Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KINGSWAY FINANCIAL SERVICES INC | exhibit9913220.htm |

| 8-K - 8-K - KINGSWAY FINANCIAL SERVICES INC | a8-k3220.htm |

Exhibit 99.2

KINGSWAY FINANCIAL SERVICES INC.

KINGSWAY FINANCIAL SERVICES INC.ANNUAL LETTER TO SHAREHOLDERS OF KINGSWAY FINANCIAL SERVICES INC.

March 2, 2020

Dear Fellow Shareholder,

This is my first letter to you as the CEO of Kingsway Financial Services Inc. (“Kingsway” or “Company). It is long overdue. I am happy to have our 2018 audit behind us, and I look forward to communicating updates on 2019 performance in the weeks to come. My goal going forward is to provide you with consistent, timely and relevant communications regarding matters of importance affecting our Company.

I have broken this first letter down into four sections. First, I have provided you with my candid view of our 2018 performance -- good and bad. I have also attempted to provide you with a view of that performance through the eyes of management (i.e., what our 2018 performance would look like after giving effect to the significant restructuring that we undertook during the 2018 fiscal year -- more on that below -- and adjusting for certain non-recurring and other items). To be clear, this view presents some non-GAAP measures as explained further in Appendix I, and my intent is that this view will provide a baseline against which to assess future performance. Second, I have provided you with some detail regarding the businesses that comprise our three operating segments: extended warranty, real estate, and asset management. Third, I have provided you with a breakdown of the Board’s and my priorities for our Company. These are the areas where I, and the rest of the management team, will be spending the bulk of our time in the pursuit of the goal of creating long-term value for our shareholders. And, finally, I have provided some closing thoughts regarding our Company.

I want to make clear that my remarks regarding historic financial and operating results below refer solely to the fiscal year ended December 31, 2018, so I urge you to take that into consideration when making any investment decision regarding any Kingsway securities. As you know, we have not yet filed quarterly or annual reports for any period after December 31, 2018. Also, please note that in places below I present some non-GAAP financial measures. For an explanation as to why I feel these are useful tools for assessing the Company’s financial performance please see Appendix I to this letter, where you will also find a reconciliation from the corresponding GAAP measures (as presented in our 2018 Annual Report) to the non-GAAP measures. Please note that the non-GAAP measures presented in this letter differ from those non-GAAP measures historically presented by the Company (adjusted operating (loss) income and EBITDA). Given the substantial changes to the Company's senior management team and sale of our non-standard auto (“NSA”) insurance business that took place in 2018, I believe the current non-GAAP measures provide management and investors a view into our ongoing business operations and are the metrics against which management will assess the Company's performance going forward.

Before I begin, I want to bring to your attention the issues behind the delay in reporting our 2018 results, which also caused the Company to restate its 2017 results. As explained more fully in Item 9A of our 2018 Annual Report filed on Form 10-K, several material weaknesses in our internal controls over financial reporting were discovered during the course of the 2018 audit. I want you to know that the Board, the Audit Committee, senior leadership and I take these findings very seriously and we are currently developing a plan of remediation to strengthen the effectiveness of the design and operation of our internal control environment. The continued integrity and timeliness of our financial reporting is of paramount importance.

*************

Exhibit 99.2

2018 TOTAL COMPANY PERFORMANCE

While we made substantial progress in our efforts to restructure the Company, 2018 was a very challenging year. It is clear that we have real work to do. We took a large charge on the sale of our NSA insurance business (after years of underwriting losses) and incurred transaction and transition expenses in the process. We incurred expenses related to our leadership changes and we incurred large unrealized losses in our passive investment portfolio. A rising interest rate environment increased our interest expense on our trust-preferred debentures. These headwinds were partially offset by growth in operating income in our extended warranty segment and gains on our sales of certain passive investments.

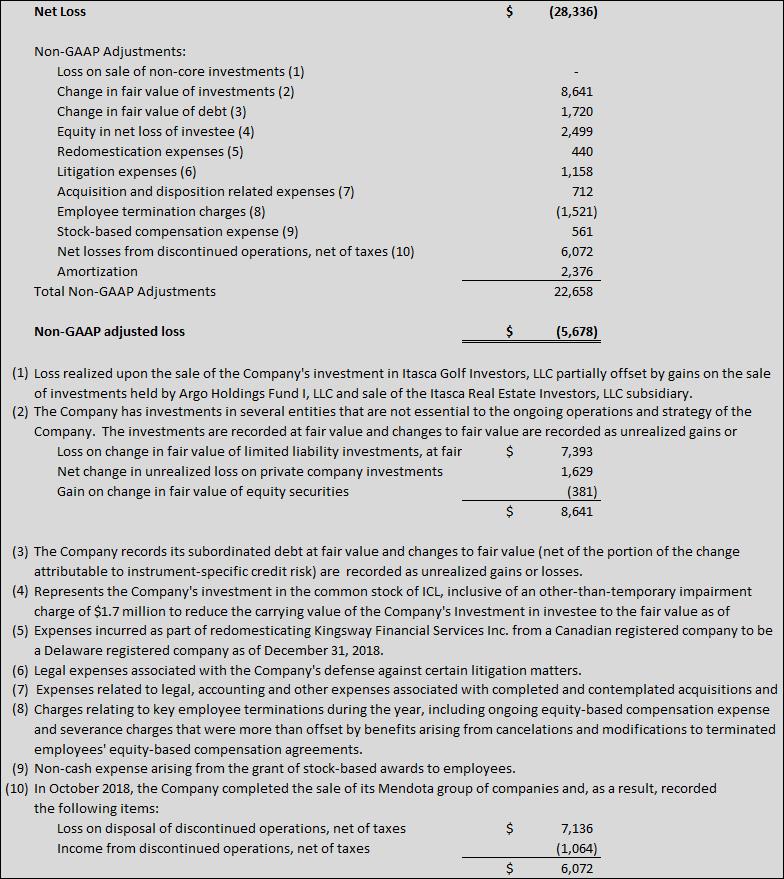

From a total company perspective, Kingsway’s net loss for 2018 was $28.3 million. We do not take these reported losses lightly, and the magnitude of the loss in 2018 is certainly worthy of serious attention. I would like to offer an explanation of some of the key items impacting net loss in 2018:

• | We recorded losses on the change in fair value of our passive investments of $8.6 million and our subordinated debt of $1.7 million; |

• | Our investment in the common stock of Itasca Capital Limited (“ICL”) resulted in $2.5 million of losses, inclusive of a $1.7 million other-than-temporary impairment charge; |

• | Expenses associated with our redomestication from Canada to the U.S., certain litigation matters, as well as acquisition and disposition related activity totaled $2.3 million; |

• | We had a net benefit as a result of our change in senior leadership of $1.5 million, primarily due to modifications made to a stock-based compensation agreement; |

• | We incurred stock-based compensation expense associated with current management of $0.6 million; |

• | We incurred losses associated with discontinued operations of $6.1 million and amortization expenses of $2.4 million; and |

• | We did realize a loss upon the sale of the Company's investment in Itasca Golf Investors, LLC, but this was essentially offset by gains on the sale of investments held by Argo Holdings Fund I, LLC and a gain on the sale of the Itasca Real Estate Investors, LLC subsidiary. |

After adjusting net loss for the items above, total Kingsway had a non-GAAP adjusted loss of $5.7 million.

It is this “steady state” view of our Company’s operating performance against which I feel future comparison should be made. For a detailed reconciliation of net loss to non-GAAP adjusted loss, as well as a detailed explanation as to why we believe non-GAAP adjusted earnings (loss) provides useful information about the Company’s operating results, refer to Appendix I.

Another measure we are highly focused on is cash flow. In spite of the previously described losses, for 2018 our Total Company cash flow from continuing operations was $11.2 million. This is comprised of cash used in operating activities of <$2.8 million>, cash provided by investing activities of $18.1 million, and cash used in financing activities of <$4.1 million>.

*************

Exhibit 99.2

2018 SEGMENT RESULTS

Extended Warranty

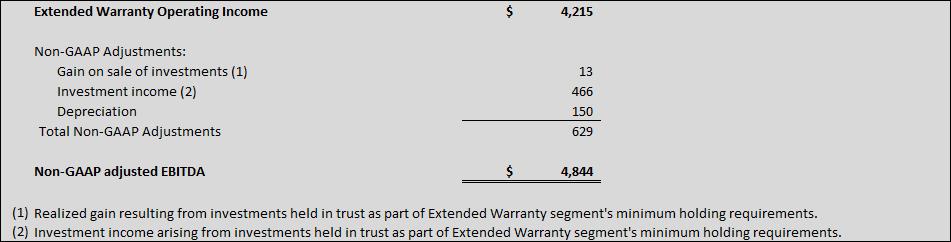

The Extended Warranty segment generated operating income of $4.2 million and non-GAAP adjusted EBITDA of $4.8 million in 2018. For a detailed reconciliation of segment operating income to non-GAAP adjusted EBITDA, refer to Appendix I.

Extended Warranty segment operating cash flow was $9.1 million in 2018. Note that operating cash flow includes a $1.3 million advance payment from a customer received late in 2018.

The 2018 results do not include the operating earnings of Geminus Holding Company, Inc. (“Geminus”), which we acquired in the first quarter of 2019 and expect to be immediately accretive. I look forward to providing more information on Geminus in the near term.

IWS Acquisition Corporation (“IWS”)

IWS, one of our vehicle service agreement (“VSA”) businesses, generated operating income of $2.0 million and operating cash flows of $4.9 million in 2018. Eric Wikander and the team at IWS continue to focus on further penetration of the credit union channel and growing our VSA’s in-force. We are happy to report that we added several new credit union partners (net) and the number of VSA’s funded during 2018 grew by 8.4%. There is continued room to grow this business, as credit unions currently hold over $1.4 trillion dollars of assets and have become an increasingly popular alternative to traditional banks. Nationally, total credit union memberships reached 118.8 million at year-end 2018, which is 36.2% of the total U.S. population of 328 million. In 2018 credit unions experienced growth of 5.1 million new members, the biggest annual increase in credit union history and four times the pace set a decade earlier. This membership surge is due in large part to the strong job market and rising credit demand.

New and used automobile loans comprise approximately one-third of credit union loan volume, and those car owners recognize the value of IWS’ protection products. Under Eric’s leadership, our focus will be on adding new distribution partners with continued penetration of the credit union channel. We are mindful of the risk of a retreat from the recent high levels of automobile sales nationally and the potential impact this could have on our growth plans going forward. That said, IWS has plenty of room to grow market share in its channel.

Trinity Warranty Solutions LLC (“Trinity”)

Trinity sells warranty products and provides maintenance support to consumers and businesses in the HVAC, standby generator, commercial LED lighting and refrigeration industries. Trinity distributes its warranty products through original equipment manufacturers, HVAC distributors and commercial and residential contractors. Trinity distributes its maintenance support directly through corporate owners of retail spaces throughout the United States.

Peter Dikeos and his team at Trinity made significant progress in 2018, generating operating income of $1.4 million and operating cash flows of $2.3 million, which includes a $1.3 million advance payment from a customer received late in 2018.

Trinity has 2 lines of business – its extended service agreement business (“ESA”) and its national accounts maintenance support business (“TNA”). Peter and the team will focus on growing the ESA business over the long term through additional channel development while continuing to delight customers with exceptional service in the TNA business.

Professional Warranty Service Corporation (“PWSC”)

PWSC sells new home warranty products and provides administration services to homebuilders and homeowners across the United States. PWSC distributes its products and services utilizing an in house sales team as well as insurance brokers and insurance carriers throughout all states except Alaska and Louisiana.

As a reminder, effective January 1, 2018, the Company adopted Accounting Standards Update 2014-09, Revenue from Contracts with Customers (“ASU 2014-09” or “ASC 606”). As a result, Kingsway recorded a cumulative effect adjustment of $0.6 million to increase deferred service fees, with an offsetting entry to accumulated deficit. While we

Exhibit 99.2

will be recognizing more revenue in future periods resulting from the amortization of this increase in deferred revenue, this increase is more than offset by the deferral of substantially more revenue under ASC 606 for new contracts than would have been deferred under previous guidance. In plain English, we are deferring substantially more revenue at the origination of our contracts under ASC 606 than we were under previous guidance, which delays when we recognize that revenue. While the impact on our other Extended Warranty businesses was minimal, the adoption of ASC 606 mainly affected PWSC due to the substantial increase in the percent of revenue deferred under ASC 606 and the life of its contracts (typically 10 years).

PWSC generated operating income of $0.8 million in 2018. However, the adoption of ASC 606 had no impact to cash flows. Operating cash flow was $1.9 million. We are very pleased with that result.

In early 2018 we recruited Tyler Gordy to PWSC. We promoted Tyler to the position of President in October of the same year. Tyler is the embodiment of the type of talent we are looking to bring into the Kingsway family. He is smart, honest, humble and gritty. When we first met, Tyler had recently graduated from Harvard Business School (“HBS”) and was pursuing his entrepreneurial dreams by searching for a business to acquire using the search fund model. His goals and our acquisition of PWSC were a good fit, and we were able to convince him to come to PWSC. We provided him a package of incentives that will allow him to participate meaningfully in the value he creates at the company.

Before HBS, Tyler had a decorated career in the US Army where he honed his leadership skills as the executive officer of a 300-man company in combat operations in Afghanistan. Tyler is a graduate of West Point and was selected as First Captain – the top cadet leadership position – during his senior year there.

Tyler’s magnetic leadership has allowed him to build a great new team at PWSC. With a revamped senior management group combined with aligned incentives, PWSC is well positioned for success!

Geminus Holding Company Inc. (“Geminus”)

On March 4, 2019 we announced the acquisition of Geminus and its wholly owned subsidiaries The Penn Warranty Corporation (“Penn”), Prime Auto Care Inc. (“Prime”), and Geminus Reinsurance Company, LTD. for $8.4 million. Headquartered in Wilkes-Barre, Pennsylvania, Geminus has been creating, marketing and administering VSAs and finance and insurance products on high-mileage used cars through its subsidiaries, Penn and Prime, since 1988. Penn and Prime distribute these products via independent used car dealerships and franchised car dealerships, respectively. We are delighted to have the Geminus team join the Kingsway family, and we look forward to building a great business together.

Real Estate

CMC Industries, Inc. (“CMC”)

CMC, through its subsidiaries, owns a large parcel of land in Texas that has been leased on a triple net basis to BNSF Railway Company (“BNSF”). We own 81% of the company, which is consolidated for accounting and tax purposes. The lease expires in 2034, by which time $112.0 million of the non-recourse debt owed by the company will have been paid down. In 2016, CMC amended the lease with BNSF. In exchange for an additional $25 million in lease payments (spread over the remaining 17 years of the lease), we provided BNSF an option to purchase the real property for $150 million. With a balloon of $68 million on the debt at lease expiration in 2034, we look forward to additional value being recognized on this operation.

2018 Real Estate Segment Operating Income was $2.5 million, inclusive of $0.7 million of legal expenses related to ongoing litigation at CMC1.

1Refer to Note 31 to the consolidated financial statements within our Annual Report on Form 10-K for the year ended December 31, 2018, for further information regarding the CMC litigation.

Exhibit 99.2

Asset Management

Argo Management Group LLC (“Argo”)

Argo is the manager of a small fund dedicated to investing in search funds and their target company acquisitions. As of this writing, the fund had investments in 17 active searchers and 10 operating companies. We believe that search funds are a compelling asset class and our experience and investment results have been strong. Additionally, managing the fund allows us access and exposure to a steady stream of exceedingly bright and entrepreneurial young managers. We view our exposure to the search fund universe as strategic to Kingsway.

*************

ORGANIZATIONAL PRIORITIES

We have a straightforward plan to improve our business and are organized around 3 priorities: focus on strategic capital allocation; execute; and attract, develop and retain world-class talent.

1. Focus on Strategic Capital Allocation

We no longer consider ourselves a ‘merchant bank’. We are a holding company exclusively focused on:

Growing our portfolio of cash flow positive operating companies

Our extended warranty businesses collectively generated $38.5 of revenue, $4.2 million of operating income (or $4.8 million of non-GAAP adjusted EBITDA), and $9.1 million of operating cash flow in 2018. With the acquisition of Geminus, beginning in 2019 we now have five warranty businesses with talented managers focused on delivering value to their customers while expanding top and bottom line performance over the long term. We will continue to look for new opportunities to grow both organically and through disciplined M&A.

Making structured investments to accelerate utilization of our deferred tax assets

Our acquisition of a controlling stake in CMC demonstrated a unique approach to leveraging our limited cash and sizeable deferred tax asset2 to make compelling investments in credit tenant triple-net lease real estate. We will actively seek similar investment opportunities going forward.

2As of December 31, 2018, we had a gross deferred tax asset of $188.3 million, before considering a valuation allowance of $171.5 million. Refer to Note 21 to the consolidated financial statements within our Annual Report on Form 10-K for the year ended December 31, 2018, for further information.

Exhibit 99.2

Monetizing our current portfolio of non-strategic passive investments

As consideration for our sale of our NSA business, we received a $22.9 million portfolio of passive investments consisting primarily of real estate, venture capital, and other equity and debt securities. We will attempt to maximize the tradeoff between liquidity and value received as we work to monetize these assets and redeploy the proceeds towards our strategy of acquiring and building cash flow generating operating companies.

Our Capital Allocation Philosophy | |||

Acquisitions:We target reasonable valuations for good businesses. We employ a 20% unlevered return on capital hurdle. Our view of a good business is one that generates enduringly high returns on net tangible capital. More specifically, businesses that satisfy many or most of these criteria: | |||

Industry Attributes | Company Attributes | ||

Growing | Recurring Revenue model | ||

Fragmented | High operating margins | ||

Non-cyclical | History of reliable and consistent profitability | ||

Low capital intensity | Low customer concentration | ||

Low or no regulatory regime | High returns on tangible capital | ||

Not overly technical or complex | Motivated seller | ||

Organic Investments: Our businesses are typically capital light, so capital reinvested in our existing operating businesses is generally low. That said, we have a focus on growing our pool of recurring revenue customers. We make investments in product development, sales, marketing and IT with a goal of growing the lifetime value of our customer base. We apply a minimum return on investment test to support our investment decisions. Debt issuance and repayment: We view debt as an important source of capital and will target using a manageable amount of leverage to support operating company acquisitions. We will then seek to repay debt using operating cash flow to enhance intrinsic value per share. Share repurchase and issuance: We currently have limited resources, which we need to devote to growing free cash flow from operations in order to cover structural holding company costs and our legacy capital structure. In the future, we would love to be acquirers of our stock if it trades meaningfully below our view of intrinsic value. | |||

2. Execute

We will champion a culture of execution and accountability. We believe that ‘well done’ is better than ‘well said’. Our people will focus on cutting non-strategic costs and eliminating waste, with the goal of reinvesting any savings in product development, sales, and marketing to enhance our competitive position and grow earnings and cash flow.

Alignment of business objectives, metrics, budgets and incentives around growth in intrinsic value.

Our business managers are measured and incented to grow profits and return on tangible capital. We have a robust process of zero-based budgeting and have deployed the Argo Business System to drive execution and a ‘cadence of accountability’ at our operating companies.

Decentralize

With the sale of our NSA business, we were afforded the opportunity to disentangle the holding company from the operations of the businesses we own. As you may know, the alluring call of consolidation ‘synergies’ is powerful and hard to avoid, yet many companies often fail to realize modeled synergies. Further, and perhaps more importantly, we believe that the prospect of autonomy and full responsibility attracts and motivates the best managers. As of this writing, we have 13 holding company staff composed of primarily accounting, tax, internal audit, investment, and legal personnel.

We view our role at the holding company as comprised of four disciplines:

• | We assist with audits, financial reporting and taxes. |

Exhibit 99.2

• | We provide risk management and controls. We institute internal controls and provide risk oversight in the areas of litigation management, insurance coverage and employment practices. Even with well-constructed incentives, autonomous operations require a tremendous amount of trust. Therefore, we set a few clear rules regarding behavior and controls and ensure their compliance. To quote a signature phrase by Ronald Reagan “Trust but verify.” |

• | We provide operating company oversight. We provide a ‘cadence of accountability’ to our operating companies on performance and metrics. We require our operating companies to adopt appropriate management tools, including Policy Deployment and Zero-based Budgeting. We offer additional ‘lean management’ and ‘value-selling’ operational tools and best practices but don’t mandate their adoption. We construct incentives and provide coaching and feedback to encourage our managers to think and behave like owners. |

• | We are capital allocators. It is our job to determine what we do with our cash. |

Our Operating Philosophy |

• We base our operational approach on continuous incremental improvement. The Japanese term is kaizen. In practice it means that we won’t settle for the status quo and we engage all of our employees to create solutions to improve our performance. • Our organization will be a meritocracy. We have designed a variable compensation plan based on individualized goals and performance reviews. In short, we reward our managers for a) getting results; b) with their team; c) while behaving the ‘right’ way. • We will create a sense of urgency -- a bias for action. As a great manager once said “if the rate of change on the outside exceeds the rate of change on the inside, the end is near.” • We seek to cut ‘non-strategic’ costs to the bone and redeploy these dollars to ‘strategic investments’ that will grow earnings and cash flow and enhance our competitive position. We expect to return any excess cash flow to the holding company as part of the capital allocation process. • We deploy tools like ‘Policy Deployment’ (hoshin kanri) and ‘Zero-based budgeting’ to drive a cadence of accountability for execution and results. • We focus on results. We are here to win – as measured by profitability! |

3. Attract, Develop and Retain World-Class Talent

• | Our goal is to build a ‘talent factory’ – a pipeline of brilliant, honest, industrious and entrepreneurial managers – who will support and grow our portfolio of operating businesses. |

• | We have those people in leadership positions at our warranty businesses, and we will look to expand our talent pool as we search for new acquisitions. |

Exhibit 99.2

Our People Philosophy |

We support mangers who possess what we refer to as the FIVE H’s: • Honesty – unimpeachable integrity; • Humility – personal awareness and the ability to know what they don’t know; • Hustle – high energy and a gritty willingness to seek and tackle challenges; • Hunger – motivated with a burning desire to succeed; and • Horsepower – strong intellect and a capacity to learn quickly. We then provide: • Accountability to living our core values and achieving established performance objectives (the right way); • Incentives to act like owners and opportunities to participate meaningfully in long-term value creation; and • An operating framework and set of business tools we call the Argo Business System. Informed by our many years investing in businesses acquired through the search fund model, we are perhaps less nervous than some in backing early-in-career managers in leadership positions and supporting them with our operating framework. |

**************

CONCLUDING THOUGHTS

We made significant changes to Kingsway’s strategy, asset portfolio, Board and management in 2018. We are grateful for your patience as we work to improve our Company.

Here is what has not changed:

We have a long-term perspective. By that, I mean we use a 20-year time horizon to guide our decision-making process in much the same way that a sole proprietor would. We use a long-term approach to investments and acquisitions, as well as incentive structures.

Our job is to compound intrinsic value per share. We are not focused on size -- generating more revenues or having more employees. We are focused on growing the value of the things we own (as measured by earnings and cash flow). We regard our equity capital as ‘precious’ – not to be wasted or treated carelessly.

We are aligned with our shareholders. As of this writing, the Board and management own approximately 47% of our current shares outstanding. We will continue to eat our own cooking.

As highlighted in this writing, we believe we have a concrete plan in place to grow the value of our Company over the long term. We look forward to demonstrating our progress to you in the future.

Respectfully,

John T. Fitzgerald

Shareholder, Director, President and CEO

************

This Annual Letter to Shareholders of Kingsway Financial Services Inc. (“Kingsway”) should be read in conjunction with Kingsway’s Annual Report on Form 10‐K for the fiscal year ended December 31, 2018, as filed with the Securities and Exchange Commission on February 27, 2020.

Forward-Looking Statements

Exhibit 99.2

This shareholder letter includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. Words such as “expects,” “believes,” “anticipates,” “intends,” “estimates,” “seeks” and variations and similar words and expressions are intended to identify such forward-looking statements. Such forward-looking statements relate to future events or future performance, but reflect Kingsway management’s current beliefs, based on information currently available. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the section entitled “Risk Factors” in Kingsway’s 2018 Annual Report on Form 10-K. Except as expressly required by applicable securities law, Kingsway disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Exhibit 99.2

APPENDIX I

TO

ANNUAL LETTER TO SHAREHOLDERS OF KINGSWAY FINANCIAL SERVICES INC.

TO

ANNUAL LETTER TO SHAREHOLDERS OF KINGSWAY FINANCIAL SERVICES INC.

The Company believes that non-GAAP adjusted earnings (loss) and non-GAAP adjusted EBITDA, when presented in conjunction with comparable GAAP measures, provide useful information about the Company’s operating results and enhances the overall ability to assess the Company’s financial performance. The Company uses non-GAAP adjusted earnings (loss) and non-GAAP adjusted EBITDA, together with other measures of performance under GAAP, to compare the relative performance of operations in planning, budgeting and reviewing the performance of its business. Non-GAAP adjusted earnings (loss) and non-GAAP adjusted EBITDA allow investors to make a more meaningful comparison between the Company’s core business operating results over different periods of time. The Company believes that non-GAAP adjusted earnings (loss) and non-GAAP adjusted EBITDA, when viewed with the Company’s results under GAAP and the accompanying reconciliations, provide useful information about the Company’s business without regard to potential distortions. By eliminating potential differences in results of operations between periods caused by the factors listed below, the Company believes that non-GAAP adjusted earnings (loss) and non-GAAP adjusted EBITDA can provide useful additional basis for comparing the current performance of the underlying operations being evaluated.

The Company utilizes non-GAAP adjusted earnings (loss) to evaluate Kingsway Financial Services Inc. at the total consolidated company level for the reasons explained above. The following is an explanation of the items excluded from non-GAAP adjusted earnings (loss) but included in net loss:

• | Adjustments relating to realized and unrealized gains and losses. The Company excludes the following realized and non-cash unrealized gains and losses: |

◦ | Loss on sale of non-core investments; Change in fair value of investments. As fully explained in its 2018 Annual Report on Form 10-K filed on February 27, 2020, the Company holds investments in several businesses that are not essential to the Company’s strategy in the extended warranty, asset management or real estate industries. These investments arose as a result of decisions made by prior management and the Company intends to monetize these investments in the most beneficial manner in order to redirect the capital into its ongoing business operations. Until such time that the investments can be monetized, the Company will continue to record realized and non-cash unrealized gains and losses. Accordingly, the Company believes that excluding these items assist management and investors in making period-to-period comparisons of operating performance. Investors should note that these items will recur in future periods until such time that the investments are fully monetized. |

◦ | Change in fair value of debt. The Company records its subordinated debt at fair value and changes to fair value (net of the portion of the change attributable to instrument-specific credit risk) are recorded as unrealized gains or losses. The change in fair value of debt will vary from period-to-period based upon specific market conditions at the time the valuation is performed. As such, the Company has excluded this item because (i) it is not directly attributable to the performance of the Company’s business operations and, accordingly, their exclusion assists management and investors in making period-to-period comparisons of operating performance and (ii) to assist management and investors in making comparisons to companies with different capital structures. Investors should note that the change in fair value of debt will recur in future periods, so long as the Company continues to hold the subordinated debt. |

• | Equity in net loss of investee. Represents the Company’s holding in Itasca Capital Limited (“ICL”) common stock. Given the Company owns more than 20% of the outstanding common stock of ICL, the Company accounts for its investment under the equity method of accounting. This requires the Company to record its portion of ICL’s net income or loss into the Company’s statement of operations every quarter. The Company is also required to review its investment on a regular basis for indicators of impairment and record impairment charges should its assessment find that its investment is other- |

Exhibit 99.2

than-temporarily impaired. Because this item is not directly attributable to the performance of the Company’s business operations it has been excluded from non-GAAP adjusted earnings (loss) in order to assist management and investors in making period-to-period comparisons of operating performance. The Company fully disposed of its investment in ICL during the fourth quarter of 2019.

• | Stock-Based Compensation Expense. Stock-based compensation expense is a non-cash expense arising from the grant of stock-based awards to employees. The Company believes that excluding the effect of stock-based compensation from non-GAAP adjusted earnings (loss) assists management and investors in making period-to-period comparisons in the Company’s operating performance because (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of its business operations and (ii) such expenses can vary significantly between periods as a result of the timing of grants of new stock-based awards. Additionally, the Company believes that excluding stock-based compensation from non-GAAP adjusted earnings (loss) assists management and investors in making meaningful comparisons between the Company’s operating performance and the operating performance of other companies that may use different forms of employee compensation or different valuation methodologies for their stock-based compensation. Investors should note that stock-based compensation is a key incentive offered to employees whose efforts contributed to the operating results in the periods presented and are expected to contribute to operating results in future periods. Investors should also note that such expenses will recur in the future. |

• | Discontinued operations related items. The Company recorded income from discontinued operations, net of taxes and loss on disposal of discontinued operations, net of taxes primarily due to the sale of the Mendota group of companies in 2018. As these items are not directly attributable to the performance of the Company’s ongoing business operations, their exclusion assists management and investors in making period-to-period comparisons of operating performance. |

• | Amortization. Amortization expense is a non-cash expense relating to intangible assets arising from acquisitions that are expensed over the estimated useful life of the related assets. The Company excludes amortization expense from non-GAAP adjusted earnings (loss) because it believes that (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of its business operations and (ii) such expenses can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired tangible and intangible assets. Accordingly, the Company believes that this exclusion assists management and investors in making period-to-period comparisons of operating performance. Investors should note that the use of intangible assets contributed to revenue in the periods presented and will contribute to future revenue generation and should also note that such expense will recur in future periods. |

• | Other Items. The Company engages in other activities and transactions that can impact its net loss. In recent periods, these other items included, but were not limited to: (i) employee termination charges; (ii) redomestication expenses; (iii) certain litigation expenses; and (iv) acquisition and disposition related expenses. The Company excludes these other items from non-GAAP adjusted earnings (loss) because it believes these activities or transactions are not directly attributable to the performance of its business operations and, accordingly, their exclusion assists management and investors in making period-to-period comparisons of operating performance. Investors should note that some of these other items may recur in future periods. |

The Company utilizes non-GAAP adjusted EBITDA to evaluate its Extended Warranty reportable segment for the reasons explained above. The Company notes that the exclusions from non-GAAP adjusted earnings (loss) explained above are not applicable to its Extended Warranty reportable segment as those items are not recorded into the Extended Warranty reportable segment operating income. The following is an explanation of the adjustments made to Extended Warranty reportable segment operating income in order to arrive at non-GAAP adjusted EBITDA:

• | Gain on sale of investments; investment income. Part of the Extended Warranty reportable segment operations is required to hold investments in trust in order to sell its products. As such, those investments generate ongoing income as well as gains and losses (realized and unrealized). However, these items |

Exhibit 99.2

are not recorded as part of the Extended Warranty reportable segment operating income. Given these items are directly attributable to the performance of the Company’s business operations, they are included in non-GAAP adjusted EBITDA.

• | Depreciation. Depreciation expense is a non-cash expense relating to capital expenditures that are expensed on a straight-line basis over the estimated useful life of the related assets. The Company excludes depreciation from non-GAAP adjusted EBITDA because it believes that the amount of such expenses in any specific period may not directly correlate to the underlying performance of its business operations. Accordingly, the Company believes that this exclusion assists management and investors in making period-to-period comparisons of operating performance. Investors should note that the use of tangible assets contributed to revenue in the periods presented and will contribute to future revenue generation and should also note that such expense will recur in future periods. |

Exhibit 99.2

Kingsway Financial Services Inc.

Reconciliation of Net Loss to Non-GAAP Adjusted Loss

For the Twelve Months Ended December 31, 2018

(in thousands)

(UNAUDITED)

Exhibit 99.2

Kingsway Financial Services Inc.

Reconciliation of Extended Warranty Segment Operating Income to Non-GAAP Adjusted EBITDA

For the Twelve Months Ended December 31, 2018

(in thousands)

(UNAUDITED)