Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HEALTHPEAK PROPERTIES, INC. | tm2012801d1_ex99-1.htm |

| 8-K - FOM 8-K - HEALTHPEAK PROPERTIES, INC. | tm2012801-1_8k.htm |

Exhibit 99.2

Perspectives and Observations on COVID - 19 Impact March 16, 2020 35 CambridgePark Drive Boston, MA

Introduction ■ The COVID - 19 pandemic is evolving every day, and although its ultimate reach is uncertain, we want to share our current perspectives on both the impact so far, and the potential future impact on Healthpeak, each of our three core business segments and our balance sheet. We are also providing the most recent on - the - ground observations from our senior housing operating partners and summarizing the enhanced infection control protocols our operators report they are using to minimize the impact of the pandemic on our senior housing properties. ■ Our guidance issued on February 11, 2020, did not include any adverse impact from the COVID - 19 outbreak. As you will note on pages 3 and 4 of this presentation, we believe the impact of COVID - 19 will vary across our diversified portfolio. When the extent and timing of the outbreak becomes more clear, and we are then in a position to estimate the impact, including an updated sources and uses, we will make additional disclosures and update our guidance as appropriate. ■ This presentation is based on our assessment of information available to us as of the current date, and we do not undertake a ny obligations to provide further updates. Please refer to the “Disclaimers” included on page 9 of this presentation. 2

Medical Office 29% Hospital 6% SHOP 15% CCRC 11% NNN 7% Life Science 31% Life Science Impact of COVID - 19 Varies Across Diversified Portfolio Healthpeak’s Pro - Forma Portfolio Income (1) Note: Percentages in chart do not sum due to rounding. (1) See Page 8 for reconciliation of Portfolio Income. • Lower risk as a result of weighted - average lease term of nearly 6 years with minimal 2020 maturities • Development pipeline approximately 60% pre - leased • Demand for life science research typically has lower correlation to economic cycles • The pandemic highlights the importance of biotech innovation, e.g ., testing, treatment and vaccine • Items we are tracking closely include: capital access for tenants, pace of FDA approvals, and timing impact on completing construction projects • Lower risk as a result of weighted - average lease term of 4+ years with 2020 maturities in - line with historic norms • Our primarily on - campus portfolio drives a high concentration of hospital and specialty physician tenants, resulting in stable performance and occupancy on a relative basis in periods of uncertainly • We are working with tenants to accommodate their patient screening processes, including adding signage to communicate CDC guidelines and procedures • Moderate risk due to recently completed portfolio restructuring • Master lease structures, current rent coverage above 1x EBITDAR, corporate guarantees, and 8 to 10 year average terms • Moderate risk due to unique form of senior housing offering a full continuum of care in combination with substantial entry fees results in stronger tenant commitments with 8 - 10 year average length of stay • R educed earnings volatility given NREF flow - through impact to earnings and low resident turnover of 10 - 12% per year • Increased risk due to ~50% annual resident turnover and relatively low operating margins • Portfolio managed by regional and national operators proficient in infection control • We do not have any ownership interest in any SHOP operator, and by law are not permitted to operate health care facilities • Please refer to page 4 for SHOP observations • Lower risk as a result of triple - net leases with rent coverage above 3.7x EBITDAR Lower Moderate Increased Risk Profile due to COVID - 19 3 Medical Office Hospital SHOP CCRC NNN

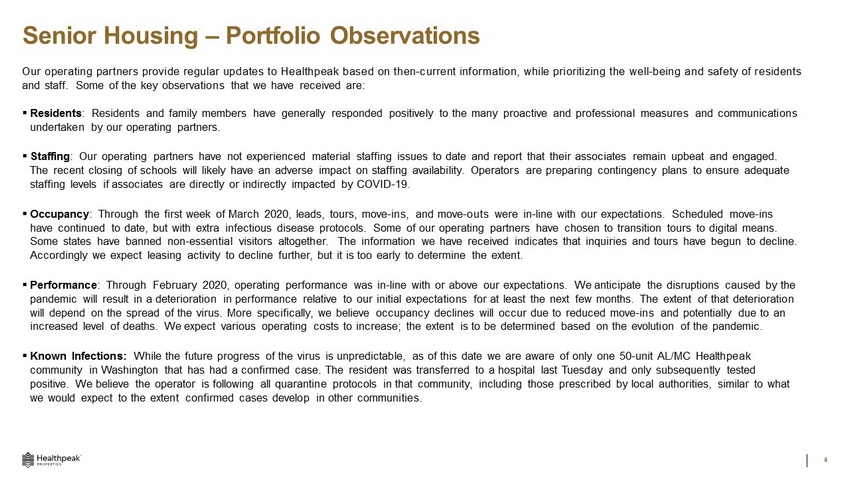

Senior Housing – Portfolio Observations 4 ▪ Residents : Residents and family members have generally responded positively to the many proactive and professional measures and communications undertaken by our operating partners. ▪ Staffing : Our operating partners have not experienced material staffing issues to date and report that their associates remain upbeat an d engaged. The recent closing of schools will likely have an adverse impact on staffing availability. Operators are preparing contingenc y p lans to ensure adequate staffing levels if associates are directly or indirectly impacted by COVID - 19. ▪ Occupancy : Through the first week of March 2020, leads, tours, move - ins, and move - outs were in - line with our expectations. Scheduled move - ins have continued to date, but with extra infectious disease protocols. Some of our operating partners have chosen to transition to urs to digital means. Some states have banned non - essential visitors altogether. The information we have received indicates that inquiries and tours have begun to decline. Accordingly we expect leasing activity to decline further, but it is too early to determine the extent. ▪ Performance : Through February 2020, operating performance was in - line with or above our expectations. We anticipate the disruptions caused by the pandemic will result in a deterioration in performance relative to our initial expectations for at least the next few months. Th e extent of that deterioration will depend on the spread of the virus. More specifically, we believe occupancy declines will occur due to reduced move - ins and potentially due to an increased level of deaths. We expect various operating costs to increase; the extent is to be determined based on the evolution of the pandemic. ▪ Known Infections: While the future progress of the virus is unpredictable, as of this date we are aware of only one 50 - unit AL/MC Healthpeak community in Washington that has had a confirmed case. The resident was transferred to a hospital last Tuesday and only subse que ntly tested positive. We believe the operator is following all quarantine protocols in that community, including those prescribed by local authorities, similar to what we would expect to the extent confirmed cases develop in other communities. Our operating partners provide regular updates to Healthpeak based on then - current information, while prioritizing the well - being and safety of residents and staff . Some of the key observations that we have received are :

Senior Housing – Operator Protocols 5 ▪ Healthpeak is in frequent contact with the management companies (SHOP) and tenants (triple - net) of its senior housing properties and is closely monitoring the rapidly evolving COVID - 19 pandemic. These perspectives and observations are based on current information and will change as the pandemic evolves. ▪ Our operating partners have well - developed protocols intended to reduce the risk of residents and staff contracting and spreadin g infectious diseases. ▪ They are also implementing enhanced protocols in response to COVID - 19, including recommendations and requirements issued by the Centers for Disease Control and Prevention (“CDC”) and state and local health authorities. ▪ Significantly increasing communication with residents, family, and staff ▪ Extra cleaning and contact prevention protocols ‒ Frequently disinfecting high - touch areas and high - traffic common areas ‒ Reinforcing hand - washing and infection control training ‒ Providing additional personal protective equipment and cleaning supplies ▪ Preparing to isolate residents and send home staff who show any symptoms or have been exposed to the virus ▪ Restricting or eliminating group activities ▪ Transitioning marketing efforts and certain property tours to digital means ▪ Stocking extra medical supplies, protective equipment, and food ▪ Taking actions to screen (including through temperature checks and/or questionnaires), limit or prohibit non - essential visitors to the properties, and in some cases moving in - person tours to digital means ▪ Prohibiting non - essential travel, including resident outings into the local community ▪ Families may, at their option, remove residents from a community at any time, subject in every case to rules and regulations of applicable health authorities Enhanced Operator Protocols

Strong Balance Sheet and Liquidity to Withstand COVID - 19 Uncertainty ■ $2.5 billion of available liquidity □ More than $2 billion of available revolver capacity (revolver matures in 2024 ) (1) □ $500 million of available capital from equity forwards (2) ■ Mid - 5x net debt to EBITDA (3) ■ Less than $60 million of long term debt maturing through 2021 □ Next bond maturity is August 2022 ($300 million) 6 (1) Balance as of February 7, 2020. Revolver maturity date assumes exercising two 6 - month extension options which are at PEAK's disc retion. (2) As of February 7, 2020, Healthpeak had 32 million shares outstanding under forward contracts, equivalent to approximately $1. 050 billion. Healthpeak expects to settle approximately $545 million to fund previously - announced acquisition activity, including $320 million for The Post and $225 million for the Brookdale CCRC transaction, to remain leve rag e - neutral . (3) As of December 31, 2019.

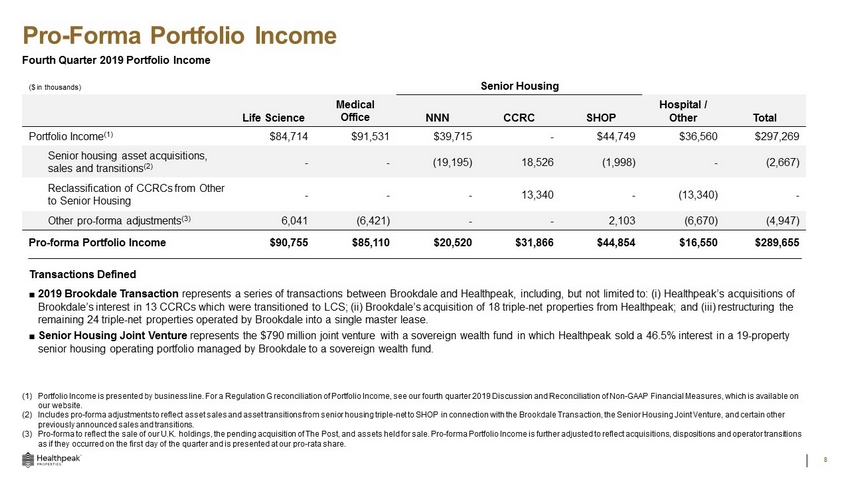

Appendix Medical City Dallas Dallas, TX

Pro - Forma Portfolio Income Fourth Quarter 2019 Portfolio Income 8 (1) Portfolio Income is presented by business line. For a Regulation G reconciliation of Portfolio Income, see our fourth quarter 2019 Discussion and Reconciliation of Non - GAAP Financi al Measures, which is available on our website . (2) Includes pro - forma adjustments to reflect asset sales and asset transitions from senior housing triple - net to SHOP in connection with the Brookdale Transaction , the Senior Housing Joint Venture, and certain other previously announced sales and transitions. (3) Pro - forma to reflect the sale of our U.K. holdings, the pending acquisition of The Post, and assets held for sale. Pro - forma Portfolio Income is further adjusted to reflect acquisitions, dispositions and operator transitions as if they occurred on the first day of the quarter and is presented at our pro - rata share. ($ in thousands) Senior Housing Life Science Medical Office NNN CCRC SHOP Hospital / O ther Total Portfolio Income (1) $84,714 $91,531 $39,715 - $44,749 $36,560 $297,269 Senior housing asset acquisitions, sales and transitions (2) - - (19,195) 18,526 (1,998) - (2,667) Reclassification of CCRCs from Other to Senior Housing - - - 13,340 - (13,340) - Other pro - forma adjustments (3) 6,041 (6,421) - - 2,103 (6,670) (4,947) Pro - forma Portfolio Income $90,755 $85,110 $20,520 $31,866 $44,854 $16,550 $289,655 Transactions Defined ■ 2019 Brookdale Transaction represents a series of transactions between Brookdale and Healthpeak, including, but not limited to : (i) Healthpeak’s acquisitions of Brookdale’s interest in 13 CCRCs which were transitioned to LCS; (ii) Brookdale’s acquisition of 18 triple - net properties from Healthpeak ; and (iii) restructuring the remaining 24 triple - net properties operated by Brookdale into a single master lease. ■ Senior Housing Joint Venture represents the $790 million joint venture with a sovereign wealth fund in which Healthpeak sold a 46.5 % interest in a 19 - property senior housing operating portfolio managed by Brookdale to a sovereign wealth fund .

Disclaimers This Healthpeak Properties, Inc . (the “Company”) presentation is solely for your information, is subject to change and speaks only as of the date hereof . This presentation is not complete and is only a summary of the more detailed information included elsewhere, including in our Securities and Exchange Commission (“SEC”) filings . No representation or warranty, expressed or implied is made and you should not place undue reliance on the accuracy, fairness or completeness of the information presented . Forward - Looking Statements Statements contained in this presentation, as well as statements made by management, that are not historical facts are "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Forward - looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,” “seek,” “target,” “forecast,” “plan,” “potential,” “estimate,” “could,” “would,” “should” and other comparable and derivative terms or the negatives thereof . Examples of forward - looking statements include, among other things, (i) the implementation of COVID - 19 protocols, (ii) operator plans relating to COVID - 19 , (iii) actions to be taken in response to COVID - 19 exposure, confirmed cases or an outbreak, (iv) future updates to residents and their families regarding COVID - 19 , (v) future senior housing staffing and related contingency plans, (vi) senior housing sales activity forecasts, including leads, tours, move - ins and move - outs, overall occupancy and performance ; (vii) senior housing operating performance forecasts ; (viii) the risk profile across our portfolio ; (ix) capital spend deployment and disposition activity forecasts ; (x) our development pipeline ; (xi) pre - leasing and leasing activity ; and (xii) available liquidity . You should not place undue reliance on these forward - looking statements . Forward - looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations . While forward - looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained . Further, we cannot guarantee the accuracy of any such forward - looking statement contained in this presentation, and such forward - looking statements are subject to known and unknown risks and uncertainties that are difficult to predict . These risks and uncertainties include, but are not limited to : COVID - 19 ’s duration, new information concerning its severity, and actions taken to contain or treat its impact ; the financial condition of the Company’s existing and future tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding the Company’s ability to continue to realize the full benefit of such tenants’ and operators’ leases and borrowers’ loans ; the ability of the Company’s existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and manage their expenses in order to generate sufficient income to make rent and loan payments to the Company and the Company’s ability to recover investments made, if applicable, in their operations ; the Company’s concentration in the healthcare property sector, particularly in senior housing, life sciences and medical office buildings, which makes its profitability more vulnerable to a downturn in a specific sector than if the Company were investing in multiple industries ; operational risks associated with third party management contracts, including the additional regulation and liabilities of RIDEA lease structures ; the effect on the Company and its tenants and operators of legislation, executive orders and other legal requirements, including compliance with the Americans with Disabilities Act, fire, safety and health regulations, environmental laws, the Affordable Care Act, licensure, certification and inspection requirements, and laws addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements or fines for noncompliance ; the Company’s ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith ; the risks associated with property development and redevelopment, including costs above original estimates, project delays and lower occupancy rates and rents than expected ; the potential impact of uninsured or underinsured losses ; the risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision making authority and its reliance on its partners’ financial condition and continued cooperation ; competition for the acquisition and financing of suitable healthcare properties as well as competition for tenants and operators, including with respect to new leases and mortgages and the renewal or rollover of existing leases ; the Company’s or its counterparties’ ability to fulfill obligations, such as financing conditions and/or regulatory approval requirements, required to successfully consummate acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions or other transactions ; the Company’s ability to achieve the benefits of acquisitions or other investments within expected time frames or at all, or within expected cost projections ; the potential impact on the Company and its tenants, operators and borrowers from current and future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments ; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect the Company’s costs of compliance or increase the costs, or otherwise affect the operations, of its tenants and operators ; the Company’s ability to foreclose on collateral securing its real estate - related loans ; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in the Company’s credit ratings, and the value of its common stock, and other conditions that may adversely impact the Company’s ability to fund its obligations or consummate transactions, or reduce the earnings from potential transactions ; changes in global, national and local economic and other conditions, including epidemics or pandemics such as the COVID - 19 pandemic ; the Company’s ability to manage its indebtedness level and changes in the terms of such indebtedness ; competition for skilled management and other key personnel ; the Company’s reliance on information technology systems and the potential impact of system failures, disruptions or breaches ; the Company’s ability to maintain its qualification as a real estate investment trust ; and other risks and uncertainties described from time to time in the Company’s SEC filings . Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward - looking statements, which speak only as of the date on which they are made . Non - GAAP Financial Measures This presentation contains certain supplemental non - GAAP financial measures . While the Company believes that non - GAAP financial measures are helpful in evaluating its operating performance, the use of non - GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP . We caution you that there are inherent limitations associated with the use of each of these supplemental non - GAAP financial measures as an analytical tool . Additionally, the Company’s computation of non - GAAP financial measures may not be comparable to those reported by other REITs . You can find reconciliations of the non - GAAP financial measures to the most directly comparable GAAP financial measures, to the extent available without unreasonable efforts, in the fourth quarter 2019 Discussion and Reconciliation of Non - GAAP Financial Measures available on our website . 9

healthpeak.com