Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOK FINANCIAL CORP | a20200331bokfconferenc.htm |

First Quarter 2020 Earnings Conference Call April 22, 2020 1

Legal Disclaimers Forward-Looking Statements: This presentation contains forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, the economy generally and the expected or potential impact of the novel coronavirus (COVID-19) pandemic, and the related responses of the government, consumers, and others, on our business, financial condition and results of operations. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. Management judgments relating to and discussion of the provision and allowance for credit losses, allowance for uncertain tax positions, accruals for loss contingencies and valuation of mortgage servicing rights involve judgments as to expected events and are inherently forward-looking statements. Assessments that acquisitions and growth endeavors will be profitable are necessary statements of belief as to the outcome of future events based in part on information provided by others which BOK Financial has not independently verified. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expected, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to changes in government, consumer or business responses to, and ability to treat or prevent further outbreak of, the COVID-19 pandemic, changes in commodity prices, interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and nontraditional competitors, changes in banking regulations, tax laws, prices, levies and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the Securities and Exchange Commission which can be accessed at www.BOKF.com. All data is presented as of March 31, 2020 unless otherwise noted. 2

Steven G. Bradshaw Chief Executive Officer 3

First Quarter Summary Net Income $142.2 Q1 Q4 Q1 $137.6 ($mil, exc. EPS) 2020 2019 2019 $110.6 $110.4 Net Income $62.1 $110.4 $110.6 Diluted EPS $0.88 $1.56 $1.54 $1.93 $2.00 $62.1 Net income before taxes $1.54 $1.56 $79.3 $141.0 $140.2 $0.88 Provision for credit losses $93.8 $19.0 $8.0 Pre-provision net revenue* $173.1 $160.0 $148.2 1Q19 2Q19 3Q19 4Q19 1Q20 Net income attributable to shareholders *Non-GAAP measure Net income per share - diluted Noteworthy items impacting profitability: • Fee income growth driven by strong performance in Brokerage & Trading and Mortgage • Diligent expense management in light of rapidly changing environment • $93.8 million in Day 2 provision for credit losses under CECL driven by adverse economic outlook and declining oil prices • Mortgage servicing rights fair value decline of $88 million completely offset by hedging positions 4

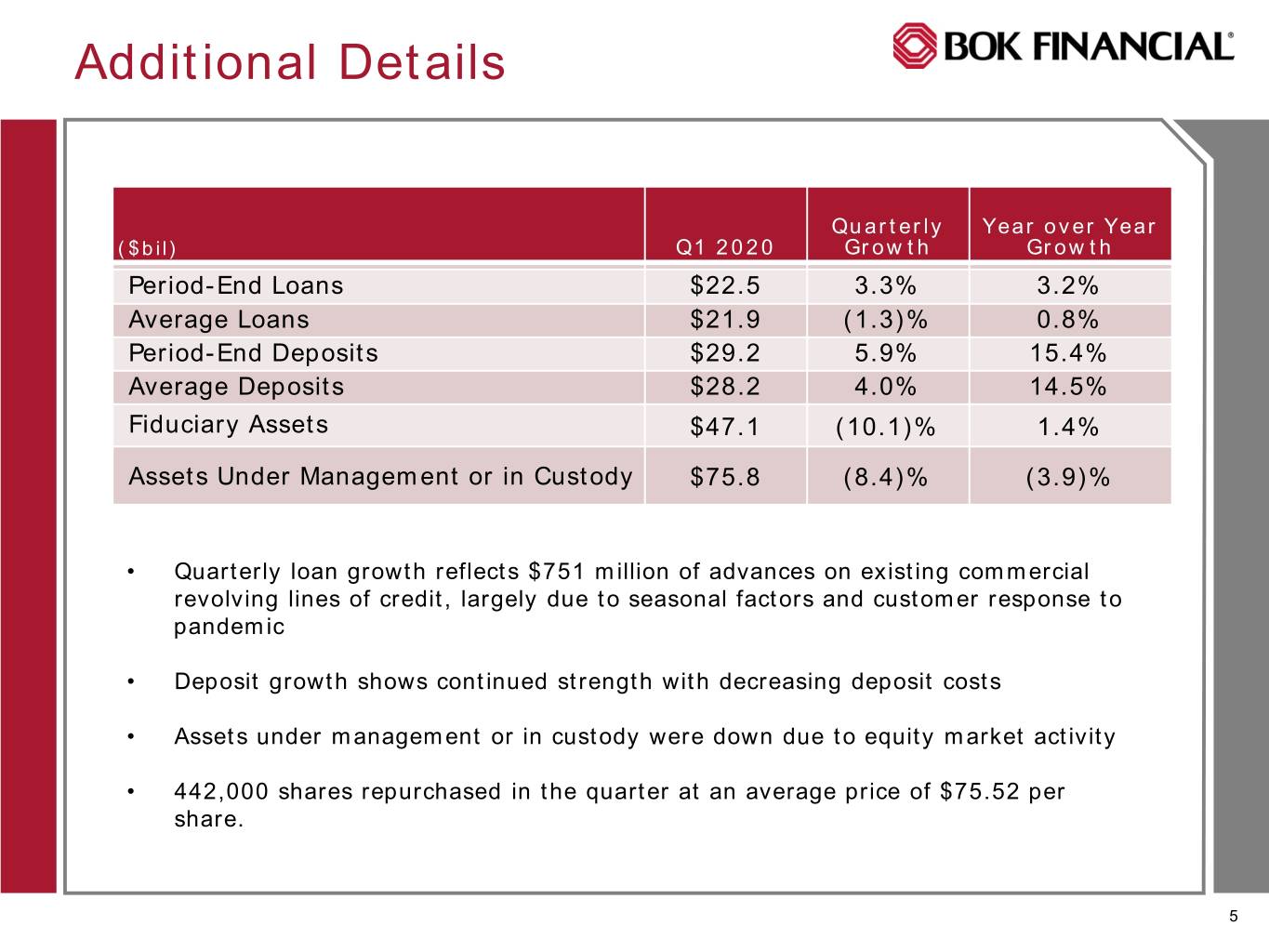

Additional Details Quarterly Year over Year ($bil) Q1 2020 Growth Growth Period-End Loans $22.5 3.3% 3.2% Average Loans $21.9 (1.3)% 0.8% Period-End Deposits $29.2 5.9% 15.4% Average Deposits $28.2 4.0% 14.5% Fiduciary Assets $47.1 (10.1)% 1.4% Assets Under Management or in Custody $75.8 (8.4)% (3.9)% • Quarterly loan growth reflects $751 million of advances on existing commercial revolving lines of credit, largely due to seasonal factors and customer response to pandemic • Deposit growth shows continued strength with decreasing deposit costs • Assets under management or in custody were down due to equity market activity • 442,000 shares repurchased in the quarter at an average price of $75.52 per share. 5

Marty Grunst EVP- Chief Risk Officer 6

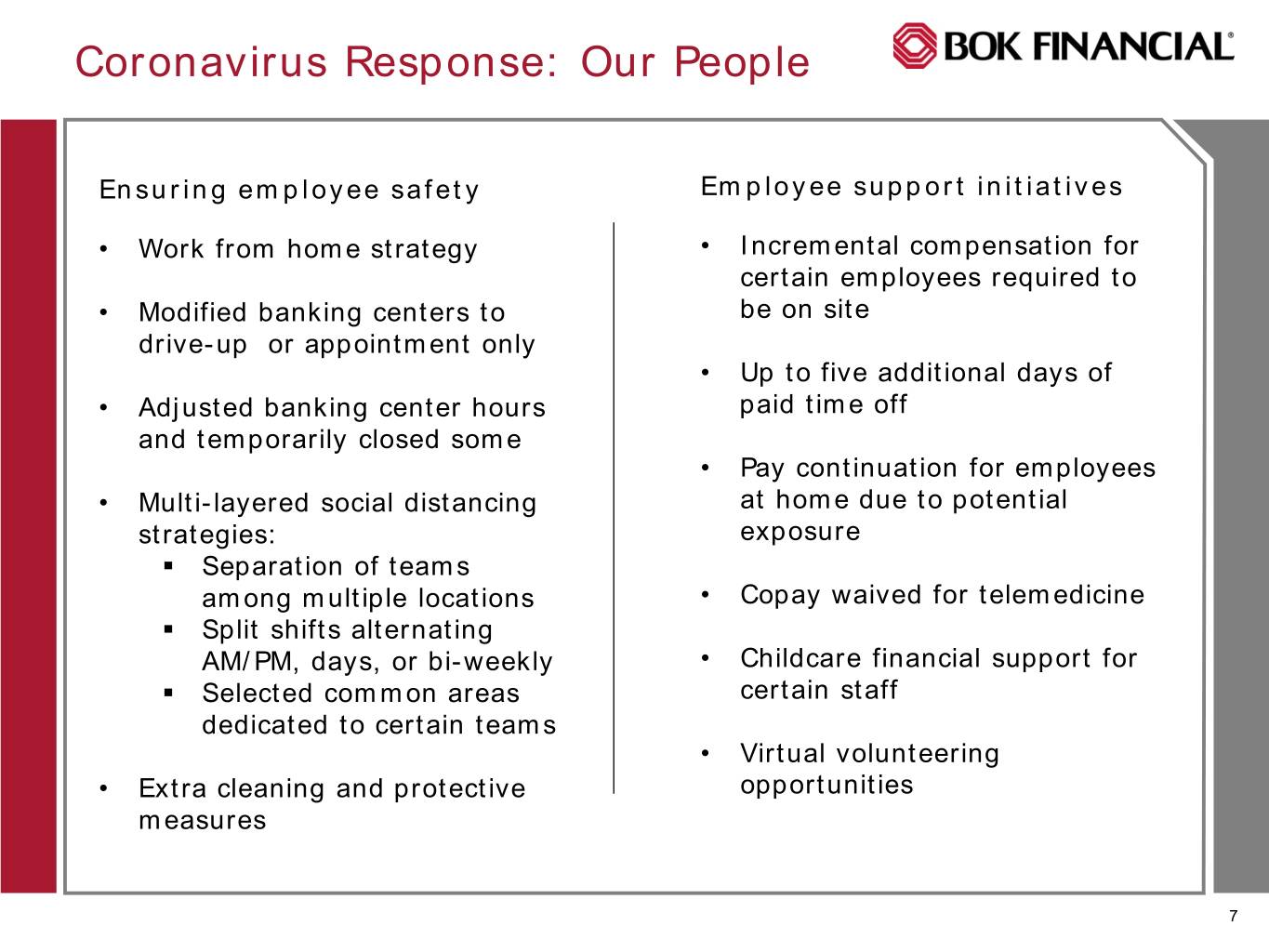

Coronavirus Response: Our People Ensuring employee safety Employee support initiatives • Work from home strategy • Incremental compensation for certain employees required to • Modified banking centers to be on site drive-up or appointment only • Up to five additional days of • Adjusted banking center hours paid time off and temporarily closed some • Pay continuation for employees • Multi-layered social distancing at home due to potential strategies: exposure . Separation of teams among multiple locations • Copay waived for telemedicine . Split shifts alternating AM/PM, days, or bi-weekly • Childcare financial support for . Selected common areas certain staff dedicated to certain teams • Virtual volunteering • Extra cleaning and protective opportunities measures 7

Norm Bagwell EVP- Regional Banking 8

Coronavirus Response: Our Clients SBA Paycheck Protection Program . Began taking applications on April 3 . Redeployed hundreds of employees to manage volume . Approximately 4,700 applications completed . Received $1.8 billion in SBA approvals . Focused intently on serving our core client base . Expect to share a portion of these amounts with the communities we serve 9

Stacy Kymes EVP-Corporate Banking 10

Loan Portfolio Seq. Mar 31, Dec 31, Mar 31, Loan YOY Loan ($mil) 2020 2019 2019 Growth Growth Energy $4,111.7 $3,973.4 $3,705.1 3.5% 11.0% Healthcare 3,165.1 3,033.9 2,915.9 4.3% 8.5% Services 3,955.7 3,832.0 4,090.6 3.2% (3.3)% General business 3,563.5 3,192.3 3,250.3 11.6% 9.6% Total C&I $14,796.0 $14,031.7 $13,962.0 5.4% 6.0% Commercial Real Estate 4,450.1 4,433.8 4,600.7 0.4% (3.3)% Loans to Individuals 3,217.9 3,285.6 3,196.4 (2.1)% 0.7% Total Loans $22,464.0 $21,751.0 $21,759.0 3.3% 3.2% • Growth in C&I is related to both seasonal factors and customer responses to the COVID-19 pandemic • Commercial Real Estate relatively flat for the quarter 11

Energy Banking Over 100 year history in energy lending Portfolio Composition at 03/31/2020 and a playbook that works • Focus on first lien, senior secured E&P lending – the “sweet spot” in energy lending • Internal staff of 16 petroleum engineers and Oil & Gas engineering techs to confirm property values 78% – a material investment that is a key to Producers strong credit performance across the cycle Midstream & Other • Focus on on-shore “lower 48” property sets Energy Services with no deep-water offshore exposure 6% and Other • Minimal exposure to second liens, 16% undeveloped reserves, or other higher-risk components of the capital stack • 50-60% loan to value on proved producing reserves • Actual forward markets are the value Strong through-the-cycle credit performance determinant for borrowing bases Net Q1 • Extraction and transportation costs are Charge 2014 2015 2016 2017 2018 2019 2020 deducted from collateral values -Offs TTM E&P 0.00% 0.07% 1.43% 0.23% 0.61% 0.91% 0.89% At 03/31/2020 • $4.1 billion outstanding and $2.6 billion Total unfunded commitments Energy -0.15% 0.17% 1.17% 0.18% 0.50% 0.74% 0.95% • E&P line utilization 62% 12

Healthcare Banking Portfolio Composition at 03/31/2020 • As of March 31, 2020, outstandings totaled $3.2 billion across 31 states • Healthcare portfolio characteristics: . Favorable LIBOR spreads . Above-average loan utilization rates 12% . Predominately BOK Financial originated 13% Senior Housing commitments - less than 12% of commitments Hospital from broadly syndicated transactions Service Medical . Senior Housing commitments real-estate 75% collateralized and secured . Favorable credit metrics Loans Outstanding ($mil) $3,500 Strong through-the-cycle credit performance $3,000 Net Q1 $2,500 Charge- 2014 2015 2016 2017 2018 2019 2020 CAGR: 15.8% Offs TTM $2,000 Senior Housing 0.00% 0.00% 0.00% 0.00% 0.00% 0.10% 0.04% $1,500 Hospital 0.00% 0.00% 0.00% 1.93% 2.05% 2.24% 1.61% $1,000 $500 Medical -0.03% -0.12% -0.02% 1.31% -0.32% -0.08% 0.02% $- 2014 2019 13

Commercial Real Estate CRE Portfolio by Product Type Retail Office 17% 22% • $4.5 billion outstanding and $1.4 billion unfunded commitments at March 31, 2020 • BOKF allocates 175% of Tier 1 capital plus reserves to CRE Industrial 16% • Further controls and limitations by product type and geography. Concentration Residential guidelines are analyzed and adjusted Multifamily Cons 29% 3% quarterly as needed Other 13% • Extensive, granular loan underwriting guideline standards reviewed and adjusted CRE Portfolio by Collateral Location semi-annually CO 10% AZ • Strong relationship between the front line NM 8% 8% production/bankers and credit concurrence KS/MO officers. Bi-weekly vetting and discussion 6% of potential opportunities in loan pipeline • Minimal exposure to residential construction and land development TX (highest risk, most cyclical sector in CRE) 25% Other 32% OK 11% 14

Marc Maun EVP-Chief Credit Officer 15

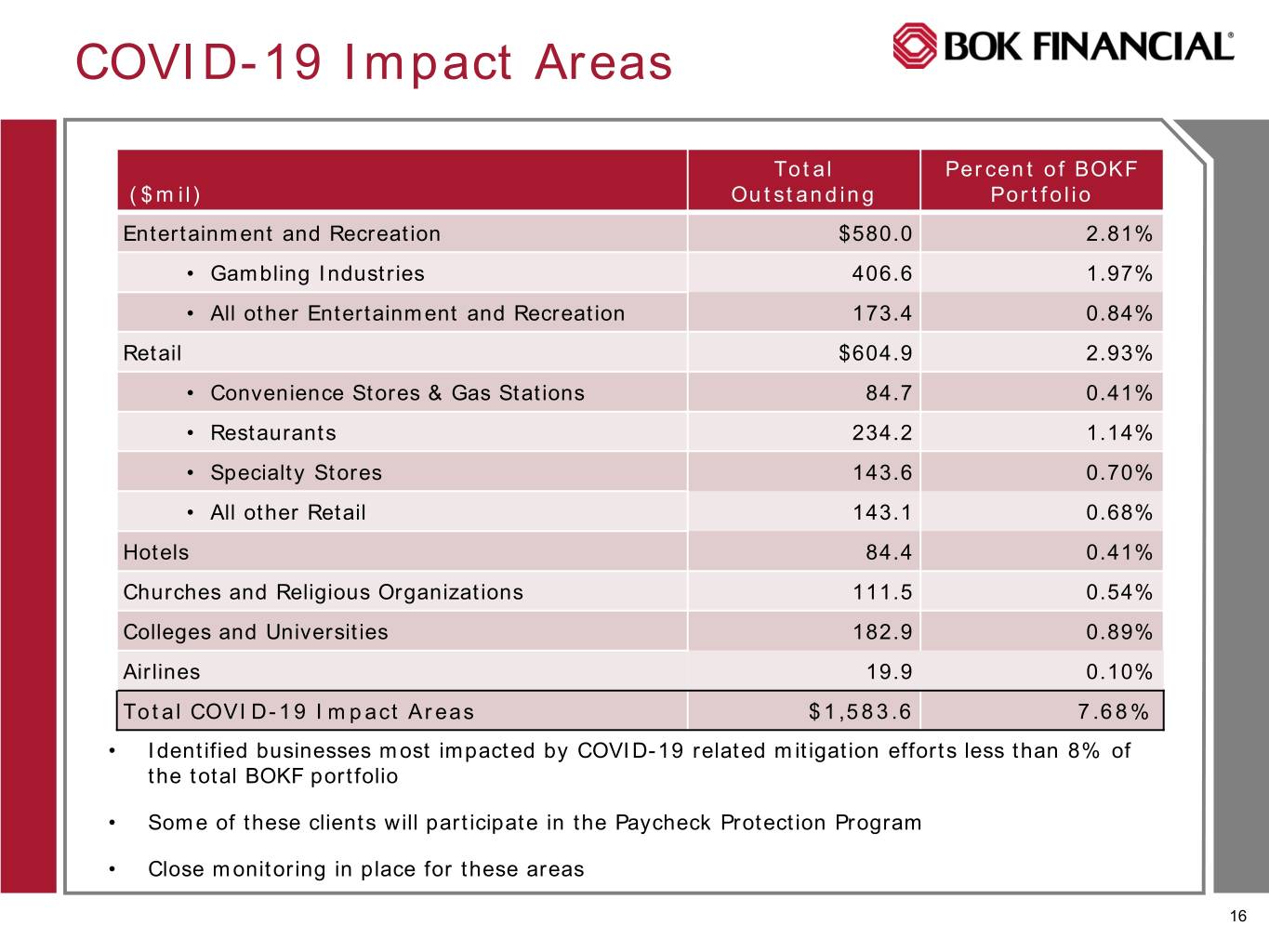

COVID-19 Impact Areas Total Percent of BOKF ($mil) Outstanding Portfolio Entertainment and Recreation $580.0 2.81% • Gambling Industries 406.6 1.97% • All other Entertainment and Recreation 173.4 0.84% Retail $604.9 2.93% • Convenience Stores & Gas Stations 84.7 0.41% • Restaurants 234.2 1.14% • Specialty Stores 143.6 0.70% • All other Retail 143.1 0.68% Hotels 84.4 0.41% Churches and Religious Organizations 111.5 0.54% Colleges and Universities 182.9 0.89% Airlines 19.9 0.10% Total COVID-19 Impact Areas $1,583.6 7.68% • Identified businesses most impacted by COVID-19 related mitigation efforts less than 8% of the total BOKF portfolio • Some of these clients will participate in the Paycheck Protection Program • Close monitoring in place for these areas 16

Key Credit Quality Metrics Non-accruals Net charge-offs (annualized) to average loans $183.8 $181.0 0.40% $172.5 $163.2 $152.6 0.31% 0.22% 0.19% 0.19% 0.20% 0.14% 0.00% 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 Energy Healthcare CRE Residential and Other • Total non-accrual loans down $17.8 million • Net charge-offs moved up to 31 basis points • An increase of $4.7 million in Energy non- • Last five quarter average net charge-offs at accruals 21 basis points continues to be well below historic range of 30 to 40 basis points • Potential problem loans (substandard, accruing) totaled $293 million at 03/31, • Appropriately reserved with an ALLL of 1.4% compared to $160 million at 12/31. The and combined allowance of 1.53% including increase largely resulted from energy and unfunded commitments service sector loans 17

CECL Combined ACL Day 1 Economic Portfolio Combined ACL 12/31/19 Adjustment Factors Changes 03/31/20 $16.0 million $66.2 Changes million due to: Impairments Based on: $49.4* Balances $343.8 Macro million economic Risk Grades million variables Payment Includes ACL Weightings Profiles for loans and assigned $212.3 leases and off- based on million balance sheet three credit scenarios exposures Qualitative factors • Combined ACL includes reserves for unfunded commitments • Total reserves assigned to Energy at 3/31/20 were $100 million 18 ⃰ Day 1 adjustment also included $10.9 million for mortgage-banking activities and $1.1 million for HTM securities.

Steven Nell EVP-Chief Financial Officer 19

Net Interest Revenue and Margin ($mil) Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 Net interest revenue $261.4 $270.2 $279.1 $285.4 $278.1 Net interest margin 2.80% 2.88% 3.01% 3.30% 3.30% Yield on loans 4.50% 4.75% 5.12% 5.39% 5.26% Cost of interest-bearing deposits 0.98% 1.09% 1.17% 1.13% 1.04% Cost of whole borrowings 1.57% 1.92% 2.39% 2.62% 2.63% • Net interest income decreased $8.9 million from Q4 • Net interest margin down only 8 basis points from Q4 . LIBOR remains elevated supporting loan yields . Interest-bearing deposit costs down 11 basis points for the quarter • The full effect of 150 basis point move down in rate will be realized in the second quarter • Will work to continue to re-price deposits over the coming months (March at 79 bps) 20

Fees and Commissions Revenue, $mil Growth: Quarterly, Quarterly, Trailing 12 Q1 2020 Sequential Year over Year Months Brokerage and Trading $50.8 15.8% 60.6% 12.0% Transaction Card 21.9 (3.0)% 5.5% 1.3% Fiduciary and Asset Management 44.5 (1.3)% 2.5% 0.6% Deposit Service Charges and Fees 26.1 (4.4)% (7.5)% (1.9)% Mortgage Banking 37.2 46.3% 55.9% 12.4% Other Revenue 12.3 (19.5)% (3.5)% (0.8)% Total Fees and Commissions $192.7 7.4% 20.0% 4.6% • Brokerage and Trading continued outperformance due to lower rate environment coupled with market volatility. Q1 MBS/TBA trading revenues were $31.7 million, a 40% increase over linked quarter • Fiduciary and Asset Management while down, is outperforming equity markets better than expected • Mortgage Banking lower rate environment spurred strong refinance and purchase volumes • Other Revenue down largely due to a decrease in repossessed asset revenue. This is offset by a reduction of expenses 21

Expenses %Incr. %Incr. ($mil) Q1 2020 Q4 2019 Q1 2019 Seq. YOY Personnel expense $156.2 $168.4 $169.2 (7.3)% (7.7)% Other operating expense $112.4 $120.4 $117.9 (6.6)% (4.7)% Total operating expense $268.6 $288.8 $287.2 (7.0)% (6.5)% Efficiency Ratio 58.62% 63.65% 64.80% • Personnel expense down $12.2 million largely due to decreases in incentive- based compensation and regular compensation • Non-personnel expense down primarily due to decreased mortgage banking costs and business promotion expense • Adds to staff and replacement positions all under CEO approval • Non-essential IT and other projects delayed to offset the less than favorable operating environment • Investments in critical client enhancement initiatives and company infrastructure will continue 22

Liquidity & Capital Q1 2020 Q4 2019 Q1 2019 Loan to Deposit Ratio 76.8% 78.7% 85.9% Period End Deposits $29.2 billion $27.6 billion $25.3 billion Available secured wholesale $12.8 billion - - borrowing capacity Common Equity Tier 1 10.9% 11.4% 10.7% Total Capital Ratio 12.5% 12.9% 12.2% Tangible Common Equity Ratio 8.4% 9.0% 8.6% • Deposit activity strong with additional ability to raise deposits • Over $12 billion of secured borrowing capacity and $7 billion of contingent liquidity capacity • CET1 and Total Capital are 390bp and 200bp above well-capitalized, respectively • BOKF N.A., the primary source of holding company liquidity, was placed on negative outlook but “A”-rating was reaffirmed recently by S&P and Moody’s 23

Steven G. Bradshaw Chief Executive Officer Closing Remarks 24

Question and Answer Session 25