Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMERICA INC /NEW/ | a2020rbcconference8-k.htm |

&RPHULFD,QFRUSRUDWHG 5%&&DSLWDO0DUNHWV)LQDQFLDO,QVWLWXWLRQV&RQIHUHQFH 0DUFK &XUW)DUPHU &KDLUPDQ3UHVLGHQW &(2 3HWH*XLOIRLOH-LP+HU]RJ3HWHU6HI]LN ([HFXWLYH9LFH3UHVLGHQW([HFXWLYH9LFH3UHVLGHQW ([HFXWLYH9LFH3UHVLGHQW &KLHI&UHGLW2IILFHU &KLHI)LQDQFLDO2IILFHU%XVLQHVV%DQN 6DIH+DUERU6WDWHPHQW Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on track,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences include credit risks (unfavorable developments concerning credit quality; declines or other changes in the businesses or industries of Comerica's customers; and changes in customer behavior); market risks (changes in monetary and fiscal policies; fluctuations in interest rates and their impact on deposit pricing; and transitions away from LIBOR towards new interest rate benchmarks); liquidity risks (Comerica's ability to maintain adequate sources of funding and liquidity; reductions in Comerica's credit rating; and the interdependence of financial service companies); technology risks (cybersecurity risks and heightened legislative and regulatory focus on cybersecurity and data privacy); operational risks (operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; the impact of legal and regulatory proceedings or determinations; losses due to fraud; and controls and procedures failures); compliance risks (changes in regulation or oversight; the effects of stringent capital requirements; and the impacts of future legislative, administrative or judicial changes to tax regulations); financial reporting risks (changes in accounting standards and the critical nature of Comerica's accounting policies); strategic risks (damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the implementation of Comerica's strategies and business initiatives; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; and any future strategic acquisitions or divestitures); and other general risks (changes in general economic, political or industry conditions; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events; and the volatility of Comerica’s stock price). Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2019. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

.H\6WUHQJWKV Well positioned to manage through cycles $/($',1*%$1.)25%86,1(66 !

5HWXUQRQ(TXLW\ RIORDQVDUH 'HHSH[SHUWLVHLQVSHFLDOW\EXVLQHVVHV

)<

,QSHUFHQWDJHSRLQWV

&RPPHUFLDOOHQGHU

RIWRWDOORDQV

FRPPHUFLDO &RPSOHPHQWHGE\5HWDLO%DQN Peer Average 11.27 :HDOWK0DQDJHPHQW 16.39 5(/$7,216+,3%$1.,1*675$7(*< 13.02 12.91 12.80 12.34 RIGHSRVLWVDUH 12.10 11.14 11.14 10.89 10.64 9.60 /RQJWHQXUHGHPSOR\HHV QRQLQWHUHVW 10.07 8.45 :LGHDUUD\RIEDQNLQJSURGXFWV VHUYLFHV EHDULQJ \HDUKLVWRU\ *52:7+23325781,7,(6 RF CFR FHN SNV KEY CFG MTB FITB CMA ZION BOKF 1LPEOH$VVHW6L]HRI% DYHUDJHORDQ HBAN 3RVLWLRQHGLQJURZLQJPDUNHWV LQGXVWULHV JURZWK +,*+/<()),&,(17 5HWXUQRQ$VVHWV

)<

,QSHUFHQWDJHSRLQWV

/HYHUDJLQJWHFKQRORJ\ HIILFLHQF\UDWLR 'LVFLSOLQHGH[SHQVHPDQDJHPHQW Peer Average 1.27 1.68 1.61 62/,'&5(',70(75,&6 1.53 ESV 1.36 1.31 &RQVHUYDWLYHXQGHUZULWLQJ 13$/RDQV 1.26 1.20 1.19 1.19 1.17 1.10 'LYHUVHSRUWIROLR 1.08 67521*&$3,7$/ 6XSSRUWVIXWXUHJURZWK RF FHN SNV KEY CFR CFG MTB &(7 FITB CMA ZION BOKF 5HGXFHGVKDUHFRXQWE\ HBAN 12/31/19 unless otherwise noted; comparisons shown 2019 vs. 2018 Ⴠ 1Source for peer data: S&P Global Market Intelligence; based on 12/31/19 regulatory data for domestic financial holding companies using C&I loans Ⴠ 2Return on average common shareholders’ equity 3 )LQDQFLDO3HUIRUPDQFH Strong results position us well for the future 5HFRUG5HYHQXH (IILFLHQF\5DWLR 5HFRUG(36

LQPLOOLRQV

$7.87 68% $7.20 3,168 3,328 3,349 2,848 59% 54% 52% $4.14 $2.68 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 5HWXUQRQ$VVHWV 5HWXUQRQ(TXLW\ 5HFRUG%RRN9DOXH $51.57 15.82% 16.39% $46.07 $46.89 1.75% 1.68% $44.47 1.04% 9.34% 0.67% 6.22% 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & a derivative contract tied to the conversion rate of Visa Class B shares Ⴠ EPS: diluted earnings per share Ⴠ 3Return on average common shareholders’ equity Average common shareholders’ equity per share Ⴠ 4

)LUVW4XDUWHU/RDQ8SGDWH Headwinds: Mortgage Banker seasonality & National Dealer auto inventory levels -DQXDU\ )HEUXDU\7UHQGV 0RUWJDJH%DQNHU

LQELOOLRQV

$YHUDJH

LQELOOLRQV

$YHUDJH

MBA Mortgage Origination Volumes2 800 51.0 50.9 50.5 700 49.7 49.0 600 2.5 2.7 500 400 2.0 2.0 1.9 1.8 1.7 300 1.4 1.3 200 100 0 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 thru 2/29 'HDOHU)ORRU3ODQ

LQELOOLRQV

3HULRGHQG

1Q19 2Q19 3Q19 4Q19 1Q20 thru 2/29 Industry DSO3 5.00 70.0 47'WUHQGVUHIOHFW

4.50 65.0 60.0 4.00 4.5 4.5 ƒ ,QFUHDVHLQ&RPPHUFLDO5HDO(VWDWH 4.2 4.2 4.3 55.0 4.0 50.0 ƒ 'HFUHDVHVLQ0RUWJDJH%DQNHU 3.50 3.9 3.7 45.0 3.00 3.5 1DWLRQDO'HDOHU6HUYLFHV (QHUJ\ 40.0 35.0 2.50 ƒ &RPPLWPHQWVUHODWLYHO\VWDEOH 30.0 SLSHOLQHVROLG 2.00 25.0 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2XWORRNIRU4

f

% thru 2/29 1Q20 average balances through 2/29/20 are preliminary & subject to change Ɣ Outlook as of 3/6/20 Ɣ 1Comparisons of 1Q20 through 2/29/20 vs 4Q19 Ɣ 2Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 2/18/20; 1Q20 is forecasted Ɣ 3Day Supply Outstanding for Industry; Source: Automotive News Data Center 5 )LUVW4XDUWHU'HSRVLW8SGDWH Seasonality impacts balances -DQXDU\ )HEUXDU\7UHQGV 7RWDO)XQGLQJ ,QWHUHVWEHDULQJ

LQELOOLRQV

$YHUDJH

6,000 &RVWV 'HSRVLW&RVW Other time/Brokered

4

4

57.2 56.3 5,000 54.0 55.0 55.7 0.85% 0.92% 0.89% 4,000 0.71% 3,000 2,000 CMA Peers CMA Peers 1,156 1,085 1,000 410 160 107 - /DUJHVW&RPSRQHQWRI1RQLQWHUHVWEHDULQJ 1Q19 2Q19 3Q19 4Q19 1Q20 thru 2/29 'HSRVLWV

4

,QSHUFHQWDJHSRLQWV

47'WUHQGVUHIOHFW

47 42 40 ƒ 00GHFUHDVHLQQRQLQWHUHVWEHDULQJ 36 35 33 28 26 26 ƒ

00GHFUHDVHLQFXVWRPHULQWHUHVW 26 25 24 EHDULQJGHSRVLWV ƒ 00GHFUHDVHLQQRQFXVWRPHUEURNHUHG 2XWORRNIRU4

% RF FHN CFR KEY SNV CFG MTB FITB CMA ZION BOKF HBAN 1Q20 average balances through 2/29/20 are preliminary and subject to change Ɣ Outlook as of 3/6/20 Ɣ 1Comparisons of 1Q20 through 2/29/20 vs 4Q19 Ɣ 2Source for peer data: S&P Global Market Intelligence 6

5HYHQXH2SSRUWXQLWLHV Relationship banking focus 1RQLQWHUHVW,QFRPH &ROODERUDWLRQ5HIHUUDO3URJUDPV

)<

LQPLOOLRQV

Fiduciary 20% Commercial Lending

5HVXOWV 9% Service Chg Foreign Exchange 4XDOLILHGUHIHUUDOVPDGH Deposits 4% 20% Total Letters of Credit Total 5HIHUUDOVFORVHGZLWKVDOH $1,010 4% $1,010 Brokerage %LQ/RDQV'HSRVLWV $80JHQHUDWHG 3% Card Other 25% 15% ƒ &ROODERUDWLRQ,QLWLDWLYH &DUG)HHV

LQPLOOLRQV

,QWURGXFLQJDQRWKHUGLYLVLRQWRDFXVWRPHU Impact of accounting change ƒ %XVLQHVV2ZQHU$GYLVRU\ 333 ,QWURGXFLQJDEXVLQHVVRZQHUWR:HDOWK 113 244 257 0DQDJHPHQW 220 ƒ %&)&3URJUDP +5% 5HIHUUDOVEHWZHHQ%DQNLQJ&HQWHUV :HDOWK 0DQDJHPHQW)LQDQFLDO&RQVXOWDQWV 2017 2018 2019 FY19 Ɣ 12017 includes presentation changes resulting from the adoption of ASC top 606 “Revenue from Contract with Customers.” See 2018 Annual Report for further information 7 7HFKQRORJ\,QYHVWPHQWV Preparing for a new age in banking &RPPHUFLDO &RQVXPHU 9 ((FUHGLWSURFHVVUHGHVLJQ 9 8SJUDGHG%DQNLQJ&HQWHULQIUDVWUXFWXUH 9 0RUWJDJH:DUHKRXVHXSJUDGH

ZLILEDQGZLWKWDEOHWVHWF

9 %XVLQHVVGHSRVLWFDSWXUH 9 ,QWHOOLJHQWURXWLQJ FRQYHUVDWLRQDOERWV 9 &RPPHUFLDOSD\PHQWVXSJUDGH GHSOR\HGLQFDOOFHQWHU ¾ 5HODWLRQVKLS0DQDJHUPRELOH 9 &RQWDFWFHQWHUYRLFHELRPHWULFV HQKDQFHPHQWV DXWKHQWLFDWLRQ ¾ 'HYHORSLQJURDGPDSIRUOHDGLQJHGJH 9 &KDULWDEOHJLYLQJRQOLQHSRUWDO 7UHDVXU\0DQDJHPHQWH[SHULHQFH ¾ 8SJUDGH$70V ,70V ¾ ([SORULQJFUHGLWVHJPHQWDWLRQWRIXUWKHU ¾ 2QOLQHDFFRXQWRSHQLQJ ORDQDSSOLFDWLRQ RSWLPL]H((SURFHVV ¾ 5HSODFHGWHOOHUSODWIRUP %RWK6HJPHQWV 9 1HZ&XVWRPHUUHODWLRQVKLSPDQDJHPHQW

&50

V\VWHP 9 'DWDDQDO\WLFVLHQH[WEHVWSURGXFW ¾ &RQWLQXHGPLJUDWLRQRIIURQWDQGEDFNRIILFHDSSOLFDWLRQV WRWKH&ORXG ¾ 'LJLWDO0DUNHWLQJSODWIRUPHQDEOHVDXWRPDWHGFXVWRPHU &RQWLQXRXVLPSURYHPHQW H[SHULHQFHPDQDJHPHQW WKURXJKGLJLWL]DWLRQ LQWHOOLJHQWUHHQJLQHHULQJ /HYHUDJLQJWKLUGSDUWLHVWRNHHSSDFHZLWKHYROYLQJ ¾ RIHQWLUHSURFHVVHV HPHUJLQJWHFKQRORJLHVLHFDUGSURGXFWVWUXVWRSHUDWLRQV ¾ (QDEOLQJUHDOHVWDWHRSWLPL]DWLRQWKURXJK&R:RUN 9 Completed ¾ - In-process 8

,QWHUHVW5DWH(QYLURQPHQW Continue to carefully manage deposit pricing (VWLPDWHGLPSDFWIURPUDWHVRQQHW (VWLPDWHG1HW,QWHUHVW,QFRPH,PSDFW LQWHUHVWLQFRPH ,Q'LIIHUHQW5DWH6FHQDULRV $QQXDO

PRQWK

6HQVLWLYLWLHV ƒ $VVXPHVUDWHVKROGDVRI %DVHGRQ6WDQGDUG0RGHODVVXPLQJ D GHSRVLWEHWD

LQFRUSRUDWHVDOOSULRUUDWHPRYHPHQWV

LQPLOOLRQV

ƒ $VVXPHVGHSRVLWEHWDRI ƒ 004UHGXFWLRQYV4

ƒ 004UHGXFWLRQYV4 ƒ 0RGHVWQHJDWLYHLPSDFWIRUWKH - 25 bps shock ~80 UHPDLQGHURIWKH\HDU ,QWHUHVW5DWH&DVKIORZ+HGJHV - 50 bps shock ~165

LQELOOLRQV

5555.55 4.55 3.80 - 75 bps shock ~250 2.80 0.80 2XWFRPHVPD\GLIIHUGXHWRDYDULHW\RI YDULDEOHVPRVWQRWDEO\WKHSDFH 1Q19 2Q19 3Q19 4Q19 1Q20 thru PDJQLWXGHRI/,%25PRYHPHQW 2/29 1Q20 though 2/29/20 Ɣ Outlook as of 3/6/20 Ɣ 1Outcomes may differ due to many variables, including pace of LIBOR change, balance sheet movements (loan, deposit & wholesale funding levels), competition for deposits Ɣ 2For standard methodology see the Company’s Form 10-K, as filed with the SEC. Estimates are based on simulation modeling analysis 9 6XSHULRU&UHGLW3HUIRUPDQFH7KURXJKWKH&\FOH 'LVFLSOLQHGXQGHUZULWLQJVWDQGDUGV 1HW&KDUJHRIIVDVDRI$YJ/RDQV ƒ

,QEDVLVSRLQWV

300 TotalTotal CMA ƒ 'LYHUVHSRUWIROLR Peer Average 250 ƒ /RQJWHQXUHGH[SHULHQFHGHPSOR\HHV 200 150 ƒ 'HHSH[SHUWLVHLQVSHFLDOW\LQGXVWULHV 100 50 - ƒ %(QHUJ\ORDQV

RIWRWDOORDQV

• 5HGXFHGH[SRVXUHE\%

VLQFH 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 )<( • (QHUJ\6HUYLFHVRQO\00 13/VDVDRI/RDQV

,QEDVLVSRLQWV

ƒ %$XWRSURGXFWLRQORDQV

RIWRWDO Total CMA ORDQV

410 Peer Average • 3ULPDULO\7LHU 7LHUVXSSOLHUV 350 • 00LQQRQDFFUXDOORDQV 290 230 • 1RPLQDOH[SRVXUHWRKRVSLWDOLW\ 170 110 FUXLVHOLQHVDLUOLQHVUHVWDXUDQWV 50 KHDOWKFOXEV 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 FYE19 Ⴠ 1Source: S&P Global Market Intelligence 10

(QHUJ\/LQHRI%XVLQHVV 40+ years industry experience 3HULRGHQG/RDQV

LQPLOOLRQV

ƒ fFXVWRPHUV

IRFXVRQIXOOUHODWLRQVKLSVZLWK ODUJHUVRSKLVWLFDWHG( 3FRPSDQLHV

DFFHVVWRD 3,559 YDULHW\RIFDSLWDOVRXUFHVKHGJLQJ GLYHUVH Exploration & Production JHRJUDSKLFIRRWSULQW

3,070 Services ƒ ([SRVXUH%XWLOL]DWLRQ Midstream ƒ 4

FKDUJHRIIVUHIOHFWYDOXDWLRQLPSDLUPHQWVRQ VHOHFWHQHUJ\FUHGLWVDVFDSLWDOPDUNHWVUHPDLQHGMixed 18% 2,250 2,221 VRIW 2,539 2,163 ƒ $SSUR[LPDWH( 3

2LO*DV2LO*DV 2,111 1,836 &ULWLFL]HG/RDQV 1,587 1,741

LQPLOOLRQV

366 1,771 1,346 NALs 240 205 210 220 566 480 289 48 195 94 454 479 374 432 84 295 298 48 33 74 43 2014 2015 2016 2017 2018 2019 4Q18 1Q19 2Q19 3Q19 4Q19 12/31/19 Ɣ 1Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories 11 $FWLYH&DSLWDO0DQDJHPHQW

4UHSXUFKDVHG00VKDUHV Target: maintain ~CET1 Target 10%1 $WWUDFWLYH'LYLGHQG<LHOG &KDQJHLQ&RPPRQ6KDUHV2XWVWDQGLQJ ,QFUHDVHGGLYLGHQGWRSHUVKDUH

YV

,QSHUFHQWDJHSRLQWV

,QSHUFHQWDJHSRLQWV

27 5.33533 5.01 4.77 4.57 4.42 4.40 4.40 4.30 10 3.62 3.50 3.16 2.84 LONGLONG HISTORYHISTORY (3) (2) (2) (1) (7) (7) (6) (4) NIMBLE(12) (11) SIZE $74B IN ASSETS RF FHN CFR SNV KEY CFG MTB FITB CMA ZION RF BOKF HBAN CFR FHN SNV KEY CFG MTB FITB CMA ZION BOKF HBAN &(75DWLR 7LHU5DWLR

,QSHUFHQWDJHSRLQWV

,QSHUFHQWDJHSRLQWV

12.99 12.36 11.39 11.39 11.39 11.39 11.26 11.26 11.22 11.22 11.11 10.99 10.94 10.91 10.85 9.88 9.75 9.72 9.68 10.21 9.43 10.13 10.24 10.15 10.13 10.01 9.20 8.95 RF RF CFR FHN KEY SNV CFG FHN CFR KEY SNV MTB CFG FITB MTB CMA FITB CMA ZION ZION BOKF HBAN BOKF HBAN 12/31/19 unless otherwise noted Ⴠ 1Outlook as of 3/6/20 Ⴠ 2Source for peer data: S&P Global Market Intelligence 12

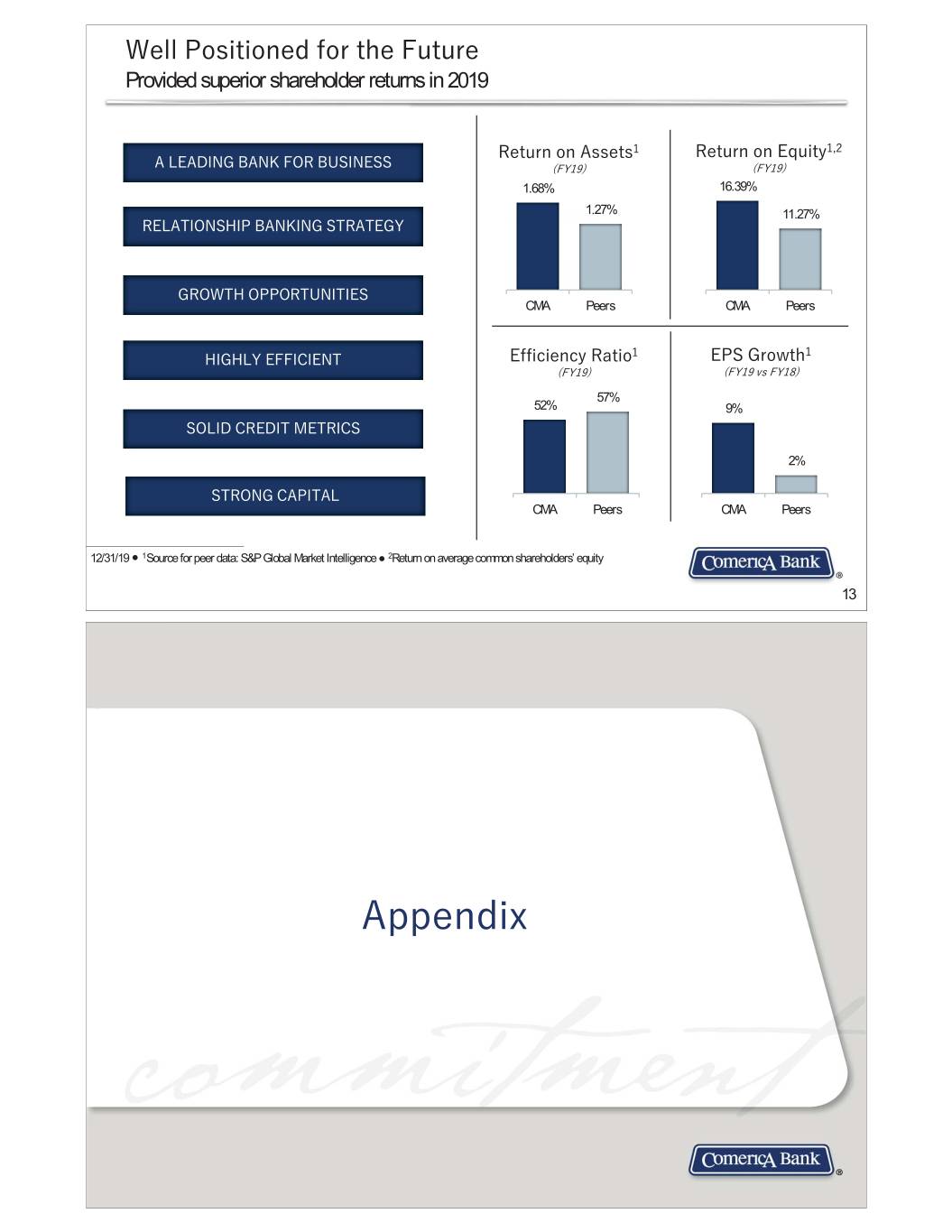

:HOO3RVLWLRQHGIRUWKH)XWXUH Provided superior shareholder returns in 2019 5HWXUQRQ$VVHWV 5HWXUQRQ(TXLW\ $/($',1*%$1.)25%86,1(66

)<

)<

1.68% 16.39% 1.27% 11.27% 5(/$7,216+,3%$1.,1*675$7(*< LONGO HISTORYS ORRY NIMBLEM LE SSIZEE $74B4 IN AASSETSE *52:7+23325781,7,(6 CMA Peers CMA Peers +,*+/<()),&,(17 (IILFLHQF\5DWLR (36*URZWK

)<

)<

YV)<

57% 52% 9% 62/,'&5(',70(75,&6 2% 67521*&$3,7$/ CMA Peers CMA Peers 12/31/19 Ⴠ 1Source for peer data: S&P Global Market Intelligence Ɣ 2Return on average common shareholders’ equity 13 $SSHQGL[

/HDGHUVKLS7HDP Curtis Farmer Chairman, President & CEO 11 / 34 Years John Buchanan Megan Burkhart Greg Carr Melinda Chausse1 Megan Crespi2 Chief Legal Officer Chief HR Officer EVP, Wealth Management Chief Credit Officer Chief Enterprise Tech. & Ops. 5 / 28 Years 22 / 22 Years 0 / 30 Years 32 / 32 Years Services Officer 0 / 11 Years James Herzog Cassandra McKinney3 Christine Moore Jay Oberg Peter Sefzik James Weber Chief Financial Officer EVP, Retail Bank General Auditor Chief Risk Officer EVP, Business Bank Chief Experience Officer 35 / 35 Years 14 / 24 Years 25 / 25 Years 28 / 28 Years 21 / 21 Years 13 / 13 Years 3/6/20; Years with Comerica / Years in Banking Ⴠ 1Effective 5/1/20 Ⴠ 2Effective 3/23/20 Ⴠ 3Effective 4/1/20 15 )<

5HVXOWV Strong loan growth, record revenue, cost control & capital management .H\<R<3HUIRUPDQFH'ULYHUV

PLOOLRQVH[FHSWSHUVKDUHGDWD

&KDQJH ƒ /RDQVLQFUHDVHG $YHUDJHORDQV $50,511 $48,766 $1,745 ƒ 'HSRVLWVUHODWLYHO\VWDEOH $YHUDJHGHSRVLWV 55,481 55,935 (454) ƒ 1HWLQWHUHVWLQFRPHVWDEOHZLWK ORDQJURZWK KLJKHUUDWHVRIIVHW 1HWLQWHUHVWLQFRPH $2,339 $2,352 $(13) E\KLJKHUIXQGLQJFRVWV 3URYLVLRQIRUFUHGLWORVVHV 74 (1) 75 ƒ 3URYLVLRQLQFUHDVHGIURPYHU\ORZ 1RQLQWHUHVWLQFRPH 1,010 976 34 OHYHO

UHIOHFWVKLJKHU(QHUJ\ UHVHUYHV 1RQLQWHUHVWH[SHQVHV 1,743 1,794 (51) 3URYLVLRQIRULQFRPHWD[ 334 300 34 ƒ 1RQLQWHUHVWLQFRPHJURZWKOHGE\ VWURQJFDUGIHHV 1HWLQFRPH 1,198 1,235 (37) ƒ ([SHQVHVZHOOFRQWUROOHG

(DUQLQJVSHUVKDUH $7.87 $7.20 $0.67 LQFOXGHG00UHVWUXFWXULQJ $YHUDJHGLOXWHGVKDUHV 151.3 170.5 (19.2) ƒ 7D[LQFOXGHGD00GHFUHDVH 52( 16.39% 15.82% LQGLVFUHWHWD[LWHPV 52$ 1.68 1.75 ƒ 5HSXUFKDVHG00VKDUHV

%UHWXUQHGWRVKDUHKROGHUV (IILFLHQF\5DWLR 51.82 53.56

EX\EDFN GLYLGHQG

FY19 compared to FY18 Ⴠ 1Includes loss related to repositioning of securities portfolio of $(20)MM FY18 & $(8)MM FY19 Ⴠ 2Includes gain/(loss) related to deferred comp plan of $9MM FY19 & $(2)MM FY18 (offset in noninterest expense) Ⴠ 3FY18 includes $53MM restructuring charge Ⴠ 4Diluted earnings per common share Ⴠ 5Return on average common shareholders’ equity Ⴠ 6Return on average assets Ⴠ 7Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & derivative contract tied to the conversion rate of Visa Class B shares Ⴠ 8Shares repurchased under share repurchase program 16

4

5HVXOWV Deposit & noninterest income growth, strong credit quality & capital management &KDQJH)URP .H\4R4 3HUIRUPDQFH'ULYHUV

PLOOLRQVH[FHSWSHUVKDUHGDWD

4

4

4 4

4 ƒ /RDQVUHODWLYHO\VWDEOH $YHUDJHORDQV $50,505 $50,887 $48,832 $(382) $1,673 $YHUDJHGHSRVLWV 57,178 55,716 55,729 1,462 1,449 ƒ 'HSRVLWVLQFUHDVHG 1HWLQWHUHVWLQFRPH $544 $586 $614 $(42) $(70) ƒ 1HWLQWHUHVWLQFRPHLPSDFWHG E\ORZHULQWHUHVWUDWHV 3URYLVLRQIRUFUHGLWORVVHV 83516(27) (8) ƒ &UHGLWPHWULFVUHPDLQHGVWURQJ 1RQLQWHUHVWLQFRPH 266 256 250 10 16 ƒ 1RQLQWHUHVWLQFRPHXSRYHU 1RQLQWHUHVWH[SHQVHV 451 435 448 16 3 ƒ ([SHQVHVUHIOHFWKLJKHUFRPS 3URYLVLRQIRULQFRPHWD[ 82 80 90 2(8) RXWVLGHSURFHVVLQJ

YHQGRU 1HWLQFRPH 269 292 310 (23) (41) WUDQVLWLRQIHH

RFFXSDQF\ (DUQLQJVSHUVKDUH $1.85 $1.96 $1.88 $(0.11) $(0.03) ƒ 5HSXUFKDVHG00VKDUHV

00UHWXUQHGWR $YHUDJHGLOXWHGVKDUHV 144.6 148.1 163.5 (3.5) (18.9) VKDUHKROGHUV

EX\EDFN 52( 14.74% 15.97% 16.36% GLYLGHQG

52$ 1.46 1.61 1.74 (IILFLHQF\5DWLR 55.46 51.54 51.93 4Q19 compared to 3Q19 Ⴠ1Includes gain(loss) related to deferred comp plan of $(7)MM 4Q18 & $3MM each 3Q19 & 4Q19 (offset in noninterest expense) Ⴠ 24Q18 includes $14MM restructuring charge Ⴠ 3Diluted earnings per common share Ⴠ 4Return on average common shareholders’ equity Ⴠ 5Return on average assets Ⴠ 6Noninterest expenses as a percentage of net interest income and noninterest income excluding net gains (losses) from securities and a derivative contract tied to the conversion rate of Visa Class B shares. Ⴠ 7Shares repurchased under share repurchase program 17 &RPHULFD&RPSDUHV)DYRUDEO\WR3HHUV

)<

4

5HWXUQRQ(TXLW\ 5HWXUQRQ$VVHWV

,QSHUFHQWDJHSRLQWV

)<

,QSHUFHQWDJHSRLQWV

)<

)<

Peer Average 11.27 Peer Average 1.27 1.68 1.61 16.39 LONGNG HISTORYH STO1.53 RY 1.36 1.31 13.02 12.91 12.80 1.26 12.34 12.10 1.20 1.19 1.19 11.14 11.14 1.17 10.89 10.64 9.60 1.10 10.07 1.08 8.45 NIMBLEN B SSIZE $74B$$74BB IINN AASASSETSSSEETTS RF RF FHN CFR SNV KEY CFR FHN SNV KEY CFG CFG MTB MTB FITB FITB CMA CMA ZION ZION BOKF BOKF HBAN HBAN 4

4

Peer Average 10.64 Peer Average 1.24 1.72 1.60 14.74 1.46 13.78 1.27 1.27 1.24 12.46 12.37 1.21 1.15 1.12 1.08 1.04 10.92 0.99 10.67 10.63 9.85 9.63 9.39 9.14 8.24 RF RF CFR FHN KEY SNV CFR FHN SNV KEY CFG CFG MTB MTB FITB FITB CMA CMA ZION ZION BOKF BOKF HBAN HBAN 1Source for peer data: S&P Global Market Intelligence; FITB 4Q19 ROA 1.25% & ROE 10.10%, ex. large gain on Worldpay transaction Ⴠ 2Return on average common shareholders’ equity 18

&RPHULFD&RPSDUHV)DYRUDEO\WR3HHUV

)<

4

(IILFLHQF\5DWLR 1HW&KDUJH2II5DWLR 1RQSHUIRUPLQJ$VVHWV

,QSHUFHQWDJHSRLQWV

$VDRIDYJORDQV

$VDRI)<(

ORDQV

)<

)<

Peer Average 57.46 0.26% 0.21% 0.72% 59.98 59.60 59.50 58.23 58.03 0.43% 56.94 56.60 55.80 55.66 NIMBLELE SSIZEE $74B7 IN AASSETS 51.82 51.82 RF CMA Peers CMA Peers CFR SNV KEY CFG MTB FITB CMA ZION BOKF HBAN 4

$OORZDQFHIRU/RDQ 4

/RVV Peer Average 58.40 0.29%

$VDRI)<(

ORDQV

1.27% 63.65 0.16% 0.96% 61.30 60.28 59.60 58.70 58.70 58.40 58.10 57.30 55.46 53.15 53.20 RF FHN CFR SNV KEY CFG MTB FITB CMA ZION CMA Peers BOKF HBAN CMA Peers 1Source for peer data: S&P Global Market Intelligence Ⴠ 2Peer Average from companies’ FY19 reported financials 19 4

/RDQV5HODWLYHO\6WDEOH Yields reflect lower rates $YHUDJH/RDQV $YHUDJHORDQVVWDEOH

LQELOOLRQV

00&RPPHUFLDO5HDO(VWDWH Loan Yields

000RUWJDJH%DQNHU 00(QYLURQPHQWDO6HUYLFHV 51.0 50.9 50.5 50.5 00*HQHUDO0LGGOH0DUNHW 49.7 48.8 48.8 001DWLRQDO'HDOHU6HUYLFHV /RDQ\LHOGV /RZHUUDWHV 1RQDFFUXDOLQWHUHVW 5.07 4.90 5.00 4.83 4.83 4.64 4.43 /RDQ3RUWIROLR

LQELOOLRQV

4

3HULRGHQG

Fixed Rate1 18% Prime- 30-Day based Total LIBOR 14% $50.4 62% 60-Day+ 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 LIBOR 6% 4Q19 compared to 3Q19 Ⴠ 1Fixed rate loans include $4.55B receive fixed / pay floating (30-day LIBOR) interest rate swaps 20

)XOO<HDU$YHUDJH/RDQVE\%XVLQHVVDQG0DUNHW %\/LQHRI%XVLQHVV

%\0DUNHW

Middle Market Michigan $12.6 $12.5 General $12.1 $11.8 Energy 2.4 1.9 California 18.5 18.3 National Dealer Services 7.7 7.3 Entertainment 0.7 0.7 Texas 10.6 9.8 Tech. & Life Sciences 1.3 1.4 Other Markets1 8.8 8.1 Equity Fund Services 2.6 2.4 Environmental Services 1.2 1.1 TOTAL $50.5 $48.8 Total Middle Market $28.0 $26.6 Corporate Banking US Banking 3.0 3.0 International 1.3 1.3 ƒ 0LGGOH0DUNHW

6HUYLQJFRPSDQLHVZLWK Commercial Real Estate 5.6 5.3 UHYHQXHVJHQHUDOO\EHWZHHQ00 Mortgage Banker Finance 2.2 1.7 ƒ &RUSRUDWH%DQNLQJ

6HUYLQJFRPSDQLHV Small Business 3.5 3.7

DQGWKHLU86EDVHGVXEVLGLDULHV

ZLWK BUSINESS BANK $43.5 $41.6 UHYHQXHVJHQHUDOO\RYHU00 Retail Banking 2.1 2.1 ƒ 6PDOO%XVLQHVV

6HUYLQJFRPSDQLHVZLWK RETAIL BANK $2.1 $2.1 UHYHQXHVJHQHUDOO\XQGHU00 Private Banking 4.9 5.1 WEALTH MANAGEMENT $4.9 $5.1 TOTAL $50.5 $48.8 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets 21 4XDUWHUO\$YHUDJH/RDQVE\%XVLQHVVDQG0DUNHW %\/LQHRI%XVLQHVV 4

4

4 %\0DUNHW 4

4

4 Middle Market Michigan $12.4 $12.6 $12.4 General $12.0 $12.2 $11.7 Energy 2.5 2.5 2.0 California 18.1 18.4 18.3 National Dealer Services 7.3 7.5 7.4 Entertainment 0.7 0.7 0.8 Texas 10.7 10.8 9.9 Tech. & Life Sciences 1.2 1.3 1.4 Other Markets1 9.3 9.1 8.2 Equity Fund Services 2.5 2.5 2.5 Environmental Services 1.3 1.2 1.2 TOTAL $50.5 $50.9 $48.8 Total Middle Market $27.4 $27.9 $27.0 Corporate Banking US Banking 2.9 3.0 2.9 %XVLQHVV/RDQVDVDRI7RWDO International 1.3 1.3 1.3

4

,QSHUFHQWDJHSRLQWV

Commercial Real Estate 5.9 5.7 5.2 91 88 87 Mortgage Banker Finance 2.7 2.5 1.7 79 76 72 71 Small Business 3.4 3.5 3.6 65 64 63 49 49 BUSINESS BANK $43.5 $43.9 $41.7 Retail Banking 2.1 2.1 2.1 RETAIL BANK $2.1 $2.1 $2.1 Private Banking 4.9 4.9 5.0 RF FHN CFR SNV KEY CFG MTB FITB CMA WEALTH MANAGEMENT $4.9 $4.9 $5.0 ZION BOKF HBAN TOTAL $50.5 $50.9 $48.8 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Source for peer data: S&P Global Market Intelligence 22

4

'HSRVLWV,QFUHDVHG%RU Deposit rates decreased 7 basis points $YHUDJH'HSRVLWV $YHUDJHGHSRVLWVLQFUHDVHG%

LQELOOLRQV

SDUWO\GXHWRVHDVRQDOLW\ Deposit Rates1 00QRQLQWHUHVWEHDULQJ 0000,$ LQWHUHVWFKHFNLQJ 57.2 55.7 55.0 55.7 55.9 55.5 00FXVWRPHU&'V 54.0 00RWKHUWLPHGHSRVLWV /RDQWRGHSRVLWUDWLR %HQHILFLDO'HSRVLW0L[

LQELOOLRQV

4

$YHUDJH

• &RPPHUFLDORIQRQLQWHUHVWEHDULQJ • 5HWDLORILQWHUHVWEHDULQJ Retail Commercial 0.94 0.99 0.92 0.91 0.78 Noninterest- Noninterest- 0.62 bearing bearing 0.46 8% 39% Total $57.2 Commercial Retail Interest- Interest- bearing 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 bearing 24% 29% 4Q19 compared to 3Q19 Ⴠ 1Interest costs on interest-bearing deposits Ⴠ 2At 12/31/19 23 )XOO<HDU$YHUDJH'HSRVLWVE\%XVLQHVVDQG0DUNHW %\/LQHRI%XVLQHVV

%\0DUNHW

Middle Market Michigan $20.1 $20.8 General $13.6 $13.6 Energy 0.4 0.5 California 16.9 17.0 National Dealer Services 0.3 0.3 Texas 8.8 9.0 Entertainment 0.1 0.1 Other Markets1 7.9 8.1 Tech. & Life Sciences 4.9 5.2 Equity Fund Services 0.8 0.9 Finance/Other2 1.9 1.1 Environmental Services 0.2 0.1 TOTAL $55.5 $55.9 Total Middle Market $20.3 $20.8 Corporate Banking US Banking 1.9 2.1 International 1.6 1.9 ƒ 0LGGOH0DUNHW

6HUYLQJFRPSDQLHVZLWK Commercial Real Estate 1.6 1.5 UHYHQXHVJHQHUDOO\EHWZHHQ00 Mortgage Banker Finance 0.7 0.6 ƒ &RUSRUDWH%DQNLQJ

6HUYLQJFRPSDQLHV Small Business 3.0 3.1

DQGWKHLU86EDVHGVXEVLGLDULHV

ZLWK BUSINESS BANK $29.0 $30.1 UHYHQXHVJHQHUDOO\RYHU00 Retail Banking 20.7 20.8 ƒ 6PDOO%XVLQHVV

6HUYLQJFRPSDQLHVZLWK RETAIL BANK $20.7 $20.8 UHYHQXHVJHQHUDOO\XQGHU00 Private Banking 3.5 3.7 WEALTH MANAGEMENT $3.8 $3.9 Finance/Other2 1.9 1.1 TOTAL $55.5 $55.9 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments 24

4XDUWHUO\$YHUDJH'HSRVLWVE\%XVLQHVVDQG0DUNHW %\/LQHRI%XVLQHVV 4

4

4 %\0DUNHW 4

4

4 Middle Market Michigan $20.4 $20.2 $20.2 General $14.1 $13.6 $13.7 Energy 0.4 0.4 0.5 California 18.1 16.7 17.2 National Dealer Services 0.3 0.3 0.3 Texas 9.0 8.7 8.9 Entertainment 0.1 0.1 0.1 1 Tech. & Life Sciences 5.1 4.6 5.2 Other Markets 8.0 7.8 8.3 Equity Fund Services 0.8 0.9 0.9 Finance/Other2 1.5 2.3 1.1 Environmental Services 0.1 0.2 0.1 TOTAL $57.2 $55.7 $55.7 Total Middle Market $21.1 $20.1 $20.9 Corporate Banking US Banking 2.3 1.9 2.0 International 1.6 1.6 1.8 $YHUDJH'HSRVLW*URZWK Commercial Real Estate 1.8 1.6 1.5

4

YV4

,QSHUFHQWDJHSRLQWV

Mortgage Banker Finance 0.7 0.7 0.6 5.4 Small Business 3.1 3.0 3.1 3.2 BUSINESS BANK $30.5 $28.9 $30.0 3.0 2.6 2.6 2.1 Retail Banking 21.1 20.7 20.6 1.4 1.3 RETAIL BANK $21.1 $20.7 $20.6 0.7 0.5 0.4 0.4 Private Banking 3.7 3.5 3.9 WEALTH MANAGEMENT $4.0 $3.8 $4.1 RF CFR FHN SNV KEY CFG MTB FITB CMA ZION BOKF Finance/Other2 1.5 2.3 1.1 HBAN TOTAL $57.2 $55.7 $55.7 $ in billions Ⴠ Totals shown above may not foot due to rounding Ⴠ 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Ⴠ 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments Ⴠ 3Source for peer data: S&P Global Market Intelligence 25 &RPPHUFLDO5HDO(VWDWH/LQHRI%XVLQHVV Long history of working with well established, proven developers &5(E\3URSHUW\7\SH &5(E\0DUNHW

LQPLOOLRQV

3HULRGHQG

LQPLOOLRQV

3HULRGHQGEDVHGRQORFDWLRQRISURSHUW\

Single Office Michigan Family Other 8% 5% Retail 5% 5% 10% Land Carry 5% Other Industrial / 18% Multi use Storage Total Total California 3% 18% $5,219 $5,219 45% Texas Multifamily 32% 46% &UHGLW4XDOLW\

LQPLOOLRQV

3HULRGHQG

4 4

4

ƒ !

RIQHZFRPPLWPHQWVIURPH[LVWLQJ &ULWLFL]HG $84 $92 $87 FXVWRPHUV 5DWLR 1.7% 1.6% 1.4% ƒ 6XEVWDQWLDOXSIURQWHTXLW\UHTXLUHG 1RQDFFUXDO $2 $2 $2 ƒ RISRUWIROLR LVFRQVWUXFWLRQ LQFOXGHV 5DWLR 0.04% 0.04% 0.03% UREXVWPRQLWRULQJ ƒ 1RVLJQLILFDQWQHWFKDUJHRIIVVLQFH 1HWFKDUJHRIIV -0- -0- -0- 12/31/19 Ⴠ 1Excludes CRE line of business loans not secured by real estate Ⴠ 2Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories Ⴠ 3Period-end loans 26

1DWLRQDO'HDOHU6HUYLFHV 70+ years of floor plan lending )UDQFKLVH'LVWULEXWLRQ ƒ 7RSWLHUVWUDWHJ\

%DVHGRQSHULRGHQGORDQRXWVWDQGLQJV

Honda/Acura ƒ )RFXVRQn0HJD'HDOHU|

ILYHRUPRUH 15% GHDOHUVKLSVLQJURXS

Toyota/Lexus Ford ƒ 6WURQJFUHGLWTXDOLW\ 15% 10% ƒ 5REXVWPRQLWRULQJRIFRPSDQ\LQYHQWRU\ DQGSHUIRUPDQFH GM Total 8% Other 1 11% $7.2B Fiat/Chrysler $YHUDJH/RDQV 10%

LQELOOLRQV

Floor Plan Mercedes 7.9 7.8 7.5 7.4 7.4 7.3 3% 7.3 7.1 7.1 7.0 6.9 Other Asian 6.8 6.6 6.5 6.3 12% Nissan/ Infiniti 6.2 6.2 Other European 4% 12% *HRJUDSKLF'LVSHUVLRQ 4.5 4.4 4.3 4.2 4.1 4.1 4.1 4.1 4.0 4.0 4.0 4.0 3.9 3.8 3.8 California 57% Texas 6% 3.7 3.7 Michigan 26% Other 11% 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 12/31/19 Ɣ 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) 27 7HFKQRORJ\DQG/LIH6FLHQFHV Deep expertise & strong relationships with top-tier investors $YHUDJH/RDQV $YHUDJH'HSRVLWV

LQPLOOLRQV

LQPLOOLRQV

5,244 5,149 4,992 4,652 4,637 1,353 1,323 1,305 1,251 1,181 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 &XVWRPHU6HJPHQW2YHUYLHZ ƒ fFXVWRPHUV

$SSUR[LPDWH

%DVHGRQSHULRGHQGORDQV

ƒ 0DQDJHFRQFHQWUDWLRQWRQXPHURXV YHUWLFDOVWRHQVXUHZLGHO\GLYHUVLILHG Growth Late Stage SRUWIROLR 50% 5% ƒ &ORVHO\PRQLWRUFDVKEDODQFHV Total PDLQWDLQUREXVWEDFNURRPRSHUDWLRQ $1.1B Early Stage Leveraged ƒ RIILFHVWKURXJKRXW86 &DQDGD 20% Finance 25% 12/31/19 28

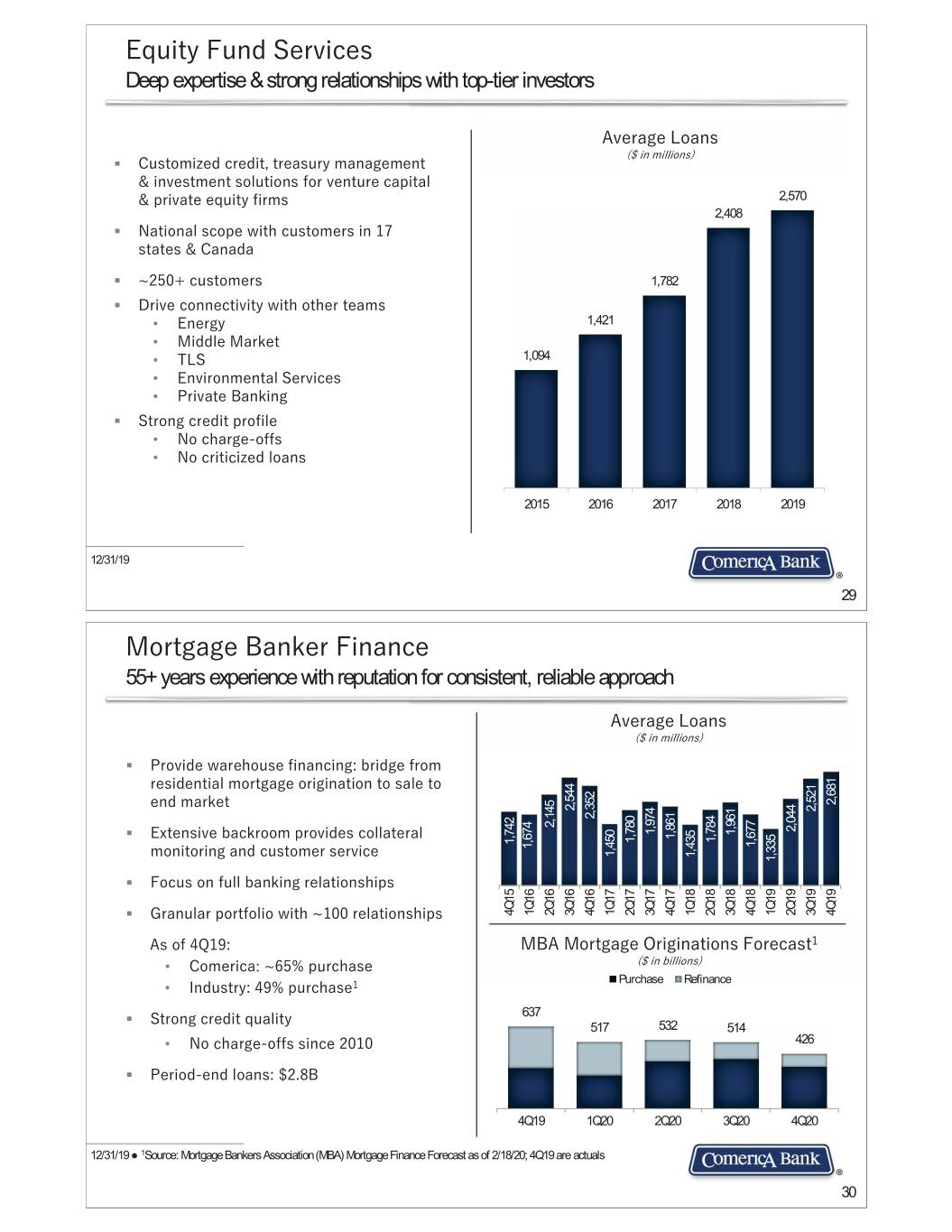

(TXLW\)XQG6HUYLFHV Deep expertise & strong relationships with top-tier investors $YHUDJH/RDQV

LQPLOOLRQV

ƒ &XVWRPL]HGFUHGLWWUHDVXU\PDQDJHPHQW LQYHVWPHQWVROXWLRQVIRUYHQWXUHFDSLWDO SULYDWHHTXLW\ILUPV 2,570 2,408 ƒ 1DWLRQDOVFRSHZLWKFXVWRPHUVLQ VWDWHV &DQDGD ƒ fFXVWRPHUV 1,782 ƒ 'ULYHFRQQHFWLYLW\ZLWKRWKHUWHDPV • (QHUJ\ 1,421 • 0LGGOH0DUNHW • 7/6 1,094 • (QYLURQPHQWDO6HUYLFHV • 3ULYDWH%DQNLQJ ƒ 6WURQJFUHGLWSURILOH • 1RFKDUJHRIIV • 1RFULWLFL]HGORDQV 2015 2016 2017 2018 2019 12/31/19 29 0RUWJDJH%DQNHU)LQDQFH 55+ years experience with reputation for consistent, reliable approach $YHUDJH/RDQV

LQPLOOLRQV

ƒ 3URYLGHZDUHKRXVHILQDQFLQJ

EULGJHIURP UHVLGHQWLDOPRUWJDJHRULJLQDWLRQWRVDOHWR HQGPDUNHW 2,681 2,544 2,521 2,352 2,145 2,044 1,974 1,961 ƒ ([WHQVLYHEDFNURRPSURYLGHVFROODWHUDO 1,861 1,784 1,780 1,742 1,677 1,674 1,450 PRQLWRULQJDQGFXVWRPHUVHUYLFH 1,435 1,335 ƒ )RFXVRQIXOOEDQNLQJUHODWLRQVKLSV ƒ *UDQXODUSRUWIROLRZLWKfUHODWLRQVKLSV 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 $VRI4

0%$0RUWJDJH2ULJLQDWLRQV)RUHFDVW • &RPHULFD

fSXUFKDVH

LQELOOLRQV

Purchase Refinance • ,QGXVWU\

SXUFKDVH ƒ 6WURQJFUHGLWTXDOLW\ 637 517 532 514 • 1RFKDUJHRIIVVLQFH 426 ƒ 3HULRGHQGORDQV

% 4Q19 1Q20 2Q20 3Q20 4Q20 12/31/19 Ɣ 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 2/18/20; 4Q19 are actuals 30

4

6HFXULWLHV3RUWIROLR6WDEOH Yields unchanged 6HFXULWLHV3RUWIROLR

LQELOOLRQV

$YHUDJH

Treasury Securities & Other Mortgage-backed Securities (MBS) Securities Yields 'XUDWLRQRI\HDUV ƒ ([WHQGVWR\HDUVXQGHUDESV 12.1 12.2 12.2 12.1 11.8 12.0 11.8 LQVWDQWDQHRXVUDWHLQFUHDVH 1HWXQUHDOL]HGSUHWD[JDLQRI00 1HWXQDPRUWL]HGSUHPLXPRI00 9.1 9.2 9.3 9.4 9.4 9.1 9.3 2.45 2.45 2.45 2.44 2.35 2.39 2.19 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 12/31/19 Ɣ 1Estimated as of 12/31/2019 Ɣ 2Net unamortized premium on the MBS portfolio 31 4

1HW,QWHUHVW,QFRPH Impacted by lower interest rates 1HW,QWHUHVW,QFRPH

LQPLOOLRQV

$586MM 3Q19 3.52% NIM 2,352 2,339 - 55MM Loans: - 0.31 - 46MM Lower rates -0.28 - 4MM Lower balances -0.01 614 606 603 586 544 -3MM Nonaccrual interest -0.01 -2MM Other dynamics -0.01 + 3MM Fed Deposits: -0.07 + 7MM Higher balances -0.05 -4MM Lower yield -0.02 3.70 3.79 3.67 3.52 3.58 3.54 + 3MM Deposits: + 0.02 3.20 + 3MM Lower rates +0.02 + 7MM Wholesale funding: + 0.04 + 7MM Lower rates +0.04 $544MM 4Q19 3.20% 4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 4Q19 compared to 3Q19 32

4

&UHGLW4XDOLW\6WURQJ Provision reflects overall strong metrics & increase in Energy reserve $OORZDQFHIRU&UHGLW/RVVHV

LQPLOOLRQV

ƒ 00LQQHWFKDUJHRIIV RUESV Allowance for Loan Losses as a % of Total Loans ƒ 1RQSHUIRUPLQJDVVHWVESVRIWRWDOORDQV 701 688 681 677 668 ƒ $///13/FRYHUDJH[ ƒ 00SURYLVLRQ00GHFUHDVHRYHU 1.34 1.29 1.27 1.27 1.27 4

ƒ &(&/'D\LPSDFW

00UHGXFWLRQLQ RYHUDOODOORZDQFHIRUFUHGLWORVVHV 4Q18 1Q19 2Q19 3Q19 4Q19 &ULWLFL]HG/RDQV $ in millions Energy Ex-Energy Total

LQPLOOLRQV

NALs Criticized as a % of Total Loans Total PE loans $2,221 $48,148 $50,369 2,120 % of total 4% 96% 100% 1,948 1,806 1,861 Criticized1 366 1,754 2,120 1,548 Ratio 16.48% 3.64% 4.21% 4.2 Nonaccrual 43 156 199 3.6 3.8 3.6 3.1 Ratio 1.94% 0.32% 0.40% 2 221 191 224 220 199 Net charge-offs 19 2 21 4Q18 1Q19 2Q19 3Q19 4Q19 12/31/19 Ɣ 1Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories Ɣ 2Net credit-related charge-offs 33 4

1RQLQWHUHVW,QFRPH Increased $10MM, over 3% 1RQLQWHUHVW,QFRPH

LQPLOOLRQV

1,010 976 00&XVWRPHUGHULYDWLYHV

RWKHU

256 266 250 238 250 00&RPPHUFLDOOHQGLQJIHHV

V\QGLFDWLRQ

00&DUG 00*DLQRQVDOHRI+6$EXVLQHVV

RWKHU

4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 4Q19 compared to 3Q19 Ɣ 1Includes losses related to repositioning of securities portfolio as follows: $(20)MM in FY18; $(8)MM in 2Q19 34

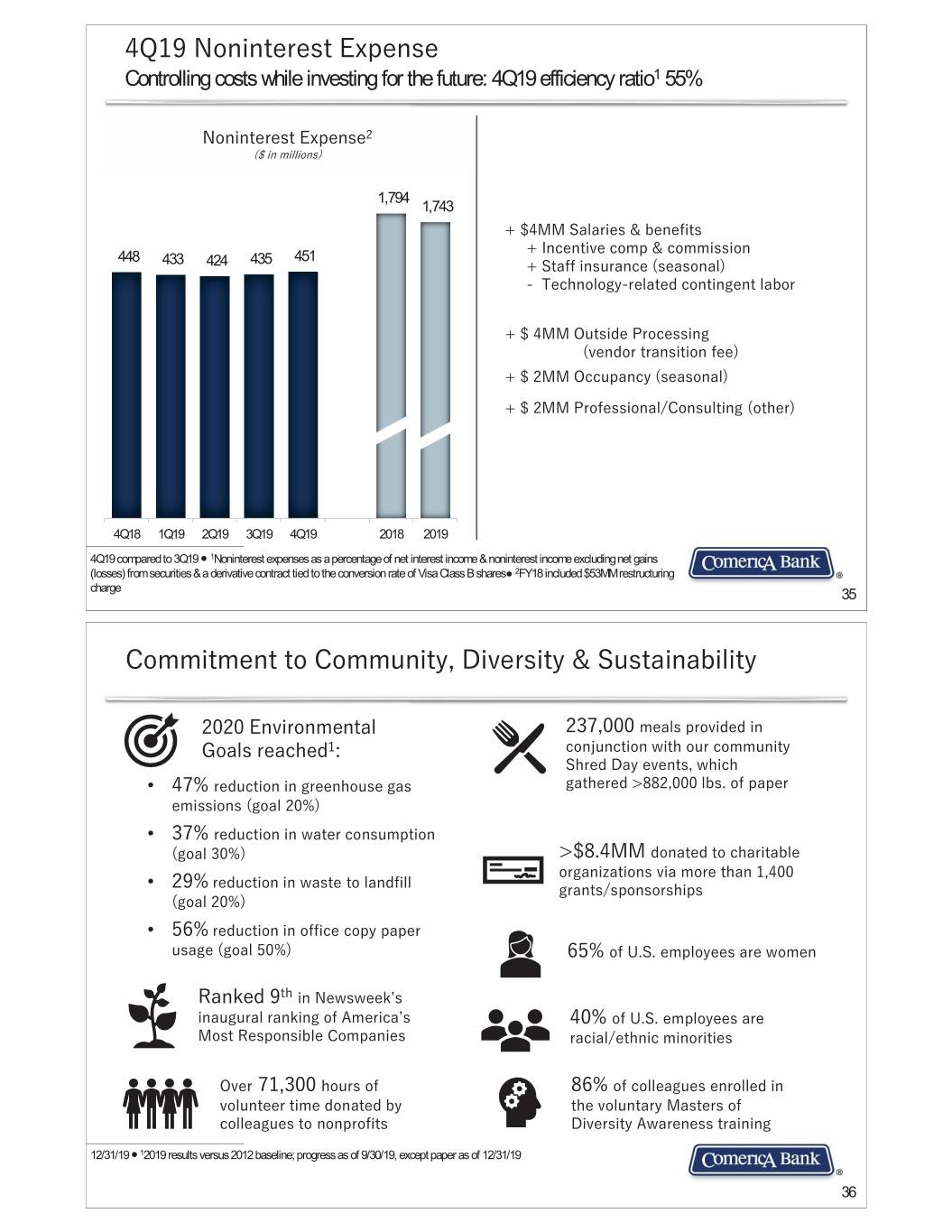

4

1RQLQWHUHVW([SHQVH Controlling costs while investing for the future: 4Q19 efficiency ratio1 55% 1RQLQWHUHVW([SHQVH

LQPLOOLRQV

1,794 1,743 006DODULHV EHQHILWV ,QFHQWLYHFRPS FRPPLVVLRQ 448 433 435 451 424 6WDIILQVXUDQFH

VHDVRQDO

7HFKQRORJ\UHODWHGFRQWLQJHQWODERU 002XWVLGH3URFHVVLQJ

YHQGRUWUDQVLWLRQIHH

002FFXSDQF\

VHDVRQDO

003URIHVVLRQDO&RQVXOWLQJ

RWKHU

4Q18 1Q19 2Q19 3Q19 4Q19 2018 2019 4Q19 compared to 3Q19 Ⴠ 1Noninterest expenses as a percentage of net interest income & noninterest income excluding net gains (losses) from securities & a derivative contract tied to the conversion rate of Visa Class B sharesƔ 2FY18 included $53MM restructuring charge 35 &RPPLWPHQWWR&RPPXQLW\'LYHUVLW\ 6XVWDLQDELOLW\ (QYLURQPHQWDO PHDOVSURYLGHGLQ *RDOVUHDFKHG

FRQMXQFWLRQZLWKRXUFRPPXQLW\ 6KUHG'D\HYHQWVZKLFK • UHGXFWLRQLQJUHHQKRXVHJDV JDWKHUHG!OEVRISDSHU HPLVVLRQV

JRDO

• UHGXFWLRQLQZDWHUFRQVXPSWLRQ

JRDO

!00GRQDWHGWRFKDULWDEOH RUJDQL]DWLRQVYLDPRUHWKDQ •

UHGXFWLRQLQZDVWHWRODQGILOO JUDQWVVSRQVRUVKLSV

JRDO

• UHGXFWLRQLQRIILFHFRS\SDSHU XVDJH

JRDO

RI86HPSOR\HHVDUHZRPHQ 5DQNHG

WK LQ1HZVZHHNbV LQDXJXUDOUDQNLQJRI$PHULFDbV RI86HPSOR\HHVDUH 0RVW5HVSRQVLEOH&RPSDQLHV UDFLDOHWKQLFPLQRULWLHV 2YHU KRXUVRI RIFROOHDJXHVHQUROOHGLQ YROXQWHHUWLPHGRQDWHGE\ WKHYROXQWDU\0DVWHUVRI FROOHDJXHVWRQRQSURILWV 'LYHUVLW\$ZDUHQHVVWUDLQLQJ 12/31/19 Ⴠ 12019 results versus 2012 baseline; progress as of 9/30/19, except paper as of 12/31/19 36

+ROGLQJ&RPSDQ\'HEW5DWLQJ 6HQLRU8QVHFXUHG/RQJ7HUP,VVXHU5DWLQJ 0RRG\bV 6 3 )LWFK &XOOHQ)URVW $ $ 0 7%DQN $ $ $ &RPHULFD $ %%% $ %2.)LQDQFLDO $ %%% $ )LIWK7KLUG %DD %%% $ +XQWLQJWRQ %DD %%% $ .H\&RUS %DD %%% $ 5HJLRQV)LQDQFLDO %DD %%% %%% 3HHU%DQNV =LRQV%DQFRUSRUDWLRQ %DD %%% %%% )LUVW+RUL]RQ1DWLRQDO&RUS %DD %%% %%% &LWL]HQV)LQDQFLDO*URXS %%% %%% 6\QRYXV)LQDQFLDO %%% %%% 86%DQFRUS $ $ $$ %DQNRI$PHULFD $ $ $ :HOOV)DUJR &RPSDQ\ $ $ $ -30RUJDQ $ $ $$ 31&)LQDQFLDO6HUYLFHV*URXS,QF $ $ $ /DUJH%DQNV 7UXLVW)LQDQFLDO&RUS $ $ $ As of 3/4/20 Ⴠ Source: S&P Global Market Intelligence Ⴠ Debt Ratings are not a recommendation to buy, sell, or hold securities 37 5HFRQFLOLDWLRQRI$GMXVWHG1HW,QFRPH 4Q19 3Q19 4Q18 FY19 FY18 Per Per Per Per Per ($ in millions, except per share data) $ Share1 $ Share1 $ Share1 $ Share1 $ Share1 Net income $269 $1.85 $292 $1.96 $310 1.88 $1,198 $7.87 $1,235 $7.20 Securities repositioning2 ------60.04150.09 Restructuring charges2 - - - - 11 0.07 - - 41 0.24 Discrete tax benefits (1) - (5) (0.03) - - (17) (0.10) (48) (0.29) Adjusted net income $268 $1.85 $287 $1.93 $321 $1.95 $1,187 $7.81 $1,243 $7.24 Efficiency Ratio4 55.46% 51.54% 51.93% 51.82% 53.56% Adjusted Efficiency Ratio3,4 55.46 51.54 50.70 51.82 51.96 1Based on diluted average common shares Ⴠ 2Net of tax Ⴠ Comerica believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts to evaluate the adequacy of equity and performance trends. Comerica believes the adjusted financial results provide a greater understanding of ongoing operations and enhance comparability of results with prior periods. 38