Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTERN ALLIANCE BANCORPORATION | a8-kinvestorpresentati.htm |

INVESTOR UPDATE March 2020

Western Alliance Bank Overview NYSE: WAL $26B+ Headquarters: Phoenix, AZ Regional Footprint in assets IPO: 2005 National Presence Market Cap1: $4.1B Top Performing Commercial Client Focused Bank Shares Outstanding: 102.5M Institutional Ownership: 88% Insider Ownership: 7.6% 21% tangible book Dividend Yield1: 2.5% value 5-Year Forward P/E1: 7.8x CAGR Employees: 1,800+ Serving a diverse range of commercial clients, from Locations: 47 corporate and small business to public and non-profit borrowers, across numerous industries nationwide 19% 2019 loan S&P GLOBAL MARKET INTELLIGENCE growth #1 Regional Bank, 2019 5 regional banking divisions with a branch-light BANK DIRECTOR MAGAZINE footprint serving attractive markets in Arizona, #1 Regional Bank, 2019 Bank Performance Scorecard Nevada, and California FORBES 19.6% Top 10 “Best Banks in 10+ specialized National Business Lines 2019 America” list 2016 - 2020 ROATCE 1) Market data as of March 6, 2020; stock price of $39.61 2

WAL’s Value Proposition 1 Diversified business model allows flexibility to sustain growth across market cycles 2 Robust risk-adjusted loan and deposit growth 3 Industry-leading profitability 4 Conservative credit culture 5 Top-decile efficiency produces strong operating leverage 6 Shareholder-focused capital management 7 Seasoned and invested leadership team A highly adaptable and efficient model coupled with a conservative credit culture enables thoughtful growth and industry-leading profitability across market environments 3

1 Diversified Business Model Allows Flexibility to Sustain Growth WAL can actively adapt business and capital allocation in response to changing external environment Regional Growth trajectory Banking Residential Ample growth maintained with Divisions Mortgage Initiative potential prudent credit risk management NBLs Geographic Growth Organic Diversification Trajectory Growth C&D Superior total Dividends Risk- Deep segment & Capital shareholder Adjusted product expertise Allocation returns without Share Yields supports cyclical curtailing growth Repurchases Hotel business lines Franchise Risk Operating Finance M&A Management Leverage Mortgage HOA Warehouse Highly efficient Pristine asset Capital Call Corporate Lines Finance lending & deposit quality platforms Illustrative as business objectives are not mutually exclusive and image does not represent full suite of WAL divisions, products and services. 4

2 Robust Risk-Adjusted Loan and Deposit Growth Diversified by product, client-type and geography emphasizing underwriting discipline • Diverse mix of regionally-focused Diversified Business Mix commercial banking divisions & nationally- oriented specialized businesses Loans by Product Type Loans by Rate Type Resi. & Consumer • Leverages deep segment expertise to 10% provide specialized banking services to niche Const. & Land markets across the country 9% Fixed Rate LIBOR C&I 32% Based • National reach enables selective 45% 42% relationships with highest asset quality and CRE, NOO 25% profitability Prime CRE, Term Based OO Adjustable 18% 11% 8% Loan and Loan Yields 5.43% 5.62% 5.82% 5.83% 6.00% 5.23% 5.18% 5.40% $20.0 5.00% $21.1 $17.7 4.00% $15.0 $13.2 $15.1 3.00% 20.8%$10.0 $11.1 2.00% CAGR $8.4 $5.0 1.00% $6.8 0.00% $0.0 2013 2014 2015 2016 2017 2018 2019 Dollars in billions 5

National Business Lines Targeting Attractive Industries Segment-focused model supports superior client value and company risk management • NBLs provide dedicated lending and deposit banking WAL Loans by Segment NBL Composition services to niche markets No Cal • Industry and nationwide geographic diversification 6% Other Hotel with centralized, sophisticated management Nevada 10% Franchise 11% Corp. Fin. 17% 10% • Unique client types and specialized banking So Cal Resi. 11% National Tech & Innov. requirements are supported by WAL’s value-added Mortgage Business 14% offerings Lines 18% Arizona 54% • Strong returns with conservative underwriting and 18% Public & Mtg. NonProfit Warehouse structuring 14% 17% NBL Loans and NBLs as a Percentage of Total WAL Loans 54% 55% 49% $12.0 50% 44% $10.0 45% 43% $11.5 $8.0 40% $8.6 33.2% 32% $6.0 35% $6.7 CAGR 30% $5.7 $4.0 25% $3.6 $2.0 20% $0.0 2015 2016 2017 2018 2019 Dollars in billions 6

Stable, Low Cost Deposit Franchise Diversified funding channels reflect long-term, stable relationships • $22.8Bn in stable deposits, typically tied to lending Solid Noninterest-Bearing Deposit Base relationship • Scalable national funding channels, such as HOA, Tech CDs 10% & Innovation, Life Sciences and capital call lines Nonint. • Core deposits fund balance sheet growth Bearing DDA 38% − Deposits compose 98.3% of total funding MMDA & − 92.7% Loan-to-Deposit ratio Savings 40% Interest • 38% of total deposits are noninterest-bearing DDA 12% Deposits, Borrowings, and Cost of Funds 0.86% $25.0 0.64% $0.4 0.39% 0.36% 0.30% 0.31% 0.37% $20.0 $0.9 0.40% $0.8 $8.5 25.4% $0.4 $15.0 $7.5 CAGR $0.4 $7.4 -0.40% $5.6 $10.0 $0.5 $0.5 $4.1 $2.3 $14.3 16.9% $2.2 $11.7 -1.20% $5.0 $8.9 $9.5 CAGR $5.6 $6.6 $7.9 $0.0 -2.00% 2013 2014 2015 2016 2017 2018 2019 Interest Bearing Deposits Non-Interest Bearing Deposits Total Borrowings Cost of Funds Dollars in billions Borrowing include customer repurchase agreements Cost of Funds defined as total expense paid on interest bearing liabilities divided by the sum of average interest bearing liabilities and average non-interest bearing demand deposits 7

3 Industry-Leading Profitability ROAA WAL Peers • Outstanding performance compared to peers with ROAA and ROATCE among highest in industry 2.05% 2.00% • Leading earning asset yield of 5.30% 1.61% 1.72% 1.50% 1.56% 1.35% • Liquid securities portfolio mainly consists of MBS (79%) and Tax Exempt (17%) investments 1.29% 1.20% • Net Interest Income continues to rise through strong 1.02% 1.00% 0.96% 0.96% 0.97% earning asset growth despite Fed rate actions 2013 2014 2015 2016 2017 2018 2019 ROATCE Net Interest Margin WAL Peers WAL Peers 20.6% 4.58% 4.65% 4.68% 19.6% 4.51% 4.52% 18.5% 4.39% 4.42% 18.3% 17.8% 17.7% 18.3% 3.50% 3.56% 15.0% 14.6% 3.39% 3.44% 3.49% 3.29% 3.26% 11.7% 11.1% 10.8% 11.1% 11.4% 2013 2014 2015 2016 2017 2018 2019 2013 2014 2015 2016 2017 2018 2019 Note: Peers consist of 55 publicly traded banks with total assets between $15B and $150B, excluding target banks of pending acquisitions, 8 as of December 31, 2019; S&P Global Market Intelligence

Reduced Asset Sensitivity with Asymmetric Return Profile Percentage Increase/(Decrease) to Net As of 12/31/2019 Interest Income • Nearly 68% of loans are variable rate (approx. $14.4Bn) Down 100bps Scenario − 68% ($9.7Bn) of variable rate loans have interest rate floors Shock Ramp1 − 35% ($3.4Bn) of variable rate loans with floors were at their floors (1.1)% Post-Fed Rate Reduction (3.0)% • After the 50bps Fed rate reduction on March 3, 2020, an additional $2.9Bn of variable rate loans hit floors • 64% ($6.4Bn) of variable rate loans with floors are at Up 100bps Scenario their floors − Any further 25bps rate reduction will result in an 4.8% additional approx. $1.0Bn of variable rate loans 3.4% reaching floors • 62% ($13.1Bn) of loan portfolio is acting as fixed rate • Reduced IRR in 100bps parallel shock scenario to 3.0% from 6.6% at June 30, 2019 Shock Ramp2 − Floors of variable rate loans increasingly in-the- Note: NII Sensitivity assumes WAL balance sheet as of January 31, 2020, but incorporates Fed’s 50bps rate reduction on March 3, 2020 money 1) Assumes a gradual monthly parallel shift of -8.3bps over a 12-month period 2) Assumes a gradual monthly parallel shift of +8.3bps over a 12-month period − Mix shift to fixed rate residential loans 9

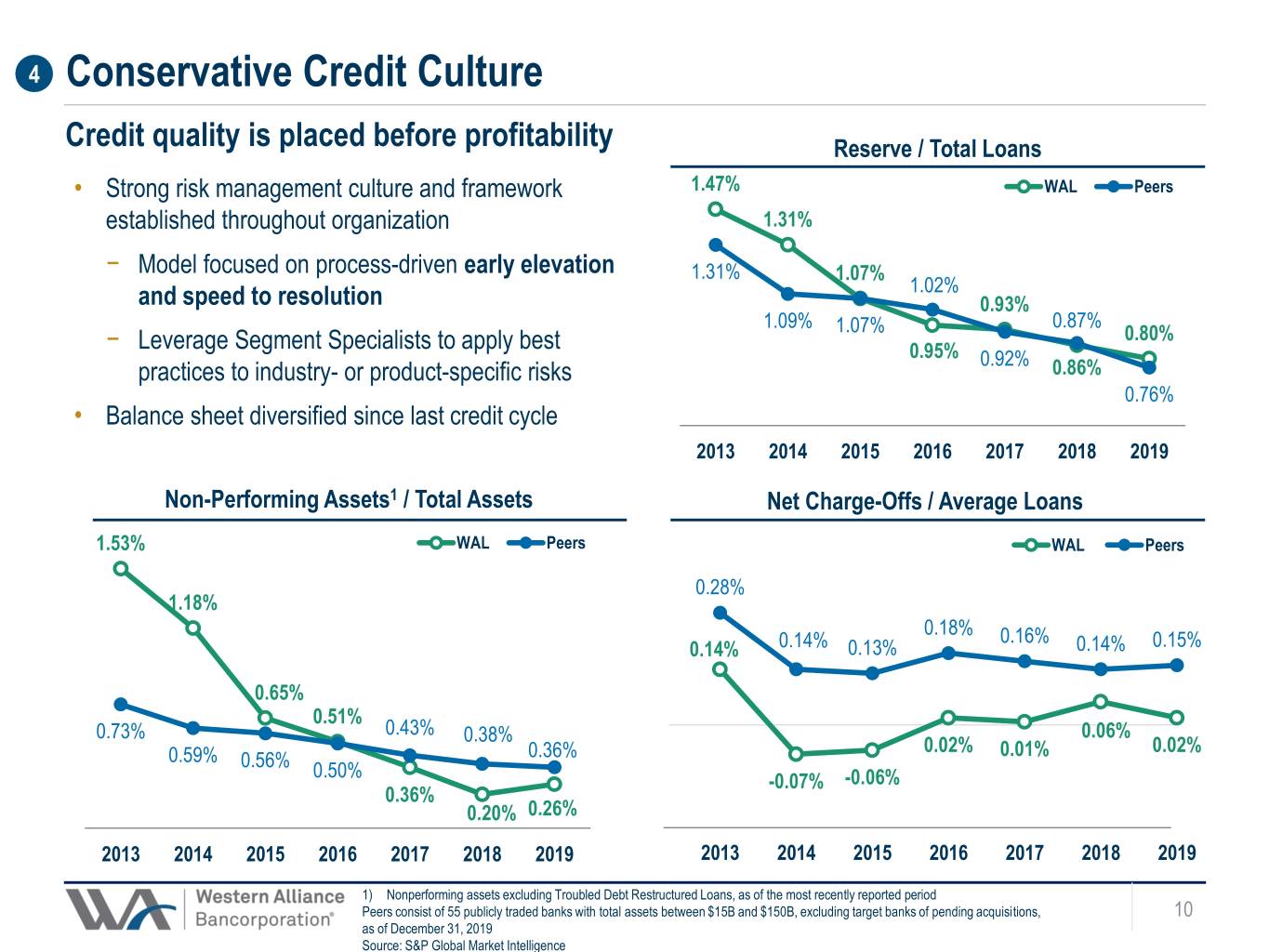

4 Conservative Credit Culture Credit quality is placed before profitability Reserve / Total Loans • Strong risk management culture and framework 1.47% WAL Peers established throughout organization 1.31% − Model focused on process-driven early elevation 1.31% 1.07% 1.02% and speed to resolution 0.93% 1.09% 1.07% 0.87% − Leverage Segment Specialists to apply best 0.80% 0.95% 0.92% practices to industry- or product-specific risks 0.86% 0.76% • Balance sheet diversified since last credit cycle 2013 2014 2015 2016 2017 2018 2019 Non-Performing Assets1 / Total Assets Net Charge-Offs / Average Loans 0.50% 1.53% WAL Peers WAL Peers 0.28% 1.18% 0.25% 0.18% 0.16% 0.14% 0.14% 0.13% 0.14% 0.15% 0.65% 0.51% 0.73% 0.43% 0.38% 0.00% 0.06% 0.59% 0.36% 0.02% 0.01% 0.02% 0.56% 0.50% -0.07% -0.06% 0.36% 0.20% 0.26% -0.25% 2013 2014 2015 2016 2017 2018 2019 2013 2014 2015 2016 2017 2018 2019 1) Nonperforming assets excluding Troubled Debt Restructured Loans, as of the most recently reported period Peers consist of 55 publicly traded banks with total assets between $15B and $150B, excluding target banks of pending acquisitions, 10 as of December 31, 2019 Source: S&P Global Market Intelligence

Asset Quality Stable Relative to Overall Balance Sheet Growth While loans have historically seen double digit growth, adversely graded loans and non- performance assets have been consistent Non-Performing Assets and Adversely Graded Assets as a Percentage of Total Assets $400 Over last 5 years, less than 1% of Special 4.3% Mention loans have migrated to loss 1.4% $312 3.1% $353 2.5% $343 1.4% 2.1% $355 1.9% $316 $341 1.4% 1.3% 0.8% 0.7% 0.3% 0.7% 0.2% 0.1% 2013 2014 2015 2016 2017 2018 2019 OREO NPLs Classified Accruing Loans Special Mention Loans Dollars in millions Accruing TDRs total $28.4mm; Amounts are net of total PCI credit and interest rate discounts of $4.4 million as of December 31, 2019 11

Hotel Franchise Finance Structured for Superior Through-Cycle Performance Financial flexibility is maximized through deep industry expertise, strong operating partners, and conservative underwriting structure • As of 12/31/2019, Hotel Franchise Finance portfolio 2 Conservative underwriting provides meaningful was 9.1% ($1.93bn) of loan portfolio cash flow cushion; focused on Loan-to-Cost • Focused on “select-service” sub-segment, which • WA LTV: 60.7% demonstrates superior through-cycle performance • WA Debt Service Coverage: 1.9x − Minimal restaurant and conference facilities • WA Debt Yield: 11.3% − Mid-30% margins allow financial flexibility • Structure provides for re-margining based on • Acquired GE Capital’s $1.4Bn US select-service declining cash flow covenant Hotel Franchise Finance business in Apr-16 • Do not finance convention centers From 2007-2Q15, GE experienced avg. loss rate of 0.6% ($52MM cum. losses) 3 Sophisticated sponsors with significant invested equity and resources to support 1 Partner with experienced hotel operators with top operations franchisor flags • 72% of commitments to Select Service and Extended 4 Geographically diversified in top national Stay hotels markets assessed on economic stability • Avg. balance per hotel of $10.6MM • 52% of commitments in the top 25 MSAs and 68% • 86% with top three franchisors (Marriott, Hilton, IHG) in the top 50 MSAs • Healthy average RevPAR Index of 115% over the • Commitments in 36 states and 77.1% outside of last 15 quarters1 WAL’s existing state footprint (AZ, CA, NV) 1) Measured on a TTM basis 12

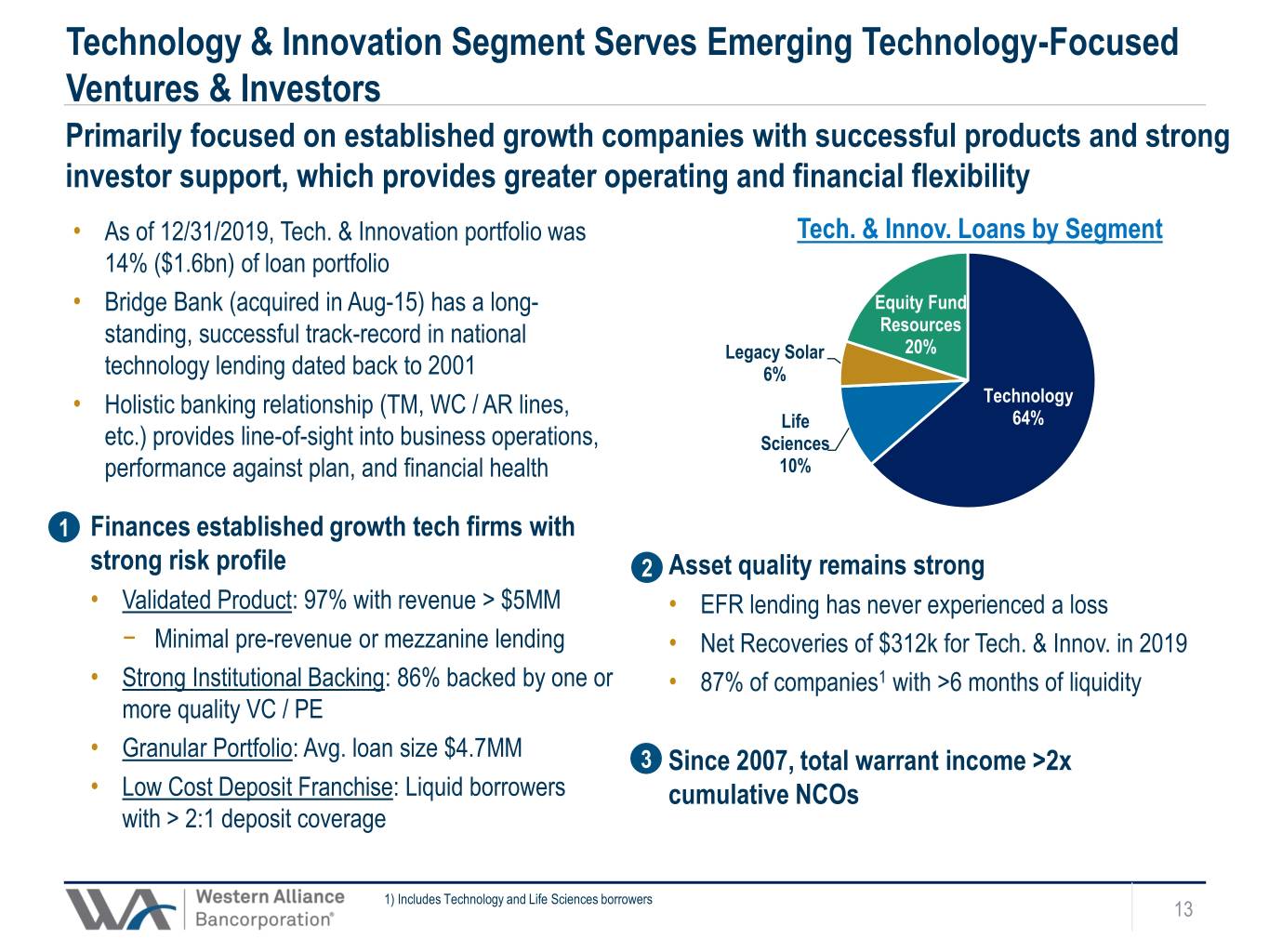

Technology & Innovation Segment Serves Emerging Technology-Focused Ventures & Investors Primarily focused on established growth companies with successful products and strong investor support, which provides greater operating and financial flexibility • As of 12/31/2019, Tech. & Innovation portfolio was Tech. & Innov. Loans by Segment 14% ($1.6bn) of loan portfolio • Bridge Bank (acquired in Aug-15) has a long- Equity Fund standing, successful track-record in national Resources Legacy Solar 20% technology lending dated back to 2001 6% • Holistic banking relationship (TM, WC / AR lines, Technology Life 64% etc.) provides line-of-sight into business operations, Sciences performance against plan, and financial health 10% 1 Finances established growth tech firms with strong risk profile 2 Asset quality remains strong • Validated Product: 97% with revenue > $5MM • EFR lending has never experienced a loss − Minimal pre-revenue or mezzanine lending • Net Recoveries of $312k for Tech. & Innov. in 2019 • Strong Institutional Backing: 86% backed by one or • 87% of companies1 with >6 months of liquidity more quality VC / PE • Granular Portfolio: Avg. loan size $4.7MM 3 Since 2007, total warrant income >2x • Low Cost Deposit Franchise: Liquid borrowers cumulative NCOs with > 2:1 deposit coverage 1) Includes Technology and Life Sciences borrowers 13

5 Top Decile Efficiency Produces Strong Operating Leverage Track record of simultaneously driving industry-leading growth and efficiency • Continued focus on expense management, while investing in growth initiatives and scalable infrastructure to be a leading nationwide banking platform 65.0% 63.2% 60.9% 60.9% 59.2% 60.0% 57.2% 55.5% 55.2% 55.0% 52.1% 50.0% 47.4% 45.2% 45.0% 43.2% 43.0% 43.2% 41.5% 40.0% 2013 2014 2015 2016 2017 2018 2019 WAL Peers Efficiency ratio for WAL and Peers as calculated and reported by SNL Financial / S&P Global Market Intelligence Peers consist of 55 publicly traded banks with total assets between $15B and $150B, excluding target banks of pending acquisitions, as of December 31, 2019; Source: S&P Global Market Intelligence 14

6 Shareholder-Focused Capital Management WAL consistently generates more capital than needed to support organic growth • Endeavor to provide superior total shareholder return without Growth in TBV per Share curtailing growth • Strong returns bolster capital above peers WAL • Under a share repurchase plan announced in Q4’18, WAL WAL with Dividends Added Back opportunistically repurchased 3.7mm shares or 3.5% of Peer Avg 243% outstanding shares Peer Avg with Dividends Added Back • The Board has authorized a share repurchase plan for 2020 237% of up to $250 million • Initiated $0.25 quarterly dividend in 3Q19 • Disciplined M&A appetite Robust Capital Levels 10.6% 10.3% 94% 9.0% 8.8% 69% 8.5% 7.4% 2013 2014 2015 2016 2017 2018 2019 Q4 2013 Q4 2014 Q4 2015 Q4 2016 Q4 2017 Q4 2018 Q4 2019 CET1 TCE Peer TCE Note: CET1 for 2013 and 2014 represents Tier 1 Common Equity Basel I Peers consist of 55 major exchange traded banks with total assets between $15B and $150B as of December 31, 2019, excluding 15 target banks of pending acquisitions; S&P Global Market Intelligence

Sound Balance Sheet Well-Positioned for the Future Strategic positioning supports ongoing versatility of business model • Net charge-offs bottom • Loan growth funded through quartile versus peers core deposits • Strategic balance sheet • $6.8Bn in unused borrowing reallocation towards low capacity (correspondent LTV residential real High- Strong banks, FHLB & FRB) estate Quality Liquidity • $2.5Bn unpledged Assets Access marketable securities Significant Robust • TCE / TA 110 bps higher • Leading ROA and than peer median Capital Cash Operating PPNR ROA • TBV per share grown 3x Levels Generation • Top decile ROATCE peer group • High operating leverage • Strong regulatory capital • Total RBC: 12.8% • CET1: 10.6% Note: Peers consist of 55 major exchange traded banks with total assets between $15B and $150B as of December 31, 2019, excluding target banks of pending acquisitions; S&P Global Market Intelligence 16

7 Seasoned and Invested Leadership Team Management averages 27+ years of industry experience. Insider ownership of ~8% Kenneth A. Vecchione Dale M. Gibbons Chief Executive Officer Vice Chairman, Chief Financial Officer 12 total years at WAL 16 years at WAL 35+ years experience, including 30+ years in commercial banking senior positions in financial services • Appointed CEO in April 2018 • Ranked #1 Best CFO overall, among Mid-cap and • Has served on Western Alliance Board of Directors since Small-cap banks, by Institutional Investor magazine 2007 and was WAL’s COO from 2010 – 2013 (2017 & 2018) • Previously, served in senior leadership positions at • CFO and Secretary of the Board at Zions MBNA Corp., Apollo Global Management, and Citi card Bancorporation (1996 – 2001) services Timothy Bruckner Robert McAuslan Executive Vice President, Chief Credit Officer Chairman of Senior Loan Committee 3 years at WAL 7 years at WAL 15+ years in senior credit administration 25+ years in senior credit administration • Previously, served as Managing Director of Arizona • Previously, served as Chief Credit Officer of WAL from Commercial Banking at BMO Harris Bank and as a Senior Feb 2011 – March 2019 Vice President in a variety of divisions including Manager of • Senior Credit Executive for western U.S. markets with the Special Assets Division, President of M&I Business Mutual of Omaha Bank and EVP, Senior Credit Officer Credit and President of M&I Equipment Finance for western U.S. markets for BBVA / Compass Bank 17

Top Performing Bank with a Discounted Multiple WAL has experienced 17 consecutive quarters of EPS stability and growth • In addition to industry-leading growth, WAL produces top decile profitability amongst the Top 50 Banks1 Quarterly EPS & Stock Price WAL Rank Metric 3.0x WAL Stock Price Total Assets 45th $26.8Bn $1.25 Quarterly EPS Net Income 27th $499mm 2.5x 5 Year EPS CAGR 7th 23.7% 2.0x ROAA 1st 2.0% 1.5x ROAE 2nd 17.5% Net Interest Margin 3rd 4.52% 1.0x th 0.7x Efficiency Ratio 6 43.2% 0.5x $39.61 Tangible Common Equity / 5th 10.3% $0.33 Tangible Assets 0.0x th $23.86 Net Charge-Offs / Avg. Loans 4 0.02% -0.5x th 12/13 12/14 12/15 12/16 12/17 12/18 12/19 ALLL / Gross Loans 28 0.80% Price / 2020 Est EPS 38th 7.8x 1) Top 50 Banks headquartered in the US by assets as of December 31, 2019, assets pro forma for pending acquisitions Market data as of March 6, 2020 Source: Median consensus estimates, S&P Global 18

Historical Valuation Multiples P / LTM EPS 23.0x WAL Peers 21.0x 19.0x 17.0x 15.0x 13.0x 11.0x 10.3x 9.0x 8.2x 7.0x 12/31/13 6/30/14 12/31/14 6/30/15 12/31/15 6/30/16 12/31/16 6/30/17 12/31/17 6/30/18 12/31/18 6/30/19 12/31/19 375% P / TBV 350% WAL Peers 325% 300% 275% 250% 225% 200% 175% 150% 149% 139% 125% 12/31/13 6/30/14 12/31/14 6/30/15 12/31/15 6/30/16 12/31/16 6/30/17 12/31/17 6/30/18 12/31/18 6/30/19 12/31/19 Note: Peers consist of 55 publicly traded banks with total assets between $15B and $150B, excluding target banks of pending acquisitions, as of December 31, 2019; S&P Global Market Intelligence Market data as of March 6, 2020 19

Forward-looking Statements This presentation contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding our expectations with regard to our business, financial and operating results, and future economic performance. The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 as filed with the Securities and Exchange Commission; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance for credit losses; legislative or regulatory changes or changes in accounting principles, policies, or guidelines; supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion through acquisitions; additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; and other factors affecting the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We do not intend to have and disclaim any duty or obligation to update or revise any industry information or forward- looking statements, whether written or oral, that may be made from time to time, set forth in this presentation to reflect new information, future events or otherwise. Non-GAAP Financial Measures This presentation contains both financial measures based on accounting principles generally accepted in the United States (“GAAP”) and non- GAAP based financial measures, which are used where management believes them to be helpful in understanding the Company’s results of operations or financial position. Reconciliations of these non-GAAP financial measures to the most comparable GAAP measures are included in the Company’s earnings release available in the Investor Relations portion of the Company’s website at http://investors.westernalliancebancorporation.com. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. 20