Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CubeSmart | tm2011333-1_8k.htm |

Exhibit 99.1

|

Statement This presentation contains certain non-GAAP financial measures. The definitions of these terms, the reasons for their use, and reconciliations to the most directly comparable GAAP measures are included in our Earnings Release as well as the Non-GAAP Financial Measures section under the caption "Management's Discussion and Analysis of Financial Condition and Results of Operations" (or similar captions) in our quarterly reports on Forms 10-Q and 10-K, and described from time to time in the Company's filings with the SEC. Financial easures UseofNon-G Safe Harbor The forward-looking statements contained in this presentation are subject to various risks and known and unknown uncertainties. Although the Company believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, there can be no assurance that the Company's expectations will be achieved. Factors which could cause the Company's actual results, performance, or achievements to differ significantly from the results, performance, or achievements expressed or implied by such statements are set forth under the captions "Item 1A. Risk Factors" and "Forward-Looking Statements" in our annual report on Form 10-K and in our quarterly reports on Form 10-Q and described from time to time in the Company's filings with the SEC. Forward-looking statements are not guarantees of performance. For forward-looking statements herein, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of1995. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events. |

|

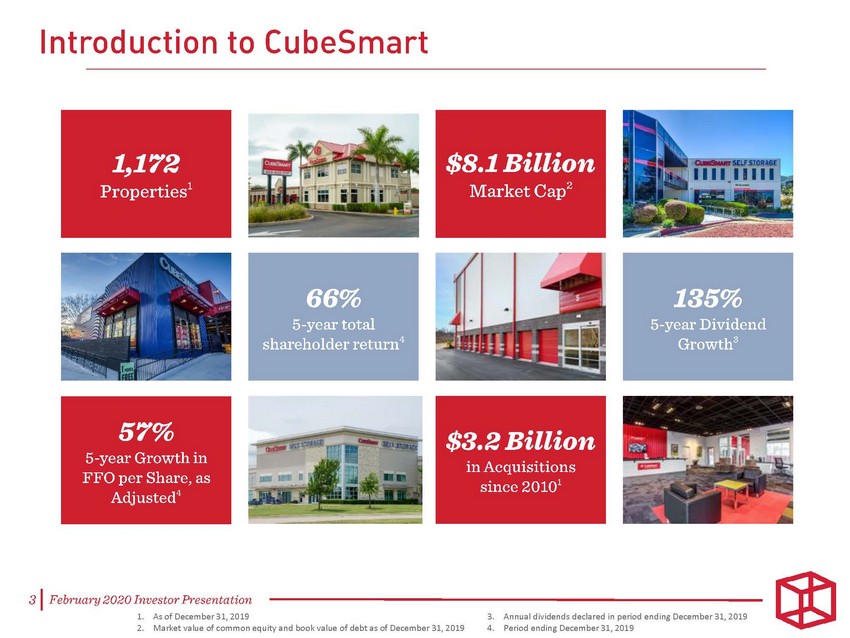

Introduction to CubeSmart MarketCap2 Adjusted4 31 February 2020 Investor Presentation 1. As of December31, 2019 2. Market value of common equity and book value of debt as of December 31,2019 3. Annual dividends declared in period ending December 31,2019 4. Period ending December31, 2019 57% 5-year Growth in FFO per Share, as $8.1 Billion |

|

It's what's inside CubeSmart: that counts. 41 February 2020 Investor Presentation |

|

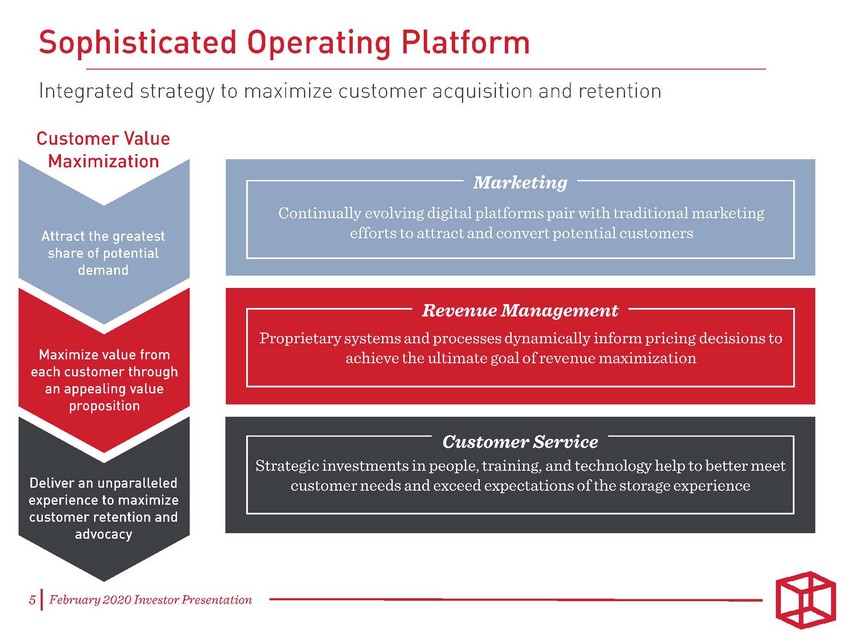

Sophisticated Operating Platform Integrated strategy to maximize customer acquisition and retention Customer Value achieve the ultimate goal of revenue maximization customer needs and exceed expectations of the storage experience 51 February 2020 Investor Presentation Customer Service Strategic investments in people, training, and technology help to better meet Proprietary systems and processes dynamically inform pricing decisions to Revenue Management |

|

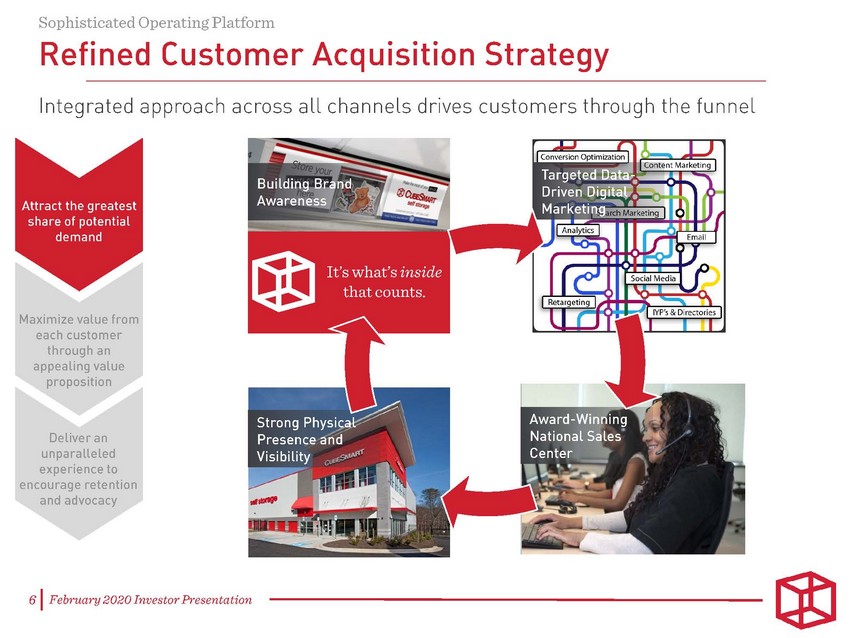

Sophisticated Operating Platform Refined Customer Acquisition Strategy Integrated approach across all channels drives customers through the funnel Maximize value from each customer through an appealing value proposition Deliver an unparalleled experience to encourage retention and advocacy 61 February 2020 Investor Presentation |

|

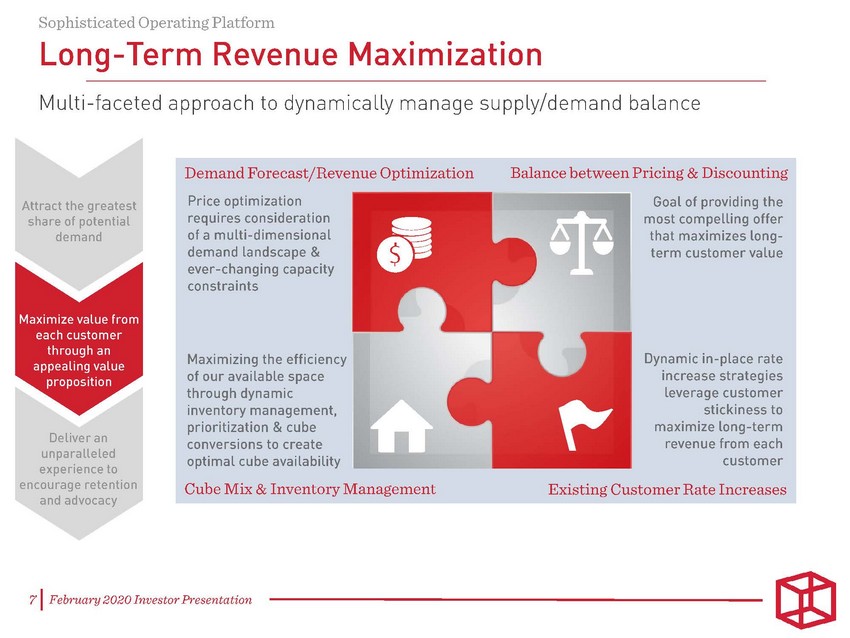

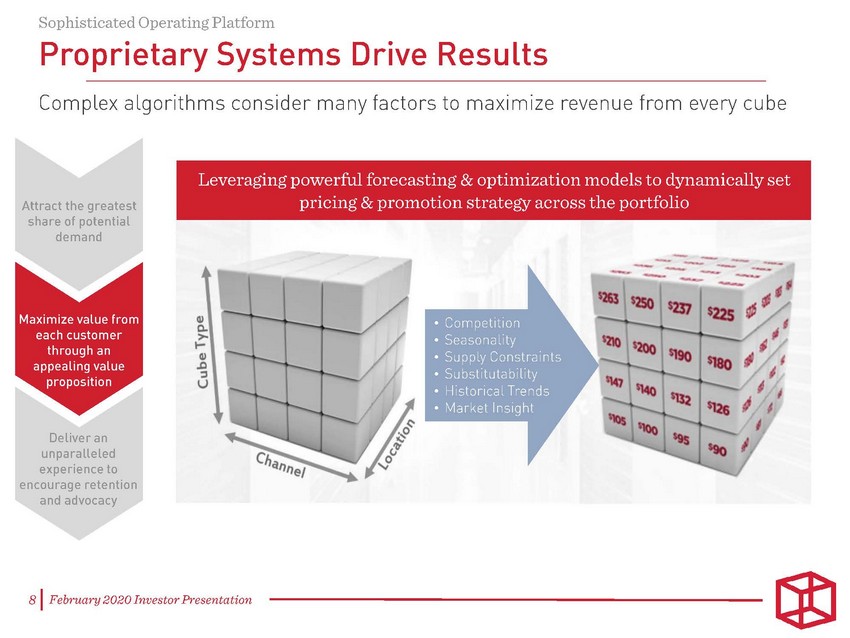

Sophisticated Operating Platform Long-Term Revenue Maximization Multi-faceted approach to dynamically manage supply/demand balance Demand Forecast/Revenue Optimization Price optimization requires consideration of a multi-dimensional demand landscape & ever-changing capacity constraints Balance between Pricing & Discounting Goalof providing the most compelling offer that maximizes long term customer value Attract the greatest share of potential demand Maximizing the efficiency of our available space through dynamic inventory management, prioritization & cube conversions to create optimalcube availability Cube Mix & Inventory Management Dynamic in-place rate increase strategies Leverage customer stickiness to maximize long-term revenue from each customer Deliver an unparalleled experience to encourage retention and advocacy Existing Customer Rate Increases 71 February 2020 Investor Presentation |

|

• • • • • • |

|

Sophisticated Operating Platform Understanding the Needs of Our Customers Striving to fulfill our mission of simplifying our customers· organizational challenges .. Attract the greatest share of potential demand Rita Ryan Mary Erik Dave Maximize value from each customer through an appealing value proposition the things impressive, since e.r.e are a lot of us. 91 February 2020 Investor Presentation "When my wife passed, I could barely imagine Life without her, let alone finding a storage unit to care for my things. But, I was grateful that CubeSmart made easy for me and was very kind to me throughout the whole process. "At the end of our move, we were tired. The last thing we wanted was to have to jump through hoops to get our extra things in storage. Lucky for us, we got squared away in record time at CubeSmart, and before we knew it, we were back home relaxing. "We Lived in our family home for 34 years, and so did my full workshop, my wife's lamp collection and everything in between. Moving to a house without a basement was incredibly stressful. We needed the experts at CubeSmart to help us solve our space puzzle. "Our business isn't big enough for a warehouse, but we have definitely outgrown the home office. We need a place where we can access our supplies without a hassle." "As a single woman, safety is criticalto me. I don't want to navigate long, dark hallways by myself. I need bright lights, open areas, and above all, I need to feel safe." "I didn't realize how much additional stress would come with building an addition. My house feels like it's in shambles at the moment. But, at least I know the important things are clean and safe, and in a secure spot at CubeSmart. "People thought I was crazy to marry a woman with three girls, when I have three boys already. Part of making us one family means making some detours to storage unit while our households merge. I like that they have a family feel, too. They greet all of us by name, which is th Senior Sam Moving Downsizing Enterprising Single Sonia Renovating Remarried |

|

Sophisticated Operating Platform Award-Winning Service Culture Attract the greatest share of potential demand Maximize value from each customer through an appealing value proposition 10 IFebruary 2020 Investor Presentation |

|

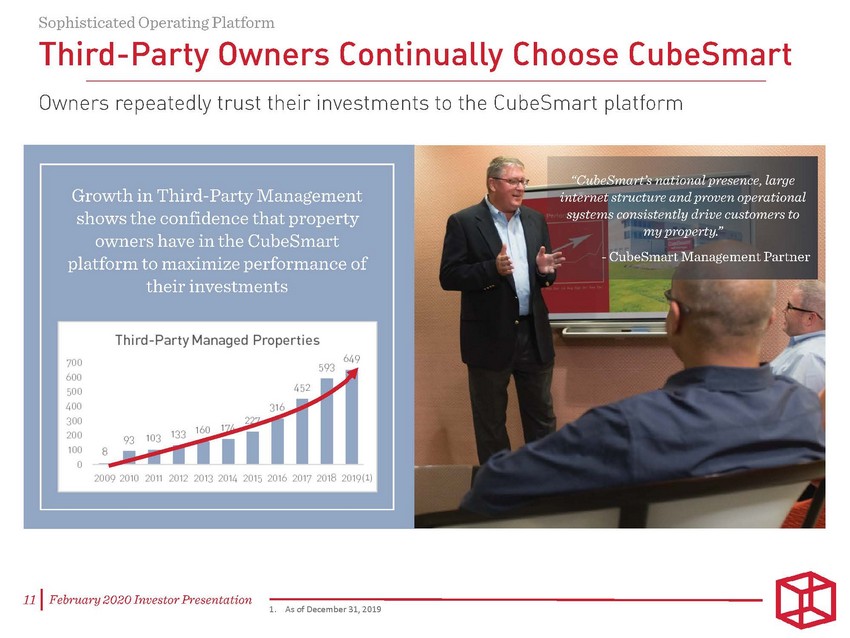

(1) 1. As of December 31, 2019 (1) |

|

1. As of December 31, 2019 ▪ ▪ ▪ ▪ ▪ ▪ ▪ |

|

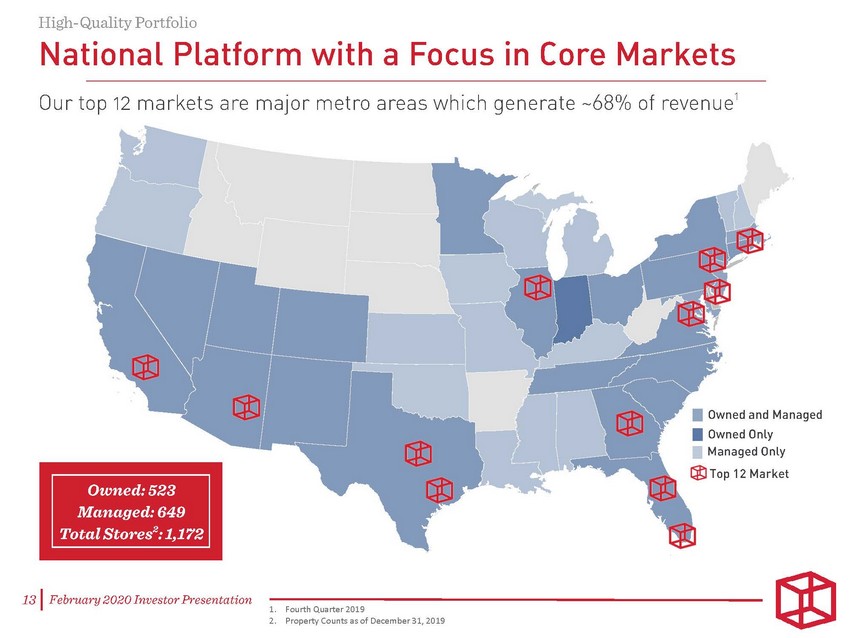

High-Quality Portfolio National Platform with a Focus in Core Markets revenue1 Our top 12 markets are major metro areas which generate 68°/o of • Owned and Managed • Owned Only Managed Only ® Top 12 Market 131 February 2020 Investor Presentation 1. Fourth Quarter 2019 2. Property Counts as of December 31,2019 |

|

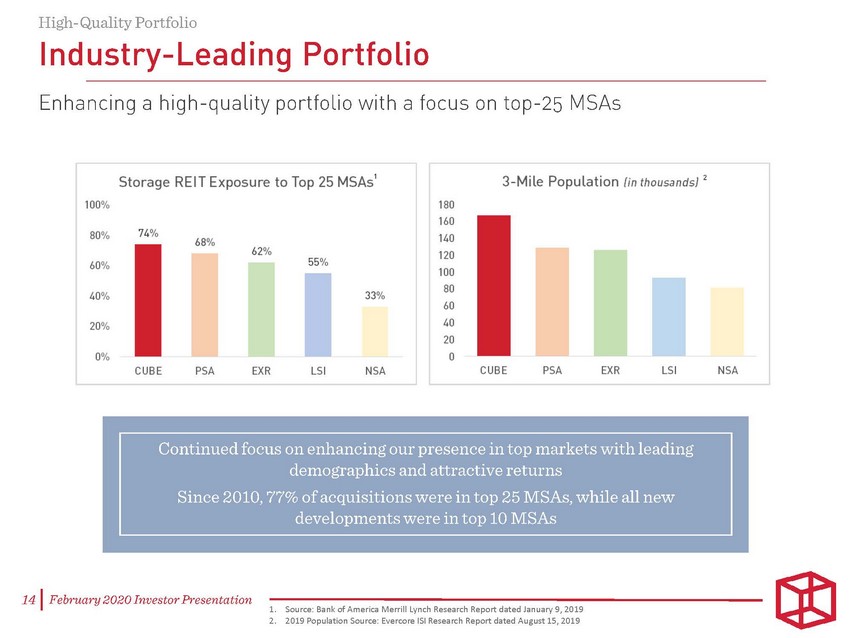

High-Quality Portfolio Industry-Leading Portfolio Enhancing a high-quality portfolio with a focus on top-25 MSAs 1 3-Mile Population {in thousands) 2 Storage REIT Exposure to Top 25 MSAs 100% 180 160 140 120 100 80 60 40 20 0 74% 80% 68% 62% 55% 60% 40% 33% 20% 0% CUBE PSA EXR LSI NSA CUBE PSA EXR LSI NSA demographics and attractive returns developments were in top 10 MSAs 141 February 2020 Investor Presentation 1. 2. Source: Bank of America Merrill Lynch Research Report dated January 9,2019 2019 Population Source: Evercore lSI Research Report dated August 15,2019 Since 2010, 77% of acquisitions were in top 25 MSAs, while all new Continued focus on enhancing our presence in top markets with leading |

|

▪ ▪ ▪ ▪ ▪ ▪ 1. Source: US Census Bureau, 2018 Self Storage Almanac, Internal Market Research 2. Source: New York City Department of City Planning |

|

High-Quality Portfolio Enhancing the Portfolio with New Properties Adding value through the development of purpose-built, class A stores $40.3M Total Chicago, IL (2) Delray Beach, FL $19.1M Total Vl c: o...-San Diego, CA :·;-:::;0 ......... -u ::J ..... e-re u <.( 161 February 2020 Investor Presentation 1. Openings peryearasofDecember31,2019 No Current C/0 Projects No Current C/O Projects East Meadow, NY. |

|

▪ ▪ ▪ ▪ ▪ ▪ |

|

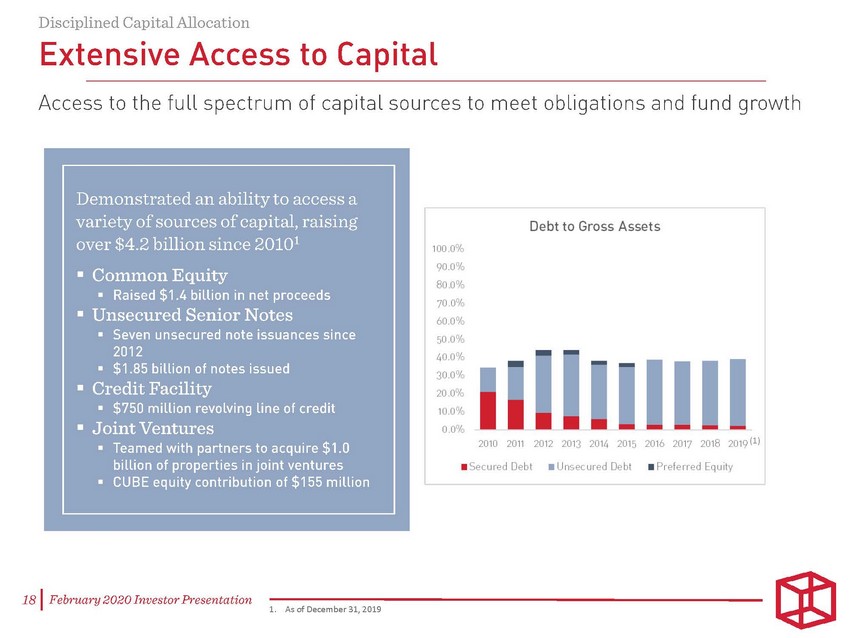

Disciplined Capital Allocation Extensive Access to Capital Access to the full spectrum of capital sources to meet obligations and fund growth Debt to Gross Assets 100.0% 90.0% 80.0% 70 0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% • Raised $1.4 billion in net proceeds • Seven unsecured note issuances since • • $750 million revolving line of credit 2017 2018 2019(1) 2010 2011 2012 2013 2014 2015 2016 • Teamed with partners to acquire $1.0 •Secured Debt •Unsec ured Debt •Pref erred Equity • 181 February 2020 Investor Presentation 1. As of December 31,2019 • Common Equity • Unsecured Senior Notes 2012 $1.85 billion of notes issued • Credit Facility • Joint Ventures billion of properties in joint ventures CUBE equity contribution of $155 million Demonstrated an ability to access a variety of sources of capital, raising over $4.2 billion since 2010 1 |

|

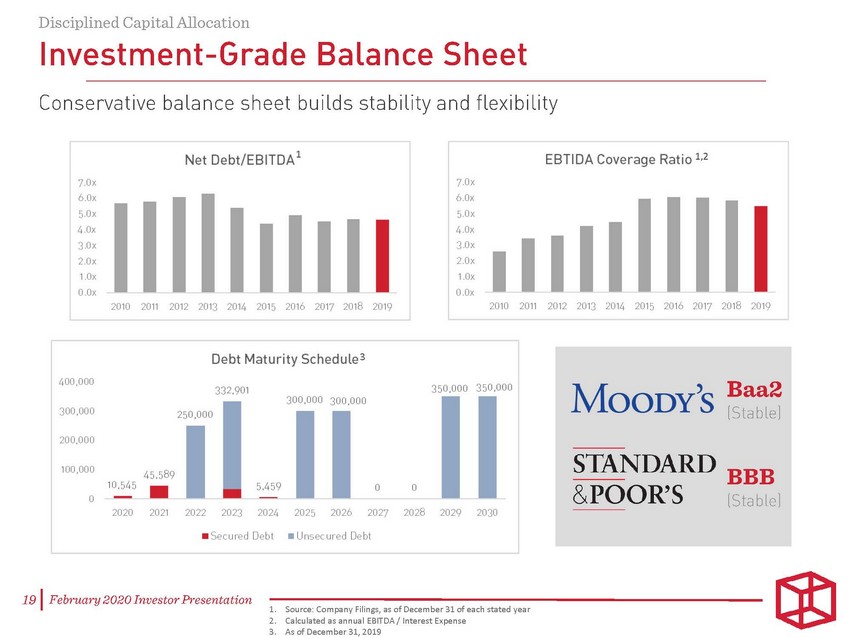

1 1,2 3 1. 2. 3. Source: Company Filings, as of December 31 of each stated year Calculated as annual EBITDA / Interest Expense As of December 31, 2019 |

|

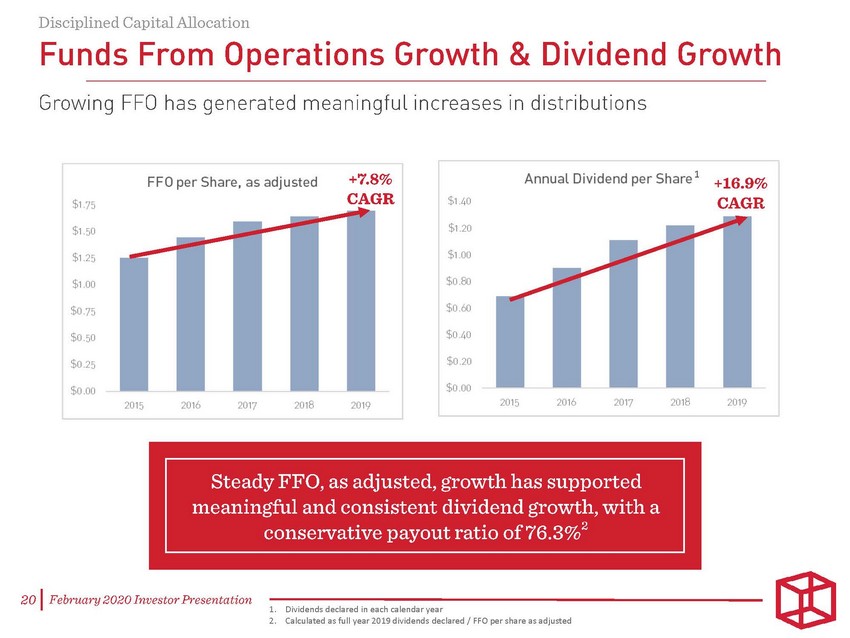

Disciplined Capital Allocation Funds From Operations Growth & Dividend Growth Growing FFO has generated meaningful increases in distributions AnnualDividend per Share 1 +7.8% +16.9% CAGR FFO per Share, as adjusted r $1.75 $1.50 C A..G. R $1.40 $1.20 $1.00 $1.25 $0.8o $1 00 $0 60 $0.75 $0.40 $0.50 $0.20 $0 25 $0 00 $0 00 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 conservative payout ratio of76.3%2 20 IFebruary 2020 Investor Presentation 1. Dividends declared in each calendar year 2. Calculated as full year 2019 dividends declared/ FFO per share as adjusted Steady FFO, as adjusted, growth has supported meaningful and consistent dividend growth, with a |

|

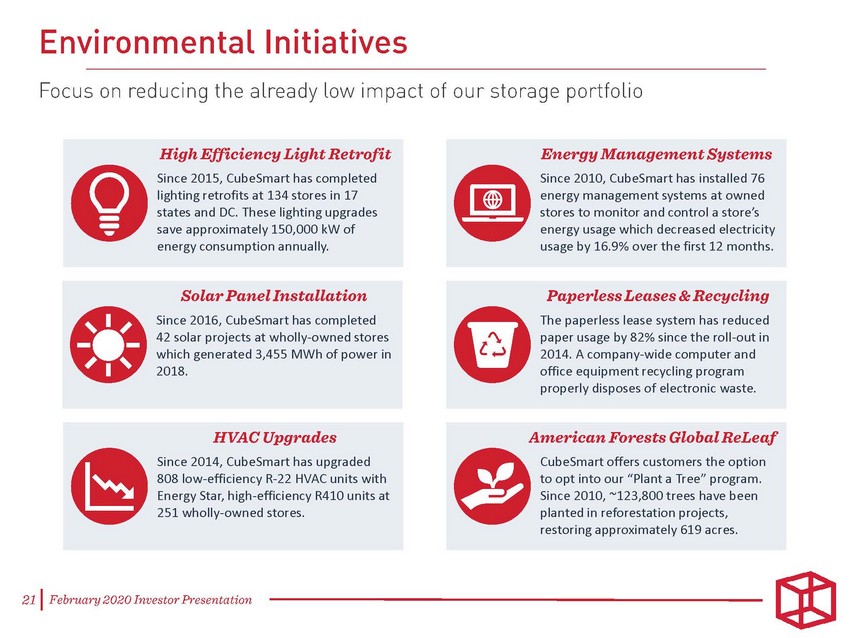

CubeSmart offers customers the option to opt into our “Plant a Tree” program. Since 2010, ~123,800 trees have been planted in reforestation projects, restoring approximately 619 acres. Since 2014, CubeSmart has upgraded 808 low-efficiency R-22 HVAC units with Energy Star, high-efficiency R410 units at 251 wholly-owned stores. The paperless lease system has reduced paper usage by 82% since the roll-out in 2014. A company-wide computer and office equipment recycling program properly disposes of electronic waste. Since 2016, CubeSmart has completed 42 solar projects at wholly-owned stores which generated 3,455 MWh of power in 2018. Since 2010, CubeSmart has installed 76 energy management systems at owned stores to monitor and control a store’s energy usage which decreased electricity usage by 16.9% over the first 12 months. Since 2015, CubeSmart has completed lighting retrofits at 134 stores in 17 states and DC. These lighting upgrades save approximately 150,000 kW of energy consumption annually. |

|

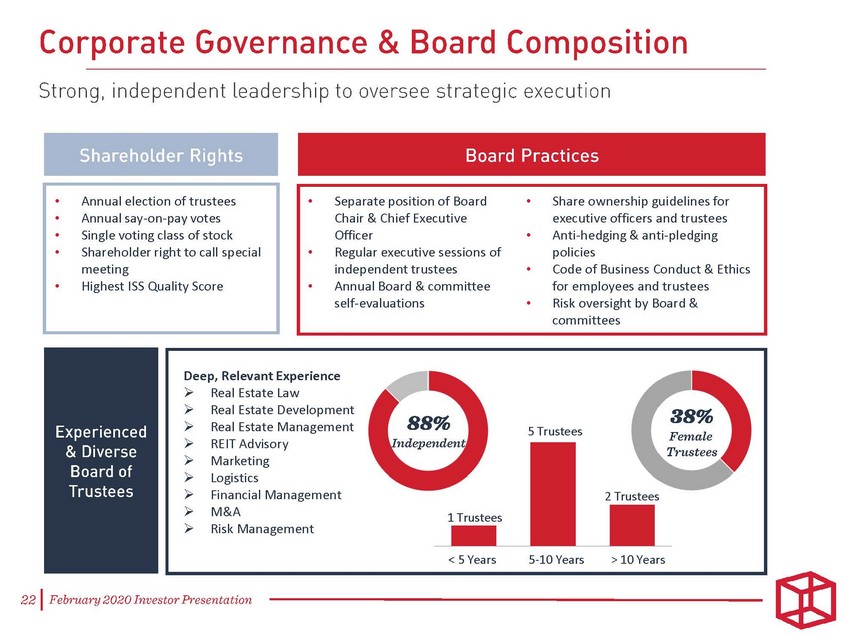

➢ REIT Advisory ➢ Risk Management Deep, Relevant Experience ➢Real Estate Law ➢Real Estate Development ➢Real Estate Management5 Trustees ➢Marketing ➢Logistics ➢Financial Management2 Trustees ➢M&A1 Trustees < 5 Years5-10 Years> 10 Years •Annual election of trustees •Annual say-on-pay votes •Single voting class of stock •Shareholder right to call special meeting •Highest ISS Quality Score •Separate position of Board • Share ownership guidelines for Chair & Chief Executive executive officers and trustees Officer • Anti-hedging & anti-pledging •Regular executive sessions ofpolicies independent trustees•Code of Business Conduct & Ethics •Annual Board & committeefor employees and trustees self-evaluations•Risk oversight by Board & committees |

|

Current Self-storage Operating Environment continues to be an attractive sector 231 February 2020 Investor Presentation |

|

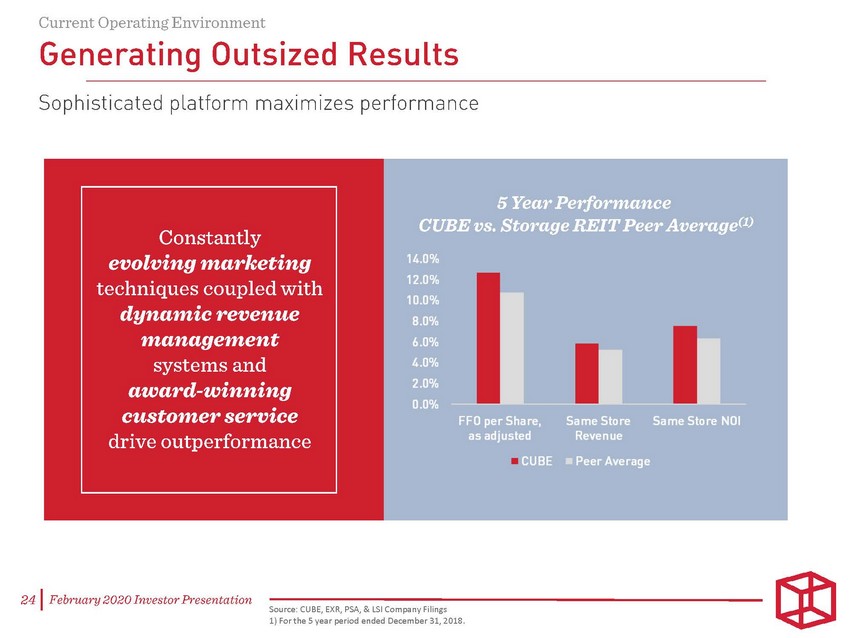

Current Operating Environment Generating Outsized Results Sophisticated platform maximizes performance dynamic revenue management systems and 241 February 2020 Investor Presentation Source: CUBE, EXR, PSA, & LSI Company Filings 1) Fort he 5 year period ended December 31, 2018. Constantly evolving marketing techniques coupled with award-winning customer service drive outperformance I I', • |

|

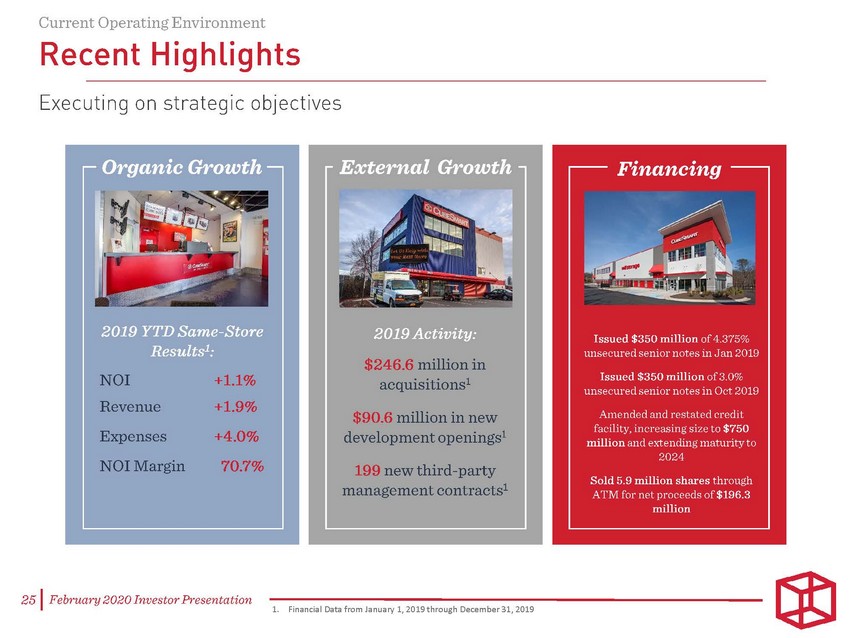

Current Operating Environment Recent Highlights Executing on strategic objectives $246.6 million in acquisitions1 NOI Revenue Expenses NOIMargin +1.1% +1.9% +4.0% 70.7% $90.6 million in new development openings1 199 new third-party management contracts1 251 February 2020 Investor Presentation 1. Financial Data from January 1, 2019through December31, 2019 |

|

It's what's inside CubeSmart: that counts. 261 February 2020 Investor Presentation |

|

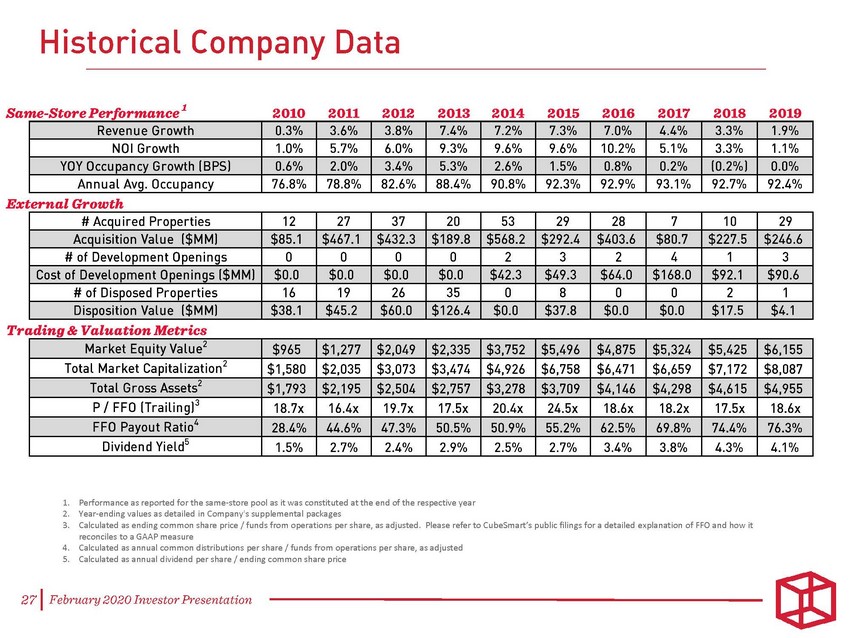

1. 2. 3. Performance as reported for the same-store pool as it was constituted at the end of the respective year Year-ending values as detailed in Company's supplemental packages Calculated as ending common share price / funds from operations per share, as adjusted. Please refer to CubeSmart’s public filings for a detailed explanation of FFO and how it reconciles to a GAAP measure Calculated as annual common distributions per share / funds from operations per share, as adjusted Calculated as annual dividend per share / ending common share price 4. 5. |

|

Additional Information • Corporate Responsibility ww-w.cubesmart.comjabout-usjcorporate-responsibility • Supplemental Financial Information http://investors.cubesmart.com • 10-K Filing http://investors.cubesmart.com • 10-QFiling http://investors.cubesmart.com • Proxy http://investors.cubesmart.com 281 February 2020 Investor Presentation |

|

291 February 2020 Investor Presentation |