Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERICAN CAMPUS COMMUNITIES INC | ex991-q12020earningsre.htm |

| 8-K - 8-K - AMERICAN CAMPUS COMMUNITIES INC | a2020q1earningsrelease.htm |

Q1 Supplemental Package April 20, 2020 Table of Contents Financial Highlights S-1 Consolidated Balance Sheets S-2 Consolidated Statements of Comprehensive Income S-3 Consolidated Statements of Funds from Operations S-4 Owned Properties Results of Operations S-5 Same Store Owned Properties Operating Expenses S-6 Seasonality of Operations S-7 COVID-19 Leasing Update S-8 Investment Update S-9 Owned Development Update S-10 Third-Party Development Update S-11 Management Services Update S-12 Capital Structure S-13 Interest Coverage S-14 Capital Allocation – Long Term Funding Plan (2020-2023) S-15 Detail of Property Groupings S-16 Definitions S-17 Investor Information S-19

Financial Highlights ($ in thousands, except share and per share data) Operating Data Three Months Ended March 31, 2020 2019 $ Change % Change Total revenues $ 249,404 $ 242,131 $ 7,273 3.0% Operating income 115,486 58,999 56,487 95.7% Net income attributable to ACC 80,855 29,640 51,215 172.8% Net income per share - basic and diluted 0.58 0.21 Funds From Operations - ("FFO") 1 95,935 98,377 (2,442) (2.5%) FFO per share - diluted 1 0.69 0.71 (0.02) (2.8%) Funds From Operations - Modified ("FFOM") 1 97,562 95,327 2,235 2.3% FFOM per share - diluted 1 0.70 0.69 0.01 1.4% Market Capitalization and Unsecured Notes Covenants 2 March 31, 2020 December 31, 2019 Debt to total market capitalization 47.9% 34.3% Net debt to EBITDA 3 6.9x 6.7x Unencumbered asset value to total asset value 83.2% 82.5% Total debt to total asset value 41.0% 39.8% Secured debt to total asset value 8.6% 9.1% Unencumbered asset value to unsecured debt 257.3% 269.5% Interest coverage 3 3.6x 3.8x 1. Refer to page S-4 for a reconciliation to net income, the most directly comparable GAAP measure. 2. Refer to the definitions outlined on pages S-17 and S-18 for detailed definitions of terms appearing on this page. 3. Refer to calculations on page S-14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures. S-1

Consolidated Balance Sheets ($ in thousands) March 31, 2020 December 31, 2019 (unaudited) Assets Investments in real estate: Owned properties, net $ 6,636,857 $ 6,694,715 On-campus participating properties, net 73,716 75,188 Investments in real estate, net 6,710,573 6,769,903 Cash and cash equivalents 176,758 54,650 Restricted cash 32,130 26,698 Student contracts receivable, net 12,287 13,470 Operating lease right of use assets 1 459,957 460,857 Other assets 1 228,051 234,176 Total assets $ 7,619,756 $ 7,559,754 Liabilities and equity Liabilities: Secured mortgage, construction and bond debt, net $ 749,902 $ 787,426 Unsecured notes, net 1,981,472 1,985,603 Unsecured term loans, net 199,209 199,121 Unsecured revolving credit facility 609,700 425,700 Accounts payable and accrued expenses 53,086 88,411 Operating lease liabilities 2 477,779 473,070 Other liabilities 2 178,702 157,368 Total liabilities 4,249,850 4,116,699 Redeemable noncontrolling interests 17,768 104,381 Equity: American Campus Communities, Inc. and Subsidiaries stockholders' equity: Common stock 1,375 1,373 Additional paid in capital 4,467,906 4,458,456 Common stock held in rabbi trust (3,615) (3,486) Accumulated earnings and dividends (1,129,108) (1,144,721) Accumulated other comprehensive loss (26,747) (16,946) Total American Campus Communities, Inc. and Subsidiaries stockholders' equity 3,309,811 3,294,676 Noncontrolling interests - partially owned properties 42,327 43,998 Total equity 3,352,138 3,338,674 Total liabilities and equity $ 7,619,756 $ 7,559,754 1. For purposes of calculating net asset value ("NAV") at March 31, 2020, the company excludes other assets of approximately $3.9 million related to net deferred financing costs on its revolving credit facility and the net value of in-place leases, as well as operating lease right of use assets disclosed above. 2. For purposes of calculating NAV at March 31, 2020, the company excludes other liabilities of approximately $50.6 million related to deferred revenue and fee income, as well as operating lease liabilities disclosed above. S-2

Consolidated Statements of Comprehensive Income (Unaudited, $ in thousands, except share and per share data) Three Months Ended March 31, 2020 2019 $ Change Revenues Owned properties $ 232,091 $ 224,419 $ 7,672 On-campus participating properties 10,709 11,448 (739) Third-party development services 2,055 3,171 (1,116) Third-party management services 3,829 2,311 1,518 Resident services 720 782 (62) Total revenues 249,404 242,131 7,273 Operating expenses Owned properties 92,474 92,169 305 On-campus participating properties 3,366 3,957 (591) Third-party development and management services 6,207 4,186 2,021 General and administrative 1 10,158 7,315 2,843 Depreciation and amortization 66,169 68,755 (2,586) Ground/facility leases 4,069 3,549 520 Gain from disposition of real estate (48,525) — (48,525) Provision for impairment 2 — 3,201 (3,201) Total operating expenses 133,918 183,132 (49,214) Operating income 115,486 58,999 56,487 Nonoperating income (expenses) Interest income 851 926 (75) Interest expense (27,783) (27,061) (722) Amortization of deferred financing costs (1,287) (1,132) (155) Loss from early extinguishment of debt 3 (4,827) — (4,827) Total nonoperating expenses (33,046) (27,267) (5,779) Income before income taxes 82,440 31,732 50,708 Income tax provision (379) (364) (15) Net income 82,061 31,368 50,693 Net income attributable to noncontrolling interests (1,206) (1,728) 522 Net income attributable to ACC, Inc. and Subsidiaries common stockholders $ 80,855 $ 29,640 $ 51,215 Other comprehensive loss Change in fair value of interest rate swaps and other (9,801) (5,794) (4,007) Comprehensive income $ 71,054 $ 23,846 $ 47,208 Net income per share attributable to ACC, Inc. and Subsidiaries common stockholders Basic and diluted $ 0.58 $ 0.21 Weighted-average common shares outstanding Basic 137,477,169 137,101,535 Diluted 138,587,513 138,152,378 1. General and administrative expenses for the three months ended March 31, 2020 include $1.1 million related to the settlement of a litigation matter. 2. Represents an impairment charge recorded in March 2019 concurrent with the classification of one owned property as held for sale. 3. Represents loss associated with the January 2020 redemption of the Company's $400 million 3.35% Senior Notes originally scheduled to mature in October 2020. S-3

Consolidated Statements of Funds from Operations ("FFO") (Unaudited, $ in thousands, except share and per share data) Three Months Ended March 31, 2020 2019 $ Change Net income attributable to ACC, Inc. and Subsidiaries common stockholders $ 80,855 $ 29,640 $ 51,215 Noncontrolling interests' share of net income 1,206 1,728 (522) Joint Venture ("JV") partners' share of FFO JV partners' share of net income (916) (1,568) 652 JV partners' share of depreciation and amortization (1,965) (2,157) 192 (2,881) (3,725) 844 Gain from disposition of real estate (48,525) — (48,525) Elimination of provision for real estate impairment — 3,201 (3,201) Total depreciation and amortization 66,169 68,755 (2,586) Corporate depreciation 1 (889) (1,222) 333 FFO attributable to common stockholders and OP unitholders 95,935 98,377 (2,442) Elimination of operations of on-campus participating properties ("OCPPs") Net income from OCPPs (3,706) (3,692) (14) Amortization of investment in OCPPs (2,037) (2,029) (8) 90,192 92,656 (2,464) Modifications to reflect operational performance of OCPPs Our share of net cashflow 2 860 882 (22) Management fees and other 583 820 (237) Contribution from OCPPs 1,443 1,702 (259) Elimination of loss from early extinguishment of debt 3 4,827 — 4,827 Elimination of FFO from property in receivership 4 — 969 (969) Elimination of litigation settlement expense 5 1,100 — 1,100 Funds from operations-modified ("FFOM") attributable to common stockholders and OP unitholders $ 97,562 $ 95,327 $ 2,235 FFO per share - diluted $ 0.69 $ 0.71 FFOM per share - diluted $ 0.70 $ 0.69 Weighted-average common shares outstanding - diluted 139,091,230 138,811,527 1. Represents depreciation on corporate assets not added back for purposes of calculating FFO. 2. 50% of the properties’ net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures which is included in ground/ facility leases expense in the consolidated statements of comprehensive income (refer to page S-3). 3. Represents loss associated with the January 2020 redemption of the company's $400 million 3.35% Senior Notes originally scheduled to mature in October 2020. 4. Represents FFO for an owned property that was transferred to the lender in July 2019 in settlement of the property's mortgage loan. 5. Represents the settlement of a litigation matter that is included in general and administrative expenses in the accompanying consolidated statements of comprehensive income. S-4

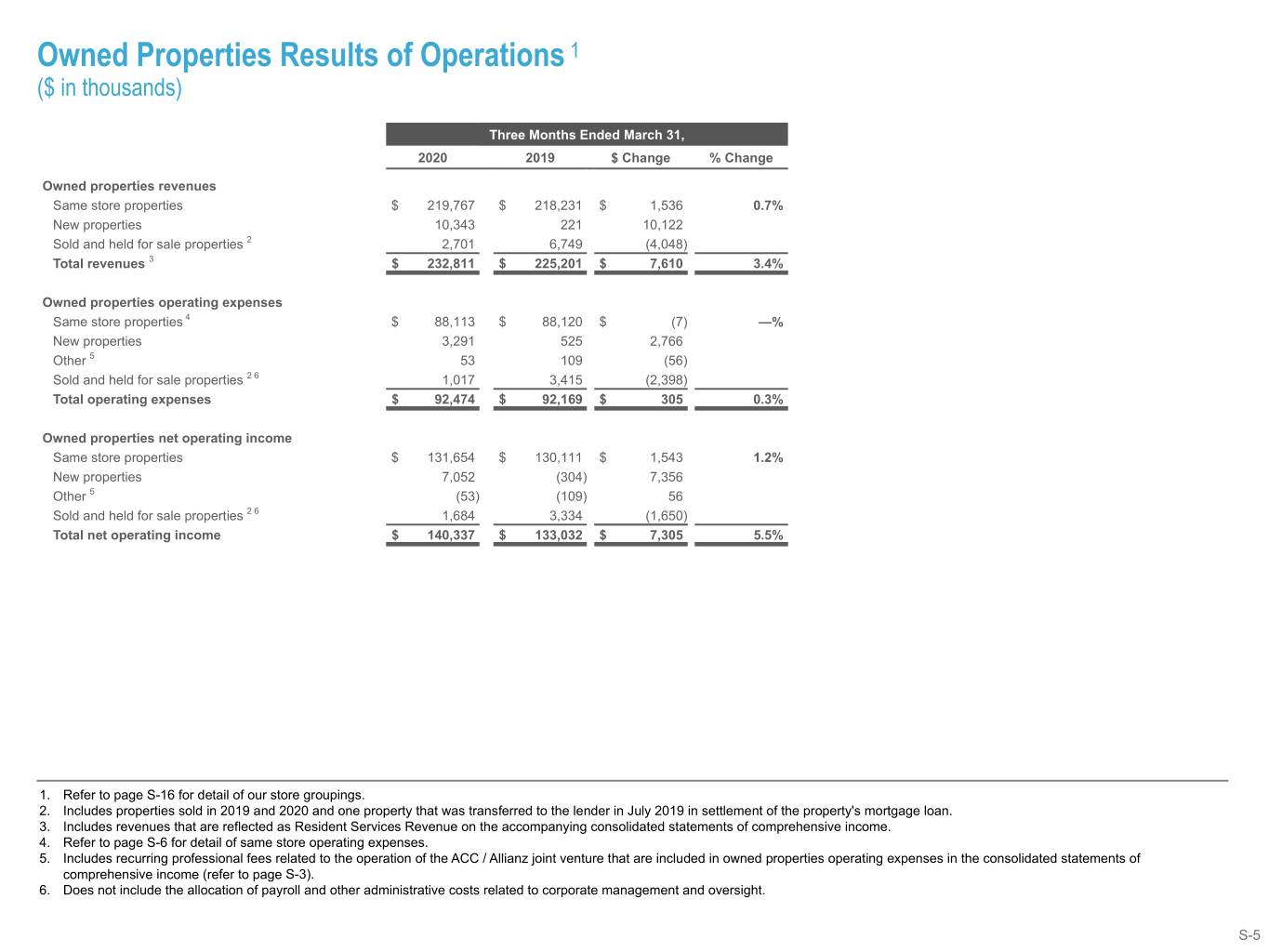

Owned Properties Results of Operations 1 ($ in thousands) Three Months Ended March 31, 2020 2019 $ Change % Change Owned properties revenues Same store properties $ 219,767 $ 218,231 $ 1,536 0.7% New properties 10,343 221 10,122 Sold and held for sale properties 2 2,701 6,749 (4,048) Total revenues 3 $ 232,811 $ 225,201 $ 7,610 3.4% Owned properties operating expenses Same store properties 4 $ 88,113 $ 88,120 $ (7) —% New properties 3,291 525 2,766 Other 5 53 109 (56) Sold and held for sale properties 2 6 1,017 3,415 (2,398) Total operating expenses $ 92,474 $ 92,169 $ 305 0.3% Owned properties net operating income Same store properties $ 131,654 $ 130,111 $ 1,543 1.2% New properties 7,052 (304) 7,356 Other 5 (53) (109) 56 Sold and held for sale properties 2 6 1,684 3,334 (1,650) Total net operating income $ 140,337 $ 133,032 $ 7,305 5.5% 1. Refer to page S-16 for detail of our store groupings. 2. Includes properties sold in 2019 and 2020 and one property that was transferred to the lender in July 2019 in settlement of the property's mortgage loan. 3. Includes revenues that are reflected as Resident Services Revenue on the accompanying consolidated statements of comprehensive income. 4. Refer to page S-6 for detail of same store operating expenses. 5. Includes recurring professional fees related to the operation of the ACC / Allianz joint venture that are included in owned properties operating expenses in the consolidated statements of comprehensive income (refer to page S-3). 6. Does not include the allocation of payroll and other administrative costs related to corporate management and oversight. S-5

Same Store Owned Properties Operating Expenses 1 2 ($ in thousands, except per bed amounts) Three Months Ended March 31, 2020 2019 % Change % of Total % of Total From Prior Operating Operating Total Per Bed Year Expenses Total Per Bed Expenses Property taxes $ 21,609 $ 235 2.3% 24% $ 21,130 $ 229 24% General & administrative and other 19,116 207 (3.1%) 21% 19,729 214 22% Utilities 18,229 198 (2.2%) 21% 18,633 202 21% Payroll 17,505 190 6.9% 20% 16,373 178 19% Repairs and maintenance 5,728 62 (5.6%) 7% 6,067 66 7% Marketing 3,605 39 (10.6%) 4% 4,032 44 5% Insurance 2,321 25 7.7% 3% 2,156 23 2% Total same store owned operating expenses $ 88,113 $ 956 — % 100% $ 88,120 $ 956 100% Same store owned beds 92,195 1. Refer to the definition of operating expenses on page S-18 for a detailed description of items included in the various expense categories. 2. Refer to page S-16 for detail of our same store groupings. S-6

Seasonality of Operations 1 ($ in thousands, except per bed amounts) Three Months Ended Total/Weighted Average- March 31, 2019 June 30, 2019 September 30, 2019 December 31, 2019 March 31, 2020 Last 12 Months 2020 Same Store Properties Average number of owned beds 92,195 92,195 92,195 92,195 92,195 92,195 Average physical occupancy for the quarter 96.9 % 88.7 % 88.9% 97.4% 97.0% 93.0% Rental revenue per occupied bed per month 2 $ 767 $ 746 $ 750 $ 783 $ 777 $ 765 Rental revenue $ 205,469 $ 183,023 $ 184,529 $ 210,989 $ 208,484 $ 787,025 Other income 3 12,762 14,377 17,035 13,339 11,283 56,034 Total revenue $ 218,231 $ 197,400 $ 201,564 $ 224,328 $ 219,767 $ 843,059 Property operating expenses 88,120 87,043 106,526 90,237 88,113 371,919 Net operating income $ 130,111 $ 110,357 $ 95,038 $ 134,091 $ 131,654 $ 471,140 Operating margin 59.6 % 55.9 % 47.2% 59.8% 59.9% 55.9% 2020 New Properties Average number of owned beds — — 1,432 3,159 3,159 1,938 Average physical occupancy for the quarter — % — % 95.0% 98.8% 97.7% 97.6% Rental revenue per occupied bed per month 2 $ — $ — $ 1,020 $ 1,069 $ 1,067 $ 1,059 Rental revenue $ — $ — $ 4,163 $ 10,010 $ 9,876 $ 24,049 Other income 3 221 222 504 573 467 1,766 Total revenue $ 221 $ 222 $ 4,667 $ 10,583 $ 10,343 $ 25,815 Property operating expenses 525 659 2,608 3,608 3,291 10,166 Net operating (loss) income $ (304) $ (437) $ 2,059 $ 6,975 $ 7,052 $ 15,649 Operating margin (137.6)% (196.8)% 44.1% 65.9% 68.2% 60.6% ALL PROPERTIES Average number of owned beds 92,195 92,195 93,627 95,354 95,354 94,133 Average physical occupancy for the quarter 96.9 % 88.7 % 89.0% 97.5% 97.0% 93.1% Rental revenue per occupied bed per month 2 $ 767 $ 746 $ 755 $ 792 $ 787 $ 771 Rental revenue $ 205,469 $ 183,023 $ 188,692 $ 220,999 $ 218,360 $ 811,074 Other income 3 12,983 14,599 17,539 13,912 11,750 57,800 Total revenue $ 218,452 $ 197,622 $ 206,231 $ 234,911 $ 230,110 $ 868,874 Property operating expenses 88,645 87,702 109,134 93,845 91,404 382,085 Net operating income $ 129,807 $ 109,920 $ 97,097 $ 141,066 $ 138,706 $ 486,789 Operating margin 59.4 % 55.6 % 47.1% 60.1% 60.3% 56.0% Sold, held for sale properties and other 4 Total revenue $ 6,749 $ 6,281 $ 5,577 $ 4,886 $ 2,701 $ 19,445 Property operating expenses 3,524 3,061 2,702 2,051 1,070 8,884 Net operating income $ 3,225 $ 3,220 $ 2,875 $ 2,835 $ 1,631 $ 10,561 1. Refer to page S-16 for detail of our store groupings. 2. Rental revenue per occupied bed per month is calculated based upon our net student rental revenue earned during the respective quarter divided by average monthly occupied beds over the periods presented. 3. Other income is all income other than net student rent. This includes, but is not limited to, utility income, damages, parking income, summer conference rent, application and administration fees, income from retail tenants, and the provision for uncollectible accounts. 4. Includes properties sold during the periods presented and costs related to the operation of the ACC / Allianz joint venture as noted on page S-5. S-7

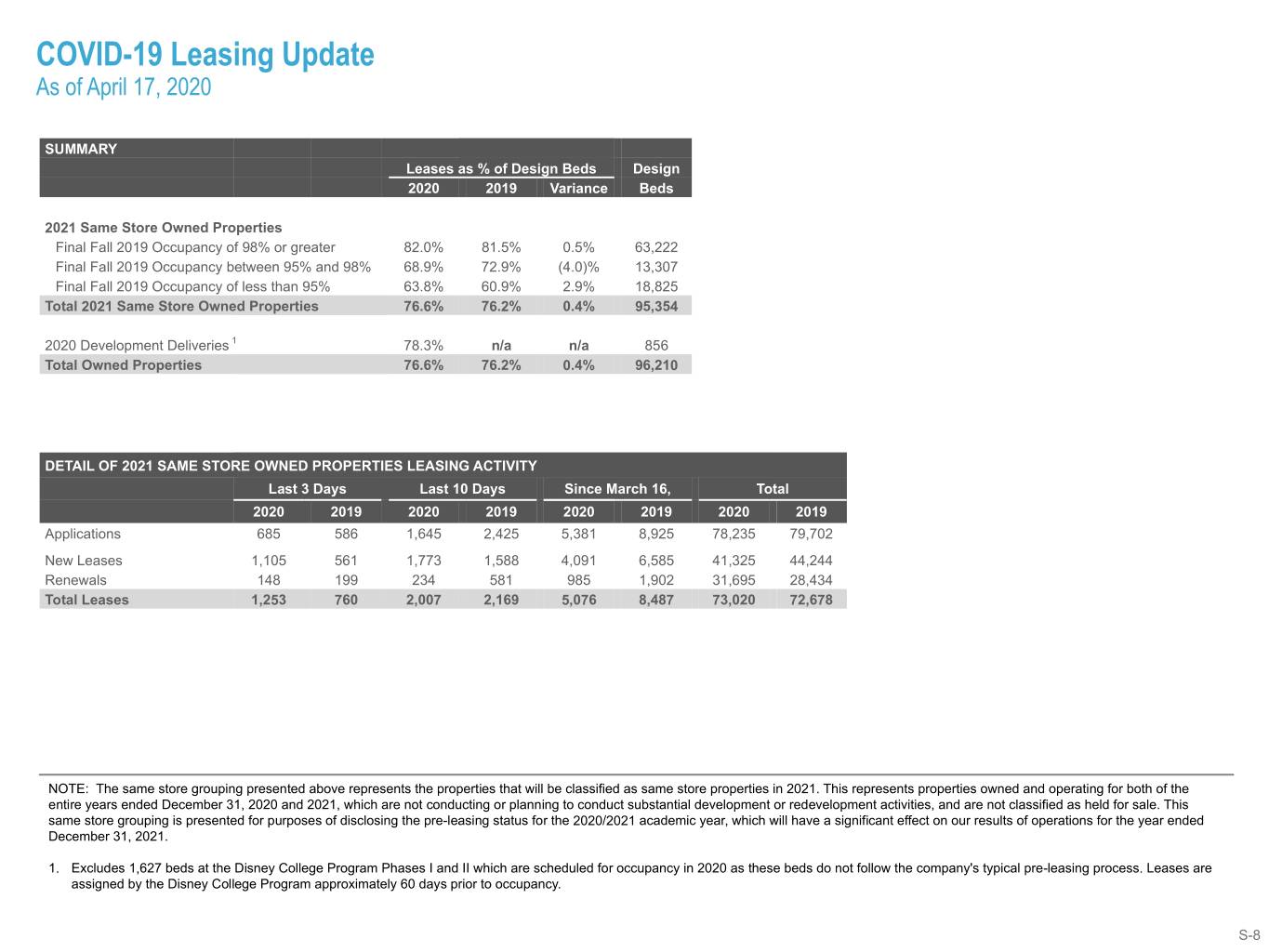

COVID-19 Leasing Update As of April 17, 2020 SUMMARY Leases as % of Design Beds Design 2020 2019 Variance Beds 2021 Same Store Owned Properties Final Fall 2019 Occupancy of 98% or greater 82.0% 81.5% 0.5% 63,222 Final Fall 2019 Occupancy between 95% and 98% 68.9% 72.9% (4.0)% 13,307 Final Fall 2019 Occupancy of less than 95% 63.8% 60.9% 2.9% 18,825 Total 2021 Same Store Owned Properties 76.6% 76.2% 0.4% 95,354 2020 Development Deliveries 1 78.3% n/a n/a 856 Total Owned Properties 76.6% 76.2% 0.4% 96,210 DETAIL OF 2021 SAME STORE OWNED PROPERTIES LEASING ACTIVITY Last 3 Days Last 10 Days Since March 16, Total 2020 2019 2020 2019 2020 2019 2020 2019 Applications 685 586 1,645 2,425 5,381 8,925 78,235 79,702 New Leases 1,105 561 1,773 1,588 4,091 6,585 41,325 44,244 Renewals 148 199 234 581 985 1,902 31,695 28,434 Total Leases 1,253 760 2,007 2,169 5,076 8,487 73,020 72,678 NOTE: The same store grouping presented above represents the properties that will be classified as same store properties in 2021. This represents properties owned and operating for both of the entire years ended December 31, 2020 and 2021, which are not conducting or planning to conduct substantial development or redevelopment activities, and are not classified as held for sale. This same store grouping is presented for purposes of disclosing the pre-leasing status for the 2020/2021 academic year, which will have a significant effect on our results of operations for the year ended December 31, 2021. 1. Excludes 1,627 beds at the Disney College Program Phases I and II which are scheduled for occupancy in 2020 as these beds do not follow the company's typical pre-leasing process. Leases are assigned by the Disney College Program approximately 60 days prior to occupancy. S-8

Investment Update ($ in thousands) DISPOSITIONS Extinguished Project Location Primary University Served Beds Closing Date Sales Price Mortgage Debt The Varsity College Park, MD University of Maryland 901 March 20, 2020 $ 148,000 $ — S-9

Owned Development Update ($ in thousands) OWNED DEVELOPMENT PROJECTS UNDER CONSTRUCTION 1 2 Primary University / Project Estimated Total Costs Incurred as Scheduled Project Location Market Served Type Beds Project Cost 3 of March 31, 2020 4 Completion Disney College Program Phases I-II 5 6 Orlando, FL Walt Disney World® Resort ACE 1,627 $ 108,500 $ 96,113 May & Aug 2020 Currie Hall Phase II Los Angeles, CA Univ. of Southern California ACE 272 42,000 32,531 August 2020 Holloway Residences San Francisco, CA San Francisco State Univ. ACE 584 129,200 107,475 August 2020 SUBTOTAL - 2020 DELIVERIES 2,483 $ 279,700 $ 236,119 5 7 ® Jan, May & Aug Disney College Program Phases III-V Orlando, FL Walt Disney World Resort ACE 3,369 $ 190,400 $ 130,262 2021 SUBTOTAL - 2021 DELIVERIES 3,369 $ 190,400 $ 130,262 5 8 ® Jan, May & Aug Disney College Program Phases VI-VIII Orlando, FL Walt Disney World Resort ACE 3,235 $ 193,000 $ 43,580 2022 SUBTOTAL - 2022 DELIVERIES 3,235 $ 193,000 $ 43,580 Disney College Program Phases IX-X 5 9 Orlando, FL Walt Disney World® Resort ACE 2,209 $ 122,700 $ 20,506 Jan & May 2023 SUBTOTAL - 2023 DELIVERIES 2,209 $ 122,700 $ 20,506 1. Although the company currently anticipates completing these projects on time and within budget, the project locations are currently subject to “shelter in place” or “stay at home” orders adopted by state and local authorities in response to the COVID-19 pandemic. Some of these orders may adversely affect the timely completion and final project costs of some or all of our projects under development if, for example, we are required to temporarily cease construction entirely, experience delays in obtaining governmental permits and authorizations, or experience disruption in the supply of materials or labor. Additionally, in response to the pandemic, Walt Disney World ® Resort has closed and has not announced a reopening date. Although completion is currently anticipated to occur as originally scheduled, the ultimate occupancy date and levels will depend on the reopening date. As such, the effect on the projects’ initial operating results cannot be determined. 2. Does not include land parcels in nine university markets totaling $55.9 million. 3. In certain instances at ACE properties, the company agrees to construct spaces within the property that will ultimately be owned, managed, and funded by the universities. Such spaces include but are not limited to dining, childcare, retail, academic, and office facilities. Estimated Project Cost excludes the costs of the construction of such facilities, as they will be reimbursed by the universities. 4. Includes $426.5 million in construction in progress ("CIP") and excludes $10.7 million of CIP balances related to ongoing renovation projects at operating properties. Total consolidated CIP as of March 31, 2020 was $437.2 million. 5. The company executed two ground lease agreements with Walt Disney World® Resort to develop, own and manage housing for college students participating in the Disney student internship program (the “Disney College Program”). The development will be delivered in multiple phases from 2020-2023. 6. Phase I, with estimated project costs of $61.6 million and 778 beds, is scheduled for completion in May 2020. Phase II, with estimated project costs of $46.9 million and 849 beds, is scheduled for occupancy in August 2020. 7. Phase III, with estimated project costs of $54.4 million and 984 beds, is scheduled for occupancy in January 2021. Phase IV, with estimated project costs of $84.5 million and 1,521 beds, is scheduled for occupancy in May 2021. Phase V, with estimated project costs of $51.5 million and 864 beds, is scheduled for occupancy in August 2021. 8. Phase VI, with estimated project costs of $61.3 million and 867 beds, is scheduled for occupancy in January 2022. Phase VII, with estimated project costs of $90.3 million and 1,632 beds, is scheduled for occupancy in May 2022. Phase VIII, with estimated project costs of $41.4 million and 736 beds, is scheduled for occupancy in August 2022. 9. Phase IX, with estimated project costs of $81.5 million and 1,473 beds, is scheduled for occupancy in January 2023. Phase X , with estimated project costs of $41.2 million and 736 beds, is scheduled for occupancy in May 2023. S-10

Third-Party Development Update ($ in thousands) Three Months Ended March 31, 2020 2019 $ Change Development services revenue $ 2,055 1 $ 3,171 $ (1,116) % of total revenue 0.8% 1.3% CONTRACTED PROJECTS IN PROGRESS Fees Earned Fees Remaining Fees as of Earned in as of Scheduled Project Location Primary University Served Beds Total Fees March 31, 2020 Current Year March 31, 2020 Completion Prairie View A&M University Phase IX Prairie View, TX Prairie View A&M University 540 $ 2,500 $ 1,848 $ 116 $ 652 August 2020 Dundee Residence Hall and Glasgow Riverside, CA University of California, Riverside 820 5,000 3,793 213 1,207 August 2020 Dining Hall University of California - Riverside North Riverside, CA University of California, Riverside 1,502 6,700 4,099 265 2,601 September 2021 District Phase I 2,862 $ 14,200 $ 9,740 $ 594 $ 4,460 ON-CAMPUS AWARD PIPELINE 2 Anticipated Anticipated Targeted Estimated Project Location Financing Structure Commencement Completion Fees Georgetown University - Capitol Campus Washington, D.C. Third-party Q3 2020 Summer 2022 $3,000 Housing 3 Upper Hearst Development for the Berkeley, CA Third-party Q3 2020 Summer 2022 $3,000 Goldman School of Public Policy 4 University of California Irvine Phase V Irvine, CA Third-party Q3 2020 Summer 2022 $5,000 Concordia University Phase II Austin, TX Third-party Q4 2020 Summer 2022 $1,000 MIT Family & Graduate Housing Cambridge, MA ACE Q3 / Q4 2021 Fall 2023 N/A Northeastern University - Phase II Boston, MA ACE Q1 / Q2 2022 Fall 2024 N/A Princeton University Lake Campus Princeton, NJ TBD TBD TBD TBD Graduate Housing University of California Berkeley Master Berkeley, CA TBD TBD TBD TBD Development 5 University of California Riverside Master Riverside, CA Third-party TBD TBD TBD Development 5 West Virginia University Master Morgantown, WV TBD TBD TBD TBD Development 5 Virginia Commonwealth University Richmond, VA TBD TBD TBD TBD (Honors College) 1. Includes $0.7 million of construction savings revenue related to one project delivered in Fall 2019. 2. These awards relate to speculative development projects that are subject to final determination of feasibility, negotiation, final award, procurement rules and other applicable law, execution and closing of definitive agreements on terms acceptable to the company, and fluctuations in the construction and financing markets. Anticipated commencement and fees are dependent upon the availability of project financing, which is affected by current capital market conditions. 3. As of March 31, 2020, the company has earned $0.7 million in pre-construction revenues related to the project. 4. Anticipated commencement and targeted completion dates may be affected by the outcome of a lawsuit filed by the city of Berkeley against the University. 5. These projects include multiple phases to be completed over several years. The full scope, transaction structure, feasibility, fees, and timing will be negotiated. S-11

Management Services Update ($ in thousands) Three Months Ended March 31, 2020 2019 $ Change Management services revenue $ 3,829 $ 2,311 $ 1,518 % of total revenue 1.5% 1.0% NEW / PENDING MANAGEMENT CONTRACTS Actual or Approximate Stabilized Anticipated Project Location Primary University / Market Served Beds Annual Fees 1 Commencement The Oasis KGI Commons Claremont, CA Keck Graduate Institute 419 $ 235 April 2020 Nevada State College 2 Henderson, NV Nevada State College 342 100 August 2020 Prairie View A&M University Phase IX Prairie View, TX Prairie View A&M University 540 190 August 2020 Dundee Residence Hall and Glasgow Dining Hall Riverside, CA University of California, Riverside 820 440 September 2020 University of California - Riverside North District Riverside, CA University of California, Riverside 1,502 540 September 2021 Phase I 3,623 $ 1,505 DISCONTINUED MANAGEMENT CONTRACTS 2020 Fee Contribution Prior to Project Location Primary University / Market Served Beds Termination Discontinued As Of The Rixey Arlington, VA Marymount University 531 $ 4 January 2020 Spinner Place Burlington, VT University of Vermont 312 18 April 2020 843 $ 22 1. Stabilized annual fees are dependent upon the achievement of anticipated occupancy levels. 2. The stabilized annual fee amount does not include an initial operations fee of $140,000 earned from May 2019 through July 2020. S-12

Capital Structure as of March 31, 2020 1 ($ in millions, except per share data) Market Capitalization & Unsecured Notes Covenants Debt Maturity Schedule Total Debt 2 $ 3,556 Total Equity Market Value 3 3,863 Total Market Capitalization 7,419 Debt to Total Market Capitalization 47.9% Net Debt to EBITDA 4 6.9x Total Asset Value 5 $ 8,683 Unencumbered Asset Value 7,228 Unencumbered Asset Value to Total Asset Value 83.2% Requirement Current Ratio Total Debt to Total Asset Value ≤ 60% 41.0% Secured Debt to Total Asset Value ≤ 40% 8.6% Unencumbered Asset Value to Unsecured Debt > 150% 257.3% Interest Coverage 4 > 1.5x 3.6x Weighted Average Principal Average Term To Outstanding ² Interest Rate Maturity Mortgage Loans 6 $ 658 4.4% 7 5.3 Yrs Unsecured Revolving Credit Facility 610 2.1% 2.0 Yrs Unsecured Term Loan 200 2.5% 2.2 Yrs Unsecured Notes 2,000 3.6% 6.2 Yrs On-Campus Participating Properties 88 4.8% 13.0 Yrs Total/Weighted Average $ 3,556 3.5% 5.3 Yrs Variable Rate Debt as % of Total Debt 8 17.2% Weighted Average Interest Rate Of Debt Maturing Each Year Fixed Rate Debt N/A 5.4% 2.9% 3.8% 4.2% N/A 3.7% 3.6% 4.1% 2.9% Total Debt N/A 5.2% 2.3% 3.9% 4.2% 7.6% 3.7% 3.6% 4.1% 2.9% 1. Refer to the definitions outlined on pages S-17 and S-18 for detailed definitions of terms appearing on this page. 2. Excludes net unamortized debt premiums related to mortgage loans assumed in connection with acquisitions of $5.0 million, unamortized original issue discount on unsecured notes of $2.8 million, and unamortized deferred financing costs of $18.1 million. 3. Based on share price of $27.75 and fully diluted share count of 139,213,331 as of March 31, 2020. Assumes conversion of 503,717 common and preferred Operating Partnership units and 1,105,167 unvested restricted stock awards. 4. Refer to calculations on page S-14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures. 5. Excludes accumulated depreciation of $1.6 billion, receivables and intangible assets, net of accumulated amortization, of $53.7 million, and lease-related right of use assets of $460.0 million. 6. Includes $330.0 million of mortgage debt related to the ACC / Allianz joint venture of which the company has a 55% interest. 7. Including the amortization of net debt premiums related to mortgage loans assumed in connection with property acquisitions, the effective interest rate for fixed rate mortgage loans is 3.9%. 8. The company's variable rate debt consists of the unsecured revolving credit facility and $2.9 million of mortgage debt at one of our on-campus participating properties. S-13

Interest Coverage 1 ($ in thousands) Three Months Ended June 30, September 30, December 31, March 31, Last Twelve 2019 2019 2019 2020 Months Net income attributable to ACC, Inc. and Subsidiaries common stockholders $ 10,386 $ 20,223 $ 24,720 $ 80,855 $ 136,184 Net (loss) income attributable to noncontrolling interests (176) (887) 1,128 1,206 1,271 Interest expense 27,068 28,303 28,855 27,783 112,009 Income tax provision 314 305 524 379 1,522 Depreciation and amortization 68,815 68,930 68,546 66,169 272,460 Amortization of deferred financing costs 1,218 1,315 1,347 1,287 5,167 Share-based compensation 3,745 3,104 3,003 3,988 13,840 Provision for real estate impairment — — 14,013 — 14,013 (Gain) loss on extinguishment of debt, net — (20,992) — 4,827 (16,165) Loss (gain) from disposition of real estate 282 — (229) (48,525) (48,472) Earnings Before Interest, Taxes, Depreciation, and Amortization ("EBITDA") $ 111,652 $ 100,301 $ 141,907 $ 137,969 $ 491,829 Pro-forma adjustments to EBITDA 2 (2,726) Adjusted EBITDA $ 489,103 Interest Expense from consolidated statement of comprehensive income $ 27,068 $ 28,303 $ 28,855 $ 27,783 $ 112,009 Amortization of mortgage debt premiums/discounts 1,246 1,212 1,233 1,411 5,102 Capitalized interest 3,623 3,072 2,669 3,246 12,610 Change in accrued interest payable 5,060 (2,013) 2,942 2,886 8,875 Cash Interest Expense $ 36,997 $ 30,574 $ 35,699 $ 35,326 $ 138,596 Pro-forma adjustments to Cash Interest Expense 2 (1,981) Adjusted Interest Expense $ 136,615 Interest Coverage 3.6x 1. Refer to pages S-17 and S-18 for detailed definitions of terms appearing on this page. 2. Adjustment to reflect all acquisitions, development deliveries, dispositions, debt repayments, and debt refinancings as if such transactions had occurred on the first day of the 12 month period presented. S-14

Capital Allocation – Long Term Funding Plan (2020-2023) ($ in millions) Sources and Uses for Development - As of March 31, 2020 Estimated Project Total Costs Remaining Estimated Capital Uses: Cost Incurred Capital Needs Development and Presale Development Pipeline 1 2020 Developments Underway or Expected to Start in Current Year $ 171 $ 140 $ 31 Disney Internships & College Program Housing Phases I-II (2020 deliveries) 109 96 13 Phases III-V (2021 deliveries) 190 130 60 Phases VI-VIII (2022 deliveries) 193 44 149 Phases IX-X (2023 deliveries) 123 21 102 Total $ 786 $ 431 $ 355 Estimated Sources through 2023: Capital Sources Cash and Cash Equivalents as of March 31, 2020 $ 177 Estimated Cash Flow Available for Investment - through 2023 2 306 Anticipated Debt (Repayment) / Funding - through 2023 3 (505) to (305) Anticipated Capital Recycling and/or Equity Funding - through 2023 3 377 to 177 Total $ 355 Selected Credit Metrics 4 Credit Metric: March 31, 2020 Pro Forma 5 Total Debt to Total Asset Value 41.0% 34.4% - 36.7% Net Debt to EBITDA 6 6.9x 5.6x - 6.1x Note: This analysis demonstrates anticipated funding for the developments currently committed, underway, or with expected starts in the current year. As future developments commence, they are expected to be funded via additional dispositions, joint ventures, free cash available for investment, and capital market transactions. 1. Includes owned development projects under construction and management’s Estimated Project Cost for future development deliveries that are expected to commence construction during the current year, as disclosed on page S-10. 2. Available cash flow is derived from disclosures in our 2019 Form 10-K and is calculated as net cash provided by operating activities of $370.4 million, excluding changes in working capital of $8.7 million plus interest rate swap related items of $12.0 million, less dividend payments of $258.6 million, less principal payments on debt of $11.9 million, less recurring capital expenditures of $21.5 million. Calculation results in available cash flow for investment in 2019 of $81.7 million, which is then annualized over the remaining 15 quarters through the end of 2023. The global disruption associated with the COVID-19 pandemic could have a material impact on the company's future cash flows and liquidity position, the magnitude of which is uncertain. Therefore, no assurances can be made that future cash flows will be consistent with historical levels. 3. Reflects the company's current anticipated capital sources to fund committed developments through 2023. The actual mix of capital sources may vary based on prevailing capital market conditions and the company's balance sheet management strategy. 4. Refer to definitions outlined on pages S-17 and S-18 for detailed definitions of terms appearing on this page. 5. Ratios represent the pro forma impact of development deliveries and funding alternatives assumed in the Sources and Uses table. The lower end of the pro forma leverage ranges assumes remaining capital needs in excess of debt are funded with equity, while the higher end assumes remaining needs in excess of debt are funded with dispositions. Actual ratios will vary based on the timing of construction funding, future cash flow available for investment, and the ultimate mix of sources from debt, equity, joint ventures, or dispositions. 6. Refer to page S-14 for a reconciliation of EBITDA to net income, the most directly comparable GAAP measure. S-15

Detail of Property Groupings As of March 31, 2020 2020 Grouping 2021 Grouping Same Store Properties New Properties Same Store Properties New Properties # of Design # of Design # of Design # of Design Properties Beds Properties Beds Properties Beds Properties Beds Properties Purchased or Developed Prior to January 1, 2019 152 92,195 152 92,195 2019 Development Deliveries 5 3,159 5 3,159 2020 Development Deliveries 3 2,483 3 2,483 2021 Development Deliveries ¹ — 3,369 — 3,369 2022 Development Deliveries ¹ — 3,235 — 3,235 2023 Development Deliveries ¹ — 2,209 — 2,209 Total Owned Properties 152 92,195 8 14,455 157 95,354 3 11,296 Grand Total # of Owned Properties (All Groupings) 160 Grand Total Owned Design Beds (All Groupings) 106,650 Note on Property Portfolio: When disclosing our number of properties and design beds as of a certain date, we include all properties that are owned and operating as of that date, as well as properties that are under construction and anticipated to open for operations in future years. Properties that are in our development pipeline but have not yet commenced construction are not included. 2020: The 2020 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2020 and 2019. This same store grouping will be used for purposes of presenting our 2020 same store operating results. 2021: The 2021 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2021 and 2020. This same store grouping will be used for purposes of presenting our 2021 same store operating results. 1. The Disney College Program project will be delivered in multiple phases over several years with initial deliveries expected in 2020 and full development completion in 2023. All phases are counted as one property in the table above. S-16

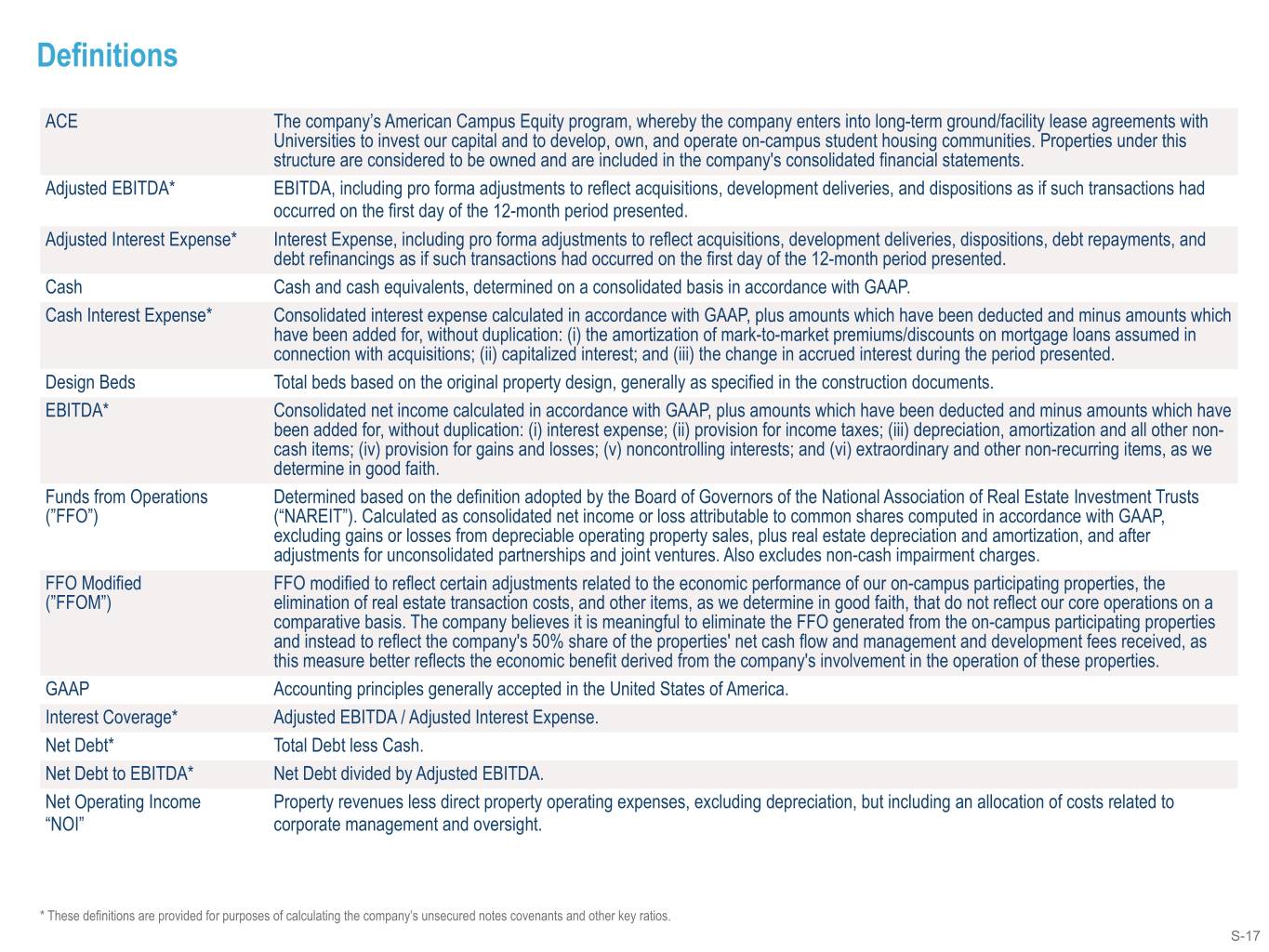

Definitions ACE The company’s American Campus Equity program, whereby the company enters into long-term ground/facility lease agreements with Universities to invest our capital and to develop, own, and operate on-campus student housing communities. Properties under this structure are considered to be owned and are included in the company's consolidated financial statements. Adjusted EBITDA* EBITDA, including pro forma adjustments to reflect acquisitions, development deliveries, and dispositions as if such transactions had occurred on the first day of the 12-month period presented. Adjusted Interest Expense* Interest Expense, including pro forma adjustments to reflect acquisitions, development deliveries, dispositions, debt repayments, and debt refinancings as if such transactions had occurred on the first day of the 12-month period presented. Cash Cash and cash equivalents, determined on a consolidated basis in accordance with GAAP. Cash Interest Expense* Consolidated interest expense calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which have been added for, without duplication: (i) the amortization of mark-to-market premiums/discounts on mortgage loans assumed in connection with acquisitions; (ii) capitalized interest; and (iii) the change in accrued interest during the period presented. Design Beds Total beds based on the original property design, generally as specified in the construction documents. EBITDA* Consolidated net income calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which have been added for, without duplication: (i) interest expense; (ii) provision for income taxes; (iii) depreciation, amortization and all other non- cash items; (iv) provision for gains and losses; (v) noncontrolling interests; and (vi) extraordinary and other non-recurring items, as we determine in good faith. Funds from Operations Determined based on the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts (”FFO”) (“NAREIT”). Calculated as consolidated net income or loss attributable to common shares computed in accordance with GAAP, excluding gains or losses from depreciable operating property sales, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Also excludes non-cash impairment charges. FFO Modified FFO modified to reflect certain adjustments related to the economic performance of our on-campus participating properties, the (”FFOM”) elimination of real estate transaction costs, and other items, as we determine in good faith, that do not reflect our core operations on a comparative basis. The company believes it is meaningful to eliminate the FFO generated from the on-campus participating properties and instead to reflect the company's 50% share of the properties' net cash flow and management and development fees received, as this measure better reflects the economic benefit derived from the company's involvement in the operation of these properties. GAAP Accounting principles generally accepted in the United States of America. Interest Coverage* Adjusted EBITDA / Adjusted Interest Expense. Net Debt* Total Debt less Cash. Net Debt to EBITDA* Net Debt divided by Adjusted EBITDA. Net Operating Income Property revenues less direct property operating expenses, excluding depreciation, but including an allocation of costs related to “NOI” corporate management and oversight. * These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios. S-17

Definitions On-campus Participating A transaction structure whereby the company enters into long-term ground/facility lease agreements with Universities to develop, Properties construct, and operate student housing communities. Under the terms of the leases, title to the constructed facilities is held by the University/lessor and such lessor receives 50% of net cash flows, as defined, on an annual basis through the term of the lease. Operating Expenses General & administrative and other expenses include security costs, shuttle costs, and property-level general and administrative costs as well as an allocation of costs related to corporate management and oversight. Also includes acquisition integration costs, food service, and other miscellaneous expenses. Utilities expense represents gross expenses prior to any recoveries from tenants, which are reflected in owned properties revenues. Payroll expense includes payroll and related expenses for on-site personnel including general managers, maintenance staff, and leasing staff. Repairs and maintenance expense includes general maintenance costs such as interior painting, routine landscaping, pest control, fire protection, snow removal, elevator maintenance, roof and parking lot repairs, and other miscellaneous building repair costs. Also includes costs related to the annual turn process. Marketing expense includes costs related to property marketing campaigns associated with our ongoing leasing efforts. Physical Occupancy Occupied beds, including staff accommodations, divided by Design Beds. Rentable Beds Design Beds less beds used by on-site staff. Same Store Grouping Properties owned and operating for both of the entire annual periods presented, which are not conducting or planning to conduct substantial development, redevelopment, or repositioning activities, and are not classified as held for sale as of the current period-end. Includes the full operating results of properties owned through joint ventures in which the company has a controlling financial interest and which are consolidated for financial reporting purposes. Secured Debt* The portion of Total Debt that is secured by a mortgage, trust, deed of trust, deed to secure indebtedness, pledge, security interest, assignment of collateral, or any other security agreement. Total Asset Value* Undepreciated book value of real estate assets and all other assets, excluding receivables, intangibles, and right of use assets, of our consolidated subsidiaries, all determined in accordance with GAAP. Total Debt* Total consolidated debt calculated in accordance with GAAP, including finance leases and excluding mark-to-market premiums/ discounts on mortgage loans assumed in connection with acquisitions, the original issued discount on unsecured notes, and deferred financing costs. Total Equity Market Value Fully diluted common shares times the company’s stock price at period-end. Unencumbered Asset Value* The sum of (i) the undepreciated book value of real estate assets which are not subject to secured debt; and (ii) all other assets, excluding accounts receivable and intangibles, for such properties. Does not include assets of unconsolidated joint ventures. Unsecured Debt* The portion of Total Debt that is not Secured Debt. * These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios. S-18

Investor Information Executive Management Bill Bayless Chief Executive Officer Jim Hopke President Jennifer Beese Chief Operating Officer Daniel Perry Chief Financial Officer William Talbot Chief Investment Officer Kim Voss Chief Accounting Officer Research Coverage Jacob Kilstein Argus Research Company (646) 747-5447 jkilstein@argusresearch.com Jeffery Spector Bank of America / Merrill Lynch (646) 855-1363 jeff.spector@baml.com Neil Malkin Capital One (571) 633-8191 neil.malkin@capitalone.com Michael Bilerman / Nick Joseph Citigroup Equity Research (212) 816-1383 / (212) 816-1909 michael.bilerman@citi.com / nicholas.joseph@citi.com Derek Johnston / Tom Hennessy Deutsche Bank Securities, Inc. (212) 250-5683 / (212) 250-4063 derek.johnston@db.com / tom.hennessy@db.com Steve Sakwa / Samir Khanal Evercore ISI (212) 446-9462 / (212) 888-3796 steve.sakwa@evercoreisi.com / samir.khanal@evercoreisi.com Richard Skidmore Goldman Sachs & Co. (801) 741-5459 richard.skidmore@gs.com John Pawlowski / Alan Peterson Green Street Advisors (949) 640-8780 / (949) 640-8780 jpawlowski@greenstreetadvisors.com / apeterson@greenstreetadvisors.com Aaron Hecht JMP Securities (415) 835-3963 ahecht@jmpsecurities.com Anthony Paolone / Nikita Bely J.P. Morgan Securities (212) 622-6682 / (212) 622-0695 anthony.paolone@jpmorgan.com / nikita.bely@jpmorgan.com Jordan Sadler / Austin Wurschmidt KeyBanc Capital Markets (917) 368-2280 / (917) 368-2311 jsadler@key.com / awurschmidt@key.com Alexander Goldfarb / Daniel Santos Piper Sandler & Co. (212) 466-7937 / (212) 466-7927 alexander.goldfarb@psc.com / daniel.santos@psc.com Drew Babin / Alex Kubicek Robert W. Baird & Co. (610) 238-6634 / (414) 765-7311 dbabin@rwbaird.com / akubicek@rwbaird.com American Campus Communities, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding American Campus Communities, Inc.'s performance made by such analysts are theirs alone and do not represent the opinions, forecasts or predictions of the company or its management. American Campus Communities, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. Corporate Headquarters Investor Relations American Campus Communities, Inc. Tel: (512) 732-1000 Ryan Dennison (512) 732-1000 12700 Hill Country Blvd., Suite T-200 Fax: (512) 732-2450 SVP, Capital Markets and Investor Relations rdennison@americancampus.com Austin, Texas 78738 www.americancampus.com S-19

Forward-looking Statements and Non-GAAP Financial Measures In addition to historical information, this press release contains forward-looking statements under the applicable federal securities law. These statements are based on management’s current expectations and assumptions regarding markets in which American Campus Communities, Inc. (the “Company”) operates, operational strategies, anticipated events and trends, the economy, and other future conditions. Forward- looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. These risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward looking-statements include those related to the COVID-19 pandemic, about which there are still many unknowns, including the duration of the pandemic and the extent of its impact, and those discussed in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2019 under the heading “Risk Factors” and under the heading “Business - Forward-looking Statements” and subsequent quarterly reports on Form 10-Q. We undertake no obligation to publicly update any forward-looking statements, including our expected 2020 operating results, whether as a result of new information, future events, or otherwise. This presentation contains certain financial information not derived in accordance with United States generally accepted accounting principles (“GAAP”). These items include earnings before interest, tax, depreciation and amortization (“EBITDA”), net operating income (“NOI”), funds from operations (“FFO”) and FFO-Modified (“FFOM”). Refer to Definitions for a detailed explanation of terms appearing in the supplement. The Company presents this financial information because it considers each item an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. These measures should not be considered as alternatives to net income or loss computed in accordance with GAAP as an indicator of the Company's financial performance or to cash flow from operating activities computed in accordance with GAAP as an indicator of its liquidity, nor are these measures indicative of funds available to fund its cash needs, including its ability to pay dividends or make distributions.