Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Neon Therapeutics, Inc. | exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - Neon Therapeutics, Inc. | exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - Neon Therapeutics, Inc. | exhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - Neon Therapeutics, Inc. | exhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - Neon Therapeutics, Inc. | exhibit211.htm |

| EX-10.14 - EXHIBIT 10.14 - Neon Therapeutics, Inc. | exhibit1014.htm |

| EX-4.3 - EXHIBIT 4.3 - Neon Therapeutics, Inc. | exhibit43.htm |

Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________________

FORM 10-K

________________________________________________________________

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-38551

________________________________________________________________

NEON THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

________________________________________________________________

Delaware (State or other jurisdiction of incorporation or organization) | 46-3915846 (I.R.S. Employer Identification No.) | |

40 Erie Street, Suite 110 | ||

Cambridge, Massachusetts | 02139 | |

(Address of principal executive offices) | (Zip Code) | |

(617) 337-4701

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trade Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.001 par value per share | NTGN | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer x | |

Non-accelerated filer ¨ | Smaller reporting company x Emerging growth company x | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $83,536,584 as of June 28, 2019 (based on a closing price of $4.74 per share as quoted by the Nasdaq Global Select Market as of such date). In determining the market value of non-affiliate common stock, shares of the registrant’s common stock beneficially owned by officers, directors and affiliates have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had 28,858,041 shares of Common Stock, $0.001 par value per share, outstanding as of February 26, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain information from the registrant’s definitive Proxy Statement for its 2020 annual meeting of shareholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year end of December 31, 2019. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part of this Form 10-K.

Neon Therapeutics, Inc.

Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2019

Table of Contents

Item No. | Page | |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements may be identified by such forward-looking terminology as "may," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue" or the negative of these terms or other comparable terminology. Our forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our company, are not guarantees of future results or performance and involve substantial risks and uncertainty. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements. Our business and our forward-looking statements involve substantial known and unknown risks and uncertainties, including the risks and uncertainties inherent in our statements regarding:

• | the success, cost and timing of our product development activities and clinical trials, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available, and our research and development programs; |

• | our ability and the potential to successfully manufacture and supply our product candidates for clinical trials and for commercial use, if approved; |

• | the potential for our identified research priorities to advance our platform, programs or product candidates; |

• | the ability and willingness of our third-party research institution collaborators to continue research and development activities relating to our product candidates; |

• | our ability to obtain and maintain regulatory approval of our lead product candidate, NEO-PV-01, and any other product candidates, and any related restrictions, limitations or warnings in the label of an approved product candidate; |

• | the ability to license additional intellectual property relating to our product candidates and to comply with our existing license agreements; |

• | our ability to commercialize our products in light of the intellectual property rights of others; |

• | our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates; |

• | our plans to research and develop our product candidates; |

• | the commercialization of our product candidates, if approved; |

• | our ability to attract collaborators with development, regulatory and commercialization expertise; |

• | future agreements with third parties in connection with the commercialization of our product candidates and any other approved product; |

• | the size and growth potential of the markets for our product candidates, and our ability to serve those markets; |

• | the rate and degree of market acceptance of our product candidates; |

• | regulatory developments in the United States and foreign countries; |

• | our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately; |

• | our ability to produce our products or product candidates with advantages in turnaround times or manufacturing cost in an economically viable manner; |

• | the success of competing therapies that are or may become available and changes in the standard of care; |

• | our ability to attract and retain key scientific or management personnel; |

• | the accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

• | our ability to continue as a going concern; |

• | the impact of laws and regulations; |

• | our use of the proceeds from our initial public offering, or IPO, and our ongoing at-the-market offering program; |

• | our expectations regarding the time during which we will be an "emerging growth company" under the Jumpstart Our Business Startups Act; and |

• | our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates. |

All of our forward-looking statements are as of the date of this Annual Report on Form 10-K only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of or any material adverse change in one or more of the risk factors or risks and uncertainties referred to in this Annual Report on Form 10-K or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the Securities and Exchange Commission, or the SEC, could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this Annual Report on Form 10-K, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. Any public statements or disclosures by us following this Annual Report on Form 10-K that

modify or impact any of the forward-looking statements contained in this Annual Report on Form 10-K will be deemed to modify or supersede such statements in this Annual Report on Form 10-K.

NOTE REGARDING TRADEMARKS

Neon Therapeutics, Inc. is the owner of trademark rights in the NEON THERAPEUTICS, RECON, NEO-STIM, Precision NEO-STIM and MAPTAC trademarks, as well as certain other trademarks, including design versions of some of these trademarks. The symbols ™ and ® are not used in connection with the presentation of these trademarks in this report and their absence does not indicate a lack of trademark rights. Certain other trademarks used in this report are the property of third-party trademark owners and may be presented with or without trademark references.

PART I

Item 1. Business

Overview

We are a clinical-stage immuno-oncology company and a leader in the field of neoantigen-targeted therapies, dedicated to transforming the treatment of cancer by directing the immune system towards neoantigens. Genetic mutations, which are a hallmark of cancer, can result in specific immune targets called neoantigens. The presence of neoantigens in cancer cells and their absence in normal cells makes them compelling, untapped targets for cancer therapy. By directing the immune system towards these targets, we believe our neoantigen-targeted therapies will offer a new level of patient and tumor specificity in the field of cancer immunotherapy that will drive a strong risk-benefit profile to dramatically improve patient outcomes.

We aim to lead a paradigm shift in the treatment of cancer patients towards an era of truly personal immuno-oncology therapies. Our founders have done pioneering work in immuno-oncology, including work that resulted in a class of immunotherapy known as checkpoint inhibitors, which aim to reactivate the immune system to kill cancer cells. Checkpoint inhibitors have demonstrated potent efficacy in cancers with higher rates of genetic mutations, or mutational burden, which provide a greater diversity of neoantigen targets. However, even in these tumor types, the majority of patients do not respond to treatment and new treatment strategies are needed. We seek to address this unmet need by leveraging the T cell modality to target neoantigens with the potential to unlock the potency of cell therapies in solid tumors.

We have deep expertise in the development of neoantigen therapies, with both T cell and vaccine modalities. We are leveraging over a decade of insights from our founders to develop neoantigen-targeted therapies that use two distinct approaches: the first approach utilizes fully personal therapies that target neoantigens specific to each individual, and the second approach utilizes therapies that target neoantigens that are shared across subsets of patients or tumor types. Both the personal neoantigen approach and the shared neoantigen approach focus on targeting a prioritized set of what we believe are the most therapeutically-relevant neoantigens.

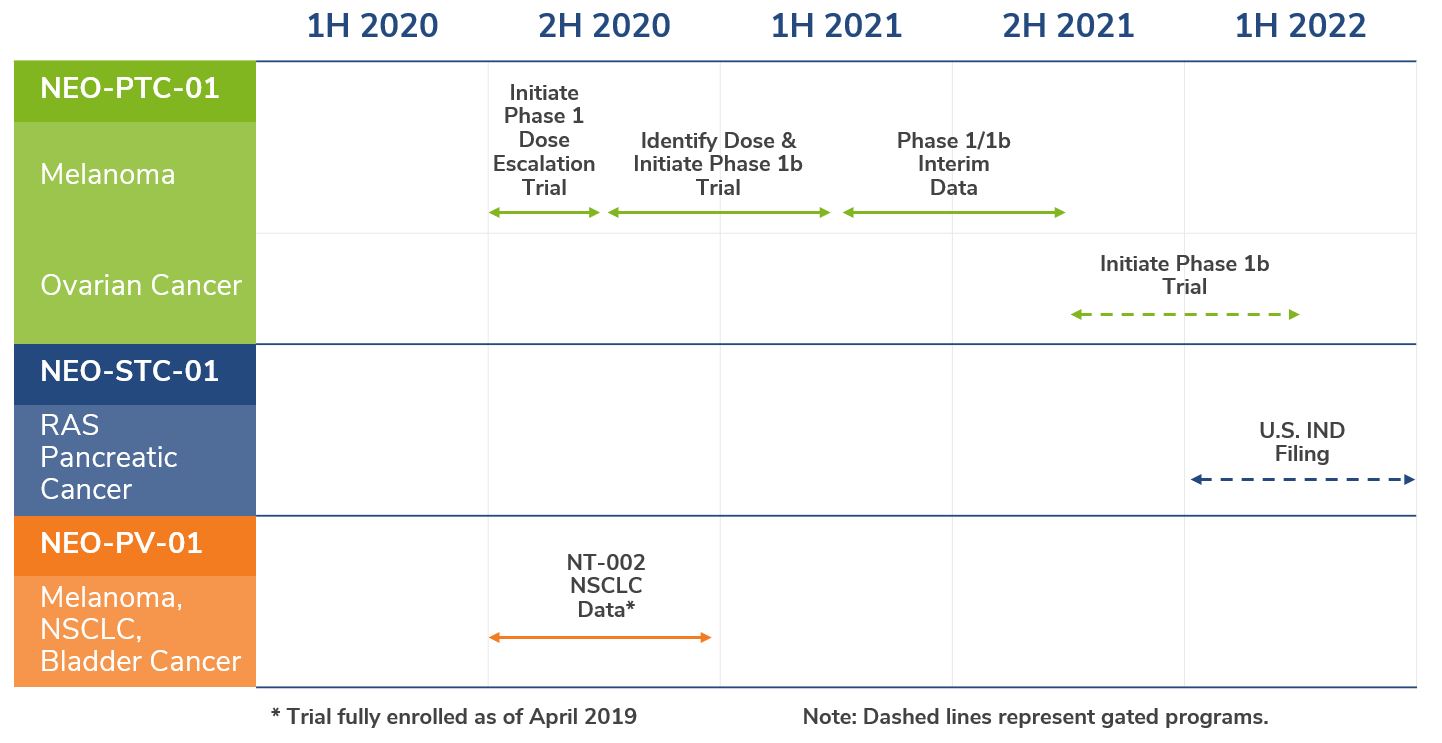

Our most advanced T cell program is NEO-PTC-01, our personal neoantigen adoptive T cell therapy, which consists of multiple T cell populations that are generated to target each individual patient's unique set of neoantigens. Data presented at the Society for Immunotherapy of Cancer meeting in November 2019, as well as our ongoing research, give us confidence that we can reliably generate multiple enriched neoantigen-specific T cell populations at a therapeutic manufacturing scale that are capable of killing tumor cells. Importantly, we showed that NEO-PTC-01-induced T cell cultures directly recognize autologous patient tumor material. We believe NEO-PTC-01 has several significant advantages that could overcome the challenges of other cell therapies in the solid tumor setting. To this end, we are focusing the initial clinical development of NEO-PTC-01 in solid tumors for patients who are refractory to checkpoint inhibitors. In December 2019, we announced that we filed a clinical trial application, or CTA, with the Dutch Health Authority to evaluate NEO-PTC-01 in a first-in-human clinical trial. We plan to initiate a Phase 1 dose escalation clinical trial in metastatic melanoma in collaboration with the Netherlands Cancer Institute in the third quarter of 2020. The second planned indication for NEO-PTC-01 is metastatic ovarian cancer, with the potential to both expand to other solid tumor types and pursue clinical development in the United States.

We are also advancing a T cell therapy program targeting shared neoantigens in genetically defined patient populations to direct the immune system towards prevalent mutations that are shared across patients in specific tumor types. We intend to develop product candidates targeting shared neoantigens using both non-engineered and engineered T cell modalities. Our first product candidate using the shared neoantigen approach, NEO-STC-01, is a non-engineered adoptive T cell therapy that targets RAS mutations prevalent across many solid tumors. We are focusing our initial efforts with NEO-STC-01 on the treatment of pancreatic ductal adenocarcinoma, or PDAC, as over 84% of PDAC tumors have a RAS mutation and there is a significant unmet medical need for PDAC therapies. We have also assembled libraries of high-quality T cell receptors, or TCRs, against various shared neoantigens across common human leukocyte antigens, or HLAs, which are suitable for an engineered TCR-T cell therapy approach.

Finally, we also have two neoantigen vaccines in our portfolio, NEO-PV-01, a fully personal neoantigen cancer vaccine, custom-designed and manufactured for each individual patient’s tumor mutations, and NEO-SV-01, a neoantigen vaccine for the treatment of a subset of hormone receptor-positive breast cancer. NEO-PV-01 is in Phase 1b clinical development in metastatic disease settings, with three ongoing trials. In November 2019, we reported top line results from the first trial, NT-001, at the Society of Immunotherapy for Cancer 2019 meeting. In November 2019, we also announced the cessation of additional spending commitments related to our cancer vaccine programs, NEO-PV-01 and NEO-SV-01. We will continue to conduct follow-up from our ongoing NT-002 clinical trial of NEO-PV-01 in first-line patients with untreated advanced or metastatic non-small cell lung cancer, with plans to report initial clinical data from this trial in the second half of 2020. We have also ceased enrollment in our NT-003 trial in metastatic melanoma.

1

In developing all of our therapeutic product candidates, we leverage our proprietary neoantigen platform, which continuously improves as our product candidates generate data. This platform comprises two key elements: our Real-time Epitope Computation for ONcology, or RECON, bioinformatics engine, and our combined T cell biology and immune-monitoring expertise, in particular NEO-STIM, our proprietary antigen-specific T cell induction protocol.

Our RECON bioinformatics engine utilizes a proprietary combination of algorithms designed to predict the most therapeutically-relevant neoantigen targets associated with each patient's tumor. As detailed in our February 2017 and October 2019 papers in Immunity, our approach to bioinformatics uses a proprietary allele-specific, or mono-allelic, approach that allows us to predict neoantigens that are presented by specific Class I and Class II HLA alleles relevant for each patient. Using this approach and with our growing proteomic database of greater than 1.7 million unique HLA bound peptides, we have generated high quality datasets that have resulted in positive predictive values greater than 50%, exceeding standard approaches by greater than ten times for Class I HLAs and by greater than sixty times for Class II HLAs when using a recall-based measurement of performance. We intend to continue to strengthen our leading position in bioinformatics and identification of therapeutic neoantigens by using data generated from our ongoing and future clinical trials, coupled with our machine learning expertise, to continue to refine RECON's neoantigen prediction algorithms.

Our combined T cell biology and immune-monitoring expertise allows us to elicit neoantigen-specific immune responses, both in vivo and ex vivo, and to evaluate these responses in patients. We have developed a proprietary method for ex vivo T cell stimulation, which we call NEO-STIM, that allows us to directly prime, activate and expand antigen-specific T cells. In addition, we have built up immune profiling capabilities using a state-of-the-art toolkit that allows us to understand the antigen-specific immune responses to our therapies, thereby providing a key feedback loop that further enables improvements in research and development of our programs.

Recent Corporate Updates

On November 20, 2019, we announced that, as part of a new strategic focus, we were reducing our workforce by approximately 24% of our then current headcount. This corporate restructuring was substantially completed during the fourth quarter of 2019. We also announced the cessation of additional spending commitments related to our cancer vaccine programs, as detailed above.

After a comprehensive review of strategic alternatives, on January 15, 2020, we entered into an agreement with BioNTech SE, or BioNTech, pursuant to which, if all of the conditions to closing are satisfied or waived, we will become a wholly-owned subsidiary of BioNTech, or the Merger Agreement and such transaction, the Merger. The Merger Agreement was unanimously approved by the members of our board of directors, or the Board, and the Board resolved to recommend approval of the Merger Agreement to our shareholders. The closing of the Merger is subject to approval of our shareholders and the satisfaction of customary closing conditions. Certain of our stockholders who collectively own approximately 36% of the outstanding shares of our common stock have entered into voting agreements, pursuant to which they have agreed, among other things, and subject to the terms and conditions of the agreements, to vote in favor of the Merger.

Subject to the terms of the Merger Agreement, at the effective time of the Merger, or the Effective Time, each share of our common stock issued and outstanding immediately prior to the Effective Time shall automatically be canceled and converted (without interest but subject to any withholding required under applicable law) into the right to receive 0.063 of an American Depositary Share of BioNTech, or Parent ADS, with each Parent ADS representing one ordinary share of BioNTech.

The transaction is expected to close in the second quarter of 2020.

2

Our Approaches and Product Candidates

The following diagram summarizes the current status of our product development pipeline:

Our Personal Neoantigen Approach

NEO-PTC-01 is a personal neoantigen adoptive T cell therapy that consists of multiple T cell populations targeting what we predict to be the most therapeutically-relevant neoantigens from each patient's tumor. T cells are a type of white blood cell that play a central role in the immune system, including both detecting and killing cancer cells. NEO-PTC-01 uses T cells from the periphery of each patient that we then specifically prime, activate and expand to generate a therapy that specifically targets that patient's personal neoantigens. We believe that NEO-PTC-01 will allow us to drive a robust and persistent anti-tumor response and could be applicable across a broad range of both hematological and solid tumors. NEO-PTC-01 is currently in preclinical development. We filed a CTA with the Dutch Health Authority in December 2019 to evaluate NEO-PTC-01 in solid tumors in patients that are refractory to checkpoint inhibitors. Our first clinical trial of NEO-PTC-01 will be in metastatic melanoma and is expected to start in the third quarter of 2020.

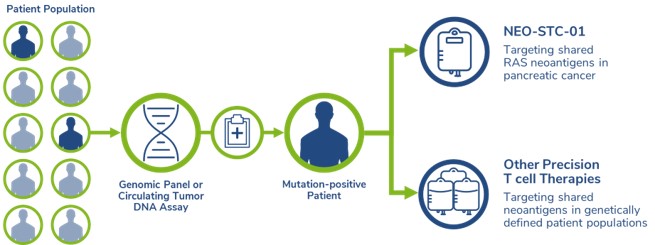

Our Shared Neoantigen Approach

Our shared neoantigen programs take a precision medicine approach to neoantigen-targeted therapies. We are seeking to discover, validate and develop therapies directed towards shared neoantigens, which are neoantigen targets that are shared across subsets of patients or tumor types. Our proprietary shared neoantigen targets will be developed as adoptive T cell therapies. Our lead shared neoantigen product candidate is NEO-STC-01, a neoantigen adoptive T cell therapy for the treatment of cancers driven or mediated by RAS mutations. We believe NEO-STC-01 has the potential to be used across multiple different tumor types harboring RAS mutations. We also continue to make significant progress with respect to shared neoantigen discovery and validation and have assembled libraries of high-quality TCRs against various shared neoantigens across common HLAs.

Our Strategy

To fulfill our mission, we are developing neoantigen-targeted therapies that we believe have the potential to lead a paradigm shift in the treatment of cancer patients. Key elements of our strategy include:

• | Advance product candidates using multiple T cell therapies across a broad array of patient populations. |

• | Develop NEO-PTC-01 to leverage the potency of cell therapies to target neoantigens specific to each individual. |

• | Develop shared neoantigen T cell therapies for patients who share specific neoantigens. |

• | Strengthen our leading position in the neoantigen field through ongoing investment in our platform technologies. |

• | Discover and validate a pipeline of TCRs than can effectively target tumor antigens across common HLAs and are suitable for an engineered TCR-T cell therapy approach. |

3

Our Neoantigen Platform

We have pioneered a proprietary neoantigen platform that we are using to develop neoantigen-targeted therapies. We believe that directing the immune system towards neoantigen targets is fundamental to driving effective cancer immunotherapies. Accordingly, our platform seeks to identify and harness the most therapeutically relevant neoantigens present within each patient's tumor.

Our platform comprises two key elements that form an iterative feedback loop: our RECON bioinformatics engine, which is designed to predict the most therapeutically-relevant neoantigen targets and our combined T cell biology and immune-monitoring expertise, in particular NEO-STIM, our proprietary antigen-specific T cell induction protocol. We are using our platform to develop product candidates across several neoantigen-targeting non-engineered and engineered T cell therapies using two distinct approaches:

• | Our personal medicine approach enables neoantigen-targeted therapies that are tailored for the individual profile of each patient's tumor. |

• | Our precision medicine approach enables neoantigen therapies that target prevalent neoantigens that are shared across subsets of patients or tumor types. |

Overview of Our Neoantigen Platform, Treatment Approaches and Treatment Modalities

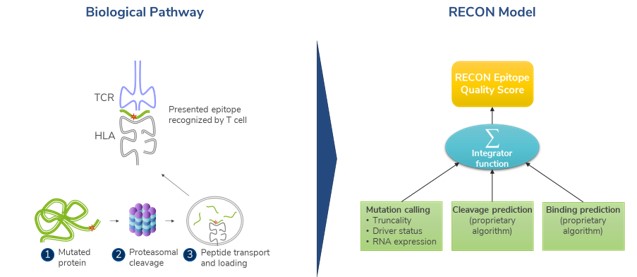

Neoantigen Selection: Our RECON Bioinformatics Engine

At the core of our neoantigen platform is our RECON bioinformatics engine, which is designed to predict the most therapeutically-relevant neoantigen targets associated with each patient's tumor. Effective prediction is critical because, although many mutations within a patient's tumor will lead to the production of a mutated protein, not all mutated proteins lead to suitable therapeutic neoantigen targets.

RECON uses a number of inputs from each patient, including DNA sequences from samples of tumor and normal tissue, RNA sequences from tumor samples, and the patient's specific MHC allele profile. RECON processes data from these inputs using a proprietary combination of algorithms in order to produce a prioritized list of neoantigen-targeting peptides that we then manufacture for use in our product candidates. These algorithms seek to:

• | Identify the mutations present within a patient's tumor; |

• | Predict which mutations will lead to neoantigens that will be presented by a patient's specific MHC allele profile; and |

• | Select the most therapeutically-relevant neoantigen-targeting peptides for use in our therapies based on a set of additional biological and pharmacological factors. |

We believe we have built RECON as a leading neoantigen bioinformatics engine. By further leveraging the combination of leading-edge proteomics and machine learning expertise, we intend to strengthen our leadership position in identifying neoantigens. Importantly, refining predictions of therapeutic relevance of neoantigens will incorporate immunogenicity data generated from our ongoing and future clinical trials for each RECON predicted neoantigen. As a result, both proteomic and clinical data will continue to refine RECON's neoantigen prediction algorithms in an iterative manner.

RECON predictions of neoantigens, which uses somatic mutations that are accurately and robustly characterized as the starting point, recapitulates the key events in this pathway, including protein cleavage, antigen-HLA binding and T cell reactivity. Factors such as quantification of RNA expression of antigens are used in multiple steps in immunogen identification and design.

4

Identification of Mutations: We believe that achieving a combination of high sensitivity and specificity is critical in identifying genetic mutations upon which to base neoantigen predictions. We use a proprietary combination of mutation detection algorithms, known as a mutation calling ensemble, to identify candidate mutations present within a patient's tumor by comparing the patient's normal DNA and tumor DNA sequences. Using this proprietary approach, we have demonstrated a consistently lower rate of false positive errors while maintaining sensitivity when compared to the use of a single mutation detection algorithm.

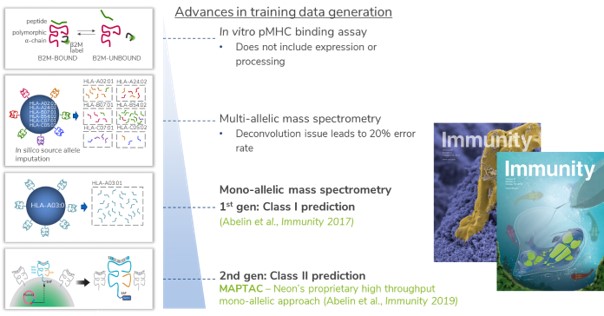

Prediction of Neoantigen-MHC Presentation: We use a novel approach to predict which mutations lead to neoantigens that will bind to and be presented by MHC on the surface of a patient's cancer cells. Conventionally, neoantigen prediction is conducted using publicly available algorithms that are trained using limited datasets derived predominantly from in vitro binding assays. The utility of these assays to develop binding predictors is limited due to low throughput and does not incorporate critical insights into how peptides are processed. Later generations of algorithms use mass spectrometry techniques to isolate and sequence peptides from multiple MHC alleles. While these approaches have made advances in predicting neoantigen-MHC binding over in vitro binding assays, the utility of this multi-allelic mass spectrometry approach is limited because these algorithms are unable to discern which peptides are presented by each MHC allele. Further, requiring the use of a predictive algorithm to assign each peptide to an allele is a process that can result in a significant error rate. While these approaches have some utility, we believe, they lack adequate precision and depth across a wide enough range of alleles to have adequate clinical utility. It is our belief that superior data inputs will yield superior predictions and we have, therefore, made significant investments to generate a high-quality dataset to build the predictive abilities of our RECON bioinformatics engine.

Overview of Data Sources for Neoantigen-MHC Presentation Prediction

As shown in the graphic above, we use a proprietary allele-specific approach that leverages our mono-allelic MHC proteomic datasets that is differentiated from earlier techniques. Overall, this approach allows us to accurately predict neoantigens that are presented by specific MHC alleles relevant for each patient. We generated our mono-allelic datasets using a novel mass spectrometry-based method for profiling MHC-bound peptides that are presented by a single Class I or Class II MHC allele. The foundation for our approach to generating mono-allelic Class I MHC ligand datasets was published in Immunity in February 2017. This work was extended by our innovative higher-throughput mono-allelic approach, which we call MAPTAC (Mono-Allelic Purification with Tagged Allele Constructs), that was published in Immunity in October 2019. In particular, MAPTAC has enabled us to rapidly extend our data for Class I MHC alleles and also generate data for many Class II MHC alleles, many of which have no publicly available data. As of March 2019, our MAPTAC dataset included 101 Class I alleles, covering greater than 95% of allelic diversity for A, B, and C alleles, and 45 Class II alleles, covering 95.0%, 78.9%, and 42.7% of allelic diversity for DR, DP and DQ, respectively. Using our MAPTAC approach, we continue to expand our dataset for Class I and Class II alleles.

Using our datasets, we have developed unique MHC allele-specific algorithms that provide far greater predictive accuracy and lower false discovery rates than standard approaches. We have used this methodology to systematically investigate Class I and II MHC alleles, enabling broad coverage of alleles across geographic populations and ethnic groups. We have already achieved greater than ninety-nine percent population coverage in the United States through our coverage of one or more Class I (HLA-A, B and C) and Class II HLA (HLA DR, DP, and DQ) alleles for each patient. We believe these enhancements will enable us to develop more effective neoantigen-targeted therapies. Using this approach and with our growing proteomic database of greater than 1.2 million unique HLA bound peptides, we have generated high quality datasets that have resulted in positive predictive

5

values greater than 50%. The performance of RECON to predict antigen-HLA binding exceeds that of standard approaches, such as netMHCPan, by up to greater than ten times for Class I HLAs and by up to greater than sixty times for Class II HLAs when using a recall-based measurement of performance. Our next-generation algorithms using mono-allelic data for Class I MHC alleles have now been deployed in our ongoing clinical trials and we plan to deploy our Class II MHC prediction capabilities in upcoming trials.

The figure below provides an overview of the neoantigen presentation pathway on the left and how RECON models this biology on the right.

Overview of Neon's RECON Bioinformatics Engine

In addition to mono-allelic mass spectrometry-based HLA-antigen presentation predictions, RECON predictions of neoantigens recapitulates other key events in this pathway. For example, we have also developed a proprietary algorithm designed to predict how proteins are processed into peptides and how this process influences which peptides can be presented by MHC. Factors such as quantification of RNA expression and truncality scores (which is a measure of the percent of cells that harbor the mutation) of antigens are used in multiple steps in immunogen identification and design. In addition, we have also observed that intra-tumoral MHC Class II presentation is dominated by professional antigen presenting cells, or APCs, rather than tumor cells. Therefore, tracking which tumor epitopes are most readily phagocytosed (or ingested by a cell) and presented by APCs further enhances the ability to pinpoint therapeutically relevant epitopes. These findings can be used to further enhance RECON’s predictive power.

Selection of the Most Therapeutically-Relevant Neoantigens: In our effort to select the most therapeutically-relevant neoantigens, in addition to the factors described above, we incorporate a number of additional filters and algorithms applied to RECON-identified neoantigens that account for several biological and pharmacological factors, as well as manufacturing considerations. These include prioritizing based on predictions of T cell reactivity. Also, features of each mutation, such as truncality, help identify the most preferred immunogenic HLA bound antigens to target.

Our current version of RECON is trained using our mono-allelic mass spectrometry data for Class I MHC epitopes and is used in our ongoing clinical trials for NEO-PV-01. We plan to incorporate Class II MHC epitope prediction into the version of RECON used for future clinical trials, including for our planned clinical trial of NEO-PTC-01. Through intensive immune monitoring of epitope immunogenicity in our clinical studies, we can improve the quality of RECON's predictions over time by understanding the immune response to each epitope.

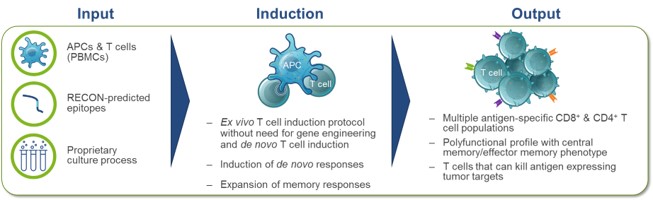

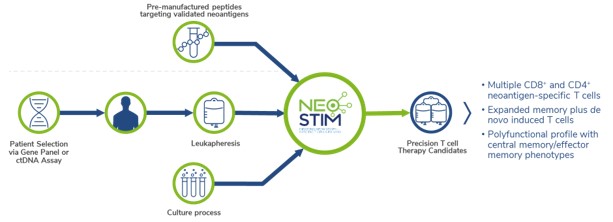

Neoantigen Immunogenicity: Inducing T cells with NEO-STIM and Evaluating Antigen-specific T Cell Responses

Fundamental to our platform is our ability to elicit neoantigen-specific immune responses, both in vivo and ex vivo, and to evaluate these responses in patients. It is therefore vital for us to understand how T cell responses can be induced and expanded to target neoantigens and to monitor the immune system response in treated patients.

We have developed a proprietary method for ex vivo T cell stimulation, which we call NEO-STIM, that allows us to directly prime, activate and expand antigen-specific T cells.

6

Overview of NEO-STIM Induction Protocol

NEO-STIM has several important advantages compared to other tumor-targeting T cell induction and expansion protocols including:

• | Starting with peripherally collected apheresis material and does not require harvesting tumor-infiltrating lymphocytes, or TILs; |

• | No cell engineering required to generate potent antigen-specific T cells; |

• | Ability to both induce de novo and expand memory antigen-specific immune responses in the laboratory; and |

• | Generating T cells with desired phenotype that can kill antigen expressing tumor targets and autologous tumor without use of IL-2, which is a potent cytokine signaling molecule for the immune system, during the T cell culture process. |

Given these advantages of NEO-STIM, we apply this important platform technology both for research purposes and as a key inline manufacturing step to generate neoantigen-specific adoptive T cell therapies. Applications for NEO-STIM include:

• | Inline manufacturing for neoantigen-specific adoptive T cell therapies: We can generate therapeutic-scale T cell populations under current Good Manufacturing Practice, or cGMP, conditions that are specific to a patient’s neoantigen targets. NEO-STIM can be used in this way for programs targeting personal neoantigens specific to a patient’s tumor, as in the case for NEO-PTC-01, or shared neoantigens such as RAS, as in the case for NEO-STC-01. |

• | Validating the immunogenicity of neoantigen targets: NEO-STIM’s ability to induce de novo neoantigen-specific T cell responses allows us to confirm the immunological relevance of specific predicted neoantigens and is an important validation step for our shared neoantigen pipeline. |

• | Isolating neoantigen-specific T cell receptors: We generate tumor antigen-specific T cells and isolate TCRs specific to each tumor antigen that have the potential to be used in developing multiple TCR-based T cell therapies. |

• | Learning the rules for which epitopes are immunogenic: By testing many epitopes and T cell responses, we can learn the rules of immunogenicity that indicate which epitopes may successfully lead to immune responses. This information can then be used to improve RECON’s prediction algorithms. |

We have also developed extensive in-house immune-monitoring capabilities that allow us to interrogate the immune state of a patient before, during and after each therapeutic intervention. We evaluate multiple components of the immune system, including different types of immune cells and important classes of cytokines, in both the periphery and the tumor. To evaluate immune responses, we use a range of cutting-edge techniques, including rapid UV-exchange MHC multimers developed by one of our founders, Ton Schumacher, which allow us to analyze neoantigen-specific CD8+T cells, TCR sequencing to determine the distribution of neoantigen-specific T cells, single cell sequencing and multi-channel flow cytometry. We complement the use of these monitoring techniques with the use of other more common immune-monitoring techniques such as ELISpot assays and immunohistochemistry. Together, these techniques allow us to generate comprehensive immunological data from our clinical trials and to correlate them with our analysis of the tumor both before and after treatment. We expect to use these data to make ongoing improvements to RECON's neoantigen selection and prioritization algorithms, identify biomarkers that can help predict which patients will be responsive to therapy, further enhance clinical development strategies and inform generational improvements to our product candidate portfolio.

7

Our Approaches and Product Candidates

Personal Neoantigen Approach

For our personal medicine approach to neoantigen-targeted therapy, we are developing therapies that are tailored to each patient's specific set of tumor neoantigens. We are currently developing a personal neoantigen adoptive T cell therapy called NEO-PTC-01. We believe our personal approach has potential to be an effective new treatment across solid tumors that are unresponsive to checkpoint inhibitor therapy.

Personal Neoantigen Adoptive T Cell Therapy Program: NEO-PTC-01

Overview

NEO-PTC-01, is a personal neoantigen T cell therapy consisting of multiple T cell populations targeting what we believe to be the most therapeutically-relevant neoantigens from each patient's tumor. NEO-PTC-01 is currently in preclinical development. In December 2019, we filed a CTA with the Dutch Health Authority to evaluate NEO-PTC-01 in the solid tumor setting in patients that are refractory to checkpoint inhibitors. We plan to initiate a Phase 1 dose escalation clinical trial in patients with metastatic melanoma who are refractory to checkpoint inhibitors in collaboration with the Netherlands Cancer Institute in the third quarter of 2020. The second planned indication for NEO-PTC-01 is metastatic ovarian cancer, with the potential to both expand to other solid tumor types and pursue clinical development in the United States.

NEO-PTC-01 leverages our neoantigen platform, including RECON and NEO-STIM. Using RECON, we select high ranking neoantigens personalized to each patient. This set of neoantigen-targeting peptides is then manufactured for each patient on an individual basis. We next leverage these custom-manufactured peptides in our proprietary ex vivo co-culture process, NEO-STIM, to prime, activate and expand autologous neoantigen-specific T cells specific for each patient's personal set of neoantigens. We believe that this approach will allow us to specifically target each patient's individual tumor with T cells that can drive a robust and persistent anti-tumor response. The graphic below outlines the process that we will employ for NEO-PTC-01:

NEO-PTC-01 Product Process

Product Development Rationale

We believe that NEO-PTC-01 has the potential to unlock the potency of cell-based therapies in solid tumors. This stands in contrast to approved T cell therapies that have been limited to hematological cancers to date.

Adoptive T cell therapies, particularly chimeric antigen receptor T cells, or CAR-Ts, have demonstrated potent efficacy in the treatment of certain hematological cancers. These therapies use genetically-engineered constructs inserted into T cells that allows for the recognition and killing of cancer cells expressing certain cell surface targets, such as the B-lymphocyte antigens CD19 and BCMA. However, CAR-T approaches are currently restricted to single targets and treatment with CAR-T therapies has been observed to come with a significant toxicity profile.

Steven Rosenberg and his colleagues at the National Cancer Institute have demonstrated the potential of neoantigen-specific T cell therapies in the case studies of two patients enrolled in an ongoing Phase 2 clinical trial that characterized tumor infiltrating lymphocytes. A case study published in Science in May 2014 discusses the results of treatment of one female patient with metastatic cholangiocarcinoma with expanded autologous tumor T cells specific towards a mutation in the gene Erbb2IP. In this case, a cell therapy was prepared containing a 95% pure population of CD4+ T cells targeting this specific Erbb2IP mutation. Treatment with this therapy was associated with tumor regression two months later, with a maximum tumor size reduction of 30% observed at seven months post-treatment and disease stabilization for 13 months. A case study published in The New England Journal of Medicine in December 2016 discusses the results of treatment of one female patient with colorectal cancer with CD8+ T cells targeting the G12D point mutation in the KRAS oncogene. Treatment with this T cell population was associated with tumor

8

regression 40 days later and disease control for nine months. In the case of this patient, the T cell therapy had no reported adverse effects and the patient was discharged from the hospital two weeks following therapy.

We believe that NEO-PTC-01’s T cell therapy approach has several key advantages that overcome the challenges of other cell therapy approaches, including:

• | T cell induction and amplification outside of the body: Using NEO-STIM, we can directly prime, activate and expand neoantigen-targeting T cells ex vivo. We believe that by performing these processes outside the body, we can avoid potential immunosuppression or inhibitory mechanisms in patients and optimize the phenotype and functionality of the neoantigen-targeting T cells. |

• | Generating multiple memory and de novo neoantigen responses: We aim to both expand existing memory T cell responses and prime de novo T cell responses from the naïve compartment that have not previously been observed in the patient. By expanding memory responses, we aim to increase the magnitude of pre-existing immune responses against neoantigens. By priming de novo responses, we believe we can educate the immune system to recognize a broader set of neoantigen targets, thereby strengthening the immune response. |

• | Broad utility across tumor types, including solid tumors: Neoantigens are present across both solid and hematological tumor types. As a result, we believe that neoantigen targets will provide the tumor specificity required to develop safe, effective and durable T cell therapies for the treatment of solid tumors. |

• | Potential impact in tumors with lower mutational burden: In tumors with lower mutational burden where checkpoint inhibitors are less likely to be efficacious, we believe it may be possible to treat these patients through expanded populations of functional T cells specific for the most therapeutically-relevant neoantigens. |

Preclinical Development

We are developing NEO-PTC-01 in collaboration with the Netherlands Cancer Institute, which is an academic research and treatment center with leading expertise in T cell biology and treatments. We presented preclinical data relating to NEO-PTC-01 at the Society of Immunotherapy of Cancer 2019 meeting, highlighting the proof of feasibility of our NEO-STIM induction protocol. Through these data, we demonstrated, reproducibly across multiple patient samples, the ability to generate multiple CD8+ and CD4+ T cell populations in each patient sample from the memory and naïve compartment. These T cells were highly functional and were specific for mutant neoantigens. In addition, these data showed that these cells were capable of in vitro cell killing and NEO-PTC-01-induced T cell cultures directly recognize autologous tumor sample material. We can now reproducibly generate these cell populations from patient material at a therapeutic manufacturing scale.

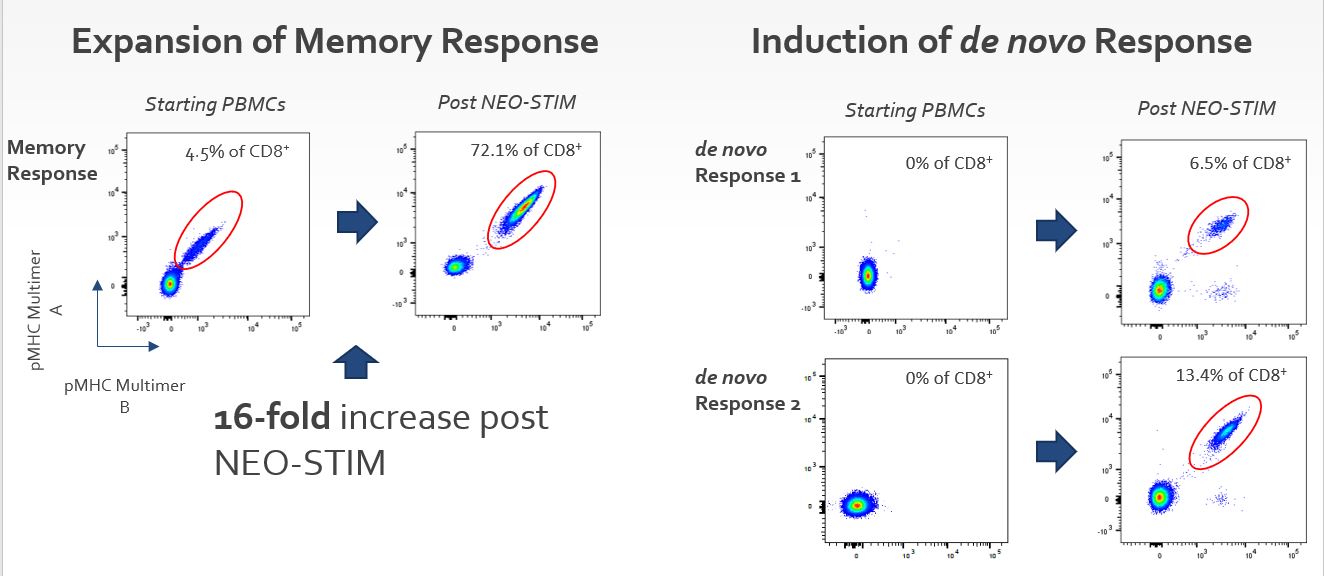

Our NEO-STIM induction protocol generates a polyclonal population of T cells. Once generated, we deeply characterize this cell product to understand the specificity and functionality of the induced cells. Data analyzed from a melanoma patient shows that NEO-STIM can induce CD8+ T cell responses towards patient-specific neoantigens in autologous patient peripheral blood mononuclear cells, or PBMCs. Specifically, in this patient, as the charts below and to the left illustrate, a pre-existing memory response was expanded 16-fold, from 4.5% of CD8+ T cells to 72.1% of CD8+ T cells being specific for the selected neoantigen. Additionally, as the charts below and to the right illustrate, we induced two CD8+ T cell responses from the naïve compartment, generating 6.5% and 13.4% of CD8+ T cells, respectively. Finally, in this patient, we induced three neoantigen specific CD4+ T cell responses as well.

9

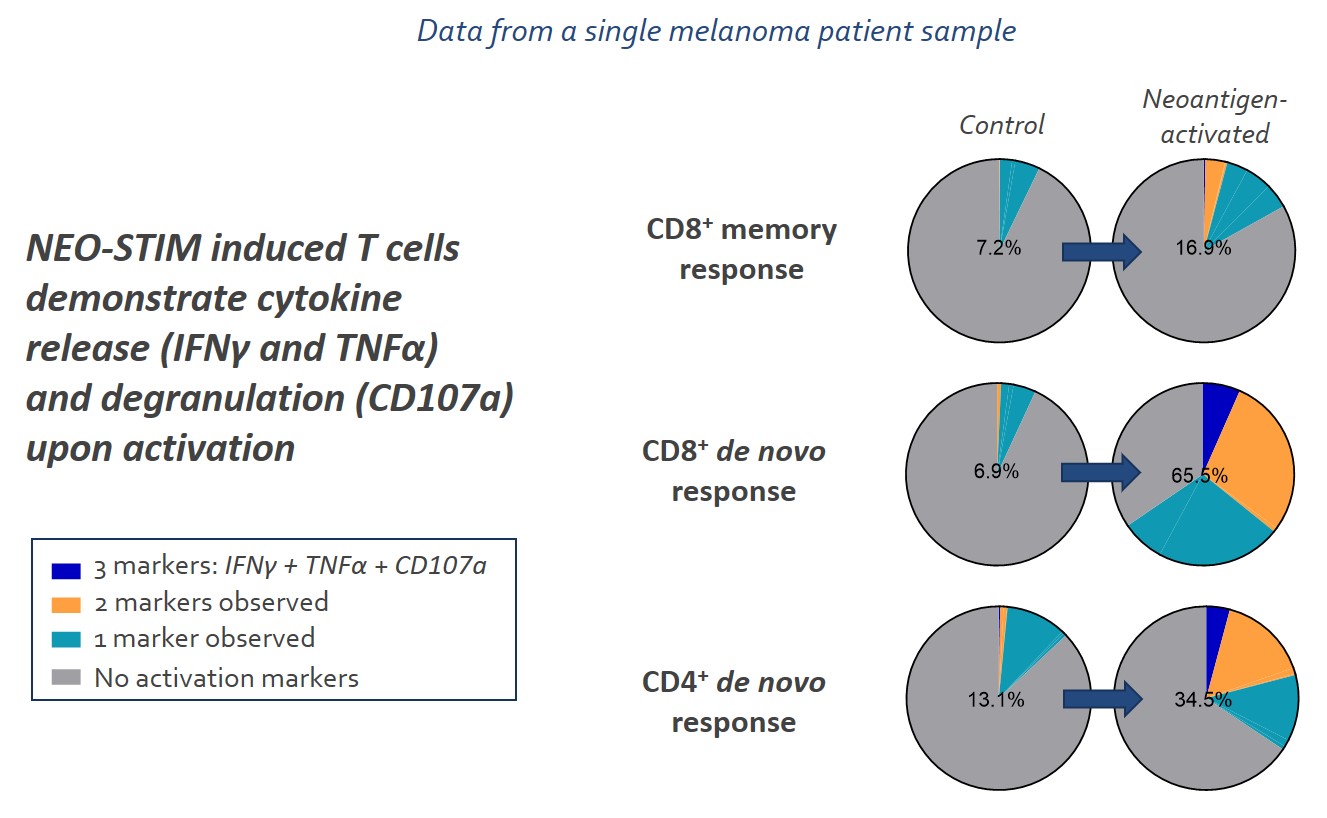

Since the infusion of polyfunctional T cells has been associated with better efficacy in vivo and long-term persistence (Appay et al., Nature Medicine, 2008), we characterized the induced CD8+ and CD4+ T cells in more detail for their functionality. As demonstrated in the charts below, upon re-challenge with mutant peptide loaded dendritic cells, neoantigen-specific T cells exhibited one, two and/or three of the following functions: IFNγ, TNFα or CD107a.

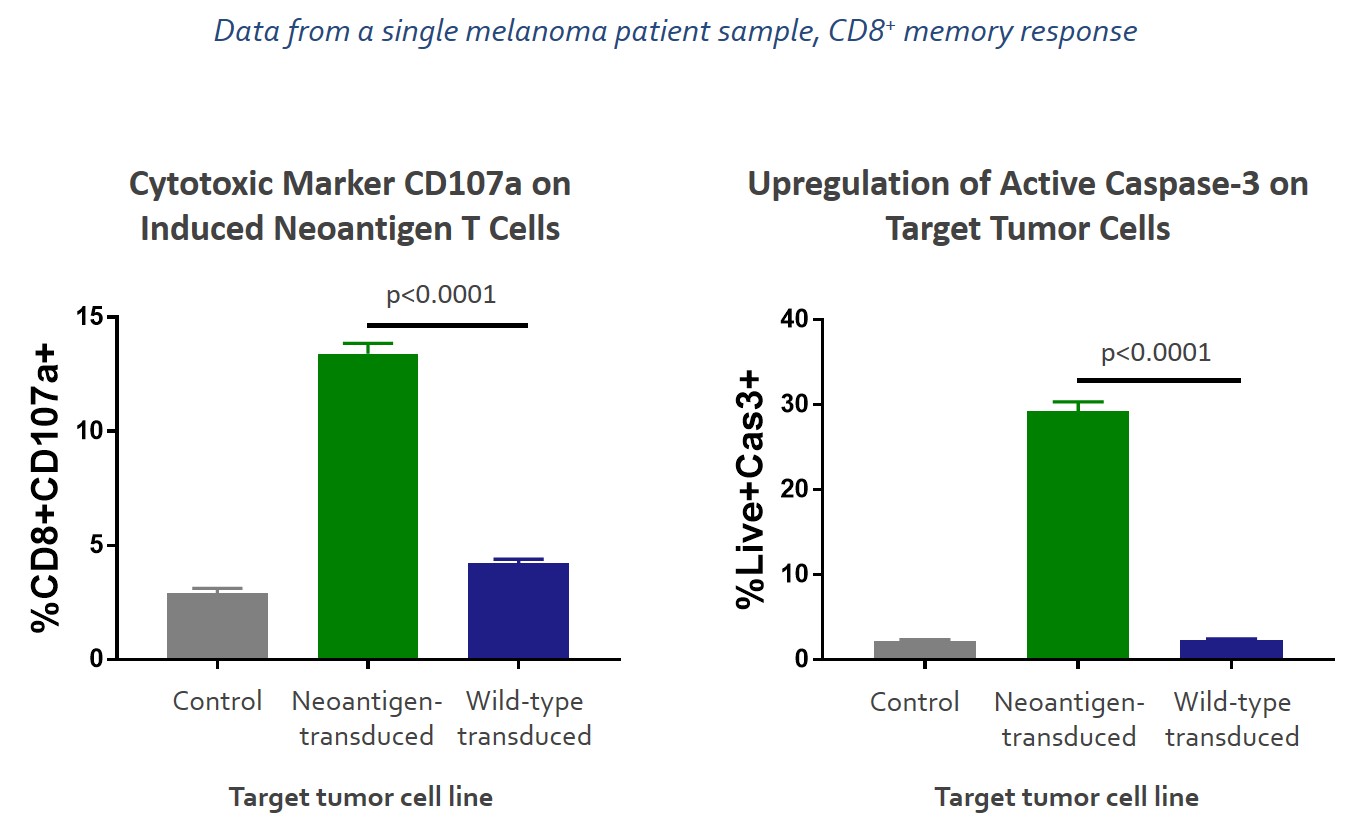

Finally, we set out to study the ability of the induced CD8+ T cells to kill tumor targets that process and present the neoantigen of interest. A375 tumor cell lines were stably transduced with the HLA restriction element, as well as the neoantigen of interest. Subsequently, and as demonstrated in the charts below, we performed a 6-hour co-culture with the induced T cells. We determined that the neoantigen specific CD8+ T cells upregulated CD107a and the tumor targets expressed active caspase 3 (an early apoptotic marker) upon co-culture.

10

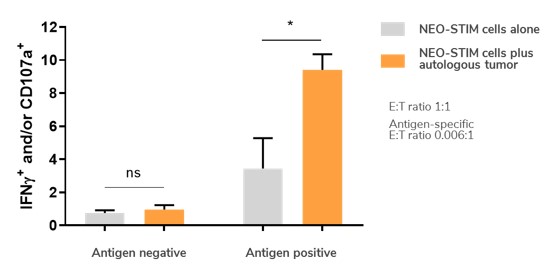

Additionally, we found that NEO-PTC-01-induced T cells can directly recognize autologous tumors as shown in the figure below.

Induced CD8+ T cells Recognize Autologous Tumors as Reflected by Induction of IFNy and/or CD107a+

In summary, our development activities confirm that the patient-specific neoantigens that were predicted through our RECON bioinformatics engine are immunogenic based on the induction of multiple neoantigen-specific CD8+ and CD4+ T cell responses. Further, the presence at the end of the NEO-STIM process of multiple enriched neoantigen-specific T cell populations (both memory and de novo) demonstrates our potential to generate new T cell responses and, as a result, cancer immunotherapies that may be effective to treat cancer patients.

Clinical Development Plan

We are focusing the initial clinical development of NEO-PTC-01 in solid tumors where we believe we can generate de novo neoantigen T cell populations ex vivo. We filed a CTA with the Dutch Health Authority in December 2019 to evaluate NEO-PTC-01 in a first-in-human clinical trial in patients that are refractory to checkpoint inhibitors. We plan to initiate a Phase 1 dose escalation clinical trial in patients with metastatic melanoma who are refractory to checkpoint inhibitors in collaboration with the Netherlands Cancer Institute in the third quarter of 2020. The primary objectives of this trial will be to evaluate the safety and feasibility of administering NEO-PTC-01 to patients. Additional objectives will be to evaluate immunogenicity and clinical efficacy. The second planned indication for NEO-PTC-01 is metastatic ovarian cancer.

Based on the data from the first exploratory trial, we will decide how to best proceed with further clinical development of NEO-PTC-01, including expanding to other tumor types and potential development in the United States.

Shared Neoantigen Approach

Overview

Our precision medicine approach to neoantigen-targeted therapy targets neoantigens shared across subsets of patients. While most neoantigen targets are specific to an individual patient's tumor, there are prevalent neoantigens that are shared across subsets of patients or tumor types, and these are known as shared neoantigens. We intend to develop multiple therapies directed towards these shared neoantigen targets using T cell therapies. We believe that our shared neoantigen approach could be complementary to our personal neoantigen therapies by providing readily available therapies that can be used in patients identified as having the relevant shared genetic mutation.

11

Shared Neoantigen Approach

Our shared neoantigen targets were identified using our bioinformatics capabilities, including RECON, to interrogate large genomic databases to discover a set of proprietary shared neoantigen targets across certain patient populations within major tumor types. This discovery work began under the direction of our founder, Nir Hacohen, at the Broad Institute, Inc., or the Broad, and continues today at Neon.

We are currently completing a comprehensive validation of our prevalent shared neoantigen targets using the following assessments:

• | Biochemical measurements leveraging mass spectrometry approaches enable us to rapidly evaluate whether shared mutations are processed and presented on common HLAs as targetable shared neoantigens. These approaches allow us to de-risk targets early in the validation process. |

• | Immunological experiments evaluate whether our shared neoantigen targets are immunogenic. We use our proprietary NEO-STIM induction process to generate neoantigen-specific T cells from which we can also isolate and sequence neoantigen-specific TCRs specific to these shared neoantigens. |

• | Functional biological assays demonstrate the ability of these neoantigen-specific T cells or neoantigen-specific TCRs to recognize and kill cancer cells expressing the relevant shared neoantigens. |

We have completed the validation of our first targets and plan to develop multiple adoptive T cell product candidates targeting different shared neoantigens. In addition, we continue to make significant progress with respect to TCR discovery and have assembled libraries of high-quality TCRs against various shared neoantigens across common HLAs. We plan to explore the potential development of our neoantigen-specific TCRs into multiple TCR-based T cell therapies, potentially in collaboration with external partners who would provide complementary technical capabilities.

NEO-STC-01: Adoptive T cell Therapy for RAS-mediated Cancers

NEO-STC-01 is a shared neoantigen adoptive T cell therapy that targets RAS mutations prevalent across many solid tumors. It is an autologous, non-engineered T cell product that leverages a premanufactured "target warehouse" for RAS driver mutations, to generate multiple CD8+ and CD4+ target-specific T cell populations for potent anti-tumor effect.

12

NEO-STC-01 Product Process

NEO-STC-01 uses a precision approach to treat a genetically defined patient population with poor prognosis, for whom there are currently no effective therapies. NEO-STC-01 will be able to address multiple HLA alleles, greatly increasing the addressable patient population. In contrast, engineered TCR T cell therapies are limited to a single HLA allele per TCR, therefore requiring multiple products to address RAS mutations in the general population. For example, based on RECON predictions, NEO-STC-01 can potentially address up to two thirds of all RAS-mutant PDAC patients versus <10% of patients when using a TCR-T cell therapy for a single HLA allele.

Our NEO-STIM technology is also used here as an inline manufacturing step, similar to NEO-PTC-01. NEO-STIM uses PBMCs as a starting material which are more accessible than TILs, which are used by other adoptive T cell therapies. Further, use of PBMCs as a starting material has been shown to produce an optimal T cell phenotype with the potential to drive persistence and tumor cell killing. NEO-STIM also generates T cell populations from both the memory and naïve T cell compartments, broadening the patient’s anti-tumor immune repertoire against the target RAS neoantigens. Additionally, since NEO-STC-01 targets known, common RAS neoantigens, we can pre-manufacture the peptides that feed into the manufacturing process for NEO-STC-01, which in turn helps to shorten the overall manufacturing time and allows patients to receive their treatments quicker.

NEO-STC-01 is currently in preclinical development and we have generated data that support mechanism of action and provide a strong rationale for further development. RAS mutant neo-epitopes in our RAS target warehouse have been extensively validated and T cell populations against them can be reproducibly induced in healthy donors. The induced T cells are cytotoxic and can kill patient-derived tumor cells at endogenous antigen levels. Process optimization will be ongoing in 2020 and learnings from NEO-PTC-01, Neon’s personal T cell therapy, are expected to help accelerate preclinical development of NEO-STC-01.

Manufacturing

We have invested in manufacturing capabilities to supply cGMP product for our clinical programs. Currently, we outsource our manufacturing to third parties. We own and control proprietary methods and intellectual property regarding peptide and cell manufacturing. As our development programs expand and we build new process efficiencies, we expect to continually evaluate this strategy with the objective of satisfying demand for registration trials and, if approved, the manufacture, sale and distribution of commercial products. We will be focusing on more efficient and scalable manufacturing, which we believe will lead to a commercially attractive cost of goods when operating at commercial scale.

We receive material from our contract manufacturing organizations, or CMOs, for preclinical testing. We receive clinical supply material manufactured in compliance with cGMP, and we conduct audits before and during the trial, in cooperation with a CMO, to ensure compliance with the mutually agreed process descriptions and cGMP regulations.

Our use of single-source suppliers of raw materials, components, key processes and finished goods exposes us to several risks, including disruptions in supply, price increases or late deliveries. As a result, we continually evaluate our supplier relationships.

Competition

The biotechnology and pharmaceutical industries, and the immunotherapy subsector in particular, are characterized by rapid evolution of technologies, fierce competition and strong defense of intellectual property. While we believe that our product candidates, discovery programs, technology, knowledge, experience and scientific resources provide us with competitive advantages, we face competition from major pharmaceutical and biotechnology companies, academic institutions, governmental agencies and public and private research institutions, among others.

13

Any product candidates that we successfully develop and commercialize will compete with currently approved therapies and new therapies that may become available in the future. Key product features that would affect our ability to effectively compete with other therapeutics include the efficacy, safety and convenience of our products.

Many of the companies against which we may compete have significantly greater financial resources and expertise than we do in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved products. In addition to fully-integrated biopharmaceutical companies and immunotherapy-focused oncology companies, we directly compete with a number of neoantigen T cell companies, including Achilles Therapeutics Limited, Adaptimmune Therapeutics plc, Adicet Bio, Inc., AgenTus Therapeutics, Inc., BioNTech SE, bluebird bio, Inc., Celgene Corporation, Genocea Biosciences, Inc., Gilead Sciences, Inc., Gritstone Oncology, Inc., Immatics Biotechnologies GmbH, IMV Inc., Iovance Biotherapeutics, Inc., Lion TCR Pte. Ltd., Marker Therapeutics, Inc., Medigene AG, Neogene Therapeutics, Inc., Nouscom AG, PACT Pharma, Inc., Regeneron Pharmaceuticals, Inc., Zelluna Immunotherapy AS and ZIOPHARM Oncology, Inc. Smaller or early-stage companies, including immunotherapy-focused and neoantigen-focused therapeutics companies, may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs.

The availability of reimbursement from government and other third-party payors will also significantly affect the pricing and competitiveness of our products. Our competitors also may obtain U.S. Food and Drug Administration, or FDA, or other regulatory approval for their products more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

Intellectual Property

Our success depends in part upon our ability to protect our core technology and intellectual property. To protect our intellectual property rights, we rely on patents, trademarks, copyrights and trade secret laws, confidentiality procedures, and employee disclosure and invention assignment agreements. Our intellectual property is critical to our business and we strive to protect it through a variety of approaches, including by obtaining and maintaining patent protection in the United States and internationally for our product candidates, novel biological discoveries, new targets and applications, and other inventions that are important to our business. For our product candidates, we generally intend to pursue patent protection covering compositions of matter, methods of making and methods of use, including formulations and combination therapies.

As we continue the development of our product candidates, we intend to identify additional means of obtaining patent protection that would potentially enhance commercial success, including through claims covering additional methods of use and biomarkers and complementary diagnostic and/or companion diagnostic related claims.

The patent positions of biotechnology companies like ours are generally uncertain and involve complex legal, scientific and factual questions. In addition, the coverage claimed in a patent application can be significantly reduced before the patent is issued and its scope can be reinterpreted after issuance. Consequently, we may not obtain or maintain adequate patent protection for any of our product candidates. As of December 31, 2019, our patent portfolio included at least two issued U.S. patents with claims directed to methods of preparing therapeutic compositions and methods of treating cancer, at least 41 pending U.S. provisional or non-provisional patent applications, at least 19 foreign patents with claims directed to methods of preparing therapeutic compositions and compositions of matter, and at least 159 pending foreign patent applications, which patents and patent applications we owned or exclusively licensed. The claims of these owned or in-licensed patents and patent applications are directed toward various aspects of our product candidates and research programs, including claims related to compositions of matter, methods of use, drug product formulations, combination therapies, methods of manufacture, manufacturing precursors and methods of identifying active compounds. These owned patent applications, if issued, are expected to expire between 2037 and 2040, and these in-licensed patents and patent applications, if issued, are expected to expire on various dates from 2031 through 2039, in each case without taking into account any possible patent term adjustments or extensions.

Within our patent portfolio, as of December 31, 2019, we had an exclusive license from the Dana-Farber Cancer Institute, or DFCI, the Broad, and The General Hospital Corporation d/b/a Massachusetts General Hospital, or MGH, pursuant to our amended license agreement with the Broad, or the Broad Agreement, to at least two issued U.S. patents, at least seven pending U.S. provisional or non-provisional patent applications, at least 13 foreign patents, and at least 77 pending foreign patent applications that include claims directed to NEO-PV-01, such as compositions of matter, combination therapies, formulations, manufacturing processes, manufacturing precursors or uses thereof. These in-licensed patents and patent applications, if issued, are expected to expire on various dates from 2031 through 2037, without taking into account any possible patent term adjustment or extensions.

Within our patent portfolio, as of December 31, 2019, we had exclusive licenses pursuant to the Broad Agreement and others to at least four pending U.S. provisional or U.S. non-provisional patent applications, at least 10 foreign patents, and at least five

14

pending foreign patent applications that include claims directed to NEO-PTC-01, such as compositions of matter, formulations, manufacturing processes, manufacturing precursors or uses thereof. These in-licensed patents and patent applications, if issued, are expected to expire on various dates from 2031 through 2040, in each case without taking into account any possible patent term adjustment or extensions.

Within our patent portfolio, as of December 31, 2019, we owned at least 10 pending U.S. provisional or U.S. non-provisional patent applications and at least 42 pending foreign patent applications, and had an exclusive license pursuant to the Broad Agreement, to at least one pending U.S. non-provisional patent application and at least 29 pending foreign patent applications that include claims directed to NEON / SELECT (including our NEO-SV-01 product candidate), such as compositions of matter, formulations, manufacturing processes, manufacturing precursors or uses thereof. These owned patent applications, if issued, are expected to expire between 2037 and 2039, and these in-licensed patent applications, if issued, are expected to expire in 2036, in each case without taking into account any possible patent term adjustment or extensions.

We also have agreements with Stichting Sanquin Bloedvoorziening, the Netherlands Cancer Institute, Oncovir and other third parties under which we have rights to certain intellectual property, such as patents or patent applications.

We cannot predict whether the patent applications we pursue will issue as patents in any particular jurisdiction or whether the claims of any issued patents will provide any proprietary protection from competitors. Even if our pending patent applications are granted as issued patents, those patents, as well as any patents we license from third parties now or in the future, may be challenged, circumvented or invalidated by third parties.

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the earliest date of filing of a non-provisional patent application. In the United States, the patent term of a patent that covers an FDA-approved drug or biologic may also be eligible for patent term extension, which permits patent term restoration as compensation for the patent term lost during FDA regulatory review process. The Hatch-Waxman Act permits a patent term extension of up to five years beyond the expiration of the patent. The length of the patent term extension is related to the length of time the drug or biologic is under regulatory review. Patent term extension cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval and only one patent applicable to an approved drug or biologic may be extended. Similar provisions are available in Europe and other foreign jurisdictions to extend the term of a patent that covers an approved drug or biologic. In the future, if our products receive FDA approval, we expect to apply for patent term extensions on patents covering those products. We plan to seek patent term extensions to any of our issued patents in any jurisdiction where these are available, however there is no guarantee that the applicable authorities, including FDA in the United States, will agree with our assessment of whether these extensions should be granted, and if granted, the length of these extensions.

In addition to our reliance on patent protection for our inventions, product candidates and research programs, we also rely on trade secret protection for our confidential and proprietary information. For example, significant elements of our products, including aspects of sample preparation, methods of manufacturing, cell culturing conditions, computational-biological algorithms and related processes and software, are based on unpatented trade secrets that are not publicly disclosed. Although we take steps to protect our proprietary information and trade secrets, including through contractual means with our employees and consultants, third parties may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets or disclose our technology. As a result, we may not be able to meaningfully protect our trade secrets. It is our policy to require our employees, consultants, outside scientific collaborators, sponsored researchers and other advisors to execute confidentiality agreements upon the commencement of employment or consulting relationships with us. These agreements provide that all confidential information concerning our business or financial affairs developed or made known to the individual or entity during the course of the party's relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees, the agreements provide that all inventions conceived of by the individual that are related to our current or planned business or research and development or are made during normal working hours on our premises or using our equipment or proprietary information are our exclusive property. In addition, we take other appropriate precautions, such as physical and technological security measures, to guard against misappropriation of our proprietary technology by third parties. We have also adopted policies and conduct training that provides guidance on our expectations and our advice for best practices in protecting our trade secrets.

License Agreement with the Broad Institute, Inc.

On November 13, 2015, we entered into the Broad Agreement with the Broad and, in January and November 2018, we entered into amendments to the Broad Agreement. Under the Broad Agreement, we have been granted an exclusive worldwide license to certain intellectual property rights owned or controlled by the Broad, DFCI and MGH to develop and commercialize any diagnostic, prognostic, preventative or therapeutic product for humans, including any neoantigen vaccine product. In particular, as of December 31, 2019, we have both exclusive and non-exclusive licenses to a patent portfolio comprised of 10 patent families, including certain granted patents and pending patent applications in the United States and foreign jurisdictions.

15

Pursuant to the terms of the Broad Agreement, we have also been granted (i) a non-exclusive license under each institution's respective interest in certain of its patent rights to exploit the licensed products in the field in the territory during the term of the license and (ii) a non-exclusive license under each institution's licensed know-how, to exploit any diagnostic, prognostic, preventative or therapeutic product in the field in the territory during the term of the license. We are also entitled to sublicense the rights granted to us under the Broad Agreement. In connection with the Broad Agreement, we have also entered into a non-exclusive software license with the Broad under which we license certain object and source codes for several software programs.

These licenses and rights are subject to certain limitations and retained rights, including field restrictions.

As consideration for the license, we paid the Broad a non-refundable license fee of $75,000. As additional consideration for the license, we must pay the Broad immaterial annual license maintenance fees and up to $12.6 million in developmental milestone payments and could be obligated to make up to $97.5 million in payments upon the achievement of specified sales milestones. We are also required to pay tiered royalties of low to mid single-digit percentages on net sales of products covered by the license, as well as between 10% to 30% of any consideration received by us from a sublicensee in consideration for a sublicense, which percentage is based on certain events set forth in the Broad Agreement. As partial consideration for the license, we reimbursed the Broad for $0.6 million of past patent expenses and issued 60,000 shares of our restricted common stock to each of the Broad, DFCI and MGH. We also agreed to reimburse the Broad for future patent expenses related to the in-licensed patents and patent applications. No development or commercial milestones have been achieved to date under the Broad Agreement. The royalty term will terminate on the later of (i) the expiration date of the last valid claim within the licensed patent rights and (ii) the 10th anniversary date of the first commercial sale of a product incorporating the licensed patent rights.

Either we, or the institutions party thereto, may terminate the Broad Agreement if the other party commits a material breach of the agreement and fails to cure that breach within 105 days (or 45 days in the case of our failure to make any payment or in the case of our breach of our diligence obligations) after written notice is provided, or, in the case of the Broad, upon our bankruptcy, insolvency, dissolution or winding up, or upon us bringing patent challenges relating to any patent families. In addition, we may terminate the Broad Agreement for convenience as it relates to certain patent families upon up to 120 days' prior written notice to the Broad. Upon expiration of the Broad Agreement, we will have a worldwide, perpetual, irrevocable, sublicensable license to the intellectual property previously covered by the Broad Agreement.

Government Regulation

Government authorities in the United States at the federal, state and local level and in other countries regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of drug and biological products. Generally, before a new drug or biologic can be marketed, considerable data demonstrating its quality, safety and efficacy must be obtained, organized into a format specific for each regulatory authority, submitted for review and approved by the regulatory authority.

U.S. Biological Product Development

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or FDCA, and its implementing regulations and biologics under the FDCA, the Public Health Service Act, or PHSA, and their implementing regulations. Both drugs and biologics are also subject to other federal, state and local statutes and regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state and local statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or post-market may subject an applicant to administrative or judicial sanctions. These sanctions could include, among other actions, the FDA's refusal to approve pending applications, withdrawal of an approval or license revocation, a clinical hold, untitled or warning letters, product recalls or market withdrawals, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement and civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.

Our product candidates must be approved by the FDA through a Biologics License Application, or BLA, process before they may be legally marketed in the United States. The process generally involves the following:

• | Completion of extensive preclinical studies in accordance with applicable regulations, including studies conducted in accordance with good laboratory practice, or GLP, requirements; |

• | Submission to the FDA of an investigational new drug, or IND, application, which must become effective before human clinical trials may begin; |

• | Approval by an institutional review board, or IRB, or independent ethics committee at each clinical trial site before each trial may be initiated; |

16

• | Performance of adequate and well-controlled human clinical trials in accordance with applicable IND regulations, good clinical practice, or GCP, requirements and other clinical trial-related regulations to establish the safety and efficacy of the investigational product for each proposed indication; |

• | Submission to the FDA of a BLA; |

• | A determination by the FDA within 60 days of its receipt of a BLA to accept the filing for review; |

• | Satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities where the biologic will be produced to assess compliance with cGMP requirements to assure that the facilities, methods and controls are adequate to preserve the biologic's identity, strength, quality and purity; |

• | Potential FDA audit of the clinical trial sites that generated the data in support of the BLA; and |

• | FDA review and approval of the BLA, including consideration of the views of any FDA advisory committee, prior to any commercial marketing or sale of the biologic in the United States. |

The preclinical and clinical testing and approval process requires substantial time, effort and financial resources, and we cannot be certain that any approvals for any of our product candidates will be granted on a timely basis, or at all.

Preclinical Studies and IND

Preclinical studies include laboratory evaluation of product chemistry and formulation, as well as in vitro and animal studies to assess the potential for adverse events and in some cases, to establish a rationale for therapeutic use. The conduct of preclinical studies is subject to federal regulations and requirements, including GLP regulations for safety/toxicology studies.

An IND sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and plans for clinical studies, among other things, to the FDA as part of an IND. An IND is a request for authorization from the FDA to administer an investigational product to humans, and must become effective before human clinical trials may begin. Some long-term preclinical testing may continue after the IND is submitted. An IND automatically becomes effective 30 days after receipt by the FDA unless, before that time, the FDA raises concerns or questions related to one or more proposed clinical trials and places the trial on clinical hold. In that case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. As a result, submission of an IND may not result in the FDA allowing clinical trials to commence.