Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - GeoVax Labs, Inc. | ex_178179.htm |

| EX-32.1 - EXHIBIT 32.1 - GeoVax Labs, Inc. | ex_178178.htm |

| EX-31.2 - EXHIBIT 31.2 - GeoVax Labs, Inc. | ex_178177.htm |

| EX-31.1 - EXHIBIT 31.1 - GeoVax Labs, Inc. | ex_178176.htm |

| EX-10.7 - EXHIBIT 10.7 - GeoVax Labs, Inc. | ex_178175.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| For the fiscal year ended December 31, 2019 |

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-52091

GEOVAX LABS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization)

1900 Lake Park Drive, Suite 380 Smyrna, GA |

87-0455038 (IRS Employer Identification Number)

30080 |

|

(Address of principal executive offices) |

(Zip Code) |

(678) 384-7220

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock $.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☑ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of Common Stock held by non-affiliates of the registrant on June 30, 2019, based on the closing price on that date was $416,380.

Number of shares of Common Stock outstanding as of March 23, 2020: 13,791,601

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed with respect to its 2020 Annual Meeting of Stockholders are incorporated by reference in Part III

Table of Contents

| PART I | 1 | ||

| ITEM 1. | BUSINESS | 1 | |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 26 | |

| ITEM 2. | PROPERTIES | 26 | |

| ITEM 3. | LEGAL PROCEEDINGS | 26 | |

| ITEM 4. | MINE SAFETY DISCLOSURES | 26 | |

| PART II | 27 | ||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 27 | |

| ITEM 6. | SELECTED FINANCIAL DATA | 28 | |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 28 | |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 33 | |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 33 | |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 33 | |

| ITEM 9A. | CONTROLS AND PROCEDURES | 34 | |

| ITEM 9B. | OTHER INFORMATION | 34 | |

| PART III | 35 | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 35 | |

| ITEM 11. | EXECUTIVE COMPENSATION | 35 | |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 35 | |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 35 | |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 36 | |

| PART IV | 36 | ||

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 36 | |

| ITEM 16. | FORM 10-K SUMMARY | 38 | |

| SIGNATURES | 39 |

This Annual Report (including the following section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements but are not the exclusive means of identifying forward-looking statements in this Annual Report. Additionally, statements concerning future matters, including statements regarding our business, our financial position, the research and development of our products and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PART I

|

ITEM 1. |

BUSINESS |

Overview

GeoVax Labs, Inc. (“GeoVax” or the “Company”) is a clinical-stage biotechnology company developing immunotherapies and vaccines against cancers and infectious diseases using a novel vector vaccine platform (Modified Vaccinia Ankara-Virus Like Particle or “GV-MVA-VLPTM”). Our current development programs are focused on preventive and therapeutic vaccines against Human Immunodeficiency Virus (HIV); preventive vaccines against hemorrhagic fever viruses (Ebola, Sudan, Marburg, and Lassa fever), Zika virus and malaria; a therapeutic vaccine for chronic hepatitis B virus infections; and immunotherapies for solid tumor cancers. We also recently entered into a letter of intent with BravoVax, an unaffiliated biotechnology company specializing in development of human vaccines based in Wuhan, China, to jointly develop a vaccine for prevention of novel coronavirus (COVID-19) infection.

For our infectious disease vaccines, our recombinant MVA vector expresses target proteins on highly immunogenic VLPs in the person being vaccinated, with the intended result of producing durable immune responses with the safety characteristics of the replication deficient MVA vector and cost-effective manufacturing.

In cancer immunotherapy, we believe that stimulating the immune system to treat or prevent cancers is a compelling concept and that the opportunity for immune-activating technologies is promising, especially in light of advancements such as checkpoint inhibitors leading the way in oncology. Despite drug approvals in limited indications and promising results in clinical trials, there remains a significant need and opportunity for further advancements. We believe our GV-MVA-VLPTM platform is well-suited for delivery of tumor-associated antigens and we plan to pursue development of our platform in this space through our subsidiary, Immutak Oncology, Inc.

Our most advanced vaccine program is focused on prevention of the clade B subtype of HIV prevalent in the regions of the Americas, Western Europe, Japan and Australia; our HIV vaccine candidate, GOVX-B11, will be included in an upcoming clinical trial (HVTN 132) managed by the HIV Vaccine Clinical Trials Network (HVTN) with support from the National Institute of Allergy and Infectious Diseases (NIAID) of the National Institutes of Health (NIH), which is targeted to begin in late 2020. Additionally, through the efforts of our collaborator, American Gene Technologies International, Inc. (AGT), we expect that our HIV vaccine will enter clinical trials during 2020 in combination with AGT’s gene therapy technology to seek a functional cure for HIV. A similar effort is underway with a consortium led by researchers at the University of California, San Francisco (UCSF), using our vaccine as part of a combinational therapy to induce remission in HIV-positive individuals; we also expect this program to enter clinical trials during 2020.

Our other vaccine and immunotherapy programs are at various other stages of development as described further in the following pages.

Our corporate strategy is to advance, protect and exploit our differentiated vaccine/immunotherapy platform leading to the successful development of preventive and therapeutic vaccines against infectious diseases and various cancers. With our design and development capabilities, we are progressing and validating an array of cancer and infectious disease immunotherapy and vaccine product candidates. Our goal is to advance products through to human clinical testing, and to seek partnership or licensing arrangements for achieving regulatory approval and commercialization. We also leverage third party resources through collaborations and partnerships for preclinical and clinical testing with multiple government, academic and corporate entities.

Our current and recent collaborators and partners include the NIAID/NIH, the HIV Vaccines Trial Network (HVTN), Centers for Disease Control and Prevention (CDC), U.S. Department of Defense (DoD), U.S. Army Research Institute of Infectious Disease (USAMRIID), U.S. Naval Research Laboratory (USNRL), Emory University, University of Pittsburgh, Georgia State University Research Foundation (GSURF), University of Texas Medical Branch (UTMB), the Institute of Human Virology (IHV) at the University of Maryland, the Scripps Research Institute (Scripps), Burnet Institute in Australia, the Geneva Foundation, American Gene Technologies International, Inc. (AGT), ViaMune, Inc., Virometix AG, Enesi Pharma, Leidos, Inc., UCSF, and BravoVax.

We are incorporated in Delaware, and our offices and laboratory facilities are in Smyrna, Georgia (metropolitan Atlanta).

Our Differentiated Vaccine and Immunotherapy Platform

Vaccines typically contain agents (antigens) that resemble disease-causing microorganisms. Traditional vaccines are often made from weakened or killed forms of the virus or from its surface proteins. Many newer vaccines use recombinant DNA (deoxyribonucleic acid) technology to generate vaccine antigens in bacteria or cultured cells from specific portions of the DNA sequence of the target pathogen. The generated antigens are then purified and formulated for use in a vaccine. We believe the most successful of these purified antigens have been non-infectious virus-like particles (VLPs) as exemplified by vaccines for hepatitis B (Merck's Recombivax® and GSK's Engerix®) and Papilloma viruses (GSK's Cervarix®, and Merck's Gardasil®). Our approach uses recombinant DNA and/or recombinant MVA to produce VLPs in the person being vaccinated (in vivo) reducing complexity and costs of manufacturing. In human clinical trials of our HIV vaccines, we believe we have demonstrated that our VLPs, expressed from within the cells of the person being vaccinated, can be safe, yet elicit both strong and durable humoral and cellular immune response.

VLPs can cause the body's immune system to recognize and kill targeted viruses to prevent an infection. VLPs can also train the immune system to recognize and kill virus-infected cells to control infection and reduce the length and severity of disease. One of the biggest challenges with VLP-based vaccines is to design the vaccines in such a way that the VLPs will be recognized by the immune system in the same way as the authentic virus would be. We design our vaccines such that, when VLPs for enveloped viruses like HIV, Ebola, Marburg or Lassa fever are produced in vivo (in the cells of the recipient), they include not only the protein antigens, but also an envelope consisting of membranes from the vaccinated individual's cells. In this way, they are highly similar to the virus generated in a person's body during a natural infection. VLPs produced in vitro (in a pharmaceutical plant), by contrast, have no envelope; or, envelopes from the cultured cells (typically hamster or insect cells) used to produce them. We believe our technology therefore provides distinct advantages by producing VLPs that more closely resemble the authentic viruses. We believe this feature of our immunogens allows the body's immune system to more readily recognize the virus. By producing VLPs in vivo, we believe we also avoid potential purification issues associated with in vitro production of VLPs.

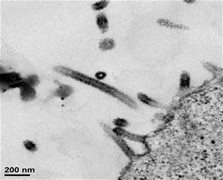

Examples of VLPs

|

|

| Ebola Virus VLPs | HIV VLPs |

Figure 1. Electron micrographs showing examples of VLPs produced by GeoVax vaccines in human cells. Note that the Ebola virus VLPs on the left self-assemble into the rod-like shape of the actual Ebola virus, while the HIV VLPs shown on the right take on the spherical shape of the actual HIV virus. While below the resolution of these micrographs, both types of VLPs display what we believe to be the native form of their respective viral envelope glycoproteins which we believe is key to generating an effective immune humoral response.

For many viral infectious diseases, natural VLPs are produced by co-assembly of, generally a matrix protein and an envelope protein. These natural VLPs resemble infectious virions but may not contain the virus’ full genetic material and are therefore considered “virus byproducts”. To develop a vaccine for an infectious disease such as Ebola, Zika, HIV, etc., we use viral proteins that naturally form VLPs. For other diseases such as cancer and malaria where there are no natural VLP counterparts, we use an array of other matrix proteins as scaffolds to deliver such antigens as VLPs. Similar approaches have been used for VLPs produced in vitro including the current malaria vaccine (RTS, S) that uses a matrix S protein from the Hepatitis B virus to deliver the malaria liver-stage protective antigen, CSP. We have successfully used viral matrix proteins as scaffolds for our oncology vaccine (MUC1) and malaria (modified CSP) vaccine candidates.

We selected MVA for use as the live viral component of our vaccines because of its well-established safety record and because of the ability of this vector to carry sufficient viral sequences to produce VLPs. MVA was originally developed as a safer smallpox vaccine for use in immune-compromised individuals. It was developed by attenuating the standard smallpox vaccine by passaging it (over 500 passages) in chicken embryos or chicken embryo fibroblasts, resulting in a virus with limited ability to replicate in human cells (thus safe) but with high replication capability in avian cells (thus cost effective for manufacturing). The deletions also resulted in the loss of immune evasion genes which assist the spread of wild type smallpox infections, even in the presence of human immune responses.

Our GV-MVA-VLPTM vaccine platform affords other advantages:

|

● |

Safety: Our HIV vaccines have demonstrated outstanding safety in multiple human clinical trials. Safety for MVA, generally, has been shown in more than 120,000 subjects in Europe, including immunocompromised individuals during the initial development of MVA and more recently with the development of MVA as a safer vaccine against smallpox. |

|

● |

Durability: Our technology raises highly durable (long-lasting) vaccine responses, the most durable in the field of vectored HIV vaccines. We hypothesize that elicitation of durable vaccine responses is conferred on responding B cells by the vaccinia parent of MVA, which raises highly durable responses for smallpox. |

|

● |

Limited pre-existing immunity to vector: Following the eradication of smallpox in 1980, smallpox vaccinations subsequently ended, leaving all but those born before 1980 and selected populations (such as vaccinated laboratory workers and first responders) unvaccinated and without pre-existing immunity to MVA-derived vaccines. A potential interference of pre-existing immunity to a vector may be more problematic with those vectors related to parent viruses used in routine vaccinations (e.g. measles) or constitute common viruses that infect people of all ages (e.g. cytomegalovirus). |

|

● |

Repeated use of the platform for different vaccines used in sequence. In mouse experiments, we have shown that two of our vaccines (e.g. GV-MVA-VLP-Zika followed by GV-MVA-VLP-Ebola) can be given at <4 weeks intervals without any negative impact on their immunogenicity (lack of vector immunity). |

|

● |

No need for adjuvants: MVA generally stimulates strong innate immune responses and does not require the use of adjuvants. |

|

● |

Thermal stability: MVA is stable in both liquid and lyophilized formats (> 6 years of storage). |

|

● |

Genetic stability and manufacturability: If appropriately engineered, MVA is genetically stable and can reliably be manufactured in either the established Chick Embryo Fibroblast cell substrate, or novel continuous cell lines that support scalability as well as greater process consistency and efficiency. |

Our Product Development Pipeline

Our primary focus is to advance, independently and in partnerships, the products developed from our GV-MVA-VLPTM platform. We are currently developing a number of vaccines and immunotherapies for prevention or treatment of infectious diseases and cancer. The table below summarizes the status of our product development programs, which are discussed in greater detail in the following pages.

|

Product Area / Indication |

Stage of Development |

Collaborators / Sponsors |

|

Cancer |

||

|

HPV-related cancers |

Preclinical |

Emory, Virometix |

|

MUC1-expressing tumors |

Preclinical completed |

Univ of Pittsburgh, ViaMune |

|

Cyclin B1-expressing tumors |

Preclinical |

|

|

Checkpoint inhibitors |

Preclinical |

Leidos |

|

Infectious Diseases |

||

|

HIV (preventive) |

Phase 2a completed |

NIH, HVTN, Emory |

|

HIV (immunotherapy) |

Phase 1 |

AGT, UCSF |

|

Zika |

Preclinical completed |

NIH, CDC |

|

Malaria |

Preclinical |

Leidos, Burnet Institute |

|

Ebola, Marburg, Sudan |

Preclinical completed |

NIH, USAMRIID, UTMB |

|

Lassa Fever |

Preclinical |

NIH, DoD, Scripps, IHV, UTMB, USNRL, Geneva Foundation |

|

Hepatitis B (immunotherapy) |

Preclinical |

GSURF |

|

Coronavirus (COVID-19) |

Preclinical |

BravoVax |

|

Novel vaccine delivery |

Preclinical |

Enesi |

We are seeking to develop a broad product pipeline based on our GV-MVA-VLPTM platform and have been very pleased with the results, particularly considering the challenges we have faced in obtaining sufficient capital, and the related relatively small number of scientifically skilled employees we employ. These constraints have made it necessary to set priorities as to our primary focuses, and those will change as opportunities, resources, and other circumstances dictate. During 2019, for example, in addition to working with our collaborators/sponsors, we chose to focus a portion of our management time and budget in the area of immuno-oncology. More recently, the emergence of novel coronavirus (COVID-19) led us to decide to devote our management time and resources, and our platform, to address this epidemic. At times, some of our development programs are paused as we shift our focus due our limited resources.

Our Cancer Immunotherapy Programs

Cancer is the second most common cause of death in the US, exceeded only by heart disease. Its global burden is expected to rise to 22 million new cases per year by 2030. Currently, there is only one FDA approved cancer vaccine, PROVENGE® (sipuleucel-T). PROVENGE® is a personalized therapy for prostate cancer patients, which prolongs survival times by about 4 months. However, the field of immuno-oncology has received new momentum with the discovery and initial launch of monoclonal antibodies (Mabs) called immune checkpoint inhibitors (ICIs). Tumors hijack the body’s natural immune checkpoints by over expressing immune checkpoint ligands (proteins that bind to and activate the inhibitory activity of immune checkpoints), as a mechanism of immune resistance, especially against the T cells that are specific for tumor antigens and can kill cancer cells. ICIs block the interaction of immune checkpoints with their ligands on tumor cells, allowing otherwise poorly functional T cells to resume proliferation, cytokine production and killing of tumor cells.

Unlike conventional therapies (e.g. radiation, chemotherapy, antibody, etc.), therapeutic cancer vaccines have the potential to induce responses that not only result in the control and even clearance of tumors but also establish immunological memory that can suppress and prevent tumor recurrence. Convenience, safety, and low toxicity of cancer vaccines could make them invaluable tools to be included in future immunotherapy approaches for treating tumors. Currently, there are only a few vectored cancer vaccines being tested in combination with ICIs, all of which are in early clinical stages.

Collaborations with University of Pittsburgh and ViaMune – We have established a collaboration with Dr. Olivera Finn, a leading expert in cancer immunotherapy at the University of Pittsburgh. Dr. Finn was the first to show that many tumors express an abnormal form of cell surface-associated Mucin 1 (MUC1) protein that is recognized by the immune system as foreign. Given this, we are developing our GV-MVA-VLPTM vaccine platform to deliver abnormal forms of MUC1 with the goal of raising protective anti-tumor antibodies and T cell responses in cancer patients. Our collaboration with Dr. Finn has shown that a combination of our MVA-VLP-MUC1 vaccine candidate with a 100-mer MUC1 peptide (experiments were performed at the University of Pittsburgh) was capable of breaking tolerance to human MUC1 tumors in huMUC1 transgenic mice and protect them against challenge in a lymphoma tumor model.

We are also collaborating with ViaMune, Inc., which has developed a fully synthetic MUC1 vaccine candidate (MTI). The collaboration will assess each companies’ vaccine platform, separately, and in combination, with the goal of developing a tumor MUC1 vaccine that can produce a broad spectrum of anti-tumor antibody and T cell responses. The resulting MUC1 vaccine would be combined with ICIs as a novel vaccination strategy for cancer patients with advanced MUC1+ tumors. We have produced an MVA-VLP-MUC1 vaccine candidate, demonstrated VLP production by electron microscopy using MUC1 immunogold staining, and showed that the VLPs express a hypo-glycosylated form of MUC1 in human cell lines. Preclinical studies of the combined MTI and MVA-VLP-MUC1 vaccines conducted at the University of North Carolina at Charlotte have shown the combination of our vaccine with MTI and ICI have significantly reduced the tumor burden in a mouse model for colorectal cancer.

Collaboration with Emory Vaccine Center – In July 2018, we began collaborating with Emory University on the development of a therapeutic vaccine for human papillomavirus (HPV) infection, with a specific focus on head and neck cancer (HNC). This is an important research area as there are currently no medical treatments for chronic HPV infections, which can lead to the formation of cancerous tumors. The GeoVax/Emory collaboration will include testing GeoVax’s MVA-VLP-HPV vaccine candidates in therapeutic animal models of HPV in the laboratory of Dr. Rafi Ahmed, Director of the Emory Vaccine Center. Dr. Ahmed, a member of the National Academy of Sciences, is a world-renowned immunologist whose work during the past decade has been highly influential in shaping understanding of memory T cell differentiation and T and B cell-mediated antiviral immunity. We believe our collaboration with Emory on the HPV project is extremely valuable as it was Dr. Ahmed who first discovered in 2006 that the PD-1 pathway could also be exploited by many pathogens to repress normal T cell function during chronic viral infection. This led to development of numerous blockbuster anti-PD1 antibodies currently being used for treatment of various cancers and which hold promise as adjunctive therapy for several chronic infectious diseases. In HIV, Ebola, Zika, and Lassa Fever, our GV-MVA-VLPTM vaccine candidates have demonstrated eliciting strong antigen-specific T cell responses in the host, a response that is critical to fight against HPV infections in HNC patients. To increase the therapeutic efficacy of our HPV vaccine, we intend to apply a combination strategy which could include co-administration of anti-PD1 antibodies and/or other newly discovered immunotherapy drugs to improve a patient’s own anti-cancer immune response.

Collaboration with Virometix – In November 2018, we announced a collaboration with Virometix AG, a company developing next-generation Synthetic Virus-Like Particle (SVLPTM) based vaccines, to develop a therapeutic vaccine for HPV infection. The collaboration will include preclinical animal testing of GeoVax’s MVA-vectored HPV vaccine candidates in combination with Virometix’ synthetic HPV vaccine candidate. This collaboration complements our collaboration with Emory University for HPV-related head and neck cancers in patients who express oncogene products of HPV16, E6 and E7 proteins. Similar to the strategy we are utilizing in our clinical trials for HIV and preclinical testing of our cancer vaccines (e.g. vector and protein combination), we believe the combination of our MVA-vectored HPV vaccines and Virometix’ SVLP-based HPV vaccine could bring a synergy that significantly increases the therapeutic potential over each platform used separately.

Collaboration with Leidos – In November 2018, we began collaborating with Leidos, Inc. on a research program evaluating the combination of the companies’ respective technologies in the field of cancer immunotherapy. Currently, there are major limitations on cancer immunotherapies which include high costs (limiting patient access, straining both the healthcare system and the patient’s own finances), the need for multiple injections, and significant side effects. Moreover, monotherapy with one checkpoint inhibitor drug can induce drug resistance in some patients making it necessary to combine with other drugs and treatments, which in turn may further increase toxicity. We have shown that our MVA platform can be safe in humans without any major side effects and hope that delivery of the immune checkpoint inhibitors with or without the tumor-associated antigens may overcome some of the challenges associated with the use of immune checkpoint inhibitors in cancers or other chronic infectious diseases. The GeoVax/Leidos collaboration will include the design, construction, and characterization of multiple immunotherapeutic vaccine candidates using our GV-MVA-VLPTM vaccine platform combined with certain novel peptide PD-1 checkpoint inhibitors developed by Leidos. The vaccine design, construction, and characterization will be performed at GeoVax with further analysis conducted by Leidos. We believe this effort may lead to expanded efforts in cancer immunotherapy, treatments for chronic Hepatitis B infections, or other diseases where an immunological-based therapeutic approach would be beneficial.

Formation of Immutak Oncology, Inc. – In September 2019, we incorporated Immutak Oncology, Inc (Immutak) as a wholly-owned subsidiary of the Company. We established Immutak to focus on the advancement of the immuno-oncology programs developed by GeoVax and to seek additional, complementary technologies and clinical-stage products in the oncology space. We have initiated separate financing efforts in support of these programs through Immutak.

Our Infectious Disease Vaccine Programs

Recent Development – Coronavirus Vaccine Collaboration

In January 2020, in response to the ongoing Coronavirus (COVID-19) epidemic which began in Wuhan, China, we signed a letter of intent with BravoVax, a vaccine developer in Wuhan, China, to collaborate on the develop a vaccine for prevention and/or control of COVID-2019 infection. Under the collaboration, we will use our GV-MVA-VLPTM vaccine platform and expertise to design and construct the vaccine candidate using genetic sequences from the ongoing COVID-2019 outbreak. Upon completion of a definitive agreement, BravoVax will provide testing and manufacturing support, as well as direct interactions with Chinese public health and regulatory authorities, for a parallel regulatory pathway to what GeoVax will pursue in the United States. To date, GeoVax has completed the vaccine construct design and has initiated applications to BARDA (Biomedical Advanced Research and Development Authority) and other entities requesting funding support of our COVID-19 vaccine development efforts. BravoVax has initiated similar funding application requests to entities such as the CNCBD (China National Center for Biotechnology Development).

About COVID-19 – Coronaviruses are common in many species of animals including mammals, avian and bats. In rare occasions these viruses can evolve to cross the animal species and infect humans and quickly spread from person to person resulting in lethal but rare respiratory infections. Recent epidemic with SARS and MERS coronaviruses resulted in 774 and 858 deaths, respectively. Since 2015 there has not been any cases of SARS and MERS reported but in January 2020, WHO identified a novel coronavirus, recently named COVID-19, in the city of Wuhan, China. On January 31, World Health Organization (WHO) declared the novel coronavirus to be a global health emergency, and on March 11, 2020 WHO declared a global pandemic. As of March 18, 2020, in excess of 200,000 people have been infected and more than 8,900 people have died as a result of COVID-19 infections. The situation is fluid, with the infection and death statistics increasing significantly each day.

Our HIV/AIDS Vaccine Programs

About HIV/AIDS. HIV/AIDS is considered by many in the scientific and medical community to be the most lethal infectious disease in the world. An estimated 37 million people are living with HIV worldwide, with approximately 1.8 million newly infected annually. Since the beginning of the epidemic, more than 70 million people have been infected with the HIV virus and about 35 million have died of HIV. The United States currently has an estimated 1.1 million HIV-infected individuals, with approximately 40,000 new infections per year. Gay and bisexual men bear the greatest burden by risk group, representing nearly 70% of new infections in the U.S. African-Americans also bear a disproportionate burden, representing 43% of people living with HIV, yet representing just 12% of the total population.

There are several AIDS-causing HIV virus subtypes, or clades, that are found in different regions of the world. These clades are identified as clade A, clade B and so on. The predominant clade found in Europe, North America, parts of South America, Japan and Australia is clade B, whereas the predominant clades in Africa are clades A and C. In India, the predominant clade is clade C. Genetic differences between the clades may mean that vaccines or treatments developed against HIV of one clade may only be partially effective or ineffective against HIV of other clades. Thus, there is often a geographical focus to designing and developing HIV vaccines.

At present, the standard approach to treating HIV infection is to inhibit viral replication through the use of combinations of drugs. Available drugs include reverse transcriptase inhibitors, protease inhibitors, integration inhibitors and inhibitors of cell entry. However, HIV is prone to genetic changes that can produce strains that are resistant to currently approved drugs. When HIV acquires resistance to one drug within a class, it can often become resistant to the entire class, meaning that it may be impossible to re-establish control of a genetically altered strain by substituting different drugs in the same class. Furthermore, these treatments continue to have significant limitations which include toxicity, patient non-adherence to the treatment regimens and cost. Thus, over time, viruses acquire drug-resistant mutations, and many patients develop intolerance to the medications or simply give up taking the medications due to cost, inconvenience or side effects.

There is no approved vaccine to prevent HIV infection. Prevention of HIV infection remains a worldwide unmet medical need, even in the United States and other first world countries where effective antiretroviral therapies are available. Current antiretroviral therapies (ART) do not eliminate HIV infection, requiring individuals to remain on such drugs for their entire lives. Uptake and successful long-term adherence to therapy is also limited. Only 30% of those infected with HIV in the US ultimately remain in HIV care with their viral load sufficiently suppressed to prevent spread of HIV. Furthermore, the financial burden to the U.S. taxpayer for HIV education, prevention, and treatment costs is borne through multiple federal agencies, totaling over $25 billion annually.

According to the International AIDS Vaccine Initiative (IAVI), the cost and complexity of new treatment advances for HIV/AIDS puts them out of reach for most people in the countries where treatment is most needed. In industrialized nations, where drugs are more readily available, side effects and increased rates of viral resistance have raised concerns about their long-term use. Vaccines are seen by many as the most promising way to end the HIV/AIDS pandemic. We expect that vaccines, once developed, will be used universally and administered worldwide by organizations that provide healthcare services, including hospitals, medical clinics, the military, prisons and schools.

Our Preventive HIV Vaccine Program

Clade B Preventive HIV Vaccine Program. Our most clinically advanced vaccine is GOVX-B11, designed to protect against the clade B subtype of the HIV virus prevalent in the Americas, Western Europe, Japan and Australia. GOVX-B11 consists of a recombinant DNA vaccine used to prime immune responses and a recombinant MVA vaccine (MVA62B) used to boost the primed responses. Both the DNA and MVA vaccines induce the production of non-infectious VLPs by the cells of the vaccinated person.

Phase 1 and phase 2a human clinical trials of GOVX-B11 have been conducted by the HVTN. In these trials, totaling approximately 500 participants, GOVX-B11 was tested at various doses and regimens and was well tolerated. The HVTN is the largest worldwide clinical trials network dedicated to the development and testing of HIV/AIDS vaccines. Support for the HVTN comes from the NIAID, part of the NIH. The HVTN’s HIV Vaccine Trial Units are located at leading research institutions in 27 cities on four continents.

In January 2017 HVTN began the next human clinical trial (HVTN 114) in the path toward pivotal efficacy trials. HVTN 114 enrolled individuals who previously participated in the HVTN 205 Phase 2a trial of the GOVX-B11 vaccine, which concluded in 2012. HVTN 114 tested the ability of late boosts (additional vaccinations) to increase the antibody responses elicited by the GeoVax vaccine regimen. These “late boosts” consist of the GeoVax MVA62B vaccine with or without a gp120 protein vaccine. The gp120 protein, AIDSVAX® B/E, is the same protein used to boost immune responses in the partially protective RV144 trial in Thailand and is being used in HVTN 114 to assess the effect of adding a protein vaccine to GOVX-B11. Participants in HVTN 114 receive either (a) another MVA62B boost, (b) a combined boost of MVA62B and AIDSVAX® B/E, or (c) AIDSVAX® B/E alone. HVTN 114 was completed during 2018 and results were presented during the HIV Research for Prevention (HIVR4P) conference in Madrid, Spain in October. The study demonstrated the most effective boost to be the combination of MVA62B live vector and AIDSVAX B/E proteins, which increased titers of antibodies to the HIV envelope glycoproteins by more than 600-fold.

Following completion of HVTN 114, the HVTN is moving forward with plans for an additional phase 1 trial, designated HVTN 132, which will be a multi-center, randomized, double-blind trial, enrolling up to 70 healthy adults. The primary objectives of HVTN 132 will be to further assess the safety, tolerability and immunogenicity (elicited antibody responses) of a prime-boost regimen of GOVX-B11, in combination with protein boost vaccines. The protein boosts are being tested for their ability to enhance the antibody response elicited by GOVX-B11 to gp120. The protein boosts to be evaluated in the trial were developed by Duke University and by the Institute of Human Virology of the University of Maryland School of Medicine. HVTN 132 will be conducted by the HVTN with support from NIAID and is expected to commence patient enrollment in late-2020.

Clade C Preventive HIV Vaccine Program. We also are developing DNA/MVA vaccines designed for use against the clade C subtype of HIV that predominate in South Africa and India. NIAID has awarded GeoVax Small Business Innovative Research (SBIR) grants in support of this effort, but further development of these vaccines will be dependent upon additional funding support.

Our HIV Immunotherapy Program – Seeking a Cure

Finding a cure for HIV/AIDS remains an elusive goal. Current anti-retroviral therapies (ART), though highly effective at suppressing HIV viral load, are unable to eliminate latent forms of HIV that are invisible to the immune system and inaccessible to antiretroviral drugs. Long-term use of ART can lead to loss of drug effectiveness and can come with severe, debilitating side effects. The lifetime medical costs saved by preventing (or curing) a single HIV infection in the U.S. are estimated to approach $400,000. Therefore, any new treatment regimen that allows patients to reduce, modify, or discontinue their antiretroviral therapy could offer measurable quality of life benefits to the patient and tremendous value to the marketplace.

Collaboration with AGT – In March 2017, we entered into collaboration with American Gene Technologies International, Inc. (AGT) whereby AGT intends to conduct a Phase 1 human clinical trial with our combined technologies, with the ultimate goal of developing a functional cure for HIV infection. In the AGT trial, the GeoVax vaccine will be used to stimulate virus specific CD4+ T cells in vivo, which will then be harvested from the patient, genetically modified ex vivo using AGT’s technology, and reinfused to the patient. The primary objectives of the trial will be to assess the safety and efficacy of the therapy, with secondary objectives to assess the immune responses as a measure of efficacy. In a previous phase 1 clinical trial (GV-TH-01), we demonstrated that our vaccine can stimulate production of CD4+ T cells in HIV infected patients– the intended use of the GV-MVA-VLPTM HIV vaccine in the proposed AGT study. AGT has recently stated their intention to begin the phase 1 trial during mid-2020.

Collaboration with UCSF – In November 2019, we entered into an agreement with the University of California, San Francisco (UCSF), whereby we will participate in a collaborative effort led by researchers at UCSF to develop a combinational therapy aimed at inducing remission in HIV-positive individuals (a “functional cure”). The studies will be conducted with funding from amfAR, The Foundation for AIDS Research. The proposed clinical trial will enroll 20 HIV-infected adults who are on stable and effective anti-retroviral therapy (ART). The therapeutic regimen to be tested involves a combination of vaccines, drugs and biologics. GeoVax will provide its novel boost component (MVA62B) for use in the studies. MVA62B is the boosting component for our preventive HIV vaccine (GOVX-B11) which has successfully completed a Phase 2a clinical trial. The primary objectives of the trial will be to assess the safety and tolerability of the combinational therapy and to determine the viral load “set-point” during a treatment interruption. Secondary objectives will be to assess immune responses and changes in viral reservoir status. Patient enrollment for the clinical trial is expected to commence during 2020.

Our Filovirus (Ebola, Sudan, Marburg) Vaccine Program

Ebola (EBOV, formerly designated as Zaire ebolavirus), Sudan (SUDV), and Marburg viruses (MARV) are the most virulent species of the Filoviridae family. They can cause up to a 90% fatality rate in humans and are epizootic in Central and West Africa with 29 outbreaks since 1976. The 2013-16 Ebola outbreak caused 28,616 cases and 11,310 deaths (case fatality rate of 40%). In August 2018, the Ministry of Health of the Democratic Republic of the Congo declared a new outbreak of Ebola virus disease in North Kivu Province. Despite responses from the Ministry of Health, WHO, and its partners to contain this outbreak, there have been 3,431 cases, 2,253 people have died after contracting the disease and 1,178 patients have recovered (case fatality rate of 66%) as of February 13, 2020. Even after the current outbreak is contained, additional outbreaks are certain in future due to indigenous reservoirs of the virus (e.g. fruit bats), the zoonotic nature of the virus, weak health systems, high population mobility, political unrest, cultural beliefs and burial practices, and for those not at natural risk, the risk of intentional release by a bioterrorist.

We believe an ideal vaccine against major filoviruses must activate both humoral and cellular arms of the immune system. It should include the induction of antibodies to slow the initial rate of infection and a cellular immune response to help clear the infection. Moreover, it should address strain variations by providing broad coverage against potential epizootic filovirus strains, and it should be safe not only in healthy individuals (e.g. travelers or health care workers), but also in immunocompromised persons (e.g., HIV infected) and those with other underlying health concerns.

Despite significant progress being made with some experimental vaccines in clinical trials, none have been fully tested for both safety and efficacy. The replication competent rVSV-ZEBOV showed safety concerns in Phase 1 trials and by virtue of being replication competent could pose threats to immunocompromised individuals, such as those infected with HIV living in West Africa where recent Ebola epidemics started. The less advanced adeno-vectored vaccine candidates may require relatively cumbersome heterologous prime/boost regimens, for example with MVA, to elicit durable protective immunity. The use of Ad5 vectors also has been associated with concerns over increased susceptibility to HIV infection in areas with high HIV incidence. Even with rVSV-ZEBOV showing promise in the 2013-2015 epidemic, the world would benefit by being prepared with a safer and effective vaccine, to prevent or alleviate the effects of the next epidemic.

To address the unmet need for a product that can respond to future filovirus epidemics we are developing innovative vaccines utilizing our GV-MVA-VLPTM platform. We are addressing strain variations, and induction of broad humoral and cellular response through development of monovalent vaccines, which we may also investigate blending together as a single vaccine to provide broad coverage, potentially with a single dose. The MVA vector itself is considered safe, having originally been developed for use in immunocompromised individuals as a smallpox vaccine. We expect our vaccines to not only protect at-risk individuals against EBOV, SUDV and MARV, but also potentially reduce or modify the severity of other re-emerging filovirus pathogens such as Bundibugyo, Ivory Coast, and Reston viruses, based on antigenic cross reactivity and the elicitation of T cells to the more conserved matrix proteins (e.g. VP40 or Z) in addition to standard GP proteins used by us and other manufacturers. Thus, the GeoVax GV-MVA-VLPTM approach could offer a unique combination of advantages to achieve breadth and safety of a pan-filo vaccine. In addition to protecting people in Africa, it is intended to prevent the spread of disease to the US, and for preparedness against terrorist release of any of bio-threat pathogens.

Our initial preclinical studies in rodents and nonhuman primates for our EBOV vaccine candidate have shown 100% protection against a lethal dose of EBOV upon a single immunization. These studies were conducted with support from NIAID and USAMRIID. We have also designed and constructed vaccine candidates for SUDV and MARV. In a recent independent, peer-reviewed paper published by Lazaro Frias et al (J Virol. 2018 Jun 1; 92(11): e00363-18), the authors concluded that the MVA-VLP-Ebola and MVA-VLP-Sudan vaccines are the best-in class vaccine in development.

In July 2019, we reported positive results (100% protection) from preclinical challenge studies of our MARV vaccine candidate. In this study, our MARV vaccine was administered by intramuscular (IM) inoculations to guinea pigs, with a control group receiving saline injections. Eight weeks after inoculation, animals in each group were exposed to a lethal dose of MARV. Within 8 days post-challenge, all animals in the control group had developed moribund conditions and had to be euthanized. At the conclusion of the study (21 days post-challenge), all vaccinated animals survived, with no weight loss or other health issues. The study was conducted in collaboration with researchers at the University of Texas Medical Branch at Galveston. (UTMB).

Further development of our filovirus vaccines will be dependent upon additional funding support.

Our Lassa Fever Vaccine Program

Lassa fever virus (LASV), a member of the Arenaviridae family, causes severe and often fatal hemorrhagic illnesses in an overlapping region with Ebola. Lassa Fever is an acute viral hemorrhagic illness caused by LASV. In contrast to the unpredictable epidemics of filoviruses, LASV is endemic in West Africa with an annual incidence of >300,000 infections, resulting in 5,000-10,000 deaths. Data from a recent independent study suggest that the number of annual Lassa Fever cases may be much higher, reaching three million infections and 67,000 deaths, putting as many as 200 million persons at risk.

Our initial preclinical studies in rodents for our LASV vaccine candidate have shown 100% single-dose protection against a lethal dose of LASV challenge composed of multiple strains delivered directly into the brain. The study was conducted at the Institute of Human Virology at the University of Maryland School of Medicine in Baltimore. Multiple repeats of the study confirmed the findings.

SBIR Grant – Subsequent to these initial findings, in April 2018 NIAID awarded us a $300,000 Small Business Innovative Research (SBIR) grant in support of further advancing our Lassa vaccine development program. The work was performed in collaboration with the Institute of Human Virology at the University of Maryland, The Scripps Research Institute, and the University of Texas Medical Branch.

Defense Department Grant – In September 2018, the U.S. Department of Defense (DoD) awarded us a $2,442,307 cooperative agreement in support of our LASV vaccine development program. The grant was awarded by the U.S. Army Medical Research Acquisition Activity pursuant to the Peer Reviewed Medical Research Program (PRMRP), part of the Congressionally Directed Medical Research Programs (CDMRP). In addition to the grant funds provided directly to GeoVax, DoD will also fund testing of the GeoVax vaccine by U.S. Army scientists at the U.S. Army Medical Research Institute of Infectious Diseases (USAMRIID), under a separate subaward. The project award is supporting generation of immunogenicity and efficacy data for our vaccine candidate in both rodent and nonhuman primate models, as well as manufacturing process development and cGMP production of vaccine seed stock in preparation for human clinical trials. The work is being performed in collaboration with USAMRIID and the Geneva Foundation.

Further development of our Lassa Fever vaccine beyond the work being funded by the U.S. DoD will be dependent upon additional funding and/or partnering support.

Our Zika Vaccine Program

Zika disease is an emerging infectious disease caused by the Zika virus (ZIKV) and has been linked to an increase in microcephaly in infants and Guillain-Barre syndrome (a neurodegenerative disease) in adults. ZIKV is a member of the Flaviviridae family, which includes medically important pathogens such as dengue fever, yellow fever, Japanese encephalitis, tick-borne encephalitis, and West Nile viruses. ZIKV, which was first discovered in 1947 in the Zika forest of Uganda, was considered only a minor public health concern for 60 years. Recently, with its appearance and rapid spread in the Americas, it has emerged as a serious threat with pandemic potential. Symptoms of Zika infection have historically been mild. In the recent epidemic, however, an alarming association between ZIKV infection and fetal brain abnormalities including microcephaly has been observed. No approved preventive or therapeutic products are currently available to fight the Zika epidemic. Public health officials recommend avoiding exposure to ZIKV, delaying pregnancy, and following basic supportive care (fluids, rest, and acetaminophen) after infection. A vaccine is needed to prevent a Zika pandemic.

To address the unmet need for a ZIKV vaccine, we are developing novel vaccine candidates constructed in our MVA live vector platform, which has already shown promise in our HIV, Ebola and Lassa vaccines. We believe that, unlike other vaccines in development, the GeoVax vaccine combines a highly potent, yet safe, replication deficient viral vector (MVA) to deliver novel antigens of ZIKV to develop a single-dose vaccine. MVA has an outstanding safety record, which is particularly important given the need to include women of child-bearing age and newborns among those being vaccinated. Our Zika vaccine does not appear to induce Antibody Dependent Enhancement (ADE) of infection. ADE is a serious side effect induced when a vaccinated individual is bitten a second time by a mosquito carrying a second flavivirus such as dengue, resulting in a more virulent reaction. These features could yield a safe and highly effective vaccine that is well suited to provide potent and durable immunity against ZIKV infection.

Our initial preclinical studies in rodents for our ZIKV vaccine candidate have shown 100% single-dose protection against a lethal dose of ZIKV delivered directly into the brain. The study was conducted and funded by the US Centers for Disease Control and Prevention (CDC), which also provided technical assistance.

SBIR Grant – Subsequent to these initial findings, in June 2017 NIAID awarded us a Small Business Innovative Research (SBIR) grant in support of further advancing our development program. The $600,000 two-year grant supported preclinical testing of our ZIKV vaccine in nonhuman primates in preparation for human clinical trials.

Further development of our ZIKV vaccine will be dependent upon additional funding and/or partnering support.

Our Malaria Vaccine Programs

Malaria is a mosquito-borne disease caused by Plasmodium parasites. Symptoms are fever, chills, sweating, vomiting and flu-like illness. If untreated, severe complications (severe anemia, cerebral malaria and organ failure) will lead to death. Over 3 billion people in 106 countries and territories live at risk of malaria infection. According to the latest estimates from the World Health Organization (WHO), 214 million new cases of malaria were recorded worldwide in 2015, resulting in 438,000 deaths. There are 1,500 cases in the US each year (travelers returning home). Children under five years of age are particularly susceptible to malaria illness, infection, and death. In 2015, malaria killed an estimated 306,000 children. Current treatments include bed net distributions, drug treatment and mosquito spraying. Malaria parasites develop resistance to drugs and insecticides. Even though vaccines have shown to be the most cost-effective ways to fight and eliminate infectious diseases (Smallpox, polio, etc.), and after many decades of research and development, there is no commercial malaria vaccine at the present time. Even a vaccine with efficacy of 30-50% will prevent hundreds of thousands of deaths annually. Current vaccine candidates generally consist of subunit proteins, are poorly immunogenic, based on limited number of antigens (generally 4-5 antigens), do not target multiple stages of parasite life cycle, and do not induce strong durable functional antibodies and T cell responses. Therefore, identification of appropriate antigens and vaccine technologies is critical for development of an effective malaria vaccine.

An ideal malaria vaccine candidate should contain antigens from multiple stages of the malaria parasite’s life cycle, and should induce both functional antibodies (predominantly IgG1 and IgG3 subtypes shown to be associated with protection) and strong cell mediated immunity (e.g. Th1 biased CD4+ ad CD8+) to reduce parasitemia by clearing infected cells (liver cells or erythrocytes). We have shown (in animal models and humans) that GV-MVA-VLPTM vaccines for non-malarial disease targets can induce a Th1 biased response with both durable functional antibodies (IgG1 and IgG3) and CD4+ and CD8+ T cell responses, both of which are hallmarks of an ideal malaria vaccine.

Collaboration with Burnet Institute – We have established a collaboration with the Burnet Institute, a leading infectious diseases research institute in Australia, for the development of a vaccine to prevent malaria infection. The project includes the design, construction, and characterization of multiple malaria vaccine candidates using GeoVax’s GV-MVA-VLPTM vaccine platform combined with malaria Plasmodium falciparum and Plasmodium vivax sequences identified by the Burnet Institute. The vaccine design, construction, and characterization will be performed at GeoVax with further characterization and immunogenicity studies in animal models conducted at Burnet Institute using their unique functional assays that provide key information on vaccine efficacy.

Collaboration with Leidos – In February 2019, we began a collaboration with Leidos, Inc. to develop malaria vaccine candidates. The work is supported under a contract to Leidos from the United States Agency for International Development (USAID) Malaria Vaccine Development Program (MVDP). Leidos has been tasked by USAID to advance promising vaccine candidates against P. falciparum malaria and selected the GeoVax GV-MVA-VLPTM platform as part of this development effort. The new collaboration with Leidos complements our ongoing malaria vaccine development project with Burnet Institute and offers a separate opportunity for success. The collaboration also expands upon our existing relationship with Leidos for our cancer immunotherapy program (see below).

Our Hepatitis B Vaccine Program

Hepatitis B is a contagious liver disease caused by the Hepatitis B virus (HBV). It is transmitted person-to-person by blood, semen, or other bodily fluids. This can happen through sexual contact, needle sharing, or mother to infant transmission during birth. For some people, Hepatitis B is an acute (or short-term) illness; but for others, it can become a long-term, chronic infection that may lead to serious health issues like cirrhosis or liver cancer. The risk of chronic infection is related to age at infection. Approximately 90% of infected infants will develop chronic infections. As a child gets older, the risk decreases. Approximately 25%–50% of children infected between the ages of 1 and 5 years will develop chronic hepatitis. The risk drops to 6%–10% when a person is infected at over 5 years of age. Worldwide, most people with chronic Hepatitis B were infected at birth or during early childhood.

The CDC estimates that between 700,000 to 1.4 million people in the United States have chronic HBV infections, with an estimated 20,000 new infections every year. Many people are unaware that they are infected or may not show any symptoms. Therefore, they never seek the attention of medical or public health officials. Globally, chronic Hepatitis B affects more than 240 million people and contributes to nearly 686,000 deaths worldwide each year. Even though a preventive HBV vaccine is available, less than 5% of chronic HBV infections are cured through currently available therapies.

There is a clear medical need to treat chronic HBV infections, which affect hundreds of millions of people around the world, many of whom die due to complications of HBV including cirrhosis and cancer. Multiple vaccines exist to protect against HBV infection, but they cannot help patients already diagnosed with the disease. Although chronic HBV can be treated with drugs, the treatments do not cure 95% of patients; they cannot induce strong neutralizing antibodies and cellular responses needed to break tolerance to HBV antigens and clear infections, but only suppress the replication of the virus. Therefore, most people who start treatments must continue with them for life. Moreover, diagnosis and treatment options are very limited in resource/low income-constrained populations, which leads to many patients succumbing within months of diagnosis.

Our combination therapeutic vaccine strategy is comprised of multivalent vaccine antigens delivered by DNA and GV-MVA-VLPTM in combination with the standard-of-care treatment to induce functional antibodies and CD4+, CD8+ T cell responses to clear infection and break tolerance needed toward a functional cure. Our goal is to significantly increase the current cure rate of HBV infections while reducing the duration of drug therapy, overall treatment costs, side effects, and potential drug resistance.

Collaboration with GSURF – Given the challenges and difficulties of developing an effective therapy for chronic HBV infections, our strategy is to engage with multiple collaborators for combination therapies to increase our chances of success. We are collaborating with Georgia State University Research Foundation (GSURF) on a project that includes the design, construction, characterization and animal testing of multiple vaccine candidates using our GV-MVA-VLPTM vaccine platform. Vaccine antigens include both GeoVax and GSURF’s proprietary designed sequences. This project is ongoing.

Further development of our Hepatitis B vaccine will be dependent upon additional funding and/or partnering support.

Novel Vaccine Delivery Evaluation

Given that several of our programs involve infectious disease targets (e.g. EBOV, LASV, etc.) prevalent in third world countries, we are exploring a novel vaccine delivery platform that may simplify vaccine administration and/or reduce storage and distribution costs.

Collaboration with Enesi – In January 2019, we announced a collaboration with Enesi Pharma, an innovative pharmaceutical company developing unique injectable solid-dose drug-device vaccine products, to develop solid-dose needle-free vaccine formulations utilizing our GV-MVA-VLPTM vaccine platform in combination with Enesi’s ImplaVax® device and formulation technology. The collaboration is expected to include development of thermostable solid-dose needle-free vaccines for a variety of infectious diseases and evaluation of the potential to generate improved vaccine responses with simplified administration and reduced storage and distribution costs. Enesi’s proprietary ImplaVax® solid-dose formulation and needle-free device technology comprises three main components: a single solid-dose Universal Vaccine Implant (UVI) containing the vaccine construct, a separate single-use disposable unit dose cassette pre-loaded with a single solid UVI and a reusable handheld spring-powered actuator. The benefits could include assured consistency with dosing, better product stability and ease of use as well as the potential to minimize vaccination pain and stress, and to eliminate needle disposal and needle stick injuries. We have successfully formulated our GV-MVA-VLPTM-Ebola in the ImplaVax device and completed vaccination of mice. We are currently analyzing the immune responses compared to that of the standard of syringe and needles.

Support from the United States Government

Grants and Contracts. We have been the recipient of multiple federal grants and contracts in support of our vaccine development programs. Our most recent awards are as follows:

Lassa DoD Grant. In September 2018, the U.S. Department of Defense (DoD) awarded us a $2,442,307 cooperative agreement in support of our LASV vaccine development program. The grant was awarded by the U.S. Army Medical Research Acquisition Activity pursuant to the Peer Reviewed Medical Research Program (PRMRP), part of the Congressionally Directed Medical Research Programs (CDMRP). In addition to the grant funds provided directly to GeoVax, DoD will also fund testing of our vaccine by U.S. Army scientists under a separate subaward. The award, entitled “Advanced Preclinical Development and Production of Master Seed Virus of GEO-LM01, a Novel MVA-VLP Vaccine Against Lassa Fever”, will support generation of immunogenicity and efficacy data for our vaccine candidate in both rodent and nonhuman primate models, as well as manufacturing process development and cGMP production of vaccine seed stock in preparation for human clinical trials.

Lassa SBIR Grant. In April 2018, NIAID awarded us a $300,000 SBIR grant entitled “Construction and efficacy testing of novel recombinant vaccine designs for eliciting both broadly neutralizing antibodies and T cells against Lassa virus.”

Malaria Contract with Leidos – In March 2019, we entered into a $196,126 subcontract with Leidos, Inc., supported by a contract to Leidos from the United States Agency for International Development (USAID) Malaria Vaccine Development Program (MVDP). Leidos has been tasked by USAID to advance promising vaccine candidates against P. falciparum malaria and selected the GeoVax GV-MVA-VLPTM platform as part of this development effort. In January 2020, the work was extended through an additional subcontract for $385,193.

Zika SBIR Grant. In June 2017, NIAID awarded us a SBIR grant entitled “Advanced Preclinical Testing of a Novel Recombinant Vaccine Against Zika Virus.” The initial grant award was $300,000 for the first year of a two-year project period beginning June 24, 2017, with a total project budget of $600,000. In May 2018, the second-year grant of $300,000 was awarded to us.

HIV Staged Vaccine Development Contract. In August 2016, NIAID awarded us a Staged Vaccine Development contract to produce our preventive HIV vaccine for use in future clinical trials. The award included a base contract of $199,442 for the initial period from August 1, 2016 to December 31, 2017 (the “base period”) to support process development, as well as $7.6 million in additional development options that can be exercised by NIAID. Prior to the end of the base period NIAID notified us that it did not plan to exercise the additional development option under the contract due to funds availability and NIAID’s programmatic needs. We do not expect this to have an impact on the human clinical trials of our preventive HIV vaccine currently being conducted by the HVTN, or future trials being planned.

HIV SBIR Grant. In April 2016, NIAID awarded us a SBIR grant entitled “Enhancing Protective Antibody Responses for a DNA/MVA HIV Vaccine.” The initial grant award was $740,456 for the first year of a two-year project period beginning April 15, 2016, with a total project budget of $1,398,615. In March 2017, NIAID awarded us $658,159 for the second year of the project period to test the effects of adding two proteins to our vaccine regimen, and we subsequently received a one-year no-cost extension of the project period, which was completed during 2019.

Clinical Trial Support. All our human clinical trials to date for our preventive HIV vaccines, including the recently completed HVTN 114 trial and the HVTN 132 trial currently planned, have been or will be conducted by the HVTN and funded by NIAID. This financial support has been provided by NIAID directly to the HVTN, so has not been recognized in our financial statements, and we do not know the cost of these trials. See “Our Preventive HIV Vaccine Program” above for the current status of our human clinical trials.

Other Federal Support. We have been the recipient of additional in-kind federal support through collaborative and intramural arrangements with CDC for our Zika vaccine program, the Rocky Mountain Laboratory facility of NIAID for our hemorrhagic fever virus vaccine program, and the United States Army Medical Research Institute of Infectious Diseases (USAMRIID) for our hemorrhagic fever virus vaccine program. This support generally has been for the conduct or support of preclinical animal studies on our behalf.

If we are unable to obtain new grants, or if grants that have been awarded are terminated, or if clinical trial and other support becomes unavailable, it could have a material adverse effect on our business.

Government Regulation

Regulation by governmental authorities in the United States and other countries is a significant factor in our ongoing research and development activities and in the manufacture of our products. Complying with these regulations involves considerable expertise, time and expense.

In the United States, drugs and biologics are subject to rigorous federal and state regulation. Our products are regulated under the Federal Food, Drug and Cosmetic Act, the Public Health Service Act, and the regulations promulgated under these statutes, and other federal and state statutes and regulations. These laws govern, among other things, the testing, manufacture, safety, efficacy, labeling, storage, record keeping, approval, advertising and promotion of medications and medical devices. Product development and approval within this regulatory framework is difficult to predict, takes several years and involves great expense. The steps required before a human vaccine may be marketed in the United States include:

|

● |

Preclinical laboratory tests, in vivo preclinical studies and formulation studies; |

|

● |

Manufacturing and testing of the product under strict compliance with current Good Manufacturing Practice (cGMP) regulations; |

|

● |

Submission to the FDA of an Investigational New Drug application for human clinical testing which must become effective before human clinical trials can commence; |

|

● |

Adequate and well-controlled human clinical trials to establish the safety and efficacy of the product; |

|

● |

The submission of a Biologics License Application to the FDA, along with the required user fees; and |

|

● |

FDA approval of the BLA prior to any commercial sale or shipment of the product |

Before marketing any drug or biologic for human use in the United States, the product sponsor must obtain FDA approval. In addition, each manufacturing establishment must be registered with the FDA and must pass a pre-approval inspection before introducing any new drug or biologic into commercial distribution.

Because GeoVax does not manufacture vaccines for human use within our own facilities, we must ensure compliance both in our own operations and in the outsourced manufacturing operations. All FDA-regulated manufacturing establishments (both domestic establishments and foreign establishments that export products to the United States) are subject to inspections by the FDA and must comply with the FDA’s cGMP regulations for products, drugs and devices.

FDA determines compliance with applicable statutes and regulations through documentation review, investigations, and inspections. Several enforcement mechanisms are available to FDA, ranging from a simple demand to correct a minor deficiency to mandatory recalls, closure of facilities, and even criminal charges for the most serious violations.

Even if FDA regulatory clearances are obtained, a marketed product is subject to continual review, and later discovery of previously unknown problems or failure to comply with the applicable regulatory requirements may result in restrictions on the marketing of a product or withdrawal of the product from the market as well as possible civil or criminal sanctions.

Whether or not the FDA has approved the drug, approval of a product by regulatory authorities in foreign countries must be obtained prior to the commencement of commercial sales of the drug in such countries. The requirements governing the conduct of clinical trials and drug approvals vary widely from country to country, and the time required for approval may be longer or shorter than that required for FDA approval.

We also are subject to various federal, state and local laws, regulations, and recommendations relating to safe working conditions, laboratory and manufacturing practices, the experimental use of animals, and the use and disposal of hazardous or potentially hazardous substances used in connection with our research. The extent of government regulation that might result from any future legislation or administrative action cannot be accurately predicted.

Manufacturing

We do not have the facilities or expertise to manufacture any of the clinical or commercial supplies of any of our products. To be successful, our products must be manufactured in commercial quantities in compliance with regulatory requirements and at an acceptable cost. To date, we have not commercialized any products, nor have we demonstrated that we can manufacture commercial quantities of our product candidates in accordance with regulatory requirements. If we cannot manufacture products in suitable quantities and in accordance with regulatory standards, either on our own or through contracts with third parties, it may delay clinical trials, regulatory approvals and marketing efforts for such products. Such delays could adversely affect our competitive position and our chances of achieving profitability. We cannot be sure that we can manufacture, either on our own or through contracts with third parties, such products at a cost or in quantities that are commercially viable.

We currently rely and intend to continue to rely on third-party contract manufacturers to produce vaccines needed for research and clinical trials. We have arrangements with third party manufacturers for the supply of our DNA and MVA vaccines for use in our planned clinical trials. These suppliers operate under the FDA’s Good Manufacturing Practices and (in the case of European manufacturers) similar regulations of the European Medicines Agency. We anticipate that these suppliers will be able to provide sufficient vaccine supplies to complete our currently planned clinical trials. Various contractors are generally available in the United States and Europe for manufacture of vaccines for clinical trial evaluation, however, it may be difficult to replace existing contractors for certain manufacturing and testing activities and costs for contracted services may increase substantially if we switch to other contractors.

The MVA component of our vaccine is currently manufactured in cells that are cultured from embryonated eggs. We are exploring a number of approaches to growing MVA in continuous cell lines that can be grown in bioreactors more suitable for commercial-scale manufacturing.

Competition

The biotechnology and pharmaceutical industries are highly competitive. There are many pharmaceutical companies, biotechnology companies, public and private universities and research organizations actively engaged in the research and development of products that may be competitive with our products. As we develop and seek to ultimately commercialize our product candidates, we face and will continue to encounter competition with an array of existing or development-stage drug and immunotherapy approaches targeting diseases we are pursuing. We are aware of various established enterprises, including major pharmaceutical companies, broadly engaged in vaccine/immunotherapy research and development. These include Janssen Pharmaceuticals, Sanofi-Aventis, GlaxoSmithKline, Merck, Pfizer, and MedImmune. There are also various development-stage biotechnology companies involved in different vaccine and immunotherapy technologies including Aduro Biotech, Advaxis, BioNTech, Curevac, Dynavax, Juno, Moderna, and Novavax. If these companies are successful in developing their technologies, it could materially and adversely affect our business and our future growth prospects. The number of companies seeking to develop products and therapies for the treatment of unmet needs in these indications is likely to increase. Some of these competitive products and therapies are based on scientific approaches that are similar to our approaches, and others are based on entirely different approaches.

Many of our competitors, either alone or with their strategic partners, have substantially greater financial, technical and human resources than we do and significantly greater experience in the discovery and development of product candidates, obtaining FDA and other regulatory approvals of products and the commercialization of those products. Our competitors’ products may be more effective, or more effectively marketed and sold, than any drug we may commercialize and may render our product candidates obsolete or non-competitive. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available. We expect any products that we develop and commercialize to compete based on, among other things, efficacy, safety, convenience of administration and delivery, price, the level of generic competition and the availability of reimbursement from government and other third-party payers.

There are currently no FDA licensed and commercialized HIV vaccines, Zika vaccines, or hemorrhagic fever virus vaccines (other than for Ebola) available in the world market. We are aware of several development-stage and established enterprises, including major pharmaceutical and biotechnology firms, which are actively engaged in vaccine research and development in these areas. For hemorrhagic fever viruses, these include NewLink Genetics and Merck, Johnson & Johnson, Novavax, Profectus Biosciences, Protein Sciences, Inovio and GlaxoSmithKline. For HIV, these include Sanofi, GlaxoSmithKline, and Johnson & Johnson. Other HIV vaccines are in varying stages of research, testing and clinical trials including those supported by the NIH Vaccine Research Center, the U.S. Military, IAVI, the European Vaccine Initiative, and the South African AIDS Vaccine Initiative. For Zika, these include NewLink Genetics, Inovio, Merck, Butantan Institute and NIH (NIAID). In December 2019, the FDA approved the first vaccine (Ervebo) for prevention of Ebola, developed by Merck.

There are numerous FDA-approved treatments for HIV, primarily antiretroviral therapies, marketed by large pharmaceutical companies. Currently, there are no approved therapies for the eradication of HIV. We expect that major pharmaceutical companies that currently market antiretroviral therapy products or other companies that are developing HIV product candidates may seek to develop products for the eradication of HIV.

There are currently no commercialized vaccines to treat chronic HBV infection. Multiple vaccines exist to protect against HBV infection, but they cannot help patients already diagnosed with the disease. Although chronic HBV can be treated with drugs, the treatments do not cure 95% of patients; they cannot induce strong neutralizing antibodies and cellular responses needed to break tolerance to HBV antigens and clear infections, but only suppress the replication of the virus.