Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FLEETCOR TECHNOLOGIES INC | a8kproxysolicitation.htm |

2020 Annual Meeting Shareholder Engagement March 2020 FLEETCOR | Proprietary & Confidential 1

This presentation contains forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements about FLEETCOR's beliefs, expectations, assumptions and future performance, are forward-looking statements. Forward-looking statements can be identified by the use of words such as "anticipate," "intend," "believe," "estimate," "plan," "seek," "project," "expect," "may," "will," "would," "could" or "should," the negative of these terms or other comparable terminology. Examples of forward-looking statements in this presentation include statements Safe Harbor Provision about FLEETCOR's beliefs, expectations and assumptions with respect to the lawsuit filed by the FTC, FLEETCOR’s intentions with respect to challenging such lawsuit and the potential impact of such lawsuit. These forward-looking statements are not a guarantee of performance, and undue reliance should not be placed on such statements. The forward-looking statements included in this presentation are made only as of the date hereof, and FLEETCOR does not undertake, and specifically disclaims, any obligation to update any such statements as a result of new information, future events or developments except as specifically stated in this presentation or to the extent required by law. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement, such as adverse outcomes with respect to current and future legal proceedings, including, without limitation, the FTC lawsuit, or actions of governmental or quasi-governmental bodies or standards or industry organizations with respect to our payment cards; fuel price and spread volatility; the impact of foreign exchange rates on operations, revenue and income; the effects of general economic and political conditions on fueling patterns and the commercial activity of fleets; changes in credit risk of customers and associated losses; failure to maintain or renew key business relationships; failure to maintain competitive product offerings; failure to maintain or renew sources of financing; failure to complete, or delays in completing, anticipated new partnership and customer agreements or acquisitions and to successfully integrate or otherwise achieve anticipated benefits from such partnerships and customer arrangements or acquired businesses; failure to successfully expand business internationally, other risks related to our international operations, including the potential impact to our business as a result of the United Kingdom’s referendum to leave the European Union, risks related to litigation, the impact of new tax regulations and the resolution of tax contingencies resulting in additional tax liabilities; as well as the other risks and uncertainties identified under the caption "Risk Factors" in FLEETCOR's Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent filings made by FLEETCOR with the Securities and Exchange Commission ("SEC"). You may obtain FLEETCOR's SEC filings for free by visiting the SEC website at www.sec.gov or FLEETCOR's investor relations website at investor.fleetcor.com. Trademarks which appear in this presentation belong to their respective owners. This presentation includes non-GAAP financial measures, which are key measures used by the Company and investors as supplemental measures to evaluate the overall operating performance of companies in our industry. By providing these non-GAAP financial measures, together with reconciliations, we believe we are enhancing investors' understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing strategic initiatives. See appendix for additional information regarding these GAAP financial measures and a reconciliation to the nearest corresponding GAAP measure. FLEETCOR | Proprietary & Confidential 2

Additional Information In connection with the Company’s 2020 Annual Meeting of Shareholders, the Company will file with the U.S. Securities and Exchange Commission (the “SEC”) and furnish to the shareholders of record entitled to vote at the 2020 Annual Meeting of Shareholders a definitive proxy statement and other documents. Proxy Solicitation Materials SHAREHOLDERS ARE ENCOURAGED TO READ THE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS WHEN FILED WITH THE SEC AND WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. When the proxy statement is filed with the SEC, a notice of internet availability of the definitive proxy statement will also be mailed to shareholders of record. Investors and other interested parties will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, or through a request in writing sent to FleetCor Technologies, Inc. at 3280 Peachtree Road, Suite 2400, Atlanta, Georgia 30305 Attention: General Counsel. Participants in Solicitation The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the 2020 Annual Meeting of Shareholders. The participants in the solicitation of proxies in connection with the 2020 Annual Meeting of Shareholders are currently anticipated to be the Company, Ronald F. Clarke, Eric R. Dey, John Coughlin, Alan King, Armando L. Netto, Steven T. Stull, Michael Buckman, Thomas M. Hagerty, Mark A. Johnson, Jeffrey S. Sloan, Hala G. Moddelmog, Joseph W. Farrelly and Richard Macchia. Information regarding the participants’ respective interests in the Company is set forth in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on March 2, 2020, and will be set forth in the proxy statement on Schedule 14A and accompanying solicitation materials and, if applicable, each participant’s respective Statements of Changes in Beneficial Ownership on Form 4, each of which as with the SEC. These documents (when they become available), are available free of charge on the SEC’s website. Additional information regarding such interests and other relevant materials will be filed with the SEC when they become available. FLEETCOR | Proprietary & Confidential 3

Overview 1 Superior Track Record of Growth 2 Forward-leaning Corporate Governance 3 Forward-leaning Compensation Governance 4 Responsive to Shareholder Feedback 5 Meaningful Changes to CEO Pay FLEETCOR | Proprietary & Confidential 4

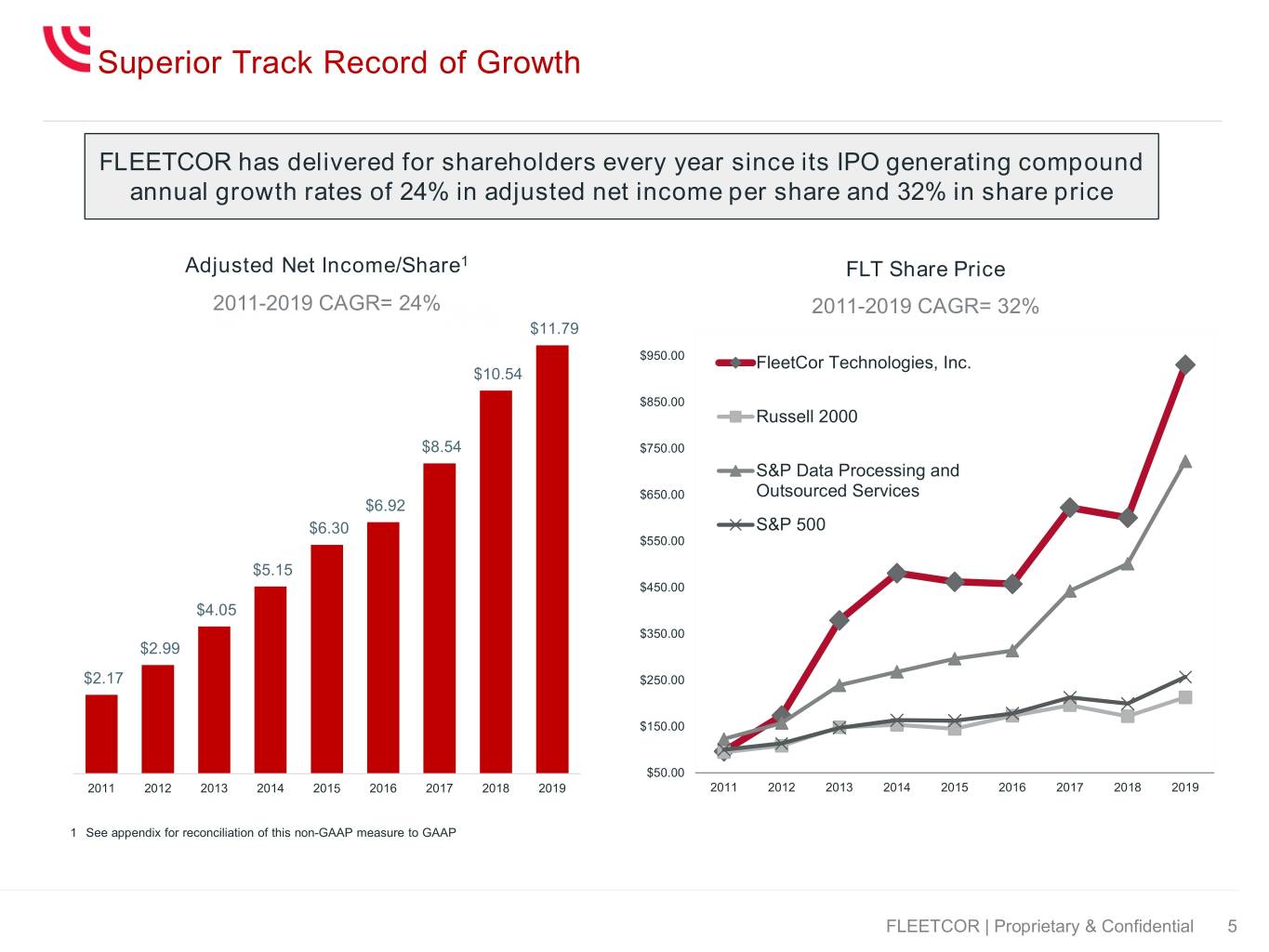

Superior Track Record of Growth FLEETCOR has delivered for shareholders every year since its IPO generating compound annual growth rates of 24% in adjusted net income per share and 32% in share price Adjusted Net Income/Share1 FLT Share Price 2011-2019 CAGR= 24% 2011-2019 CAGR= 32% 2017 2018 $11.79 $950.00 FleetCor Technologies, Inc. $10.54 $850.00 Russell 2000 $8.54 $750.00 S&P Data Processing and $650.00 Outsourced Services $6.92 $6.30 S&P 500 $550.00 $5.15 $450.00 $4.05 $350.00 $2.99 $2.17 $250.00 $150.00 $50.00 2011 2012 2013 2014 2015 2016 2017 2018 2019 2011 2012 2013 2014 2015 2016 2017 2018 2019 1 See appendix for reconciliation of this non-GAAP measure to GAAP FLEETCOR | Proprietary & Confidential 5

Forward-leaning Corporate Governance FLEETCOR has made significant improvements in Corporate Governance Highly engaged, experienced Board Proxy access 8 of 9 Directors are independent No supermajority shareholder voting Broader Director diversity search criteria Expanded shareholder engagement Declassified Board of Directors Regular review of governance practices Majority voting in Director elections Expanded ESG initiatives FLEETCOR | Proprietary & Confidential 6

Forward-leaning Compensation Governance FLEETCOR has made significant improvements in Compensation Governance CEO compensation aligned with Company CEO equity incentive tied to longer performance performance period NEO (other than CEO) comp aligned with Company No repricing or cashing out of underwater stock and Division performance options or stock appreciation Total compensation levels aligned with peer No hedging or pledging of common shares companies No excise tax gross-up Base salary levels general alignment with the peer median No excessive perquisites Target bonus levels general alignment with the peer Stronger compensation Clawback Policy median Double-trigger change of control provisions Compensation overwhelmingly in stock Below-market severance coverage Significant stock ownership requirements Shareholder engagement includes Compensation Different performance metrics for different Committee Chair, additional Board members, and compensation components management Incentive payouts tied closely to achieving published Regular review of compensation programs guidance Independent Compensation Consultant CEO equity incentive based on financial and relative metrics FLEETCOR | Proprietary & Confidential 7

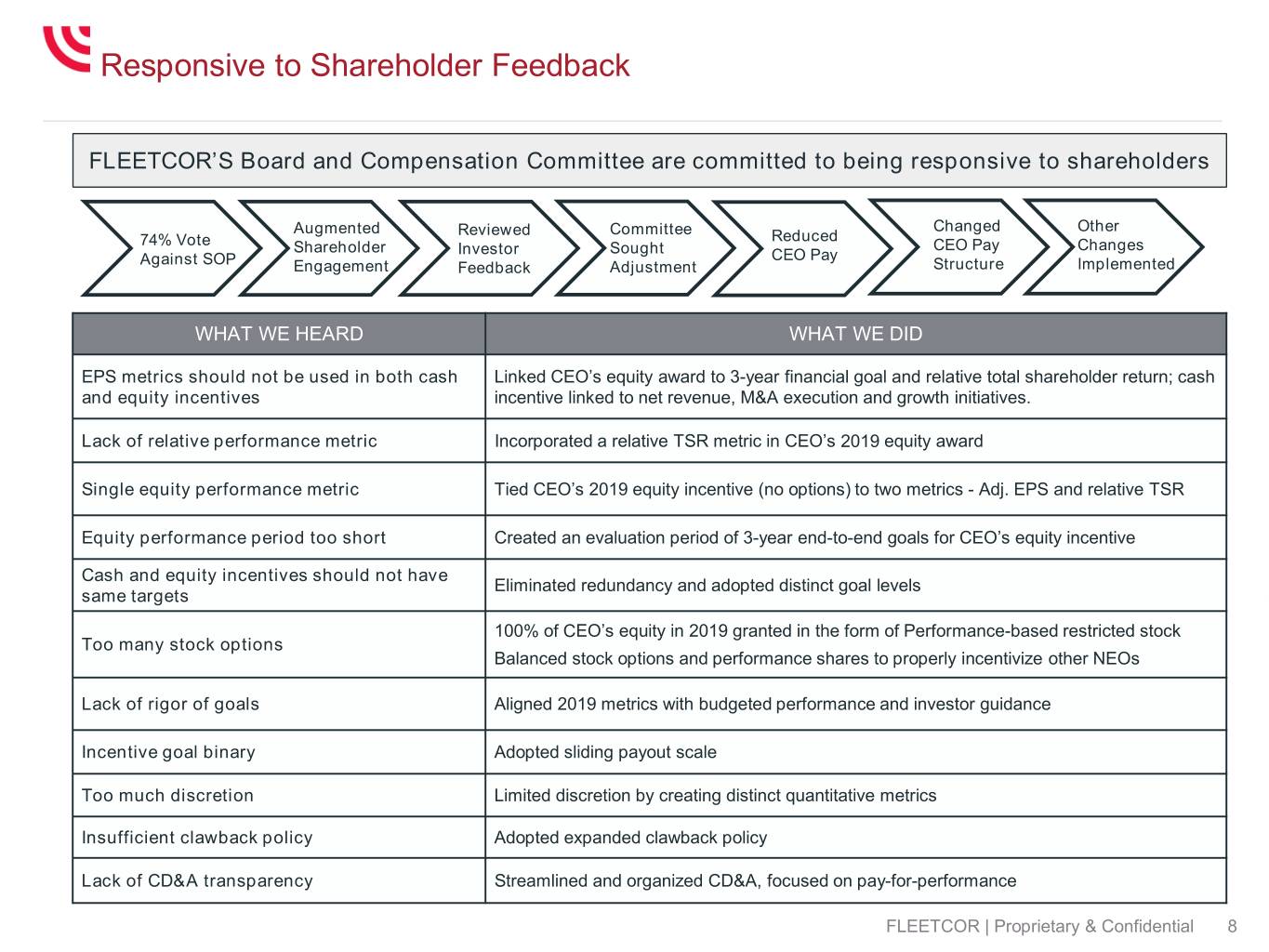

Responsive to Shareholder Feedback FLEETCOR’S Board and Compensation Committee are committed to being responsive to shareholders 73% Vote AgainstAugmented SOP Reviewed Committee Changed Other 74% Vote Reduced Shareholder Investor Sought CEO Pay Changes Against SOP CEO Pay Engagement Feedback Adjustment Structure Implemented WHAT WE HEARD WHAT WE DID EPS metrics should not be used in both cash Linked CEO’s equity award to 3-year financial goal and relative total shareholder return; cash and equity incentives incentive linked to net revenue, M&A execution and growth initiatives. Lack of relative performance metric Incorporated a relative TSR metric in CEO’s 2019 equity award Single equity performance metric Tied CEO’s 2019 equity incentive (no options) to two metrics - Adj. EPS and relative TSR Equity performance period too short Created an evaluation period of 3-year end-to-end goals for CEO’s equity incentive Cash and equity incentives should not have Eliminated redundancy and adopted distinct goal levels same targets 100% of CEO’s equity in 2019 granted in the form of Performance-based restricted stock Too many stock options Balanced stock options and performance shares to properly incentivize other NEOs Lack of rigor of goals Aligned 2019 metrics with budgeted performance and investor guidance Incentive goal binary Adopted sliding payout scale Too much discretion Limited discretion by creating distinct quantitative metrics Insufficient clawback policy Adopted expanded clawback policy Lack of CD&A transparency Streamlined and organized CD&A, focused on pay-for-performance FLEETCOR | Proprietary & Confidential 8

Meaningful Changes to CEO Pay FLEETCOR has taken dramatic steps to align CEO compensation principles with shareholder feedback and best practices Total target compensation for both 2018 and 2019 set in alignment with peer median Base pay restricted to 2018 amounts Incentives earned only upon satisfaction of quantitative goals (no discretion) Cash and equity incentives performance metrics vastly different, including both operational and shareholder return metrics Grant of only performance based restricted stock and no stock options 3-year evaluation period for equity incentives Relative total shareholder return evaluation in addition to financial goal requirements New grants subject to enhanced clawback policy Increased equity ownership requirements to 6x base pay FLEETCOR | Proprietary & Confidential 9

Appendix Non-GAAP to GAAP Reconciliations About Non-GAAP Financial Measures This presentation includes certain measures described below that are non-GAAP financial measures. Adjusted net income is calculated as net income, adjusted to eliminate (a) non-cash stock based compensation expense related to share based compensation awards, (b) amortization of deferred financing costs, discounts and intangible assets, amortization of the premium recognized on the purchase of receivables, and our proportionate share of amortization of intangible assets at our equity method investment, and (c) other non-recurring items, such as the impact of the Tax Act, impairment of investment, asset write-offs, restructuring costs, gains and related taxes due to disposition of assets and a business, loss on extinguishment of debt, legal settlements, and the unauthorized access impact. We prepare adjusted net income to eliminate the effect of items that we do not consider indicative of our core operating performance. We may also refer to adjusted net income as free cash flow or cash net income. Adjusted net income is a supplemental measure of operating performance that does not represent and should not be considered as an alternative to revenues, net income or cash flow from operations, as determined by U.S. generally accepted accounting principles, or U.S. GAAP, and our calculation thereof may not be comparable to that reported by other companies. We believe it is useful to exclude non-cash stock based compensation expense from adjusted net income because non-cash equity grants made at a certain price and point in time do not necessarily reflect how our business is performing at any particular time and stock based compensation expense is not a key measure of our core operating performance. We also believe that amortization expense can vary substantially from company to company and from period to period depending upon their financing and accounting methods, the fair value and average expected life of their acquired intangible assets, their capital structures and the method by which their assets were acquired; therefore, we have excluded amortization expense from our adjusted net income. We also believe one-time non-recurring gains, losses and impairment charges do not necessarily reflect how our investments and business are performing. Organic revenue growth is calculated as revenue growth in the current period adjusted for the impact of changes in the macroeconomic environment (to include fuel price, fuel price spreads and changes in foreign exchange rates) over revenue in the comparable prior period adjusted to include/remove the impact of acquisitions and/or divestitures and non-recurring items that have occurred subsequent to that period. We believe that organic revenue growth on a macro-neutral, one-time items, and consistent acquisition/divestiture/non-recurring item basis is useful to investors for understanding the performance of FLEETCOR. Management uses adjusted net income, adjusted net income per diluted share and organic revenue growth : as measurements of operating performance because they assist us in comparing our operating performance on a consistent basis; for planning purposes, including the preparation of our internal annual operating budget; ⦁ to allocate resources to enhance the financial performance of our business; and ⦁ to evaluate the performance and effectiveness of our operational strategies. ⦁ We believe⦁ adjusted net income, adjusted net income per diluted share and organic revenue growth are key measures used by FLEETCOR and investors as supplemental measures to evaluate the overall operating performance of companies in our industry. By providing these non-GAAP financial measures, together with reconciliations, we believe we are enhancing investors' understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing strategic initiatives. Reconciliations of GAAP results to non-GAAP results are provided in the attached Appendix. FLEETCOR | Proprietary & Confidential 10

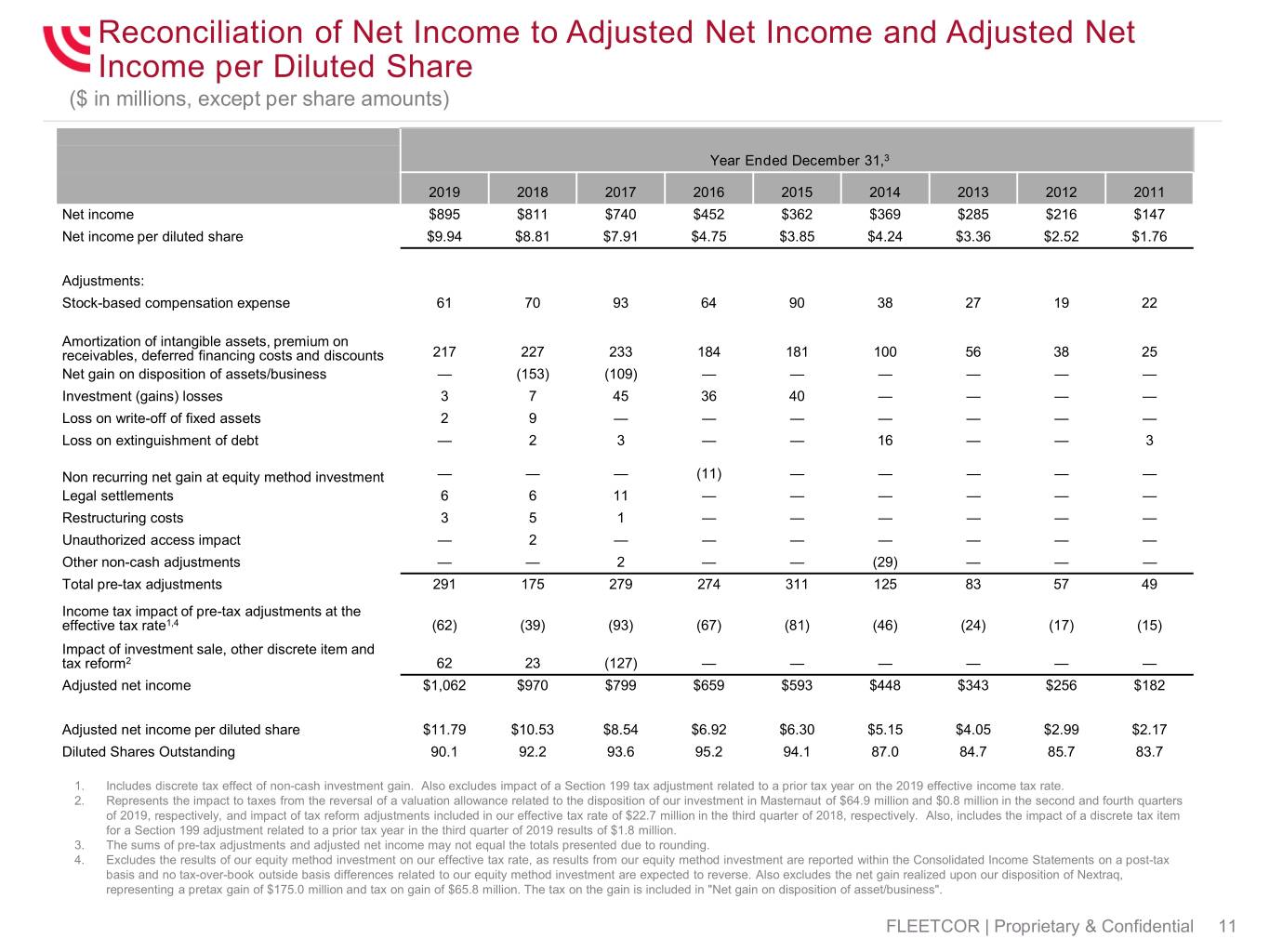

Reconciliation of Net Income to Adjusted Net Income and Adjusted Net Income per Diluted Share ($ in millions, except per share amounts) Year Ended December 31,3 2019 2018 2017 2016 2015 2014 2013 2012 2011 Net income $895 $811 $740 $452 $362 $369 $285 $216 $147 Net income per diluted share $9.94 $8.81 $7.91 $4.75 $3.85 $4.24 $3.36 $2.52 $1.76 Adjustments: Stock-based compensation expense 61 70 93 64 90 38 27 19 22 Amortization of intangible assets, premium on receivables, deferred financing costs and discounts 217 227 233 184 181 100 56 38 25 Net gain on disposition of assets/business — (153) (109) — — — — — — Investment (gains) losses 3 7 45 36 40 — — — — Loss on write-off of fixed assets 2 9 — — — — — — — Loss on extinguishment of debt — 2 3 — — 16 — — 3 Non recurring net gain at equity method investment — — — (11) — — — — — Legal settlements 6 6 11 — — — — — — Restructuring costs 3 5 1 — — — — — — Unauthorized access impact — 2 — — — — — — — Other non-cash adjustments — — 2 — — (29) — — — Total pre-tax adjustments 291 175 279 274 311 125 83 57 49 Income tax impact of pre-tax adjustments at the effective tax rate1,4 (62) (39) (93) (67) (81) (46) (24) (17) (15) Impact of investment sale, other discrete item and tax reform2 62 23 (127) — — — — — — Adjusted net income $1,062 $970 $799 $659 $593 $448 $343 $256 $182 Adjusted net income per diluted share $11.79 $10.53 $8.54 $6.92 $6.30 $5.15 $4.05 $2.99 $2.17 Diluted Shares Outstanding 90.1 92.2 93.6 95.2 94.1 87.0 84.7 85.7 83.7 1. Includes discrete tax effect of non-cash investment gain. Also excludes impact of a Section 199 tax adjustment related to a prior tax year on the 2019 effective income tax rate. 2. Represents the impact to taxes from the reversal of a valuation allowance related to the disposition of our investment in Masternaut of $64.9 million and $0.8 million in the second and fourth quarters of 2019, respectively, and impact of tax reform adjustments included in our effective tax rate of $22.7 million in the third quarter of 2018, respectively. Also, includes the impact of a discrete tax item for a Section 199 adjustment related to a prior tax year in the third quarter of 2019 results of $1.8 million. 3. The sums of pre-tax adjustments and adjusted net income may not equal the totals presented due to rounding. 4. Excludes the results of our equity method investment on our effective tax rate, as results from our equity method investment are reported within the Consolidated Income Statements on a post-tax basis and no tax-over-book outside basis differences related to our equity method investment are expected to reverse. Also excludes the net gain realized upon our disposition of Nextraq, representing a pretax gain of $175.0 million and tax on gain of $65.8 million. The tax on the gain is included in "Net gain on disposition of asset/business". FLEETCOR | Proprietary & Confidential 11