Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Western Asset Mortgage Capital Corp | wmcq4fy19ex991.htm |

| 8-K - 8-K - Western Asset Mortgage Capital Corp | wmcq4fy198-k.htm |

Fourth Quarter 2019 Investor Presentation March 4, 2020

Safe Harbor Statement We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward- looking: our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and advance rates for MBS and our potential target assets; our expected leverage; general volatility of the securities markets in which we invest and the market price of our common stock; our expected investments; interest rate mismatches between MBS and our potential target assets and our borrowings used to fund such investments; changes in interest rates and the market value of MBS and our potential target assets; changes in prepayment rates on Agency MBS and Non-Agency MBS; effects of hedging instruments on MBS and our potential target assets; rates of default or decreased recovery rates on our potential target assets; the degree to which any hedging strategies may or may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a REIT; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of investment opportunities in mortgage-related, real estate-related and other securities; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; and market trends in our industry, interest rates, real estate values, the debt securities markets or the general economy. The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is not an offer to sell securities nor a solicitation of an offer to buy securities in any jurisdiction where the offer and sale is not permitted. 1

Fourth Quarter 2019 WMC Earnings Call Presenters Jennifer W. Murphy Lisa Meyer Harris Trifon Chief Executive Officer & Chief Financial Officer & Chief Investment Officer President Treasurer 2

Overview of Western Asset Mortgage Capital Corporation Western Asset Mortgage Capital Corporation (“WMC”) is a public REIT that benefits from the leading fixed income management capabilities of Western Asset Management Company, LLC ("Western Asset"). • One of the largest U.S. fixed income asset managers with AUM of $460.1 billion(1) ◦ The AUM of the Mortgage and Consumer Credit Group is $83.7 billion(1) ◦ Extensive mortgage and consumer credit investing track record • Publicly traded diversified mortgage REIT positioned to capture attractive current and long-term investment opportunities in the residential and commercial mortgage markets • Completed Initial Public Offering in May 2012 Please refer to page 20 for footnote disclosures. 3

Corporate Overview ▪ WMC is a diversified mortgage finance REIT supported by the deep investment experience of the mortgage and consumer credit group and risk management teams of Western Asset, a leading global fixed income manager. ▪ Western Asset's depth and breadth of fixed income expertise, comprehensive platform, and global institutional relationships provide WMC key advantages: * Best-in-class portfolio and risk management capabilities; * Access to investment opportunities and financing relationships and terms reflective of Western Asset's global platform; * Operational excellence and efficiencies; and * Highest standards of financial reporting, disclosure and transparency. ▪ WMC has paid a consistent dividend for 15 quarters, reflecting a philosophy of delivering a sustainable dividend that is supported by the core earnings of the portfolio. ▪ WMC has built a barbell investment strategy pairing Agency commercial mortgage- backed securities ("Agency CMBS") and opportunistic Agency residential mortgage- backed securities ("Agency RMBS") with credit investments, which include residential and commercial loan exposure. 4

Barbell Investment Strategy • An investment strategy designed to balance our interest rate investments with residential and commercial credit investments. • Primary goal of generating attractive returns while preserving book value. $5.0 Billion Hybrid Portfolio Comprised of Interest Rate and Credit Investments Interest Rate Investments Credit Investments • Agency CMBS • Residential Mortgages • Agency RMBS • Commercial Loans ◦ Opportunistic Exposure • Non-Agency Securities 5

Target Investment Opportunities Interest Rate Investments ▪ Multifamily residential loans guaranteed by Fannie Mae and Freddie Mac. ▪ Market size of more than $700 billion with annual issuance in excess of $100 billion. Agency CMBS ▪ Prepayment protection in the form of defeasance, yield maintenance or points. ▪ Interest only securities receive the prepayment penalties. ▪ Principal bearing bonds have soft bullets and tight windows for principal payment. Credit Investments ▪ Generally invest in transactions where our manager has an opportunity to Commercial Loans negotiate deal structure and covenants. ▪ Attractive yields of LIBOR plus 4% to 10%. ▪ Target floating rate assets and short term loans. • Strategic partnerships with seasoned originators. Non-Qualifying ▪ Mainly 3/1, 5/1, and 7/1 ARM loans. Residential Mortgages ▪ Coupon between 4.0% to 5.5%. ▪ Target loan to value below 70%. 6

2020 Global Outlook Western Asset Long-Term Themes ▪ Coronavirus-related growth setbacks have delayed pick-up of the global recovery ▪ US and global inflation rates will continue to be subdued ▪ Central bank focus on core inflation outcomes suggests “low for long” ▪ Spread products should outperform government bonds ▪ Selectivity in credit will be key 7

Portfolio View Credit investments have performed relatively well and are expected to continue to offer attractive returns. During the forth quarter we added credit sensitive mortgages and expect to continue to invest in this asset class in 2020 ▪ Commercial real estate fundamentals continue to be positive. We expect to continue to deploy capital in commercial loans and CMBS. ▪ We expect to continue to deploy capital in residential mortgages, mainly non-qualifying mortgages. ▪ Opportunistically deploy capital into agency mortgages, both residential and commercial. 8

Fourth Quarter Financial Highlights ▪ December 31, 2019 book value per share of $10.55, net of fourth quarter common dividend of $0.31 per share declared on December 19, 2019. ▪ GAAP net income of $12.5 million, or $0.23 per basic and diluted share. ▪ Core earnings plus drop income of $15.8 million(4), or $0.30 per basic and diluted share. ▪ Economic return on book value was 2.5%(3) for the quarter. ▪ 1.72%(6) annualized net interest margin on our investment portfolio. ▪ 5.4x leverage excluding non-recourse debt as of December 31, 2019 (8.0x including non-recourse debt). ▪ Issued $50.0 million aggregate principal amount of 6.75% convertible senior unsecured notes ▪ Acquired $479.0 million in credit sensitive investments, consisting of: * $180.5 million million in Non-Agency CMBS, * $249.2 million in Residential Whole Loans, * $49.3 million in Commercial Whole Loans. Please refer to page 20 for footnote disclosures. 9

Full Year 2019 Financial Highlights ▪ Maintained a consistent $0.31 per share quarterly common dividend throughout 2019 for total annual common dividends of $1.24 per share. ▪ GAAP net income of $70.7 million, or $1.37 per basic and diluted share. ▪ Core earnings plus drop income of $62.1 million(4), or $1.21 per basic and diluted share. ▪ Economic return on book value was 12.8%(3) for the year. ▪ 1.95%(6) annualized net interest margin on our investment portfolio. ▪ $49.3 million of common equity raised in secondary offering, net of offering costs. ▪ Completed a securitization of $945.5 million of our Residential Whole Loan investments involving the issuance of $919.0 million of mortgage-backed notes. ▪ Issued $90.0 million aggregate principal amount of 6.75% convertible senior unsecured notes. ▪ Obtained two new longer term financing facilities, consisting of $200.0 million commercial whole loan financing facility and $700.0 million residential whole loan financing facility. Please refer to page 20 for footnote disclosures. 10

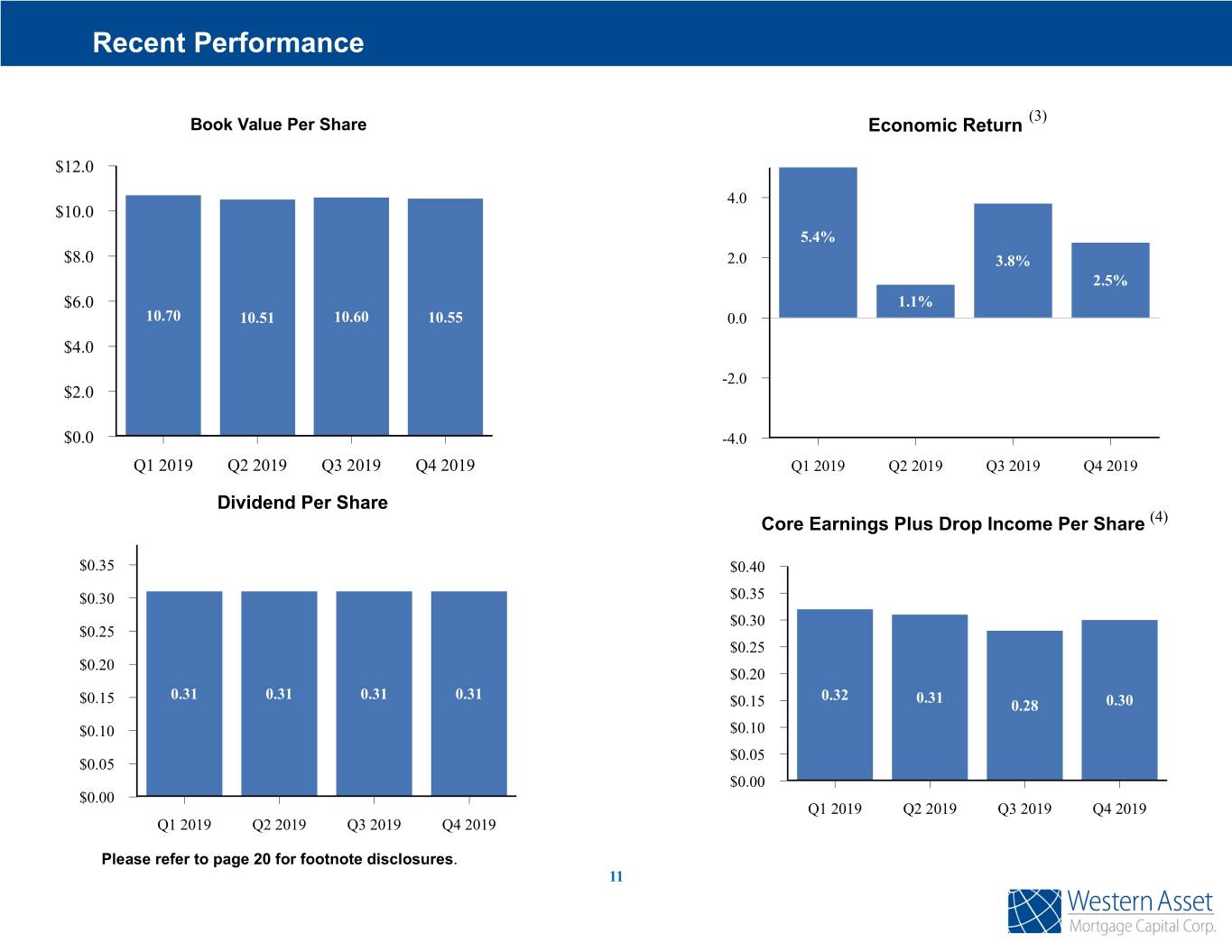

Recent Performance (3) Book Value Per Share Economic Return $12.0 4.0 $10.0 5.4% $8.0 2.0 3.8% 2.5% $6.0 1.1% 10.70 10.51 10.60 10.55 0.0 $4.0 -2.0 $2.0 $0.0 -4.0 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Dividend Per Share Core Earnings Plus Drop Income Per Share (4) $0.35 $0.40 $0.30 $0.35 $0.30 $0.25 $0.25 $0.20 $0.20 0.31 0.31 0.31 0.31 0.32 0.31 $0.15 $0.15 0.28 0.30 $0.10 $0.10 $0.05 $0.05 $0.00 $0.00 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Please refer to page 20 for footnote disclosures. 11

WMC Returns as of December 31, 2019 Economic Return(3) Total Stock Return(17) 3 Years 5/5/12 to 3 Years 5/5/12 to QTD YTD Ended 12/31/2019 QTD YTD Ended 12/31/2019 2.5% 12.8% 38.9% 41.7% 10.3% 38.7% 39.5% 40.6% 12

Portfolio Composition Agency RMBS Total Investment Portfolio, at fair value 6.4% ($ in millions) 0.9% 28.0% Agency CMBS 12/31/2019 Agency RMBS $ 357 Non-Agency RMBS Agency CMBS 1,439 Non-Agency CMBS 46 Non-Agency RMBS 29.2% 0.7% Residential Whole-Loans Non-Agency CMBS 316 Residential Whole-Loans 1,376 Residential Bridge Loans (12) 36 Residential Bridge Loans Securitized Loans Securitized Loans(2) 909 18.5% Commercial Loans Commercial Loans 370 7.2% 7.5% Other Investments(10) 80 1.6% Other Investments Total $ 4,929 Select Sector Categories Credit Sensitive Securities Agency Portfolio Loans Portfolio 1.4% 79.9% 33.8% 8.6% 71.5% 1.8% 0.9% 51.1% 19.0% 18.1% 13.7% 0.2% Agency CMBS Non-Agency CMBS Residential Whole-Loans Agency RMBS IO & IIO Non-Agency RMBS Residential Bridge Loans Agency RMBS Non-Agency RMBS IO & IIO Securitized Commercial Loans Agency CMBS IO & IIO ABS and GSE CRT Securities Please refer to page 20 for footnote disclosures. 13 Commercial Loans

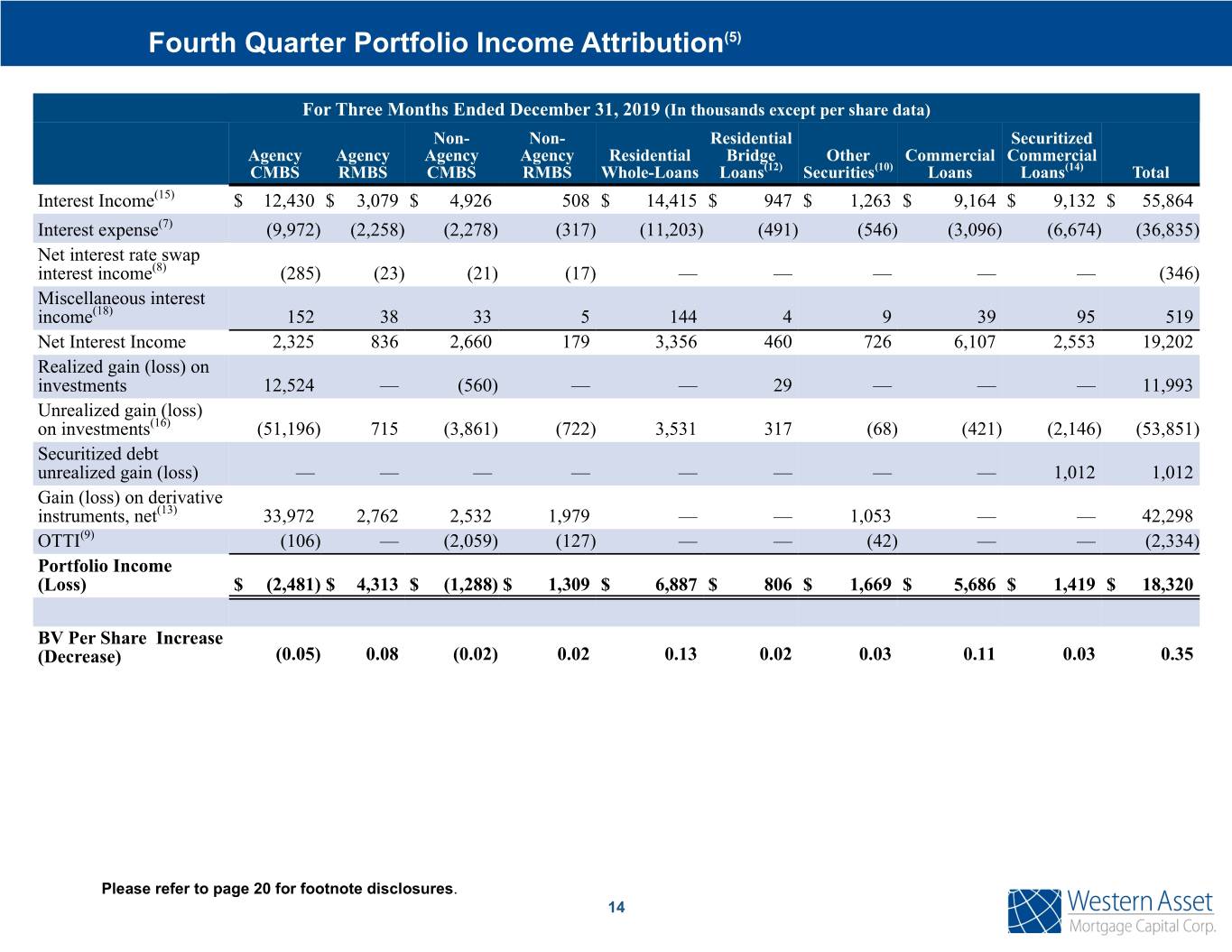

Fourth Quarter Portfolio Income Attribution(5) For Three Months Ended December 31, 2019 (In thousands except per share data) Non- Non- Residential Securitized Agency Agency Agency Agency Residential Bridge Other Commercial Commercial CMBS RMBS CMBS RMBS Whole-Loans Loans(12) Securities(10) Loans Loans(14) Total Interest Income(15) $ 12,430 $ 3,079 $ 4,926 508 $ 14,415 $ 947 $ 1,263 $ 9,164 $ 9,132 $ 55,864 Interest expense(7) (9,972) (2,258) (2,278) (317) (11,203) (491) (546) (3,096) (6,674) (36,835) Net interest rate swap interest income(8) (285) (23) (21) (17) — — — — — (346) Miscellaneous interest income(18) 152 38 33 5 144 4 9 39 95 519 Net Interest Income 2,325 836 2,660 179 3,356 460 726 6,107 2,553 19,202 Realized gain (loss) on investments 12,524 — (560) — — 29 — — — 11,993 Unrealized gain (loss) on investments(16) (51,196) 715 (3,861) (722) 3,531 317 (68) (421) (2,146) (53,851) Securitized debt unrealized gain (loss) — — — — — — — — 1,012 1,012 Gain (loss) on derivative instruments, net(13) 33,972 2,762 2,532 1,979 — — 1,053 — — 42,298 OTTI(9) (106) — (2,059) (127) — — (42) — — (2,334) Portfolio Income (Loss) $ (2,481) $ 4,313 $ (1,288) $ 1,309 $ 6,887 $ 806 $ 1,669 $ 5,686 $ 1,419 $ 18,320 BV Per Share Increase (Decrease) (0.05) 0.08 (0.02) 0.02 0.13 0.02 0.03 0.11 0.03 0.35 Please refer to page 20 for footnote disclosures. 14

Financing Summary Repurchase Agreements n Borrowings under 21 of our 34 master repurchase agreements. n Capacity in excess of our current needs. Portfolio Financing ($ in thousands) 12/31/2019 Outstanding Weighted Average Interest Weighted Average Repurchase Agreements Amounts Rate Interest Rate Remaining Days to Maturity Short Term Borrowings: Agency RMBS $ 348,274 1.99% 52 Agency CMBS 1,352,248 2.05% 26 Non-Agency RMBS 30,481 3.56% 9 Non-Agency CMBS 190,390 3.05% 35 Residential Whole Loans 102,029 3.51% 27 Residential Bridge Loans 29,869 3.93% 28 Commercial Loans 62,746 4.04% 28 Securitized commercial loans 116,087 3.93% 49 Other Securities(10) 56,762 3.23% 34 Subtotal 2,288,886 2.41% 32 Long Term Borrowings: Residential Whole Loans(19) 374,143 3.27% 898 Commercial Loans(19) 161,848 3.88% 590 Subtotal 535,991 3.45% 805 Repurchase agreements borrowings $ 2,824,877 2.61% 179 Less unamortized debt issuance costs 76 N/A N/A Repurchase agreements borrowings, net $ 2,824,801 2.61% 179 Please refer to page 20 for footnote disclosures. 15

Financing Summary Convertible Senior Unsecured Notes ▪ At December 31, 2019, the Company had $205.0 million aggregate principal amount of 6.75% convertible senior unsecured notes. The notes mature on October 1, 2022, unless earlier converted, redeemed or repurchased by the holders pursuant to their terms, and are not redeemable by the Company except during the final three months prior to maturity. The initial conversion rate was 83.1947 shares of common stock per $1,000 principal amount of notes and represented a conversion price of $12.02 per share of common stock. Mortgage-Backed Notes ▪ The following table summarizes the residential mortgage-backed notes issued by the Company's securitization trust (the "Arroyo Trust") at December 31, 2019 (dollars in thousands): Principal Contractual Classes Balance Coupon Carrying Value Maturity Offered Notes:(20) Class A-1 $ 681,668 3.3% $ 681,666 4/25/2049 Class A-2 36,525 3.5% 36,524 4/25/2049 Class A-3 57,866 3.8% 57,864 4/25/2049 Class M-1 25,055 4.8% 25,055 4/25/2049 Subtotal $ 801,114 $ 801,109 Less: Unamortized Deferred Financing Costs N/A 5,298 Total $ 801,114 $ 795,811 The securitized debt of the Arroyo Trust can only be settled with the residential loans that serve as collateral for the securitized debt and are non-recourse to the Company. ▪ As of December 31, 2019, the Company had three consolidated variable interest entities that had an aggregate securitized debt balance of $681.7 million. The securitized debt of these trusts can only be settled with the collateral held by the trusts and is non- recourse to the Company. Please refer to page 20 for footnote disclosures. 16

Hedging Summary(11) The following tables provide additional information on our fixed pay interest rate swaps and the variable pay interest rate swap as of December 31, 2019 ($ in thousands): Fixed Pay Interest Rate Swaps Avg. Fixed Pay Avg. Floating Average Maturity Maturity Notional Amount Rate Receive Rate (Years) 1 year or less $ 200,000 1.8% 1.9% 0.4 Greater than 3 years and less than 5 years 622,400 2.6% 1.9% 4.1 Greater than 5 years 1,728,600 2.1% 2.0% 8.9 Total $ 2,551,000 2.2% 2.0% 7.1 Variable Pay Interest Rate Swaps Avg. Variable Pay Avg. Fixed Average Maturity Maturity Notional Amount Rate Receive Rate (Years) Greater than 1 year and less than 3 years $ 810,000 2.0% 2.0% 1.6 Greater than 3 years and less than 5 years 550,000 1.9% 1.6% 5.0 Greater than 5 years 45,000 1.9% 2.3% 19.5 Total $ 1,405,000 2.0% 1.9% 3.5 Please refer to page 20 for footnote disclosures. 17

Hedging Summary(11) The following tables provide information on other derivative instruments as of December 31, 2019 ($ in thousands): Other Derivative Instruments Notional Amount Fair Value Credit default swaps, asset $ 60,100 $ 948 TBA securities, asset 1,000,000 1,146 Other derivative instruments, assets 2,094 Credit default swaps, liability $ 90,900 (3,795) TBA securities, liability 1,000,000 (2,074) Total other derivative instruments, liabilities (5,869) Total other derivative instruments, net $ (3,775) Please refer to page 20 for footnote disclosures. 18

Duration as of December 31, 2019 Agency Holdings Key Rate Duration Contribution Total 6-Months 2-Year 5-Year 10-Year 20-Year Agency IO/IIO 0.04 0.01 0.02 0.01 — — Agency RMBS 0.30 0.02 0.06 0.09 0.09 0.04 — Agency CMBS 3.35 0.01 0.05 0.60 2.48 0.21 Swaps and Futures (3.55) 0.07 0.06 (0.64) (3.24) 0.20 Repurchase Agreements (0.07) (0.07) — — — — — Total 0.07 0.04 0.19 0.06 (0.67) 0.45 19

Footnotes (1) As of December 31, 2019. (2) The Company acquired Non-Agency CMBS securities with certain control rights, which resulted in the consolidation of three variable interest entities and the recording $909.0 million in securitized commercial loans. (3) Economic return, for any period, is calculated by taking the sum of (i) the total dividends declared and (ii) the change in net book value during the period and dividing by the beginning book value. (4) Core earnings is a non-GAAP measures which includes the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives. Drop income is income derived from the use of ‘to-be-announced’ forward contract (“TBA”) dollar roll transactions which is a component of our gain (loss) on derivative instruments on our consolidated statement of operations, but is not included in core earnings. Drop income was approximately $986 thousand for the three months ended and the year ended December 31, 2019. (5) Non-GAAP measure which includes net interest margin (as defined in footnote 6), realized and unrealized gains or losses in the portfolio and other than temporary impairment. (6) Non-GAAP measures which include interest income, interest expense, the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives, and are weighted averages for the period. Excludes the net income from the consolidation of VIE Trusts required under GAAP. (7) Convertible senior notes interest expense has been allocated based on deployment of proceeds from October 2017 through May 2018 Convertible senior notes interest expense has been allocated based on based on fair value of investments at December 31, 2019. (8) Net interest rate swaps interest income have been allocated based on average duration contribution. (9) Includes other than temporary impairments on IO's and IIO's accounted for as derivatives. (10) Other investments include ABS and GSE Credit Risk Transfer securities. (11) While we use hedging strategies as part of our overall portfolio management, these strategies are not designed to eliminate all risks in the portfolio. There can be no assurance as to the level or effectiveness of these strategies. (12) The bridge loans acquired prior to October 25, 2017 are carried at amortized costs, since we did not elect the fair value option for these loans. For the bridge loans acquired subsequent to October, 25, 2017, we elected the fair value option to be consistent with the accounting of other investments. Accordingly, the carrying amount of the bridge loans as of December 31, 2019 includes $33.3 million of residential bridge loans carried at fair value and $3.2 million of residential bridge loans carried at amortized costs. (13) Gain (loss) on derivative instruments, net, has been allocated based average duration contribution (excludes cost of hedging and gains or losses on IO's and IIO's accounted for as derivatives). (14) The portfolio income attribution for securitized commercial loan is presented on a consolidated basis. (15) Non-GAAP measure which includes interest income on IO's and IIO's accounted for as derivatives. (16) Non-GAAP measure which includes net unrealized gains on IO's and IIO's accounted for as derivatives (17) Total Stock return is calculated by taking the sum of: (i) the total dividends declared; and (ii) the change in stock price during the period and dividing by the beginning stock price. (18) Miscellaneous interest income on cash investments has been allocated based on based on fair value of investments at December 31, 2019 (19) Certain Residential Whole Loans and Commercial Loans were financed under two longer term repurchase agreements. The Company entered into a $700.0 million residential and $200.0 million commercial facility. These facilities automatically renew until such time as they are terminated or until certain conditions of default. The weighted average remaining maturity days was calculated using expected weighted life of the underlying collateral. (20) The subordinate notes were retained by the Company. 20

Supplemental Information

Book Value Roll Forward Q4 2019 FY 2019 Amounts Amounts ($ in thousands) Per Share ($ in thousands) Per Share Beginning Book Value $ 564,360 $ 10.60 $ 503,009 $ 10.45 Proceeds from public offerings of common stock, net 3,013 — 52,355 (0.05) Equity portion of our convertible senior unsecured notes, net 1,026 0.02 2,374 0.04 Common Dividend (16,592) (0.31) (64,540) (1.21) 551,807 10.31 493,198 9.23 Portfolio Income (Loss) Net Interest Margin(6) 18,267 0.34 77,377 1.45 Net realized gain (loss) on investments and derivatives 48,145 0.91 (94,930) (1.78) Net unrealized gain (loss) on investments and derivatives (45,758) (0.86) 119,192 2.22 Other than temporary impairment(9) (2,334) (0.04) (8,939) (0.17) Net Portfolio Income (Loss) 18,320 0.35 92,700 1.72 Operating expense (3,066) (0.06) (12,873) (0.24) General and administrative (excludes stock-based compensation) (1,978) (0.04) (7,507) (0.14) Income tax benefit (provision) (622) (0.01) (1,057) (0.02) Book Value at December 31, 2019 $ 564,461 $ 10.55 $ 564,461 $ 10.55 Please refer to page 20 for footnote disclosures. 21

Adjusted* Portfolio Composition Total Investment Portfolio ($ in millions) 12/31/2019 Consolidated Third Party Company Sponsored Unconsolidated (As Reported) Consolidated Trust Securitization (Non GAAP) Agency RMBS $ 357 $ — $ — $ 357 Agency CMBS 1,439 — — 1,439 Non-Agency RMBS 46 227 — 273 Non-Agency CMBS 316 — 60 376 Residential Whole-Loans 1,376 — (846) 530 Residential Bridge Loans 36 — — 36 Securitized Commercial Loans 909 (909) — — Commercial Loans 370 — — 370 Other Securities(7) 80 — — 80 Total $ 4,929 $ (682) $ (786) $ 3,461 *Excludes consolidation of VIE Trusts required under GAAP 7.9% Agency RMBS 41.6% Agency CMBS 10.9% Non-Agency RMBS Non-Agency CMBS Residential Whole-Loans 15.3% Residential Bridge Loans Commercial Loans 10.3% 1.0% Other Securities 2.3% 10.7% Please refer to page 20 for footnote disclosures. 22

Adjusted* Portfolio Income Attribution(5) For Three Months Ended December 31, 2019 (In millions except per share data) Non- Non- Residential Residential Agency Agency Agency Agency Whole- Bridge Loans Other Commercial CMBS RMBS CMBS RMBS Loans (12) Securities(10) Loan Total Interest Income(15) $ 12,430 $ 3,079 $ 6,840 508 $ 14,415 $ 947 $ 1,263 $ 9,164 $ 48,646 Interest expense(7) (9,972) (2,258) (2,669) (317) (11,203) (491) (546) (3,096) (30,552) Net interest rate swap interest income(8) (285) (23) (21) (17) — — — — (346) Miscellaneous interest income(18) 176 44 66 6 168 4 10 45 519 Net Interest Income 2,349 842 4,216 180 3,380 460 727 6,113 18,267 Realized gain (loss) on investments 12,524 — (560) — — 29 — — 11,993 Unrealized gain (loss) on investments(16) (51,196) 715 (4,061) (722) 3,531 317 (68) (420) (51,904) Gain (loss) on derivative instruments, net(13) 33,972 2,762 2,532 1,979 — — 1,053 — 42,298 OTTI(9) (106) — (2,059) (127) — — (42) — (2,334) Portfolio Income (loss) (2,457) 4,319 68 1,310 6,911 806 1,670 5,693 18,320 BV Per Share Increase (Decrease) $ (0.05) $ 0.08 $ — $ 0.03 $ 0.13 $ 0.02 $ 0.03 $ 0.11 $ 0.35 * Excludes the securitized commercial loan and debt from the consolidation of VIE trusts required under GAAP. Reflects only our interest in the Non-Agency CMBS security that was acquired. 23 Please refer to page 20 for footnote disclosures.

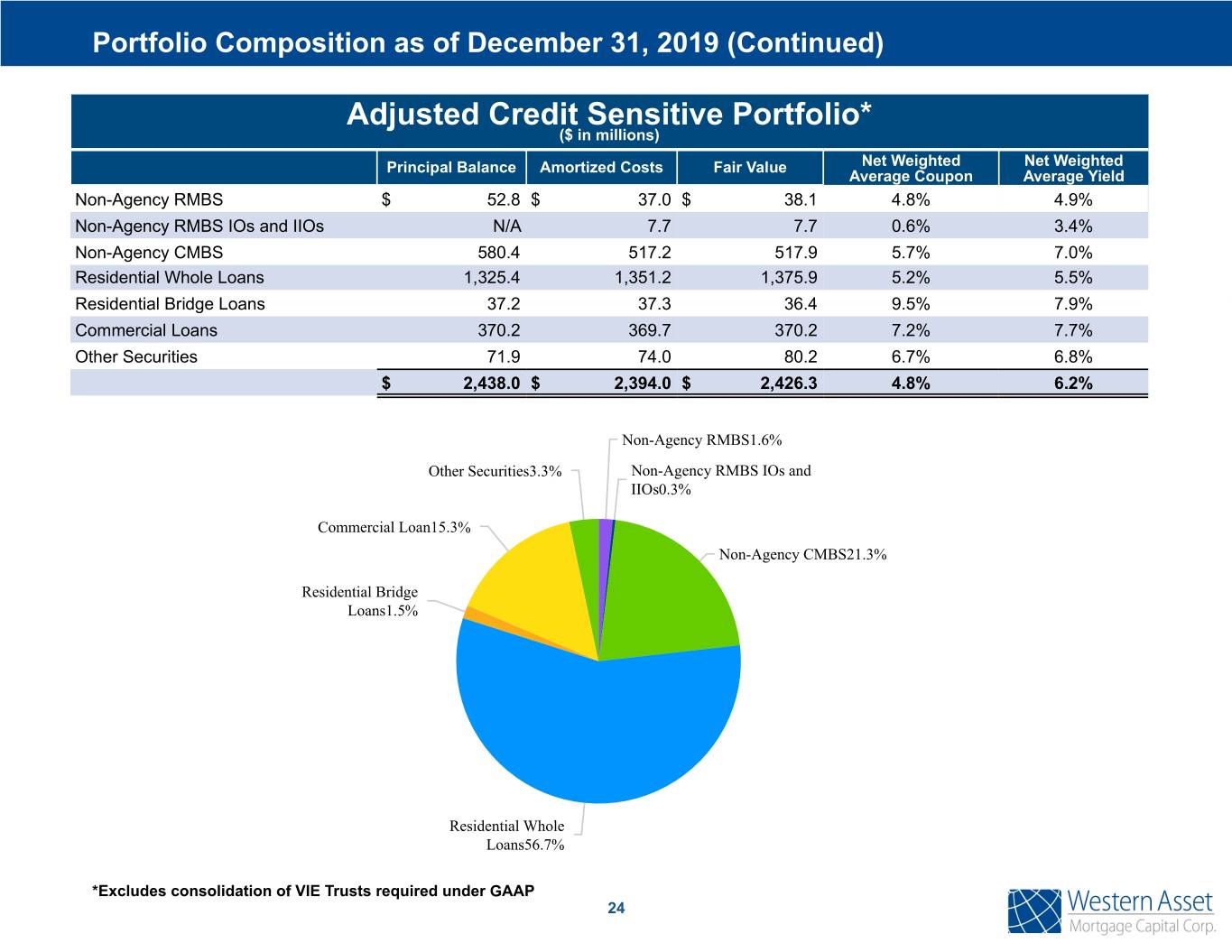

Portfolio Composition as of December 31, 2019 (Continued) Adjusted Credit Sensitive Portfolio* ($ in millions) Principal Balance Amortized Costs Fair Value Net Weighted Net Weighted Average Coupon Average Yield Non-Agency RMBS $ 52.8 $ 37.0 $ 38.1 4.8% 4.9% Non-Agency RMBS IOs and IIOs N/A 7.7 7.7 0.6% 3.4% Non-Agency CMBS 580.4 517.2 517.9 5.7% 7.0% Residential Whole Loans 1,325.4 1,351.2 1,375.9 5.2% 5.5% Residential Bridge Loans 37.2 37.3 36.4 9.5% 7.9% Commercial Loans 370.2 369.7 370.2 7.2% 7.7% Other Securities 71.9 74.0 80.2 6.7% 6.8% $ 2,438.0 $ 2,394.0 $ 2,426.3 4.8% 6.2% Non-Agency RMBS1.6% Other Securities3.3% Non-Agency RMBS IOs and IIOs0.3% Commercial Loan15.3% Non-Agency CMBS21.3% Residential Bridge Loans1.5% Residential Whole Loans56.7% *Excludes consolidation of VIE Trusts required under GAAP 24

Commercial Loans as of December 31, 2019 ($ in millions) Acquisition Principal Fair Maturity Extension Loan Date Loan Type Balance Value LTV Interest Rate Date Option Collateral Interest-Only 1-Month LIBOR plus Two One-Year CRE 1 March 2018 Mezzanine loan $ 20.0 $ 20.0 71.0% 6.50% 12/9/2020 Extensions Hotel Interest-Only First 1-Month LIBOR plus One-Year CRE 2 June 2018 Mortgage 30.0 30.0 65.0% 4.50% 6/9/2020 Extension Hotel Principal & Interest 1-Month LIBOR plus Two One-Year Nursing CRE 4 June 2019 First Mortgage 50.0 50.0 75.0% 4.75% 1/11/2022 Extensions Facilities Interest-Only 1-Month LIBOR plus Two-Year First Entertainment CRE 5 August 2019 Mezzanine loan 90.0 90.0 57.9% 9.25% 6/29/2021 Extension and and Retail Interest-Only First 1-Month LIBOR plus One-YearTwo One-Year Second CRE 6 September 2019 Mortgage 40.0 40.0 63.0% 3.02% 8/6/2021 Extensions Retail Interest-Only First 1-Month LIBOR plus Three One-Year CRE 7 December 2019 Mortgage 24.5 24.5 61.8% 3.75% 11/6/2021 Extensions Hotel Interest-Only First 1-Month LIBOR plus Three One-Year CRE 8 December 2019 Mortgage 13.2 13.2 61.8% 3.75% 11/6/2021 Extensions Hotel Interest-Only First 1-Month LIBOR plus Three One-Year CRE 9 December 2019 Mortgage 7.3 7.3 61.8% 3.75% 11/6/2021 Extensions Hotel Interest-Only First 1-Month LIBOR plus CRE 10 December 2019 Mortgage 4.4 4.4 79.0% 4.85% 12/6/2022 None Assisted Living Interest-Only One-Month LIBOR Two One-Year Nursing SBC 1 July 2018 First Mortgage 45.2 45.2 74.0% plus 4.25% (1) 7/1/2020 Extensions Facilities Interest-Only One-Month LIBOR One-Year Apartment SBC 4 January 2019 First Mortgage 13.6 13.6 84.0% plus 4.00%(2) 12/1/2021 Extension Complex Interest-Only One-Month LIBOR Nursing SBC 5 January 2019 First Mortgage 32.0 32.0 49.0% plus 4.10% 7/1/2021 None Facilities $ 370.2 $ 370.2 Footnotes (1) Subject to LIBOR floor of 1.25%. (2) Subject to LIBOR floor of 2.0%. 25

Contact Information Western Asset Mortgage Capital Corporation c/o Financial Profiles, Inc. 11601 Wilshire Blvd., Suite 1920 Los Angeles, CA 90025 www.westernassetmcc.com Investor Relations Contact: Larry Clark Tel: (310) 622-8223 lclark@finprofiles.com