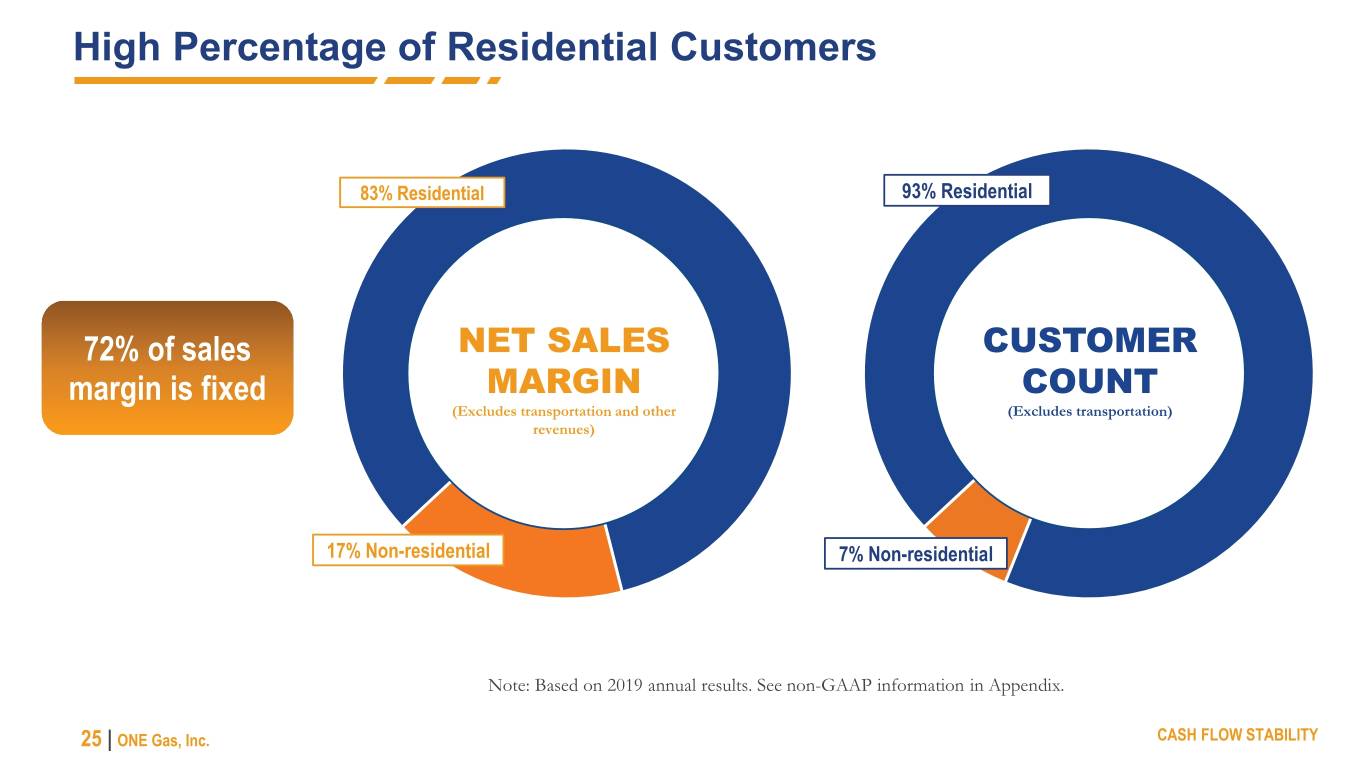

High Percentage of Residential Customers 83% Residential 93% Residential 72% of sales NET SALES CUSTOMER margin is fixed MARGIN COUNT (Excludes transportation and other (Excludes transportation) revenues) 17% Non-residential 7% Non-residential Note: Based on 2019 annual results. See non-GAAP information in Appendix. 25 | ONE Gas, Inc. CASH FLOW STABILITY

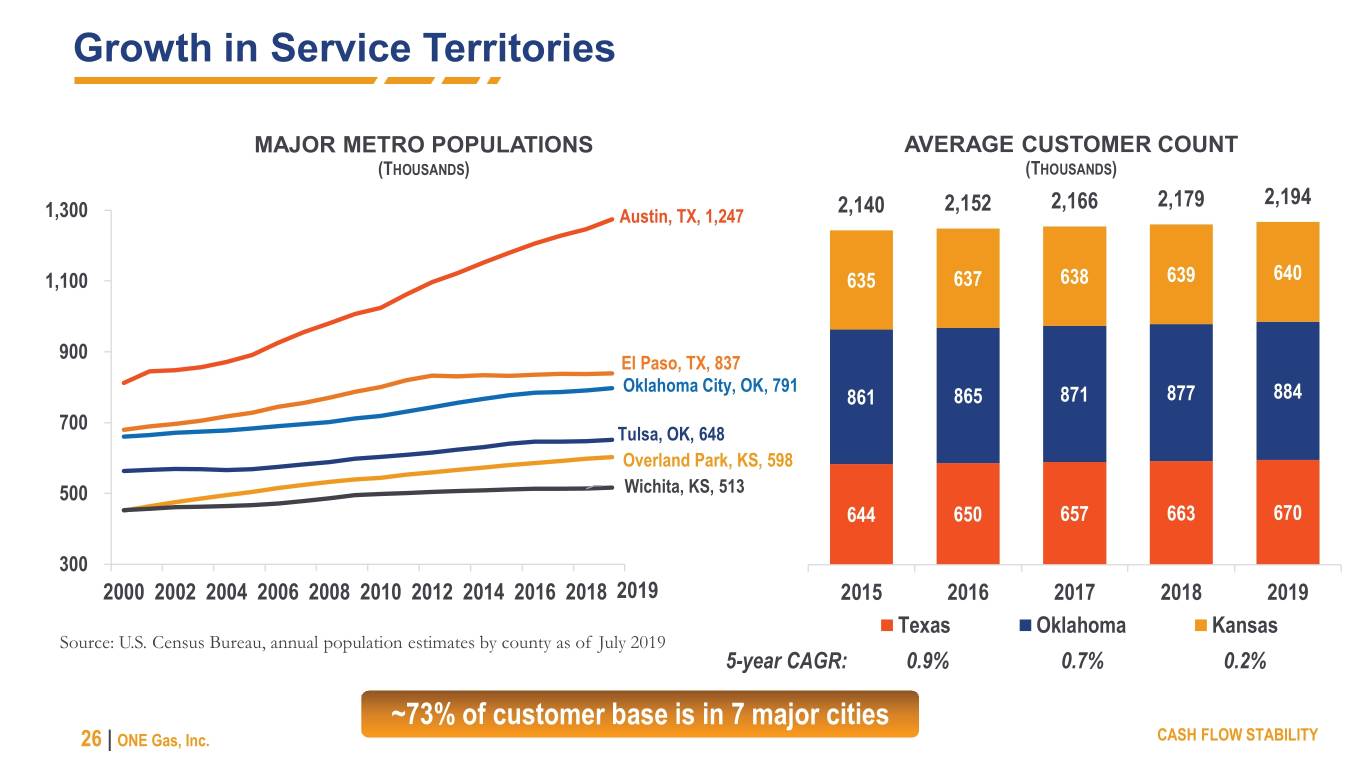

Growth in Service Territories MAJOR METRO POPULATIONS AVERAGE CUSTOMER COUNT (THOUSANDS) (THOUSANDS) 2,152 2,166 2,179 2,194 1,300 Austin, TX, 1,247 2,140 1,100 635 637 638 639 640 900 El Paso, TX, 837 Oklahoma City, OK, 791 861 865 871 877 884 700 Tulsa, OK, 648 Overland Park, KS, 598 500 Wichita, KS, 513 644 650 657 663 670 300 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2019 2015 2016 2017 2018 2019 Texas Oklahoma Kansas Source: U.S. Census Bureau, annual population estimates by county as of July 2019 5-year CAGR: 0.9% 0.7% 0.2% ~73% of customer base is in 7 major cities 26 | ONE Gas, Inc. CASH FLOW STABILITY

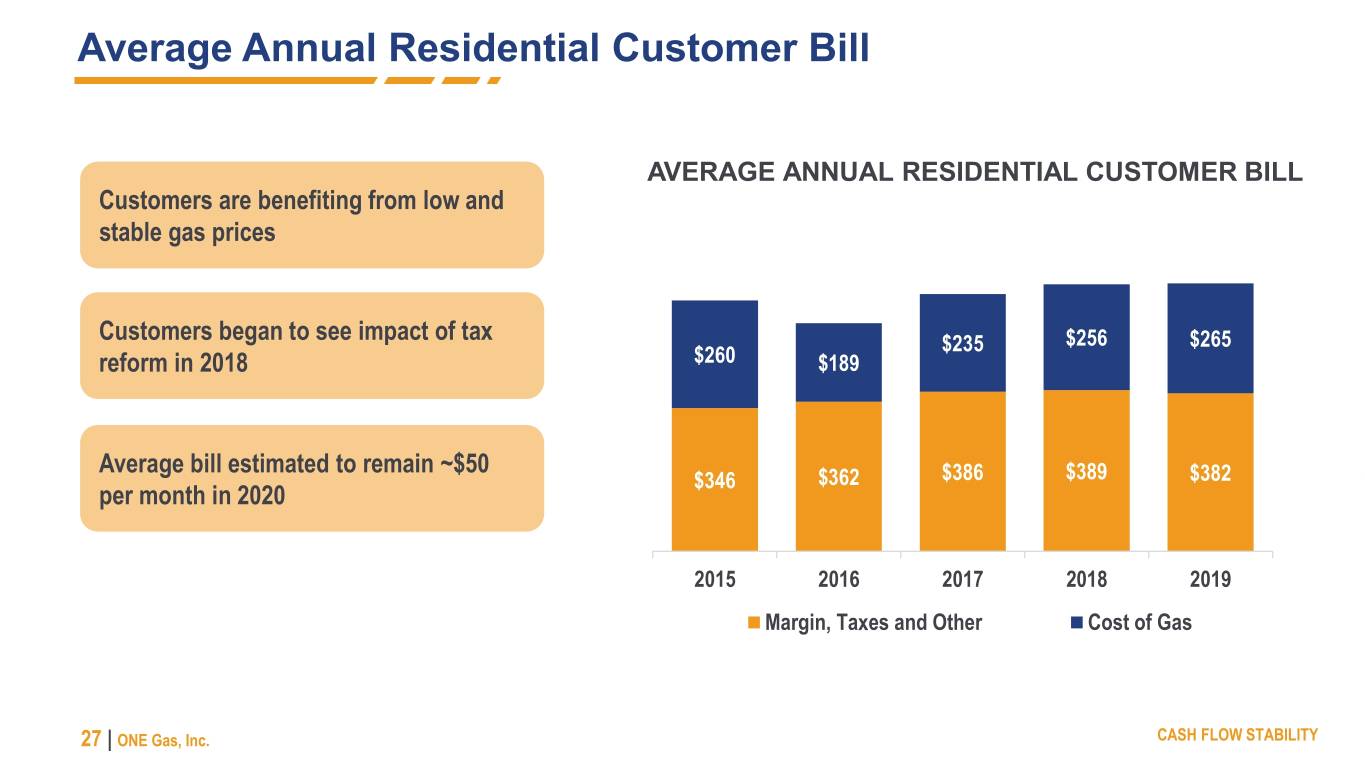

Average Annual Residential Customer Bill AVERAGE ANNUAL RESIDENTIAL CUSTOMER BILL Customers are benefiting from low and stable gas prices Customers began to see impact of tax $235 $256 $265 reform in 2018 $260 $189 Average bill estimated to remain ~$50 $346 $362 $386 $389 $382 per month in 2020 2015 2016 2017 2018 2019 Margin, Taxes and Other Cost of Gas 27 | ONE Gas, Inc. CASH FLOW STABILITY

COMPETITIVE ADVANTAGE

Proximity to Supply Location Supports Sustainability Close proximity to significant natural gas reserves and transportation infrastructure • Results in lower transportation, storage and commodity costs • Multiple supply points allow for reduced operating pressures Net natural gas exports² • 54% of all rigs in U.S. operating in Oklahoma and Texas1 • Texas: 2.7 Tcf of 8.9 Tcf produced • Oklahoma: 1.7 Tcf of 2.9 Tcf produced Estimated future supply of natural gas • United States: 3,838 Tcf 3 • ~ 44 Tcf annual production4 1 Source: Baker Hughes, as of April 2020 2 Source: EIA.gov, as of 2018 3 Source: Potential Gas Committee, reserves plus resources, as of 2018 ONE Gas Natural Gas Distribution Areas 4 Source: EIA.gov, trailing 12 months, as of January 2020 Natural Gas Shale Plays 29 | ONE Gas, Inc. COMPETITIVE ADVANTAGE

3.4-to-1 Average Advantage in ONE Gas Territories KWH EQUIVALENT ELECTRICITY VS. NATURAL GAS DTH EQUIVALENT ELECTRICITY VS. NATURAL GAS 3.9x 3.9x 3.0x 3.1x 3.0x 12.67¢ 3.1x $37.13 11.96¢ $35.05 10.12¢ $29.66 3.93¢ $11.52 3.24¢ 3.23¢ $9.49 $9.46 Texas Oklahoma Kansas Texas Oklahoma Kansas ¹ Avg. retail price of electricity/kWh ¹ Natural gas price equivalent of electricity/Dth ² ONE Gas delivered cost of natural gas/kWh ² ONE Gas delivered cost of natural gas/Dth ³ Nat gas advantage ratio ³ Natural gas advantage ratio ¹ Source: United States Energy Information Agency, www.eia.gov, for the twelve-month period ended December 31, 2019. ² Represents the average delivered cost of natural gas to a residential customer, including the cost of the natural gas supplied, fixed customer charge, delivery charges and charges for riders, surcharges and other regulatory mechanisms associated with the services we provide, for the year ended December 31, 2019. ³ Calculated as the ratio of the ONE Gas delivered average cost of natural gas per kilowatt hour (kWh) equivalent to the average retail price of electricity per kWh. 30 | ONE Gas, Inc. COMPETITIVE ADVANTAGE

FINANCIAL PERFORMANCE & OBJECTIVES

2020 Guidance Summary Initiated Jan. 21, 2020; Affirmed April 27, 2020 DILUTED EPS • Net income range of $186 ‒ $198 million $3.51 $3.56** • EPS range of $3.44 ‒ $3.68 per diluted share $3.25 • Impacts from COVID-19 could result in net $3.08 income and diluted EPS below the midpoint of the guidance range $2.65 • Estimated average rate base* of $3.91 billion • Average rate base growth of 7% between 2019 ‒ 2024 2016 2017 2018 2019 2020G * For definition of estimated average rate base, see Appendix ** Represents midpoint of guidance range Expected average annual EPS growth of 5 – 7% between 2019 and 2024 32 | ONE Gas, Inc. FINANCIAL PERFORMANCE & OBJECTIVES

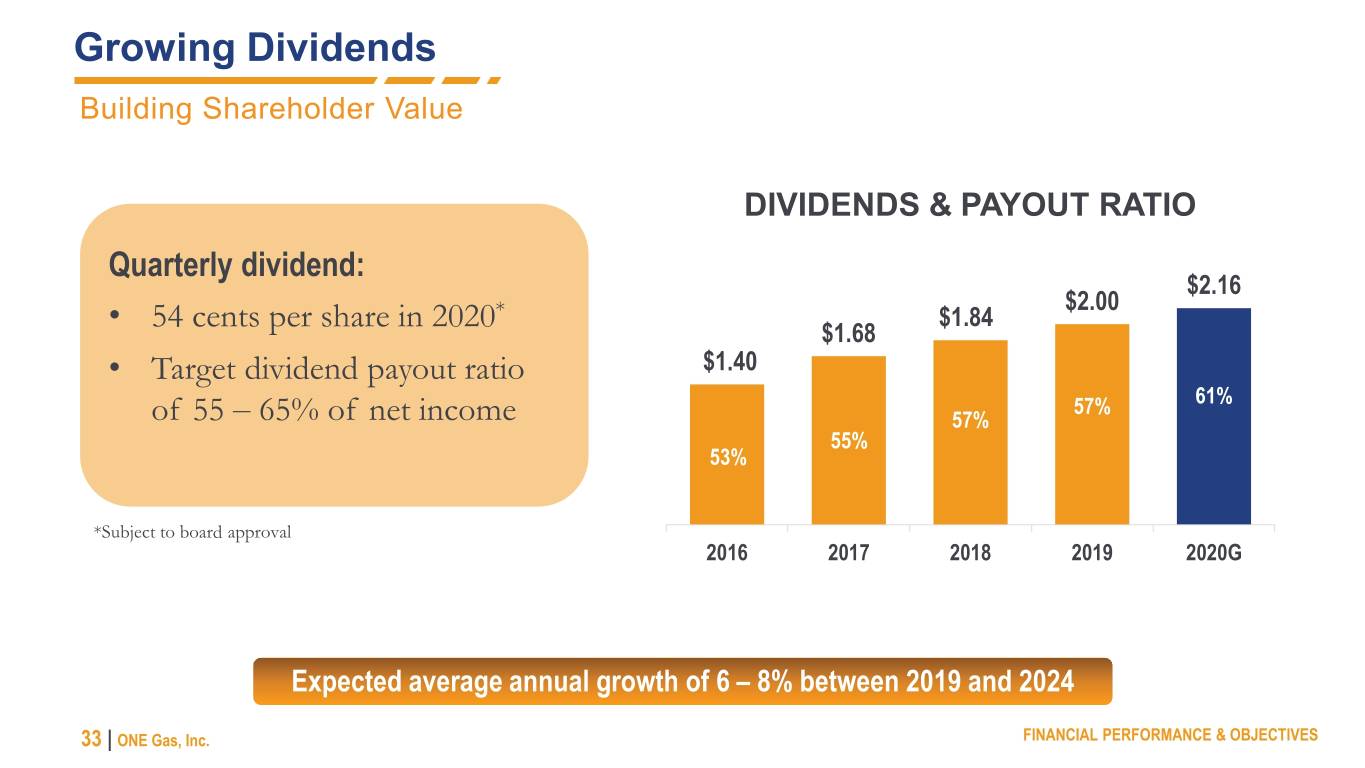

Growing Dividends Building Shareholder Value DIVIDENDS & PAYOUT RATIO Quarterly dividend: $2.16 $2.00 54 cents per share in 2020* $1.84 • $1.68 • Target dividend payout ratio $1.40 57% 61% of 55 ‒ 65% of net income 57% 55% 53% *Subject to board approval 2016 2017 2018 2019 2020G Expected average annual growth of 6 – 8% between 2019 and 2024 33 | ONE Gas, Inc. FINANCIAL PERFORMANCE & OBJECTIVES

Operating Cost Control Building a Foundation for Long-term Affordability OPERATING COSTS* (MILLIONS) $489 $496 Expense control execution through: $471 $453 $457 • Leveraging technology • Increasing efficiency and optimizing processes • Making it easier for customers to self-serve 2016 2017 2018 2019 2020G * Operating costs include operations and maintenance and general taxes Expected average annual increase in operating costs of 2 – 3% between 2020 and 2024 34 | ONE Gas, Inc. FINANCIAL PERFORMANCE & OBJECTIVES

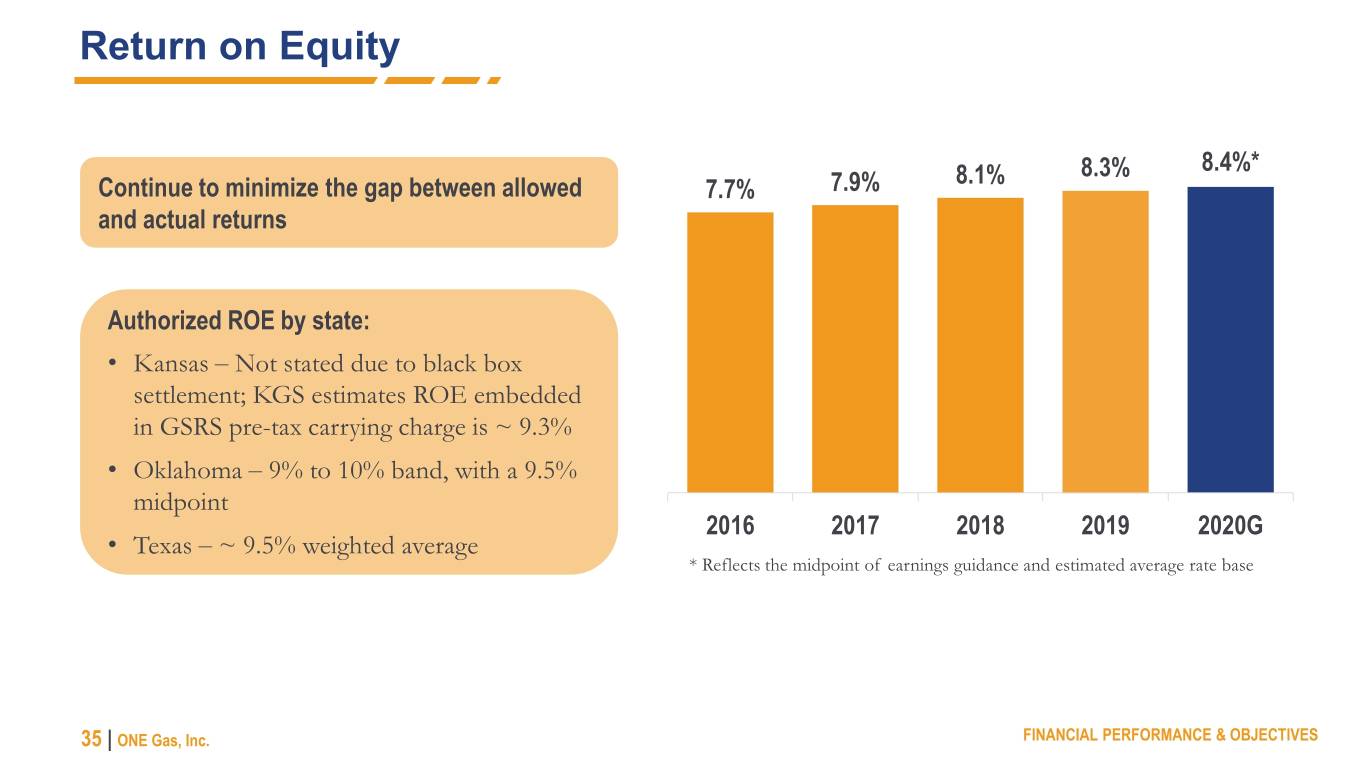

Return on Equity 8.1% 8.3% 8.4%* Continue to minimize the gap between allowed 7.7% 7.9% and actual returns Authorized ROE by state: • Kansas ‒ Not stated due to black box settlement; KGS estimates ROE embedded in GSRS pre-tax carrying charge is ~ 9.3% • Oklahoma ‒ 9% to 10% band, with a 9.5% midpoint 2016 2017 2018 2019 2020G • Texas ‒ ~ 9.5% weighted average * Reflects the midpoint of earnings guidance and estimated average rate base 35 | ONE Gas, Inc. FINANCIAL PERFORMANCE & OBJECTIVES

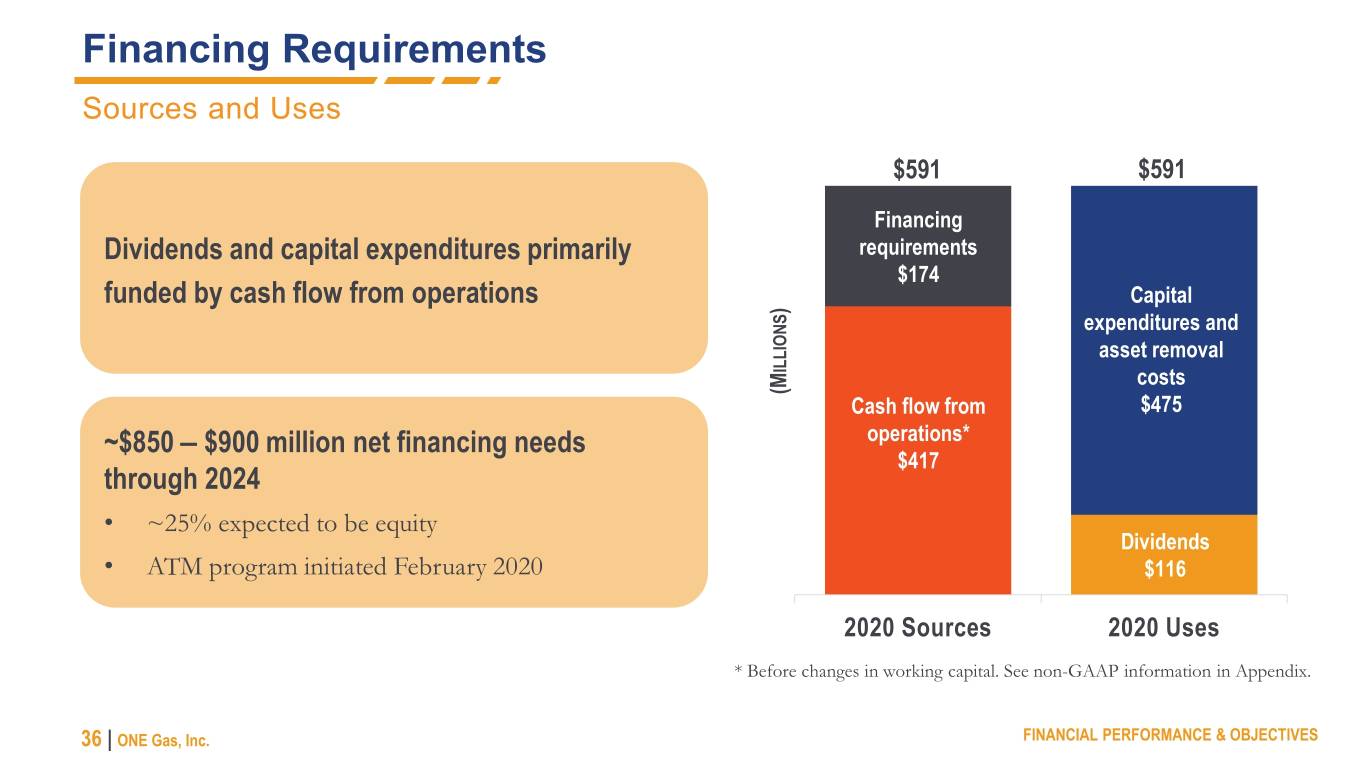

Financing Requirements Sources and Uses $591 $591 Financing Dividends and capital expenditures primarily requirements $174 funded by cash flow from operations Capital ) expenditures and asset removal ILLIONS costs (M Cash flow from $475 ~$850 ‒ $900 million net financing needs operations* $417 through 2024 • ~25% expected to be equity Dividends • ATM program initiated February 2020 $116 2020 Sources 2020 Uses * Before changes in working capital. See non-GAAP information in Appendix. 36 | ONE Gas, Inc. FINANCIAL PERFORMANCE & OBJECTIVES

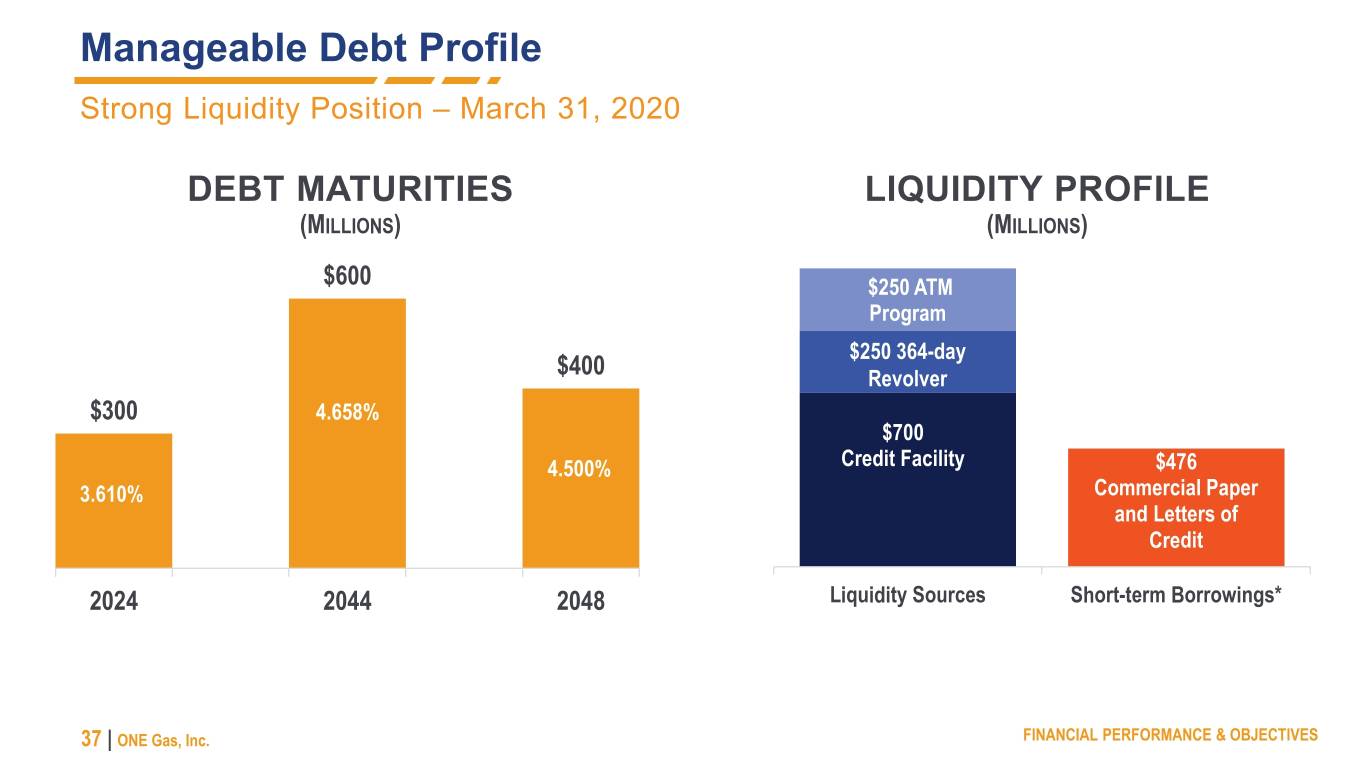

Manageable Debt Profile Strong Liquidity Position – March 31, 2020 DEBT MATURITIES LIQUIDITY PROFILE (MILLIONS) (MILLIONS) $600 $250 ATM Program $250 364-day $400 Revolver $300 4.658% $700 4.500% Credit Facility $476 3.610% Commercial Paper and Letters of Credit 2024 2044 2048 Liquidity Sources Short-term Borrowings* 37 | ONE Gas, Inc. FINANCIAL PERFORMANCE & OBJECTIVES

KEY TAKEAWAYS

Key Takeaways Focused Well-defined business capital investment strategy plan Regulatory Stable construct cash flow profile Competitive advantage 39 | ONE Gas, Inc. KEY TAKEAWAYS

APPENDIX

Corporate Structure INCORPORATED ENTITY 100% regulated natural gas distribution No levered holding company; all debt issued at OGS Division capital structures match Corporate capital structure 41 | ONE Gas, Inc. APPENDIX

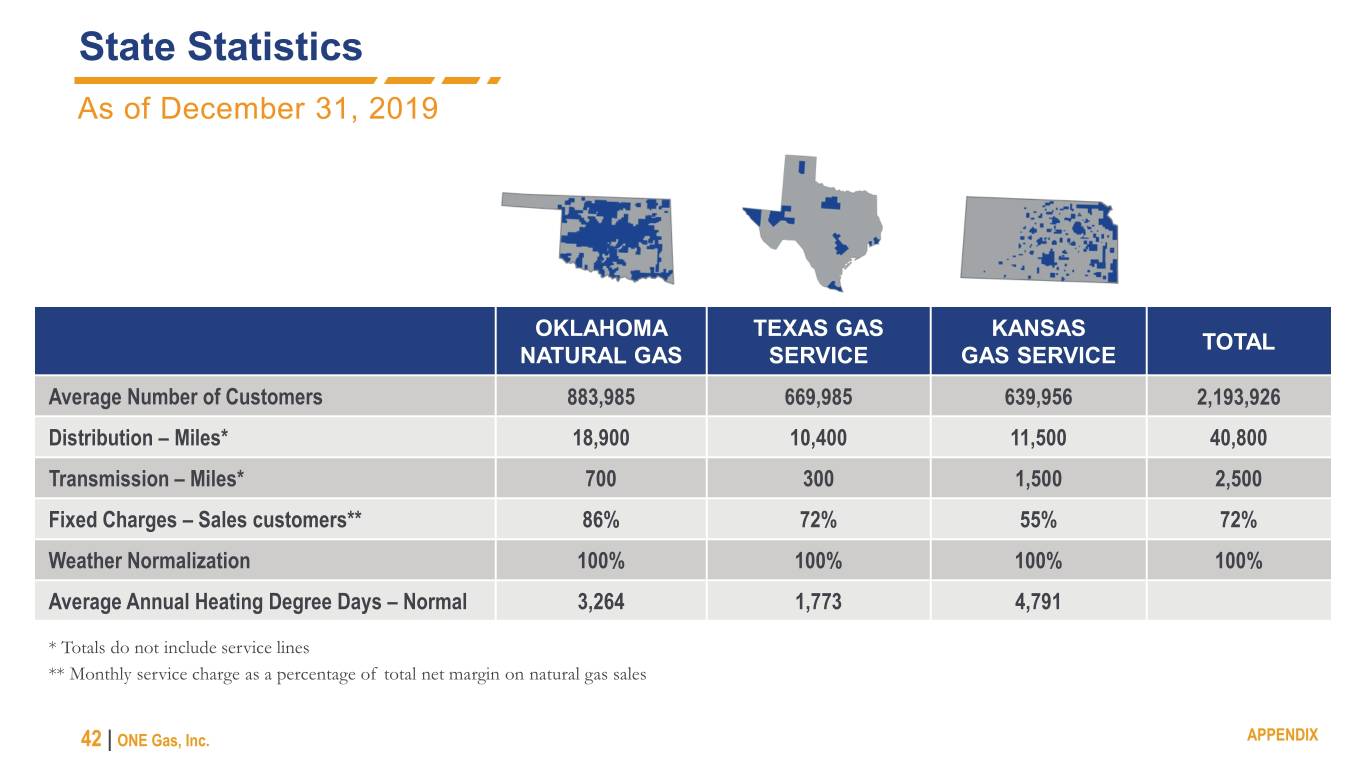

State Statistics As of December 31, 2019 OKLAHOMA TEXAS GAS KANSAS TOTAL NATURAL GAS SERVICE GAS SERVICE Average Number of Customers 883,985 669,985 639,956 2,193,926 Distribution – Miles* 18,900 10,400 11,500 40,800 Transmission – Miles* 700 300 1,500 2,500 Fixed Charges – Sales customers** 86% 72% 55% 72% Weather Normalization 100% 100% 100% 100% Average Annual Heating Degree Days – Normal 3,264 1,773 4,791 * Totals do not include service lines ** Monthly service charge as a percentage of total net margin on natural gas sales 42 | ONE Gas, Inc. APPENDIX

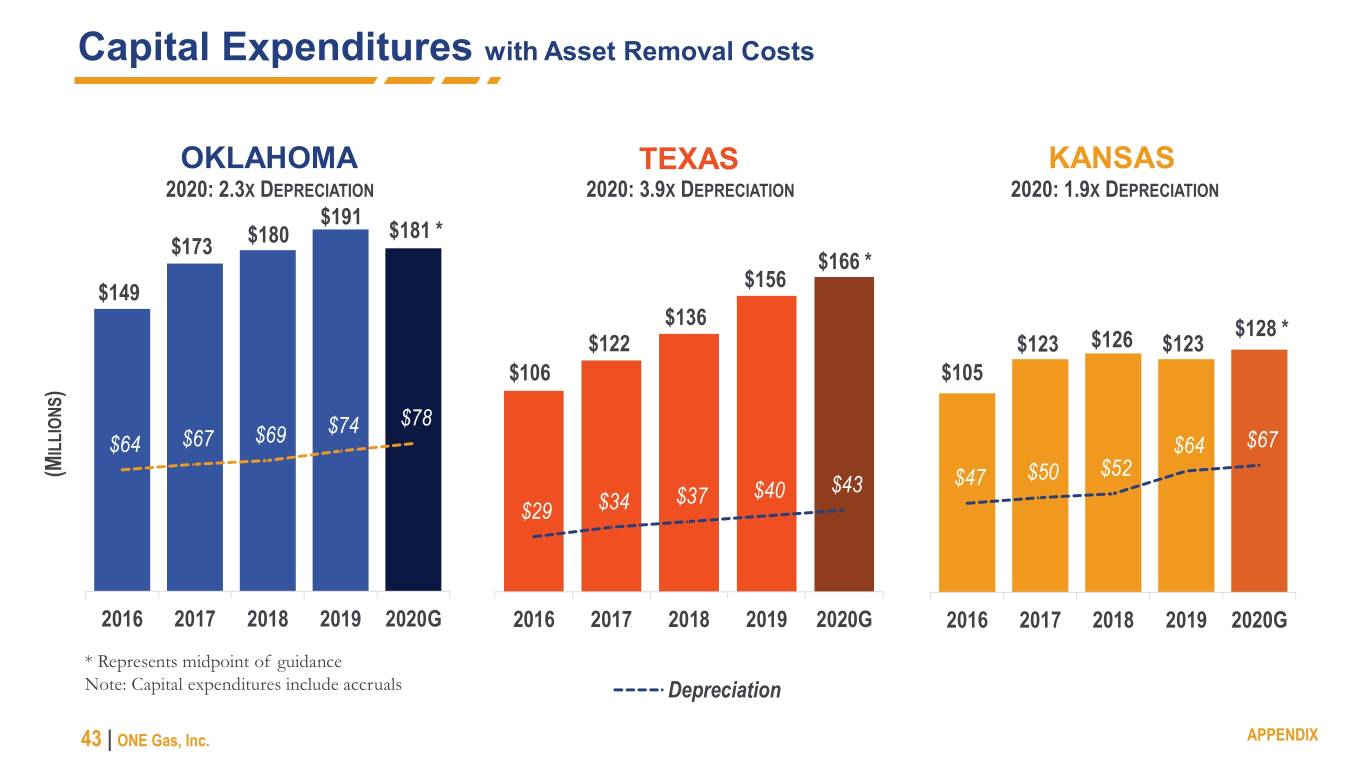

Capital Expenditures with Asset Removal Costs OKLAHOMA TEXAS KANSAS 2020: 2.3X DEPRECIATION 2020: 3.9X DEPRECIATION 2020: 1.9X DEPRECIATION $191 $180 $181 * $173 $166 * $156 $149 $136 $128 * $122 $123 $126 $123 $106 $105 ) $74 $78 $67 $69 $67 ILLIONS $64 $64 (M $47 $50 $52 $37 $40 $43 $29 $34 2016 2017 2018 2019 2020G 2016 2017 2018 2019 2020G 2016 2017 2018 2019 2020G * Represents midpoint of guidance Note: Capital expenditures include accruals Depreciation 43 | ONE Gas, Inc. APPENDIX

Authorized Rate Base OKLAHOMA¹ KANSAS² TEXAS¹ $1,475 $1,407 3 $1,202 $1,257 $1,033 $1,068 $947 $986 $979 $925 $895 $826 $822 $781 $745 $639 ) ILLIONS (M 2015 2016 2017 2018 2019 2014 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 ¹ Rate bases presented in this table are those from the last approved rate filings for each jurisdiction. These amounts are not necessarily indicative of current or future rate bases. ² KGS’ most recent rate case, approved in February 2019, was settled without a determination of rate base and reflects Kansas Gas Service’s estimate of rate base contained within the settlement; these amounts are not necessarily indicative of current or future rate base. 3 Reflects the 2018 PBRC filing, approved in January 2019 44 | ONE Gas, Inc. APPENDIX

Rate Base Definition Authorized Rate Base – $3.53 billion (as of Q1 2020) • Includes capital investments authorized in most recent rate case and interim filings • Does not include any capital investments since last approved rate case or filings 2020G Estimated Average Rate Base – $3.91 billion • Average of rate base per book at beginning and end of year • Includes capital investments and other changes in rate base not yet approved for recovery 45 | ONE Gas, Inc. APPENDIX

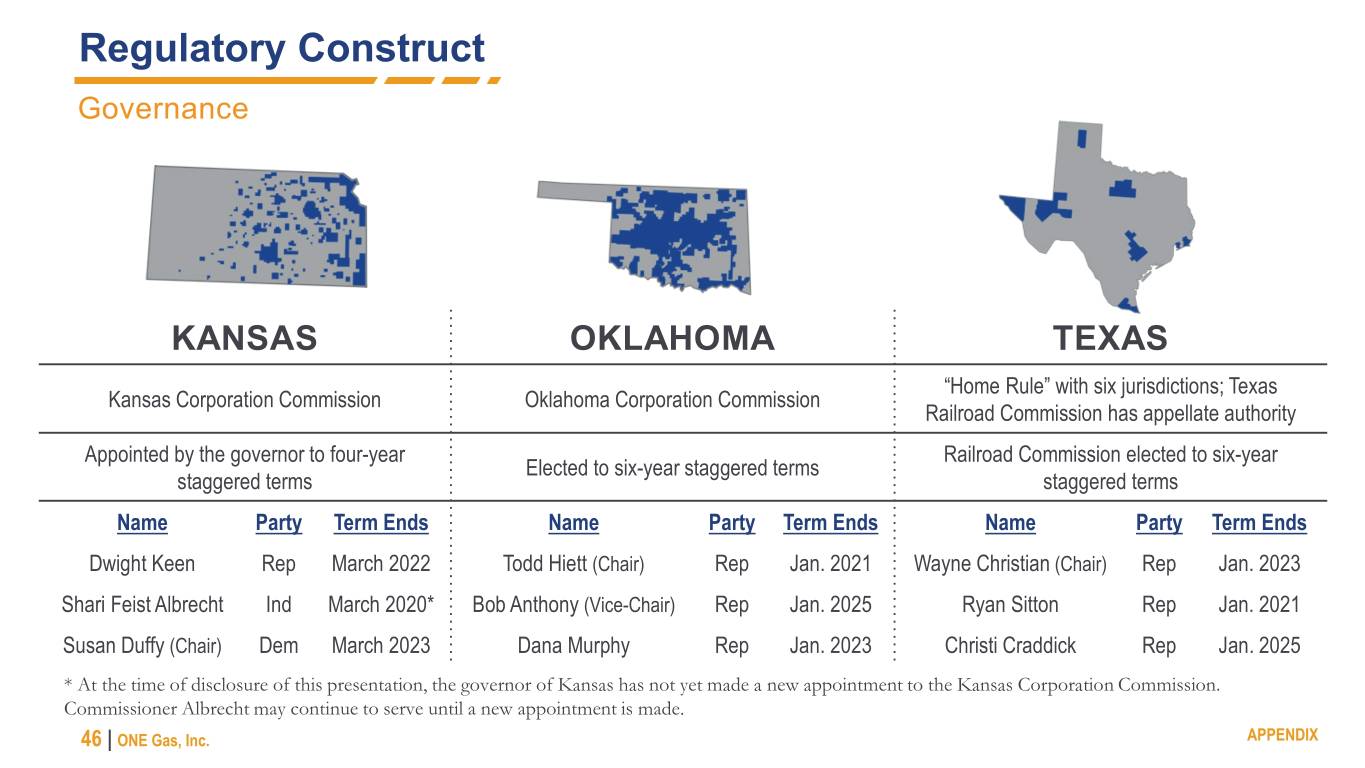

Regulatory Construct Governance KANSAS OKLAHOMA TEXAS “Home Rule” with six jurisdictions; Texas Kansas Corporation Commission Oklahoma Corporation Commission Railroad Commission has appellate authority Appointed by the governor to four-year Railroad Commission elected to six-year Elected to six-year staggered terms staggered terms staggered terms Name Party Term Ends Name Party Term Ends Name Party Term Ends Dwight Keen Rep March 2022 Todd Hiett (Chair) Rep Jan. 2021 Wayne Christian (Chair) Rep Jan. 2023 Shari Feist Albrecht Ind March 2020* Bob Anthony (Vice-Chair) Rep Jan. 2025 Ryan Sitton Rep Jan. 2021 Susan Duffy (Chair) Dem March 2023 Dana Murphy Rep Jan. 2023 Christi Craddick Rep Jan. 2025 * At the time of disclosure of this presentation, the governor of Kansas has not yet made a new appointment to the Kansas Corporation Commission. Commissioner Albrecht may continue to serve until a new appointment is made. 46 | ONE Gas, Inc. APPENDIX

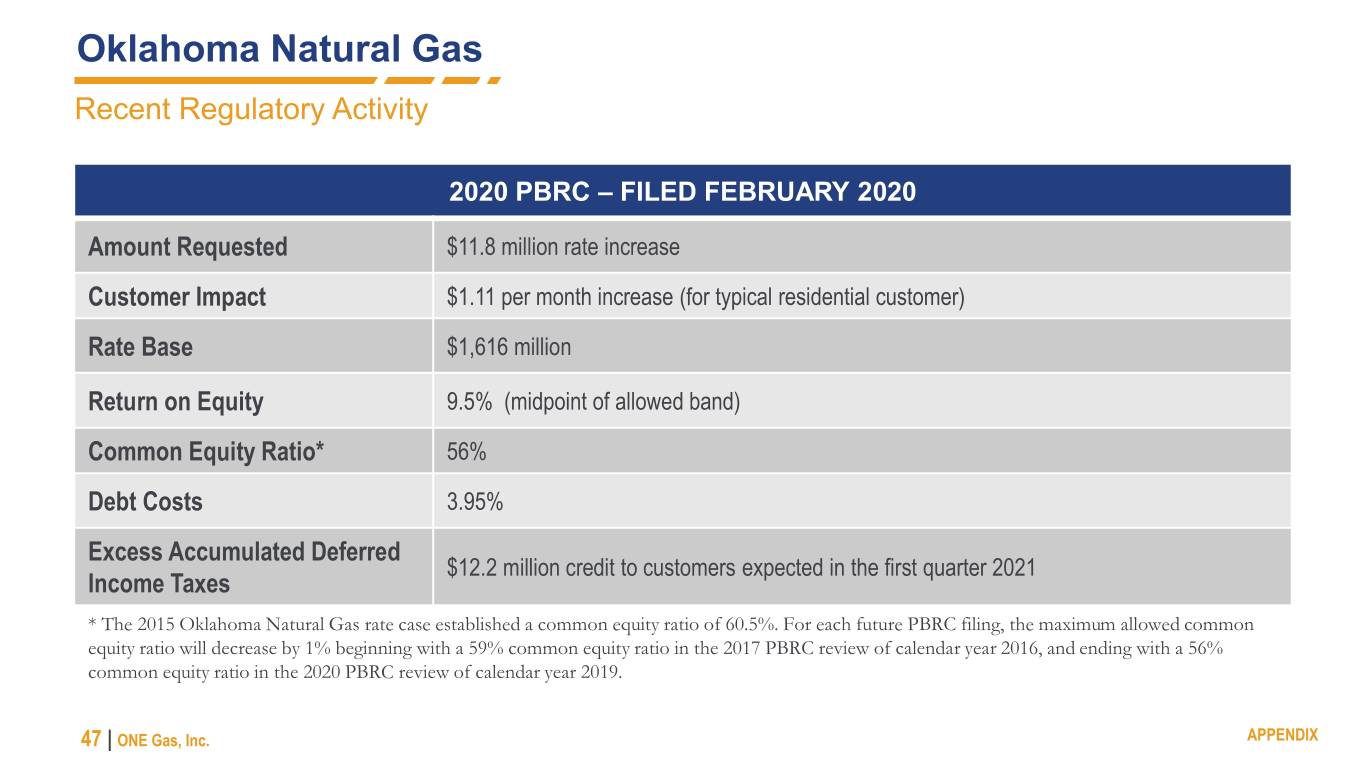

Oklahoma Natural Gas Recent Regulatory Activity 2020 PBRC – FILED FEBRUARY 2020 Amount Requested $11.8 million rate increase Customer Impact $1.11 per month increase (for typical residential customer) Rate Base $1,616 million Return on Equity 9.5% (midpoint of allowed band) Common Equity Ratio* 56% Debt Costs 3.95% Excess Accumulated Deferred $12.2 million credit to customers expected in the first quarter 2021 Income Taxes * The 2015 Oklahoma Natural Gas rate case established a common equity ratio of 60.5%. For each future PBRC filing, the maximum allowed common equity ratio will decrease by 1% beginning with a 59% common equity ratio in the 2017 PBRC review of calendar year 2016, and ending with a 56% common equity ratio in the 2020 PBRC review of calendar year 2019. 47 | ONE Gas, Inc. APPENDIX

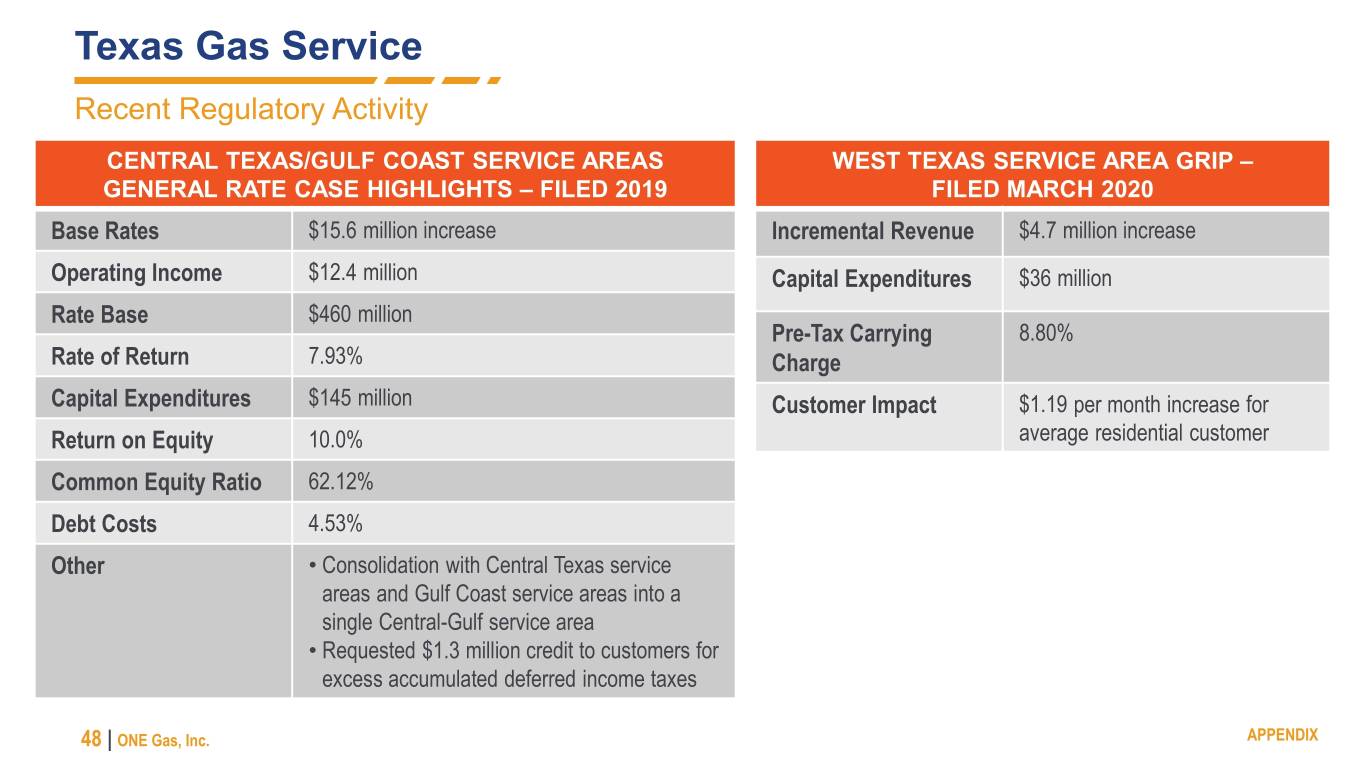

Texas Gas Service Recent Regulatory Activity CENTRAL TEXAS/GULF COAST SERVICE AREAS WEST TEXAS SERVICE AREA GRIP – GENERAL RATE CASE HIGHLIGHTS – FILED 2019 FILED MARCH 2020 Base Rates $15.6 million increase Incremental Revenue $4.7 million increase Operating Income $12.4 million Capital Expenditures $36 million Rate Base $460 million Pre-Tax Carrying 8.80% Rate of Return 7.93% Charge Capital Expenditures $145 million Customer Impact $1.19 per month increase for Return on Equity 10.0% average residential customer Common Equity Ratio 62.12% Debt Costs 4.53% Other • Consolidation with Central Texas service areas and Gulf Coast service areas into a single Central-Gulf service area • Requested $1.3 million credit to customers for excess accumulated deferred income taxes 48 | ONE Gas, Inc. APPENDIX

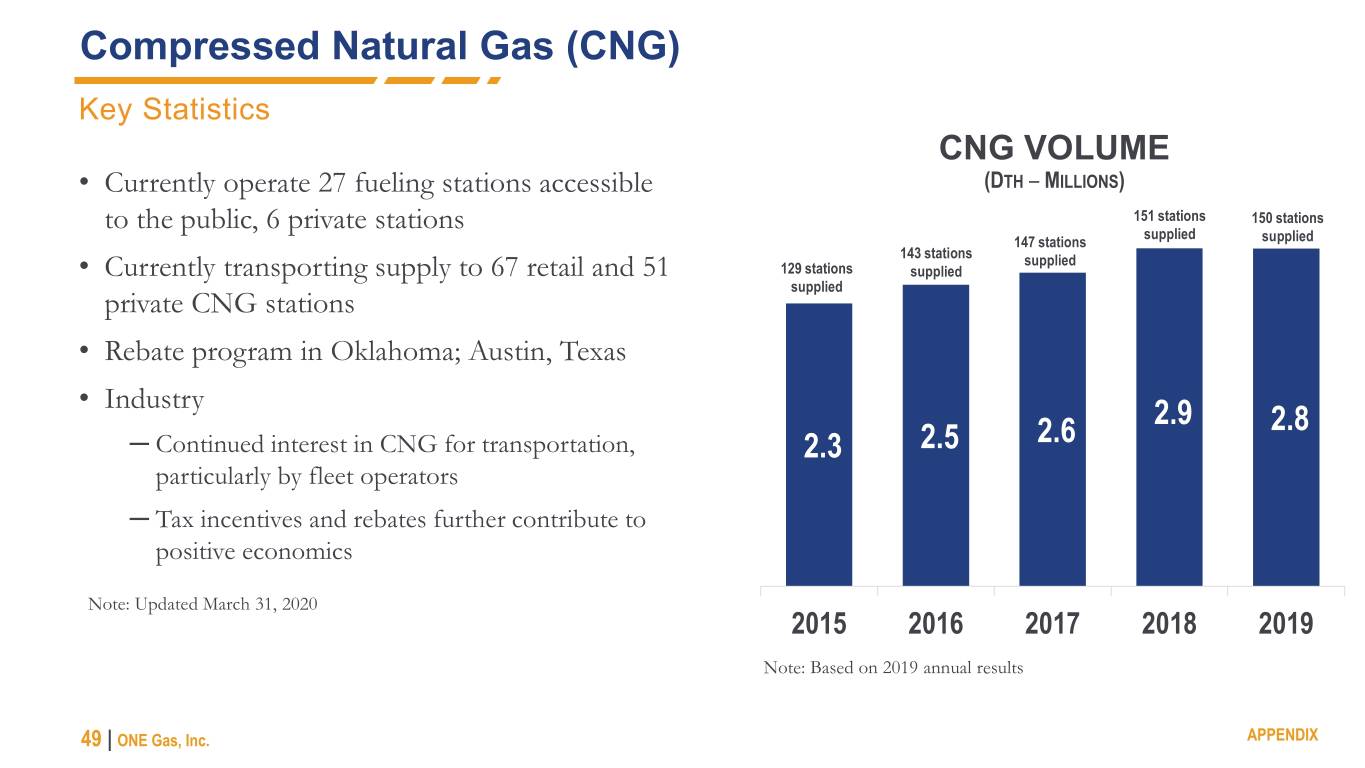

Compressed Natural Gas (CNG) Key Statistics CNG VOLUME • Currently operate 27 fueling stations accessible (DTH – MILLIONS) 151 stations 150 stations to the public, 6 private stations supplied 147 stations supplied 143 stations supplied • Currently transporting supply to 67 retail and 51 129 stations supplied supplied private CNG stations • Rebate program in Oklahoma; Austin, Texas • Industry 2.9 2.8 ─ Continued interest in CNG for transportation, 2.3 2.5 2.6 particularly by fleet operators ─ Tax incentives and rebates further contribute to positive economics Note: Updated March 31, 2020 2015 2016 2017 2018 2019 Note: Based on 2019 annual results 49 | ONE Gas, Inc. APPENDIX

Non-GAAP Information ONE Gas has disclosed in this presentation cash flow from operations before changes in working capital and net margin, which are non-GAAP financial measures. Cash flow from operations before changes in working capital is used as a measure of the company's financial performance. Cash flow from operations before changes in working capital is defined as net income adjusted for depreciation and amortization, deferred income taxes, and certain other noncash items. This non-GAAP financial measure is useful to investors as an indicator of financial performance of the company to generate cash flows sufficient to support our capital expenditure programs and pay dividends to our investors. Net margin is defined as total revenues less cost of natural gas. Cost of natural gas includes commodity purchases, fuel, storage, transportation and other gas purchase costs recovered through our cost of natural gas regulatory mechanisms, as required by our regulators, and does not include an allocation of general operating costs or depreciation and amortization. In addition, our cost of natural gas regulatory mechanisms provide a method of recovering natural gas costs on an ongoing basis without a profit. Therefore, although our revenues will fluctuate with the cost of natural gas that we pass-through to our customers, net margin is not affected by fluctuations in the cost of natural gas. We believe that net margin provides investors a more relevant and useful measure to analyze our financial performance as a 100% regulated natural gas utility than total revenues because the change in the cost of natural gas from period to period does not impact our operating income. ONE Gas cash flow from operations before changes in working capital and net margin should not be considered in isolation or as substitutes for net income, total revenue or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures exclude some, but not all, items that affect net income. Additionally, these calculations may not be comparable with similarly titled measures of other companies. Reconciliations of cash flow from operations before changes in working capital and net margin to the most directly comparable GAAP measure are included in this presentation. 50 | ONE Gas, Inc. APPENDIX

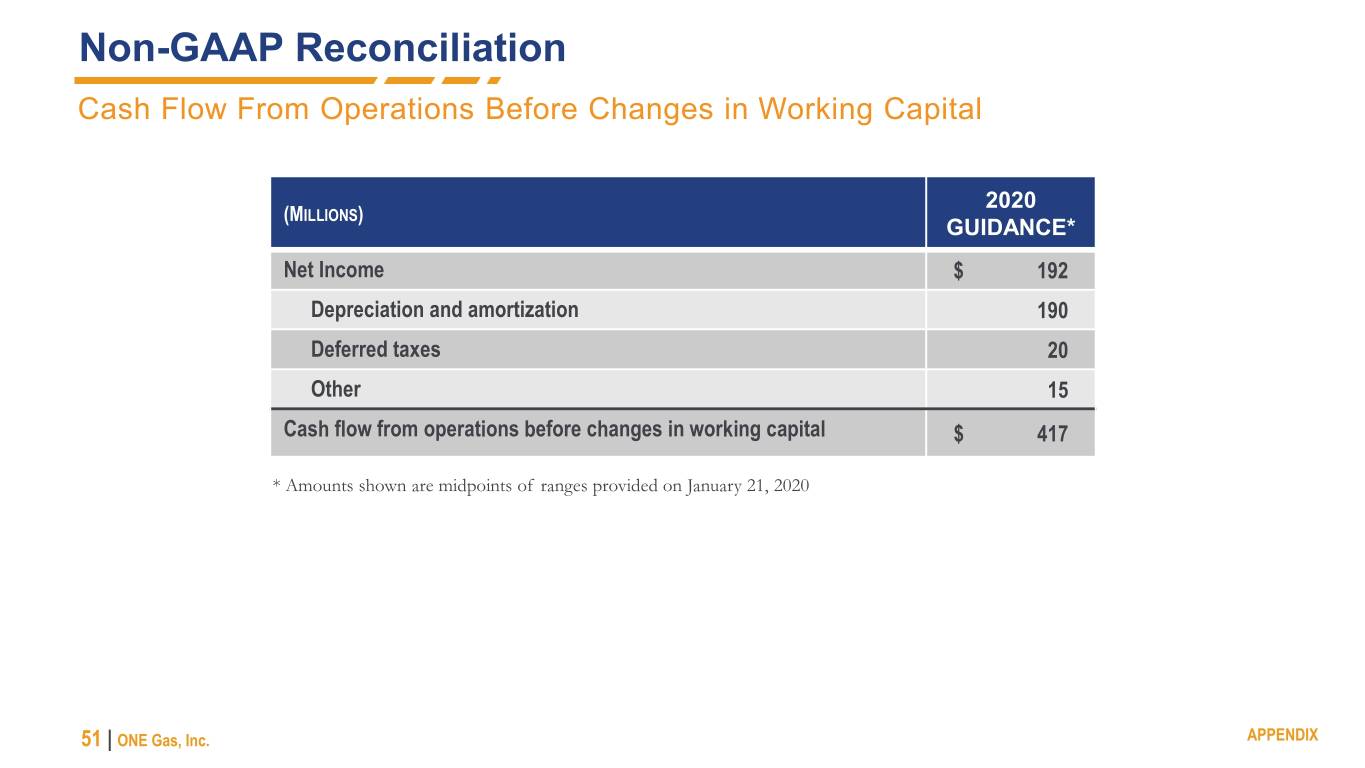

Non-GAAP Reconciliation Cash Flow From Operations Before Changes in Working Capital 2020 (MILLIONS) GUIDANCE* Net Income $ 192 Depreciation and amortization 190 Deferred taxes 20 Other 15 Cash flow from operations before changes in working capital $ 417 * Amounts shown are midpoints of ranges provided on January 21, 2020 51 | ONE Gas, Inc. APPENDIX

Non-GAAP Reconciliation Net Margin (MILLIONS) 2019 Total revenues $ 1,652.7 Cost of natural gas 687.9 Net margin $ 964.8 (MILLIONS) 2019 Natural gas sales Residential $ 681.0 Commercial and industrial 131.5 Wholesale and public authority 7.7 Net margin on natural gas sales $ 820.2 Transportation revenues 114.1 Other revenues 30.5 Net margin $ 964.8 52 | ONE Gas, Inc. APPENDIX