Attached files

| file | filename |

|---|---|

| 8-K - 2020-03-27 IR UPDATE FORM 8-K - DOMINION ENERGY, INC | d-8k_20200327.htm |

Investor materials March 27, 2020

Important note to investors This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding Dominion Energy. The statements relate to, among other things, expectations, estimates and projections concerning the business and operations of Dominion Energy. We have used the words "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", “outlook”, "predict", "project", “should”, “strategy”, “target”, "will“, “potential” and similar terms and phrases to identify forward-looking statements in this presentation. As outlined in our SEC filings, factors that could cause actual results to differ include, but are not limited to: unusual weather conditions and their effect on energy sales to customers and energy commodity prices; extreme weather events and other natural disasters; federal, state and local legislative and regulatory developments; the impact of extraordinary external events, such as the current pandemic health event resulting from the novel coronavirus (COVID-19); changes to federal, state and local environmental laws and regulations, including proposed carbon regulations; cost of environmental compliance; changes in enforcement practices of regulators relating to environmental standards and litigation exposure for remedial activities; capital market conditions, including the availability of credit and the ability to obtain financing on reasonable terms; fluctuations in interest rates; changes in rating agency requirements or credit ratings and their effect on availability and cost of capital; impacts of acquisitions, divestitures, transfers of assets by Dominion Energy to joint ventures, and retirements of assets based on asset portfolio reviews; receipt of approvals for, and timing of, closing dates for acquisitions and divestitures; changes in demand for Dominion Energy’s services; additional competition in Dominion Energy’s industries; changes to regulated rates collected by Dominion Energy; changes in operating, maintenance and construction costs; timing and receipt of regulatory approvals necessary for planned construction or expansion projects and compliance with conditions associated with such regulatory approvals; adverse outcomes in litigation matters or regulatory proceedings; and the inability to complete planned construction projects within time frames initially anticipated. Other risk factors are detailed from time to time in Dominion Energy’s quarterly reports on Form 10-Q and most recent annual report on Form 10-K filed with the Securities and Exchange Commission. The information in this presentation was prepared as of March 27, 2020. Dominion Energy undertakes no obligation to update any forward-looking information statement to reflect developments after the statement is made.

COVID-19 Health, safety and well-being of employees and communities is first priority Early directives limiting travel, instituting work-from-home protocols, expanding health and PTO benefits for employees, suspending service disconnections, and donating over $1 million to relief efforts Usage trends and earnings sensitivities Liquidity and long-term debt financing plan Pension Virginia legislative session (consistent with previous disclosures) Update topics Summary

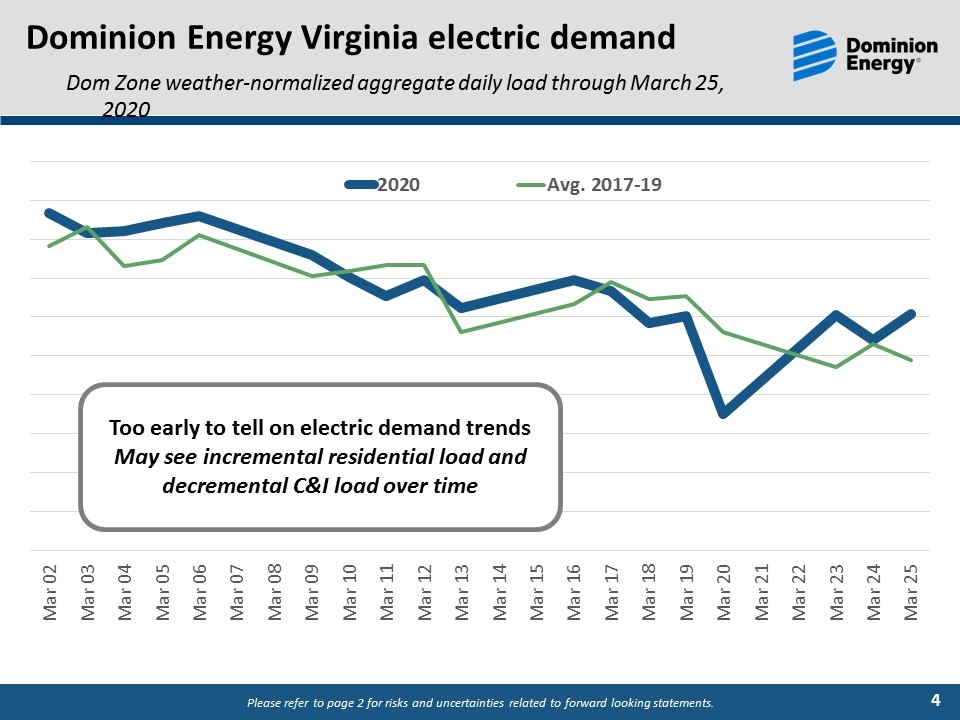

Dominion Energy Virginia electric demand Dom Zone weather-normalized aggregate daily load through March 25, 2020 Too early to tell on electric demand trends May see incremental residential load and decremental C&I load over time

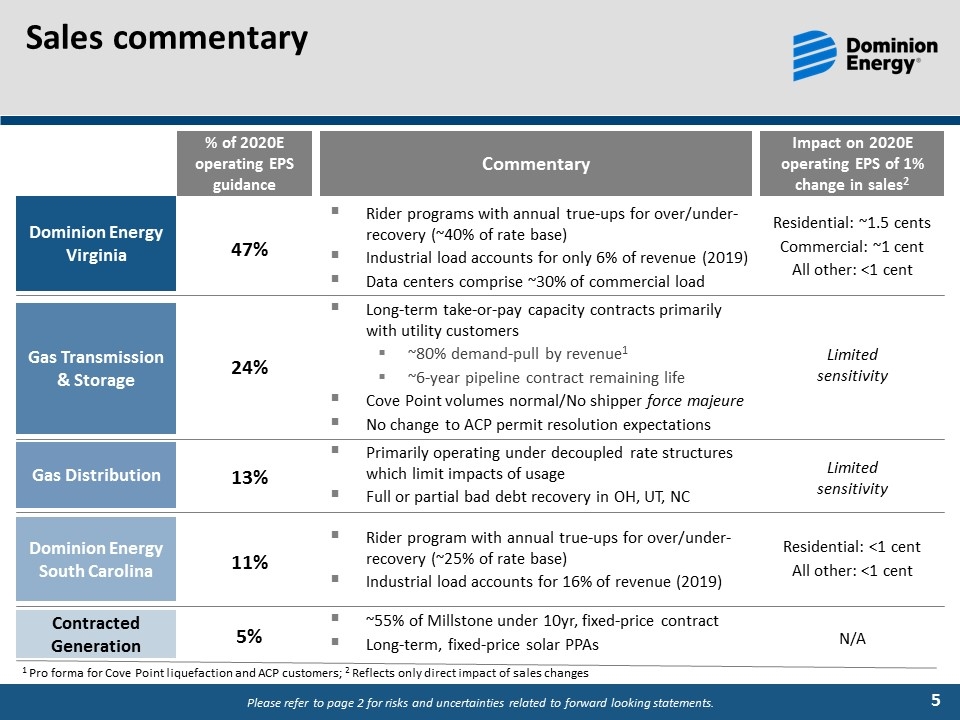

Sales commentary Dominion Energy Virginia Gas Transmission & Storage Gas Distribution Dominion Energy South Carolina Contracted Generation Commentary Rider programs with annual true-ups for over/under-recovery (~40% of rate base) Industrial load accounts for only 6% of revenue (2019) Data centers comprise ~30% of commercial load Impact on 2020E operating EPS of 1% change in sales2 % of 2020E operating EPS guidance 47% 24% 13% 11% 5% ~55% of Millstone under 10yr, fixed-price contract Long-term, fixed-price solar PPAs Rider program with annual true-ups for over/under-recovery (~25% of rate base) Industrial load accounts for 16% of revenue (2019) Primarily operating under decoupled rate structures which limit impacts of usage Full or partial bad debt recovery in OH, UT, NC Long-term take-or-pay capacity contracts primarily with utility customers ~80% demand-pull by revenue1 ~6-year pipeline contract remaining life Cove Point volumes normal/No shipper force majeure No change to ACP permit resolution expectations Residential: ~1.5 cents Commercial: ~1 cent All other: <1 cent Limited sensitivity Limited sensitivity Residential: <1 cent All other: <1 cent N/A 1 Pro forma for Cove Point liquefaction and ACP customers; 2 Reflects only direct impact of sales changes

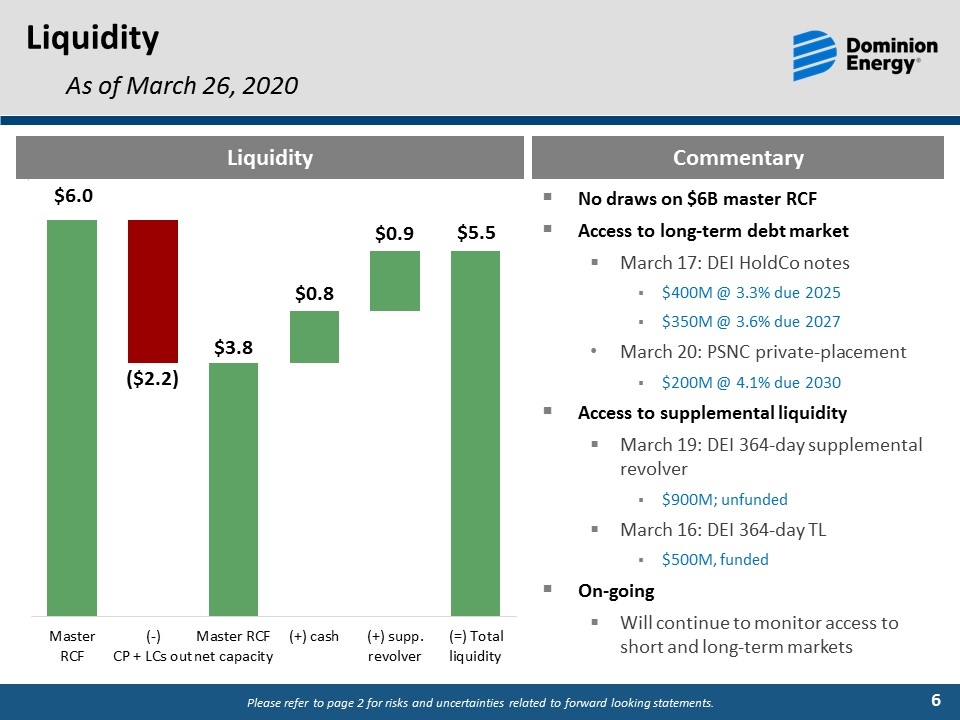

Liquidity As of March 26, 2020 $6.0 $0.8 $5.5 ($2.2) $3.8 $0.9 Liquidity Commentary No draws on $6B master RCF Access to long-term debt market March 17: DEI HoldCo notes $400M @ 3.3% due 2025 $350M @ 3.6% due 2027 March 20: PSNC private-placement $200M @ 4.1% due 2030 Access to supplemental liquidity March 19: DEI 364-day supplemental revolver $900M; unfunded March 16: DEI 364-day TL $500M, funded On-going Will continue to monitor access to short and long-term markets

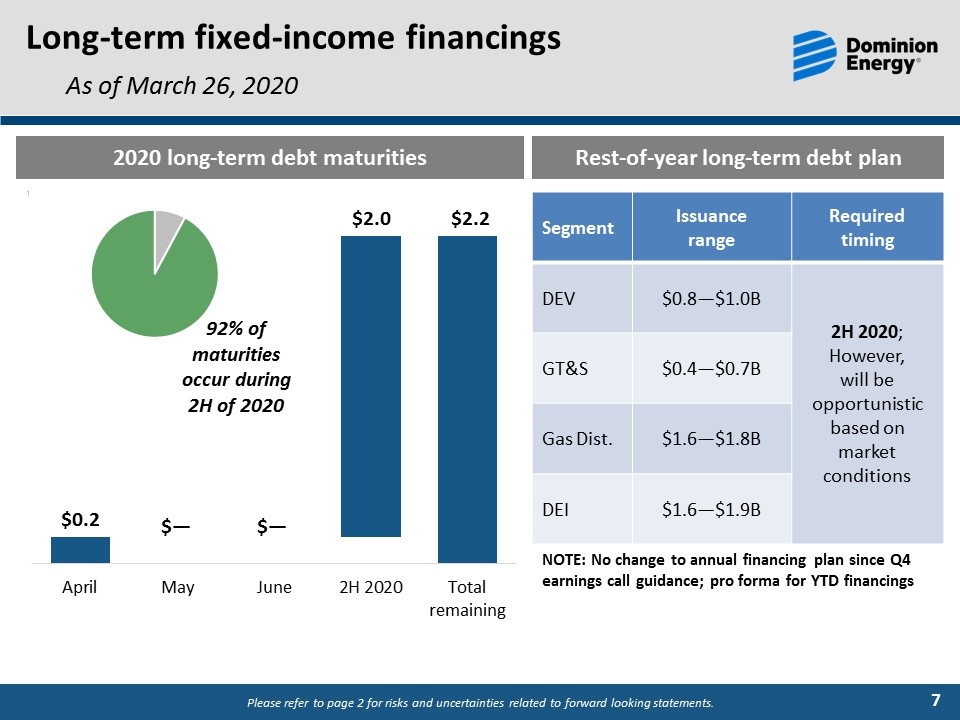

Segment Issuance range Required timing DEV $0.8—$1.0B 2H 2020; However, will be opportunistic based on market conditions GT&S $0.4—$0.7B Gas Dist. $1.6—$1.8B DEI $1.6—$1.9B Long-term fixed-income financings $0.2 $— $— $2.0 $2.2 2020 long-term debt maturities Rest-of-year long-term debt plan NOTE: No change to annual financing plan since Q4 earnings call guidance; pro forma for YTD financings 92% of maturities occur during 2H of 2020 As of March 26, 2020

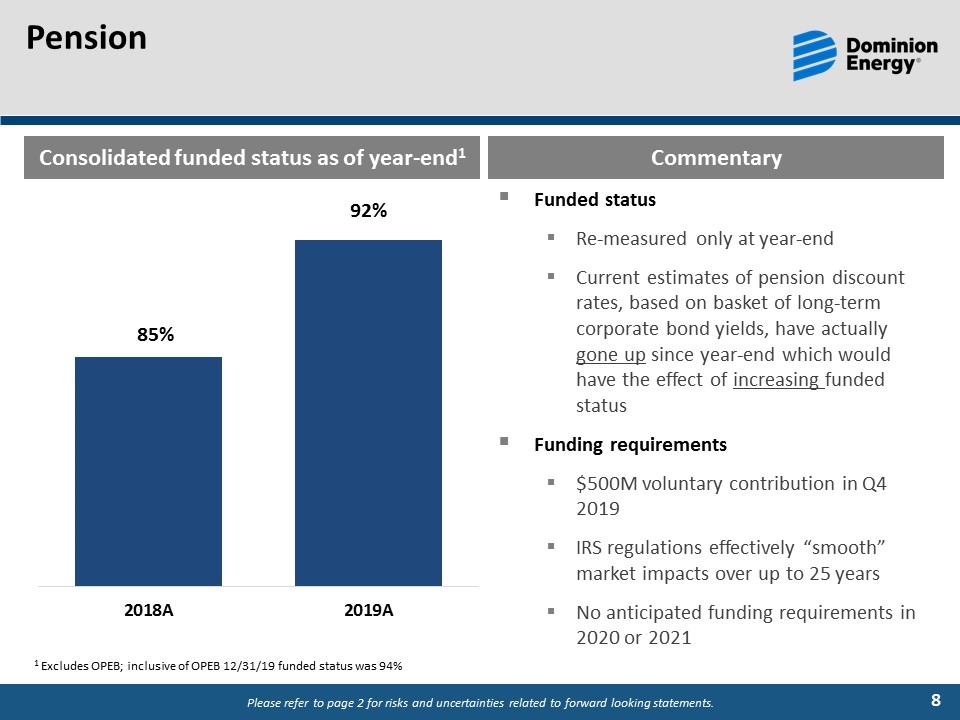

Pension Consolidated funded status as of year-end1 85% 92% Commentary Funded status Re-measured only at year-end Current estimates of pension discount rates, based on basket of long-term corporate bond yields, have actually gone up since year-end which would have the effect of increasing funded status Funding requirements $500M voluntary contribution in Q4 2019 IRS regulations effectively “smooth” market impacts over up to 25 years No anticipated funding requirements in 2020 or 2021 1 Excludes OPEB; inclusive of OPEB 12/31/19 funded status was 94%

Establishes robust zero-carbon electric generation targets 100% zero-carbon by 2046 via renewable energy portfolio standard (RPS) Provides direction for deployment of wind, solar, and energy storage resources Includes customer protections for reliability Outlines regulatory approval criteria, process and timelines Increases net-metering including an allocation for low-income customers Incentivizes energy efficiency programs Provides options for customers to increase their sustainability Directs Virginia to join the Regional Greenhouse Gas Initiative (RGGI) Virginia legislative session Awaiting Governor review and action

Virginia legislative session (cont’d) Maintains triennial review framework and timing First triennial: 2017 through 2020 performance with 2021 regulatory review Second triennial: 2021 through 2023 performance with 2024 regulatory review Recovery period for unit retirements at Commission discretion Next steps General Assembly adjourned sine die on March 12, 2020 Governor has up to 30 days to review and act on bills passed by General Assembly Company will address legislation in additional detail during Q1 2020 earnings call Awaiting Governor review and action

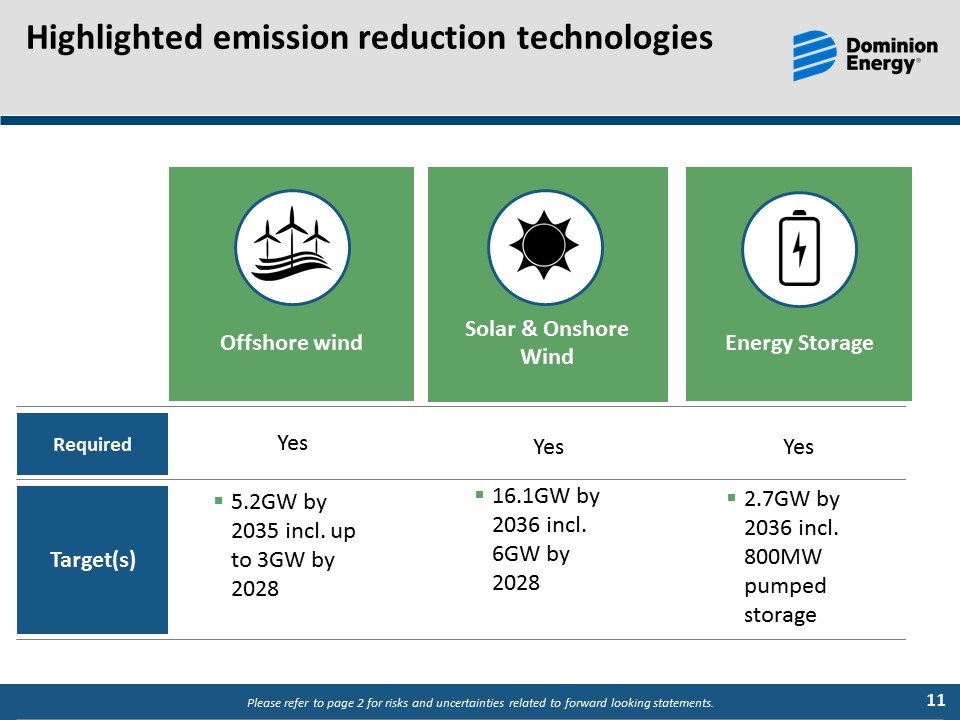

Offshore wind 5.2GW by 2035 incl. up to 3GW by 2028 Required Target(s) Yes Energy Storage 16.1GW by 2036 incl. 6GW by 2028 Solar & Onshore Wind 2.7GW by 2036 incl. 800MW pumped storage Yes Yes Highlighted emission reduction technologies

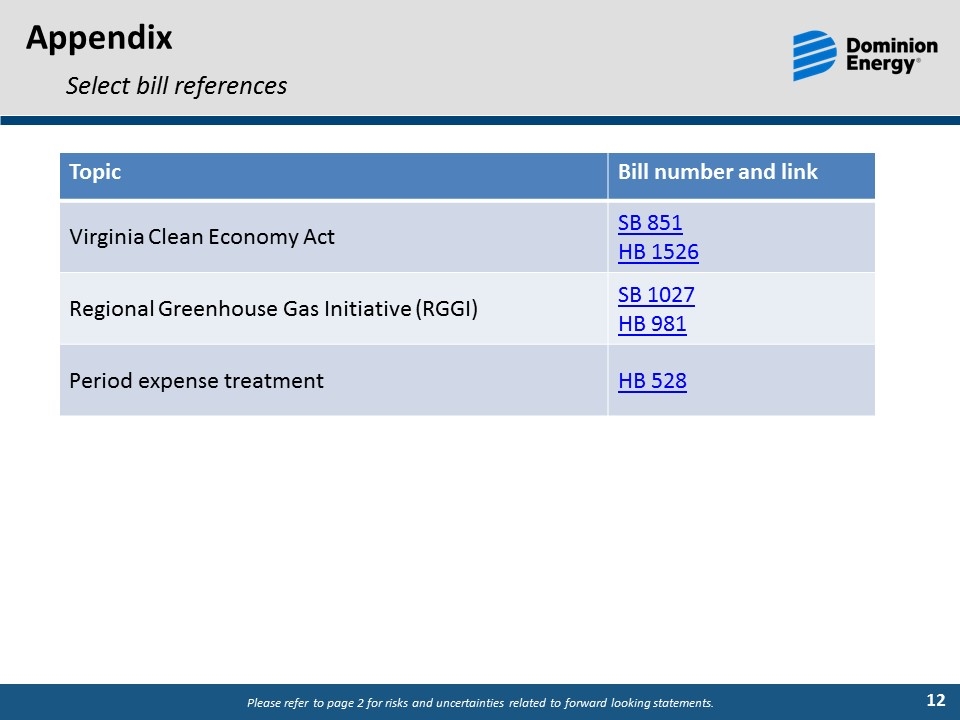

Appendix Select bill references Topic Bill number and link Virginia Clean Economy Act SB 851 HB 1526 Regional Greenhouse Gas Initiative (RGGI) SB 1027 HB 981 Period expense treatment HB 528