Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | a8-kq12020investorslid.htm |

1st Quarter 2020 as of April 27, 2020 Nasdaq: HMST

Important Disclosures Forward-Looking Statements This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance, business plans and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. Forward-looking statements in this presentation include, among other matters, statements regarding our business plans and strategies, general economic trends, strategic initiatives we have announced, including forecasted reductions in the Company’s cost structure and future run rates, growth scenarios and performance targets. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our Annual Report on Form 10-K for the year ended December 31, 2019 and the subsequent Quarterly Report on Form 10-Q to be filed in early May for the quarter ended March 31, 2020. Many of these factors and events that affect the volatility in our stock price and shareholders’ response to those events and factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These risks include, without limitation, changes in general political and economic conditions that impact our markets and our business, actions by the Federal Reserve Board and financial market conditions that affect monetary and fiscal policy, regulatory and legislative findings or actions that may increase capital requirements or otherwise constrain our ability to do business, including restrictions that could be imposed by our regulators on certain aspects of our operations or on our growth initiatives and acquisition activities, risks related to our ability to: retain adequate key personnel to operate our business, realize the expected cost savings from restructuring activities and cost containment measures that we have recently undertaken or that we have announced, continue to expand our commercial and consumer banking operations, grow our franchise and capitalize on market opportunities, cost-effectively manage our overall growth efforts to attain the desired operational and financial outcomes, manage the losses inherent in our loan portfolio, assess the novelty of the recently adopted “Current Expected Credit Losses,” or CECL, accounting standard which replaced the “Allowance for Loan and Lease Losses” accounting standard coupled with our relative inexperience with the newer standard, improve long-term shareholder value through effective use of our surplus capital, make accurate estimates of the value of our non-cash assets and liabilities, maintain electronic and physical security of customer data, respond to our restrictive and complex regulatory environment and effectively respond to the changes in the global, national, state and local markets caused by or related to the COVID-19 pandemic. Actual results may fall materially short of our expectations and projections, and we may be unable to execute on our strategic initiatives, or we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward- looking statements. All forward-looking statements are based on information available to us as of the date hereof, and we do not undertake to update or revise any forward-looking statements for any reason. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending March 31, 2020, and is unaudited, although certain information related to the year ended December 31, 2019, has been derived from our audited financial statements. All financial data should be read in conjunction with the notes in our consolidated financial statements. Non-GAAP Financial Measures and Targets Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures, may also be found in the appendix, our SEC filings, and in the earnings release available on our web site. This presentation refers to long-term targets. Because targets are forward-looking and not based on historical performance, it is not possible to provide a reconciliation without undertaking unreasonable efforts. A GAAP reconciliation would require estimates of such excluded items, and it is not possible to estimate such excluded items at this time. p. 1

Highlights and Developments Results of Operations • Adopted CECL accounting standard resulting in a “Day 1” increase in our allowance for credit losses of $3.7 million at January 1, 2020 • Recorded a provision for credit losses of $14.0 million exclusively due to the forecasted impacts of COVID-19 • Net income of $7.1 million, or $0.30 diluted EPS Entered the COVID- • Core net income of $8.1 million, or $0.34 diluted EPS 19 pandemic with • Pre-provision core income from continuing operations before income strong capital, ample taxes of $24.1 million on and off-balance • Net interest margin increased 6 bps to 2.93% on lower cost of interest bearing liabilities sheet liquidity, a • Period ending cost of deposits fell from 1.22% on December 31, 2019, conservatively to 0.72% on March 31, 2020 underwritten loan • Business and consumer core deposits increased during the quarter portfolio, $72.6 million, or 4.5%, and $117.5 million, or 6.1%, respectively experienced bankers • Reduced FTE to 996 at March 31, 2020, an 18.4% reduction since June and credit 30, 2019 administrators • Ended the quarter with consolidated Tier 1 and Risk-Based capital ratios of 10.06% and 13.95%, respectively at the Bank, 10.15% and seasoned in the 13.50%, respectively at the Company, and tangible book value per great recession, and share of $27.52 well positioned to • Suspended our $25 million stock repurchase program with $17.1 meet the challenges million in authorized purchases remaining, and withdrew the of this crisis and subsequent $10 million additional repurchase authorization support our Recent Developments customers and • From April 3, 2020, through April 16, 2020, approved and registered 396 loans under the Paycheck Protection Program for a total of $158.2 communities million • As of April 23, 2020, 306 loans have been granted forbearance for a total of $182.1 million • Authorized a quarterly dividend of $0.15 per share to be paid on May 20, 2020, to holders of record on May 4, 2020 p. 2

Programs to Support our Employees, Customers and Communities Employees Customers Communities • All employees that are able • From April 3, 2020, through • The HomeStreet Foundation to work from home are April 16, 2020, approved is matching employee doing so and registered 396 loans for donations to food banks, • Branches operating at a total of $158.2 million the food distribution reduced hours and by under the Paycheck agencies that support the appointment only to Protection Program (“PPP”) food banks, and COVID-19 manage traffic • Prepared to process those response funds in our • No COVID-19 related layoffs customers that were not communities • No out-of-pocket expenses able to be registered during • Employees transacting for COVID-19 related the initial pool when the business at cars for elderly medical care additional funds or at-risk customers • Additional time off for appropriated by Congress • Employees completing COVID related issues not are available transaction at customers charged to sick or vacation • $378.3 million loan place of business time forbearances requested and • Branch staff offering • COVID-19 related furlough $182.1 million requests delivery services to place of program granted business or homes • Regular delivery of personal • No residential construction protective equipment and or commercial real estate physical barriers for requests granted as of April customer facing employees 23, 2020 • Paused foreclosure sales • No negative credit bureau reporting for previously up- to-date clients p. 3

Nasdaq: HMST Focus on efficiency and profitability while emerging as a Leading West • Seattle-based diversified commercial & consumer bank – company founded in Coast regional 1921 bank • Locations in all of the major coastal markets in the Western U.S. and Hawaii • 67 bank branches and primary offices • Total assets $6.8 billion p. 4

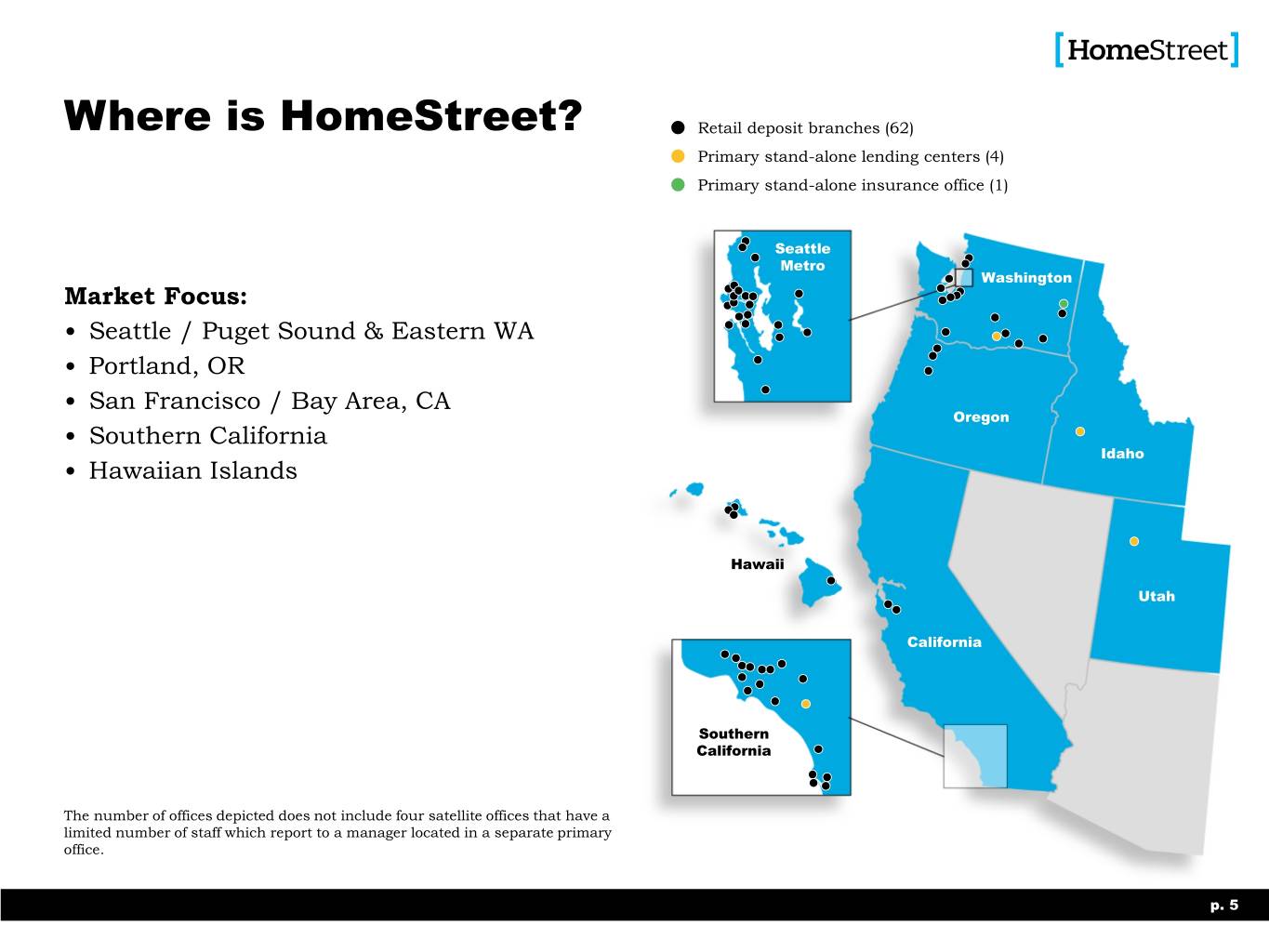

Where is HomeStreet? Retail deposit branches (62) Primary stand-alone lending centers (4) Primary stand-alone insurance office (1) Seattle Metro Washington Market Focus: • Seattle / Puget Sound & Eastern WA • Portland, OR • San Francisco / Bay Area, CA Oregon • Southern California Idaho • Hawaiian Islands Hawaii Utah California Southern California The number of offices depicted does not include four satellite offices that have a limited number of staff which report to a manager located in a separate primary office. p. 5

Strategy Focus on Commercial & Consumer Banking • Improve operating efficiency • Optimize capitalization • Grow market share in highly attractive metropolitan markets • Grow loan portfolio with focus on diversification and profitability • Grow core deposits to improve deposit mix • Introduce smart product offerings - fast- follower of technology (1) DUS® is registered trademark of Fannie Mae p. 6

The HomeStreet Brand 2019 Net Promoter Score 2019 Customer Satisfaction Survey How likely is it that you would Overall, are you satisfied or dissatisfied with the recommend HomeStreet Bank to a customer service you receive from HomeStreet Bank? friend or colleague? NPS Very Satisfied - 70% 61 Satisfied - 23% Up 5 points over 2018 National average for community banks and credit unions is 34 2019 Brand Awareness/Health Percentage of consumers that have a positive perception/awareness of the HomeStreet Bank brand when asked about topics like loan rates, community support, and convenience. Greater Puget Sound Portland Southern CA Hawaii 43% 14% 13% 27% Up 7% since 2015 Down 3% since 2015 Up 4% since 2017 Up 1% since 2015 p. 7

Improving Operating Efficiency Simplifying the organizational structure by reducing management levels and management redundancy Consolidating similar functions currently residing in multiple business units Renegotiating where possible our contracts – primarily technology Identifying and eliminating redundant or unnecessary systems and services Rationalizing staffing appropriate to the significant changes in work volumes and company direction p. 8

Results of Operations 3 Months Ended $ Thousands Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Net Interest Income $45,434 $45,512 $47,134 $49,187 $47,557 Provision for Credit Losses 14,000 (2,000) - - 1,500 Noninterest Income 32,630 21,931 24,580 19,829 8,092 Noninterest Expense 55,184 53,215 55,721 58,832 47,846 Income from Continuing Operations Before Taxes 8,880 16,228 15,993 10,814 6,303 Income Tax 1,741 3,123 2,328 1,292 1,245 Net Income from Continuing Operations 7,139 13,105 13,665 8,892 5,058 Income from Discontinued Operations Before - (3,357) 190 (16,678) (8,440) Taxes Income Tax - (1,240) 28 (2,198) (1,667) Net Income from Discontinued Operations - (2,117) 162 (14,480) (6,773) Net Income 7,139 10,998 13,827 (5,588) (1,715) Diluted EPS $0.30 $0.45 $0.55 ($0.22) ($0.06) Diluted EPS from Continuing Operations $0.30 $0.54 $0.54 $0.32 $0.19 Tangible BV/Share(1) $27.52 $27.02 $26.83 $26.34 $26.26 Net Interest Margin 2.93% 2.87% 2.96% 3.11% 3.11% Core ROAA – Continuing Operations(1) 0.48% 0.87% 0.82% 0.55% 0.29% Core ROAE – Continuing Operations(1) 4.70% 8.53% 8.27% 5.41% 2.80% Core ROATE – Continuing Operations (1) 4.94% 8.98% 8.73% 5.69% 2.91% Core Efficiency Ratio of Continuing Operations(1) 69.11% 75.45% 76.51% 83.17% 85.53% Tier 1 Leverage Ratio (Bank) 10.06% 10.56% 10.17% 9.86% 11.17% Total Risk-Based Capital (Bank) 13.95% 14.37% 14.37% 14.15% 15.77% Tier 1 Leverage Ratio (Company) 10.15% 10.16% 10.04% 10.12% 10.73% Total Risk-Based Capital (Company) 13.50% 13.40% 13.69% 13.95% 14.58% (1) See appendix for reconciliation of non-GAAP financial measures. p. 9

Net Interest Income & Margin Lower interest rates and Net Interest Income reduction of higher-cost $ Millions brokered and consumer Net Interest Income CDs reduced cost of Net Interest Margin deposits 3.11% 3.11% 2.96% 2.93% • 1Q20 Net Interest Margin increased to 2.93% 2.87% but net interest income decreased to $45.4 million compared to the prior quarter • Decline in net interest income driven by lower $47.6 balances and costs on interest bearing $49.2 $47.1 liabilities and lower balances and yields interest earning assets $45.5 $45.4 1Q19 2Q19 3Q19 4Q19 1Q20 p. 10

Interest-Earning Assets Cash & Cash Equivalents Investment Securities • Approximately $436 million of Loans Held for Sale higher yielding loans prepaid during Loans Held for Investment 1Q20 Average Yield • Approximately 29% of variable rate Average Balances loans were at contractual floors at Average Yield quarter end $ Billions Percent $8 4.60% $6.47 $6.70 $6.44 $6.33 $6.25 $7 4.50% $6 4.40% $5 4.50% 4.50% 4.38% $4 4.30% $3 4.20% $2 4.21% 4.10% $1 4.10% $0 4.00% 1Q19 2Q19 3Q19 4Q19 1Q20 p. 11

Deposits and Liquidity Balances Interest-Bearing Transaction & Savings Deposits Noninterest-Bearing Transaction & Savings Deposits $ Millions Time Deposits Mortgage Svcg. Escrow Accts. & Other $6,000 $5,724 $5,804 $5,397 $5,340 $5,257 $5,000 47% 47% 49% $4,000 53% 56% $3,000 12% 12% 13% $2,000 13% 15% 31% 36% 37% $1,000 30% 25% $- 7% 5% 4% 4% 5% 3/31/2019 6/30/2019 9/30/2019 12/31/2019 3/31/2020 Total Cost of Deposits 1.14% 1.26% 1.41% 1.33% 1.14% • The first quarter 2020 decrease in deposits was primarily driven reduction in brokered deposits and the maturity of promotional certificate of deposits that we previously issued to fund the transfer of servicing related deposits in 2019 • Period ending cost of deposits fell from 1.22% on December 31, 2019, to 0.72% on March 31, 2020 • The decrease in total deposits was offset by increases of $72.6 million, or 4.5%, and $117.5 million, or 6.1%, of business and consumer core deposits - checking, savings and money market deposits, respectively • Noninterest bearing accounts increased $64.0 million, or 9.1%, to 15% of total deposits p. 12

Noninterest Income from Continuing Operations Noninterest Income Net Gain on Mortgage Loan Origination and Sale Activities $ Millions Loan Servicing Income Depositor & Other Retail Fees Other $35 $32.6 $30 $24.6 $25 $21.9 $19.8 $20 $15 $10 $8.1 $5 $0 1Q19 2Q19 3Q19 4Q19 1Q20 • The 1Q20 Increase was primarily due to an 87% increase single-family rate lock volume and an increase in loan servicing risk management results • Other consists of insurance agency commissions, swap income, prepayment fee income, FHLB dividends, and other miscellaneous income Effective April 1, 2019, the newly organized bank location-based mortgage banking business commenced operations and the associated revenues were reported as part of the Company's continuing operations beginning in the second quarter of 2019 p. 13

Noninterest Expense from Continuing Operations Salaries & related costs Noninterest Expense FTE General & administrative $ Millions Other noninterest expense $60 1,937 FTE 2,100 $50 1,800 $40 1,221 1,132 1,071 $30 996 1,500 $20 1,200 $10 $0 900 1Q19 2Q19 3Q19 4Q19 1Q20 Noninterest Expense $47.8 $58.8 $55.7 $53.2 $55.2 Salaries & Related Costs $25.3 $34.2 $32.8 $29.9 $32.0 General & Administrative $8.2 $7.8 $9.5 $8.3 $8.0 Other Noninterest Expense $14.3 $16.8 $13.4 $15.0 $15.2 FTE 1,937 1,221 1,132 1,071 996 • The 1Q20 increase was due primarily to a $2.0 million recovery of stock-based compensation expense in the fourth quarter of 2019 • This increase is partially offset by a decrease in occupancy costs as we reduce our headcount and the corresponding need for office space Effective April 1, 2019, the newly organized bank location-based mortgage banking business commenced operations and the associated revenues were reported as part of the Company's continuing operations beginning in the second quarter of 2019 p. 14

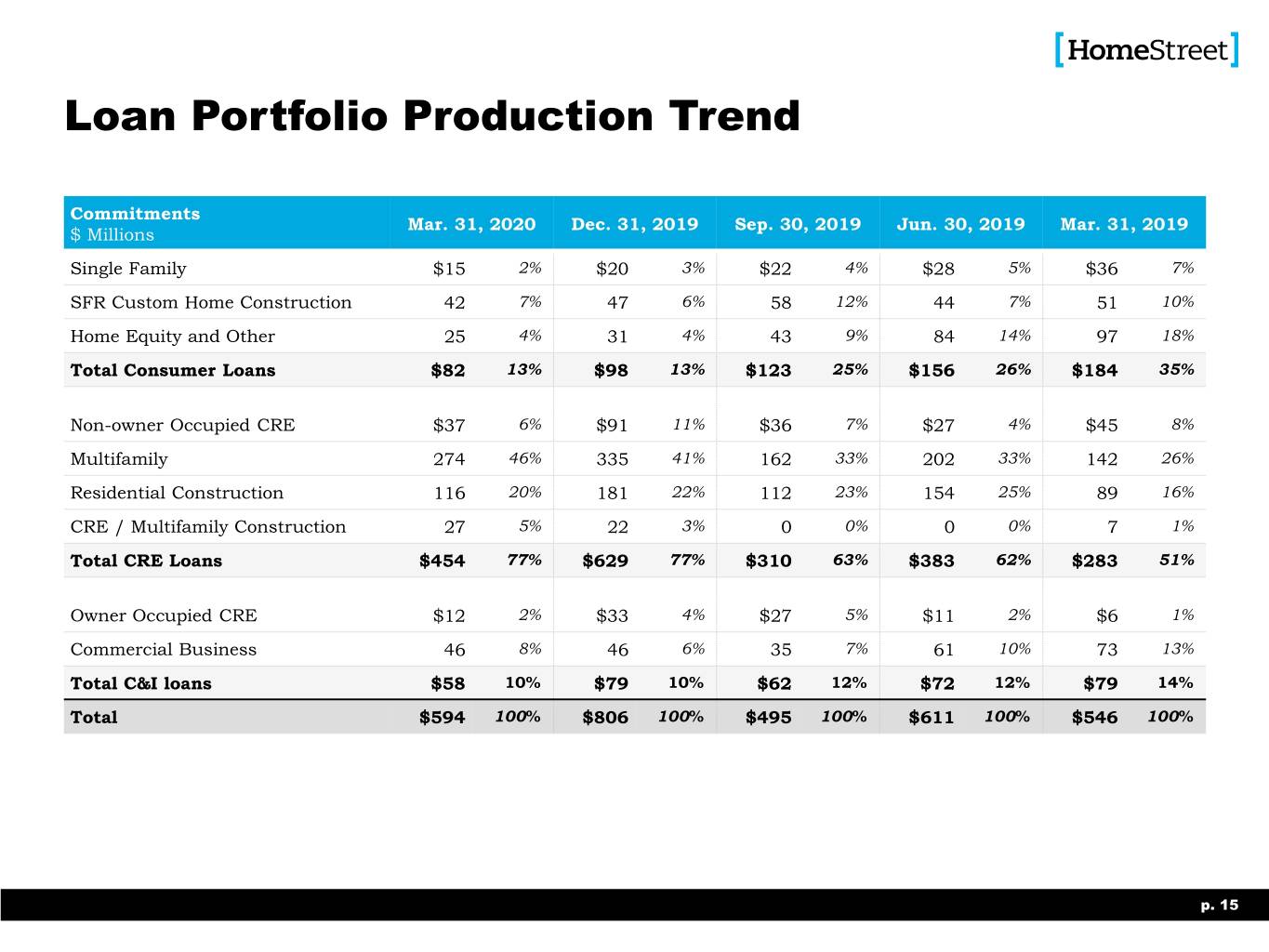

Loan Portfolio Production Trend Commitments Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 $ Millions Single Family $15 2% $20 3% $22 4% $28 5% $36 7% SFR Custom Home Construction 42 7% 47 6% 58 12% 44 7% 51 10% Home Equity and Other 25 4% 31 4% 43 9% 84 14% 97 18% Total Consumer Loans $82 13% $98 13% $123 25% $156 26% $184 35% Non-owner Occupied CRE $37 6% $91 11% $36 7% $27 4% $45 8% Multifamily 274 46% 335 41% 162 33% 202 33% 142 26% Residential Construction 116 20% 181 22% 112 23% 154 25% 89 16% CRE / Multifamily Construction 27 5% 22 3% 0 0% 0 0% 7 1% Total CRE Loans $454 77% $629 77% $310 63% $383 62% $283 51% Owner Occupied CRE $12 2% $33 4% $27 5% $11 2% $6 1% Commercial Business 46 8% 46 6% 35 7% 61 10% 73 13% Total C&I loans $58 10% $79 10% $62 12% $72 12% $79 14% Total $594 100% $806 100% $495 100% $611 100% $546 100% p. 15

Loan Balance Trend Balances Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 $ Millions Single Family $989 20% $1,073 21% $1,191 23% $1,262 24% $1,351 25% SFR Custom Home Construction 157 3% 173 3% 189 4% 200 4% 193 4% Home Equity and Other 526 10% 533 11% 589 11% 611 11% 607 11% Total Consumer Loans $1,672 33% $1,799 35% $1,969 38% $2,073 39% $2,151 40% Non-owner Occupied CRE $872 17% $895 17% $796 15% $768 14% $781 14% Multifamily 1,167 23% 999 20% 922 18% 998 19% 942 17% Residential Construction 260 5% 285 6% 279 5% 302 6% 337 6% CRE / Multifamily Construction 210 4% 245 5% 295 6% 276 5% 308 6% Total CRE Loans $2,509 49% $2,424 47% $2,292 44% $2,344 44% $2,368 44% Owner Occupied CRE $473 9% $477 9% $476 9% $470 9% $448 8% Commercial Business 439 9% 415 8% 446 9% 444 8% 422 8% Total C&I Loans $912 18% $892 17% $922 18% $914 17% $870 16% Total Loans Held for Investment $5,093 100% $5,115 100% $5,183 100% $5,331 100% $5,389 100% p. 16

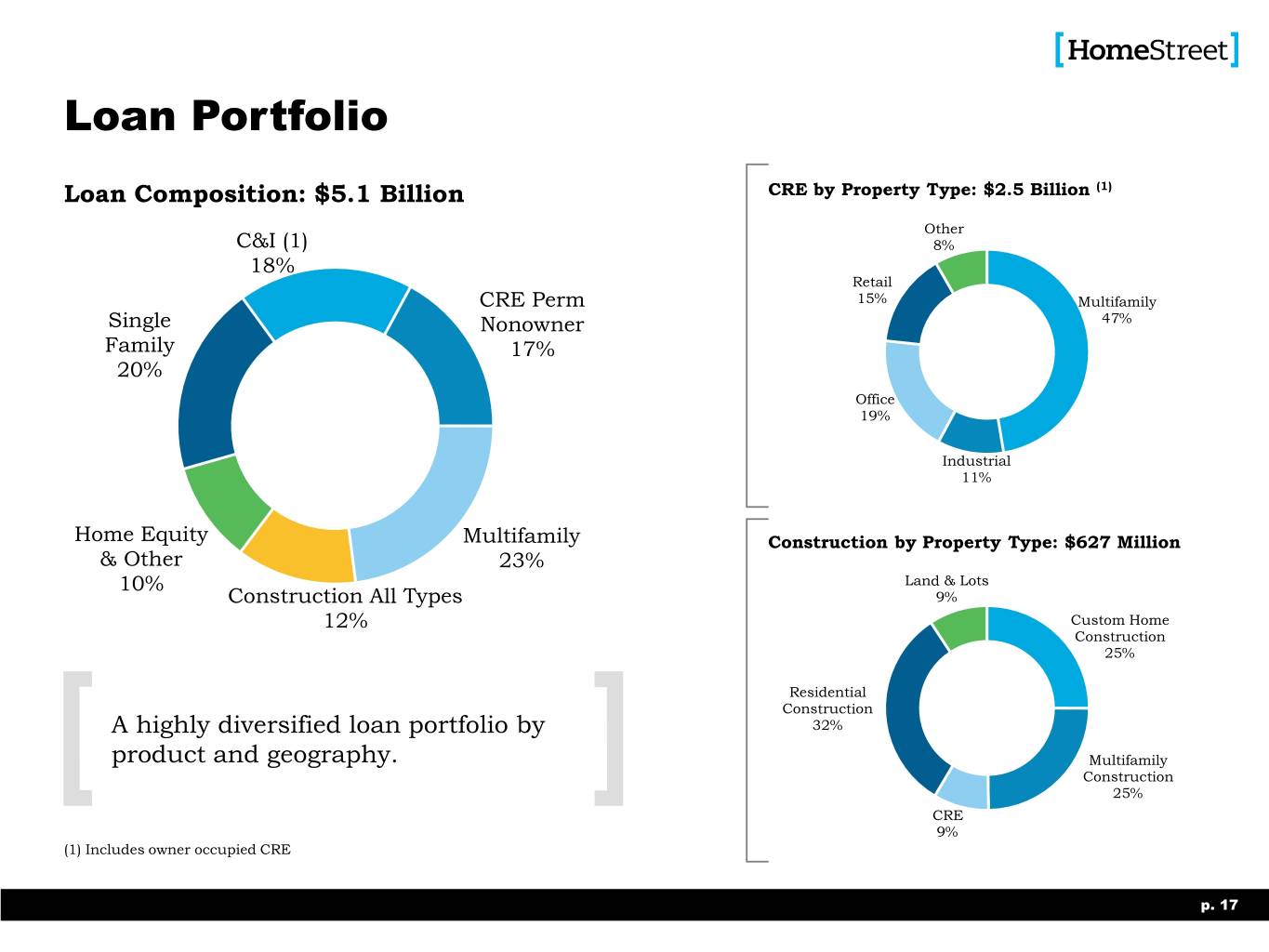

Loan Portfolio Loan Composition: $5.1 Billion CRE by Property Type: $2.5 Billion (1) Other C&I (1) 8% 18% Retail CRE Perm 15% Multifamily Single Nonowner 47% Family 17% 20% Office 19% Industrial 11% Home Equity Multifamily Construction by Property Type: $627 Million & Other 23% 10% Land & Lots Construction All Types 9% 12% Custom Home Construction 25% Residential Construction A highly diversified loan portfolio by 32% product and geography. Multifamily Construction 25% CRE 9% (1) Includes owner occupied CRE p. 17

Commercial & Industrial Lending Overview C&I Commitments Outstanding as of 3/31/2020 Commitments by Industry • Unused C&I commitments of 11% approximately $223.8 million as of 22% 3/31/20 4% 4% • Limited amounts of energy or aviation loans 5% $662.8M • Suspended most C&I lending except to 6% support existing clients 13% 6% • Elevated scrutiny of pipeline to mitigate risk through declines and/or credit 7% 13% enhancements 9% Health Care Manufacturing Wholesale Trade Finance and Insurance Professional, Scientific, & Technical Construction Waste Mangement Accomodation and Food Service Transportation and Warehousing Agriculture, Forestry, Fishing and Hunting All Other p. 18

Permanent Commercial Real Estate CA Los Angeles County Other Lending Overview CA Other WA King/Pierce/Snohomish Oregon WA Other Geographical Distribution (Balances) 12% 9% 18% 13% 15% 19% 13% 5% 6% 7% 7% 7% 48% 14% 1% 10% 35% 39% 21% 6% 28% 7% 17% 45% 3% 3% 6% 7% 11% 68% Multifamily Industrial / Warehouse Office Retail Other Loan Characteristics • Up To 30 Year Term • Up To 15 Year Term • Up To 15 Year Term • Up To 15 Year Term • Additional property types are • $30MM Loan Amt. Max • $30MM Loan Amt. Max • $30MM Loan Amt. Max • $30MM Loan Amt. Max reviewed on a case by case • ≥ 1.15 DSCR • ≥ 1.25 DSCR • ≥ 1.25 DSCR • ≥ 1.25 DSCR basis • Avg. LTV @ Orig. ~ 60% • Avg. LTV @ Orig. ~ 62% • Avg. LTV @ Orig. ~ 68% • Avg. LTV @ Orig. ~ 62% • Includes acquired loan types • Examples include: hotels, schools, churches, marinas 03/31/20 Balances Outstanding Totaling $2.5 Billion • Balance: $1,162M • Balance: $261M • Balance: $472M • Balance: $367M • Balance: $249M • % of Balances: 46% • % of Balances: 10% • % of Balances: 19% • % of Balances: 15% • % of Balances: 10% • Portfolio Avg. LTV ~ 55%(1) • % Owner Occupied: 47% • % Owner Occupied: 26% • % Owner Occupied: 22% • % of Owner Occupied: 26% • Portfolio Avg. DSCR ~ 1.43x • Portfolio LTV ~ 54%(1) • Portfolio LTV ~ 61%(1) • Portfolio LTV ~ 54%(1) • Portfolio LTV ~ 41%(1) • Avg. Loan Size: $3.0M • Portfolio Avg. DSCR ~ 1.62x • Portfolio Avg. DSCR ~ 1.71x • Portfolio Avg. DSCR ~ 1.64x • Portfolio Avg. DSCR ~ 1.61x • Largest Dollar Loan: $24.4M • Avg. Loan Size: $1.9M • Avg. Loan Size: $2.2M • Avg. Loan Size: $2.3M • Avg. Loan Size: $2.2M • Largest Dollar Loan: $19.9M • Largest Dollar Loan: $24.1M • Largest Dollar Loan: $18.5M • Largest Dollar Loan: $26.7M • “Other” category includes loans secured by Schools ($81.1 million), Hotels ($36.4 million), and Churches ($21.0 million) • We have suspended the origination of loans on retail, office, industrial, or self-storage properties with some exceptions authorized by credit administration (1) Property values as of origination date. p. 19

Seattle Metro Hawaii Construction Lending Overview Puget Sound Other California WA Other Utah Portland Metro Idaho OR Other Other: AZ, CO Geographical Distribution (Balances) 3% 2% 4% 9% 11 2% 14% 23% % 6% 14% 31% 22% 9% 40% 28% 44% 1% 36% 2% 10% 13% 8% 18% 27% 24% 25% 12% 24% 23% 1% 1% 3% 7% 2% Custom Home Construction Multifamily Commercial Residential Construction Land and Lots Loan Characteristics • 18-36 Month Term • 18-36 Month Term • 12-18 Month Term • ≤ 80% LTC • 12-24 Month Term • 12 Month Term • ≤ 80% LTC • LTC: ≤ 95% Presale & Spec • Minimum 15% Cash Equity • ≤ 50% -80% LTC • Consumer Owner Occupied • Minimum 15% Cash Equity • Leverage, Liquid. & Net • ≥ 1.25 DSC • Strong, experienced, • Borrower Underwritten • ≥ 1.20 DSC Worth Covenants as • ≥ 50% pre-leased office/retail vertically integrated builders similar to Single Family • Portfolio LTV ~ 61% appropriate • Portfolio LTV ~58% • Portfolio LTV ~ 68% • Liquidity and DSC covenants • Portfolio LTV ~ 73% • Liquidity and DSC covenants 03/31/20 Balances Outstanding Totaling $627 Million • Balance: $157M • Balance: $155M • Balance: $55M • Balance: $202M • Balance: $58M • Unfunded Commitments: • Unfunded Commitments: • Unfunded Commitments: • Unfunded Commitments: • Unfunded Commitments: $106M $75M $4M $226M $8M • % of Balances: 25% • % of Balances: 25% • % of Balances: 9% • % of Balances: 32% • % of Balances: 9% • % of Unfunded • % of Unfunded • % of Unfunded • % of Unfunded • % of Unfunded Commitments: 25% Commitments: 18% Commitments: 1% Commitments: 54% Commitments: 2% • Avg. Loan Size: $506K • Avg. Loan Size: $10.3M • Avg. Loan Size: $9.1M • Avg. Loan Size: $346K • Avg. Loan Size: $673K • Largest Dollar Loan: $2.1M • Largest Dollar Loan: $26.7M • Largest Dollar Loan: $14.5M • Largest Dollar Loan: $7.9M • Largest Dollar Loan: $3.1M • We have suspended the origination of commercial real estate related new construction and land loans, and residential construction related acquisition & development and raw land loans • Residential construction lending sales remain strong despite lower traffic volume p. 20

Allocation of Allowance by Product Type CECL 4Q19 Probable January 1, 2020 Reserve March 31, 2020 Adoption $ Thousands Incurred Losses CECL Adoption build CECL Impact Allowance for Credit Losses Reserve Reserve Reserve Reserve Reserve Reserve Amount Rate Amount Rate Amount Rate Single Family $6,450 0.60% $468 $6,918 0.64% $1,669 $8,587 0.87% SFR Custom Home Construction 1,003 0.58% 200 1,203 0.70% 309 1,512 0.97% Home Equity and Other 6,233 1.13% 4,635 10,868 1.96% 1,540 12,408 2.36% Total Consumer Loans $13,686 0.76% $5,303 $18,989 1.06% $3,518 $22,507 1.35% Non-owner Occupied CRE $7,245 0.81% $(3,392) $3,853 0.43% $5,168 $9,021 1.03% Multifamily 7,015 0.70% (2,977) 4,038 0.40% 227 4,265 0.37% Residential Construction 3,800 1.33% 4,280 8,080 2.84% (1,495) 6,585 2.53% CRE / Multifamily Construction 3,472 1.42% 578 4,050 1.66% (450) 3,600 1.71% Total CRE Loans $21,532 0.89% $(1,511) $20,021 0.83% $3,450 $23,471 0.94% Owner Occupied CRE $3,639 0.76% $(2,459) $1,180 0.25% $2,980 $4,160 0.88% Commercial Business 2,915 0.70% 510 3,425 0.83% 4,736 8,161 1.86% Total C&I Loans $6,554 0.73% $(1,949) $4,605 0.52% $7,716 $12,321 1.35% Total Loans $41,772 0.82% $1,843 $43,615 0.85% $14,684 $58,299 1.14% Reserve for unfunded lending commitments $1,065 $1,897 $2,962 $(655) $2,307 Allowance for Credit Losses $42,837 $3,740 $46,577 $14,029 $60,606 p. 21

CECL Key Drivers and Assumptions • Asset quality remains strong; COVID-19 uncertainties are the exclusive driver of the $14 million Allowance for Credit Losses increase • Expected loss rates continue to decline due to minimal losses and stable portfolio credit composition • The allowance for credit losses for loans held for investment that are collectively evaluated consider eight qualitative factors (“Q-Factors”) for each loan pool including changes in collateral values and economic conditions • Q-Factor forecast was based on inputs from Moody’s economic scenarios released on March 27, 2020, which include COVID-19 pandemic effects: – A sudden sharp recession is now the baseline forecast – U.S. Real GDP change is -2.5% in 1Q20, -18.3% in 2Q20, and 10.9% in 3Q20 – Aided by the fiscal stimulus and the assumption that COVID-19 infections peak in May and begin to abate by July, GDP growth is forecast to bounce back in the second half of the year – The unemployment rate will jump sharply during the second quarter, with it averaging 8.7% • Final forecast inputs were based on Moody’s Baseline scenario – These results were compared to and consistent with results derived using forecast inputs from Moody’s Moderate Recession scenario • Moody’s recently released their April Baseline Forecast which reflects a more severe outlook with U.S. Real GDP changes of -8.0% for 1Q20, -30.2% for 2Q20 & 16.7% for 3Q20. Application of these updated inputs would not have materially changed our Allowance for Credit Losses in 1Q20 • Loans most at risk are not yet being downgraded or designated as troubled debt restructuring based on regulatory guidance p. 22

Forbearance Requests as of April 23, 2020 Portfolio Requests Granted ($ in thousands) Balance Loan Count Balance Loan Count Single Family $58,472 150 $58,472 150 Commercial Real Estate 98,583 18 - - Residential Construction 10,254 11 - - (1) Commercial and Industrial 211,012 291 123,656 156 Grand Total $378,321 470 $182,128 306 Commercial & Industrial from above Requests Granted ($ in thousands) Balance Loan Count Balance Loan Count Dentists and Other Healthcare Providers $86,182 168 $58,533 112 Restaurants / Bars / Entertainment(2) 60,778 43 59,185 30 Church 14,342 1 - - Transportation 12,967 8 - - Real Estate Industry and Investor CRE 10,438 9 1,119 1 Veterinarians 6,677 10 1,999 5 All Other 19,628 52 2,820 8 (3) Grand Total $211,012 291 $123,656 156 (1) Includes $$88.8 million of owner occupied commercial real estate (2) Includes, $52.7 million exposure, 61% of which is real estate secured, to a Pacific Northwest specialty restaurant / bar hotel operator for which we arranged a $4.5 million liquidity line secured by $11.5 million of additional collateral. We also made a $10 million Paycheck Protection Program loan to this borrower. (3) We have made Paycheck Protection Program loans for 106 of these C&I loans before funding was exhausted and we are hoping to make 113 more from the subsequent additional allocation to the program. p. 23

Credit Quality Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Group Group Group Group Group $ Thousands HMST Median HMST Median HMST Median HMST Median HMST Median Nonperforming Assets(1) $14,318 -- $14,254 -- $14,186 -- $11,683 -- $16,712 -- Nonperforming Loans $12,975 -- $12,861 -- $12,433 -- $9,930 -- $15,874 -- OREO $1,343 -- $1,393 -- $1,753 -- $1,753 -- $838 -- Nonperforming Assets/Total Assets(1) 0.21% (3) 0.21% 0.23% 0.21% 0.26% 0.16% 0.16% 0.23% 0.20% Nonperforming Loans/Total Loans 0.25% (3) 0.25% 0.31% 0.24% 0.32% 0.19% 0.31% 0.29% 0.23% Total Delinquencies/Total Loans 0.86% (3) 0.86% 0.53% 0.87% 0.55% 0.85% 0.41% 1.10% 0.52% Total Delinquencies/Total Loans, 0.28% (3) 0.31% 0.41% 0.28% 0.38% 0.21% 0.41% 0.37% 0.50% Adjusted(2) ACL/Total Loans 1.14% (3) 0.82% 1.09% 0.84% 1.09% 0.81% 0.98% 0.80% 0.99% ACL/Nonperforming Loans (NPLs) 449.32% (3) 324.80% 354.13% 349.37% 339.73% 435.59% 457.32% 271.99% 442.65% The credit comparison group -- selected in consultation with our regulators, comprising banks with similar geographic footprint and loan portfolio characteristics -- consists of: Alpine Bank, Avidbank, Banc of California, Bank of Marin, Bank of the Sierra, Banner Bank, Cashmere Valley Bank, Cathay Bank, Central Valley Community Bank, Coastal Community Bank, Commercial Bank of California, CTBC Bank Corp., Exchange Bank, Farmers & Merchants Bank of Long Beach, First Choice Bank, First Financial Northwest Bank, Five Star Bank, Heritage Bank, Heritage Bank of Commerce, Kitsap Bank, Manufacturers Bank, Mechanics Bank, Montecito Bank & Trust, Oak Valley Community Bank, Opportunity Bank of Montana, Pacific Mercantile Bank, Pacific Premier Bank, Pacific Western Bank, Peoples Bank, Poppy Bank, Preferred Bank, Royal Business Bank, Silvergate Bank, Sunwest Bank, Tri Counties Bank, Umpqua Bank, Washington Federal Bank NA, and Washington Trust Bank. This group is not used for any other comparative purposes by HomeStreet. (1) Nonperforming assets includes nonaccrual loans and OREO; excludes performing TDRs and SBAs. (2) Total delinquencies and total loans – adjusted (net of Ginnie Mae EBO loans (FHA/VA loans) and guaranteed portion of SBA loans). (3) Not available at time of publishing. p. 24

Outlook p. 25

Key Drivers Guidance Metric Outlook Comments • Growth in multifamily originations and C&I lending related to PPP • Offset somewhat by low interest rates resulting in higher level of Average Loans Held for Flat prepayments Investment • Suspended origination of various loan categories due to COVID-19 pandemic Flat to Slightly • Continued reduction of brokered deposits due to lower loan growth Average Deposits Decreasing • Offset by continued growth of consumer and business deposits • Lower cost of funds as deposits reprice down to lower market interest Net Interest Margin Increasing rates • Lower balances of higher costing brokered deposits • Lower headcount resulting in lower base salaries and related occupancy expenses Noninterest Expense Decreasing • Somewhat offset by higher commission expense as 1Q20 single family mortgage lock pipeline is closed As a result of the ongoing COVID-19 pandemic and the related uncertainty on its impact on our results of operations, we are withdrawing our previously established guidance for operating performance targets, although absent continued loan loss provisioning we believe we have the opportunity to achieve those recently guided targets at the time-frames previously established. The information in this presentation, particularly including but not limited to that presented on this slide, is forward-looking in nature, and you should review Item 1A, “Risk Factors,” in our most recent SEC filings including our Annual Report on Form 10-K for the year ended December 31, 2019, for a list of factors that may cause us to deviate from our plans or to fall short of our expectations. p. 26

Appendix p. 27

Statements of Financial Condition Quarter Ended $ Thousands Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Cash and Cash Equivalents $72,441 $57,880 $74,788 $99,602 $67,690 Investment Securities 1,058,492 943,150 866,736 803,819 816,878 Loans Held For Sale 140,527 208,177 172,958 145,252 56,928 Loans Held For Investment, Net 5,034,930 5,072,784 5,139,108 5,287,859 5,345,969 Mortgage Servicing Rights 80,053 97,603 90,624 94,950 95,942 Other Real Estate Owned 1,342 1,393 1,753 1,753 838 Goodwill 28,492 28,492 30,170 30,170 29,857 Operating Lease Right-of-Use Assets 91,375 94,873 101,843 102,353 113,083 Other Assets 299,066 279,455 274,987 282,103 287,436 Assets of Discontinued Operations - 28,628 82,911 352,929 356,784 Total Assets $6,806,718 $6,812,435 $6,835,878 $7,200,790 $7,171,405 Deposits $5,257,057 $5,339.959 $5,804,307 $5,590,893 $5,178,334 Federal Home Loan Bank Advances 463,590 346,590 5,590 387,590 599,590 Accounts Payable And Other Liabilities 78,959 79,818 84,905 102,943 126,546 Federal funds purchased & securities sold under agreements to repurchase - 125,000 - - 27,000 Other borrowings 95,000 - - - - Long-term Debt 125,697 125,650 125,603 125,556 125,509 Operating Lease Liabilities 109,101 113,092 120,072 121,677 130,221 Liabilities of Discontinued Operations - 2,603 5,075 148,221 237,174 Total Liabilities 6,129,404 6,132,712 6,144,742 6,476,880 6,424,374 Common Stock 511 511 511 511 511 Shares Subject to Repurchase - - - 52,735 - Additional Paid-in Capital 293,791 300,218 309,649 308,705 342,049 Retained Earnings 365,283 374,673 372,981 359,252 411,826 Accumulated Other Comprehensive Income (Loss) 17,729 4,321 7,995 2,707 (7,355) Total Shareholders’ Equity 677,314 679,723 691,136 671,175 747,031 Total Liabilities and Shareholders’ Equity $6,806,718 $6,812,435 $6,835,878 $7,200,790 $7,171,405 p. 28

Non-GAAP Financial Measures Consolidated Results 3 Months Ended $ Thousands Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Net Income $7,139 $10,988 $13,827 ($5,588) ($1,715 Impact of Restructuring-related Items (Net of Tax) 960 1,699 (326) 9,697 9,564 Impact of Acquisition-related Items (Net of Tax) 11 28 4 (33) 290 Core Net Income 8,110 12,715 13,505 4,076 8,139 Noninterest Expense 55,184 56,540 57,644 101,585 97,700 Impact of Restructuring-related Expenses (1,215) (2,150) 413 (12,274) (12,106) Impact of Acquisition-related Expenses (14) (36) (5) 42 (367) Noninterest Expense, Excluding Restructuring and Acquisition- 53,955 54,354 58,052 89,353 85,227 related Expenses Diluted Earnings Per Common Share $0.30 $0.45 $0.55 ($0.22) ($0.06) Impact of Restructuring-related Items (Net of Tax) 0.04 0.07 (0.01) 0.36 0.35 Impact Of Acquisition-related Items (Net of Tax) - - - - 0.01 Diluted Earnings Per Common Share, Excluding Income Tax Reform- related Benefit, Restructuring (Net of Tax) and Acquisition-related 0.34 0.52 0.54 0.14 0.30 Items (Net of Tax) p. 29

Non-GAAP Financial Measures Consolidated Results (cont.) 3 Months Ended $ Thousands Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Return On Average Shareholders' Equity 4.13% 6.27% 7.98% (3.02)% (0.91)% Impact of Restructuring-related Items (Net of Tax) 0.56% 0.97% (0.19)% 5.23% 5.10% Impact of Acquisition-related Items (Net of Tax) 0.01% 0.02% - (0.02)% 0.15% Return On Average Shareholders' Equity, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) And Acquisition- 4.70% 7.26% 7.79% 2.19% 4.34% related Items (Net of Tax) Return On Average Tangible Shareholders' Equity 4.35% 6.60% 8.42% (3.17)% (0.95)% Impact of Restructuring-related Items (Net of Tax) 0.58% 1.02% (0.20)% 5.50% 5.30% Impact of Acquisition-related Items (Net of Tax) 0.01% 0.02% - (0.02)% 0.16% Return On Average Tangible Shareholders' Equity, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) And 4.94% 7.64% 8.22% 2.31% 4.51% Acquisition-related Items (Net of Tax) Efficiency Ratio 70.69% 83.87% 78.08% 106.83% 100.66% Impact of Restructuring-related Items (1.56)% (3.19)% 0.56% (12.91)% (12.47)% Impact of Acquisition-related Items (0.02)% (0.05)% (0.01)% 0.04% (0.38)% Efficiency Ratio, Excluding Restructuring and Acquisition-related 69.11% 80.63% 78.63% 93.96% 87.81% Items Return On Average Assets 0.42% 0.64% 0.79% (0.31)% (0.10)% Impact of Restructuring-related Items (Net Of Tax) 0.06% 0.10% (0.02)% 0.53% 0.53% Impact of Acquisition-related Items (Net of Tax) - - - - 0.02% Return On Average Assets, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) and Acquisition-related Items (Net 0.48% 0.74% 0.77% 0.22% 0.45% of Tax) p. 30

Non-GAAP Financial Measures Continuing Operations 3 Months Ended $ Thousands Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Net Income $7,139 $13,105 $13,665 $8,892 $5,058 Impact of Restructuring-related Items (Net of Tax) 960 1,811 669 1,159 (93) Impact of Acquisition-related Items (Net of Tax) 11 28 4 (33) 290 Core Net Income 8,110 14,944 14,338 10,018 5,255 Noninterest Expense 55,184 53,215 55,721 58,832 47,846 Impact of Restructuring-related Expenses (1,215) (2,292) (847) (1,467) 118 Impact of Acquisition-related Expenses (14) (36) (5) 42 (367) Noninterest Expense, Excluding Restructuring and Acquisition- 53,955 50,887 54,869 57,407 47,597 related Expenses Diluted Earnings Per Common Share $0.30 $0.54 $0.54 $0.32 $0.19 Impact of Restructuring-related Items (Net of Tax) 0.04 0.07 0.03 0.04 - Impact Of Acquisition-related Items (Net of Tax) - - - - 0.01 Diluted Earnings Per Common Share, Excluding Income Tax Reform- related Benefit, Restructuring (Net of Tax) and Acquisition-related 0.34 0.61 0.57 0.36 0.20 Items (Net of Tax) Income from continuing operations before income taxes $8,880 $16,228 $15,993 $10,184 $6,303 Provision for credit losses 14,000 (2,000) - - 1,500 Pre-provision operating income 22,880 14,228 15,993 10,184 7,803 Impact of restructuring-related (expenses) recoveries 1,215 2,292 847 1,467 (118) Impact of acquisition-related (expenses) recoveries 14 36 5 (42) 367 Core pre-provision operating income from continuing operations $24,109 $16,556 $16,845 $11,609 $8,052 p. 31

Non-GAAP Financial Measures Continuing Operations (cont.) 3 Months Ended $ Thousands Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Return On Average Shareholders' Equity 4.13% 7.48% 7.88% 4.80% 2.70% Impact of Restructuring-related Items (Net of Tax) 0.56% 1.03% 0.39% 0.63% (0.05)% Impact of Acquisition-related Items (Net of Tax) 0.01% 0.02% - (0.02)% 0.15% Return On Average Shareholders' Equity, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) And Acquisition- 4.70% 8.53% 8.27% 5.41% 2.80% related Items (Net of Tax) Return On Average Tangible Shareholders' Equity 4.35% 7.87% 8.32% 5.05% 2.80% Impact of Restructuring-related Items (Net of Tax) 0.58% 1.09% 0.41% 0.66% (0.05)% Impact of Acquisition-related Items (Net of Tax) 0.01% 0.02% - (0.02)% 0.16% Return On Average Tangible Shareholders' Equity, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) And 4.94% 8.98% 8.73% 5.69% 2.91% Acquisition-related Items (Net of Tax) Efficiency Ratio 70.69% 78.90% 77.70% 85.24% 85.98% Impact of Restructuring-related Items (1.56)% (3.40)% (1.18)% (2.13)% 0.21% Impact of Acquisition-related Items (0.02)% (0.05)% (0.01)% 0.06% (0.66)% Efficiency Ratio, Excluding Restructuring and Acquisition-related 69.11% 75.45% 76.51% 83.17% 85.53% Items Return On Average Assets 0.42% 0.76% 0.78% 0.49% 0.28% Impact of Restructuring-related Items (Net Of Tax) 0.06% 0.11% 0.04% 0.06% (0.01)% Impact of Acquisition-related Items (Net of Tax) - - - - 0.02% Return On Average Assets, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) and Acquisition-related Items (Net 0.48% 0.87% 0.82% 0.55% 0.29% of Tax) p. 32

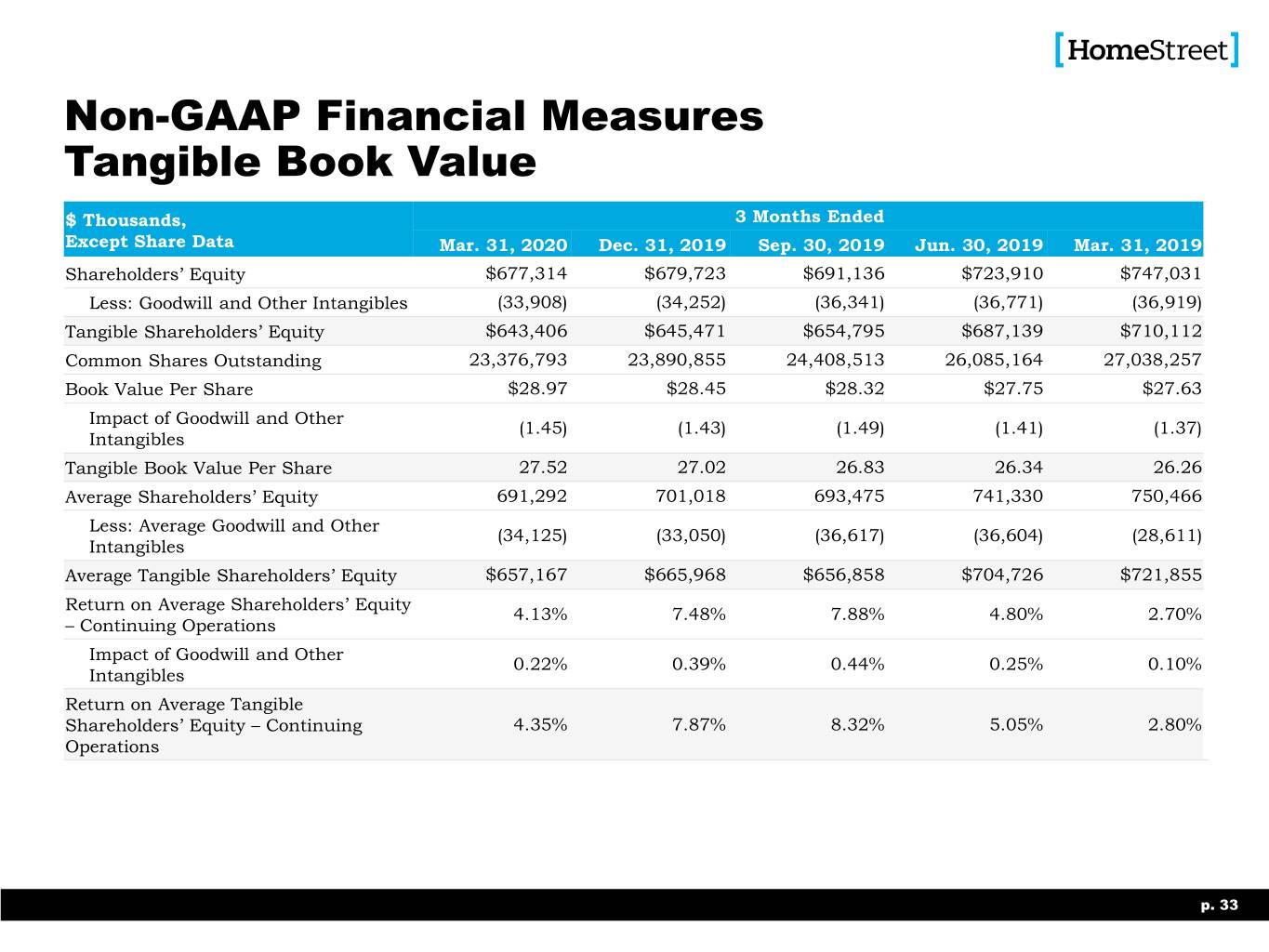

Non-GAAP Financial Measures Tangible Book Value $ Thousands, 3 Months Ended Except Share Data Mar. 31, 2020 Dec. 31, 2019 Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Shareholders’ Equity $677,314 $679,723 $691,136 $723,910 $747,031 Less: Goodwill and Other Intangibles (33,908) (34,252) (36,341) (36,771) (36,919) Tangible Shareholders’ Equity $643,406 $645,471 $654,795 $687,139 $710,112 Common Shares Outstanding 23,376,793 23,890,855 24,408,513 26,085,164 27,038,257 Book Value Per Share $28.97 $28.45 $28.32 $27.75 $27.63 Impact of Goodwill and Other (1.45) (1.43) (1.49) (1.41) (1.37) Intangibles Tangible Book Value Per Share 27.52 27.02 26.83 26.34 26.26 Average Shareholders’ Equity 691,292 701,018 693,475 741,330 750,466 Less: Average Goodwill and Other (34,125) (33,050) (36,617) (36,604) (28,611) Intangibles Average Tangible Shareholders’ Equity $657,167 $665,968 $656,858 $704,726 $721,855 Return on Average Shareholders’ Equity 4.13% 7.48% 7.88% 4.80% 2.70% – Continuing Operations Impact of Goodwill and Other 0.22% 0.39% 0.44% 0.25% 0.10% Intangibles Return on Average Tangible Shareholders’ Equity – Continuing 4.35% 7.87% 8.32% 5.05% 2.80% Operations p. 33