Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Roadrunner Transportation Systems, Inc. | primeclosingreleasefinal.htm |

| 8-K - 8-K - Roadrunner Transportation Systems, Inc. | a8kproforma-saleofprime.htm |

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION On January 28, 2020, Roadrunner Transportation Systems, Inc. (the “Company”), entered into a definitive stock purchase agreement to sell all of the outstanding equity of its subsidiary Prime Distribution Services, Inc. (“Prime”) to C.H. Robinson Company, Inc. (“Buyer”) for $225 million, subject to customary purchase price adjustments (the “Disposition”). The Disposition closed on March 2, 2020. The Disposition constitutes a significant disposition for purposes of Item 2.01 of Form 8-K. As a result, the following unaudited pro forma condensed consolidated statements of operations for the nine months ended September 30, 2019 and unaudited pro forma condensed consolidated statements of operations for each of the years ended December 31, 2018, 2017 and 2016 are presented as if the Disposition and related events had occurred on January 1, 2016, the first day of fiscal year 2016. The following unaudited pro forma condensed consolidated balance sheet as of September 30, 2019 is presented as if the Disposition and related events had occurred on September 30, 2019, the Company's latest balance sheet date. Based on the magnitude of Prime’s contribution to total assets, the Disposition represents a strategic shift that has a major effect on the Company’s operations and financial results. Accordingly, the Company will be applying discontinued operations treatment for the Disposition in the Company’s Quarterly Report on Form 10-Q for the quarter ending March 31, 2020. The unaudited consolidated pro forma financial statements have been derived from historical financial statements prepared in accordance with U.S. generally accepted accounting principles (“US GAAP”) and are presented based on information currently available and certain assumptions that the Company's management believes are reasonable. The pro forma adjustments reflect the impact of events directly attributable to the Disposition, that are factually supportable, and for purposes of the unaudited pro forma condensed consolidated statements of operations, expected to have a continuing impact on the Company. They are intended for informational purposes only and are not intended to represent the Company’s financial position or results of operations had the Disposition and related events occurred on the dates indicated, or to project the Company’s financial performance for any future period. Beginning in the first quarter of fiscal 2020, the historical financial results attributable to Prime for periods prior to the Disposition will be reflected in the Company’s consolidated statements of operations as discontinued operations. The unaudited pro forma consolidated financial statements and the accompanying notes should be read in conjunction with the following: (i) the audited consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Form 10-K for the year ended December 31, 2018, and (ii) the unaudited consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Form 10-Q for the third quarter and nine months ended September 30, 2019.

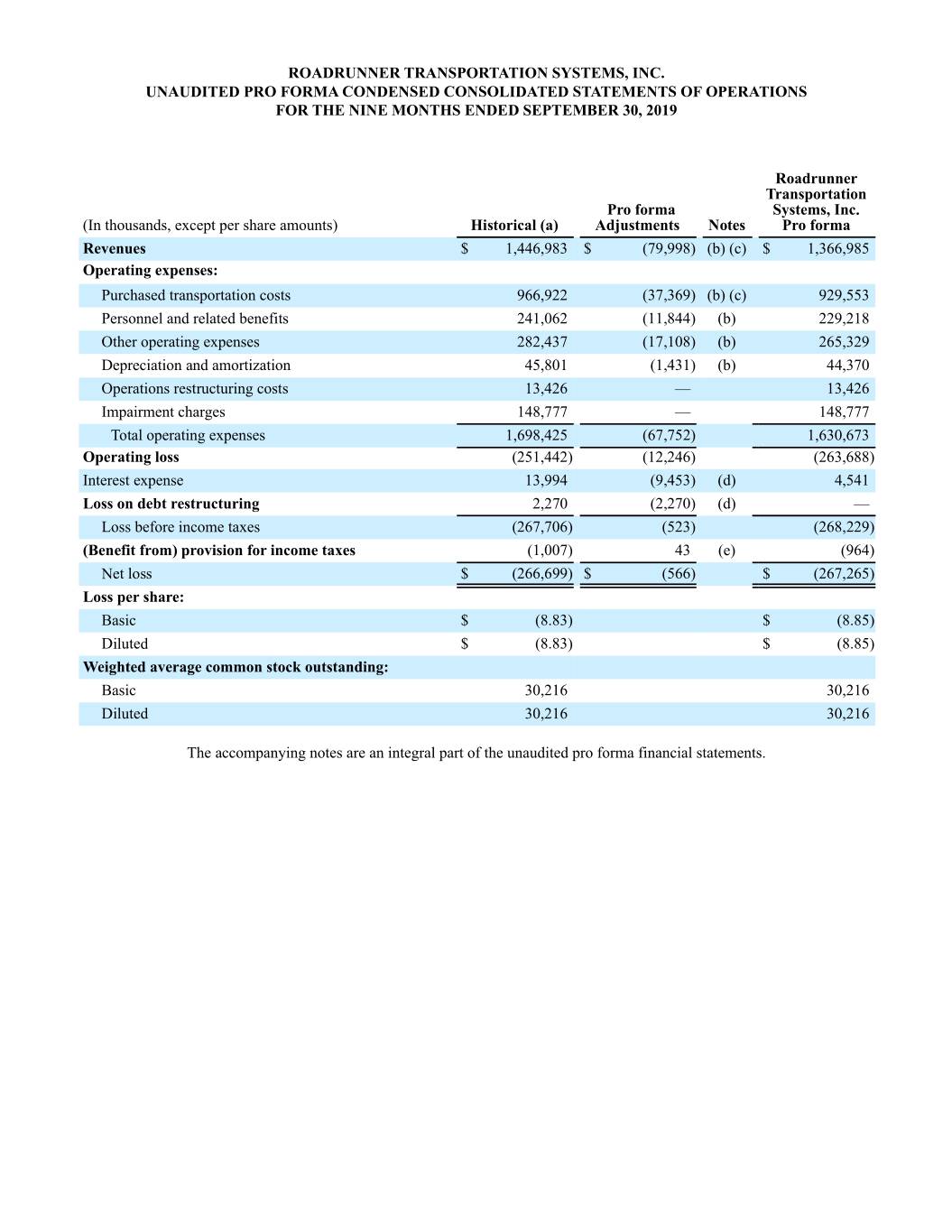

ROADRUNNER TRANSPORTATION SYSTEMS, INC. UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2019 Roadrunner Transportation Pro forma Systems, Inc. (In thousands, except per share amounts) Historical (a) Adjustments Notes Pro forma Revenues $ 1,446,983 $ (79,998) (b) (c) $ 1,366,985 Operating expenses: Purchased transportation costs 966,922 (37,369) (b) (c) 929,553 Personnel and related benefits 241,062 (11,844) (b) 229,218 Other operating expenses 282,437 (17,108) (b) 265,329 Depreciation and amortization 45,801 (1,431) (b) 44,370 Operations restructuring costs 13,426 — 13,426 Impairment charges 148,777 — 148,777 Total operating expenses 1,698,425 (67,752) 1,630,673 Operating loss (251,442) (12,246) (263,688) Interest expense 13,994 (9,453) (d) 4,541 Loss on debt restructuring 2,270 (2,270) (d) — Loss before income taxes (267,706) (523) (268,229) (Benefit from) provision for income taxes (1,007) 43 (e) (964) Net loss $ (266,699) $ (566) $ (267,265) Loss per share: Basic $ (8.83) $ (8.85) Diluted $ (8.83) $ (8.85) Weighted average common stock outstanding: Basic 30,216 30,216 Diluted 30,216 30,216 The accompanying notes are an integral part of the unaudited pro forma financial statements.

ROADRUNNER TRANSPORTATION SYSTEMS, INC. UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2018 Roadrunner Transportation Pro forma Systems, Inc. (In thousands, except per share amounts) Historical (a) Adjustments Notes Pro forma Revenues $ 2,216,141 $ (105,638) (b) (c) $ 2,110,503 Operating expenses: Purchased transportation costs 1,518,415 (51,401) (b) (c) 1,467,014 Personnel and related benefits 309,753 (13,951) (b) 295,802 Other operating expenses 397,468 (22,544) (b) 374,924 Depreciation and amortization 42,767 (1,800) (b) 40,967 Operations restructuring costs 4,655 — 4,655 Impairment charges 1,582 — 1,582 Total operating expenses 2,274,640 (89,696) 2,184,944 Operating loss (58,499) (15,942) (74,441) Interest expense: Interest expense - preferred stock 105,688 — 105,688 Interest expense - debt 11,224 (9,582) (d) 1,642 Total interest expense 116,912 (9,582) 107,330 Loss before income taxes (175,411) (6,360) (181,771) (Benefit from) provision for income taxes (9,814) 910 (e) (8,904) Net loss $ (165,597) $ (7,270) $ (172,867) Loss per share: Basic $ (107.39) $ (112.11) Diluted $ (107.39) $ (112.11) Weighted average common stock outstanding: Basic 1,542 1,542 Diluted 1,542 1,542 The accompanying notes are an integral part of the unaudited pro forma financial statements.

ROADRUNNER TRANSPORTATION SYSTEMS, INC. UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2017 Roadrunner Transportation Pro forma Systems, Inc. (In thousands, except per share amounts) Historical (a) Adjustments Notes Pro forma Revenues $ 2,091,291 $ (82,908) (b) (c) $ 2,008,383 Operating expenses: Purchased transportation costs 1,430,378 (37,668) (b) (c) 1,392,710 Personnel and related benefits 296,925 (12,669) (b) 284,256 Other operating expenses 393,731 (20,129) (b) 373,602 Depreciation and amortization 37,747 (1,884) (b) 35,863 Gain on sale of business (35,440) — (35,440) Impairment charges 4,402 — 4,402 Total operating expenses 2,127,743 (72,350) 2,055,393 Operating loss (36,452) (10,558) (47,010) Interest expense: Interest expense - preferred stock 49,704 — 49,704 Interest expense - debt 14,345 (14,012) (d) 333 Total interest expense 64,049 (14,012) 50,037 Loss from debt extinguishment 15,876 (15,876) (d) — Loss before income taxes (116,377) 19,330 (97,047) (Benefit from) provision for income taxes (25,191) 2,075 (e) (23,116) Net loss $ (91,186) $ 17,255 $ (73,931) Loss per share: Basic $ (59.37) $ (48.13) Diluted $ (59.37) $ (48.13) Weighted average common stock outstanding: Basic 1,536 1,536 Diluted 1,536 1,536 The accompanying notes are an integral part of the unaudited pro forma financial statements.

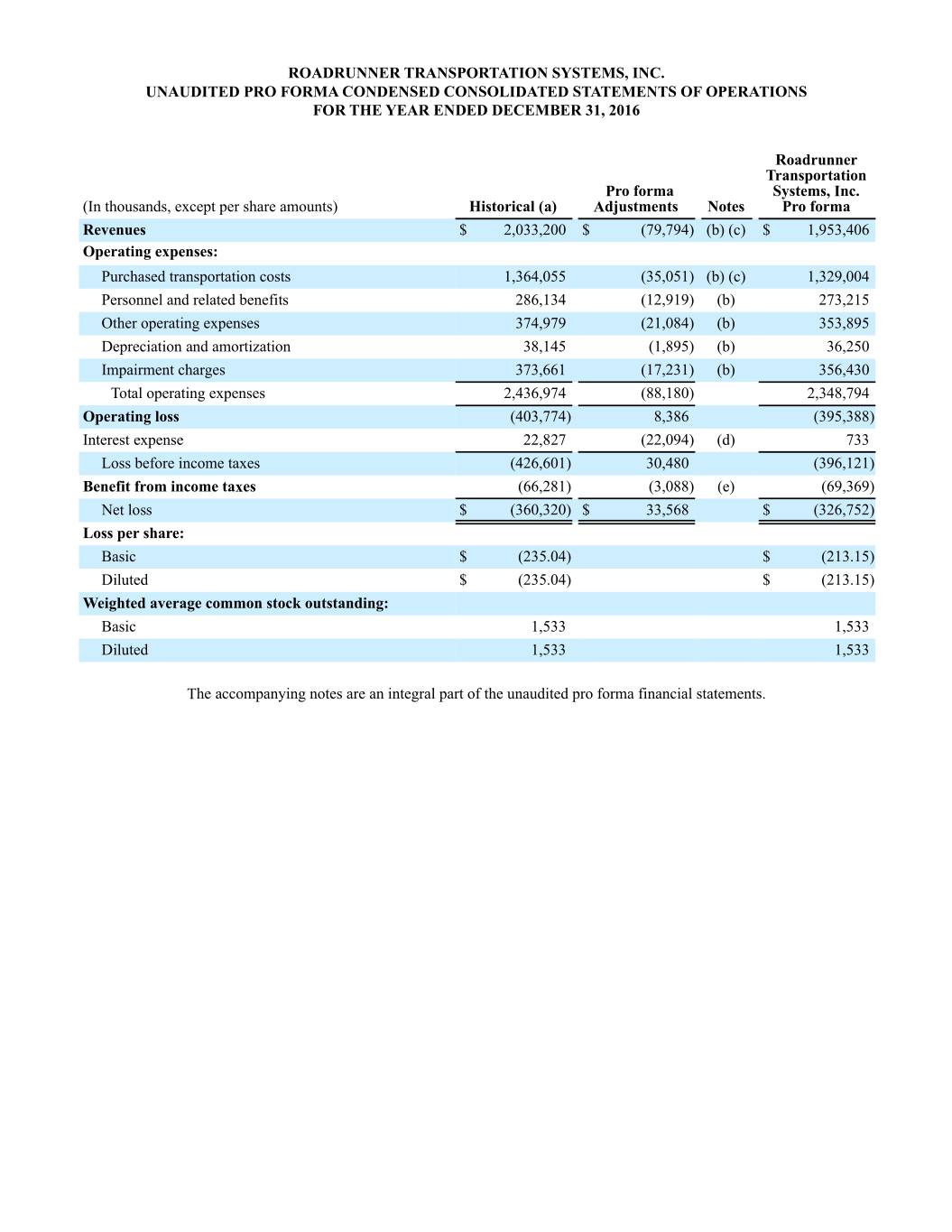

ROADRUNNER TRANSPORTATION SYSTEMS, INC. UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2016 Roadrunner Transportation Pro forma Systems, Inc. (In thousands, except per share amounts) Historical (a) Adjustments Notes Pro forma Revenues $ 2,033,200 $ (79,794) (b) (c) $ 1,953,406 Operating expenses: Purchased transportation costs 1,364,055 (35,051) (b) (c) 1,329,004 Personnel and related benefits 286,134 (12,919) (b) 273,215 Other operating expenses 374,979 (21,084) (b) 353,895 Depreciation and amortization 38,145 (1,895) (b) 36,250 Impairment charges 373,661 (17,231) (b) 356,430 Total operating expenses 2,436,974 (88,180) 2,348,794 Operating loss (403,774) 8,386 (395,388) Interest expense 22,827 (22,094) (d) 733 Loss before income taxes (426,601) 30,480 (396,121) Benefit from income taxes (66,281) (3,088) (e) (69,369) Net loss $ (360,320) $ 33,568 $ (326,752) Loss per share: Basic $ (235.04) $ (213.15) Diluted $ (235.04) $ (213.15) Weighted average common stock outstanding: Basic 1,533 1,533 Diluted 1,533 1,533 The accompanying notes are an integral part of the unaudited pro forma financial statements.

ROADRUNNER TRANSPORTATION SYSTEMS, INC. UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET AS OF SEPTEMBER 30, 2019 Roadrunner Transportation Pro forma Systems, Inc. (In thousands, except par value) Historical (a) Adjustments Notes Pro forma ASSETS Current assets: Cash and cash equivalents $ 5,825 $ 61,464 (f) $ 67,289 Accounts receivable, net 223,966 (7,802) (h) 216,164 Income tax receivable 2,275 — 2,275 Prepaid expenses and other current assets 70,471 (58) (h) 70,413 Total current assets 302,537 53,604 356,141 Property and equipment, net 201,077 (6,331) (h) 194,746 Other assets: Operating lease right-of-use asset 115,385 (31,388) (h) 83,997 Goodwill 137,372 (73,422) (h) 63,950 Intangible assets, net 30,994 (744) (h) 30,250 Other noncurrent assets 5,839 2,085 (g) (h) 7,924 Total other assets 289,590 (103,469) 186,121 Total assets $ 793,204 $ (56,196) $ 737,008 LIABILITIES AND STOCKHOLDERS' INVESTMENT Current liabilities: Current maturities of debt $ 2,558 $ (1,661) (f) $ 897 Current maturities of indebtedness to related party 9,141 — 9,141 Current finance lease liability 22,598 (3) (h) 22,595 Current operating lease liability 35,924 (6,673) (h) 29,251 Accounts payable 128,998 (7,210) (h) 121,788 Accrued expenses and other current liabilities 117,565 (3,355) (h) 114,210 Total current liabilities 316,784 (18,902) 297,882 Long-term debt, net of current maturities 152,052 (151,496) (f) 556 Long-term indebtedness to related party 31,265 (684) (f) 30,581 Long-term finance lease liability 69,743 (28) (h) 69,715 Long-term operating lease liability 90,327 (27,689) (h) 62,638 Deferred tax liabilities 2,621 — (i) 2,621 Other long-term liabilities 3,558 — 3,558 Total liabilities 666,350 (198,799) 467,551 Stockholders’ investment: Common stock $.01 par value; 44,000 shares authorized; 37,642 shares issued and outstanding 376 — 376 Additional paid-in capital 850,591 — 850,591 Retained deficit (724,113) 142,603 (j) (581,510) Total stockholders’ investment 126,854 142,603 269,457 Total liabilities and stockholders’ investment $ 793,204 $ (56,196) $ 737,008 The accompanying notes are an integral part of the unaudited pro forma financial statements.

NOTE 1. Basis of Presentation The Company’s historical consolidated financial statements have been adjusted in the unaudited pro forma condensed consolidated financial statements to present events that are (i) directly attributable to the Disposition, (ii) factually supportable and (iii) are expected to have a continuing impact on the Company’s consolidated results following the Disposition. The allocation of corporate support expenses and assets and liabilities may differ from amounts that would have been included on a stand-alone basis. The unaudited pro forma condensed consolidated statements of operations do not reflect the estimated gain on the Disposition. NOTE 2. Pro Forma Adjustments The following adjustments have been reflected in the unaudited pro forma condensed consolidated financial statements: (a) Reflects the Company’s historical US GAAP consolidated financial statements, as reported, before pro forma adjustments related to the Disposition. For the nine months ended September 30, 2019 and the years ended December 31, 2018, 2017 and 2016, Prime’s results of operations were reported as part of the Company’s Ascent segment. The Company adopted Accounting Standards Codification (ASC) Topic 606 Revenue from Contracts with Customers (Topic 606) on January 1, 2018. As such, Topic 606 was effective during the nine months ended September 30, 2019 and the year ended December 31, 2018, while during the years ended December 31, 2017 and 2016, Topic 606 was not effective. (b) Reflects the elimination of revenues and expenses representing the historical operating results of the Prime business. In addition to the elimination of revenues and expenses representing the historical Prime business, this pro forma adjustment reflects intercompany revenue and transportation costs which were eliminated in the historical consolidated financial statements. (c) Intercompany transportation services sold to Prime were $0.1 million, $0.3 million, $0.5 million and $0.3 million for the nine months ended September 30, 2019, and the years ended December 31, 2018, 2017, and 2016, respectively. (d) The pro forma adjustment includes interest expense and losses on debt restructuring related to the ABL Loan and Term Loan which were paid off with the proceeds from the Disposition as required by the terms of the ABL Loan and Term Loan. (e) The pro forma adjustment for benefit from income taxes was calculated as the difference between the historical benefit from income taxes as reported, and pro forma benefit from income taxes as calculated by using the statutory rate for the Company excluding the Prime business and adjusting for permanent items. Adjustments to permanent items include the change to the valuation allowance for deferred tax assets. Additionally, for 2017, adjustments to permanent items include those related to the impact of recalculating the carrying value of the Company’s deferred tax assets and liabilities as a result of the reduction of the corporate income tax rate from 35% to 21% pursuant to the Tax Cuts and Jobs Act signed on December 31, 2017. (f) Reflects estimated net cash proceeds from the Disposition of $61.5 million, representing the gross sale price of $225.0 million less certain purchase price adjustments, estimated transaction costs and the payment of all outstanding balances under our ABL Loan and Term Loan of $148.9 million and $7.3 million, respectively. Includes the write-off of $0.1 million of unamortized debt issuance costs associated with the Term Loan. (g) The $2.3 million in unamortized debt issuance costs associated with the ABL Loan was reclassed to Other noncurrent assets. (h) Represents the assets and liabilities conveyed to the Buyer in the Disposition. (i) The Company has historical losses, and expects to offset the taxable gain on the Disposition with current losses and tax loss carryforwards. The Company has a valuation allowance against these deferred tax assets, and no net change to the net deferred tax liabilities is expected. (j) Represents the estimated after-tax gain on the Disposition of $142.6 million, which was calculated as follows (in thousands):

Estimated proceeds, net of transaction costs, and write-off of unamortized debt issuance costs $ 217,674 Assets of Prime (120,003) Liabilities of Prime 44,977 Gain on sale of Prime 142,648 NOTE 3. Transition Services Agreement Pursuant to a transition services agreement entered into and effective on the closing of the Disposition, the Company will provide certain human resource and information technology services to Prime for a period generally not to exceed 6 months. No pro forma adjustments have been made associated with this agreement as services to be provided with a defined monetary value are not considered material and will not have a continuous impact, and the variable elements associated with those services are not estimable at this time.