Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SCOTTS MIRACLE-GRO CO | smg2020-03x028xkinvest.htm |

Raymond James 41st Annual Institutional Investors Conference MARCH 2020 1

Safe Harbor Disclosure Statement under the Private Securities Litigation Act of 1995: Certain of the statements contained in this presentation, including, but not limited to, information regarding the future economic performance and financial condition of the Company, the plans and objectives of the Company’s management, and the Company’s assumptions regarding such performance and plans are forward- looking in nature. Actual results could differ materially from the forward-looking information in this presentation due to a variety of factors. Scotts Miracle-Gro encourages investors to learn more about these risk factors. A detailed explanation of these factors is available in the Company’s quarterly and annual reports filed with the Securities and Exchange Commission. 2

Today’s discussion • Philosophy and track record for driving long-term shareholder value • Overview of our industry-leading U.S. Consumer business • Hawthorne: Building competitive advantages in a fast-growing category 3

Our approach to running the business has led to consistent growth and significant value creation for shareholders 2-4% Sales Stable core and higher growth hydroponics 4-6% Operating Income Hawthorne margin benefits, SG&A control 8-10% EPS Share buybacks enhance EPS growth 10-12% Shareholder Return EPS + dividend drives returns in rational market 4

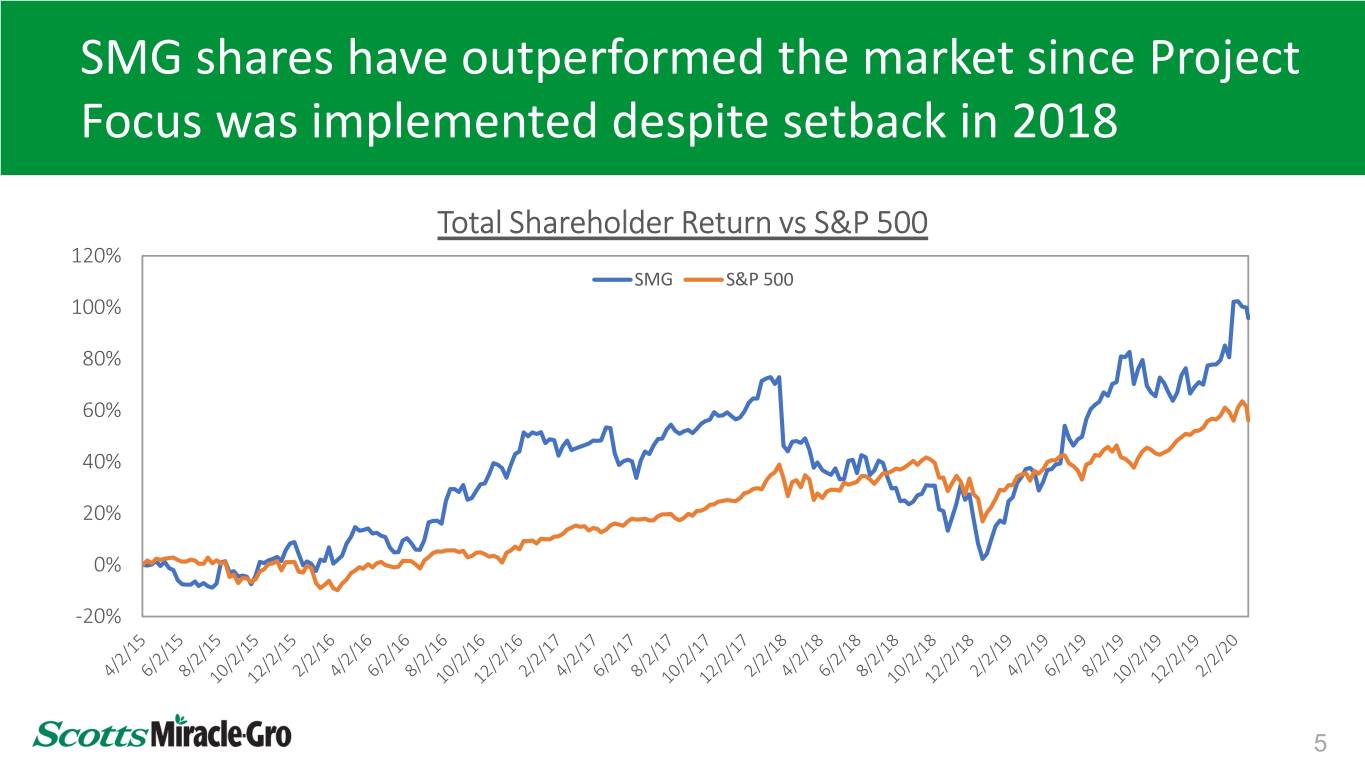

SMG shares have outperformed the market since Project Focus was implemented despite setback in 2018 Total Shareholder Return vs S&P 500 120% SMG S&P 500 100% 80% 60% 40% 20% 0% -20% 5

U.S. Consumer segment remains the earnings and cash flow engine of SMG, Hawthorne is driving growth FY 2019 Revenue % by Segment FY 2019 Net Profit % by Segment Other 6.5% Hawthorne Other 1.7% 9.0% Hawthorne 21.3% U.S. U.S. Consumer Consumer 72.3% 89.2% 6

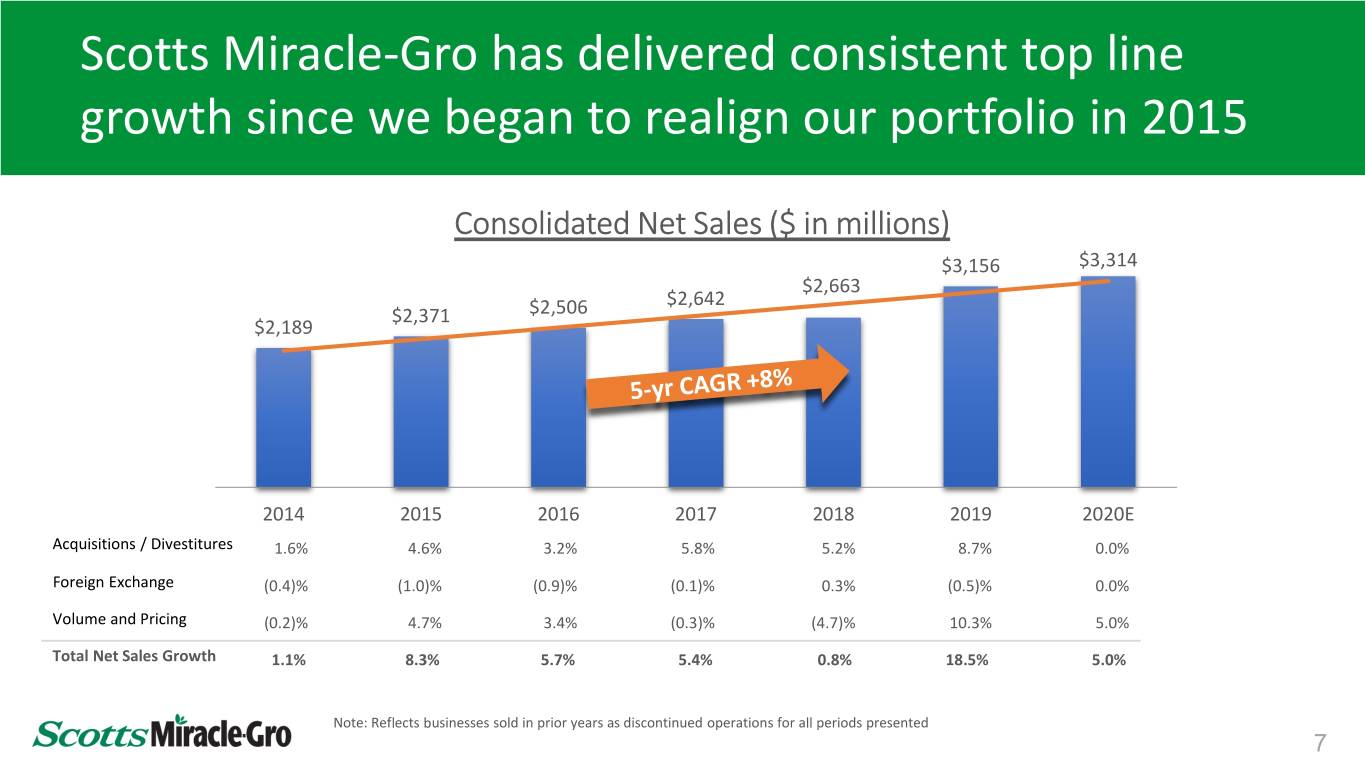

Scotts Miracle-Gro has delivered consistent top line growth since we began to realign our portfolio in 2015 Consolidated Net Sales ($ in millions) $3,156 $3,314 $2,663 $2,642 $2,371 $2,506 $2,189 2014 2015 2016 2017 2018 2019 2020E Acquisitions / Divestitures 1.6% 4.6% 3.2% 5.8% 5.2% 8.7% 0.0% Foreign Exchange (0.4)% (1.0)% (0.9)% (0.1)% 0.3% (0.5)% 0.0% Volume and Pricing (0.2)% 4.7% 3.4% (0.3)% (4.7)% 10.3% 5.0% Total Net Sales Growth 1.1% 8.3% 5.7% 5.4% 0.8% 18.5% 5.0% Note: Reflects businesses sold in prior years as discontinued operations for all periods presented 7

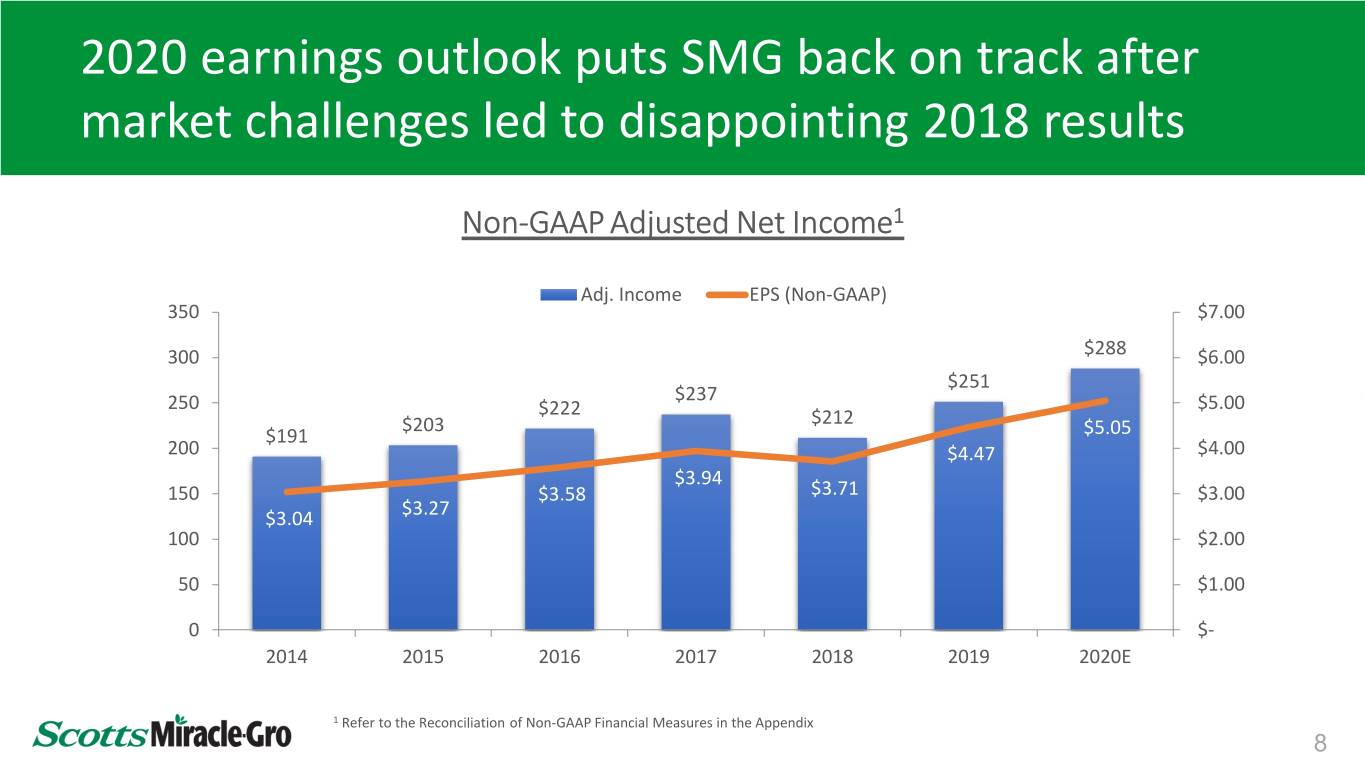

2020 earnings outlook puts SMG back on track after market challenges led to disappointing 2018 results Non-GAAP Adjusted Net Income1 Adj. Income EPS (Non-GAAP) 350 $7.00 300 $288 $6.00 $251 $237 250 $222 $5.00 $203 $212 $191 $5.05 200 $4.47 $4.00 $3.94 150 $3.58 $3.71 $3.00 $3.04 $3.27 100 $2.00 50 $1.00 0 $- 2014 2015 2016 2017 2018 2019 2020E 1 Refer to the Reconciliation of Non-GAAP Financial Measures in the Appendix 8

Pay-for-performance has led to consistent cash flow performance with opportunities for further improvement Historical Cash Flow1 400 Project Focus 350 300 250 200 150 100 50 - Free Cash Flow Legal Adj. TruGreen Tax Adj. Operating Cash Flow Capital Expenditures SMG defines free cash flow as operating cash flow minus capital expenditures * Legal settlements accrued in fiscal 2018 1 Refer to the Reconciliation of Non-GAAP Financial Measures in the Appendix 9

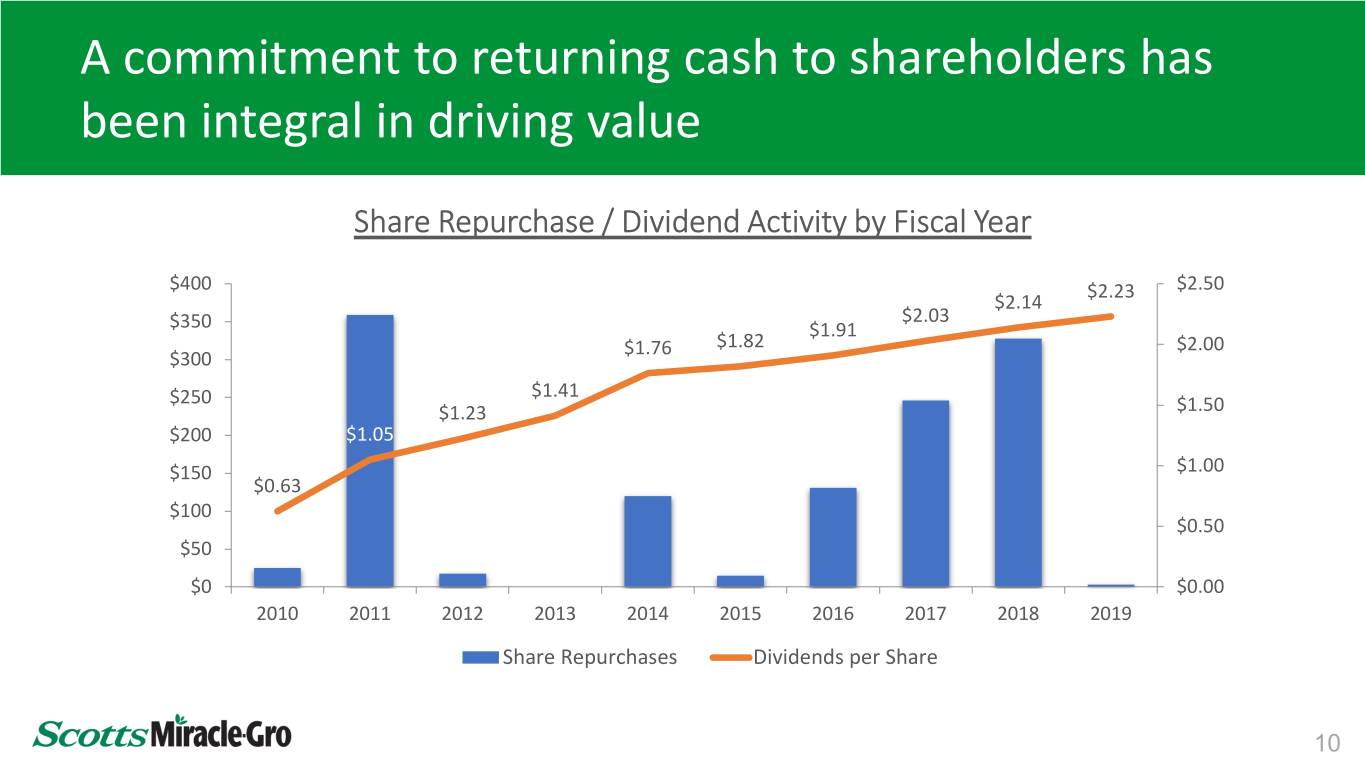

A commitment to returning cash to shareholders has been integral in driving value Share Repurchase / Dividend Activity by Fiscal Year $400 $2.23 $2.50 $2.14 $2.03 $350 $1.91 $1.76 $1.82 $2.00 $300 $250 $1.41 $1.23 $1.50 $200 $1.05 $150 $1.00 $0.63 $100 $0.50 $50 $0 $0.00 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Share Repurchases Dividends per Share 10

Today’s discussion • Philosophy and track record for driving long-term shareholder value • Overview of our industry-leading consumer goods business • Hawthorne: Building competitive advantages in a fast-growing category 11

U.S. Consumer A series of unique competitive advantages has made ScottsMiracle-Gro the clear leader in lawn & garden Industry-Leading Brands Products that Deliver Consumer-based innovation model delivers innovation Brands foster unrivaled consumer relationships to drive profitable growth In-Store Execution Global Supply Chain In-store sales associates enhance the shopping Supply Chain network provides best-in-class service while experience and drive consumer sales consistently delivering cost savings 12

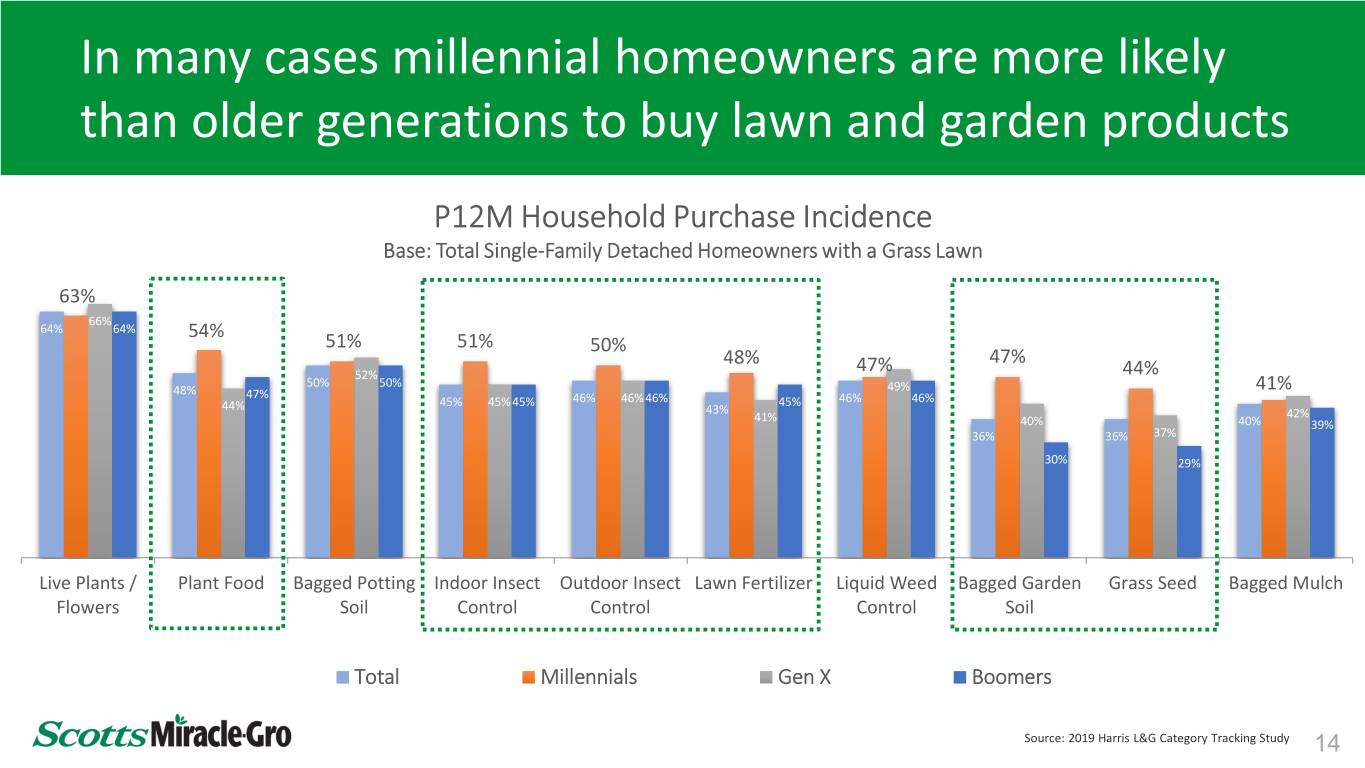

U.S. Consumer Retail trends and favorable demographics should continue to benefit SMG into the future Key trends • Brick-and-mortar retailers, especially home centers, continue to view lawn and garden as a destination category • Online retail is the fastest growing channel, but remains less than 5% of total sales • Millennials have a passion for gardening and are just as likely as Baby Boomers to support SMG core brands 13

In many cases millennial homeowners are more likely than older generations to buy lawn and garden products P12M Household Purchase Incidence Base: Total Single-Family Detached Homeowners with a Grass Lawn 63% 66% 64% 64% 54% 51% 51% 50% 48% 47% 52% 47% 44% 50% 50% 49% 48% 47% 41% 45% 45% 45% 46% 46% 46% 45% 46% 46% 44% 43% 41% 42% 40% 40% 39% 36% 36% 37% 30% 29% Live Plants / Plant Food Bagged Potting Indoor Insect Outdoor Insect Lawn Fertilizer Liquid Weed Bagged Garden Grass Seed Bagged Mulch Flowers Soil Control Control Control Soil Total Millennials Gen X Boomers 14 Source: 2019 Harris L&G Category Tracking Study 14

U.S. Consumer Innovation in R&D and Marketing will be key in driving future growth especially with millenials Disruptive products and brands Successful transition to digital marketing 15

U.S. Consumer Roundup remains important to SMG performance, consumer engagement remains solid Key points • Roundup POS up more than 10 percent entering March • Ortho GroundClear continues to gain momentum, backed by high levels of advertising and retail support • While SMG serves as marketing agent for Roundup, it is not involved in litigation, settlement or other legal issues with Bayer 16

U.S. Consumer We expect retailers and consumers to remain highly engaged in 2020, driving 1 to 3% full-year growth High engagement • Through first five fiscal months, consumer purchases up 8 percent entering critical weeks of season • All key categories higher • May-June comps are difficult and growth will likely moderate These five retail partners constitute roughly 85% of U.S. Consumer sales 17

Today’s discussion • Philosophy for and track record driving long-term shareholder value • Overview of our industry-leading consumer goods business • Hawthorne: Building competitive advantages in a fast-growing category 18

Hawthorne Gardening Company Hawthorne has assembled a portfolio of industry-leading products to service an expanding market • Our signature brands have led the market since 1976 • Opening world's 1st and largest cannabis-specific R&D facility (Kelowna, B.C.) • Conducting hemp research at R&D Field Station in Oregon 19

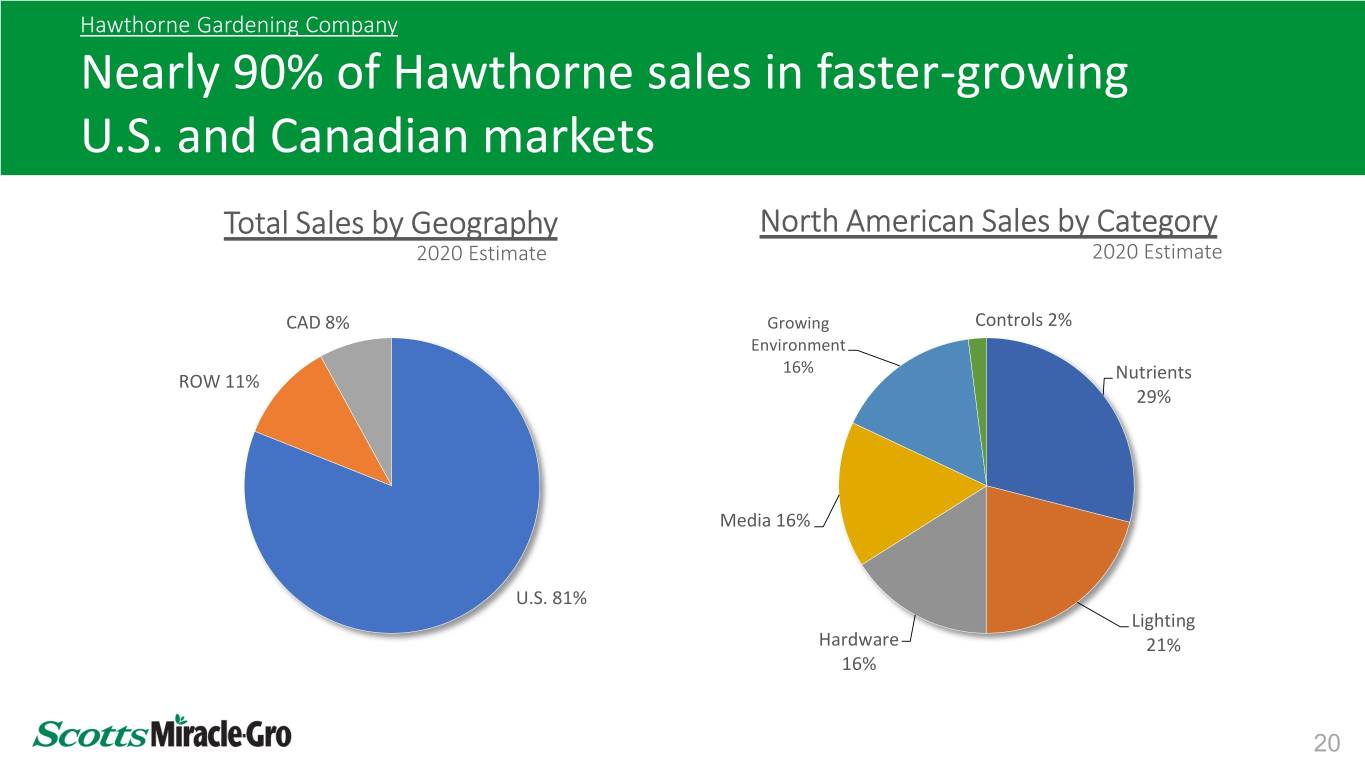

Hawthorne Gardening Company Nearly 90% of Hawthorne sales in faster-growing U.S. and Canadian markets Total Sales by Geography North American Sales by Category 2020 Estimate 2020 Estimate CAD 8% Growing Controls 2% Environment 16% ROW 11% Nutrients 29% Media 16% U.S. 81% Lighting Hardware 21% 16% 20

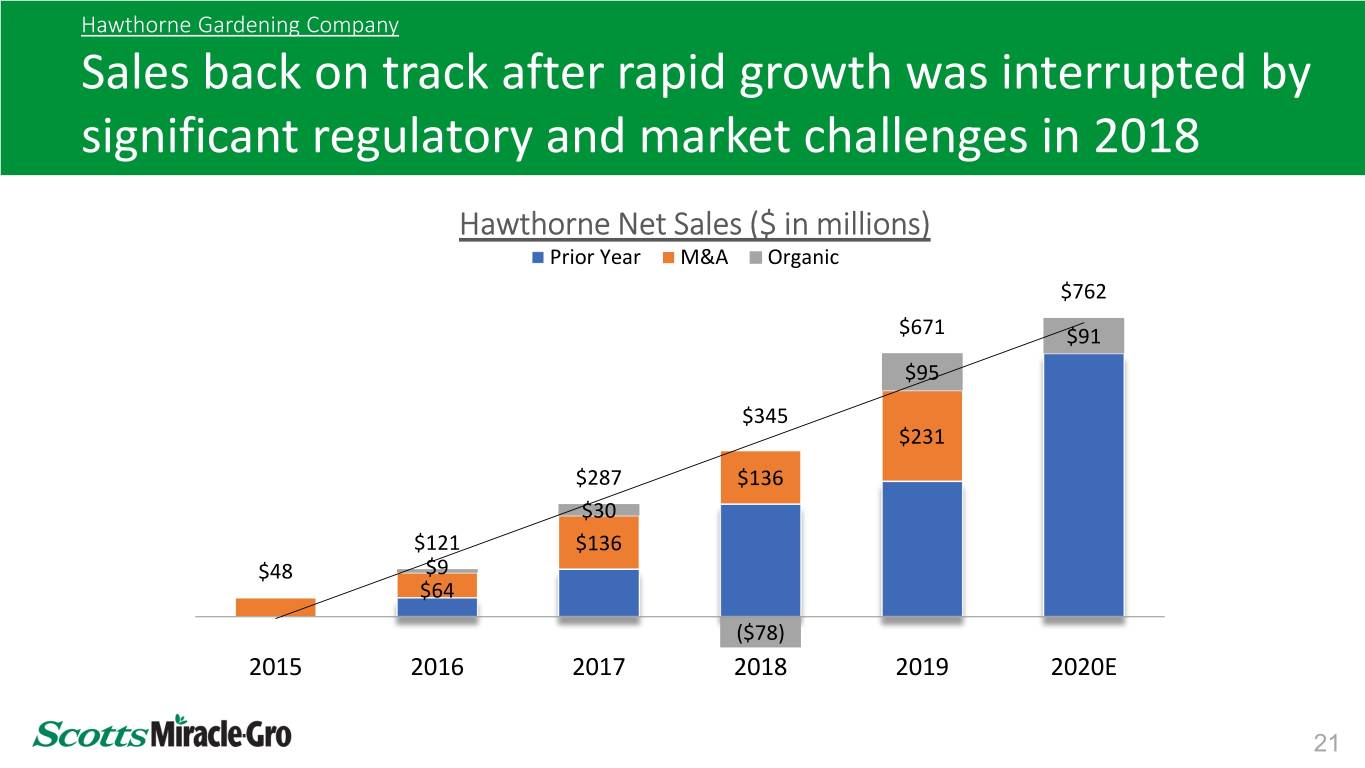

Hawthorne Gardening Company Sales back on track after rapid growth was interrupted by significant regulatory and market challenges in 2018 Hawthorne Net Sales ($ in millions) Prior Year M&A Organic $762 $671 $91 $95 $345 $231 $287 $136 $30 $121 $136 $48 $9 $64 ($78) 2015 2016 2017 2018 2019 2020E 21

Hawthorne Gardening Company Building competitive advantages to serve a quickly evolving market OUR PLANS: Products that serve all market segments • Professional growers are the No. 1 target • At-home growers represent less than 10% of market • Breadth of portfolio appeals to both Unmatched technical expertise • Decades of expertise in supporting specialty crops • Deep understanding of indoor growing environment • Industry’s best technically trained sales team Leadership in a quickly evolving industry • Solution selling that benefits retailers / end users • Supply chain that is evolving with marketplace • Engaged in impactful government dialogue 22

Hawthorne Gardening Company A bullish outlook on long-term Hawthorne prospects Our viewpoint: • Major new markets likely to emerge over next several years • Consumer consumption poised to continue growing high-single digits • Hawthorne outpacing competitors • Market-leading product portfolio and brand recognition • Operating margins will be a significant focus going forward 23

Hawthorne Gardening Company YTD performance trending above guidance and will likely provide upside to our current full-year outlook Current Hawthorne outlook • 12 to 15% sales growth with higher growth in U.S. indoor & hydroponic categories • YTD sales +50% entering March, will moderate due to strong comps through year-end • 10+% operating margin • Improved efficiencies due to SAP implementation • Promotional activity more focused, reduced on a percentage basis 24

ScottsMiracle-Gro: Appealing for both the near- and long-term investors What we expect • Continued strength at Hawthorne in 2020; long-term growth/margin improvement • Steady performance from U.S. Consumer segment • Continued focus on cash flow productivity • Financial flexibility to explore and/or invest in M&A while returning cash to shareholders 25

Appendix 26

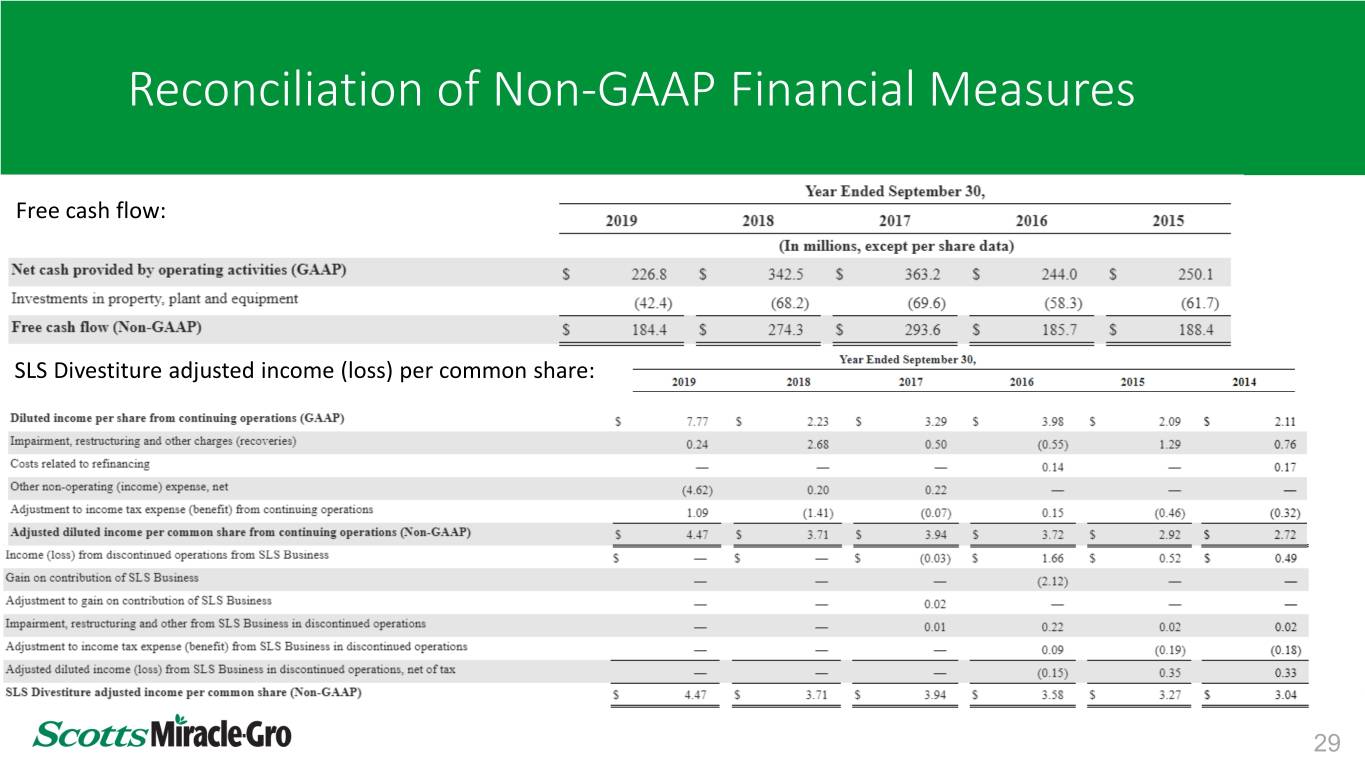

Reconciliation of Non-GAAP Financial Measures Use of Non-GAAP Measures To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), the Company uses non-GAAP financial measures. The reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are shown in the tables below. These non-GAAP financial measures should not be considered in isolation from, or as a substitute for or superior to, financial measures reported in accordance with GAAP. Moreover, these non-GAAP financial measures have limitations in that they do not reflect all the items associated with the operations of the business as determined in accordance with GAAP. Other companies may calculate similarly titled non-GAAP financial measures differently than the Company, limiting the usefulness of those measures for comparative purposes. In addition to GAAP measures, management uses these non-GAAP financial measures to evaluate the Company’s performance, engage in financial and operational planning and determine incentive compensation because it believes that these measures provide additional perspective on and, in some circumstances are more closely correlated to, the performance of the Company’s underlying, ongoing business. Management believes that these non-GAAP financial measures are useful to investors in their assessment of operating performance and the valuation of the Company. In addition, these non-GAAP financial measures address questions routinely received from analysts and investors and, in order to ensure that all investors have access to the same data, management has determined that it is appropriate to make this data available to all investors. Non-GAAP financial measures exclude the impact of certain items and provide supplemental information regarding operating performance. By disclosing these non-GAAP financial measures, management intends to provide investors with a supplemental comparison of operating results and trends for the periods presented. Management believes these measures are also useful to investors as such measures allow investors to evaluate performance using the same metrics that management uses to evaluate past performance and prospects for future performance. Management views free cash flow as an important measure because it is one factor used in determining the amount of cash available for dividends and discretionary investment. 27

Reconciliation of Non-GAAP Financial Measures Definitions of Non-GAAP Financial Measures The reconciliations of non-GAAP disclosure items include the following financial measures that are not calculated in accordance with GAAP and are utilized by management in evaluating the performance of the business, engaging in financial and operational planning, the determination of incentive compensation, and by investors and analysts in evaluating performance of the business: SLS (Scotts Lawn Service) Divestiture adjusted income (loss) per common share: Diluted net income (loss) per common share excluding impairment, restructuring and other charges / recoveries, costs related to refinancing and TruGreen Joint Venture non-GAAP adjustments, each net of tax. This measure also includes income (loss) from discontinued operations related to the SLS Business; however, excludes the gain on the contribution of the SLS Business to the TruGreen Joint Venture, each net of tax. Free cash flow: Net cash provided by (used in) operating activities reduced by investments in property, plant and equipment. SLS Divestiture adjusted income: Net income (loss) from continuing operations excluding impairment, restructuring and other charges / recoveries, costs related to refinancing and TruGreen Joint Venture non-GAAP adjustments, each net of tax. This measure also includes income (loss) from discontinued operations related to the SLS Business; however, excludes the gain on the contribution of the SLS Business to the TruGreen Joint Venture, each net of tax. Forward Looking Non-GAAP Measures In this presentation, the Company presents its outlook for fiscal 2020 non-GAAP adjusted EPS. The Company does not provide a GAAP EPS outlook, which is the most directly comparable GAAP measure to non-GAAP adjusted EPS, because changes in the items that the Company excludes from GAAP EPS to calculate non-GAAP adjusted EPS, described above, can be dependent on future events that are less capable of being controlled or reliably predicted by management and are not part of the Company’s routine operating activities. Additionally, due to their unpredictability, management does not forecast the excluded items for internal use and therefore cannot create or rely on a GAAP EPS outlook without unreasonable efforts. The timing and amount of any of the excluded items could significantly impact the Company’s GAAP EPS. As a result, the Company does not provide a reconciliation of guidance for non-GAAP adjusted EPS to GAAP EPS, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. 28

Reconciliation of Non-GAAP Financial Measures Free cash flow: SLS Divestiture adjusted income (loss) per common share: 29

Reconciliation of Non-GAAP Financial Measures SLS Divestiture adjusted income: 30