Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Funko, Inc. | ex-991.htm |

| 8-K - 8-K - Funko, Inc. | fnko-20200305.htm |

Exhibit 99.2 Fourth Quarter and Fiscal Year 2019 Earnings March 5, 2020

Cautionary Notes This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding our future results of operations and financial position, industry dynamics, our mission, growth opportunities and business strategy and plans and our objectives for future operations, including expanding into new product categories, broadening our retailer network and increasing international sales, are forward-looking statements. The words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this presentation are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including without limitation our ability to execute our business strategy; our ability to maintain and realize the full value of our license agreements; the ongoing level of popularity of our products with consumers; changes in the retail industry and markets for our consumer products; our ability to maintain our relationships with retail customers and distributors; our ability to compete effectively; fluctuations in our gross margin; our dependence on content development and creation by third parties; our ability to manage our inventories; our ability to develop and introduce products in a timely and cost-effective manner; increases in tariffs, trade restrictions or taxes; risks related to Brexit; counterfeit product risks; risks relating to intellectual property; our ability to attract and retain qualified employees and maintain our corporate culture; our use of third-party manufacturing; risks associated with our international operations; risks related to the recent coronavirus outbreak; changes in effective tax rates; foreign currency exchange rate exposure; economic downturns; our dependence on vendors and outsourcers; risks relating to government regulation; risks relating to litigation; any failure to successfully integrate or realize the anticipated benefits of acquisitions or investments; reputational risk resulting from our e-commerce business and social media presence; risks relating to our indebtedness and our ability to secure additional financing; the potential for our electronic data or the electronic data of our customers to be compromised, risks relating to our organizational structure; risks associated with our internal control over financial reporting; and the important factors discussed under the caption “Risk Factors” in our Form 10-K for the year ended December 31, 2019 and our other filings with the Securities and Exchange Commission. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward- looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date hereof, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. You should read this presentation with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as of the date of this presentation, and except as otherwise required by law, we do not plan to publicly update or revise any forward-looking statements contained in this presentation, whether as a result of any new information, future events or otherwise. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by us. 2

is built on the principle that everyone is a fan of something… 3

…and Funko has something for every fan Funko is like an “index fund” for pop culture 4 NOTE: Represents a sampling of our current portfolio of properties as of January 2019.

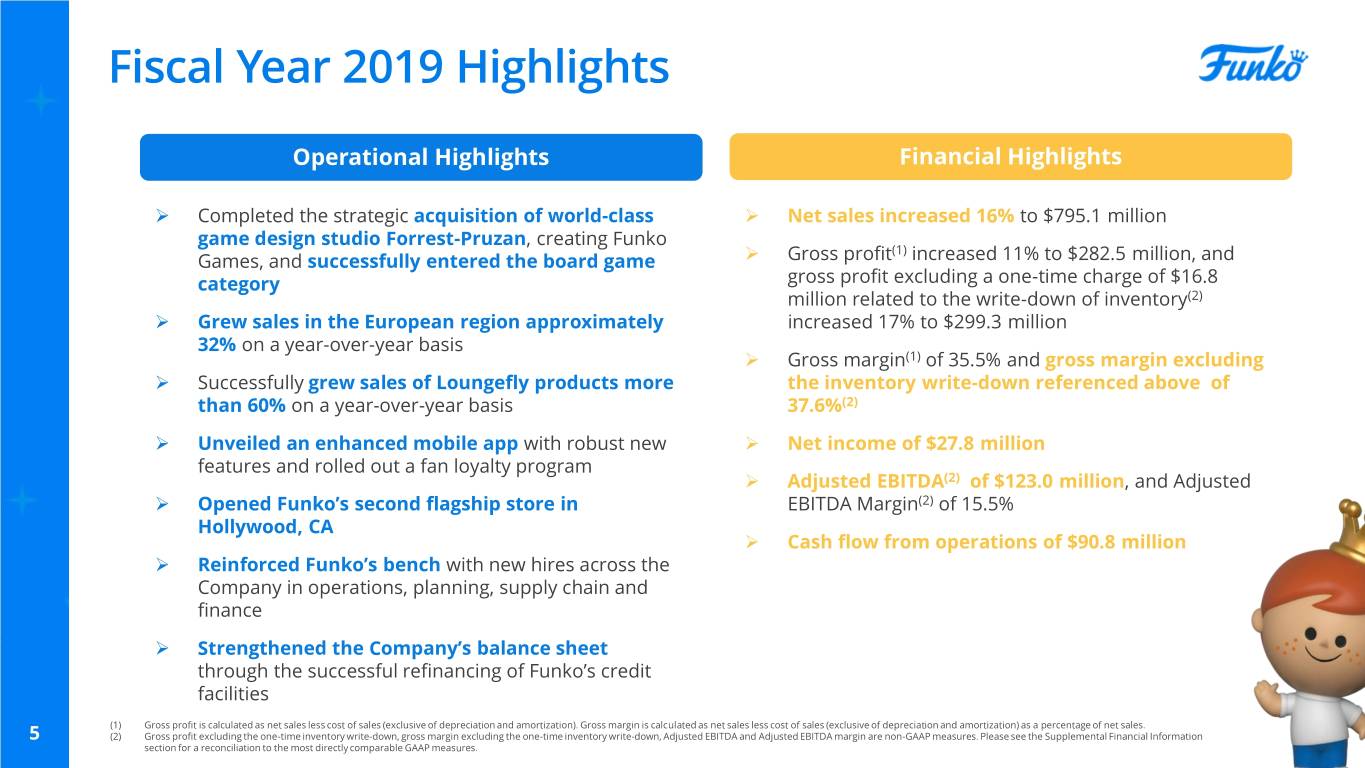

Fiscal Year 2019 Highlights Operational Highlights Financial Highlights Completed the strategic acquisition of world-class Net sales increased 16% to $795.1 million game design studio Forrest-Pruzan, creating Funko (1) Games, and successfully entered the board game Gross profit increased 11% to $282.5 million, and category gross profit excluding a one-time charge of $16.8 million related to the write-down of inventory(2) Grew sales in the European region approximately increased 17% to $299.3 million 32% on a year-over-year basis Gross margin(1) of 35.5% and gross margin excluding Successfully grew sales of Loungefly products more the inventory write-down referenced above of than 60% on a year-over-year basis 37.6%(2) Unveiled an enhanced mobile app with robust new Net income of $27.8 million features and rolled out a fan loyalty program Adjusted EBITDA(2) of $123.0 million, and Adjusted Opened Funko’s second flagship store in EBITDA Margin(2) of 15.5% Hollywood, CA Cash flow from operations of $90.8 million Reinforced Funko’s bench with new hires across the Company in operations, planning, supply chain and finance Strengthened the Company’s balance sheet through the successful refinancing of Funko’s credit facilities (1) Gross profit is calculated as net sales less cost of sales (exclusive of depreciation and amortization). Gross margin is calculated as net sales less cost of sales (exclusive of depreciation and amortization) as a percentage of net sales. 5 (2) Gross profit excluding the one-time inventory write-down, gross margin excluding the one-time inventory write-down, Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures. Please see the Supplemental Financial Information section for a reconciliation to the most directly comparable GAAP measures.

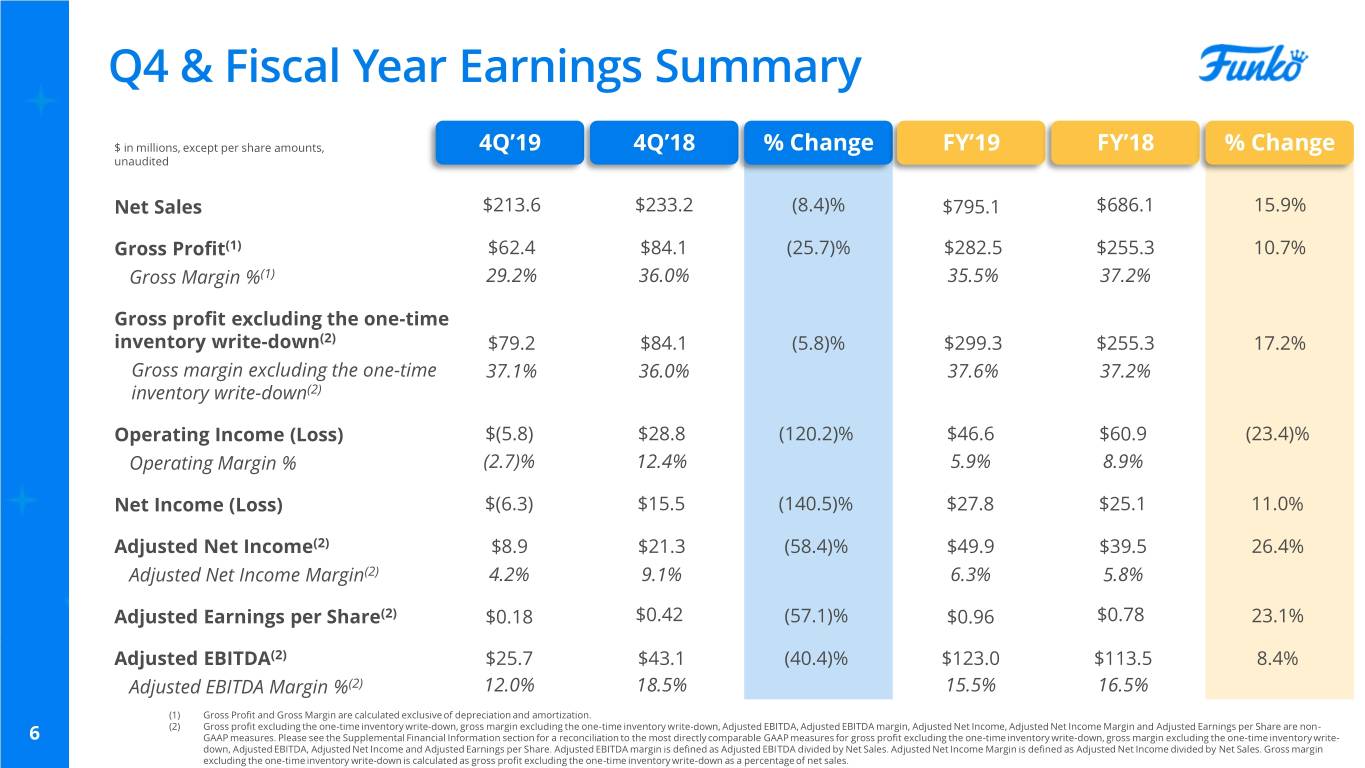

Q4 & Fiscal Year Earnings Summary $ in millions, except per share amounts, 4Q’19 4Q’18 % Change FY’19 FY’18 % Change unaudited Net Sales $213.6 $233.2 (8.4)% $795.1 $686.1 15.9% Gross Profit(1) $62.4 $84.1 (25.7)% $282.5 $255.3 10.7% Gross Margin %(1) 29.2% 36.0% 35.5% 37.2% Gross profit excluding the one-time inventory write-down(2) $79.2 $84.1 (5.8)% $299.3 $255.3 17.2% Gross margin excluding the one-time 37.1% 36.0% 37.6% 37.2% inventory write-down(2) Operating Income (Loss) $(5.8) $28.8 (120.2)% $46.6 $60.9 (23.4)% Operating Margin % (2.7)% 12.4% 5.9% 8.9% Net Income (Loss) $(6.3) $15.5 (140.5)% $27.8 $25.1 11.0% Adjusted Net Income(2) $8.9 $21.3 (58.4)% $49.9 $39.5 26.4% Adjusted Net Income Margin(2) 4.2% 9.1% 6.3% 5.8% Adjusted Earnings per Share(2) $0.18 $0.42 (57.1)% $0.96 $0.78 23.1% Adjusted EBITDA(2) $25.7 $43.1 (40.4)% $123.0 $113.5 8.4% Adjusted EBITDA Margin %(2) 12.0% 18.5% 15.5% 16.5% (1) Gross Profit and Gross Margin are calculated exclusive of depreciation and amortization. (2) Gross profit excluding the one-time inventory write-down, gross margin excluding the one-time inventory write-down, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Net Income Margin and Adjusted Earnings per Share are non- 6 GAAP measures. Please see the Supplemental Financial Information section for a reconciliation to the most directly comparable GAAP measures for gross profit excluding the one-time inventory write-down, gross margin excluding the one-time inventory write- down, Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings per Share. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by Net Sales. Adjusted Net Income Margin is defined as Adjusted Net Income divided by Net Sales. Gross margin excluding the one-time inventory write-down is calculated as gross profit excluding the one-time inventory write-down as a percentage of net sales.

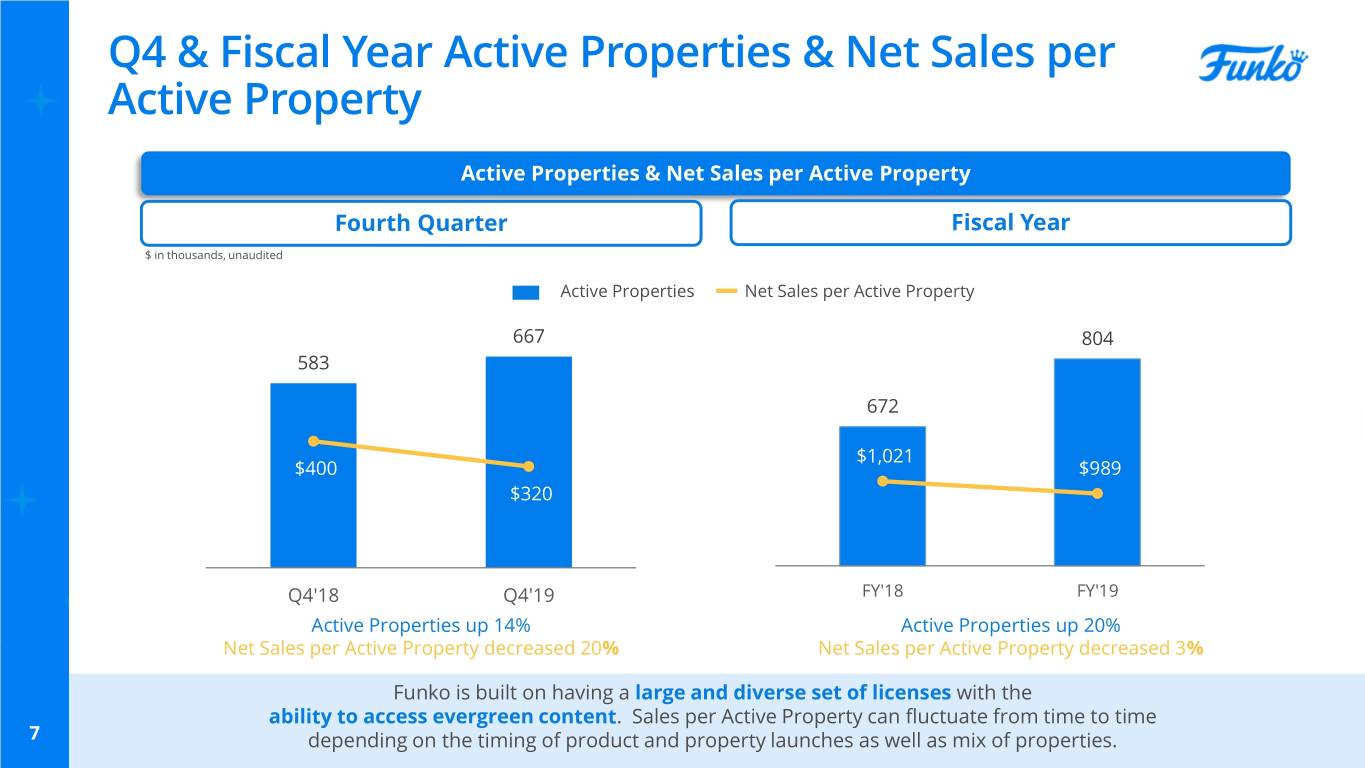

Q4 & Fiscal Year Active Properties & Net Sales per Active Property Active Properties & Net Sales per Active Property Fourth Quarter Fiscal Year $ in thousands, unaudited Active Properties Net Sales per Active Property 667 850 804 $1,400 583 800 $1,300 750 700 672 $1,200 650 $1,021 $1,100 $400 600 $989 $320 550 $1,000 500 $900 450 400 $800 Q4'18 Q4'19 FY'18 FY'19 Active Properties up 14% Active Properties up 20% Net Sales per Active Property decreased 20% Net Sales per Active Property decreased 3% Funko is built on having a large and diverse set of licenses with the ability to access evergreen content. Sales per Active Property can fluctuate from time to time 7 depending on the timing of product and property launches as well as mix of properties.

Top Properties Breakout Q4’18 Q1’19 Q2’19 Q3’19 Q4’19 The top property in 1 12%* 10%* 6%* 9%* 6%* Q4’19 represented only 6% of sales 2 Evergreen properties 3 accounted for 52% of sales in Q4’19 4 5 6 7 8 9 10 Top 10 Properties 38% 41% 37% 38% 38% *% of net sales 8 % of Net Sales

Q4 & Fiscal Year Product Category Performance Figures Other Fourth Quarter Fiscal Year Fourth Quarter Fiscal Year $ in millions, unaudited 10% 15% 4% 21% Decrease Growth Decrease Growth $188.3 $642.5 $152.6 $560.1 $170.2 $126.0 $45.0 $43.3 Q4'18 Q4'19 FY'18 FY'19 Q4'18 Q4'19 FY'18 FY'19 The sales growth in the figure category in 2019 was primarily due to Pop! Vinyl growth and the expanded selection of 9 advent calendars; growth in Other products in 2019 was driven by the expansion of our soft lines products which include apparel, bags and wallets as well as board games

Annual Product Category Performance Annual Product Category Performance $ in millions, unaudited ’16-’19 CAGR Figures Other Figures 22% $795 Other 26% $686 Total 23% $153 $126 $516 $427 $94 $77 $643 $560 $422 $350 FY'16 FY'17 FY'18 FY'19 % Figures 82% 82% 82% 81% Funko is able to continue to drive growth through the addition of new properties and product categories 10

Something for Everyone Fans can find their something as the world of Funko continues to expand with new product categories. FIGURES OTHER 80% of 20% of Sales* Sales* 11 *% of net sales for Q4’ 19

Recent Non-Licensed Toy Line Announcements Funko is expanding its addressable market by launching new non-licensed toy lines that will live in the toy aisle and be supported by Funko Animation Studios 12

Recent Board Game Announcements Funko Games are expecting to release dozens of new board games in 2020 that include new Funkoverse games as well as new licensed and non-licensed games 13

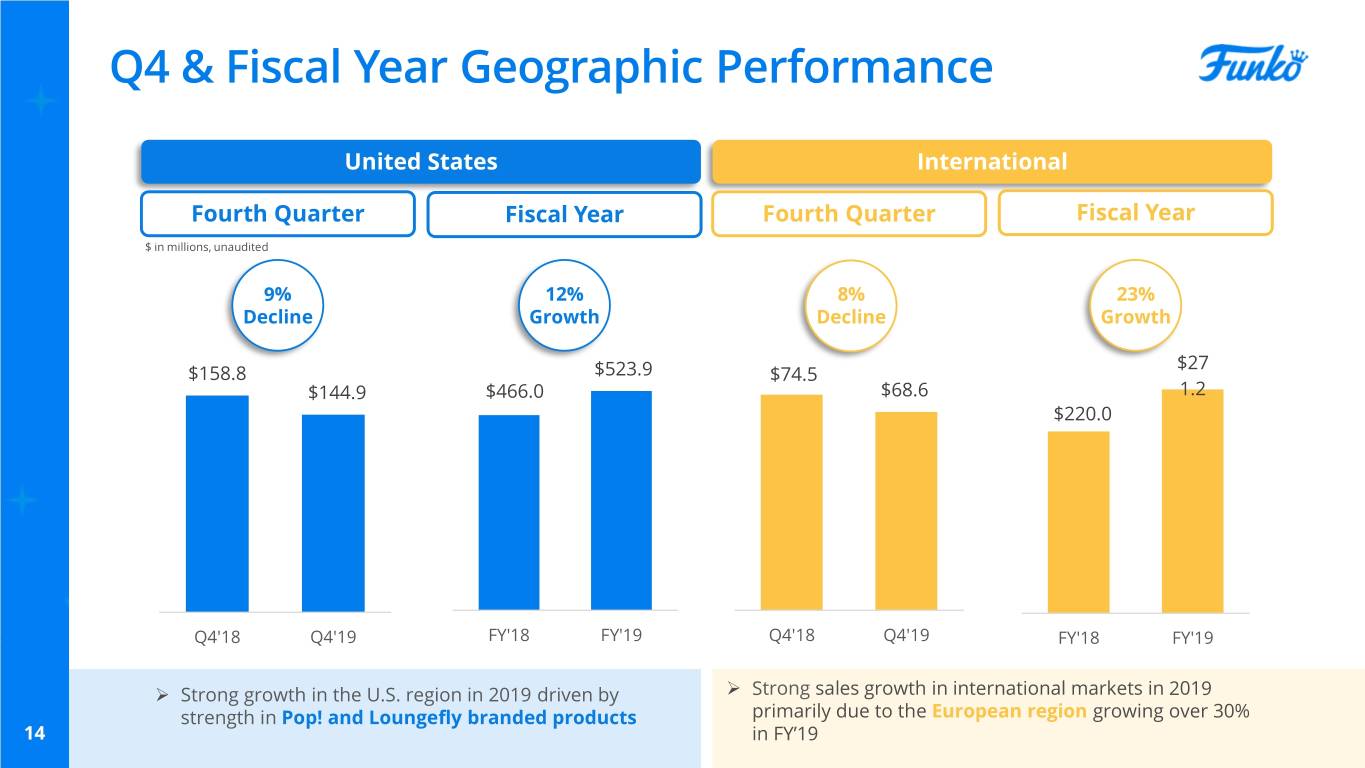

Q4 & Fiscal Year Geographic Performance United States International Fourth Quarter Fiscal Year Fourth Quarter Fiscal Year $ in millions, unaudited 9% 12% 8% 23% Decline Growth Decline Growth $27 $158.8 $523.9 $74.5 $144.9 $466.0 $68.6 1.2 $220.0 Q4'18 Q4'19 FY'18 FY'19 Q4'18 Q4'19 FY'18 FY'19 Strong growth in the U.S. region in 2019 driven by Strong sales growth in international markets in 2019 strength in Pop! and Loungefly branded products primarily due to the European region growing over 30% 14 in FY’19

Annual Geographic Performance Annual Geographic Performance $ in millions, unaudited ’16-’19 CAGR US International $795 U.S. 14% International 54% $686 Total 23% $271 $516 $220 $427 $140 $74 $524 $466 $353 $376 FY'16 FY'17 FY'18 FY'19 % U.S. 83% 73% 68% 66% Funko can leverage its diverse property and product category portfolio by 15 leveraging them across new regions and channels

Q4 & Fiscal Year Adjusted Net Income(1) Adjusted Net Income(1) Fourth Quarter Fiscal Year $ in millions, unaudited 58% 26% Decline Growth $49.9 $21.3 $39.5 $8.9 Q4'18 Q4'19 FY'18 FY'19 Adjusted Net Income 9.1% 4.2% 5.8% 6.6%6.3% Margin(1) Q4’19 decline in Adjusted Net Income(1) is primarily due to the decrease in net sales and the planned increase in investments in SG&A in the second half of 2019 as well as interest expense savings and lower depreciation and amortization expense as a percent of net sales 16 (1) See Supplemental Financial Information section for a reconciliation of Adjusted Net Income, a non-GAAP measure, to the most directly comparable GAAP measure. Adjusted Net Income Margin is defined as Adjusted Net Income divided by net sales.

Q4 & Fiscal Year Adjusted EBITDA(1) Adjusted EBITDA(1) Fourth Quarter Fiscal Year $ in millions, unaudited 40% 8% Decline Growth $43.1 $123.0 $113.5 $25.7 Q4'18 Q4'19 FY'18 FY'19 Adj. EBITDA 18.5% 12.0% 16.5% 15.5% Margin %(1) Adj. EBITDA Margin(1) decreased in Q4’19 due to sales decline and the planned increase in investments in SG&A in the second half of 2019 17 (1) See Supplemental Financial Information section for a reconciliation of Adjusted EBITDA, a non-GAAP measure, to the most directly comparable GAAP measure. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net sales.

Key Balance Sheet Highlights 12/31/2019 12/31/2018 YoY % Change $ in millions, unaudited Cash & Cash Equivalents $25.2 $13.5 87.1% Accounts $151.6 $148.6 2.0% Receivable, net Inventory $62.1 $86.6 (28.3)% Total Debt(1) $242.3 $247.3 (2.0)% 18 (1) Total Debt is defined as Line of Credit Outstandings plus Current Portion of Long-Term Debt, Net of Unamortized Discount plus Long-Term Debt, Net of Unamortized Discount.

Fiscal Year 2020 Guidance Fiscal Year 2020 Guidance Range(1) Net Sales $840 to $865 million Adjusted EBITDA(2) $115 to $125 million Adjusted Net Income(2) $43 to $51 million Adjusted EPS(2) $0.85 to $1.00 (1) The guidance should be read in conjunction with Funko’s fourth quarter 2019 earnings release issued on March 5, 2020 and is as of such date and does not take into account any future changes in currency fluctuation. (2) Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings per Share are non-GAAP measures. Please see the Supplemental Financial Information section for a reconciliation to the most directly comparable GAAP 19 measures for Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings per Share.

Supplemental Financial Information

Q4 & Fiscal Year Condensed Consolidated Statements of Operations Q4’19 Q4’18 % Change FY’19 FY’18 % Change $ in thousands, unaudited Net Sales $213,551 $233,224 (8.4)% $795,122 $686,073 15.9% Cost of Sales(1) 151,125 149,172 1.3% 512,580 430,746 19.0% Gross Profit(1) 62,426 84,052 (25.7)% 282,542 255,327 10.7% Gross Margin(1) 29.2% 36.0% 35.5% 37.2% Selling, General and Administrative Expenses 57,264 45,015 27.2% 193,803 155,321 24.8% Acquisition Transaction Costs - - n/a - 28 (100.0)% Depreciation and Amortization 10,999 10,204 7.8% 42,126 39,116 7.7% Income (Loss) from Operations (5,837) 28,833 (120.2)% 46,613 60,862 (23.4)% Interest Expense, net 2,887 4,509 (36.0)% 14,342 21,739 (34.0) Loss on extinguishment of debt -- 4,547 n/a -- 4,547 (100.0)% Other (Income) Expense, net (448) 1,488 (130.1)% (25) 4,082 (100.6)% Income (Loss) before Income Taxes (8,276) 18,289 (145.3)% 32,296 30,494 5.9% Income Tax (Benefit) Expense (1,988) 2,770 (171.8)% 4,476 5,432 (17.6)% Net Income (Loss) $(6,288) $15,519 (140.5)% $27,820 $25,062 11.0% Less: Net Income (Loss) Attributable to Non-Controlling Interests (2,047) 10,292 (119.9)% 16,095 17,599 (8.5)% Net Income (Loss) Attributable to Funko, Inc. $(4,241) $5,227 (181.1)% $11,725 $7,463 57.1% 21 (1) Cost of Sales, Gross Profit and Gross Margin are shown exclusive of depreciation and amortization.

Condensed Consolidated Balance Sheet 12/31/2019 12/31/2018 $ in thousands, unaudited Cash and Cash Equivalents $25,229 $13,486 Accounts Receivable, net 151,564 148,627 Inventory 62,124 86,622 Prepaid Expenses & Other Current Assets 20,280 11,904 Total Current Assets 259,197 260,639 Property & Equipment, net 65,712 44,296 Operating Lease Right-Of-Use Assets 62,901 - Goodwill & Intangible Assets, net 346,327 349,723 Deferred Tax Asset 57,547 7,407 Other Assets 4,783 4,275 Total Assets $796,467 $666,340 Line of Credit $25,822 $20,000 Current Portion of Long-Term Debt, net 13,685 10,593 Current Portion of Operating Lease Liability 11,314 -- Accounts Payable 42,531 36,130 Income Taxes Payable 637 4,492 Accrued Royalties 34,625 39,020 Accrued Expenses & Other Current Liabilities 28,955 33,015 Total Current Liabilities 157,569 143,250 Long-Term Debt, net 202,816 216,704 Operating Lease Liabilities, net 61,622 - Deferred Tax Liability & Liabilities under TRA 61,895 6,509 Deferred Rent & Other Long-Term Liabilities 7,421 6,623 Total Liabilities 491,323 373,086 Total Shareholders’ Equity Attributable to Funko, Inc. 225,411 154,708 Non-Controlling Interests 79,733 138,546 Total Liabilities & Stockholders’ Equity $796,467 $666,340 22

Reconciliation of Non-GAAP Financial Metrics Three Months Ended December 31, Twelve Months Ended December 31, 2019 2018 2019 2018 (amounts in thousands) Net sales $ 213,551 $ 233,224 $ 795,122 $ 686,073 Cost of sales (exclusive of depreciation and amortization) 151,125 149,172 512,580 430,746 Gross profit (1) $ 62,426 $ 84,052 $ 282,542 $ 255,327 Gross margin (1) 29.2% 36.0% 35.5% 37.2% Adjustments: One-time inventory write-down (2) 16,775 — 16,775 — Gross profit excluding the one-time inventory write-down $ 79,201 $ 84,052 $ 299,317 $ 255,327 Gross margin excluding the one-time inventory write-down 37.1% 36.0% 37.6% 37.2% 1) Gross profit is calculated as net sales less cost of sales (exclusive of depreciation and amortization). Gross margin is calculated as net sales less cost of sales (exclusive of depreciation and amortization) as a percentage of net sales. 2) Represents a one-time $16.8 million charge for the three and twelve months ended December 31, 2019 to cost of goods sold for additional inventory reserves to dispose of certain inventory items. This charge is incremental to normal course inventory reserves and was recorded as a result of the Company’s decision to dispose of slower moving inventory to increase operational capacity. 23

Reconciliation of Non-GAAP Financial Metrics Cont. Three Months Ended December 31, Twelve Months Ended December 31, 2019 2018 2019 2018 (In thousands, except per share data) Net income (loss) attributable to Funko, Inc. $ (4,241) $ 5,227 $ 11,725 $ 7,463 Reallocation of net income (loss) attributable to non-controlling interests from the assumed exchange of common units of FAH, LLC for Class A common stock (1) (2,047) 10,292 16,095 17,599 Equity-based compensation (2) 3,214 3,390 13,044 9,140 Loss on extinguishment of debt — 4,547 — 4,547 Acquisition transaction costs and other expenses (3) — 700 383 3,391 Customs investigation and related costs (4) — — 3,357 — Certain severance, relocation and related costs (5) 559 — 739 1,031 Foreign currency transaction (gain) loss (6) (600) 1,488 (177) 4,082 Tax receivable agreement liability adjustments 152 — 152 — One-time inventory write-down (7) 16,775 — 16,775 — Income tax expense (benefit) (8) (4,944) (4,334) (12,166) (7,739) Adjusted net income 8,868 21,310 49,927 39,514 Adjusted net income margin (9) 4.2% 9.1% 6.3% 5.8% Weighted-average shares of Class A common stock outstanding - basic 34,883 24,821 30,898 23,821 Equity-based compensation awards and common units of FAH, LLC that are convertible into Class A common stock 15,403 26,054 21,167 26,858 Adjusted weighted-average shares of Class A stock outstanding - diluted 50,286 50,875 52,065 50,679 Adjusted earnings per diluted share $ 0.18 $ 0.42 $ 0.96 $ 0.78 1) Represents the reallocation of net income attributable to non-controlling interests from the assumed exchange of common units of FAH, LLC for Class A common stock in periods in which income was attributable to non-controlling interests. 2) Represents non-cash charges related to equity-based compensation programs, which vary from period to period depending on timing of awards. 3) Represents legal, accounting, and other related costs incurred in connection with acquisitions and other potential transactions. Included for the twelve months ended December 31, 2018 is a one-time $2.0 million consent fee related to certain existing license agreements and $0.7 million for the recognition of a pre-acquisition contingency related to our Loungefly acquisition. 4) Represents legal, accounting and other related costs incurred in connection with the Company's investigation of the underpayment of customs duties at Loungefly. For the twelve months ended December 31, 2019, includes the accrual of a contingent liability of $0.5 million related to potential penalties that may be assessed by U.S. Customs in connection with the underpayment of customs duties at Loungefly. 5) Represents certain severance, relocation and related costs. For the three months and twelve months ended December 31, 2019, includes $0.4 million of severance costs incurred in connection with the departure of our former Chief Financial Officer as well as severance, relocation and related costs associated with the consolidation of our warehouse facilities in the United Kingdom. For the twelve months ended December 31, 2018, includes severance costs incurred in connection with the departure of certain members of senior management, including the founders of Loungefly. 6) Represents both unrealized and realized foreign currency losses on transactions other than in U.S. dollars. 7) Represents a one-time $16.8 million charge for the three and twelve months ended December 31, 2019 to cost of goods sold for additional inventory reserves to dispose of certain inventory items. This charge is incremental to normal course inventory reserves and was recorded as a result of the Company’s decision to dispose of slower moving inventory to increase operational capacity. 8) Represents the income tax expense effect of the above adjustments. This adjustment uses an effective tax rate of 25% for all periods presented. 24 9) Adjusted net income margin is calculated as Adjusted net income as a percentage of net sales.

Reconciliation of Non-GAAP Financial Metrics Cont. Three Months Ended December 31, Twelve Months Ended December 31, 2019 2018 2019 2018 (amounts in thousands) Net income (loss) $ (6,288) $ 15,519 $ 27,820 $ 25,062 Interest expense, net 2,887 4,509 14,342 21,739 Income tax (benefit) expense (1,988) 2,770 4,476 5,432 Depreciation and amortization 10,999 10,204 42,126 39,116 EBITDA $ 5,610 $ 33,002 $ 88,764 $ 91,349 Adjustments: Equity-based compensation (1) 3,214 3,390 13,044 9,140 Loss on extinguishment of debt — 4,547 — 4,547 Acquisition transaction costs and other expenses (2) — 700 383 3,391 Customs investigation and related costs (3) — — 3,357 — Certain severance, relocation and related costs (4) 559 — 739 1,031 Foreign currency transaction (gain) loss (5) (600) 1,488 (177) 4,082 One-time inventory write-down (6) 16,775 — 16,775 — Tax receivable agreement liability adjustments 152 — 152 — Adjusted EBITDA $ 25,710 $ 43,127 $ 123,037 $ 113,540 Adjusted EBITDA margin (7) 12.0% 18.5% 15.5% 16.5% 1) Represents non-cash charges related to equity-based compensation programs, which vary from period to period depending on timing of awards. 2) Represents legal, accounting, and other related costs incurred in connection with acquisitions and other potential transactions. Included for the twelve months ended December 31, 2018 is a one-time $2.0 million consent fee related to certain existing license agreements and $0.7 million for the recognition of a pre-acquisition contingency related to our Loungefly acquisition. 3) Represents legal, accounting and other related costs incurred in connection with the Company's investigation of the underpayment of customs duties at Loungefly. For the twelve months ended December 31, 2019, includes the accrual of a contingent liability of $0.5 million related to potential penalties that may be assessed by U.S. Customs in connection with the underpayment of customs duties at Loungefly. 4) Represents certain severance, relocation and related costs. For the three months and twelve months ended December 31, 2019, includes $0.4 million of severance costs incurred in connection with the departure of our former Chief Financial Officer as well as severance, relocation and related costs associated with the consolidation of our warehouse facilities in the United Kingdom. For the twelve months ended December 31, 2018, includes severance costs incurred in connection with the departure of certain members of senior management, including the founders of Loungefly. 5) Represents both unrealized and realized foreign currency losses on transactions other than in U.S. dollars. 6) Represents a one-time $16.8 million charge for the three and twelve months ended December 31, 2019 to cost of goods sold for additional inventory reserves to dispose of certain inventory items. This charge is incremental to normal course inventory reserves and was recorded as a result of the Company’s decision to dispose of slower moving inventory to increase operational capacity. 7) Adjusted EBITDA margin is calculated as Adjusted EBITDA as a percentage of net sales. 25

Guidance Reconciliation of Net Income to EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Earnings per Diluted Share Estimated Range for the Year Ending December 31, 2020 (In millions, except per share amounts) Net Sales $ 840.0 $ 865.0 Net income $ 34.1 $ 41.9 Interest expense, net 11.5 11.5 Income tax expense 9.6 11.8 Depreciation and amortization 45.8 45.8 EBITDA $ 101.0 $ 111.0 Adjustments: Equity-based compensation (1) 13.3 13.3 Certain severance, relocation and related costs (2) 0.7 0.7 Adjusted EBITDA $ 115.0 $ 125.0 Adjusted EBITDA Margin(3) 13.7% 14.5% Net income $ 34.1 $ 41.9 Equity-based compensation (1) 13.3 13.3 Certain severance, relocation and related costs (2) 0.7 0.7 Income tax expense (4) (4.8) (5.1) Adjusted net income $ 43.3 $ 50.8 Weighted-average shares of Class A common stock outstanding 35.6 35.6 Equity-based compensation awards and common units of FAH, LLC that are convertible into Class A common stock 15.4 15.4 Adjusted weighted-average shares of Class A stock outstanding - diluted 51.0 51.0 Adjusted earnings per diluted share $ 0.85 $ 1.00 (1) Represents non-cash charges related to equity-based compensation programs, which vary from period to period depending on timing of awards. (2) Represents severance, relocation and related costs associated with the consolidation of our new warehouse facilities in the United Kingdom. (3) Adjusted EBITDA Margin is calculated as Adjusted EBITDA as a percentage of net sales. (4) Represents the income tax expense effect of the above adjustments. This adjustment uses an effective tax rate of 25% for the year ending December 31, 2020. The Company is not able to provide the expected impact of unrealized and realized foreign currency gains and losses for the year ending December 31, 2020 on transactions without unreasonable efforts because the calculation for that change is primarily driven by changes in foreign currency exchange rates, principally British pounds and euros. Additionally, the impacts are also driven by fluctuations in product sales and operating expenses in each of those local currencies, which can fluctuate month to month. 26 Therefore, the Company’s Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Earnings per Diluted Share for the year ending December 31, 2020, including the above adjustments, may differ materially from that forecasted in the table above.