Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Tronox Holdings plc | ex99_1.htm |

| 8-K - 8-K - Tronox Holdings plc | form8k.htm |

Exhibit 99.2

Investor UpdateTronox Holdings plc March 26, 2020 © 2020 Tronox Holdings plc. | All rights reserved.

| tronox.com

Safe Harbor Statement and Non-U.S. GAAP Financial Terms Cautionary Statement about Forward-Looking

StatementsStatements in this presentation that are not historical are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are subject to known and

unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance (including anticipated synergies) based on our growth and other strategies and anticipated trends in our business. These

statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance, actual synergies, or achievements to

differ materially from the results, level of activity, performance, anticipated synergies or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and

other factors include, but are not limited to, (i) we may not realize the anticipated benefits of the Cristal acquisition, experience unexpected difficulties integrating the Cristal operations and/or assume unexpected liabilities arising from

the Cristal acquisition; (ii) English law and our articles of association may limit our flexibility to manage our capital structure and/or have anti-takeover effects; (iii) the risk that our customers might reduce demand for our products;

(iv) market conditions and price volatility for titanium dioxide (“TiO2”), zircon, and other feedstock materials, as well as global and regional economic downturns, including as a result of the coronavirus outbreak, that adversely affect the

demand for our end-use products; (v) changes in prices or supply of energy or other raw materials may negatively impact our business; (vi) an unpredictable regulatory environment in South Africa where we have significant mining and

beneficiation operations; (vii) the risk that our ability to use our tax attributes to offset future income may be limited; (viii) that the agreements governing our debt may restrict our ability to operate our business in certain ways, as

well as impact our liquidity; (ix) our inability to obtain additional capital on favorable terms; (x) fluctuations in currency exchange rates; (xi) compliance with, or claims under environmental, health and safety regulations may result in

unanticipated costs or liabilities, including the classification of TiO2 as a Category 2 Carcinogen in the EU; (xii) the possibility that cybersecurity incidents or other security breaches may seriously impact our results of operations and

financial condition; (xiii) liability, production delays and additional expenses from environmental and industrial accidents; (xiv) equipment upgrades, equipment failures and deterioration of assets may lead to production curtailments,

shutdowns or additional expenditures; (xv) political and social instability, and unrest, in the Middle East region; (xvi) Chinese production of chloride technology and improvements in product quality may occur more quickly than anticipated;

and (xvii) other factors described in more detail in the company's filings with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time

to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity,

performance, synergies or achievements. Neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of

future events. Unless otherwise required by applicable laws, we undertake no obligation to update or revise any forward-looking statements, whether because of new information or future developments. Use of Non-GAAP InformationTo provide

investors and others with additional information regarding the financial results of Tronox Holdings plc, we have disclosed in this presentation certain non-U.S. GAAP operating performance measures of Adjusted EBITDA and Adjusted EPS. These

non-U.S. GAAP financial measures are a supplement to and not a substitute for or superior to, the Company's results presented in accordance with U.S. GAAP. The non-U.S. GAAP financial measures presented by the Company may be different from

non-U.S. GAAP financial measures presented by other companies. The Company believes the non-U.S. GAAP information provides useful measures to investors regarding the Company's financial performance by excluding certain costs and expenses that

the Company believes are not indicative of its core operating results. The presentation of these non-U.S. GAAP financial measures is not meant to be considered in isolation or as a substitute for results or guidance prepared and presented in

accordance with U.S. GAAP. For the Company’s guidance with respect to first quarter 2020 Adjusted EBITDA and Adjusted diluted earnings per share, we are not able to provide without unreasonable effort the most directly comparable GAAP

financial measure, or reconciliation to such GAAP financial measure, because certain items that impact such measure are uncertain or out of our control, or cannot be reasonably predicted. 2 © 2020 Tronox Holdings plc. | All rights reserved.

| tronox.com

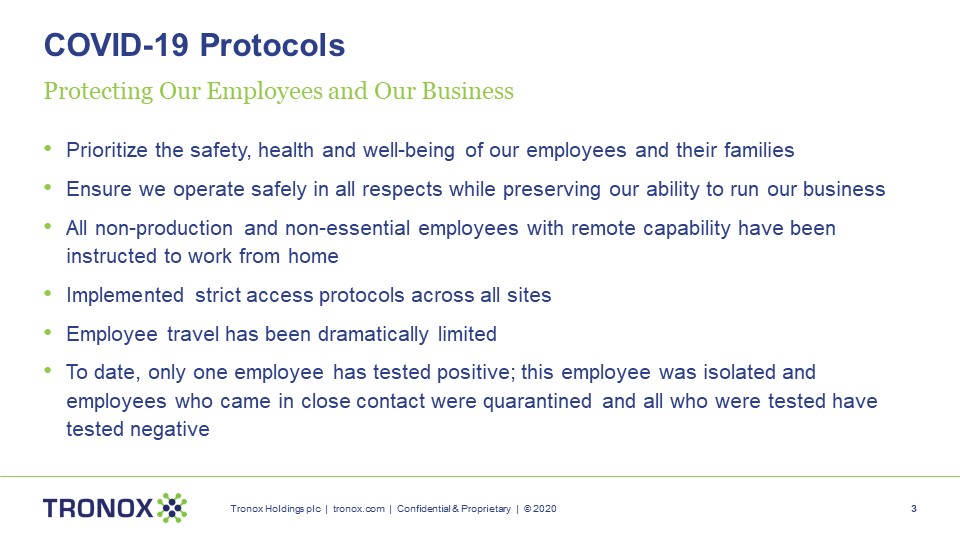

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2020 3 COVID-19

Protocols Protecting Our Employees and Our Business Prioritize the safety, health and well-being of our employees and their familiesEnsure we operate safely in all respects while preserving our ability to run our businessAll non-production

and non-essential employees with remote capability have been instructed to work from homeImplemented strict access protocols across all sitesEmployee travel has been dramatically limitedTo date, only one employee has tested positive; this

employee was isolated and employees who came in close contact were quarantined and all who were tested have tested negative

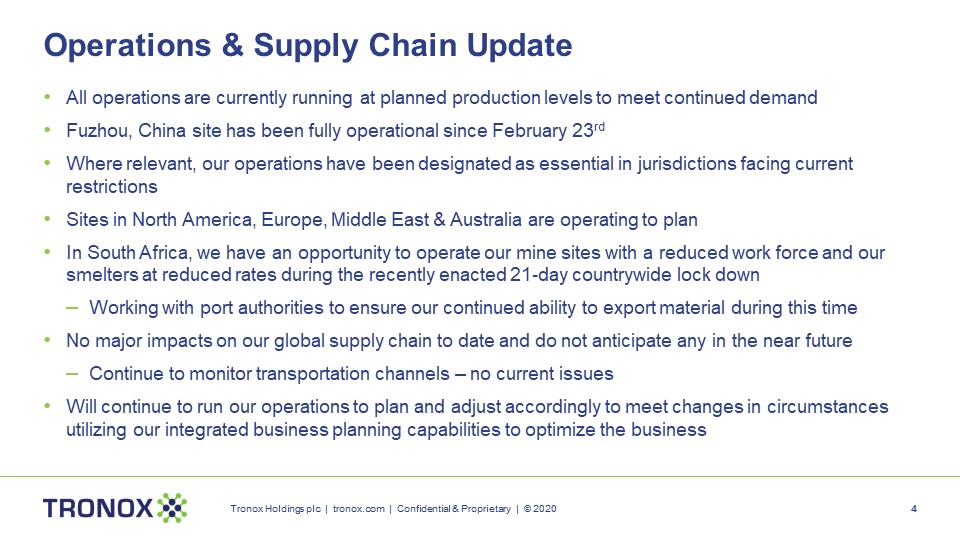

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2020 4 Operations & Supply

Chain Update All operations are currently running at planned production levels to meet continued demandFuzhou, China site has been fully operational since February 23rdWhere relevant, our operations have been designated as essential in

jurisdictions facing current restrictionsSites in North America, Europe, Middle East & Australia are operating to plan In South Africa, we have an opportunity to operate our mine sites with a reduced work force and our smelters at reduced

rates during the recently enacted 21-day countrywide lock downWorking with port authorities to ensure our continued ability to export material during this time No major impacts on our global supply chain to date and do not anticipate any in

the near future Continue to monitor transportation channels – no current issues Will continue to run our operations to plan and adjust accordingly to meet changes in circumstances utilizing our integrated business planning capabilities to

optimize the business

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2020 5 Commercial Update Solid

demand for Q1, including March, across our end markets with minimal order cancellationsOrder book continues to build for AprilSeeing some temporary customer plant closures in highly restricted countries across our customer baseMore customer

plant closures in the countries hit hardest in EuropeChina demand recovering while demand in the balance of Asia is mixed depending on timing of restrictionsBenefiting in North America and other mature economies from exposure to architectural

coatings and limited auto exposurePrior to the outbreak, inventories across the value chain were normal to lowRestocking at a customer level is driving some of the demand increaseSome customers expressing concerns about supply

availabilityGlobal customer base provides diversification insulating us from local, regional specific shut downs

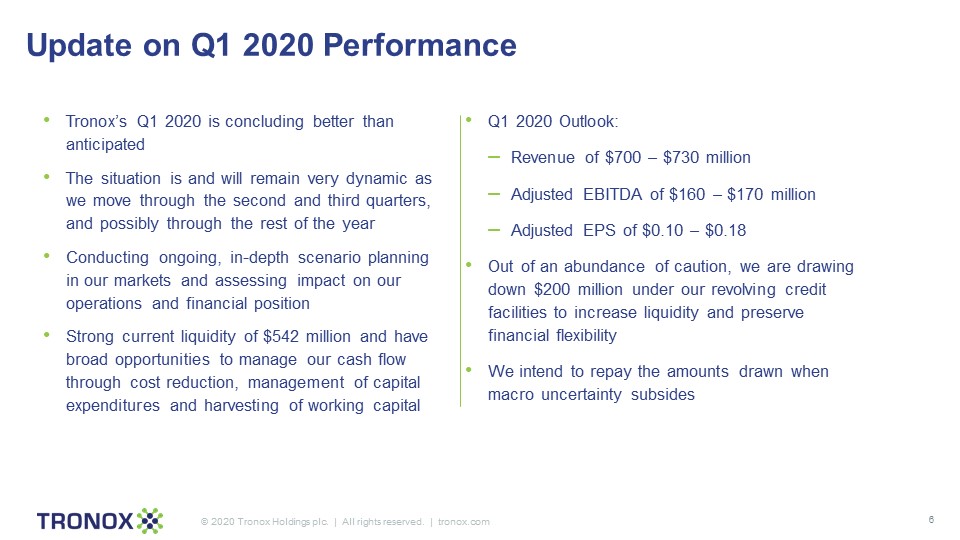

Tronox’s Q1 2020 is concluding better than anticipatedThe situation is and will remain very dynamic as

we move through the second and third quarters, and possibly through the rest of the yearConducting ongoing, in-depth scenario planning in our markets and assessing impact on our operations and financial positionStrong current liquidity of

$542 million and have broad opportunities to manage our cash flow through cost reduction, management of capital expenditures and harvesting of working capital Q1 2020 Outlook: Revenue of $700 – $730 millionAdjusted EBITDA of $160 – $170

millionAdjusted EPS of $0.10 – $0.18Out of an abundance of caution, we are drawing down $200 million under our revolving credit facilities to increase liquidity and preserve financial flexibilityWe intend to repay the amounts drawn when macro

uncertainty subsides © 2020 Tronox Holdings plc. | All rights reserved. | tronox.com Update on Q1 2020 Performance

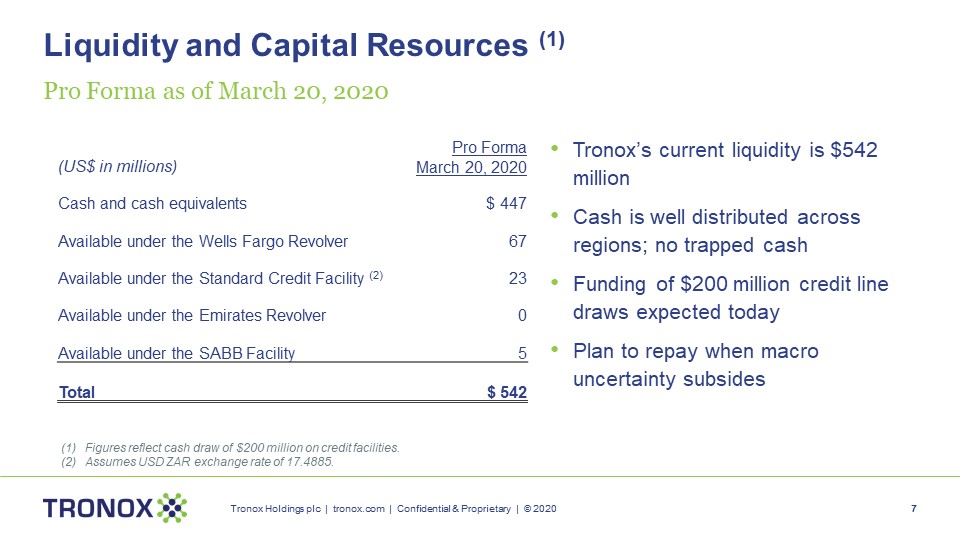

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2020 7 Liquidity and Capital

Resources (1) Pro Forma as of March 20, 2020 Tronox’s current liquidity is $542 millionCash is well distributed across regions; no trapped cashFunding of $200 million credit line draws expected todayPlan to repay when macro uncertainty

subsides (US$ in millions) Pro Forma March 20, 2020 Cash and cash equivalents $ 447 Available under the Wells Fargo Revolver 67 Available under the Standard Credit Facility (2) 23 Available under the Emirates Revolver 0 Available

under the SABB Facility 5 Total $ 542 Figures reflect cash draw of $200 million on credit facilities.Assumes USD ZAR exchange rate of 17.4885.

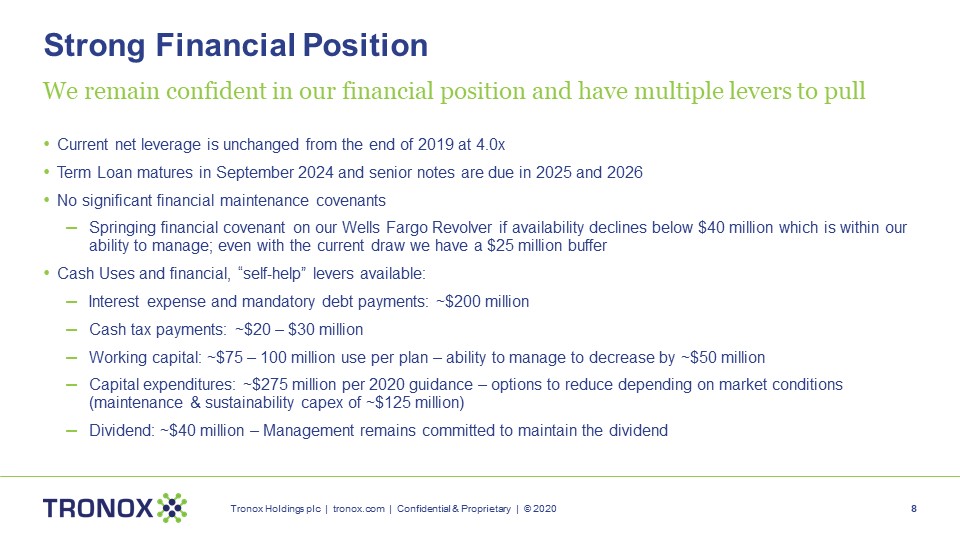

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2020 8 Strong Financial

Position We remain confident in our financial position and have multiple levers to pull Current net leverage is unchanged from the end of 2019 at 4.0x Term Loan matures in September 2024 and senior notes are due in 2025 and 2026No

significant financial maintenance covenantsSpringing financial covenant on our Wells Fargo Revolver if availability declines below $40 million which is within our ability to manage; even with the current draw we have a $25 million bufferCash

Uses and financial, “self-help” levers available: Interest expense and mandatory debt payments: ~$200 million Cash tax payments: ~$20 – $30 million Working capital: ~$75 – 100 million use per plan – ability to manage to decrease by ~$50

millionCapital expenditures: ~$275 million per 2020 guidance – options to reduce depending on market conditions (maintenance & sustainability capex of ~$125 million)Dividend: ~$40 million – Management remains committed to maintain the

dividend