Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CROSSFIRST BANKSHARES, INC. | q12020crossfirst8kform.htm |

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - CROSSFIRST BANKSHARES, INC. | exhibit991q12020.htm |

NASDAQ: CFB | April 23, 2020

FORWARD-LOOKING STATEMENTS. This presentation and oral statements made during this meeting contain forward-looking statements. These forward- looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as "may," "might," "should," "could," "predict," "potential," "believe," "expect," "continue," "will," "anticipate," "seek," "estimate," "intend," "plan," "strive," "projection," "goal," "target," "outlook," "aim," "would," "annualized" and "outlook," or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: risks relating to the COVID-19 pandemic; risks related to general business and economic conditions and any regulatory responses to such conditions; our ability to effectively execute our growth strategy and manage our growth, including identifying and consummating suitable mergers and acquisitions; the geographic concentration of our markets; fluctuation of the fair value of our investment securities due to factors outside our control; our ability to successfully manage our credit risk and the sufficiency of our allowance; regulatory restrictions on our ability to grow due to our concentration in commercial real estate lending; our ability to attract, hire and retain qualified management personnel; interest rate fluctuations; our ability to raise or maintain sufficient capital; competition from banks, credit unions and other financial services providers; the effectiveness of our risk management framework in mitigating risks and losses; our ability to maintain effective internal control over financial reporting; our ability to keep pace with technological changes; system failures and interruptions, cyber-attacks and security breaches; employee error, fraudulent activity by employees or clients and inaccurate or incomplete information about our clients and counterparties; our ability to maintain our reputation; costs and effects of litigation, investigations or similar matters; risk exposure from transactions with financial counterparties; severe weather, acts of god, acts of war or terrorism; compliance with governmental and regulatory requirements; changes in the laws, rules, regulations, interpretations or policies relating to financial institutions, accounting, tax, trade, monetary and fiscal matters; compliance with requirements associated with being a public company; level of coverage of our business by securities analysts; and future equity issuances. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward- looking statement, whether as a result of new information, future developments or otherwise, except as required by law. NON-GAAP FINANCIAL INFORMATION. This presentation contains certain non-GAAP measures. These non-GAAP measures, as calculated by CrossFirst, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measures of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See the Appendix for reconciliations of certain non-GAAP measures. MARKET AND INDUSTRY DATA. This presentation references certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data, forecasts and information from various independent, third party industry sources and publications. Nothing in the data, forecasts or information used or derived from third party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable but have not independently verified them. Statements as to our market position are based on market data currently available to us. Although we are not aware of any misstatements regarding the economic, employment, industry and other market data presented herein, these estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. 2

George F. Jones Jr. – President, CEO and Director of CrossFirst Other Senior Executives • Joined CrossFirst in 2016 after a short retirement from Texas Capital Bancshares, Inc. (TCBI) • Founding executive of TCBI in 1998 • Led TCBI through 50 consecutive profitable quarters and growth to $12 billion in assets Amy Fauss Chief Operating Officer of CrossFirst Bank 28+ years of banking experience Mike Maddox – President, CEO of CrossFirst Bank and Director of CrossFirst Joined CrossFirst in 2009 • Joined CrossFirst in 2008 after serving as Kansas City regional president for Intrust Bank Tom Robinson • Practicing lawyer for more than six years before joining Intrust Bank Chief Risk Officer of CrossFirst • Graduate School of Banking at the University of Wisconsin - Madison 35+ years of banking experience Joined CrossFirst in 2011 David O’Toole – CFO, Chief Investment Officer and Director of CrossFirst, CFO of CrossFirst Bank Aisha Reynolds General Counsel of CrossFirst and • More than 40 years of experience in banking, accounting, valuation and investment banking CrossFirst Bank • Founding shareholder and director of CrossFirst Bank and became CFO in 2008 13+ years of experience • Co-founder and managing partner of a national bank consulting and accounting firm Joined CrossFirst in 2018 • Served on numerous boards of directors of banks and private companies, including the Continental Airlines, Inc. travel agency advisory board Randy Rapp – Chief Credit Officer of CrossFirst Bank • More than 30 years of experience in banking, primarily as a credit analyst, commercial relationship manager and credit officer • Joined CrossFirst in April 2019 after serving as Executive Vice President and Chief Credit Officer of Texas Capital Bank, National Association from May 2015 until March 2019 • Mr. Rapp joined Texas Capital Bank in 2000 Matt Needham – Director of Strategy and Investor Relations of CrossFirst • More than 15 years experience in banking, strategy, accounting and investment banking, five with CrossFirst • Deep experience in capital markets including valuation, mergers, acquisitions and divestitures • Provided assurance and advisory services with Ernst & Young • Former Deputy Bank Commissioner in Kansas and has served on several bank boards • MBA Wake Forest University, obtained CFA designation and CPA, Graduate School of Banking at the University of Colorado 3

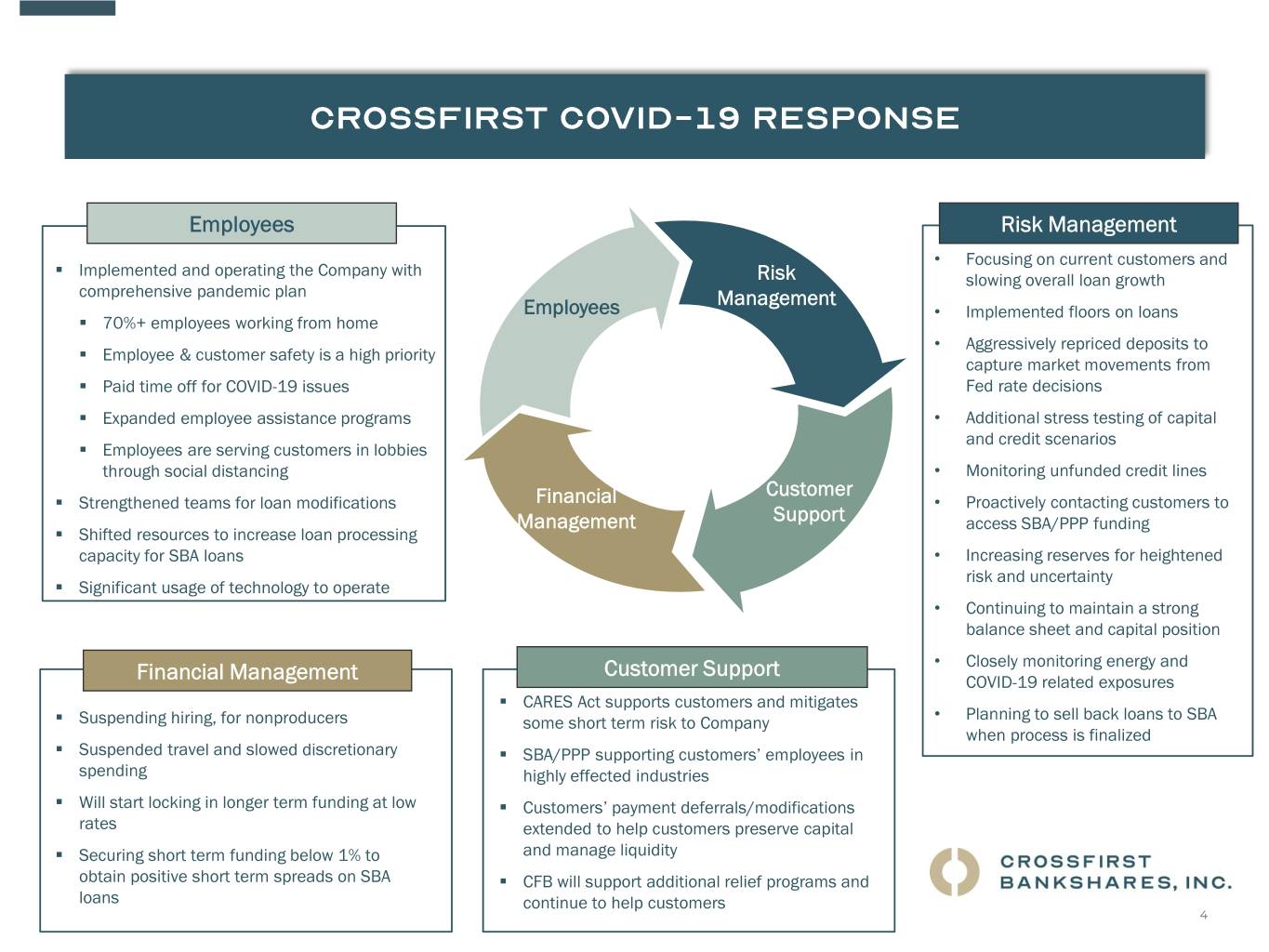

Employees Risk Management • Focusing on current customers and ▪ Implemented and operating the Company with Risk slowing overall loan growth comprehensive pandemic plan Management Employees • Implemented floors on loans ▪ 70%+ employees working from home • Aggressively repriced deposits to ▪ Employee & customer safety is a high priority capture market movements from ▪ Paid time off for COVID-19 issues Fed rate decisions ▪ Expanded employee assistance programs • Additional stress testing of capital and credit scenarios ▪ Employees are serving customers in lobbies through social distancing • Monitoring unfunded credit lines Customer ▪ Strengthened teams for loan modifications Financial • Proactively contacting customers to Management Support access SBA/PPP funding ▪ Shifted resources to increase loan processing capacity for SBA loans • Increasing reserves for heightened risk and uncertainty ▪ Significant usage of technology to operate • Continuing to maintain a strong balance sheet and capital position Customer Support • Closely monitoring energy and Financial Management COVID-19 related exposures ▪ CARES Act supports customers and mitigates Planning to sell back loans to SBA ▪ Suspending hiring, for nonproducers some short term risk to Company • when process is finalized ▪ Suspended travel and slowed discretionary ▪ SBA/PPP supporting customers’ employees in spending highly effected industries ▪ Will start locking in longer term funding at low ▪ Customers’ payment deferrals/modifications rates extended to help customers preserve capital ▪ Securing short term funding below 1% to and manage liquidity obtain positive short term spreads on SBA ▪ CFB will support additional relief programs and loans continue to help customers 4

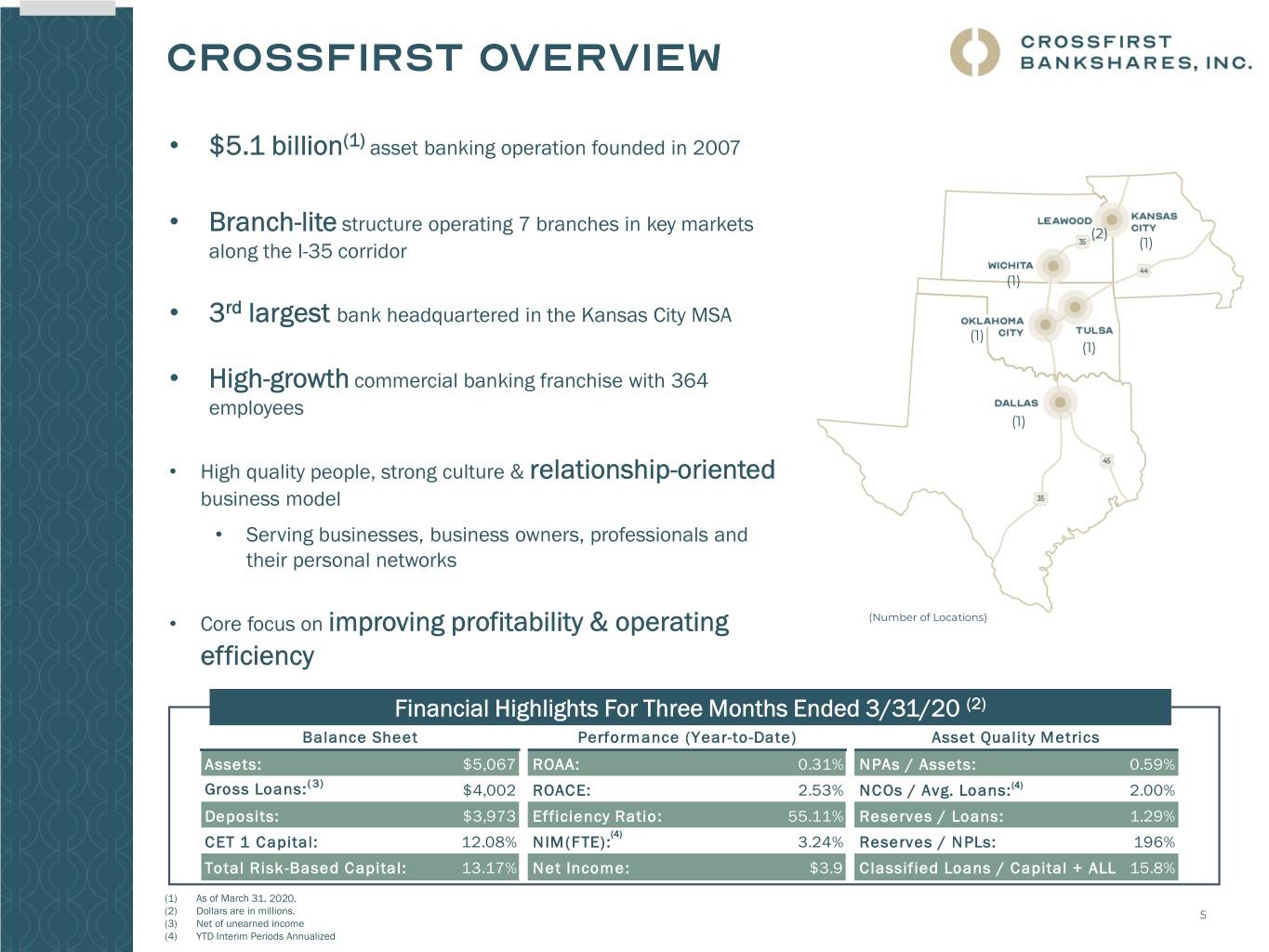

• $5.1 billion(1) asset banking operation founded in 2007 • Branch-lite structure operating 7 branches in key markets (2) along the I-35 corridor (1) (1) • 3rd largest bank headquartered in the Kansas City MSA (1) (1) • High-growth commercial banking franchise with 364 employees (1) • High quality people, strong culture & relationship-oriented business model • Serving businesses, business owners, professionals and their personal networks • Core focus on improving profitability & operating (Number of Locations) efficiency Financial Highlights For Three Months Ended 3/31/20 (2) Balance Sheet Performance (Year-to-Date) Asset Quality Metrics Assets: $5,067 ROAA: 0.31% NPAs / Assets: 0.59% Gross Loans:( 3) $4,002 ROACE: 2.53% NCOs / Avg. Loans:(4) 2.00% Deposits: $3,973 Efficiency Ratio: 55.11% Reserves / Loans: 1.29% (4) CET 1 Capital: 12.08% NIM(FTE): 3.24% Reserves / NPLs: 196% Total Risk-Based Capital: 13.17% Net Income: $3.9 Classified Loans / Capital + ALLL 15.8% (1) As of March 31, 2020. (2) Dollars are in millions. 5 (3) Net of unearned income (4) YTD Interim Periods Annualized

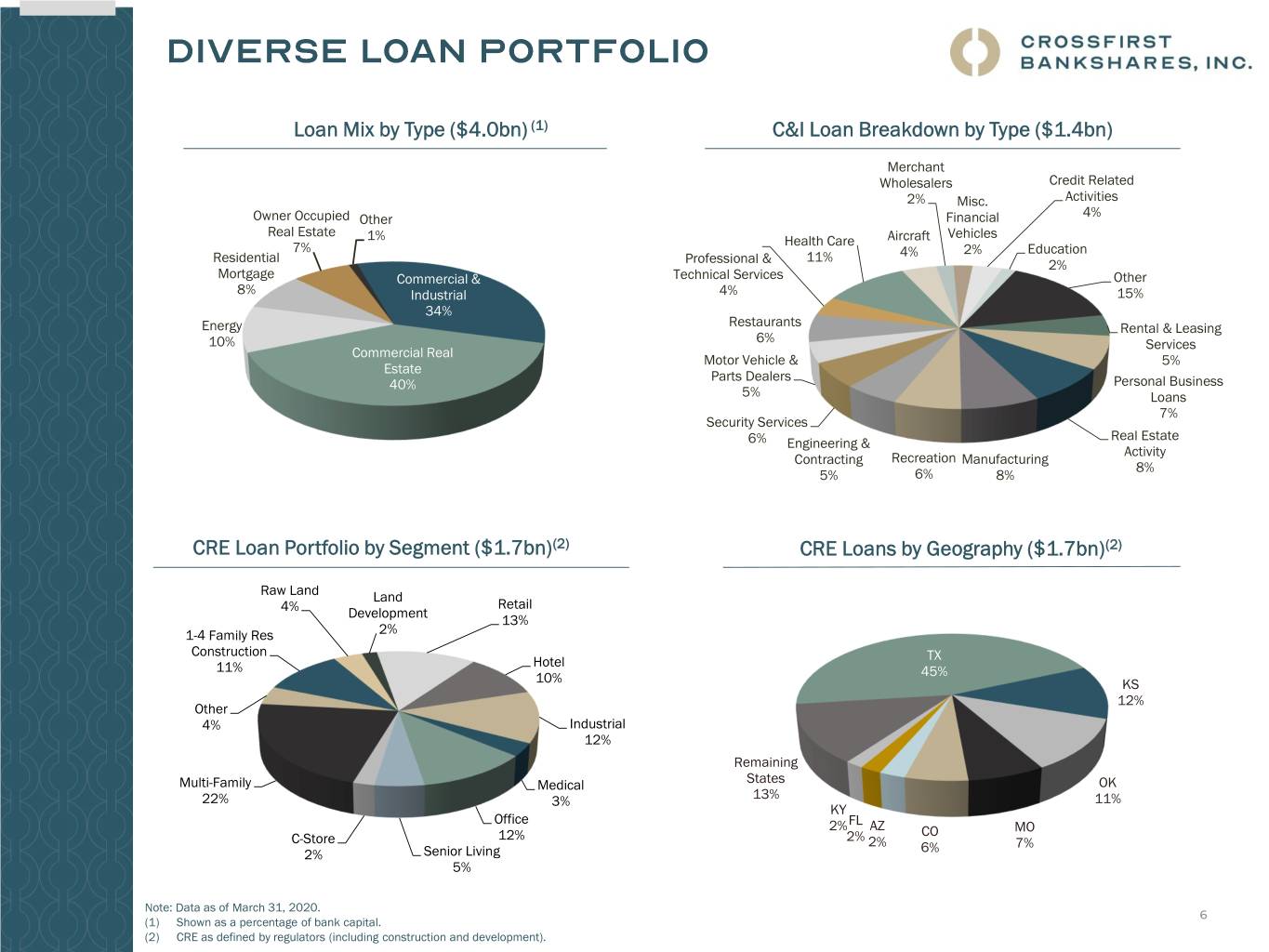

Loan Mix by Type ($4.0bn) (1) C&I Loan Breakdown by Type ($1.4bn) Merchant Wholesalers Credit Related 2% Misc. Activities 4% Owner Occupied Other Financial Real Estate Vehicles 1% Health Care Aircraft 7% 2% Education Residential 11% 4% Professional & 2% Mortgage Commercial & Technical Services Other 8% Industrial 4% 15% 34% Energy Restaurants Rental & Leasing 10% 6% Services Commercial Real Motor Vehicle & 5% Estate Parts Dealers 40% Personal Business 5% Loans 7% Security Services Real Estate 6% Engineering & Activity Contracting Recreation Manufacturing 8% 5% 6% 8% CRE Loan Portfolio by Segment ($1.7bn)(2) CRE Loans by Geography ($1.7bn)(2) Raw Land Land 4% Retail Development 13% 1-4 Family Res 2% Construction Hotel TX 11% 45% 10% KS 12% Other 4% Industrial 12% Remaining Multi-Family Medical States OK 22% 3% 13% 11% KY Office FL 2% AZ CO MO C-Store 12% 2% 2% 6% 7% 2% Senior Living 5% Note: Data as of March 31, 2020. 6 (1) Shown as a percentage of bank capital. (2) CRE as defined by regulators (including construction and development).

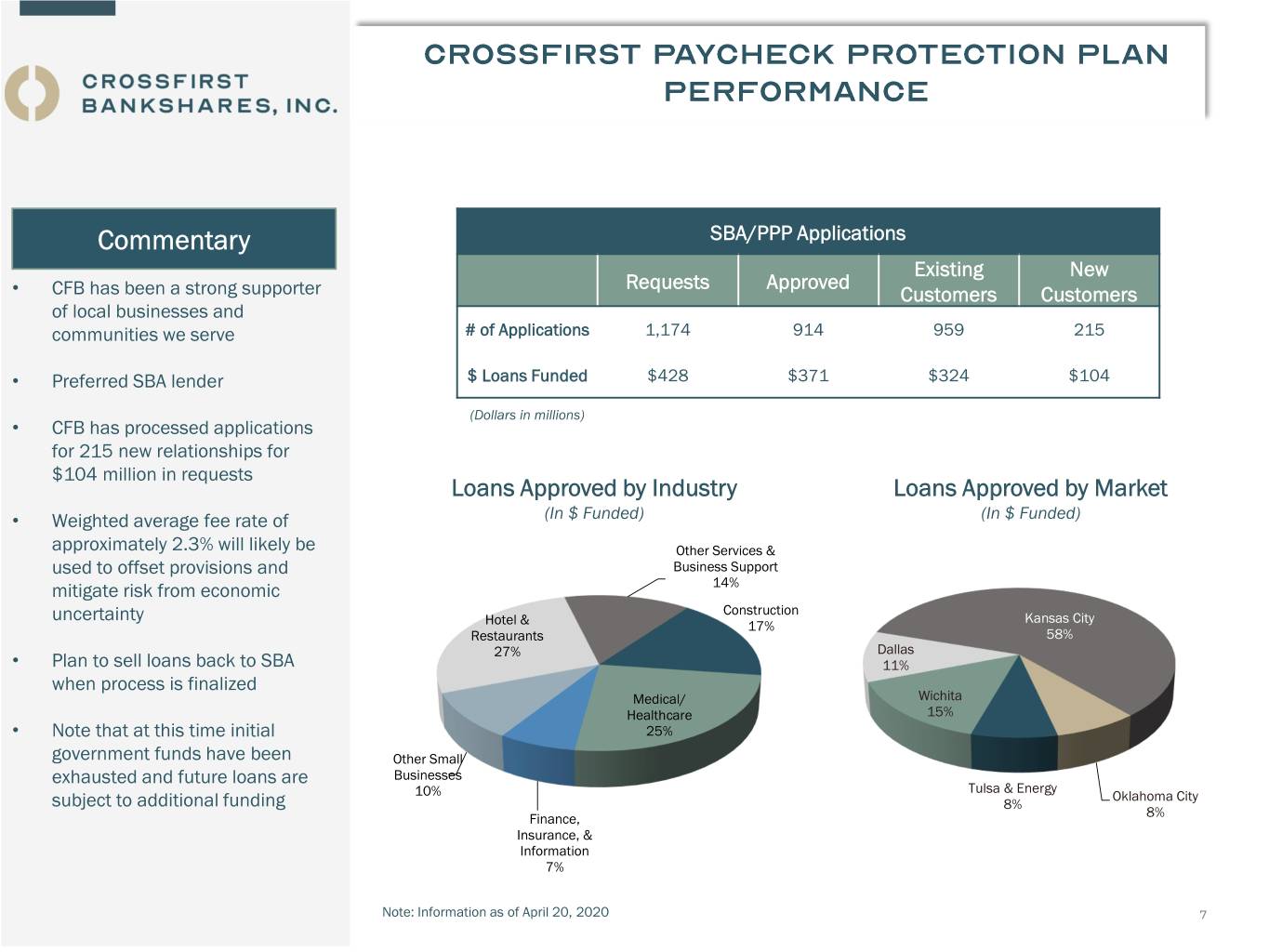

Commentary SBA/PPP Applications Existing New Requests Approved • CFB has been a strong supporter Customers Customers of local businesses and communities we serve # of Applications 1,174 914 959 215 • Preferred SBA lender $ Loans Funded $428 $371 $324 $104 (Dollars in millions) • CFB has processed applications for 215 new relationships for $104 million in requests Loans Approved by Industry Loans Approved by Market • Weighted average fee rate of (In $ Funded) (In $ Funded) approximately 2.3% will likely be Other Services & used to offset provisions and Business Support mitigate risk from economic 14% Construction uncertainty Kansas City Hotel & 17% Restaurants 58% 27% Dallas • Plan to sell loans back to SBA 11% when process is finalized Medical/ Wichita Healthcare 15% • Note that at this time initial 25% government funds have been Other Small exhausted and future loans are Businesses Tulsa & Energy 10% Oklahoma City subject to additional funding 8% Finance, 8% Insurance, & Information 7% Note: Information as of April 20, 2020 7

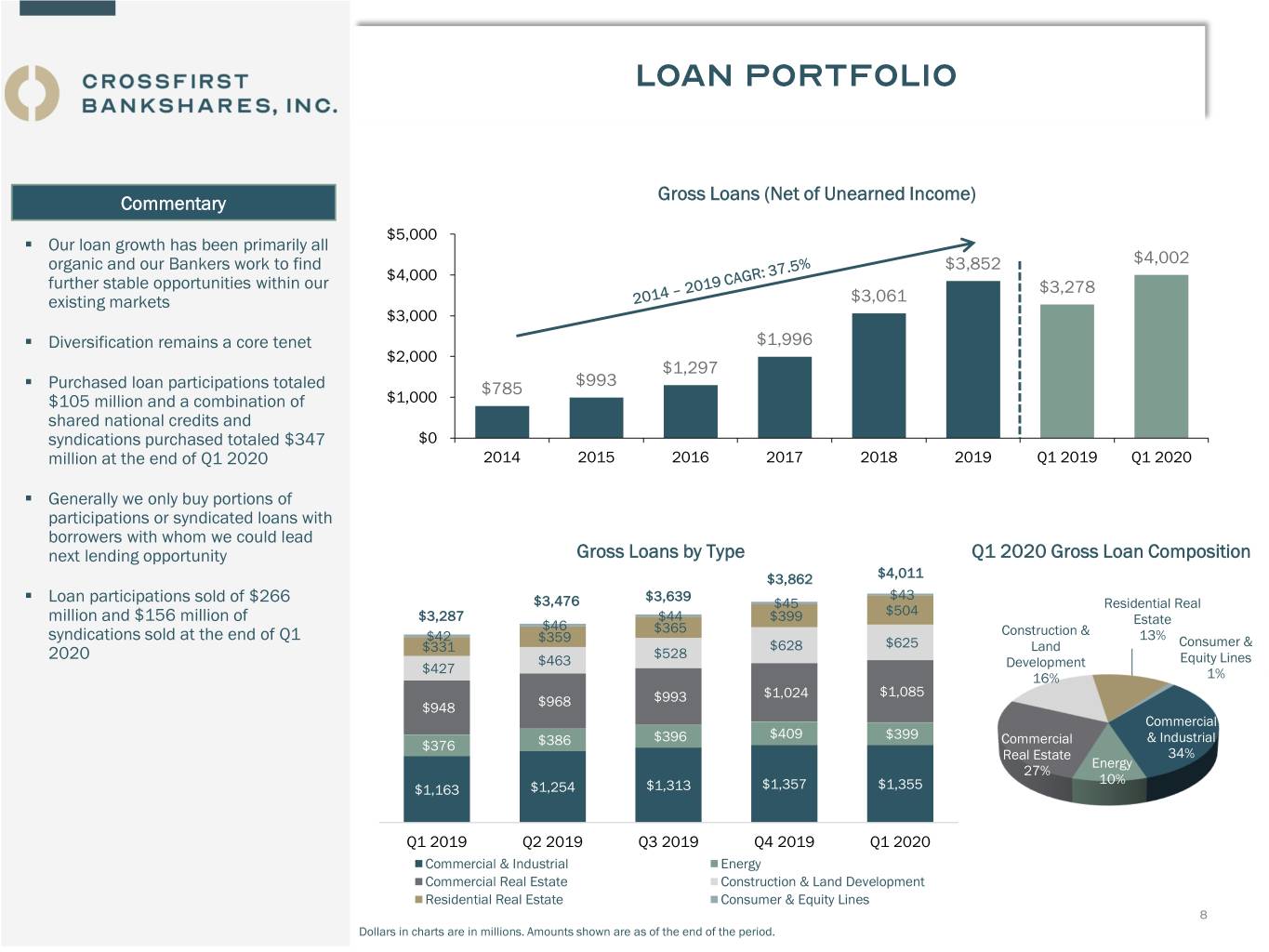

Gross Loans (Net of Unearned Income) Commentary $5,000 ▪ Our loan growth has been primarily all organic and our Bankers work to find $3,852 $4,002 $4,000 further stable opportunities within our $3,278 existing markets $3,061 $3,000 ▪ Diversification remains a core tenet $1,996 $2,000 $1,297 ▪ Purchased loan participations totaled $785 $993 $105 million and a combination of $1,000 shared national credits and syndications purchased totaled $347 $0 million at the end of Q1 2020 2014 2015 2016 2017 2018 2019 Q1 2019 Q1 2020 ▪ Generally we only buy portions of participations or syndicated loans with borrowers with whom we could lead next lending opportunity Gross Loans by Type Q1 2020 Gross Loan Composition $3,862 $4,011 $4,000 $3,639 $43 ▪ Loan participations sold of $266 $3,476 $45 Residential Real $3,287 $44 $399 $504 million and $156 million of $3,500 Estate $46 $365 Construction & 13% syndications sold at the end of Q1 $42 $359 $625 Consumer & $3,000 $628 Land 2020 $331 $528 $463 Development Equity Lines $427 1% $2,500 16% $1,024 $1,085 $968 $993 $2,000 $948 Commercial $1,500 $396 $409 $399 & Industrial $376 $386 Commercial Real Estate 34% $1,000 Energy 27% 10% $1,254 $1,313 $1,357 $1,355 $500 $1,163 $0 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Commercial & Industrial Energy Commercial Real Estate Construction & Land Development Residential Real Estate Consumer & Equity Lines 8 Dollars in charts are in millions. Amounts shown are as of the end of the period.

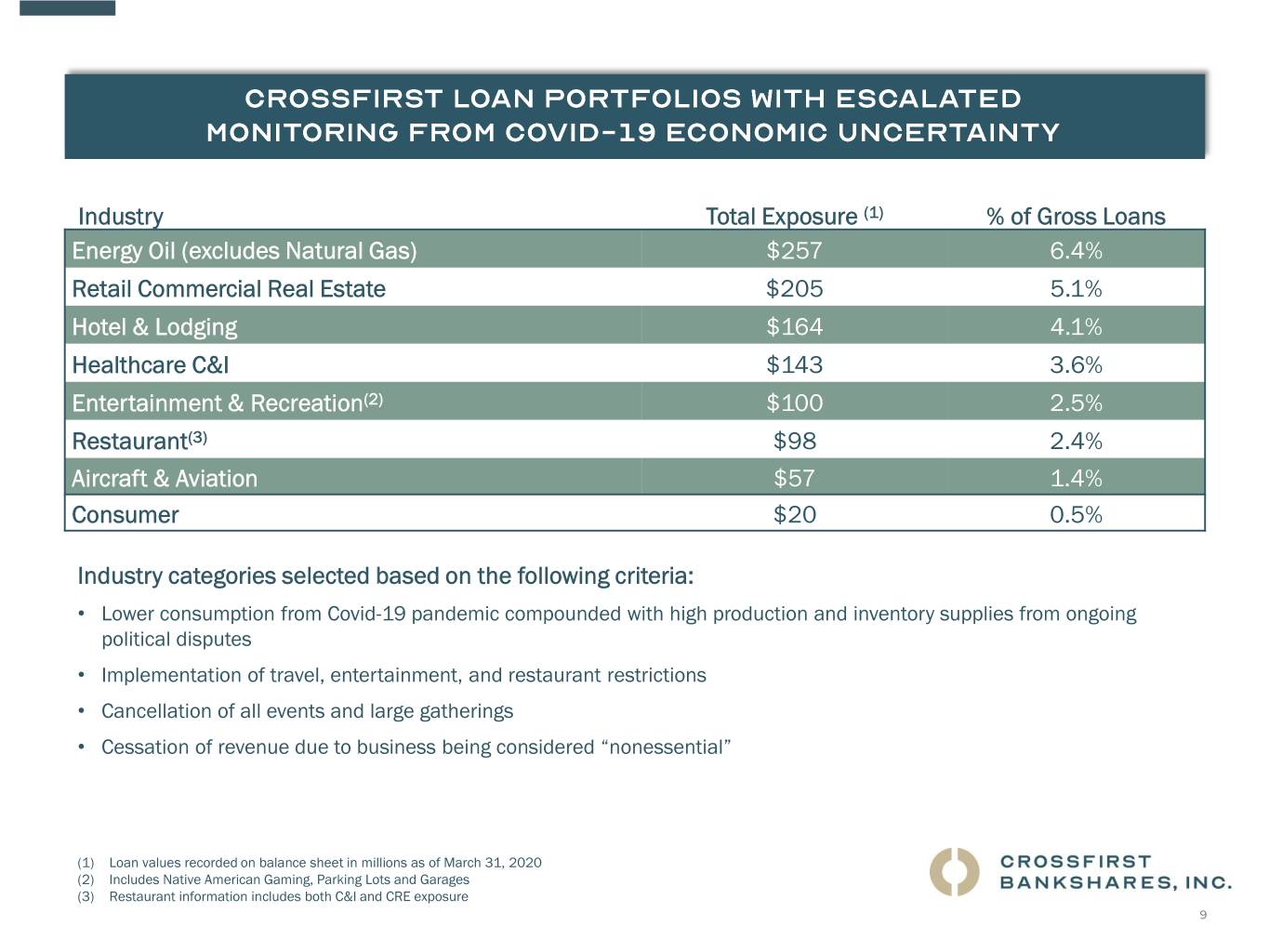

Industry Total Exposure (1) % of Gross Loans Energy Oil (excludes Natural Gas) $257 6.4% Retail Commercial Real Estate $205 5.1% Hotel & Lodging $164 4.1% Healthcare C&I $143 3.6% Entertainment & Recreation(2) $100 2.5% Restaurant(3) $98 2.4% Aircraft & Aviation $57 1.4% Consumer $20 0.5% Industry categories selected based on the following criteria: • Lower consumption from Covid-19 pandemic compounded with high production and inventory supplies from ongoing political disputes • Implementation of travel, entertainment, and restaurant restrictions • Cancellation of all events and large gatherings • Cessation of revenue due to business being considered “nonessential” (1) Loan values recorded on balance sheet in millions as of March 31, 2020 (2) Includes Native American Gaming, Parking Lots and Garages (3) Restaurant information includes both C&I and CRE exposure 9

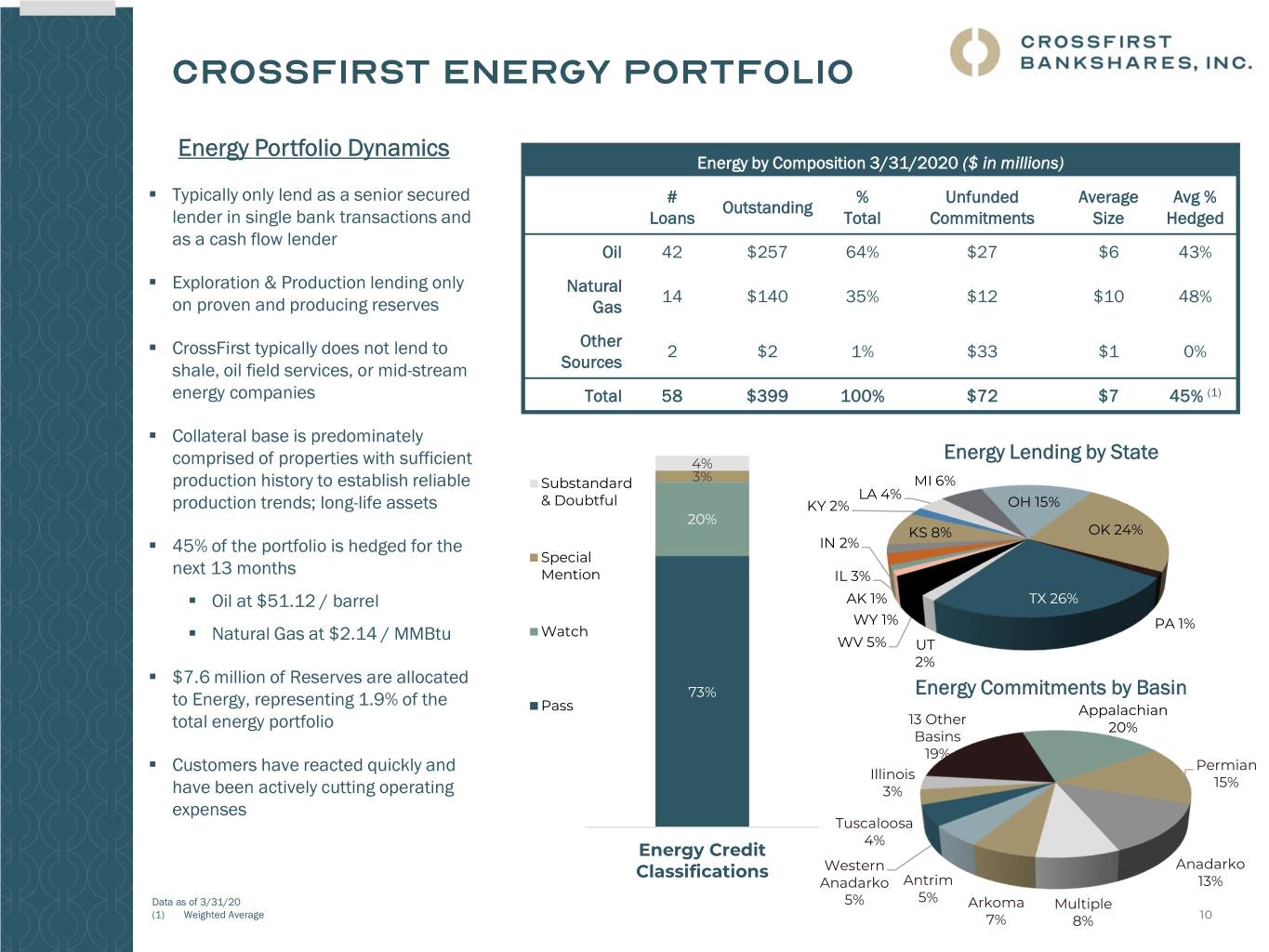

Energy Portfolio Dynamics Energy by Composition 3/31/2020 ($ in millions) ▪ Typically only lend as a senior secured # % Unfunded Average Avg % Outstanding lender in single bank transactions and Loans Total Commitments Size Hedged as a cash flow lender Oil 42 $257 64% $27 $6 43% ▪ Exploration & Production lending only Natural 14 $140 35% $12 $10 48% on proven and producing reserves Gas Other ▪ CrossFirst typically does not lend to 2 $2 1% $33 $1 0% shale, oil field services, or mid-stream Sources energy companies Total 58 $399 100% $72 $7 45% (1) ▪ Collateral base is predominately Energy Lending by State comprised of properties with sufficient 100% 4% production history to establish reliable Substandard 3% MI 6% 90% LA 4% production trends; long-life assets & Doubtful KY 2% OH 15% 20% 80% KS 8% OK 24% ▪ 45% of the portfolio is hedged for the IN 2% Special next 13 months 70%Mention IL 3% ▪ Oil at $51.12 / barrel 60% AK 1% TX 26% WY 1% PA 1% ▪ Natural Gas at $2.14 / MMBtu Watch 50% WV 5% UT 2% ▪ $7.6 million of Reserves are allocated 40% Energy Commitments by Basin to Energy, representing 1.9% of the 73% Pass Appalachian 30% 13 Other total energy portfolio 20% Basins 20% 19% ▪ Customers have reacted quickly and Permian Illinois 15% have been actively cutting operating 10% 3% expenses 0% Tuscaloosa 4% Energy Credit Classifications Western Anadarko Anadarko Antrim 13% Data as of 3/31/20 5% 5% Arkoma Multiple (1) Weighted Average 7% 8% 10

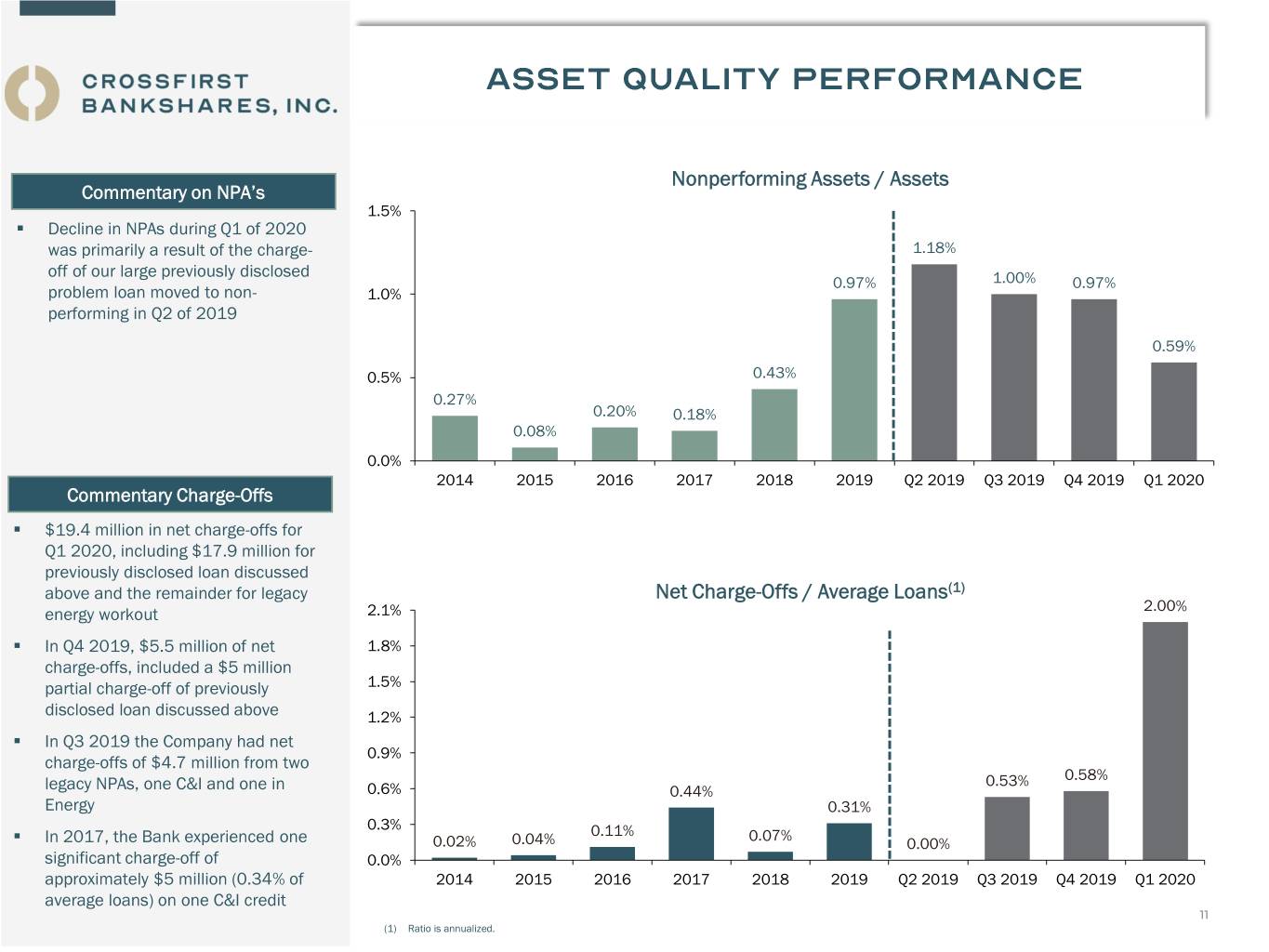

Nonperforming Assets / Assets Commentary on NPA’s 1.5% ▪ Decline in NPAs during Q1 of 2020 was primarily a result of the charge- 1.18% off of our large previously disclosed 0.97% 1.00% 0.97% problem loan moved to non- 1.0% performing in Q2 of 2019 0.59% 0.5% 0.43% 0.27% 0.20% 0.18% 0.08% 0.0% 2014 2015 2016 2017 2018 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Commentary Charge-Offs ▪ $19.4 million in net charge-offs for Q1 2020, including $17.9 million for previously disclosed loan discussed above and the remainder for legacy Net Charge-Offs / Average Loans(1) energy workout 2.1% 2.00% ▪ In Q4 2019, $5.5 million of net 1.8% charge-offs, included a $5 million partial charge-off of previously 1.5% disclosed loan discussed above 1.2% ▪ In Q3 2019 the Company had net 0.9% charge-offs of $4.7 million from two 0.53% 0.58% legacy NPAs, one C&I and one in 0.6% 0.44% Energy 0.31% 0.3% 0.11% 0.07% ▪ In 2017, the Bank experienced one 0.02% 0.04% 0.00% significant charge-off of 0.0% approximately $5 million (0.34% of 2014 2015 2016 2017 2018 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 average loans) on one C&I credit 11 (1) Ratio is annualized.

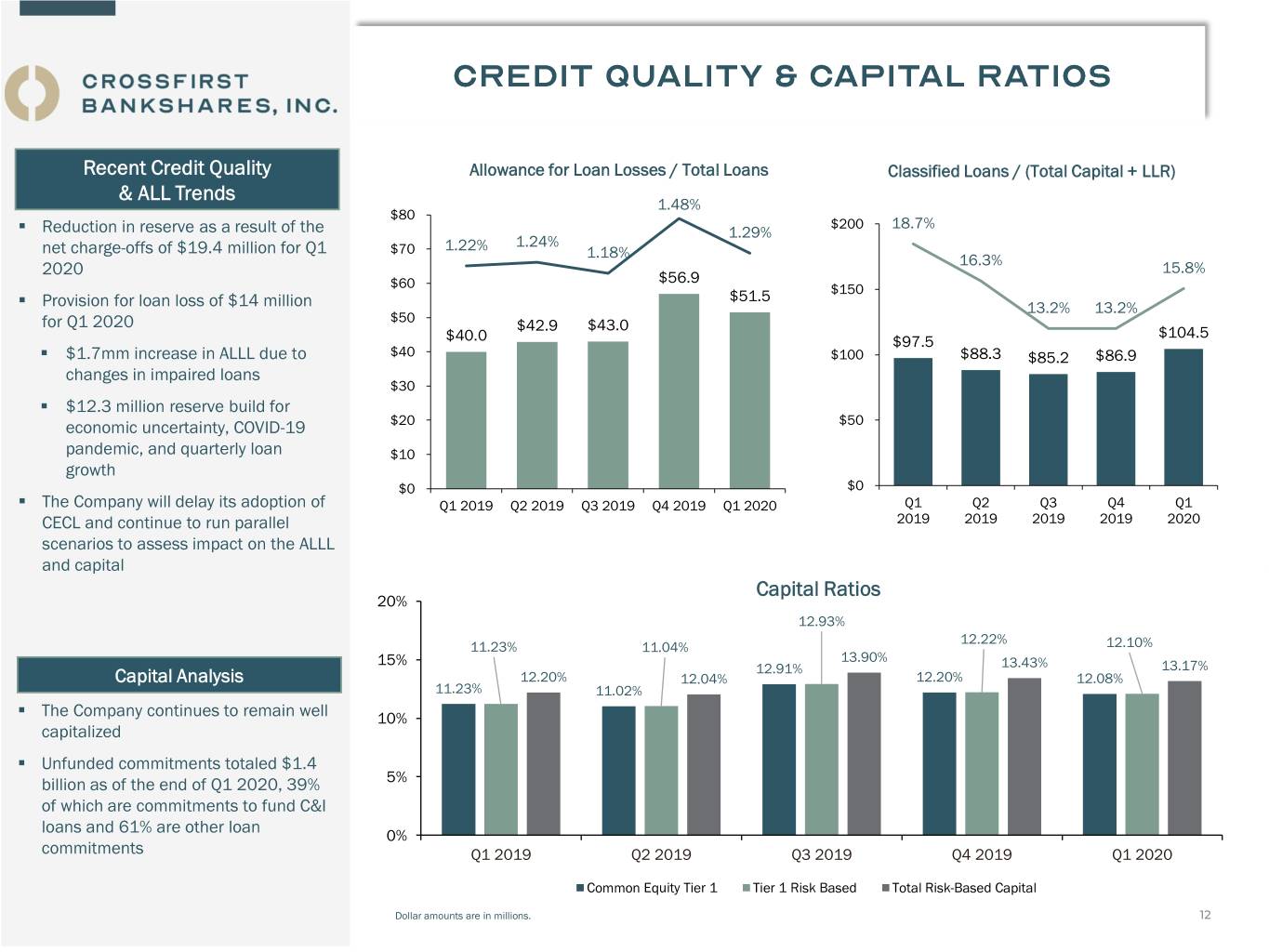

Recent Credit Quality Allowance for Loan Losses / Total Loans Classified Loans / (Total Capital + LLR) & ALL Trends 1.48% $80 $200 18.7% ▪ Reduction in reserve as a result of the 1.29% net charge-offs of $19.4 million for Q1 $70 1.22% 1.24% 1.18% 18.0% 2020 16.3% 15.8% $60 $56.9 $51.5 $150 ▪ Provision for loan loss of $14 million 13.2% 13.2% $50 for Q1 2020 $42.9 $43.0 $104.5 13.0% $40.0 $97.5 ▪ $1.7mm increase in ALLL due to $40 $100 $88.3 $85.2 $86.9 changes in impaired loans $30 ▪ $12.3 million reserve build for 8.0% economic uncertainty, COVID-19 $20 $50 pandemic, and quarterly loan $10 growth 3.0% $0 0.00% $0 ▪ The Company will delay its adoption of Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q1 Q2 Q3 Q4 Q1 CECL and continue to run parallel 2019 2019 2019 2019 2020 scenarios to assess impact on the ALLL and capital Capital Ratios 20% 12.93% 12.22% 11.23% 11.04% 12.10% 15% 13.90% 12.91% 13.43% 13.17% Capital Analysis 12.20% 12.04% 12.20% 12.08% 11.23% 11.02% ▪ The Company continues to remain well 10% capitalized ▪ Unfunded commitments totaled $1.4 billion as of the end of Q1 2020, 39% 5% of which are commitments to fund C&I loans and 61% are other loan 0% commitments Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Common Equity Tier 1 Tier 1 Risk Based Total Risk-Based Capital Dollar amounts are in millions. 12

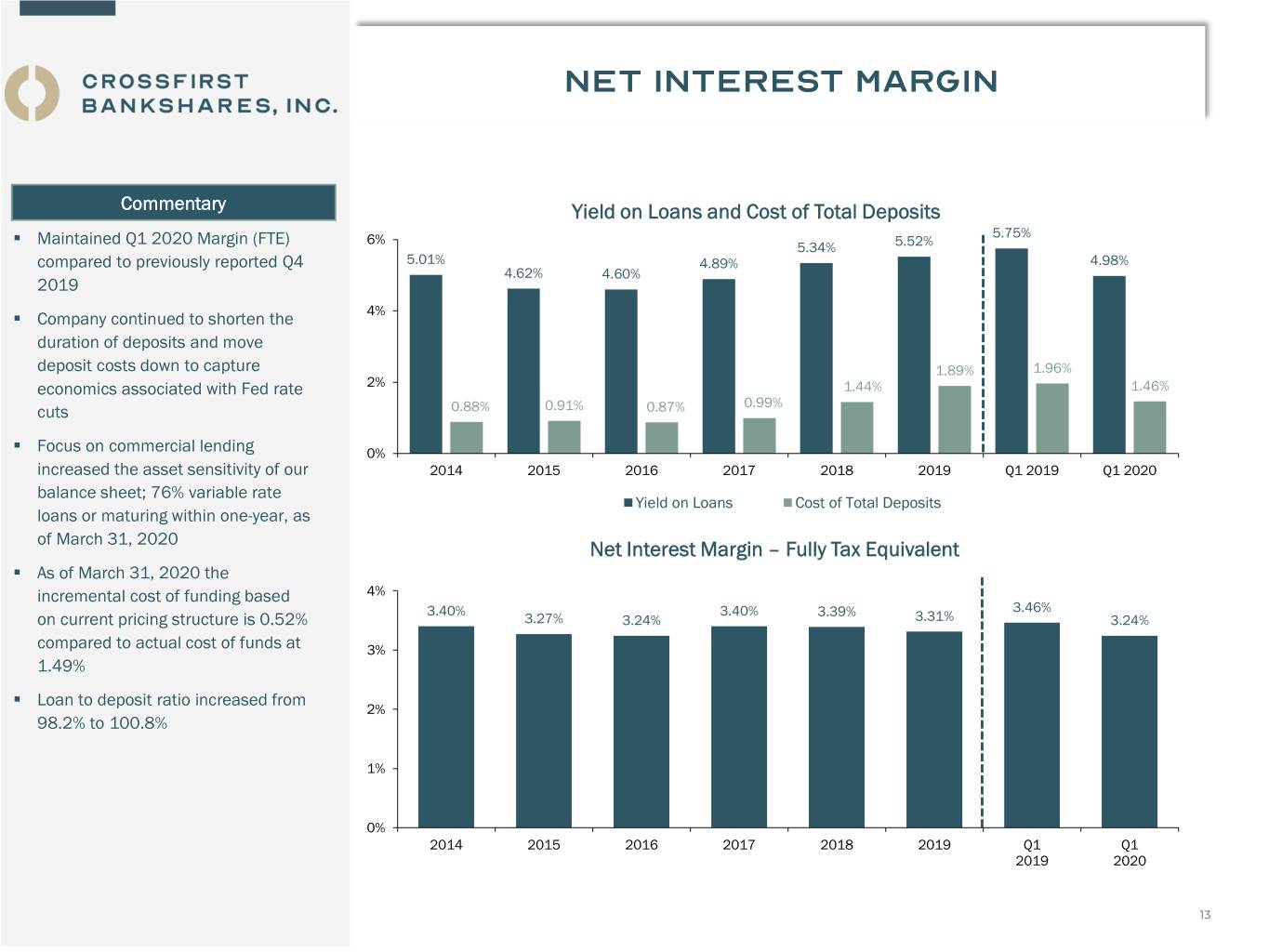

Commentary Yield on Loans and Cost of Total Deposits Maintained Q1 2020 Margin (FTE) 6% 5.75% ▪ 5.34% 5.52% compared to previously reported Q4 5.01% 4.89% 4.98% 4.62% 4.60% 2019 ▪ Company continued to shorten the 4% duration of deposits and move deposit costs down to capture 1.89% 1.96% economics associated with Fed rate 2% 1.44% 1.46% 0.99% cuts 0.88% 0.91% 0.87% ▪ Focus on commercial lending 0% increased the asset sensitivity of our 2014 2015 2016 2017 2018 2019 Q1 2019 Q1 2020 balance sheet; 76% variable rate Yield on Loans Cost of Total Deposits loans or maturing within one-year, as of March 31, 2020 Net Interest Margin – Fully Tax Equivalent ▪ As of March 31, 2020 the incremental cost of funding based 4% 3.40% 3.40% 3.39% 3.46% on current pricing structure is 0.52% 3.27% 3.24% 3.31% 3.24% compared to actual cost of funds at 3% 1.49% ▪ Loan to deposit ratio increased from 2% 98.2% to 100.8% 1% 0% 2014 2015 2016 2017 2018 2019 Q1 Q1 2019 2020 13

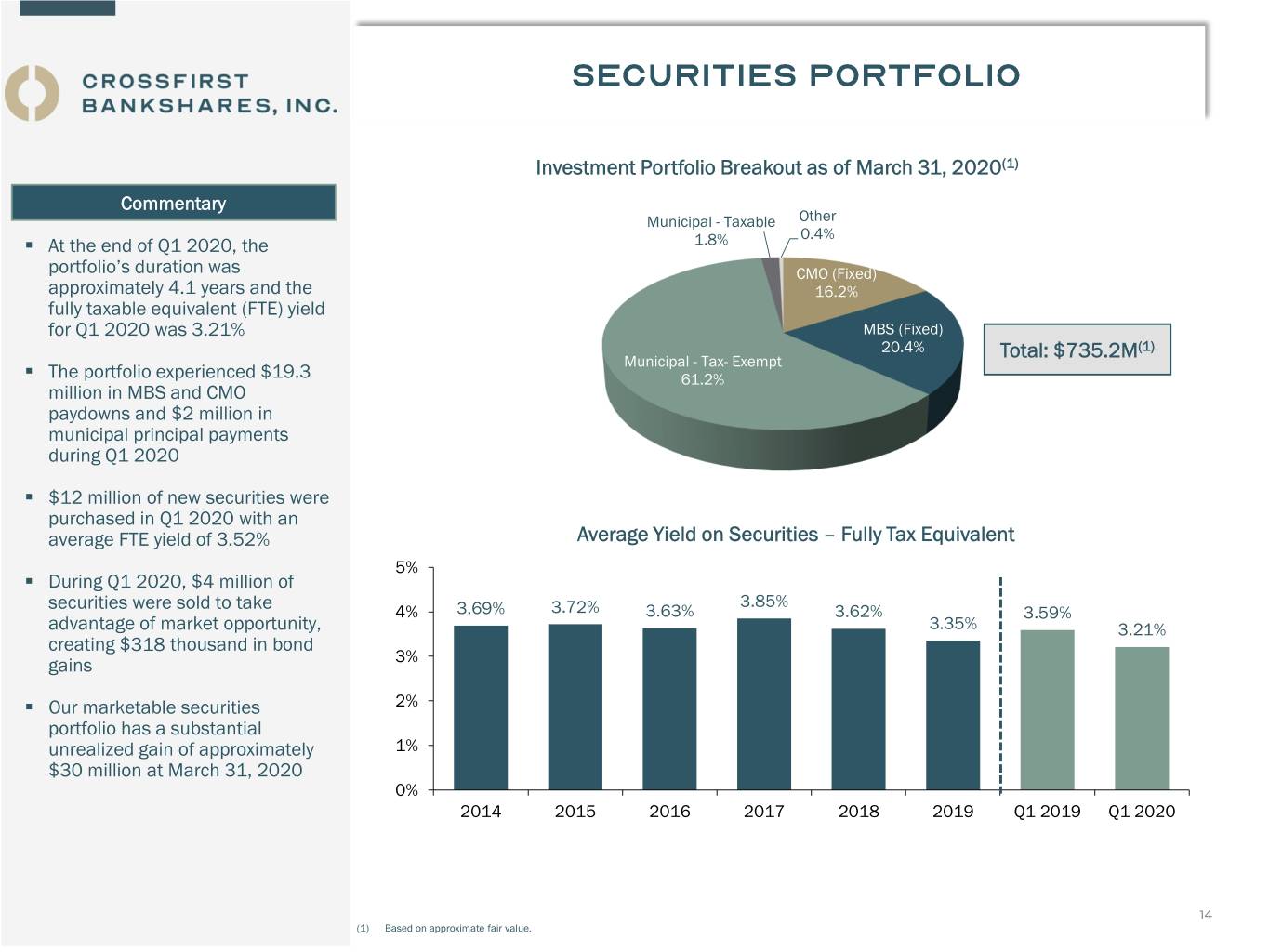

Investment Portfolio Breakout as of March 31, 2020(1) Commentary Municipal - Taxable Other 0.4% ▪ At the end of Q1 2020, the 1.8% portfolio’s duration was CMO (Fixed) approximately 4.1 years and the 16.2% fully taxable equivalent (FTE) yield for Q1 2020 was 3.21% MBS (Fixed) 20.4% Total: $735.2M(1) Municipal - Tax- Exempt ▪ The portfolio experienced $19.3 61.2% million in MBS and CMO paydowns and $2 million in municipal principal payments during Q1 2020 ▪ $12 million of new securities were purchased in Q1 2020 with an average FTE yield of 3.52% Average Yield on Securities – Fully Tax Equivalent 5% ▪ During Q1 2020, $4 million of securities were sold to take 3.85% 4% 3.69% 3.72% 3.63% 3.62% 3.59% advantage of market opportunity, 3.35% 3.21% creating $318 thousand in bond gains 3% ▪ Our marketable securities 2% portfolio has a substantial unrealized gain of approximately 1% $30 million at March 31, 2020 0% 2014 2015 2016 2017 2018 2019 Q1 2019 Q1 2020 14 (1) Based on approximate fair value.

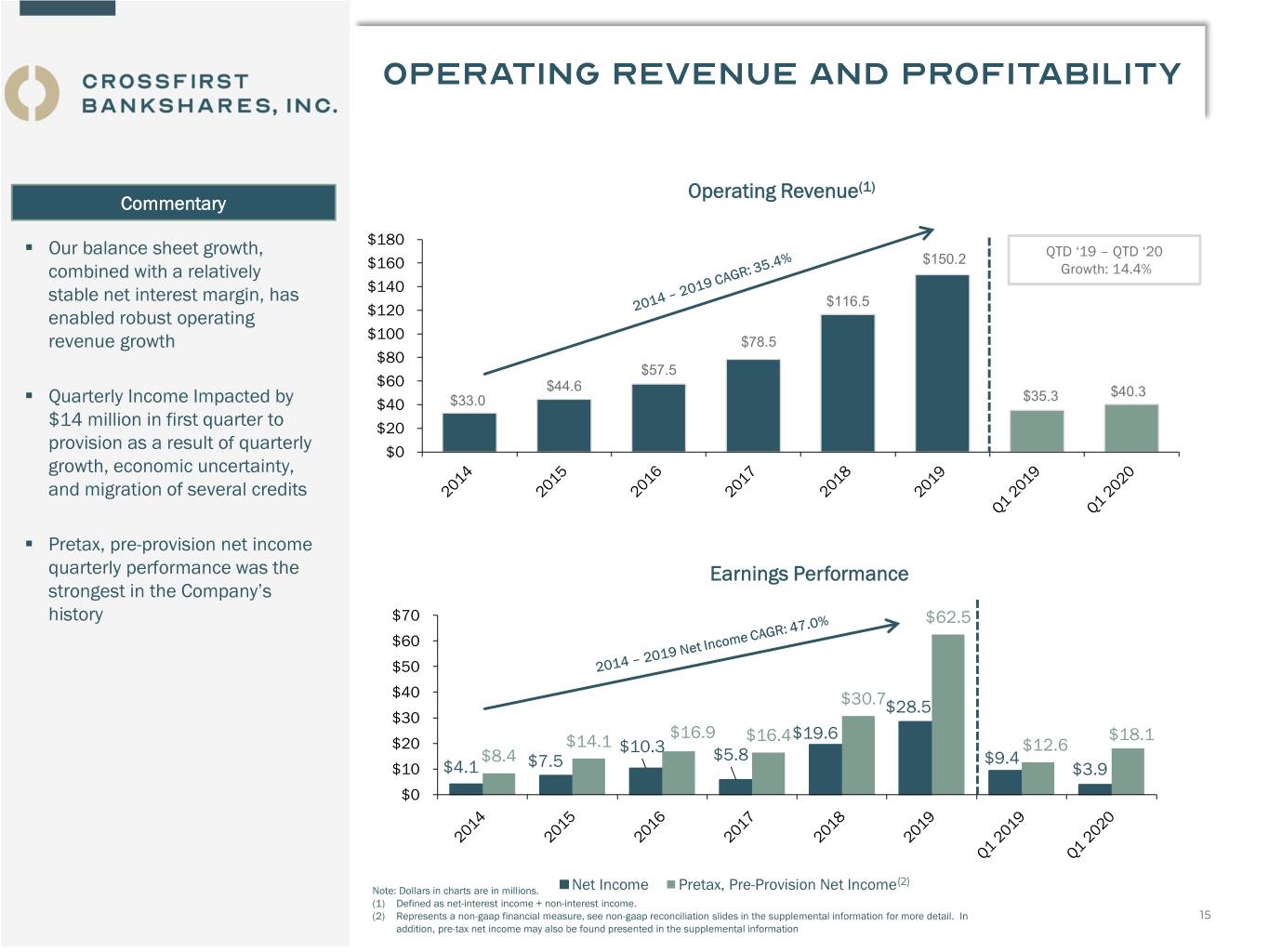

Operating Revenue(1) Commentary $180 ▪ Our balance sheet growth, QTD ‘19 – QTD ‘20 $150.2 combined with a relatively $160 Growth: 14.4% $140 stable net interest margin, has $116.5 enabled robust operating $120 $100 revenue growth $78.5 $80 $57.5 $60 $44.6 $35.3 $40.3 ▪ Quarterly Income Impacted by $40 $33.0 $14 million in first quarter to $20 provision as a result of quarterly $0 growth, economic uncertainty, and migration of several credits ▪ Pretax, pre-provision net income quarterly performance was the Earnings Performance strongest in the Company’s history $70 $62.5 $60 $50 $40 $30.7$28.5 $30 $16.9 $16.4 $19.6 $18.1 $20 $14.1 $10.3 $12.6 $8.4 $5.8 $9.4 $10 $4.1 $7.5 $3.9 $0 (2) Note: Dollars in charts are in millions. Net Income Pretax, Pre-Provision Net Income (1) Defined as net-interest income + non-interest income. (2) Represents a non-gaap financial measure, see non-gaap reconciliation slides in the supplemental information for more detail. In 15 addition, pre-tax net income may also be found presented in the supplemental information

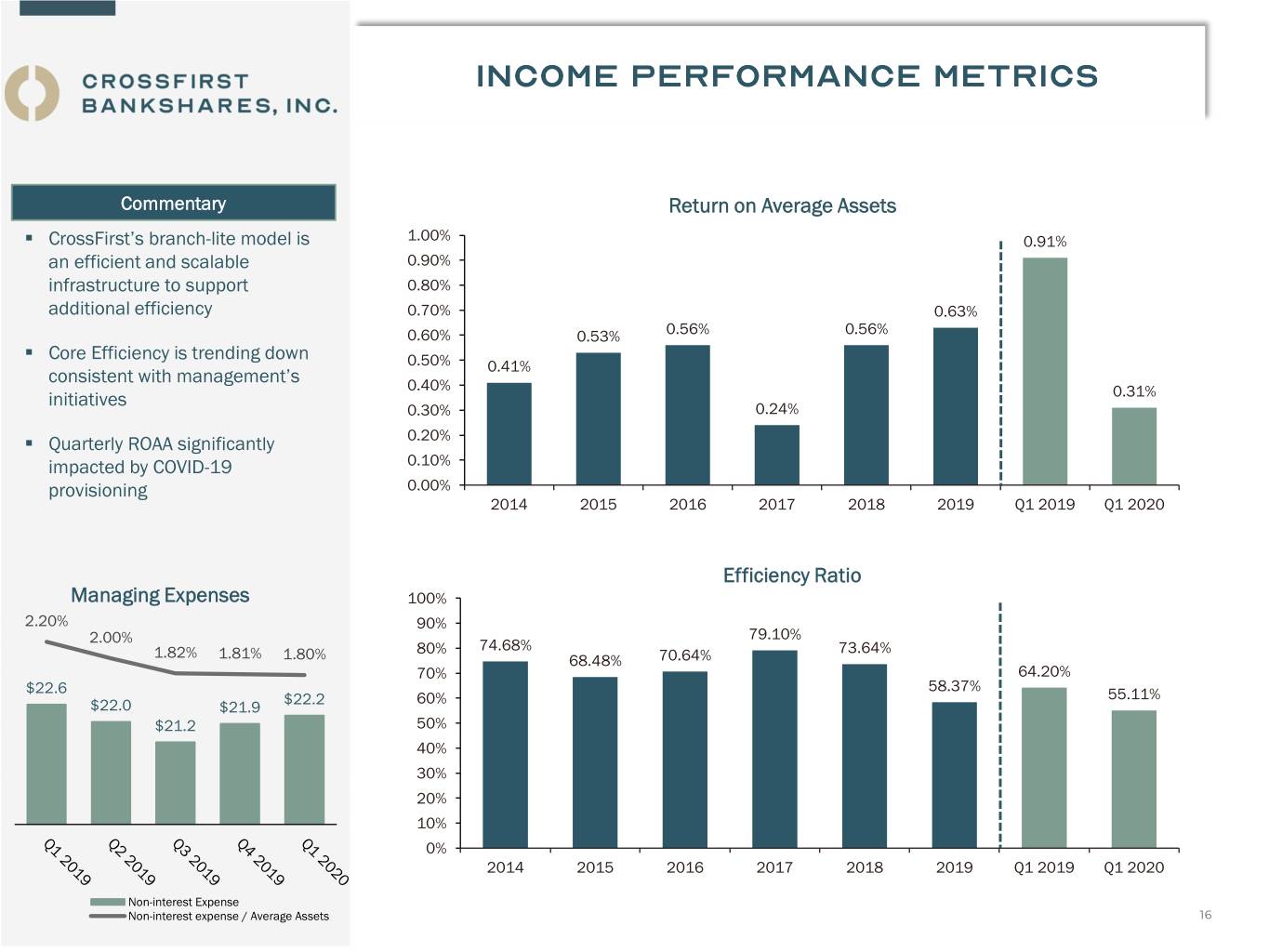

Commentary Return on Average Assets ▪ CrossFirst’s branch-lite model is 1.00% 0.91% an efficient and scalable 0.90% infrastructure to support 0.80% additional efficiency 0.70% 0.63% 0.60% 0.53% 0.56% 0.56% ▪ Core Efficiency is trending down 0.50% 0.41% consistent with management’s 0.40% initiatives 0.31% 0.30% 0.24% ▪ Quarterly ROAA significantly 0.20% impacted by COVID-19 0.10% provisioning 0.00% 2014 2015 2016 2017 2018 2019 Q1 2019 Q1 2020 Efficiency Ratio Managing Expenses 100% $26.0 2.20% 2.50% 90% 79.10% $25.0 2.00% 1.82% 80% 74.68% 73.64% 1.81% 1.80% 2.00% 68.48% 70.64% $24.0 70% 64.20% $22.6 58.37% $23.0 $22.2 1.50% 60% 55.11% $22.0 $21.9 $22.0 $21.2 50% 1.00% $21.0 40% $20.0 30% 0.50% $19.0 20% $18.0 0.00% 10% 0% 2014 2015 2016 2017 2018 2019 Q1 2019 Q1 2020 Non-interest Expense Non-interest expense / Average Assets 16

17

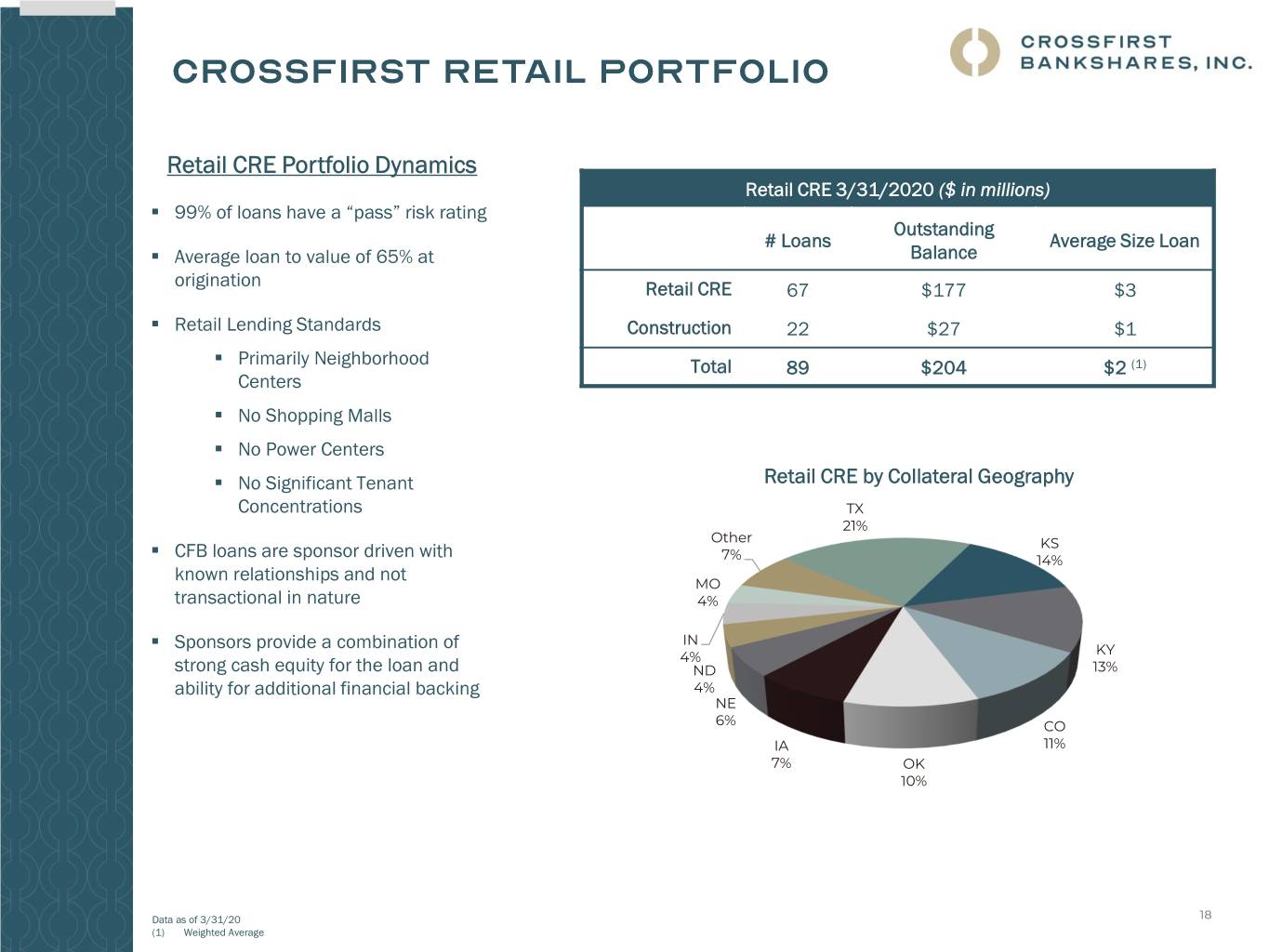

Retail CRE Portfolio Dynamics Retail CRE 3/31/2020 ($ in millions) ▪ 99% of loans have a “pass” risk rating Outstanding # Loans Average Size Loan ▪ Average loan to value of 65% at Balance origination Retail CRE 67 $177 $3 ▪ Retail Lending Standards Construction 22 $27 $1 ▪ Primarily Neighborhood Total 89 $204 $2 (1) Centers ▪ No Shopping Malls ▪ No Power Centers ▪ No Significant Tenant Retail CRE by Collateral Geography Concentrations TX 21% Other ▪ CFB loans are sponsor driven with KS 7% 14% known relationships and not MO transactional in nature 4% IN ▪ Sponsors provide a combination of KY 4% strong cash equity for the loan and ND 13% ability for additional financial backing 4% NE 6% CO IA 11% 7% OK 10% Data as of 3/31/20 18 (1) Weighted Average

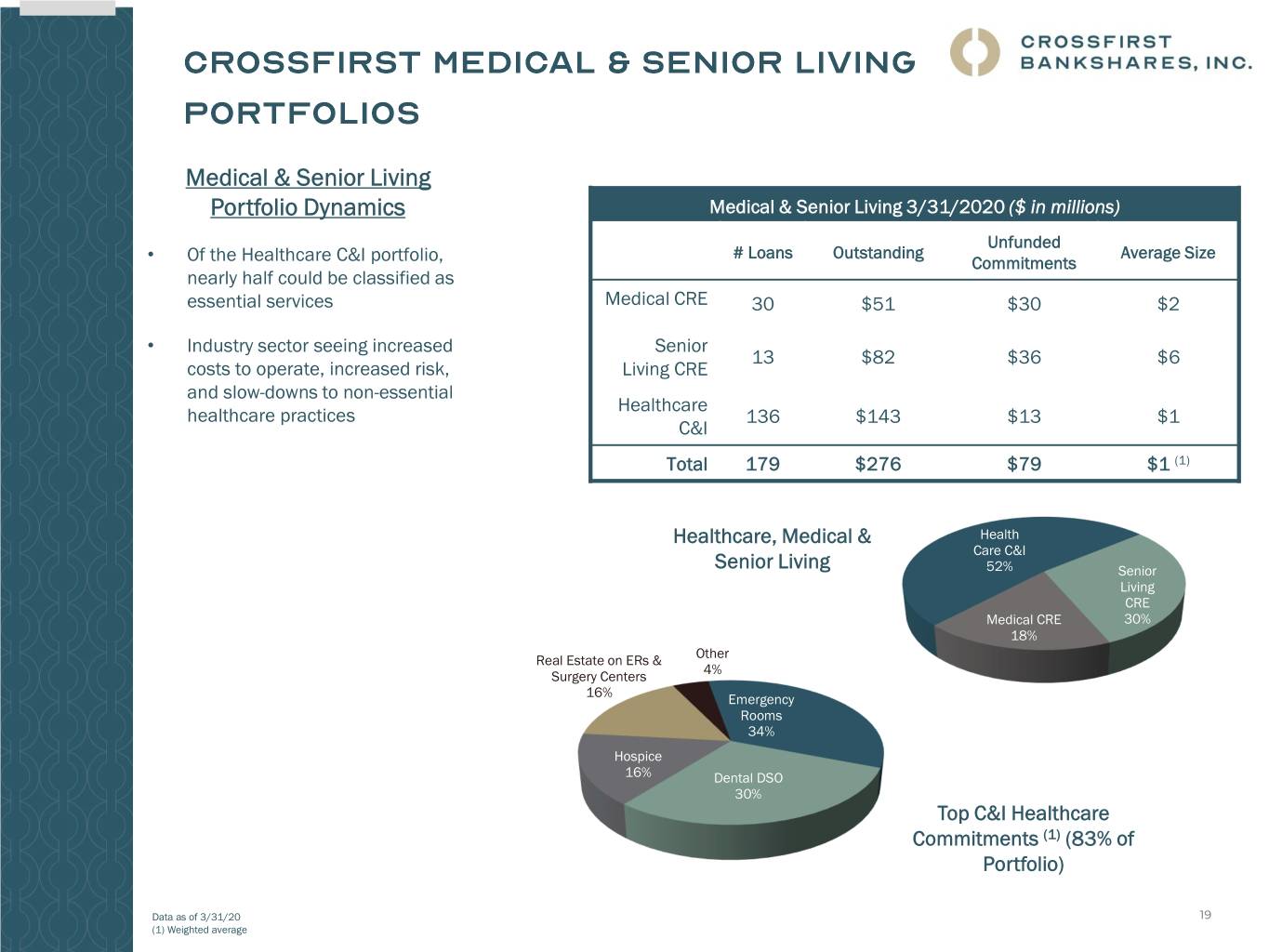

Medical & Senior Living Portfolio Dynamics Medical & Senior Living 3/31/2020 ($ in millions) Unfunded # Loans Outstanding Average Size • Of the Healthcare C&I portfolio, Commitments nearly half could be classified as essential services Medical CRE 30 $51 $30 $2 • Industry sector seeing increased Senior 13 $82 $36 $6 costs to operate, increased risk, Living CRE and slow-downs to non-essential Healthcare healthcare practices 136 $143 $13 $1 C&I Total 179 $276 $79 $1 (1) Healthcare, Medical & Health Care C&I Senior Living 52% Senior Living CRE Medical CRE 30% 18% Other Real Estate on ERs & 4% Surgery Centers 16% Emergency Rooms 34% Hospice 16% Dental DSO 30% Top C&I Healthcare Commitments (1) (83% of Portfolio) Data as of 3/31/20 19 (1) Weighted average

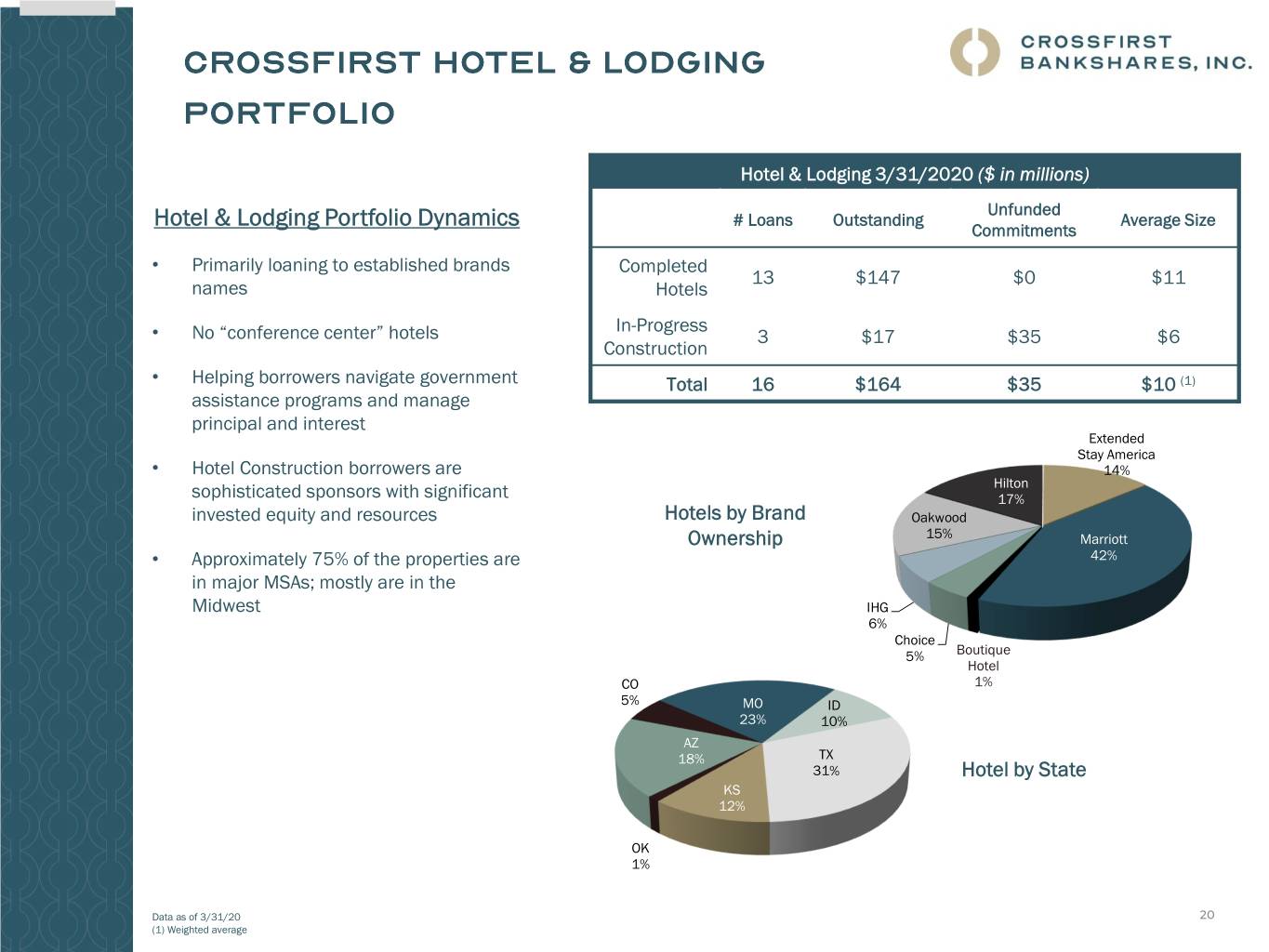

Hotel & Lodging 3/31/2020 ($ in millions) Unfunded Hotel & Lodging Portfolio Dynamics # Loans Outstanding Average Size Commitments • Primarily loaning to established brands Completed 13 $147 $0 $11 names Hotels In-Progress • No “conference center” hotels 3 $17 $35 $6 Construction • Helping borrowers navigate government Total 16 $164 $35 $10 (1) assistance programs and manage principal and interest Extended Stay America • Hotel Construction borrowers are 14% Hilton sophisticated sponsors with significant 17% invested equity and resources Hotels by Brand Oakwood Ownership 15% Marriott • Approximately 75% of the properties are 42% in major MSAs; mostly are in the Midwest IHG 6% Choice 5% Boutique Hotel CO 1% 5% MO ID 23% 10% AZ 18% TX 31% Hotel by State KS 12% OK 1% Data as of 3/31/20 20 (1) Weighted average

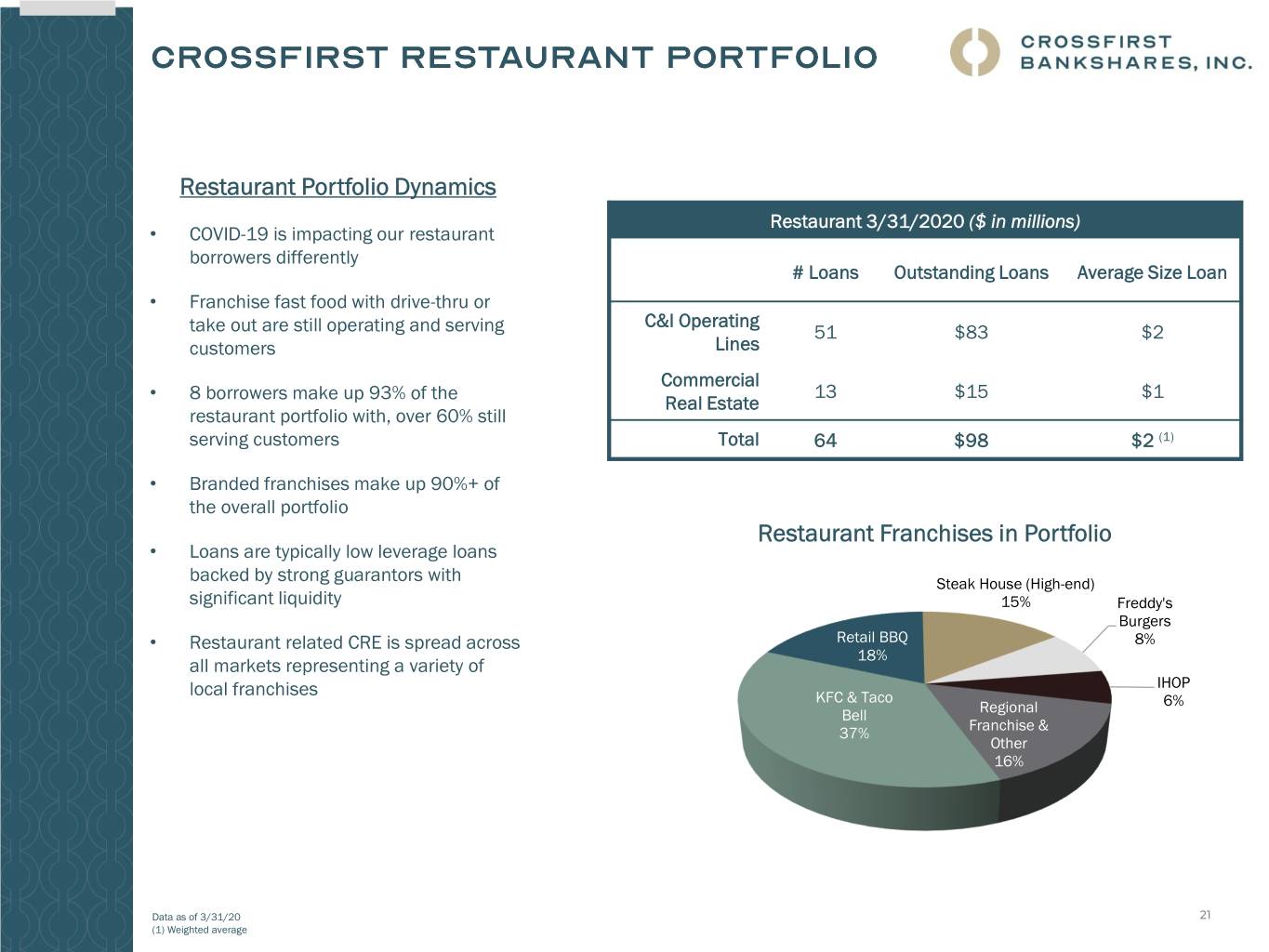

Restaurant Portfolio Dynamics Restaurant 3/31/2020 ($ in millions) • COVID-19 is impacting our restaurant borrowers differently # Loans Outstanding Loans Average Size Loan • Franchise fast food with drive-thru or C&I Operating take out are still operating and serving 51 $83 $2 customers Lines Commercial • 8 borrowers make up 93% of the 13 $15 $1 Real Estate restaurant portfolio with, over 60% still serving customers Total 64 $98 $2 (1) • Branded franchises make up 90%+ of the overall portfolio Restaurant Franchises in Portfolio • Loans are typically low leverage loans backed by strong guarantors with Steak House (High-end) significant liquidity 15% Freddy's Burgers • Restaurant related CRE is spread across Retail BBQ 8% 18% all markets representing a variety of IHOP local franchises KFC & Taco Regional 6% Bell Franchise & 37% Other 16% Data as of 3/31/20 21 (1) Weighted average

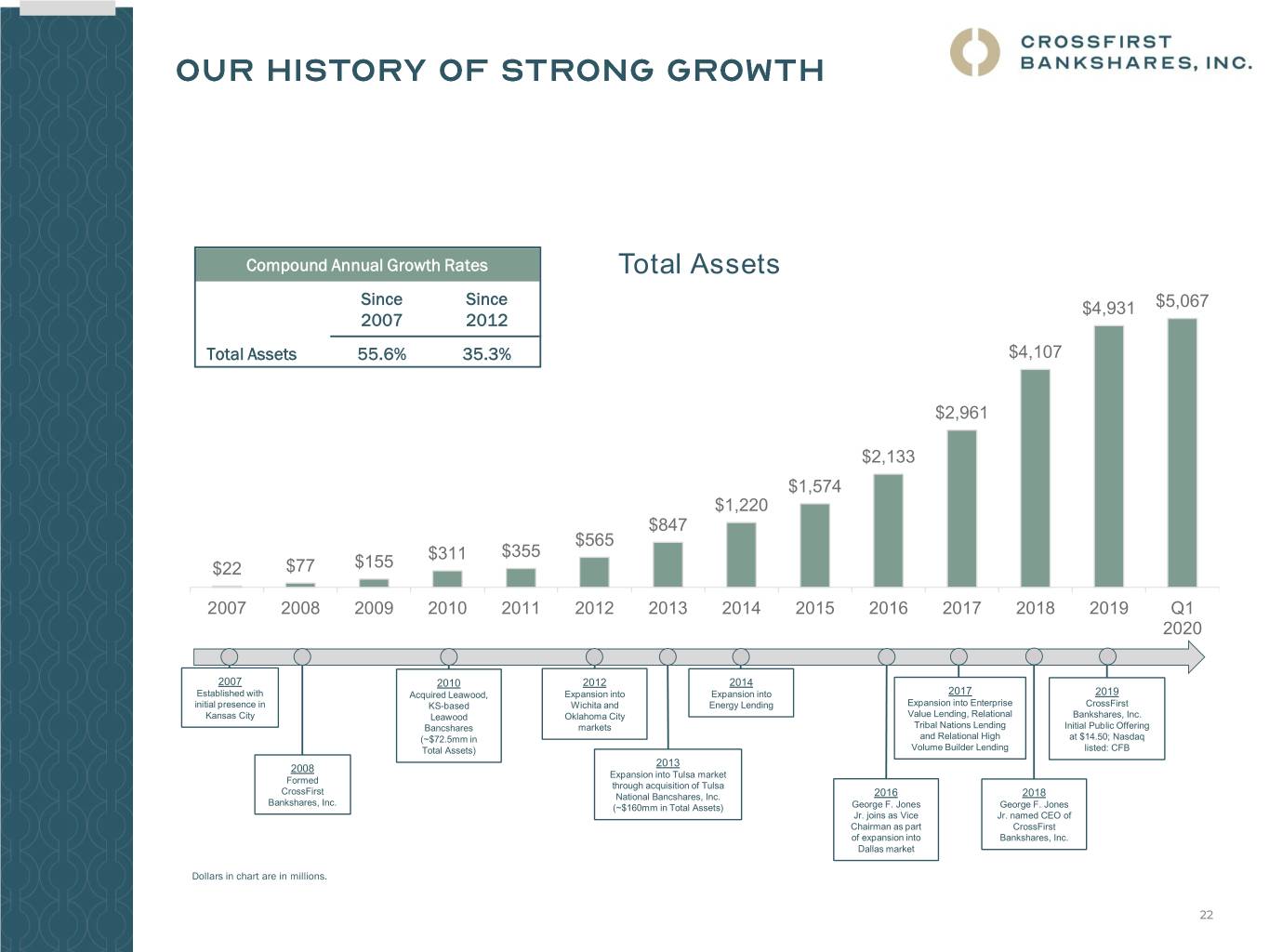

Compound Annual Growth Rates Total Assets Since Since $4,931 $5,067 2007 2012 Total Assets 55.6% 35.3% $4,107 $2,961 $2,133 $1,574 $1,220 $847 $565 $311 $355 $22 $77 $155 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q1 2020 2007 2010 2012 2014 Established with Acquired Leawood, Expansion into Expansion into 2017 2019 initial presence in KS-based Wichita and Energy Lending Expansion into Enterprise CrossFirst Kansas City Leawood Oklahoma City Value Lending, Relational Bankshares, Inc. Bancshares markets Tribal Nations Lending Initial Public Offering (~$72.5mm in and Relational High at $14.50; Nasdaq Total Assets) Volume Builder Lending listed: CFB 2013 2008 Expansion into Tulsa market Formed through acquisition of Tulsa CrossFirst National Bancshares, Inc. 2016 2018 Bankshares, Inc. (~$160mm in Total Assets) George F. Jones George F. Jones Jr. joins as Vice Jr. named CEO of Chairman as part CrossFirst of expansion into Bankshares, Inc. Dallas market Dollars in chart are in millions. 22

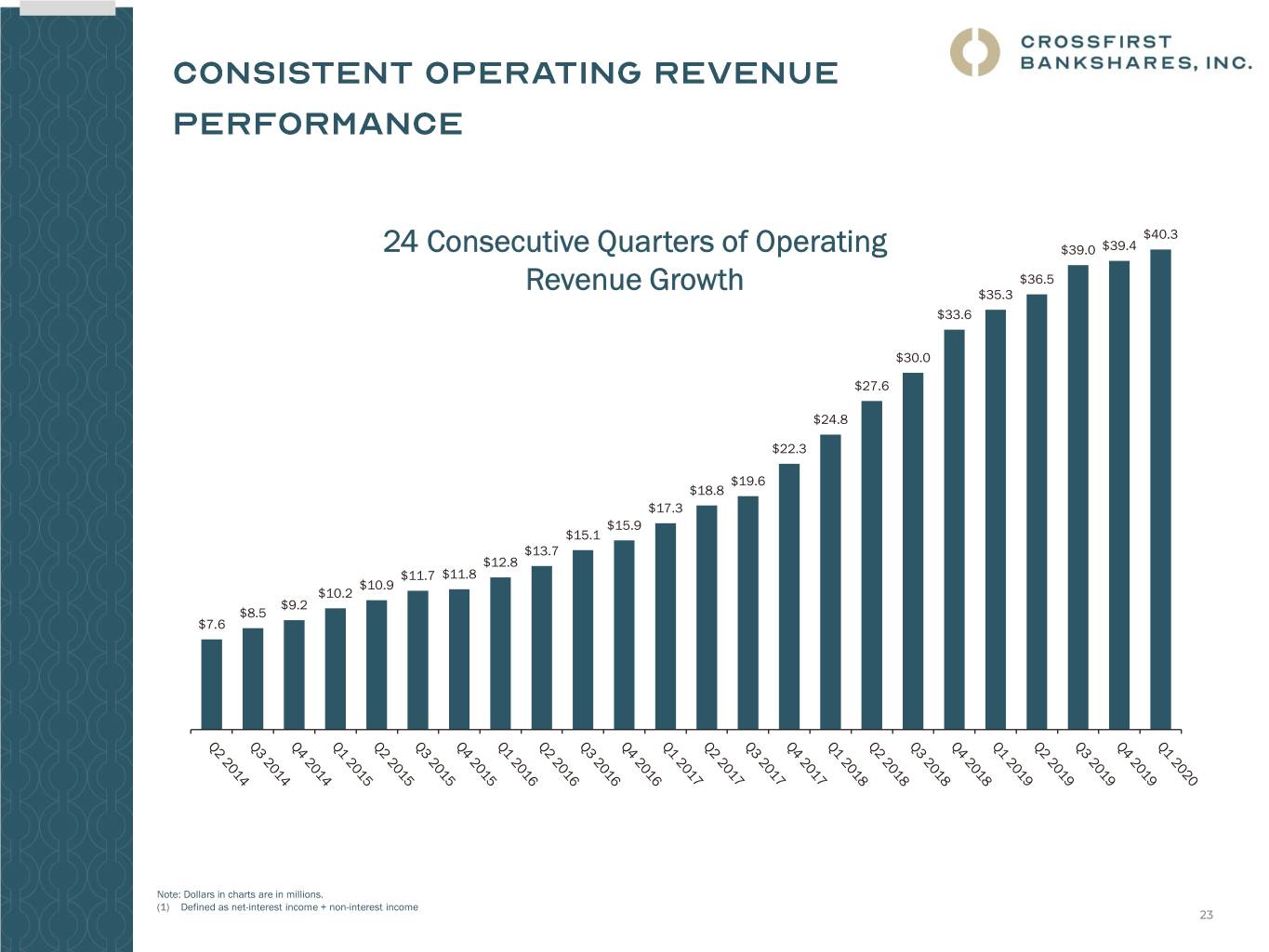

$45 $40.3 $39.4 $40 24 Consecutive Quarters of Operating $39.0 $36.5 Revenue Growth $35.3 $35 $33.6 $30.0 $30 $27.6 $24.8 $25 $22.3 $19.6 $20 $18.8 $17.3 $15.9 $15.1 $15 $13.7 $12.8 $11.7 $11.8 $10.9 $10.2 $9.2 $10 $8.5 $7.6 $5 $- Note: Dollars in charts are in millions. (1) Defined as net-interest income + non-interest income 23

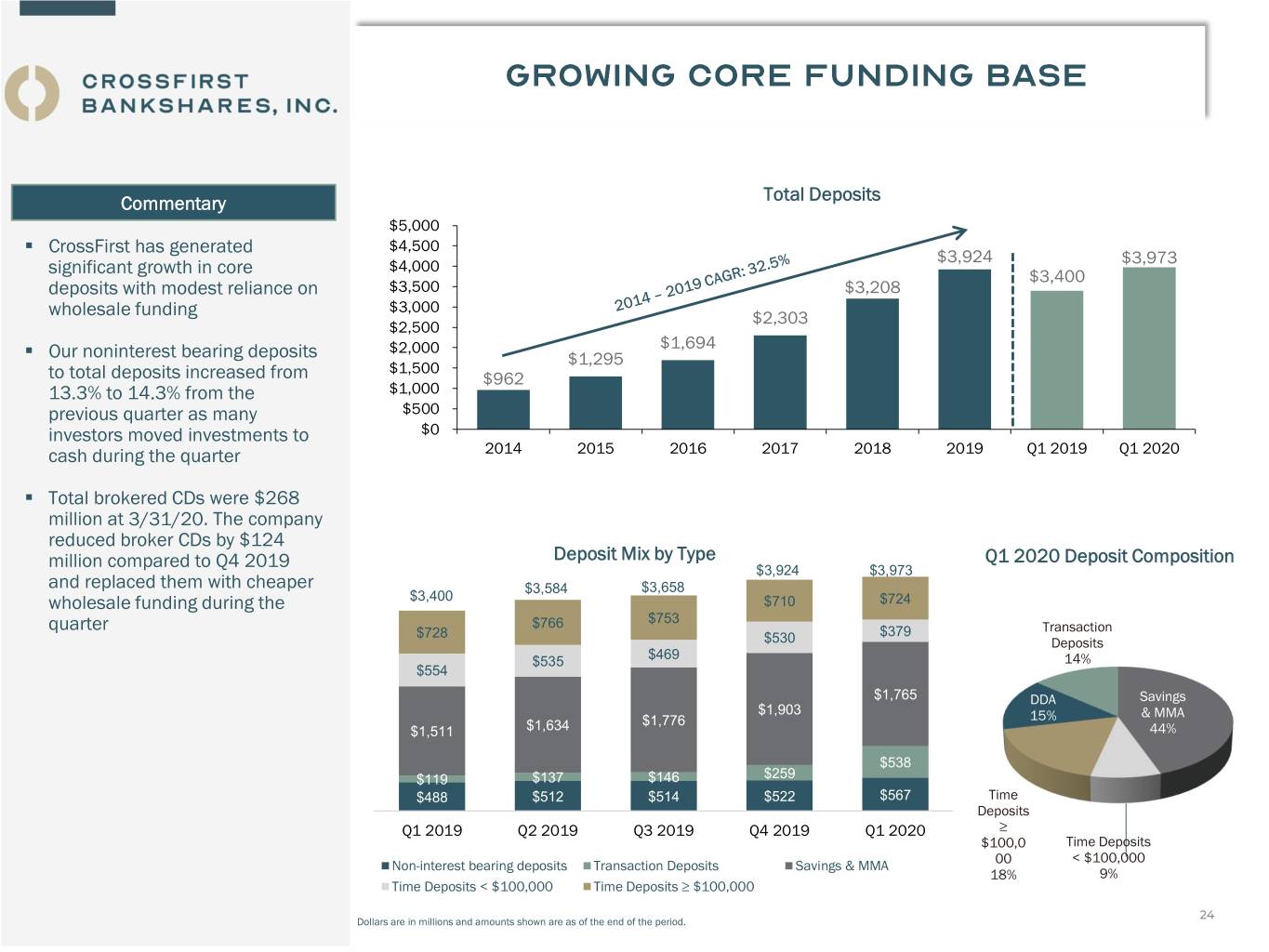

Commentary Total Deposits $5,000 ▪ CrossFirst has generated $4,500 $3,924 $4,000 $3,973 significant growth in core $3,400 deposits with modest reliance on $3,500 $3,208 $3,000 wholesale funding $2,303 $2,500 $2,000 $1,694 ▪ Our noninterest bearing deposits $1,295 $1,500 to total deposits increased from $962 13.3% to 14.3% from the $1,000 previous quarter as many $500 investors moved investments to $0 cash during the quarter 2014 2015 2016 2017 2018 2019 Q1 2019 Q1 2020 ▪ Total brokered CDs were $268 million at 3/31/20. The company reduced broker CDs by $124 million compared to Q4 2019 Deposit Mix by Type Q1 2020 Deposit Composition $4,000 $3,924 $3,973 and replaced them with cheaper $3,584 $3,658 $3,400 $724 wholesale funding during the $3,500 $710 $753 quarter $766 Transaction $3,000 $728 $379 $530 Deposits $469 $2,500 $535 14% $554 $2,000 $1,765 DDA Savings $1,903 15% & MMA $1,500 $1,776 $1,511 $1,634 44% $1,000 $538 $259 $500 $119 $137 $146 $488 $512 $514 $522 $567 Time $0 Deposits Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 ≥ $100,0 Time Deposits < $100,000 Non-interest bearing deposits Transaction Deposits Savings & MMA 00 18% 9% Time Deposits < $100,000 Time Deposits ≥ $100,000 24 Dollars are in millions and amounts shown are as of the end of the period.

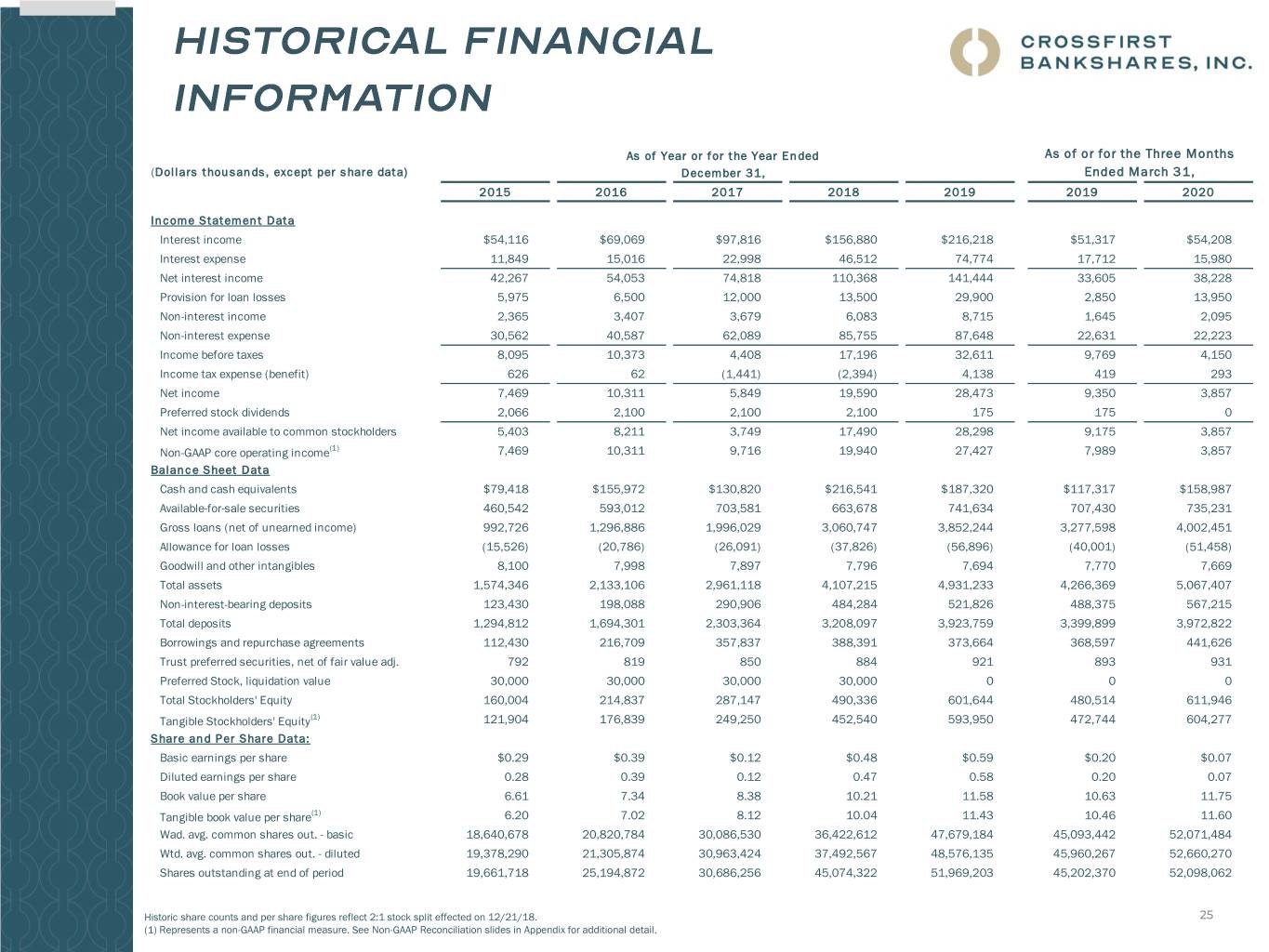

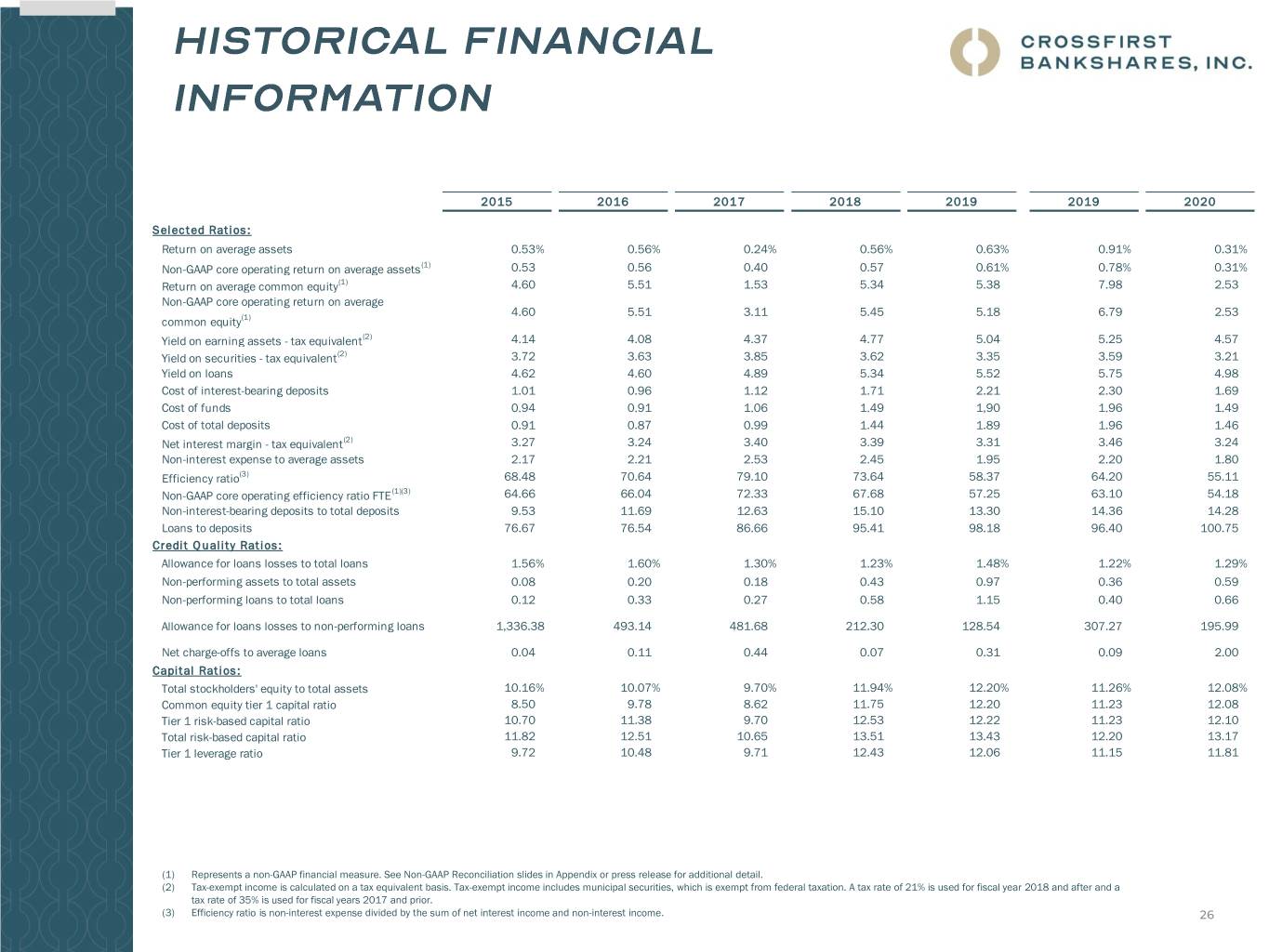

As of Year or for the Year Ended As of or for the Three Months (Dollars thousands, except per share data) December 31, Ended March 31, 2015 2016 2017 2018 2019 2019 2020 Income Statement Data Interest income $54,116 $69,069 $97,816 $156,880 $216,218 $51,317 $54,208 Interest expense 11,849 15,016 22,998 46,512 74,774 17,712 15,980 Net interest income 42,267 54,053 74,818 110,368 141,444 33,605 38,228 Provision for loan losses 5,975 6,500 12,000 13,500 29,900 2,850 13,950 Non-interest income 2,365 3,407 3,679 6,083 8,715 1,645 2,095 Non-interest expense 30,562 40,587 62,089 85,755 87,648 22,631 22,223 Income before taxes 8,095 10,373 4,408 17,196 32,611 9,769 4,150 Income tax expense (benefit) 626 62 (1,441) (2,394) 4,138 419 293 Net income 7,469 10,311 5,849 19,590 28,473 9,350 3,857 Preferred stock dividends 2,066 2,100 2,100 2,100 175 175 0 Net income available to common stockholders 5,403 8,211 3,749 17,490 28,298 9,175 3,857 Non-GAAP core operating income(1) 7,469 10,311 9,716 19,940 27,427 7,989 3,857 Balance Sheet Data Cash and cash equivalents $79,418 $155,972 $130,820 $216,541 $187,320 $117,317 $158,987 Available-for-sale securities 460,542 593,012 703,581 663,678 741,634 707,430 735,231 Gross loans (net of unearned income) 992,726 1,296,886 1,996,029 3,060,747 3,852,244 3,277,598 4,002,451 Allowance for loan losses (15,526) (20,786) (26,091) (37,826) (56,896) (40,001) (51,458) Goodwill and other intangibles 8,100 7,998 7,897 7,796 7,694 7,770 7,669 Total assets 1,574,346 2,133,106 2,961,118 4,107,215 4,931,233 4,266,369 5,067,407 Non-interest-bearing deposits 123,430 198,088 290,906 484,284 521,826 488,375 567,215 Total deposits 1,294,812 1,694,301 2,303,364 3,208,097 3,923,759 3,399,899 3,972,822 Borrowings and repurchase agreements 112,430 216,709 357,837 388,391 373,664 368,597 441,626 Trust preferred securities, net of fair value adj. 792 819 850 884 921 893 931 Preferred Stock, liquidation value 30,000 30,000 30,000 30,000 0 0 0 Total Stockholders' Equity 160,004 214,837 287,147 490,336 601,644 480,514 611,946 Tangible Stockholders' Equity(1) 121,904 176,839 249,250 452,540 593,950 472,744 604,277 Share and Per Share Data: Basic earnings per share $0.29 $0.39 $0.12 $0.48 $0.59 $0.20 $0.07 Diluted earnings per share 0.28 0.39 0.12 0.47 0.58 0.20 0.07 Book value per share 6.61 7.34 8.38 10.21 11.58 10.63 11.75 Tangible book value per share(1) 6.20 7.02 8.12 10.04 11.43 10.46 11.60 Wad. avg. common shares out. - basic 18,640,678 20,820,784 30,086,530 36,422,612 47,679,184 45,093,442 52,071,484 Wtd. avg. common shares out. - diluted 19,378,290 21,305,874 30,963,424 37,492,567 48,576,135 45,960,267 52,660,270 Shares outstanding at end of period 19,661,718 25,194,872 30,686,256 45,074,322 51,969,203 45,202,370 52,098,062 Historic share counts and per share figures reflect 2:1 stock split effected on 12/21/18. 25 (1) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides in Appendix for additional detail.

2015 2016 2017 2018 2019 2019 2020 Selected Ratios: Return on average assets 0.53% 0.56% 0.24% 0.56% 0.63% 0.91% 0.31% Non-GAAP core operating return on average assets(1) 0.53 0.56 0.40 0.57 0.61% 0.78% 0.31% Return on average common equity(1) 4.60 5.51 1.53 5.34 5.38 7.98 2.53 Non-GAAP core operating return on average 4.60 5.51 3.11 5.45 5.18 6.79 2.53 common equity(1) Yield on earning assets - tax equivalent(2) 4.14 4.08 4.37 4.77 5.04 5.25 4.57 Yield on securities - tax equivalent(2) 3.72 3.63 3.85 3.62 3.35 3.59 3.21 Yield on loans 4.62 4.60 4.89 5.34 5.52 5.75 4.98 Cost of interest-bearing deposits 1.01 0.96 1.12 1.71 2.21 2.30 1.69 Cost of funds 0.94 0.91 1.06 1.49 1,90 1.96 1.49 Cost of total deposits 0.91 0.87 0.99 1.44 1.89 1.96 1.46 Net interest margin - tax equivalent(2) 3.27 3.24 3.40 3.39 3.31 3.46 3.24 Non-interest expense to average assets 2.17 2.21 2.53 2.45 1.95 2.20 1.80 Efficiency ratio(3) 68.48 70.64 79.10 73.64 58.37 64.20 55.11 Non-GAAP core operating efficiency ratio FTE(1)(3) 64.66 66.04 72.33 67.68 57.25 63.10 54.18 Non-interest-bearing deposits to total deposits 9.53 11.69 12.63 15.10 13.30 14.36 14.28 Loans to deposits 76.67 76.54 86.66 95.41 98.18 96.40 100.75 Credit Quality Ratios: Allowance for loans losses to total loans 1.56% 1.60% 1.30% 1.23% 1.48% 1.22% 1.29% Non-performing assets to total assets 0.08 0.20 0.18 0.43 0.97 0.36 0.59 Non-performing loans to total loans 0.12 0.33 0.27 0.58 1.15 0.40 0.66 Allowance for loans losses to non-performing loans 1,336.38 493.14 481.68 212.30 128.54 307.27 195.99 Net charge-offs to average loans 0.04 0.11 0.44 0.07 0.31 0.09 2.00 Capital Ratios: Total stockholders' equity to total assets 10.16% 10.07% 9.70% 11.94% 12.20% 11.26% 12.08% Common equity tier 1 capital ratio 8.50 9.78 8.62 11.75 12.20 11.23 12.08 Tier 1 risk-based capital ratio 10.70 11.38 9.70 12.53 12.22 11.23 12.10 Total risk-based capital ratio 11.82 12.51 10.65 13.51 13.43 12.20 13.17 Tier 1 leverage ratio 9.72 10.48 9.71 12.43 12.06 11.15 11.81 (1) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides in Appendix or press release for additional detail. (2) Tax-exempt income is calculated on a tax equivalent basis. Tax-exempt income includes municipal securities, which is exempt from federal taxation. A tax rate of 21% is used for fiscal year 2018 and after and a tax rate of 35% is used for fiscal years 2017 and prior. (3) Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income. 26

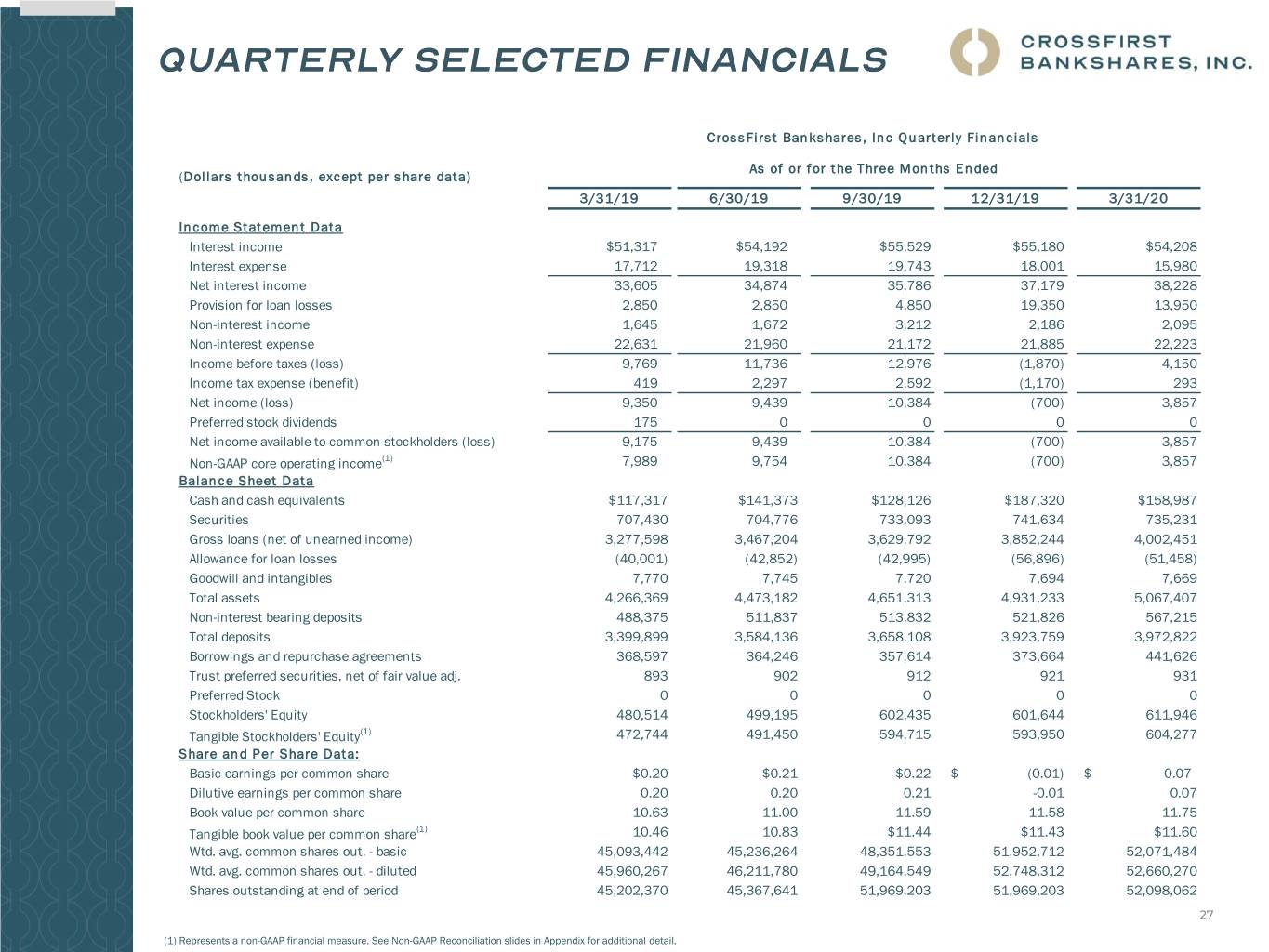

CrossFirst Bankshares, Inc Quarterly Financials As of or for the Three Months Ended (Dollars thousands, except per share data) 3/31/19 6/30/19 9/30/19 12/31/19 3/31/20 Income Statement Data Interest income $51,317 $54,192 $55,529 $55,180 $54,208 Interest expense 17,712 19,318 19,743 18,001 15,980 Net interest income 33,605 34,874 35,786 37,179 38,228 Provision for loan losses 2,850 2,850 4,850 19,350 13,950 Non-interest income 1,645 1,672 3,212 2,186 2,095 Non-interest expense 22,631 21,960 21,172 21,885 22,223 Income before taxes (loss) 9,769 11,736 12,976 (1,870) 4,150 Income tax expense (benefit) 419 2,297 2,592 (1,170) 293 Net income (loss) 9,350 9,439 10,384 (700) 3,857 Preferred stock dividends 175 0 0 0 0 Net income available to common stockholders (loss) 9,175 9,439 10,384 (700) 3,857 Non-GAAP core operating income(1) 7,989 9,754 10,384 (700) 3,857 Balance Sheet Data Cash and cash equivalents $117,317 $141,373 $128,126 $187,320 $158,987 Securities 707,430 704,776 733,093 741,634 735,231 Gross loans (net of unearned income) 3,277,598 3,467,204 3,629,792 3,852,244 4,002,451 Allowance for loan losses (40,001) (42,852) (42,995) (56,896) (51,458) Goodwill and intangibles 7,770 7,745 7,720 7,694 7,669 Total assets 4,266,369 4,473,182 4,651,313 4,931,233 5,067,407 Non-interest bearing deposits 488,375 511,837 513,832 521,826 567,215 Total deposits 3,399,899 3,584,136 3,658,108 3,923,759 3,972,822 Borrowings and repurchase agreements 368,597 364,246 357,614 373,664 441,626 Trust preferred securities, net of fair value adj. 893 902 912 921 931 Preferred Stock 0 0 0 0 0 Stockholders' Equity 480,514 499,195 602,435 601,644 611,946 Tangible Stockholders' Equity(1) 472,744 491,450 594,715 593,950 604,277 Share and Per Share Data: Basic earnings per common share $0.20 $0.21 $0.22 $ (0.01) $ 0.07 Dilutive earnings per common share 0.20 0.20 0.21 -0.01 0.07 Book value per common share 10.63 11.00 11.59 11.58 11.75 Tangible book value per common share(1) 10.46 10.83 $11.44 $11.43 $11.60 Wtd. avg. common shares out. - basic 45,093,442 45,236,264 48,351,553 51,952,712 52,071,484 Wtd. avg. common shares out. - diluted 45,960,267 46,211,780 49,164,549 52,748,312 52,660,270 Shares outstanding at end of period 45,202,370 45,367,641 51,969,203 51,969,203 52,098,062 27 (1) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides in Appendix for additional detail.

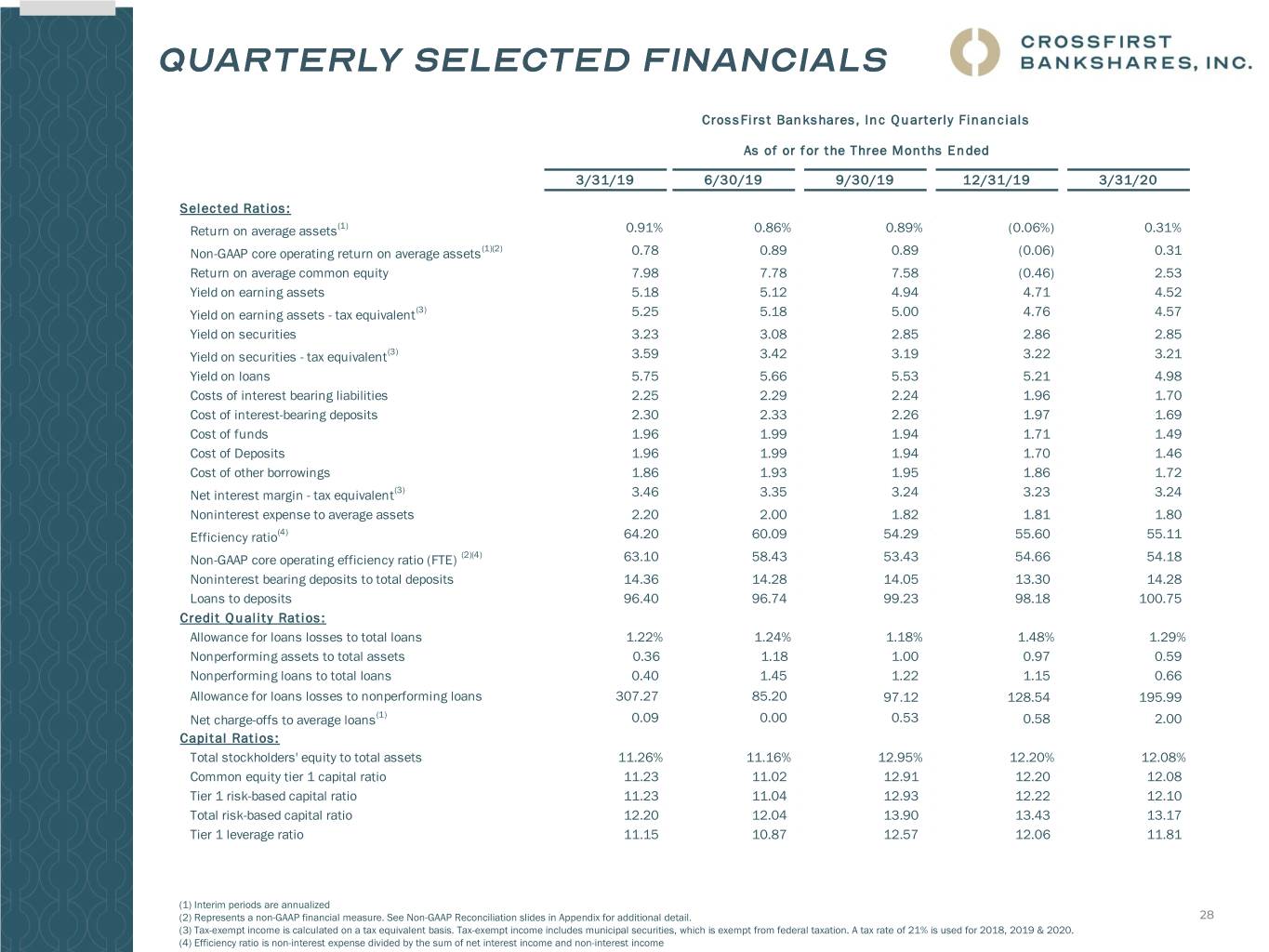

CrossFirst Bankshares, Inc Quarterly Financials As of or for the Three Months Ended 3/31/19 6/30/19 9/30/19 12/31/19 3/31/20 Selected Ratios: - - - - Return on average assets(1) 0.91% 0.86% 0.89% (0.06%) 0.31% - - - - Non-GAAP core operating return on average assets(1)(2) 0.78 0.89 0.89 (0.06) 0.31 Return on average common equity 7.98 - 7.78 - 7.58 - (0.46) - 2.53 Yield on earning assets 5.18 - 5.12 - 4.94 - 4.71 - 4.52 - - - - Yield on earning assets - tax equivalent(3) 5.25 5.18 5.00 4.76 4.57 Yield on securities 3.23 - 3.08 - 2.85 - 2.86 - 2.85 - - - - Yield on securities - tax equivalent(3) 3.59 3.42 3.19 3.22 3.21 Yield on loans 5.75 - 5.66 - 5.53 - 5.21 - 4.98 Costs of interest bearing liabilities 2.25 - 2.29 - 2.24 - 1.96 - 1.70 Cost of interest-bearing deposits 2.30 - 2.33 - 2.26 - 1.97 - 1.69 Cost of funds 1.96 - 1.99 - 1.94 - 1.71 - 1.49 Cost of Deposits 1.96 - 1.99 - 1.94 - 1.70 - 1.46 Cost of other borrowings 1.86 - 1.93 - 1.95 - 1.86 - 1.72 - - - - Net interest margin - tax equivalent(3) 3.46 3.35 3.24 3.23 3.24 Noninterest expense to average assets 2.20 - 2.00 - 1.82 - 1.81 - 1.80 - - - - Efficiency ratio(4) 64.20 60.09 54.29 55.60 55.11 - - - - Non-GAAP core operating efficiency ratio (FTE) (2)(4) 63.10 58.43 53.43 54.66 54.18 Noninterest bearing deposits to total deposits 14.36 - 14.28 - 14.05 - 13.30 - 14.28 Loans to deposits 96.40 - 96.74 - 99.23 - 98.18 - 100.75 Credit Quality Ratios: Allowance for loans losses to total loans 1.22% 1.24% 1.18% 1.48% 1.29% Nonperforming assets to total assets 0.36 1.18 1.00 0.97 0.59 Nonperforming loans to total loans 0.40 1.45 1.22 1.15 0.66 Allowance for loans losses to nonperforming loans 307.27 85.20 97.12 128.54 195.99 Net charge-offs to average loans(1) 0.09 0.00 0.53 0.58 2.00 Capital Ratios: Total stockholders' equity to total assets 11.26% - 11.16% - 12.95% - 12.20% - 12.08% Common equity tier 1 capital ratio 11.23 - 11.02 - 12.91 - 12.20 - 12.08 Tier 1 risk-based capital ratio 11.23 - 11.04 - 12.93 - 12.22 - 12.10 Total risk-based capital ratio 12.20 - 12.04 - 13.90 - 13.43 - 13.17 Tier 1 leverage ratio 11.15 - 10.87 - 12.57 - 12.06 - 11.81 (1) Interim periods are annualized (2) Represents a non-GAAP financial measure. See Non-GAAP Reconciliation slides in Appendix for additional detail. 28 (3) Tax-exempt income is calculated on a tax equivalent basis. Tax-exempt income includes municipal securities, which is exempt from federal taxation. A tax rate of 21% is used for 2018, 2019 & 2020. (4) Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income

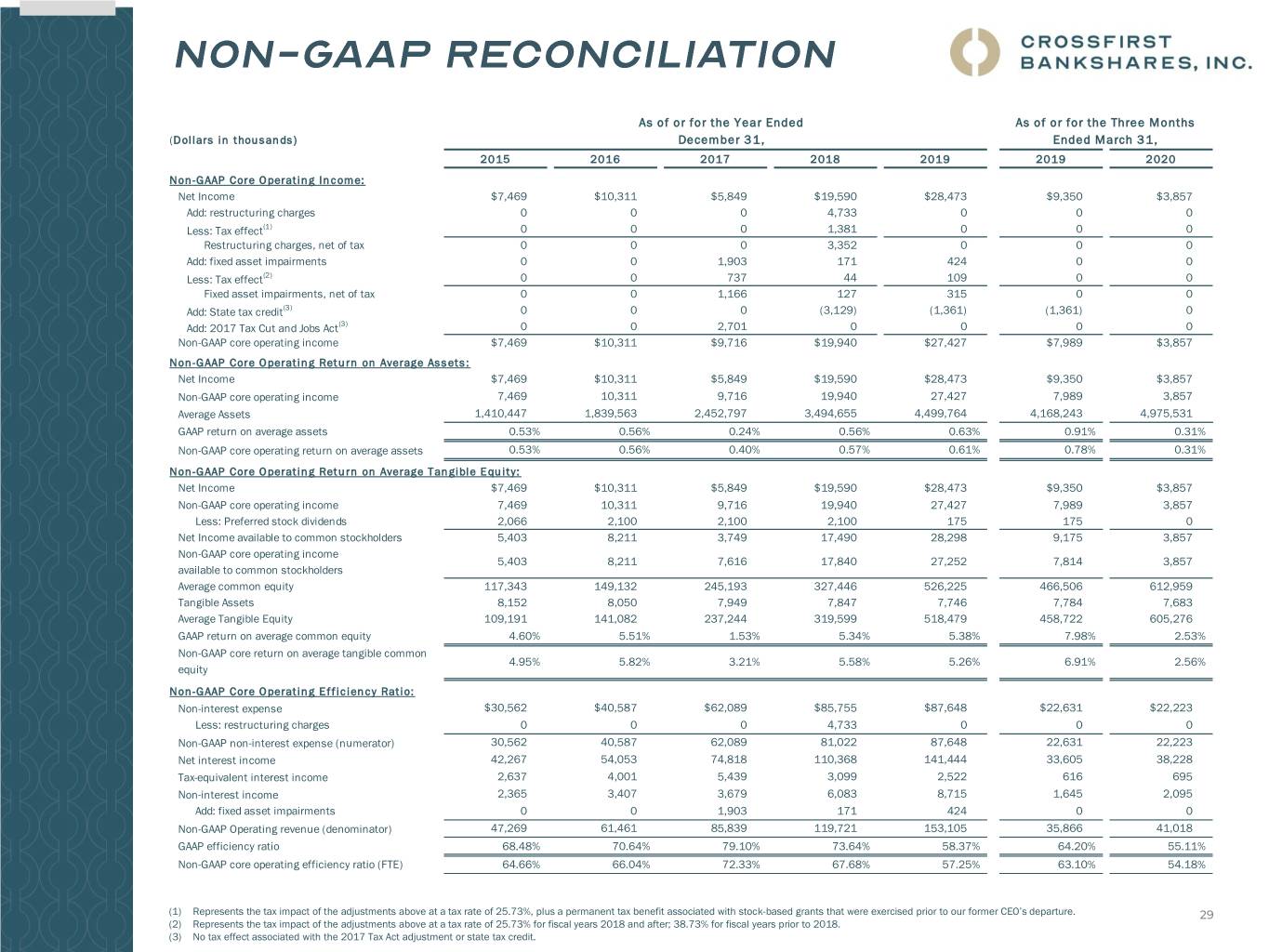

As of or for the Year Ended As of or for the Three Months (Dollars in thousands) December 31, Ended March 31, 2015 2016 2017 2018 2019 2019 2020 Non-GAAP Core Operating Income: Net Income $7,469 $10,311 $5,849 $19,590 $28,473 $9,350 $3,857 Add: restructuring charges 0 0 0 4,733 0 0 0 Less: Tax effect(1) 0 0 0 1,381 0 0 0 Restructuring charges, net of tax 0 0 0 3,352 0 0 0 Add: fixed asset impairments 0 0 1,903 171 424 0 0 Less: Tax effect(2) 0 0 737 44 109 0 0 Fixed asset impairments, net of tax 0 0 1,166 127 315 0 0 Add: State tax credit(3) 0 0 0 (3,129) (1,361) (1,361) 0 Add: 2017 Tax Cut and Jobs Act(3) 0 0 2,701 0 0 0 0 Non-GAAP core operating income $7,469 $10,311 $9,716 $19,940 $27,427 $7,989 $3,857 Non-GAAP Core Operating Return on Average Assets: Net Income $7,469 $10,311 $5,849 $19,590 $28,473 $9,350 $3,857 Non-GAAP core operating income 7,469 10,311 9,716 19,940 27,427 7,989 3,857 Average Assets 1,410,447 1,839,563 2,452,797 3,494,655 4,499,764 4,168,243 4,975,531 GAAP return on average assets 0.53% 0.56% 0.24% 0.56% 0.63% 0.91% 0.31% Non-GAAP core operating return on average assets 0.53% 0.56% 0.40% 0.57% 0.61% 0.78% 0.31% Non-GAAP Core Operating Return on Average Tangible Equity: Net Income $7,469 $10,311 $5,849 $19,590 $28,473 $9,350 $3,857 Non-GAAP core operating income 7,469 10,311 9,716 19,940 27,427 7,989 3,857 Less: Preferred stock dividends 2,066 2,100 2,100 2,100 175 175 0 Net Income available to common stockholders 5,403 8,211 3,749 17,490 28,298 9,175 3,857 Non-GAAP core operating income 5,403 8,211 7,616 17,840 27,252 7,814 3,857 available to common stockholders Average common equity 117,343 149,132 245,193 327,446 526,225 466,506 612,959 Tangible Assets 8,152 8,050 7,949 7,847 7,746 7,784 7,683 Average Tangible Equity 109,191 141,082 237,244 319,599 518,479 458,722 605,276 GAAP return on average common equity 4.60% 5.51% 1.53% 5.34% 5.38% 7.98% 2.53% Non-GAAP core return on average tangible common 4.95% 5.82% 3.21% 5.58% 5.26% 6.91% 2.56% equity Non-GAAP Core Operating Efficiency Ratio: Non-interest expense $30,562 $40,587 $62,089 $85,755 $87,648 $22,631 $22,223 Less: restructuring charges 0 0 0 4,733 0 0 0 Non-GAAP non-interest expense (numerator) 30,562 40,587 62,089 81,022 87,648 22,631 22,223 Net interest income 42,267 54,053 74,818 110,368 141,444 33,605 38,228 Tax-equivalent interest income 2,637 4,001 5,439 3,099 2,522 616 695 Non-interest income 2,365 3,407 3,679 6,083 8,715 1,645 2,095 Add: fixed asset impairments 0 0 1,903 171 424 0 0 Non-GAAP Operating revenue (denominator) 47,269 61,461 85,839 119,721 153,105 35,866 41,018 GAAP efficiency ratio 68.48% 70.64% 79.10% 73.64% 58.37% 64.20% 55.11% Non-GAAP core operating efficiency ratio (FTE) 64.66% 66.04% 72.33% 67.68% 57.25% 63.10% 54.18% (1) Represents the tax impact of the adjustments above at a tax rate of 25.73%, plus a permanent tax benefit associated with stock-based grants that were exercised prior to our former CEO’s departure. 29 (2) Represents the tax impact of the adjustments above at a tax rate of 25.73% for fiscal years 2018 and after; 38.73% for fiscal years prior to 2018. (3) No tax effect associated with the 2017 Tax Act adjustment or state tax credit.

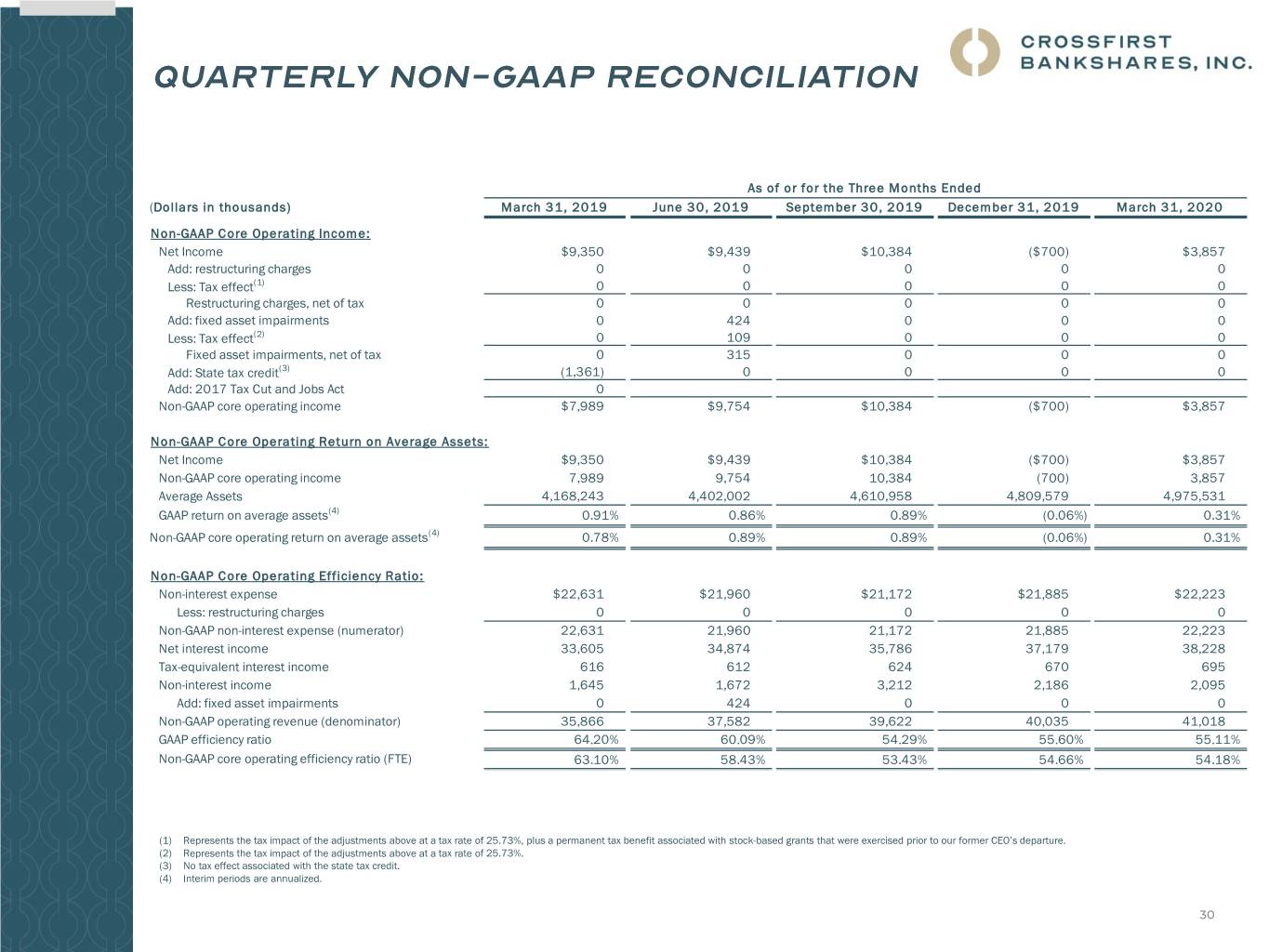

As of or for the Three Months Ended (Dollars in thousands) March 31, 2019 June 30, 2019 September 30, 2019 December 31, 2019 March 31, 2020 Non-GAAP Core Operating Income: Net Income $9,350 $9,439 $10,384 ($700) $3,857 Add: restructuring charges 0 0 0 0 0 Less: Tax effect(1) 0 0 0 0 0 Restructuring charges, net of tax 0 0 0 0 0 Add: fixed asset impairments 0 424 0 0 0 Less: Tax effect(2) 0 109 0 0 0 Fixed asset impairments, net of tax 0 315 0 0 0 Add: State tax credit(3) (1,361) 0 0 0 0 Add: 2017 Tax Cut and Jobs Act 0 Non-GAAP core operating income $7,989 $9,754 $10,384 ($700) $3,857 Non-GAAP Core Operating Return on Average Assets: Net Income $9,350 $9,439 $10,384 ($700) $3,857 Non-GAAP core operating income 7,989 9,754 10,384 (700) 3,857 Average Assets 4,168,243 4,402,002 4,610,958 4,809,579 4,975,531 GAAP return on average assets(4) 0.91% 0.86% 0.89% (0.06%) 0.31% Non-GAAP core operating return on average assets(4) 0.78% 0.89% 0.89% (0.06%) 0.31% Non-GAAP Core Operating Efficiency Ratio: Non-interest expense $22,631 $21,960 $21,172 $21,885 $22,223 Less: restructuring charges 0 0 0 0 0 Non-GAAP non-interest expense (numerator) 22,631 21,960 21,172 21,885 22,223 Net interest income 33,605 34,874 35,786 37,179 38,228 Tax-equivalent interest income 616 612 624 670 695 Non-interest income 1,645 1,672 3,212 2,186 2,095 Add: fixed asset impairments 0 424 0 0 0 Non-GAAP operating revenue (denominator) 35,866 37,582 39,622 40,035 41,018 GAAP efficiency ratio 64.20% 60.09% 54.29% 55.60% 55.11% Non-GAAP core operating efficiency ratio (FTE) 63.10% 58.43% 53.43% 54.66% 54.18% (1) Represents the tax impact of the adjustments above at a tax rate of 25.73%, plus a permanent tax benefit associated with stock-based grants that were exercised prior to our former CEO’s departure. (2) Represents the tax impact of the adjustments above at a tax rate of 25.73%. (3) No tax effect associated with the state tax credit. (4) Interim periods are annualized. 30

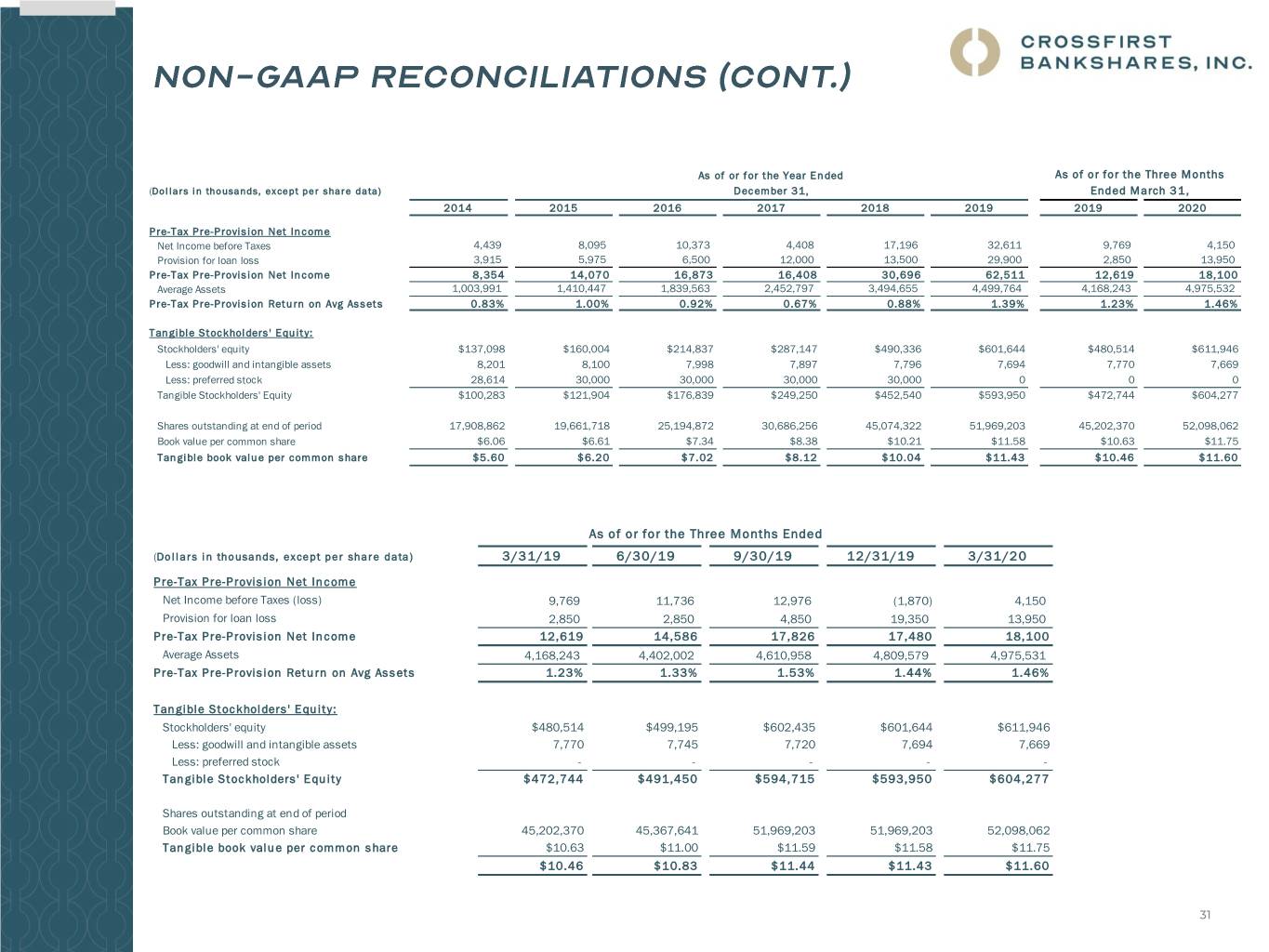

As of or for the Year Ended As of or for the Three Months (Dollars in thousands, except per share data) December 31, Ended March 31, 2014 2015 2016 2017 2018 2019 2019 2020 Pre-Tax Pre-Provision Net Income Net Income before Taxes 4,439 8,095 10,373 4,408 17,196 32,611 9,769 4,150 Provision for loan loss 3,915 5,975 6,500 12,000 13,500 29,900 2,850 13,950 Pre-Tax Pre-Provision Net Income 8,354 14,070 16,873 16,408 30,696 62,511 12,619 18,100 Average Assets 1,003,991 1,410,447 1,839,563 2,452,797 3,494,655 4,499,764 4,168,243 4,975,532 Pre-Tax Pre-Provision Return on Avg Assets 0.83% 1.00% 0.92% 0.67% 0.88% 1.39% 1.23% 1.46% Tangible Stockholders' Equity: Stockholders' equity $137,098 $160,004 $214,837 $287,147 $490,336 $601,644 $480,514 $611,946 Less: goodwill and intangible assets 8,201 8,100 7,998 7,897 7,796 7,694 7,770 7,669 Less: preferred stock 28,614 30,000 30,000 30,000 30,000 0 0 0 Tangible Stockholders' Equity $100,283 $121,904 $176,839 $249,250 $452,540 $593,950 $472,744 $604,277 Shares outstanding at end of period 17,908,862 19,661,718 25,194,872 30,686,256 45,074,322 51,969,203 45,202,370 52,098,062 Book value per common share $6.06 $6.61 $7.34 $8.38 $10.21 $11.58 $10.63 $11.75 Tangible book value per common share $5.60 $6.20 $7.02 $8.12 $10.04 $11.43 $10.46 $11.60 As of or for the Three Months Ended (Dollars in thousands, except per share data) 3/31/19 6/30/19 9/30/19 12/31/19 3/31/20 Pre-Tax Pre-Provision Net Income Net Income before Taxes (loss) 9,769 11,736 12,976 (1,870) 4,150 Provision for loan loss 2,850 2,850 4,850 19,350 13,950 Pre-Tax Pre-Provision Net Income 12,619 14,586 17,826 17,480 18,100 Average Assets 4,168,243 4,402,002 4,610,958 4,809,579 4,975,531 Pre-Tax Pre-Provision Return on Avg Assets 1.23% 1.33% 1.53% 1.44% 1.46% Tangible Stockholders' Equity: Stockholders' equity $480,514 $499,195 $602,435 $601,644 $611,946 Less: goodwill and intangible assets 7,770 7,745 7,720 7,694 7,669 Less: preferred stock - - - - - Tangible Stockholders' Equity $472,744 $491,450 $594,715 $593,950 $604,277 Shares outstanding at end of period Book value per common share 45,202,370 45,367,641 51,969,203 51,969,203 52,098,062 Tangible book value per common share $10.63 $11.00 $11.59 $11.58 $11.75 $10.46 $10.83 $11.44 $11.43 $11.60 31