Richard T. Choi

Shareholder

202-965-8127 Direct Dial

rchoi@carltonfields.com

April 3, 2020

VIA EDGAR

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

Re: Midland National Life Insurance Company (the “Company”)

Pre-Effective Amendment No. 1 to Registration Statement on Form S-1

File No. 333-233821

Commissioners:

On behalf of the Company, we hereby electronically file the Pre-Effective Amendment No. 1 (“Amendment No. 1”) to the above-captioned Registration Statement on Form S-1 ("Registration Statement") under the Securities Act of 1933, as amended. The Company is filing the Amendment No. 1 for the purpose of registering securities in connection with index-linked investment contracts ("Contracts") to be issued by the Company, which are regulated as group funding agreements under state insurance law.

The Company will file a subsequent pre-effective amendment to include the following:

· year-end audited financial statements of the Company,

· any exhibits required by Form S-1 that have not yet been filed, and

· any required disclosures not yet provided, and

· any disclosure changes made in response to Commission staff comments.

All required disclosures and exhibits that are missing from Amendment No. 1 will be added to the Registration Statement by another pre-effective amendment before the Company requests acceleration.

Please direct any questions or comments concerning this submission to the undersigned.

Very truly yours,

/s/ Richard T. Choi Richard T. Choi

cc: Brett L. Agnew, Esq. (Midland National Life Insurance Company)

As filed with the Securities and Exchange Commission on April 3, 2020

Registration No. 333-233821

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

Pre-Effective Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

______________________

Midland National Life Insurance Company

(Exact name of registrant as specified in its charter)

______________________

|

|

6311 |

|

|

Iowa |

(Primary Standard Industrial |

46-0164570 |

|

(State or other jurisdiction of |

Classification Code |

(I.R.S. Employer |

|

incorporation or organization) |

Number) |

Identification Number) |

4350 Westown Parkway

West Des Moines, Iowa 50266-1071

(877) 586 0240

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

______________________

Brett L. Agnew

Midland National Life Insurance Company

4350 Westown Parkway

West Des Moines, Iowa 50266-1071

(515) 327 5890

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Richard T. Choi

Carlton Fields, P.A.

1025 Thomas Jefferson Street, N.W., Suite 400W

Washington, D.C. 20007-5208

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

|

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Calculation of Registration Fee

|

Title of each class of securities to be registered |

Amount to be registered* |

Proposed maximum offering price per unit* |

Proposed maximum aggregate offering price** |

Amount of registration fee*** |

|

Index-Linked Investment Contract |

N/A |

N/A |

$1,000,000.00 |

$129.80 |

* The amount to be registered and the proposed maximum offering price per unit are not applicable because the securities are not issued in predetermined amounts or units.

** The proposed maximum aggregate offering price is estimated solely for the purpose of determining the registration fee. This figure will be revised in a subsequent pre-effective amendment to reflect the final proposed maximum aggregate offering price.

*** The registrant previously paid a registration fee of $129.80 in connection with the initial filing of the Registration Statement on September 18, 2019, based upon a proposed maximum aggregate offering price of $1,000,000. Any additional registration fees for additional amounts registered will be paid in connection with a subsequent pre-effective amendment.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

INSURED INVESTMENT OPTION

An index-linked investment contract

Prospectus Dated

_______, 2020

This prospectus contains important information about the Insured Investment Option (the “IIO” or “Contract”), an index-linked investment contract issued by Midland National Life Insurance Company (“Midland National,” “we,” “our,” “us” or the “Company”). Please read it carefully before investing, and keep it for future reference.

The IIO is currently offered exclusively to life insurance companies (“Insurance Companies”) that issue annuity and life insurance contracts (“Insurance Contracts”), custodians (“Custodians”) of individual retirement accounts (“IRAs”), investment platforms (“Platforms”), and trustees (“Trustees”) of pension and retirement benefit plans (“Benefit Plans” or “Plans”). Insurance Companies, Custodians, Platforms, and Trustees that purchase the IIO are Contract Holders and as such exercise all rights under their Contracts. Individuals may participate in the IIO only through Insurance Contracts, IRAs, Platforms, and Benefit Plans that Contract Holders or their designees administer. See “Individual Participation in the IIO” on page __ for more information.

The IIO offers investments in one or more Cycles. Each Cycle is linked to an Index and provides a return that is based on the performance of the Index, subject to certain limits described in this prospectus. We currently offer Cycles of 1, 2, 3, 4, 5, and 6 year terms or Cycle Terms that are linked to the following Indexes:

· S&P 500® Index

· Russell 2000® Index

· MSCI® Emerging Markets Index

The Indexes that we offer may change from time to time. Please see “Indices” on page __ for more information.

The value of an Index may go up or down. Accordingly, the IIO involves risks, including the risk of loss of principal. Please review “IIO Risks” on page __ and “Risk Factors Relating to Midland National and Its Business” on page ___ carefully before investing.

Each Cycle enables Contract Holders to select a guaranteed level of protection against loss, including no more than 0% loss, on their investments due to negative Index performance if held through the Cycle Term. The guarantees under the IIO are provided solely by Midland National and are subject to our financial strength and claims-paying ability, and therefore, to the risk that we may default on those guarantees. Please see “Payment Obligation and Financial Strength of Midland National” on page __ for more information.

This prospectus describes all material features, rights, and obligations under the IIO. The description in this prospectus is current as of the date of this prospectus. We will periodically supplement or update this prospectus to reflect material changes to the IIO. Please read this prospectus along with any supplements carefully before investing.

The IIO is currently approved for sale in 44 states. As of the date of this prospectus, there were no state variations to the IIO.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THE DISCLOSURES IN THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE CONTRACTS ARE NOT INSURED BY THE FDIC OR ANY OTHER AGENCY. THEY ARE NOT DEPOSITS OR OTHER OBLIGATIONS OF ANY BANK AND ARE NOT BANK GUARANTEED. THEY ARE SUBJECT TO INVESTMENT RISKS AND POSSIBLE LOSS.

The principal underwriter of the IIO is Sammons Financial Network, LLC. The offering of the IIO is intended to be continuous. This prospectus does not constitute an offering in any jurisdiction in which such offering may not be lawfully made. We reserve the right to not offer any Cycles at any particular time, and may reject and/or place limitations on the amount of Cycle investments we will accept.

A registration statement relating to this offering has been filed with the Securities and Exchange Commission (“SEC”). To request the written prospectus please contact our processing office at Annuity Service Center: P.O. Box 79907, Des Moines, Iowa 50325-0907. This prospectus can also be obtained from the SEC’s website at www.sec.gov.

Contents of this Prospectus

Definitions........................................................................................................................................ 5

Summary......................................................................................................................................... 7

Key Features............................................................................................................................... 7

Investment Process...................................................................................................................... 9

Cycle Investment Value............................................................................................................. 10

Withdrawals.............................................................................................................................. 11

Maturity Date Payments; Rollovers............................................................................................. 11

IIO Risks........................................................................................................................................ 11

More Information on the IIO......................................................................................................... 15

Indices...................................................................................................................................... 15

Discontinuation of or Substantial Change to an Index................................................................... 16

Establishment of Cycles and Performance Ceiling Rate................................................................ 16

Cycle Investment amount requirements....................................................................................... 17

Value of Cycle Investment......................................................................................................... 17

Individual Participation in the IIO............................................................................................... 20

Federal Taxes................................................................................................................................. 21

Additional Information About the IIO........................................................................................... 22

Other Contracts.......................................................................................................................... 22

Expenses of Midland National for the IIO.................................................................................... 22

Statutory Compliance................................................................................................................. 22

Changes to the IIO..................................................................................................................... 22

Errors........................................................................................................................................ 22

Misstatement and Adjustments................................................................................................... 22

Reservation of Rights................................................................................................................. 23

Assignment............................................................................................................................... 23

Termination............................................................................................................................... 23

Other Information......................................................................................................................... 24

General Account........................................................................................................................ 24

Non-Unitized Separate Account.................................................................................................. 24

Distribution............................................................................................................................... 25

Legal Proceedings...................................................................................................................... 26

Securities Law Matters............................................................................................................... 26

Information About Midland National............................................................................................ 26

Generally.................................................................................................................................. 26

Midland National's Business....................................................................................................... 26

Financial strength ratings............................................................................................................ 27

Risk Factors Related to Midland National and Its Business........................................................... 28

Directors, Executive Officers and Corporate Governance............................................................. 40

Executive Compensation............................................................................................................ 40

ESOP........................................................................................................................................ 43

ESOP SERP A........................................................................................................................... 43

ESOP SERP B........................................................................................................................... 44

Security Ownership of Certain Beneficial Owners and Management............................................. 45

Transactions with Related Persons Promoters and Certain Control Persons.................................... 45

Financial Information.................................................................................................................... 47

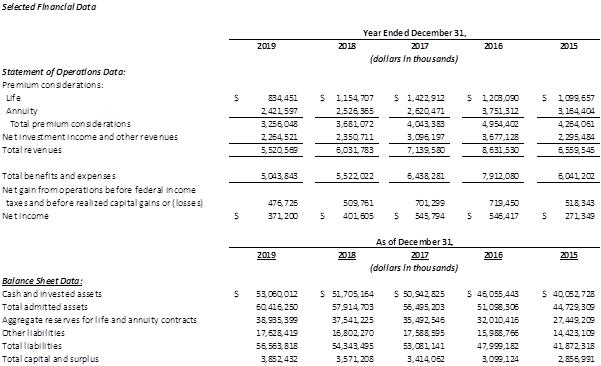

Selected Financial Data.............................................................................................................. 48

Supplementary Financial information.......................................................................................... 48

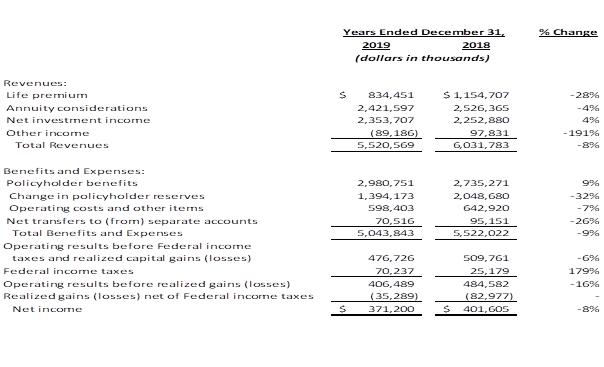

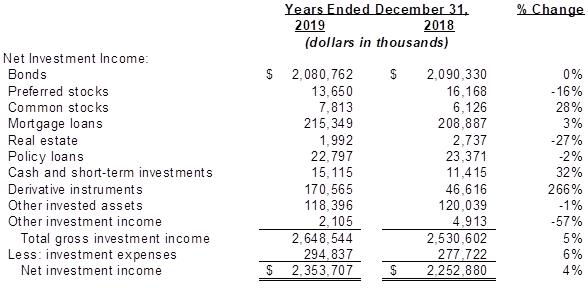

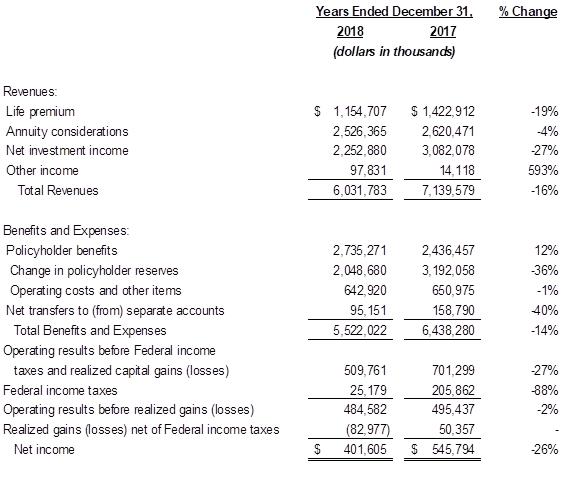

Management's Discussion and Analysis of Financial Conditions and Results of Operation.............. 48

Qualitative and Quantitative Disclosures about Market Risk......................................................... 67

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure............. 68

Financial Statements.................................................................................................................. 68

Appendix – Unit Value Examples................................................................................................... 69

Appendix – Index Disclaimers........................................................................................................ 72

Definitions

Business Day – Our “Business Day” is generally any day that (i) we are open for business and (ii) the New York Stock Exchange (“NYSE”) is open for trading. A Business Day ends at the Close of Trading.

Close of Trading – 4:00 p.m. Eastern Time or, if earlier, the time that the NYSE closes.

IIO – An index-linked investment contract that offers returns based on investments in Cycles, each tied to the performance of an Index and subject to the Performance Ceiling Rate and Maturity Date Floor Rate.

Contract Holder –the Insurance Company, Custodian, Platform provider, or Benefit Plan that is the owner of the IIO.

Cycle – An investment option available under the IIO. Each Cycle has a specific Index, Cycle Term, Start Date, Maturity Date, Maturity Date Floor Rate, and Performance Ceiling Rate.

Cycle Business Day – Any Business Day on which a Unit Value for a Cycle is determined.

Cycle Investment – The amount invested in a Cycle as measured by Units. The value of a Cycle Investment on any Cycle Business Day is equal to the number of Units multiplied by that day’s Unit Value.

Cycle Term – The term of a Cycle, which starts on a Start Date and ends on a Maturity Date.

Fair Value – A value used to determine a Cycle’s Unit Value during a Cycle Term.

Fair Value Calculation Agent – An independent third party with whom we contract to determine the Fair Value of a Cycle during the Cycle Term. We may use different Fair Value Calculation Agents for the different Cycles. We will provide the Contract Holder advance Notice of the Fair Value Calculation Agent for each Cycle.

Index – The index that is linked to a Cycle. We currently offer Cycles based on the performance of financial indices. In the future, we may offer Cycles based on other types of indices.

Index Value – The value of an Index as reported to us by the Fair Value Calculation Agent.

IRS – The Internal Revenue Service.

Maturity Date – The Cycle Business Day on which a Cycle matures.

Maturity Date Floor Rate – The rate that will be used to determine the Maturity Date Unit Value Floor as described in “Unit Value – On the Maturity Date” on page__. It represents the maximum potential loss in Unit Value for a Cycle at the Maturity Date. During the Cycle Term prior to the Maturity Date, no floor applies, which means the decrease in the Unit Value is not limited.

Performance Ceiling Rate – The rate that will be used to determine the Unit Value Ceiling. It represents the maximum potential increase in the Unit Value for a Cycle on the Maturity Date.

Performance Ceiling Threshold – The minimum Performance Ceiling Rate for a Cycle that a Contract Holder may elect to establish by sending us a Written Notice prior to a Cycle Start Date. If the Performance Ceiling Rate for a Cycle is lower than the Contract Holder’s Performance Ceiling Threshold Contract Holder will not be invested in the Cycle.

Proportional Performance Ceiling Rate – A proportion of the Performance Ceiling Rate that is used to determine the maximum potential increase in the Unit Value before the Maturity Date. The Proportional Performance Ceiling Rate is equal to the Performance Ceiling Rate multiplied by the number of days lapsed during the Cycle Term divided by the Cycle Term measured in days.

SEC – U.S. Securities and Exchange Commission.

Start Date – The Business Day on which a Cycle is established.

Unit – The measurement we use to calculate a Cycle Investment. Units may only be purchased on a Start Date. Units may not be withdrawn on a Start Date.

Unit Value – The value of a Unit on a Cycle Business Day. The initial Unit Value on the Start Date is $10.00.

Unit Value Ceiling – The maximum Unit Value at any time during the Cycle Term.

Written Notice and Notice – Written Notice means a notice of instruction submitted in writing and signed by the Contract Holder satisfactory to us, which we may require to be on a form we provide and be transmitted to us in electronic format or such other commercially acceptable means as may be specified by us. A Written Notice will not be satisfactory to us if we believe it is incomplete or we would be required to exercise any discretion in satisfying the instruction or request. Notice means information provided by us or made available to the Contract Holder that may be in writing, via telephone, electronically, on a website, or through other commercially acceptable means.

Summary

This summary provides an overview of the IIO. The overview is not a complete description of the IIO. Please read this entire prospectus for more details and other information regarding the IIO.

Key Features

The IIO offers investments in Cycles. The key features of a Cycle include:

· the Index to which it is linked,

· the term of the Cycle or Cycle Term,

· the minimum rate of return at the end of the Cycle Term or Maturity Date Floor Rate, and

· the maximum rate of return at the end of the Cycle Term or Performance Ceiling Rate.

Each of these features is described below.

Indices. We currently offer Cycles linked to the following indices (each, an “Index”):

• S&P 500® Index, which is a market-capitalization-weighted index of the 500 largest U.S. publicly-traded companies.

• Russell 2000® Index, which measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which is made up of 3,000 of the largest publicly-traded U.S. companies.

• MSCI® Emerging Markets Index, which is a market-capitalization-weighted index measuring large- and mid-capitalization companies in 26 emerging market countries.

We may offer Cycles linked to the same or different indices in the future as described in “Indices” on page __. Each Index involves risks, including the risk of loss of principal. See “IIO Risks” on page ___ for more information.

Cycle Terms. A Cycle Term begins on the Start Date and ends on the Maturity Date. We currently offer Cycle Terms of 1, 2, 3, 4, 5, and 6 years for Cycles linked to each available Index described above and with each Maturity Date Floor Rate described below.

Maturity Date Floor Rate. The minimum rate of return on a Cycle if invested through the end of a Cycle Term is called the Maturity Date Floor Rate, and it protects against negative Index performance. We currently offer Maturity Date Floor Rates of 0%, -5%, -10%, and -15% for Cycles linked to each available Index and each available Cycle Term, but may offer the same or different rates in the future.

The different Maturity Date Floor Rates enable Contract Holders to select different levels of protection against potential losses due to negative Index performance. The highest level of protection we currently offer is the 0% Maturity Date Floor Rate, which means the rate of return on a Cycle Investment would not fall below 0% if invested through the end of the Cycle Term, i.e., through the Cycle’s Maturity Date. The lowest level of protection we currently offer is the negative 15% Maturity Date Floor Rate, which means the rate of return on a Cycle Investment would not be below negative 15% if invested through the end of the Cycle Term, i.e., through the Cycle’s Maturity Date.

Example 1: If the performance of an Index at the end of a 1-year Cycle Term is -10%, but the Maturity Date Floor Rate selected is 0%, the return on the Cycle Investment would be 0%. In this Example, a 0% Maturity Date Floor Rate applies and Midland National bears the risk of any loss due to negative Index performance.

Example 2: If the performance of an Index at the end of a 1-year Cycle Term is -5%, but the Maturity Date Floor Rate selected is -15%, the return on the Cycle Investment would be ‑5%. In this Example, the -15% Maturity Date Floor Rate does not kick in because the return on the Cycle Investment is higher. Midland National would bear the risk of loss due to any negative Index performance beyond -15%.

The Maturity Date Floor Rate will not apply to any partial or full withdrawals of a Cycle Investment prior to the Maturity Date, which means losses are potentially unlimited on amounts withdrawn.

Example: If the Maturity Date Floor Rate selected is 0%, but the entire Cycle Investment is withdrawn prior to its Maturity Date at a time when the performance of the Index is -10%, the Maturity Date Floor Rate would not apply and the Cycle Investment would incur a loss.

We will provide the available Maturity Date Floor Rate for each Cycle to Contract Holders at least 30 days in advance of the Start Date for that Cycle. Please note, generally the higher the Maturity Date Floor Rate the lower the Performance Ceiling Rate we will set. In other words, selecting more protection from potential losses due to negative Index performance will generally result in a lower Performance Ceiling Rate.

Performance Ceiling Rate. The maximum rate of return on a Cycle at the end of a Cycle Term is called the Performance Ceiling Rate and it limits participation in positive Index performance. This limit means that even if the Index performance for a Cycle at the end of a Cycle Term is higher, the return on the Cycle Investment would be limited to the Performance Ceiling Rate.

Example 1. If the performance of an Index at the end of a 5-year Cycle Term is 10%, but the Performance Ceiling Rate is 8%, the return on your Cycle Investment for that Cycle Term would be limited to 8%, which is the Performance Ceiling Rate.

Example 2. If the performance of an Index at the end of year of a 5-year Cycle Term is 5%, but the Performance Ceiling Rate is 8%, the return on your Cycle Investment for that Cycle Term would be the full 5% because it is below the Performance Ceiling Rate.

The return on a Cycle Investment is measured from the Start Date through the Maturity Date of the Cycle. The Performance Ceiling Rate is a limit on the maximum rate of return on a Cycle Investment at the end of the Cycle Term (not the end each year of the Cycle Term). Interim changes in the value of the Cycle Investment during a Cycle Term will occur, and may be higher or lower, sometimes significantly higher or lower, than the return on the Cycle Investment at the end of a Cycle Term.

We will provide an indicative Performance Ceiling Rate for a Cycle at least 30 days in advance of the Start Date for that Cycle. The “indicative Performance Ceiling Rate” is an indication of the Performance Ceiling Rate that we expect to set on the Start Date. The actual Performance Ceiling Rate we set on the Start Date may differ from the indicative Performance Ceiling Rate. We set the Performance Ceiling Rate on the Start Date of a Cycle in our sole discretion based on a variety of factors described in “Establishment of Cycles and Performance Ceiling Rate” on page __. Because the Start Date is the date on which the Cycle Investment begins, the Contract Holder will not know the actual Performance Ceiling Rate before the Cycle starts, which is why the IIO allows the Contract Holder to establish a Performance Ceiling Rate Threshold. Similar to a limit order condition on a stock purchase order, the Performance Ceiling Rate for a Cycle must meet the Contract Holder’s Performance Ceiling Rate Threshold in order for the Cycle Investment to proceed. If we establish a Cycle with a Performance Ceiling Rate lower than the Contract Holder’s Performance Ceiling Threshold, the Cycle Investment will not proceed and we will return the Contract Holder’s money within three (3) Business Days, subject to our right to defer payment described below under “Deferral of Payment” on page __.

Example: A Contract Holder establishes a Performance Ceiling Rate Threshold of 4% for a Cycle. If on the Start Date of the Cycle, we do not set a Performance Ceiling Rate of at least 4%, the Contract Holder will not be invested in the Cycle and we will return the Contract Holder’s money.

Investment Process

Subject to our right not to offer any Cycles, we will provide Contract Holders with a Notice about available Cycles at least 30 calendar days in advance of their Start Dates. The Notice will include the following information for each available Cycle:

1) Index, Cycle Term, and Maturity Date Floor Rate,

2) Start Date and Maturity Date,

3) indicative Performance Ceiling Rate,

4) deadline (“Deadline”) for providing us Written Notice of an investment order in a Cycle (“Investment Order”), and

5) any requirements on the minimum or maximum aggregate amount of investments we are accepting for a Cycle.

The Performance Ceiling Rate we establish on the Start Date of a Cycle may be different from the indicative Performance Ceiling Rate previously provided.

To invest in a Cycle, Contract Holders must provide us with their Investment Orders by the Deadline. Each Investment Order must specify:

1) the Cycle selected by the Contract Holder,

2) the amount and source of proposed investment into the Cycle, i.e., either additional monies sent to us or proceeds from a Cycle maturing prior to the applicable Start Date, and

3) any Performance Ceiling Threshold established by the Contract Holder.

If we do not receive the Investment Order by the Deadline, we will reject it. In addition, we must receive immediately available funds to be invested in a Cycle no later than the Start Date to avoid rejection of the investment. If we receive Investment Orders for aggregate amounts in excess of any limit we have established for investment in a Cycle, we will pro-rate each Investment Order and return the excess to Contract Holders. Contract Holders are solely responsible for aggregating investments by individuals participating in the IIO through Insurance Contracts, IRAs, Platforms, and Plans as described in “Individual Participation in the IIO” on page __.

Depending on market and business considerations, we may determine not offer a Cycle on a Start Date and may reject or limit the amount of any investments in a Cycle in our sole discretion at any time until the Close of Business on each Start Date which Cycles to make available on that Start Date. We may choose not to offer any Cycle for any period or we may decide to cease offering Cycles. If we decide to cease offering Cycles, each outstanding Cycle with the same Index, Cycle Term, and Maturity Date Floor Rate will continue until its respective Maturity Date. Contract Holders may terminate the IIO at any time, without charge, on 30 days’ Notice as described in “Termination” on page __.

Cycle Investment Value

The value of a Cycle Investment may increase, decrease, or stay the same. The value of each Cycle Investment is measured in terms of the number of Units credited to the Contract Holder upon investment and the Unit Value of such Units. The Unit Value on the Start Date of each Cycle will be $10.00.

During a Cycle Term, the Unit Value will be based upon the Fair Value of the Cycle Investment determined by a third-party Fair Value Calculation Agent as described in “Value of Cycle Investment” on page __. The Unit Value of a Cycle during a Cycle Term may be less than or greater than the Cycle Investment on the Start Date and the amount payable on the Maturity Date. Thus, it is possible that the Unit Value reflects positive Index performance during the Cycle Term, but flat or negative Index performance on the Maturity Date.

In determining the Fair Value of a Unit during a Cycle Term, the Fair Value Calculation Agent will take into account a variety of factors, such as the change in the Index Value from the Start Date, volatility of the Index, interest rate changes, and time remaining to the Maturity Date. During the Cycle Term, the Unit Value will also take into account the length of time since the Start Date and the Proportional Performance Ceiling Rate.

The Proportional Performance Ceiling Rate reduces the Performance Ceiling Rate based on the time lapsed during the Cycle Term relative to the Cycle Term. As a result, for withdrawals made during the Cycle Term, the Unit Value may reflect a lesser increase due to positive performance of the Index than the Unit Value on the Maturity Date. In addition, all other factors being equal, the earlier a withdrawal is made during a Cycle the greater the impact of the Proportional Performance Ceiling Rate on the Unit Value used to compute the withdrawal. There is no Maturity Date Floor on a withdrawal taken during a Cycle Term.

Example: The Performance Ceiling Rate of a 5-year Cycle’s is 5%. At the end of year 3, Contract Holder decides to fully withdraw from the Cycle. The Proportional Performance Ceiling Rate would be 3/5 x 5% or 3%, which means the return provided at the time of withdrawal will not be greater than 3%.

On the Maturity Date, the Unit Value for each Cycle will be computed based on the change in the Index Value, which excludes dividends, the Performance Ceiling Rate, and the Maturity Date Floor Rate.

Example: The Unit Value on the Cycle Start Date is $10 and on the Maturity Date it is $12, representing an increase of 20%. The Performance Ceiling Rate for the Cycle is 9%, and the Maturity Date Floor Rate is 7%. The ending Unit Value on the Maturity will be $10.90 or 9% x $10.

For more information, see “Value of Cycle Investment” on page __.

Withdrawals

To withdraw money from a Cycle, a Contract Holder must transmit to us a Written Notice containing the pertinent details of the withdrawal request, including the amount of the withdrawal and the Cycle or Cycles from which to withdraw money (“withdrawal request”). We will process withdrawal requests that we receive by the Close of Trading on a Cycle Business Day using that Day’s Unit Value. For withdrawal requests we receive after the Close of Trading on a Cycle Business Day, we will use the Unit Value of the next Cycle Business Day. We will use the Unit Value provided by the Fair Value Calculation Agent to process your withdrawal request. See “Value of Cycle Investment” on page __ for more information.

We will pay the withdrawal amount to the Contract Holder no later than three (3) Business Days after the Cycle Business Day on which we received the Written Notice, subject to our right to defer payment discussed below. If amounts are withdrawn from a Cycle before its Maturity Date, any increase in the Unit Value will be subject to the Proportional Performance Ceiling Rate, which reduces the Performance Ceiling Rate and any decrease in Unit Value is not subject to the Maturity Date Floor Rate. THERE IS NO DOWNSIDE PROTECTION (I.E., NO FLOOR ON LOSS) ON AMOUNTS WITHDRAWN FROM A CYCLE PRIOR TO ITS MATURITY DATE.

Deferral of Payment. We may defer payment of any withdrawal request or other payment under the IIO if, due to the closing or other disruption of financial markets or exchanges, the failure of the Fair Value Calculation Agent to provide us with timely values, or other circumstances beyond the Company’s control, the Company is unable to settle the necessary transactions prudently as reasonably determined by the Company. Payments may be deferred for up to six months if the insurance regulatory authority of the state in which the IIO is issued approves such deferral.

Maturity Date Payments; Rollovers

We will pay the Contract Holder the proceeds of the Contract Holder’s Cycle Investment on the Maturity Date. A Contract Holder may provide Written Notice to us of its desire to roll over its Cycle Investment proceeds into a new Cycle that has a Start Date within three (3) Business Days after the Maturity Date of the Cycle that just ended. Absent such a Written Notice, the Company will pay any amounts payable in connection with a Maturity Date no later than three (3) Business Days after the Maturity Date, subject to our right to defer payment discussed under “Deferral of Payment” above.

IIO Risks

This section provides a general overview of the risks related to the IIO.

General Risks

We reserve the right, consistent with the terms of the Contract and applicable law, to make certain changes to the structure and operation of the IIO as described herein at our discretion and without Contract Holder consent, such as the right to reject or limit investments into the Contract, the right to not offer Cycles, and the right to offer new indices.

Risk of Loss

A Cycle Investment is subject to the risk of loss of principal due to negative Index performance. At the Maturity Date, the IIO provides protection from any negative Index performance starting at the Maturity Date Floor Rate. Thus, the Contract Holder will bear the risk of loss for any negative Index performance down to the Maturity Date Floor Rate. If the Contract Holder takes a withdrawal from a Cycle during the Cycle Term, the Contract Holder bears the entire risk of loss because no Maturity Date Floor Rate would apply. The amount available for the withdrawal during a Cycle Term will be based upon the Fair Value for the Cycle, which may be lower or higher than the initial Cycle Investment.

Hedging Risk

There is no guarantee that any hedging strategies that we use will be successful. Changes in the value of a hedging transaction may not completely offset changes in the value of the Index being hedged. Hedging transactions also involve costs and may result in losses.

Liquidity Risk

The IIO is not designed to be a short-term investment as many of the Cycles will have Cycle Terms in excess of one year. In addition, if the Contract Holder takes a withdrawal from a Cycle during the Cycle Term prior to the Maturity Date, the amount available for the withdrawal will take into account the Proportional Performance Ceiling Rate. This further reduces the Performance Ceiling Rate based on the remaining time left until the Maturity Date relative to the Cycle Term. Thus, the earlier the withdrawal, the greater the Proportional Performance Ceiling Rate reduces the amount available for withdrawal.

Availability of Cycles, Maturity Date Floor Rates, and Performance Ceiling Rates

We reserve the right to not offer any Cycles, and to reject or limit the amount that can be invested in a Cycle. We set Maturity Date Floor Rates and Performance Ceiling Rates in our discretion based on a variety of factors. These rates may change from Cycle to Cycle. Contract Holders bear the risk that the rates we set will be lower than what they find acceptable.

Limited Participation in Positive Performance

Any increase in the value of the Contract Holder’s Cycle Investment for any Cycle is limited by the Cycle’s Performance Ceiling Rate, which could cause the Contract Holder’s Cycle Investment on any Cycle Business Day to be lower than they would otherwise be if the Contract Holder invested, for example, in a mutual fund or exchange-traded fund. The Performance Ceiling Rates benefit us because they limit the amount of increase in the Cycle Investment that we may be obligated to pay. We set the Performance Ceiling Rates in our discretion. Prior to the Maturity Date, the amount available for the withdrawal will take into account the Proportional Performance Ceiling Rate, which reduces the Performance Ceiling Rate based on the remaining time left until the Maturity Date relative to the Cycle Term. Generally, Cycles with greater protection tend to have lower Performance Ceiling Rates than other Cycles that use the same Index and Cycle Term but provide less protection.

Performance Ceiling Rate Not Set Until Start Date

The Performance Ceiling Rate for a Cycle is determined at the time we establish a Cycle and therefore may be different from the indicative Performance Ceiling Rate. While we will provide Notice of the indicative Performance Ceiling Rate at least 30 calendar days prior to a Start Date, the Contract Holder will not know the actual rate before the Cycle starts. Therefore, the Contract Holder will not know in advance the upper limit on the return that may be credited to the Contract Holder’s investment in a Cycle. The Performance Ceiling Rate for a new Cycle Term may be higher, lower, or equal to the Performance Ceiling Rate for the prior Cycle Term.

To mitigate against the risk, the Contract Holder may provide us Written Notice of the Performance Ceiling Threshold, which is the minimum Performance Ceiling Rate for the Contract Holder’s investment into a Cycle. If the Cycle we establish has a Performance Ceiling Rate lower than the Performance Ceiling Threshold specified by the Contract Holder in the Written Notice for investment, we will not process the Contract Holder’s investment into the Cycle.

The Performance Ceiling Rate applies from the Start Date to the Maturity Date, and is not an annual limit.

Unit Value Based Upon Fair Value During Cycle Term

On each Cycle Business Day, other than the Start Date and Maturity Date, we determine the Unit Value by reference to a Fair Value. The Fair Value of a Cycle reflects the current value of financial instruments that may be purchased to provide a return equal to the change in Index Value at the end of the Cycle Term subject to the Performance Ceiling Rate and the Maturity Date Floor Rate. We contract with Fair Value Calculation Agents to determine the Fair Value of a Cycle based on a variety of factors such as the change in the Index Value from the Start Date, implied volatility of the Index, interest rate changes, and the time remaining to the Maturity Date. The Fair Value is determined using a formula which is determined based on the economic value of hypothetical underlying investments at the time of the valuation designed to match Cycle value at the Maturity Date. This means the Fair Value of a Cycle during a Cycle Term could be different than the change in the valuation of the underlying Index during the calculation period.

Midland may publish on a website or otherwise make available Unit Values prior to the Maturity Date. For more information and to see how Fair Value and Unit Value are calculated, see “Appendix – Unit Value Examples.”

Risk Associated with Indices

The value of the Contract Holder’s Cycle Investment is dependent on the performance of the applicable Index. The performance of an Index is based on changes in the values of the securities or other investments that comprise or define the Index. The securities comprising or defining the Indices are subject to a variety of investment risks, many of which are complicated and interrelated. These risks may affect capital markets generally, specific market segments, or specific issuers. The performance of the Indices may fluctuate, sometimes rapidly and unpredictably. Negative Index performance may cause the Contract Holder to realize investment losses. The historical performance of an Index does not guarantee future results. It is impossible to predict whether an Index will perform positively or negatively over the course of a Cycle Term.

While it is not possible to invest directly in an Index, if the Contract Holder chooses to allocate amounts to the IIO, the Contract Holder is indirectly exposed to the investment risks associated with the applicable Index. Because each Index is comprised or defined by a collection of equity securities, each Index is largely exposed to market risk and issuer risk. Market risk is the risk that market fluctuations may cause the value of a security to fluctuate, sometimes rapidly and unpredictably. Issuer risk is the risk that the value of an issuer’s securities may decline for reasons directly related to the issuer, as opposed to the market generally. We may also add or remove Indices at our discretion. Provided below is a summary of important investment risks to which each Index is exposed. For more information, see "Indices" on page __.

· S&P 500® Index. The S&P 500® Index is comprised of equity securities issued by large-capitalization U.S. companies. In general, large-capitalization companies may be unable to respond quickly to new competitive challenges, and may not be able to attain the high growth rate of successful smaller companies.

· Russell 2000® Index. The Russell 2000® Index is comprised of equity securities of small-capitalization U.S. companies. In general, the securities of small-capitalization companies may be more volatile and may involve more risk than the securities of larger companies. Small-capitalization companies are more likely to fail than larger companies.

· MSCI® Emerging Markets Index. The MSCI® Emerging Markets Index is comprised of equity securities of large- and mid-capitalization companies in emerging markets. In general, large-capitalization companies may be unable to respond quickly to new competitive challenges, and may not be able to attain the high growth rate of successful smaller companies. Generally, the securities of mid-capitalization companies may be more volatile and may involve more risk than the securities of larger companies. Mid-capitalization companies are more likely to fail than larger companies. Securities issued by non-U.S. companies (including related depositary receipts) are subject to the risks related to investments in foreign markets (e.g., increased price volatility; changing currency exchange rates; and greater political, regulatory, and economic uncertainty). Those risks are typically more acute when issuers are located or operating in emerging markets. Emerging markets may be more likely to experience inflation, political turmoil, and rapid changes in economic conditions than developed markets. Emerging markets often have less uniformity in accounting and reporting requirements, less reliable valuations, and greater risk associated with custody of securities than developed markets.

In addition, Index performance does not does not reflect dividends or distributions paid on the stocks comprising the Index, and, therefore, the calculation of the performance of the Index for a Cycle Investment does not reflect the full investment performance of the underlying securities.

No Rights in the Securities Underlying the Index

A Cycle Investment does not involve investing in the associated Index nor in any securities included in that Index. As a result, Contract Holders will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of securities comprising the indexes would have. We calculate the increase in value of Cycle Investment without taking into account any such distributions or dividends paid.

Substitution of an Index

There is no guarantee that an Index will remain available through the end of a Cycle Term. In the event an Index is discontinued or undergoes a substantial change, we may substitute an alternative Index prior to the Maturity Date or terminate a Cycle, as described further in “Discontinuation of or Substantial Change to an Index” on page __. If we substitute an Index, there is the risk that the performance of the new Index will differ from that of the original Index, and possibly be less favorable. If we terminate a Cycle, the Maturity Date will be the last Cycle Business Day prior to the date the Index is discontinued or changed, and we will use the Index Value on that date to compute the Maturity Date Unit Value and each Cycle Investment. There is the risk that the performance of such truncated Cycle Term may not be as favorable. Contract Holders may not transfer from the affected Cycle into another Cycle that has already commenced. Withdrawals from a Cycle prior to its Maturity Date will result in the application of the Proportional Performance Ceiling Rate, which will lower the rate of return.

Payment Obligation and Financial Strength of Midland National

No company other than Midland National has any legal responsibility to pay the amounts that Midland National owes under the IIO. Our General Account assets support the guarantees under the IIO and are subject to the claims of our creditors. As such, the guarantees under the IIO are subject to our financial strength and claims-paying ability, and therefore, to the risk that we may default on those guarantees. For information on our financial condition, please review our financial statements included in this Prospectus. Additionally, information concerning our business and operations is set forth in the section of this Prospectus entitled “Information about Midland National” on page __.

Cybersecurity

We rely heavily on interconnected computer systems and digital data to conduct our insurance business activities. Because our insurance business is highly dependent upon the effective operation of our computer systems and those of our business partners, our business is potentially vulnerable to disruptions from utility outages and other problems, and susceptible to operational and information security risks resulting from information systems failure (hardware and software malfunctions) and cyber-attacks. These risks include, among other things, the theft, misuse, corruption and destruction of data maintained online or digitally, and unauthorized release of confidential customer information. For instance, cyber-attacks may: interfere with our processing of IIO transactions, including the processing of orders from our website; cause the release and possible destruction of confidential customer or business information; impede order processing; subject us and/or our service providers and intermediaries to regulatory fines and financial losses; and/or cause reputational damage.

Cybersecurity risks may also affect the Indices. Breaches in cybersecurity may cause an Index’s performance to be incorrectly calculated, which could affect the calculation of values under the IIO. We are not responsible for the calculation of any Index. Breaches in cybersecurity may also negatively affect the value of the securities or other investments that comprise or define the Index.

More Information on the IIO

The IIO is regulated as a group funding agreement under insurance laws of the state of Iowa, and is currently offered exclusively to Insurance Companies, Custodians, Platforms, and Trustees that allow individuals to participate in the IIO through Insurance Contracts, IRAs, Platforms, and Benefit Plans.

The IIO does not involve an investment in any underlying portfolio of securities or financial instruments, and is not a mutual fund or an investment advisory account. Furthermore, Midland National does not provide any investment advice or manage any retirement and non-retirement savings allocated to any Cycle.

Indices

S&P 500 Index. The S&P 500 Index was established by Standard & Poor’s. The S&P 500 Index includes 500 leading companies in leading industries of the U.S. economy, capturing 75% coverage of U.S. equities. The S&P 500 Index does not include dividends declared by any of the companies included in this Index.

Russell 2000 Index. The Russell 2000 Index measures the performance of the small-capitalization segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest companies based on a combination of their market cap and current index membership.

MSCI® Emerging Markets Index. The MSCI® Emerging Markets Index is designed to represent performance of large- and mid-capitalization companies across 26 emerging markets.

Please see the “Appendix - Indices Disclaimers” for important information regarding the Indices.

Discontinuation of or Substantial Change to an Index

In the event that the Index for a Cycle is discontinued, or is changed substantially, we may substitute an available comparable Index or terminate the Cycle. In determining which action to take, we will consider the costs related to the action to be taken, and such other factors we deem relevant.

If we substitute a comparable Index, we will first seek any required regulatory approval. Then, we may adjust the Index Value used on the Start Date to the Index Value of the substitute Index on the Start Date or adjust the Unit Value as of the date we substitute the comparable Index, taking into account the performance of the discontinued or changed Index from the Start Date. The Cycle Term, Maturity Date, and Maturity Date Floor Rate will not change due to the substitution.

We would attempt to choose a new Index that has a similar investment objective and risk profile to the original Index. The selection criteria for a suitable alternative Index may include the following:

1. There is a sufficiently large market in exchange traded and/or over-the counter options, futures, and similar derivative instruments based on the index to allow the Company to hedge fluctuations of the Index Value.

2. The Index is recognized as a broad-based Index for the relevant market; and

3. The publisher of the Index allows the Company to use the Index and other materials for a reasonable fee.

If we terminate the Cycle, the Maturity Date will be as of the last Cycle Business Day prior to the date the Index is discontinued or changed. We will use the Index Value on such date to compute the Maturity Date Unit Value and each Cycle Investment.

We will provide prompt Notice to the Contract Holder if the Index for a Cycle is discontinued or changed substantially and the action we have decided to take.

Establishment of Cycles and Performance Ceiling Rate

Cycles. On a Start Date, we will establish a Cycle based on the following factors:

1) A minimum investment into each Cycle.

2) A maximum investment into each Cycle.

3) All timely Written Notices for investment into Cycles we have received.

4) Our ability to hedge our obligations under each Cycle, given the availability of counterparties and derivatives on the underlying index.

5) Economic and market factors including, but not limited to, market volatility and interest rates.

Once we have determined to establish a Cycle, we will (i) set the Performance Ceiling Rate for each Cycle we are establishing and (ii) provide Notice to the Contract Holder of each Cycle we are establishing and its Performance Ceiling Rate. We will provide the Notice no later than the Start Date.

Performance Ceiling Rate Threshold. For each investment into a Cycle, the Performance Ceiling Rate must be greater than or equal to the Contract Holder’s Performance Ceiling Threshold. The Contract Holder’s Written Notice must specify the requested investment amount attributable to each Performance Ceiling Threshold. For any amounts to be transferred to us for investment in a Cycle, we must receive in immediately available funds by federal funds transfer, no later than the close of the Federal Reserve Wire Transfer System on the Start Date. We reserve the right to reject, limit, restrict, or suspend investments made to the Contract.

Cycle Investment amount requirements

The amount of the Contract Holder’s investment into each Cycle will be equal to the least of the amounts described in paragraphs 1, 2, or 3 below:

1) The amount contained in the Contract Holder’s Written Notice.

2) The sum of: (a) the amount received from the Contract Holder for investment in each Cycle by the Start Date, and (b) the amount from a Cycle or Cycles maturing prior to the applicable Start Date. In the event that the sum exceeds the amount contained in the Contract Holder’s Written Notice or the pro rata share of the maximum aggregate investment into the Cycle, we will return any excess amounts to the Contract Holder.

3) If the total amount received for investment into a Cycle for all Contracts is more than the maximum aggregate investment into the Cycle, then a pro rata share of the maximum aggregate investment into the Cycle.

Example: We offer a Cycle with a 1-year Cycle Term on Tuesday May 1, 2020. We provide notice to the Contract Holder by April 1, 2020. Our Notice states the following investment requirements:

· The minimum aggregate required investment is $500,000.

· The maximum aggregate investment is $1,000,000.

· The Deadline for Contract Holder to provide Written Notice of investment is 5 p.m. Eastern on April 15, 2020.

We receive a Contract Holder’s Written Notice of investment by the Deadline that the Contract Holder’s investment will be $750,000. If other Contract Holders seek to invest $500,000, and we receive $750,000 from the Contract Holder, then the Contract Holder’s pro rata share of the maximum aggregate investment is: $750,000 * ($1,000,000/$1,250,000) or $600,000 and we will return the $150,000 excess.

Value of Cycle Investment

The amount invested in a Cycle by the Contract Holder is the Cycle Investment. As of any Cycle Business Day, the Cycle Investment is measured by the number of Units of the Cycle credited to the Contract Holder multiplied by the Unit Value, each as of that Cycle Business Day. The Cycle Investment will reflect withdrawals and fluctuations in the Unit Value. ON ANY CYCLE BUSINESS DAY AFTER THE START DATE, THE CONTRACT HOLDER’S CYCLE INVESTMENT MAY BE LESS THAN THE AMOUNT INITIALLY INVESTED.

Units

The number of initial Units credited to the Contract Holder is the Contract Holder’s initial Cycle Investment divided by $10.00. The number of Units credited to the Contract Holder will be reduced by withdrawals made prior to the Maturity Date.

Example. A withdrawal request for $10,000 from a Cycle prior to the Cycle Maturity Date is received. At the time of the request, the number of Units owned by the Contract Holder is 10,000 and the Unit Value is $10 for a total value of $100,000. After the withdrawal the total value is $90,000 = $100,000 - $10,000. The total number of Units withdrawn is 1,000 = $10,000/$10 per unit. The number of Units owned after the withdrawal is 9,000 = 10,000 – 1,000.

Unit Value

For each Cycle, we will establish the Unit Value on the Start Date, and calculate the Unit Value on each Cycle Business Day and on the Maturity Date. The methods used to calculate the Unit Value on each Cycle Business Day and on the Maturity Date are different.

On the Start Date. For each Cycle, on its Start Date, we set the initial Unit Value at $10.00.

During the Cycle Term. For each Cycle, we determine its Unit Value as of each Cycle Business Day based on its Fair Value and the Proportional Performance Ceiling Rate.

We have contracted with IHS Markit, an independent analytics firm, to be the Fair Value Calculation Agent to compute the Fair Value of a Cycle.

The Fair Value of a Cycle is determined by the Fair Value Calculation Agent as of the end of each Cycle Business Day. The Fair Value reflects the current value of the financial instruments that may be purchased to provide a return equal to the change in Index Value at the end of the Cycle Term subject to the Performance Ceiling Rate and subject to the Maturity Date Floor Rate. The Fair Value is based on a variety of factors considered by the Fair Value Calculation Agent, and may include the change in the Index Value from the Start Date, volatility of the Index, changes in the interest rate environment and the time remaining to the Maturity Date. The Fair Value is based on the economic value of hypothetical underlying investments at the time of the valuation designed to match Cycle value at the Maturity Date. This means the Fair Value of a Cycle during a Cycle Term could be different than the change in the valuation of the underlying Index during the calculation period.

There are five hypothetical financial instruments used in the determination of Fair Value of a Cycle. These hypothetical financial instruments are constructed to produce a return equal to the Cycle return on the maturity date of the Cycle. These financial instruments are combined as described below.

1) A zero-coupon bond with a maturity date equal to the Cycle Maturity Date, plus;

2) An at-the-money call option. This is an option to buy a position in the Index on the Cycle Maturity Date at a strike price equal to the price of the Index on the Cycle Start Date, less;

3) An at-the-money put option. This is an option to sell a position in the Index on the Cycle Maturity Date at a strike price equal to the price of the Index on the Cycle Start Date, less;

4) An out-of-the-money call option. This is an option to buy a position in the Index on the Cycle Maturity Date at a strike price equal to the price of the Index on the Cycle Start Date times (1 + Performance Ceiling Rate), plus;

5) An out-of-the-money put option. This is an option to sell a position in the Index on the Cycle Maturity Date at a strike price equal to the price of the Index on the Cycle Start Date times (1 – Maturity Date Floor Rate).

The value of each of these financial instruments is determined by a Fair Value Calculation Agent using standard financial industry techniques. The call and put options are all valued using the Black-Scholes option valuation formula. The value of the zero-coupon bond is determined by a present value of the maturity value at an applicable proxy for the risk-free interest rate (currently LIBOR Swap rates).

Once we receive the Fair Value, we compute a preliminary Unit Value. The Cycle Business Day's Unit Value will equal the Cycle Business Day Preliminary Unit Value (see A Below) subject to being no greater than the Cycle Business Day Unit Value Ceiling (see B below).

A. Cycle Business Day Preliminary Unit Value

The Cycle Business Day Preliminary Unit Value equals the Cycle’s Fair Value divided by the total number of Units outstanding, each as of that day.

B. Cycle Business Day Unit Value Ceiling

If the Cycle Business Day Preliminary Unit Value is greater than the initial Unit Value, we determine the Cycle Business Day Unit Value Ceiling. The Cycle Business Day Unit Value Ceiling equals: (i) the initial Unit Value multiplied by (ii) one plus the Proportional Performance Ceiling Rate. The Proportional Performance Ceiling Rate is equal to the (i) Performance Ceiling Rate multiplied by (ii) the time lapsed during the Cycle Term divided by the Cycle Term.

The Maturity Date Floor Rate does not apply during the Cycle Term prior to the Maturity Date. Thus, there is no protection against any decrease in value of the Cycle Investment for withdrawals during the Cycle Term prior to the Maturity Date.

See “Appendix – Unit Value Examples” for illustrations of how Unit Values are computed.

On the Maturity Date

For each Cycle, we determine its Unit Value as of its Maturity Date based on the change in the Index Value, the Performance Ceiling Rate, and the Maturity Date Floor Rate. As of the Maturity Date, we compute the Maturity Date Preliminary Unit Value (see B below). The Maturity Date Unit Value will equal the Maturity Date Preliminary Unit Value subject to being no greater than the Maturity Date Unit Value Ceiling (see C below) and being no less than the Maturity Date Unit Value Floor (see D below).

A. Change in the Index Value

The change in Index Value equals:

1) The last reported value of the Index on the Maturity Date, minus the last reported value of the Index on the Start Date, divided by

2) The last reported value of the Index on the Start Date.

B. Maturity Date Preliminary Unit Value

The Maturity Date's preliminary Unit Value equals

1) The initial Unit Value multiplied by

2) One plus the change in Index Value, computed as set forth in A above.

C. Maturity Date Unit Value Ceiling

The Maturity Date's Unit Value Ceiling equals the initial Unit Value multiplied by one plus the Performance Ceiling Rate.

D. Maturity Date Unit Value Floor

The Maturity Date Unit Value Floor equals the initial Unit Value multiplied by one plus the Maturity Date Floor Rate.

See “Appendix – Unit Value Examples” for illustrations of how Unit Values are computed.

Once we use the value of an Index reported to us to determine the amounts payable on any withdrawals or to determine the Unit Value at Maturity Date, we will not change the Index Value even if it is subsequently changed. Misreporting of the index value to us by the Fair Value Calculation Agent is an unlikely event, but one example where this may occur is if the Index provider has misreported the Index value.

Reporting

For each Cycle invested in by a Contract Holder, we will make electronically available for each Cycle Business Day (i) the number of Units credited to the Contract Holder and (ii) the Unit Value on the Business Day preceding the Cycle Business Day.

At least once each year, we will send Contract Holders a report containing information required by applicable state law and the following:

1) The beginning date and end date for the reporting period.

2) For each Cycle in which the Contract Holder has invested during the reporting period:

a) The Start Date, Cycle Term, Maturity Date Floor Rate, Performance Ceiling Rate, and the value of the Index on the Start Date, and if there was a Maturity Date, the value of the Index on the Maturity Date.

b) The number of Units credited to the Contract Holder (i) at the beginning of the reporting period, and (ii) on the Cycle Business Day immediately prior to the date of the report.

c) The number of Units redeemed and the Unit Value in connection with each withdrawal made during the current reporting period.

d) The Unit Value (i) at the beginning of the reporting period, and (ii) on the Cycle Business Day immediately prior to the date of the report.

3) The Index price for each Cycle on the Start Date and, at the end of the current report period.

Individual Participation in the IIO

The IIO is a group funding agreement currently offered exclusively to Insurance Companies, Custodians, Platforms, and Trustees (collectively, the “Contract Holders”). Contract Holders allow individuals to participate in their IIOs through Insurance Contracts, IRAs, Platforms, and Benefit Plans that the Contract Holders or their designees administer. Contract Holders exercise all rights under the IIO, and make all decisions regarding Contract features, such as selecting Cycles, Performance Ceiling Rate Thresholds, Maturity Date Floor Rates, Cycle Terms, and withdrawals.

Only Contract Holders may submit Investment Orders and Notices or Written Notices regarding their Contracts to us. Individuals participating in the IIO through Insurance Contracts, IRAs, Platforms, and Benefit Plans may only submit investment, withdrawal, and other instructions to the Contract Holders or their designees, who will then aggregate such instructions before submitting a Written Notice to us. Individuals may participate only in the Cycles selected by the Contract Holders through whom they are investing.

Midland National is not responsible for the failure of any Contract Holder to timely submit Investment Orders by the Deadline for a Cycle or for any decision made by a Contract Holder or designee that affects any individual participation in the IIO. Contract Holders may establish their own limits on individual participation. Individuals who wish to participate in the IIO through an Insurance Contract, IRA, Platform, or Benefit Plan should contact the Contract Holder for information on any requirements imposed by the Contract Holder, including any investment limitations, and any account information relating to their investments in the IIO through Insurance Contracts, IRAs, Platforms, or Plans.

The IIO is a complex investment. Individuals should consult their financial professional about the risks, benefits, and other features of the IIO, and whether it is appropriate based upon their financial situations and objectives. Please consider carefully the important information contained in this prospectus before participating in the IIO through an Insurance Contract, IRA, Platform, or Benefit Plan.

Midland National is not an investment adviser and does not provide any investment advice with respect to the IIO.

Federal Taxes

In this part of the prospectus, we discuss the current federal income tax rules that generally apply to the IIO owned by an insurance company, bank, employer or employee benefit plan. The tax rules can differ, depending on the type of contract, whether qualified traditional IRA or Roth IRA.

Federal income tax rules include the United States laws in the Internal Revenue Code, and Treasury Department Regulations and IRS interpretations of the Internal Revenue Code. These tax rules may change without notice. We cannot predict whether, when, or how these rules could change. Any change could affect contracts purchased before the change. Congress may also consider proposals in the future to comprehensively reform or overhaul the United States tax and retirement systems, which if enacted, could affect the tax benefits of a contract. We cannot predict what, if any, legislation will actually be proposed or enacted.

We cannot provide detailed information on all tax aspects of the IIO. Moreover, the tax aspects that apply to a particular person’s investment may vary depending on the facts applicable to that person. We do not discuss state income and other state taxes, federal income tax and withholding rules for non-U.S. taxpayers, or federal gift and estate taxes. We also do not discuss the Employee Retirement Income Security Act of 1974 (ERISA). Please consult a tax adviser before investing in the IIO.

Additional Information About the IIO

Other Contracts

We offer a variety of fixed and variable insurance contracts with differing features, including investment options, and differing fees and charges. These contracts are different and separate from the IIO offered by this prospectus.

Expenses of Midland National for the IIO

In setting the Performance Ceiling Rate, we may take into account that we incur expenses in connection with the Cycle, including insurance, distribution, investment, and administrative expenses. In particular, if there were no such expenses, the Performance Ceiling Rate might be greater.

Statutory Compliance

We have the right to change the IIO without the consent of any other person in order to comply with any laws and regulations that apply, including but not limited to changes in the Internal Revenue Code, in Treasury Regulations or in published rulings of the IRS, and in U.S. Department of Labor regulations.

Any change in the IIO must be in writing and made by an authorized officer of Midland National. We will provide Notice of any material change.

Changes to the IIO

Only an authorized officer of the Midland National at its Home Office or an employee acting pursuant to a written delegation of authority from such officer may change the terms of the IIO. No other employee, producer, or representative of the Company may make any change in the terms of the IIO.

The terms of the IIO may be changed at any time by written mutual agreement of the Contract Holder and the Company. If we propose a change to the terms of the IIO requiring written mutual agreement and the Contract Holder does not agree to such change, we reserve the right to cease offering to the Contract Holder new Cycles under the terms of the IIO.

Midland National may change the IIO without the Contract Holder’s consent to conform to federal or state laws or regulations by attaching an Endorsement or Rider.

Any change to the IIO under this Section will not be applied to outstanding Cycles as of the effective date of the change. The change will be applicable to any new Cycles established and Cycle Investments made in such Cycles on or after the effective date of the change.

We will notify the Contract Holder in writing before the effective date of any such change.

Errors

The Contract Holder will be solely responsible for the accuracy of any Written Notice transmitted to us or our agent and the transmission of any Written Notice will constitute the Contract Holder’s representation to us that the Written Notice is accurate, complete and duly authorized.

Misstatement and Adjustments

We reserve the right to correct any informational or administrative errors.

Reservation of Rights

The Company may, in its sole discretion, elect not to exercise a right or reservation specified in this Contract. Such election will not constitute a waiver of the right to exercise such right or reservation at any subsequent time.

Assignment

The Contract Holder may assign this Contract only with the Company's written consent. The Contract Holder must provide Written Notice to us at least 30 calendar days before the assignment effective date. If we agree, the assignment will take effect on the date the Written Notice is signed, unless otherwise specified by the Contract Holder. We will not be bound by any assignment until it is filed with us. We will not be responsible for the validity of any assignment. We will not be liable for any payments we make before recording the Written Notice of assignment. To the extent allowed by applicable state law, we reserve the right to refuse Our consent to any assignment at any time on a nondiscriminatory basis if the assignment would violate or result in noncompliance with any applicable state or federal law or regulation. In addition, we will not be liable for any tax consequences that may occur due to the assignment of the Contract.

Termination

By the Company

The Company may terminate the Contract at any time. To terminate the Contract, the Company must provide Notice of the termination at least 30 calendar days before the termination Effective Date.

Upon the effective date of the termination, no new Cycles will be made available to the Contract Holder. Outstanding Cycles on the effective date of the termination will continue to operate as set forth in this Contract. Upon the payment to the Contract Holder of the Cycle Investments for all outstanding Cycles on the termination effective date, the Company's obligations under this Contract will be fully discharged and no further payments will be due to the Contract Holder.

By the Contract Holder

The Contract Holder may terminate this Contract at any time. To terminate this Contract, the Contract Holder must provide Us Written Notice at least 30 calendar days before the termination effective date including:

(1) the effective date of the termination by the Contract Holder; and

(2) the Contract Holder's election to withdraw all amounts from the outstanding Cycles or to continue the Cycle Investments in all the outstanding Cycles, as of the termination effective date.

If the Contract Holder elects a withdrawal of all amounts from all outstanding Cycles as of the termination effective date, the Company will pay the Cycle Investments for all outstanding Cycles determined as of the termination effective date within three (3) Business Days after the termination effective date. Such payment will fully discharge the Company’s obligations under this Contract.

If the Contract Holder elects to continue the Cycle Investments in all outstanding Cycles as of the termination effective date, those Cycles will continue to operate as set forth in this Contract. Upon the payment to the Contract Holder of the applicable Cycle Investments for all outstanding Cycles, the Company's obligations under this Contract will be fully discharged and no further payments will be due to the Contract Holder.

Other Information

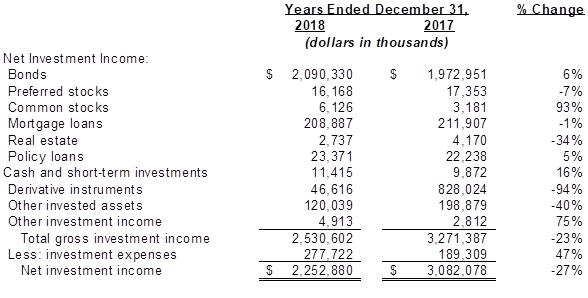

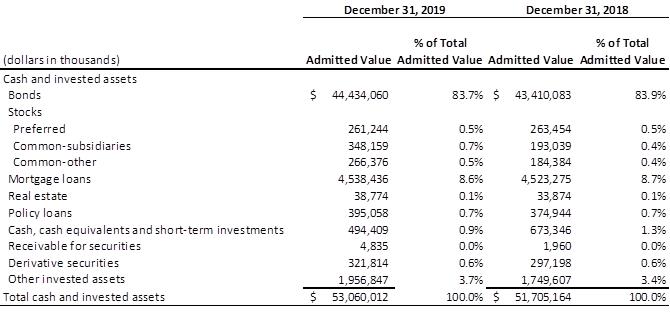

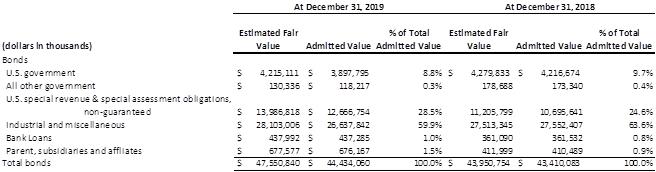

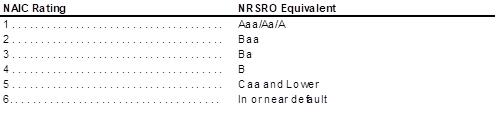

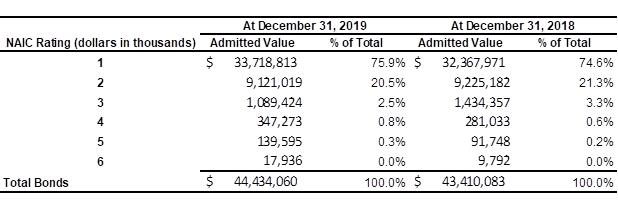

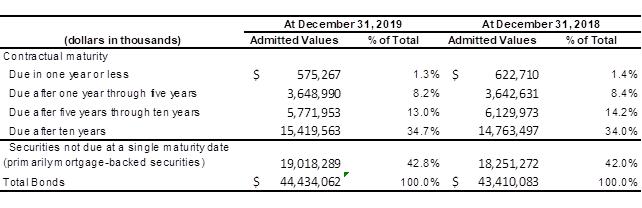

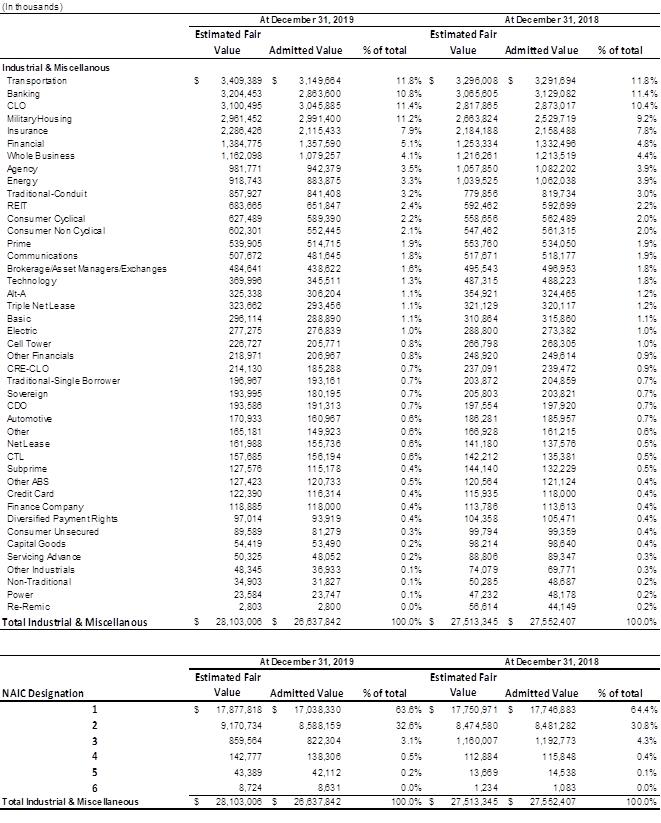

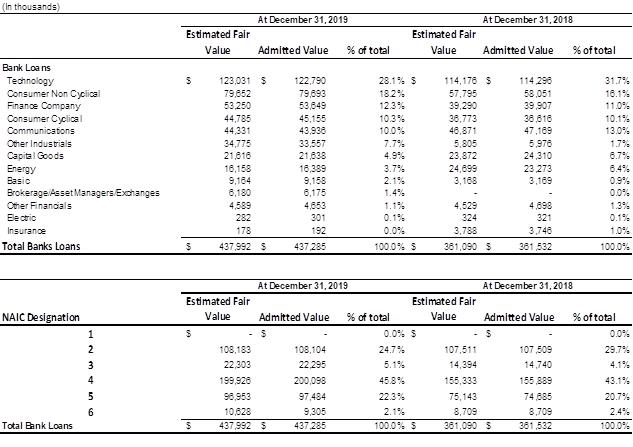

General Account