Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ALLIANT ENERGY CORP | lnt040320208-k.htm |

Powering What’s Next Investor Materials April 3, 2020

Safe harbor This presentation contains statements that may be considered forward looking statements. Such statements contain the word “expect,” “anticipates” or words of similar import, or speak to management’s expectations regarding the EPS growth goal, sales, EPS sensitivity, financing plans, pension funding plans, new generation plans and accounting charges. These statements speak of Alliant’s plans and expectations. Actual results could differ materially, because the realization of those results is subject to many uncertainties including: regulatory approvals and results; the direct or indirect impacts from the novel coronavirus (COVID-19) pandemic on our sales, our operations and our ability to complete construction projects; unanticipated construction costs or delays; economic conditions in our service territories; and other factors, some of which are discussed in more detail in Alliant’s Form 10-K for the year ended December 31, 2019. The information in this presentation was prepared as of April 2, 2020. Alliant undertakes no obligation to update any forward-looking information statement to reflect developments after the statement is made. 2

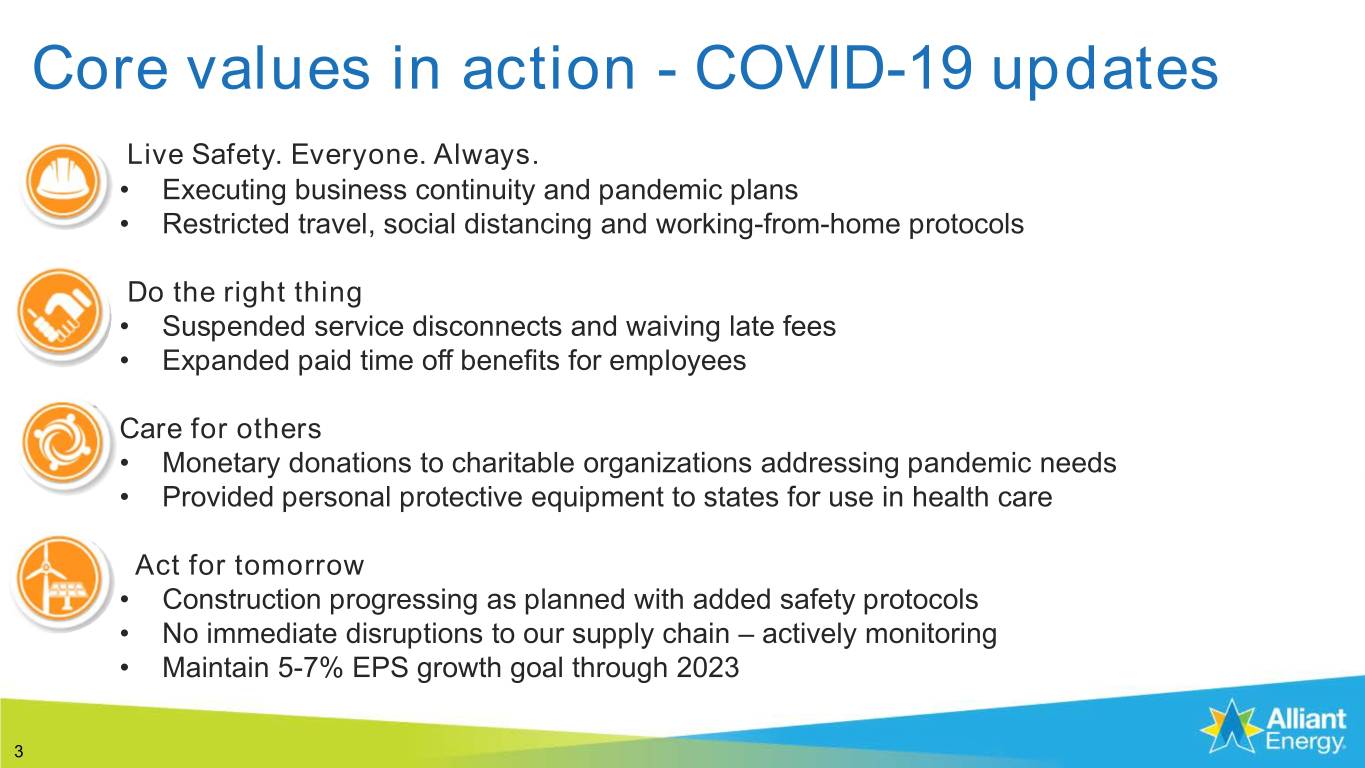

Core values in action - COVID-19 updates Live Safety. Everyone. Always. • Executing business continuity and pandemic plans • Restricted travel, social distancing and working-from-home protocols Do the right thing • Suspended service disconnects and waiving late fees • Expanded paid time off benefits for employees Care for others • Monetary donations to charitable organizations addressing pandemic needs • Provided personal protective equipment to states for use in health care Act for tomorrow • Construction progressing as planned with added safety protocols • No immediate disruptions to our supply chain – actively monitoring • Maintain 5-7% EPS growth goal through 2023 3

Sales sensitivities 2019 Retail Electric Margins Residential 46% Impact on 2020 sales not yet known Anticipate higher electric residential sales and lower Commercial Industrial 28% commercial and industrial (C&I) sales 26% EPS Sensitivity to +/- 1% change in Customer Class electric sales Commercial and Industrial Customer Profile Residential $0.02 Iowa Wisconsin Commercial $0.01 Primarily food, chemicals, Primarily fabricated metals, and other manufacturing chemicals, petroleum, plastics, Industrial $0.01 and food Large commercial and industrial margins include both an energy and a demand component. Approximately 40% of Iowa and 30% of Wisconsin C&I margins come from demand-based charges. 4

Strong liquidity / financings • Flexible credit facility – Can shift borrowing capacity between AEC, IPL Liquidity (in millions) and WPL; WPL has a floor of $300 million per PSCW order Total credit facility capacity $1,000 Total sale of receivables capacity 90 • Limited long-term debt maturities in 2020 ($350 million). No maturities in 2021 Total cash/investments 186 Total utilized (106) • Refinanced $300 million term loan at AEF and extended to March 2022 Available liquidity April 2, 2020 $1,170 • Solid investment grade credit ratings with stable outlook Utility Long-Term Debt IPL WPL (in millions) Amount Coupon Month Amount Coupon Month Issuances Up to $300 $350 3.65% April Maturities(a) ($200) 3.65% Sept. ($150) 4.60% June Common Equity (in millions) Timing Method $222 March 2020 Forward Sale Agreements of 4.3 million shares initially priced at $52.235 per share ~$25 2020 Shareowner Direct Plan (a) No maturities in 2021 5

Pension plan funding manageable • No expected earnings impact to 2020 as a result of any changes in discount rate or earnings on assets due to remeasurement at year-end • $60 million planned pension funding in 2020 • 73% qualified and non-qualified funded status at year-end 2019 • Asset allocation as of year-end 2019 • 47% equity • 29% fixed income • 19% other • 5% cash • Unfunded pension liabilities are included when establishing rates 6

Construction projects Projects proceeding as planned, no supply chain disruptions at this time Generation Size Project Type Owner (MW) Expected in-service Whispering Willow North Wind IPL 201 In-service January, 2020 Golden Plains Wind IPL 200 In-service March, 2020 West Riverside Energy Center Gas WPL ~730 Q2 2020 Richland Wind IPL ~130 Q3 2020 Kossuth Wind WPL ~150 Q4 2020 7

Credit risk exposure Alliant is well-positioned with counterparty default risk • Alliant’s customer arrears have decreased by more than 50% since 2016 Customer arrears at year-end* ($ millions) $150 $100 $50 $- *Arrears represent accounts past due by more 2016 2017 2018 2019 than 30 days • At the present time, Alliant anticipates no material credit risk due to commodity transactions • As a result of the new credit loss accounting standard effective January 1, 2020, Alliant anticipates recording a modest charge related to the legacy guarantee obligation from its divestiture of Whiting Petroleum 8