Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CRAWFORD & CO | exhibit991123119q4pressrel.htm |

| 8-K - 8-K - CRAWFORD & CO | a3520208-k.htm |

Forward-Looking Statements and Additional Information Forward-Looking Statements This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawco.com. Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. Revenues Before Reimbursements ("Revenues") Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this presentation. Segment and Consolidated Operating Earnings Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its three operating segments. Segment operating earnings represent segment earnings, including the direct and indirect costs of certain administrative functions required to operate our business, but excludes unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill and intangible asset impairment charges, certain tax valuation allowances, loss on disposition of business line, arbitration and claim settlements , income taxes, and net income or loss attributable to noncontrolling interests and redeemable noncontrolling interests. Earnings Per Share The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class. In certain periods, the Company has paid a higher dividend on CRD-A than on CRD-B. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two-class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. Segment Gross Profit Segment gross profit is defined as revenues, less direct costs, which exclude indirect centralized administrative support costs allocated to the business. Indirect expenses consist of centralized administrative support costs, regional and local shared services that are allocated to each segment based on usage. Non-GAAP Financial Information For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. 2

Crawford & Company The world’s largest publicly listed independent provider of global outsourced claims management solutions to carriers, brokers and corporates 1.6Million Claims handled worldwide Organized across global service lines: 9,000 • Crawford Claims Solutions (P&C adjusting solutions) Total employees • Crawford TPA Solutions (Broadspire) CRD-A & CRD-B • Crawford Specialty Solutions (Global Technical Listed on NYSE Services & Contractor Connection) 3

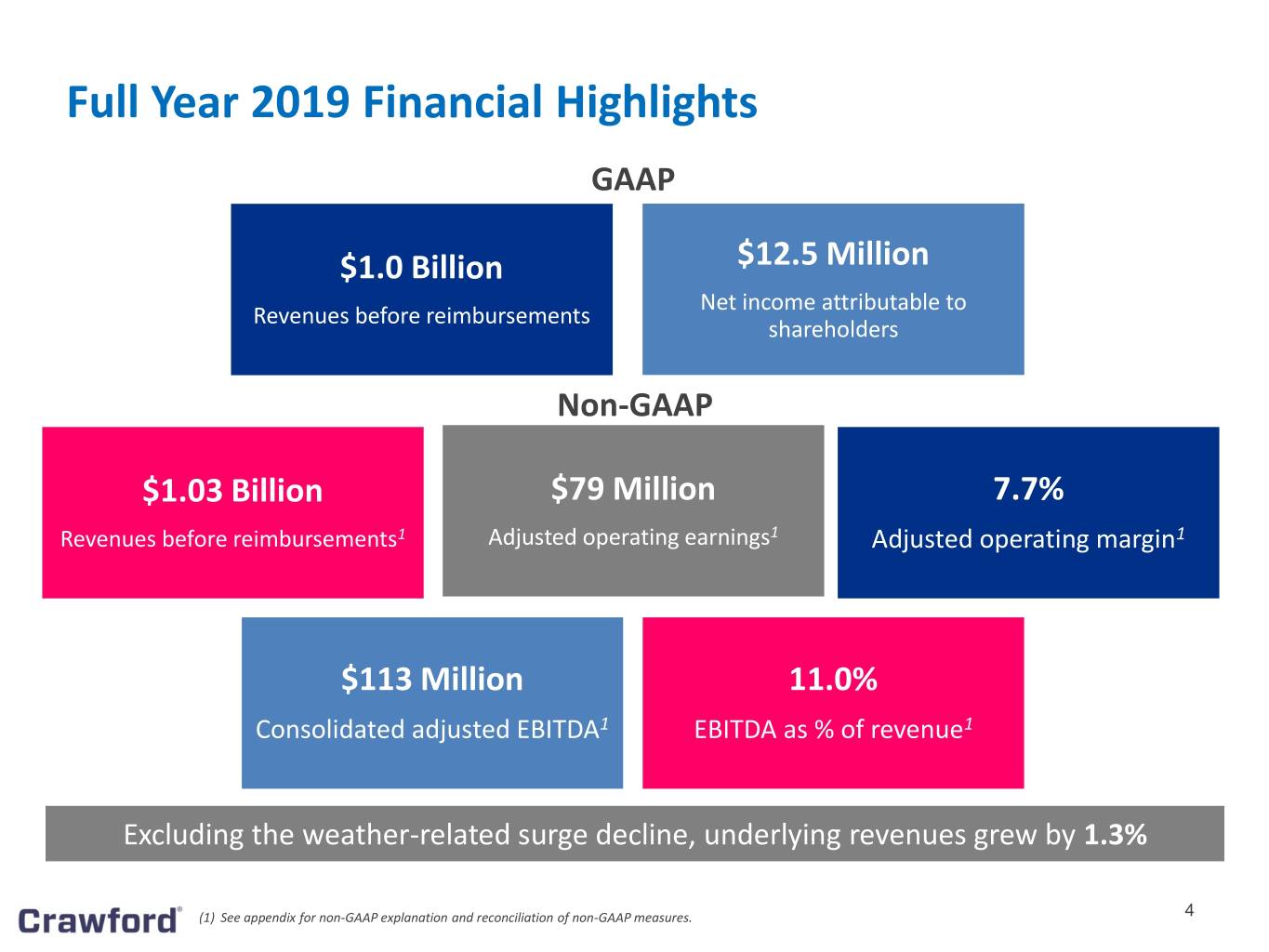

Full Year 2019 Financial Highlights GAAP $1.0 Billion $12.5 Million Net income attributable to Revenues before reimbursements shareholders Non-GAAP $1.03 Billion $79 Million 7.7% Revenues before reimbursements1 Adjusted operating earnings1 Adjusted operating margin1 $113 Million 11.0% Consolidated adjusted EBITDA1 EBITDA as % of revenue1 Excluding the weather-related surge decline, underlying revenues grew by 1.3% (1) See appendix for non-GAAP explanation and reconciliation of non-GAAP measures. 4

2019 Accomplishments •Added over 600 client programs in 2019, contributing to Crawford’s growth strategy Increased free cash flow by more than $31 million year-over-year Success from ongoing sales and new product development investments Ended 2019 with the strongest sales pipeline at nearly $250 million Enhancing IT capabilities to better serve clients and drive operating leverage Signed $81 million in estimated annual new revenues through the fourth quarter 5

Execution Across Our Service Lines •Crawford Claims Solutions • Momentum building with increased revenues and renewed contracts • New multi-year contract with a top-5 carrier Crawford TPA Solutions • 168 new clients this year worth $45 million annually Crawford Specialty Solutions • Global Technical Services contributed positive revenues • Contractor Connection added new programs, including a program with a current top-5 carrier client One Crawford • Vertical solutions gaining traction with the construction, hospitality and transportation verticals attracting a fast-growing pipeline 6

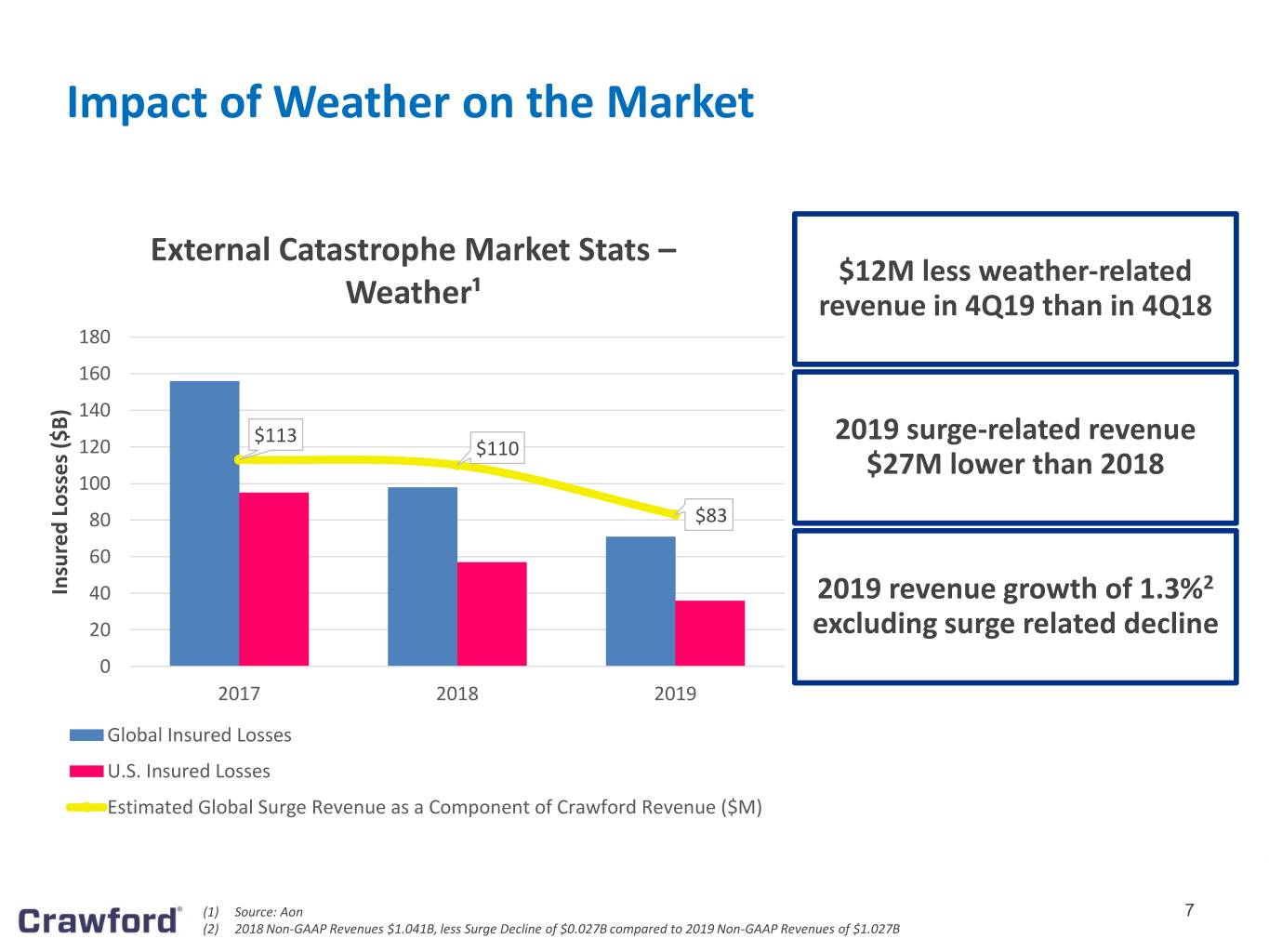

Impact of Weather on the Market External Catastrophe Market Stats – $12M less weather-related Weather¹ revenue in 4Q19 than in 4Q18 180 160 140 $113 2019 surge-related revenue 120 $110 $27M lower than 2018 100 80 $83 60 2 Insured Losses ($B) Losses Insured 40 2019 revenue growth of 1.3% 20 excluding surge related decline 0 2017 2018 2019 Global Insured Losses U.S. Insured Losses Estimated Global Surge Revenue as a Component of Crawford Revenue ($M) (1) Source: Aon 7 (2) 2018 Non-GAAP Revenues $1.041B, less Surge Decline of $0.027B compared to 2019 Non-GAAP Revenues of $1.027B

Disciplined Capital Allocation 1.5x Net Debt to + $31.7M Growth in EBITDA Free Cash Flow Leverage at three-year low Cash flow at three-year high 2.8M Shares $0.28 & $0.20 Repurchased in 2019 Consistent cash dividends per Outstanding shares reduced share for CRD-A and CRD-B, by 5% respectively 8

9

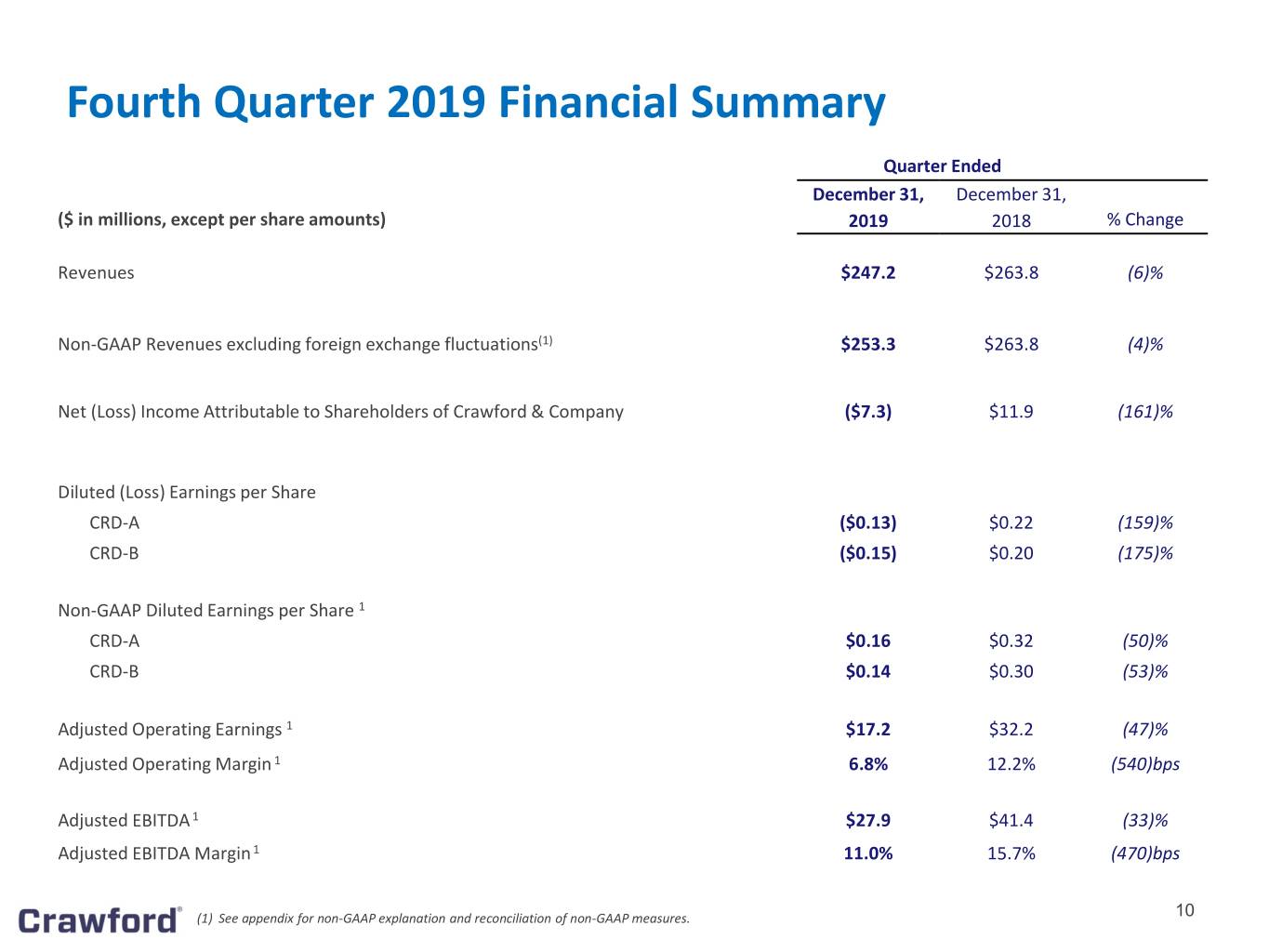

Fourth Quarter 2019 Financial Summary Quarter Ended December 31, December 31, ($ in millions, except per share amounts) 2019 2018 % Change Revenues $247.2 $263.8 (6)% Non-GAAP Revenues excluding foreign exchange fluctuations(1) $253.3 $263.8 (4)% Net (Loss) Income Attributable to Shareholders of Crawford & Company ($7.3) $11.9 (161)% Diluted (Loss) Earnings per Share CRD-A ($0.13) $0.22 (159)% CRD-B ($0.15) $0.20 (175)% Non-GAAP Diluted Earnings per Share 1 CRD-A $0.16 $0.32 (50)% CRD-B $0.14 $0.30 (53)% Adjusted Operating Earnings 1 $17.2 $32.2 (47)% Adjusted Operating Margin 1 6.8% 12.2% (540)bps Adjusted EBITDA 1 $27.9 $41.4 (33)% Adjusted EBITDA Margin 1 11.0% 15.7% (470)bps (1) See appendix for non-GAAP explanation and reconciliation of non-GAAP measures. 10

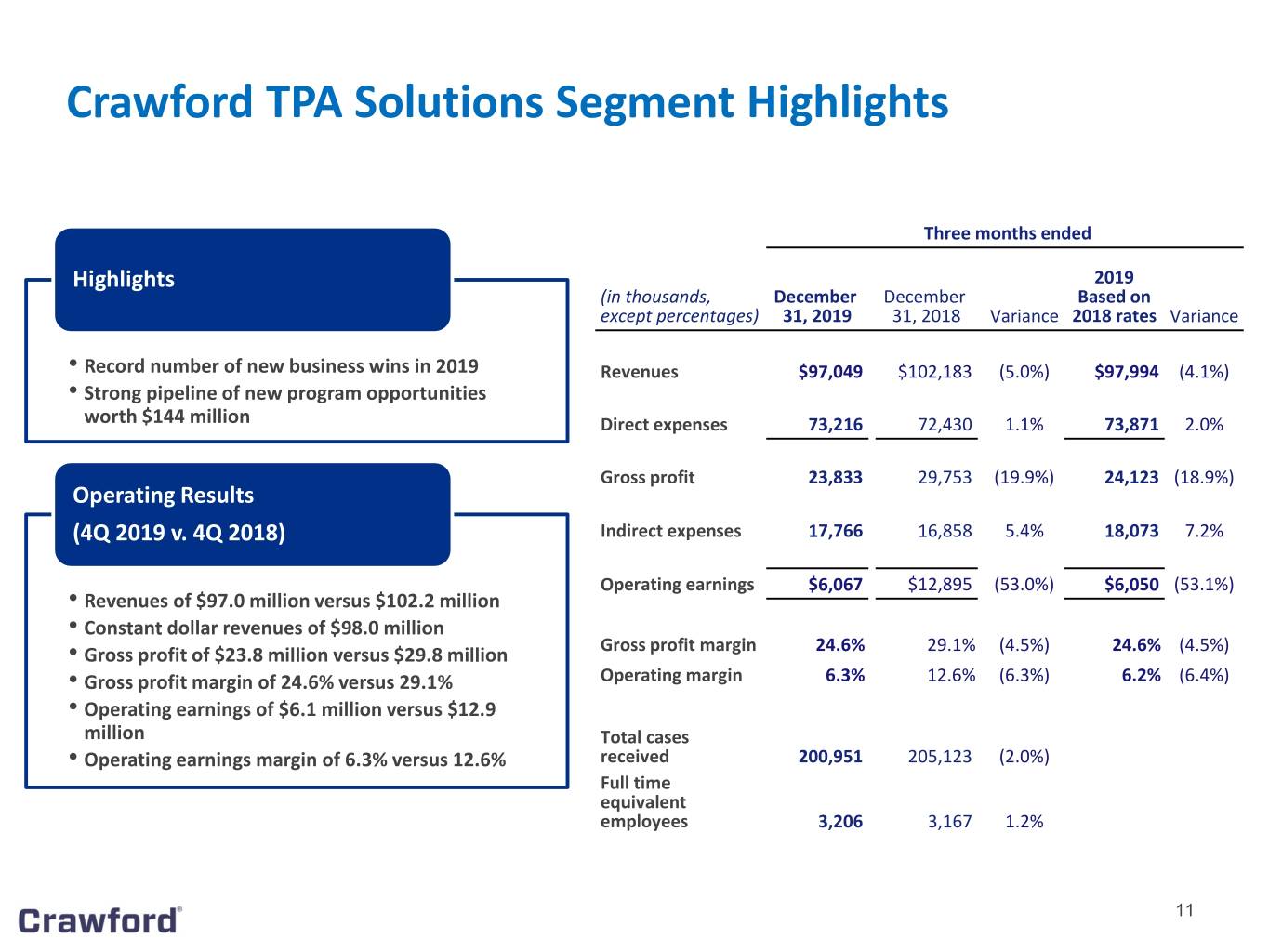

Crawford TPA Solutions Segment Highlights Three months ended Highlights 2019 (in thousands, December December Based on except percentages) 31, 2019 31, 2018 Variance 2018 rates Variance • Record number of new business wins in 2019 Revenues $97,049 $102,183 (5.0%) $97,994 (4.1%) • Strong pipeline of new program opportunities worth $144 million Direct expenses 73,216 72,430 1.1% 73,871 2.0% Gross profit 23,833 29,753 (19.9%) 24,123 (18.9%) Operating Results (4Q 2019 v. 4Q 2018) Indirect expenses 17,766 16,858 5.4% 18,073 7.2% Operating earnings $6,067 $12,895 (53.0%) $6,050 (53.1%) • Revenues of $97.0 million versus $102.2 million • Constant dollar revenues of $98.0 million • Gross profit of $23.8 million versus $29.8 million Gross profit margin 24.6% 29.1% (4.5%) 24.6% (4.5%) • Gross profit margin of 24.6% versus 29.1% Operating margin 6.3% 12.6% (6.3%) 6.2% (6.4%) • Operating earnings of $6.1 million versus $12.9 million Total cases • Operating earnings margin of 6.3% versus 12.6% received 200,951 205,123 (2.0%) Full time equivalent employees 3,206 3,167 1.2% 11

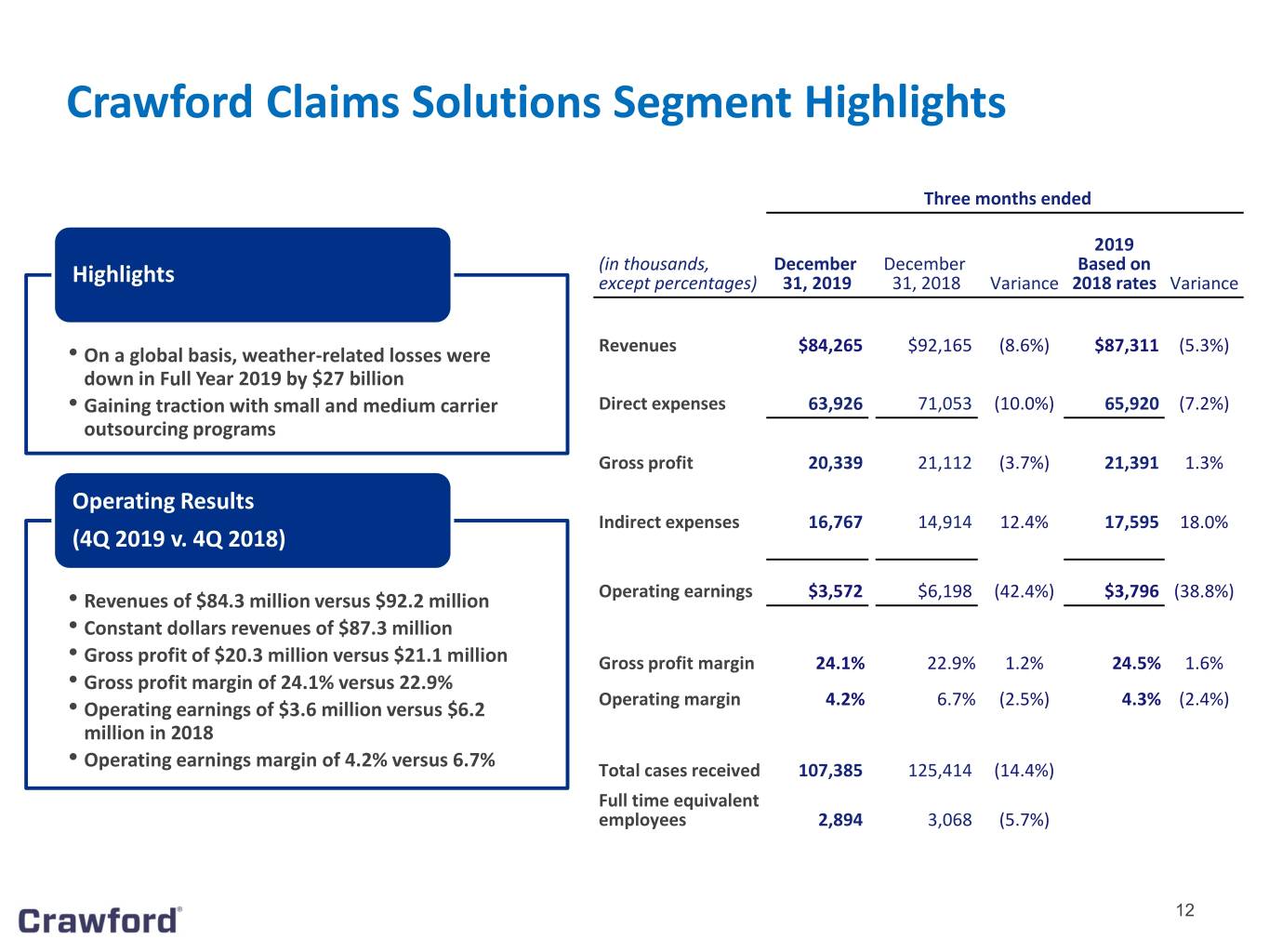

Crawford Claims Solutions Segment Highlights Three months ended 2019 (in thousands, December December Based on Highlights except percentages) 31, 2019 31, 2018 Variance 2018 rates Variance • On a global basis, weather-related losses were Revenues $84,265 $92,165 (8.6%) $87,311 (5.3%) down in Full Year 2019 by $27 billion • Gaining traction with small and medium carrier Direct expenses 63,926 71,053 (10.0%) 65,920 (7.2%) outsourcing programs Gross profit 20,339 21,112 (3.7%) 21,391 1.3% Operating Results Indirect expenses 16,767 14,914 12.4% 17,595 18.0% (4Q 2019 v. 4Q 2018) • Revenues of $84.3 million versus $92.2 million Operating earnings $3,572 $6,198 (42.4%) $3,796 (38.8%) • Constant dollars revenues of $87.3 million • Gross profit of $20.3 million versus $21.1 million Gross profit margin 24.1% 22.9% 1.2% 24.5% 1.6% • Gross profit margin of 24.1% versus 22.9% • Operating earnings of $3.6 million versus $6.2 Operating margin 4.2% 6.7% (2.5%) 4.3% (2.4%) million in 2018 • Operating earnings margin of 4.2% versus 6.7% Total cases received 107,385 125,414 (14.4%) Full time equivalent employees 2,894 3,068 (5.7%) 12

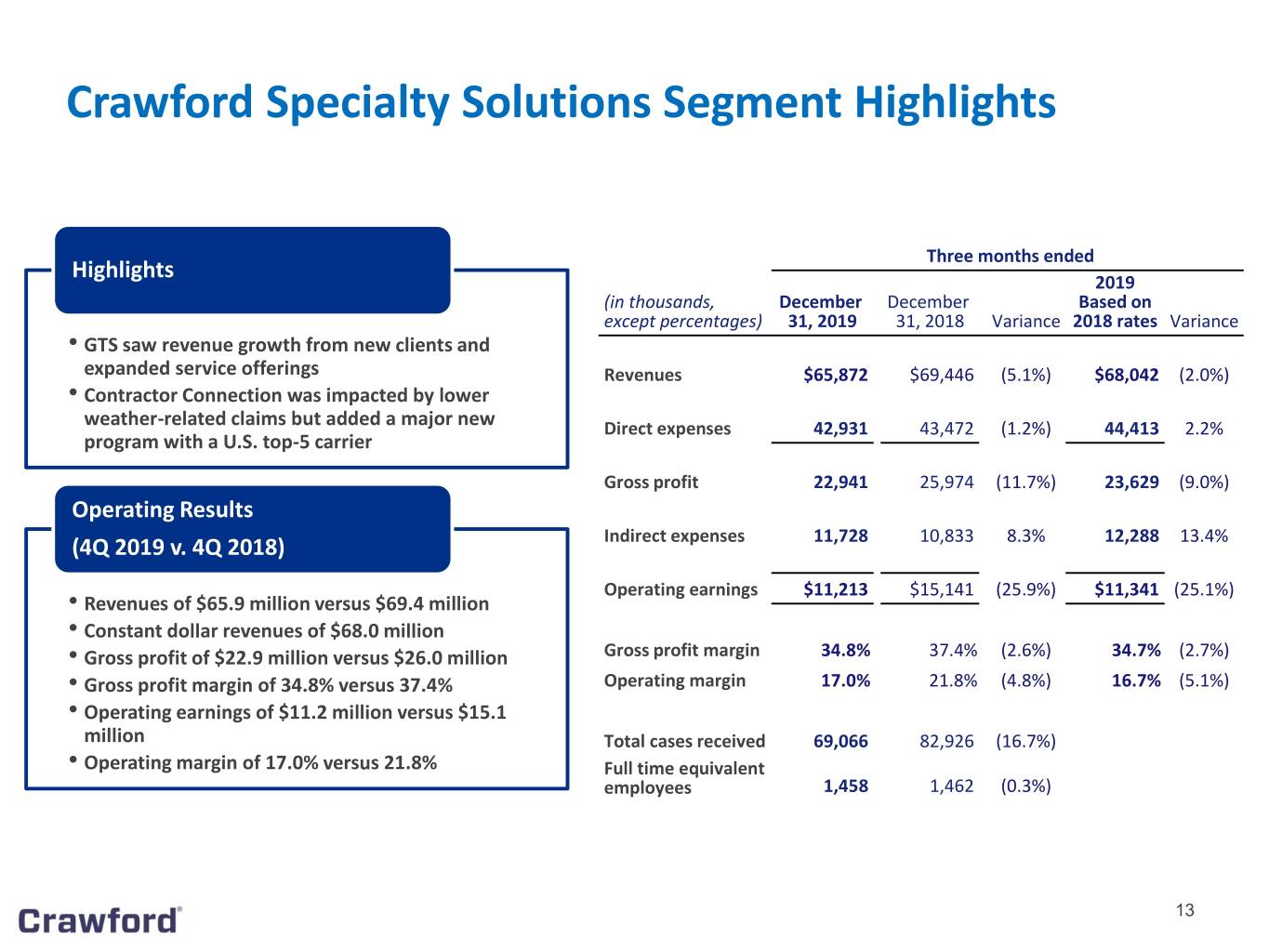

Crawford Specialty Solutions Segment Highlights Three months ended Highlights 2019 (in thousands, December December Based on except percentages) 31, 2019 31, 2018 Variance 2018 rates Variance • GTS saw revenue growth from new clients and expanded service offerings Revenues $65,872 $69,446 (5.1%) $68,042 (2.0%) • Contractor Connection was impacted by lower weather-related claims but added a major new Direct expenses 42,931 43,472 (1.2%) 44,413 2.2% program with a U.S. top-5 carrier Gross profit 22,941 25,974 (11.7%) 23,629 (9.0%) Operating Results (4Q 2019 v. 4Q 2018) Indirect expenses 11,728 10,833 8.3% 12,288 13.4% Operating earnings $11,213 $15,141 (25.9%) $11,341 (25.1%) • Revenues of $65.9 million versus $69.4 million • Constant dollar revenues of $68.0 million • Gross profit of $22.9 million versus $26.0 million Gross profit margin 34.8% 37.4% (2.6%) 34.7% (2.7%) • Gross profit margin of 34.8% versus 37.4% Operating margin 17.0% 21.8% (4.8%) 16.7% (5.1%) • Operating earnings of $11.2 million versus $15.1 million Total cases received 69,066 82,926 (16.7%) • Operating margin of 17.0% versus 21.8% Full time equivalent employees 1,458 1,462 (0.3%) 13

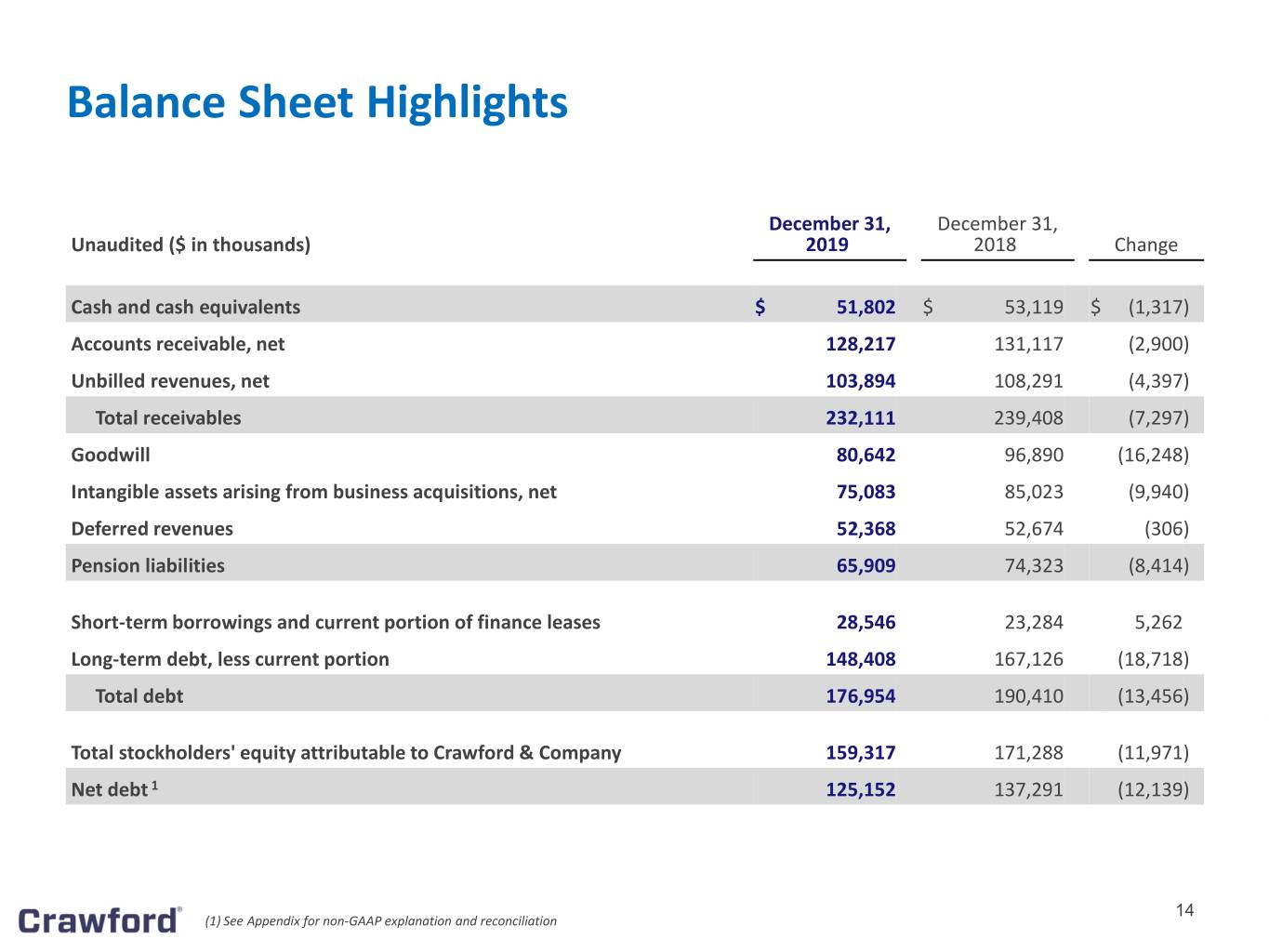

Balance Sheet Highlights December 31, December 31, Unaudited ($ in thousands) 2019 2018 Change Cash and cash equivalents $ 51,802 $ 53,119 $ (1,317) Accounts receivable, net 128,217 131,117 (2,900) Unbilled revenues, net 103,894 108,291 (4,397) Total receivables 232,111 239,408 (7,297) Goodwill 80,642 96,890 (16,248) Intangible assets arising from business acquisitions, net 75,083 85,023 (9,940) Deferred revenues 52,368 52,674 (306) Pension liabilities 65,909 74,323 (8,414) Short-term borrowings and current portion of finance leases 28,546 23,284 5,262 Long-term debt, less current portion 148,408 167,126 (18,718) Total debt 176,954 190,410 (13,456) Total stockholders' equity attributable to Crawford & Company 159,317 171,288 (11,971) Net debt 1 125,152 137,291 (12,139) 14 (1) See Appendix for non-GAAP explanation and reconciliation

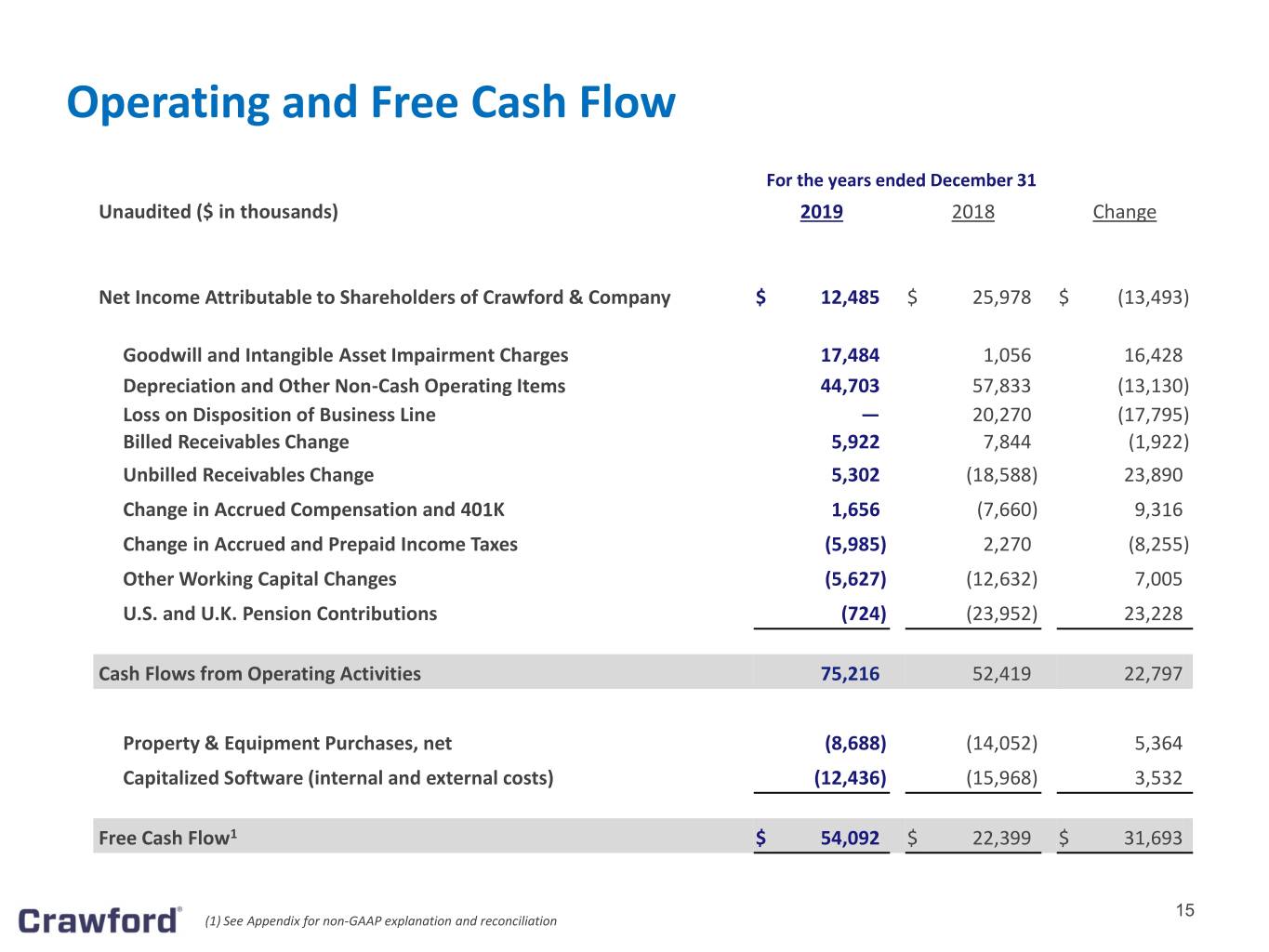

Operating and Free Cash Flow For the years ended December 31 Unaudited ($ in thousands) 2019 2018 Change Net Income Attributable to Shareholders of Crawford & Company $ 12,485 $ 25,978 $ (13,493) Goodwill and Intangible Asset Impairment Charges 17,484 1,056 16,428 Depreciation and Other Non-Cash Operating Items 44,703 57,833 (13,130) Loss on Disposition of Business Line — 20,270 (17,795) Billed Receivables Change 5,922 7,844 (1,922) Unbilled Receivables Change 5,302 (18,588) 23,890 Change in Accrued Compensation and 401K 1,656 (7,660) 9,316 Change in Accrued and Prepaid Income Taxes (5,985) 2,270 (8,255) Other Working Capital Changes (5,627) (12,632) 7,005 U.S. and U.K. Pension Contributions (724) (23,952) 23,228 Cash Flows from Operating Activities 75,216 52,419 22,797 Property & Equipment Purchases, net (8,688) (14,052) 5,364 Capitalized Software (internal and external costs) (12,436) (15,968) 3,532 Free Cash Flow1 $ 54,092 $ 22,399 $ 31,693 15 (1) See Appendix for non-GAAP explanation and reconciliation

Share Repurchases During the three months ended December 31, 2019, the Company repurchased approximately 56 thousand shares of CRD-B at a weighted average cost of $9.65 During the year ended December 31, 2019, the Company repurchased approximately 1.1 million shares of CRD-A and 1.7 million shares of CRD-B at a weighted average cost of $9.23 During 2019, the Company repurchased 5.3% of its average common shares outstanding At December 31, 2019, the Company had remaining authorization to repurchase approximately 959 thousand shares under the 2019 Repurchase Authorization 16

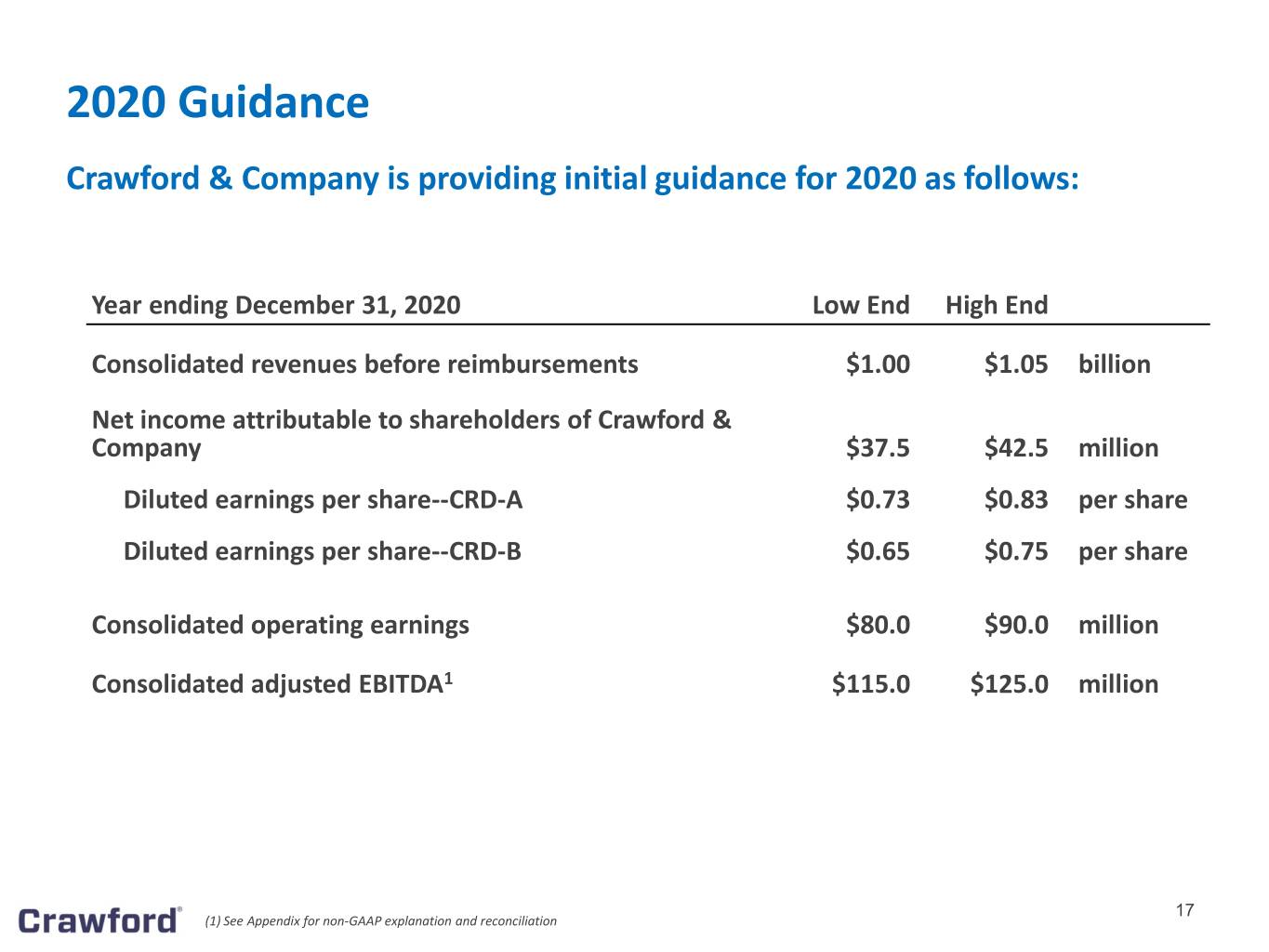

2020 Guidance Crawford & Company is providing initial guidance for 2020 as follows: Year ending December 31, 2020 Low End High End Consolidated revenues before reimbursements $1.00 $1.05 billion Net income attributable to shareholders of Crawford & Company $37.5 $42.5 million Diluted earnings per share--CRD-A $0.73 $0.83 per share Diluted earnings per share--CRD-B $0.65 $0.75 per share Consolidated operating earnings $80.0 $90.0 million Consolidated adjusted EBITDA1 $115.0 $125.0 million 17 (1) See Appendix for non-GAAP explanation and reconciliation

Conclusion Looking forward at Crawford’s primary objectives: Maximize Growth System Readiness Continue new business momentum and Strategically invest in technology to add achieve sustained revenue and earnings value to customers and maintain a growth competitive edge People Readiness Fiscal Responsibility Strengthen our global sales teams, advance Drive cash flow generation while delivering employee development, and strive to carry a meaningful return to shareholders out Crawford’s mission 18

19 Crawford – Attractive Business Model Experienced Management Team Technology Enabled BPO Aligned with Shareholders Platform Global Product and Geographic Blue Chip Global Client Base Diversification with Long-Term Relationships Recurring Fee For Service Solid Balance Sheet and Low Revenue Model Debt Profile Strong Cash Flow Generation Healthy Dividend Yield Over 50 Years as a Public Company

20

Appendix: Non-GAAP Financial Information Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings. As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill and intangible asset impairment charges, loss on disposition of business line, arbitration and claim settlements, certain tax valuation allowances and net income or loss attributable to noncontrolling interests. 21

Appendix: Non-GAAP Financial Information (cont.) Segment and Consolidated Gross Profit Gross profit is defined as revenues less direct expenses which exclude indirect overhead expenses allocated to the business. Indirect expenses consist of centralized administrative support costs, regional and local shared services that are allocated to each segment based on usage. Adjusted EBITDA Adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results and the Company believes that adjusted EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income attributable to shareholders of the Company with recurring adjustments for depreciation and amortization, net corporate interest expense, income taxes and stock-based compensation expense and foreign exchange fluctuations. Additionally, adjustments for non-recurring expenses for goodwill and intangible asset impairment charges, certain tax valuation allowances, arbitration and claim settlements, loss on disposition of business line and the disposed GCG business results have been included in the calculation of adjusted EBITDA. Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be comparable to similarly titled measures used by other companies. Adjusted Revenue, Operating Earnings, Pretax Earnings, Net Income, Diluted Earnings per Share and EBITDA Included in non-GAAP adjusted measurements as an add back or subtraction to GAAP measurements, are impacts of the disposed of GCG business, goodwill and intangible asset impairment charges, arbitration and claim settlements, certain tax valuation allowances, foreign exchange impacts, impact of tax reform in the U.S. and loss on disposition of business line net of tax, which arise from non-core items not directly related to our normal business or operations, or our future performance. Management believes it is useful to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations 22

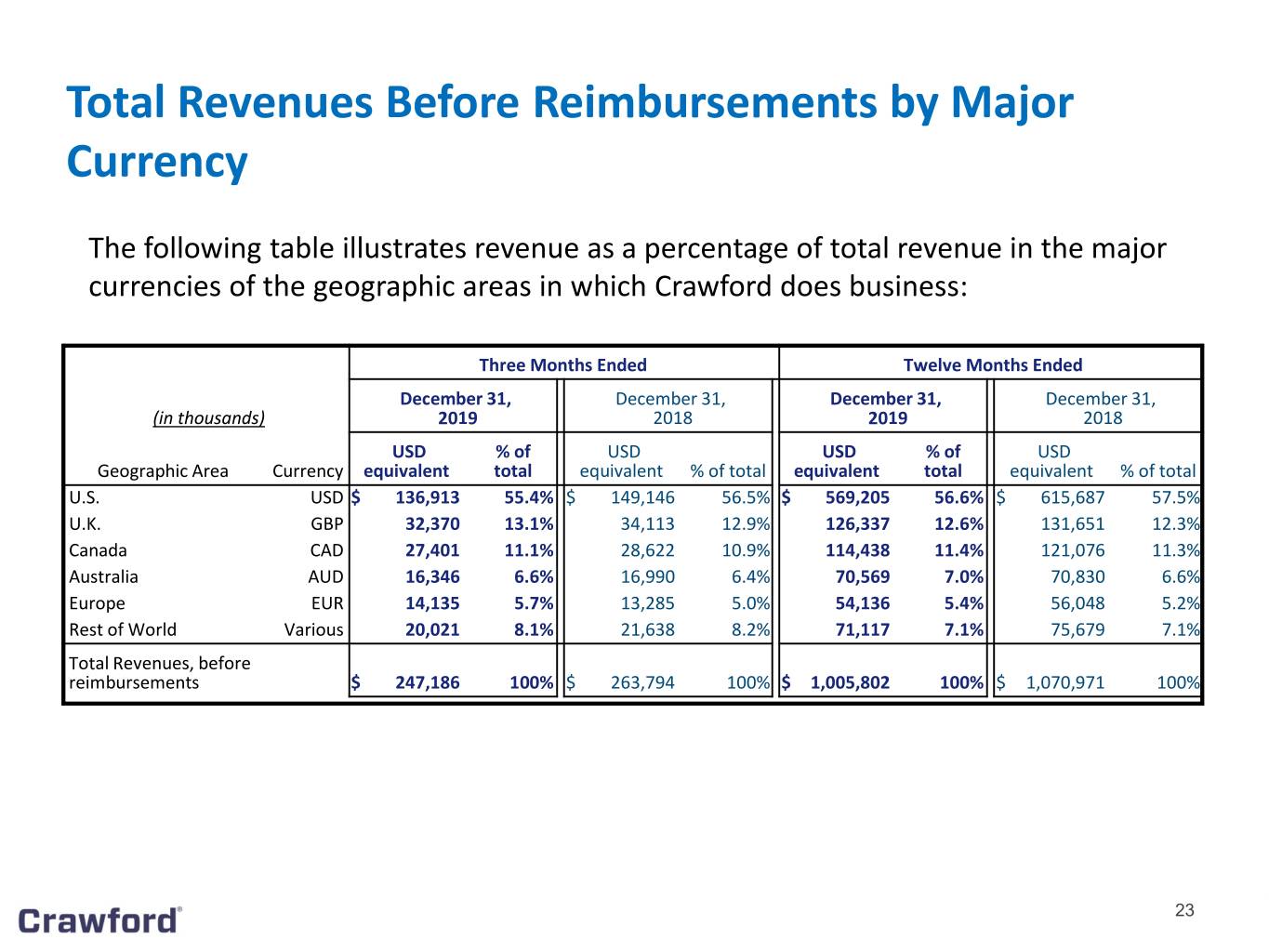

Total Revenues Before Reimbursements by Major Currency The following table illustrates revenue as a percentage of total revenue in the major currencies of the geographic areas in which Crawford does business: Three Months Ended Twelve Months Ended December 31, December 31, December 31, December 31, (in thousands) 2019 2018 2019 2018 USD % of USD USD % of USD Geographic Area Currency equivalent total equivalent % of total equivalent total equivalent % of total U.S. USD $ 136,913 55.4% $ 149,146 56.5% $ 569,205 56.6% $ 615,687 57.5% U.K. GBP 32,370 13.1% 34,113 12.9% 126,337 12.6% 131,651 12.3% Canada CAD 27,401 11.1% 28,622 10.9% 114,438 11.4% 121,076 11.3% Australia AUD 16,346 6.6% 16,990 6.4% 70,569 7.0% 70,830 6.6% Europe EUR 14,135 5.7% 13,285 5.0% 54,136 5.4% 56,048 5.2% Rest of World Various 20,021 8.1% 21,638 8.2% 71,117 7.1% 75,679 7.1% Total Revenues, before reimbursements $ 247,186 100% $ 263,794 100% $ 1,005,802 100% $ 1,070,971 100% 23

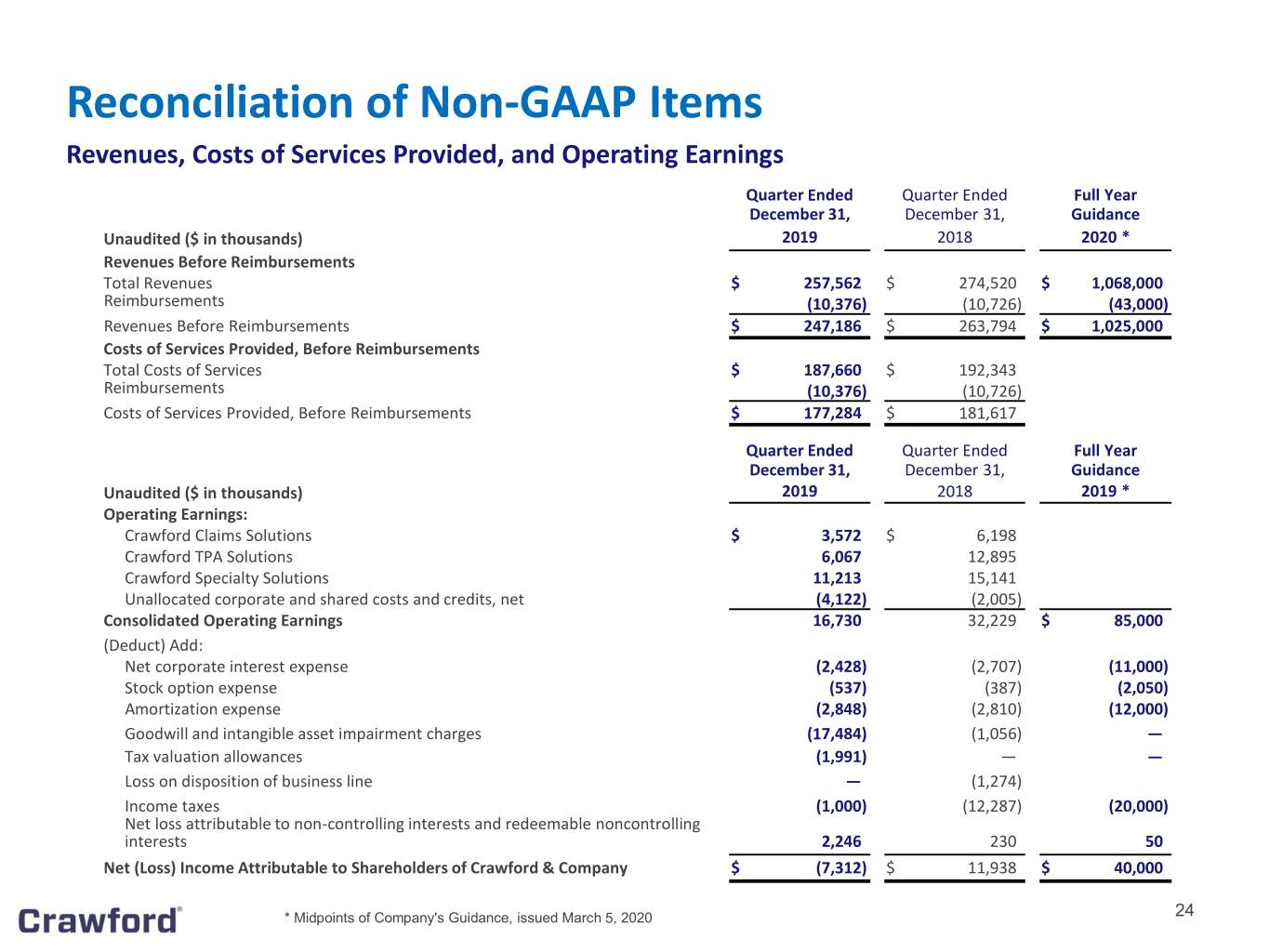

Reconciliation of Non-GAAP Items Revenues, Costs of Services Provided, and Operating Earnings Quarter Ended Quarter Ended Full Year December 31, December 31, Guidance Unaudited ($ in thousands) 2019 2018 2020 * Revenues Before Reimbursements Total Revenues $ 257,562 $ 274,520 $ 1,068,000 Reimbursements (10,376) (10,726) (43,000) Revenues Before Reimbursements $ 247,186 $ 263,794 $ 1,025,000 Costs of Services Provided, Before Reimbursements Total Costs of Services $ 187,660 $ 192,343 Reimbursements (10,376) (10,726) Costs of Services Provided, Before Reimbursements $ 177,284 $ 181,617 Quarter Ended Quarter Ended Full Year December 31, December 31, Guidance Unaudited ($ in thousands) 2019 2018 2019 * Operating Earnings: Crawford Claims Solutions $ 3,572 $ 6,198 Crawford TPA Solutions 6,067 12,895 Crawford Specialty Solutions 11,213 15,141 Unallocated corporate and shared costs and credits, net (4,122) (2,005) Consolidated Operating Earnings 16,730 32,229 $ 85,000 (Deduct) Add: Net corporate interest expense (2,428) (2,707) (11,000) Stock option expense (537) (387) (2,050) Amortization expense (2,848) (2,810) (12,000) Goodwill and intangible asset impairment charges (17,484) (1,056) — Tax valuation allowances (1,991) — — Loss on disposition of business line — (1,274) Income taxes (1,000) (12,287) (20,000) Net loss attributable to non-controlling interests and redeemable noncontrolling interests 2,246 230 50 Net (Loss) Income Attributable to Shareholders of Crawford & Company $ (7,312) $ 11,938 $ 40,000 * Midpoints of Company's Guidance, issued March 5, 2020 24

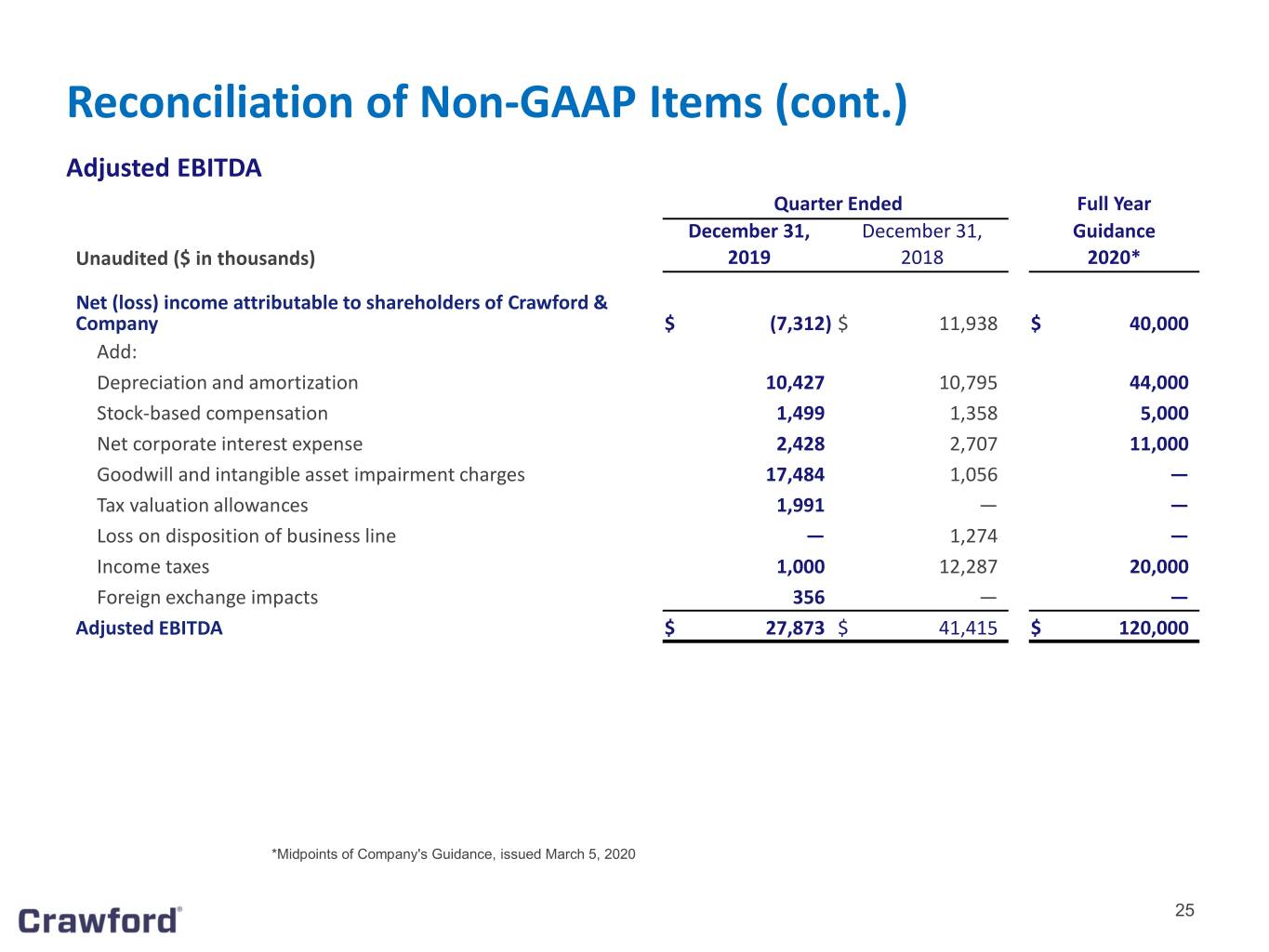

Reconciliation of Non-GAAP Items (cont.) Adjusted EBITDA Quarter Ended Full Year December 31, December 31, Guidance Unaudited ($ in thousands) 2019 2018 2020* Net (loss) income attributable to shareholders of Crawford & Company $ (7,312) $ 11,938 $ 40,000 Add: Depreciation and amortization 10,427 10,795 44,000 Stock-based compensation 1,499 1,358 5,000 Net corporate interest expense 2,428 2,707 11,000 Goodwill and intangible asset impairment charges 17,484 1,056 — Tax valuation allowances 1,991 — — Loss on disposition of business line — 1,274 — Income taxes 1,000 12,287 20,000 Foreign exchange impacts 356 — — Adjusted EBITDA $ 27,873 $ 41,415 $ 120,000 *Midpoints of Company's Guidance, issued March 5, 2020 25

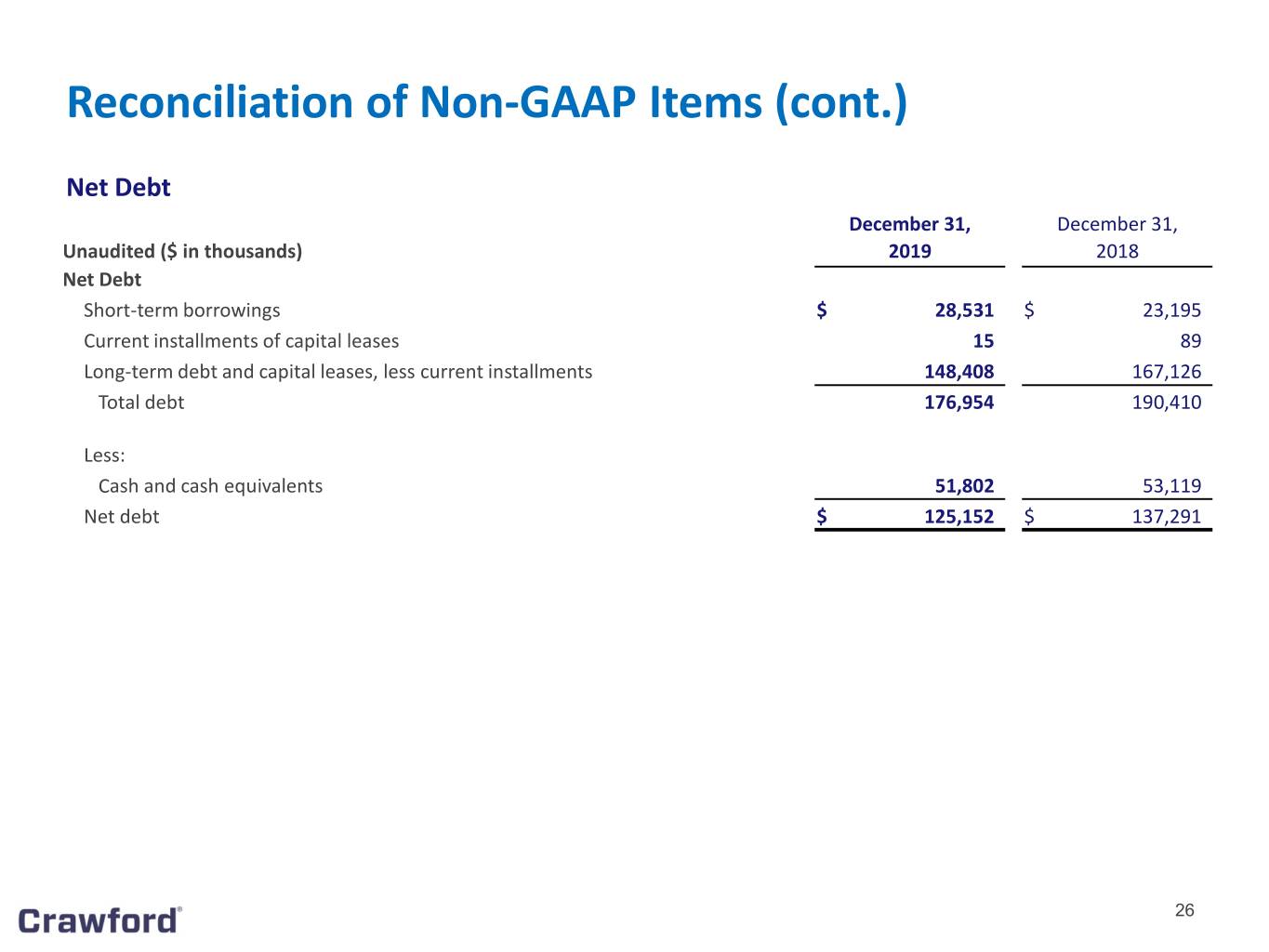

Reconciliation of Non-GAAP Items (cont.) Net Debt December 31, December 31, Unaudited ($ in thousands) 2019 2018 Net Debt Short-term borrowings $ 28,531 $ 23,195 Current installments of capital leases 15 89 Long-term debt and capital leases, less current installments 148,408 167,126 Total debt 176,954 190,410 Less: Cash and cash equivalents 51,802 53,119 Net debt $ 125,152 $ 137,291 26

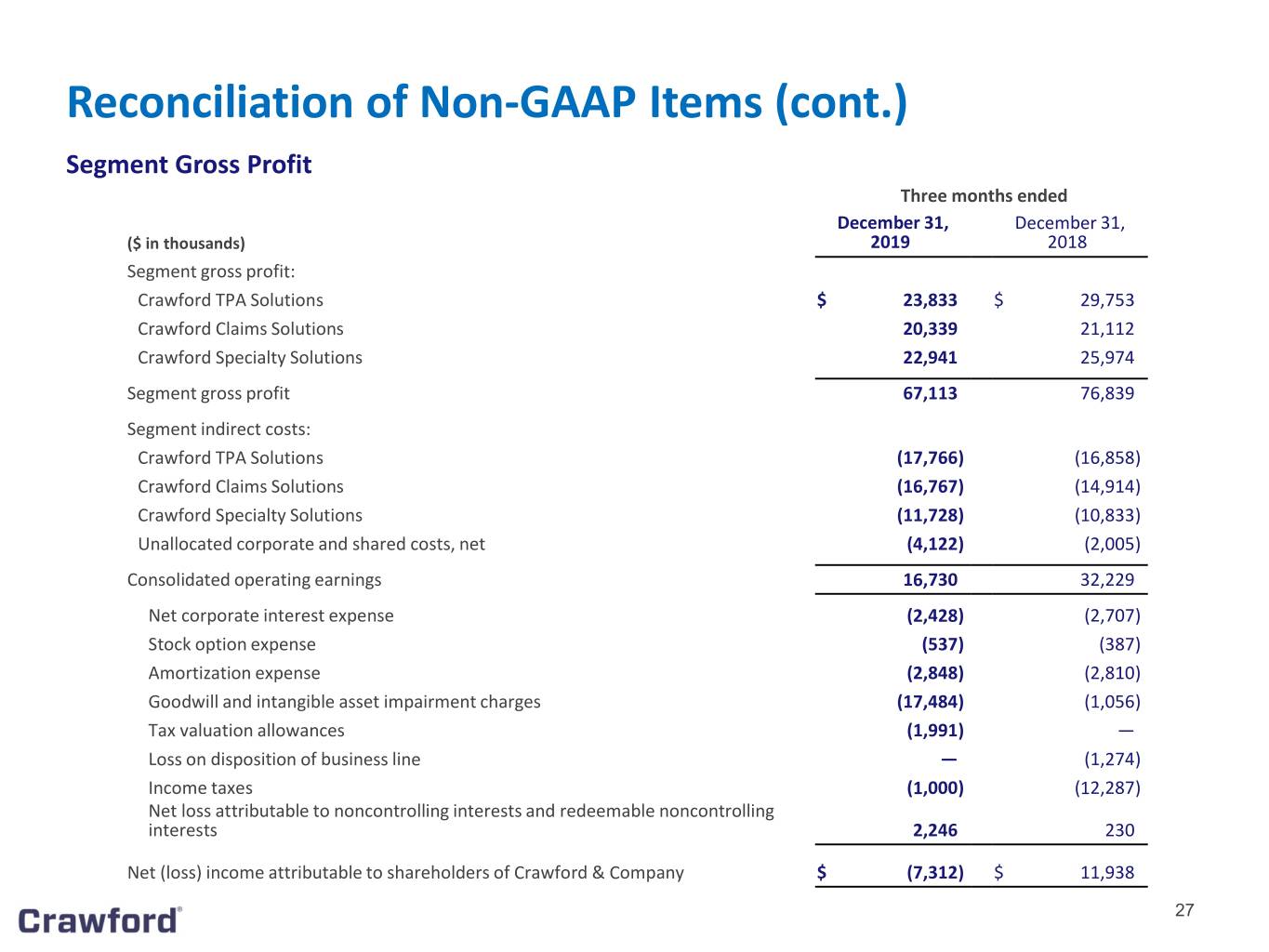

Reconciliation of Non-GAAP Items (cont.) Segment Gross Profit Three months ended December 31, December 31, ($ in thousands) 2019 2018 Segment gross profit: Crawford TPA Solutions $ 23,833 $ 29,753 Crawford Claims Solutions 20,339 21,112 Crawford Specialty Solutions 22,941 25,974 Segment gross profit 67,113 76,839 Segment indirect costs: Crawford TPA Solutions (17,766) (16,858) Crawford Claims Solutions (16,767) (14,914) Crawford Specialty Solutions (11,728) (10,833) Unallocated corporate and shared costs, net (4,122) (2,005) Consolidated operating earnings 16,730 32,229 Net corporate interest expense (2,428) (2,707) Stock option expense (537) (387) Amortization expense (2,848) (2,810) Goodwill and intangible asset impairment charges (17,484) (1,056) Tax valuation allowances (1,991) — Loss on disposition of business line — (1,274) Income taxes (1,000) (12,287) Net loss attributable to noncontrolling interests and redeemable noncontrolling interests 2,246 230 Net (loss) income attributable to shareholders of Crawford & Company $ (7,312) $ 11,938 27

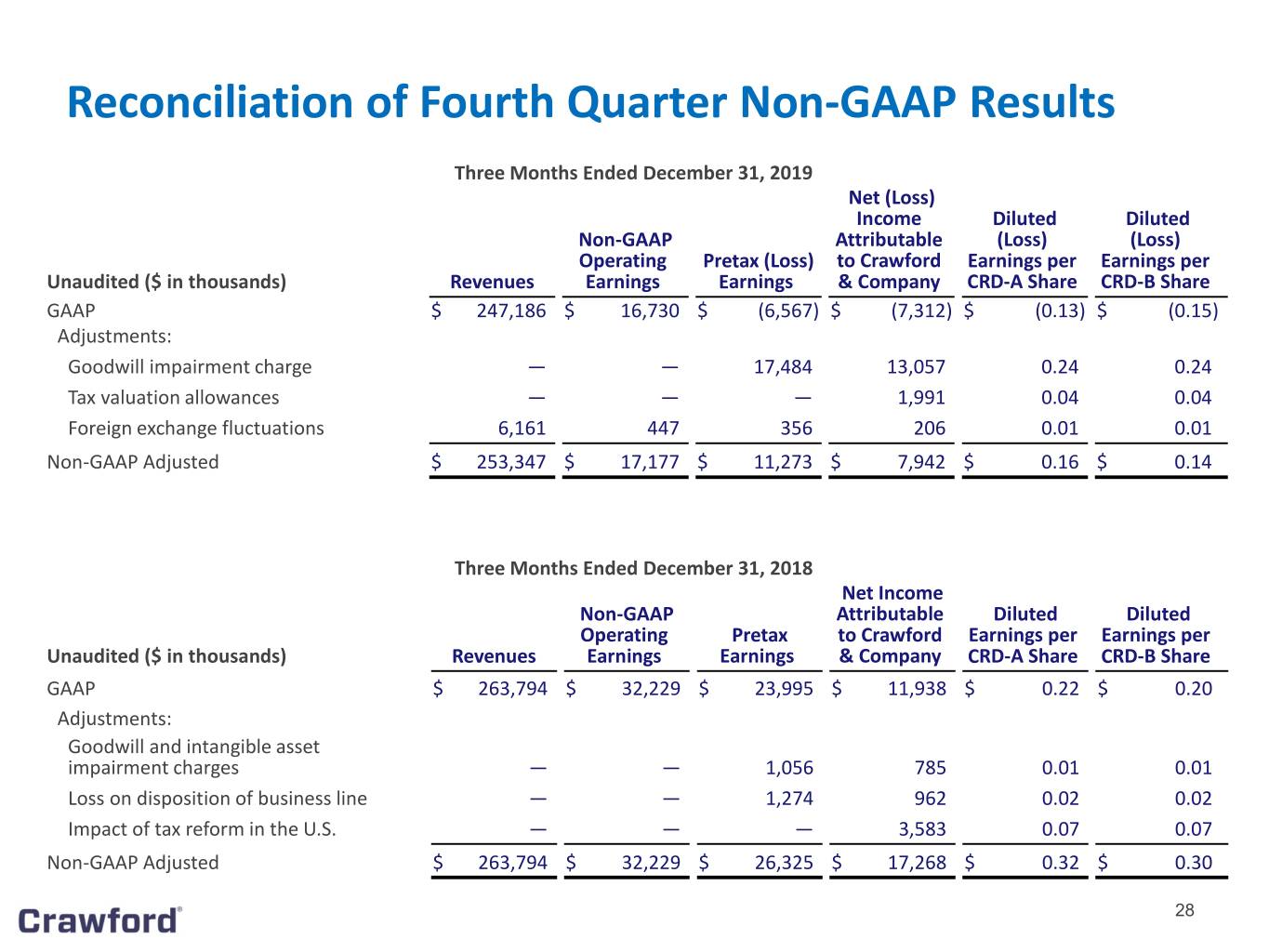

Reconciliation of Fourth Quarter Non-GAAP Results Three Months Ended December 31, 2019 Net (Loss) Income Diluted Diluted Non-GAAP Attributable (Loss) (Loss) Operating Pretax (Loss) to Crawford Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings & Company CRD-A Share CRD-B Share GAAP $ 247,186 $ 16,730 $ (6,567) $ (7,312) $ (0.13) $ (0.15) Adjustments: Goodwill impairment charge — — 17,484 13,057 0.24 0.24 Tax valuation allowances — — — 1,991 0.04 0.04 Foreign exchange fluctuations 6,161 447 356 206 0.01 0.01 Non-GAAP Adjusted $ 253,347 $ 17,177 $ 11,273 $ 7,942 $ 0.16 $ 0.14 Three Months Ended December 31, 2018 Net Income Non-GAAP Attributable Diluted Diluted Operating Pretax to Crawford Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings & Company CRD-A Share CRD-B Share GAAP $ 263,794 $ 32,229 $ 23,995 $ 11,938 $ 0.22 $ 0.20 Adjustments: Goodwill and intangible asset impairment charges — — 1,056 785 0.01 0.01 Loss on disposition of business line — — 1,274 962 0.02 0.02 Impact of tax reform in the U.S. — — — 3,583 0.07 0.07 Non-GAAP Adjusted $ 263,794 $ 32,229 $ 26,325 $ 17,268 $ 0.32 $ 0.30 28

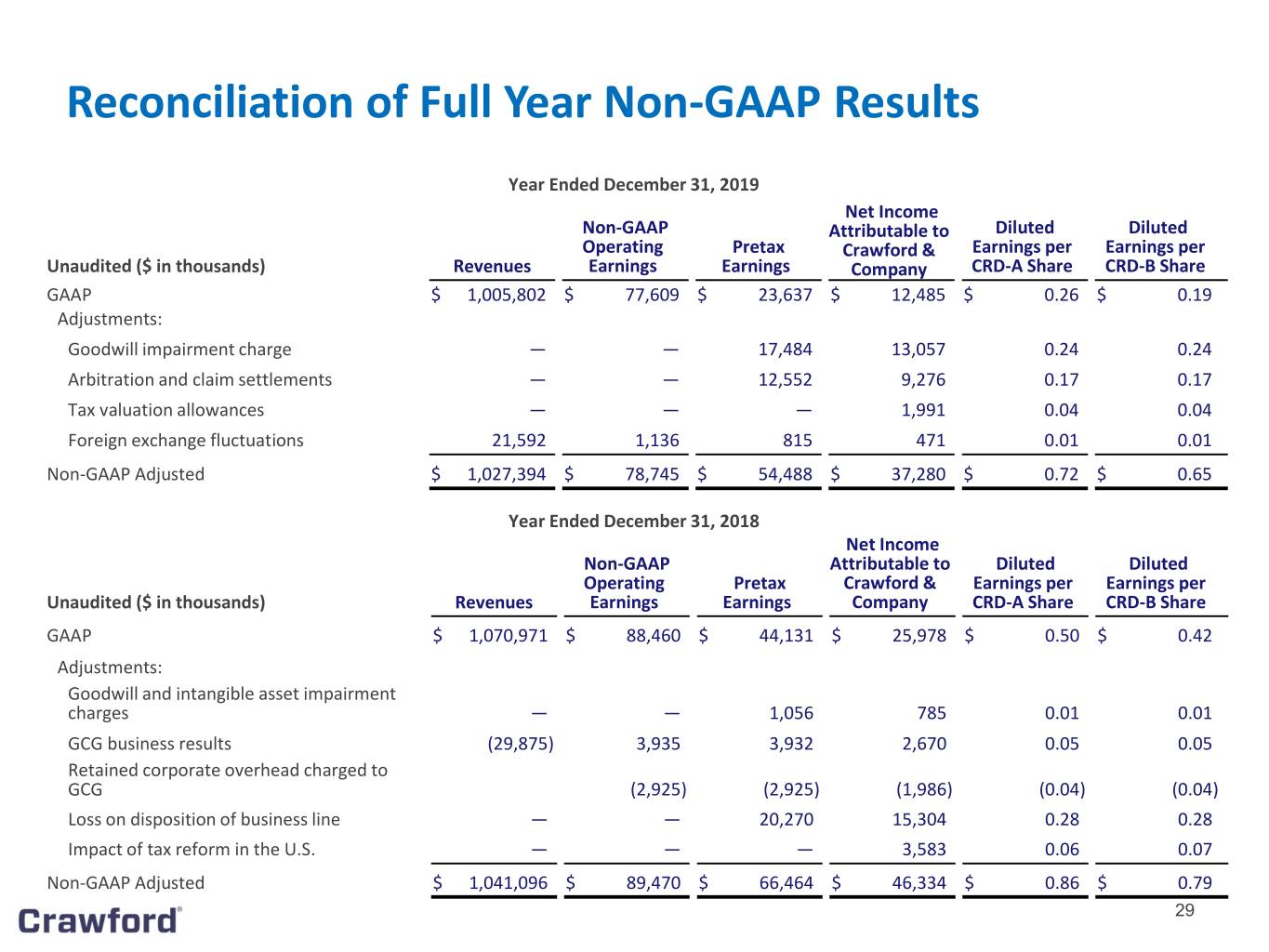

Reconciliation of Full Year Non-GAAP Results Year Ended December 31, 2019 Net Income Non-GAAP Attributable to Diluted Diluted Operating Pretax Crawford & Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings Company CRD-A Share CRD-B Share GAAP $ 1,005,802 $ 77,609 $ 23,637 $ 12,485 $ 0.26 $ 0.19 Adjustments: Goodwill impairment charge — — 17,484 13,057 0.24 0.24 Arbitration and claim settlements — — 12,552 9,276 0.17 0.17 Tax valuation allowances — — — 1,991 0.04 0.04 Foreign exchange fluctuations 21,592 1,136 815 471 0.01 0.01 Non-GAAP Adjusted $ 1,027,394 $ 78,745 $ 54,488 $ 37,280 $ 0.72 $ 0.65 Year Ended December 31, 2018 Net Income Non-GAAP Attributable to Diluted Diluted Operating Pretax Crawford & Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings Company CRD-A Share CRD-B Share GAAP $ 1,070,971 $ 88,460 $ 44,131 $ 25,978 $ 0.50 $ 0.42 Adjustments: Goodwill and intangible asset impairment charges — — 1,056 785 0.01 0.01 GCG business results (29,875) 3,935 3,932 2,670 0.05 0.05 Retained corporate overhead charged to GCG (2,925) (2,925) (1,986) (0.04) (0.04) Loss on disposition of business line — — 20,270 15,304 0.28 0.28 Impact of tax reform in the U.S. — — — 3,583 0.06 0.07 Non-GAAP Adjusted $ 1,041,096 $ 89,470 $ 66,464 $ 46,334 $ 0.86 $ 0.79 29