Attached files

Exhibit 99.2

Investment Summary Report

AMAZING ENERGY OIL AND GAS, CO.

Please see last page for important disclosures

Company

Sponsored Research

Investment Summary Report

Oil

& Gas Exploration and Production

02/24/2020

| AMAZING ENERGY OIL AND GAS, CO. (OTCQB: AMAZ) |

| Underfollowed Oil and Gas Opportunity in Permian Basin and Gulf Coast |

Investment Summary:

| ● | Amazing Energy Oil and Gas Co. (AMAZ) holds attractive core oil and gas assets in the Permian Basin and Gulf Coast Region, with the company holding roughly 75,000 acres in Pecos County, Texas, Lea County, New Mexico and Walthall County, Mississippi, with Pecos county representing the most significant revenue driver for the company. The company focuses primarily on drilling shallow (2,000-4,000 feet) oil and gas wells, with the acreage secured on attractive financial terms (roughly $200 per acre) with stacked pay zones with significant vertical and horizontal potential near large formations. We believe Amazing Energy Oil and Gas Co. is suited for higher risk tolerant investors looking for exposure to a Permian Basin asset play with unique geological approach and differentiated financial model. |

| ● | The company has adopted a conservative approach to exploration and well management, which allows it to operate in a lower oil and gas price environment relative to many of its overleveraged peers and it is able to grow with lower capital expenditure requirements, mitigating additional dilution. The company is also seeking out joint ventures where possible and using well ownerships to pursue unique financing structures, helping to maintain its balance sheet position. |

| ● | Company benefits from wholly owned subsidiary Jilpetco, which owns multiple rigs, trailers, trucks and equipment needed for all operational needs, allowing reduced costs and providing the capability to drill new wells efficiently. |

| ● | The company benefits from a strong management team, including recently announced CFO, with extensive experience in the oil and gas industry. AMAZ’s management team and board bring years of operational and financial experience in the oil and gas industry (Exxon, Torchlight) and with public companies, specifically building companies from the start-up stages. |

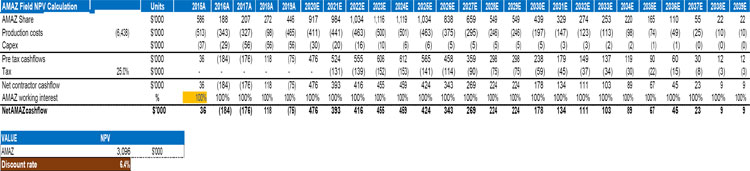

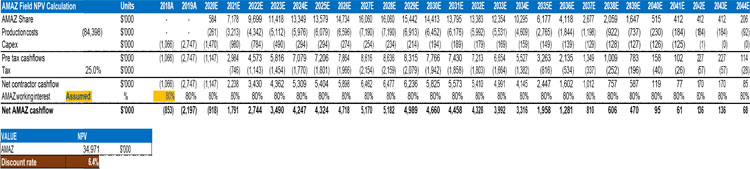

| ● | We value AMAZ based on NAV (WACC 6.4% and long-term oil price assumption of $55/bbl) - producing asset at NPV of $3.1 million, while majority of the values are derived from the potential asset at NPV of $34.9 million. As such we view AMAZ as appropriate for institutional and very high-risk tolerant retail investors seeking exposure to a unique oil and gas exploration company. |

Company Description |

Amazing Energy Oil and Gas, Co. is an independent oil and gas exploration and production company headquartered in Plano, Texas. The company’s operations are in the Permian Basin and Gulf Coast region. The company holds a primary leasehold in the Permian Basin of West Texas their main asset, controlling over 75,000 acres between their rights in Texas, New Mexico and Mississippi. |

| Price-Volume History |

|

| Key Statistics | |

| Closing Price (As of 02/21/2020) | $0.12 |

| 52 Week Range | $0.06-$0.40 |

| Average Daily Volume (th) | 29.69 |

| Shares Outstanding (th) | 98,101 |

| Market Capitalization (M) | $11.33 |

| Enterprise Value/Revenue (FY21E) | 2.01x |

| Revenue ($ in thousands) | |||

| Dec. FY | 2018A | 2019A | 2020E |

| 1Q | 148 | 130 | 229 |

| 2Q | 116 | 96 | 164 |

| 3Q | 126 | 151 | 532 |

| 4Q | 56 | 219 | 776 |

| FY | 447 | 597 | 1,701 |

| EPS ($) | |||

| Dec. FY | 2018A | 2019A | 2020E |

| 1Q | (0.04) | (0.02) | (0.03) |

| 2Q | (0.02) | (0.02) | (0.02) |

| 3Q | (0.02) | (0.03) | (0.02) |

| 4Q | (0.02) | (0.05) | (0.02) |

| FY | (0.09) | (0.09) | (0.08) |

Please see last page for important disclosures

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Investment Thesis

Strategically Located Assets

AMAZ holds attractive core oil and gas assets in the Permian Basin and U.S. Gulf Coast: it has ~75,000 acres in Pecos County, Texas; Lea County, New Mexico; and Walthall County, Mississippi. Pecos County is a rich production resource area with proved production history. It has more than 1,863 exploration and production leases operated by ~192 companies. The major oil companies operating in Pecos County are Chevron, Conoco Phillips Apache Corporation, Kinder Morgan, and Occidental. This field also accounts for more than 21,000 wells, with more than 30 thousand barrels per day (kbpd) of oil production.

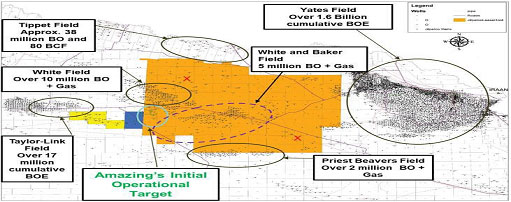

Fig 1: Pecos County – A strategically placed asset

Source: Amazing Energy, Diamond Equity Research, January 2020

The leasehold area lies within the Central Basin Platform of the Permian Basin, west of the Yates Field and east of the Taylor Link Field. More specifically, AMAZ’s leasehold property lies within the White & Baker Field and portions of the Walker Field. The two fields have produced over one billion barrels of oil to date.

Fig 2: Strategically located acreage

Source: Amazing Energy Presentation, Diamond Equity Research, January 2020

AMAZ has oil and gas assets spreading over 75,000 acres in Pecos County, Texas, Lea County, New Mexico and Walthall County, Mississippi |

More than one billion barrels of oil to date has been produced from AMAZ’s adjacent fields, situated between the White & Baker Field and part of the Walker Field |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Holding assets adjacent to a proven oil field is often a good indicator that production from the property could be strong, if properly developed. AMAZ began drilling operations in October 2010. Its current field operations center on optimizing relatively shallow vertical wells, referred to as the Queen Sand development program. The company is also evaluating drilling deeper wells past the Queen Sand by using vertical drilling, as it has in the past. AMAZ estimates potential of thousands of additional drilling locations (at least 3,500), which could result in increased production.

Attractive core oil and gas assets in the Permian Basin

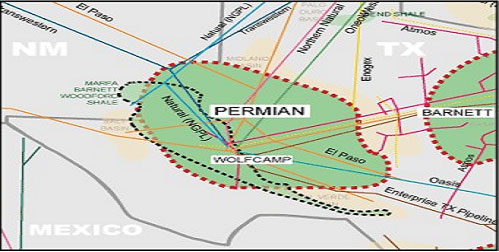

In the Permian Basin, located between West Texas and a part of southeastern New Mexico, experts still see substantial oil and natural gas potential . Exploration of this oil-rich area has fundamentally changed the energy dynamic not only in the U.S., but also worldwide, having attracted oil and natural gas businesses for decades.

Fig 3: A map of the Permian Basin

Source: Naturalgasintel.com, Diamond Equity Research, January 2020

The Permian Basin – One of the United States most important oil sources

The Basin covers an area ~250 miles wide and 300 miles long – a substantial 75,000 square miles, with oil and gas produced from depths of a few hundred feet to miles below the surface. In context, more than 30 billion barrels of oil have been extracted from the area since 19231.

AMAZ expects additional drilling locations, approximately 3,500, which could result in higher production |

Permian Basin, located between West Texas and part of Southeastern New Mexico, has altered the U.S as well as the global energy market |

Since 1923, over 30 billion barrels of oil have been extracted from the Permian basin encompassing 75,000 square miles |

| 1 | Rapier, R. (2018, December 27). Why The Permian Basin May Become The World’s Most Productive Oil Field. Forbes. Retrieved from https://www.forbes.com/sites/rrapier/2018/12/27/why-the-permian-basin-may-become-the-worlds-most-productive-oil-field/#3ac8b9e75ccb |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

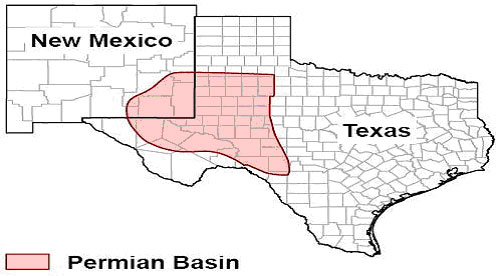

Fig 4: Location of Permian Basin reserves

Source: Shale Industry News, Diamond Equity Research, January 2020

The Basin’s importance to almost all U.S. oil and gas companies has continued to grow, evidenced by the fact that it accounted for ~40% of expenditure on oil exploration acreage acquired in the U.S. in 2018 according to Shale Industry News.

Technological advancements have added to the Permian Basin’s attractiveness. Moreover, this reservoir is largely untapped, making it even more attractive to oil and gas companies. Research firms continue to raise their estimates of reserves buried within the Permian Basin, and it is believed that it could be the world’s richest oil field. Recent studies suggest that the area has far more deposits than previously forecast, estimating a reserve potential of 60-70 billion barrels of oil. At today’s crude oil prices, resources in area could be worth more than $3 trillion.

There are technological reasons for rising estimates of the Basin’s reserves. Two technologies have had significant impact on the U.S. oil industry – hydraulic fracturing (often referred to as fracking) and horizontal drilling techniques – both of which enable far more efficient extraction of oil from shale formations. Often, as is the case with some Permian Basin drilling, fracking and horizontal drilling are combined to maximize production.

The Basin also benefits from highly developed energy infrastructure, being connected to several established pipelines and other essential infrastructure required for production and transportation. Additionally, it benefits from friendly tax policies in the state of Texas.

| Nearly 40% of capital allocated for acquired U.S. oil exploration acreages was spent in the Permian Basin |

| Permian Basin is estimated to be the richest oil field worldwide with reserve estimates being revised quite often |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Moreover, the increase in oil prices since 2016 has made the Basin more economical. With prices remaining above $50 per barrel, it has become a profitable production area, and it is expected to remain attractive over the long term.

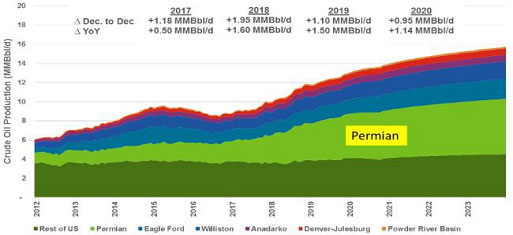

Growing importance – Production from Permian slated to grow faster than rest of U.S. assets

U.S. oil production grew by 1.5 million barrels per day (MMbbl/d) in 2019 to 12.3 MMbbl/d), according to one of the energy industry’s leading data, software, and insights company, Enverus. This was a 13% increase over 2018. However, Enverus estimates that production growth could moderate and increase only by a 6% CAGR from 2020 to 2023 (adding 3.2 MMbbl/d) to reach 15.5 MMbbl/d in 2023.

Fig 5: US crude – Production forecast

Source: Enverus, January 2020

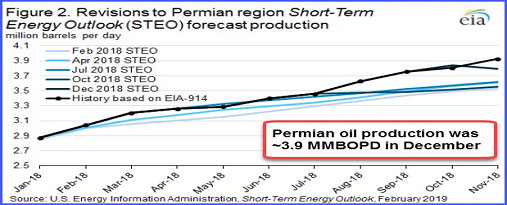

Most of this growth could come from the Permian Basin, where production grew by 0.8 MMbbl/d in 2019, i.e., average production of 4.3 MMbbl/d. Enverus suggests that production at Permian could grow to an average of 5.7 MMbbl/d by 2023, i.e., at a 7.3% CAGR from 2020 to 2023. This growth in U.S. oil production will likely be driven by substantial land bands that are currently de-risked and economical at prices of $55 per barrel or less West Texas Intermediate (WTI).

| U.S. oil production rose 13% year-on-year in 2019 and is anticipated to grow at 6% CAGR from 2020 to 2023 |

| Production from Permian basin is expected to increase by 7.3% CAGR between 2020 and 2023 |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Fig 6: Permian to lead production – Estimates revised upwards

Source: US EIA, Diamond Equity Research, January 2020

AMAZ leased Permian asset at very low cost - unique in the industry

AMAZ has received the lease right of its acreages (70,000 acre) in the Permian for a lower rate. The Company paid (continues to pay) ~$200-$300 per acre, while acreage in Permian is very high at ~$60,000/acre. This is unique for any Oil and Gas Company and works in favor of AMAZ. The lease term allows AMAZ to just drill and bank time its drilling commitment as required. Further, The Company can just go out and lease part of the acreages that they need when it is ready to drill a well. Moreover, AMAZ doesn’t have to go through the financial burden to maintain the lease agreement (lease terms require Companies to drill the acres to maintain the lease). Thus, acquiring the acreages at a lower cost frees up capital for asset development in the shallow zones (~2,000 feet and up).

The following table summarizes AMAZ’s leased acreage as of July 31, 2019. The company has 2P reserve life of 52 years.

Table 1: AMAZ has rights in multiple locations

| Total Acres | AMAZ Interest Developed Acres | AMAZ Interest Undeveloped Acres | ||||||||||||||||||||||

| Leasehold Interests - 7/31/2019 | Gross | Net | Gross | Net | Gross | Net | ||||||||||||||||||

| Surface through San Andres- | ||||||||||||||||||||||||

| Pecos County, Texas AMI | 35,382 | 18,707 | 465 | 465 | 34,917 | 18,242 | ||||||||||||||||||

| Lea County, New Mexico | 5,385 | 4,682 | 520 | 416 | 4,865 | 4,266 | ||||||||||||||||||

| Total Acreage | 40,767 | 23,389 | 985 | 881 | 39,782 | 22,508 | ||||||||||||||||||

| Additional Lease Deep Rights for a portion of Pecos County acreage | 37,454 | 19,276 | 0 | 0 | 37,454 | 19,276 | ||||||||||||||||||

Source: Amazing Energy, Diamond Equity Research, January 2020

| Amazing Energy has leased Permian field at a lower rate of $200-$300/acre with a unique lease contract |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Additional Company Assets

| 1. | Lea County, New Mexico |

AMAZ has also acquired acreage in Lea County, New Mexico. The properties are in the Northeastern Shelf of the Permian Basin, where AMAZ has a 56% working interest in two leases and a 100% working interest in a third lease, and total 16,904 gross and 10,501 net effective acres. Its JV partner Devon Energy will own a 30% working interest in the asset, while the rest will be held by EOG WI Partner. These assets are “held by production” in nature. AMAZ acquired the assets from Wyatt Energy in January 2019, and has acquired several producing properties, constituting 5,385 gross acres and 4,682 net acres, in Lea County. AMAZ operated seven producing oil wells as of July 31, 2019. The assets have ~93 potential horizontal drilling locations, targeting the prolific San Andres area. A recent reserve report produced by petroleum consulting firm Ryder Scott calculates potential reserves of 20.2 million barrels of oil equivalent and estimated ultimate recovery (EUR) of 250 thousand barrels of oil per well, pegging the PV-10 at ~$146.7 million.

AMAZ’s strategy for this location is to increase production by drilling shallow, low-cost wells, typically with investors sharing the risk and profits. Most of the wells it has drilled are completed for ~$275,000 or less at depths of ~2,000 feet.

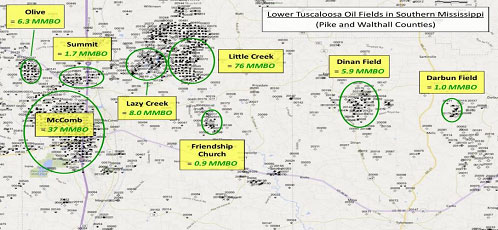

| 2. | New field – Denver Mint Project, Walthall County, Mississippi |

AMAZ also holds an interest in assets located in Walthall County, Mississippi, known as the “Denver Mint Project”. These assets consist of 900 acres of leasehold acreage, nine oil wells and a saltwater disposal well. This field was discovered in 1970, has produced over 6 million barrels of oil equivalent from the Lower Tuscaloosa B, C, and D sands and ranges in depth from 10,100-11,100 ft. AMAZ’s acquired assets include the associated production facilities and installed infrastructure.

| AMAZ has property in New Mexico with a 56% working interest in two leases and 100% working interest in the third lease, totaling 16,904 gross and 10,501 net effective acres |

| Denver Mini Project, located in Mississippi, constitutes 900 acres of leasehold acreages, 9 oil wells and a saltwater disposal well |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Fig 7: Denver Mint Project – Prolific production

Source: Amazing Energy, Diamond Equity Research, January 2020

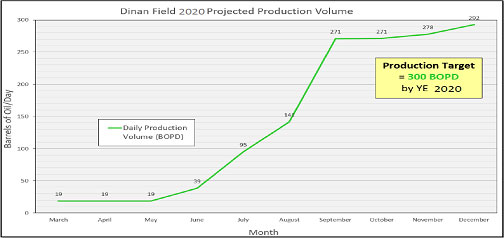

We believe this infrastructure will bode well for AMAZ, increasing the assets’ current production profile. AMAZ plans to increase production from these fields by (1) restoring existing Lower Tuscaloosa production, (2) pursuing a Lower Tuscaloosa water flood project, (3) perforating and testing shallow, 3,300 ft. zones, and (4) recompleting wells in other Lower Tuscaloosa zones. The combined efforts could allow for recompletions up-hole and increase production over the next one year. The company has already closed $4.5 million in financing for the development of the Denver Mint Project. The assets have the potential to add approximately 300 barrels of oil per day (bopd) to AMAZ’s production by December 2020.

Fig 8: Projected oil production from Denver Mint Project

Source: Amazing Energy, Diamond Equity Research, January 2020

| AMAZ intends to increase production through several means including perforating and testing shallow 3,300 ft. zones |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

The company’s total 2P reserves were 709.8 barrels of oil equivalent as of July 31, 2019. Proved reserves accounted for 70%. The following table summarizes AMAZ’s assets, with estimated 2P oil and gas reserves as of July 31, 2019.

Table 2: AMAZ’s assets and their potential – 2P

| Proved and Probable Reserves (BOE) July 31, | ||||||||

| 2019 | 2018 | |||||||

| Proved developed | 190,833 | 40,090 | ||||||

| Proved undeveloped | 308,833 | 358,218 | ||||||

| Total proved | 499,666 | 398,308 | ||||||

| Probable undeveloped | 210,167 | 211,355 | ||||||

| Total reserves | 709,833 | 609,663 | ||||||

| Percent of total proved reserves | 70.39 | % | 65.33 | % | ||||

Source: Amazing Energy, Diamond Equity Research, January 2020

Table 3: Summary of oil and gas reserves as of July 31, 2019

| Proved and Probable Reserves | ||||||||||||||||||||

| Oil | Natural Gas | Total | Percent | PV-10 | ||||||||||||||||

| (BbI) | (Mcf) | (BOE) | (%) | ($) | ||||||||||||||||

| Proved developed | 151,450 | 239,220 | 190,833 | 26.88 | % | $ | 1,580,000 | |||||||||||||

| Proved undeveloped | 212,790 | 575,680 | 308,833 | 43.51 | % | $ | 4,663,000 | |||||||||||||

| Total proved | 364,240 | 814,900 | 499,666 | 70.39 | % | $ | 6,243,000 | |||||||||||||

| Probable undeveloped | 154,000 | 337,000 | 210,167 | 29.61 | % | $ | 2,347,000 | |||||||||||||

| Total Proved and Probable Reserves | 518,240 | 1,151,900 | 709,833 | 100.00 | % | $ | 8,590,000 | |||||||||||||

Source: Amazing Energy, Diamond Equity Research, January 2020

AMAZ’s current production

AMAZ currently produces ~100 barrels of oil equivalent per day with a 77% net revenue interest. It had drilled 26 wells across its properties as of July 31, 2019. Of these, 16 are in production, eight are shut for further evaluation and two are permanently closed.

Jilpetco – Oil Service Company Adds Synergies

In 2016, AMAZ acquired Jilpetco, an oilfield services company that owns and operates drilling, completion, and workover rigs, and leases operational services equipment. While Jilpetco had previously provided services for other companies, it became a wholly owned subsidiary in 2016, servicing only AMAZ’s assets and related properties.

Jilpetco introduced important assets to the AMAZ group, including multiple rigs, trucks, trailers, and heavy equipment. Management is positive about the acquisition, as it also introduced experienced staff, enabling AMAZ to reduce costs and increased the capability to drill new wells efficiently. We expect Jilpetco to grow at the same pace as AMAZ’s Pecos County operations.

| AMAZ produces nearly 100 barrels of oil equivalent per day, owning 77% net revenue interest |

| Jilpetco acquisition adds key assets such as multiple rigs, trucks, trailers and heavy equipment for the company’s assets |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Company Overview

AMAZ is a U.S. independent oil and gas exploration and production company headquartered in Plano, Texas. It was first established in 2008 as a Texas Limited Liability Company and in 2010, it changed its domicile to Nevada.

AMAZ’s primary operations are in the Permian Basin and in the Gulf Coast. It has over 75,000 acres of exploration rights in Pecos County, Texas; Lea County, New Mexico; and Walthall County, Mississippi, with Pecos County being its most significant revenue driver. AMAZ is focused primarily on drilling shallow (2,000- 4,000 ft) oil and gas wells, with the acreage secured on attractive financial terms (~$200 per acre), with stacked pay zones and significant vertical and horizontal potential near large formations.

AMAZ has an experienced management team with extensive industry financial and business experience, having built oil and gas companies from the ground up and with experience working at larger competitors. AMAZ is aggressively developing its existing operations and simultaneously pursuing reservoir rights to build large acreage for future development.

The company was previously listed on OTCQX prior to uplisting to the OTCQB in February 2020. We believe that trading on this platform is noteworthy and a significant upgrade from trading on the regular OTC market with the company looking to move to senior exchange in the future.

The company has also entered multiple transactions to grow inorganically. We believe the most notable and, by far, the most important one was its acquisition of Jilpetco, Inc., an oilfield services company, in 2016. This acquisition has enabled AMAZ to reduce costs and have the capability to drill new wells efficiently.

| Formed in 2008 as Texas Limited Liability Company, AMAZ changed its domicile to Nevada in 2010 |

| AMAZ is listed on OTCQB exchange and plans to up list to senior exchange |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Corporate timeline

| ● | February 13, 2020-AMAZ announced CFO departure and appointment of Benjamin Jacobson III as new CFO |

| ● | February 12, 2020-AMAZ announces new subsidiary Amazing Energy Technologies, LLC (AET) with experienced professional Mark Moss to run subsidiary as CEO |

| ● | February 10, 2020 – AMAZ announced resignation of Director Jed Miesner with agreement to settle debt |

| ● | February 1, 2020 – AMAZ uplisted to OTCQB market |

| ● | November 25, 2019 – AMAZ acquires assets in Walthall County, Mississippi, and closes a $4.5 million financing |

| ● | January 22, 2019 – AMAZ acquires acreage in Lea County, New Mexico, from Wyatt Energy |

| ● | November 13, 2018 – AMAZ appoints David Arndt as its chief operating officer |

| ● | October 24, 2018 – AMAZ appoints Marty Dobbins as its chief financial officer |

| ● | March 13, 2018 – AMAZ enters into a joint venture agreement with Encore Natural Resources, LLC to develop multiple sections within AMAZ’s current holdings in Pecos County |

| ● | January 25, 2018 – AMAZ is nominated to be listed among the 2018 OTCQX Best 50, a ranking of top-performing companies traded on the OTCQX Best Marketplace roster |

| ● | September 19, 2017 – AMAZ acquires an 87.5% working interest in Butler County, Kansas, for $600,000 from E-Land Ventures, LLC |

| ● | August 16, 2017 – AMAZ appoints Willard G. McAndrew III as CEO and a member of the board of directors |

| ● | April 19, 2016 – AMAZ agrees to acquire Jilpetco, Inc. from Jed Miesner, and acquires Gulf South Securities, Inc., a firm specializing in raising drilling capital |

| ● | June 17, 2015 – AMAZ is listed on the OTCQX Best Marketplace roster |

| ● | 2010 – AMAZ changes its domicile to Nevada |

| ● | 2008 – Amazing Energy Oil & Gas is first incorporated as a Texas limited liability company |

| AMAZ has completed numerous acquisitions in Mississippi, New Mexico, and Kansas |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Key Investment Items

| ● | AMAZ’s assets have stacked pay zones with deep vertical and horizontal potential |

| ● | A large, promising asset base with unmatched proven records of exploration |

| ● | Well-funded, with non-dilutive capital to conduct future exploration and production activities |

| ● | Newly acquired wells simply need maintenance or facilities work to return to production |

| ● | Seasoned management professionals with extensive industry experience |

| ● | Knowledgeable and experienced geologists and geoscientists in the team to provide additional expertise |

| ● | Production strategy focused on low cost of lifting and efficient oil extraction |

Competitive Landscape

AMAZ is engaged in the acquisition and exploration of oil and natural gas properties. Its main operation is oil and gas exploration and production. This business is extremely competitive, and industry participants range from large conglomerates Chevron, Conoco, and Exxon to smaller players like AMAZ.

| - | AMAZ’s primary business is in the U.S., confined to a few natural assets where all industry participants operate |

| - | It faces competition in the acquisition and development of oil and gas assets not only from independent operators but also from oil majors |

| - | Moreover, the industry is highly capital intensive; companies, therefore, compete to obtain capital from investors via debt and equity financing |

| - | AMAZ also faces competition from industry participants in hiring experienced personnel. It is competitive to hire highly experience oil and gas professionals. |

| - | Lastly, access to technology and services at lower costs is key for this industry, another area in which AMAZ competes with industry participants |

Growth in Reserves and Production

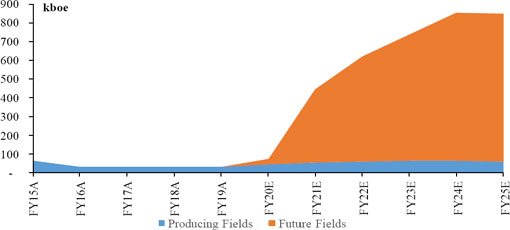

Production volumes to increase rapidly – AMAZ’s oil and gas (O&G) production levels have increased (reaching a peak of 62.9 bopd in 2016). However, production fell to 32.4 bopd in 2018 due to lower production at existing fields. The company has since worked to address the decline. AMAZ has also acquired assets to increase production. With inorganic growth (in Lea County and Denver) and organic growth in Pecos County, AMAZ’s production could increase significantly. The model projects it to add ~58 kboe/year until FY25E.

| Oil production strategy focused on low cost of lifting and rapid oil extraction |

| AMAZ operates in a highly competitive environment with many larger players |

| AMAZ’s production decreased in 2018 to 32.4 bopd, from 62.9 bopd in 2016, since then it is redressing production |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Growth projects to add a cumulative 539 kboe of production a year, starting in 4QFY20E – The Denver Mint Project (Mississippi) and Lea County (New Mexico) could potentially add 539 kboe/year (peak production: 878 kboe/year, with the project starting in FY20) until FY25E. We have factored in the full project life for these projects but expect most of the production between FY23E to FY30E. However, we have not factored in potential additional production from Pecos County, pending further studies. We may revise our production targets periodically, based on these studies.

Fig 9: Production – Modelled to grow at a 73% CAGR from FY20 to FY25E

Source: Amazon Energy, Diamond Equity Research, January 2020

| Several growth projects, such as Denver Mini, Mississippi and New Mexico, have potential to add 539 kboe/year till FY25E |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Valuation

AMAZ’s primary leasehold in the Permian Basin in West Texas is its main asset, and it controls over 75,000 acres in rights in Texas, New Mexico and Mississippi. One of the major positives for the company is its low-cost lease terms (~$200/acre). The lease terms are unique for companies operating in the oil and gas space. We value the company using an NPV analysis and have also performed sensitivity analysis. Our combined valuation analysis is shown below and subject to numerous assumptions, which investors can modify given their expectations and investors should be aware of the substantial risk in oil and gas investments.

Table 4: Key Assumptions

| FY2017A | FY2018A | FY2019A | FY2020E | FY2021E | FY2022E | |

| WTI rice ($/bbl) | 50.2 | 69.9 | 58.5 | 60.7 | 54.8 | 52.1 |

| Discount to WTI ($/bbl) | 10.8 | 17.3 | 7.5 | 4.9 | 4.9 | 4.9 |

| Realized oil price ($/bbl) | 39.4 | 52.6 | 51.0 | 55.8 | 49.9 | 47.2 |

| Oil production (kbpd) | 32 | 31 | 32 | 74 | 448 | 622 |

Source: Amazon Energy, Diamond Equity Research, FactSet, January 2020

We value AMAZ based on NPV [WACC: 6.4% and a long-term oil price assumption of $55/barrel (bbl); forecast-period oil prices are from FactSet] to derive our target price of $0.35/share, representing upside potential (even the conservative side of the range indicates upside potential from current trading levels). We assign the producing asset an NPV of $3.1 million, while we derive most of the values from the potential asset valued at an NPV of $34.5 million. However, we have not assigned a value to any potential production from Pecos County and will revisit our valuations on any significant developments.

| Valuation of AMAZ performed via NPV analysis, supplemented by scenario analysis |

| With WACC of 6.4% and long-term price assumption of $55/bbl |

Fig 10: NPV of Producing Filed Production

Source: Amazing Energy, Diamond Equity Research, January 2020

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Fig 11: NPV of Future Field Production

Source: Amazing Energy, Diamond Equity Research, January 2020

Bull-Bear - Case analysis

We outlined several scenarios to assess how the NPV of AMAZ fluctuates and its potential impact on the share price. The scenarios assume a change in oil price of $5/bbl per interval and a change in production of 2.5 million boe/year. Our best-case scenario yields an NPV of $60.7 million, and the downside scenario an NPV of $20.4 million, corresponding to the best-case TP of $0.59/share compared with $0.17/share at the lowest level. We note these valuations are subject to significant assumptions and investors need to be aware of the significant risk in energy investments and do not function as formal price targets.

| Bull-case scenario indicates an NPV of $60.7 million while worst case yields an NPV of $20.4mn |

Fig 12: NPV and Share Price at different production levels and oil prices

Source: Diamond Equity Research, January 2020

Comparable Company Analysis

We have analyzed AMAZ’s competitive valuation landscape, sourcing data from FactSet. We consider eight close competitors (oil and gas exploration companies) in similar lines of business and that operate in the same geographies (either in Texas or Mississippi) as AMAZ. We note the limited number of micro capitalization exploration and production companies.

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Table 5: Comparable Company Analysis

| Company Name | Latest Period | Price (US$) | Market Value | Shares Outstanding | EV ($) | Sales ($) | EBIT ($) | EBITDA ($) | EV/EBIT | EV/EBITDA |

| Amazing Energy Oil & Gas | Oct-19 | 0.15 | 14.2 | 96.9 | 20.9 | 0.7 | -4.9 | -4.5 | - | - |

| Tenth Avenue Petroleum | Sep-19 | 0.03 | 0.4 | 10.5 | 1.0 | 0.6 | -0.1 | 0.2 | - | 5.25x |

| Metalore Resources | Sep-19 | 1.71 | 3.0 | 1.8 | 2.6 | 0.5 | -0.1 | 0.1 | - | 21.64x |

| New Concept Energy | Sep-19 | 1.30 | 6.7 | 5.1 | 6.9 | 0.6 | -0.5 | -0.4 | - | - |

| Paleo Resources | Sep-19 | 0.03 | 6.3 | 235.3 | 11.3 | 0.3 | -1.8 | -1.2 | - | - |

| Cobra Venture | Aug-19 | 0.07 | 1.0 | 15.9 | -0.3 | 0.9 | 0.0 | 0.1 | - | -3.12x |

| Viking Energy Group | Sep-19 | 0.13 | 12.2 | 92.6 | 112.0 | 28.7 | 3.3 | 10.7 | 34.36x | 10.46x |

| Average | 0.54 | 4.9 | 60.2 | 22.2 | 5.3 | 0.1 | 1.6 | 34.36x | 8.56x | |

| Median | 0.10 | 4.7 | 13.2 | 4.7 | 0.6 | -0.1 | 0.1 | 34.36x | 7.85x |

Source: FactSet, Diamond Equity Research, January 2020

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Experienced Management Team

Amazing Energy Oil and Gas’s management team and board of directors brings years of experience in the oil and gas industry and extensive financial experience. Management brings a blend of investment and relevant operational experience.

Willard McAndrew III (President/Chief Executive Officer, Director): Mr. McAndrew brings extensive experience with over 48 years’ experience in the oil and gas industry including field operations, refining and management. Mr. McAndrew brings experience working at well-known oil and gas companies, including over five years work experience at Exxon and additional work experience at Hercules Oil. Previously he served as COO and director for three years at Torchlight Energy Inc., a NASDAQ listed oil and gas E&P Company. Mr. McAndrew brings over 35 years of work experience in the equity markets and brings experience being the president and owner of various businesses in various stages within the oil and gas industry owning over 200 miles of gas gathering and transmission pipelines. Mr. McAndrew graduated from Louisiana State University and served honorably in the United States Marine Corps.

Benjamin Jacobson III, (Chief Financial Officer & Treasurer): Mr. Jacobson co-founded ICP, LLC, a business focused on exploration and production companies targeting domestic oil field profitable assets. ICP focused on finding distressed oil assets and improving them through operational and financial actions. Previously Mr. Jacobson also worked as an alternative investment manager and as a Specialist at a New York Stock Exchange Member Firm, as well as a Vice President at Goldman Sachs. Mr. Jacobson holds his Bachelor of Arts degree from the University of Denver.

David Arndt (Chief Operating Officer): Mr. Arndt is a seasoned oil and gas executive bringing over 50 years of operational, engineering and management experience. David’s experience consists of developing drilling projects and economic reports for exploration and production in North Dakota, Texas, and the Gulf Coast. Prior to joining Amazing Energy, David was in senior roles at energy companies including Torchlight Energy (NASDAQ:TRCH), Conoco, Scotia Group, Sundance Resources and Petrosearch Energy Corporation where he worked on Permian Basin and Mid-Continent U.S. assets. David holds his B.S. in Petroleum Engineering from Penn State University.

Management is supported by a diverse Board of Directors with full bios available here

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Risk Factors

| ● | AMAZ is a micro-capitalization equity and thus subject to inherent risks of that asset class including, limited liquidity, low sell-side coverage, no institutional ownership, and start-up type business risks with only five full time employees |

| ● | Oil and gas investments are very risky even for larger players, the company is subject to substantial risk including financial, operational, competitive, and risk of overall business failure |

| ● | The company has a substantial amount of dilutive securities including options, convertible debt, convertible preferred stock and warrants which could dilute investors and place downward pressure on shares. The company had 64,902,975 in potentially dilutive securities as of October 31, 2019. |

| ● | The company faces legal risks having been subject to numerous historical and current lawsuits, if outcomes are adverse it could have material effects on the company and shareholders |

| ● | AMAZ has limited cash and is not profitable, there is no assurance the company will be able to raise financing or do so on attractive terms and/or become profitable. Investors also have been limiting capital for shale investments recently |

| ● | The company is subject to intense governmental environmental risk including restrictions on fracking |

| ● | The company is highly subject to commodity pricing, specifically prices of oil and natural gas. The company has not entered into derivative contracts or swap agreements for oil and gas |

| ● | Reserve estimates are subject to considerable risks and various assumptions, there is no assurance they may prove as forecasted |

| ● | Large insider ownership with over 47% of shares held by insiders who may not always align with shareholder interests |

| ● | The oil and natural gas industry contain numerous operating risks including risk of fire, explosions, pipe failures and environmental hazards. The company is not insured fully against all potential exposure because either insurance is unavailable, or the premium costs are prohibitively high |

These Risk Factors Are Not Comprehensive and investors should not invest in the company discussed unless they have a very high-risk tolerance. Investors need to be aware of the substantial risks within the oil and gas industry and within micro-cap equities.

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Appendix

Income Statement

| AMAZ Financials | FY2015A | FY2016A | FY2017A | FY2018A | FY2019A | FY2020E | FY2021E | FY2022E | FY2023E | FY2024E | FY2025E |

| ($’000) | Jul-15 | Jul-16 | Jul-17 | Jul-18 | Jul-19 | Jul-20 | Jul-21 | Jul-22 | Jul-23 | Jul-24 | Jul-25 |

| INCOME STATEMENT | |||||||||||

| Oil and gas sales | 781 | 250 | 277 | 362 | 595 | 1,501 | 8,095 | 10,684 | 12,452 | 14,465 | 14,698 |

| Oilfield service revenue | - | 324 | 125 | 84 | 2 | 200 | 1,079 | 1,425 | 1,660 | 1,929 | 1,960 |

| Total revenue | 781 | 574 | 401 | 447 | 597 | 1,701 | 9,174 | 12,108 | 14,112 | 16,394 | 16,658 |

| Gorth (YoY, %) | -26.5% | -30.2% | 11.3% | 33.6% | 185.2% | 439.3% | 32.0% | 16.6% | 16.2% | 1.6% | |

| Production costs | (684) | (458) | (437) | (130) | (620) | (672) | (3,654) | (4,805) | (5,611) | (6,477) | (6,542) |

| General and administrative expense | (694) | (645) | (822) | (6,287) | (4,201) | (4,285) | (4,370) | (4,458) | (4,547) | (4,638) | (4,730) |

| Accretion | (12) | (13) | (9) | (9) | (32) | (32) | (32) | (32) | (32) | (32) | (32) |

| Potential litigation settlement | - | - | - | - | (341) | - | - | - | - | - | - |

| Impairment of oil and gas properties | - | - | - | - | (2,164) | (606) | - | - | - | - | - |

| Gain on sale of mineral rights | 5 | 104 | 170 | - | - | ||||||

| Operating Expenses | (1,385) | (1,012) | (1,098) | (6,426) | (7,357) | (5,594) | (8,056) | (9,295) | (10,190) | (11,147) | (11,305) |

| Depreciation, depletion and amortization | (328) | (205) | (301) | (342) | (365) | (464) | (507) | (543) | (569) | (585) | (597) |

| EBIT | (932) | (643) | (998) | (6,322) | (7,126) | (4,357) | 611 | 2,271 | 3,354 | 4,663 | 4,756 |

| Interest and other income | 0 | 2 | 3 | 14 | 3 | 0 | - | - | - | - | - |

| Interest expense | (14,152) | (6,268) | (378) | (207) | (928) | (3,697) | (1,880) | (1,481) | (869) | (381) | (106) |

| Total other income/expense | (14,152) | (6,266) | (374) | (193) | (925) | (3,697) | (1,880) | (1,481) | (869) | (381) | (106) |

| Profit/(Loss) before taxes (PBT) | (15,084) | (6,909) | (1,373) | (6,515) | (8,051) | (8,054) | (1,269) | 789 | 2,485 | 4,282 | 4,650 |

| Taxes on income | - | - | - | - | - | - | - | (197) | (621) | (1,070) | (1,162) |

| Tax rate (%) | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 25.0% | 25.0% | 25.0% | 25.0% |

| Profit after Taxes (PAT) | (15,084) | (6,909) | (1,373) | (6,515) | (8,051) | (8,054) | (1,269) | 592 | 1,864 | 3,211 | 3,487 |

| Deemed capital distribution on acquisition of common control entity | 6,158 | - | (424) | - | - | ||||||

| Deemed capital contribution on exchange of related party debt and interest for preferred stock | - | 454 | - | - | - | ||||||

| Profit after Taxes (PAT) to common shareholders | (8,926) | (6,455) | (1,796) | (6,515) | (8,051) | (8,054) | (1,269) | 592 | 1,864 | 3,211 | 3,487 |

| Reported & diluted EPS | (0.51) | (0.12) | (0.03) | (0.09) | (0.09) | (0.08) | (0.01) | 0.01 | 0.02 | 0.03 | 0.03 |

| DPS - adjusted for split and bonus | - | - | - | - | - | - | - | - | - | - | - |

| Dividend Payout ratio (%) | - | - | - | - | - | - | - | - | - | - | - |

| Basic number of shares outstanding | 17,510 | 53,465 | 64,437 | 70,733 | 86,500 | 99,405 | 104,405 | 109,405 | 109,405 | 109,405 | 109,405 |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Balance Sheet

| BALANCE SHEET | FY2015A | FY2016A | FY2017A | FY2018A | FY2019A | FY2020E | FY2021E | FY2022E | FY2023E | FY2024E | FY2025E |

| ($’000) | Jul-15 | Jul-16 | Jul-17 | Jul-18 | Jul-19 | Jul-20 | Jul-21 | Jul-22 | Jul-23 | Jul-24 | Jul-25 |

| Cash and cash equivalents | 98 | 345 | 757 | 524 | 177 | 1,130 | 249 | 1,738 | 3,228 | 5,238 | 7,725 |

| Receivables | 112 | 180 | 104 | 82 | 132 | 382 | 2,059 | 2,718 | 3,168 | 3,680 | 3,739 |

| Other current assets | 19 | 61 | 68 | 40 | 70 | 70 | 70 | 70 | 70 | 70 | 70 |

| Total current assets | 228 | 586 | 929 | 646 | 380 | 1,582 | 2,378 | 4,526 | 6,465 | 8,988 | 11,534 |

| Oil and gas properties - proved and unproved, net | 6,132 | 6,237 | 5,919 | 8,502 | 10,009 | 11,369 | 12,299 | 13,041 | 13,501 | 13,777 | 14,057 |

| Property and equipment, net | 25 | 399 | 546 | 435 | 297 | 338 | 365 | 387 | 401 | 409 | 417 |

| Other assets | 30 | 27 | 77 | 79 | 126 | 392 | 392 | 392 | 392 | 392 | 392 |

| Total Non-current Assets | 6,187 | 6,662 | 6,542 | 9,016 | 10,432 | 12,099 | 13,057 | 13,821 | 14,295 | 14,579 | 14,867 |

| Total Assets | 6,415 | 7,248 | 7,470 | 9,661 | 10,812 | 13,681 | 15,435 | 18,347 | 20,760 | 23,567 | 26,401 |

| Accounts payable and accrued liabilities | 115 | 207 | 140 | 295 | 1,988 | 215 | 1,170 | 1,539 | 1,797 | 2,074 | 2,095 |

| Other Payables | 547 | 530 | 1,177 | 738 | 766 | 766 | 1,281 | 1,081 | 881 | 766 | 766 |

| Note payable, acquisition | 1,900 | 1,900 | 1,900 | - | - | - | - | ||||

| Equipment note payable | - | - | 10 | 10 | 12 | 12 | 12 | 12 | 12 | 12 | 12 |

| Due to working interest owners | - | 423 | 421 | 390 | 414 | 414 | 414 | 414 | 414 | 414 | 414 |

| Current portion of convertible debt, related party | 519 | - | - | - | - | - | - | - | - | - | - |

| Others | 100 | 50 | - | - | - | - | - | - | - | - | - |

| Total Current Liabilities | 1,281 | 1,209 | 1,748 | 1,432 | 5,080 | 3,308 | 4,777 | 3,046 | 3,104 | 3,267 | 3,288 |

| Promissory note payable, net of debt discount | - | - | - | - | 201 | - | |||||

| Notes payable, related party | 2,849 | 2,752 | 2,650 | 2,769 | 3,453 | 7,625 | 7,519 | 7,405 | 5,792 | 3,178 | 1,064 |

| Stock subscriptions | - | - | - | - | 330 | - | - | - | - | - | - |

| Asset retirement obligation | 240 | 211 | 183 | 259 | 636 | 636 | 636 | 636 | 636 | 636 | 636 |

| Other Payables | - | 32 | 35 | 23 | 9 | 9 | 9 | 9 | 9 | 9 | 9 |

| Operating Lease liability | - | - | - | - | - | - | - | - | - | - | - |

| Total Non-Current Liabilities | 3,090 | 2,995 | 2,869 | 3,051 | 4,629 | 8,270 | 8,165 | 8,051 | 6,437 | 3,823 | 1,709 |

| Total Liabilities | 4,371 | 4,204 | 4,616 | 4,483 | 9,709 | 11,578 | 12,942 | 11,097 | 9,541 | 7,090 | 4,997 |

| Shareholders equity | 20,534 | 27,699 | 28,882 | 37,722 | 41,698 | 43,561 | 43,561 | 43,561 | 43,561 | 43,561 | 43,561 |

| Other equity capital | (18,491) | (24,655) | (26,028) | (32,544) | (40,595) | (41,457) | (41,068) | (36,311) | (32,342) | (27,084) | (22,157) |

| Total Shareholders Equity | 2,044 | 3,044 | 2,854 | 5,178 | 1,103 | 2,104 | 2,493 | 7,250 | 11,219 | 16,477 | 21,404 |

| Total liabilities & shareholders’ funds | 6,415 | 7,248 | 7,470 | 9,661 | 10,812 | 13,681 | 15,435 | 18,347 | 20,760 | 23,567 | 26,401 |

Cash Flow Statement

| CASH FLOWS | FY2015A Jul-15 | FY2016A Jul-16 | FY2017A Jul-17 | FY2018A Jul-18 | FY2019A Jul-19 | FY2020E Jul-20 | FY2021E Jul-21 | FY2022E Jul-22 | FY2023E Jul-23 | FY2024E Jul-24 | FY2025E Jul-25 |

| Net Profit/Loss | (15,084) | (6,909) | (1,373) | (6,515) | (8,051) | (8,054) | (1,269) | 592 | 1,864 | 3,211 | 3,487 |

| Add: Depreciation, depletion and amortization | 328 | 205 | 301 | 342 | 377 | 464 | 507 | 543 | 569 | 585 | 597 |

| Add back amortization of note discount | - | - | - | - | 469 | 469 | 469 | 469 | 469 | 469 | 469 |

| Add back impairment of oil and gas properties | - | - | - | - | 2,164 | 606 | - | - | - | - | - |

| Add: Stock based compensation | 242 | 109 | 12 | 3,795 | 1,954 | 1,954 | - | - | - | - | - |

| Add: Others | 13,928 | 5,885 | (23) | 9 | 97 | 97 | 97 | 97 | 97 | 97 | 97 |

| Change in net working capital | 431 | (44) | 121 | 353 | 1,605 | 2,525 | 420 | 2,603 | 604 | 562 | 251 |

| Receivable from working interest owners | 123 | 182 | (24) | 30 | (60) | - | |||||

| Production revenue receivable | - | 69 | (3) | (8) | 10 | 250 | 1,677 | 659 | 450 | 512 | 59 |

| Other current assets | - | (30) | (7) | 28 | (30) | - | - | - | - | - | - |

| Other assets | (19) | - | - | (2) | 22 | 266 | - | - | - | - | - |

| Accounts payable and accrued liabilities | 95 | (160) | (67) | 155 | 1,819 | 1,796 | (1,470) | 1,731 | (58) | (162) | (21) |

| Due to working interest owners | - | (394) | (1) | (7) | 25 | 213 | 213 | 213 | 213 | 213 | 213 |

| Accrued interest payable | 231 | 290 | 224 | 157 | (181) | - | - | - | - | - | - |

| Net Cashflow from Operations | (155) | (754) | (961) | (2,015) | (1,385) | (1,939) | 224 | 4,303 | 3,603 | 4,924 | 4,901 |

| Capital Expenditure | (371) | (286) | (562) | (1,122) | (2,803) | (1,500) | (1,000) | (800) | (500) | (300) | (300) |

| Acquisition of property and equipment | 38 | (6) | (213) | (12) | - | - | - | - | - | - | - |

| Proceeds from sale of oil and gas working interests | 86 | 21 | 831 | 200 | 925 | - | - | - | - | - | - |

| Purchase letter of credit for operator bond | - | - | (50) | - | - | - | - | - | - | - | - |

| Net Cashflow from Investing Activities | (247) | (271) | 6 | (934) | (1,878) | (1,500) | (1,000) | (800) | (500) | (300) | (300) |

| Proceeds from sale of common stock and warrants | 1,519 | 182 | 1,604 | 3,230 | 750 | 150 | - | - | - | - | - |

| Proceeds from sale of common stock with working interest | - | 32 | - | - | 1,548 | - | - | - | - | - | - |

| Proceeds from notes payable, related parties | - | - | 225 | 25 | 600 | 4,172 | (105) | (114) | (1,614) | (2,614) | (2,114) |

| Proceeds from notes payable | - | - | 50 | - | 500 | - | - | (1,900) | - | - | - |

| Payments on note payable, related parties | - | - | (58) | (373) | (400) | - | - | - | - | - | - |

| Others | (1,454) | 180 | (454) | (166) | (12) | - | - | - | - | - | - |

| Net Cashflow from Financing Activities | 65 | 394 | 1,368 | 2,716 | 2,986 | 4,322 | (105) | (2,014) | (1,614) | (2,614) | (2,114) |

| Net Changes in Cash inflow / (outflow) | (337) | (631) | 412 | (233) | (276) | 883 | (881) | 1,490 | 1,489 | 2,010 | 2,487 |

| Cash and cash equivalents - beginning of year | 435 | 976 | 345 | 757 | 524 | 247 | 1,130 | 249 | 1,738 | 3,228 | 5,238 |

| Cash and cash equivalents - end of year | 98 | 345 | 757 | 524 | 247 | 1,130 | 249 | 1,738 | 3,228 | 5,238 | 7,725 |

| CFO - Capex (standalone) | (525) | (1,040) | (1,523) | (3,137) | (4,187) | (3,439) | (776) | 3,503 | 3,103 | 4,624 | 4,601 |

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |

|

AMAZING

ENERGY OIL AND GAS, CO. Institutional Investment Summary Report |

Disclosures

Diamond Equity Research, LLC has created and distributed this report. This report is based on information we consider reliable, including the subject of the report, but have not been provided any non-public information. This report does not explicitly or implicitly affirm that the information contained within this document is accurate and/or comprehensive, and as such should not be relied on in such a capacity. All information contained within this report is subject to change without any formal or other notice provided. Diamond Equity Research, LLC is not a FINRA registered broker/dealer or investment adviser and does not provide investment banking services and follows customary internal trading procedures pending the release of the report found on disclosure page.

This document is not produced in conjunction with a security offering and is not an offering to purchase securities. This report does not consider individual circumstances and does not take into consideration individual investor preferences. Recipients of this report should consult professionals around their personal situation, including taxation. Statements within this report may constitute forward-looking statements, these statements involve many risk factors and general uncertainties around the business, industry, and macroeconomic environment. Investors need to be aware of the high degree of risk in micro capitalization equities.

Diamond Equity Research LLC is being compensated by Amazing Energy Oil & Gas Co. for producing research materials regarding Amazing Energy Oil & Gas Co. and its securities, which is meant to subsidize the high cost of creating the report and monitoring the security, however the views in the report reflect that of Diamond Equity Research. All payments are received upfront and are billed for an annual or semi-annual research engagement. As of 02/24/2020 the issuer had paid us $15,000 for our services, which commenced 12/17/2019 and is billed annually. Diamond Equity Research LLC may be compensated for non-research related services, including presenting at Diamond Equity Research investment conferences, press releases and other additional services. The non-research related service cost is dependent on the company, but usually do not exceed $5,000. The issuer has paid us for non-research related services as of 02/24/2020 consisting of $2,000 for presenting at investment conference. Issuers are not required to engage us for these additional services. Additional fees may have accrued since then.

Diamond Equity Research, LLC is not a registered broker dealer and does not conduct investment banking or receive commission sharing revenue arrangements related to the subject company of the report. The price per share and trading volume of Subject Company and companies referenced in this report may fluctuate and Diamond Equity Research, LLC is not liable for these inherent market fluctuations. The past performance of this investment is not indicative of the future performance, no returns are guaranteed, and a loss of capital may occur. Certain transactions, such as those involving futures, options, and other derivatives, can result in substantial risk and are not suitable for all investors.

Photocopying, duplicating or otherwise altering or distributing Diamond Equity Research, LLC reports is prohibited without explicit written permission. This report is disseminated primarily electronically and is made available to all recipients. Additional information is available upon request. For further questions, please contact research@diamondequityresearch.com

| Please see last page for important disclosures | 1441 Broadway, 3rd Floor New York, NY 10018 | www.diamondequityresearch.com |