Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Rimini Street, Inc. | a41620form8-kapril2020inve.htm |

Investor Presentation For Fiscal Year Ended December 31, 2019 Property of Rimini Street © 2020 1

Legal Notice “© 2020 Rimini Street, Inc. All rights reserved. “Rimini Street” is a registered trademark of Rimini Street, Inc. in the United States and other countries, and Rimini Street, the Rimini Street logo, and combinations thereof, and other marks marked by TM are trademarks of Rimini Street, Inc. All other trademarks remain the property of their respective owners, and unless otherwise specified, Rimini Street claims no affiliation, endorsement, or association with any such trademark holder or other companies referenced herein. Investor Presentation This presentation is for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a proposed investment in Rimini Street. The information contained herein does not purport to be all-inclusive. Rimini Street assumes no obligation to update the information in this presentation. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale, issuance or transfer of securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful. Forward-Looking Statements Certain statements included in this communication are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “may,” “should,” “would,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “seem,” “seek,” “continue,” “future,” “will,” “expect,” “outlook” or other similar words, phrases or expressions. These forward-looking statements include, but are not limited to, statements regarding our expectations of future events, future opportunities, global expansion and other growth initiatives and our investments in such initiatives. These statements are based on various assumptions and on the current expectations of management and are not predictions of actual performance, nor are these statements of historical facts. These statements are subject to a number of risks and uncertainties regarding Rimini Street’s business, and actual results may differ materially. These risks and uncertainties include, but are not limited to, changes in the business environment in which Rimini Street operates, including inflation and interest rates, and general financial, economic, regulatory and political conditions affecting the industry in which Rimini Street operates; adverse developments in pending litigation or in the government inquiry or any new litigation; our need and ability to raise additional equity or debt financing on favorable terms and our ability to generate cash flows from operations to help fund increased investment in our growth initiatives; the sufficiency of our cash and cash equivalents to meet our liquidity requirements; the terms and impact of our outstanding 13.00% Series A Preferred Stock; changes in taxes, laws and regulations; competitive product and pricing activity; difficulties of managing growth profitably; the customer adoption of our recently introduced products and services, including our Application Management Services (AMS), Rimini Street Advanced Database Security, and services for Salesforce Sales Cloud and Service Cloud products, in addition to other products and services we expect to introduce in the near future; the loss of one or more members of Rimini Street’s management team; uncertainty as to the long-term value of Rimini Street’s equity securities; and those discussed under the heading “Risk Factors” in Rimini Street’s Annual Report on Form 10-K filed on March 12, 2020, and as updated from time to time by Rimini Street’s future Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings by Rimini Street with the Securities and Exchange Commission. In addition, forward-looking statements provide Rimini Street’s expectations, plans or forecasts of future events and views as of the date of this communication. Rimini Street anticipates that subsequent events and developments will cause Rimini Street’s assessments to change. However, while Rimini Street may elect to update these forward-looking statements at some point in the future, Rimini Street specifically disclaims any obligation to do so, except as required by law. These forward- looking statements should not be relied upon as representing Rimini Street’s assessments as of any date subsequent to the date of this communication. Non-GAAP Financial Measures This communication contains certain “non-GAAP financial measures.” Non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles. This non-GAAP information supplements, and is not intended to represent a measure of performance in accordance with disclosures required by U.S. generally accepted accounting principles, or GAAP. Non-GAAP financial measures should be considered in addition to, and not as a substitute for or superior to, financial measures determined in accordance with GAAP. A reconciliation of GAAP to non-GAAP results is included in the financial tables included in this press release. Presented under the heading “About Non-GAAP Financial Measures and Certain Key Metrics” is a description and explanation of our non-GAAP financial measures. Property of Rimini Street ©2020 2

About Rimini Street Property of Rimini Street ©2020 3

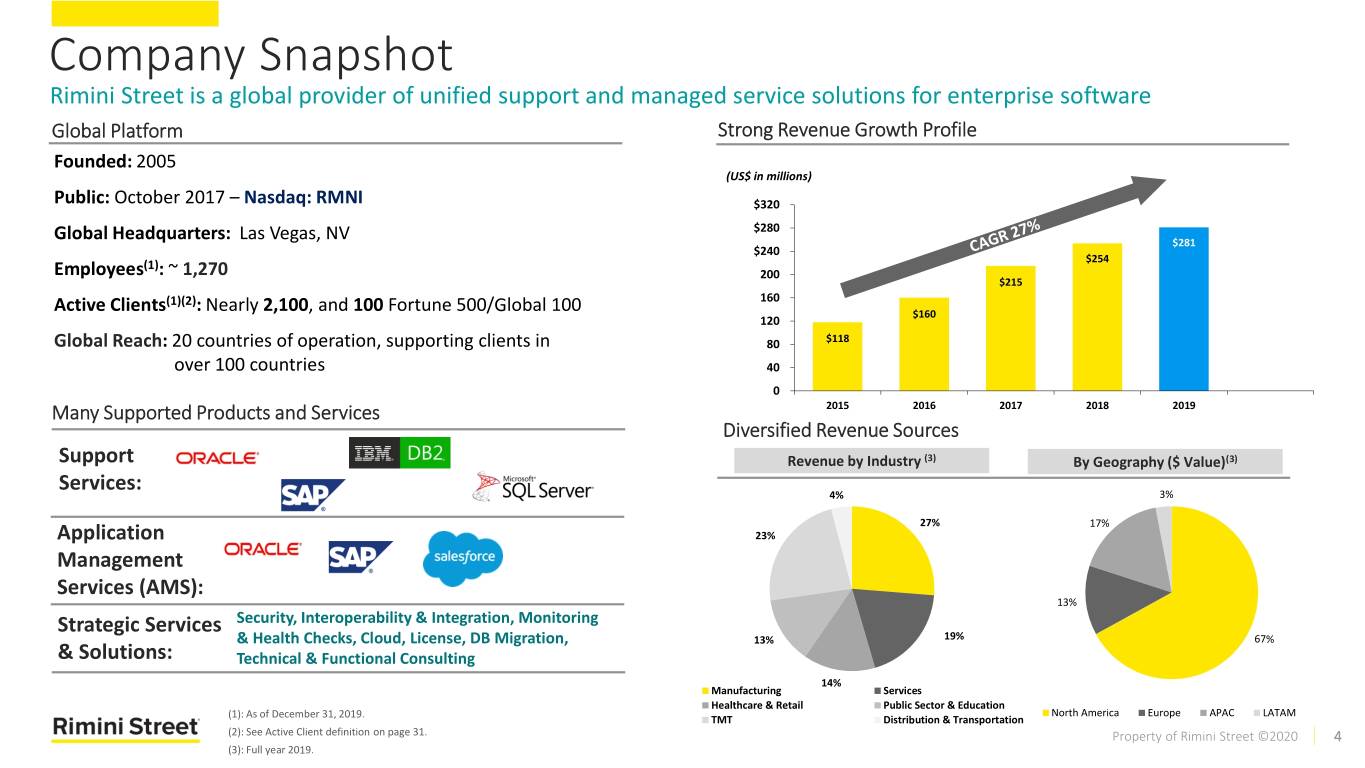

Company Snapshot Rimini Street is a global provider of unified support and managed service solutions for enterprise software Global Platform Strong Revenue Growth Profile Founded: 2005 (US$ in millions) Public: October 2017 – Nasdaq: RMNI $320 $280 Global Headquarters: Las Vegas, NV $281 $240 (1) $254 Employees : ~ 1,270 200 $215 (1)(2) 160 Active Clients : Nearly 2,100, and 100 Fortune 500/Global 100 $160 120 Global Reach: 20 countries of operation, supporting clients in 80 $118 over 100 countries 40 0 Many Supported Products and Services 2015 2016 2017 2018 2019 Diversified Revenue Sources Support Revenue by Industry (3) By Geography ($ Value)(3) Services: 4% 3% 27% 17% Application 23% Management Services (AMS): 13% Strategic Services Security, Interoperability & Integration, Monitoring & Health Checks, Cloud, License, DB Migration, 13% 19% 67% & Solutions: Technical & Functional Consulting 14% Manufacturing Services Healthcare & Retail Public Sector & Education (1): As of December 31, 2019. North America Europe APAC LATAM TMT Distribution & Transportation (2): See Active Client definition on page 31. Property of Rimini Street ©2020 4 (3): Full year 2019.

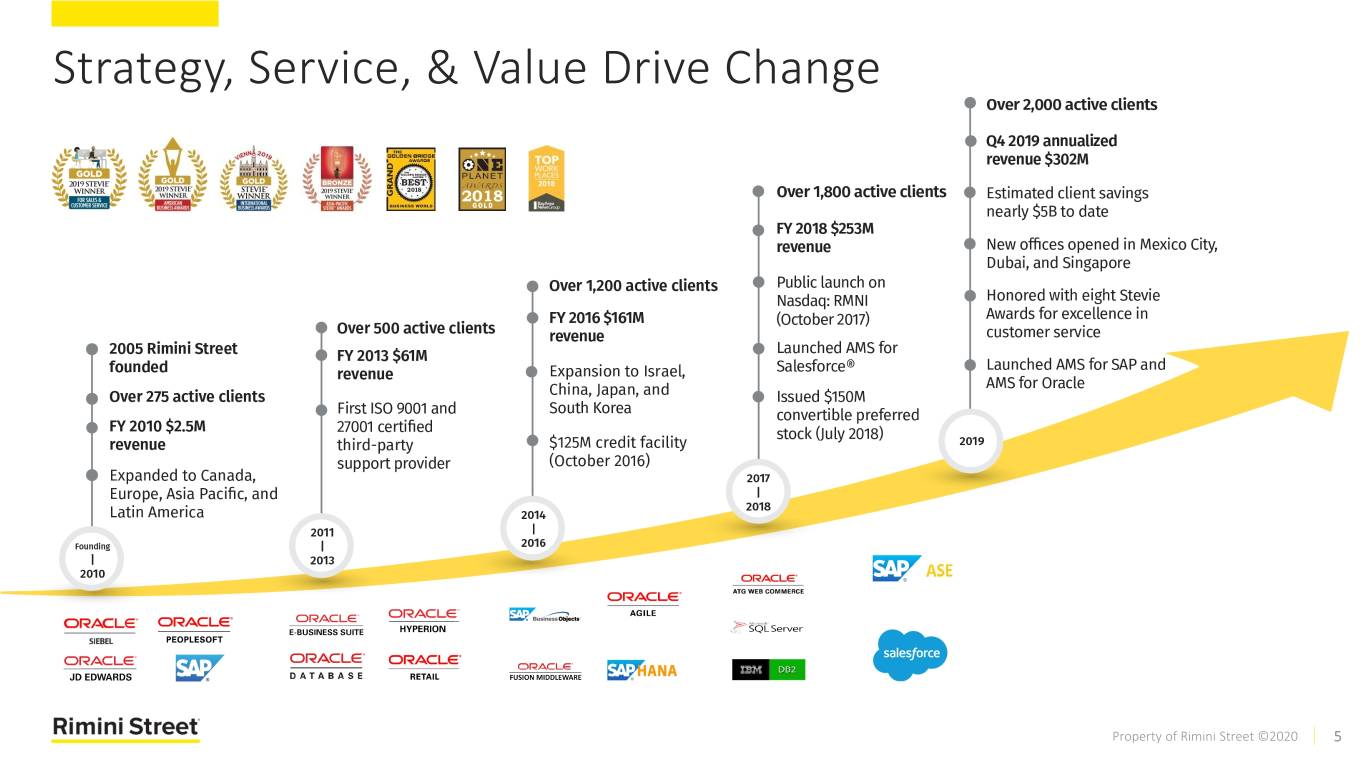

Strategy, Service, & Value Drive Change Property of Rimini Street ©2020 5

Senior Management Team Seth Ravin Sebastian Stanley Mbuga Founder & Grady GVP & Chief CEO President Accounting Officer Daniel B. Kevin David Rowe Steven Salaets Nancy Winslow Maddock SVP & CMO SVP, Global Lyskawa SVP & SVP, Global Security & SVP, Global General Sales – Compliance Client Counsel Recurring Revs and CIO Onboarding Brian Slepko Anthony Julie Murphy James Butler SVP, Global DeShazor SVP & Chief SVP & Chief Service SVP & Chief People Officer Ethics and Delivery Client Officer Compliance Officer Property of Rimini Street ©2020 6

Market Opportunity Property of Rimini Street ©2020 7

Market Opportunity: Support + AMS (1,4) $88 Billion(2) $170 Billion Total Addressable Market Total Addressable Market Subscription Services (L3/L4 Support and AMS) Subscription Services (L3/L4 Support) $29.2B(1,3) Rimini Street 2020 TAM for Currently Offered Subscription Services $14.5B(1) Rimini Street 2018 TAM for Offered L3/L4 Support AMS for Oracle Apps, $3.8 B SAP AMS for Oracle Support, Oracle Support, 2x Salesforce, $8.3 B Support, $6.2B $3.5 B $8.3B 2018 2020 AMS for SAP, $7.4 B SAP Support, $6.2 B (1): Rimini Street bottom-up estimate.as of May 2019, assuming Rimini charges 50% of vendor L3/L4 support fees. (2): Based on data from Forrester Research’s “The Midyear Global Tech Market Outlook for 2016 to 2017” as of September 16, 2016 . and Rimini Street’s own calculations. On-premise Maintenance was estimated to be a $176 billion annual market by Forrester in 2018. (3) Gartner Market Guide for Salesforce Service Providers, Nov 17 2016, Sullivan and Karamouzis. (4) Market Share Analysis: Application Managed Services, Worldwide, 2018. Property of Rimini Street ©2020 8

Growth Drivers Numerous avenues for future expansion Global • Enter additional countries Expansion • Expand capabilities in existing countries • Pursue premium support services for SaaS products, New Products including Salesforce and Workday • Application Management Services (AMS) New License • Add product support for additional software products Products from SAP, Oracle, and other vendors New Clients • Expand beyond existing number of global sales reps Existing • Upsell / cross-sell additional products & packages to our Clients client base Note: Diagram shown only for illustrative purposes and is not indicative of magnitude of growth driver potential or priority. Property of Rimini Street ©2020 9

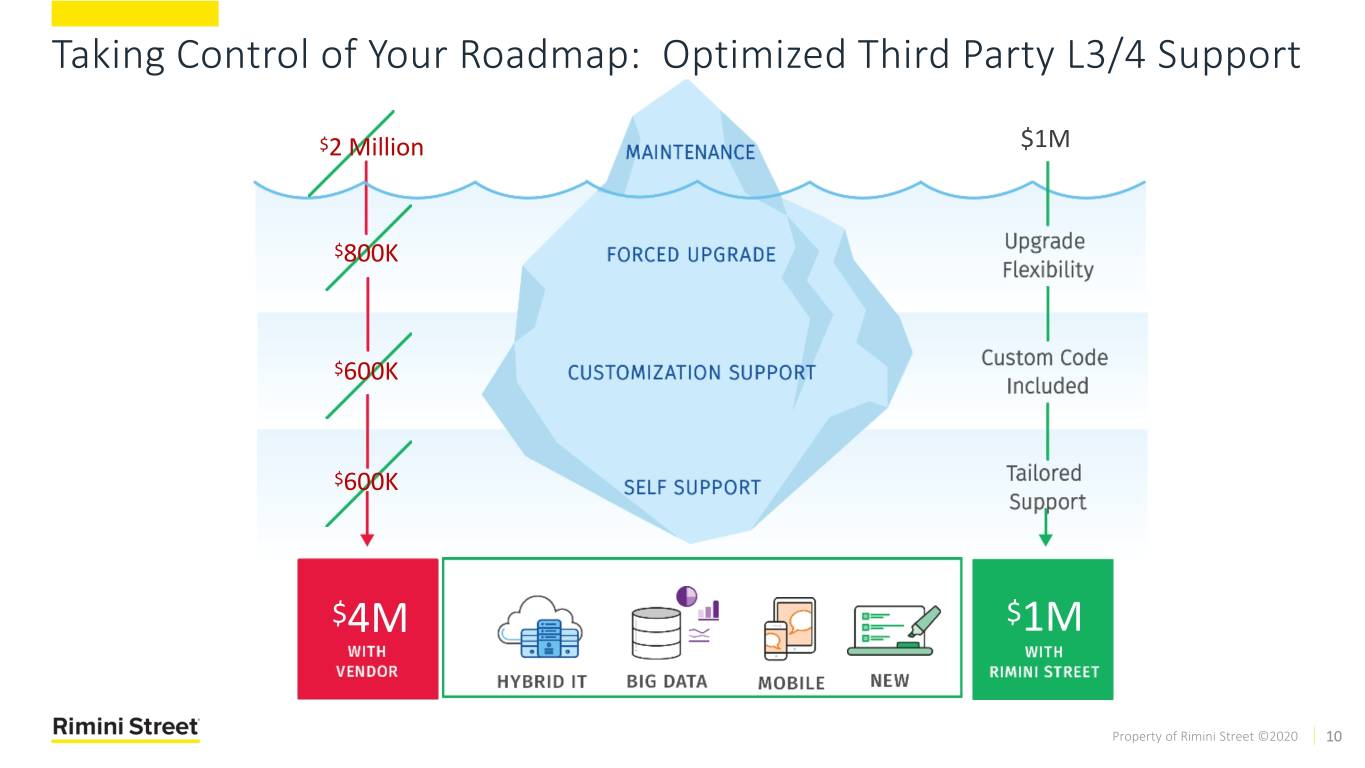

Taking Control of Your Roadmap: Optimized Third Party L3/4 Support $2 Million $1M $800K $600K $600K $4M $1M Property of Rimini Street ©2020 10

The Enterprise Software Maintenance Support Problem 1 High Cost, Low Value for Maintenance Dollars 2 Limited Innovation in Core ERP • “Enterprises have come to believe that there is • "EBS 12 didn’t have any features our business needed. We not enough value received for the high annual were very conscious that we needed to identify an cost of the ERP vendor's maintenance organization to support our company-wide EBS 11i, agreement.” including payroll.” • “We analyzed what we were paying and what we • “SAP upgrades to subsequent versions provide few were getting, and the service levels weren’t up to or no advantages for the user. We wanted to par with what we needed from the standpoints continue using our current SAP R/3 4.7 version, of issue turnaround and accuracy.” while we explore alternatives for the future.” 3 No Choice – Forced Upgrades 4 No Business Case for Oracle ERP Cloud • “We were faced with the tough decision of going through a forced upgrade to SAP ECC 6.0 or having • “60% of respondents see no strong business case to to deal with the downsides of customer-specific migrate to Oracle Cloud/Fusion applications.” maintenance. Once we discovered Rimini Street, we were extremely pleased” • “Fusion is not a full functional replacement for EBS …there are many industry use cases that Fusion • “One of our goals was to become more flexible in wasn't built for as the core apps platform.” our PeopleSoft applications’ upgrade strategy to decide when and how we upgrade. Thanks to Rimini Street, we’ve successfully done that.” Property of Rimini Street ©2020 11

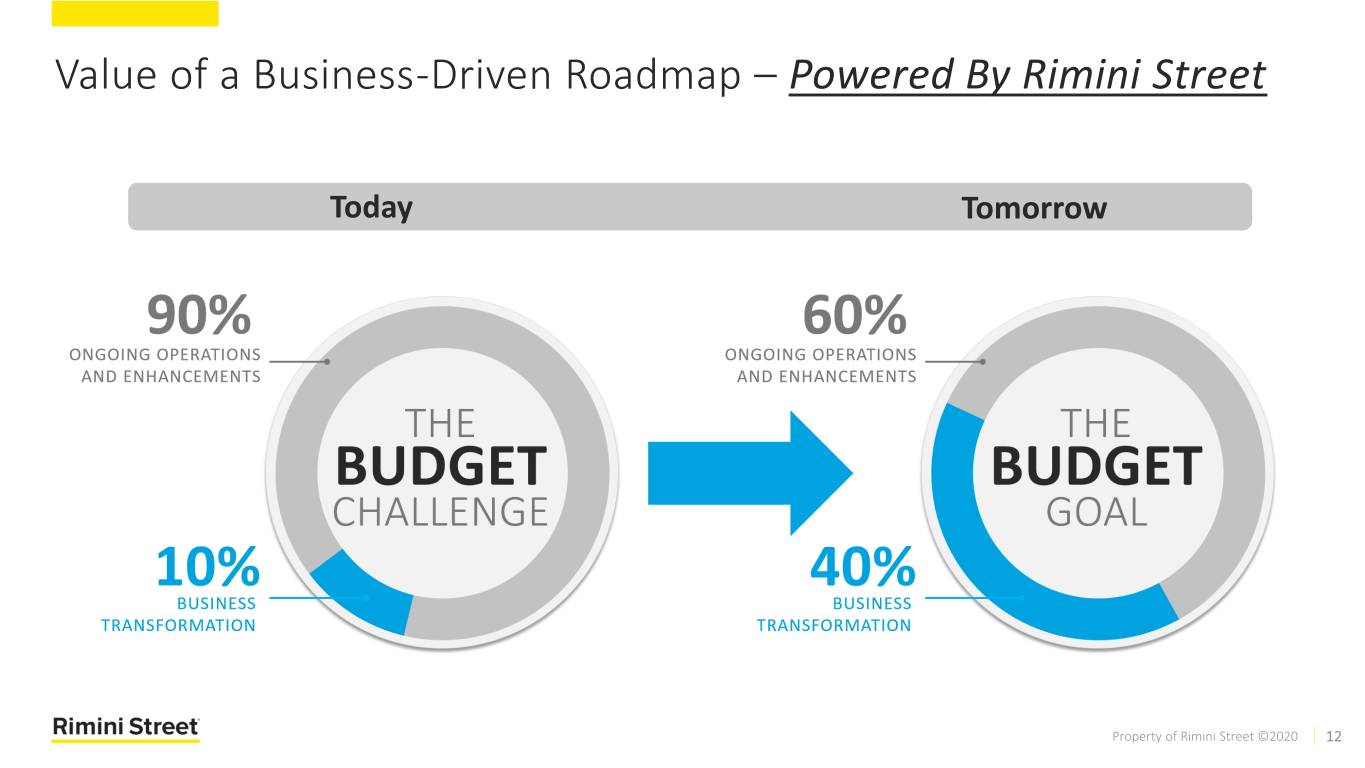

Value of a Business-Driven Roadmap – Powered By Rimini Street Today Tomorrow Property of Rimini Street ©2020 12

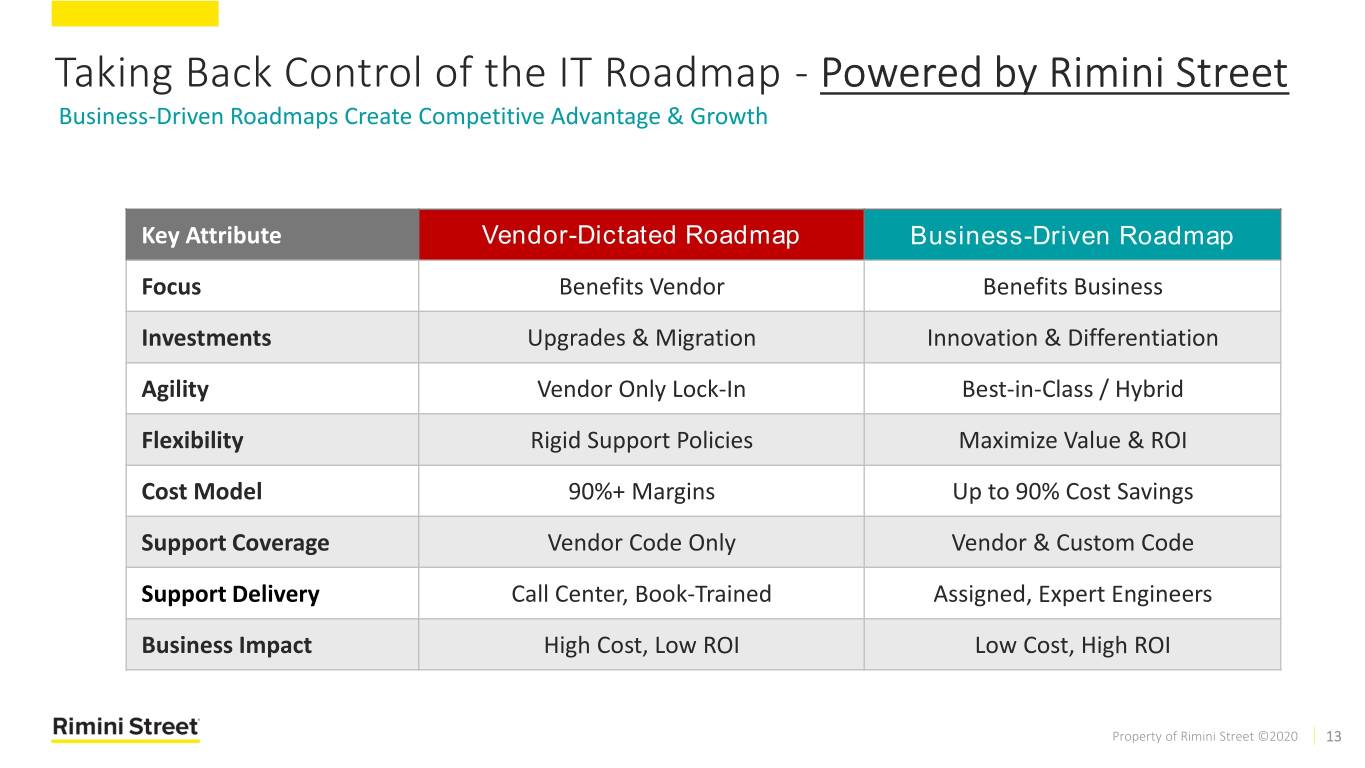

Taking Back Control of the IT Roadmap - Powered by Rimini Street Business-Driven Roadmaps Create Competitive Advantage & Growth Key Attribute Vendor-Dictated Roadmap Business-Driven Roadmap Focus Benefits Vendor Benefits Business Investments Upgrades & Migration Innovation & Differentiation Agility Vendor Only Lock-In Best-in-Class / Hybrid Flexibility Rigid Support Policies Maximize Value & ROI Cost Model 90%+ Margins Up to 90% Cost Savings Support Coverage Vendor Code Only Vendor & Custom Code Support Delivery Call Center, Book-Trained Assigned, Expert Engineers Business Impact High Cost, Low ROI Low Cost, High ROI Property of Rimini Street ©2020 13

Competitive Landscape for Enterprise Software Support Few competitors and a defensible market position Primary Competitors Why Rimini Street Wins • Substantial cost savings Software Support & Maintenance: • Support for all custom code • Custom global tax, legal and regulatory support • Excellent service experience (4.8 out of 5 client satisfaction score)(1) • Guaranteed no required major upgrade for minimum fifteen (15) years • Preferred proprietary tools, methodologies and processes (and patents pending) Application Management Services •Combined Support and AMS services with a single trusted IT partner (AMS): •Unlimited cases for incidents and service requests •Enhancement Support •System Health Monitoring (1): Automated customer surveys performed by Rimini Street. Property of Rimini Street ©2020 14

The Rimini Street Solution Property of Rimini Street ©2020 15

Rimini Street Support Hierarchy Based on ITIL Support Stack Definition Level 1 – Helpdesk End-user inquiries Converging Rimini Street Application Management Services (AMS) Application Layers Management Level 2/3 support System System health Development Services (AMS) Operational administration monitoring support support Level 3/4 Support Vendor-Replacement Application Support Rimini Street Support Services Property of Rimini Street ©2020 16

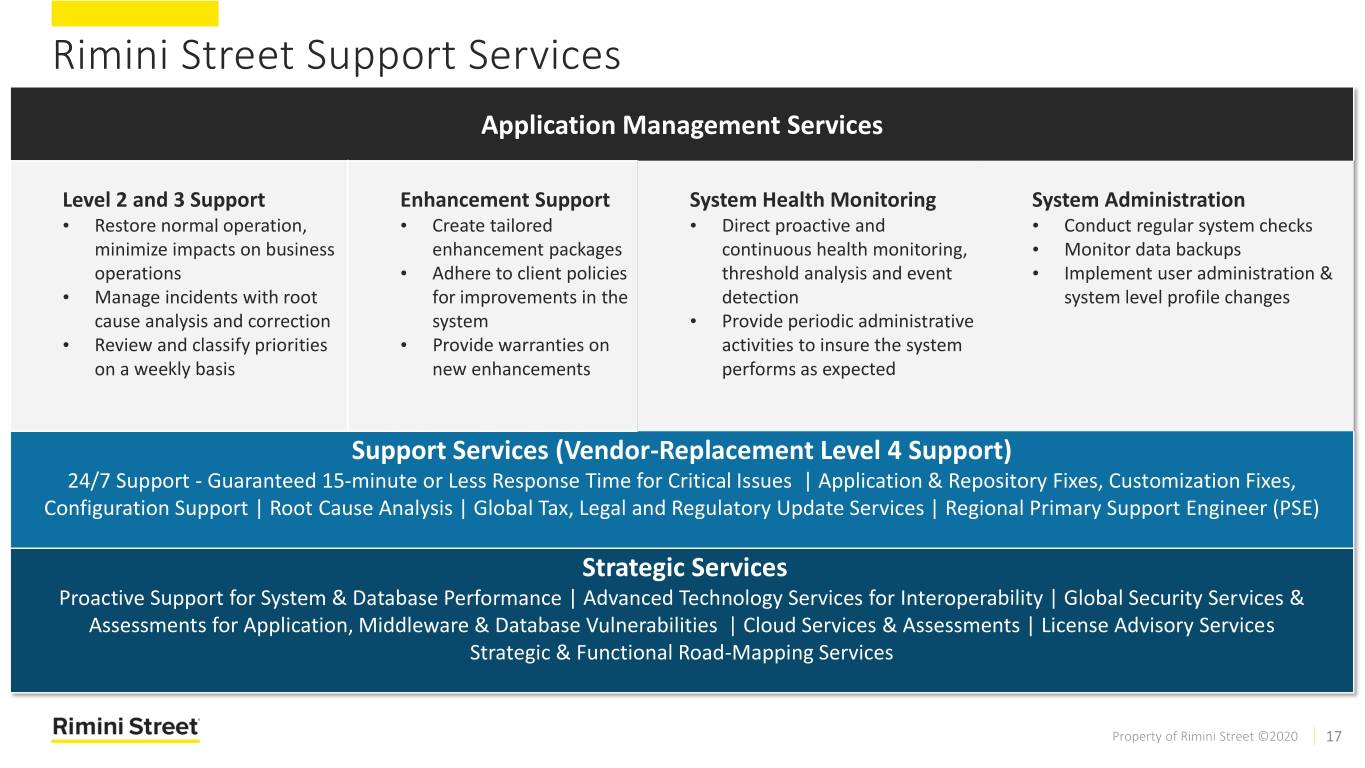

Rimini Street Support Services Application Management Services Level 2 and 3 Support Enhancement Support System Health Monitoring System Administration • Restore normal operation, • Create tailored • Direct proactive and • Conduct regular system checks minimize impacts on business enhancement packages continuous health monitoring, • Monitor data backups operations • Adhere to client policies threshold analysis and event • Implement user administration & • Manage incidents with root for improvements in the detection system level profile changes cause analysis and correction system • Provide periodic administrative • Review and classify priorities • Provide warranties on activities to insure the system on a weekly basis new enhancements performs as expected Support Services (Vendor-Replacement Level 4 Support) 24/7 Support - Guaranteed 15-minute or Less Response Time for Critical Issues | Application & Repository Fixes, Customization Fixes, Configuration Support | Root Cause Analysis | Global Tax, Legal and Regulatory Update Services | Regional Primary Support Engineer (PSE) Strategic Services Proactive Support for System & Database Performance | Advanced Technology Services for Interoperability | Global Security Services & Assessments for Application, Middleware & Database Vulnerabilities | Cloud Services & Assessments | License Advisory Services Strategic & Functional Road-Mapping Services Property of Rimini Street ©2020 17

Why Clients Choose Rimini Street STRATEGIC Drive innovation agility, shift IT budget (80/20) Take control of application strategy Award-winning service Transition to new system Hard budget constraints Avoid expensive upgrade TACTICAL End of Support Property of Rimini Street ©2020 18

The Value Proposition Property of Rimini Street ©2020 19

AGILE LEVERAGING A BUSINESS DRIVEN ROADMAP POWERED BY RIMINI STREET BUSINESS Five (5) Pillars of ERP Optimization & Savings That Create Funding & Resources for Optimize Software Licenses Innovation that Supports Growth Manage Public Cloud Usage Leverage Public Cloud Benefits Improve ERP App Management Outcomes Reduce Total ERP Support and Operating Costs Property of Rimini Street ©2020 20

Innovation & Transformation: Rimini Street Supports Clients’ Growth and Innovation Perform Roll-Out Expand Change Innovate with Upgrades Globally Capabilities Infrastructure Hybrid IT Hundreds of Upgrades Support 120+ Countries Licenses and Products Run 15+ More Years Innovate Around Edges • Upgrade Support • Accelerate Globalization • Expand License Rights • Migrate HW/OS/MW/DB • Innovate Without Upgrading • Upgrade If and When Desired • Avoid Business Disruption • Purchase New Products • Upgrade OS/DB/MW/Browsers • Choose Best in Class Solutions • Application and Tech Stack • TLR Capabilities for ~ 200 • Mergers & Acquisitions • ‘Lift & Shift’ to Cloud • Orchestrated Applications Upgrades Countries Property of Rimini Street ©2020 21

Comprehensive Support: Keeping Systems Running Smoothly, Securely and In Compliance Rimini Street… ▪ Assigns senior engineers directly to each client No call centers – each client is assigned a Primary Support Engineer (PSE) with an average of 15 years of real-world experience ▪ Delivers 15-minute guaranteed urgent issue response time Average case response time by engineer to client less than five (5) minutes ▪ Works every issue based on client prioritization Rimini Street PSEs work every case at the client’s priority without any required justification ▪ Offers more comprehensive, relevant services Additional support services at no additional charge, including support for customizations ▪ Provides extensive client success program Focus on ensuring success and satisfaction utilizing Rimini Street products & services ▪ Compensates employees based on success Company bonus program based on client satisfaction survey results and client retention Property of Rimini Street ©2020 22

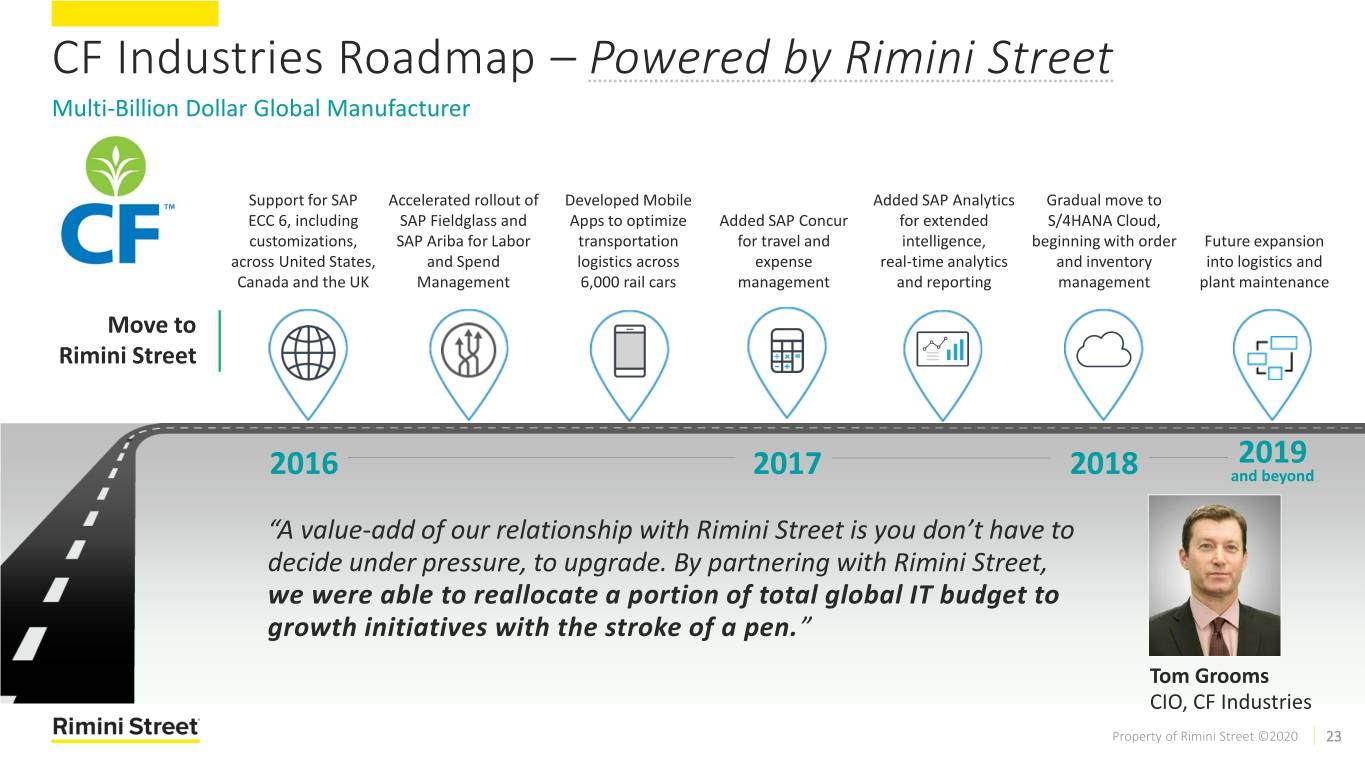

CF Industries Roadmap – Powered by Rimini Street Multi-Billion Dollar Global Manufacturer Support for SAP Accelerated rollout of Developed Mobile Added SAP Analytics Gradual move to ECC 6, including SAP Fieldglass and Apps to optimize Added SAP Concur for extended S/4HANA Cloud, customizations, SAP Ariba for Labor transportation for travel and intelligence, beginning with order Future expansion across United States, and Spend logistics across expense real-time analytics and inventory into logistics and Canada and the UK Management 6,000 rail cars management and reporting management plant maintenance Move to Rimini Street 2019 2016 2017 2018 and beyond “A value-add of our relationship with Rimini Street is you don’t have to decide under pressure, to upgrade. By partnering with Rimini Street, we were able to reallocate a portion of total global IT budget to growth initiatives with the stroke of a pen.” Tom Grooms CIO, CF Industries Property of Rimini Street ©2020 23

Financial Information Property of Rimini Street ©2020 24

Key Operating Metrics Active Clients(1) Annualized Subscription Revenue(2) (US$ in millions) 2,250 $350 2,000 2,063 $300 1,750 $302 1,802 $250 1,500 $271 1,566 1,250 200 $229 1,226 1,000 150 $187 750 853 100 $132 500 250 50 0 0 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Revenue Retention Rate(3) Gross Margin 65% 100% 63% 61% 62% 60 58% 94% 95 93% 92% 55% 91% 91% 55 90 50 85 45 80 40 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 (1): See Active Client definition on page 31. (2): See Annualized Subscription Revenue definition on page 31. Property of Rimini Street ©2020 25 (3): See Revenue Retention Rate definition on page 31.

Historical Financial Performance Observations (US$ in millions) 2015 2016 2017 2018 2019 • Strong revenue growth across the years Revenue $118.2 $160.2 $214.9 $253.5 $281.1 • Continued gross margin expansion Gross Profit 65.4 93.1 132.0 157.5 176.0 • Sales & Marketing Expenses 50.3 72.9 65.7 89.5 107.3 Sales & Marketing spend decreased in 2017 due to covenant General & Administrative Expenses 24.2 36.2 36.1 37.2 47.4 restrictions, the covenants are now Litigation Expenses, net of Insurance Recoveries 32.8 (29.9) 4.9 1.3 (0.8) gone and we are ramping up spending in sales and marketing to Deferred Revenue 107.1 154.4 169.0 196.7 235.5 drive revenue growth (1) (41.5) 3.7 (1.3) (27.6) 22.6 EBITDA • Increased Adjusted EBITDA(2) as the Adjusted EBITDA(2) ($6.5) ($12.0) $37.4 $35.3 $27.0 business scales, flat in 2018 and 2019 with the increased Revenue Growth, YoY 38.4% 35.6% 34.2% 18.0% 10.9% investment in S&M Gross Margin 55.3% 58.1% 61.4% 62.1% 62.6% • Working capital driven by upfront Sales & Marketing Expenses, % Revenue 42.6% 45.5% 30.6% 35.3% 38.2% payments on subscription sales General & Administrative Expenses, % Revenue 20.5% 22.6% 16.8% 14.7% 16.9% • Attractive tax attributes driven by EBITDA Margin % (35.1%) 2.3% (0.6%) (10.9%) 8.0% operating losses of $172M as of Adjusted EBITDA Margin % (5.5%) (7.5%) 17.4% 13.9% 9.6% December 31, 2019 (1): EBITDA is a non-GAAP measure, see EBITDA reconciliation on page 27 for historical reconciliation to the closest GAAP measure. (2): Adjusted EBITDA is a non-GAAP measure, see Adjusted EBITDA reconciliation on page 27 for historical reconciliation to the closest GAAP measure. Property of Rimini Street ©2020 26

Unaudited GAAP to Non-GAAP Historical Reconciliations 2015 2016 2017 2018 2019 GAAP Net Income (Loss) ($ 45.3) ($ 12.9) ($ 48.0) ($ 64.0) $ 17.5 Interest expense 0.8 13.4 43.4 32.5 0.4 Income tax expense 1.5 1.5 1.3 2.0 2.7 Depreciation and amortization expense 1.5 1.8 2.0 1.8 1.9 EB IT D A ($ 41.5) $ 3.8 ($ 1.4) ($ 27.6) $ 22.6 Litigation costs, net of related recoveries 32.7 (29.9) 4.9 1.3 (0.8) Write-off of deferred financing costs 0.0 1.7 0.0 0.7 0.0 Post-judgment interest on litigation appeal award 0.0 0.0 0.0 (0.2) (0.2) Other debt financing expenses (1) 0.0 6.4 18.4 58.2 0.0 Loss on embedded derivatives and redeemable warrants, net 0.0 3.8 12.6 (1.6) 0.0 Stock-based compensation expense 2.3 2.3 3.0 4.4 5.5 Adjusted EBITDA ($ 6.5) ($ 12.0) $ 37.5 $ 35.3 $ 27.0 (1) 2018 includes the write-off of debt discount, issuance and other costs from the payoff and termination of our former credit facility, see 2018 form 10-K. Property of Rimini Street ©2020 27

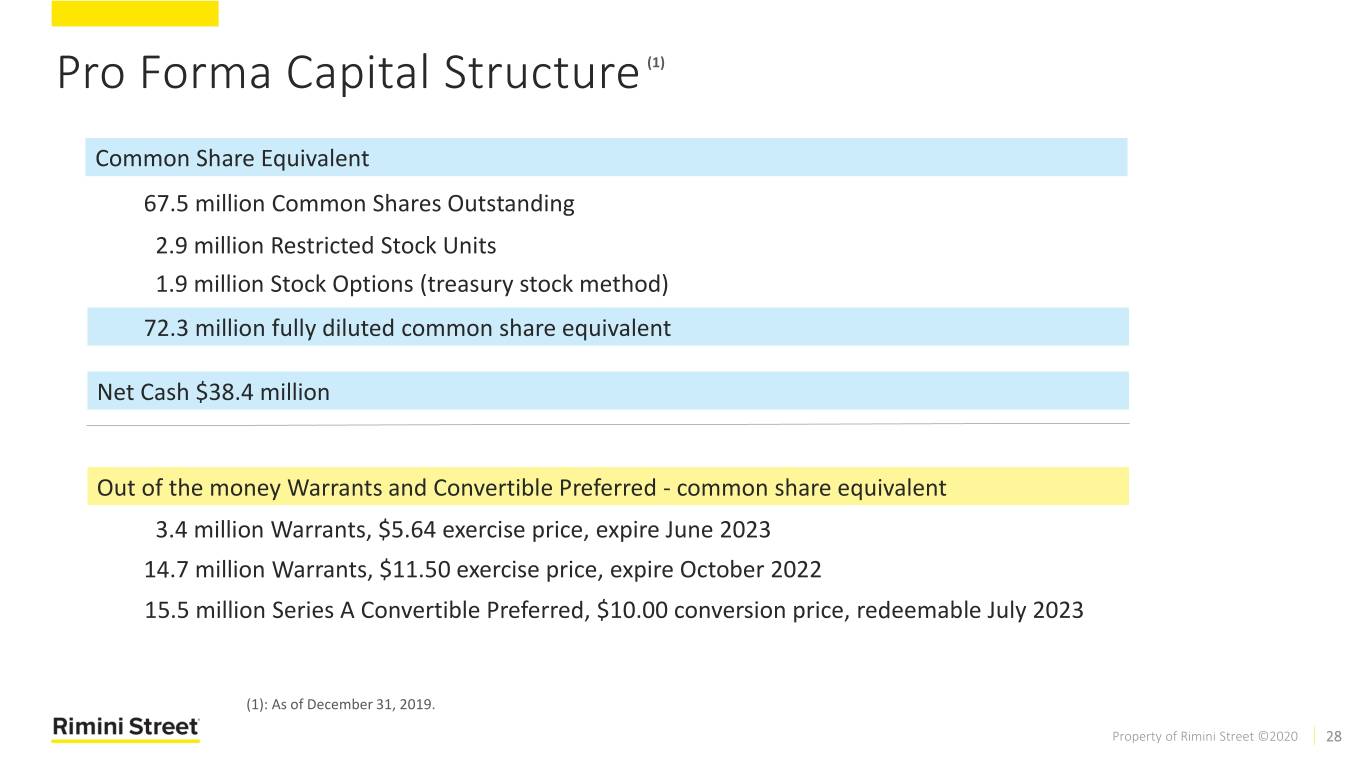

Pro Forma Capital Structure (1) Common Share Equivalent 67.5 million Common Shares Outstanding 2.9 million Restricted Stock Units 1.9 million Stock Options (treasury stock method) 72.3 million fully diluted common share equivalent Net Cash $38.4 million Out of the money Warrants and Convertible Preferred - common share equivalent 3.4 million Warrants, $5.64 exercise price, expire June 2023 14.7 million Warrants, $11.50 exercise price, expire October 2022 15.5 million Series A Convertible Preferred, $10.00 conversion price, redeemable July 2023 (1): As of December 31, 2019. Property of Rimini Street ©2020 28

Summary Highlights • $88 billion TAM for on-premise maintenance opportunities Large Market Opportunity • $82 billion TAM for Application Management Services (AMS) and supplemental cloud premium maintenance • Clients can save up to 90% in total maintenance costs by replacing vendors with Rimini Street Compelling Client Value Proposition • Supports custom & standard code with no forced upgrades; enables clients to control their own IT strategy and roadmap (Business-Driven Roadmap) • 27%+ revenue CAGR 2015 thru 2019 Historically High Growth, Predictable • Backlog of $468 million as of December 31, 2019 Business Model • Approximately 100% subscription and recurring revenue, 90%+ Revenue Retention Rate(1) Significant Cash Flow Generation • Adjusted EBITDA(2) growth and low CapEx expected to drive growth in cash flow Diverse & Prominent Client Base • Proven management team with experience at leading companies including: Experienced Management Team (1): See Revenue Retention Rate definition on page 31. Property of Rimini Street ©2020 29 (2): Adjusted EBITDA is a non-GAAP measure, see reconciliation on page 27 for historical reconciliation to the closest GAAP measure.

Appendix Property of Rimini Street ©2020 30

Summary of Key Operating Metrics • Active client - Distinct entity, such as a company, an educational or government institution, or a subsidiary, Number of Clients division, or business unit of a company that purchases Rimini Street services to support a specific product • Growth in the number of clients is an indication of the increased adoption of the Company’s enterprise software products and services Annualized Subscription • The amount of subscription revenue recognized during a quarter and multiplied by four • Gives an indication of the revenue that can be earned in the following 12-month period from the Revenue Company’s existing client base assuming no cancellations or price changes occur during that period • Actual subscription revenue (dollar-based) recognized in a 12-month period from clients that were clients on the day prior to the start of the 12-month period divided by the Company’s annualized subscription Revenue Retention Rate revenue as of the day prior to the start of the 12-month period • Provides insight into the quality of Rimini Street’s products and services and the value that the Company’s products and services provide clients • Difference between revenue and the costs incurred in providing the software products and services divided Gross Margin by revenue • Provides an indication of how efficiently and effectively Rimini Street is operating the business and serving clients Property of Rimini Street ©2020 31

Terminology and Definitions Traditional IT Support Levels based on ITIL Framework Support Function Description Level • Rimini Street is expanding its Level 1 Basic Help Record user requests, attending user phone calls, replying emails, services to include Application Desk logging issues, basic troubleshooting by using questionnaires Management Services (AMS) relate to the issue Level 2 Technical Troubleshooting, technical analysis, request support from • AMS is only available for purchase Support software or hardware experts, adequate knowledge and when bundled with our traditional experience on the specified product/service vendor-replacement Support Level 3 Expert Highest level of technical support, root cause analysis, issue Product and resolution or new feature creation provided by subject matter Services Service experts and/or engineers for the product or service. Support Level 4 Outside or Outsourced support for products or services that are not directly Vendor serviced by the Level 3 organization - printer support, machine Support maintenance or vendor software support. Property of Rimini Street ©2020 32

About Non-GAAP Financial Measures and Certain Key Metrics To provide investors and others with additional information regarding Rimini Street’s results, we have disclosed the following non-GAAP financial measures and certain key metrics. We have described below Active Clients, Annualized Subscription Revenue and Revenue Retention Rate, each of which is a key operational metric for our business. In addition, we have disclosed the following non-GAAP financial measures: non-GAAP operating income, non-GAAP net income (loss), EBITDA, and adjusted EBITDA. Rimini Street has provided in the tables above a reconciliation of each non-GAAP financial measure used in this earnings release to the most directly comparable GAAP financial measure. Due to a valuation allowance for our deferred tax assets, there were no tax effects associated with any of our non-GAAP adjustments. These non-GAAP financial measures are also described below. The primary purpose of using non-GAAP measures is to provide supplemental information that management believes may prove useful to investors and to enable investors to evaluate our results in the same way management does. We also present the non-GAAP financial measures because we believe they assist investors in comparing our performance across reporting periods on a consistent basis, as well as comparing our results against the results of other companies, by excluding items that we do not believe are indicative of our core operating performance. Specifically, management uses these non-GAAP measures as measures of operating performance; to prepare our annual operating budget; to allocate resources to enhance the financial performance of our business; to evaluate the effectiveness of our business strategies; to provide consistency and comparability with past financial performance; to facilitate a comparison of our results with those of other companies, many of which use similar non-GAAP financial measures to supplement their GAAP results; and in communications with our board of directors concerning our financial performance. Investors should be aware however, that not all companies define these non-GAAP measures consistently. Active Client is a distinct entity that purchases our services to support a specific product, including a company, an educational or government institution, or a business unit of a company. For example, we count as two separate active clients when support for two different products is being provided to the same entity. We believe that our ability to expand our active clients is an indicator of the growth of our business, the success of our sales and marketing activities, and the value that our services bring to our clients. Annualized Subscription Revenue is the amount of subscription revenue recognized during a fiscal quarter and multiplied by four. This gives us an indication of the revenue that can be earned in the following 12-month period from our existing client base assuming no cancellations or price changes occur during that period. Subscription revenue excludes any non-recurring revenue, which has been insignificant to date. Revenue Retention Rate is the actual subscription revenue (dollar-based) recognized over a 12-month period from customers that were clients on the day prior to the start of such 12-month period, divided by our Annualized Subscription Revenue as of the day prior to the start of the 12-month period. Non-GAAP Operating Income is operating income (loss) adjusted to exclude: litigation costs and recoveries, net, and stock-based compensation expense. The exclusions are discussed in further detail below. Non-GAAP Net Income (Loss) is net income (loss) adjusted to exclude: litigation costs and recoveries, net, write-off of deferred debt financing costs, post-judgment interest in litigation awards, stock-based compensation expense, and loss from change in fair value of embedded derivatives. These exclusions are discussed in further detail below. Specifically, management is excluding the following items from its non-GAAP financial measures, as applicable, for the periods presented: Litigation Costs and Recoveries, Net: Litigation costs and the associated insurance and appeal recoveries relate to outside costs of litigation activities. These costs and recoveries reflect the ongoing litigation we are involved with, and do not relate to the day-to-day operations or our core business of serving our clients. Stock-Based Compensation Expense: Our compensation strategy includes the use of stock-based compensation to attract and retain employees. This strategy is principally aimed at aligning the employee interests with those of our stockholders and to achieve long-term employee retention, rather than to motivate or reward operational performance for any particular period. As a result, stock-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period. Write-off of Deferred Debt Financing Costs: The write-off of deferred financing costs related to certain costs that were expensed in 2018 due to an unsuccessful debt financing. Extinguishment charges upon payoff of Credit Facility: These costs included interest expense and other debt financing expenses, including the make-whole applicable premium and the write-off of debt discount and issuance costs that resulted from the payoff of our former credit facility on July 19, 2018. Since these amounts related to our debt financing structure, we have excluded them since they do not relate to the day-to-day operations or our core business of serving our clients. Post. -judgment Interest on Litigation Appeal Award: Post-judgment interest resulted from our appeal of ongoing litigation and does not relate to the day-to-day operations or our core business of serving our clients. Gain from Change in Fair Value of Embedded Derivatives: Our former credit facility included features that were determined to be embedded derivatives requiring bifurcation and accounting as separate financial instruments. We have determined to exclude the gains and losses on embedded derivatives related to the change in fair value of these instruments given the financial nature of this fair value requirement. We were not able to manage these amounts as part of our business operations, nor were the costs core to servicing our clients, so we have excluded them. Other Debt Financing Expenses: Other debt financing expenses included non-cash write-offs (including write-offs due to payoff), accretion, amortization of debt discounts and issuance costs, and collateral monitoring and other fees payable in cash related to our former credit facility. Since these amounts related to our debt financing structure, we have excluded them since they do not relate to the day-to-day operations or our core business of serving our clients. EBITDA is net income (loss) adjusted to exclude: interest expense, income tax expense, and depreciation and amortization expense. Adjusted EBITDA is EBITDA adjusted to exclude: litigation costs and related recoveries, net, write-off of deferred debt financing costs, post-judgment interest in litigation awards, write-off of deferred debt financing costs, stock-based compensation expense, gain from change in fair value of embedded derivatives, and other debt financing expenses, as discussed above. Property of Rimini Street ©2020 33