Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - AMAG PHARMACEUTICALS, INC. | tm2011642d1_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - AMAG PHARMACEUTICALS, INC. | tm2011642d1_ex99-1.htm |

| 8-K - FORM 8-K - AMAG PHARMACEUTICALS, INC. | tm2011642-1_8k.htm |

Exhibit 99.2

1 © 2020 AMAG Pharmaceuticals, Inc. All rights reserved AMAG Pharmaceuticals Fourth Quarter / Full Year 2019 Financial Results March 4, 2020

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1 995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts, including, among others, expectations related to the time to complete a CEO search the ability to effect a suc cessful transition; AMAG’s expectations regarding its ability to successfully divest Intrarosa and Vyleesi and the effect and amount of associated expense reductions; plans to reduce operating expenses; beliefs that a streamlined po rtf olio and infrastructure will position AMAG for near - and long - term profitability; AMAG’s expectations regarding its ability to drive continued Feraheme growth and that Feraheme will provide positive cash flow to fund its development programs; AMAG’s expectations regarding its ability to ensure continu ed patient access to Makena and the associated effect on cash flow; AMAG’s expectations for its product and product candidate portfolio, including belief s a bout the assumptions regarding market share and commercial potential of AMAG’s key commercial and product candidates; plans to continue to invest in late - stage development programs and the results thereof; beliefs about the be haviors of patients and prescribers of Makena and the associated risks; beliefs about the NOAC market and that ciraparantag’s characteristics may offer a more optimal reversal agent; beliefs that AMAG will be able to work collaboratively with the FDA on a path forward that would allow for continued patient access to Makena; AMAG’s expectations regarding the potential for ex - U.S. out - licensing and partnership opportunities; 2020 financial guid ance, including forecasted GAAP revenue and operating loss and non - GAAP adjusted EBITDA; and AMAG’s 2020 goals and key areas of focus, including expectations and beliefs regarding ( i ) AMAG’s ability to successfully achieve benefits from its leadership transition plan, including managing the search for and tra nsition to a new chief executive officer, (ii) AMAG’s ability to successfully divest Intrarosa and Vyleesi and the effect and amount of associated expense reductions; (iii) AMAG’s ability to drive continued Feraheme growth sufficient to support AMAG’s development programs, (iv) AMAG’s ability to ensure continued patient access to Makena and that Makena is cash flow po sit ive in 2020, (v) AMAG’s pipeline, including AMAG - 423 and ciraparantag, (vi) AMAG’s ability to successfully out - license its products or product candidates in ex - U.S. territories and (vii) AMAG’s ability to meet or exceed it s 2020 financial guidance are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among others: the risk that AMAG will be unable to divest Intrarosa and Vyleesi in the expected timeframe, or at all, or that any transaction will be on terms that are favorable to AMAG or that yield any value for its shareholders; the risk that the anticipated benefits of such a divestiture, including anticipated exp ens e reductions, will not be realized at expected levels or at all or that cash expenditures will be greater than anticipated; the risk that the FDA will recommend that Makena be removed from the market, in line with the recommendation of the Advisory Committee; the risk that the FDA could take other adverse action related to Makena given the findings and recommendation of the Advisory Committee; the risk that, even if the FDA does not recommend that Maken a b e removed from the market, sales of Makena will continue to be negatively impacted, including as a result of the recommendation of the Advisory Committee; the risk that AMAG may not be able to generate additional effica cy data that will be satisfactory to the FDA (if the FDA permits AMAG to submit additional data to support or as a condition to the continued commercialization of Makena); the risk that healthcare providers may be reluctant to continue to prescribe the Makena auto - injector or the FDA may require that the Makena label may include restrictions to the current indication or the insertion of new warnings or precautions; the risk that AMAG will face dif ficulties or delays in appointing a chief executive officer to succeed Mr. Heiden or otherwise be unable to successfully transition to a new CEO or be unable to successfully achieve the anticipated benefits from its leadership transi tio n plan; the possibility that AMAG will encounter challenges retaining or attracting talent; the risk that AMAG may be unable to gain approval of its product candidates, including AMAG - 423 and ciraparantag, on a timely basis, or at all ; the risk that such approvals, if obtained, will include unanticipated restrictions or warnings; the risk that the costs and time investments for AMAG’s development efforts will be higher than anticipated; the possibility that AMAG ha s over - estimated the market and potential revenues for its products and product candidates, if approved, including AMAG - 423 and ciraparantag; the risk that AMAG is unable to generate sufficient cash to satisfy its debt obli gations and could face challenges undertaking fundraising, restructuring or strategic transactions in order to meet these obligations, including under convertible notes due June 1, 2022; the risk that AMAG will be significantly de pendent on sales of Feraheme to support its ongoing operations, including its development pipeline, and Feraheme could face increased competition in the near term, including as a result of the recent approval of Monoferric ® or if Sandoz’s ANDA is approved; the risk that AMAG will be unable to successfully identify and enter into partnerships with out - licensees for its product candidates in ex - U.S. territories, which could delay the commercialization of th ose product candidates in certain geographies; the risk that AMAG will not be able to continue to execute on its business plan; the speculative nature of AMAG’s estimates as to market share for its products and potential market sha re for its product candidates and the risk that such estimates are inaccurate and those risks identified in AMAG’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K for the ye ar ended December 31, 2018, its Quarterly Reports on Form 10 - Q for the quarters ended March 31, 2019, June 30, 2019 and September 30, 2019, and subsequent filings with the SEC, which are available at the SEC’s website at www .sec.gov. Any such risks and uncertainties could materially and adversely affect AMAG’s results of operations, its profitability and its cash flows, which would, in turn, have a significant and adverse impact on AMAG’s stock pr ice. AMAG cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in ev ent s, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. AMAG Pharmaceuticals ® , the logo and designs, Feraheme ® and Vyleesi ® are registered trademarks of AMAG Pharmaceuticals, Inc. Makena ® is a registered trademark of AMAG Pharma USA, Inc. Intrarosa ® is a registered trademark of Endoceutics , Inc. Other trademarks referred to in this report are the property of their respective owners. Forward - Looking Statements 2

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Agenda 2019 in review 2019 financial overview Core Value Drivers: 2020 and beyond 2020 financial guidance 2020 goals Q&A 4 6 2 3 1 5 3

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Option 4 2019 In Review 1) Feraheme market share is based on IQVIA data and internal analytics. Completed acquisition of Perosphere Pharmaceuticals and added ciraparantag to development portfolio Steadily grew Intrarosa revenue and market share 2019 YEAR IN REVIEW Advanced enrollment in Phase 2b/3a trial for orphan drug candidate AMAG - 423 for severe preeclampsia Gained FDA approval of Vyleesi and commercially launched in September Grew Feraheme revenue 24% over 2018 to record revenue of $168M and achieved Q4 market share of 17.7% 1 Mixed year for Makena • IM supply disruptions resulted in removal of both brand and authorized generic • PROLONG study results and AdCom meeting challenges brand durability • Maintained strong Q4 market share of 63% for subcutaneous auto - injector, but experienced market contraction and price erosion post AdCom meeting 4

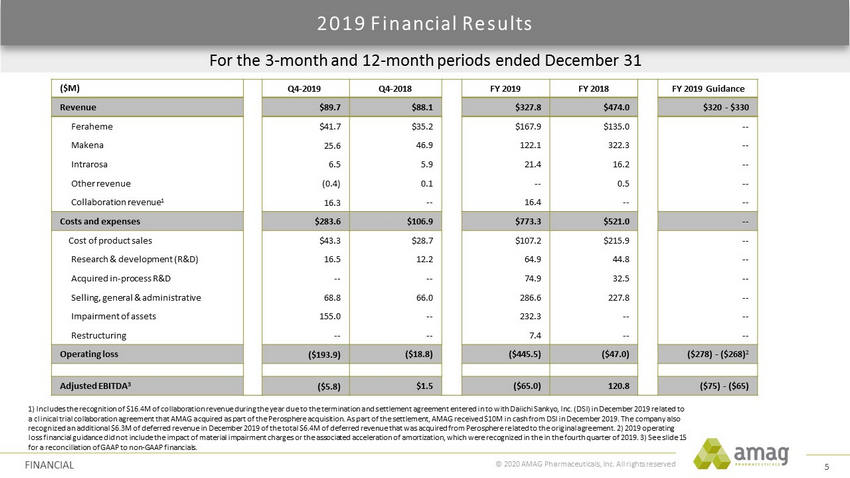

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved For the 3 - month and 12 - month periods ended December 31 2019 Financial Results FINANCIAL 1) Includes the recognition of $16.4M of collaboration revenue during the year due to the termination and settlement agreement e ntered in to with Daiichi Sankyo, Inc. (DSI) in December 2019 related to a clinical trial collaboration agreement that AMAG acquired as part of the Perosphere acquisition. As part of the settlement, AMAG received $10M in cash from DSI in December 2019. The company also recognized an additional $6.3M of deferred revenue in December 2019 of the total $6.4M of deferred revenue that was acquired fro m Perosphere related to the original agreement. 2) 2019 operating loss financial guidance did not include the impact of material impairment charges or the associated acceleration of amortization , which were recognized in the in the fourth quarter of 2019. 3) See slide 15 for a reconciliation of GAAP to non - GAAP financials. ($M) Q4 - 2019 Q4 - 2018 FY 2019 FY 2018 FY 2019 Guidance Revenue $89.7 $88.1 $327.8 $474.0 $320 - $330 Feraheme $41.7 $35.2 $167.9 $ 135.0 -- Makena 25.6 46.9 122.1 322.3 -- Intrarosa 6.5 5.9 21.4 16.2 -- Other revenue (0.4) 0.1 -- 0.5 -- Collaboration revenue 1 16.3 -- 16.4 -- -- Costs and expenses $283.6 $106.9 $773.3 $521.0 -- Cost of product sales $43.3 $28.7 $107.2 $ 215.9 -- Research & development (R&D) 16.5 12.2 64.9 44.8 -- Acquired in - process R&D -- -- 74.9 32.5 -- Selling, general & administrative 68.8 66.0 286.6 227.8 -- Impairment of assets 155.0 -- 232.3 -- -- Restructuring -- -- 7.4 -- -- Operating loss ($193.9) ($18.8) ($445.5) ($47.0) ($278) - ($268) 2 Adjusted EBITDA 3 ($5.8) $1.5 ($65.0) 120.8 ($75) - ($65) 5

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Hematology COMMERCIAL Maternal Health PIPELINE PHYSICIAN DRIVEN Ciraparantag AMAG - 423 Streamlined Portfolio and Infrastructure Positions AMAG for Near - and Long - term Profitability Focus on Core Value Drivers Feraheme • Provides continued growth and positive cash flow ‒ Sufficient to fund pipeline assets • Exploring new opportunities for future growth Makena • Risk profile heightened with PROLONG study results and FDA AdCom meeting ‒ Soft Q4 - 2019 results inform view of 2020 ‒ Proactively managing product to be cash - flow positive Development Assets • Continue to invest in pipeline programs that have opportunities to address significant unmet medical needs ‒ Development assets provide opportunity for next chapter of long - term revenue growth PORTFOLIO SNAPSHOT 2020 Divest Women’s Health PHYSICIAN/CONSUMER(DTC) DRIVEN 6

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Continued strong performance FERAHEME 1) AMAG estimates Feraheme’s average market share and IV iron market growth using IQVIA data and internal analytics. • Build on strong performance of past years, including record annual 2019 revenues • Strong IV iron market growth of approximately ~12% over 2018 1 • Feraheme to fund development of pipeline assets • Potential competitive dynamics • Exploring new opportunities for future growth Consistent Volume Growth Ex - factory Grams 0 100,000 200,000 300,000 2017 2018 2019 $0 $100 $200 2017 2018 2019 Consistent Revenue Growth Revenue ($M) 0% 5% 10% 15% 20% 2017 2018 2019 Growing Market Share Avg. Market Share 1 Core Value Drivers: 2020 and Beyond - Feraheme 7

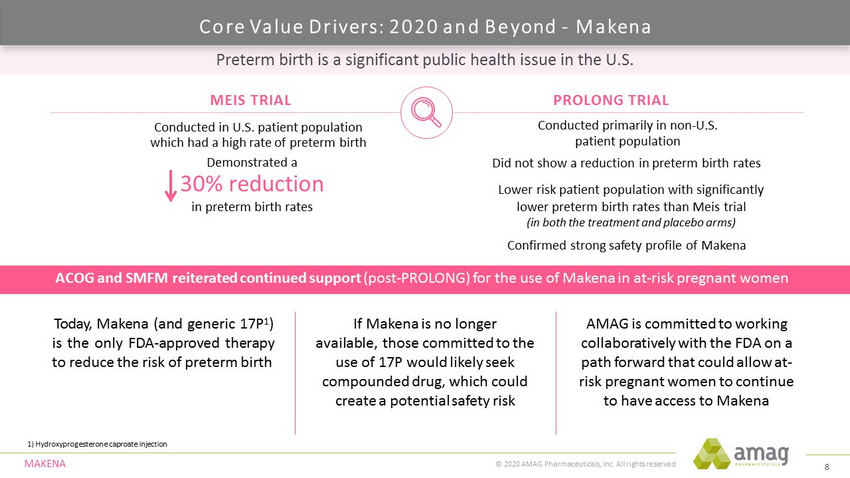

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Preterm birth is a significant public health issue in the U.S. 1) Hydroxyprogesterone caproate injection ACOG and SMFM reiterated continued support (post - PROLONG) for the use of Makena in at - risk pregnant women Today, Makena (and generic 17 P 1 ) is the only FDA - approved therapy to reduce the risk of preterm birth If Makena is no longer available, those committed to the use of 17P would likely seek compounded drug, which could create a potential safety risk AMAG is committed to working collaboratively with the FDA on a path forward that could allow at - risk pregnant women to continue to have access to Makena MEIS TRIAL PROLONG TRIAL Conducted in U.S. patient population which had a high rate of preterm birth Demonstrated a 30% reduction in preterm birth rates Conducted primarily in non - U.S. patient population Did not show a reduction in preterm birth rates MA KENA Lower risk patient population with significantly lower preterm birth rates than Meis trial (in both the treatment and placebo arms) Confirmed strong safety profile of Makena Core Value Drivers: 2020 and Beyond - Makena 8

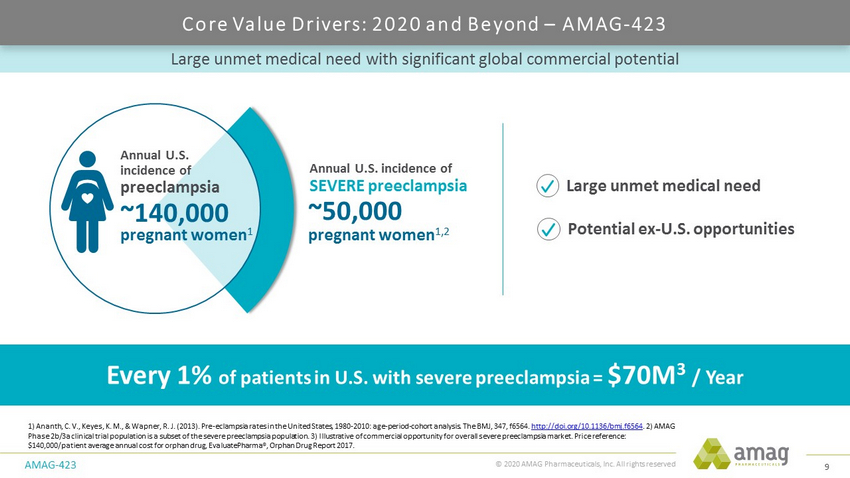

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Large unmet medical need with significant global commercial potential AMAG - 423 1) Ananth, C. V., Keyes, K. M., & Wapner , R. J. (2013). Pre - eclampsia rates in the United States, 1980 - 2010: age - period - cohort analysis. The BMJ, 347, f6564. http://doi.org/10.1136/bmj.f6564 . 2) AMAG Phase 2b/3a clinical trial population is a subset of the severe preeclampsia population. 3) Illustrative of commercial opportuni ty for overall severe preeclampsia market. Price reference : $140,000/patient average annual cost for orphan drug, EvaluatePharma ®, Orphan Drug Report 2017. Every 1% of patients in U.S. with severe preeclampsia = $70M 3 / Year ~50,000 pregnant women 1,2 Annual U.S. incidence of SEVERE preeclampsia ~140,000 pregnant women 1 preeclampsia Annual U.S. incidence of Potential ex - U.S. opportunities Large unmet medical need Core Value Drivers: 2020 and Beyond – AMAG - 423 9

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Large unmet medical need with s ignificant global commercial potential Core Value Drivers: 2020 and Beyond - Ciraparantag CIRAPARANTAG 1) Perosphere sponsored commercial assessment report conducted by a third party in May 2016. 2) AMAG estimate based on the following: ( i ) Zhu J., Alexander GC, et al. Pharmacotherapy 2018 September; 38(9): 907 - 920. (ii) Sindet - Pedersen C, et al. European Heart Journal - Cardiovascular Pharmacotherapy (2018) 4, 220 – 227. (iii) Garcia D, Alexander JH, et al. Blood 2014 124: 3692 - 3698. (iv) www.aha - org/statistics/fast - facts - us - hospitals . (v) Balakrishna, P, et al. Blood 2017 130:5585. (vi) www.cdc.gov/dhdsp/data_statistics/fact_sheets/fs_atrial_fibrillation.hem . 3) Illustrative of commercial opportunity for overall NOAC/LMWH market. Price reference: The c urrently approved reversal agent (coagulation factor Xa recombinant, inactivated - zhzo ) price of ~$24,000. Large unmet medical need • Opportunity to provide an improved reversal agent to NOACs Numerous characteristics suggest ciraparantag may offer a more optimal reversal agent • Ready to use • Potential for a fixed dose for all Xa inhibitors • Demonstrates sustained effect over 24 hours after one IV dose ‒ Opportunity to include patients requiring emergent surgery • No prothrombotic signal to date Potential ex - U.S. partnership opportunities Every 1% of patients in U.S. requiring reversal treatment = $36M 3 / Year ~150,000 2 ~6 Million Patients on NOAC / LMWH therapy 1 U.S. market opportunity NOAC / LMWH patients per year requiring a reversal agent 10

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved 2020 Financial Guidance Reflects a Return to Positive Adjusted EBITDA FINANCIAL 1) 2020 financial guidance reflects management’s current assumptions about the range of potential impact of multiple scenario s a cross our product portfolio, including ( i ) various potential regulatory outcomes related to Makena and (ii) that the divestitures of Intrarosa and Vyleesi will be reported in discontinued operations for accounting purposes in 2020. Therefore, 2020 financial guidance excludes revenue and expenses related to Intrarosa and Vyleesi . 2) Operating income does not include the GAAP impact of the planned divestitures of Intrarosa and Vyleesi . 3) See slide 16 for a reconciliation of GAAP to non - GAAP financial guidance. 2020 FINANCIAL GUIDANCE 1 ($M) Total revenue $230 - $280 Operating income 2 $2 - $32 Adjusted EBITDA 3 $20 - $50 Continued growth of Feraheme to fund the development of pipeline assets Risk - adjusted topline view of Makena given the uncertainty caused by: • FDA Advisory Committee outcome • Soft Q4 - 2019 enrollments and revenue Significant reduction in operating expenses (>$100M) vs. 2019 • Driven by divestiture of Intrarosa and Vyleesi 11

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved 2020: Goals and Key Areas of Focus for AMAG Drive continued Feraheme growth Divest Intrarosa and Vyleesi to align with new strategic direction Work with the FDA to maintain patient access to Makena Advance ciraparantag and AMAG - 423 development programs Meet/exceed financial guidance Pursue ex - U.S. portfolio partnering opportunities Complete successful CEO transition 12

© 2019 AMAG Pharmaceuticals, Inc. All rights reserved © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 13 AMAG Pharmaceuticals Q&A

Appendix 14

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Reconciliation of GAAP to Non - GAAP Preliminary Financial Results APPENDIX ($M) Q4 - 2019 Q4 - 2018 FY 2019 FY 2018 GAAP operating loss ($193.9) ($18.8) ($445.5) ($47.0) Depreciation and intangible asset amortization 13.5 14.0 27.3 160.0 Non - cash inventory step - up adjustments -- 0.1 -- 3.7 Stock - based compensation 4.8 5.3 18.5 19.9 Adjustments to contingent consideration -- (0.4) -- (49.6) Restructuring -- -- 7.4 -- Transaction/acquisition - related costs -- 1.3 0.3 1.3 Acquired IPR&D -- -- 74.9 32.5 Asset impairment charges 169.8 -- 252.1 -- Non - GAAP adjusted EBITDA ($5.8) $1.5 ($65.0) $120.8 15

© 2020 AMAG Pharmaceuticals, Inc. All rights reserved Reconciliation of GAAP to Non - GAAP 2020 Financial Guidance APPENDIX ($M) 2020 Financial Guidance GAAP operating income $2 - $32 Depreciation 2 Stock - based compensation 16 Non - GAAP a djusted EBITDA $20 - $50 16

© 2019 AMAG Pharmaceuticals, Inc. All rights reserved © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 17 AMAG Pharmaceuticals Fourth Quarter / Full Year 2019 Financial Results March 4, 2020