Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FUELCELL ENERGY INC | fcel-ex991_31.htm |

| 8-K - 8-K - FUELCELL ENERGY INC | fcel-8k_20200316.htm |

First Quarter of Fiscal 2020 Financial Results & Business Update March 16, 2020 Exhibit 99.2

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements with respect to the Company’s anticipated financial results and statements regarding the Company's plans and expectations regarding the continuing development, commercialization and financing of its fuel cell technology and its business plans and strategies. All forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Factors that could cause such a difference include, without limitation, changes to projected deliveries and order flow, changes to production rate and product costs, general risks associated with product development, manufacturing, changes in the regulatory environment, customer strategies, ability to access certain markets, unanticipated manufacturing issues that impact power plant performance, changes in critical accounting policies, access to and ability to raise capital and attract financing, potential volatility of energy prices, rapid technological change, competition, the Company’s ability to successfully implement its new business strategies and achieve its goals, the Company’s ability to achieve its sales plans and cost reduction targets, and the current implications of the novel coronavirus (Covid-19), as well as other risks set forth in the Company’s filings with the Securities and Exchange Commission (SEC). The forward-looking statements contained herein speak only as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which any such statement is based. The Company refers to non-GAAP financial measures in this presentation. The Company believes that this information is useful to understanding its operating results and assessing performance and highlighting trends on an overall basis. Please refer to the Company’s earnings release and the appendix to this presentation for further disclosure and reconciliation of non-GAAP financial measures. (As used herein, the term “GAAP” refers to generally accepted accounting principles in the U.S.) The information set forth in this presentation is qualified by reference to, and should be read in conjunction with, our Annual Report on Form 10-K for the fiscal year ended October 31, 2019, filed with the SEC on January 22, 2020, our Quarterly Report on Form 10-Q for the fiscal quarter ended January 31, 2020, filed with the SEC on March 16, 2020, and our earnings release for the first quarter ended January 31, 2020, filed as an exhibit to our Current Report on Form 8-K filed with the SEC on March 16, 2020.

2020 Conference Appearances Upcoming Conference Appearances Date Event Location May 12th Oppenheimer 5th Annual Emerging Growth Conference NYC May 20th – 21st B. Riley FBR’s 21st Annual Institutional Investor Conference Beverly Hills May 28th Cowen’s 48th Annual TMT Conference NYC

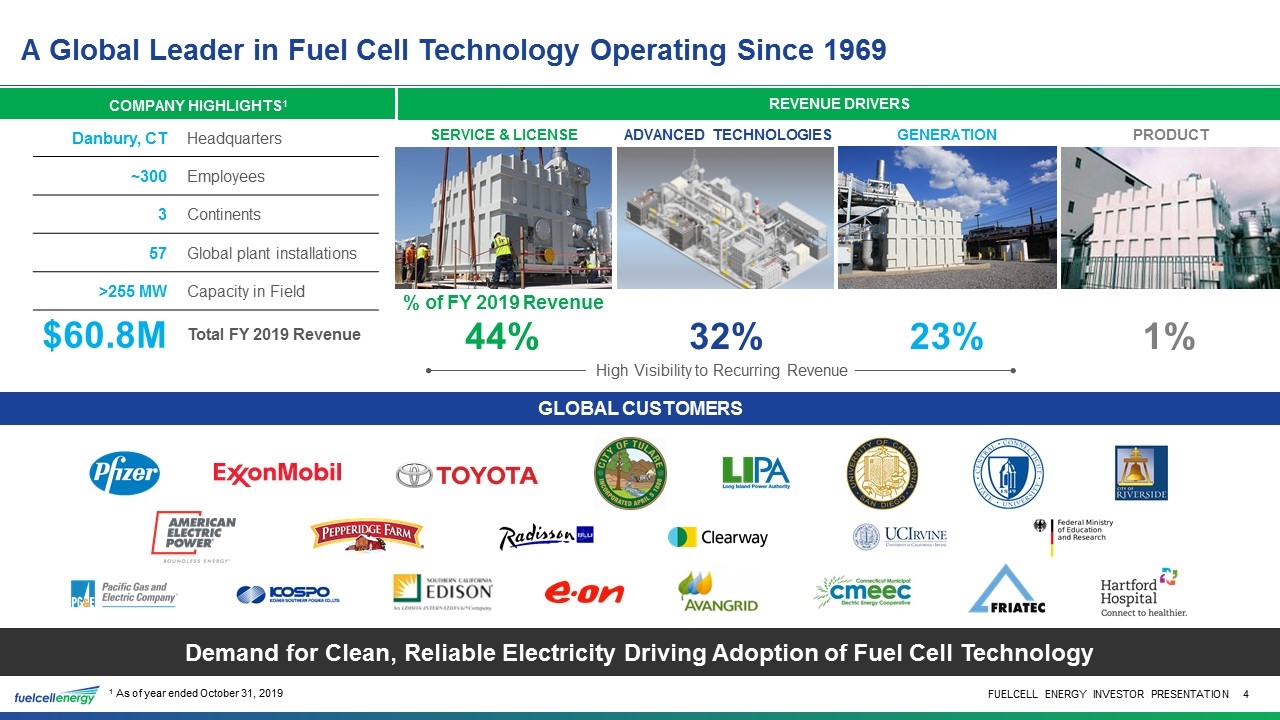

A Global Leader in Fuel Cell Technology Operating Since 1969 Demand for Clean, Reliable Electricity Driving Adoption of Fuel Cell Technology GLOBAL CUSTOMERS 1 As of year ended October 31, 2019 GENERATION SERVICE & LICENSE % of FY 2019 Revenue 44% Advanced Technologies Product Company Highlights1 Revenue Drivers Danbury, CT Headquarters ~300 Employees 3 Continents 57 Global plant installations >255 MW Capacity in Field $60.8M Total FY 2019 Revenue 23% 32% 1% High Visibility to Recurring Revenue

Purpose Statement Enable the world to live a life empowered by clean energy

Today’s Messages Q1 in line with management expectations; solid gross margins and cash on hand in the first quarter Advancing Powerhouse Strategy across global operating model Expect revenue growth for the balance of fiscal 2020 vs. 2019, driven by Generation revenue and Advanced Technology work with ExxonMobil Research and Engineering Company (“EMRE”) Extending leadership in sustainability and environmental stewardship As mentioned at ExxonMobil’s Investor Day this month, we are a key technology partner in the pursuit of a Carbon Capture solution that will clean up industrial and combustion-based power generation emissions We have thoroughly assessed the potential impacts of the Coronavirus: We remain vigilant and are taking precautions to help our team members remain safe and are monitoring supply lines and the potential impact of the coronavirus on our operations. We will comply with all state, federal and international government rules that dictate how we must respond to the virus

Q1 2020 Financial Performance

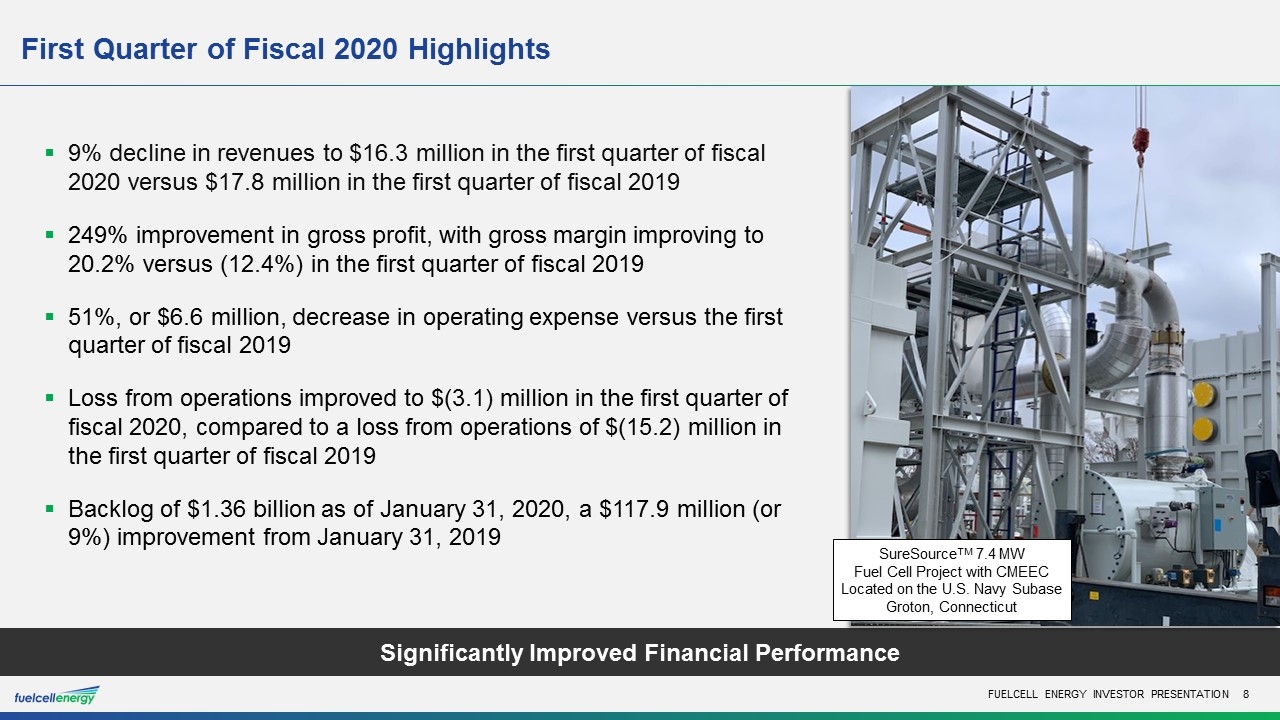

First Quarter of Fiscal 2020 Highlights Significantly Improved Financial Performance 9% decline in revenues to $16.3 million in the first quarter of fiscal 2020 versus $17.8 million in the first quarter of fiscal 2019 249% improvement in gross profit, with gross margin improving to 20.2% versus (12.4%) in the first quarter of fiscal 2019 51%, or $6.6 million, decrease in operating expense versus the first quarter of fiscal 2019 Loss from operations improved to $(3.1) million in the first quarter of fiscal 2020, compared to a loss from operations of $(15.2) million in the first quarter of fiscal 2019 Backlog of $1.36 billion as of January 31, 2020, a $117.9 million (or 9%) improvement from January 31, 2019 SureSourceTM 7.4 MW Fuel Cell Project with CMEEC Located on the U.S. Navy Subase Groton, Connecticut

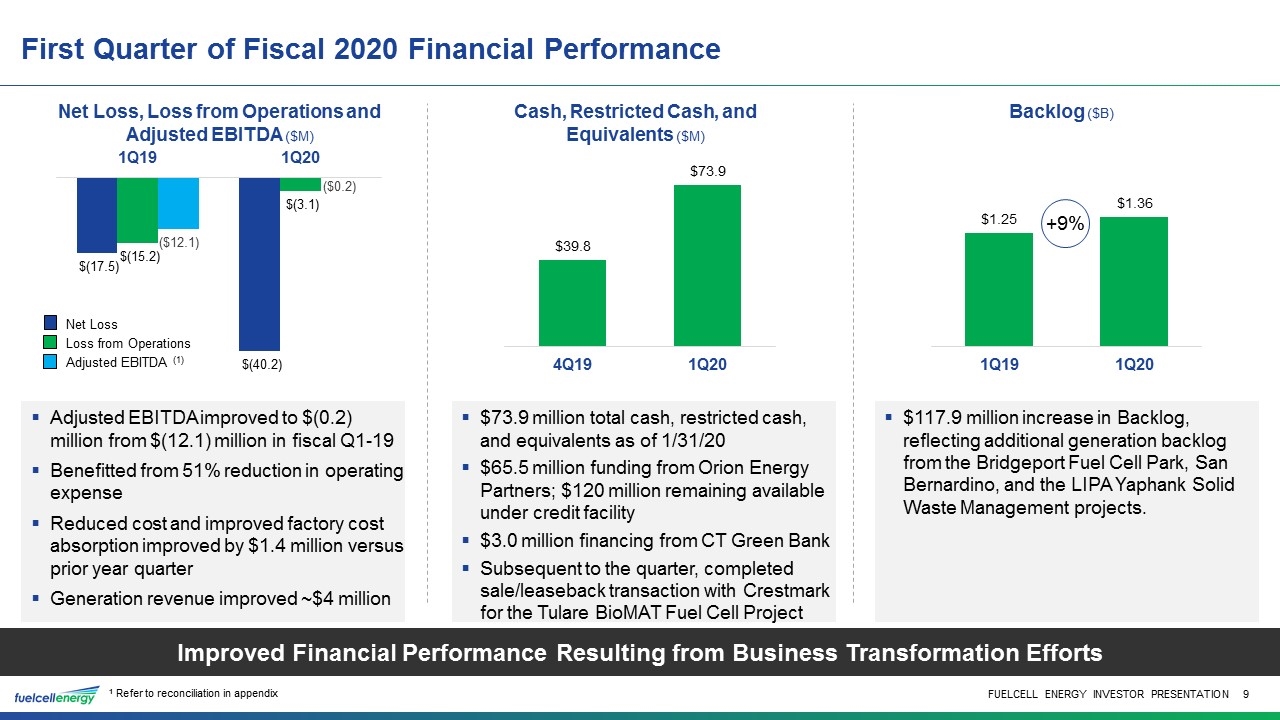

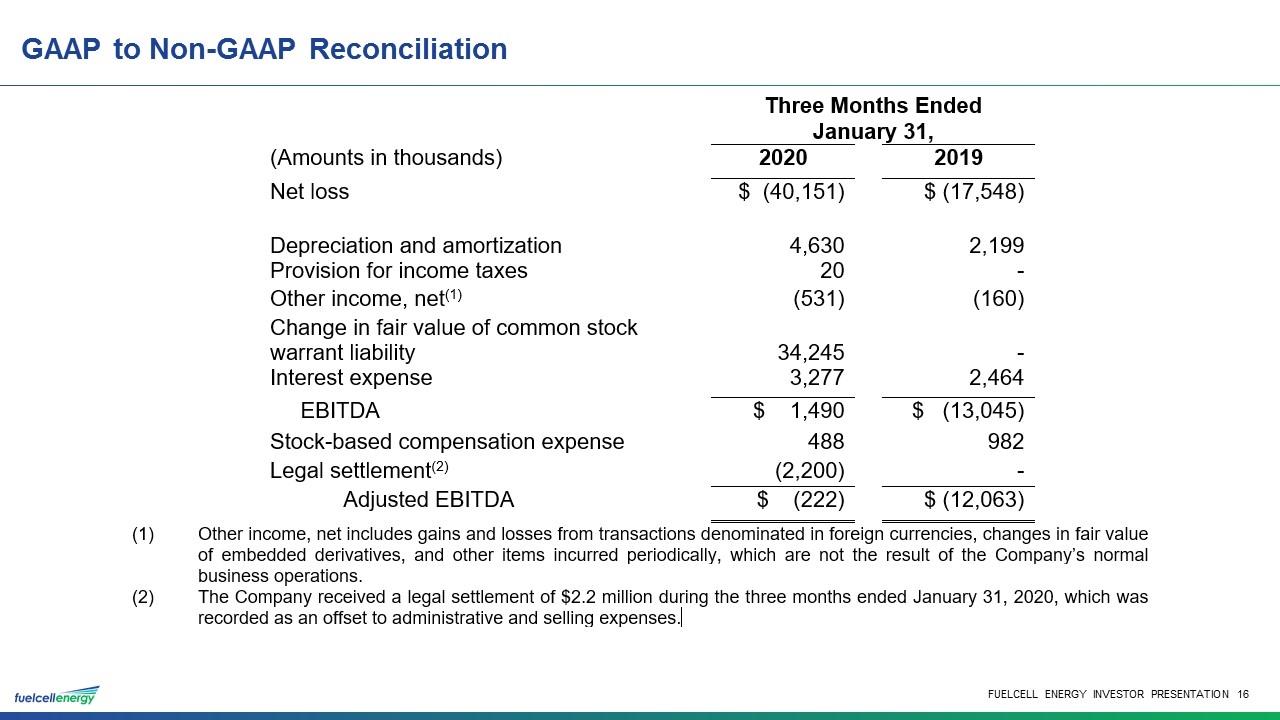

First Quarter of Fiscal 2020 Financial Performance Improved Financial Performance Resulting from Business Transformation Efforts 1 Refer to reconciliation in appendix Backlog ($B) Net Loss, Loss from Operations and Adjusted EBITDA ($M) Adjusted EBITDA improved to $(0.2) million from $(12.1) million in fiscal Q1-19 Benefitted from 51% reduction in operating expense Reduced cost and improved factory cost absorption improved by $1.4 million versus prior year quarter Generation revenue improved ~$4 million Cash, Restricted Cash, and Equivalents ($M) $73.9 million total cash, restricted cash, and equivalents as of 1/31/20 $65.5 million funding from Orion Energy Partners; $120 million remaining available under credit facility $3.0 million financing from CT Green Bank Subsequent to the quarter, completed sale/leaseback transaction with Crestmark for the Tulare BioMAT Fuel Cell Project $117.9 million increase in Backlog, reflecting additional generation backlog from the Bridgeport Fuel Cell Park, San Bernardino, and the LIPA Yaphank Solid Waste Management projects. Loss from Operations Adjusted EBITDA (1) Net Loss

Powerhouse Business Strategy: Positioning FuelCell Energy for Long-Term Growth and Value Creation On a Three-year Execution Path to Transform The Company TRANSFORM STRENGTHEN GROW Build a solid financial foundation Strengthen the business and maximize operational efficiencies Capture growth by leveraging core strengths and partnerships Delivered cost savings: Realized annualized operating savings of approximately $15 million through the restructuring of our business Capital deployment: Obtained low-cost, long-term financing for generation projects including Tulare and new loan through Connecticut Green Bank Commercial excellence: Strengthened customer relationships and built a customer-centric reputation driving significant increase in YOY sales pipeline Operational excellence: Backlog execution on time and on budget demonstrated through delivery of Tulare Project and significant progress on CMEEC/US Naval Submarine Base Project Cost reductions: Lean resource management driving significant year over year change in operating expense Sales growth: Well positioned to increase product sales with key strategic customers Innovation: Successful delivery of extended 7-year life stack modules; expanding commercialization of new technologies including proprietary gas treatment systems Segment leadership: Capitalizing on expertise and competitive advantages in key markets—biofuels, microgrid development, and hydrogen economy expansion Education: Working with legislators and regulators in target geographies to increase awareness of benefits of FuelCell SureSourceTM platforms Geographic and market expansion: Increased the cadence of action to resolve POSCO Energy situation with the goal of pursuing growth in Asia; and pursue other global markets

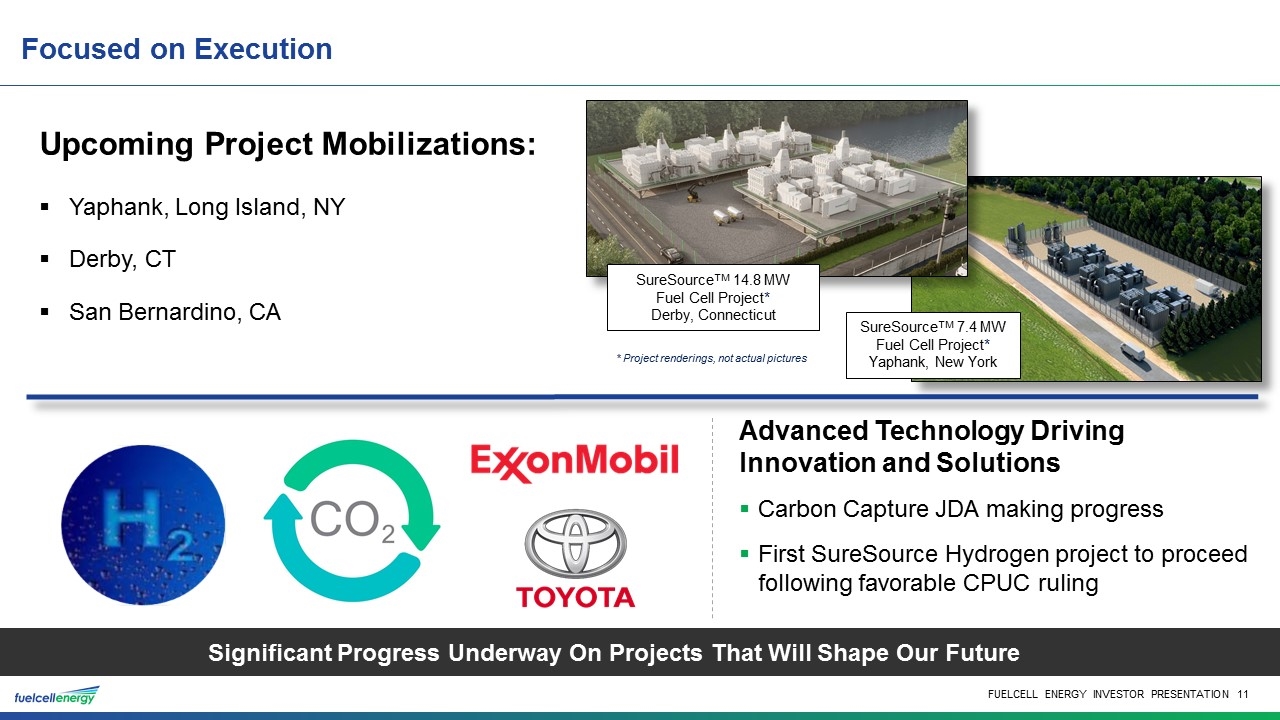

* Project renderings, not actual pictures Focused on Execution Significant Progress Underway On Projects That Will Shape Our Future Advanced Technology Driving Innovation and Solutions Carbon Capture JDA making progress First SureSource Hydrogen project to proceed following favorable CPUC ruling Upcoming Project Mobilizations: Yaphank, Long Island, NY Derby, CT San Bernardino, CA SureSourceTM 7.4 MW Fuel Cell Project* Yaphank, New York SureSourceTM 14.8 MW Fuel Cell Project* Derby, Connecticut

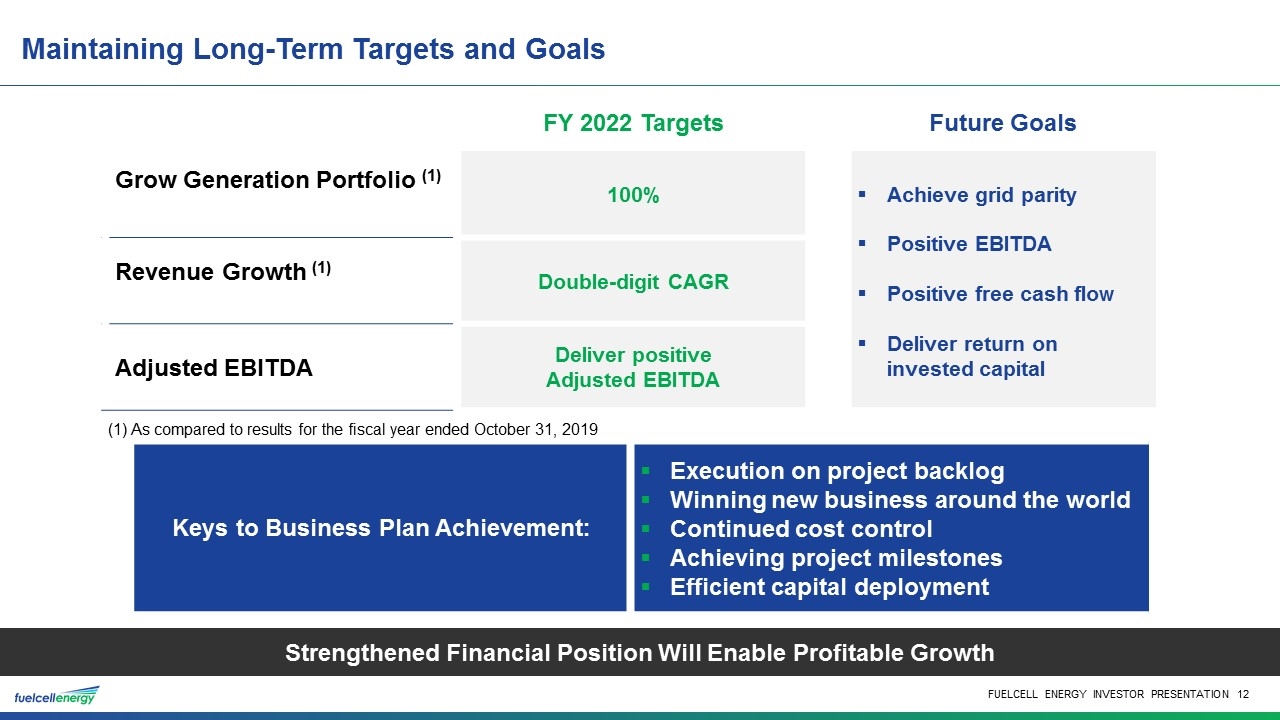

Maintaining Long-Term Targets and Goals Strengthened Financial Position Will Enable Profitable Growth FY 2022 Targets Grow Generation Portfolio (1) 100% Revenue Growth (1) Double-digit CAGR Adjusted EBITDA Deliver positive Adjusted EBITDA Keys to Business Plan Achievement: Execution on project backlog Winning new business around the world Continued cost control Achieving project milestones Efficient capital deployment Future Goals Achieve grid parity Positive EBITDA Positive free cash flow Deliver return on invested capital (1) As compared to results for the fiscal year ended October 31, 2019

Key Company Highlights Strengthened balance sheet with funding secured to deliver long-term projects to generate recurring revenue 1 New leadership committed to project execution, achieving financial milestones and operational efficiencies 2 On a three-year path of execution to Transform, Strengthen and Grow the organization for long-term success 4 Unrivaled technology for ultra-clean, reliable and scalable baseload power 3

Q&A

Appendix

GAAP to Non-GAAP Reconciliation

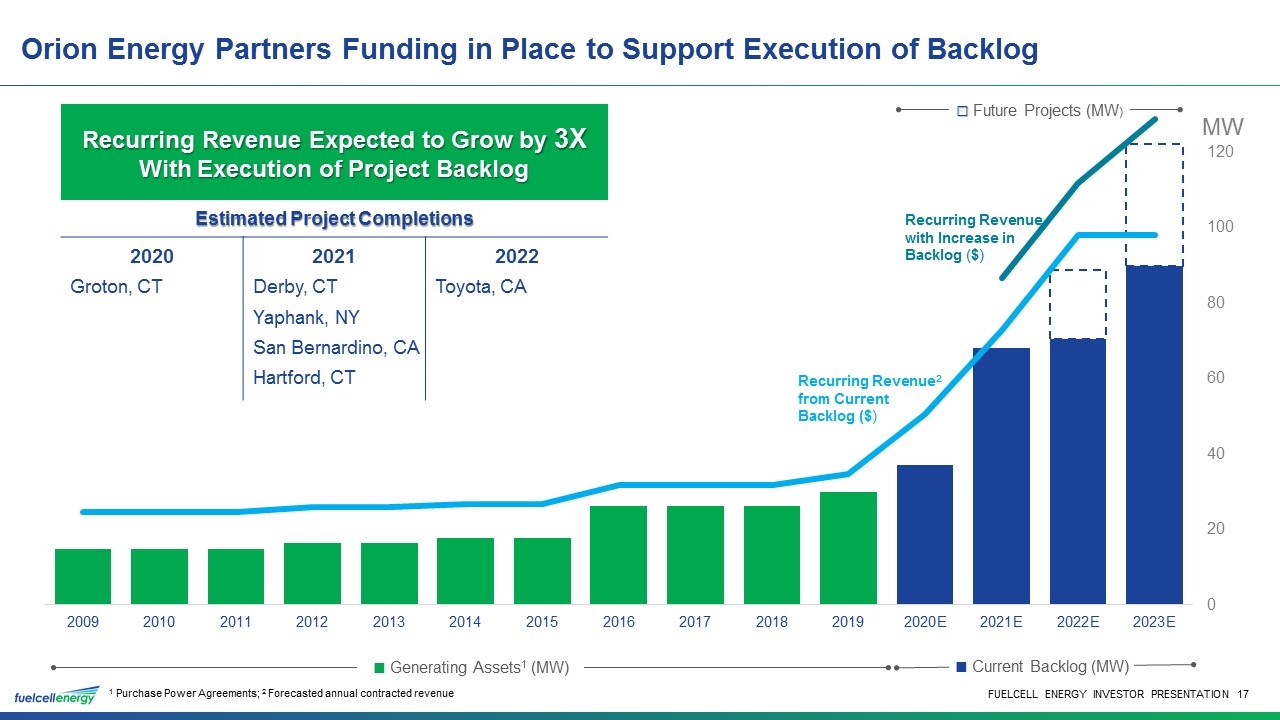

■ Generating Assets1 (MW) ■ Current Backlog (MW) Orion Energy Partners Funding in Place to Support Execution of Backlog 1 Purchase Power Agreements; 2 Forecasted annual contracted revenue Recurring Revenue with Increase in Backlog ($) Recurring Revenue2 from Current Backlog ($) □ Future Projects (MW) Recurring Revenue Expected to Grow by 3X With Execution of Project Backlog Estimated Project Completions 2020 2021 2022 Groton, CT Derby, CT Yaphank, NY San Bernardino, CA Hartford, CT Toyota, CA MW

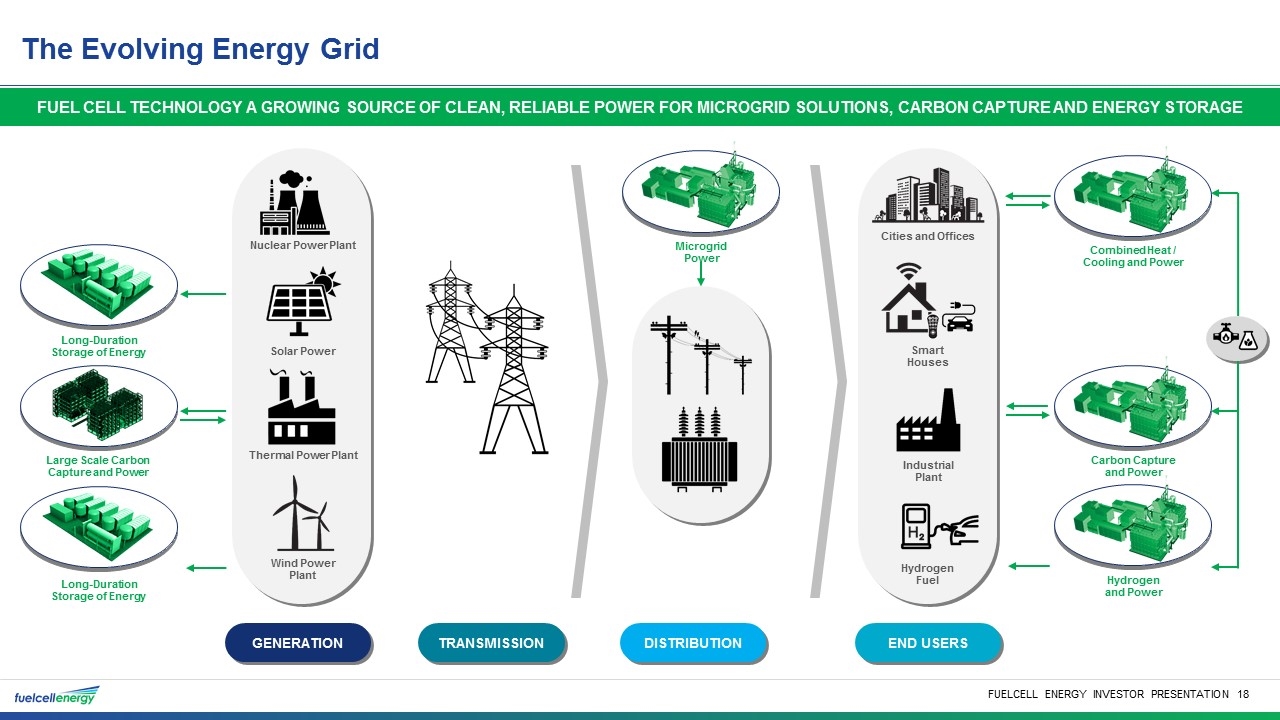

The Evolving Energy Grid Fuel Cell Technology a growing source of clean, reliable power for microgrid solutions, Carbon Capture and Energy Storage GENERATION Solar Power Nuclear Power Plant Thermal Power Plant Wind Power Plant TRANSMISSION Hydrogen Fuel Cities and Offices Smart Houses Industrial Plant Large Scale Carbon Capture and Power Long-Duration Storage of Energy Long-Duration Storage of Energy Combined Heat / Cooling and Power Carbon Capture and Power Hydrogen and Power Microgrid Power DISTRIBUTION END USERS