Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LUNA INNOVATIONS INC | exhibit9912019q4pressrelea.htm |

| 8-K - 8-K - LUNA INNOVATIONS INC | a8-kforq42019andfullrelease.htm |

Fourth-Quarter and Year-End Fiscal 2019 Earnings Investor Supplemental Materials March 5, 2020

Safe Harbor Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding the company's future financial performance and the potential demand for its products, the company's growth potential, its balance sheet and capitalization, its valuation, its leadership team, its technological advantages, and market trends. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for the company’s products and services to meet expectations, failure of target markets to grow and expand, technological and strategic challenges, market valuation of the company and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Adjusted Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA, a non-GAAP financial measure. This non-GAAP financial measure is in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Adjusted EBITDA to Net Income is included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2020

4Q & Full-Year FY19 Results

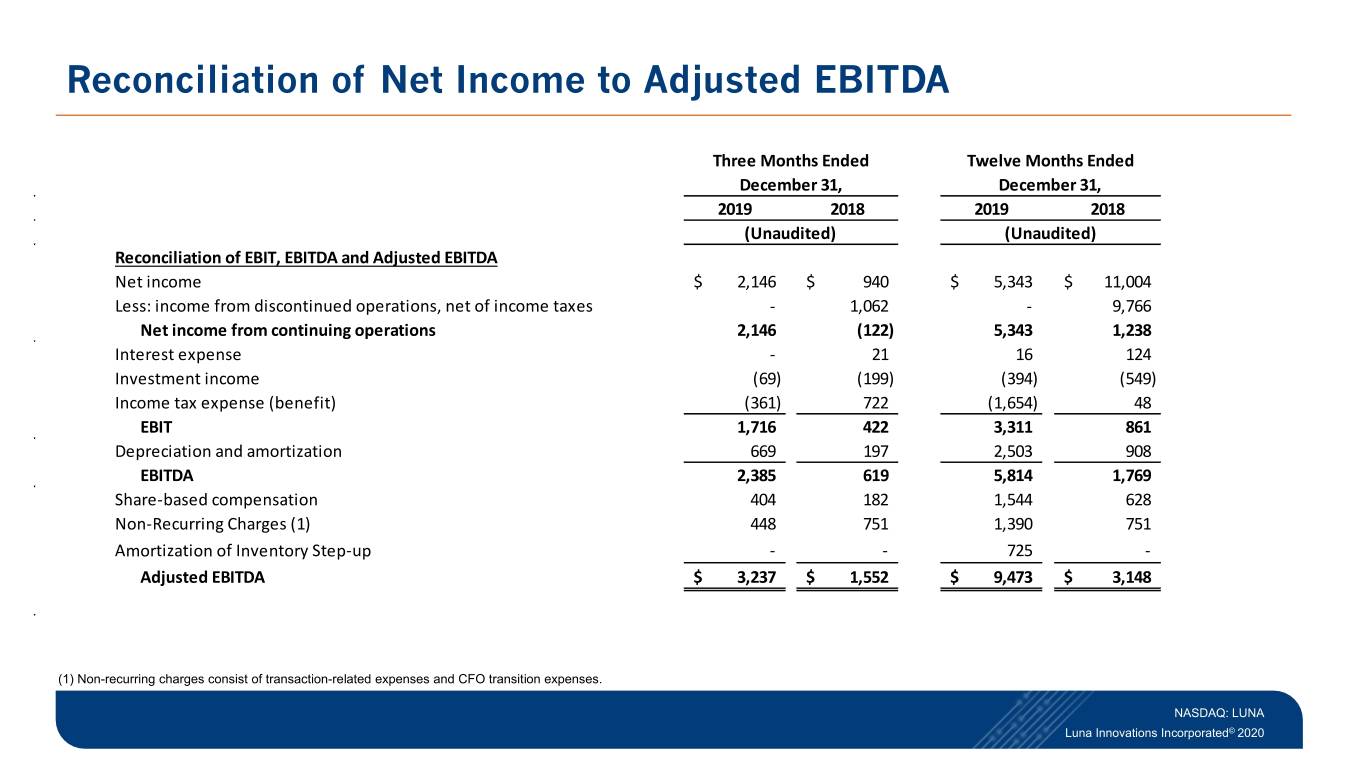

Fourth-Quarter 2019: Financial Results Strong financial performance: . Ninth consecutive quarter of year-over-year, double-digit revenue growth from continuing operations . $1.7M improvement in Adjusted EBITDA year-over-year Total revenues of $19.5M; up 44% year-over-year: . Products and licensing revenue of $13.0M; up 63% year-over-year . Technology development revenue of $6.4M; up 16% year-over-year Net income from continuing operations of $2.1M, or $0.07 per fully diluted share, for the three months ended December 31, 2019, compared to ($0.1M), or $0.00 per fully diluted share, for the three months ended December 31, 2018 Adjusted EBITDA1 doubled to $3.2M for the three months ended December 31, 2019, compared to $1.6M for the three months ended December 31, 2018 1Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2020

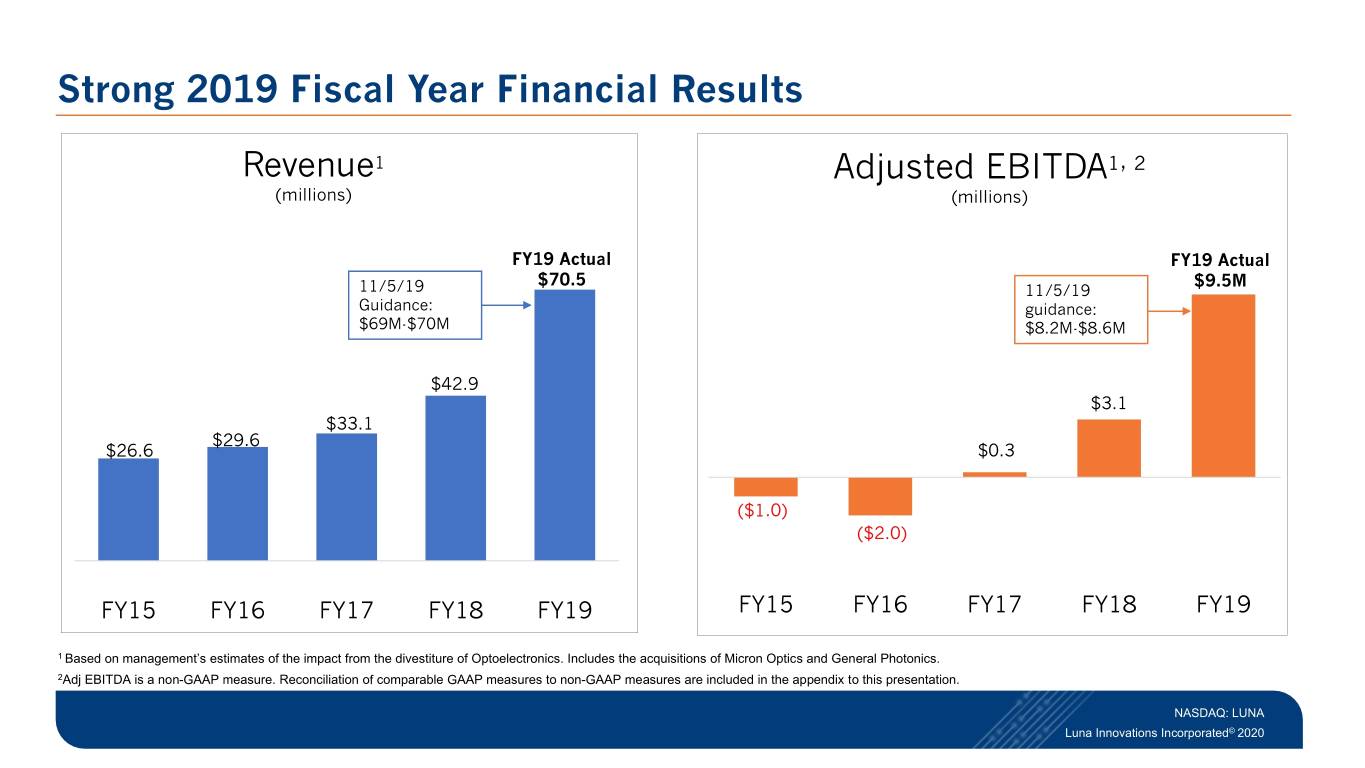

Full-Year 2019: Financial Results Strong financial performance: . Second full fiscal year of year-over-year, double-digit revenue growth from continuing operations . Nearly $6.4M improvement in Adjusted EBITDA year-over-year, representing 201% growth Total revenues of $70.5M; up 64% year-over-year: . Products and licensing revenue of $44.5M; up 103% year-over-year . Technology development revenue of $26.0M; up 24% year-over-year Net income from continuing operations of $5.3M, or $0.17 per fully diluted share, for the year ended December 31, 2019, compared to $1.2M, or $0.04 per fully diluted share, for the year ended December 31, 2018 . FY19 includes a tax benefit of $3.3M due to the release of valuation allowances against NOLs Adjusted EBITDA1 improved to $9.5M for the year ended December 31, 2019, compared to $3.1M for the year ended December 31, 2018 1Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2020

Fiscal 2019 Accomplishments Acquired General Photonics, leader in characterization and control of light for photonics applications Received large purchase order for tunable lasers from industry-leading robotics company Named 2019 Innovator of the Year by the Roanoke-Blacksburg Technology Council Launched Luna 6415, providing breakthrough measurement capability for fiber optics Signed exclusive license agreement for the supply of fiber optic technology with Meggitt PLC Initiated and fully executed $2 million stock buyback program Added diversity and cybersecurity expertise to our Board, with addition of Mary Beth Vitale Simplified capital structure by converting Series A convertible preferred stock into common stock; ceased accrual of preferred dividends; all resulting in a single class of common stock and no preferred dividends Put in place a new $10 million revolving credit facility Selected as NASA Partner for Moon and Mars Technologies (exploration studies) Named Gene Nestro as Chief Financial Officer NASDAQ: LUNA Luna Innovations Incorporated© 2020

Strong 2019 Fiscal Year Financial Results Revenue1 Adjusted EBITDA1, 2 (millions) (millions) FY19 Actual FY19 Actual $70.5 $9.5M 11/5/19 11/5/19 Guidance: guidance: $69M-$70M $8.2M-$8.6M $42.9 $3.1 $33.1 $29.6 $26.6 $0.3 ($1.0) ($2.0) FY15 FY16 FY17 FY18 FY19 FY15 FY16 FY17 FY18 FY19 1 Based on management’s estimates of the impact from the divestiture of Optoelectronics. Includes the acquisitions of Micron Optics and General Photonics. 2Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2020

A Flexible Balance Sheet and Strong Cash Position Balance sheet on December 31, 2019: . $86.5M in total assets • $25.0M in cash and cash equivalents • $41.1M in working capital Continued focus on working capital and reinvestment in business in order to generate long-term sustainable growth NASDAQ: LUNA Luna Innovations Incorporated© 2020

2020 Financial Outlook

2020 Financial Outlook Issuing FY2020 outlook: . Total revenues of $81M to $84M . Adjusted EBITDA of $10M to $12M1 1Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures are included in the appendix to this presentation. The outlook above does not include any future acquisitions, divestitures, or unanticipated events. NASDAQ: LUNA Luna Innovations Incorporated© 2020

Why Invest in Luna? Proprietary, measurement technology, offering unprecedented combination of resolution, accuracy and speed Customers in attractive markets: Aerospace, Automotive, Communications, Energy and Defense Positioned to take advantage of trends such as vehicle light-weighting and increasing demands on data centers and broadband capacity Adequately capitalized to fund growth Long-tenured, experienced executive team / board Corporate culture of innovation and integrity NASDAQ: LUNA Luna Innovations Incorporated© 2020

Appendix

Pro-forma Luna Financials, Adjusted for the sale of Optoelectronics and the Acquisitions of Micron Optics and General Photonics (in thousands) Three Months Ended1 December 31, 2018 2 March 31, 2019 3 June 20, 2019 September 30, 2019 December 31, 2019 Revenues: Products and licensing $ 11,345 $ 10,221 $ 11,373 $ 11,926 $ 13,032 Technology development 5,548 6,641 6,441 6,495 6,448 Total revenues 16,893 16,862 17,814 18,421 19,480 Cost of revenues: Products and licensing 4,002 3,836 4,578 4,562 4,317 Technology development 4,268 4,816 4,484 4,574 4,775 Total cost of revenues 8,270 8,652 9,062 9,136 9,092 Gross Profit 8,623 8,210 8,752 9,285 10,388 Operating expense: Selling, general and administrative 6,394 7,165 6,003 5,754 6,415 Research, development and engineering 1,894 1,708 1,735 2,047 2,255 Total operating expense 8,288 8,873 7,738 7,801 8,670 Operating income/(loss) $ 335 $ (663) $ 1,014 $ 1,484 $ 1,718 1 Unaudited pro forma financials assumes the Optoelectronics business was sold and the Micron Optics and General Photonics businesses were acquired on January 1, 2018. 2 Includes $751,000 of costs associated with the acquisition of Micron Optics. 3 Includes $898,000 of costs associated with the acquisition of General Photonics. NASDAQ: LUNA Luna Innovations Incorporated© 2020

Reconciliation of Net Income to Adjusted EBITDA Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 (Unaudited) (Unaudited) Reconciliation of EBIT, EBITDA and Adjusted EBITDA Net income $ 2,146 $ 940 $ 5,343 $ 11,004 Less: income from discontinued operations, net of income taxes - 1,062 - 9,766 Net income from continuing operations 2,146 (122) 5,343 1,238 Interest expense - 21 16 124 Investment income (69) (199) (394) (549) Income tax expense (benefit) (361) 722 (1,654) 48 EBIT 1,716 422 3,311 861 Depreciation and amortization 669 197 2,503 908 EBITDA 2,385 619 5,814 1,769 Share-based compensation 404 182 1,544 628 Non-Recurring Charges (1) 448 751 1,390 751 Amortization of Inventory Step-up - - 725 - Adjusted EBITDA $ 3,237 $ 1,552 $ 9,473 $ 3,148 (1) Non-recurring charges consist of transaction-related expenses and CFO transition expenses. NASDAQ: LUNA Luna Innovations Incorporated© 2020

Reconciliation of Net Income to Adjusted EBITDA: Full Fiscal Year Year Ended December 31, (unaudited) 2017 2018 2019 Reconciliation of EBITDA and Adjusted EBITDA Net income $ 14,615 $ 11,004 $ 5,343 Less: income from discontinued operations, net of income taxes 15,866 9,766 - Net income from continuing operations (1,251) 1,238 5,343 Interest expense 217 124 16 Investment income (549) (394) Income tax expense (benefit) (1,148) 48 (1,654) Depreciation and amortization 1,137 908 2,503 EBITDA (1,045) 1,769 5,814 Share-based compensation 715 628 1,544 Non-Recurring Charges (1) 596 751 1,390 Amortization of Inventory Step-up - - 725 Adjusted EBITDA $ 266 $ 3,148 $ 9,473 (1) Non-recurring charges include the following: 2017) CEO separation costs and other share-based compensation; 2018) Transaction-related expenses associated with the acquisition of Micron Optics, Inc.; 2019) Transaction related expenses and inventory step-up amortization relate to General Photonics acquisition and CFO transition expenses NASDAQ: LUNA Luna Innovations Incorporated© 2020