Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANTARES PHARMA, INC. | atrs-8k_20200304.htm |

Antares Pharma Investor’s Update March 2020 Exhibit 99.1

This presentation contains forward-looking statements within the meaning of the safe harbour provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: achievement of the Company’s 2020 revenue guidance; market acceptance, adequate reimbursement coverage and commercial success of XYOSTED® and future revenue from the same; market acceptance of Teva’s generic epinephrine auto-injector product and future revenue from the same; successful development including the timing and results of the clinical bridging and Phase 3 clinical trial of the drug device combination product for Selatogrel with Idorsia Pharmaceuticals and FDA and global regulatory approvals and future revenue from the same; our expectations regarding whether the FDA will pursue withdrawal of approval for AMAG Pharmaceuticals Inc.’s Makena® subcutaneous auto injector following the recent FDA advisory committee meeting and future prescriptions, market acceptance and revenue from Makena® subcutaneous auto injector; Teva’s ability to successfully commercialize VIBEX® Sumatriptan Injection USP and the amount of revenue from the same; continued growth of prescriptions and sales of OTREXUP®; the timing and results of the Company’s or its partners’ research projects or clinical trials of product candidates in development; actions by the FDA or other regulatory agencies with respect to the Company’s products or product candidates of its partners; continued growth in product, development, licensing and royalty revenue; the Company’s ability to meet loan extension and interest only payment milestones and the ability to repay the debt obligation to Hercules Capital; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities and other statements regarding matters that are not historical facts, and involve predictions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward-looking statements. In some cases you can identify forward-looking statements by terminology such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is contained in the "Risk Factors" section of the Company's most recently filed Annual Report on Form 10-K, and in the Company's other periodic reports and filings with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this press release. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation, except as required by law. ©2020 Copyright Antares Pharma, Inc. All Rights Reserved. Safe Harbor Statement

At Antares Pharma, we leverage pharmaceutical and medical device expertise to develop innovative products that address needs in underserved therapeutic areas Who We Are – A Pharmaceutical Technology Company Our novel drug delivery technology can provide multiple product opportunities and life-cycle management solutions Revenue streams from our portfolio of proprietary and partnered products provide robust opportunities for continued growth

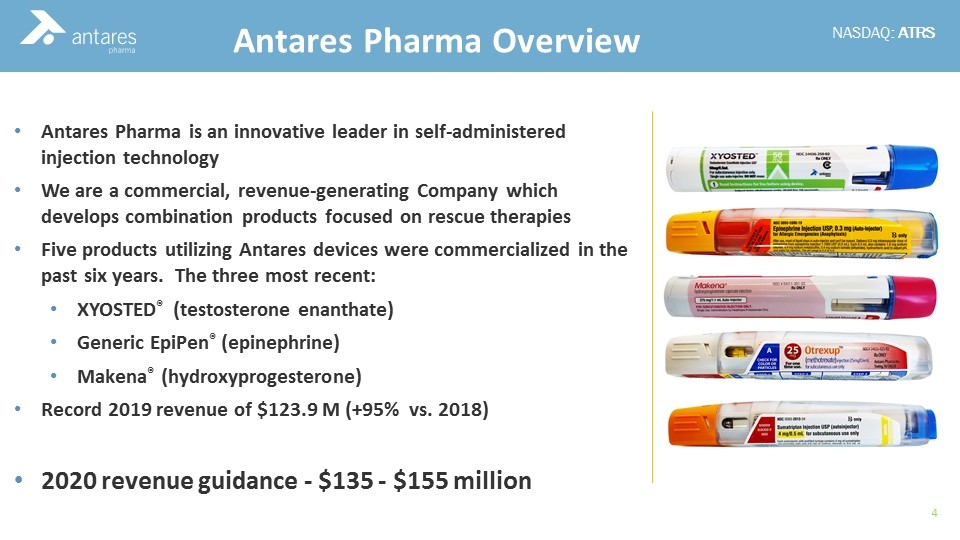

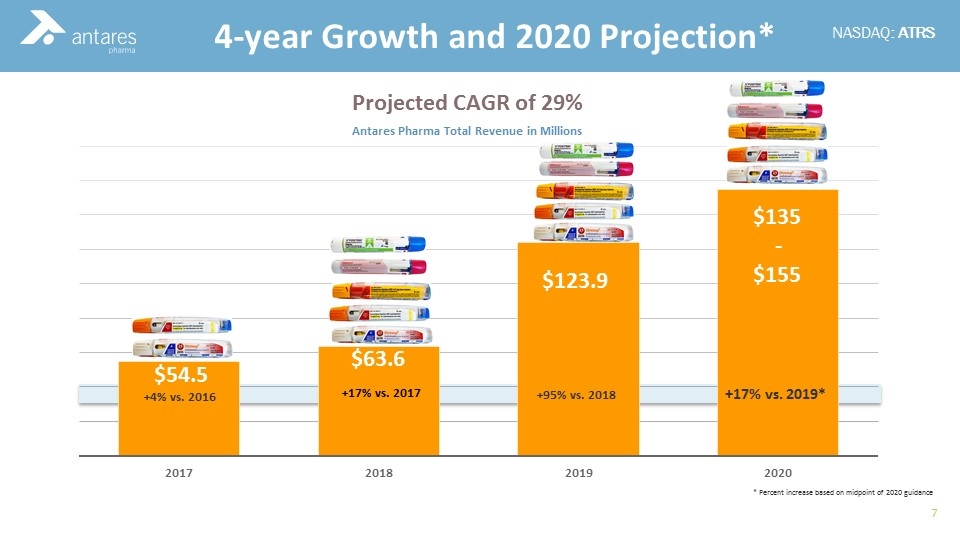

Antares Pharma is an innovative leader in self-administered injection technology We are a commercial, revenue-generating Company which develops combination products focused on rescue therapies Five products utilizing Antares devices were commercialized in the past six years. The three most recent: XYOSTED® (testosterone enanthate) Generic EpiPen® (epinephrine) Makena® (hydroxyprogesterone) Record 2019 revenue of $123.9 M (+95% vs. 2018) 2020 revenue guidance - $135 - $155 million Antares Pharma Overview

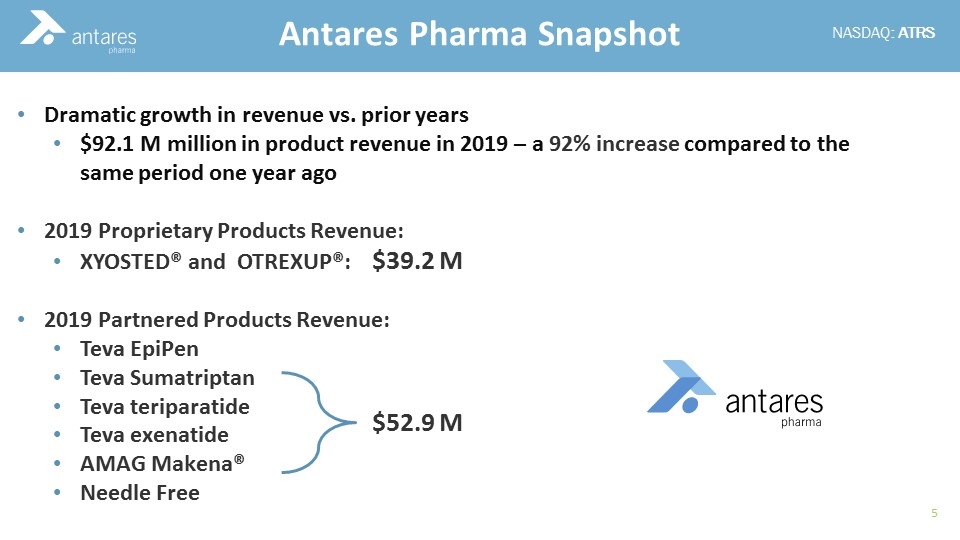

Dramatic growth in revenue vs. prior years $92.1 M million in product revenue in 2019 – a 92% increase compared to the same period one year ago 2019 Proprietary Products Revenue: XYOSTED® and OTREXUP®: $39.2 M 2019 Partnered Products Revenue: Teva EpiPen Teva Sumatriptan Teva teriparatide Teva exenatide AMAG Makena® Needle Free Antares Pharma Snapshot $52.9 M

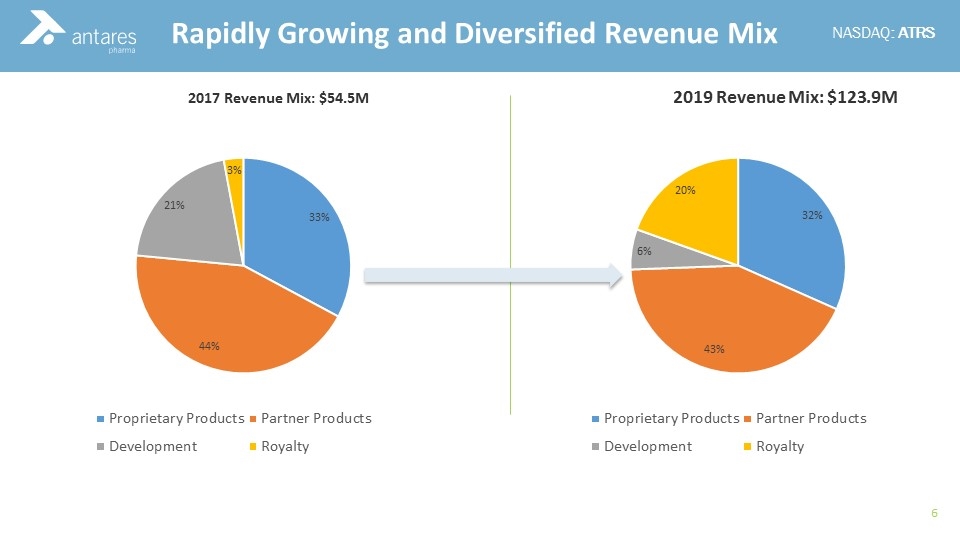

2019 Revenue Mix: $123.9M Rapidly Growing and Diversified Revenue Mix 2017 Revenue Mix: $54.5M

+95% vs. 2018 +17% vs. 2019* 4-year Growth and 2020 Projection* Projected CAGR of 29% * Percent increase based on midpoint of 2020 guidance +4% vs. 2016 $135 - $155

Antares Pharma Proprietary Commercial Products March 2020

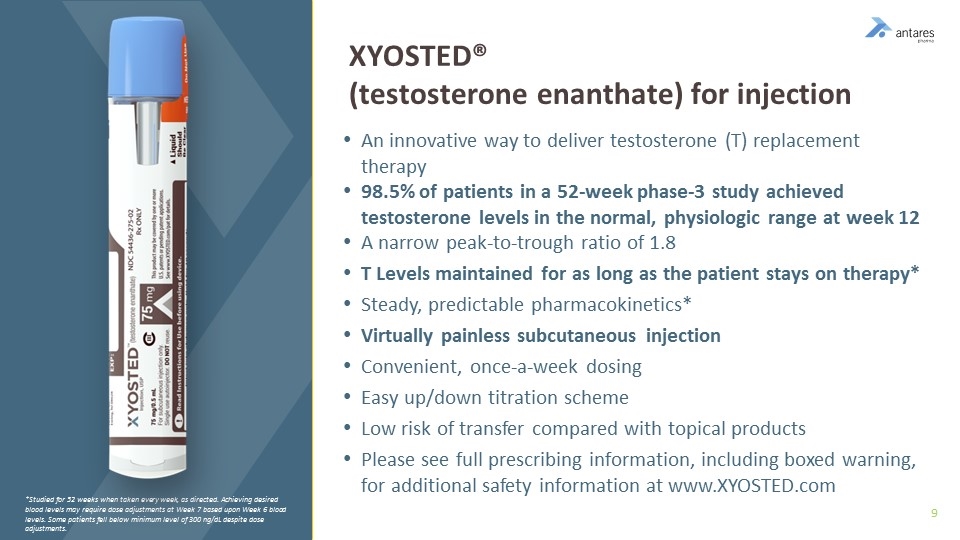

An innovative way to deliver testosterone (T) replacement therapy 98.5% of patients in a 52-week phase-3 study achieved testosterone levels in the normal, physiologic range at week 12 A narrow peak-to-trough ratio of 1.8 T Levels maintained for as long as the patient stays on therapy* Steady, predictable pharmacokinetics* Virtually painless subcutaneous injection Convenient, once-a-week dosing Easy up/down titration scheme Low risk of transfer compared with topical products Please see full prescribing information, including boxed warning, for additional safety information at www.XYOSTED.com XYOSTED® (testosterone enanthate) for injection *Studied for 52 weeks when taken every week, as directed. Achieving desired blood levels may require dose adjustments at Week 7 based upon Week 6 blood levels. Some patients fell below minimum level of 300 ng/dL despite dose adjustments.

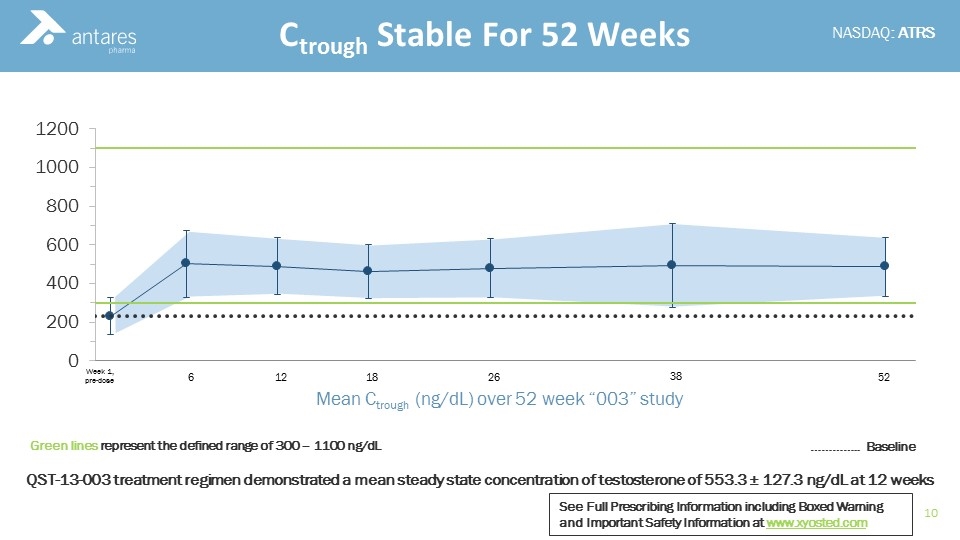

Ctrough Stable For 52 Weeks 6 12 18 26 38 52 Week 1, pre-dose Mean Ctrough (ng/dL) over 52 week “003” study Green lines represent the defined range of 300 – 1100 ng/dL ………….. Baseline QST-13-003 treatment regimen demonstrated a mean steady state concentration of testosterone of 553.3 ± 127.3 ng/dL at 12 weeks See Full Prescribing Information including Boxed Warning and Important Safety Information at www.xyosted.com

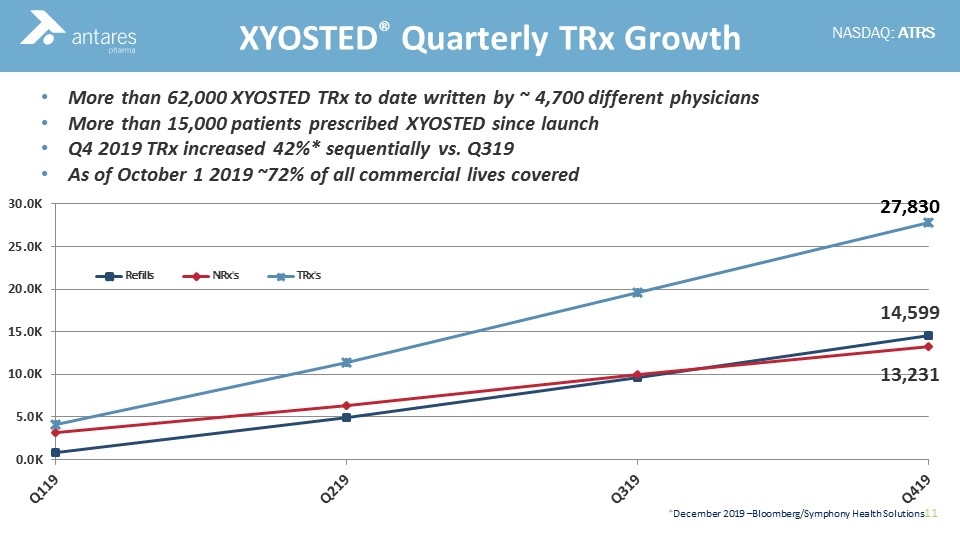

More than 62,000 XYOSTED TRx to date written by ~ 4,700 different physicians More than 15,000 patients prescribed XYOSTED since launch Q4 2019 TRx increased 42%* sequentially vs. Q319 As of October 1 2019 ~72% of all commercial lives covered XYOSTED® Quarterly TRx Growth 14,599 13,231

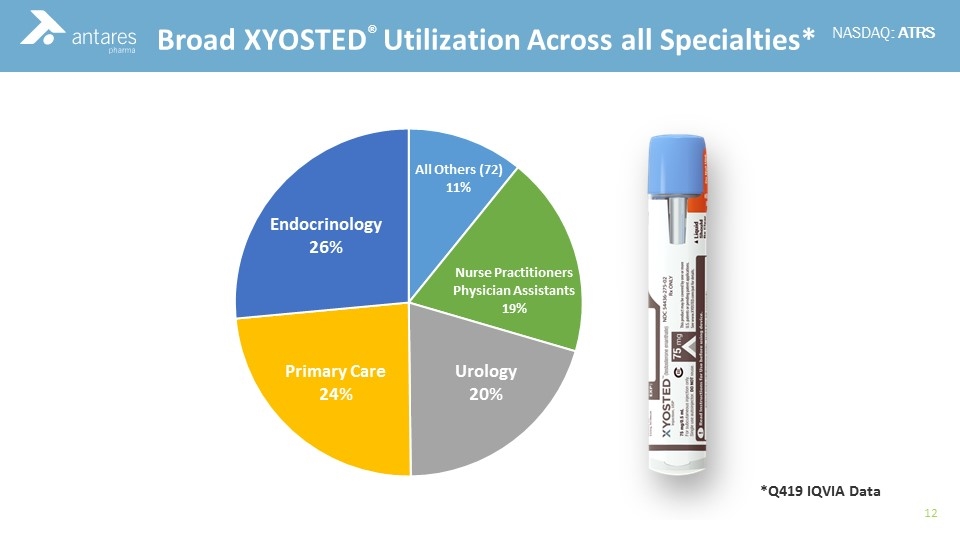

Commercial Experience Broad XYOSTED® Utilization Across all Specialties* *Q419 IQVIA Data

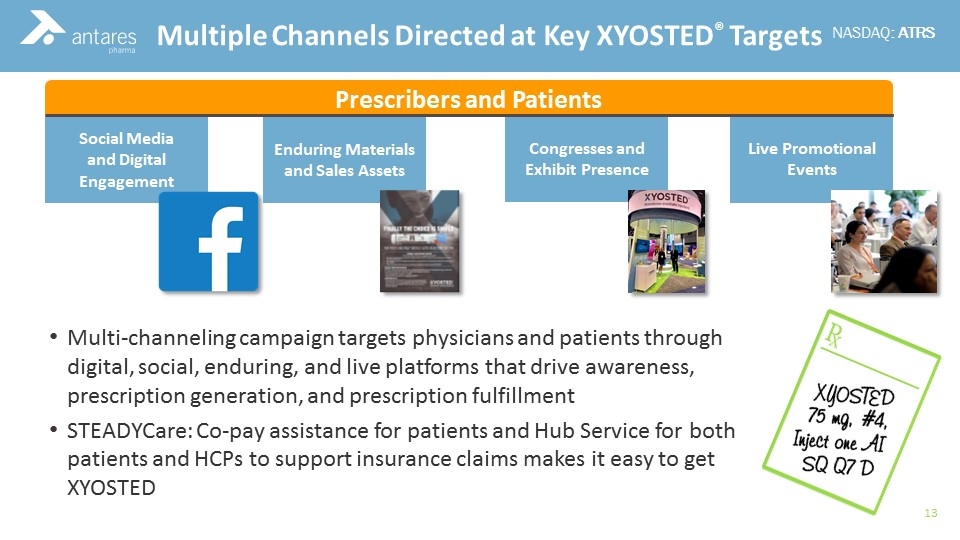

Trial Experience Multiple Channels Directed at Key XYOSTED® Targets Multi-channeling campaign targets physicians and patients through digital, social, enduring, and live platforms that drive awareness, prescription generation, and prescription fulfillment STEADYCare: Co-pay assistance for patients and Hub Service for both patients and HCPs to support insurance claims makes it easy to get XYOSTED Social Media and Digital Engagement Enduring Materials and Sales Assets Congresses and Exhibit Presence Prescribers and Patients Live Promotional Events

Antares Pharma Partnered Products March 2020

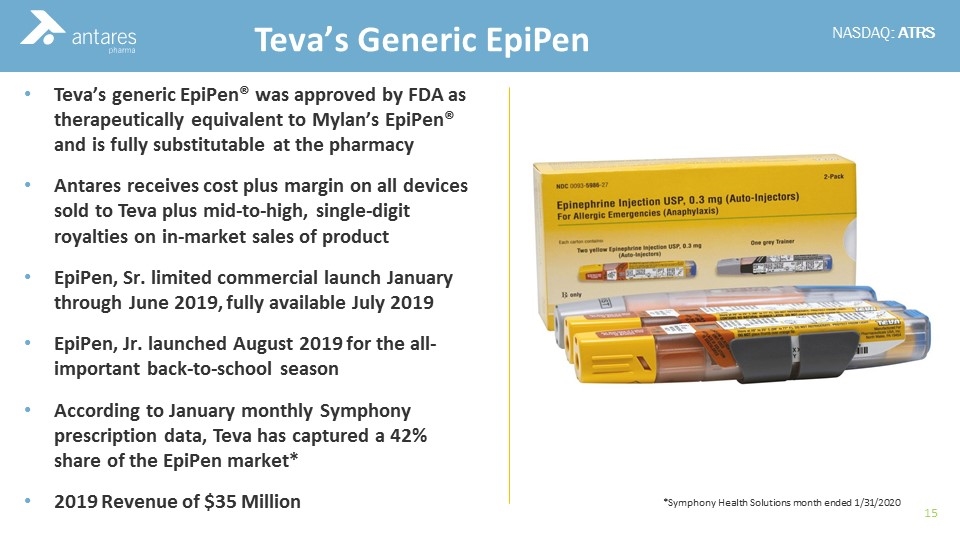

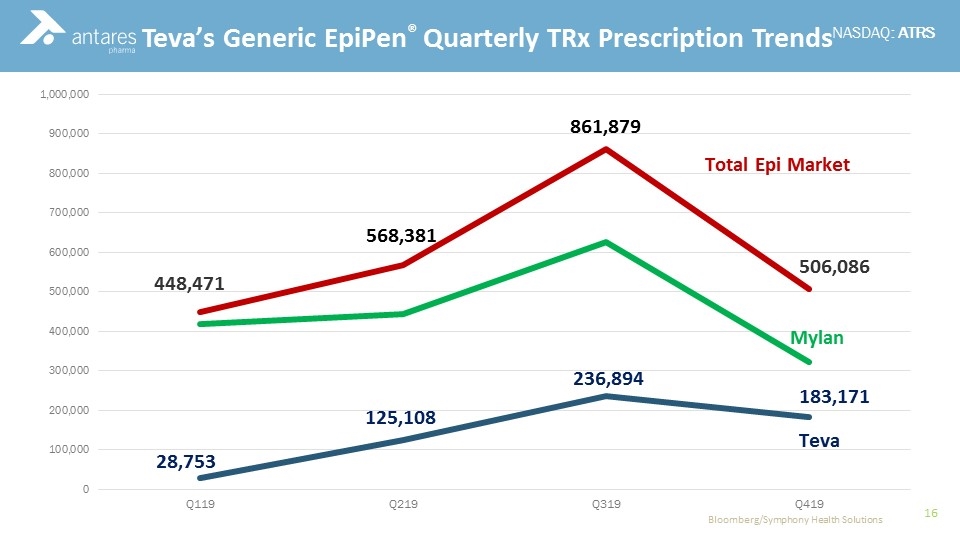

Commercial Experience Teva’s Generic EpiPen Teva’s generic EpiPen® was approved by FDA as therapeutically equivalent to Mylan’s EpiPen® and is fully substitutable at the pharmacy Antares receives cost plus margin on all devices sold to Teva plus mid-to-high, single-digit royalties on in-market sales of product EpiPen, Sr. limited commercial launch January through June 2019, fully available July 2019 EpiPen, Jr. launched August 2019 for the all-important back-to-school season According to January monthly Symphony prescription data, Teva has captured a 42% share of the EpiPen market* 2019 Revenue of $35 Million *Symphony Health Solutions month ended 1/31/2020

Commercial Experience Teva’s Generic EpiPen® Quarterly TRx Prescription Trends Bloomberg/Symphony Health Solutions 448,471 506,086

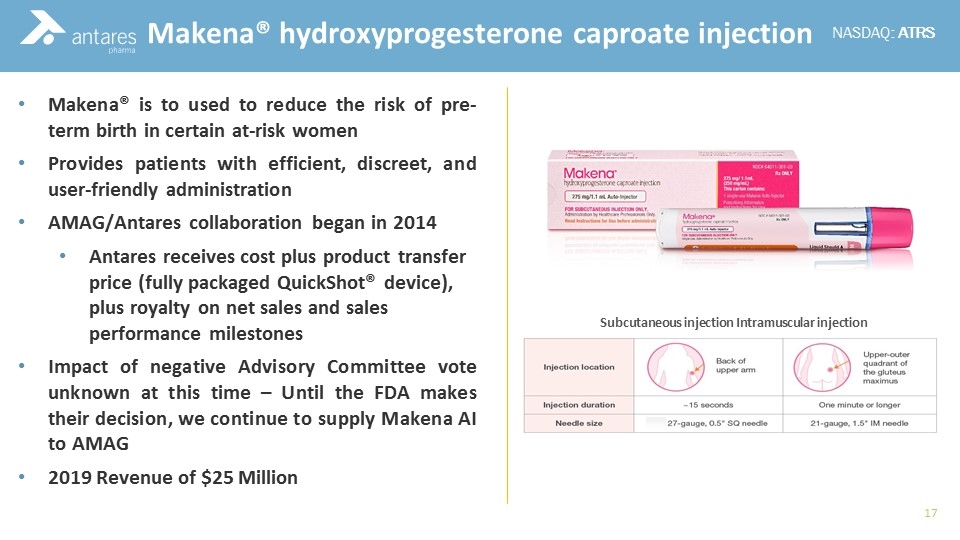

Commercial Experience Makena® hydroxyprogesterone caproate injection Makena® is to used to reduce the risk of pre-term birth in certain at-risk women Provides patients with efficient, discreet, and user-friendly administration AMAG/Antares collaboration began in 2014 Antares receives cost plus product transfer price (fully packaged QuickShot® device), plus royalty on net sales and sales performance milestones Impact of negative Advisory Committee vote unknown at this time – Until the FDA makes their decision, we continue to supply Makena AI to AMAG 2019 Revenue of $25 Million Subcutaneous injection Intramuscular injection

Antares Pharma Development Pipeline March 2020

Global Development Agreement with Idorsia for Selatogrel Antares entered into a global agreement with Idorsia Pharmaceuticals to develop a drug device product combining selatogrel, a New Chemical Entity - with the QuickShot Auto Injector Selatogrel is a fast acting and highly selective P2Y12 receptor antagonist for the treatment of suspected Acute Myocardial Infarction (AMI) – US IP granted until 2034 Phase 2 data demonstrated that subcutaneous administration of selatogrel resulted in a potent and rapid platelet inhibition effect Idorsia is preparing for a clinical bridging study followed by a global Phase 3 study for the pre-hospital treatment of a suspected AMI – P3 study could potentially commence mid 2021

Around 7.6 million Americans have survived an MI (Myocardial Infarction) Each year, around 750,000 have a new or recurrent MI1 550,000 have a first MI - 200,000 have a recurrent MI Product justification Onset of action of all oral P2Y12 inhibitors may be delayed by up to 6 hours or more in the setting of acute myocardial infarction (AMI) Currently, the only non-oral P2Y12 inhibitor available is Cangrelor, which is administered IV in patients undergoing PCI Need for a P2Y12 inhibitor that achieves consistently fast and effective platelet inhibition in AMI Selatogrel data – Phase II Single-dose administration of SQ selatogrel (8 mg and 16 mg) induced a rapid IPA response in patients with AMI at 30 min (as early as 15 min and maintained at 60 min post-dose) and was well-tolerated with no major bleeding events (N=47) Selatogrel has a rapid effect following SQ injection in patients with stable CAD, within 15 min in most patients and sustained for over 4 hours and was well tolerated. (N=345) Millions of Americans Have a History of MI 1. Mozaffarian D et al. Circulation 2016

Global Development Agreement With Idorsia For Selatogrel Idorsia will pay for the development of the combination product and take responsibility for obtaining global regulatory approvals Antares and Idorsia intend to enter into a separate license and commercial supply agreement under which Antares will supply fully assembled and labeled product to Idorsia at cost plus margin Idorsia will be responsible for global commercialization of the product pending FDA or foreign approval Antares will receive royalties on net sales of the commercial product

Teva continues to work with the FDA on their generic Forteo application* Teva has successfully completed a decentralized registration process in 17 countries in Europe and Canada and is waiting to launch globally According to Lilly’s 2019 reported results, Forteo® full year global revenues were $1.4 billion - $646 million U.S. and $759 million ROW ATRS will supply devices at reasonable margin plus receive single digit to mid-teens royalty on Teva end sales of generic Forteo * Discussed on Teva’s fourth quarter 2019 Earnings Call Generic Forteo® (teriparatide)

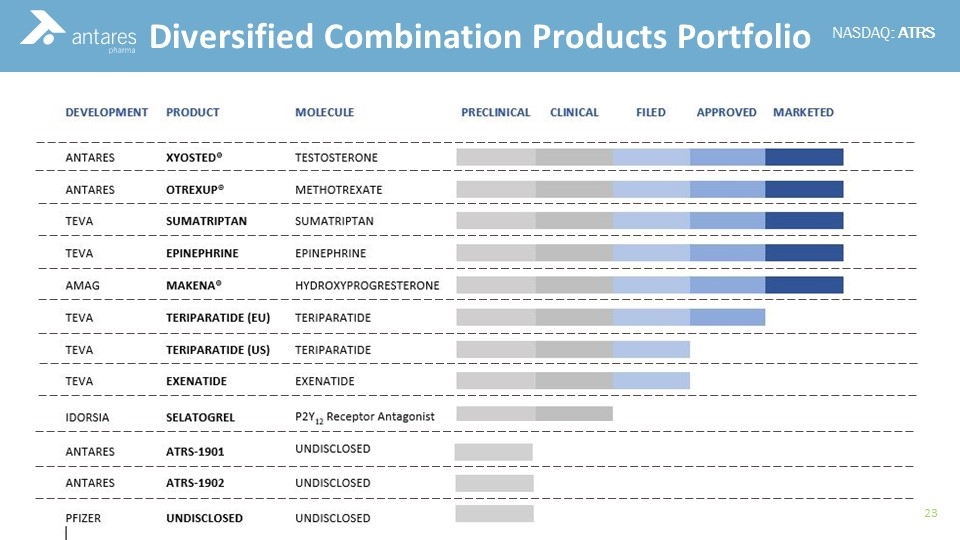

Diversified Combination Products Portfolio

Antares Pharma Q4 2019 Financial Results March 2020

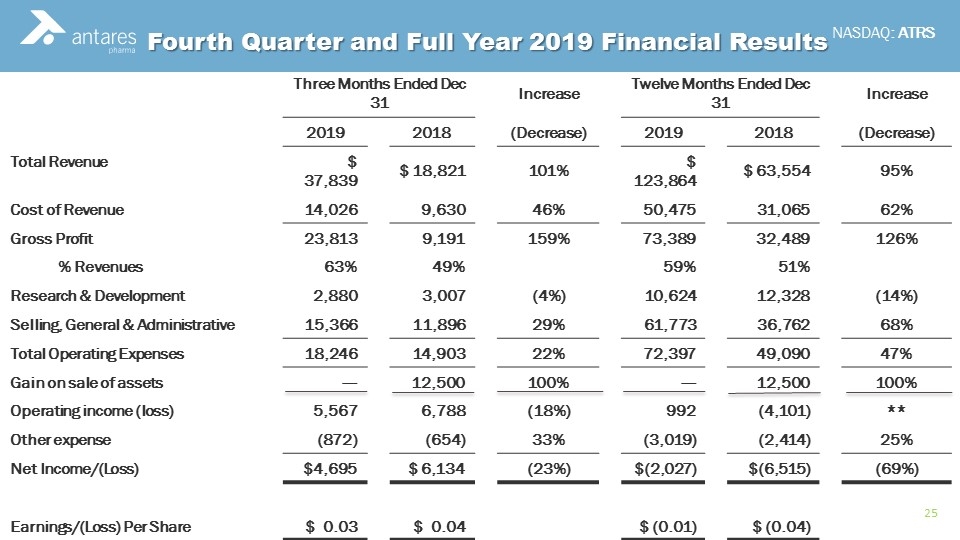

Fourth Quarter and Full Year 2019 Financial Results Three Months Ended Dec 31 Increase Twelve Months Ended Dec 31 Increase 2019 2018 (Decrease) 2019 2018 (Decrease) Total Revenue $ 37,839 $ 18,821 101% $ 123,864 $ 63,554 95% Cost of Revenue 14,026 9,630 46% 50,475 31,065 62% Gross Profit 23,813 9,191 159% 73,389 32,489 126% % Revenues 63% 49% 59% 51% Research & Development 2,880 3,007 (4%) 10,624 12,328 (14%) Selling, General & Administrative 15,366 11,896 29% 61,773 36,762 68% Total Operating Expenses 18,246 14,903 22% 72,397 49,090 47% Gain on sale of assets --- 12,500 100% --- 12,500 100% Operating income (loss) 5,567 6,788 (18%) 992 (4,101) ** Other expense (872) (654) 33% (3,019) (2,414) 25% Net Income/(Loss) $4,695 $ 6,134 (23%) $(2,027) $(6,515) (69%) Earnings/(Loss) Per Share $ 0.03 $ 0.04 $ (0.01) $ (0.04)

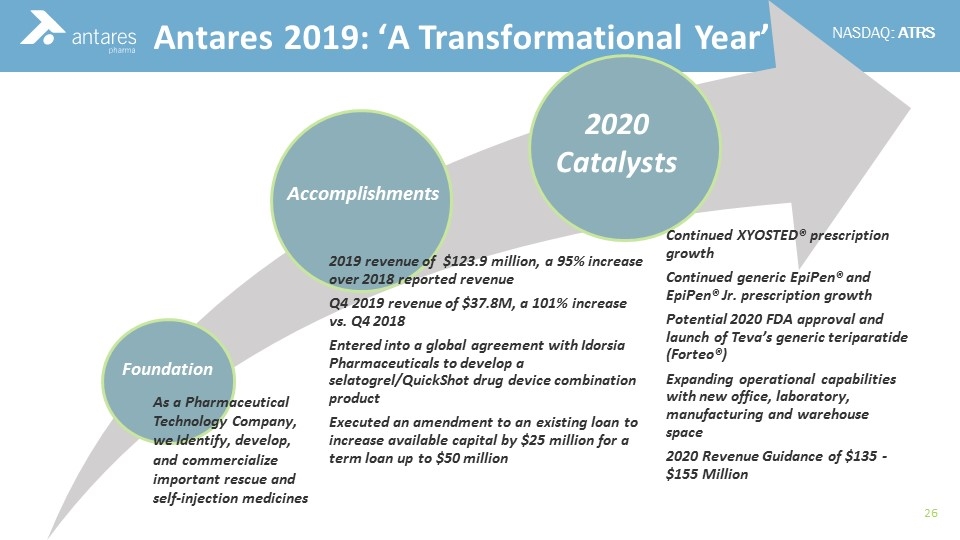

2020 Catalysts Accomplishments Foundation As a Pharmaceutical Technology Company, we Identify, develop, and commercialize important rescue and self-injection medicines Antares 2019: ‘A Transformational Year’ 2019 revenue of $123.9 million, a 95% increase over 2018 reported revenue Q4 2019 revenue of $37.8M, a 101% increase vs. Q4 2018 Entered into a global agreement with Idorsia Pharmaceuticals to develop a selatogrel / QuickShot drug device combination product Executed an amendment to an existing loan to increase available capital by $25 million for a term loan up to $50 million Continued XYOSTED® prescription growth Continued generic EpiPen® and EpiPen® Jr. prescription growth Potential 2020 FDA approval and launch of Teva’s generic teriparatide ( Forteo ®) Expanding operational capabilities with new office, laboratory, manufacturing and warehouse space 2020 Revenue Guidance of $135 - $155 Million

Thank you Questions