Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - AMYRIS, INC. | ex992031620.htm |

| 8-K - FORM 8-K - AMYRIS, INC. | f8k_031620.htm |

Amyris, Inc. March 16, 2020

Cautionary Notes Cautionary Notes FORWARD-LOOKING STATEMENTS This presentation and oral statements accompanying this presentation contain forward-looking statements, and any statements other than statements of historical fact could be deemed to be forward-looking statements. These forward-looking statements include, among other things, statements regarding future events, such as such as expected revenue, gross margin, profit and EBITDA in 2020 and beyond, including related growth rates, the anticipated development, scaling and commercialization of Amyris’s product pipeline and introduction of new products, including HMOs, vitamins and cannabinoid ingredients, including the cost and purity of such products, expected growth of Amyris’s Clean Beauty, baby skincare, Sweetener and F&F businesses, the anticipated size and growth of the global beauty and personal care market, expected distribution channels for Amyris’s baby skincare products, the anticipated size, growth and composition of the global baby care market, the expected size, growth and composition of the global psychoactive market and the U.S. and global cannabinoid markets, anticipated sources of liquidity and improvements to Amyris’s capital structure and balance sheet, including future exercises or expiration of warrants and stock options and proceeds to be received in connection thereto, the operational capacity and availability of inventory for critical demands through the end of 2020, and expectations regarding Amyris’s financial and operational results and ability to achieve its business plan in 2020 and beyond. These statements are based on management’s current expectations and actual results and future events may differ materially due to risks and uncertainties, including risks related to Amyris’s liquidity and ability to fund operating and capital expenses, risks related to potential delays or failures in development, production and commercialization of products, risks related to Amyris's reliance on third parties, and other risks detailed from time to time in filings Amyris makes with the Securities and Exchange Commission, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Amyris disclaims any obligation to update information contained in these forward-looking statements, whether as a result of new information, future events, or otherwise. © 2020 Amyris, Inc. All rights reserved. 2

Make good. No compromise.®

We Are on a Mission to Make Our Planet Healthier A consumer driven company powered by a leading life sciences platform The fastest growing skin care brand in North America The world’s leading synthetic biology platform making sustainable ingredients accessible to the world’s leading brands for health, personal care, beauty and wellness applications © 2020 Amyris, Inc. All Rights Reserved. 4

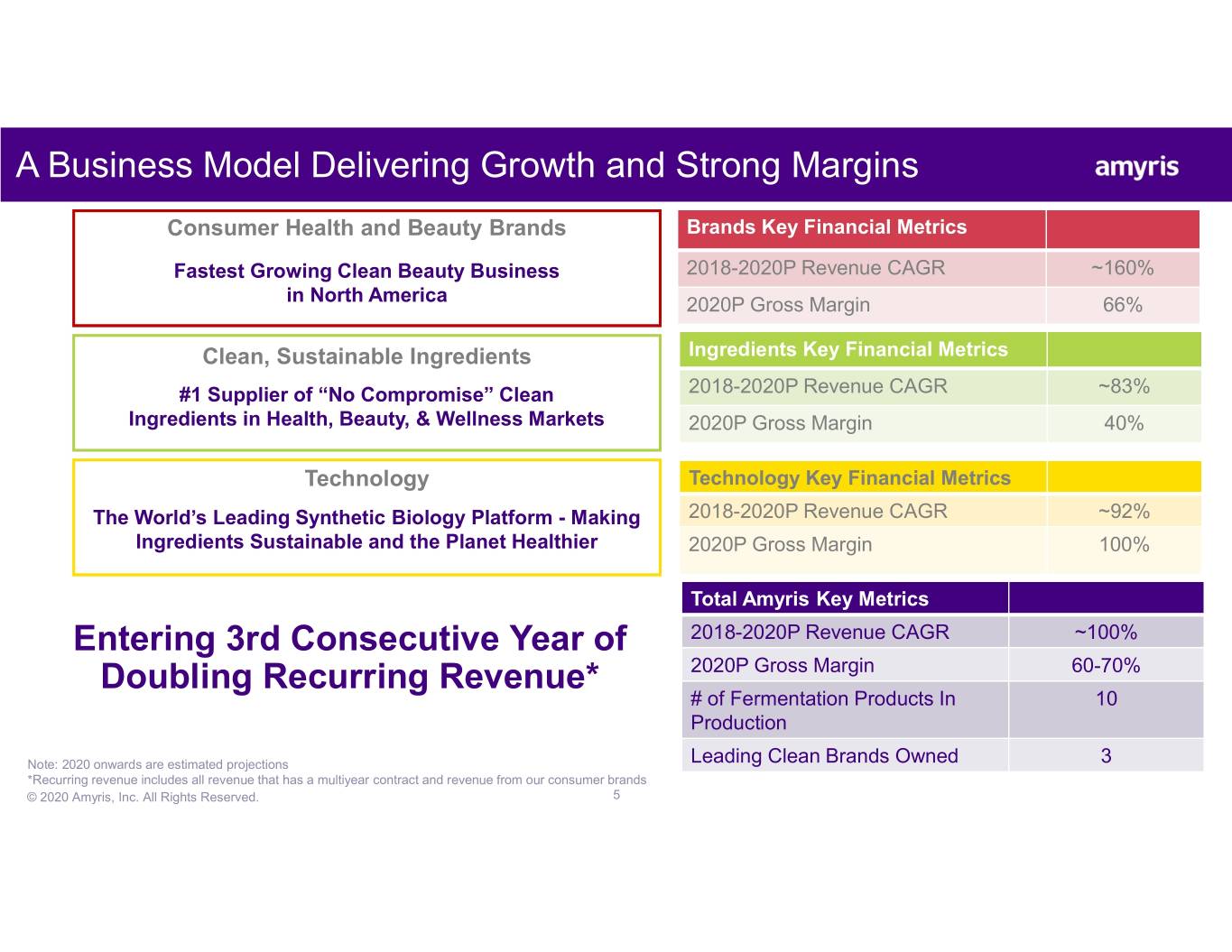

A Business Model Delivering Growth and Strong Margins Consumer Health and Beauty Brands Brands Key Financial Metrics Fastest Growing Clean Beauty Business 2018-2020P Revenue CAGR ~160% in North America 2020P Gross Margin 66% Clean, Sustainable Ingredients Ingredients Key Financial Metrics #1 Supplier of “No Compromise” Clean 2018-2020P Revenue CAGR ~83% Ingredients in Health, Beauty, & Wellness Markets 2020P Gross Margin 40% Technology Technology Key Financial Metrics The World’s Leading Synthetic Biology Platform - Making 2018-2020P Revenue CAGR ~92% Ingredients Sustainable and the Planet Healthier 2020P Gross Margin 100% Total Amyris Key Metrics Entering 3rd Consecutive Year of 2018-2020P Revenue CAGR ~100% Doubling Recurring Revenue* 2020P Gross Margin 60-70% # of Fermentation Products In 10 Production Note: 2020 onwards are estimated projections Leading Clean Brands Owned 3 *Recurring revenue includes all revenue that has a multiyear contract and revenue from our consumer brands © 2020 Amyris, Inc. All Rights Reserved. 5

Business Model Creates Value for Partners & Customers PROVEN TECH PLATFORM VALUE CREATION MODEL Ingredients: Apply Synthetic Biology to • Farnesene Making Natural Ingredients • Patchouli • Squalane • Sclareol Platform • Manool Ingredients Disruptive • Bisabolol • Fragrance 5* Product • Flavor 1* Efficacy • Reb M with Pure Owning Fermentation DELIVERING TO THE MARKET Consumer Source Sell Ingredients to the Leading Brands Launch Consumer Health & Mindshare Beauty Brands Leading Brands New Stories *Confidential molecules © 2020 Amyris, Inc. All rights reserved. 6

Strong & Sustainable Growth Doubling Recurring Revenue Yearly and over 30% Adj EBITDA by 2022 Amyris Total Revenue ($M) Technology Collaborations Product Revenue & Royalties $220* $153 $64 2018 2019P 2020P 2021P 2022P 2023P Gross Profit % 57% 56% 60-70% 65-70% 65-70% 65-70% *With potential upside of $20-40M, Note: 2020 onwards are projections 7 © 2020 Amyris, Inc. All rights reserved.

2019 Financial Highlights 2019 Actuals 2018 Actuals Revenue Product Revenue $59.9M $33.6M Licenses & Royalties $54.0M $7.7M Collaborations & Grants $38.6M $22.3M Total $152.6M $63.6M Non- GAAP % Gross Profit 56.0% 56.9% Adjusted EBITDA (i,ii) (i) Excludes depreciation & amortization and stock compensation expense -$104.8M -$118.6M © 2020 Amyris, Inc. All rights reserved. 8

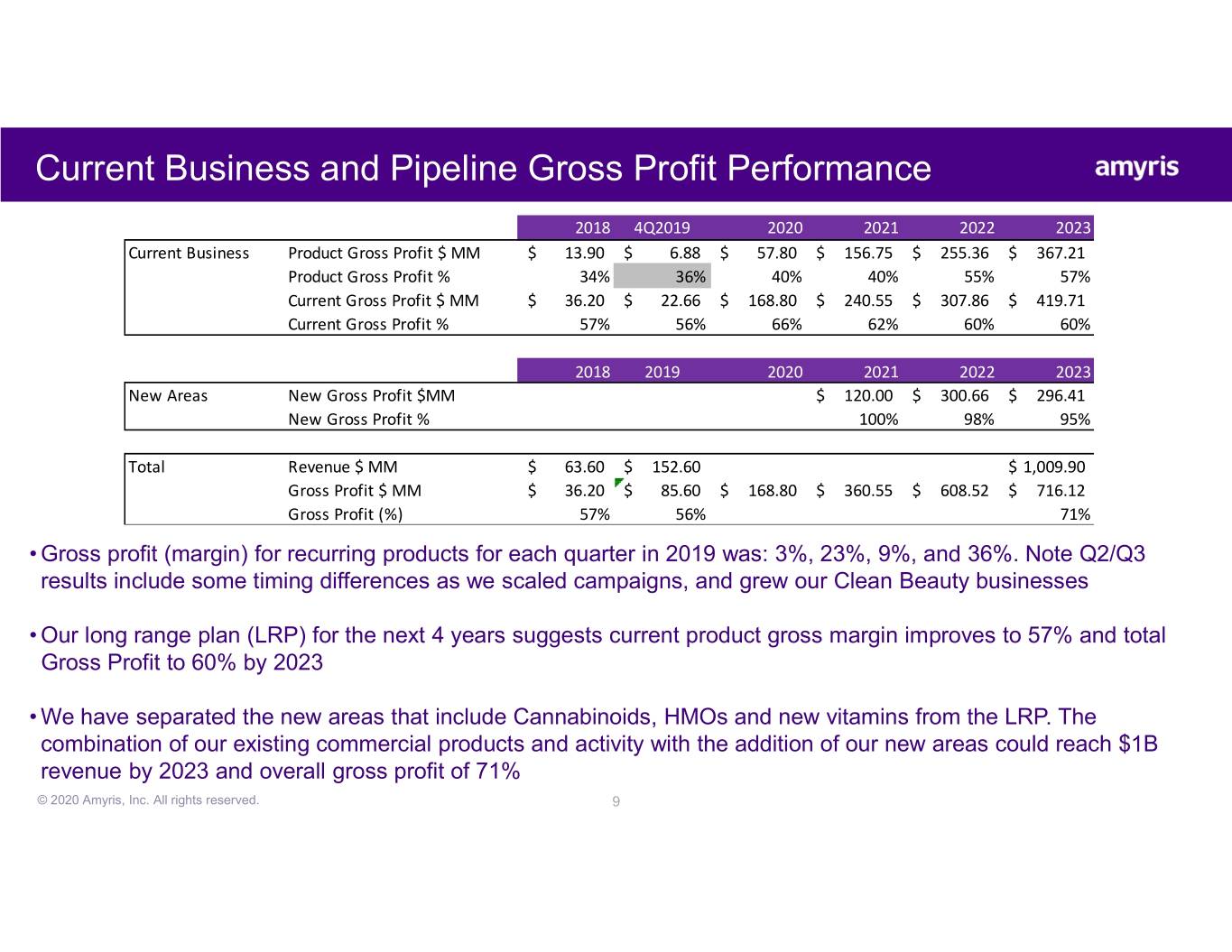

Current Business and Pipeline Gross Profit Performance 2018 4Q2019 2020 2021 2022 2023 Current Business Product Gross Profit $ MM$ 13.90 $ 6.88 $ 57.80 $ 156.75 $ 255.36 $ 367.21 Product Gross Profit % 34% 36% 40% 40% 55% 57% Current Gross Profit $ MM$ 36.20 $ 22.66 $ 168.80 $ 240.55 $ 307.86 $ 419.71 Current Gross Profit % 57% 56% 66% 62% 60% 60% 2018 2019 2020 2021 2022 2023 New Areas New Gross Profit $MM$ 120.00 $ 300.66 $ 296.41 New Gross Profit % 100% 98% 95% Total Revenue $ MM$ 63.60 $ 152.60 $ 1,009.90 Gross Profit $ MM$ 36.20 $ 85.60 $ 168.80 $ 360.55 $ 608.52 $ 716.12 Gross Profit (%) 57% 56% 71% • Gross profit (margin) for recurring products for each quarter in 2019 was: 3%, 23%, 9%, and 36%. Note Q2/Q3 results include some timing differences as we scaled campaigns, and grew our Clean Beauty businesses • Our long range plan (LRP) for the next 4 years suggests current product gross margin improves to 57% and total Gross Profit to 60% by 2023 • We have separated the new areas that include Cannabinoids, HMOs and new vitamins from the LRP. The combination of our existing commercial products and activity with the addition of our new areas could reach $1B revenue by 2023 and overall gross profit of 71% © 2020 Amyris, Inc. All rights reserved. 9

We have ~57 MM of Warrants – about 75% owned by insiders Cash From Warrants Total Shares Categories Strike price Shares (M) ($M) (M) Common Shares Outstanding 163.8 Warrants: $ 0.015 6.3$ 0.94 $ 2.87 34.0$ 97.48 Warrant Expirations # of $ 3.25 3.0$ 9.75 by Year % Warrants Cash $ 3.87 2.0$ 7.74 2020 12.7% 7.2 $ 54.3 $ 4.76 3.4$ 16.05 2021 53.3% 30.3 $ 97.3 $ 5.02 1.0$ 4.82 2022 34.0% 19.3 $ 39.5 $ 7.52 7.2$ 54.29 Total 100% 56.8 $ 191.08 Total Warrants 56.8$ 191.08 56.8 Preferred and Converts 11.2 Employee Stock Plans 12.8 Fully Diluted Shares 244.6 • Shares Outstanding of 163.8M Mid March • We have 56.8M warrants expiring over the next 2 years • If these all are “in the money” and if 100% converted, this will result in $191M in new cash proceeds • Most likely scenario: we believe a portion of the warrants can provide us access to an additional $100M of proceeds and based on our calculations of what employee options and warrants will expire, we expect a total fully diluted share count of about 220M shares © 2020 Amyris, Inc. All rights reserved. 10

Debt Schedule © 2020 Amyris, Inc. All rights reserved. 11

We Have Production Resilience to Deliver Through Coronavirus Production Volume Scenarios (MT) 1200 Inventory Scenarios (MT) 1600 1000 1400 1200 800 Inventory can 1000 600 Supply Q2 800 sales 600 400 400 200 Modeled 0 MT 200 in Q2 0 0 EOY 2019 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2020 Plan Corona Virus Scenario 2020 Plan Corona Virus Scenario • Starting Inventory: Started 2020 with 850 MT of inventory. We knew our product growth in 2020 was larger than our available production capacity in low cost locations (Brazil). • Uninterrupted Supply: Even if Q2 production is 0 MT, we have enough inventory to deliver product needed to meet our 2020 plan (within ~5% tolerance). • Better cash flow: We need minimal cash to fund our production during the 1st half as a result of our 4th quarter inventory build to meet 1st half 2020 demand and contractual obligations. • Consumer brands: Our supply for Biossance and Pipette raw materials is not constrained. © 2020 Amyris, Inc. All rights reserved. 12

Amyris Technology Accelerating Industry Disruption Key Technical Metrics Amyris Global Market Opportunities ($B) 350 Molecules commercialized per year 2-4 $323B TAM Number of PhD’s ~85 Number of US and foreign patents issued and 300 871 applications pending Amyris CAGR Molecules Manufactured 10 250 2019-2025 CAGR*: 4% Pipeline of molecules in development 17 $183B 2018-2020P: 138% 200 150 2018-2025 CAGR: 24% 2019-2020P: 369% 100 $66B 2019-2025 CAGR: 5% 2018-2020P: 89% 50 29B 2019-2025: 6% $17B 2019-2020P: 2267% 2019-2025: 6% 0 $9B 2018-2020P: 663% Global markets represent: skincare, legal cannabinoids, flavors & fragrances, baby products, and alternative sweeteners using the following sources: Grand View Research, Allied Market Research, Industry Experts *CAGR = Market Compound Annual Growth Rate 13 © 2020 Amyris, Inc. All rights reserved.

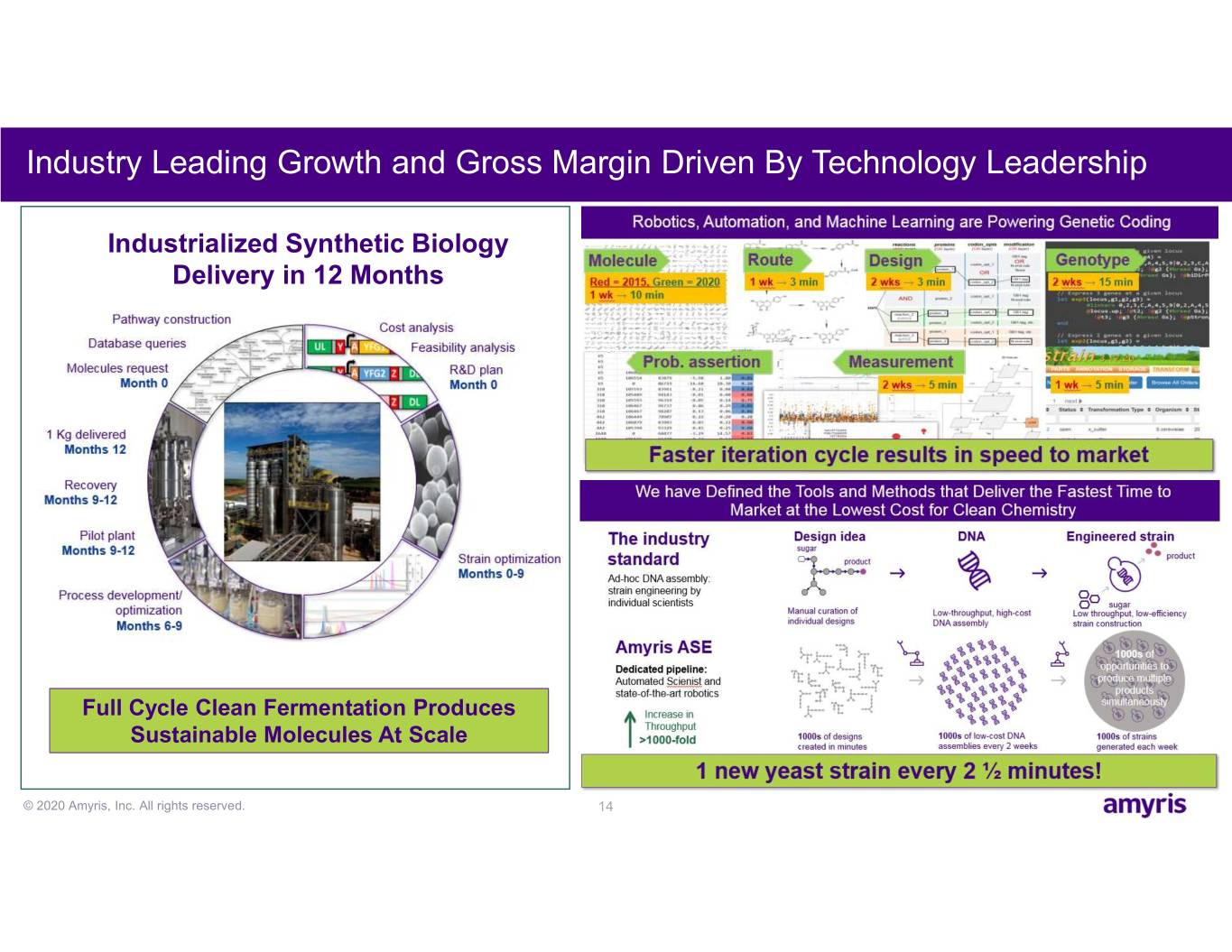

Industry Leading Growth and Gross Margin Driven By Technology Leadership Industrialized Synthetic Biology Delivery in 12 Months Full Cycle Clean Fermentation Produces Sustainable Molecules At Scale © 2020 Amyris, Inc. All rights reserved. 14

DARPA Funding Helped Create Our Synthetic Leadership in the US >100 molecules >20 molecules $8M DARPA Award; $36M DARPA Award; produced at produced at > 10 mg/L Living Foundries ATCG Designed 535 molecules > 25 mg/L scale scale 18 delivered to DoD Completion of Living 247 molecules produced >50 molecules produced at > Prototyping of novel Foundries ATCG at mg scale 250 mg/L scale materials by DoD 2012-2014 2016 2017 2018 2019 2020……. Development of tools for Integration and deployment DoD and Amyris have technology pipeline of technology pipeline access to 100s of DoD interest in 100s inaccessible molecules of inaccessible molecules $44M funded with 535 molecules designed © 2020 Amyris, Inc. All rights reserved. 15

Clean Beauty

The Leading Beauty Brand in Sustainability RENEWABLE RESOURCE CLEAN NO DEFORESTATION BEAUTY LOW WATER USAGE DOWN TO A SCIENCE CRUELTY-FREE & VEGAN RECYCLABLE NONTOXIC

Leading Supplier of Clean Ingredients to the Beauty Industry: We are Setting the Standard with Biossance We supply the world’s leading brands Our brand sets the standard for consumers Cosmetic Ingredient Sales Biossance Consumer Sell-through Volume Through Primary Distributors Differentiators that Elevate the Brand Among Competitors Formulations Product Influencer Love Expert chemists in Marine Algae Eye Jonathan Van Ness mixing clean Cream named top 3 Brand Ambassador 2012 2013 2014 2015 2016 2017 2018 2019 ingredients with a focus eye creams in 4.3M Followers on efficacy Sephora US • Rapid adoption from formulators and distributors validated the squalane movement • This rapid growth led to the creation of Biossance • Today, our cosmetic ingredient sales has: Return on Advertising Spend: • Global demand of 50%+ market share Q3 2019: $3.76 • 200% growth since 2015 in end products Q4 2019: $5.43 We are now in 3,000+ brands YTD*: $9.20 Source of Jonathan Van Ness photo: Jimmy Kimmel Live! *As of 2/20/2020 © 2020 Amyris, Inc. All rights reserved. 18 *YTD as of 2/20/2020

Biossance is on Track to Become a Billion Dollar Brand Biossance Key Growth Drivers DOORS SALES Sephora End Caps produces 2-2.5X more retail revenue Sephora Monthly Productivity* Dec 2018 = 104% 297 296 255 240 113 130 June 2019 = 141% 2017 2018 2019 YE Dec 2019 = 135% EC (17 SKUs) Wall (6SKUs) Jan 2020 = 205% 2019 YE: in all 495 Sephora NA stores *Sephora Productivity is how Biossance performs compared to its 2020: will participate in Sephora NA’s 100 new store openings peers in revenue per square foot per month TOTAL # OF BIOSSANCE.COM CUSTOMERS (000’s) 299 2017-2019 CAGR = ~350% 250 222 237 194 154 127 97 40 62 15 26 2017-Q1 2017-Q2 2017-Q3 2017-Q4 2018-Q1 2018-Q2 2018-Q3 2018-Q4 2019-Q1 2019-Q2 2019-Q3 2019-Q4 © 2020 Amyris, Inc. All rights reserved. 19

Launched September 4, 2019 • EWG Verified™ • Leaping Bunny Approved Retail Channel Distribution • Dermatologist tested • Pediatrician approved • Hypoallergenic • Nontoxic • Vegan • Synthetic fragrance-free 20 Copyright © 2020 Amyris, Inc. All rights reserved

Health & Ingredients Health & Ingredients

Growing our Sustainable Health & Ingredients Business FRAGRANCE FLAVOR Delivering Sustainable Fragrances Delivering a Revolutionary Sweetener • Global partners choose Amyris to develop sustainable ingredients they could not scale on their own Amyris Sweetener • We supply 3 of the Top 5 Flavors & Fragrance Houses in 100% Natural from sugarcane. Zero calories. Zero aftertaste. the world reaching over 80M consumers globally delivering sustainable fragrances for the world’s leading brands Prestige B2B Business & Direct to Consumer Mass 22 © 2020 Amyris, Inc. All rights reserved.

23

Amyris is Disrupting the Sweetener Market SWEETNESS EQUIVALENCY 100% SWEET 100% SUSTAINABLE 350-500 grams of sugar* 1 gram of Reb M 0 bitter aftertaste responsibly grown sugarcane 0 glycemic index 10x less farmland to produce 0 calories 1 clean fermentation process 0 GMO all recycled cane-based packaging fermented for a healthy gut 0 waste (almost, we’re working on it) *Depending on application *depending on application © 2020 Amyris, Inc. All rights reserved. 24

Cannabinoids: Establishing Market Leadership For Sustainable Health •Up to $300M cannabinoids collaboration with LAVVAN with plans to commercialize Clean CBD & CBG in 2020 •Delivering cannabinoids at significant cost advantage with ultra purity, which is essential for accelerating brand adoption •We expect to become the leading supplier of Cannabinoids with Gross Margins of better than 70% for the best performing products in the market – Natural, Sustainable, Highest Purity at Lowest Cost Sources: PR Newswire, MarketWatch, Allied Market, Statista, Grand View Research, Paradigm Capital Inc © 2020 Amyris, Inc. All rights reserved. 25

Synthetic Biology Competitive Landscape Fermentation Total Equity 2019 Annual Enterprise Products Commercial Capital Annual Growth Rate Value Currently in Visibility Invested Revenue (2018-2019) Production Amyris $670M ~$1B* $153M 140% 10 Gingko $4B(est) $719M $80M(est) 100%(est) 2(est) Zymergen $1B+(est) $574M N/A N/A N/A *Total equity capital investments do not include any debt instruments Sources: Forbes, Business Wire, PR Newswire, Industry Expert Source, SF Business Times, Tech Crunch © 2020 Amyris, Inc. All rights reserved. 26

Select Executive Team & Board of Director Members Amyris Executive Team Members include: John Melo Eduardo Alvarez Sunil Chandran Catherine Gore Caroline Hadfield President & CEO Chief Operation Officer SVP, R&D President, Biossance President, Pipette & Aprinnova Previous: BP Plc, Ernst & Previous: GE, PwC, Previous: Kosan Biosciences Previous: Kendo, Sephora Previous: Bodyshop Young Booz Allen International, Sephora Board of Director Members include: John Doerr Geoff Duyk Lisa Qi Patrick Yang, Ph.D. Jim McCann KPCB, Google, Amazon Circularis, TPG Biotechnology Daling Family, Native F. Hoffmann-La Roche, 1-800-FLOWERS.COM, IGT PLC, Beauty, Dupont Lycra Genentech, Merck & Co The Scotts Miracle-Gro Company © 2020 Amyris, Inc. All rights reserved. 27

Environmental, Social, and Governance (ESG) at Amyris ESG* data is most often categorized as “non-accounting” information because it captures components important for valuations that are not traditionally reported. The valuation of companies has become more complex, with a growing portion tied up in intangible assets. ESG metrics provide insights into these intangibles, such as brand value and reputation, by measuring decisions taken by company management that affect operational efficiency and future strategic directions. People R&D Supply Chain Manufacturing Products Governance • 100% gender- • EPA Green • Renewable • Renewable • Non-shark derived • Management equality employer Chemistry Award sugarcane sugarcane squalane** training and • Fostering • My Green Lab packaging feedstock communications diversity Award materials • Leadership training • Global anti- corruption policy • OECD human • Sustainably- and training rights and labor derived fragrances • Biosafety law policy • USDA certified Committee • Sugarcane Biopreferred • Safety committee with executive • Annual waste • Ethical sourcing bagasse co-gen • EPA safer choice reduction metrics practices chemicals reporting program • Reduce GHGs • Code of conduct • Supply compared to • Naturally-derived and diversity • Operationalize agreements with petrochemical products (ISO training Nagoya Protocol human rights and derived products 16128) Biodiversity labor law • Annual energy • Local community requirements • Hemisqualane programs • Harmonization audits replacement for with CITES • Championing • Water recycling D5 and other • Safety audits and protocol responsible and reduction silicones tracking sourcing *ESG as defined by BlackRock **Amyris squalane has offset the demand of over 6 million sharks to date Copyright © 2020 Amyris, Inc. All rights reserved 28

• Our ingredients are inside over $10B of consumer retail purchases sold through 3,000+ of the world’s leading Make good. personal care and beauty brands • Our Biossance Skin Care Brand is the ™ fastest growing Skin Care Brand in No compromise. North America • We have the leading product in the Good for People natural Sweetener market. We are Good for the Planet committed to a healthier planet and a sweet life for all! Good for Business • Most profitable & fastest growing product portfolio in Synthetic Biology Copyright © 2020 Amyris, Inc. All rights reserved 29