Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BANK OF HAWAII CORP | boh1q2020erex991042020.htm |

| 8-K - 8-K - BANK OF HAWAII CORP | boh-20200420.htm |

4/18/2020 Bank of Hawaii Corporation COVID-19 supplement April 2020 overview For more than 120 years, Bank of Hawaii has served our island communities. Natural events, over the decades, have taught us to prepare for the unexpected. As islanders, we are naturally conservative and place a premium on conservation. Having always been part of our communities, we are innately driven to nurture our community. As we confront COVID-19, we are well prepared and indeed uniquely positioned to weather the storm. the Hawaii market faces short/mid term long term value COVID-19 is challenge will accrue to we are well a health, although the firms committed positioned ethical, social long term to balancing the and economic attractiveness of and well needs of all crisis its visitor & prepared stakeholders military assets remains intact 2 1

4/18/2020 Hawaii COVID-19 infection activity 3 response timeline 3/25 branches rationalized 3/23 Honolulu C&C work from home 2/3 mass purchase of PPE and sanitation 2/20 3/18 products board review & BOH discussion work from home 1/28 3/10 Initial exec plan presented to meeting BOD January February March 4 2

4/18/2020 COVID-19 strategic implementation plan objectives • the health and safety of our employees are paramount. we are committed to providing a safe working environment • we are committed to providing for the essential financial needs of our customers and our community • we recognize certain customers provide essential service for our community. we will prioritize their banking needs accordingly 5 operations • branch structure reduced from 68 branches to 31 branches – coverage in all markets • 1,300 person corporate headquarters - tower reduced to 250 personnel effective week prior to shelter in place order • redundant teams and location sites created for certain operational functions • ~60% of workforce working from home. all equipped with laptop, VPN and mobile token capabilities 6 3

4/18/2020 employee support / workplace considerations • onsite employees receive $500/mos. stipend FT, $250/mos. PT • all COVID-19 incidents managed in conjunction with medical and industrial cleaning advisory groups • web based employee morale/engagement tool deployed • onsite employees afforded surplus sick leave as needed • executive team participates in twice daily video conference. frequent engagement with downline reports 7 customer • committed to providing full service banking capabilities via revised physical layout, work-from-home workforce and digital capabilities • payment relief provided to both consumer and commercial customers • processed over 2,100 PPP loans totaling in excess of $525 million • electronically distributed 65,000 stimulus payments totaling $112 million • committed to exploring emerging loan products 8 4

4/18/2020 customer modifications commercial - $ commercial - count # 451 15.7% oustandings $ $711 348 $613 95 $90 8 $9 principal interest P&I total principal interest P&I total consumer - count # 4,728 consumer – $ 3,827 5.9% outstandings $ $399 $333 901 $66 forbearance extension total forbearance extension total 9 community support • $3 million donation from Bank of Hawaii Foundation to Hawaii Community Foundation to support Hawaii COVID-19 support activities. proceeds focused on protecting frontline health professionals, nourishing the community and revitalization • donated 1,200 PPE items to the two largest healthcare providers in the state plus $100,000 in financial support for further PPE investment • waived ATM fees on all BOH ATM’s through June 2020 • provided line staff with broader authority to waive account level fees 10 5

4/18/2020 economic impact • unprecedented modern economic event • obvious and substantial impact to Hawaii and West Pacific markets • federal stimulus – both monetary and fiscal critical and meaningful • quality health outcome and recovery key to Hawaii market re-emergence 11 diversified Hawaii economy GDP by Industry Real Estate and Rentals 20% jobs by industry Government and Defense… 20% Trade, Transportation and Utilities 19% Professional Services 11% Leisure and Government Hospitality and Defense Leisure and Hospitality 10% 19% 19% Education and Health Services 8% Natural Resources, Mining and… 6% Real Estate and Rentals Finance, Finance, Insurance and Information 6% 2% Insurance and Information Personal Income by Industry Trade, 8% Transportati Government and Defense Spending 29% on and Professional Utilities Services Trade, Transportation and Utilities 16% 19% 12% Natural Professional Services 16% Resources, Education Mining and and Health Education and Health Services 12% Construction Services Leisure and Hospitality 11% 8% 13% Natural Resources, Mining and… 8% Finance, Insurance and Information 5% Real Estate and Rentals 3% Source: UHERO, 2019 data 12 6

4/18/2020 UHERO economic forecast Unemployment Rate Non-Farm Payroll 656.1 652.6 13.7 648.9 642.8 $ in in $ thousands 582.1 4.1 2.7 2.8 2.8 2019 2020F 2021F 2022F 2023F 2019 2020F 2021F 2022F 2023F Source: UHERO Forecast as of March 31, 2020 13 economic forecast Real GDP Personal Income Total Vistor Arrivals (MMs) Real Visitor Expenditures ($B) 17.7 99.2 16.8 17.0 98.0 15.9 97.3 96.7 89.9 87.6 10.3 10.5 10.2 10.4 9.3 84.5 $ in in $ billions 81.3 81.0 6.1 79.2 2019 2020F 2021F 2022F 2023F 2019 2020F 2021F 2022F 2023F 53.652.0 7.6 4.4 3.3 3.7 2.1 2.2 1.3 1.3 5.3 8.9 5.5 2.4 1.0 -0.3 % Change % Change -2.6 -40.8 -40.8 -7.7 2019 2020F 2021F 2022F 2023F 2019 2020F 2021F 2022F 2023F Source: UHERO Forecast as of March 31, 2020 14 7

4/18/2020 over $6 billion Hawaii COVID-19 relief Hawaii Funding $Millions State and County Government Response Efforts $1,250 Paycheck Protection 21% Hawaii Airports Program SBA Loans $133 $2,046 2% 33% Hawaii Health Care Providers $143 2% Local Schools and Colleges Unemployment Assistance $53 $1,140 1% 19% Supplemental Nutrition Direct Cash Payments Assistance Program Kauai Public Transit $1,240 $130 Services & Community 20% 2% Development Block Grants $13 0% Source: Press releases from Senator Brian Schatz as of April 14 and SBA as of April 16 15 BOH well positioned COVID-19 Bank of Hawaii • unprecedented • seasoned management team • substantial economic impact • exceptional liquidity • likely prolonged return • conservative loan to pre COVID-19 levels portfolio • Hawaii visitor industry • preeminent market reliant on normalized position social distancing • strong capital levels 16 8

4/18/2020 exceptional liquidity • high quality, liquid investment portfolio • exceptional core deposit base • flexible loan to deposit ratio • low cost funding base 17 conservative investment portfolio securities portfolio as of March 31, 2020 our investment securities portfolio consists of high-quality securities Sector Muni 2% Corp • 94% Aaa-rated, 100% A-rated 4% or higher • Highly Liquid and Pledgeable • Secure and Reliable Cash Flows Government/ Agency 94% Moody’s Rating Cash Flow Aa A 2% Bullets 4% 10% Monthly Payments Aaa 90% 94% 18 9

4/18/2020 strong mix of deposits as of March 31, 2020 solid base of core customers and core deposits Public Funds Time 9% 11% Commercial 39% Checking 48% Consumer Savings 52% 41% 91% core consumer and 89% core checking and commercial customers savings deposits 19 solid funding base loan to deposit ratio compared with peers supports balance sheet flexibility 110% 98% 98% 100% 93% 93% 94% 94% 91% 91% 91% 90% 87% 83% 85% 83% 84% 79% 80% 70% 70% 70% 66% 63% 61% 59% 60% 54% 55% 52% 51% 51% 50% 40% 30% 20% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Bank of Hawaii Peer Median S&P Regional Bank Index excluding banks greater than $50BN 20 10

4/18/2020 long history of deposit growth we have a long history of sustained deposit growth and low cost of deposits Financial Crisis 18,000 5.0 16,000 4.5 14,000 4.0 3.5 12,000 Deposit Cost 3.0 10,000 2.5 8,000 2.0 6,000 1.5 TotalMillions) ($ Deposits 1.10 4,000 1.0 0.73 2,000 0.610.5 - 0.0 Total Deposits Deposit Cost - BOH Deposit Cost - Hawaii Average Deposit Cost - National Average 21 conservative underwriting & portfolio construction we lend in markets we understand, to people we know, in communities we trust • diversified loan portfolio by category • disciplined approach to exposure limits • 73% of overall portfolio secured by quality real estate with combined wtd avg LTV of 57% • higher risk categories well mitigated 22 11

4/18/2020 geographic footprint – 92% Hawaii 23 long term relationships 57% of consumer borrowers > 10 year BOH relationship 64% of commercial borrowers > 10 year BOH relationship 24 12

4/18/2020 commercial loans – granularity 04^ 93% of loans under $30MM 72% under $15MM 25 loan portfolio C&I residential 14% mortgage 35% 60% consumer 40% commercial CRE 23% home equity 15% auto other construction 4% 6% 2% leasing 1% 26 13

4/18/2020 consumer loans • 57% wtd avg LTV • 798 wtd avg FICO • 0.2% <700FICO/>80% LTV residential mortgage $3.9B • 750 wtd avg FICO (58%) • 1.4% + 30 days delinquent • 1.1% <700FICO/30+ day other $0.5B Indirect (7%) home $0.7B equity (10%) $1.7B (25%) • 723 wtd avg FICO • 59% wtd avg LTV • 29% wtd avg DTI • 780 wtd avg FICO • 4.2% <700 FICO/>45% DTI • 3.3% <700FICO/>80% LTV 27 commercial loans leasing $0.1B / (2%) • seasoned Hawaii portfolio • 61% Hawaii based • 55% wtd avg LTV • 37% national large • 97% LTV ≤ 75% ticketed • 4% criticized construction $0.2B / (5%) CRE • 61% wtd avg LTV (5%) $2.6B • concentration in housing (58%) • Oahu centric C&I $1.6B (35%) • seasoned Hawaii centric • 94.4% non-levered • 1.3% levered & criticized 28 14

4/18/2020 higher risk industries lodging, retail, restaurant/entertainment represent 11% of outstandings restaurant/entertainment retail Lodging` 1% lodging retail 5% 5% all others 89% 29 retail – $0.6 B (5%) retail industry exposure • 88% real estate secured • 52% wtd avg LTV • average exposure $3.3 MM • largest exposure $25 MM • 76% of portfolio has an LTV ≤ 65% • 95.8% is secured or has essential anchor essential business anchors 30 15

4/18/2020 lodging – $0.5 B (5%) • 71% real estate secured • 51% wtd avg LTV • average exposure $11 MM • largest exposure $40 MM • 84% of portfolio has an LTV ≤ 65% • 95% of unsecured outstandings to global hotel and timeshare brands 31 restaurant/entertainment – $0.1 B (1%) • 39% secured with wtd avg LTV 63% • granular unsecured exposure with 82% under $10MM 32 16

4/18/2020 strong capital levels • capital levels substantially above “well capitalized” minimums • simple capital structure • strong history of dividends 33 strong capital position as of December 31, 2019 capital maintained at levels well in excess of required minimums and comparatively low risk assets 78.4 13.28 % 12.18 12.18 58.5 10.00 % 8.00 6.50 Common Equity Tier 1 Tier 1 Capital Ratio Total Capital Ratio BOH $10-50B Capital Ratio BOH Regulatory Well-Cap Minimum RWA/Total Assets S&P Regional Bank Index excluding banks greater than $50BN 34 17

4/18/2020 unbroken history of dividends we have a long and unbroken history of dividends $3.00 Recession Recession Financial Crisis $2.50 $2.00 $1.50 $1.00 $0.50 $0.00 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Historical dividends adjusted for stock splits 35 appendix 18

4/18/2020 consumer behavior pivot consumer deposits % 60% online deposit openings 43% % 35% 32% 28% 25% 14% 12% 1/31/20 4/10/20 1/31/20 4/10/20 teller ATM mobile online loan application Zelle enrollees % 35% 38% # 39,038 30,377 22% 15% 1/31/20 4/10/20 1/31/20 4/10/20 residential mortgage home equity 37 diversified and stable deposits commercial and consumer (as of March 31, 2020) our deposits are granular and stable Account Size Age $8,000 $10MM+ Consumer & Business Balances 14% $7,000 Millions $5MM- <$100K $6,000 10MM 31% 5% $5,000 $1MM- $4,000 5MM 14% $3,000 $500K- $2,000 1MM $100-250K 8% 17% $1,000 $250-500K 11% $- 0 - 1 year 1 - 5 years 5 - 10 years 10+ years 86% have a balance less than $10MM 67% have a balance less than $1MM 68% have tenure greater than 5 years 47% have a balance less than $250K Charts represent sum of commercial and consumer customer deposit balances in each category shown. 38 19

4/18/2020 single family home price performance Honolulu single family home prices were relatively stable through great recession 350 Financial Crisis 303 300 297 296 250 200 150 100 50 0 Urban Honolulu San Francisco/ San Mateo/ Redwood City Los Angeles/ Long Beach/ Glendale Source: Federal Reserve Economic Data, All-Transaction House Price Index, Index 2000 Q1=100. 39 residential mortgage – current LTV 40 20

4/18/2020 residential mortgage – monitoring FICO 41 home equity – current CLTV 42 21

4/18/2020 home equity – monitoring FICO 43 automobile – DTI 44 22

4/18/2020 automobile – monitoring FICO 45 other consumer – delinquency status 46 23

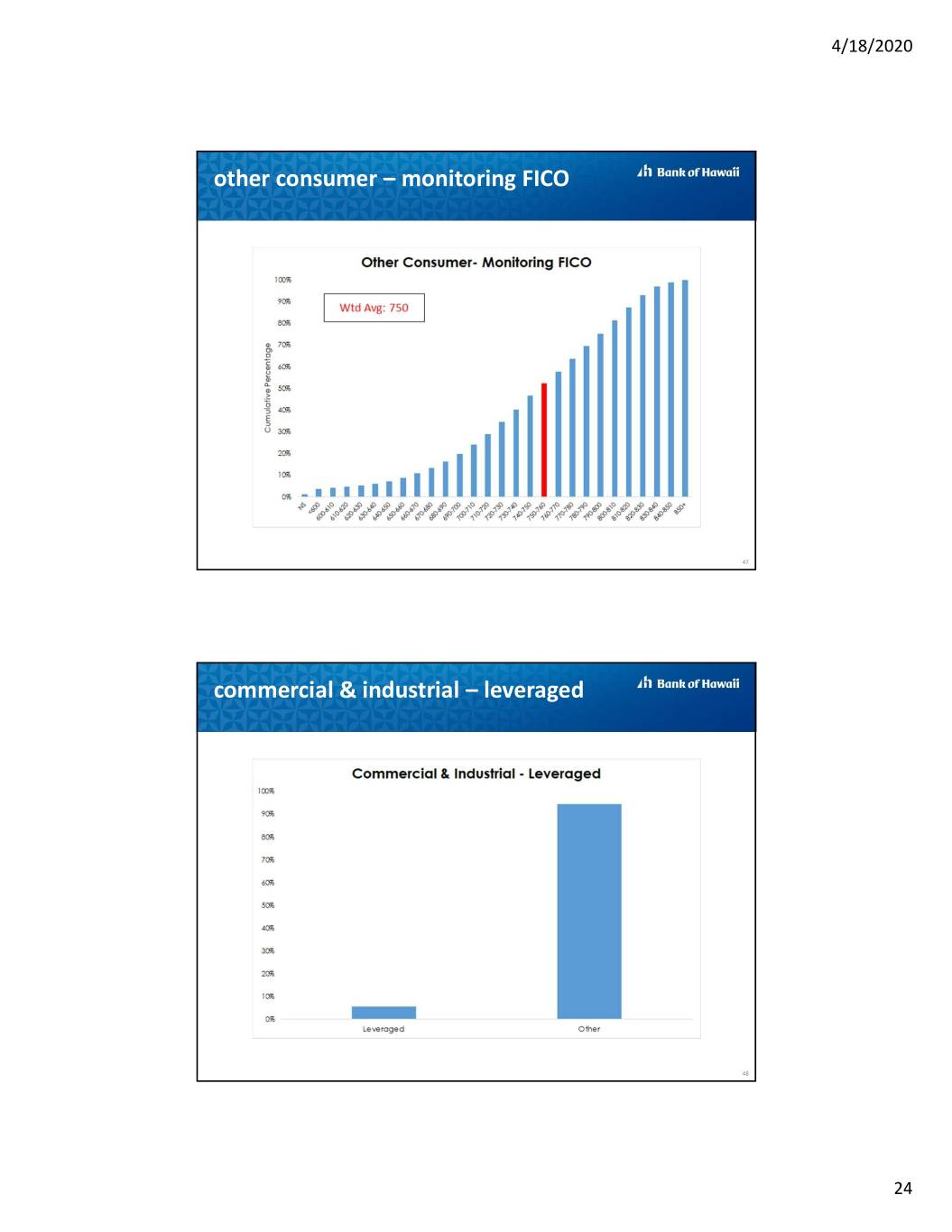

4/18/2020 other consumer – monitoring FICO 47 commercial & industrial – leveraged 48 24

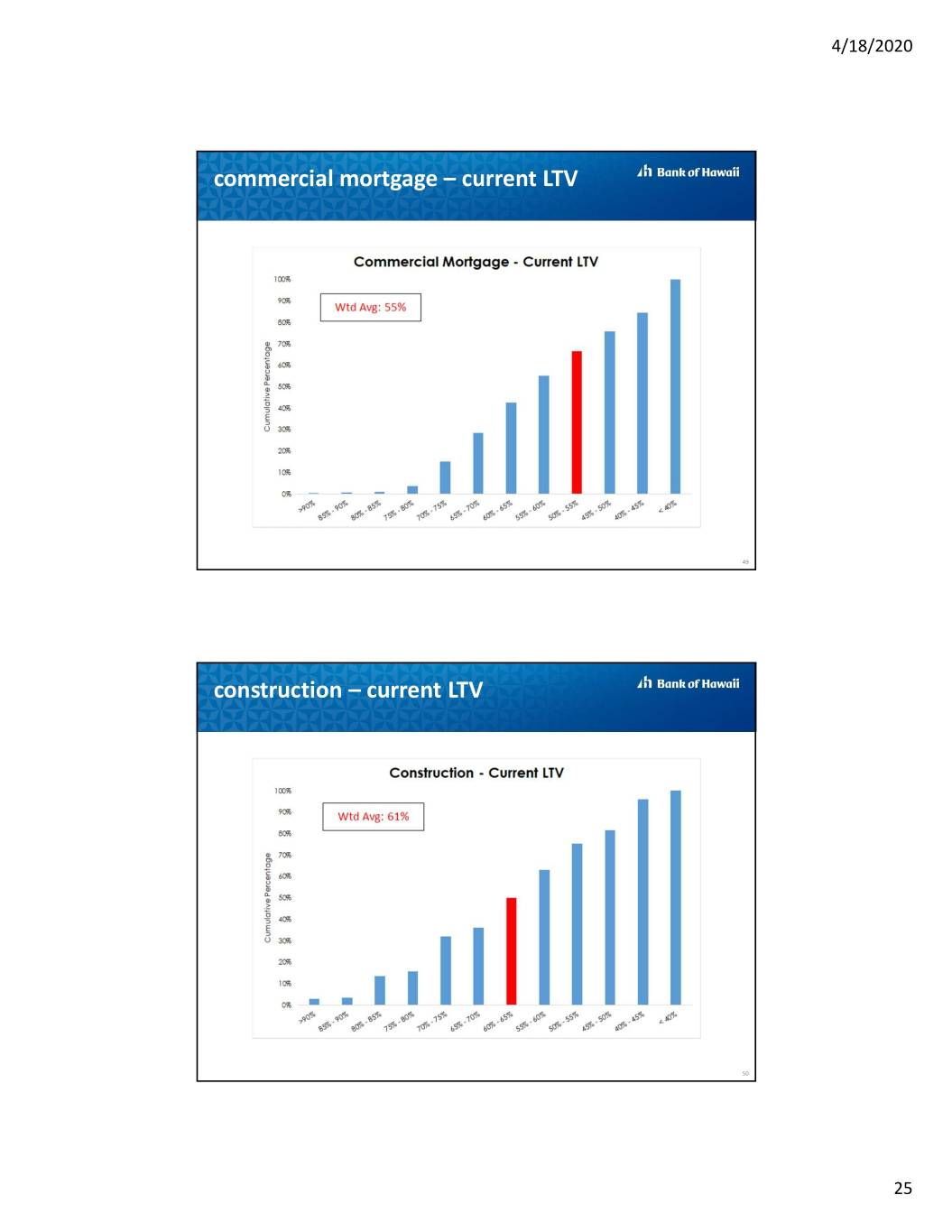

4/18/2020 commercial mortgage – current LTV 49 construction – current LTV 50 25

4/18/2020 lease financing – leveraged vs non-leveraged 51 26