Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OCEANFIRST FINANCIAL CORP | ocfc8-kinvestorpresent.htm |

. . . Exhibit 99.1 OceanFirst Financial Corp. COVID-19 Pandemic Response Overview March 24, 2020 . . .

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Forward Looking Statements In addition to historical information, this presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to the following: changes in interest rates, general economic conditions, public health crises (such as the governmental, social and economic effects of the novel coronavirus), levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines, the Bank’s ability to successfully integrate acquired operations and the other risks described in the Company’s filings with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation is not an offer to sell securities, nor is it a solicitation of an offer to buy securities in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of the presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the . . . Company after the date hereof. M A R C H | 2020 2

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Operational Response and Preparedness . . . M A R C H | 2020 3

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Timeline of Actions Management initiated preparations beginning in January with continuous updates implemented as COVID-19 spread JANUARY FEBRUARY MARCH Monitor Act Escalate Monitoring information regarding flu Feb. 4 – First Pandemic Planning Meeting Begin testing work from home and arranging season and COVID-19 in China. with Core team members. alternate locations for staff in HQs. IT orders laptops, increases VPN licenses, reviews video and January 28- Employee communications Feb. 7 – Headquarters equipped with hand conference line functionality. begin with reminders regarding sanitizer dispensers on every floor. March 9, 10, 13 and 15 – Communications include precautions during flu season. Feb. 24 – Instituted Loan Price Floors. reinforcement of best practices and escalating precautionary measures. Ordered gloves and masks as a precaution. Feb. 27 – Initial COVID-19 response March 16th – Announce temporary branch closures, information, instructions shared with all robust Borrower Relief Programs, OceanFirst employees for 3/1 implementation. Foundation $250,000 grant program. Employees instructed to report illness to Week of March 16th – Multiple emails to customers, HR. social media messages and website updated to Feb. 28 – Suspend share repurchases. reflect expanded initiatives and digital banking functionality. . . . M A R C H | 2020 4

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . POC Activated on March 6, 2020 Pandemic Oversight Committee (POC) Board Involvement Engaged Meetings 7-days a week, 2x a day Finance Committee • Chairman, President and CEO • Chief Operating Officer • Chief Risk Officer (Committee Chair) HR/Compensation • Chief Administrative Officer • EVP, General Counsel Committee • Chief Information Officer • Chief Financial Officer Risk Committee • Regional Presidents (Updated Weekly) • Central, Southern, Greater Philadelphia, Metropolitan NYC • Chief Retail Banking Officer • Chief Technology Officer Leadership Committee . . . • Chief Information Security Officer M A R C H | 2020 • Business Continuity Coordinator 5

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Operational Response and Preparedness • Dispersion of key operating functions, (e.g. wire, treasury, call center, and executive) • Since March 3rd, Executive and other key officers have been dispersed and either working from home or other OFB locations • 20 Customer Care Center Agents are working remotely, while 10 remain in the operations campus. Overflow call groups established in branches • Wireroom full remote access capabilities were implemented in 2018 • Treasury Client Services has been dispersed to alternate locations and has remote access . . . M A R C H | 2020 6

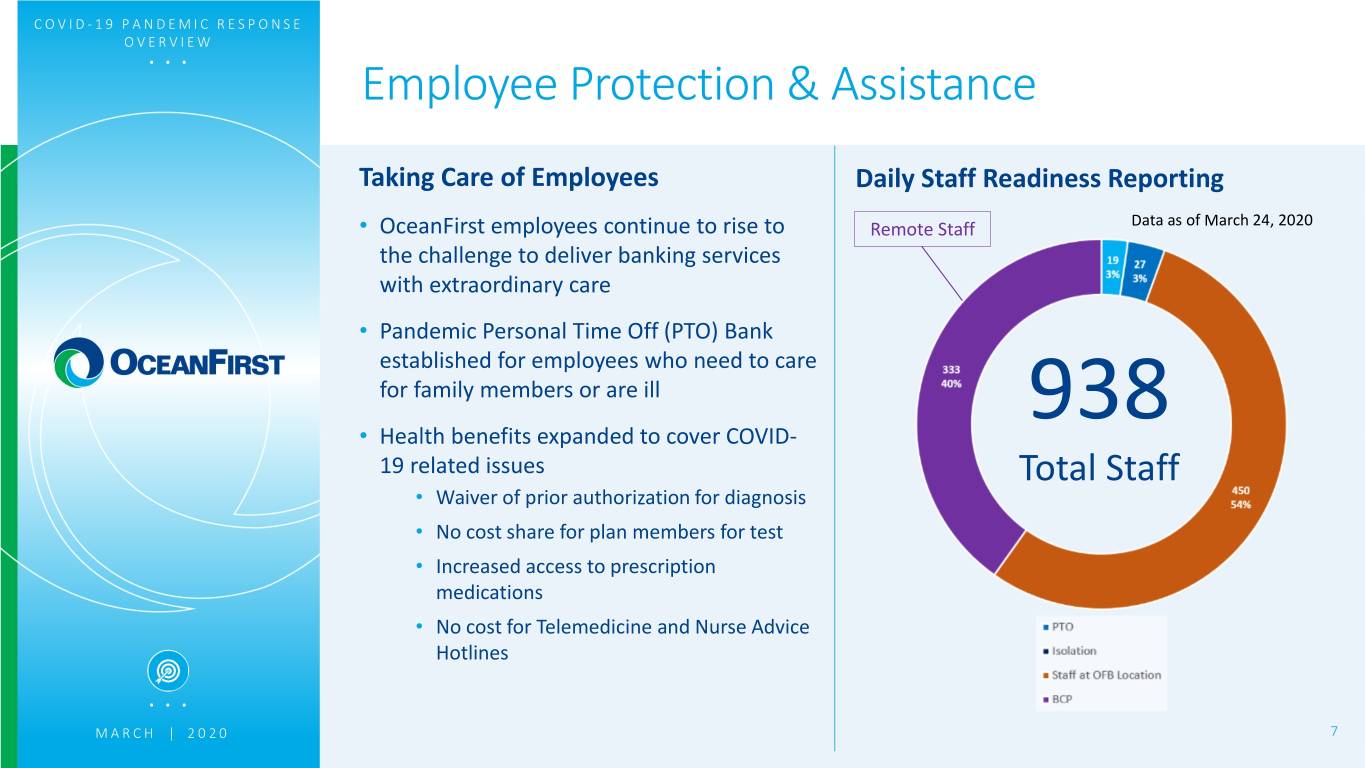

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Employee Protection & Assistance Taking Care of Employees Daily Staff Readiness Reporting • OceanFirst employees continue to rise to Remote Staff Data as of March 24, 2020 the challenge to deliver banking services with extraordinary care • Pandemic Personal Time Off (PTO) Bank established for employees who need to care for family members or are ill 938 • Health benefits expanded to cover COVID- 19 related issues Total Staff • Waiver of prior authorization for diagnosis • No cost share for plan members for test • Increased access to prescription medications • No cost for Telemedicine and Nurse Advice Hotlines . . . M A R C H | 2020 7

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Programs to Support Our Clients and Communities . . . M A R C H | 2020 8

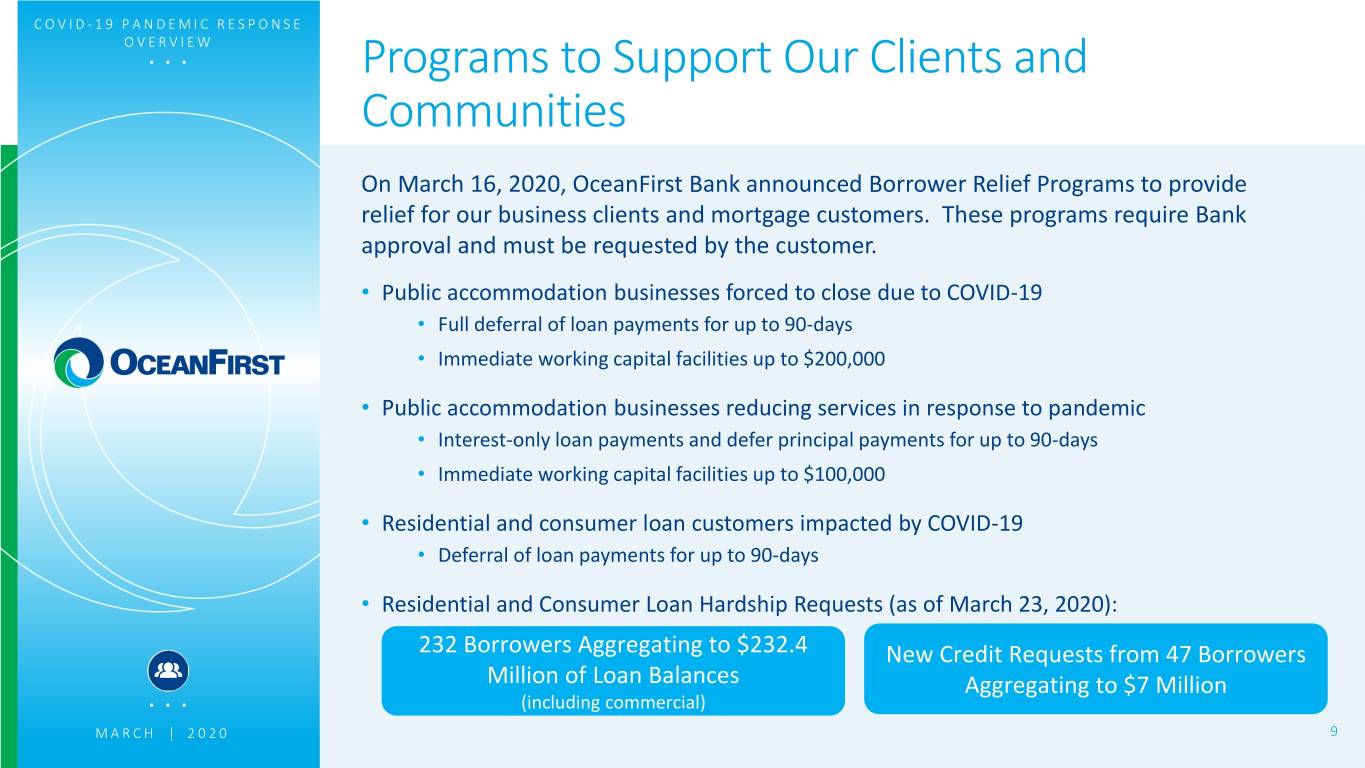

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Programs to Support Our Clients and Communities On March 16, 2020, OceanFirst Bank announced Borrower Relief Programs to provide relief for our business clients and mortgage customers. These programs require Bank approval and must be requested by the customer. • Public accommodation businesses forced to close due to COVID-19 • Full deferral of loan payments for up to 90-days • Immediate working capital facilities up to $200,000 • Public accommodation businesses reducing services in response to pandemic • Interest-only loan payments and defer principal payments for up to 90-days • Immediate working capital facilities up to $100,000 • Residential and consumer loan customers impacted by COVID-19 • Deferral of loan payments for up to 90-days • Residential and Consumer Loan Hardship Requests (as of March 23, 2020): 232 Borrowers Aggregating to $232.4 New Credit Requests from 47 Borrowers Million of Loan Balances Aggregating to $7 Million . . . (including commercial) M A R C H | 2020 9

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Branch Delivery Changes • Temporarily closed 12 branches and directed customers to local receiving branches with additional temporary closures and changes to branch hours continually assessed • Branches are providing drive-thru only service for customer transactions • Modified hours at NYC branch locations • Accommodate customers in lobby for special needs such as safe deposit box access or large cash transactions • Emergency Cash Protocol • Increased physical cash inventory at select strategic locations • Daily monitoring of cash activities and vault balances to maintain sufficient supply • Frequent replenishment of ATM’s to ensure cash access for customers . . . M A R C H | 2020 10

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Additional Customer Considerations • Waive late payment fees and overdraft fees for healthcare workers, first responders and customers directly impacted by COVID-19 – upon request. • Waive early CD withdrawal penalties. • Assist debit card customers with merchant disputes for cancelled services. . . . M A R C H | 2020 11

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Digital Support Plays Critical Role1 Daily In-Branch Transaction Count PrePandemic Pandemic Feb Avg 20,000 18,000 16,000 14,000 Avg 4.0NJ = 12,000 10,000 8,000 4.7 = OceanFirst 6,000 4,000 2,000 - 2/3 3/2 3/9 2/10 2/17 2/24 3/16 • 26% fewer in-branch transactions in first OceanFirst has highest Digital Customer days of limited operations Satisfaction of every bank in New Jersey • Mobile & online banking training programs according to Google & Apple. in place and communicated to customers . . . • 350+ mobile activations in March 1Sources: Google My Business, Google Play Store, Apple iTunes Store. Data as of 1Q20. M A R C H | 2020 2Digital CSat Rating calculated as average of branch ratings and Mobile App ratings. To avoid sample size error, banks with no app ratings and with 10 and fewer branches12 were excluded. 38 banks included, 2,527 branches, 22,000+ branch reviews.

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Customer Reaction to Pandemic Programs Customer Satisfaction has been positive since beginning of limited branch operations: ”They were very flexible in these trying times…we are living in a shutdown zone, nothing that the bank can make better except for maintaining its high customer service.” 10 Score NPS Survey 3.17.2020 ”Since the bank was closed due to the virus…Debbie was (still) able to…take care of everything!” 10 Score NPS Survey 3.19.2020 “…In this craziness, it is so appreciative to have someone take the time and have patience for someone who needed help and could not go inside the bank. It was an excellent experience.” 5-Star Google Review 3.18.2020 • Google Local Rating Before Pandemic: 4.7 • Google Local Rating During Pandemic: 5.0 (7 new ratings) • NPS Rating Before Pandemic: 79 . . . • NPS Rating During Pandemic: 80 (83 new surveys) M A R C H | 2020 13

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Financial Data . . . M A R C H | 2020 14

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Balance Sheet Concentrations Potential indirect impact from Only 15% of the balance Pandemic sheet has been extended to commercial borrowers that may be sensitive to Pandemic impacts. . . . Potential direct impact from M A R C H | 2020 Pandemic 15 Pro-forma amounts as of December 31, 2019, inclusive of Two River and Country Banks.

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Owner Occupied Real Estate / C&I by Industries Sectors that May Experience Direct Impacts from the Pandemic (Does not reflect an additional $233M of undrawn commitments) . . . Note: Includes but not limited to C&I and Owner-Occupied Real Estate M A R C H | 2020 16 Pro-forma amounts as of December 31, 2019, inclusive of Two River and Country Banks.

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Owner Occupied Real Estate / C&I (Secured By Real Estate vs Non-Real Estate Collateral) Sectors that May Experience Direct Impacts from the Pandemic . . . M A R C H | 2020 17 Pro-forma amounts as of December 31, 2019, inclusive of Two River and Country Banks.

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Investor Real Estate by Industries Sectors that May Experience Indirect Impacts from the Pandemic (Does not reflect an additional $11M of undrawn commitments) . . . M A R C H | 2020 18 Pro-forma amounts as of December 31, 2019, inclusive of Two River and Country Banks.

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Recap of Hurricane Sandy Experience Experience from Superstorm Sandy (October 2012) offers insight to create strategy for Coronavirus Borrower Relief Programs Loans Impacted Financial Impact (Forbearance Program) • 133 Loans • $1.8 Million provision – Q4 2012 • $38.1 Million in Balances • Net Charge-offs of less than $500,000 • 1.2% Net Charge-off experience . . . M A R C H | 2020 19

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Actions to Offset NIM Compression • Established floors for fixed and floating rate commercial loans • Required minimum loan spreads over LIBOR and US Treasuries • Focus on Interest Rate Swaps for longer term, higher loan amounts to reduce bank interest rate risk • Re-priced over $630 million in deposits for estimated annual save of $1.75 million • Lengthened FHLB term borrowings maturities from 25 months to a weighted average of 35 months on maturity scale while reducing the average interest rate from 1.84% at year-end by approximately 30 basis points. . . . M A R C H | 2020 20

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Historical Credit Quality 0.70 0.60 58 basis points peak net charge-off ratio in 2011 0.60 0.50 0.50 0.40 0.40 • Credit metrics reflect 0.30 conservative lending culture NPA/TA NPA/TA (%) offs/Loans Receivable (%) Receivable offs/Loans 0.30 - • Allowance for Loan Losses 0.20 averaged over 94% of total non- Net charge Net 0.20 performing loans (from 2016 to 2019) 0.10 0.10 0.00 0.00 2016 2017 2018 2019 . . . NPA/TA Basis Points Net Charge Offs M A R C H | 2020 21

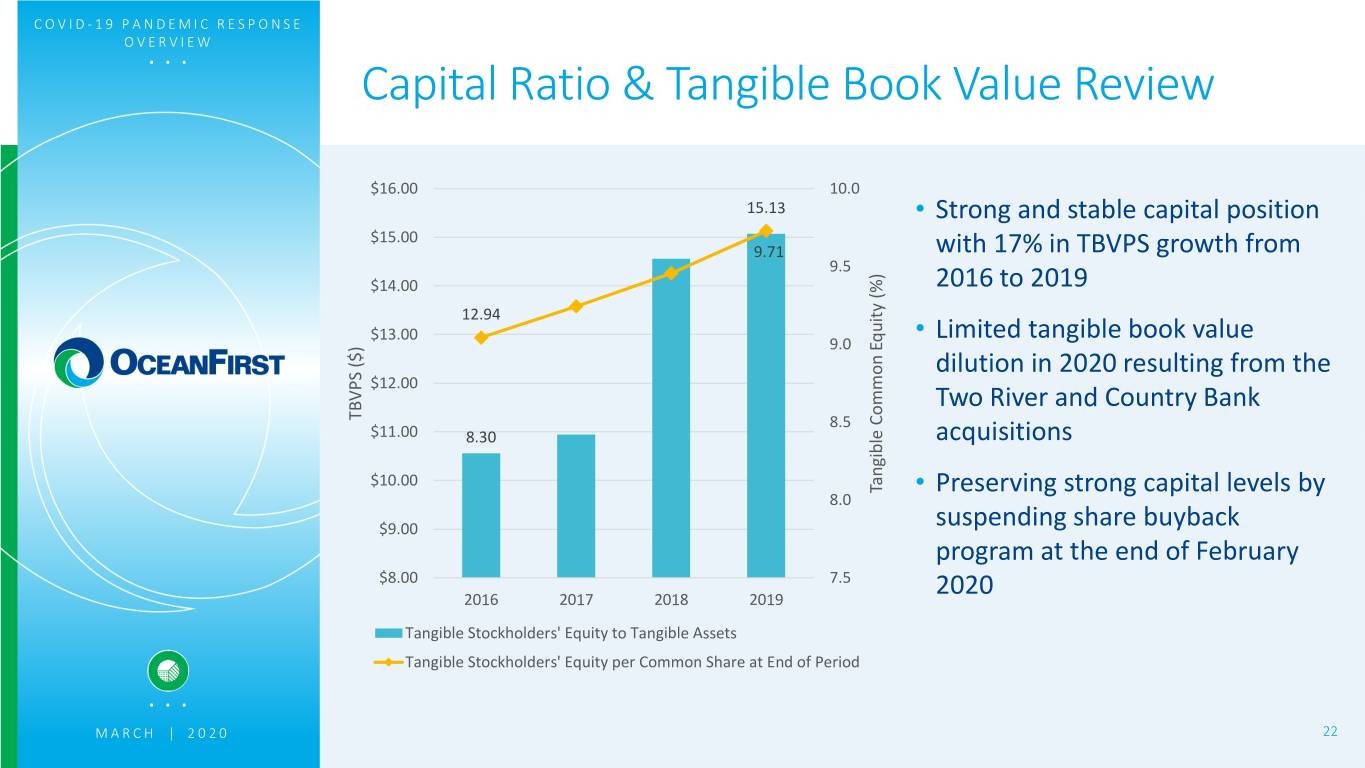

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Capital Ratio & Tangible Book Value Review $16.00 10.0 15.13 • Strong and stable capital position $15.00 9.71 with 17% in TBVPS growth from 9.5 $14.00 2016 to 2019 12.94 $13.00 • Limited tangible book value 9.0 dilution in 2020 resulting from the $12.00 Two River and Country Bank TBVPS ($) TBVPS 8.5 $11.00 8.30 acquisitions $10.00 Tangible Common Equity (%) Equity Common Tangible • Preserving strong capital levels by 8.0 $9.00 suspending share buyback program at the end of February $8.00 7.5 2016 2017 2018 2019 2020 Tangible Stockholders' Equity to Tangible Assets Tangible Stockholders' Equity per Common Share at End of Period . . . M A R C H | 2020 22

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Supplementary Data . . . M A R C H | 2020 23

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Links to Regulatory Resources: Office of the Comptroller of Currency (OCC) Information COVID-19 is a respiratory disease caused by a novel (new) coronavirus that was first detected in Wuhan, Hubei Province, China. The OCC is working cooperatively with all state and federal banking agencies and other organizations to assist regulated institutions and their customers in managing the impact of the outbreak. If you have questions concerning the operations of your financial institution, please call your financial institution or visit your financial institution’s website. The following is additional information for use by national banks, federal savings associations, federal branches of foreign banks operating in the United States, and their customers. Consumer Information • OCC Frequently Asked Questions for Bank Customers Regarding COVID-19 • Information to help protect yourself financially from the Consumer Financial Protection Bureau • Answers to frequently asked questions from the Federal Deposit Insurance Corporation • Assistance with questions and complaints regarding national banks and federal savings associations News Releases • NR 2020-39 Agencies Provide Additional Information to Encourage Financial Institutions to Work with Borrowers Affected by COVID-19 • NR 2020-38 OCC Revises Short-Term Investment Fund Rule • NR 2020-36 Federal Bank Regulatory Agencies Issue Interim Final Rule for Money Market Liquidity Facility • NR 2020-34 Federal Banking Agencies Provide Banks Additional Flexibility to Support Households and Businesses • NR 2020-32 Federal Banking Agencies Encourage Banks to Use Federal Reserve Discount Window • NR 2020-30 Agencies Encourage Financial Institutions to Meet Financial Needs of Communities Affected by . . . Coronavirus M A R C H | 2020 24

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Links to Regulatory Resources: Office of the Comptroller of Currency (OCC) Additional Links Supervisory Guidance • OCC Bulletin 2020-22: Short-Term Investment Funds: Interim Final Rule and Order • OCC Bulletin 2020-21: Troubled Debt Restructurings: Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working With Customers Affected by COVID-19 • OCC Bulletin 2020-20: Licensing Filings: Use of Electronic Methods for Submission of Licensing Filings • OCC Bulletin 2020-19: Pandemic Planning: Joint Statement on Community Reinvestment Act Consideration for Activities in Response to COVID-19 • OCC Bulletin 2020-18: Money Market Liquidity Facility: Interim Final Rule • OCC Bulletin 2020-17: Pandemic Planning: Joint Questions and Answers Regarding Statement About the Use of Capital and Liquidity Buffers • OCC Bulletin 2020-15: Pandemic Planning: Working With Customers Affected by Coronavirus and Regulatory Assistance • FFIEC Highlights Pandemic Preparedness Guidance • OCC Bulletin 2020-13: Pandemic Planning: Updated FFIEC Guidance • OCC Bulletin 2006-12: Interagency advisory on influenza pandemic preparedness Resources • Centers for Disease Control and Prevention • Department of Homeland Security • U.S. Department of State overseas travel information • World Health Organization • Ready.gov - Prepare your home and family in the event of a pandemic. . . . • What the U.S. Government is Doing (Spanish: https://gobierno.usa.gov/coronavirus) M A R C H | 2020 25

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Links to Regulatory Resources: Troubled Debt Restructurings (TDRs) FFIEC website • https://www.ffiec.gov/pdf/FFIEC_forms/FFIEC031_FFIEC041_201912_i.pdf Bank Accounting Advisory Series (BAAS) • Refer to Topic 12B • https://www.occ.gov/publications-and-resources/publications/banker- education/files/pub-bank-accounting-advisory-series.pdf Federal Reserve Board of Governors • https://www.federalreserve.gov/newsevents/pressreleases.htm • Interagency Statement . . . • https://www.fdic.gov/news/news/press/2020/pr20038a.pdf M A R C H | 2020 26

COVID - 19 PANDEMIC RESPONSE OVERVIEW. . . Investor Relations Inquiries Jill A. Hewitt Senior Vice President, Director of Investor Relations & Corporate Communications jhewitt@oceanfirst.com (732) 240-4500, ext. 7513 . . . M A R C H | 2020 27