Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Covia Holdings Corp | cvia-ex991_32.htm |

| 8-K - 8-K - Covia Holdings Corp | cvia-8k_20200310.htm |

Fourth Quarter 2019 Earnings Presentation March 10, 2020 NYSE: CVIA Exhibit 99.2

Forward Looking Statements Forward-Looking Statements This presentation contains forward-looking statements intended to qualify for the protection of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “estimate,” “expect,” “objective,” “goal,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “may,” “target,” “forecast,” “guidance,” “outlook” and similar expressions generally identify forward-looking statements. Similarly, descriptions of the Company’s objectives, strategies, plans, goals or targets are also forward-looking statements. Forward-looking statements are based upon management’s then-current views and assumptions regarding future events and operating performance that may ultimately prove to be inaccurate. Although management believes the expectations expressed in forward-looking statements are based on reasonable assumptions within the bounds of its knowledge, forward-looking statements involve risks, uncertainties and other factors which may materially affect the Company’s business, financial condition, results of operations or liquidity. Forward-looking statements are not guarantees of future performance and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including, but not limited to, the risks discussed in the Risk Factors section of the Company’s Annual Report on Form 10-K as filed with the Securities and Exchange Commission (“SEC”) on March 22, 2019; and the other factors discussed from time to time in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC. This release should be read in conjunction with such filings, and you should consider all of such risks, uncertainties and other factors carefully in evaluating forward-looking statements. Pro Forma Information and Non-GAAP Financial Measures This presentation includes pro forma financial results which include the combined results of operations for Fairmount Santrol and Unimin for periods preceding the June 1, 2018 merger. This presentation also includes non-GAAP financial measures, including segment contribution margin, EBITDA, adjusted EBITDA and other measures identified as “adjusted” results. Please refer to the Appendix for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Management believes this supplemental financial information enhances an investor’s understanding of Covia’s financial performance as it excludes those items which impact comparability of operating trends. The non-GAAP financial information should not be considered in isolation or viewed as a substitute for measures of performance calculated in accordance with GAAP, but should be viewed in addition to the results as reported by Covia. The inclusion of non-GAAP financial information as used in this presentation is not necessarily comparable to other similarly titled measures of other companies due to the potential inconsistencies in the method of presentation and items considered.

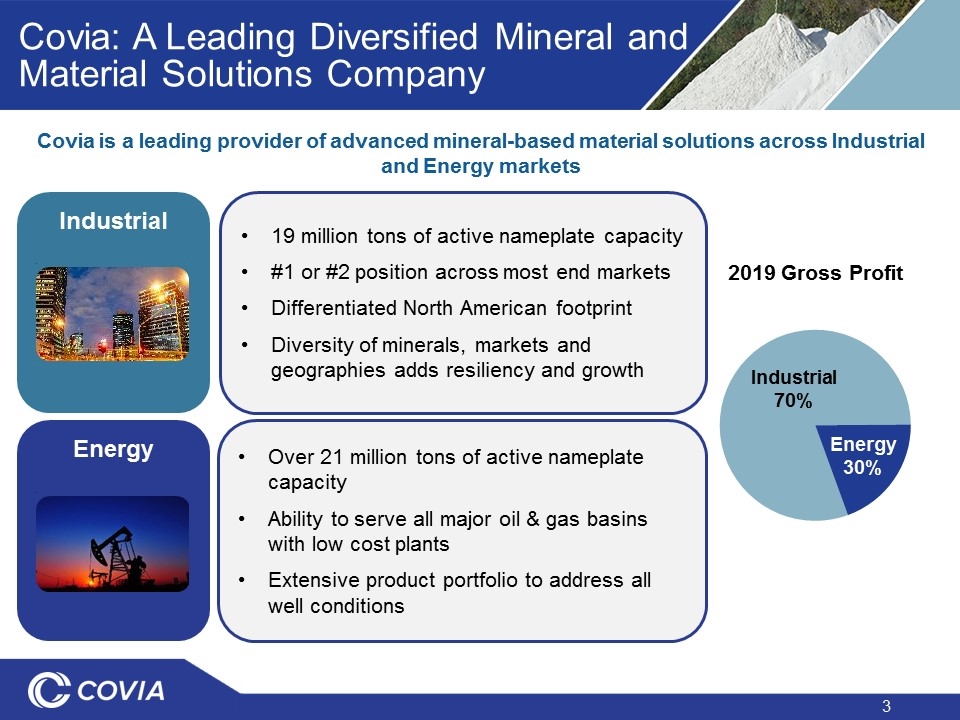

Covia: A Leading Diversified Mineral and Material Solutions Company Covia is a leading provider of advanced mineral-based material solutions across Industrial and Energy markets Energy Over 21 million tons of active nameplate capacity Ability to serve all major oil & gas basins with low cost plants Extensive product portfolio to address all well conditions Industrial 19 million tons of active nameplate capacity #1 or #2 position across most end markets Differentiated North American footprint Diversity of minerals, markets and geographies adds resiliency and growth Industrial 70% Energy 30% 2019 Gross Profit

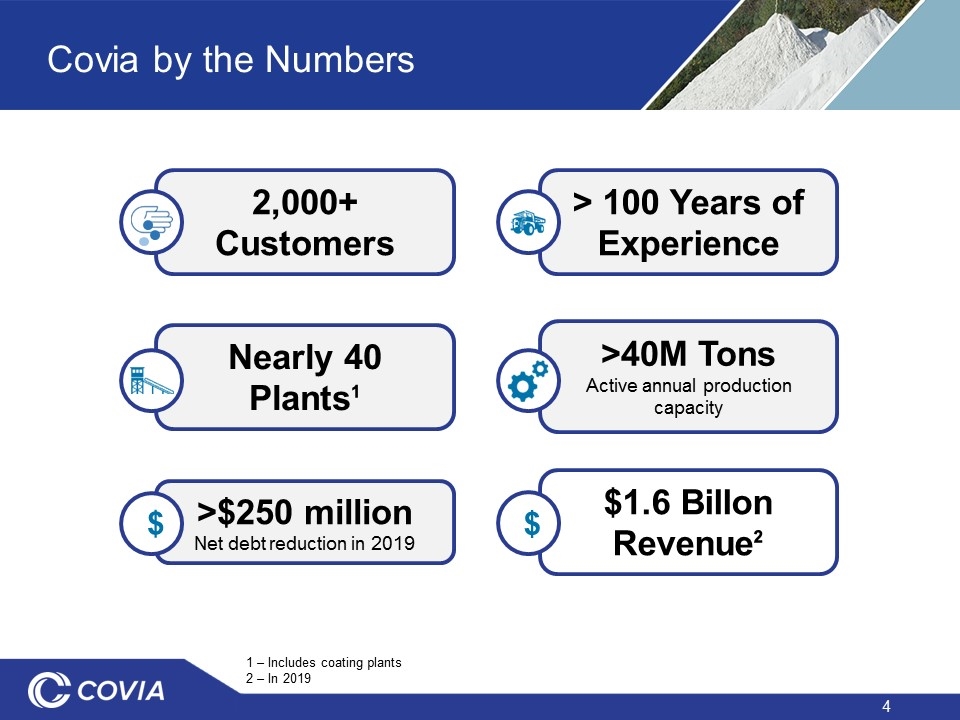

Covia by the Numbers 2,000+ Customers Nearly 40 Plants¹ > 100 Years of Experience >40M Tons Active annual production capacity $1.6 Billon Revenue² 1 – Includes coating plants 2 – In 2019 >$250 million Net debt reduction in 2019 $ $

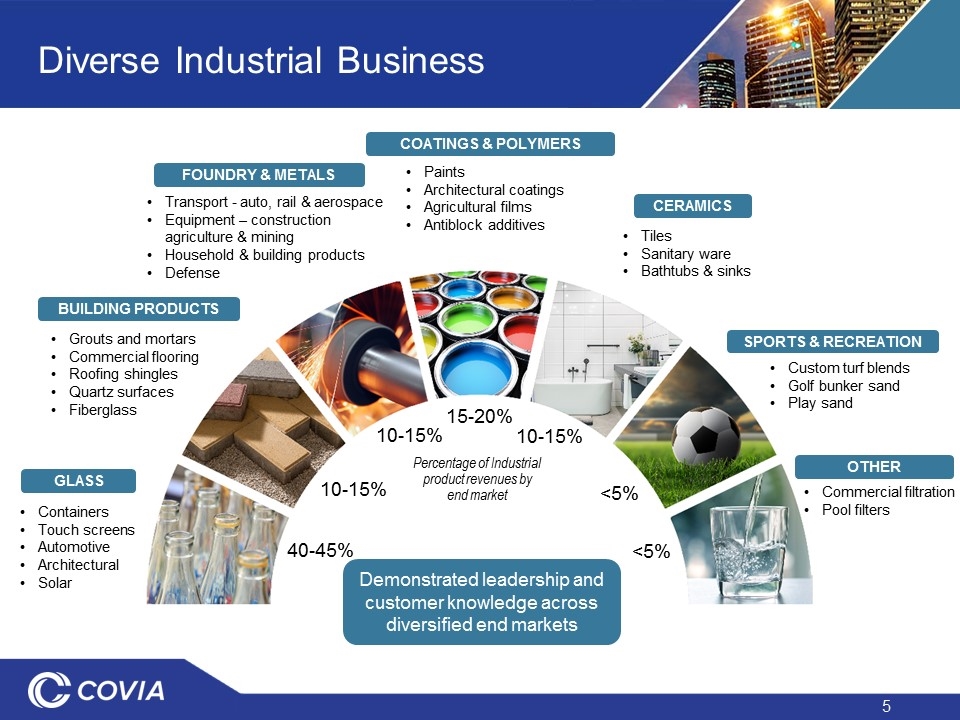

Diverse Industrial Business Containers Touch screens Automotive Architectural Solar Tiles Sanitary ware Bathtubs & sinks Demonstrated leadership and customer knowledge across diversified end markets Grouts and mortars Commercial flooring Roofing shingles Quartz surfaces Fiberglass Transport - auto, rail & aerospace Equipment – construction agriculture & mining Household & building products Defense Paints Architectural coatings Agricultural films Antiblock additives Custom turf blends Golf bunker sand Play sand Commercial filtration Pool filters GLASS BUILDING PRODUCTS FOUNDRY & METALS COATINGS & POLYMERS SPORTS & RECREATION OTHER CERAMICS 15-20% 10-15% <5% Percentage of Industrial product revenues by end market <5% 10-15% 10-15% 40-45%

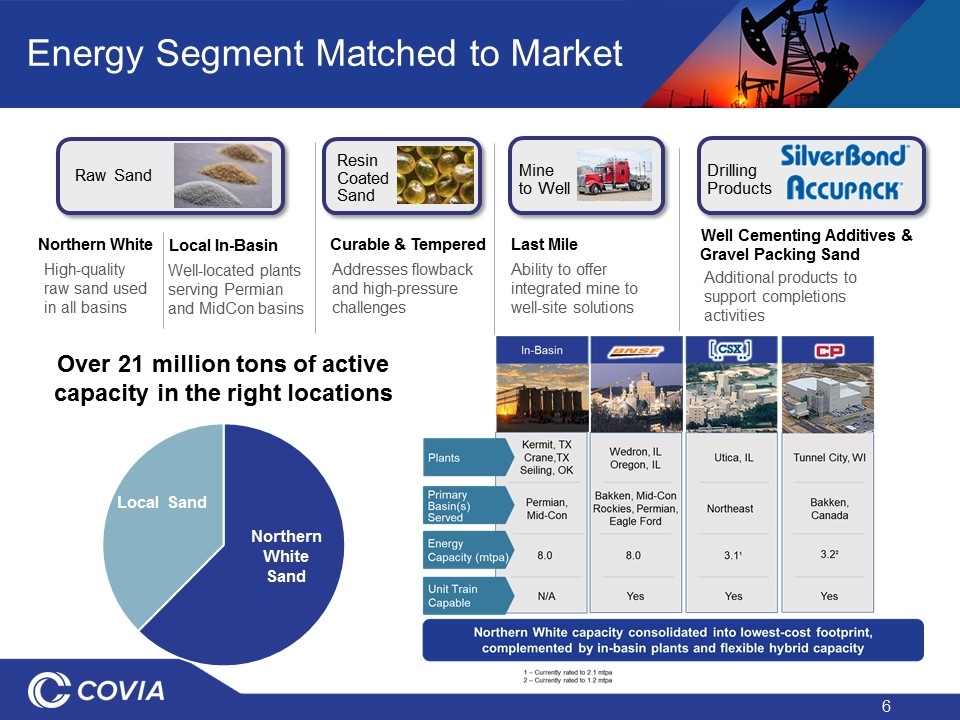

Size and Scale Local In-Basin Northern White Curable & Tempered Well Cementing Additives & Gravel Packing Sand Energy Segment Matched to Market Raw Sand Resin Coated Sand Drilling Products Well-located plants serving Permian and MidCon basins High-quality raw sand used in all basins Addresses flowback and high-pressure challenges Additional products to support completions activities Mine to Well Last Mile Ability to offer integrated mine to well-site solutions Over 21 million tons of active capacity in the right locations

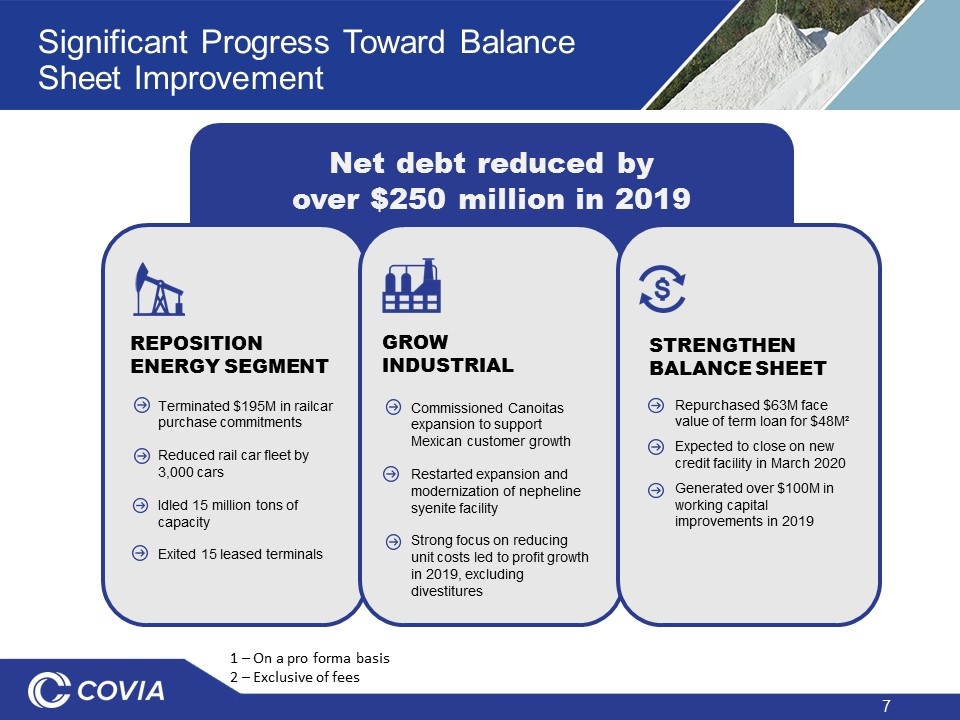

Net debt reduced by over $250 million in 2019 Significant Progress Toward Balance Sheet Improvement Strengthen Balance Sheet 1 – On a pro forma basis 2 – Exclusive of fees Repurchased $63M face value of term loan for $48M² Expected to close on new credit facility in March 2020 Generated over $100M in working capital improvements in 2019 Terminated $195M in railcar purchase commitments Reduced rail car fleet by 3,000 cars Idled 15 million tons of capacity Exited 15 leased terminals REPOSITION Energy Segment Grow Industrial Commissioned Canoitas expansion to support Mexican customer growth Restarted expansion and modernization of nepheline syenite facility Strong focus on reducing unit costs led to profit growth in 2019, excluding divestitures

Nepheline Syenite Expansion and Modernization Project Overview Modernization and expansion of the only facility of its kind in North America Facility built in 1935 Expands capabilities to serve coating & polymers end markets and creates highly efficiency modern facility Status Approximately $45M spent to date Project resumed in 4Q 2019 $20M to $25M to be spent in 2020 $20M to $25M to be spent in 2021, with completion by mid-year Key Industrial Projects Canoitas, Mexico Expansion Project Overview 350k ton expansion of silica annual production capacity Project fueled by customers’ growth in Mexico Status Completed in 4Q 2019 Primary end market Glass

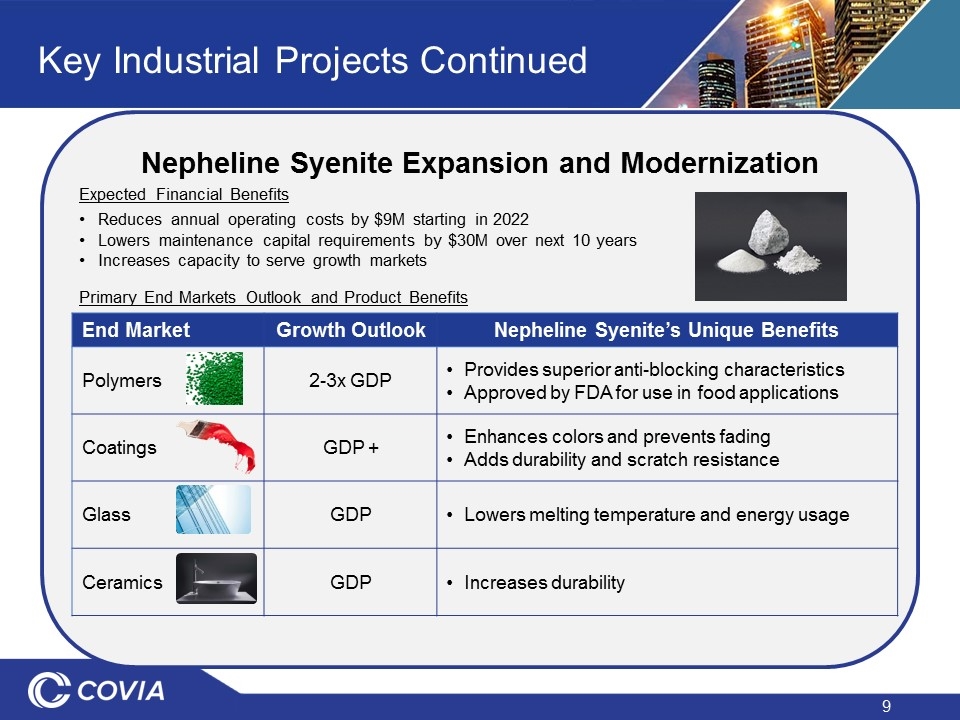

Nepheline Syenite Expansion and Modernization Expected Financial Benefits Reduces annual operating costs by $9M starting in 2022 Lowers maintenance capital requirements by $30M over next 10 years Increases capacity to serve growth markets Primary End Markets Outlook and Product Benefits Key Industrial Projects Continued End Market Growth Outlook Nepheline Syenite’s Unique Benefits Polymers 2-3x GDP Provides superior anti-blocking characteristics Approved by FDA for use in food applications Coatings GDP + Enhances colors and prevents fading Adds durability and scratch resistance Glass GDP Lowers melting temperature and energy usage Ceramics GDP Increases durability

Financial Transition Slide FINANCIALS and OUTLOOK

Quarter Highlights Fourth Quarter and Full-Year 19 Highlights Generated cash flow from operating activities of $35 million in Q4 and $104 million in 2019 Reduced net debt by $256 million in 2019 Completed Canoitas, Mexico expansion in Q4 Terminated $195 million railcar purchase commitment Received commitment for $75 million receivables-backed credit facility 2017 Q3 18 LTM

Fourth Quarter 2019 Results In millions Industrial Energy Total Company Volumes (tons) 3.2 3.3 6.6 Revenue $161.4 $151.9 $313.3 Gross Profit $46.4 $(12.5)¹ $33.9¹ Contribution Margin $46.4 $1.7¹ $48.1¹ SG&A -- -- $37.4² Adjusted EBITDA -- -- $0.1 1 - Includes negative impact of $1.9 mm lease expense from lease accounting standard change 2 – Includes $1.7 million in non-cash stock compensation expenses

Full Year 2019 Results In millions Industrial Energy Total Company Volumes (tons) 14.0 16.5 30.5 Revenue $732.6 $862.9 $1,595.4 Gross Profit $222.2 $54.1¹ $276.3¹ Contribution Margin $222.2 $89.2¹ $311.4¹ SG&A -- -- $153.6 Adjusted EBITDA -- -- $143.0 1 - Includes negative impact of $7.9 mm lease expense from lease accounting standard change 2 – Includes $10.0 million in non-cash stock compensation expenses

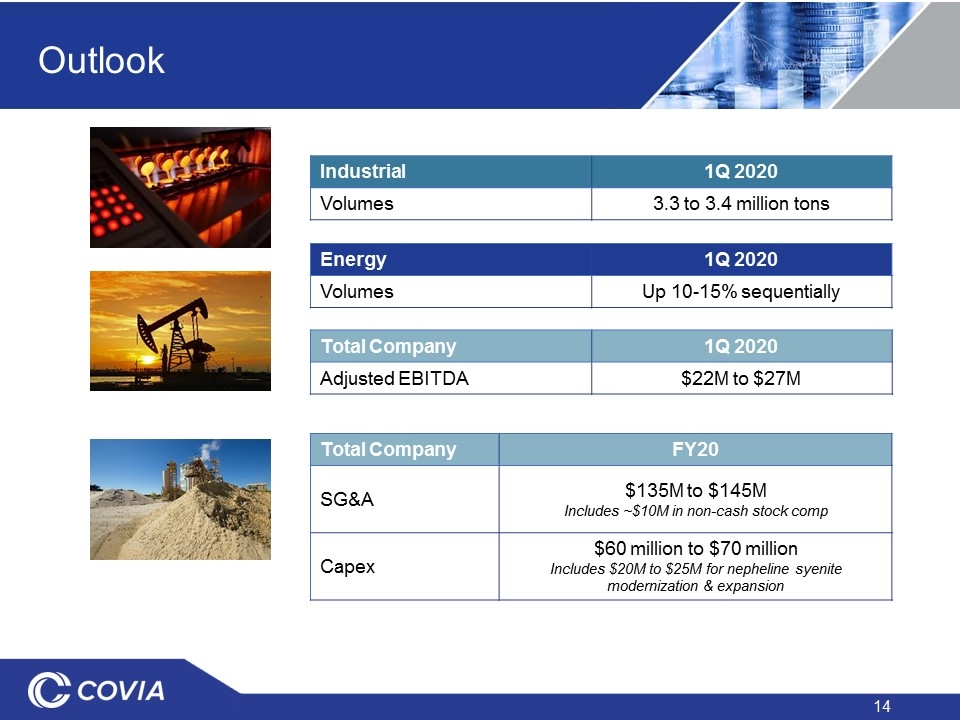

Outlook Industrial 1Q 2020 Volumes 3.3 to 3.4 million tons Energy 1Q 2020 Volumes Up 10-15% sequentially Total Company FY20 SG&A $135M to $145M Includes ~$10M in non-cash stock comp Capex $60 million to $70 million Includes $20M to $25M for nepheline syenite modernization & expansion Total Company 1Q 2020 Adjusted EBITDA $22M to $27M

Appendix

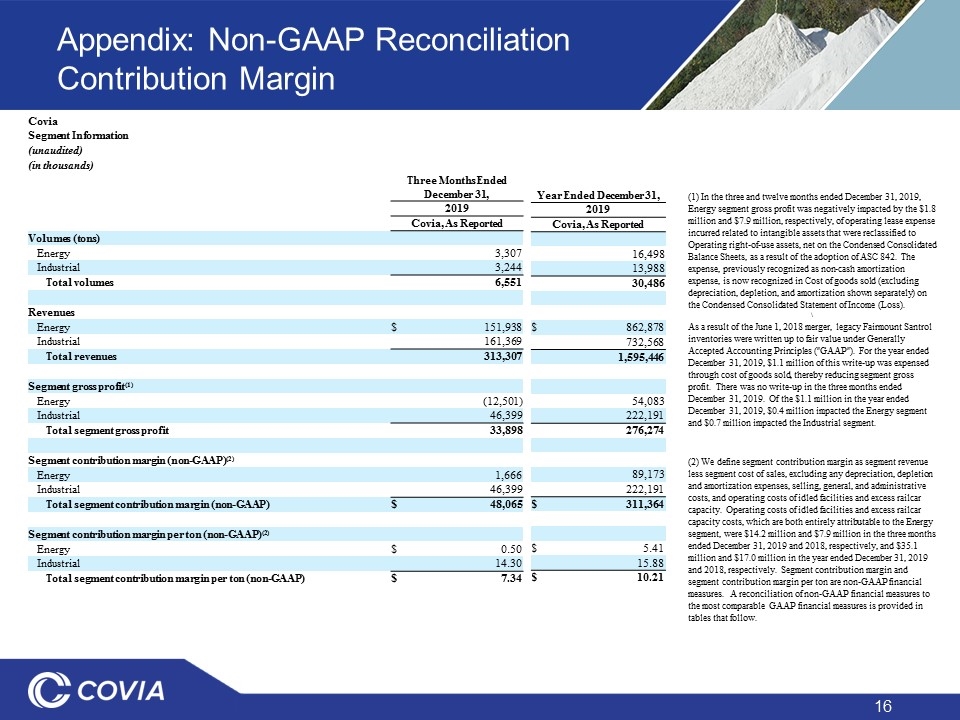

Appendix: Non-GAAP Reconciliation Contribution Margin Covia Segment Information (unaudited) (in thousands) Three Months Ended December 31, 2019 Covia, As Reported Volumes (tons) Energy 3,307 Industrial 3,244 Total volumes 6,551 Revenues Energy $ 151,938 Industrial 161,369 Total revenues 313,307 Segment gross profit(1) Energy (12,501) Industrial 46,399 Total segment gross profit 33,898 Segment contribution margin (non-GAAP)(2) Energy 1,666 Industrial 46,399 Total segment contribution margin (non-GAAP) $ 48,065 Segment contribution margin per ton (non-GAAP)(2) Energy $ 0.50 Industrial 14.30 Total segment contribution margin per ton (non-GAAP) $ 7.34 (1) In the three and twelve months ended December 31, 2019, Energy segment gross profit was negatively impacted by the $1.8 million and $7.9 million, respectively, of operating lease expense incurred related to intangible assets that were reclassified to Operating right-of-use assets, net on the Condensed Consolidated Balance Sheets, as a result of the adoption of ASC 842. The expense, previously recognized as non-cash amortization expense, is now recognized in Cost of goods sold (excluding depreciation, depletion, and amortization shown separately) on the Condensed Consolidated Statement of Income (Loss). \ As a result of the June 1, 2018 merger, legacy Fairmount Santrol inventories were written up to fair value under Generally Accepted Accounting Principles ("GAAP"). For the year ended December 31, 2019, $1.1 million of this write-up was expensed through cost of goods sold, thereby reducing segment gross profit. There was no write-up in the three months ended December 31, 2019. Of the $1.1 million in the year ended December 31, 2019, $0.4 million impacted the Energy segment and $0.7 million impacted the Industrial segment. (2) We define segment contribution margin as segment revenue less segment cost of sales, excluding any depreciation, depletion and amortization expenses, selling, general, and administrative costs, and operating costs of idled facilities and excess railcar capacity. Operating costs of idled facilities and excess railcar capacity costs, which are both entirely attributable to the Energy segment, were $14.2 million and $7.9 million in the three months ended December 31, 2019 and 2018, respectively, and $35.1 million and $17.0 million in the year ended December 31, 2019 and 2018, respectively. Segment contribution margin and segment contribution margin per ton are non-GAAP financial measures. A reconciliation of non-GAAP financial measures to the most comparable GAAP financial measures is provided in tables that follow. Year Ended December 31, 2019 Covia, As Reported 16,498 13,988 30,486 $ 862,878 732,568 1,595,446 54,083 222,191 276,274 89,173 222,191 $ 311,364 $ 5.41 15.88 $ 10.21

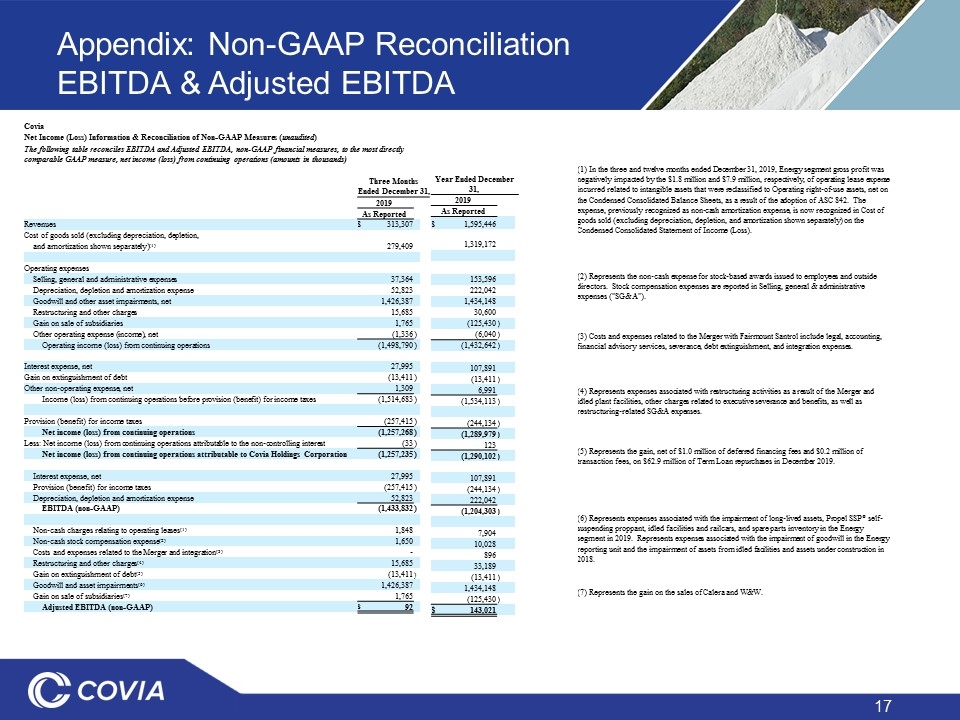

Appendix: Non-GAAP Reconciliation EBITDA & Adjusted EBITDA Covia Net Income (Loss) Information & Reconciliation of Non-GAAP Measures (unaudited) The following table reconciles EBITDA and Adjusted EBITDA, non-GAAP financial measures, to the most directly comparable GAAP measure, net income (loss) from continuing operations (amounts in thousands) Three Months Ended December 31, 2019 As Reported Revenues $ 313,307 Cost of goods sold (excluding depreciation, depletion, and amortization shown separately)(1) 279,409 Operating expenses Selling, general and administrative expenses 37,364 Depreciation, depletion and amortization expense 52,823 Goodwill and other asset impairments, net 1,426,387 Restructuring and other charges 15,685 Gain on sale of subsidiaries 1,765 Other operating expense (income), net (1,336 ) Operating income (loss) from continuing operations (1,498,790 ) Interest expense, net 27,995 Gain on extinguishment of debt (13,411 ) Other non-operating expense, net 1,309 Income (loss) from continuing operations before provision (benefit) for income taxes (1,514,683 ) Provision (benefit) for income taxes (257,415 ) Net income (loss) from continuing operations (1,257,268 ) Less: Net income (loss) from continuing operations attributable to the non-controlling interest (33 ) Net income (loss) from continuing operations attributable to Covia Holdings Corporation (1,257,235 ) Interest expense, net 27,995 Provision (benefit) for income taxes (257,415 ) Depreciation, depletion and amortization expense 52,823 EBITDA (non-GAAP) (1,433,832 ) Non-cash charges relating to operating leases(1) 1,848 Non-cash stock compensation expense(2) 1,650 Costs and expenses related to the Merger and integration(3) - Restructuring and other charges(4) 15,685 Gain on extinguishment of debt(5) (13,411 ) Goodwill and asset impairments(6) 1,426,387 Gain on sale of subsidiaries(7) 1,765 Adjusted EBITDA (non-GAAP) $ 92 Year Ended December 31, 2019 As Reported $ 1,595,446 1,319,172 153,596 222,042 1,434,148 30,600 (125,430 ) (6,040 ) (1,432,642 ) 107,891 (13,411 ) 6,991 (1,534,113 ) (244,134 ) (1,289,979 ) 123 (1,290,102 ) 107,891 (244,134 ) 222,042 (1,204,303 ) 7,904 10,028 896 33,189 (13,411 ) 1,434,148 (125,430 ) $ 143,021 (1) In the three and twelve months ended December 31, 2019, Energy segment gross profit was negatively impacted by the $1.8 million and $7.9 million, respectively, of operating lease expense incurred related to intangible assets that were reclassified to Operating right-of-use assets, net on the Condensed Consolidated Balance Sheets, as a result of the adoption of ASC 842. The expense, previously recognized as non-cash amortization expense, is now recognized in Cost of goods sold (excluding depreciation, depletion, and amortization shown separately) on the Condensed Consolidated Statement of Income (Loss). (2) Represents the non-cash expense for stock-based awards issued to employees and outside directors. Stock compensation expenses are reported in Selling, general & administrative expenses ("SG&A"). (3) Costs and expenses related to the Merger with Fairmount Santrol include legal, accounting, financial advisory services, severance, debt extinguishment, and integration expenses. (4) Represents expenses associated with restructuring activities as a result of the Merger and idled plant facilities, other charges related to executive severance and benefits, as well as restructuring-related SG&A expenses. (5) Represents the gain, net of $1.0 million of deferred financing fees and $0.2 million of transaction fees, on $62.9 million of Term Loan repurchases in December 2019. (6) Represents expenses associated with the impairment of long-lived assets, Propel SSP® self-suspending proppant, idled facilities and railcars, and spare parts inventory in the Energy segment in 2019. Represents expenses associated with the impairment of goodwill in the Energy reporting unit and the impairment of assets from idled facilities and assets under construction in 2018. (7) Represents the gain on the sales of Calera and W&W.

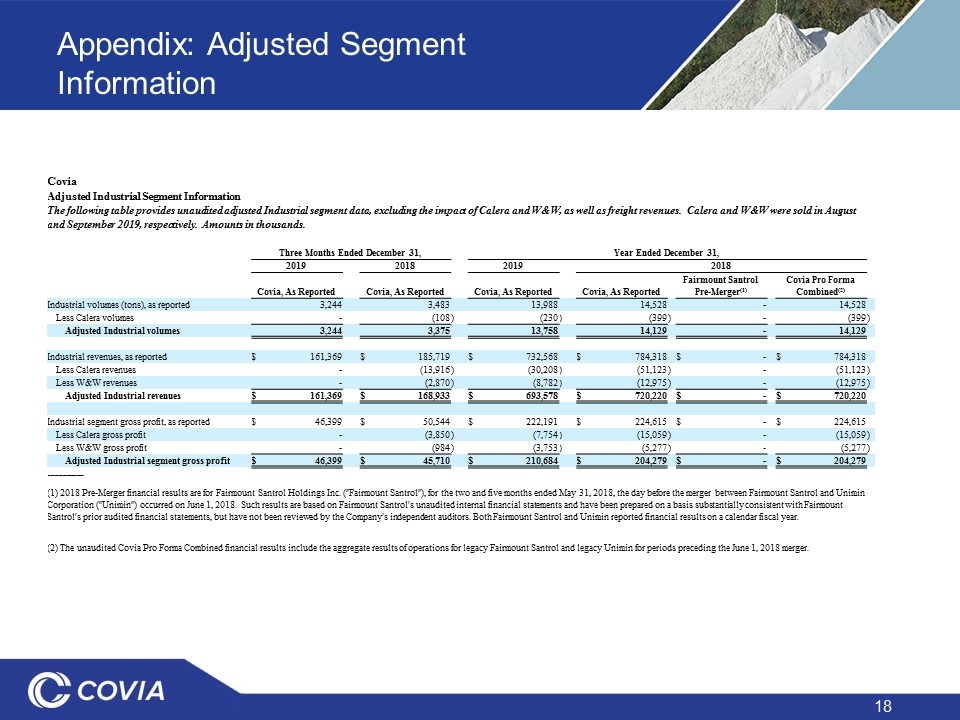

Appendix: Adjusted Segment Information Covia Adjusted Industrial Segment Information The following table provides unaudited adjusted Industrial segment data, excluding the impact of Calera and W&W, as well as freight revenues. Calera and W&W were sold in August and September 2019, respectively. Amounts in thousands. Three Months Ended December 31, Year Ended December 31, 2019 2018 2019 2018 Covia, As Reported Covia, As Reported Covia, As Reported Covia, As Reported Fairmount Santrol Pre-Merger(1) Covia Pro Forma Combined(2) Industrial volumes (tons), as reported 3,244 3,483 13,988 14,528 - 14,528 Less Calera volumes - (108 ) (230 ) (399 ) - (399 ) Adjusted Industrial volumes 3,244 3,375 13,758 14,129 - 14,129 Industrial revenues, as reported $ 161,369 $ 185,719 $ 732,568 $ 784,318 $ - $ 784,318 Less Calera revenues - (13,916 ) (30,208 ) (51,123 ) - (51,123 ) Less W&W revenues - (2,870 ) (8,782 ) (12,975 ) - (12,975 ) Adjusted Industrial revenues $ 161,369 $ 168,933 $ 693,578 $ 720,220 $ - $ 720,220 Industrial segment gross profit, as reported $ 46,399 $ 50,544 $ 222,191 $ 224,615 $ - $ 224,615 Less Calera gross profit - (3,850 ) (7,754 ) (15,059 ) - (15,059 ) Less W&W gross profit - (984 ) (3,753 ) (5,277 ) - (5,277 ) Adjusted Industrial segment gross profit $ 46,399 $ 45,710 $ 210,684 $ 204,279 $ - $ 204,279 __________ (1) 2018 Pre-Merger financial results are for Fairmount Santrol Holdings Inc. ("Fairmount Santrol"), for the two and five months ended May 31, 2018, the day before the merger between Fairmount Santrol and Unimin Corporation ("Unimin") occurred on June 1, 2018. Such results are based on Fairmount Santrol's unaudited internal financial statements and have been prepared on a basis substantially consistent with Fairmount Santrol's prior audited financial statements, but have not been reviewed by the Company's independent auditors. Both Fairmount Santrol and Unimin reported financial results on a calendar fiscal year. (2) The unaudited Covia Pro Forma Combined financial results include the aggregate results of operations for legacy Fairmount Santrol and legacy Unimin for periods preceding the June 1, 2018 merger.