Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTERSPACE | form8-kandinvestorpres.htm |

Raymond James Institutional Investor Conference Orlando, Florida March 1-4, 2020

SAFE HARBOR STATEMENT AND LEGAL DISCLOSURE Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from expected results. These statements may be identified by our use of words such as “expects,” “plans,” “estimates,” “anticipates,” “projects,” “intends,” “believes,” and similar expressions that do not relate to historical matters. Such risks, uncertainties, and other factors include, but are not limited to, changes in general and local economic and real estate market conditions, rental conditions in our markets, fluctuations in interest rates, the effect of government regulations, the availability and cost of capital and other financing risks, risks associated with our value-add and redevelopment opportunities, the failure of our property acquisition and disposition activities to achieve expected results, competition in our markets, our ability to attract and retain skilled personnel, our ability to maintain our tax status as a real estate investment trust (REIT), and those risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” contained in our Form 10-K for the period ended December 31, 2019. We assume no obligation to update or supplement forward-looking statements that become untrue due to subsequent events. www.iretapartments.com 2

COMPANY SNAPSHOT PORTFOLIO SUMMARY Increased exposure to target Differentiated markets in Minneapolis and ▪ Founded in 1970 Markets Denver through disciplined ▪ Apartment owner/operator with 11,953 homes capital recycling in differentiated markets ▪ Publicly traded since 1997 Enhanced operating Internal Growth platform opportunities to ▪ (1) Total capitalization of $1.7 billion Opportunity spur organic growth with minimal capital requirement ▪ Added to the S&P SmallCap 600 Index in 2020 PERCENT OF PRO FORMA 2020 NOI BY STATE Value-Add Deep pipeline of value-add opportunities in our current portfolio Minot Opportunity Grand Forks 5% 20% Billings Bismarck 49% St. Cloud Strong balance sheet with Minneapolis sufficient liquidity to 3% Rochester Increased Rapid City Flexibility capitalize on future opportunities 8% Omaha Lincoln Denver Dynamic and experienced Experienced management team and 15% board of trustees with an Leadership owner mentality and sound strategic plan (1) See page 11 for breakdown www.iretapartments.com 3

PORTFOLIO OVERVIEW % of Pro Avg. Rev Region Forma 2020 Homes per Home NOI Minot Grand Forks Minneapolis, MN 26% 2,355 $1,682 Billings Bismarck St. Cloud Denver, CO 15% 992 $1,986 Rapid Minneapolis City Rochester Rochester, MN 15% 1,711 $1,325 Omaha Grand Forks, ND 9% 1,555 $994 Denver Omaha, NE 8% 1,370 $1,027 St. Cloud, MN 8% 1,190 $1,093 Bismarck, ND 6% 845 $1,131 Billings, MT 5% 749 $1,025 Minot, ND 4% 712 $1,063 Rapid City, SD 3% 474 $1,050 Total / Average(1) 100% 11,953 $1,397 State Fiscal Health Rank (1) Total average revenue shown is calculated by weighting each Above Below region’s average revenue by that regions percentage of total pro Size of the circle Top 5 Average Bottom 5 Average Average forma NOI represents approximate proportion of total pro forma NOI Source: Mercatus % of NOI by Market - Pro Forma 2020 vs 2017 30% 25% 20% 15% 10% 5% 0% Minneapolis Denver Rochester Grand Forks St Cloud Omaha Bismarck Billings Minot Rapid City Topeka Sioux Falls Williston Pro Forma 2017 www.iretapartments.com 4

2019 HIGHLIGHTS (1) Acquisition/Disposition Activity Core FFO per Share ▪ Acquired three new properties in our core markets for an 4Q19 vs 4Q18 2019 vs 2018 aggregate purchase price of $169.3 million $0.96 ▪ Lugano at Cherry Creek, a 328-home community in $3.72 Denver, CO ▪ FreightYard Townhomes and Flats, a 96-home community in Minneapolis, MN $0.92 ▪ SouthFork Townhomes, a 272-home community in $3.41 Lakeville, MN ▪ Sold 21 communities for $203.1 million, including our entire Topeka, KS, Sioux Falls, SD and Sioux City, IA portfolios 2018 2019 2018 2019 Capital Markets Activity Same-Store Operating Results ▪ Completed our inaugural unsecured private placement debt financing, issuing $125.0 million of senior notes with a YoY Growth YoY Growth 4Q19 vs 4Q18 2019 vs 2018 blended 3.78% interest rate and 9.6 average years to maturity Revenues 2.8% 3.7% Controllable ▪ Filed $150.0 million at-the-market equity distribution 8.0% 1.8% program (ATM) with $22 million issued in Q4, our first Expenses Non-Controllable common stock issuance since 2013. Cash proceeds will be 3.1% 8.1% used to achieve our goals of per share metrics, improving Expenses markets, and maintaining a strong balance sheet Total Expenses 6.4% 3.8% (1) Reconciliation for non-GAAP measures is provided in the appendix NOI 0.2% 3.6% www.iretapartments.com 5

STRONG OPERATING RESULTS Our plan is producing consistent growth YoY Same-Store NOI % Growth Trailing 3 Months 10.0% 9.0% 8.7% 8.0% 7.0% 6.4% 6.0% 5.8% 5.3% 5.0% 4.7% 4.6% 4.0% 2.8% 3.0% 2.6% 2.0% 1.0% 0.2% 0.0% 1/31/2018 4/30/2018 7/31/2018 10/31/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 12/31/2019 IRET Multifamily Peer Average Growth rate comparisons are made based on most comparable calendar quarter to IRET’s previous fiscal quarter schedule Multifamily peer average is simple average of AIV, AVB, BRG, CPT, EQR, ESS, IRT, MAA, NXRT, UDR IRET converted to a December 31 fiscal year-end as of December 31, 2018 www.iretapartments.com 6

OPERATIONAL AND MARGIN-ENHANCING INITIATIVES Focusing efforts to harvest organic growth from operational enhancements and margin-enhancing initiatives ▪ “Rise By 5” margin expansion program targets key 60% 59% 61% opportunities to sustainably increase cash flow, including: 58% 62% ▪ Revenue optimization ($2.7+ million in run-rate revenue realized to date) 57% 63% 5% increase ▪ Lease-end management to reduce average days vacant in SS 56% operating 64% ▪ Value-add program margin ▪ Technology solutions for leasing, work orders and 55% 65% inspections ▪ Improved processes and training ▪ Procurement and vendor management driving expense savings Average Monthly Revenue / Home Revenue Optimization Progress Includes rent and other income Initial 2019 vs 2017 Revenue Optimization Initiative Implementation Fin. Impact $1,869 Implement lease administration fee February 2018 $470,000 Review pet fees, rent and deposits October 2017 $510,000 $1,169 $992 Utility Billing Fees May 2018 $60,000 Review of RUBS May 2019 $1,540,000 Renter's Insurance May 2019 $170,000 Lead to Lease Technology Initiatives May 2019 2,500 Hours Saved Apr-18 Current Current Non- Same-Store Same-Store Same-Store Total Incremental Annual Revenue to Date $2,750,000 Pool Pool Pool www.iretapartments.com 7

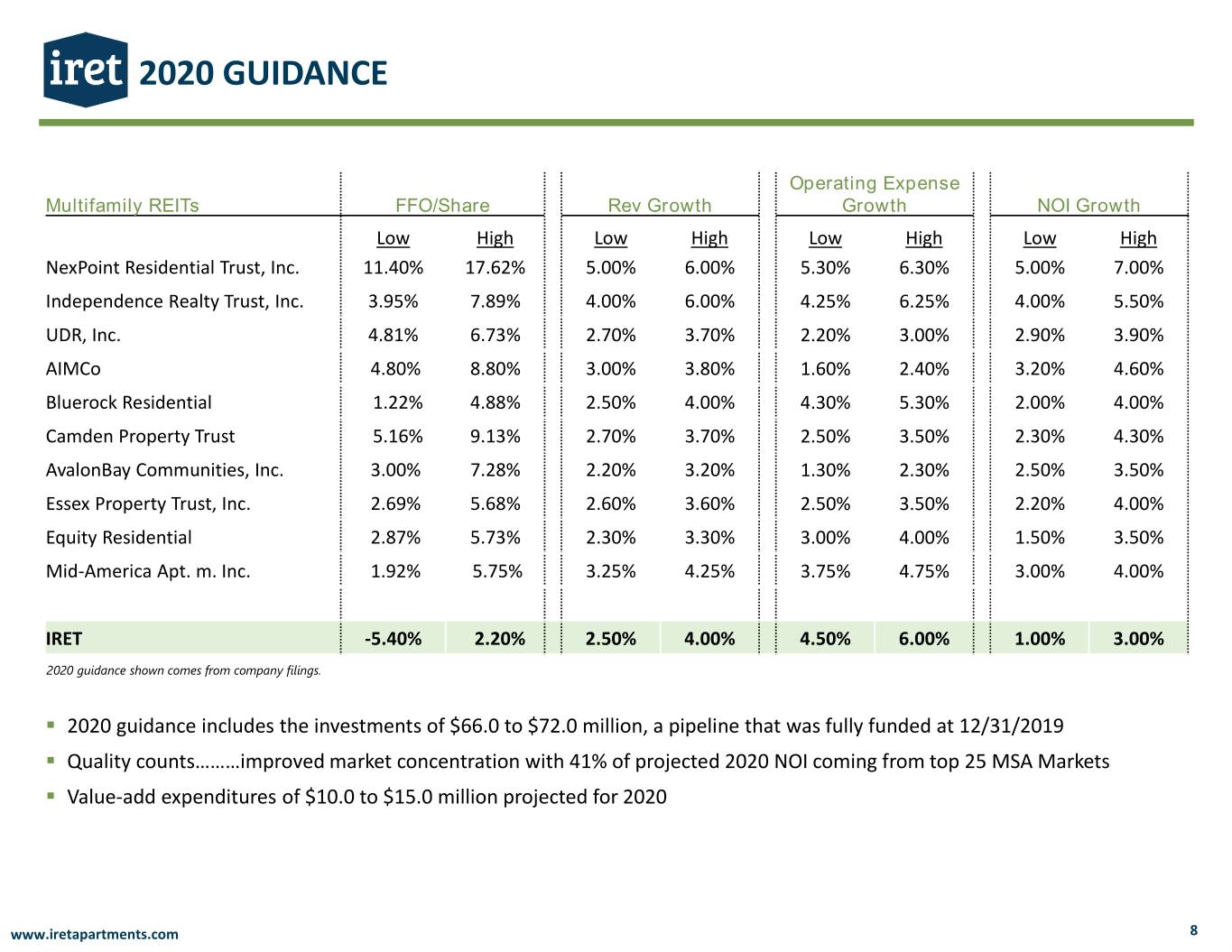

2020 GUIDANCE Operating Expense Multifamily REITs FFO/Share Rev Growth Growth NOI Growth Low High Low High Low High Low High NexPoint Residential Trust, Inc. 11.40% 17.62% 5.00% 6.00% 5.30% 6.30% 5.00% 7.00% Independence Realty Trust, Inc. 3.95% 7.89% 4.00% 6.00% 4.25% 6.25% 4.00% 5.50% UDR, Inc. 4.81% 6.73% 2.70% 3.70% 2.20% 3.00% 2.90% 3.90% AIMCo 4.80% 8.80% 3.00% 3.80% 1.60% 2.40% 3.20% 4.60% Bluerock Residential 1.22% 4.88% 2.50% 4.00% 4.30% 5.30% 2.00% 4.00% Camden Property Trust 5.16% 9.13% 2.70% 3.70% 2.50% 3.50% 2.30% 4.30% AvalonBay Communities, Inc. 3.00% 7.28% 2.20% 3.20% 1.30% 2.30% 2.50% 3.50% Essex Property Trust, Inc. 2.69% 5.68% 2.60% 3.60% 2.50% 3.50% 2.20% 4.00% Equity Residential 2.87% 5.73% 2.30% 3.30% 3.00% 4.00% 1.50% 3.50% Mid-America Apt. m. Inc. 1.92% 5.75% 3.25% 4.25% 3.75% 4.75% 3.00% 4.00% IRET -5.40% 2.20% 2.50% 4.00% 4.50% 6.00% 1.00% 3.00% 2020 guidance shown comes from company filings. ▪ 2020 guidance includes the investments of $66.0 to $72.0 million, a pipeline that was fully funded at 12/31/2019 ▪ Quality counts………improved market concentration with 41% of projected 2020 NOI coming from top 25 MSA Markets ▪ Value-add expenditures of $10.0 to $15.0 million projected for 2020 www.iretapartments.com 8

VALUE-ADD OPPORTUNITY Highlights ▪ Currently, we have approved $40.9 million of value-add projects in about a third of the homes in our portfolio ▪ Expected investment of $10.0 - $15.0 million in 2020 Duration of Estimated Estimated Region Projects Cost ROI1 Minneapolis, MN 1.0 – 4.0 $21,500,000 16% - 18% Omaha, NE 1.0 – 3.0 $14,200,000 15% - 17% Rochester, MN 1.0 – 2.0 $1,800,000 12% - 14% St. Cloud, MN 2.5 $2,400,000 15% - 17% Multi-Region 1.0 $1,000,000 22% - 26% Initiatives2 Total Approved Pipeline $40,900,000 15% - 18% 1 Estimated ROI includes any expected vacancy loss and only includes return on invested capital of project and does not include any rent increase due to normal year-over-year market rent increase 2 Initiatives include Laundry Coin to Card Conversion, In-Unit Laundry Conversion, and LED Retrofit www.iretapartments.com 9

CAPITAL RECYCLING Significantly improved the quality of our portfolio since 2017 We focus our energy and capital on Portfolio quality has improved since 2017 improving 3 Long-Term Metrics FY2017 Today NOI Margin NOI Margin 55.3% 58.3% Portfolio Quality Communities Communities 92 69 Homes per Property Homes per Property NAV per Distributable Share Cash Growth 144 173 Apartment Buildings Apartment Buildings 696 486 Over the past 2 years, our capital recycling program has enhanced our multifamily portfolio by improving: NOI per FTE NOI per FTE ▪ The quality of our portfolio as evidenced by the increased $216k $270k concentration in Top-25 MSAs. ▪ Core FFO per share % of NOI in % of NOI in Top-25 MSA Top-25 MSA ▪ Management calculated NAV per share 13% 41% www.iretapartments.com 10

DECEMBER 31, 2019 CAPITAL STRUCTURE A strong and flexible balance sheet allows us to execute our investment and operational strategies $ in thousands, except where noted $1.7B Total Capitalization % of Weighted Weighted Debt Summary Amount Total Avg. Rate Avg. Maturity Debt Summary $954M $651M Total Secured Debt 331,376 51% 4.02% 5.8 Years Common Total Debt Total Unsecured Debt 320,079 49% 3.93% 6.3 Years Equity* Secured Debt Line of Credit(1) 50,079 8% 3.54% 2.7 Years 19% Term Loans 145,000 22% 4.19% 4.9 Years Private Placement 125,000 19% 3.78% 9.3 Years Unsecured Debt Total Debt 651,455 100% 3.97% 6.0 Years Common 19% Equity Fixed Rate 651,376 99.9% 3.97% 6.0 Years 55% Series C Preferred Variable Rate 79 .01% 3.84% 0.3 Years 6% $120M Preferred (1) LOC commitments total $250M Equity Series D *Share price $72.50 as of 12/31/2019 Preferred 1% $108,689 Unsecured Debt $84,449 $75,000 Secured Debt $70,000 Term Loan $59,900 $55,023 $54,459 LOC $48,226 $50,000 $36,097 Private Placement Term Loan Private $9,611 Placement $0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 % of Total Maturing 1.5% 5.5% 13.0% 7.4% 10.7% 16.7% 8.4% 8.4% 7.7% 11.5% 0.0% 9.2% Weighted Average Interest Rate 4.84% 5.36% 3.81% 4.02% 3.68% 4.36% 3.74% 3.47% 3.69% 3.84% 3.88% www.iretapartments.com 11

RECENT ACQUISITIONS SouthFork Lugano at FreightYard Townhomes Cherry Creek Townhomes and Flats Minneapolis, MN Denver, CO Minneapolis, MN $44.0 million $99.3 million $26.0 million ▪ A 272‐unit community built in 1988 & 1990 ▪ 328 homes and 13,262 square feet of retail ▪ Unique 96-home community located in the on 14.2 acres of land built in 2010 North Loop area of Minneapolis ▪ Approximately 38% of the purchase price was paid in Series D Preferred Operating ▪ Centrally located within the Denver metro ▪ Adaptive re-use of a brick and timber freight Partnership Units, which yield 3.9% and are area house that was refurbished in 2018 and convertible to common shares at $72.50 per 2019 share ▪ Fully amenitized clubhouse, outdoor swimming pool, fitness center, and ▪ One and two-bedroom townhouses and ▪ Opportunity to improve resident experience structured parking apartment units feature high ceilings and and optimize revenue exposed brick and timber ▪ Granite countertops, large cabinets, nine- ▪ Potential for future value-add in unit foot ceilings, walk-in closets, full-sized ▪ Located in one of the best urban washer/dryer, and private patios/balconies neighborhoods in the Twin Cities www.iretapartments.com 12

TOP MARKET FUNDAMENTALS Minneapolis – St. Paul and Denver boast extremely tight job markets, characterized by a highly educated workforce Educational Attainment: % of Adult Population with Bachelor's Degree or Higher Unemployment Rate(1) Washington-Arlington-Alexandria, DC-VA-MD-WV MSA 51.6% 3.5% San Francisco-Oakland-Hayward, CA MSA 51.0% 3.0% Boston-Cambridge-Newton, MA-NH MSA 49.1% Denver-Aurora-Lakewood, CO MSA 44.8% 2.3% Seattle-Tacoma-Bellevue, WA MSA 43.6% Minneapolis-St. Paul-Bloomington, MN-WI MSA 42.6% Baltimore-Columbia-Towson, MD MSA 41.2% New York-Newark-Jersey City, NY-NJ-PA MSA 41.1% Portland-Vancouver-Hillsboro, OR-WA MSA 40.0% Atlanta-Sandy Springs-Roswell, GA MSA 39.4% Denver Twin Cities US Average Both of these characteristics support strong incomes Rank Metropolitan Area Median Household Income 1 San Francisco-Oakland-Hayward, CA MSA $107,898 2 Washington-Arlington-Alexandria, DC-VA-MD-WV MSA $102,180 3 Boston-Cambridge-Newton, MA-NH MSA $88,711 4 Seattle-Tacoma-Bellevue, WA MSA $87,910 5 Baltimore-Columbia-Towson, MD MSA $80,469 6 Minneapolis-St. Paul-Bloomington, MN-WI MSA $79,578 7 Denver-Aurora-Lakewood, CO MSA $79,478 8 San Diego-Carlsbad, CA MSA $79,079 9 New York-Newark-Jersey City, NY-NJ-PA MSA $78,478 10 Portland-Vancouver-Hillsboro, OR-WA MSA $75,599 Sources: US Census Bureau and Bureau of Labor Statistics (1) Preliminary December 2019 Unemployment Rate www.iretapartments.com 13

FOCUSED SECONDARY MARKET PRESENCE These four markets, plus Minneapolis-St. Paul and Denver make up 81% of pro forma NOI Rochester, MN Omaha, NE Grand Forks, ND St. Cloud, MN Population 219,802 942,198 102,277 199,801 Median Household Income $72,129 $66,241 $54,659 $60,759 Unemployment Rate(1) 3.0% 2.7% 2.5% 3.7% Mayo Clinic State of Nebraska University of ND CentraCare Health Major Employers IBM Union Pacific Altru Health State of Minnesota Number of IRET Homes 1,711 1,370 1,555 1,190 Total Multifamily Supply 8,404 72,177 9,110 14,474 Same-Store Average Revenue per Unit(2) $1,316 $977 $978 $1,058 Same-Store Average Revenue per Unit / Median 21.9% 17.7% 21.5% 20.9% Household Income (Monthly) Same-Store Occupancy(3) 94.5% 93.5% 94.8% 94.0% Sources: US Census Bureau, Bureau of Labor Statistics, IRET, CoStar, Company Filings and Disclosures, and IRET Research (1) Preliminary December 2019 Unemployment Rate (2) 4Q19 Weighted Average Monthly Revenue per Occupied Home (3) 4Q19 Weighted Average Occupancy www.iretapartments.com 14

BEST IN CLASS GOVERNANCE Executive Management Team Mark O. Decker, Jr. John A. Kirchmann Anne M. Olson PRESIDENT AND CEO EVP AND CFO EVP AND COO IRET rated ISS’s top score of 1 - indicating highest quality corporate governance practices and lowest governance risk Jeffrey P. Caira Michael T. Dance Mark O. Decker Jr. Emily Nagle Green Linda J. Hall John A. Schissel Mary J. Twinem Terrance P. Maxwell Since 2015 Since 2016 Since 2017 Since 2018 Since 2011 Since 2016 Since 2018 Since 2013 TRUSTEE TENURE GENDER DIVERSITY BOARD INDEPENDENCE 13% 25% 37% 25% 63% 50% 87% Less than 2 years 2-5 years More than 5 years Female Male Non-independent Independent www.iretapartments.com 15

INVESTMENT HIGHLIGHTS Differentiated Market Exposure Internal Growth Opportunities Value-Add Opportunities Flexible Balance Sheet Best in Class Governance www.iretapartments.com 16

Appendix www.iretapartments.com 17

RECONCILIATION TO NON-GAAP MEASURES Reconciliation of Net Income (Loss) Available to Common Shareholders to Funds From Operations and Core Funds From Operations We use the definition of FFO adopted by the National Association of Real Estate Investment Trusts, Inc. (“Nareit”). Nareit defines FFO as net income or loss calculated in accordance with GAAP, excluding: depreciation and amortization related to real estate; gains and losses from the sale of certain real estate assets; and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. Due to the limitations of the Nareit FFO definition, we have made certain interpretations in applying this definition. We believe that all such interpretations not specifically identified in the Nareit definition are consistent with this definition. Nareit's FFO White Paper 2018 Restatement clarified that impairment write-downs of land related to a REIT's main business are excluded from FFO and a REIT has the option to exclude impairment write-downs of assets that are incidental to its main business. We believe that FFO, which is a standard supplemental measure for equity real estate investment trusts, is helpful to investors in understanding our operating performance, primarily because its calculation excludes depreciation and amortization expense on real estate assets, thereby providing an additional perspective on our operating results. We believe that GAAP historical cost depreciation of real estate assets is not correlated with changes in the value of those assets, whose value does not diminish predictably over time, as historical cost depreciation implies. The exclusion in Nareit’s definition of FFO of impairment write-downs and gains and losses from the sale of real estate assets helps to identify the operating results of the long-term assets that form the base of our investments, and assists management and investors in comparing those operating results between periods. While FFO is widely used by us as a primary performance metric, not all real estate companies use the same definition of FFO or calculate FFO in the same way. Accordingly, FFO presented here is not necessarily comparable to FFO presented by other real estate companies. FFO should not be considered as an alternative to net income or any other GAAP measurement of performance, but rather should be considered as an additional, supplemental measure. FFO also does not represent cash generated from operating activities in accordance with GAAP and is not necessarily indicative of sufficient cash flow to fund all of our needs or our ability to service indebtedness or make distributions. Core Funds from Operations ("Core FFO") is FFO as adjusted for non-routine items or items not considered core to our business operations. By further adjusting for items that are not considered part of our core business operations, we believe that Core FFO provides investors with additional information to compare our core operating and financial performance between periods. Core FFO should not be considered as an alternative to net income as an indication of financial performance, or as an alternative to cash flows from operations as a measure of liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to make distributions to shareholders. Core FFO is a non-GAAP and non-standardized measure that may be calculated differently by other REITs and should not be considered a substitute for operating results determined in accordance with GAAP. www.iretapartments.com 18

RECONCILIATION TO NON-GAAP MEASURES (in thousands, except per share amounts) Three Months Ended Twelve Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/19 12/31/2018 12/31/2019 12/31/2018 Net (loss) income available to common shareholders $ 46,953 $ 29,891 $ 1,407 $ (6,403 ) $ (5,811 ) $ 71,848 $ (21,844 ) Adjustments: Noncontrolling interests - Operating Partnership 4,202 3,145 148 (743) (665 ) 6,752 (2,553 ) Depreciation and amortization 18,972 18,751 18,437 18,111 18,812 74,271 77,624 Less depreciation - non real estate (88 ) (71) (79 ) (85) (76 ) (322 ) (305 ) Less depreciation - partially owned entities (454 ) (452) (474 ) (678) (680 ) (2,059 ) (2,795 ) Impairment of real estate — — — — 1,221 — 19,030 Gain on sale of real estate (57,850 ) (39,105) (615 ) (54) (612 ) (97,624 ) (25,245 ) FFO applicable to common shares and Units $ 11,735 $ 12,159 $ 18,824 $ 10,148 $ 12,189 $ 52,866 $ 43,912 Adjustments to Core FFO: Casualty loss write off — — — — 43 — 43 Loss on extinguishment of debt 864 1,087 407 2 5 2,360 678 Gain on litigation settlement — (300) (6,286 ) — — (6,586 ) — Severance and transitions costs — — — — — — 811 Other miscellaneous items (113 ) — — — — (113 ) — Core FFO applicable to common shares and Units $ 12,486 $ 12,946 $ 12,945 $ 10,150 $ 12,237 $ 48,527 $ 45,444 FFO applicable to common shares and Units $ 11,735 $ 12,159 $ 18,824 $ 10,148 $ 12,189 $ 52,866 $ 43,912 Dividends to preferred unitholders 160 160 160 57 — 537 — FFO applicable to common shares and Units - diluted $ 11,895 $ 12,319 $ 18,984 $ 10,205 $ 12,189 $ 53,403 $ 43,912 Core FFO applicable to common shares and Units $ 12,486 $ 12,946 $ 12,945 $ 10,150 $ 12,237 $ 48,527 $ 45,444 Dividends to preferred unitholders 160 160 160 57 — 537 — Core FFO applicable to common shares and Units - diluted $ 12,646 $ 13,106 $ 13,105 $ 10,207 $ 12,237 $ 49,064 $ 45,444 Per Share Data Earnings (loss) per share and unit - diluted $ 3.89 $ 2.54 $ 0.12 $ (0.54 ) $ (0.49 ) $ 6.00 $ (1.83 ) FFO per share and unit - diluted $ 0.90 $ 0.93 $ 1.45 $ 0.77 $ 0.92 $ 4.05 $ 3.29 Core FFO per share and unit - diluted 0.96 $ 0.99 $ 1.00 $ 0.77 $ 0.92 $ 3.72 $ 3.41 Weighted average shares and units - diluted 13,188 13,087 13,197 13,230 13,317 13,182 13,344 www.iretapartments.com 19

RECONCILIATION TO NON-GAAP MEASURES Reconciliation of Net Income (Loss) Available to Common Shareholders to Adjusted EBITDA Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization, gain/loss on sale of real estate and other investments, impairment of real estate investments, gain/loss on extinguishment of debt, gain on litigation settlement, and gain/loss from involuntary conversion. We consider Adjusted EBITDA to be an appropriate supplemental performance measure because it permits investors to view income from operations without the effect of depreciation, the cost of debt, or non-operating gains and losses. Adjusted EBITDA is a non-GAAP measure and should not be considered a substitute for operating results determined in accordance with GAAP. Adjusted EBITDA as calculated by us may not be comparable to Adjusted EBITDA reported by other REITs that do not define Adjusted EBITDA exactly as we do. (in thousands) Three Months Ended Twelve Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 12/31/2019 12/31/2018 Net income (loss) attributable to controlling interests $ 48,658 $ 31,596 $ 3,113 $ (4,698) $ (4,106 ) $ 78,669 $ (15,023 ) Adjustments: Dividends to preferred unitholders 160 160 160 57 — 537 — Noncontrolling interests – Operating Partnership 4,202 3,145 148 (743 ) (665 ) 6,752 (2,553 ) Income (loss) before noncontrolling interests – Operating Partnership 53,020 34,901 3,421 (5,384 ) (4,771 ) 85,958 (17,576 ) Adjustments: Interest expense 7,112 7,448 7,343 7,558 7,336 29,461 31,193 Loss on extinguishment of debt 864 1,087 407 2 4 2,360 677 Depreciation/amortization related to real estate investments 18,518 18,299 17,963 17,433 18,133 72,213 74,832 Impairment of real estate investments — — — — 1,221 — 19,030 Interest income (415) (402 ) (402 ) (407 ) (465 ) (1,626 ) (1,933 ) Gain (loss) on sale of real estate and other investments (57,850) (39,105 ) (615 ) (54 ) (611 ) (97,624 ) (25,244 ) Gain on litigation settlement — (300 ) (6,286 ) — — (6,586 ) — Other miscellaneous items (113) — — — — (113 ) — Adjusted EBITDA $ 21,136 $ 21,928 $ 21,831 $ 19,148 $ 20,847 $ 84,043 $ 80,979 www.iretapartments.com 20