Attached files

| file | filename |

|---|---|

| EX-4.4 - DESCRIPTION OF REGISTRANT'S SECURITIES - Parking REIT, Inc. | exhibit44.htm |

| EX-32 - Parking REIT, Inc. | exhibit32.htm |

| EX-31.2 - Parking REIT, Inc. | exhibit312.htm |

| EX-31.1 - Parking REIT, Inc. | exhibit311.htm |

| EX-21.1 - Parking REIT, Inc. | exhibit21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

|

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2019

Or

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _________ to _________

Commission File Number: 000-55760

|

THE PARKING REIT, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

MARYLAND

|

47-3945882

|

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer

|

|

|

Incorporation or Organization)

|

Identification No.)

|

9130 WEST POST ROAD SUITE 200, LAS VEGAS, NV 89148

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (702) 534-5577

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, $0.0001 Par Value

|

|

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that

the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [ X ]

Emerging growth company [ X ]

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange

Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such

common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

There is no established market for the Registrant's shares of common stock. On May 28, 2019, the board of directors of the Registrant approved an estimated net asset value per share of the Registrant's common stock of

$25.10. However, current market disruptions relating to COVID-19 have significantly and adversely impacted the market for a wide variety of real estate assets as well as the supply of debt financing for real estate assets. As a result, we believe that

the value of our assets might have been impacted since the World Health Organization declared the outbreak of the COVID-19 pandemic on March 11, 2020. However, we cannot determine the ultimate impact, if any, on our estimate of net asset value per

share as of the filing date of this report. There were approximately 6,001,300 shares of common stock held by non-affiliates at June 30, 2019, the last business day of the registrant's most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

Class

|

Number of Shares Outstanding

As of March 30, 2020

|

||

|

Common Stock, $0.0001 Par Value

|

7,330,071

|

|

Page

|

|||

| 2 |

|||

| 7 |

|||

| 28 |

|||

| 28 |

|||

| 30 |

|||

| 30 |

|||

| 30 |

|||

| 32 |

|||

| 33 |

|||

| 50 |

|||

| 51 |

|||

| 97 |

|||

| 97 |

|||

| 98 |

|||

| 98 |

|||

| 104 |

|||

| 107 |

|||

| 108 |

|||

| 110 |

|||

| 111 |

|||

| 111 |

|||

| 112 |

|||

Certain statements included in this annual report on Form 10-K (this “Annual Report”) that are not historical facts (including any statements concerning investment objectives, other plans and objectives of management for

future operations or economic performance, or assumptions or forecasts related thereto) are forward-looking statements. Forward-looking statements are typically identified by the use of terms such as “may,” “should,” “expect,” “could,” “intend,”

“plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology.

The forward-looking statements included herein are based upon our current expectations, plans, estimates, assumptions and beliefs, which involve numerous risks and uncertainties. Assumptions relating to the foregoing

involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although

we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could

have a material adverse effect on our operations and future prospects include, but are not limited to:

|

•

|

the fact that the Company has a limited operating history, as property operations began in 2016;

|

|

•

|

the fact that the Company has experienced net losses since inception and may continue to experience additional losses;

|

|

•

|

the performance of properties the Company has acquired or may acquire or loans the Company has made or may make that are secured by real property;

|

|

•

|

changes in economic conditions generally and the real estate and debt markets specifically;

|

|

•

|

legislative or regulatory changes, including changes to the laws governing the taxation of real estate investment trusts (“REITs”);

|

|

•

|

the outcome of pending litigation or investigations;

|

|

•

|

potential damage and costs arising from natural disasters, terrorism and other extraordinary events, including extraordinary events affecting parking facilities included in the Company’s portfolio;

|

|

•

|

risks inherent in the real estate business, including ability to secure leases or parking management contracts at favorable terms, tenant defaults, potential liability relating to environmental matters and the

lack of liquidity of real estate investments;

|

|

•

|

competitive factors that may limit the Company’s ability to make investments or attract and retain tenants;

|

|

•

|

the Company’s ability to generate sufficient cash flows to pay distributions to the Company’s stockholders;

|

|

•

|

the Company’s failure to maintain status as a REIT;

|

|

•

|

the Company’s ability to successfully integrate pending transactions and implement an operating strategy;

|

|

•

|

the Company’s ability to list shares of common stock on a national securities exchange or complete another liquidity event;

|

|

•

|

the availability of capital and debt financing generally, and any failure to obtain debt financing at favorable terms or a failure to satisfy the conditions, covenants and requirements of that debt;

|

|

•

|

changes in interest rates;

|

|

•

|

changes to generally accepted accounting principles, or GAAP;

|

|

•

|

the impact on our business and those of our tenants from epidemics, pandemics or outbreaks of an illness, disease or virus (including COVID-19); and

|

|

•

|

potential adverse impacts from changes to the U.S. tax laws.

|

Any of the assumptions underlying the forward-looking statements included herein could be inaccurate, and undue reliance should not be placed upon any forward-looking statements included herein. All forward-looking

statements are made as of the date of this Annual Report, and the risk that actual results will differ materially from the expectations expressed herein will increase with the passage of time. Except as otherwise required by the federal securities

laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements made after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light

of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and

plans set forth in this Annual Report will be achieved.

This Annual Report may include market data and forecasts with respect to the REIT industry. Although the Company is responsible for all of the disclosure contained in this Annual Report, in some cases the Company relies

on and refers to market data and certain industry forecasts that were obtained from third party surveys, market research, consultant surveys, publicly available information and industry publications and surveys that the Company believes to be reliable.

General

The Parking REIT, Inc., formerly known as MVP REIT II, Inc. (the “Company,” “we,” “us” or “our”), is a Maryland corporation formed on May 4, 2015 and has elected to be taxed, and has operated in a manner that will allow

the Company to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes beginning with the taxable year ended December 31, 2017; therefore, it is the Company’s intention to file its income tax return as a REIT for the

year ended December 31, 2019.

The Company was formed to focus primarily on investments in parking facilities, including parking lots, parking garages and other parking structures throughout the United States. To a lesser extent, the Company may

invest in parking properties that contain other sources of rental income, potentially including office, retail, storage, residential, billboards or cell towers.

The Company is the sole general partner of MVP REIT II Operating Partnership, LP, a Delaware limited partnership (the “Operating Partnership”). The Company owns substantially all of its assets and conducts substantially

all of its operations through the Operating Partnership. The Company’s wholly owned subsidiary, MVP REIT II Holdings, LLC, is the sole limited partner of the Operating Partnership. The operating agreement provides that the Operating Partnership is

operated in a manner that enables the Company to (1) satisfy the requirements to qualify and maintain qualification as a REIT for federal income tax purposes, (2) avoid any federal income or excise tax liability and (3) ensure that the Operating

Partnership is not classified as a “publicly traded partnership” for purposes of Section 7704 of the Internal Revenue Code of 1986, as amended (the “Code”), which classification could result in the Operating Partnership being taxed as a corporation.

The Company utilizes an Umbrella Partnership Real Estate Investment Trust (“UPREIT”) structure to enable the Company to acquire real property in exchange for limited partnership

interests in the Operating Partnership from owners who desire to defer taxable gain that would otherwise normally be recognized by them upon the disposition of their real property or transfer of their

real property to the Company in exchange for shares of the Company’s common stock or cash.

The Company’s former advisor is MVP Realty Advisors, LLC, dba The Parking REIT Advisors (the “former Advisor”), a Nevada limited liability company, which is owned 60% by Vestin Realty Mortgage II, Inc. (“VRM II”) and 40%

by Vestin Realty Mortgage I, Inc. (“VRM I”). Prior to the Internalization (as defined below), the former Advisor was responsible for managing the Company’s affairs on a day-to-day basis and for identifying and making investments on the Company’s behalf

pursuant to a second amended and restated advisory agreement among the Company, the Operating Partnership and the former Advisor (the “Amended and Restated Advisory Agreement”). VRM II and VRM I are Maryland corporations that trade on the OTC pink

sheets and were managed by Vestin Mortgage, LLC, an affiliate of the former Advisor, prior to being internalized in January 2018.

As part of the Company’s initial capitalization, 8,000 shares of common stock were sold for $200,000 to an affiliate of the former Advisor.

Objectives

The Company’s primary objectives are to:

|

•

|

preserve capital;

|

|

•

|

generate current income; and

|

|

•

|

explore strategic alternatives to provide liquidity to stockholders, including sales of assets, potential liquidation of the Company, a sale of the Company or a portion thereof or a strategic business combination.

|

In mid-2019, the Company engaged financial and legal advisors and began to explore a broad range of potential strategic alternatives to provide liquidity to stockholders. The Company is currently exploring certain

strategic alternatives, including potential sales of assets, a potential sale of the Company or a portion thereof, a potential strategic business combination or a potential liquidation. However, there can be no assurance that the Board’s exploration

of potential strategic alternatives will result in any change of strategy or transaction being entered into or consummated or, if a transaction is undertaken, as to its terms, structure or timing. In addition, the value received in any potential

strategic alternative would likely be less than the net asset value (“NAV”) most recently estimated by the Company’s board of directors. Our assets have been valued based upon appraisal standards and the values of our assets using these methods are not

required to reflect market value under those standards and will not necessarily result in a reflection of fair value under generally accepted accounting principles. Further, different parties using different property-specific and general real estate

and capital market assumptions, estimates, judgments and standards could derive a different estimated NAV per share, which could be significantly different from the estimated NAV per share determined by our board of directors. The estimated NAV per

share is not a representation or indication that, among other things a stockholder would ultimately realize distributions per share equal to the estimated NAV per share upon liquidation of assets and settlement of our liabilities or upon a sale of our

company or a third party would offer the estimated NAV per share in an arms-length transaction to purchase all or substantially all of our shares of common stock. For example, we expect to incur additional costs in connection with ongoing litigation,

the SEC investigation discussed in Note P - Legal in Part II, Item 8 Notes to the Consolidated Financial Statements of this Annual Report on Form 10-K and legal and

consulting fees associated with pursuing any potential strategic alternatives, which in the aggregate may be material, none of which was taken in consideration when the board of directors determined the prior estimated NAV per share. Please see our

Current Reports on Form 8-K filed with the SEC on May 28, 2019 for additional information regarding the NAV calculation, as well as “Item 1A. Risk Factors—Risks Related to an Investment in the Company–Stockholders should not rely on the estimated NAV

per share as being an accurate measure of the current value of our shares of common stock” in this Annual Report on Form 10-K.

Prior Investment Strategy

The Company’s investment strategy has historically focused primarily on acquiring, owning and managing parking facilities, including parking lots, parking garages and other parking structures throughout the United States

and Canada. The Company historically focused primarily on investing in income-producing parking lots and garages with air rights in central business districts. In building its current portfolio, the Company sought geographically targeted investments

that present key demand drivers, that were expected to generate cash flows and provide greater predictability during periods of economic uncertainty. Such targeted investments include, but are not limited to, parking facilities near one or more of the

following demand drivers:

|

•

|

Downtown core

|

|

•

|

Government buildings and courthouses

|

|

•

|

Sporting venues

|

|

•

|

Hospitals

|

|

•

|

Hotels

|

However, as a result of the current COVID-19 pandemic, among other factors, such demand drivers have been and are expected to be significantly diminished for an indeterminate period of time. Many state and local

governments are currently restricting public gatherings or requiring people to shelter in place, which has in some cases eliminated or severely reduced the demand for parking. For more information on the effect of COVID-19 on our business, see “Item

1A. Risk Factors—Risks Related to Our Business—Our business and those of our tenants may be adversely affected by epidemics, pandemics or other outbreaks.”

Prior Investment Criteria

The Company historically focused on acquiring properties that met the following criteria:

|

•

|

properties that were expected to generate current cash flow;

|

|

•

|

properties that were expected to be located in populated metropolitan areas; and

|

|

•

|

properties were expected to produce income within 12 months of the Company’s acquisition.

|

As noted above, the Company does not currently expect to make any additional acquisitions unless and until it is able to sell some of its existing assets, and then only after ensuring that it has sufficient liquidity

resources. In the unlikely event of a future acquisition, the Company would expect the foregoing criteria to serve as guidelines, however, Management and the Company’s board of directors may vary from these guidelines to acquire properties which they

believe represent value opportunities.

Management Internalization

On March 29, 2019, the Company and the former Advisor entered into definitive agreements to internalize the Company’s management function effective April 1, 2019 (the “Internalization”). Since their formation, under the

supervision of the board of directors (the “Board of Directors”), the former Advisor has been responsible for managing the operations of the Company and MVP REIT, Inc., a Maryland corporation (“MVP I”), which merged with a wholly owned indirect

subsidiary of the Company in December 2017. As part of the Internalization, among other things, the Company agreed with the former Advisor to (i) terminate the Second Amended and Restated Advisory Agreement, dated as of May 26, 2017 and, for the

avoidance of doubt, the Third Amended and Restated Advisory Agreement, dated as of September 21, 2018, which by its terms would have become effective only upon a listing of the Company’s common stock on a national securities exchange (collectively, the

“Management Agreements”), each entered into among the Company, the former Advisor and MVP REIT II Operating Partnership, LP (the “Operating Partnership”); (ii) extend employment to the executives and other employees of the former Advisor; (iii) arrange

for the former Advisor to continue to provide certain services with respect to outstanding indebtedness of the Company and its subsidiaries; and (iv) lease the employees of the former Advisor for a limited period of time prior to the time that such

employees become employed by the Company.

Contribution Agreement

On March 29, 2019, the Company entered into a Contribution Agreement (the “Contribution Agreement”) with the former Advisor, Vestin Realty Mortgage I, Inc. (“VRTA”) (solely for purposes of Section 1.01(c) thereof),

Vestin Realty Mortgage II, Inc. (“VRTB”) (solely for purposes of Section 1.01(c) thereof) and Shustek (solely for purposes of Section 4.03 thereof). In exchange for the Contribution, the Company agreed to issue to the former Advisor 1,600,000 shares of

Common Stock as consideration (the “Internalization Consideration”), issuable in four equal installments. The first and second installments of 400,000 shares of Common Stock per installment were issued on April 1, 2019 and December 31, 2019,

respectively. See Note S — Deferred Management Internalization in Part II, Item 8 Notes to the Consolidated Financial Statements of

this Annual Report for additional information. The remaining installments will be issued on December 31, 2020 and December 31, 2021 (or if December 31st is not a business day, the day that is the last business day of such year). If requested by the

Company in connection with any contemplated capital raise by the Company, the former Advisor has agreed not to sell, pledge or otherwise transfer or dispose of any of the Internalization Consideration for a period not to exceed the lock-up period that

otherwise would apply to other stockholders of the Company in connection with such capital raise. See the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on April 3, 2019 for more information regarding

the Management Internalization.

Concentration

The Company had fifteen parking tenants as of December 31, 2019 and 2018. One tenant, SP Plus Corporation (Nasdaq: SP) (“SP+”), represented 60.8% of the Company’s base parking rental revenue for the year ended December

31, 2019.

SP+ is one of the largest providers of parking management in the United States. As of December 31, 2019, SP+ managed approximately 3,100 locations in North America.

Below is a table that summarizes parking rent by tenant for the years ended December 31, 2019 and 2018:

|

For the Years Ended December 31,

|

||||||||

|

Parking Tenant

|

2019

|

2018

|

||||||

|

SP +

|

60.8

|

%

|

57.3

|

%

|

||||

|

Premier Parking

|

14.8

|

%

|

17.1

|

%

|

||||

|

ISOM Mgmt

|

3.9

|

%

|

4.3

|

%

|

||||

|

ABM

|

3.9

|

%

|

4.6

|

%

|

||||

|

Interstate Parking

|

2.9

|

%

|

2.8

|

%

|

||||

|

342 N. Rampart

|

2.9

|

%

|

2.6

|

%

|

||||

|

Denison

|

2.7

|

%

|

2.5

|

%

|

||||

|

Lanier

|

2.4

|

%

|

2.4

|

%

|

||||

|

St. Louis Parking

|

2.0

|

%

|

2.2

|

%

|

||||

|

Premium Parking

|

1.2

|

%

|

--

|

|||||

|

TNSH, LLC

|

1.1

|

%

|

0.6

|

%

|

||||

|

Riverside Parking

|

0.9

|

%

|

1.0

|

%

|

||||

|

BEST PARK

|

0.2

|

%

|

1.5

|

%

|

||||

|

Denver School

|

0.2

|

%

|

0.2

|

%

|

||||

|

Secure

|

0.1

|

%

|

0.1

|

%

|

||||

|

PCAM, LLC

|

--

|

0.8

|

%

|

|||||

* During June 2018 Premier Parking acquired iPark Services. Subsequent to the acquisition Premier and iPark continue to operate under their original company

names.

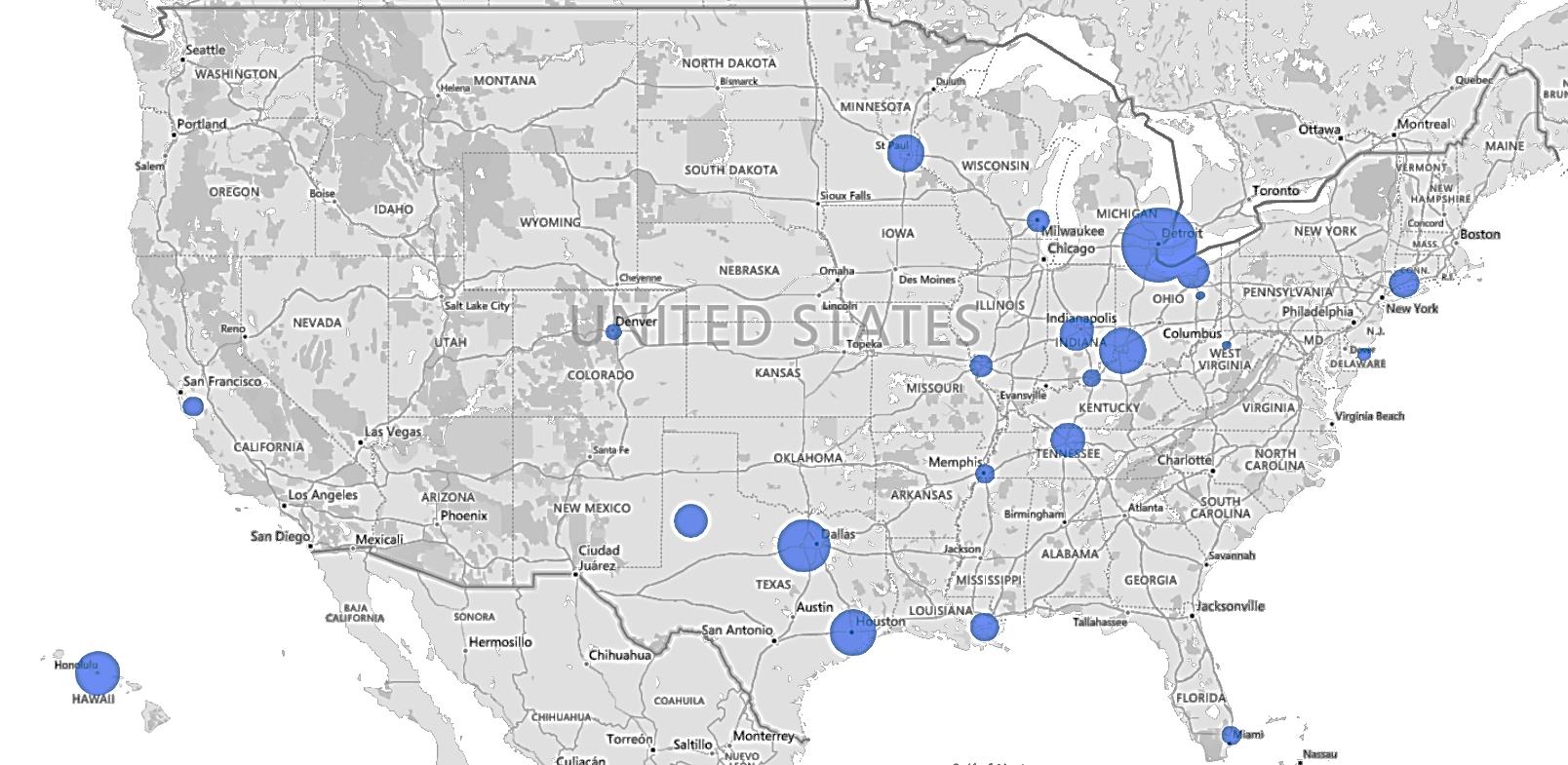

In addition, the Company had concentrations in various cities based on parking rental revenue for the years ended December 2019 and 2018, as well as concentrations in various cities based on the real estate the Company owned as of December 31, 2019

and 2018. The below tables summarize this information by city.

|

City Concentration for Parking Rental Revenue

|

||||||||

|

For the Years Ended December 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

Detroit

|

22.6

|

%

|

18.2

|

%

|

||||

|

Houston

|

11.7

|

%

|

13.3

|

%

|

||||

|

Cincinnati

|

9.3

|

%

|

9.2

|

%

|

||||

|

Fort Worth

|

7.0

|

%

|

8.1

|

%

|

||||

|

Indianapolis

|

6.1

|

%

|

6.5

|

%

|

||||

|

Cleveland

|

5.8

|

%

|

5.3

|

%

|

||||

|

St. Louis

|

5.0

|

%

|

5.4

|

%

|

||||

|

Honolulu

|

4.3

|

%

|

2.6

|

%

|

||||

|

Lubbock

|

3.9

|

%

|

4.2

|

%

|

||||

|

Milwaukee

|

3.7

|

%

|

3.7

|

%

|

||||

|

Minneapolis

|

3.6

|

%

|

4.3

|

%

|

||||

|

Nashville

|

3.1

|

%

|

3.5

|

%

|

||||

|

St Paul

|

2.9

|

%

|

2.7

|

%

|

||||

|

New Orleans

|

2.9

|

%

|

2.7

|

%

|

||||

|

San Jose

|

2.0

|

%

|

2.4

|

%

|

||||

|

Bridgeport

|

1.9

|

%

|

2.3

|

%

|

||||

|

Memphis

|

1.4

|

%

|

1.6

|

%

|

||||

|

Louisville

|

0.9

|

%

|

1.0

|

%

|

||||

|

Denver

|

0.7

|

%

|

0.8

|

%

|

||||

|

Ft. Lauderdale

|

0.4

|

%

|

0.6

|

%

|

||||

|

Wildwood

|

0.3

|

%

|

0.4

|

%

|

||||

|

Clarksburg

|

0.3

|

%

|

0.3

|

%

|

||||

|

Canton

|

0.2

|

%

|

0.3

|

%

|

||||

|

Kansas City

|

--

|

0.6

|

%

|

|||||

|

Real Estate Investment Concentration by City

|

||||||||

|

As of December 31,

|

||||||||

|

2019

|

2018

|

|||||||

|

Detroit

|

17.7

|

%

|

17.6

|

%

|

||||

|

Houston

|

12.1

|

%

|

11.9

|

%

|

||||

|

Fort Worth

|

8.8

|

%

|

8.8

|

%

|

||||

|

Cincinnati

|

8.8

|

%

|

8.7

|

%

|

||||

|

Honolulu

|

6.8

|

%

|

6.7

|

%

|

||||

|

Cleveland

|

6.3

|

%

|

6.2

|

%

|

||||

|

Indianapolis

|

5.8

|

%

|

5.8

|

%

|

||||

|

St Louis

|

4.4

|

%

|

4.4

|

%

|

||||

|

Minneapolis

|

4.3

|

%

|

4.4

|

%

|

||||

|

Lubbock

|

4.3

|

%

|

3.5

|

%

|

||||

|

Milwaukee

|

3.9

|

%

|

3.8

|

%

|

||||

|

Nashville

|

3.7

|

%

|

3.7

|

%

|

||||

|

St Paul

|

2.7

|

%

|

2.7

|

%

|

||||

|

Bridgeport

|

2.6

|

%

|

2.6

|

%

|

||||

|

New Orleans

|

2.6

|

%

|

2.6

|

%

|

||||

|

Memphis

|

1.3

|

%

|

1.5

|

%

|

||||

|

San Jose

|

1.1

|

%

|

1.2

|

%

|

||||

|

Denver

|

1.0

|

%

|

1.0

|

%

|

||||

|

Louisville

|

1.0

|

%

|

1.0

|

%

|

||||

|

Wildwood

|

0.4

|

%

|

0.4

|

%

|

||||

|

Clarksburg

|

0.2

|

%

|

0.2

|

%

|

||||

|

Canton

|

0.2

|

%

|

0.2

|

%

|

||||

|

Fort Lauderdale

|

--

|

1.1

|

%

|

|||||

Economic Dependency

Prior to the Internalization, under various agreements, the Company engaged the former Advisor and its affiliates to provide certain services that were essential to the Company, including asset management services,

supervision of the management and leasing of properties owned by the Company, asset acquisition and disposition services, the sale of shares of the Company’s securities available for issuance, as well as other administrative responsibilities for the

Company, including accounting services and investor relations. In addition, the Sponsor paid selling commissions in connection with the sale of the Company’s shares in the Common Stock Offering and the former Advisor paid the Company’s organization and

offering expenses.

As a result of these relationships, prior to the Internalization, the Company was wholly dependent upon the former Advisor and its affiliates.

Competition

The Company is unaware of any REITs in the United States that invest predominantly in parking facilities; nevertheless, the Company has significant competition with respect to the acquisition of real property.

Competitors include other REITs, owners and managers of parking facilities, private investment funds, hedge funds and other investors, many of which have significantly greater resources. The Company may not be able to compete successfully for

investments, particularly in light of the Company’s lack of liquidity available for investments which would preclude the Company from making any additional investments unless it sells some of its existing assets and enhances existing liquidity

resources. In addition, the number of entities and the amount of funds competing for suitable investments may increase. If the Company pays higher prices for investments the returns will be lower, and the value of assets may not increase or may

decrease significantly below the amount paid for such assets.

The Company’s parking facilities face intense competition, which may adversely affect rental and fee income. The Company believes that competition in parking facility operations is intense. The relatively low cost of

entry has led to a strongly competitive, fragmented market consisting of competitors ranging from single facility operators to large regional and national multi-facility operators, including several public companies. In addition, the Company’s

facilities compete with building owners that provide on-site paid parking. Many of the competitors have more experience in owning and operating parking facilities. Moreover, some of the competitors will have greater capital resources, greater cash

reserves, less demanding rules governing distributions to stockholders and a greater ability to borrow funds. Competition for investments may reduce the number of suitable investment opportunities available, may increase acquisition costs and may

reduce demand for parking facilities, all of which may adversely affect operating results.

In addition, the Company may compete against VRM I and VRM II, both of which are managed by affiliates of the Company’s Sponsor and the former Advisor, for the acquisition of investments to the extent that the Company is

able to pursue acquisition in the future. The Company believes this potential conflict is mitigated, in part, by the Company's focus on parking facilities as its core investments, while the investment strategy of VRM I and VRM II focuses on acquiring

office buildings and other commercial real estate and loans secured by commercial real estate.

Income Taxes

Commencing with the taxable year ended December 31, 2017, the Company believes it has been organized and has conducted its operations to qualify as a REIT under Sections 856 to 860 of the Code. A REIT is generally not

subject to federal income tax on that portion of its REIT taxable income which is distributed to its stockholders provided that at least 90% of such taxable income is distributed and provided that certain other requirements are met. The Company’s REIT

taxable income may substantially exceed or be less than the income calculated according to GAAP. In addition, the Company will be subject to corporate income tax to the extent that less than 100% of the net taxable income is distributed, including any

net capital gain.

The Company uses a two-step approach to recognize and measure uncertain tax positions. The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it

is more likely than not that the position will be sustained on audit, including resolutions of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest amount that is more likely than not of being

realized upon ultimate settlement. The Company believes that its income tax filing positions and deductions would be sustained upon examination; thus, the Company has not recorded any uncertain tax positions as of December 31, 2019.

A full valuation allowance for deferred tax assets was provided since the Company believes that it is more likely than not that it will not realize the benefits of its deferred tax assets. A change in circumstances may

cause the Company to change its judgment about whether deferred tax assets should be recorded, and further whether any such assets would more likely than not be realized. The Company would generally report any change in the valuation allowance through

its income statement in the period in which such changes in circumstances occur. Because the Company is a REIT, it will generally not be subject to corporate level federal income taxes on earnings distributed to the Company’s stockholders and therefore

may not realize any benefit from deferred tax assets arising during 2019 or any prior period in which a valid REIT election was in effect. The Company intends to distribute at least 100% of its taxable income annually and intends to do so for the tax

year ended December 31, 2019 and in all future periods. The Company has placed a full valuation allowance on all of its deferred tax assets, and thus no asset is recorded on the Company’s balance sheet.

Regulations

The Company’s investments are subject to various federal, state, local and foreign laws, ordinances and regulations, including, among other things, zoning regulations, land use controls, environmental controls relating

to air and water quality, noise pollution and indirect environmental impacts such as increased motor vehicle activity. The Company intends to obtain all permits and approvals necessary under current law to operate the Company’s investments.

Review of the Company’s Policies

The Company’s board of directors, including the independent directors, has reviewed the policies described in this Annual Report and determined that they are in the best interest of the Company’s stockholders because:

(1) they increase the likelihood that the Company will be able implement and execute the Company’s business strategies; (2) the Company’s executive officers and directors have expertise with the type of real estate investments the Company seeks; and

(3) borrowings should enable the Company to purchase assets and earn rental income more quickly, thereby increasing the likelihood of generating income for the Company’s stockholders and preserving stockholder capital.

Employees

The Company had approximately 16 employees as of December 31, 2019. Prior to July 1, 2019 the Company had no employees.

Available Information

The Company is subject to the reporting and information requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, as a result, files the Company’s annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K, proxy statements and other information with the SEC from time to time. The SEC maintains a website (http://www.sec.gov) that contains the Company’s annual, quarterly and current reports, proxy and

information statements and other information the Company files electronically with the SEC from time to time. Access to these filings is free of charge and can be accessed on the Company’s website, www.theparkingreit.com. The information on, or

accessible through, the Company’s website is not incorporated into and does not constitute a part of this Annual Report or any other report or document the Company files with or furnishes to the SEC from time to time.

Risks Related to an Investment in the Company

There are a number of pending legal matters involving us and our affiliates, which could distract our officers from attending to the Company's business and could have a material

adverse effect on the Company.

The pending investigations and legal proceedings involving us, and our affiliates could harm the reputation of the Company and may distract our management from attending to the Company's business. The adverse publicity

arising out of the pendency of such investigations or proceedings could impair our ability to raise additional capital or pursue liquidity transactions as it could make the Company less attractive to potential counterparties. We maintain insurance in

such amounts and with such coverage and deductibles as management believes is reasonable. However, there can be no assurance that our insurance will be sufficient to fully cover all potential liabilities from any such proceedings. Accordingly, our

failure to successfully defend or settle such legal proceedings could result in liability that, to the extent not covered by insurance, could have an adverse effect on our business, financial condition, results of operations and cash flow. The loss of

key personnel or circumstances causing such personnel to otherwise become unavailable to manage our business, would result in the loss of experience, skill, resources, relationships and contacts of individuals that we believe are important to our

investment and operating strategies.

On March 12, 2019, stockholder SIPDA Revocable Trust (“SIPDA”) filed a purported class action complaint in the United States District Court for the District of Nevada, against the Company and certain of its current and

former officers and directors. SIPDA filed an Amended Complaint on October 11, 2019. The Amended Complaint purports to assert class action claims on behalf of all public shareholders of the Company and MVP I between August 11, 2017 and April 1, 2019 in

connection with the (i) August 2017 proxy statements filed with the SEC to obtain shareholder approval for the merger of the Company and MVP I (the “proxy statements”), and (ii) August 2018 proxy statement filed with the SEC to solicit proxies for the

election of certain directors (the “2018 proxy statement”). The Amended Complaint alleges, among other things, that the 2017 proxy statements failed to disclose that two major reasons for the merger and certain charter amendments implemented in

connection therewith were (i) to facilitate the execution of an amended advisory agreement that allegedly was designed to benefit Mr. Shustek financially in the event of an internalization and (ii) to give Mr. Shustek the ability to cause the Company

to internalize based on terms set forth in the amended advisory agreement. The Amended Complaint further alleges, among other things, that the 2018 proxy statement failed to disclose the Company’s purported plan to internalize its management function.

The Amended Complaint alleges, among other things, (i) that all defendants violated Section 14(a) of the Exchange Act and Rule 14a-9 promulgated thereunder, by disseminating proxy statements that allegedly contain false

and misleading statements or omit to state material facts; (ii) that the director defendants violated Section 20(a) of the Exchange Act; and (iii) that the director defendants breached their fiduciary duties to the members of the class and to the

Company.

The Amended Complaint seeks, among other things, unspecified damages; declaratory relief; and the payment of reasonable attorneys' fees, accountants' and experts' fees, costs and expenses.

On June 13, 2019, the court granted SIPDA’s motion for Appointment as Lead Plaintiff. The litigation is still at a preliminary stage. On January 9, 2020, the Company and the Board of Directors moved to dismiss the

Amended Complaint. The Company and the Board of Directors have reviewed the allegations in the Amended Complaint and believe the claims asserted against them in the Amended Complaint are without merit and intend to vigorously defend this action.

On May 31, 2019, and June 27, 2019, alleged stockholders filed class action lawsuits alleging direct and derivative claims against the Company, certain of our officers and directors, MVP Realty Advisors, Vestin Realty

Mortgage I, and Vestin Realty Mortgage II in the Circuit Court for Baltimore City, captioned Arthur Magowski v. The Parking REIT, Inc., et. al, No. 24-C-19003125 (filed on May 31, 2019) (the “Magowski Complaint”) and Michelle Barene v. The Parking

REIT, Inc., et. al, No. 24-C-19003527 (filed on June 27, 2019) (the “Barene Complaint”).

The Magowski Complaint asserts purportedly direct claims on behalf of all stockholders (other than the defendants and persons or entities related to or affiliated with any defendant) for breach of fiduciary duty and

unjust enrichment arising from the Company’s decision to internalize its advisory function. In this Complaint, Plaintiff Magowski asserts that the stockholders have allegedly been directly injured by the internalization and related transactions. The

Barene Complaint asserts both direct and derivative claims for breach of fiduciary duty arising from substantially similar allegations as those contained in the Magowski Complaint. The purportedly direct claims are asserted on behalf of the same class

of stockholder as the purportedly direct claims in the Magowski Complaint, and the derivative claims in the Barene Complaint are asserted on behalf of the Company.

On September 12 and 16, 2019, the defendants filed motions to dismiss the Magowski and Barene complaints, respectively. The Magowski and Barene Complaints seek, among other things, damages; declaratory relief; equitable

relief to reverse and enjoin the internalization transaction; and the payment of reasonable attorneys' fees, accountants' and experts' fees, costs and expenses. The actions are at a preliminary stage. The Company and the board of directors intend to

vigorously defend against these lawsuits.

The Magowski Complaint also previewed that a stockholder demand would be made on the Board to take action with respect to claims belonging to the Company for the alleged injury to the Company. On June 19, 2019, Magowski

submitted a formal demand letter to the Board asserting the same alleged wrongdoing as alleged in the Magowski Complaint and demanding that the Board investigate the alleged wrongdoing and take action to remedy the alleged injury to the Company. The

demand includes that claims be initiated against the same defendants as are named in the Magowski Complaint. In response to this stockholder demand letter, on July 16, 2019, the Board established a demand review committee of one independent director to

investigate the allegations of wrongdoing made in the letter and to make a recommendation to the Board for a response to the letter. On September 27, 2019, the Board replaced the demand review committee with a special litigation committee. The special

litigation committee is responsible for investigating the allegations of wrongdoing made in the letter and making a final determination regarding the allegations. The work of the special litigation committee is on-going.

The SEC is conducting an investigation relating to the Parking REIT. In June 2019, the SEC issued subpoenas to the Company and its chairman and chief executive officer Michael V. Shustek. In connection with each

subpoena, the SEC stated that: “this investigation is a non-public, fact-finding inquiry. We are trying to determine whether there have been any violations of the federal securities laws. The investigation and the subpoena do not mean that we have

concluded that the recipient of the subpoena or anyone else has violated the law. Also, the investigation does not mean that we have a negative opinion of any person, entity or security.” The Company has received additional requests for information and

expects to receive more in the future. The Company and Mr. Shustek intend to cooperate fully with the SEC in this matter. However, the Company cannot predict the outcome or the duration of the SEC investigation or any other legal proceedings or any

enforcement actions or other remedies, if any, that may be imposed on Mr. Shustek, the Company or any other entity arising out of the SEC investigation.

Our business and those of our tenants may be adversely affected by epidemics, pandemics or other outbreaks.

Epidemics, pandemics or other outbreaks of an illness, disease or virus (including COVID-19) that affect areas in which our tenants operate or in which our properties are located, and actions taken to contain or prevent

their further spread, may have a material and adverse impact on general commercial activity, the financial condition, results of operations and liquidity of us and our tenants. In particular, many of our properties are located near government

buildings and sports centers, which depend in large part on customer traffic, and conditions that lead to a decline in customer traffic will have a material and adverse impact on those businesses. Several such conditions already exist and may

intensify. Many state and local governments are currently restricting public gatherings or requiring people to shelter in place, which has in some cases eliminated or severely reduced the demand for parking. Such events are adversely impacting and

may continue to adversely impact our tenants’ sales and/or cause the temporary closure of our tenants’ businesses, which could significantly disrupt or cause a closure of their operations and, in turn, significantly impact or eliminate the rental

revenue we generate from our leases with them. In particular, a majority of the Company’s property leases call for additional percentage rent, which will be adversely impacted by a decline in the demand for parking. We are in preliminary discussions

with some of our tenants and currently expect to grant relief to some our tenants to defer rent payments as a result of their estimated lost revenues from the current COVID-19 pandemic; however, there can be no assurance we will reach an agreement with

any tenant or if an agreement is reached, that any such tenant will be able to repay any such deferred rent in the future. Epidemics, pandemics or other outbreaks of an illness, disease or virus could also cause our employees and those of our tenants,

vendors or other business on which we rely to avoid reporting for work at their respective places of employment, which could adversely affect our ability and their respective abilities to adequately manage our and their respective businesses. In

addition, risks related to epidemics, pandemics or other outbreaks of an illness, disease or virus have begun (and may continue) to adversely affect the economies in impacted countries, including the United States, and the global financial markets,

including the global debt and equity capital markets, which have begun (and may continue) to experience significant volatility, potentially leading to an economic downturn that could adversely affect our and our tenants’ respective businesses,

financial condition, liquidity, results of operations and prospects. The ultimate extent of the impact of any epidemic, pandemic or other outbreak of an illness, disease or virus on our business, financial condition, liquidity, results of operations

and prospects will depend on future developments, which are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of such epidemics, pandemics or other outbreaks of an illness, disease or virus and

actions taken to contain or prevent their further spread, among others. These and other potential impacts of epidemics, pandemics or other outbreaks of an illness, disease or virus could therefore materially and adversely affect our business, financial

condition, liquidity, results of operations and prospects.

The Company will need to improve cash flow from operations or through a sale of assets to avoid a future liquidity shortfall.

The Company has significantly limited liquidity. Absent operational improvements or additional funds from an asset sale, the Company could face a liquidity shortfall in 2020. While

the Company is actively focused on operational and other initiatives to increase cash flow, no assurances can be given that these initiatives will be successful. The Company’s ability to generate sufficient cash flow from operations will depend on a

range of economic, competitive and business factors, many of which are outside its control, including the impact of COVID-19. As a result of current economic conditions, the Company’s cash flow from operations might be impacted. The Company is in

preliminary discussions with its lenders, including Bank of America, to obtain waivers from certain liquidity requirements and defer payments due under its loans in light of the current economic conditions and the fact that the Company expects to allow

tenants to defer rents under its leases with its tenants as a result of the current COVID-19 pandemic; however, there can be no assurance that the Company will reach any such agreement with its lenders. In particular, some of the Company’s loan

agreements require that the Company maintain certain liquidity and net worth levels. For example, the loan with Bank of America for MVP Detroit garage requires the Company to maintain $2.3 million of unencumbered cash and cash equivalents at all times.

As of the time of this filing, the Company was in compliance with this lender requirement; however, unless the Company sells some of its existing assets, it does not expect that it will be able to maintain such required minimum balances beyond the

third quarter of 2020, if the Company does not receive a waiver for this requirement. The Company may be unable to sell assets and may be unable to negotiate a waiver or amendment of the liquidity and net worth requirements, in which case, the Company

could experience an event of technical default under its loan agreements, which, if uncured, could result in an acceleration of such indebtedness.

We have engaged financial and legal advisors and begun to explore a broad range of potential strategic alternatives to provide liquidity to

stockholders; however, there can be no assurance that our exploration of potential strategic alternatives will result in any transaction being completed, and speculation and uncertainty regarding the outcome of our exploration of strategic alternatives

may adversely affect our business.

In mid-2019, we engaged financial and legal advisors and began to explore a broad range of potential strategic alternatives to provide liquidity to stockholders. We are currently exploring certain strategic alternatives,

including potential sales of assets, a potential sale of the Company or a portion thereof, a potential strategic business combination or a potential liquidation. The process of exploring and executing potential strategic alternatives may be time

consuming and disruptive to our business operations, and if we are unable to effectively manage the process, our business, financial condition and results of operations could be adversely affected. Any potential transaction and the related valuation

would be dependent upon a number of factors that may be beyond our control, including, among other factors, market conditions, industry trends, the interest of third parties in our business and the availability of financing to potential buyers on

reasonable terms. There can be no assurance that the Board’s exploration of potential strategic alternatives will result in any change of strategy or transaction being entered into or consummated or, if a transaction is undertaken, as to its terms,

structure or timing.

Shares of our common stock are illiquid. No public market currently exists for our shares, and our charter does not require us to liquidate our assets or list our shares on an

exchange by any specified date, or at all. It will be difficult for stockholders to sell shares, and if stockholders are able to sell shares, it will likely be at a substantial discount.

There is no current public market for our shares, and our charter does not require us to liquidate our assets or list our shares on an exchange by any specified date, or at all. Our charter limits stockholders' ability

to transfer or sell shares unless the prospective stockholder meets the applicable suitability and minimum purchase standards. Our charter also prohibits the ownership of more than 9.8% in value of the aggregate of our outstanding capital stock or more

than 9.8% in value or number, whichever is more restrictive, of the aggregate of our outstanding common stock unless exempted prospectively or retroactively by our board of directors. These restrictions may inhibit large investors from desiring to

purchase stockholders' shares. Moreover, our share repurchase program was suspended in May 2018, other than with respect to hardship repurchases in connection with a shareholders’ death, which were suspended by the board of directors on March 24, 2020.

It will be difficult for stockholders to sell shares promptly or at all. If stockholders are able to sell shares, stockholders will likely have to sell them at a substantial discount to their purchase price. It is also likely that stockholders' shares

would not be accepted as the primary collateral for a loan.

In addition, Nasdaq has informed us that (i) our common stock will not be approved for listing currently on the Nasdaq Global Market, and (ii) it is highly unlikely that our common stock would be approved for listing

while the SEC investigation is ongoing. There can be no assurance that our common stock will ever be approved for listing on the Nasdaq Global Market or any other stock exchange, even if the SEC investigation referred to above is completed and no

wrongdoing is found and no action is taken in connection therewith against us, Mr. Shustek or any other person. Accordingly, we are not pursuing a listing and do not anticipate the ability to list in the foreseeable future. Our board of directors is

actively evaluating actions that could provide liquidity for our stockholders. However, our ability to achieve liquidity for our stockholders is subject to market conditions, legal requirements and loan covenants, and there can be no assurance that we

will affect a liquidity event. If we do not successfully implement a liquidity event, our shares of common stock may continue to be illiquid and stockholders may, for an indefinite period of time, be unable to convert their investments to cash easily

and could suffer losses on their investments.

We have a limited operating history which makes our future performance difficult to predict.

We were formed on May 4, 2015 and merged with MVP REIT, Inc., which was formed on April 3, 2012, on December 15, 2017. In addition, our management function was internalized effective April 1, 2019. Accordingly, we have a

limited operating history, particularly as an internally managed company. Stockholders should not assume that our performance will be similar to the past performance of other real estate investment programs sponsored by an affiliate of the former

Advisor. Our lack of an operating history increases the risk and uncertainty that stockholders face in making or holding an investment in our shares.

We have experienced net losses in the past, and we may experience additional net losses in the future.

Historically, we have experienced net losses (calculated in accordance with GAAP), and we may not be profitable or realize growth in the value of our investments. Many of our losses can be attributed to start-up costs,

depreciation and amortization, as well as acquisition expenses incurred in connection with purchasing properties or making other investments. For a further discussion of our operational history and the factors affecting our net losses, see “Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this Annual Report and our accompanying consolidated financial statements and notes thereto.

Our cash distributions are not guaranteed and may fluctuate.

The Company's board of directors unanimously authorized a suspension of our cash distributions and stock dividends to holders of our common stock, effective as of March 22, 2018. In addition, on March 24, 2020, the

Company’s board of directors unanimously authorized the suspension of the payment of distributions on the Series A Convertible Redeemable Preferred Stock and Series 1 Convertible Redeemable Preferred Stock, however such distributions will continue to

accrue in accordance with the terms of the Series A Convertible Redeemable Preferred Stock and Series 1 Convertible Redeemable Preferred Stock. Our board is focused on preserving capital in order to maintain sufficient liquidity to continue to operate

the business and maintain compliance with debt covenants, including minimum liquidity covenants and to seek to provide liquidity to stockholders through potential strategic transactions. Our board will continue to evaluate our performance and expects

to assess our distribution policy quarterly, although we do not currently expect to resume paying cash distributions in the near future. There can be no assurance that we will resume payment of distributions to common or preferred stockholders at any

time in the future, or that any liquidity event will occur or when such event may occur. As the Company does not expect to have any REIT taxable income, the Company does not believe this policy will affect the Company’s ability to maintain its status

as a REIT.

We depend on our management team. The loss of key personnel could have a material adverse effect upon our ability to conduct and manage our business.

Our ability to achieve our investment objectives and to pay distributions is dependent upon the performance of our management team in the identification and acquisition of investments, the determination of any financing

arrangements, the management of our assets and operation of our day-to-day activities. The loss of services of one or more members of our key personnel or our inability to attract and retain highly qualified personnel, could adversely affect our

business, diminish our investment opportunities and weaken our relationships with lenders, business partners, parking facility operators and managers and other industry personnel, which could materially and adversely affect our business, financial

condition, results of operations and ability to make distributions to stockholders in the future and the value of our common stock. . Furthermore, the loss of one or more of our key personnel may constitute an event of default under certain of our

limited non-recourse property-level indebtedness, which could result in such indebtedness being accelerated.

Stockholders should not rely on the estimated NAV per share as being an accurate measure of the current value of our shares of common stock.

Our board of directors, including all of our independent directors, approves and establishes at least annually an estimated per share NAV of our common stock, which is based on an estimated market value of our assets

less the estimated market value of our liabilities, divided by the number of shares of our common stock outstanding. The objective of our board of directors in determining the estimated NAV per share was to arrive at a value, based on the most recent

data available, that it believed was reasonable based on methodologies that it deemed appropriate. As with any valuation method, the methods used to determine the estimated NAV per share were based upon a number of assumptions, estimates, forecasts

and judgments that over time may prove to be incorrect, incomplete, or may change materially. For example, current market disruptions relating to COVID-19 have significantly and adversely impacted the market for a wide variety of real estate assets,

commercial businesses that are adjacent to parking structures and the supply of debt financing for real estate assets. Our business could be significantly and adversely affected by the COVID-19 pandemic and we expect to continue to experience adverse

effects resulting therefrom, all of which is likely to cause the actual NAV and any amount that may be available to stockholders upon a liquidation to be significantly less than the NAV estimated in May 2019.

In the most recent estimation of NAV, our assets were valued based upon appraisal standards and the values of our assets using these methods are not required to reflect market value under those standards and will not

necessarily result in a reflection of fair value under generally accepted accounting principles. Further, different parties using different property-specific and general real estate and capital market assumptions, estimates, judgments and standards

could derive a different estimated NAV per share, which could be significantly different from the estimated NAV per share determined by our board of directors. The estimated NAV per share is not a representation or indication that, among other things:

a stockholder would be able to realize the estimated NAV per share if he or she attempts to sell shares; a stockholder would ultimately realize distributions per share equal to the estimated NAV per share; a third party would offer the estimated NAV

per share in an arms-length transaction to purchase all or substantially all of our shares of common stock or the Employee Retirement Income Security Act of 1974, as amended, or ERISA, or other regulatory authorities (including state regulators), with

respect to their respective requirements. For example, we expect to incur additional costs in connection with ongoing litigation, the SEC investigation discussed in Note P - Legal in Part II, Item 8 Notes to the Consolidated Financial Statements of this Annual Report on Form 10-K and legal and consulting fees associated with pursuing any potential strategic alternatives, which in the aggregate may be material,

none of which was taken into consideration when the board of directors determined the prior estimated NAV per share. Further, the estimated NAV per share was calculated as of a specific time based on the shares then outstanding and the amount and value

of our shares will fluctuate over time as a result of, among other things, future acquisitions or dispositions of assets, developments related to individual assets and changes in the real estate and capital markets and issuances and redemptions of

shares of our common stock after that date that the estimated NAV per share was established. Since the date that the last estimated NAV per share was established, the Company has redeemed 30,858 shares under the Company’s Share Repurchase Program

(related solely to hardship repurchases in connection with stockholder deaths) and on December 31, 2019, issued to the former Advisor the second tranche of 400,000 shares payable in respect of the Internalization. As discussed under Part II, Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations – Management Internalization and Note S – Deferred Management Internalization in Part II, Item 8 Notes to the Consolidated Financial Statements, the Company will issue the remaining 800,000 shares of common stock payable in respect of the Internalization in two 400,000 share tranches on December 31, 2020 and December 31, 2021,

which will have a further dilutive impact on NAV per share.

We disclose funds from operations (“FFO”), a non-GAAP financial measure, in communications with investors, including documents filed with the SEC; however, FFO is not equivalent to

our net income or loss as determined under GAAP, and our computation of FFO may not be comparable to other REITs.

Cash generated from operations is not equivalent to our net income from continuing operations as determined under GAAP. One non-GAAP supplemental performance measure that we consider due to the certain unique operating

characteristics of real estate companies is known as FFO. The National Association of Real Estate Investment Trusts, or NAREIT, an industry trade group, promulgated this measure, which it believes more accurately reflects the operating performance of a

REIT. As defined by NAREIT, FFO means net income computed in accordance with GAAP, excluding gains or losses from sales of property, plus depreciation and amortization on real property and after adjustments for unconsolidated partnerships and joint

ventures in which we hold an interest. In addition, NAREIT has recently clarified its computation of FFO, which includes adding back real estate impairment charges for all periods presented; however, under GAAP, impairment charges reduce net income.

While impairment charges are added back in the calculation of FFO, we caution that due to the fact that impairments to the value of any property are typically based on estimated future undiscounted cash flows compared to current carrying value,

declines in the undiscounted cash flows which led to the impairment charges reflect declines in property operating performance which may be permanent.

The calculation of FFO may vary from entity to entity since capitalization and expense policies tend to vary from entity to entity. Items that are capitalized do not impact FFO, whereas items that are expensed reduce

FFO. Consequently, our presentation of FFO may not be comparable to other similarly titled measures presented by other REITs. FFO does not represent cash flows from operations as defined by GAAP, it is not indicative of cash available to fund all cash

flow needs nor is it indicative of liquidity, including our ability to pay distributions, and should not be considered as an alternative to net income, as determined in accordance with GAAP, for purposes of evaluating our operating performance.

Management uses the calculation of FFO for multiple reasons. We use FFO to compare our operating performance to that of other REITs. Additionally, we compute FFO as part of our acquisition process to determine whether a proposed investment will satisfy

our investment objectives.

The historical cost accounting rules used for real estate assets require, among other things, straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes

predictably over time, especially if such assets are not adequately maintained or repaired and renovated as required by relevant circumstances and/or is requested or required by lessees for operational purposes. We believe that, since real estate

values historically rise and fall with market conditions, including inflation, interest rates, the business cycle, unemployment and consumer spending, presentations of operating results for a REIT using historical cost accounting for depreciation may

be less informative than FFO. We believe that the use of FFO, which excludes the impact of real estate related depreciation and amortization, provides a more complete understanding of our operating performance to investors and to management, and when

compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses and interest costs.

However, FFO should not be construed to be equivalent to or a substitute for the current GAAP methodology in calculating net income or in its applicability in evaluating our operating performance. The method utilized to

evaluate the performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non- GAAP FFO measures and the adjustments to GAAP in calculating FFO. Furthermore,

FFO is not indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from continuing operations as an indication of our performance, as an alternative to cash flows from

operations calculated in accordance with GAAP, or indicative of funds available to fund our cash needs, including our ability to make distributions to our stockholders.

FFO should be reviewed in conjunction with other GAAP measurements as an indication of our performance. The exclusion of impairments limits the usefulness of FFO as a historical operating performance measure since an

impairment indicates that the property’s operating performance may have been permanently affected. FFO is not a useful measure in evaluating NAV because impairments are considered in determining NAV but not in determining FFO.

We face risks associated with security breaches through cyber-attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology networks

and related systems.

We face risks associated with security breaches, whether through cyber-attacks or cyber intrusions over the Internet, malware, computer viruses, attachments to e-mails, persons inside our organization or persons with

access to systems inside our organization, and other significant disruptions of our information technology, or IT, networks and related systems. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion,

including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Our IT networks and related systems

are essential to the operation of our business and our ability to perform day-to-day operations, and, in some cases, may be critical to the operations of certain of our tenants. There can be no assurance that our efforts to maintain the security and

integrity of these types of IT networks and related systems will be effective or that attempted security breaches or disruptions would not be successful or damaging. A security breach or other significant disruption involving our IT networks and

related systems could adversely impact our financial condition, results of operations, cash flow and our ability to satisfy our debt service obligations and to pay distributions to our stockholders.

Risks Related to Our Investments

Our revenues are significantly influenced by demand for parking facilities generally, and a decrease in such demand would likely have a greater adverse effect on our revenues than

if we owned a more diversified real estate portfolio.

The focus for our portfolio of investments and acquisitions is on parking facilities. A decrease in the demand for parking facilities, or other developments adversely affecting such sectors of the property market would

likely have a more pronounced effect on our financial performance than if we owned a more diversified real estate portfolio. If adverse economic conditions reduce discretionary spending, business travel or other economic activity, such as sporting

events and entertainment, that fuels demand for parking services, our revenues could be reduced. In addition, our parking facilities tend to be concentrated in urban areas. The recent COVID-19 pandemic has resulted in reduced discretionary spending,

reduced travel and other activity. Users of our parking facilities include workers who commute by car to their places of employment in these urban centers. The return on our investments may be materially adversely affected by restrictions requiring

people to shelter in place in reaction to the COVID-19 outbreak and may continue to be materially adversely affected to the extent that economic conditions result in the elimination of jobs or the migration of jobs from the urban centers where our

parking facilities are situated to other locations. We are in preliminary discussions with some of our tenants and currently expect to grant relief to some our tenants to defer rent payments as a result of their estimated lost revenues from the current

COVID-19 pandemic; however, there can be no assurance we will reach an agreement with any tenant or if an agreement is reached, that any such tenant will be able to repay any such deferred rent in the future. Increased office vacancies in urban areas,

movement toward home office alternatives or lower consumer spending could reduce consumer demand for parking, which could adversely impact our revenues and financial condition. Moreover, changing lifestyles and technology innovations also may decrease