Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMICUS THERAPEUTICS, INC. | exhibit99122.htm |

| 8-K - 8-K - AMICUS THERAPEUTICS, INC. | form8-k3220.htm |

2019 Financial Results Conference Call & Webcast March 2, 2020

Introduction 2 Forward-Looking Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 relating to preclinical and clinical development of our product candidates, the timing and reporting of results from preclinical studies and clinical trials, the prospects and timing of the potential regulatory approval of our product candidates, commercialization plans, manufacturing and supply plans, financing plans, and the projected revenues and cash position for the Company. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. Any or all of the forward-looking statements in this presentation may turn out to be wrong and can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. For example, with respect to statements regarding the goals, progress, timing, and outcomes of discussions with regulatory authorities, and in particular the potential goals, progress, timing, and results of preclinical studies and clinical trials, actual results may differ materially from those set forth in this release due to the risks and uncertainties inherent in our business, including, without limitation: the potential that results of clinical or preclinical studies indicate that the product candidates are unsafe or ineffective; the potential that it may be difficult to enroll patients in our clinical trials; the potential that regulatory authorities, including the FDA, EMA, and PMDA, may not grant or may delay approval for our product candidates; the potential that we may not be successful in commercializing Galafold in Europe, Japan, the US and other geographies or our other product candidates if and when approved; the potential that preclinical and clinical studies could be delayed because we identify serious side effects or other safety issues; the potential that we may not be able to manufacture or supply sufficient clinical or commercial products; and the potential that we will need additional funding to complete all of our studies and manufacturing. Further, the results of earlier preclinical studies and/or clinical trials may not be predictive of future results. In addition to financial information prepared in accordance with U.S. G A A P, this presentation also contains adjusted financial measures that we believe provide investors and management with supplemental information relating to operating performance and trends that facilitate comparisons between periods and with respect to projected information. These adjusted financial measures are non-GAAP measures and should be considered in addition to, but not as a substitute for, the information prepared in accordance with U.S. GAAP. With respect to statements regarding projections of the Company's revenue and cash position, actual results may differ based on market factors and the Company's ability to execute its operational and budget plans. In addition, all forward-looking statements are subject to other risks detailed in our Annual Report on Form 10-K for the year ended December 31, 2019 to be filed today. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update this news release to reflect events or circumstances after the date hereof. In addition to financial information prepared in accordance with U.S. GAAP, this presentation also contains adjusted financial measures that we believe provide investors and management with supplemental information relating to operating performance and trends that facilitate comparisons between periods and with respect to projected information. These adjusted financial measures are non-GAAP measures and should be considered in addition to, but not as a substitute for, the information prepared in accordance with U.S. GAAP. We typically exclude certain GAAP items that management does not believe affect our basic operations and that do not meet the GAAP definition of unusual or non-recurring items. Other companies may define these measures in different ways. Full reconciliations of GAAP results to the comparable non-GAAP measures for the reported periods appear in the financial tables section of this presentation. When we provide our expectation for non-GAAP operating expenses on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectation and the corresponding GAAP measure generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains or losses. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results.

Introduction 3 A leading fully-integrated, global rare disease biotechnology company Gene Therapy World Class PLATFORM BIOLOGICS Protein Engineering Capabilities & Glycobiology AT-GAA EMPLOYEES Phase 3 in Robust R&D in 27 Countries Pompe Disease Engine Nearly 50+ Lysosomal GLOBAL Disorders and More Prevalent Rare Diseases $450M+ Two Clinical- COMMERCIAL Cash Stage Gene ORGANIZATION as of 12/31/19 Therapies

Introduction 4 Key Takeaways Recent successes across our science, clinical, regulatory and commercial efforts position us for the future Galafold Continues AT-GAA for Pompe Portfolio of Gene Strong Financial Strong Launch Advances Toward Therapy Programs Outlook with Current Performance & Approval as “Crown and Technologies Cash Well into 2022 Cornerstone of Jewel” of Amicus Provides Foundation Amicus Success Portfolio for Future

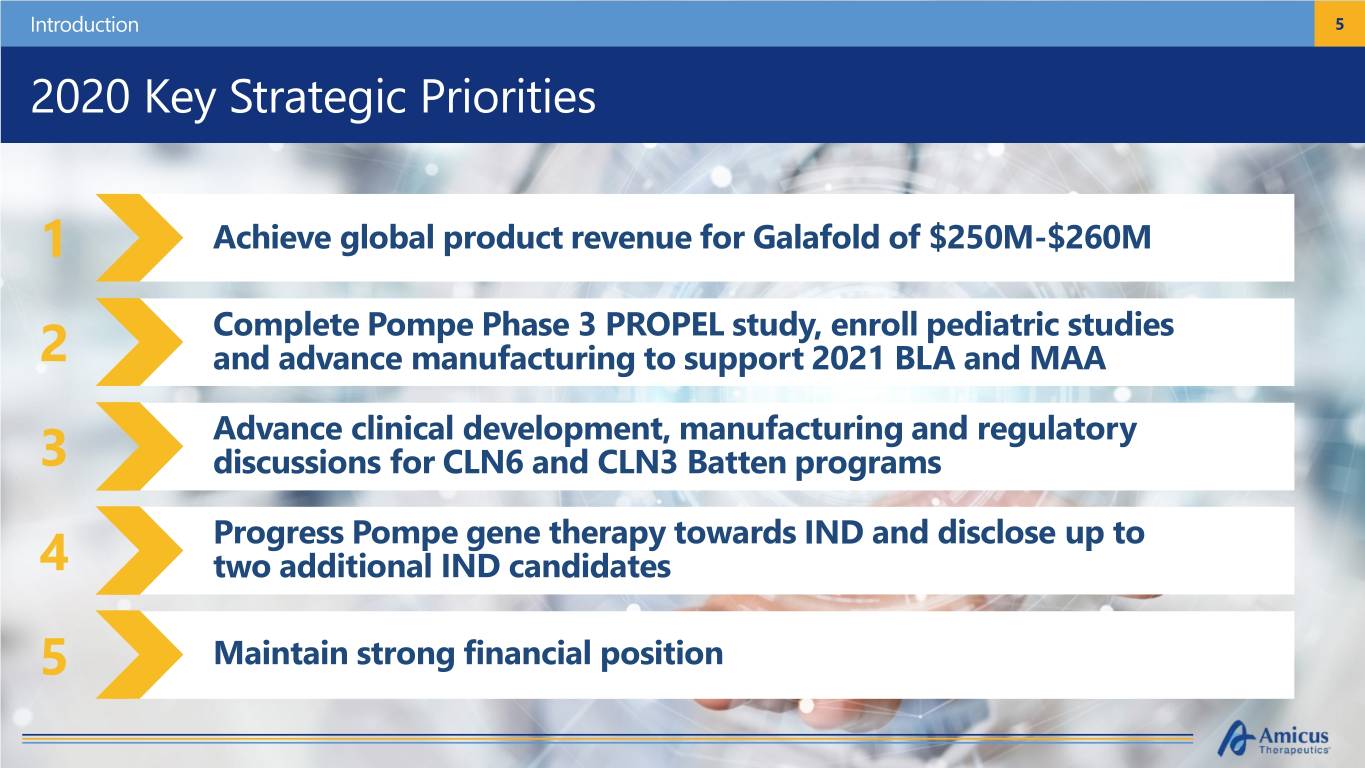

Introduction 5 2020 Key Strategic Priorities 1 Achieve global product revenue for Galafold of $250M-$260M Complete Pompe Phase 3 PROPEL study, enroll pediatric studies 2 and advance manufacturing to support 2021 BLA and MAA Advance clinical development, manufacturing and regulatory 3 discussions for CLN6 and CLN3 Batten programs Progress Pompe gene therapy towards IND and disclose up to 4 two additional IND candidates 5 Maintain strong financial position

Galafold® (migalastat) Global Launch… …taking a leadership role in the treatment of Fabry disease “We push ideas as far and as fast as possible” - Amicus Belief Statement

Galafold: Precision Medicine for Fabry Disease 7 Galafold Snapshot (as of December 31, 2019) Galafold is the cornerstone of Amicus’ success. It is an orally delivered small molecule precision medicine with a unique mechanism of action for Fabry patients with amenable variants that replaces the need for intravenously delivered enzyme replacement therapy One of the Most Successful $182M FY19 Galafold $ Rare Disease Launches Revenue 250M-260M FY20 Global Galafold Rev. Guidance Geographic Expansion in 2019 Including Argentina, Brazil, Colombia, Taiwan 348 Amenable Variants 40+ in U.S. Label Countries with Regulatory Approvals: Including U.S., EU, U.K., Galafold is indicated for adults with a confirmed diagnosis of Fabry Disease and an amenable mutation/variant. The most common adverse reactions reported with Galafold (≥10%) were headache, Japan, and Other nasopharyngitis, urinary tract infection, nausea and pyrexia. For additional information about Galafold, including the full U.S. Prescribing Information, please visit https://www.amicusrx.com/pi/Galafold.pdf. For further important safety information for Galafold, including posology and method of administration, special warnings, drug interactions and adverse drug reactions, please see the European SmPC for Countries Galafold available from the EMA website at www.ema.europa.eu.

Galafold: Precision Medicine for Fabry Disease 8 2019 Galafold Success Strong full-year revenue performance of $182M, exceeding guidance of $170M-$180M Quarterly Galafold Sales Year-over-Year Galafold Sales Growth 60.0 $55M 50.0 $49M -5% $44M 40.0 +105% $34M 30.0 $182M 20.0 $91M 10.0 0.0 1Q19 2Q19 3Q19 4Q19 FY18 Operational Growth FX Impact FY19 FY18 vs FY19

Galafold: Precision Medicine for Fabry Disease 9 Galafold Growth Trajectory Galafold is on track to generate $1B+ in projected cumulative revenues from 2020-2022 and is on an anticipated path to $500M+ in annual sales in 2023 and $1B+ annual sales at peak $500M+ $1B Annual Revenue $250M- $91M $182M $260M FY18 FY19 FY20 FY21 FY22 FY23 Peak ~$1B Projected Cumulative Revenues (2020-2022)

AT-GAA: Next Potential Standard of Care for Pompe Disease “We encourage and embrace constant innovation” - Amicus Belief Statement

AT-GAA for Pompe Disease 11 U.S. FDA Granted BTD to AT-GAA in Late-Onset Pompe Disease (LOPD) AT-GAA is the first ever second-generation product for any lysosomal disorder to earn FDA Breakthrough Therapy Designation (BTD) AT-GAA BTD Based on Ph 1/2 Clinical Efficacy • Improvements in 6-minute walk distance Plans to apply for and • Comparison to natural history of treated patients initiate a rolling BLA submission for AT-GAA in LOPD in 2020 BTD Features • Intensive guidance on an efficient drug development program • Organizational commitment involving senior agency staff • All Fast Track program features including rolling submission BTD Criteria • Intended to treat a serious or life-threatening disease or condition • Preliminary clinical evidence indicates drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints

AT-GAA for Pompe Disease 12 AT-GAA: Key Takeaways • PROPEL pivotal study exceeded enrollment with data expected 1H2021 • Breakthrough Therapy Designation and the Promising Innovative Medicine designation highlight unmet need in AT-GAA for Pompe Pompe disease today Advances Toward • Plan to submit and initiate rolling submission of Biologics Approval as “Crown License Application in 2020 Jewel” of Amicus Portfolio • Manufacturing PPQ runs at WuXi biologics on track • Peak revenue potential of $1B-$2B, with exclusivity well into 2030s

Financial Summary “We are business led and science driven” - Amicus Belief Statement

Financial Summary 14 2019 Select Financial Results 2019 revenue of $182M from global Galafold sales Dec. 31, 2019 (in thousands, except per share data) Dec. 31, 2018 Product Revenue $182,237 $91,245 Cost of Goods Sold 21,963 14,404 R&D Expense* 286,378 270,902 SG&A Expense 169,861 127,200 Changes in Fair Value of Contingent Consideration 3,297 3,300 Depreciation and Amortization 4,775 4,216 Loss from Operations (304,037) (328,777) Income Tax (Expense) Benefit (478) 94 Net Loss (356,388) (348,995) Net Loss Per Share (1.48) (1.88) *Inclusive of the 2018 upfront payment of $100 million for the Celenex asst acquisition.

Financial Summary 15 Cash Runway Now to Well into 2022 (~2+ years) Fully funded through major milestones in portfolio and continued global growth $450M+ Well into Cash ~2+ Years Cash Runway 2022 YE2019

Financial Summary 16 Financial Outlook: Key Takeaways • Company fully funded through major milestones in portfolio and continued global growth • Cumulative Galafold projected revenue of $1B+ in 2020-2022 offsets significant majority of company spend/investments • Extended cash flow runway through OpEx savings, CapEx phasing, program prioritization and increased Galafold revenue projections • No material business development planned or needed in next several years • Only modest additional capital required in the outer years to extend runway into profitability with multiple non-equity sources available as/when needed

Next Generation Gene Therapy Platform “We have a duty to obsolete our own technologies” - Amicus Belief Statement

Next Generation Gene Therapy Platform 18 DISCOVERY PRECLINICAL PHASE 1/2 PHASE 3 REGULATORY COMMERCIAL Fabry Franchise Galafold®(migalastat) Monotherapy ODD Fabry Gene Therapy PENN Pompe Franchise AT-GAA (Novel ERT + Chaperone) ODD Pompe Gene Therapy PENN Batten Franchise – Gene Therapies CLN6 Batten Disease ODD RPD NCH CLN3 Batten Disease ODD RPD NCH CLN8 Batten Disease NCH CLN1 Batten Disease NCH Next Generation Research Programs and CNS Gene Therapies CDKL5 Deficiency Disorder GTx / ERT PENN Niemann-Pick Type C (NPC) NCH / PENN Others NCH / PENN MPS Franchise LEGEND Mepsevii™ (vestronidase alfa) (Japan Only)* ODD - Orphan Drug Designation Next Generation MPSIIIA PENN RPD - Rare Pediatric Disease Designation MPSIIIB PENN *Exclusive license from Ultragenyx for Japanese rights to Mepsevii™, investigator-sponsored trial in Japan underway

Next Generation Gene Therapy Platform 19 Combines Amicus and Penn Expertise Across Lysosomal and Rare Diseases An R&D platform with rights to 50+ diseases, including 8 active preclinical programs Protein Team of 200+ Engineering & scientists bringing Glycobiology expertise and Expertise Next- experience in: Clinical and Vectors, Tropisms, Generation Capsids Regulatory Expertise Gene Therapy Safety Dosing, Global Commercial Platform Immunology Infrastructure Manufacturing, Scalability Driving 1-2 new INDs every year starting in 2020

Next Generation Gene Therapy Platform 20 Gene Therapy: Updates & Key Takeaways • CLN6 Phase 1/2 interim data shows profound impact with potential to become first ever approved gene therapy for fatal brain disease in children • Plan to report initial data for patients enrolled in CLN3 Phase 1/2 Portfolio of Gene study in 2H’20 Therapy Programs • Orphan drug designations granted in U.S. and EU for intrathecal and Technologies AAV gene therapies for CLN6 and CLN3 Batten disease. Provides Foundation for Future • Pompe gene therapy moving into IND-enabling studies • Penn Collaboration is R&D engine, with rights to 50+ diseases • 8 preclinical gene therapies in development

Closing Remarks “We are business led and science driven” - Amicus Belief Statement

Thank You “Our passion for making a difference unites us” -Amicus Belief Statement

Appendix

Appendix 24 Non-GAAP Reconciliation