Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Moleculin Biotech, Inc. | exh991-pressreleaseshareho.htm |

| 8-K - 8-K - Moleculin Biotech, Inc. | form8-kq1shareholderletter.htm |

Moleculin in 2020 Developing ground-breaking therapies for highly resistant cancers March 4, 2020 Shareholder Letter 2020 Public Corporate Presentation (Nasdaq: MBRX) Disclaimer All statements contained herein other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including those discussed under Item 1A. "Risk Factors" in our most recently filed Form 10-K filed with the Securities and Exchange Commission ("SEC") and updated from time to time in our Form 10-Q filings and in our other public filings with the SEC. Any forward-looking statements contained in this release speak only as of its date. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward looking statements. More detailed information about Moleculin is set forth in our filings with the Securities and Exchange Commission. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. 2

Hello, I’m Wally Klemp, Chairman and CEO of Moleculin Biotech and I’ve been looking forward to giving you this preview of what’s ahead for 2020. This should be a big year for us at Moleculin, and in this video, I’d like to bring investors up to date on some exciting developments in our drug portfolio. We are now in an enviable position: we have 2 drugs, Annamycin and WP1220 that we believe are approvable on an accelerated basis by simply expanding results we have already seen to a larger patient population. Importantly, our successful clinical activity thus far has now allowed us to narrow our development focus to our nearest term opportunities. This should allow us to reduce our cash needs until we reach a significant value inflection point. At the same time, institutional support for our technologies has increased dramatically and should provide substantial outside funding to help reduce future dilution. Becoming More Focused When we took Moleculin public in 2016, we placed a great deal of emphasis on the breadth of our portfolio providing “multiple shots on goal.” This was important because the inherent risk of developing new biotechnology. But now we are now seeing real and promising human activity in both Annamycin and our STAT3 inhibitors, which is in turn beginning to drive interest by outside institutions to support our development efforts. As you can see from this graphic of our internally funded development pipeline, we are focusing on 3 clinical development pathways, 2 for Annamycin and 1 for WP1220. We have now seen human activity in both drugs that we think is capable of supporting an accelerated approval pathway.

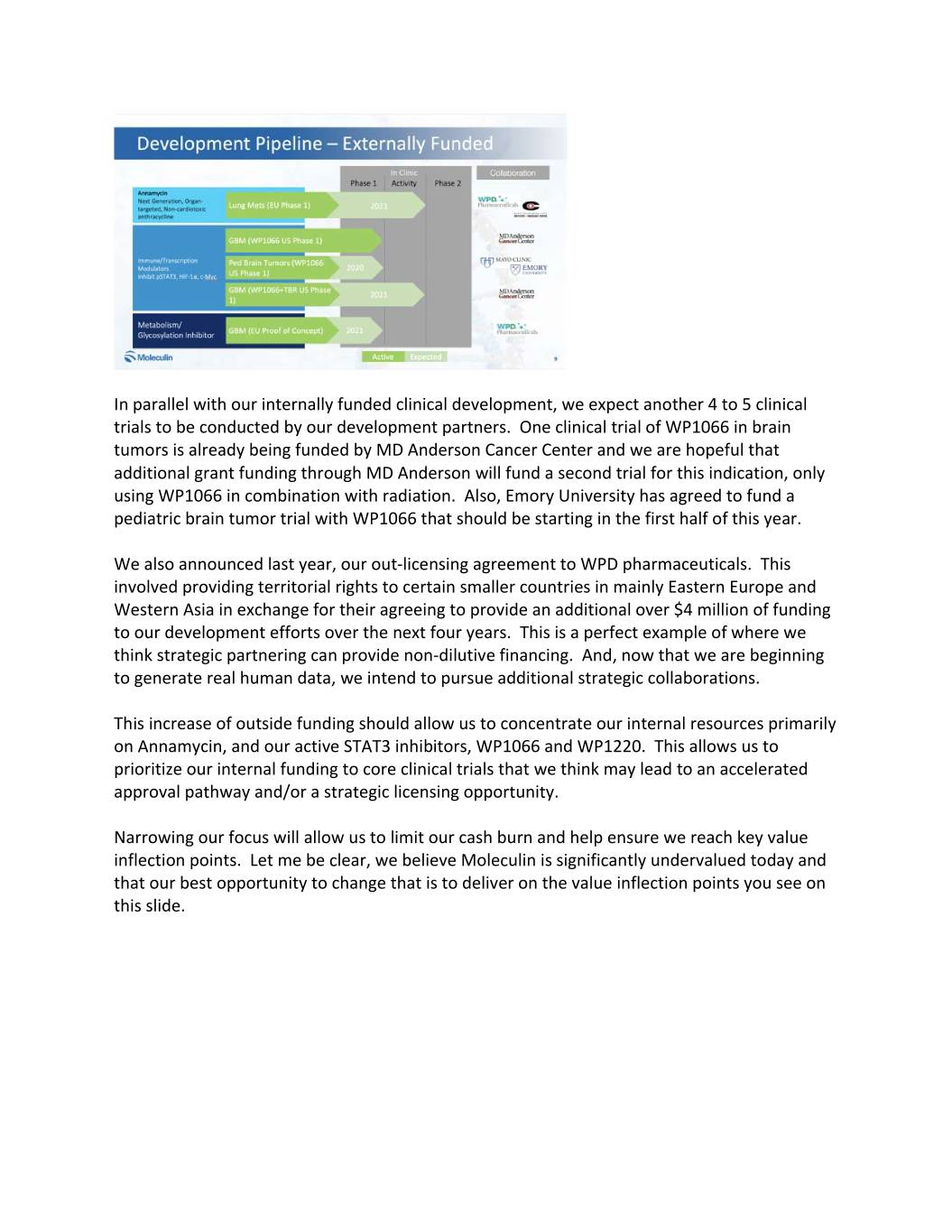

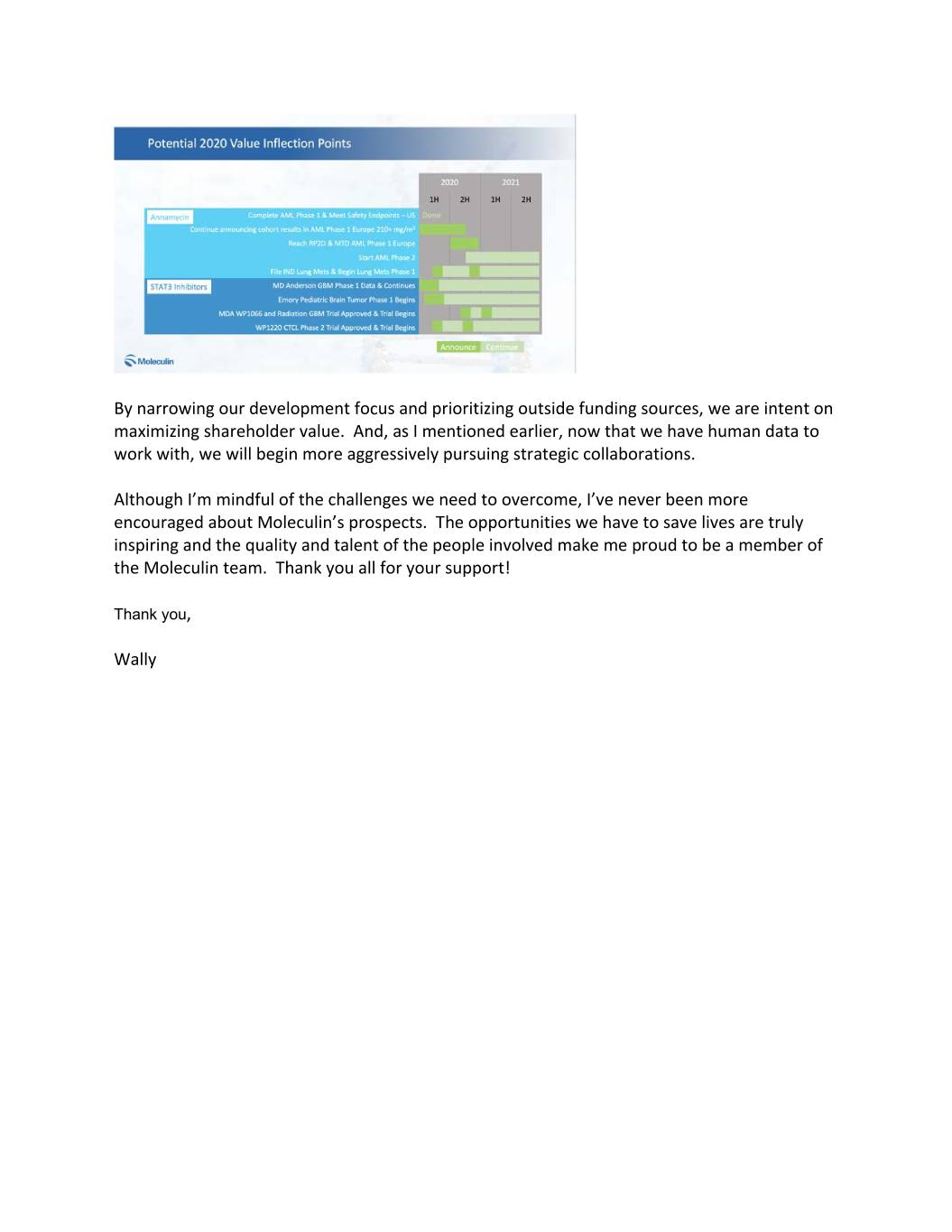

In parallel with our internally funded clinical development, we expect another 4 to 5 clinical trials to be conducted by our development partners. One clinical trial of WP1066 in brain tumors is already being funded by MD Anderson Cancer Center and we are hopeful that additional grant funding through MD Anderson will fund a second trial for this indication, only using WP1066 in combination with radiation. Also, Emory University has agreed to fund a pediatric brain tumor trial with WP1066 that should be starting in the first half of this year. We also announced last year, our out-licensing agreement to WPD pharmaceuticals. This involved providing territorial rights to certain smaller countries in mainly Eastern Europe and Western Asia in exchange for their agreeing to provide an additional over $4 million of funding to our development efforts over the next four years. This is a perfect example of where we think strategic partnering can provide non-dilutive financing. And, now that we are beginning to generate real human data, we intend to pursue additional strategic collaborations. This increase of outside funding should allow us to concentrate our internal resources primarily on Annamycin, and our active STAT3 inhibitors, WP1066 and WP1220. This allows us to prioritize our internal funding to core clinical trials that we think may lead to an accelerated approval pathway and/or a strategic licensing opportunity. Narrowing our focus will allow us to limit our cash burn and help ensure we reach key value inflection points. Let me be clear, we believe Moleculin is significantly undervalued today and that our best opportunity to change that is to deliver on the value inflection points you see on this slide.

We take pride in being very transparent about our expected milestones, as well as reporting our performance against those milestones. The graphic you see on this slide presents our milestones as they were set and communicated to the public at the beginning of each year. We clearly missed some key milestones during our first year of being public, but since then, we have been hitting them on a consistent basis. For the sake of time in this video, I won’t cover this in detail, but you can access this graphic, and this entire presentation, any time from the Investor section of our web site. In summary, 2 years ago, we had no clinical activity. Since then we’ve launched 4 Phase 1 clinical trials and a small proof of concept trial, which is now complete. And, importantly, we think we are likely to start at least two Phase 2 clinical trials in 2020. Annamycin Annamycin is lining up to be an even greater opportunity than we thought. We believe it’s lack of cardiotoxicity could position Annamycin to become a replacement for doxorubicin in many situations.

For example, 65% of patients who receive the equivalent of 550 mg/m2 of doxorubicin will exhibit cardiotoxicty, which is why the FDA now limits patients to that that amount as a lifetime maximum cumulative dose. And, as many as 40% of patients treated with an anthracycline are likely to experience long-term heart damage. Annamycin was designed from the start to be noncardiotoxic and this has been shown in the animal test relied upon by the FDA. Moreover, it’s been shown to be safe in 6 prior clinical trials involving 114 patients. And, in our current AML clinical trials, we’ve now treated 17 patients, 8 of whom have been treated above the 550 mg/m2 maximum, and none have shown any evidence of cardiotoxicity. We now also believe Annamycin has the potential to treat distant metastases. Our sponsored research at MD Anderson has paid off in a very big way, showing consistently remarkable efficacy in lung metastases in different tumor animal models. In fact, the latest research has demonstrated that in animal models Annamycin accumulates in the lungs at 5- to 6-fold higher concentrations than doxorubicin, the current standard of care. And, we are now working with Dr. Robert Benjamin and his team at MD Anderson, one of the world’s foremost authorities on sarcomas (including lung metastases), to design clinical trials to demonstrate this potential. At the same time, our acute myeloid leukemia (or, AML) trials have dealt us a bit of a surprise. With patients now being treated at 210 mg/m2, we expected to see even stronger activity than we have so far…at least based on the prior Callisto Pharmaceuticals clinical trial. On the

surface, this could be interpreted as a reduced level of activity, but upon deeper analysis, it turns out that this may be a blessing in disguise. The Callisto trial was actually the second trial to study Annamycin in acute leukemia. The first trial was sponsored by a company called Aronex Pharmaceuticals, and that trial actually produced better results than the Callisto trial. The reason for this series of Phase 1 trials has to do with subtle changes in formulation. The Aronex formulation posed a challenge to ultimate commercialization and when Callisto acquired the technology and made changes in manufacturing methods to address this, they had to run another Phase 1 dose ranging trial. Unexpectedly, that trial yielded a significantly different result than the Aronex trial. These differences can be seen in the graphic shown here. Although the Callisto trial restarted at the same 190 mg/m2 starting dose used in the Aronex trial, there were immediate instances of mucositis, causing the dosing to be reduced instead of escalated. Something had changed in the Callisto product that appeared to make it more potent, but slightly less effective than the Aronex product. The production of liposome formulated anthracyclines is very sensitive to subtle changes in production method and starting materials. It is partly for this reason that, more than 10 years later and with entirely new contractors, we had to run yet another Phase 1 dose ranging study. And, now, the Moleculin product appears to be behaving much more like the Aronex product. If this is the case, we wouldn’t expect to see the best activity from Annamycin until we get above 240 mg/m2! All of this suggests that our Phase 1 trial will run longer than originally expected and we may well have to reach 300 mg/m2 or higher before we run into DLTs (dose limiting toxicities). The bad news is that this will take longer, and we shouldn’t expect to see consistent efficacy until we get to higher dosing levels. The good news is that, if the current product is in fact behaving more like the original Aronex product, we could actually see better overall activity than in the Callisto trial once we reach the MTD (or, maximum tolerated dose).

While we believe reaching an MTD may take longer, we are focused on creating an accelerated approval pathway for Annamycin. The FDA has granted Annamycin Fast Track status and Orphan Drug Designation for AML. And, following our successful Phase 1 trial in AML, we plan to discuss with the FDA and EMA our intent to conduct a single arm Phase 2 trial. Our goal is for this trial serve as the basis for accelerated approval of Annamycin in AML and for the FDA to allow us to rely on our European trial to establish a recommended Phase 2 dose. The absence of cardiotoxicity coupled with a potential ability to treat tumors that current anthracyclines cannot is why we believe Annamycin’s opportunity is now much larger than we had originally thought. WP1066 and STAT3 Inhibitor Family This year could also be big for our STAT3 inhibitors as well. The Emory University pediatric brain tumor trial is about to begin, which should provide more valuable information about the bioavailability of WP1066. At the same time, the MD Anderson discovery that WP1066 appears to have a synergistic effect when used in combination with traditional radiation therapy is potentially game-changing news. The animal studies done by the team at MD Anderson are so compelling that we hope the findings will be able to attract grant funding to conduct a combination trial this year. We’ve also stepped up our efforts to develop an IV infusion formulation for WP1066. If successful, the resulting IV formulation should allow us to treat a wider range of tumors with potentially increased bioavailability of WP1066 and without the limitations imposed by complicated oral delivery. Adding to the achievements we have made with the WP1066 portfolio, we made significant strides in our proof of concept trial of a topically applied STAT3 inhibitor, WP1220, on CTCL, which were recently presented at the World Congress on Cutaneous Lymphoma in Barcelona. If we can replicate those results in a Phase 2 trial, we believe that we may have the first approvable inhibitor of activated STAT3 on the market. We recently closed on an additional $6 million of equity funding through the sale of stock, which included the issuance of additional warrants as well. To be clear, we do not believe the current stock price recognizes the potential value of Moleculin in light of our clinical progress and what we believe may be possible for Annamycin, WP1220 and WP1066. For this reason, we made a prudent decision to minimize funding activity. Also, we continue to have access to additional capital via our equity line and our Equity ATM. As you can see from the graphic on this slide, this runway should allow us to get closer to some key inflection points.

By narrowing our development focus and prioritizing outside funding sources, we are intent on maximizing shareholder value. And, as I mentioned earlier, now that we have human data to work with, we will begin more aggressively pursuing strategic collaborations. Although I’m mindful of the challenges we need to overcome, I’ve never been more encouraged about Moleculin’s prospects. The opportunities we have to save lives are truly inspiring and the quality and talent of the people involved make me proud to be a member of the Moleculin team. Thank you all for your support! Thank you, Wally